#Health Insurance Companies In India

Explore tagged Tumblr posts

Text

Tax Benefits of Health Insurance in India

Introduction

Health insurance is an essential aspect of financial planning in India, providing individuals and families with the much-needed financial security during medical emergencies. Besides the obvious advantages of health insurance, one often overlooked aspect is the tax benefits it offers. In this article, we will explore the tax benefits of health insurance in India, which can significantly reduce your tax liability.

Section 1: Tax Deductions Under Section 80D

One of the most significant tax benefits of health insurance in India is the deductions available under Section 80D of the Income Tax Act. This section allows taxpayers to claim deductions for the premiums paid for health insurance policies. The deductions vary depending on the age of the insured and the premiums paid, making it a valuable incentive for individuals and families to invest in health insurance.

Taxpayers can claim deductions for health insurance premiums paid for themselves, their spouse, children, and parents. The maximum deduction allowed under this section is subject to certain conditions. For those below the age of 60, the maximum deduction is different from those above the age of 60. It's important to understand that these deductions can significantly reduce your taxable income, thereby reducing your tax liability.

Section 2: Tax Benefits for Preventive Health Check-ups

In addition to deductions on premiums, taxpayers can also claim deductions for the expenses incurred on preventive health check-ups. The deduction for these expenses is available under Section 80D as well, further encouraging individuals to invest in their health and well-being.

Preventive health check-ups are an essential aspect of healthcare, as they help in early detection of potential health issues, thereby reducing the overall medical costs. By claiming deductions for these expenses, taxpayers not only save on taxes but also promote a healthier lifestyle.

Section 3: Tax Benefits for Senior Citizens

Senior citizens in India enjoy additional tax benefits when it comes to health insurance. Under Section 80D, the maximum deduction for premiums paid for senior citizens is higher compared to those under 60 years of age. This is a crucial aspect of the tax benefits of health insurance, as medical expenses tend to increase with age.

Investing in a health insurance policy for senior citizens can be a strategic financial move, as it not only provides them with the necessary healthcare coverage but also offers substantial tax savings.

Section 4: Tax Benefits for Family Coverage

Health insurance policies in India often allow for family coverage. This means that a single policy can cover all family members, making it a cost-effective option. The tax benefits under Section 80D extend to family coverage, enabling individuals to claim deductions for premiums paid to cover their entire family.

This feature is particularly advantageous for families, as it provides comprehensive healthcare coverage and substantial tax benefits. It ensures that your loved ones are protected against unexpected medical expenses, and it reduces your tax liability simultaneously.

Section 5: The Role of Top Health Insurance Companies in India

While discussing the tax benefits of health insurance in the country, it is essential to acknowledge the role of top health insurance companies in India. These companies offer various policies that cater to various needs and preferences. They play a significant role in promoting health insurance as a viable means of financial security.

The top health insurance companies in India have established a reputation for providing quality healthcare coverage, ensuring that policyholders receive the best possible medical care during times of need. Their policies often come with additional features and benefits, enhancing the overall value of health insurance.

In conclusion, health insurance in India not only provides financial security during medical emergencies but also offers valuable tax benefits. As healthcare costs continue to rise, having the right health insurance policy can safeguard your financial well-being and help you save on taxes.

Ultimately, it is advisable to consult a tax advisor or financial expert to understand the specific tax benefits applicable to your situation, as the rules and regulations may change over time.

0 notes

Text

Find out how an insurance broker license can help you serve clients better, increase your revenue, and operate independently. Also, learn about the steps for insurance company registration and insurance surveyor licenses in India.

#insurance marketing firms in India#insurance agent license in India#isnp certification in Indi#insurance self-network platforms#insurance web aggregator license registration#insurance surveyors and loss assessors license registration#health insurance company license registration

0 notes

Text

What is Claim Settlement Ratio?

