#How Tesla could dominate Fleet Vehicles

Explore tagged Tumblr posts

Text

Robotaxi Market Share, Sales Channels and Overview Till 2030

The Robotaxi Market was valued at USD 0.5 billion in 2023 and will surpass USD 42.1 billion by 2030; growing at a CAGR of 88.4% during 2024 - 2030. These autonomous vehicles, designed to operate without a human driver, are poised to revolutionize urban mobility, offering a glimpse into a world where transportation is safer, more efficient, and more accessible. The robotaxi market, though still in its nascent stages, is growing at an unprecedented pace, driven by advances in artificial intelligence, machine learning, and automotive technology.

The concept of robotaxis represents a paradigm shift in how we think about transportation. Unlike traditional taxis or ridesharing services, robotaxis are fully autonomous, relying on a combination of sensors, cameras, and sophisticated algorithms to navigate complex urban environments. This autonomy eliminates the need for a human driver, which not only reduces operating costs but also addresses some of the key challenges facing the transportation industry, such as driver shortages and safety concerns.

Get a Sample Report: https://intentmarketresearch.com/request-sample/robotaxi-market-3650.html

Market Growth and Key Players

The robotaxi market is expected to witness significant growth over the next decade, driven by the increasing demand for autonomous vehicles and the rapid development of supporting technologies. Major automotive manufacturers, technology companies, and startups are all vying for a share of this emerging market. Companies like Tesla, Waymo (a subsidiary of Alphabet Inc.), and Cruise (backed by General Motors) are leading the charge, each with their own approach to developing and deploying robotaxi fleets.

In addition to these established players, numerous startups are entering the fray, bringing innovative solutions to the table. For instance, companies like Zoox, Aurora, and Nuro are exploring different aspects of the robotaxi ecosystem, from vehicle design to software development, contributing to the overall growth and diversification of the market.

Benefits and Challenges

The widespread adoption of robotaxis promises numerous benefits, both for consumers and society at large. For consumers, robotaxis offer a convenient, on-demand transportation option that is likely to be more affordable than traditional taxis or ridesharing services, thanks to the elimination of driver-related costs. Moreover, the use of electric vehicles in robotaxi fleets can contribute to reducing greenhouse gas emissions, supporting the global push towards sustainable transportation.

From a societal perspective, robotaxis have the potential to significantly reduce traffic accidents, the vast majority of which are caused by human error. Autonomous vehicles are designed to operate with a high degree of precision and can communicate with other vehicles and infrastructure in real time, minimizing the risk of collisions.

However, the transition to a robotaxi-dominated transportation landscape is not without its challenges. Regulatory hurdles, cybersecurity concerns, and the need for robust infrastructure to support autonomous vehicles are all significant obstacles that must be addressed. Additionally, the impact on employment in the transportation sector cannot be overlooked, as the widespread adoption of robotaxis could lead to job losses for drivers.

The Road Ahead

As the robotaxi market continues to evolve, it is clear that we are on the cusp of a transportation revolution. The benefits of autonomous vehicles are undeniable, but the road to widespread adoption will require careful navigation of the various challenges that lie ahead. Governments, businesses, and consumers all have a role to play in shaping the future of transportation.

For businesses, investing in the development and deployment of robotaxi technology presents a significant opportunity. Those who can successfully navigate the technical and regulatory challenges will be well-positioned to capitalize on the growing demand for autonomous transportation services.

For consumers, the advent of robotaxis promises to make urban mobility more convenient, affordable, and sustainable. As the technology matures and becomes more widely available, it is likely that robotaxis will become a common sight on our streets, reshaping the way we think about transportation.

Get an insights of Customization: https://intentmarketresearch.com/ask-for-customization/robotaxi-market-3650.html

Conclusion

the rise of robotaxis represents a bold step forward in the evolution of transportation. While challenges remain, the potential benefits are immense, making the robotaxi market one of the most exciting and dynamic sectors to watch in the coming years.

#Autonomous taxi#Self-driving taxi#Driverless taxi#Robo-cab#Autonomous ride-hailing vehicle#Driverless ride service#AI-powered taxi

0 notes

Text

Will Tesla (TSLA) dominate the Auto Business?

Tesla (TSLA) could dominate the auto business with an old-fashioned business strategy: discounting. To explain, Tesla Motors’ (TSLA) production costs could fall so low. Competitors cannot match them. Hence, Tesla could dominate the market with cheap electric vehicles. Tesla has cut the cost of its vehicles in half in the last five years, Eletrek claims. Elektrek provides no numbers but a new…

View On WordPress

#How Much Cash is Tesla (TSLA) generating?#How Tesla could dominate Fleet Vehicles#How Tesla Threatens all Automakers#Lower Operating Costs#Tesla (NASDAQ: TSLA)#Tesla can Undercut Other Automakers#Tesla Motors’ (TSLA)#Tesla’s Impressive Growth#Will Tesla (TSLA) dominate the Auto Business?

0 notes

Text

VENOM PROJECT: USAF plans autonomous F-16s to test drone technology wings

Fernando Valduga By Fernando Valduga 03/31/23 - 07:58 in Military

The next big step of the U.S. Air Force (USAF) to establish a drone network could come in a small fleet of experimental self-flying F-16 fighters.

The fiscal budget proposed by the service for 2024 includes almost $50 million to start a program called Project Venom - or Viper Experimentation and Next-gen Operations Model - to help you experiment and refine the standalone software loaded on six F-16 jets.

The USAF wants to develop a fleet of at least 1,000 collaborative combat aircraft, or CCA, which will use autonomous resources to fly alongside the future family of Next-Generation Air Dominance fighter systems and F-35A fighters of the service. CCAs can carry missiles or other weapons, perform electronic warfare operations or fly in front of other aircraft so that their sensors can provide intelligence, surveillance and reconnaissance.

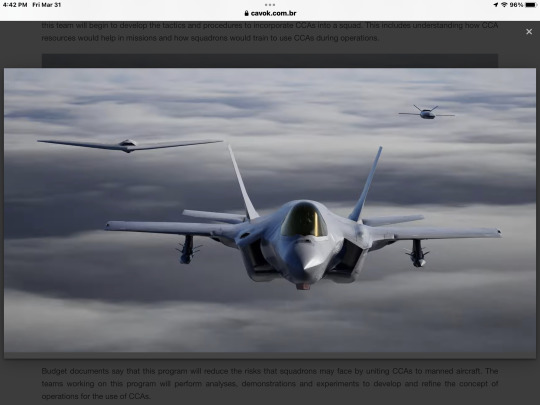

Lockheed Martin concept art showing an F-35 Joint Strike Fighter flying with various types of unmanned aircraft. (Photo: Lockheed Martin)

But before the U.S. Air Force can take the CCAs into combat, aviators need to make sure that the standalone software that operates the drones will work properly, said General Brigadier Dale White, executive director of the service's advanced fighter and aircraft program, in an online forum hosted by the Mitchell Institute for Aerospace Studies.

"Without reliable autonomy, it is one of those things that people will always wonder whether or not they will act [according to] the program," White said. "This autonomous central system is absolutely critical."

In an interview in January for the service's internal Airman Magazine, USAF chief scientist Victoria Coleman called Project Venom "a bridge between a fully autonomous capacity set and a fully manned capacity set, which is where we are today".

Under the Venom Project, Coleman said that the U.S. Air Force plans to add autonomous code to six F-16s. The human pilots took off with the jets, but would allow the software to take control in the air to determine if it works and offers the expected benefits, Coleman said.

Two U.S. Air Force F-16 Fighting Falcons fly over Afghanistan on March 17, 2020. The F-16 Fighting Falcon is a compact and multifunctional fighter aircraft that provides air war power to the U.S. Central Command's area of responsibility. (Photo: U.S. Air Force / Tech. Sgt. Matthew Lotz)

Coleman explained that this approach will allow USAF to add new software to speed up the experimentation process beyond what is normally required to certify software for flight.

“Autonomous cars have not gone from fully manual to fully automated,” Coleman said. “The [vehicles] Tesla and other electric vehicles have traveled millions or billions of miles where they have learned and discovered how to interact with a human operator and do it safely. We can't skip that part in the U.S. Air Force.

Supporting budget documents released by the U.S. Air Force say that Project Venom will allow the service to test new autonomous aircraft capabilities for the CCA program, keeping a human in the cabin to reduce risk.

