#How to Report Lost or Stolen Bank Card

Explore tagged Tumblr posts

Text

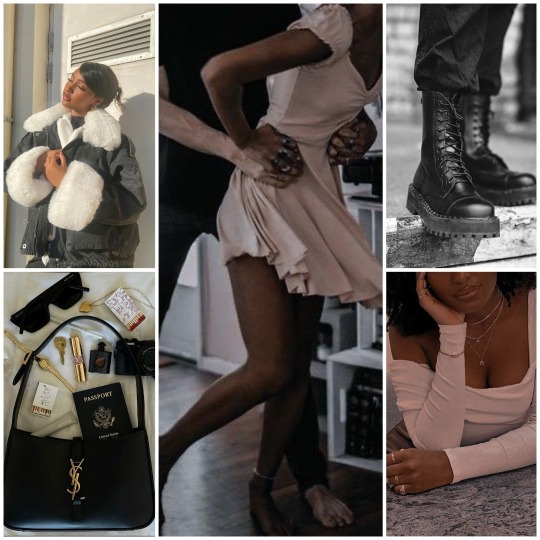

Bite me. Love me

König x black reader

Part 2

A/N-He's weird a walking red flag but the red flags are hazy almost like they're not there? Like a marage. His red flags are something you quite can't put a finger on at first until you realise it's everything it's the sum of all he's doing. A good boyfriend but a bit strange Idk he's sort of a you gotta get uncomfortable before you get comfortable

For me könig a bit of a strange man a man. He kinda understands social cues, but sometimes gets them a bit wrong. he slightly pushes your boutons and boundaries to see what he can get away with and how he can squeeze you

It's kinda like he has you in his teeth but he's not actually biting down, just grinding and rolling you in-between his teeth, he likes it and you're 'safe' that way, he wouldn't actually hurt you

Listen, sorry for all that yapping, but you needed to hear it. Anyway, a longer/second part to könig failed flirting attempt.Please like, reblog, and comment. Not proofread

Tag list: @thatmusedhatter @himboelover @canyonswft13 @montenegroisr @kneelingshadowsalome @havikshoochiemama @wordstome @lanalafey

You lost a bag that's cool, that's fine, although wouldn't call it lost, stolen more like given? Bag was practically thrown it into the robbers' hands. self-preservation above all else.

You couldn't focus on a single thing. Thoughts and worries tangle in your head as you recall the past events in your kitchen. You survive all that time back home, not getting robbed, only for your black ass to be robbed in a cafe in Austria!

'Come to Austria they said it'll be fun they said!'

ID, cards, money, everything in that bag gone. Thrown to the hands of a strange man. Why you. You'd have to go to the police, file a report, call the bank, and freeze your cards. "Aghhh!" All you could do was drop the floor and cry.

Surprisingly, this wasn't the worst pick-up fail könig had, so he can at least find comfort in that. can't get any lower than rock bottom...

The purse in his hands looked comical small, maybe its him, his hands that are making it look so small. you couldn't keep all your things in here? maybe it's a trend for women to carry purses the size of apples, putting fashion over function. Not something that könig would do.

Those who saw the whole ordeal go down, now eye him with suspicion, wondering what his next move will be, gripping their own items closer. He can only laugh to himself if he wanted he'd have no problem taking their stuff away. But it's better to leave so he can find you.

Walking out, he takes the time to look through your bag. cards, ID, cash, so manu important things, and you just handed them over to him. Playing with the ID card in his hands, mulling over your features. you had such a pretty name, such a serious face you were making in your photo too, not at all like the frightened look you had before.

It's more than enough to track you down he still didn't get the chance to ask you out. He couldn't bring it back empty-handed. Maybe a new purse would do.

‿︵‿︵ʚ˚̣̣̣͙ɞ・❉・ ʚ˚̣̣̣͙ɞ‿︵‿︵

The kitchen floor provides a surprising amount of comfort in these moments. 5 panic attacks down, and you're only down starting to cry. The knock on the door is either about to be a blessing or curse. Maybe the police finally came, or a good samartain got your purse back.

There wouldn't be any blessing today. The other side of the door only showed your assailant. If the panic attacks weren't enough to send you over the edge, spiralling, seeing this man at your door certainly was. taking your purse wasn't enough, like some sick grim reaper he's come for your life.

Playing dead is an option, right? You'd have to be stupid to think you could outrun this man. Yeah, laying down for a quick kill would be best-

" I brought you a gift, to apologise"

A gift?

You kept your eyes on bag half because you couldn't believe him and also you were too scared to look him in the eyes.

"It seems I scared you back at the cafe, I only wanted to ask you out" he holds out a bag in front of you.

Ha. It was a mistake. A simple misunderstanding. You'd spent the better half of today crying on the floor because of some big man's poor flirting skills. You wanted to cry again.

Might as well take the bag. What's one more mistake or bad choice today. All your items are there, and you suddenly feel relife, tears welling in eyes as your knees buckle. Your purse, cards, sweets, the second half of the book you're reading? Wait, some of this isn't yours.... was he using your bag to hold his stuff?? You stare back at him, waiting for an answer.

" they're yours a gift to apologize"

"Oh"

Maybe it's all in your head. You're just on edge in a new place. You feel like you can finally relax. The tension knotted in your shoulders slowly unravels. You feel silly and like a wet dog

" I'm sorry about that. Thank you for bringing it back,"

"A date"

What. You see him now only closer than before threatening to enter the boundaries of your home.

" Let me take you out for a drink to apologise." It's such an intense stare he has, focused souly on you. It makes you uncomfortable, stepping back slightly to put some space between you, a bad idea, as he matched your pace stepping forward, foot now fully in your house. You started in disbelief. There's no way this man just stepped in your house, muddy shoes and all. For the last time today, you look back at him, annoyed. An surprise for könig but not an unwelcome one.

"I don't drink"

"coffee"

"No"

"Tea"

"Hmm "

he squints and pauses at that answer

'"a cafe"

"Leave please"

"I'll pick you up on Thursday"

He's barley out the door before you shut it on him, locking the door and pulling the chain

she didn't say no right away. That means he still got a chance.

‿︵‿︵ʚ˚̣̣̣͙ɞ・❉・ ʚ˚̣̣̣͙ɞ‿︵‿︵

It's Thursday afternoon and once again you're sat in the kitchen panicking as your feet tap along with the rhythm of the clock.

The whole morning was spent worrying out your mind. It's a miracle your heart hasn't given out yet. Maybe he was just messing you, and now you've spent the whole morning worrying for nothing. more time passed, and your worry turned to annoyance. You did your whole makeup for this, and he didn't show.

You jump up at the sound of the door, rushing to open it. You pause. Taking a moment to collect yourself before before opening the door.

He looks better than before, still donning that scary balaclava, but in more casual clothes and flowers in hand. He's too forward with his actions, pushing the bouquet in your hands before he even spoke.

It's awkward. He doesn't say much(because that worked so well the first time), and neither do you. This silent walk is too painful to bear.

At least you can say he's a gentleman (sort of). The date was paid in full, and he got a gift. You've learned a few things about könig now. His jokes are cheesy, but they did make you laugh. He resides in an upscale apartment that's too big for him (his words)outside of the city centre. Currently on break from the army (a potential red flag that'll lingered in your thoughts), he's got a big appetite and love for strong drinks.

This afternoon hadn't been all that unpleasant. You quite like the man, you find some strange comfort and safety in him. It's even nice when he pulls you close to him, resting a hand on your hip.

"Haha, are you happy to see me, or is that a knife in your pocket?"

"Knife."

"Hah-" and He pulled out a blade.

...

Oh. Now we're back to weird again.

Why couldn't he just be normal!? It's too casual the tricks he's doing with the knife. How were you supposed to pretend this was normal

You try your best to smile, to not turn and flee scream but your lips tremble. You're really wishing he did have a boner instead. You're not sure what to say or what annoys you more how casual he is, not a single worry on his face.

This is exactly why you shouldn't go out with strange men who randomly appear at your doorstep. At the very least, he's a strong contender for the "Most Heart Attacks Caused by a Man" award.

