#Hydrogen Generation Industry

Explore tagged Tumblr posts

Text

Hydrogen is used as a fuel for FCEVs. With the need for sustainable transport developing across various countries, so is the demand for clean hydrogen that will power such transport vehicles. Transitioning toward a hydrogen-based economy could reduce carbon emissions upto 99%, according to numerous reports, where it is used to replace fossil fuels.

0 notes

Text

Hydrogen Generation Market Key Players, Supply and Consumption Demand Analysis to 2030

The global hydrogen generation market size is expected to reach USD 317.39 billion by 2030, registering a CAGR of 9.3% from 2024 to 2030, according to a new report by Grand View Research, Inc. The global hydrogen generation market is likely to be driven by the growing demand for cleaner fuel, coupled with increasing governmental regulations for the desulphurization of petroleum products. Hydrogen…

#Hydrogen Generation Industry#Hydrogen Generation Market Forecast#Hydrogen Generation Market Research#Hydrogen Generation Market Size

0 notes

Text

Hydrogen Generation Market Business Growth, Opportunities and Forecast 2024-2030

The global hydrogen generation market size was estimated at USD 170.14 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.3% from 2024 to 2030.

Demand for cleaner fuel and increasing government regulations for desulphurization of petroleum products. Hydrogen is an effective energy carrier, and this attribute is expected to contribute significantly to its further penetration into newer markets. Global electricity demand is anticipated to witness an increase of nearly two-thirds of current demand over the forecast period. Focus on projects related to distributed power & utility is anticipated to bolster industry’s growth.

Gather more insights about the market drivers, restrains and growth of the Hydrogen Generation Market

U.S. is among the early adopters of clean energy solutions in world for sectors such as power generation, manufacturing, and transportation. The U.S. Department of Energy (DOE) and Department of Transportation (DOT) introduced a Hydrogen Posture Plan in December 2006. This plan was aimed at enhancing research and development (R&D) and validating technologies that can be employed for setting up hydrogen infrastructure.

This plan provided deliverables set by the Federal government to support development of hydrogen infrastructure in the country. It was developed following the National Hydrogen Energy Vision and Roadmap. Development and construction of cost-effective and energy-saving hydrogen stations across the country are among key objectives planned by government agencies. All these factors are expected to propel hydrogen generation demand in the U.S.

German Ministry of Transport took an initiative in June 2012 to establish a countrywide hydrogen network and boost hydrogen infrastructure for hydrogen refueling stations. As a part of this initiative, the ministry signed a letter of intent (LoI) with industry players such as Total; The Linde Group; Air Products and Chemicals, Inc.; Daimler AG; and Air Liquide. Under its terms, these industry players were given a target to construct at least 50 hydrogen fueling stations by 2015 in metropolitan cities and major corridors in Germany.

Hydrogen Generation Market Segmentation

Grand View Research has segmented the global hydrogen generation market report based on technology, application, system, source, and region:

Technology Outlook (Volume, Million Metric Tons; Revenue, USD Billion, 2018 - 2030)

• Steam Methane Reforming

• Coal Gasification

• Others

Application Outlook (Volume, Million Metric Tons; Revenue, USD Billion, 2018 - 2030)

• Methanol production

• Ammonia Production

• Petroleum Refining

• Transportation

• Power Generation

• Others

System Outlook (Volume, Million Metric Tons; Revenue, USD Billion, 2018 - 2030)

• Captive

• Merchant

Source Outlook (Volume, Million Metric Tons; Revenue, USD Billion, 2018 - 2030)

• Natural Gas

• Coal

• Biomass

• Water

Regional Outlook (Volume, Million Metric Tons; Revenue, USD Billion, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o Russia

o UK

o France

o Spain

o Italy

• Asia Pacific

o China

o India

o Japan

o South Korea

o Australia

• Central & South America

o Brazil

o Colombia

o Paraguay

• Middle East & Africa

o Saudi Arabia

o U.A.E

o South Africa

o Egypt

Browse through Grand View Research's Sustainable Energy Industry Research Reports.

• The global voluntary carbon credit market size was estimated at USD 2.97 billion in 2023 and is projected to grow at a CAGR of 34.6% from 2024 to 2030.

• Consumer batteries are projected to be widely used across various electronic applications including laptops, flashlights, lamps, personal care, power tools, mobile phones, toys, and other electronics.

Key Companies & Market Share Insights

Hydrogen generation industry is competitive with key participants involved in R&D and constant innovation done by vendors has become one of the most important factors for companies to perform in this industry. For instance, Matheson Tri-Gas, Inc. acquired Linde HyCO business that produces hydrogen, carbon monoxide, or syngas. This acquisition is expected to promote expansion of company’s capabilities and serve petrochemical and refining industries.