Most of the U.S. Air Force's Ana Fiscal 24 request for the Venom Project - or $47.4 million - will go to research and development efforts, with another $2.5 million to support the acquisition.

The USAF told Defense News that it did not make a final decision on which base and organization will host Project Venom. However, the budget requests 118 team positions to support Project Venom at Eglin Air Base in Florida. The service also intends to spend between US$ 17 million and US$ 19 million per year on the program between fiscal years 25 to 28. This means that the Venom Project would cost about $120 million over the next five years.

At Monday's Mitchell Institute event, Major General Evan Dertien, head of the U.S. Air Force Test Center, said that the pilot of a Venom F-16 Project can fly to and from airspace where autonomous capabilities and manned and unmanned teams will be subjected to tests and development.

The Venom Project would be based on the Air Force's previous work, testing autonomous software on the X-62A VISTA, a heavily modified F-16 test aircraft. (Alex Lloyd/U.S. Air Force)

Dertien said that the program does not intend to reinvent what exists, but rather to develop similar efforts, such as the Skyborg, an unmanned aircraft powered by artificial intelligence, and the X-62A VISTA. The latter - which stands for Variable In-flight Simulator Aircraft - is a strongly adapted F-16 at Edwards Air Base, California, which the Air Force Research Laboratory uses to test standalone software.

White said that USAF continues to test Skyborg software on XQ-58 Valkyrie drones in Eglin.

And Venom's results can be feedback in other programs, such as VISTA's own autonomy mechanism, Dertien said.

"It's a natural evolution of everything you've seen before and it will also be a feedback cycle," Dertien said. "The things we learned there, we can incorporate back into the VISTA autonomy mechanism or basically into the [software development] there in Eglin to help develop this economy. But all this is focused on providing a CCA capability."

A Variable In-flight Simulator Aircraft (VISTA) flies in the skies of Edwards Air Base, California, on August 26. The aircraft was redesignated from NF-16D to X-62A, June 14, 2021.( Photo: U.S. Air Force / Kyle Brasier)

The generals said that the ultimate goal of the U.S. Air Force is to have a central autonomy engine that can be used on its aircraft, rather than investing in various autonomy acquisition programs for different platforms.

“We will not recreate the wheel every time we go to a different platform or if we evolve to a different platform,” White said. "Autonomy will be something that will be continuously iterated [over] time. VISTA and Venom are extremely important for the development of the algorithm and take us to the next level."

The commander of the Air Force Research Laboratory, Major General Heather Pringle, said that Project Venom will produce a large amount of in-flight data on how pilots and machines work together. Researchers will classify this information to develop the next generation of autonomy.

Dertien said that VISTA has been useful for developing autonomous capabilities, but the aircraft does not have many sensors. The F-16s used for Venom will come with an active electronic scanning radar, electronic alert systems and other detection features that can expand the vision of the autonomous software to help you make decisions.

But although the U.S. Air Force sees the Next Generation Air Domain and its accompanying CCAs as elements of a so-called system family, it does not plan to wait until all NGAD elements are completed before launching them, according to Major General Scott Jobe, director of plans, programs and requirements of the Air Combat Command. This may mean placing CCAs next to existing aircraft, such as F-35s, even if the manned NGAD component is not ready.

"We are not going to do this in a way that everything will come out in a large package, like a Christmas gift that you open on Christmas Day," Jobe said during the think tank event. "This will be implemented and integrated into our fleet and existing forces we have - both in the U.S. Air Force and on the Navy side."

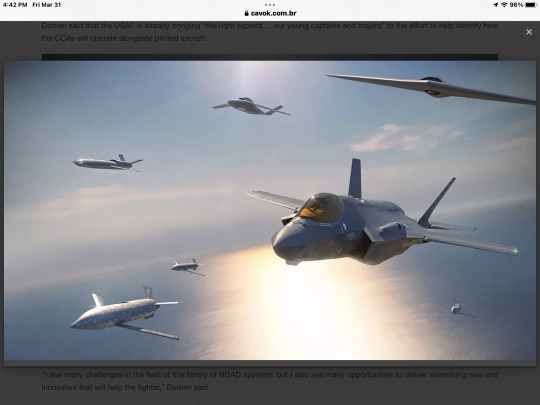

The budget also proposes $69 million to launch an experimental operations unit team. Coleman said in the January interview that this team will begin to develop the tactics and procedures to incorporate CCAs into a squad. This includes understanding how CCA resources would help in missions and how squadrons would train to use CCAs during operations.

"I can guarantee that a squad that is half a man, half a machine will look very different from what we have today," Coleman said.

U.S. Air Force budget documents indicate that it wants to spend $44.5 million on the experimental operations unit by 2025 and between $56 million and $58 million per year by 2028.

Budget documents say that this program will reduce the risks that squadrons may face by uniting CCAs to manned aircraft. The teams working on this program will perform analyses, demonstrations and experiments to develop and refine the concept of operations for the use of CCAs.

Dertien said that the USAF is already bringing “the right experts ... our young captains and majors” to the effort to help identify how the CCAs will operate alongside piloted aircraft.

But while doubts remain about how the NGAD and its drones will work, the generals said that the technology is necessary to ensure that the United States can maintain air superiority. As an example of the importance of protecting the skies, Jobe pointed out Russia's invasion of Ukraine, in which Moscow fought for more than a year to achieve air superiority.

“I see many challenges in the field of this family of NGAD systems, but I also see many opportunities to deliver something new and innovative that will help the fighter,” Dertien said.

Source: Defense News

Tags: Military AviationDronesF-16 Fighting FalconLoyal WingmanUSAF - United States Air Force / U.S. Air Force

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. Uses Canon equipment during his photographic work throughout the world of aviation.

Related news

MILITARY

Exclusive oxygen and anti-g system tests put Gripen F to the test in extreme conditions

31/03/2023 - 13:18

MILITARY

Bayraktar drones would be "completely eliminated" in Ukraine

31/03/2023 - 12:00

MILITARY

Rostec claims innovative stealth technology

31/03/2023 - 09:04

BRAZILIAN AIR FORCE

FAB: Santa Maria Air Base performs IVR Operational Exercise

30/03/2023 - 21:02

EMBRAER

Embraer says it considers civil version of the C-390

30/03/2023 - 19:23

HELICOPTERS

Bahrain aims to acquire 24 more retired AH-1W helicopters from the USMC

30/03/2023 - 14:00

homeMain PageEditorialsINFORMATIONeventsCooperateSpecialitiesadvertiseabout

Cavok Brazil - Web Creation Tchê Digital

Commercial

Executive

Helicopters

HISTORY

Military

Brazilian Air Force

Space

Specialities

Cavok Brazil - Web Creation Tchê Digital

8 notes

·

View notes

Link

Is it a silly prank, a Pagan ritual, or a genius discovery about the next era of mass transit? In a picture posted to Flickr by artist James Bridle—known for coining the term, "New Aesthetic"—a car is sitting in the middle of a parking lot has been surrounded by a magic salt circle. In the language of road markings, the dotted white lines on the outside say, "Come On In," but the solid white line on the inside says, "Do Not Cross." To the car's built-in cameras, these are indomitable laws of magic: Petrificus Totalus for autonomous automobiles.

Captioned simply, "Autonomous Trap 001," the scene evokes a world of narratives involving the much-hyped technology of self-driving cars. It could be mischievous hackers disrupting a friend's self-driving ride home; the police seizing a dissident's getaway vehicle; highway robbers trapping their prey; witches exorcizing a demon from their hatchback.

Self-driving cars aren't there yet, but the artist-philosopher-programmer's thought-provoking photo is a reminder that we'll have to start thinking about these things soon. If a self-driving car is designed to read the road, what happens when the language of the road is abused by those with nefarious intent?

Bridle has carved out a space for himself among those thinking 10–100 years in the future. His website Booktwo.org is lousy with philosophical treatises, thought experiments, creative code, and art projects. His "collaboration with technology" Five Eyes was part of the V&A Museum's privacy-oriented show All of This Belongs to You, which also included the remains of whistleblower Edward Snowden's smashed hard drive full of leaked documents. Bridle has spent the last decade making drones more relatable, uncovering the mysteries of weather prediction, and otherwise trying to elucidate the invisible technologies—usually military in origin—that rule our world.