König wasn't stupid he could sense your worry as you tried to hide behind a lopsided smile. Watching your eyes shift between him and blade, waiting for his next move. You're cute. He'll have fun messing with you.

‿︵‿︵ʚ˚̣̣̣͙ɞ・❉・ ʚ˚̣̣̣͙ɞ‿︵‿︵

You couldn't be happier to be home. You survived! You'd never have to see that nasty man again!

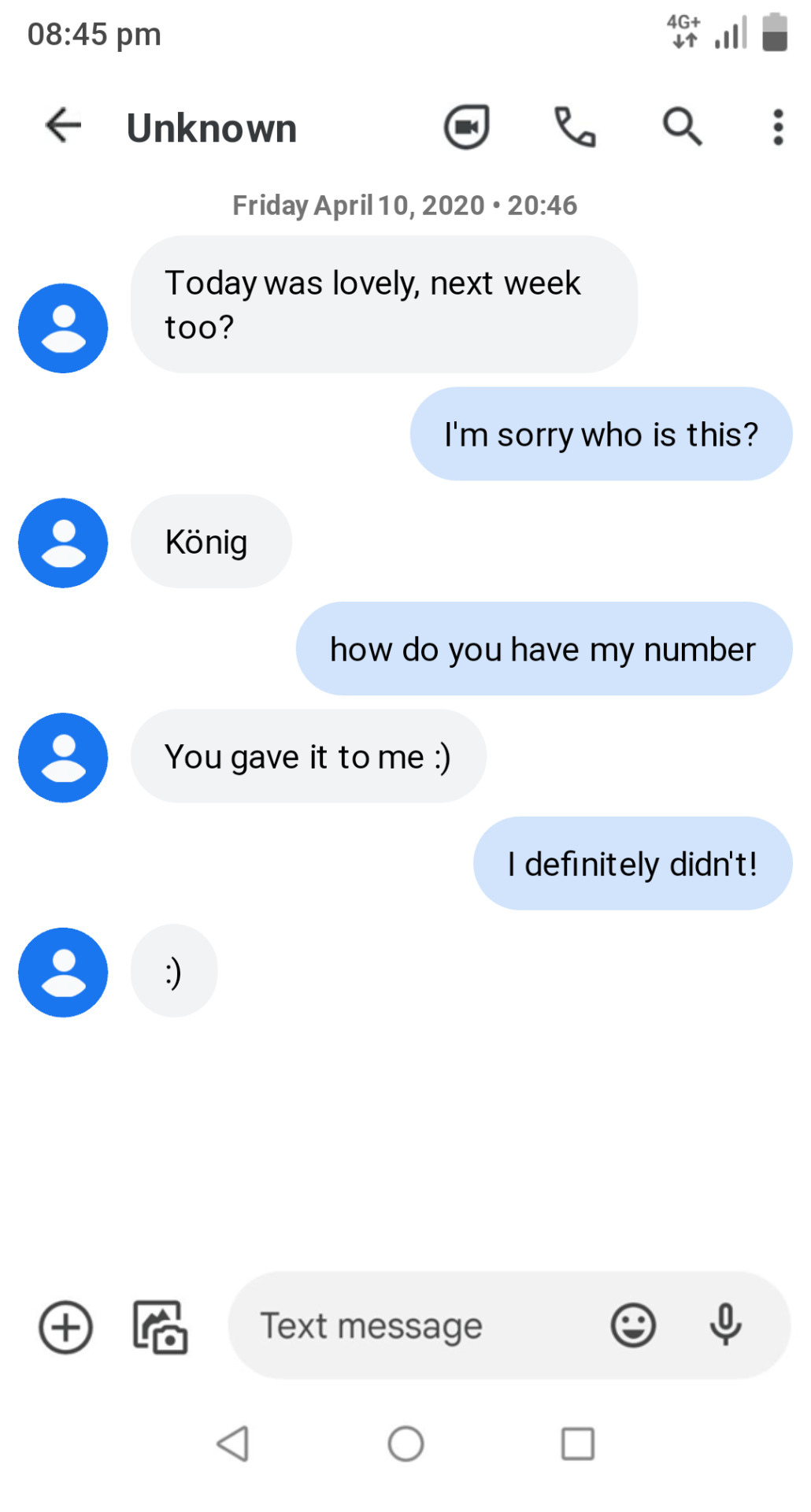

*beep*

It doesn't matter how long you stare at your phone in confusion and annoyance. The message on your phone is clear

......

Where did this man even get your number!? He's known for a 2 whole day's, there's no chance he knows anyone close to you.

You're never going to be free of this man

#könig x black reader#könig x reader#cod x black reader#call of duty x black reader#cod x reader#call of duty x reader#könig x you#könig x y/n#black reader insert#x black reader#könig imagine#my writing#konig x reader#konig call of duty#black reader#black writers#black writblr

362 notes

·

View notes

Text

It's bad when you have to report bank cards as lost when you've lost your wallet but worse when you have to do it with dyscalculia.

Reported a card as lost through my online banking app and only took 5 clicks. Reported my travel money card as lost by having to call them up - bit of a pain, tbh - but it was a short and sweet phone call.

All fine and dandy til I had to report my work discount card as stolen - had to fight an IVR that wouldn't respond to me and ended up kicking me from the call, and then it made me key in my full 19 digit card number.

The card number, on their website, that's displayed in one big clump of numbers (1234567891234567890) instead of spacing it out (1234 5678 9123 4567 890) so that made it the most difficult one to do.

Remember when we talk about making things neurodivergent friendly, it's not just hashtags and "speak up if you're feeling sad", it's making processes like this more user-friendly as well.

Especially for stuff that's more urgent like a lost/stolen card that could result in financial harm if not dealt with quickly.

Also remember in a lot of these cases, people might not be in the best frame of mind.

They could be panicking because they can't find their card and wondering how they're going to be able to get necessities or pay for things like rent, etc. or in the worst case scenario they could be a victim of crime who's been mugged or defrauded and really not in the right headspace.

17 notes

·

View notes

Text

STEPS TO FOLLOW WHEN YOU LOOSE YOUR PASSPORT IN INDIAN AND ABROAD

Losing your passport can be a daunting experience, and it’s essential to understand the legal steps you can take to mitigate any potential issues. If you lose your passport in India, the first thing you should do is remain calm and check your surroundings to ensure it isn’t simply misplaced. Once you confirm it’s lost, your immediate step should be to file a First Information Report (FIR) at your local police station. This FIR serves as a legal document that records the loss and protects you against potential misuse by others. It’s important to keep a copy of the FIR, as you will need it when applying for a replacement passport.

After filing the FIR, you must apply for a new passport. This can be done by visiting the nearest Passport Seva Kendra (PSK) or by applying online through the official Passport Seva website. Make sure to gather all the required documents for the application, including the FIR copy, identity proof (such as an Aadhar card or voter ID), address proof, and passport-sized photographs. In cases where you suspect your passport was stolen, you can also request an alert on your passport to prevent unauthorized use. Authorities may take additional steps to investigate, especially if there is evidence of fraudulent activity.

If you lose your passport while abroad, the process can be more complex due to the legal implications involved. The first step is to contact the nearest Indian Embassy or Consulate immediately. They will guide you on the necessary procedures and provide emergency contact numbers for local authorities. Next, file a police report in the local jurisdiction where you lost your passport. This report is crucial for documenting the loss and may be required when you apply for a replacement. Be sure to obtain a copy of the police report for your records and future use.

Once you have the police report, visit the Indian Embassy or Consulate with the necessary documents, including the police report, a filled application form for a new passport or an Emergency Certificate (EC), and any identification documents you may have, such as photocopies of your passport or Aadhar card. You will also need passport-sized photographs. If you believe your passport was stolen, the embassy may advise you to monitor your personal information and bank accounts for any signs of identity theft or fraud. Informing your bank and credit card companies about the loss is also a prudent step to prevent unauthorized transactions.

In both scenarios whether losing your passport in India or abroad protecting yourself legally is vital. If you believe your passport is lost or stolen, take proactive measures such as notifying your bank and credit card companies, keeping copies of your documents for reference, and consulting legal help if necessary. If your passport has been used fraudulently, a lawyer can provide guidance on how to proceed. By understanding these legal steps and acting promptly, you can effectively navigate the challenges that arise from losing your passport.