Air Liquide announced that it will manufacture and market renewable liquid hydrogen to the U.S. West Coast mobility market. This large-scale project is expected to produce 30 tons of liquid hydrogen per day using biogas technology.

Key Hydrogen Generation Companies:

• Air Liquide International S.A

• Air Products and Chemicals, Inc

• Hydrogenics Corporation

• INOX Air Products Ltd.

• Iwatani Corporation

• Linde Plc

• Matheson Tri-Gas, Inc.

• Messer

• SOL Group

• Tokyo Gas Chemicals Co., Ltd.

Order a free sample PDF of the Hydrogen Generation Market Intelligence Study, published by Grand View Research.

#Hydrogen Generation Market#Hydrogen Generation Industry#Hydrogen Generation Market size#Hydrogen Generation Market share#Hydrogen Generation Market analysis

0 notes

Text

A Closer Look at the Environmental Impact of Hydrogen Generation

Like-minded stakeholders, innovators and entrepreneurs are counting on hydrogen generation to combat climate change and dramatically minimize CO2 emissions. Well-established players are prioritizing decarbonized hydrogen to propel the green portfolio. The environmental, social and governance (ESG) performance has received an impetus with bullish government policies. In April 2021, U.S. President Joe Biden announced a robust goal of minimizing greenhouse gas emissions by 50-52% by 2030. Green hydrogen—created from the electrolysis of water—has gained ground as the most environmentally friendly fuel to produce energy without emitting CO2. In common parlance, hydrogen is a major enabler of clean energy transition and produces zero emission at the point of use.

Exponential demand for green hydrogen has boded well for ESG policies amidst the fuel warranting significant storage, transportation and production infrastructure. The U.S. has proposed Climate Disclosure Rule requiring public companies to make GHG-related disclosures. Besides, it mandates public companies to disclose Scope 1, 2 and 3 emissions. The disclosure rule is poised to prompt and incentivize industry participants to infuse funds into greener energy. Hydrogen could be a silver bullet to minimize GHG emissions. Industry players are gearing up to provide a sustainable future with cost-effective, dependable and accessible green hydrogen energy.

Key Companies in this theme

• Linde PLC

• Indian Oil Corporation

• Air Products and Chemicals Ltd.

• Air Liquide

• Bloom Energy Corporation

• Ceres Power Holdings PLC

• Plug Power, Inc.

• FuelCell Energy, Inc.

Environmental Perspective

As stakeholders emphasize a clean hydrogen economy to boost productivity, reduce carbon footprints and minimize operating costs, bespoke hydrogen generation solutions could bring a paradigm shift globally. Investors are aligning their businesses with environmental performance, with companies striving to inject funds into clean energy technologies to foster energy efficiency and cut climate-changing emissions. Even though hydrogen is a low-carbon energy source, transportation of hydrogen using internal combustion engine trucks contributes to GHG emissions. These trends have compelled leading companies to invest in green hydrogen. In 2022, Plug Power acquired Joule Processing to bolster its green hydrogen ecosystem and reduce the logistics networks and hydrogen infrastructure cost. The company plans to augment the green hydrogen production to 200 TPD by 2023 across North America.

Leading players aspire to infuse funds into clean energy technologies to reduce fleet emissions. Linde asserts around 83% GHG emissions could be reduced from transportation using renewable diesel. The company has implemented an environmental management system in line with ISO 14001—the international standard for EMS—for the management of atmospheric emissions and waste, to leverage pollution prevention and control, management of environmental impacts from transportation and protection of biodiversity and natural resources. Around 99% by weight of the raw materials used in 2021 were renewable raw materials, such as produce hydrogen, oxygen, gaseous nitrogen, carbon dioxide and argon. It has an audacious target to cut absolute GHG emissions by 35% by 2035 and claims it helped customers do away with over 88 million metric tons of CO2 in 2021.

Is your business one of participants to the Hydrogen Generation Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices

Social Perspective

Investors prioritize community investment, diversity & inclusion, ethical supply chain, harassment-free workplace and employee health. Prominently, these factors act as a marker shaping the future of business, creating resilient business plans and cementing equality of opportunity. Linde has been at the helm with over 80% social score as it integrates sustainable strategies into business strategy. The company introduced the Global Giving program to infuse over USD 4 million into educational programs. The Board of Directors and CEO are accountable for social issues affecting Linde. Meanwhile, the CHRO oversees management and retention, talent sourcing, inclusion and diversity. However, the global voluntary turnover rate was pegged at 6.7%, according to its Sustainable Development Report 2021.