Claim Settlement Ratio (CSR) is a crucial metric used in the insurance industry to evaluate the performance of insurance companies in settling claims. It represents the percentage of claims settled by an insurance company against the total number of claims received during a specific period, usually within a financial year. The formula for calculating Claim Settlement Ratio is:

Claim Settlement Ratio=Number of Claims Settled/Total Number of Claims Received×100%

Claim Settlement Ratio=Total Number of Claims Received/Number of Claims Settled×100%

A higher Claim Settlement Ratio indicates that the insurance company is more efficient and reliable in processing and settling claims. It signifies the insurer's ability to honor the policyholder's claims promptly and fairly. A low CSR may indicate potential issues such as delays or denials in claim settlements, which could affect the reputation and trustworthiness of the insurance company.

It's essential to consider other factors along with CSR when evaluating an insurance company, such as customer service, product offerings, financial stability, and overall reputation.

#claim settlement ratio#health insurance#health insurance policy#health insurance in india#claim settlement in insurance#best health insurance#best health insurance policy#best health insurance policy in india#claim settlement#health insurance claim#health insurance claims ratio#health insurance claims ratio 2020#incurred claim ratio#irda claim settlement ratio of health insurance company 2019-2020#health insurance claim settlement ratio#nidhiverma22#algatesinsurance

0 notes

Text

Importance of life and health insurance

Life and health insurance are among the most critical risk management solutions available today. Life insurance is basically contractual agreement between a policy holder and the insurance company, which tends to promise to provide the amount insured to the bereaved family after the demise of the policy holder. Best company for Life insurance in Delhi can provide coverage for the financial needs of a family, as well as future plans or investments.

Health insurance, on the other hand, provides compensation when the policy holder requires medical assistance and hospitalization. The policy holder has to pay a fixed amount as a premium for their health insurance. Subsequent to doing so, they would get their medical expenses reimbursed by the insurance company after paying for the same or the company takes care of the expenses directly with the hospital. Many businesses today have tie ups with the Best health insurance company in Delhi to provide their employees with the necessary coverage.

Life insurance and health insurance is required by every person worried about their own and their family’s future. While health insurance provides coverage for medical bills, life insurance provides coverage to families after the death of a breadwinner. Life is fairly uncertain. Hence, people to try their best to protect themselves and their loved ones by investing in appropriate insurance coverage. In addition to life and health insurance, people should also seek out the policies offered by the Best car insurance company in Delhi, India.

#Best company for Life insurance in Delhi#Best car insurance company in Delhi#India#Best health insurance company in Delhi

1 note

·

View note

Text

Types of Health Insurance Plans In 2024

Health insurance is a crucial aspect of financial planning and healthcare management, offering individuals and families protection against high medical costs. Understanding the different types of health insurance plans available is essential for selecting coverage that aligns with your healthcare needs and budget. In this guide, we’ll explore the various types of health insurance plans,…

View On WordPress

#affordable health insurance#best health insurance#best health insurance company#best health insurance policy in india#health insurance#health insurance 101#health insurance agent#health insurance claim#health insurance explained#health insurance gov#health insurance guide#health insurance in usa#health insurance marketplace#health insurance plan#health insurance plans#health insurance policy#health plans#individual health insurance#insurance

0 notes

Text

Best Home Insurance in Mohan Garden - Bima View

When it comes to protecting your haven in Mohan Garden, your search for the best home insurance in Mohan Garden stops at Bima View. We truly grasp how crucial it is to safeguard your home and valued possessions. In this detailed guide, we'll explore why Bima View stands out as the top choice in home insurance, surpassing all others in Mohan Garden.

The Bima Advantage

Comprehensive Coverage:

At Bima View, we offer a wide-ranging coverage that ensures every aspect of your home and belongings is protected. From structural damage to personal items, we've got you covered.

Affordable Premiums:

We understand the importance of budget-friendly options. Bima View provides competitive premiums without compromising on the quality of coverage. Your peace of mind shouldn't come at a hefty price.