“PRIME LEGAL is a full-service law firm in Bangalore that has won a National Award and has more than 20 years of experience in an array of sectors and practice areas. We provide exceptional legal services in family law, divorce law, criminal law, consumer law, civil law, and more.

Don’t face your legal challenges alone! Reach out to Prime Legal for a consultation with the best advocates in Bangalore. Our dedicated team is here to support you and guide you toward a favorable outcome.”

WRITTEN BY: ABHISHEK AIYAPPA.

#best lawyers in bangalore#best law firm in bangalore#legal advice#prime legal#Passport in india#Passport in India and Abroad#Passport in Abroad#Lost your passport in india#Lost your passport in abroad

0 notes

Text

Buy Registered And Unregistered U.S.A Passport

BUY DIPLOMATIC PASSPORT ONLINE BUY US REGISTERED AND UNREGISTERED PASSPORTS ONLINE

In order to enable you to travel outside of security, we guarantee your new identity beginning with the original and new birth certificates, new KTP, driver's license, passport, social security card with SSN, new school card, school report card, and bank statement. All of these documents are issued with YOUR NEW NAME and entered into the government database system. Regarding official checks, your paper bearing the new number is likewise regarded as legitimate. Our primary forms for producing documents are registered and unregistered databases.

Our passports are identical to the actual document and are of excellent quality. All security features are acceptable to us, including laser perforation, latent image, laser image, fluorescent dye, color-changing ink, thread protector, gravure printing, microprinting, special paper, watermark, and laser image.

Why choose Get Novelty Docs as a novelty for passport?

Get Novelty Docs has completed hundreds of orders pertaining to passports. We pledge to give our clients the finest service possible based on this experience. We keep our clients informed of every development that takes place while their passports are being created.

There are instances when you truly need a passport and are trying to find a quick spot to get one. That's what we're here to handle, though. We have accumulated knowledge and maturity in this field over our lengthy tenure in this industry.

Best fake passport seller online, Best producers of fake Polish passport, British Passport for sale online, buy a real passport online, Buy Database British Passport, Buy fake Polish passport, Buy Novelty UK Passport online, Buy Official Polish passport, Buy original Polish passport, Buy Polish passport online, Buy Real Polish passport, Buying UK Passports Online, CHILD PASSPORT, DAMAGED PASSPORT, How to order a passport online, LOST PASSPORT, NAME CHANGE, NEW PASSPORT, Original Poland Passport, PASSPORT RENEWAL, SECOND PASSPORT, STOLEN PASSPORT, buy UK Passport Online, Where to Buy UK passport online

Click here for more information!

0 notes

Text

How to Block a Lost or Stolen Credit Card: A Comprehensive Guide

Losing your credit card or having it stolen can be a stressful experience, but acting quickly can help mitigate potential financial losses. First and foremost, contact your bank's customer service immediately to block your lost or stolen credit card. Most banks have a dedicated helpline available 24/7 for emergencies, allowing you to report the issue promptly. Alternatively, you can often block your card through your bank’s mobile app or online banking portal.

Once you've blocked the card, it's essential to monitor your account for any unauthorized transactions. Report any suspicious activity to your bank as soon as possible, as most institutions have zero liability policies for fraud if reported in a timely manner.

After blocking your card, request a replacement. Your bank will typically send a new card to your registered address within a few days. When you receive it, sign the back and update your PIN to a secure number.

Consider placing a fraud alert on your credit report to protect against identity theft. By taking these steps swiftly, you can minimize the risks associated with a lost or stolen credit card and safeguard your financial well-being. Remember, staying vigilant is key to maintaining your security.

0 notes

Text

How to Regain Control of Your Crypto Assets: A Guide to Recovering Lost Wallets and Reporting Scams

Cryptocurrency offers exciting opportunities, but it also comes with risks. Many people face the frustration of losing access to their wallets or falling victim to reclaim stolen crypto scams. Understanding how to recover lost bitcoin wallets, report broker scams, reclaim stolen crypto, and seek refunds can help restore your peace of mind.

Understanding Bitcoin Wallet Losses

Losing access to a bitcoin wallet can happen for several reasons:

Forgetting passwords

Losing hardware wallets

Accidental deletions

Each scenario can be distressing. However, there are steps you can take to recover your assets.

Tips for Recovering a Lost Bitcoin Wallet

Use Seed Phrases: Most wallets provide a seed phrase when you create them. This phrase can restore your wallet on a compatible platform. If you have it written down, use it.

Check Backup Locations: If you created backups, check all possible locations—cloud storage, USB drives, or even physical copies.

Seek Professional Help: If recovery seems impossible, consider contacting a recovery expert. They can assist you in navigating complex recovery processes.

Reporting Broker Scams

Scams involving cryptocurrency brokers have increased. Knowing how to identify and report these scams can protect others from similar fates.

Signs of a Scam Broker

Promises of high returns with low risk

Lack of regulatory oversight

Pressure to invest quickly

If you suspect you’ve been scammed, act fast.

How to Report a Scam Broker

Gather Evidence: Collect all relevant communication and transaction details. Screenshots and emails can serve as proof.

Report to Regulatory Bodies: In the U.S., report scams to the Federal Trade Commission (FTC) and the Commodity Futures Trading Commission (CFTC).

Contact Local Authorities: File a report with your local law enforcement. They may not recover your funds but can help track scammers.

Notify Your Bank: If you used your bank account, inform them about the scam. They may be able to assist in freezing transactions.

Reclaiming Stolen Cryptocurrency

If someone has stolen your crypto, reclaiming it can be challenging but not impossible. Here’s how to start.

Steps to Reclaim Stolen Crypto

Identify the Theft: Ensure that the transaction was unauthorized. Review your wallet history carefully.

Document Everything: Keep records of all transactions and communications related to the theft.

Contact the Exchange: If the theft occurred through an exchange, contact them immediately. Provide details about the transaction.

Report to Authorities: File a report with local law enforcement. Also, consider notifying the FBI’s Internet Crime Complaint Center (IC3).

Engage with Recovery Services: Some firms specialize in cryptocurrency recovery. They can track stolen funds and help in the recovery process.

Seeking a Refund After a Scam

If you’ve lost money due to a scam, it’s natural to want to get your money back. Here are steps to help you in that pursuit.

Steps to Seek a Refund

Document the Scam: Similar to reporting scams, gather all related evidence. This includes transaction IDs, dates, and amounts.

Contact Your Bank or Credit Card Company: If you made a payment with a credit card or bank transfer, contact your provider. They may offer chargeback options.

File Complaints: In addition to regulatory bodies, consider filing complaints with consumer protection agencies like the Better Business Bureau (BBB).

Consult Legal Professionals: If the amount is significant, consulting with a legal expert can provide guidance on possible actions.

Staying Safe in the Crypto Space

Prevention is always better than recovery. Here are some practices to enhance your security.

Security Best Practices

Use Strong Passwords: Combine letters, numbers, and symbols. Avoid common phrases.

Enable Two-Factor Authentication: This adds an extra layer of protection.

Educate Yourself on Scams: Knowledge is power. Stay updated on the latest scams in the crypto world.

Keep Software Updated: Ensure that your wallets and exchanges have the latest security patches.

Conclusion

Recovering lost bitcoin wallets, reporting broker scams, reclaiming stolen crypto, and seeking refunds can be overwhelming.

However, knowing the right steps to take can significantly improve your chances of success.

By understanding the processes involved and taking proactive measures, you can protect your assets and help others avoid similar pitfalls.

Stay informed, stay secure, and remember that you’re not alone in this journey.

0 notes

Text

How Chime Keeps Your Money Safe and Secure

Chime has a multi-layered approach towards safety and security of one's money. Such commitment makes sure your personal and financial information remains safe. From advanced encryption down to real-time fraud alerts, Chime has a number of security measures whenever it involves securing your account.