Linde has furthered its efforts on a safe operating environment through investment in cutting-edge technologies. For instance, in 2021, the industrial gas company invested around 5 million hours in safety training for its contractors and employees. The company is leaving no stone unturned to promote gender diversity. It introduced a “30 by 30” gender balance goal with the aim of having 30% females at all professional levels by 2030. The company is emphasizing training for inclusion, business accountability and strengthening the pipeline program to achieve the ambitious goal.

IndianOil has propelled its recruitment strategy and equal opportunities policy to develop, attract and retain top talent from diverse backgrounds. According to its Sustainability Report 2020-21, the company hired 490 new employees; 90% of these hires were below 30 years of age, while 43 were female during the year. It also formulated Talent Vision and Strategy Framework for the 2021-24 period to foster learning, employee engagement and workplace safety, among others.

Notably, the Indian giant rolled out the revamped employee satisfaction and engagement survey in 2021—Pratidhwani—to underscore engagement activities and understand the feedback and opinions of internal stakeholders. The company has also established reporting kiosk to report near-miss incidents. It conducts regular safety audits to comply with standard operating procedures, detect unsafe and hazardous acts, and analyze the effectiveness of safety systems. The energy major has developed Emergency Response and Disaster Management Plans (ERDMP) to streamline preparedness during fires, spills, leaks, explosions and other risk scenarios. The Indian PSU asserts its 100% locations are equipped with ERDMP plans and performs liaison activities with central government agencies, including National Disaster Response Force (NDRF). Amidst strong safety policies, IndianOil recorded 8 cases of fatalities during 2020-21, a two-fold rise from 2019-2020.

Governance Perspective

Ensuring compliance with the rules, regulations and laws has become a major prerequisite for sound corporate governance. NEL ASA published its first sustainability report in 2020 with the goal of 100% of executive management and other employees completing anti-corruption training by 2022. In September 2020, the company launched its whistleblowing channel—NEL Ethics Hotline. In the next month, it introduced the Nel Anti-Bribery and Corruption Policy and the Nel Competition Law Policy.

A transparent government structure is a vital cog in the governance pillar for sustainable growth. Companies such as Plug have set the goal of continuing the development of ESG governance to boost transparency, standardization and consistency across the landscape. The CEO at Plug organizes weekly hall meetings with employees to share updates on initiatives and answer questions and queries. The company provided compulsory training on vigilance to eradicate corruption and bribery.

Air Liquide has propelled its sustainability portfolio, contributing to ESG commitments and creating positive impacts for climate, people and health. In April 2022, the French company published its first Sustainable Development report, taking a giant leap toward transparency. In March 2022, the Group laid out a strategic plan—ADVANCE—to combine financial performance, environmental and societal performances. The company aims to augment the investments to around 16 billion euros (approximately USD 16.5 billion) from 2022 through 2025, with 50% earmarked for the energy transition.

The France-based company aims to increase the percentage of women among managers and professionals to 35% by 2025, up from 31% in 2021. The company has spotlighted an international, independent, gender-balanced board of directors. Prominently, 50% of its board are women and around 92% are independent members. In June 2022, the board of directors announced the separation of the roles of Chief Executive Officer and the Chairman of the Board of Directors.

With a strong case of independent directors in better-performing organizations, forward-looking companies have reinforced their governance profile. In essence, Linde’s 8 BOD are independent non-executive directors. The board has fostered its governance structure with a focus on, including but not limited to split roles of Chairperson and CEO, director independence, board effectiveness, ideal board committees, alignment with shareholder interests, shareholder outreach, limits to service and board diversity. In 2021, the BOD included a new Sustainability Committee emphasizing clean energy initiatives and environmental aspects. During this period, the executive leadership team reviewed the ESG presentations prepared for the BOD.

Governing bodies and other stakeholders are emphasizing sustainability development targets through innovations and decarbonization investments. In December 2021, the European Commission reportedly proposed an EU framework to boost hydrogen, decarbonize gas markets and minimize methane emissions. The European Network of Network Operators for Hydrogen (ENNOH) would be formed to underpin dedicated hydrogen infrastructure, interconnecting network infrastructure and cross-border coordination. The new rule is expected to expand in two phases with access to the separation of hydrogen production, tariff setting, transportation activities and hydrogen infrastructure.

Industry participants are striving to create a business model that enhances social, economic, governance and environmental values. Well-established players are prioritizing hydrogen as a cornerstone of the energy transition. For instance, Air Liquide has earmarked 8 billion euros (around USD 8.25 billion)—over the next ten years—for the full hydrogen value chain, such as electrolysis, supply chain, carbon capture and storage. It expects its hydrogen revenue to be pegged at 6 billion euros (approximately USD 6.2 billion) by 2035. In 2021, Shell initiated production at the electrolyzer with the 10 MW proton exchange membrane using renewable energy to produce up to 1,300 tons of decarbonized hydrogen annually. In January 2022, Shell New Energy was involved in a joint venture with Zhangjiakou City Transport to start a hydrogen electrolyzer in China with 20 MW capacity. It expected the electrolyzer to render around 50% of the total green hydrogen supply for fuel cell vehicles during the Winter Olympic Games in the Zhangjiakou competition zone. The hydrogen generation market size garnered USD 129.85 billion in 2021 and could witness a 6.4% CAGR from 2022 to 2030. Soaring hydrogen demand and a surge in global spending on energy research will provide a quantum leap to the ESG efforts.