Clear and Simple Policies:

Our insurance policies are designed with simplicity in mind. No confusing jargon or hidden clauses. Bima View believes in transparency, making it easy for you to understand the terms and conditions.

Quick and Hassle-Free Claims:

In the unfortunate event of a claim, Bima View ensures a swift and hassle-free process. Our dedicated team is ready to assist you through every step, making the experience as smooth as possible during challenging times.

Tailored Solutions:

Every home is unique, and so are its insurance needs. Bima View offers customized solutions, allowing you to pick and choose coverage that specifically fits your requirements. No one-size-fits-all policies here.

Local Expertise:

Being familiar with Mohan Garden and its specific nuances, Bima View brings a local touch to insurance. Our team understands the locality, making us better equipped to address your needs effectively.

Customer-Centric Approach:

Bima View values its customers above all. Our customer service is dedicated to providing assistance and guidance whenever you need it. Your satisfaction is our priority.

In conclusion, when it comes to securing your Best home Insurance in Mohan Garden, Bima View emerges as the ultimate choice. Our commitment to comprehensive coverage, affordability, clarity, quick claims, tailored solutions, local expertise, and customer satisfaction sets us apart. Trust Bima View to be your partner in safeguarding your cherished abode.

#insurance companies in Dwarka#Life Insurance Companies in Dwarka#Best Health Insurance Companies in Nawada#general insurance companies in Nawada#Best Life Insurance Plans in Dwarka#Life Insurance Plan & Policy in Nawada#Best Health Insurance Plans in Dwarka#medical insurance plans#Home Insurance Policy Online in India#Best home insurance in Mohan Garden#Business Liability Insurance in Dwarka#car insurance near me#term insurance in Mohan Garden#Whole Life Insurance Plan in Nawada#Top LIC Agents in Dwarka#whole life insurance policy in Mohan Garden#Bima View Health Insurance Companies in Nawada#affordable whole life insurance policy in Mohan Garden#whole life insurance family plans in Dwarka#term insurance plan in Dwarka

0 notes

Text

Who'll pay for claims if Insurance Company goes bankrupt?

If an insurance company is declared insolvent or bankrupt, then IRDAI will guaranty an association and guaranty fund swing into action. The association will transfer the insurer’s policies to another insurance company or continue providing coverage itself for policyholders. So it’s important for policyholders to continue paying premiums if their insurer is taken over by the state.

#Insurance Company Bankruptcy#Bankrupt Insurance Companies#Insurance Company Insolvency#What Happens If Your Insurance Company Goes Out Of Business?#What Will Happen When Insurance Company Goes Bankrupt in India?#Insurance Company Bankruptcy Causes.#best term insurance#best term life insurance#how to choose term insurance plan#what is term insurance#best health insurance plans#how to buy health insurance

0 notes

Text

How to Choose the Perfect Health Insurance Company

Health insurance is an essential safeguard that provides financial protection during medical emergencies. With the rising costs of healthcare services in India, having the right health insurance plan can make a significant difference in ensuring you receive quality medical care without worrying about the financial burden. However, with numerous insurance providers and policies available on the market, selecting the best health insurance company in India can be a daunting task. In this blog, we will guide you through the process of choosing the perfect health insurance company to suit your needs.

Assess Your Health needs.

Before you begin searching for a health insurance company, it's crucial to assess your specific health needs. Consider factors such as your age, current health condition, family medical history, and the number of family members to be covered under the plan. If you have any pre-existing conditions, look for companies that offer comprehensive coverage for those conditions.

Coverage Options

Once you have a clear understanding of your health needs, it's time to evaluate the coverage options offered by different health insurance companies in India. Look for plans that include a wide range of medical treatments, hospitalisation expenses, outpatient services, and maternity benefits. Adequate coverage for critical illnesses and daycare procedures should also be considered.