There is first the use of robust encryption technology in Chime. It is important for encryption to protect your data from unauthorized access. That is to say, in case anybody intercepts your information, they will never be able to read it. Take, for example, an account being accessed through public Wi-Fi; it's the encryption by Chime that makes any chance of stolen login credentials or any other account details impossible. This is one degree of protection that will play a significant role in ensuring information considered sensitive remains out of the reach of cyber thieves.

Chime also offers real-time fraud alerts that will help you monitor any suspicious activity. In such cases, when there are odd transactions taking place, Chime immediately makes it known to you. Of course, the advantage to this feature would be the ability to act fast in case there were to be a potential security threat. For example, if your card was used in a location or for a purchase you never made, then Chime's alert system would instantly let you know such activities. With this, you can then review the transaction and report fraud immediately, without running the risk of continuing unauthorized transactions.

Another major security feature: the ability to lock your card directly from an app. Anytime you misplace your debit card or suspect it has been stolen, you can instantly lock it right from within the Chime application. The feature locks down any person from using your card for purchases until you unlock or report it lost. For many, this comes in very handy, especially when on a far-off journey, and during periods like these—with the crowded shopping season—losing a card is given major thought.

Another very significant factor contributing to the safety of your money is the fact that Chime partners with well-established banks. The money resting in Chime remains within accounts that are covered by the Federal Deposit Insurance Corporation. This essentially means that account holders are covered to a tune of up to $250,000 should Chime go through some financial troubles. However, even then, your cash would still be protected from anything that may go wrong with Chime per se.

Lastly, Chime offers ease of customer support in regard to any security issues. That is, when one has an issue or question about his account security, he can always reach out to the company's support service. Their commitment to good customer service will have you solving any security concerns in an easy and timely manner. By implementing these broad-ranging security features, Chime aims to provide safe and reliable banking to all its customers.

0 notes

Text

How Much Can You Withdraw from a Cash App Card Per ATM Transaction?

In the digital age, financial transactions have shifted from traditional banking methods to more convenient and accessible mobile apps. Cash App is one of the most popular mobile payment services, allowing users to send and receive money, pay bills, and even invest in stocks and Bitcoin with just a few taps on their smartphones. One of the standout features of Cash App is its Cash Card—a customizable debit card linked directly to your Cash App balance, which can be used to make purchases or withdraw cash at ATMs.

However, like any financial service, Cash App limits how much money you can withdraw from an ATM using your Cash Card. These limits are crucial to understanding whether you rely on Cash App for daily expenses or frequently withdraw cash. In this blog, we'll explore the Cash App ATM limit, how it works, and how you can increase it if necessary. We'll also address some frequently asked questions to ensure you have all the information you need to manage your Cash App Card effectively.

What is the Cash App ATM Limit?

The Cash App ATM limit refers to the maximum amount of money you can withdraw from an ATM using your Cash Card within a specific period. As of the latest update, the standard ATM withdrawal limit for Cash App users is:

$310 per transaction

$1,000 per day

$1,000 per week

These limits are in place to protect users from potential fraud and unauthorised transactions while ensuring that Cash App can comply with financial regulations.

How Does the Cash App ATM Limit Work?

Understanding how the Cash App ATM limit works is essential for managing your finances effectively. The limits are structured to provide a balance between convenience and security. Here's a breakdown of how these limits apply:

Per Transaction Limit: The maximum amount you can withdraw in a single ATM transaction is $310. If you need to withdraw more, you'll have to make multiple transactions, keeping the daily and weekly limits in mind.

Daily Withdrawal Limit: You can withdraw up to $1,000 from an ATM using your Cash App Card within 24 hours. This limit resets every day, so if you reach the maximum amount, you'll need to wait until the next day to make additional withdrawals.

Weekly Withdrawal Limit: The Cash App weekly withdrawal limit is also $1,000, meaning you cannot withdraw more than this amount from an ATM within seven days. This limit resets every week.

Why Do Cash App Have ATM Limits?

ATM limits are a common feature of most debit cards, including those offered by traditional banks. Cash App's ATM limits serve several important purposes:

Security: By limiting the amount of money that can be withdrawn from an ATM, Cash App reduces the risk of unauthorised transactions and potential fraud. If your Cash Card is lost or stolen, these limits help minimise the amount of money that can be taken from your account.

Compliance with Regulations: Financial services like Cash App must adhere to various regulations related to money laundering and fraud prevention. ATM limits help Cash App stay compliant with these regulations.

Manage Cash Flow: The Cash App's limits also help the platform manage its cash flow and ensure that it can meet the needs of all its users.

How to Increase ATM Limit on Cash App

If you find that the standard ATM limits on Cash App are too restrictive, there are steps you can take to increase them. Here's how to increase ATM limits on Cash App by account verification:

Your full legal name

Date of birth

The last four digits of your Social Security Number (SSN)

A clear photo of a government-issued ID (such as a driver's license or passport)

Once your identity is verified, you may be eligible for higher withdrawal limits. While the increase varies, some users have reported receiving daily limits of up to $2,500.

Managing Your Cash App ATM Withdrawals

Even with higher ATM limits, managing your withdrawals wisely is essential. Here are some tips to help you make the most of your Cash App Card:

Plan Your Withdrawals: If you know you'll need more cash than your daily or weekly limit allows, plan your withdrawals. This might mean spreading them out over multiple days or weeks.

Use Multiple Cards: If you frequently need to withdraw large amounts of cash, consider using multiple debit cards (including those from traditional banks) to spread out your withdrawals.

Monitor Your Limits: Keep track of your daily and weekly withdrawals to avoid hitting your limit unexpectedly. You can check your remaining limit within the Cash App by navigating to the "Profile" section and viewing your "Limits."

FAQs About Cash App ATM Limits

1. What is the Cash App ATM withdrawal limit per day?

The standard Cash App ATM withdrawal limit per day is $1,000. This limit applies to all withdrawals made within 24 hours and resets daily.

2. Can I increase my Cash App ATM limit?

You can increase Cash App ATM limit by verifying your identity, enabling direct deposits, and maintaining a positive transaction history. Contacting Cash App support for further assistance may also help.

3. How much can I withdraw from a Cash App Card at an ATM per transaction?

The maximum amount you can withdraw from an ATM using your Cash App Card in a single transaction is $310.

4. What is the Cash App ATM withdrawal limit per week?

The Cash App weekly ATM withdrawal limit is $1,000. This limit applies to all ATM withdrawals made within seven days and resets every week.

5. How do I check my Cash App ATM limit?

You can check your Cash App ATM limit by navigating to the "Profile" section within the app and viewing the "Limits" section.

6. What should I do if I reach my Cash App ATM limit?

If you reach your ATM limit, you'll need to wait until the limit resets (either daily or weekly) to make additional withdrawals. You can also consider using other debit cards if you need more cash immediately.

7. Does setting up direct deposits affect my ATM limit?

Setting up direct deposits into your Cash App account can increase your ATM limit. Cash App often grants higher limits to users who receive regular direct deposits.

8. Can I withdraw more than the Cash App ATM limit by making multiple transactions?

You cannot exceed the daily or weekly ATM withdrawal limits while making multiple transactions. The limits apply to the total amount withdrawn within the specified period.

9. How does Cash App ensure the security of my ATM withdrawals?

Cash App's ATM limits are part of its broader security measures to protect users from fraud and unauthorized transactions. Additionally, Cash App uses encryption and two-factor authentication to safeguard your account.

10. What are the ATM fees associated with Cash App withdrawals?

Cash App charges a $2.50 fee per ATM withdrawal. However, if you have set up direct deposits, Cash App will reimburse ATM fees for up to three withdrawals per 31 days.

Conclusion

Understanding and managing your Cash App ATM limits is essential for making the most of your Cash Card. While the standard limits may be sufficient for some users, others may find them restrictive, mainly if they rely heavily on cash withdrawals. By verifying your identity, enabling direct deposits, and maintaining a positive transaction history, you can increase your ATM limits and enjoy greater flexibility with your Cash App Card.

Remember, these limits are in place to protect you and ensure the security of your account. By staying informed and managing your withdrawals wisely, you can navigate the limitations effectively and continue to enjoy the convenience that Cash App offers. Whether you're a casual user or someone who frequently withdraws cash, understanding these limits will help you maximise the utility of your Cash App Card.