About Astra – ESG Solutions by Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

#hydrogen generation industry esg#hydrogen generation market#hydrogen generation industry#hydrogen generation sustainable

0 notes

Text

Ive been waiting for ages in oni for my future industrial block to be vacuumed out so I decided to doodle some furry women while I waited (it’s still not done)

#keese draws#oxygen not included#olivia broussard#jackie stern#trying to hold strong and main tag doodles even if I don’t like some of them#anyways I definitely made my industrial brick Way too big for the things I currently plan on using it for#the main reason I made it so big is that I have two minor volcanoes in it that I may or may not unplug at some point to experiment#I’ve never used magma before so I think it’d be a good thing to try to get comfortable doing#even if I doubt it’ll work out in my case since I imagine having the volcano in the sauna itself could cause problems#mainly that I can only fit so many steam turbines so overheating could still be a problem#I’m hoping that it’ll be balanced out by me not currently having too much stuff in there but idk#in the future once I start digging through my second planet I might use that sauna for natural gas generators#I’d have to adjust some stuff but I think that could be a decent use of my time#especially given that currently I’m relying on a hydrogen vent and coal generators for power#which tbf I am on like cycle 200 smth so that should suffice for a while but eventually I’m going to run out of coal#I’ve been ranchinh sage hatches and pips but I just don’t have the space or resources to farm enough of both to keep up with the coal demand#the main problem with the pips is that almost everywhere is just too cold for arbor trees#and I’m currently using my warmer spaces for bristle berries#now I do have a cool steam vent which I could in theory try to use to warm up a large area for pip farms#but that would be tricky to balance well and I think I’d be better off just trying to work towards space travel and getting access to oil#maybe I can go for slicksters in the meantime? I do have a lot of carbon dioxide sitting around#anyways uhhh doomed toxic yuri on the mind happy pride month or smth idk#the real take I need from everyone is if gravitas goes rainbow for pride month of not

2 notes

·

View notes

Text

Green Ammonia Market Statistics, Segment, Trends and Forecast to 2033

The Green Ammonia Market: A Sustainable Future for Agriculture and Energy

As the world pivots toward sustainable practices, the green ammonia market is gaining momentum as a crucial player in the transition to a low-carbon economy. But what exactly is green ammonia, and why is it so important? In this blog, we'll explore the green ammonia market, its applications, benefits, and the factors driving its growth.

Request Sample PDF Copy:https://wemarketresearch.com/reports/request-free-sample-pdf/green-ammonia-market/1359

What is Green Ammonia?

Green ammonia is ammonia produced using renewable energy sources, primarily through the electrolysis of water to generate hydrogen, which is then combined with nitrogen from the air. This process eliminates carbon emissions, setting green ammonia apart from traditional ammonia production, which relies heavily on fossil fuels.

Applications of Green Ammonia

Agriculture

One of the most significant applications of green ammonia is in agriculture. Ammonia is a key ingredient in fertilizers, and its sustainable production can help reduce the carbon footprint of farming. By using green ammonia, farmers can produce food more sustainably, supporting global food security while minimizing environmental impact.

Energy Storage

Green ammonia can also serve as an effective energy carrier. It can be synthesized when there is surplus renewable energy and later converted back into hydrogen or directly used in fuel cells. This capability makes it an attractive option for balancing supply and demand in renewable energy systems.

Shipping Fuel

The maritime industry is under increasing pressure to reduce emissions. Green ammonia has emerged as a potential zero-emission fuel for ships, helping to decarbonize one of the most challenging sectors in terms of greenhouse gas emissions.

Benefits of Green Ammonia

Environmental Impact

By eliminating carbon emissions during production, green ammonia significantly reduces the environmental impact associated with traditional ammonia. This aligns with global efforts to combat climate change and achieve sustainability goals.

Energy Security

Investing in green ammonia can enhance energy security. As countries strive to reduce their dependence on fossil fuels, green ammonia offers a renewable alternative that can be produced locally, minimizing reliance on imported fuels.

Economic Opportunities

The growth of the green ammonia market presents numerous economic opportunities, including job creation in renewable energy sectors, research and development, and new supply chain dynamics. As demand increases, investments in infrastructure and technology will drive innovation.