Recently Bridle has become fascinated by autonomous vehicles. Self-driving cars will be available to the public soon. Singapore is considering the purchase of a fleet of 300,000 driverless taxis to replace the 780,000 manned ones currently clogging their streets. Google's self-driving car initiative, now called Waymo, has been investing in the technology since 2009. Elon Musk's Tesla is already implementing limited automated features in the United States, and even slow-moving large scale car manufacturers like Ford are getting into the game. If driverless cars become anywhere as ubiquitous as the horseless carriage, innocuous vandalism like the Autonomous Trap is just the beginning the problems engineers will have to solve.

Now Bridle is trying to build his own self-driving car, and made the sardonic artwork Autonomous Trap 001 in the process. He's released all the code developed in pursuit of the DIY self-driving car here. We spoke to Bridle to learn more about the circumstances behind this vague photo series and better understand his apprehension and curiosity about the robot chauffeurs of the future.

Creators: What are we looking at here? Can you give me a brief explanation of Autonomous Trap 001?

James Bridle: What you're looking at is a salt circle, a traditional form of protection—from within or without—in magical practice. In this case it's being used to arrest an autonomous vehicle—a self-driving car, which relies on machine vision and processing to guide it. By quickly deploying the expected form of road markings—in this case, a No Entry glyph—we can confuse the car's vision system into believing it's surrounded by no entry points, and entrap it.

Is this actually an autonomous car, or is it conceptual?

I don't actually have a self-driving car, unfortunately—I don't think any have made it to Greece yet, plus the cost issue—but I do have a pretty good understanding of how the things work, having been researching them for a while. And the one in the picture is a research vehicle for building my own. As usual, I've got totally carried away in the research, and ended up writing a bunch of my own software, rigging up cameras and building neural networks to reproduce some of the more interesting currents in the field. Like the trap, I wouldn't entirely trust what I've built, but the principles are sound.

Where did you take these pictures?

I made this Trap while training the car on the roads around Mount Parnassus in Central Greece. Parnassus feels like an appropriate location because, as well as being quite spectacular scenery and wonderful to drive and hike around, it's the home of the Muses in mythology, as well as the site of the Delphic Oracle. The ascent of Mount Parnassus is, in esoteric terms, the journey towards knowledge, and art.

What is your role in the project and is there anyone else involved?

It's just me. I did a project last year called Cloud Index Index which used satellite imagery and machine learning to explore politics and computational thinking, and I had a lot of help on that, particularly from Gene Kogan, another artist who works with machine learning. This time I wanted to do it all myself—mostly to show that I could, and therefore, in theory and accepting an immense amount of privilege and good fortune, anyone can. These technologies are for everyone: you can read the papers, repeat the findings, study the code, build your own tools. This radically reshapes the way you understand and interact with the world, and is something I think is quite crucial to propagate in the current age.

Why did you create Autonomous Trap 001, besides poking fun at an incredibly hyped technology?

It's part of a body of work / research / writing / fooling about to explore and understand the contemporary technologies of automation, in order to better use them, and in some cases to disrupt and oppose them.

Self-driving cars bring together a bunch of really interesting technologies—such as machine vision and intelligence—with crucial social issues such as the atomization and changing nature of labor, the shift of power to corporate elites and Silicon Valley, and the quasi-religious faith in computation as the only framework for the production of truth—and hence, ethics and social justice.

The Trap falls into the category of resistance, while the attempt to build my own car is a process of understanding how the dominant narratives of these technologies are produced, and could be changed. I don't see why cab drivers of the future shouldn't be chalking white lines on side streets to derail self-driving Ubers which are putting them out of work, and I also think we need more eyes and hands on the tools which are shaping all of our futures.

Were there any unexpected challenges in creating the piece?

I ran out of salt, and had to drive back to the nearest village to buy a few more kilos. Luckily, salt, unlike bandwidth and computational power, is a pretty cheap resource. Also, I should have pulled my trousers up for the video.

This is Autonomous Car Trap 001. Do you have more planned?

I have a habit of numbering things, but yes, there will definitely be more. Like the Drone Shadows, which proliferate to this day, consciously starting a series seems to have generative effects.

Where does this fit in your larger body of work?

It's all part of the same attempt to understand the world and act in it, if that doesn't sound too pompous. This work follows directly from projects on machine vision, artificial intelligence, militarized technology, big data etc.—as well as more, shall we say, poetic interventions into emerging technologies. It's one big rolling project, with occasional bouts of specific obsession.

What's next for you? What other projects are you working on?

This body of work is in part in preparation for a solo exhibition which opens next month in Berlin, at Nome Gallery, called Failing to Distinguish Between a Tractor Trailer and the Bright White Sky. I'll be showing a bunch of different outcomes of the research, including interpretations of the machine vision systems I've been building, and the results of the self-driving car training—and hopefully connecting them to some of my more mythological interests.

I've also got a new commission opening in London next week, as part of Convergence—a series of billboards in East London continuing my search for the Render Ghosts. Beyond that, I'm mostly working on writing projects about the new dark age and the relationship between technology, knowledge, understanding, and agency.

Keep up with James Bridle's work on his website.

#technology#tech#stem#steam#engineering#software#machine learning#cs#compsci#computer science#programming#coding#math#mathematics#fae#witchy#magic#cars

22 notes

·

View notes

Text

Global Robo-Taxi Market

Global Robo-Taxi Market Size, Share, Application Analysis, Regional Outlook, Growth Trends, Key Players, Competitive Strategies and Forecasts to 2030

Global Robo-Taxi Market size accounted XXX in 2020 is estimated to reach XXX by 2030 growing with a CAGR of XXX during the forecast period. The robo-taxi is a self-driving autonomous car operated for on-demand mobility service, also known as robo-cab. It is fuel-efficient vehicles, which do not emit any kind of harmful carbon gases, thereby it helps in protecting the environment. Further, this car has become a more affordable solution for the customer by eliminating the need for a human chauffeur, which considered a significant part of the operating costs. Additionally, many companies are coming forward and involving in partnership, collaboration and a joint venture to boost the robo-taxi market growth. For instance, in July 2018 Daimler AG and Bosch Corp, the largest automotive supplier have entered into a partnership to develop driverless cabs. The robo-cab vehicle would be run by a strong and reliable energy-efficient computer, loaded with sensors, and an artificial intelligence software that would be acting as the virtual chauffeur. This partnership between the biggest players in the automobile industry, would revolutionize the entire automobile industry and help the robo-taxi market to flourish positively.

Download Sample Copy of the Report to understand the structure of the complete report (Including Full TOC, Table & Figures) @ https://www.decisionforesight.com/request-sample/DFS020297

Market Dynamics and Factors:

Currently, three robo-taxi market trends are accelerating transformative change in the automotive industry which are zero-emission vehicles, new mobility models and autonomous driving. All three of these trends, offering the potential for convenient, personalized transport as an attractive alternative to owning a car or using public transport. The growing issues of traffic congestion, increasing pollution are adversely impacting health and overall quality of life. The demand for zero-emission vehicles or green vehicles is rising, also there is a surge in autonomous cars demand. Companies such as Uber, Lyft, and Baidu are collaborating with Tier 1 companies in the race for the deployment of autonomous fleet. For instance, in 2018, Lyft partnered with Aptiv Plc for its self-driving cars. Lyft has completed approximate 5,000 rides in 2018 through its ride-hailing app. Hence all these developments will lead to market growth. However, the robo-cabs are still in testing phases and carries baggage of challenges which includes, high manufacturing cost, the risk of injury to drivers and pedestrians. These factors are expected to restrain the robo-taxi market. Technological advancements and product innovation will lead to an opportunity for robo-taxi market growth

Market Segmentation:

Global Robo-Taxi Market – By Level of Autonomy

Level 4

Level 5

Global Robo-Taxi Market – By Propulsion

Hybrid Cell

Fuel

Electric

b

Passenger

Goods

Global Robo-Taxi Market – By Geography

North America

U.S.

Canada

Mexico

Europe

U.K.