#cash app atm withdrawal limit#increase cash app withdrawal limit#cash app atm withdrawal limit per day#cash app daily atm withdrawal limit#cash app withdrawal limit#cash app card atm withdrawal limit per week

1 note

·

View note

Text

Zelle says it's up to the police to stop scams

New Post has been published on https://sa7ab.info/2024/08/11/zelle-says-its-up-to-the-police-to-stop-scams-2/

Zelle says it's up to the police to stop scams

A government agency is investigating after a series of scams on payment apps like Zelle.NurPhoto/Getty ImagesFederal authorities are investigating how banks reimburse consumers who are scammed on Zelle.Lawmakers say the banks behind payment apps need to offer more protections.Zelle says it should fall on law enforcement to stop the scammers.Scams on payment apps like Zelle are getting so out of hand that federal authorities are starting to investigate.This week, the Consumer Financial Protection Bureau launched an investigation into JP Morgan, Bank of America, and Wells Fargo — all part owners of Zelle — after Sen. Richard Blumenthal wrote a letter to the agency.The Senate's Permanent Subcommittee on Investigations found that reimbursements from the three banks for transactions that Zelle users disputed fell from 62% in 2019 to 38% in 2023, Blumenthal said in the letter."PSI's investigation of the three banks indicates that they provide their respective employees with broad discretion to determine whether a disputed transaction is unauthorized, and, in turn, whether a consumer is entitled to reimbursement," the letter says.Zelle's chief fraud risk manager, Ben Chance, meanwhile, told Fortune that the app is doing everything it can to minimize the risk of scams. He also told the outlet that the best way to prevent scams on money-sharing apps is better user education, sound policy and more funding for law enforcement."The real solution is to focus on the criminals who are perpetrating these crimes across phone, text message, email, digital marketplaces, and social media platforms…and of course, partnering with those platforms, along with financial services and law enforcement in the prosecution and removal of these criminal actors," Chance told the outlet.But even for law enforcement, money lost in a scam can be difficult to recover. On August 2, Democrats in Congress introduced a bill that would give increased reimbursement protections to people who lose money to scams on peer-to-peer payment apps.The Protecting Consumers from Payment Scams Act, proposed by Rep. Maxine Waters, Sen. Richard Blumenthal, and Sen. Elizabeth Warren, would increase financial institutions' responsibility for helping consumers resolve fraud disputes.Consumers can be reimbursed for unauthorized transactions under existing federal law, like purchases on a stolen credit card. However, getting money back after sending it through Zelle or other payment apps is much more difficult.If you accidentally send money to a scammer, the Federal Trade Commission recommends asking the company you send the money through if there's a way to recover the funds. If you lose the money through a money transfer app, the agency says to report the fraudulent transaction to the app's parent company."If you linked the app to a credit card or debit card, report the fraud to your credit card company or bank. Ask them to reverse the charge," the FTC says.Zelle did not immediately return a request for comment from Business Insider on Saturday.

0 notes

Text

Understanding the Emirates ID: A Comprehensive Guide:

The Emirates ID is an essential identification card for residents of the United Arab Emirates (UAE). Issued by the Federal Authority for Identity and Citizenship (ICA), it plays a crucial role in various administrative, legal, and daily activities in the UAE. Here's a detailed look into what the Emirates ID is, its importance, how to obtain it, and its uses.

What is the Emirates ID?

The Emirates ID is a mandatory identification card for UAE citizens and residents. It features a unique identification number and contains personal details, including the holder’s name, photo, and biometric information. This card is part of the UAE's effort to streamline administrative processes and enhance security.

Key Features

Biometric Data: The Emirates ID incorporates biometric information, including fingerprints and facial recognition data, to ensure the accuracy of identification.

Digital Integration: The card is integrated into various governmental and private sector services, making it a central part of the UAE’s digital infrastructure.

Smart Technology: It features a chip that holds encrypted data, enhancing security and reducing the risk of fraud.

Importance of the Emirates ID

Legal Requirement: It is mandatory for all UAE residents to have an Emirates ID. It is used for various legal and administrative processes.

Access to Services: The Emirates ID is required for accessing a wide range of services, including healthcare, banking, and government services.

Security and Fraud Prevention: The biometric data helps prevent identity fraud and ensures the security of personal information.

Travel: It can be used as a travel document within the Gulf Cooperation Council (GCC) countries.

How to Obtain an Emirates ID

Eligibility: All UAE residents, including expatriates, are required to obtain an Emirates ID. Citizens and residents must apply within 120 days of obtaining residency.

Application Process:

For UAE Nationals: Apply through the ICA or designated registration centers.

For Expatriates: Apply through the ICA website or designated typing centers.

Documents Required:

For UAE Nationals: Birth certificate, passport, and family book.

For Expatriates: Passport, residency visa, and a completed application form.

Biometric Enrollment: Both UAE nationals and expatriates must undergo a biometric scan during the application process.

Fees: The cost of obtaining an Emirates ID varies depending on the duration of validity (usually 1, 2, or 3 years).

Processing Time: The process typically takes a few weeks. Applicants can track the status of their application online.

Using the Emirates ID

Healthcare: The Emirates ID is used to access healthcare services and is linked to health insurance plans.

Banking and Financial Services: It is required for opening bank accounts and conducting financial transactions.

Government Services: It is necessary for various governmental transactions, such as renewing a driving license or accessing public services.

Voting and Elections: UAE citizens use their Emirates ID to participate in local elections and other voting processes.

Travel: The card can be used for travel within the GCC countries and serves as an official document for identification.

Renewal and Replacement

Renewal: Emirates IDs must be renewed before they expire. The renewal process involves updating personal information if necessary and paying the applicable fee.

Replacement: If an ID is lost or stolen, it must be reported to the ICA and a replacement card can be issued.

Future Developments

The Emirates ID continues to evolve with advancements in technology. Future updates may include enhanced security features, broader integration with digital services, and increased ease of use for residents and visitors.

Conclusion

The Emirates ID is more than just an identification card; it is a cornerstone of the UAE’s administrative and security infrastructure. Understanding its features, importance, and the application process is essential for anyone living in or visiting the UAE. As the UAE continues to innovate and integrate technology into everyday life, the Emirates ID will remain a vital tool in facilitating efficient and secure interactions within the country.

1 note

·

View note

Text

Lost or Stolen Credit Card? Immediate Steps to Take

Losing your credit card or having it stolen can be a stressful experience, but taking prompt and decisive action can help protect your finances and personal information. Here are the immediate steps you should take if your credit card is lost or stolen in India.

1. Report the Loss Immediately

The first and most crucial step is to report the loss to your credit card issuer as soon as possible. Most banks in India provide 24/7 customer service for such emergencies. Here’s how to proceed:

a. Call Customer Service: Locate the customer service number on your credit card statement or the bank's website. Inform the representative that your card has been lost or stolen.

b. Use Mobile Banking Apps: Many banks offer the option to report a lost or stolen card via their mobile apps. This feature allows you to block your card instantly and request a replacement.

c. Online Banking: If you have access to online banking, log in and navigate to the section for reporting lost or stolen cards. Follow the prompts to block your card and request a new one.

2. Monitor Your Account for Unauthorized Transactions

After reporting your lost or stolen card, closely monitor your credit card statement and online account for any unauthorized transactions. Most banks provide real-time notifications for transactions, helping you quickly identify suspicious activity. If you notice any unauthorized charges, report them to your bank immediately for investigation.

3. File a Police Report

Filing a police report is essential, especially if your card was stolen. This report can be helpful for your bank’s investigation and any insurance claims you might need to make. Provide as much detail as possible about the loss or theft, including the last known use of the card and any unauthorized transactions.

4. Notify Credit Bureaus

Informing credit bureaus about your lost or stolen card can help protect your credit score and prevent identity theft. In India, you can contact major credit bureaus like CIBIL, Experian, and Equifax. Request a fraud alert on your credit report, which will make it harder for fraudsters to open new accounts in your name.