Factors Driving the Growth of the Green Ammonia Market

Regulatory Support

Governments worldwide are implementing policies and incentives to promote the adoption of green technologies. These regulations often include subsidies for renewable energy production and carbon pricing mechanisms, making green ammonia more competitive.

Rising Demand for Sustainable Solutions

With consumers and businesses becoming increasingly aware of their environmental impact, the demand for sustainable solutions is on the rise. Green ammonia aligns with this trend, providing an eco-friendly alternative to traditional ammonia.

Advancements in Technology

Ongoing advancements in electrolysis and ammonia synthesis technologies are making the production of green ammonia more efficient and cost-effective. As these technologies mature, they will further enhance the viability of green ammonia in various applications.

Conclusion

The green ammonia market represents a promising avenue for sustainable development across agriculture, energy, and transportation sectors. As technology advances and regulatory support strengthens, green ammonia is poised to become a cornerstone of the global transition to a greener economy. Investing in this market not only contributes to environmental preservation but also opens up new economic opportunities for innovation and growth.

#The Green Ammonia Market: A Sustainable Future for Agriculture and Energy#As the world pivots toward sustainable practices#the green ammonia market is gaining momentum as a crucial player in the transition to a low-carbon economy. But what exactly is green ammon#and why is it so important? In this blog#we'll explore the green ammonia market#its applications#benefits#and the factors driving its growth.#Request Sample PDF Copy:https://wemarketresearch.com/reports/request-free-sample-pdf/green-ammonia-market/1359#What is Green Ammonia?#Green ammonia is ammonia produced using renewable energy sources#primarily through the electrolysis of water to generate hydrogen#which is then combined with nitrogen from the air. This process eliminates carbon emissions#setting green ammonia apart from traditional ammonia production#which relies heavily on fossil fuels.#Applications of Green Ammonia#Agriculture#One of the most significant applications of green ammonia is in agriculture. Ammonia is a key ingredient in fertilizers#and its sustainable production can help reduce the carbon footprint of farming. By using green ammonia#farmers can produce food more sustainably#supporting global food security while minimizing environmental impact.#Energy Storage#Green ammonia can also serve as an effective energy carrier. It can be synthesized when there is surplus renewable energy and later convert#Shipping Fuel#The maritime industry is under increasing pressure to reduce emissions. Green ammonia has emerged as a potential zero-emission fuel for shi#helping to decarbonize one of the most challenging sectors in terms of greenhouse gas emissions.#Benefits of Green Ammonia#Environmental Impact#By eliminating carbon emissions during production#green ammonia significantly reduces the environmental impact associated with traditional ammonia. This aligns with global efforts to combat

4 notes

·

View notes

Text

Understanding VHP Sterilization: The Future of Sterility with Vaporized Hydrogen Peroxide

Vaporized Hydrogen Peroxide (VHP) sterilization is transforming the way industries ensure safety and sterility. This comprehensive guide explores how VHP works, its applications in healthcare, pharmaceuticals, and biotechnology, and the benefits it offers. Learn why VHP is becoming the preferred sterilization method for its effectiveness, eco-friendliness, and ability to decontaminate even the most sensitive materials. Discover how VHP sterilization is shaping the future of infection control and contamination prevention.

#ozone generators#commercial ozone generator#industrial ozone generator#best ozone generators#ozone generator for cars#home ozone generator#hydroxyl generator#ozone machine#vapor hydrogen peroxide#best ozone machines#vhp sterilization#odor removal

0 notes

Text

Laboratory Gas Generators Market worth $686 million by 2026

The Global Laboratory Gas Generators Market is projected to reach USD 686 million by 2026 from USD 353 million in 2021, at a CAGR of 14.2% during the forecast period. The growth of the laboratory gas generators market is primarily driven by the growing importance of analytical techniques in drug and food approval processes, rising food safety concerns, increasing adoption of laboratory gas generators owing to their various advantages over conventional gas cylinders, growing demand for hydrogen gas as an alternative to helium, and the increasing R&D spending in target industries. On the other hand, reluctance shown by lab users in terms of replacing conventional gas supply methods with modern laboratory gas generators and the availability of refurbished products are the major factors expected to hamper the growth of this market.

Download PDF Brochure:

Global Nitrogen gas generators Market Dynamics

Market Growth Drivers

Increasing R&D spending in target industries

Growing importance of analytical techniques in drug approval processes

Rising food safety concerns

Increasing adoption of laboratory gas generators owing to their various advantages over conventional gas cylinders

Growing demand for hydrogen gas as an alternative to helium

Market Growth Opportunities

Growing demand for laboratory automation

Opportunities in the life sciences industry

Cannabis testing

Proteomics

Market Challenges

Reluctance to replace conventional gas supply methods with modern laboratory gas generators

Availability of refurbished products

Request 10% Customization:

The hydrogen gas generators segment accounted for the highest growth rate in the Labortaory gas generators market, by type, during the forecast period

Based on type, the laboratory gas generators market is segmented into nitrogen gas generators, hydrogen gas generators, zero air generators, purge gas generators, TOC gas generators, and other gas generators. The hydrogen gas generators segment accounted for the highest growth rate in the Labortaory gas generators market in 2020. This can be attributed to the growing preference for hydrogen as a cost-effective alternative to helium, as it offers faster analysis and optimal results.