Network Hospitals

A strong network of hospitals is a crucial factor to consider when choosing a health insurance company. Ensure that the insurer has ties with reputable hospitals in your city or region. Having a nearby network hospital can save you the hassle of travelling long distances during emergencies.

Claim Process and Settlement Ratio

An efficient and hassle-free claim process is essential for a good health insurance experience. Research the claim settlement ratio of different insurers, as it indicates the percentage of claims settled by the company. A higher settlement ratio implies better chances of your claim being honoured without unnecessary delays.

Premium Costs

Compare premium costs for different plans offered by various health insurance companies. Remember that the cheapest plan may not always provide the necessary coverage. Strike a balance between premium costs and coverage to find a plan that best fits your budget while providing adequate protection.

Co-payments and Deductibles

Check if the health insurance plan has any co-payment or deductible clauses. Co-payments require you to pay a specific percentage of the medical expenses, while deductibles are a fixed amount that you must pay before the insurance coverage kicks in. Understand these clauses to avoid surprises at the time of the claim.

Add-on Benefits

Some health insurance companies offer add-on benefits that enhance your coverage. These may include critical illness riders, wellness programmes, coverage for alternative treatments, or even OPD (outpatient department) expenses. Assess the importance of these add-ons based on your healthcare requirements.

Customer Reviews and Reputation

Research the reputation of the health insurance companies you are considering. Look for customer reviews and feedback online to understand the experiences of policyholders with the insurer. A company with positive customer reviews and a strong reputation for customer service is more likely to be trustworthy.

Financial Stability

A financially stable health insurance company is better equipped to handle claim settlements and provide long-term coverage. Check the company's financial strength rating from independent rating agencies to ensure its stability.

Inclusions and Exclusions

Carefully read the policy's fine print to understand the inclusions and exclusions. Knowing what is covered and what is not will prevent misunderstandings later on.

In conclusion, choosing the best health insurance company in India requires thorough research and evaluation of various factors. By assessing your health needs, coverage options, claim process, and add-on benefits, you can make an informed decision that ensures your health and financial security. Remember to compare different insurers, read customer reviews, and prioritise financial stability to find the perfect health insurance company that meets your requirements. With the right health insurance plan, you can enjoy peace of mind knowing that you and your family are protected during medical emergencies.

Here you can find our reference post: https://twowheelerinsuranceserviceinindia.blogspot.com/2023/07/how-to-choose-perfect-health-insurance.html

#best health insurance company in India#health insurance company in India#health insurance company#health insurance

0 notes

Text

So Disco Elysium is the only game you've ever really liked

I get it! It's a phenomenal game with superb art and writing, and its themes are consistent and deeply explored. It sets a high bar for video games. But there are other really, really fantastic games out there. This is a list that is 100% my own taste of things that aren't necessarily similar, other than the fact that they're really fucking good. (A lot of these are on sale for the Steam Summer Sale until July 11 2024!)

In Stars and Time

In Stars and Time is a time loop game where you play as Siffrin, the rogue of a party at the end of their quest to save the day by defeating the King, who is freezing everybody in time! But something is wrong: every time you die, you loop back to the day before you fight the King. You're the only one who remembers the loops, so it's up to you to figure out why it's happening, and how to break out.

In Stars and Time is a heart-wrenching dive into mental health, friendship, and love. It's about feeling alone, and how awful it is when the people who love you don't notice (and how awful it is when they do). It's about falling deeper and deeper into your worst self and your worst tendencies, and how to come back from it.

The creator also did one of my favorite Disco Elysium comics ever, which is only tangentially relevant but worth mentioning.