5. Update Automatic Payments

If you have automatic payments set up with your lost or stolen card, update your payment information with the new card details once you receive it. This step ensures that your regular payments, such as utility bills, subscriptions, and loan EMIs, are not disrupted.

6. Review and Change Online Account Details

Review your online accounts where you have saved your credit card information, such as e-commerce sites and online services. Remove the lost or stolen card details and update them with your new card information. Changing your account passwords can also enhance security.

7. Set Up Transaction Alerts

To enhance security and stay informed about your account activity, set up transaction alerts with your bank. These alerts notify you of any transactions made with your card, allowing you to quickly spot and report any unauthorized activity.

8. Monitor Your Credit Report

Regularly monitoring your credit report can help you detect any unusual activity that may indicate identity theft. You can request a free credit report once a year from each of the major credit bureaus in India. Look for any accounts or inquiries you don’t recognize and report them immediately.

9. Secure Your Personal Information

Ensure your personal information is secure to prevent further fraud. Shred any documents containing sensitive information before discarding them. Be cautious about sharing personal details over the phone or online, especially with unsolicited contacts.

Conclusion

Losing your credit card or having it stolen can be alarming, but taking immediate and systematic action can help mitigate the risks and protect your finances. Report the loss promptly, monitor your accounts, and keep your personal information secure. By staying vigilant and proactive, you can minimize the impact of such incidents and maintain your financial security.

0 notes

Text

Checking the Status of Your NID Smart Card

Have you recently applied for a National Identity (NID) Smart Card and are eager to know its status? Keeping track of your NID Smart Card application status is crucial to ensure that all your information is accurate and up to date. In this article, we will guide you on how to check the status of your NID Smart Card so you can stay informed throughout the process. Whether you applied for your NID Smart Card online or offline, it is important to regularly check its status to see if there are any updates or issues with your application. By checking the status of your NID Smart Card, you can verify that all your personal information is correct and that your card is being processed in a timely manner. Stay tuned as we provide you with the necessary steps to easily track the status of your NID Smart Card and ensure a smooth application process.

Importance of checking NID Smart Card status Ways to check NID Smart Card status online How to check NID Smart Card status through SMS Common issues when checking NID Smart Card status Tips for resolving NID Smart Card status related problems

Importance of checking NID Smart Card status

In today's fast-paced world, having a valid NID Smart Card is essential for various purposes, from voting in elections to opening a bank account or even applying for a passport. As such, it is crucial to regularly check the status of your NID Smart Card to ensure that it is up to date and valid. One of the main reasons why it is important to check the status of your NID Smart Card is to ensure that you are able to exercise your right to vote in elections. Without a valid NID Smart Card, you may not be able to cast your vote, which is a fundamental right in a democratic society. By regularly checking the status of your NID Smart Card, you can ensure that you are able to participate in the electoral process and have your voice heard. Another important reason to check the status of your NID Smart Card is for identification purposes. Your NID Smart Card serves as a primary form of identification in various situations, such as when opening a bank account, applying for a job, or accessing government services. By keeping your NID Smart Card up to date, you can avoid any complications or delays when trying to prove your identity. Moreover, checking the status of your NID Smart Card can also help prevent identity theft and fraud. If your NID Smart Card is lost or stolen, you can report it immediately and take the necessary steps to protect your identity and prevent any unauthorized use of your card. By monitoring the status of your NID Smart Card regularly, you can detect any suspicious activity and take action before it escalates into a more serious problem. Additionally, having an updated NID Smart Card can also make your life more convenient. With a valid NID Smart Card, you can easily access various services and benefits without any hassle or delay. Whether you need to apply for a loan, renew your driver's license, or prove your age for a certain purchase, having a valid NID Smart Card can simplify the process and save you time and effort. In conclusion, checking the status of your NID Smart Card is essential for various reasons, including ensuring your right to vote, protecting your identity, and making your life more convenient. By staying on top of the status of your NID Smart Card, you can avoid any issues or complications that may arise from having an outdated or invalid card. So, take the time to check the status of your NID Smart Card regularly and ensure that it is valid and up to date. Your future self will thank you for it.

Ways to check NID Smart Card status online

If you're eagerly awaiting the arrival of your National ID (NID) Smart Card, you'll want to stay updated on its status to know when it's ready for collection. Thankfully, there are several convenient ways to check the status of your NID Smart Card online. One of the easiest ways to check your NID Smart Card status is by visiting the official website of the Bangladesh Election Commission. Once on the website, look for the option to check the NID Smart Card status. You will be prompted to enter your tracking number, which you would have received at the time of applying for your NID Smart Card. Once you enter the tracking number, the website will display the current status of your NID Smart Card, whether it's in production, ready for collection, or already dispatched. If you prefer to use your mobile phone to check the status of your NID Smart Card, you can simply send an SMS to a designated number provided by the Bangladesh Election Commission. In the SMS, you will need to include certain details such as your NID number and date of birth. After sending the SMS, you will receive a response with the current status of your NID Smart Card. Another way to check the status of your NID Smart Card online is by visiting the official website of the Smart National ID Card Project. On the website, navigate to the section where you can check the status of your NID Smart Card. Similar to the Bangladesh Election Commission website, you will need to enter your tracking number to view the status of your NID Smart Card. The website will provide real-time updates on the progress of your NID Smart Card, so you can stay informed every step of the way. For those who prefer using mobile apps, there are also options available to check the status of your NID Smart Card on the go. Several apps have been developed to provide users with quick and easy access to their NID Smart Card status. By downloading one of these apps and entering your tracking number, you can see the current status of your NID Smart Card in just a few taps on your phone. If you have access to a computer or laptop, you can also check the status of your NID Smart Card through various online platforms. Simply perform a quick search on the internet for websites that offer NID Smart Card status checking services. Once you find a reputable website, enter your tracking number to view the latest updates on your NID Smart Card status. In conclusion, checking the status of your NID Smart Card online is a simple and convenient process that can be done from the comfort of your home or on the go. By utilizing the official websites of the Bangladesh Election Commission and the Smart National ID Card Project, as well as mobile apps and online platforms, you can easily track the progress of your NID Smart Card and know exactly when it's ready for collection. Stay informed and stay up to date on the status of your NID Smart Card today!

How to check NID Smart Card status through SMS

If you're waiting for your NID Smart Card and eager to know its status, there's an easy way to do so through SMS. By following these simple steps, you can quickly check the status of your NID Smart Card without any hassle. To begin, grab your mobile phone and make sure you have a signal to send an SMS. Open your messaging app and create a new message. In the recipient field, type in the designated number for checking NID Smart Card status. Next, type in the following information in the message body: NID

Common issues when checking NID Smart Card status

When it comes to checking the status of your NID Smart Card, there are a few common issues that people often face. One of the most common problems is not knowing where to go to check the status in the first place. Some people might assume that they can check online, while others might think they need to visit a specific office or center in person. Another issue that people often encounter is not having the necessary information or documentation to check the status. In some cases, you may need to provide your NID number, date of birth, or other personal details to access the status of your Smart Card. If you don't have this information readily available, it can be frustrating trying to track down the necessary details. Additionally, technical issues can also arise when attempting to check the status of your NID Smart Card. This could include problems with the website or portal you are using to check the status, such as pages not loading properly or error messages popping up. It could also be due to internet connectivity issues, which can prevent you from accessing the necessary information. If you are experiencing any of these common issues when trying to check the status of your NID Smart Card, it is important to remain calm and patient. The process can be frustrating, but there are usually ways to resolve these problems. To start, make sure you are checking the status through the official website or portal provided by the relevant government agency. This will help ensure that you are accessing accurate and up-to-date information about your Smart Card. If you are having trouble accessing the necessary information or documentation, reach out to the appropriate authorities for assistance. They may be able to provide you with guidance on what information is needed and how to obtain it. If technical issues are preventing you from checking the status online, try accessing the website or portal from a different device or internet connection. This can help determine if the issue is with your current setup or if there is a larger problem with the system. It is also a good idea to double-check any information you are inputting when trying to check the status of your NID Smart Card. Make sure that you are entering your details correctly and that there are no typos or mistakes in the information you are providing. Overall, while encountering common issues when trying to check the status of your NID Smart Card can be frustrating, there are steps you can take to address these problems. By staying patient, reaching out for assistance when needed, and ensuring that you are using the correct methods to check the status, you can hopefully resolve any issues and obtain the information you need about your Smart Card.