Gas chromatography segment accounted for the highest CAGR

Based on application, the laboratory gas generators market is segmented into gas chromatography (GC), liquid chromatography-mass spectrometry (LC-MS), gas analyzers, and other applications. In 2020, gas chromatography accounted for accounted for the highest growth rate. The major factors driving the growth of this is the adoption of hydrogen over helium due to the latter's high cost and scarcity in gas chromatography.

Life science industry accounted for the largest share of the laboratory gas generators market in 2020

Based on end user, the laboratory gas generators market is segmented into the life science industry, chemical and petrochemical industry, food and beverage industry, and other end users (environmental companies and research & academic institutes). The life science industry accounted for the largest share of the global laboratory gas generators market. The major factors driving the growth of this segment are the rising demand for laboratory analytical instruments, increase in drug research activities, and stringent regulations relating to the drug discovery process.

North America accounted for the largest share of the hydrogen gas generators market in 2020

The laboratory gas generators market is divided into five regions, namely, North America, Europe, Asia Pacific, and Rest of the World. North America dominated the global laboratory gas generators market. The large share of the North American region is mainly attributed to the high investments in R&D in the US and Canada, which has led to a higher demand for efficient and advanced laboratory equipment.

Recent Developments:

In 2020, PeakGas launched various laboratory gas generators such as Genius XE SCI 2, MS Bench (G) SCI 2, MS Bench SCI 2, and i-Flow O2 oxygen gas generator.

In 2019, Laboratory Supplies Ltd. (Ireland), a supplier of scientific, industrial, and laboratory apparatus, joined the distributor network of the Asynt Ltd.

Report Highlights

To define, describe, and forecast the laboratory gas generators market by type, application, end user, and region

To provide detailed information regarding the factors influencing the market growth (such as drivers, opportunities, and challenges)

To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the laboratory gas generators market

To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

To forecast the size of the market segments in North America, Europe, Asia Pacific, and the Rest of the World (RoW)

To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

To track and analyze competitive developments, such as product launches, expansions, agreements, and acquisitions in the laboratory gas generators market

Key Players:

Hannifin Corporation (US), PeakGas (UK), Linde plc (Ireland), Nel ASA (Norway), PerkinElmer Inc. (US), VICI DBS (US), Angstrom Advanced Inc. (US), Dürr Group (Germany), ErreDue spa (Italy), F-DGSi (France), LabTech S.r.l. (Italy), CLAIND S.r.l. (Italy).

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global laboratory gas generators market?

The global laboratory gas generators market boasts a total revenue value of $686 million by 2026.

What is the estimated growth rate (CAGR) of the global laboratory gas generators market?

The global laboratory gas generators market has an estimated compound annual growth rate (CAGR) of 14.2% and a revenue size in the region of $353 million in 2021.

#Laboratory Gas Generators Market#Nitrogen Gas Generators Industry Size#Hydrogen Gas Generators Industry Share#Laboratory Gas Generators Market Growth

0 notes

Text

The global Hydrogen IC Engines Market in terms of revenue was estimated to be worth $12 million in 2024 and is poised to reach $327 million by 2035, growing at a CAGR of 34.7% from 2024 to 2035 according to a new report by MarketsandMarkets™. The global Hydrogen IC Engines Market is anticipated to grow at a higher level. There are various drivers responsible for the growth of the market such as government policies and incentives and technological advancements among others. Existing ICE technologies can be adapted to run on hydrogen with modifications, leveraging established manufacturing and maintenance infrastructure, and reducing the development costs and time compared to completely new technologies.

#hydrogen#hydrogen fuel cells#hydrogene#renewable hydrogen#energy#energia#power generation#utilities#power#utility#renewableenergy#hydrogen industry#Hydrogen IC Engines#Hydrogen IC Engines Market#hydrogen combustion engines#hydrogen technologies#hydrogen fuel companies#hydrogen future#hydrogen fuel cell#hydrogen fuel cell vehicle#hydrogen car

0 notes

Text

ASTM A516 GR. 60 HIC Plates: Ensuring Reliability in Pressure Vessel Applications

ASTM A516 GR. 60 HIC (Hydrogen Induced Cracking) plates are pivotal components in industries requiring robust materials for pressure vessels and boilers. These carbon steel plates are specifically engineered to withstand hydrogen-induced cracking, ensuring safety and durability in high-pressure environments. This blog explores the key features, applications, and advantages of ASTM A516 GR. 60 HIC plates, highlighting their critical role in maintaining structural integrity and reliability in industrial settings.