France

Germany

Italy

Rest of Europe

Asia-Pacific

Japan

China

India

Australia

Rest of Asia Pacific

ROW

Latin America

Middle East

Africa

New Business Strategies, Challenges & Policies are mentioned in Table of Content, Request TOC at @ https://www.decisionforesight.com/toc-request/DFS020297

Geographic Analysis:

Europe is the dominating region across the world. The growth in this region is imputed to the technological advancements and developed & supportive infrastructure has helped the fleet operators to test and deploy easily in this region. For instance, as per the European Commission, there are about 180 automobile facilities across the EU and the sector is the largest investor in R&D. Followed by Europe, Asia- Pacific is the second biggest contributor across the world, due to heavy demand for the electric vehicle, and recently the joint venture between Volvo and Baidu for electric self-driving taxis, which further helps as eco-friendly and advanced technical approach. North America is expected to show significant robo-taxi market growth in the upcoming years.

Competitive Scenario:

The key players in the robo-taxi industry are Waymo LLC, Daimler AG., GM Cruise LLC., Aptiv., AB Volvo, Google, Ridecell Inc., Tesla, Uber Technologies Inc., Volkswagen AG, Lyft, Inc., General Motors., BMW AG, Toyota Motor Corporation, Ford Motor Company, Robert Bosch GmbH, Continental AG, Denso Corporation, and NVIDIA Corporation

Connect to Analyst @ https://www.decisionforesight.com/speak-analyst/DFS020297

How will this Market Intelligence Report Benefit You?

The report offers statistical data in terms of value (US$) as well as Volume (units) till 2030.

Exclusive insight into the key trends affecting the Global Robo-Taxi industry, although key threats, opportunities and disruptive technologies that could shape the Global Robo-Taxi Market supply and demand.

The report tracks the leading market players that will shape and impact the Global Robo-Taxi Market most.

The data analysis present in the Global Robo-Taxi Market report is based on the combination of both primary and secondary resources.

The report helps you to understand the real effects of key market drivers or retainers on Global Robo-Taxi Market business.

The 2021 Annual Global Robo-Taxi Market offers:

100+ charts exploring and analysing the Global Robo-Taxi Market from critical angles including retail forecasts, consumer demand, production and more

15+ profiles of top producing states, with highlights of market conditions and retail trends

Regulatory outlook, best practices, and future considerations for manufacturers and industry players seeking to meet consumer demand

Benchmark wholesale prices, market position, plus prices for raw materials involved in Global Robo-Taxi Market type

Buy This Premium Research Report@ https://www.decisionforesight.com/checkout/DFS020297

About Us:

Decision Foresight is a market research organization known for its reliable and genuine content, market estimation and the best analysis which is designed to deliver state-of-the-art quality syndicate reports to our customers. Apart from syndicate reports, you will find the best market insights, strategies that will help in taking better business decisions on subjects that may require you to develop and grow your business-like health, science, technology and many more. At Decision Foresight, we truly believe in disseminating the right piece of knowledge to a large section of the audience and cover the in-depth insights of market leaders across various verticals and horizontals.

Contact:

Email: [email protected]

For Latest Update Follow Us:

https://www.facebook.com/Decision-Foresight-110793387201935

https://twitter.com/DecisionFs

https://www.linkedin.com/company/decision-foresight/

0 notes

Text

Uber and Lyfts Can Be Electrified Now, But Drivers Aren’t So Sure

Ben Valdez needs a new car. He has been driving full-time for Uber and Lyft in Los Angeles for almost six years and his 2016 Toyota Prius C has more than 240,000 miles on the odometer.

In theory, Valdez should be a great candidate for switching to an electric vehicle. He drives a lot for work—somewhere between 400 and 700 miles a week depending on whether he's doing more food delivery for Uber Eats or traditional ridehailing—so he would save money on fuel. Plus, even though Valdez lives in an apartment and doesn't have anywhere to charge a car at home, he drives in Los Angeles, so Valdez has access to one of the most robust public charging networks in the country.

Valdez understands the theory, but he doesn't think it matches reality quite yet. In a recent interview with Motherboard, he said he plans to get a Toyota Highlander hybrid instead, which gets 36 miles to the gallon according to the Environmental Protection Agency's fuel economy ratings, about 15 miles per gallon worse than what Valdez says he has been getting on his Prius.

This is the exact opposite direction that California regulators want Uber and Lyft drivers to be going. In May, the California Air Resources Board passed a rule that mandates the ridehail giants increase the number of miles its vehicles travel powered by zero emissions on an increasing basis. By 2025, 13 percent of each company's vehicle miles traveled must be electric. By 2028, 65 percent. And by 2030, 90 percent must be electric. (A different regulatory agency is responsible for deciding the penalties for failing to meet these benchmarks, but hasn't decided what they will be yet.) CARB's analysis found that in order to reach that goal, 43 percent of all ridehail vehicles would have to be electric by 2030 as long as it is the 43 percent that drive the most, like Valdez.

In other words, CARB just passed a rule that's supposed to get drivers like Valdez to switch to electric vehicles, not get cars that are even worse for the environment. This wouldn't merely undermine CARB's goals, but also Uber and Lyft's. Both companies have made even more aggressive pledges than CARB's regulations mandate and say they will be all-electric by 2030. They plan to accomplish this mainly through lobbying efforts for more EV incentives that would apply to drivers.

Valdez is aware of all of this, and he has nothing against electric cars. But there is one big challenge with CARB's new rules and the push for electrification for ridehail vehicles: there is no such thing as "Uber's fleet" or "Lyft's fleet." Ridehail drivers pay to use and maintain their own vehicles, a central proposition of the gig economy model that allows the multi-billion dollar companies to pass the costs of vehicle purchase and maintenance onto low-wage workers. And so the decision of which car to buy is not an institutional one made by a big company with hundreds of thousands of vehicles and large purchasing power, but to individual drivers like Valdez.

"I'm paying 100 percent of the cost," Valdez said, so he has to do what makes the most sense to him. And, despite all the claims about the future Uber and Lyft want, many of the incentives still reflect the oil-dominated energy landscape we have today.

A few years ago, Valdez looked into this when Uber and Lyft slashed the per-mile rate for drivers in Los Angeles. He was looking for a way to make more money and considered the cost savings EVs might offer. During this research, he found that if he gets a Highlander or similarly-sized six-seater SUV, it will qualify as an "XL" vehicle for which Uber and Lyft will pay him roughly double his per-mileage earnings on qualifying ridehail rides, from about 64 cents a mile to $1.20. Over the hundreds of thousands of miles he will put on the Highlander, Valdez figures the extra money he can earn would cover the roughly $40,000 suggested retail price of the Highlander as well as the extra fuel costs compared to the Prius.

But, there are currently no electric vehicles that seat more than three passengers standard and could therefore qualify as an XL. The biggest EV, the Tesla Model X, comes in an optional seven-seat configuration, but it starts at $93,500, more than double the suggested retail price of the Highlander hybrid. More may come on the market in the coming years—an electric Cadillac Escalade is rumored to be in the works—but they are unlikely to be significantly cheaper given the battery size required to power them.

Uber and Lyft do have incentive programs for "green" rides, but it pays out a fraction of XL rides. Hybrids and EVs can accept "green" rides, which riders opt into in select markets by paying an extra $1 per ride. The companies then split that dollar 50/50 with the drivers. Uber and Lyft say its own half goes into a fund that, ironically, is used to encourage drivers to switch to electric vehicles. Uber says it also gives electric vehicle drivers an extra $1 per trip, meaning drivers can receive up to $1.50 per trip on top of the regular fare.

But Valdez already gets that 50 cent green fee on the rides that qualify because he drives a hybrid, which in Uber and Lyft's accounting are "green" vehicles. So, he would continue to do so if he got a Highlander hybrid.

Incidentally, the green fee may have unintended consequences, Carnegie Mellon professor and director of the Vehicle Electrification Group Jeremy Michalek told Motherboard, such as actually increasing emissions by having the limited number of qualifying vehicles travel further to match with riders.

Motherboard requested interviews with both Uber and Lyft regarding their vehicle electrification policies. Uber declined an interview and responded to written questions only. A Lyft spokesman said he had to cancel a scheduled interview with Lyft's head of sustainability due to a scheduling conflict, but also replied to written questions. In those responses, both companies said XL vehicles actually lower emissions because they often have more passengers, thus emitting less than if the passengers had to use multiple cars.