Tips for resolving NID Smart Card status related problems

If you're facing issues with your NID Smart Card status, don't worry, you're not alone. Many people encounter problems with their NID Smart Cards, but there are ways to resolve these issues. Here are some tips to help you with any status-related problems you may be experiencing. First and foremost, make sure you have all the necessary documents and information ready. This includes your NID number, date of birth, and any other relevant details. Having this information on hand will make it easier for you to communicate with the authorities and provide them with the required information. If you're having trouble checking the status of your NID Smart Card online, try using a different browser or device. Sometimes, technical issues can prevent you from accessing the website or portal where you can check the status of your card. Switching to a different browser or device might help resolve this problem. If you're still unable to check the status online, consider reaching out to the relevant authorities for assistance. You can contact the NID wing of the Election Commission or visit their office in person to inquire about the status of your card. They may be able to provide you with the information you need and assist you in resolving any issues. If you've applied for a new NID Smart Card and haven't received it within the expected timeframe, it's important to follow up on your application. Reach out to the authorities to inquire about the status of your card and find out if there are any delays or issues that need to be addressed. In some cases, errors or discrepancies in your application can lead to delays in processing your NID Smart Card. Make sure to review your application and double-check all the information you've provided. If you spot any mistakes or inaccuracies, inform the authorities immediately so that they can rectify the issue and expedite the processing of your card. If you're experiencing difficulties with your NID Smart Card after receiving it, such as the card not working or being damaged, contact the authorities for guidance. They may be able to provide you with a replacement card or assist you in resolving any technical issues you're facing. It's important to stay patient and persistent when dealing with NID Smart Card status-related problems. Remember that such issues are not uncommon, and with the right approach and communication, you can resolve them effectively. Don't hesitate to seek help from the authorities or reach out to others who may have faced similar challenges. By following these tips and staying proactive in addressing any NID Smart Card status-related problems, you can ensure that you have a smooth and hassle-free experience with your card. Remember to stay informed, keep your documents handy, and reach out for assistance whenever needed. With the right approach, you can overcome any obstacles and enjoy the benefits of having an NID Smart Card.

In conclusion, it is important to regularly check the status of your NID smart card to ensure that it is up to date and you have the correct information on file. By following the simple steps outlined in this article, you can easily verify the status of your smart card and make any necessary updates. Remember, your NID smart card is an important piece of identification, so make sure you keep it current and accurate.

1 note

·

View note

Text

Non Vbv Credit Cards

Non Vbv Credit Cards

In general, it is unlikely for reputable banks or financial institutions to offer Non Vbv credit cards because VBV is an important security measure that helps prevent fraud and protect cardholders from identity theft. cc sites

By requiring additional authentication during online transactions, VBV helps to ensure that the person using the card is the legitimate cardholder. buy credit card numbers with cvv

It is possible that Non Vbv credit cards may be available through less reputable sources or in countries where VBV is not widely used or supported. buy cc

However, the use of Non Vbv credit cards for any illegal or unethical activities can result in severe legal and financial consequences. It is always recommended to use financial products and services in a legitimate and responsible manner.

Some common methods used by cybercriminals to steal Non Vbv credit cards information online include:

Phishing scams: Criminals send fraudulent emails or text messages that appear to be from a legitimate company, asking the recipient to provide their credit card information.

Skimming: Criminals use a small device called a skimmer to steal credit card information when a card is swiped at a point of sale terminal or an ATM.

Malware: Criminals use malicious software to infect a victim’s computer or mobile device and steal credit card information.

Data breaches: Large-scale data breaches of retailers, financial institutions, and other organizations can result in the theft of millions of credit card numbers.

To protect yourself from credit card theft online, it’s important to use strong, unique passwords, be wary of suspicious emails or messages, monitor your credit card statements regularly, and use reputable antivirus software to protect your devices.

If you suspect that your credit card information has been stolen, you should contact your credit card company immediately to report the unauthorized activity and request a replacement card.

Frequently asked questions about credit cards:-

What is a credit card? A credit card is a plastic card that allows you to borrow money from a lender to make purchases. The borrowed money must be repaid with interest.

What are the benefits of having a credit card? Credit cards can provide benefits such as cashback, rewards points, and purchase protection. They also offer a convenient way to make purchases and can help build your credit score if used responsibly.

What is an APR? APR stands for Annual Percentage Rate and is the interest rate charged on the balance carried on a credit card. It includes both the interest rate and any fees associated with the card.

What is a credit limit? A credit limit is the maximum amount of money you can borrow on your credit card. This limit is determined by the credit card issuer based on factors such as your credit history and income.

What is a minimum payment? A minimum payment is the smallest amount you must pay on your credit card balance each month to avoid late fees and penalties.

However, it’s important to note that making only the minimum payment will result in accruing more interest and taking longer to pay off the balance.

What is a credit score? A credit score is a number that represents your creditworthiness and is based on your credit history. A higher credit score generally means you are more likely to be approved for credit and receive better interest rates.

How can I improve my credit score? To improve your credit score, you can make sure to pay your bills on time, keep your credit card balances low.

avoid opening too many new credit accounts at once. It’s also a good idea to regularly check your credit report for errors and dispute any inaccuracies.

What should I do if my credit card is lost or stolen? If your credit card is lost or stolen, you should contact your card issuer immediately to report it and have the card canceled. This will prevent unauthorized charges from being made on your account.

Overall, it is important to note that the use of non-VBV credit cards for any illegal or unethical activities is highly discouraged and can result in severe legal and financial consequences. It is always recommended to use financial products and services in a legitimate and responsible manner.

0 notes

Text

How to Recover Money from Binary Options Scam — Recover lost money

How to Recover Money from a Binary Options Scam — Recover Lost Money

Binary options scams have become increasingly prevalent, leaving many victims with significant financial losses. However, there is hope for those affected by these fraudulent schemes. This article will guide you through the steps to recover your lost money, highlighting the expertise of Recuva Hacker Solutions in assisting victims of binary options scams.

Understanding Binary Options Scams

Binary options are financial instruments that allow investors to predict the price movement of assets such as stocks, commodities, or currencies within a specified time frame. Legitimate binary options trading can be risky but potentially profitable. Unfortunately, fraudulent platforms have exploited this market, luring investors with promises of high returns and minimal risk, only to steal their funds.

Steps to Recover Money from a Binary Options Scam

Step 1: Gather Evidence

Before taking any action, collect all relevant evidence related to the scam. This includes:

- Emails and communication with the scam company

- Transaction records and bank statements

- Screenshots of the trading platform and website

- Any contracts or agreements you signed

Having comprehensive documentation will strengthen your case and aid in the recovery process.

Step 2: Report the Scam

Report the scam to relevant authorities, such as:

- Your local police department

- Financial regulatory bodies in your country

- Online trading regulatory organizations (e.g., the Commodity Futures Trading Commission in the U.S.)

- Consumer protection agencies

Filing a report helps initiate an official investigation and may prevent others from falling victim to the same scam.

Step 3: Contact Your Bank or Payment Provider

If you transferred funds to the scam company via bank transfer or credit card, contact your bank or payment provider immediately. They might be able to reverse the transaction or provide additional assistance in recovering your funds.

Step 4: Engage with Online Communities

Join online forums and communities dedicated to binary options trading and financial fraud. These platforms can provide valuable advice, support, and potentially connect you with others who have successfully recovered their funds.

Hiring Experts for Recovery: Recuva Hacker Solutions

While the above steps are essential, they might not be sufficient to recover your lost money from sophisticated scams. This is where professional recovery services like Recuva Hacker Solutions come into play.

Why Choose Recuva Hacker Solutions?

Recuva Hacker Solutions is a leading company specializing in the recovery of funds lost to binary options scams and other financial fraud. Here’s why they stand out:

1. Expertise and Experience

Recuva Hacker Solutions has a team of seasoned professionals with extensive experience in cybersecurity, digital forensics, and financial fraud recovery. Their expertise enables them to navigate complex scam structures and track down stolen funds effectively.