Introduction to ASTM A516 GR. 60 HIC Plates

ASTM A516 GR. 60 HIC plates are normalized carbon steel plates known for their excellent weldability and toughness. They are designed to resist hydrogen-induced cracking, a common issue in environments with high hydrogen content. These plates undergo a stringent heat treatment process to enhance their mechanical properties, making them suitable for use in pressure vessels and boilers operating at moderate temperatures.

Key Features of ASTM A516 GR. 60 HIC Plates

Hydrogen Induced Cracking Resistance: These plates are specifically formulated to resist hydrogen-induced cracking, ensuring long-term reliability and safety.

Good Tensile Strength: ASTM A516 GR. 60 HIC plates offer good tensile strength, providing structural integrity and durability under high-pressure conditions.

Normalized Heat Treatment: The plates undergo normalization to improve their mechanical properties and ensure uniformity across the thickness.

Excellent Weldability: They exhibit excellent weldability, facilitating ease of fabrication and assembly in pressure vessel manufacturing.

Applications of ASTM A516 GR. 60 HIC Plates

ASTM A516 GR. 60 HIC plates are widely used across various industries, including:

Oil and Gas: Used in storage tanks and pressure vessels for oil refining, gas processing, and offshore platforms.

Power Generation: Essential for boilers and heat exchangers in thermal power plants for generating electricity.

Chemical Processing: Ideal for chemical reactors and vessels handling corrosive substances and high-pressure gases.

Petrochemical Industry: Critical for storing and transporting petrochemical products under high-pressure conditions.

Advantages of ASTM A516 GR. 60 HIC Plates

Hydrogen Induced Cracking Resistance: Ensures safety and reliability in environments prone to hydrogen-induced cracking.

High Tensile Strength: Offers robust mechanical properties suitable for demanding industrial applications.

Reliability: Known for consistent performance under varying temperature and pressure conditions.

Cost-Effectiveness: Provides a cost-effective solution with long-term durability and low maintenance requirements.

Conclusion

ASTM A516 GR. 60 HIC plates play a crucial role in ensuring safety and reliability in pressure vessel applications across diverse industries. Their resistance to hydrogen-induced cracking, combined with good weldability and mechanical strength, makes them an ideal choice for critical applications where structural integrity is paramount. Understanding the unique features and applications of ASTM A516 GR. 60 HIC plates empowers industries to select materials that meet stringent safety standards and ensure operational efficiency.

#ASTM A516 GR. 60 HIC plates#hydrogen induced cracking resistance#pressure vessel steel#boiler plates#industrial applications#oil and gas#power generation#chemical processing

0 notes

Text

Powering the Future: Exploring the Hydrogen Generation Market

As the world transitions towards a low-carbon economy, hydrogen emerges as a versatile and sustainable energy carrier with the potential to revolutionize various sectors, from transportation and industry to power generation and heating. At the heart of this energy revolution lies the hydrogen generation market, which is experiencing rapid growth and innovation driven by the imperative of decarbonization and the pursuit of cleaner energy solutions.

Hydrogen generation technologies encompass a diverse range of methods, including electrolysis, steam methane reforming (SMR), biomass gasification, and solar-driven processes. Each of these methods offers unique advantages and challenges, depending on factors such as cost, efficiency, scalability, and environmental impact.

One of the key drivers of the hydrogen generation market is the increasing focus on renewable hydrogen production. Electrolysis, powered by renewable energy sources such as wind and solar, is emerging as a clean and sustainable method for generating hydrogen without greenhouse gas emissions. As renewable energy costs continue to decline and government incentives support the transition to green hydrogen, the market for renewable hydrogen is poised for significant growth.

Moreover, the expanding application of hydrogen fuel cells in transportation, stationary power, and industrial processes is driving demand for hydrogen as a clean energy carrier. Fuel cell electric vehicles (FCEVs) offer zero-emission transportation solutions with fast refueling and long-range capabilities, making hydrogen an attractive alternative to conventional internal combustion engines and battery-electric vehicles.

Another factor driving market growth is the increasing recognition of hydrogen's potential to address energy storage and grid stability challenges associated with intermittent renewable energy sources. Hydrogen storage and conversion technologies enable the storage of excess renewable energy during periods of low demand and its conversion back to electricity or heat when needed, thus enhancing grid flexibility and resilience.