But those analyses only consider rides where the XL option is selected by the rider and therefore doesn't tell the full story. When no XL rides are available, Uber and Lyft will match XL vehicles with regular Uber and Lyft ride requests. (I do not use ridehail often, but when I do, I get assigned a large SUV more than half of the time despite never requesting one. I also had no idea before I reported this article that the "Green" option existed, but I did know about "XL" because it is a prominently displayed option on both apps.) Neither company provides an analysis of the emissions impact of XL vehicles for all rides they provide, tipping the scales to make it look like XL vehicles are better for the environment than they are.

But the problem for Valdez switching to an electric vehicle extends beyond the XL ride incentives. It has to do with the very nature of the gig economy business model.

It is true ridehail vehicles are great candidates for early electrification based on the kinds of trips they make. Alan Jenn, a researcher at the University of California, Davis who has studied electrification of ridehail fleets, told Motherboard that over the millions of trips of both types of cars he's evaluated, he has found "no statistically significant difference" between gas and electric cars on the number of trips completed or the miles they travel, even though the "vast majority" of charging events are occurring at public charging stations, not private ones.

But while ridehail vehicles are great candidates for electrification, ridehail drivers tend to differ from the profile of people buying electric vehicles right now. While EV buyers tend to be higher income earners who can afford the pricier vehicles—and take advantage of the tax credits—ridehail drivers tend to be lower income, which makes buying an expensive EV which tend to be luxury models "untenable" for many of them, as Jenn put it.

"It's really hard to think about buying a luxury vehicle when you're not getting fair pricing for your rides," siad Nicole Moore, a ridehail driver since 2017 and leader of Rideshare Drivers United. "People are just not getting, after expenses, even minimum wage."

The big question, Jenn said, is who will be responsible for bridging that economic gap. Will state or federal governments step in with bigger incentives that come out of the purchase price rather than tax credits? California has already started to do this to a limited extent. Will Uber and Lyft offer some kind of credit? Lyft has hinted it may be open to "negotiate with auto manufacturers for group discounts for drivers using the Lyft platform," although it's not clear whether this would involve any money coming out of Lyft's pocket. Or will the industry rely on falling EV prices and hope that, because full-time drivers go through vehicles every 4 to 6 years, there is still time to buy one more gas car before the regulations kick in, impact on the planet be damned?

In the short term, Lyft is most excited about getting more drivers into electric vehicles using the Express Drive program, which partners with rental car agencies, and allows drivers who cannot afford EVs to use one right now by renting one. Lyft says drivers save $50 to $70 a week on fuel. But the scale of this program is simply too small to hit meaningful goals; just a few hundred EVs are available to be rented out across the three pilot cities of Seattle, Atlanta, and Denver, and it's not clear how much the program can be scaled up.

EV usage is similarly limited in other major ridehail cities. There are two major ridehail markets that have publicly available data on ridehail vehicle types. Chicago does not specifically say if a ridehail vehicle is gas, hybrid, or electric in its open data portal, but it does list the make and model. Of the 49,563 vehicles registered to give rides in April, the most recent month for which data is available, just 87 were Teslas and 11 were Chevy Bolts, the two most popular electric vehicle brands. New York City doesn't specify the make and model of the city's for-hire vehicle fleet, but it does have a field that denotes hybrid or electric vehicles. According to that count, the city currently had 1,480 hybrids, 460 electric vehicles, and 89,009 regular gas cars. (New York City's Taxi and Limousine Commission has had a cap on new for-hire vehicle licenses since 2018, but it allowed exceptions for new EVs until this week when it ended that exemption.)

These statistics exemplify what seems to be a gap between what the experts say and what drivers believe. The experts are convinced that buying an EV will save ridehail drivers money not 10 years in the future, but today. For example, a Volkswagen ID.4 small SUV, which just came on the market this year, starts at $40,000—roughly the same as a Highlander Hybrid—and according to Jenn's research, will be three to four times cheaper to power with electricity than buying gas. With a range of about 250 miles, a driver like Valdez would have to charge it two or three times a week. And both ridehail companies have partnerships with major fast charger companies that reduce charging costs.

So are drivers like Valdez simply being irrational, slowing down the electric revolution and working against their own self-interest? Even though he is one of those experts, Michalek doesn't see it that way.

Although there "may be truths about EVs that are well known by experts, policymakers or companies but not yet well understood by average consumers or drivers," Michalek said, "there may be things most experts believe that turn out to be false because experts make different assumptions than drivers." He added that we shouldn't confuse "the wait-and-see approach that a lot of consumers take" with irrationality.

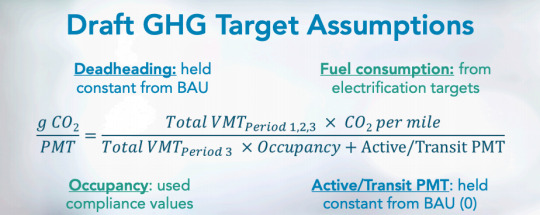

To his point, much of the back-and-forth over the CARB regulations between policymakers, professors like Michalek, and interested parties like Uber and Lyft had to do with precisely how to calculate those assumptions, which involve formulas like this:

Screenshot: California Air Resources Board

which may or may not reflect reality.

Valdez also carefully considers what to do based on his lived experience. A key part of his calculation is embracing uncertainty rather than trying to quantify it. Uber and Lyft can, and have, reduced his take-home pay with the flip of an algorithmic switch. Plans that sound nice on paper suddenly become financially untenable. He's deeply skeptical of rental programs like Express Drive that operate through the ridehail companies because he recalls the ones of the past that charged exorbitant rates and trapped drivers in debt. Both he and Moore said they would be extremely hesitant to take an offer from Uber or Lyft to subsidize the cost of a new EV, worrying about onerous terms and conditions or even reneging on the deal in the same way that product features, bonuses, and rates of pay come and go by the week. Valdez knows the entire business model of ridehailing is to experiment on drivers and pass all the costs and risk off to them. So whenever there is some aspect of his job he can control, he goes for the lowest-risk approach.

Along those lines, there is the issue of range. Although Uber and Lyft have previously had this feature, drivers can no longer see the destination of a ride until they accept it. So EV drivers may be forced to cancel potentially lucrative longer trips if they're running short of range, which would also hurt their rating, impacting their ability to get similar trips in the future. But with a gas car, drivers can simply make a quick stop for gas along the way.

"You never know if you're going to get into a car accident, you never know if you're going to be deactivated," Valdez said. "You don't know if the rates are going to drop. There's just a lot of uncertainty." In a profession where very little can be counted on, there is one thing Valdez knows: there will be a gas station nearby when he needs it.

Uber and Lyfts Can Be Electrified Now, But Drivers Aren’t So Sure syndicated from https://triviaqaweb.wordpress.com/feed/

0 notes

Text

New Post has been published on All about business online

New Post has been published on http://yaroreviews.info/2021/06/lordstown-clarifies-that-vehicle-purchase-agreements-arent-binding-orders

Lordstown Clarifies That Vehicle Purchase Agreements Aren't Binding Orders

Lordstown Motors Corp. RIDE -2.23% said in a securities filing that although it has struck vehicle-purchase agreements with fleet-management companies, the agreements don’t represent binding purchase orders.

The clarification on Thursday comes after the troubled electric-truck startup’s president told reporters Tuesday the company had “pretty binding” preorders and enough interest from potential buyers to sustain factory output through the end of 2022.

Shares were down about 1% Thursday morning. The company’s stock rose after its president’s comments and closed Tuesday having gained 11.3%.

The Ohio-based company said in its filing that building relationships with specialized trucking and fleet-management companies to incorporate its debut model, the Endurance, into their programs is an essential sales and marketing strategy.

“They do not commit the counterparties to purchase vehicles, but we believe that they provide us with a significant indicator of demand for the Endurance,” Lordstown Motors said of the vehicle-purchase agreements.

Lordstown Motors and several rival electric-vehicle challengers have experienced a reversal of fortune in recent months, going from being among Wall Street’s hottest investments to targets of short sellers, financial regulators and critics doubting their futures.

In March, the company said it struck agreements with an affiliate of the dealership group Holman Enterprises to co-market and co-develop business opportunities. The pact also includes a co-marketing agreement involving Lordstown Motors and Holman’s leasing and fleet-management services arm, Lordstown Motors said.