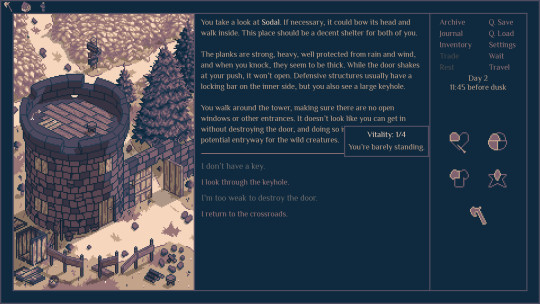

Roadwarden

In Roadwarden, you play as the titular Roadwarden for an undeveloped and "wild" part of the kingdom. Monsters roam the forests and roads, and it's your job to keep people safe. On paper, anyway. Your real mission is to find out what is of value in the area, and how to take it from its people. How well you perform this task is up to you. It's an oldschool text-based RPG, and I take a lot of notes by hand when I play.

Roadwarden explores exploitation and industrialization by making you look in the face of your potential victims. You can only learn what your bosses want you to report on by getting close to the residents, after all. There are mysteries to be solved, secrets to be gathered, and hearts to win.

The Longing

The Longing is an adventure-idle game where you play as the solitary servant of a sleeping king. Your task is to wait for him, for four hundred days. Time in the game passes in realtime (for the most part). There are caves to explore, books to be read, and drawings to make.

The Longing is about loneliness and depression. It's about whether or not you decide to stay in that hole, and if you do, what you do with yourself while you're there. Maybe you'll wander. Maybe you'll stare at a wall. Maybe you'll just sleep until it's all over.

Papers, Please

Papers, Please casts you as a newly hired customs officer in a country that is rapidly tightening its borders as its fascist government tightens its fist. This game is stressful. Sometimes you intend to help out the revolutionaries when they asked, but then you got so stressed out trying to make your quota so you can feed your family and pay your bills that you didn't notice the name of the person they were hoping to contact while going through their papers. Sometimes someone puts a bomb in front of you and expects you to defuse it. Sometimes someone suggests you steal people's passports so you can get your family out, and with the horror you see daily, the idea tempts you more than you'd like.

Papers, Please is all about hard choices and testing your moral fortitude. Everything you do has consequences. Being a good person in this game is hardly ever rewarded, but not in a way that feels overly cynical. Papers, Please asks you what kind of person you want to be and what you're willing to sacrifice to get there.

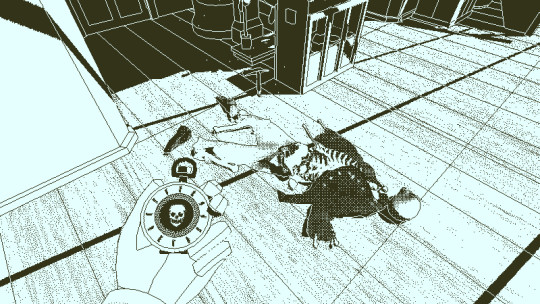

The Return of the Obra Dinn

From the creator of Papers, Please, The Return of the Obra Dinn is a game where you play as an insurance investigator for the East India Trading Company. The ship the Obra Dinn has just floated back into port, its entire crew missing or dead. It's your job to figure out what happened aboard the vessel. For insurance reasons.

I don't know how to go into the themes of this too deeply without giving away too much, but the mechanics of the game itself make the game worth playing. You have a magic stopwatch that allows you to go back to the moment of a person's death, allowing you to try and figure out who (or what) killed them, and how. And the soundtrack is extremely good.

Outer Wilds

In Outer Wilds you play as an unnamed alien, and it's your first day going to space! Your planet's space program is pretty new still, so there's still lots to explore and discover on the planets within your system. There are ancient ruins from a mysterious race that once lived in your system, long before your species began to record history. Why were they here? Where did they go? How are they connected to the weird thing that keeps happening to you?

The fun of Outer Wilds is in the discovery and answering your own questions. The game never tells you where to go, and it never outright tells you anything. There are clues scattered through the system, and it's up to you to put them together and figure out your next steps. It's about the way that life always goes on, no matter what, even when it seems like the end of everything, forever. I'd recommend NOT reading anything else about this game. Just go play it. Seriously, the less you know, the more fun this is.