Furthermore, partnerships and investments across the hydrogen value chain are accelerating the commercialization and deployment of hydrogen technologies. From electrolyzer manufacturers and hydrogen infrastructure developers to energy companies and automakers, stakeholders are collaborating to overcome technical, economic, and regulatory barriers and unlock the full potential of hydrogen as a clean and sustainable energy solution.

In conclusion, the hydrogen generation market is poised for exponential growth as the world transitions towards a low-carbon future. With advancing technologies, expanding applications, and growing investment, hydrogen is set to play a pivotal role in powering the transition to a more sustainable and resilient energy system, driving innovation, economic growth, and environmental stewardship.

#Hydrogen Generation#Renewable Energy#Fuel Cells#Green Technology#Industrial Innovation#sustainability#technology#innovation#augmented reality#environmental sustainability#immersive experiences#additive manufacturing#ai#aiincelltherapy#compliance

0 notes

Text

Hydrogen Generation Market Size is projected to grow from USD 158.8 billion in 2023 to USD 257.9 billion by 2028, at a CAGR of 10.2% according to a new report by MarketsandMarkets™. The growing emphasis on environmental sustainability, rising adoption of fuel cell vehicles, and intermittent renewable energy integration accelerate the growth of the Hydrogen Generation Market.

0 notes

Text

Europe Gas Generator Market Growth, Trends, Demand, Industry Share, Challenges, Future Opportunities and Competitive Analysis 2033: SPER Market Research

The Europe Gas Generator Market encompasses the production, distribution, and utilization of gas-powered generators across European countries. With increasing concerns about energy security, environmental sustainability, and power reliability, the demand for gas generators is rising. Key drivers include the transition to cleaner energy sources, infrastructure development, and backup power requirements. Additionally, advancements in gas generator technology, such as improved efficiency and reduced emissions, contribute to market growth. Key players focus on innovation, product differentiation, and service quality to meet the diverse needs of customers and capitalize on market opportunities in Europe.

#Europe Gas Generator Market#Europe Gas Generator Market Challenges#Europe Gas Generator Market Competition#Europe Gas Generator Market Demand#Europe Gas Generator Market Future Outlook#Europe Gas Generator Market Growth#Europe Gas Generator Market Report#Europe Gas Generator Market Revenue#Europe Gas Generator Market Segmentation#Europe Gas Generator Market Share#Europe Gas Generator Market Size#Europe Gas Generator Market Trends#Europe Hydrogen Gas Generator Market#Europe Industrial Gas Generator Market#Europe Laboratory Gas Generators Market#Europe Large Generator Market#Europe Natural Gas Generator Market#Europe Natural Gas Generator Market Forecast#Europe Natural Gas Generator Market Opportunities#Europe Power Generator Market#Europe Residential Gas Generator Market#Gas Generator Market

0 notes

Text

#United Kingdom Hydrogen Generation Market#Market Size#Market Share#Market Trends#Market Analysis#Industry Survey#Market Demand#Top Major Key Player#Market Estimate#Market Segments#Industry Data

0 notes

Text

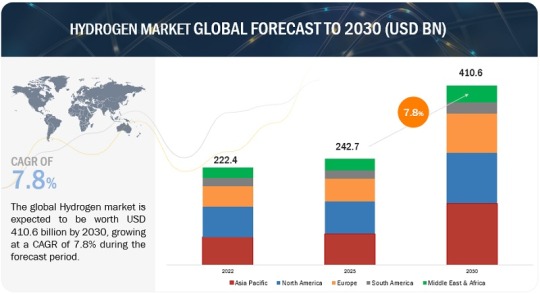

Hydrogen Market Recent Developments & Emerging Trends To 2030

According to a research report “Hydrogen Market by Sector (Generation Type (Gray, Blue, Green), Storage (Physical, Material), Transportation (Long, Short)), Application (Energy (Power, CHP), Mobility, Chemical & Refinery (Refinery, Ammonia, Methanol)), Region – Global Forecast to 2030″ published by MarketsandMarkets, the hydrogen market is projected to reach USD 410.6 billion by 2030 from an…

View On WordPress

#Energy#hydrogen generation#Hydrogen Industry#Hydrogen Market#Hydrogen Market Share#Hydrogen Market Size#Hydrogen Market Trends#Power#Power Generation

0 notes

Text

The global electrolyzers market is expected to grow from an estimated USD 1.2 billion in 2023 to USD 23.6 billion in 2028, at a CAGR of 80.3% according to a new report by MarketsandMarkets™.

#electrolyzers#electrolyzer#hydrogen electrolyzer market#electrolyzers market#electrolysis#energy#electricity#power#power generation#renewable energy#renewable#hydrogen economy#green hydrogen#green hydrogen industry#hydrogen#green hydrogen market#hydrogene#hydrogen production#electrolytes#green energy#hydrogen fuel#hydrogen storage#green ammonia market

0 notes