Lordstown Motors said the vehicle-purchase agreements generally include a term of three to five years, a designation of Lordstown as the preferred supplier and down payment terms, which are usually 5% down 90 days before the requested delivery date.

Earlier this month, the company warned it didn’t have enough capital to start commercial production and that there were doubts it could continue operations for another year. The company’s two top leaders resigned unexpectedly after a new report from a board committee found inaccuracies in parts of the company’s disclosures on truck preorders. On Thursday, Lordstown Motors said it tapped John Whitcomb, most recently the managing director for global automotive and mobility at Ernst & Young LLP, as its vice president for global commercial operations.

Mr. Whitcomb, who also served as General Motors Co. ’s director of global retail and sales technology, will oversee Lordstown Motors’ go-to-market strategy ahead of the start of the production of Endurance in late September, the company said.

Lucid, Fisker, Rivian and Canoo are among the well-funded startups racing to release new electric vehicles. WSJ asked CEOs and industry insiders how new auto companies plan to challenge Tesla’s market dominance and take on legacy car makers. Photo composite: George Downs

Write to Dave Sebastian at [email protected]

Copyright ©2020 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

0 notes

Link

Ford’s Electric F-150 Pickup Aims to Be the Model T of E.V.s Ford Motor is about to open a major new front in the battle to dominate the fast-growing electric vehicle market, and it’s banking on one of the world’s most powerful business franchises. In a splashy presentation Wednesday night at a Ford plant in Dearborn, Mich., the automaker will unveil an electric version of its popular F-150 pickup truck, which will be called the Lightning. Ford’s F-Series trucks, including the F-150, make up the top-selling vehicle line in the United States, and typically generate about $42 billion a year in revenue, according to a study commissioned by Ford — or more than twice what McDonald’s brought in last year. It is one of the most anticipated introductions of a new car and invites comparisons to Ford’s Model T, the car that made automobiles affordable to the masses. Ford has a lot at stake in the new vehicle’s success. If it can turn the F-150 Lightning into a big seller, it could accelerate the move toward electric vehicles, which scholars say is critical for the world to avoid the worst effects of climate change. Tailpipe pollution from cars and trucks represent the largest source of greenhouse gas emissions in the United States and one of the largest in the world. But if the Lightning does not sell well, it could suggest that the transition to E.V.s will be a lot slower than President Biden and other world leaders need to achieve climate goals. “The F-150 will put electric vehicles in a totally different realm,” said Michael Ramsey, a Gartner analyst. “It’s huge for Ford, but also huge for the whole industry. If you’re going to electrify the whole vehicle fleet in the United States, the F-150 going electric is a big step in that direction.” The F-150 Lightning signals a shift in the auto industry’s E.V. push, which has been aimed at niche markets, so far. Tesla has grown rapidly for the last several years by selling flashy sports cars to the affluent and early adopters. It sold close to 500,000 cars globally last year, a little more than half as many F-Series trucks Ford sold. Other electric models that have sold well have been small cars, such as the Chevrolet Bolt and Nissan Leaf, that appeal to environmentally minded consumers. The F-150 Lightning, in contrast, is aimed at small businesses and corporate customers such as building contractors and mining and construction companies that buy lots of rugged pickups. These buyers typically care not just about the sticker price of a truck but also how much it costs to operate and maintain. Electric vehicles tend to cost more to buy but less to own than conventional cars and trucks because they have fewer parts and electricity is cheaper than gasoline or diesel on a per mile basis. “There are a lot of big fleets who have been looking for green solutions but haven’t had any answers until now,” William C. Ford Jr., the company’s chairman and a great-grandson of Henry Ford, said in an interview. General Motors and start-ups like Rivian are also working on electric pickups. Rivian has said it will start delivering its truck, the R1T, this summer and G.M. is expected to sell the GMC Hummer pickup truck later this year. A big question about electric pickups is whether many people will buy them. Beyond commercial buyers, trucks like the F-150, Chevrolet Silverado and the Ram tend to be bought by people who have a lot of stuff to haul or by people — usually men — who like driving trucks. Updated May 19, 2021, 3:44 p.m. ET “There will probably be some initial raised eyebrows, but once we get people to experience the driving dynamics and the extra room, the skepticism will abate,” Mr. Ford said. The F-Series trucks have been the top-selling model line in the United States for the last 44 years. A 2020 study by the Boston Consulting Group found the truck supports 500,000 jobs at Ford, parts suppliers and dealerships. Ford’s introduction of the Lightning got a major boost from Mr. Biden, who on Tuesday visited the company’s Rouge Electric Vehicle Center where the pickup will be made. Before a pool of White House reporters gathered at the plant, Mr. Biden pulled up behind the wheel of a prototype covered in black-and-white camouflage sheeting used to conceal the shape of the truck ahead of the Wednesday event. “This sucker’s quick,” Mr. Biden said, and let slip that the truck can zoom to 60 miles an hour in 4.4 seconds, a detail that wasn’t supposed to be released until Wednesday. Mr. Biden then zoomed off, reaching a top speed of 80 m.p.h. The Secret Service normally does not allow presidents to drive. Ford officials were not sure Mr. Biden would drive the truck until he arrived at the Rouge center, but it’s not a surprise he did. Mr. Biden is a well known car enthusiast and owns a green 1967 Corvette that was given to him by his father as a wedding present. In 2016, he and his Corvette appeared on an episode of “Jay Leno’s Garage,” in which he drove the car at an enclosed Secret Service training facility. Ford’s plan to produce an electric truck in the Midwest with union labor closely aligns with the Biden administration’s goal to cut greenhouse gas emissions, increase domestic manufacturing, support unions and accelerate the transition to electric vehicles. The administration’s $2 trillion infrastructure proposal includes money to help build half a million charging stations and incentives for the purchase of electric vehicles. Ford has said it plans on spending $22 billion to develop electric vehicles over a five-year period ending in 2025. Other automakers are moving in the same direction. G.M. is spending a similar sum and has said it aims to produce only electric vehicles by 2035, setting a target date for phasing out the internal combustion engine, which has powered the auto industry for more than a century. G.M. recently introduced an updated version of its electric car, the Chevrolet Bolt. It also plans to make an electric version of its popular Silverado pickup truck, which is one of the biggest competitors to the F-150. Source link Orbem News #Aims #Electric #EVs #F150 #Fords #Model #Pickup

0 notes

Text

Rental car shortage is a boon for Turo, the Airbnb of cars

New Post has been published on https://appradab.com/rental-car-shortage-is-a-boon-for-turo-the-airbnb-of-cars/

Rental car shortage is a boon for Turo, the Airbnb of cars

Traditional car rental companies recorded massive drops in rental revenue thanks to the steep plunge in travel last year. Not so for Turo, whose revenue rose 7% as more car owners signed up to rent their privately owned vehicles sitting unused in the driveway because of job loss or working from home.

“Often times it does start with the car you already have or a second car that you’re not using very frequently,” said CEO and founder Andre Haddad.

And for some travelers unable to find their normal choice of rental cars lately, Turo has proved a savior.

Julian Levesque flew into Phoenix a week ago from his home in Newport Beach, California, and started searching for a traditional car rental only to discover there wasn’t much available.

“All I found was a minivan for $300, but I don’t need a minivan. So I checked Turo, and there was a Jaguar there, also for $300,” he said. “I figured I might as well get the Jaguar.”

That broader selection of cars is one of the advantages of Turo, said Haddad, which offers users more than just the economy cars that dominate many traditional rental fleets. Renters can find Teslas and various luxury cars such as Porsches that are difficult if not impossible to find on the mainstream rental market.

Turo started in a couple of markets in 2010 and went national two years later. While most car owners registered on Turo are offering only a single vehicle or two, a growing number are buying additional cars to add to their rental fleet.

One of those power users is Ryan Costello of Kailua Kona, Hawaii, a former handyman who has made the car rental business his full-time job.

“I don’t have time to be a handyman any more. I’m too busy cleaning and maintaining and delivering cars,” he said.

Costello got started in 2017 with his Chevrolet Silverado pickup, and now rents out 10 Jeep Wranglers and Gladiators, saying, “it’s much cheaper than buying a home and renting it out and the return is much better. In a bad month I’m making $800 per car. In a good month, $2,000.”