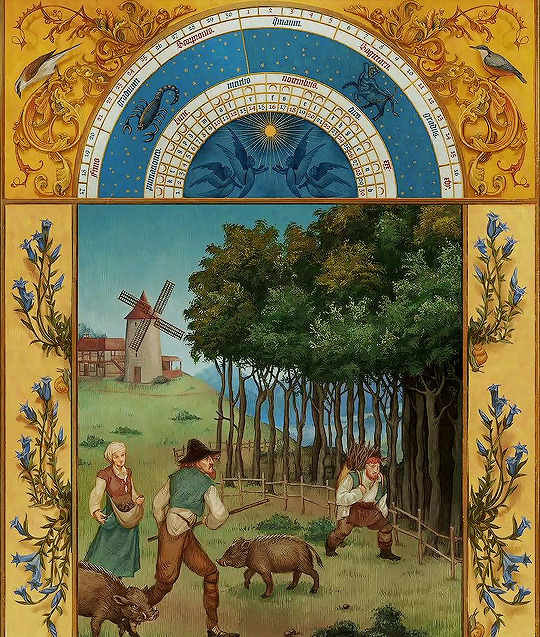

If on a Winter's Night, Four Travelers

In If on a Winter's Night, Four Travelers, you explore the circumstances of the deaths of four individuals.

This is a short one that took me about two and a half hours to play. If for no other reason, play it for the stunning pixel art. The game explores sexism, racism, and homophobia in the Victorian era and leans heavily into horror themes. Best of all: it's completely free!

Pentiment

Pentiment takes you to the 16th century, where you take the role of Andreas Maler, a journeyman artist working on his masterwork in the scriptorium of an abbey. When someone is murdered, Andreas takes responsibility for finding the culprit.

The game is set over 20~ years and you get to watch how Andreas' actions affect the village in various ways (who's alive the next time you come by, have people gotten married and had children...). It's an exploration of how the past affects the future, and what parts of that past we choose to keep or discard. It has beautiful art, and fans of both Disco and Pentiment often compare them.

Other games you might wanna check out

Night in the Woods, Dredge, Oxenfree, A House of Many Doors, Inscryption, Slay the Princess, Citizen Sleeper, Chants of Sennar, Loop Hero, The Cosmic Wheel Sisterhood, The Pale Beyond, Where the Water Tastes Like Wine, Elsinore, Her Story, Before Your Eyes, Pathologic (not delved into above because the venn diagram of Pathologic fans and Disco fans is basically a circle)

#disco elysium#pentiment#outer wilds#in stars and time#roadwarden#if on a winters night four travelers#papers please#the return of the obra dinn#the longing#video games#hoping so badly there are no glaring errors in this#made this because i have spoken to many people who Dont Play video games but liked disco

2K notes

·

View notes

Text

Best Insurance Broking Advisory services in Bangalore | India

Looking for the best insurance advisory services in India? Look no further than our top-rated insurance broking company. Our team of experts provides comprehensive corporate general insurance and health insurance advisory services, as well as insurance investments advisory services to help you make the most of your insurance services. Contact us today to learn more.

#insurance advisory services#insurance broking companies in india#corporate general insurance#health insurance advisor#insurance services#insurance investments advisory services#right horizons

0 notes

Text

You can secure the future's of your loved one's effectively when you make a wise and informed policy buying decision. For more details visit us at Safetree.

#best health insurance#best health insurance companies#health insurance plan in india#health insurance companies#buy health insurance

0 notes

Text

What is CANSLIM method in Indian stock market?

The CANSLIM method is a popular stock selection strategy developed by William O'Neil, founder of Investor's Business Daily. This method is widely applied in global markets, including India, to identify high-growth stocks with strong potential for long-term gains. CANSLIM is an acronym that represents seven key criteria used to evaluate stocks. Here’s a breakdown of the method as it applies to the Indian stock market:

C - Current Earnings Growth:

Look for companies with a high quarterly earnings growth rate (usually above 25% year-over-year) as a sign of financial strength. In India, strong earnings growth can indicate resilience in a company amid fluctuating economic conditions.