2. Advanced Technology

Utilizing cutting-edge technology and forensic tools, Recuva Hacker Solutions can trace transactions and identify the movement of stolen assets. This technological edge significantly enhances the chances of recovering your money.

3. Legal Support

The company collaborates with legal experts to pursue legal action against fraudulent brokers if necessary. They can help initiate lawsuits, negotiate settlements, and work with regulatory bodies to hold scammers accountable.

4. Comprehensive Investigations

Recuva Hacker Solutions conducts thorough investigations into each case, ensuring no stone is left unturned. Their detailed approach increases the likelihood of a successful recovery.

How to Get Started with Recuva Hacker Solutions

If you have been a victim of a binary options scam, contacting Recuva Hacker Solutions is a crucial step toward recovering your lost funds. Here’s how you can reach them:

- Email: [recuvahackersolutions @ inbox . lv

- Phone: +1 (315) (756)(1228)

Recovering money from a binary options scam is challenging but not impossible. By taking immediate action, gathering evidence, reporting the scam, and seeking professional help from experts like Recuva Hacker Solutions, you can significantly improve your chances of reclaiming your lost funds. Don't let scammers get away with your hard-earned money—start your recovery journey today with the right support and resources.

0 notes

Text

What Time Does Venmo Direct Deposit Hit? Timing Your Transactions

Venmo Direct Deposit is a feature that allows users to receive their paycheck, government benefits, and other payments directly into their Venmo account. This service offers convenience and speed, making it a popular choice for many Venmo users. In this article, we'll explore what Venmo Direct Deposit is, how it works, and answer some common questions about the service.

What is Venmo Direct Deposit?

Venmo Direct Deposit is a service provided by Venmo that enables users to have their paychecks or other recurring payments deposited directly into their Venmo account. This eliminates the need for physical checks and provides faster access to funds. Users can use these funds to make payments, transfer money to their bank account, or withdraw cash from ATMs using the Venmo card.

Setting Up Venmo Direct Deposit

To set up Venmo Direct Deposit, follow these steps:

Go to the "Settings" tab in your Venmo app.

Select "Direct Deposit" and note the routing and account numbers provided.

Provide these numbers to your employer or payment issuer.

Once set up, your payments will automatically be deposited into your Venmo account.

What Time Does Venmo Direct Deposit Hit?

Venmo Direct Deposit typically arrives in your account by 9:00 AM on your payday. However, the exact timing can vary depending on your employer's payment processing and Venmo's processing time. It's always a good idea to check your account on the morning of your expected payday to confirm the deposit.

Does Venmo Direct Deposit Early?

Yes, Venmo offers an early direct deposit feature that allows users to receive their paycheck up to two days earlier than the traditional payday. This feature depends on when Venmo receives the payment instructions from your employer, so the actual timing may vary.

Advantages of Venmo Direct Deposit

The main advantages of Venmo Direct Deposit include:

Convenience: No need to deposit physical checks or wait for funds to clear.

Speed: Access your funds faster, often on the same day your paycheck is issued.

Security: Secure electronic transfer reduces the risk of lost or stolen checks.

Common Questions About Venmo Direct Deposit

Eligibility: Most employers and government agencies can deposit funds into your Venmo account.

Fees: Venmo does not charge a fee for direct deposits.

Limits: There are limits on how much you can receive and transfer from your Venmo account. Check Venmo's website for the latest limits.

Comparing Venmo Direct Deposit to Other Methods

Compared to traditional bank transfers or other payment apps, Venmo Direct Deposit offers a faster and more convenient way to access your funds. However, it's important to consider factors like transaction limits and the availability of features like early direct deposit when choosing the best service for your needs.

Managing Your Venmo Direct Deposit

To manage your Direct Deposit Venmo, you can update your personal information, monitor your transactions, and make adjustments to your deposit settings directly through the Venmo app. This allows you to stay in control of your finances and ensure that your deposits are processed smoothly.

Safety and Security of Venmo Direct Deposit

Venmo uses encryption and other security measures to protect your personal and financial information. Additionally, following best practices like using strong passwords and enabling two-factor authentication can further enhance the security of your Venmo account.

Troubleshooting Venmo Direct Deposit Issues

If you encounter issues with your Venmo Direct Deposit, such as delayed deposits or error messages, check your account information for accuracy, ensure your employer has the correct details, and contact Venmo support for assistance.

User Experiences with Venmo Direct Deposit

Overall, many users have positive experiences with Venmo Direct Deposit, citing its convenience and speed. However, some users have reported issues with pending transactions or delays in receiving their funds. It's important to read reviews and consider other users' experiences when deciding if Venmo Direct Deposit is right for you.

Future of Venmo Direct Deposit

As Venmo continues to expand its services, we can expect to see enhancements to the Direct Deposit feature, such as increased limits, improved processing times, and additional security measures.

Conclusion

Venmo Direct Deposit offers a convenient and efficient way to receive your paycheck and other payments directly into your Venmo account. By understanding how the service works and addressing any potential issues, you can make the most of this feature and enjoy faster access to your funds.

FAQs

Can I cancel a Venmo Direct Deposit?

Once a direct deposit has been initiated, it cannot be canceled. However, you can update your direct deposit settings for future payments.

How do I know if my Venmo Direct Deposit is set up correctly?

You will receive a confirmation from Venmo once your direct deposit is set up. You can also verify your account and routing numbers in the Venmo app.

Can I deposit a physical check into my Venmo account?

Currently, Venmo does not support depositing physical checks into your account. You can only receive direct deposits electronically.

What should I do if my Venmo Direct Deposit is late?

If your direct deposit is late, check with your employer to ensure the payment was processed on their end. If everything is in order, contact Venmo support for assistance.

Can I split my direct deposit between my Venmo account and another bank account?

Yes, you can split your direct deposit between your Venmo account and another bank account. Provide your employer with the routing and account numbers for both accounts and specify the amount or percentage to be deposited into each.

0 notes

Text

How to Manage Your Bank of America Credit Card?

Managing your Bank of America/Activate credit card involves several key steps to ensure responsible usage, security, and maximizing benefits. Here's a comprehensive guide:

Activate Your Card: Once you receive your Bank of America credit card, follow the instructions provided to activate it. This is typically done through a toll-free number or online via the Bank of America website or mobile app.

Set Up Online Banking: Register for online banking with Bank of America if you haven't already. This allows you to access your account anytime, anywhere, to check your balance, view transactions, make payments, and manage account preferences.

Secure Your Card: Keep your credit card in a safe place and never share your card information with anyone. If your card is lost or stolen, report it immediately to Bank of America to prevent unauthorized use.

Monitor Transactions: Regularly review your credit card transactions online or through the mobile app to ensure they are accurate and authorized. If you notice any unfamiliar charges, report them to Bank of America immediately.

Set Up Account Alerts: Take advantage of Bank of America's alert features to receive notifications about account activity, such as large purchases, low balances, or payment due dates. This helps you stay informed and detect any potential fraud or overspending.

Pay Your Bill On Time: Make timely payments on your credit card bill to avoid late fees and negative impacts on your credit score. You can set up automatic payments through online banking to ensure payments are made by the due date each month.

Manage Your Credit Limit: Be mindful of your credit limit and avoid maxing out your credit card. Keeping your credit utilization ratio below 30% is recommended to maintain a healthy credit score.

Review Your Statements: Carefully review your monthly credit card statements to verify charges and identify any errors or unauthorized transactions. If you find discrepancies, report them to Bank of America promptly.

Utilize Rewards and Benefits: If your Bank of America credit card offers rewards, cashback, or other benefits, make sure to take advantage of them. Familiarize yourself with the rewards program and redeem points or cashback for maximum value.

Contact Customer Service: If you have questions, concerns, or need assistance with your Bank of America credit card, don't hesitate to contact customer service. They can provide support and guidance on various account-related matters.

By following these steps, you can effectively manage your Bank of America/Activate credit card, maintain financial control, and enjoy the benefits it offers.

0 notes