His rental business did take a hit in early 2020 when tourism and travel came to a near halt in Hawaii, as he had just bought three new Jeeps that he couldn’t rent for seven to eight months. But now Costello is busier than he’s ever been, especially with the shortage of traditional rental cars in the state.

“I’m completely booked the next four months, and every day I’m getting about 20 calls or emails from people asking for cars,” Costello said. “People are desperate when they get here and realize there’s no way to get around.”

How Turo makes money

Turo says its hosts earn about $10,500 per vehicle annually after paying the company its commission, which runs between 7.5% and 40% depending on the level of insurance the vehicle owners arrange through Turo.

And compared to Hertz (HTZ), Avis Budget (CAR) and Enterprise, Turo has a big advantage on expenses: Because it doesn’t own the vehicles, the company doesn’t need to shell out to purchase and maintain a fleet of cars.

By contrast, traditional rental companies spent much of last year selling off the vehicles they didn’t need during the worst of the pandemic, partly to raise cash to make up for lost rentals. This year they’ve been having trouble adding back cars to meet the rebound in demand.

“That’s the problem with this asset-heavy model. We don’t have that problem. We’re an asset-light business,” said Haddad. “In many ways the pandemic has shown the advantage of the flexibility of our model.”

Turo is privately held, although it is looking at various options including going public — a move that could help the “Airbnb of cars” become its own household name.

“We’re very flattered” when someone refers to Turo that way, he said. “We hope to one day reach that level of awareness.”

0 notes

Text

Waymo Vs. Uber Vs. Tesla Vs. Amazon Vs. Others: Who Will Sell You Your Robotaxi Ride?

New Post has been published on https://perfectirishgifts.com/waymo-vs-uber-vs-tesla-vs-amazon-vs-others-who-will-sell-you-your-robotaxi-ride-2/

Waymo Vs. Uber Vs. Tesla Vs. Amazon Vs. Others: Who Will Sell You Your Robotaxi Ride?

Uber self-driving prototype, now part of Aurora.

The agreement to merge Aurora and Uber ATG announced yesterday prompts the big question about just how the planned Robotaxi world will work. A core part of the deal was a strong relationship (though presumably not exclusive) between the new Aurora and Uber UBER , its 26% owner. Uber has the top position in the world of selling rides — though Didi sells more rides but only in one country — and the robotaxi business is all based on changing the automotive industry from being about selling cars to selling rides.

So how strong and useful is that position for Uber? Why has Uber been able to hold that position when the barriers to entry aren’t clear? If it’s hard to unseat Uber in that space, do some special companies — in particular Google GOOG — have a special position which makes it easier for them?

The future of automotive will all turn on which app customers pull out to summon a ride. Earlier, I wrote a guide to all the potential elements of robotaxi competition and identified these key factors:

Price — For many the most powerful factor.

Wait Time — The most complex, with so many driving factors beyond fleet size.

Territory — The subject of the coming land rush.

Brand & Style — The current biggest competitive element.

Luxury and Features — The small stuff can be big.

Innovation — Being ahead of the curve.

Customer Service — How well they treat people and cities.

Pooling — Can you efficiently combine rides?

Today, people pull out the Uber app most of all, though Lyft LYFT continues to grow in tandem. In Asia, Uber lost to companies like Didi and Grab — in the first case with the aid of the government, but not so much in the second. Why do they use Uber? It’s trivially easy to use a competing app in most cases. Uber is larger, but it turns out that having a larger fleet isn’t nearly the advantage it seems — what really governs service is the ratio of customers to available cars in the area. A smaller company with fewer customers and fewer cars can offer the same level of service if it gets over a basic threshold, which Lyft has done.

Presuming Aurora can deliver, Uber now can put Aurora-driven vehicles into the Uber fleet. It can buy and own vehicles made by contract manufacturers with Aurora driver installed, or it can let others own and manage those fleets who may, one might speculuate, have to agree to make them available inside Uber in order to get Aurora driver. Possibly exclusively inside Uber, or possibly simultaneously available in other networks too.

Human drivers and anywhere-to-anywhere

Uber, Lyft, Grab and a few other companies doing this have to decide how to combine their human-driven services with their future robot-driven services. The simplest plan would be to offer two options — if a robot is available for your route, you can agree to that or ask for that and presumably get a much lower price for your ride, probably starting at $1/mile compared to $2/mile for human driven.

Alternately, Uber could take the bolder step of selling all rides at $1.50/mile, for example, subsidizing human drivers with the robots to offer a unified “anywhere to anywhere service.”

Companies instead may also offer other pricing styles, including monthly subscriptions, which will, to be attractive, offer anywhere-to-anywhere service service. One needs to offer that to convince people to give up car ownership for robotaxi service, which is key to truly upending the old automobile industry.

A Waymo self-driving car pulls into a parking lot at the Google-owned company’s headquarters in … [] Mountain View, California, on May 8, 2019. (Photo by Glenn CHAPMAN / AFP) (Photo credit should read GLENN CHAPMAN/AFP via Getty Images)

Upstarts, even Google/Waymo, do not have a human driver service to take you between locations not in the service area of their vehicles. Without addressing that, their services can’t be a car replacement and customers will need to also use a different company for those trips. On the other hand, it may not be hard to get a company who will provide that for a small margin. (Though since Uber, Lyft and others all have their own robotaxi aspirations, maybe it will be harder to get a partner than a company would like.)

Google is a special animal, though. While most investors have not felt it would be easy to compete with Uber, Google is a much bigger company than Uber with a better brand. More than half of Uber’s customers summon Ubers with Android phones, the rest with iPhones. Google Maps and Waze are dominant in use by people on the move. Of all companies, if Google wanted to build a service like Uber, they would be the best positioned. Apple AAPL has a similar position (its robotaxi ambitions have waxed and waned and mostly been kept under wraps, but they are there.)

Google has a strong position, but what about the others? As big car brands ponder their futures, they will remember that they do have strong brands. A mobility service with a “Mercedes” or even “GM (Cruise)” brand on it could get immediate acceptance. They have, however, the fear that any accident under their brand could hurt the entire precious brand, while a Waymo accident (or even a Google branded car accident) doesn’t stop people from advertising with Google.

Tesla’s TSLA brand is new, but also very good. Tesla claims that once they have a real true full self driving product, they will open up a “Tesla Network” where ride-hail is done with Tesla owned vehicles (which it will take back and modify when they come off-lease) and private vehicles that owners authorize to do taxi rides when not in use. That prediction is still somewhat fanciful: Tesla isn’t close yet to actual real self driving, and it’s unclear if they ever will with existing hardware, but this is their plan.

Tesla Model 3 can have its steering wheel and pedals removed easily after lease, allowing the … [] sleekest conversion from car to robotaxi.

Tesla’s advantage, though, is by using off-lease and owner vehicles, their hardware cost will be much less than that of other companies, and the hardware depreciation is a large part of the cost of running a vehicle once you are doing it in quantity and pricing it at a competitive price. Tesla could be the leading competitor in a space on price.

Zoox has no brand with the public. To compete, they will really need to convince customers that their custom vehicle makes a ride that much better. On the other hand, Amazon AMZN has a huge brand, but unrelated to mobility. But even with no brand there, it may not be that hard a job for Amazon to declare, “Just use the Amazon app to get a ride. Ask Alexa for a ride from home” and for people to readily switch from Uber.

Indeed, even companies with no brand, but lots of money, can probably get people to use their app if their service is up to snuff. All is not lost for the other players, even if Uber has a current leg up. As long as people are paying by the mile or by the ride, switching from service to service will be easy, reducing barriers to entry. This is why subscription pricing models will be pushed, because they create barriers to switching. Companies may even subsidize those models just in the hope of locking in customers.

It should be noted that Didi is bigger than Uber just with China. It seems unlikely any non-Chinese player will be able to win in China, so most of this analysis is about the rest of the world.

If there’s competition

All of this, of course, presumes there is competition. There will be competition in just a few places at first – San Francisco Bay, New York, Shanghai and perhaps a few others. Since starting service in a town will be expensive in both money and human time, at first, companies will simply start up in virgin territory rather than compete on day one. In a new city, with no competition, you can charge $1 or even $1.50/mile and compete with $2/mile Uber service. Head to head, prices will fall below $1/mile and subscription models will arise. But for the 2020s there may not be much competition which allows many companies to thrive.

Comments can be read/left here.

From Transportation in Perfectirishgifts

0 notes

Text

Global Robo-Taxi Market

Global Robo-Taxi Market Size, Share, Growth, Industry Trends and Forecast 2020-2030

Global Robo-Taxi Market size accounted XXX in 2020 is estimated to reach XXX by 2030 growing with a CAGR of XXX during the forecast period. The robo-taxi is a self-driving autonomous car operated for on-demand mobility service, also known as robo-cab. It is fuel-efficient vehicles, which do not emit any kind of harmful carbon gases, thereby it helps in protecting the environment. Further, this car has become a more affordable solution for the customer by eliminating the need for a human chauffeur, which considered a significant part of the operating costs. Additionally, many companies are coming forward and involving in partnership, collaboration and a joint venture to boost the robo-taxi market growth. For instance, in July 2018 Daimler AG and Bosch Corp, the largest automotive supplier have entered into a partnership to develop driverless cabs. The robo-cab vehicle would be run by a strong and reliable energy-efficient computer, loaded with sensors, and an artificial intelligence software that would be acting as the virtual chauffeur. This partnership between the biggest players in the automobile industry, would revolutionize the entire automobile industry and help the robo-taxi market to flourish positively.

Download Sample Copy of the Report to understand the structure of the complete report (Including Full TOC, Table & Figures) @ https://www.decisionforesight.com/request-sample/DFS020297

Market Dynamics and Factors:

Currently, three robo-taxi market trends are accelerating transformative change in the automotive industry which are zero-emission vehicles, new mobility models and autonomous driving. All three of these trends, offering the potential for convenient, personalized transport as an attractive alternative to owning a car or using public transport. The growing issues of traffic congestion, increasing pollution are adversely impacting health and overall quality of life. The demand for zero-emission vehicles or green vehicles is rising, also there is a surge in autonomous cars demand. Companies such as Uber, Lyft, and Baidu are collaborating with Tier 1 companies in the race for the deployment of autonomous fleet. For instance, in 2018, Lyft partnered with Aptiv Plc for its self-driving cars. Lyft has completed approximate 5,000 rides in 2018 through its ride-hailing app. Hence all these developments will lead to market growth. However, the robo-cabs are still in testing phases and carries baggage of challenges which includes, high manufacturing cost, the risk of injury to drivers and pedestrians. These factors are expected to restrain the robo-taxi market. Technological advancements and product innovation will lead to an opportunity for robo-taxi market growth

Market Segmentation:

Global Robo-Taxi Market – By Level of Autonomy

Level 4

Level 5

Global Robo-Taxi Market – By Propulsion

Hybrid Cell

Fuel

Electric

Global Robo-Taxi Market – By Application

Passenger

Goods

Global Robo-Taxi Market – By Geography

North America

U.S.

Canada

Mexico

Europe

U.K.

France

Germany

Italy

Rest of Europe

Asia-Pacific

Japan

China

India

Australia

Rest of Asia Pacific

ROW

Latin America

Middle East

Africa

New Business Strategies, Challenges & Policies are mentioned in Table of Content, Request TOC at @ https://www.decisionforesight.com/toc-request/DFS020297

Geographic Analysis:

Europe is the dominating region across the world. The growth in this region is imputed to the technological advancements and developed & supportive infrastructure has helped the fleet operators to test and deploy easily in this region. For instance, as per the European Commission, there are about 180 automobile facilities across the EU and the sector is the largest investor in R&D. Followed by Europe, Asia- Pacific is the second biggest contributor across the world, due to heavy demand for the electric vehicle, and recently the joint venture between Volvo and Baidu for electric self-driving taxis, which further helps as eco-friendly and advanced technical approach. North America is expected to show significant robo-taxi market growth in the upcoming years.

Competitive Scenario:

The key players in the robo-taxi industry are Waymo LLC, Daimler AG., GM Cruise LLC., Aptiv., AB Volvo, Google, Ridecell Inc., Tesla, Uber Technologies Inc., Volkswagen AG, Lyft, Inc., General Motors., BMW AG, Toyota Motor Corporation, Ford Motor Company, Robert Bosch GmbH, Continental AG, Denso Corporation, and NVIDIA Corporation

Connect to Analyst @ https://www.decisionforesight.com/speak-analyst/DFS020297

How will this Market Intelligence Report Benefit You?

The report offers statistical data in terms of value (US$) as well as Volume (units) till 2030.

Exclusive insight into the key trends affecting the Global Robo-Taxi industry, although key threats, opportunities and disruptive technologies that could shape the Global Robo-Taxi Market supply and demand.

The report tracks the leading market players that will shape and impact the Global Robo-Taxi Market most.

The data analysis present in the Global Robo-Taxi Market report is based on the combination of both primary and secondary resources.

The report helps you to understand the real effects of key market drivers or retainers on Global Robo-Taxi Market business.

The 2021 Annual Global Robo-Taxi Market offers:

100+ charts exploring and analysing the Global Robo-Taxi Market from critical angles including retail forecasts, consumer demand, production and more

15+ profiles of top producing states, with highlights of market conditions and retail trends

Regulatory outlook, best practices, and future considerations for manufacturers and industry players seeking to meet consumer demand

Benchmark wholesale prices, market position, plus prices for raw materials involved in Global Robo-Taxi Market type

Buy This Premium Research Report@ https://www.decisionforesight.com/checkout/DFS020297

About Us:

Decision Foresight is a market research organization known for its reliable and genuine content, market estimation and the best analysis which is designed to deliver state-of-the-art quality syndicate reports to our customers. Apart from syndicate reports, you will find the best market insights, strategies that will help in taking better business decisions on subjects that may require you to develop and grow your business-like health, science, technology and many more. At Decision Foresight, we truly believe in disseminating the right piece of knowledge to a large section of the audience and cover the in-depth insights of market leaders across various verticals and horizontals.

Contact:

Email: [email protected]

For Latest Update Follow Us:

https://www.facebook.com/Decision-Foresight-110793387201935

https://twitter.com/DecisionFs

https://www.linkedin.com/company/decision-foresight/

0 notes

Text

THE TOP 25 MODELS TO COME, ACCORDING TO CAR AND DRIVER

The American magazine Car and Driver recently published its list of 25 models that deserve to be expected over the next few years. We’re going through this fine selection of vehicles with a grain of salt.

Ah yes, don’t think that these 25 upcoming models are the only ones planned for the next 3-4 seasons. Even though the pandemic is currently affecting the entire industry, the automotive world is preparing for what’s next… and the resumption of production as soon as possible!

Chevrolet Corvette Z06 2022

According to the publication, the next level of Corvette is expected in 2022. We can expect a multiplication of versions of the model, which, it should be remembered, now uses a centrally located engine. Over the years, Chevrolet has introduced us to several liveries of the sports car, and it wouldn’t be surprising to see the ZR1 badge coming back. For this future Z06, a naturally aspirated V8 engine is probably the solution, while on-road performance is likely to be more spicy.

Porsche 718 GT4 RS 2022

Still in the ultra-sporty segment, Porsche is busy pushing the limits of its most affordable coupe even further. After the GT4, the RS badge would theoretically end the career of this generation of the coupe. The 4.0-liter naturally aspirated 6-cylinder flat-bed engine is expected to be more muscular than ever in this track-ready car.

McLaren 765LT 2021

This “longer” evolution of the 720S (LT stands for Long Tail) has already been unveiled on the web. So we know many details about the final version, because even the pictures are available. What is certain is that the 765LT will certainly be even more formidable than the 720S. Lighter than the 720S, the 765LT will also be more powerful thanks to a 755-hp twin-turbo V8 engine. Its arrival is expected before the end of the year.

Aston Martin Vanquish 2024

Let’s stay in the UK if you don’t mind, as Aston Martin is also preparing a metamorphosis of its entire line-up.

Obviously, the DBX SUV is the number one priority for the next few months, but after that, the British firm’s engineers will have to focus on moving the majority of sports cars to a mid-engine configuration. After the Valkyrie supercar, the automaker intends to market a Vanquish with a turbocharged V6 engine and electric power assist. Yes, even Aston Martin cannot escape electrification.

Maserati MC20 2021

There’s also something new at Maserati, the Italian automaker, which is already working on a mid-engine sports car powered by a twin-turbo V6 engine that could, according to the magazine, surpass the 600-horsepower mark.