A - Annual Earnings Growth:

Annual earnings should ideally grow by at least 25% over the last three to five years. This long-term growth indicates consistency and helps differentiate solid companies from those with temporary gains.

N - New Product, Service, or Management:

Companies launching innovative products or services, entering new markets, or led by effective management often outperform. In India, sectors like technology, finance, and consumer goods regularly see innovation, making them ideal for CANSLIM.

S - Supply and Demand:

Stocks with lower supply (fewer shares available) and high demand typically have higher potential for price increases. In India, high promoter stakes and low float can create such conditions, particularly in niche companies or emerging sectors.

L - Leader or Laggard:

Choose sector leaders over laggards, as they usually have strong financials, established market share, and brand recognition. Investors in the Indian market may favor blue-chip stocks or leaders within specific sectors.

I - Institutional Sponsorship:

Institutional investment in a company is often a positive sign, reflecting the confidence of large investors. In India, stocks with backing from mutual funds, insurance companies, or foreign institutional investors (FIIs) tend to be more stable.

M - Market Direction:

Invest when the overall market is trending upwards. In India, tracking major indices like the NIFTY 50 or SENSEX can indicate market health. The CANSLIM approach emphasizes that it's better to avoid investments during a bear market phase.

CANSLIM in Practice

The CANSLIM approach is more suited to growth stocks rather than value stocks. Investors in India using this strategy often focus on mid-cap and large-cap stocks with a high growth potential, such as those in sectors like IT, financials, and consumer goods, which have demonstrated strong earnings potential. It requires technical and fundamental analysis, making it ideal for investors willing to stay engaged with market trends.

#growth stocks#share market#stocks#indian stock market#breakout stocks#canslim#investments#market outlook#stocks to buy#stock market#bse#nse#financetips#investing#invest#investors#personal finance

3 notes

·

View notes

Text

Payroll Processing in India by MAS LLP: Streamlining Your Business Operations

In today’s fast-paced business environment, efficient payroll management is essential for any organization. Payroll processing involves managing employee salaries, benefits, taxes, and deductions, making it a complex and time-consuming task. For businesses operating in India, outsourcing payroll processing to professional services like MAS LLP can offer immense benefits, allowing you to focus on your core business while ensuring compliance with local regulations.

What is Payroll Processing? Payroll processing refers to the administration of employees' financial records, including salaries, bonuses, deductions, and net pay. It also encompasses tasks like generating payslips, managing leave entitlements, and ensuring timely tax payments. In India, payroll processing must adhere to various legal requirements, including labor laws, tax regulations, and statutory compliances such as Provident Fund (PF), Employee State Insurance (ESI), and professional tax.

Why Choose Payroll Processing in India by MAS LLP? MAS LLP is a trusted provider of payroll services in India, known for its efficient and accurate payroll management solutions. Here’s why MAS LLP is the right partner for your business:

Expertise in Local Compliance India’s payroll system is governed by multiple laws and regulations that vary across states. MAS LLP’s team of payroll experts ensures your business stays compliant with all statutory requirements, reducing the risk of fines and legal complications.

Customized Solutions MAS LLP understands that every business has unique payroll needs. They offer tailored payroll processing solutions that fit the size and scope of your business, ensuring seamless operations without unnecessary costs.

Cutting-Edge Technology With the integration of modern payroll software, MAS LLP provides automated payroll services that minimize errors and ensure data security. Their technology-driven approach enables real-time reporting, helping businesses monitor their payroll activities efficiently.

Cost-Effective Services Managing payroll in-house can be resource-intensive, requiring dedicated staff and software tools. Outsourcing payroll processing to MAS LLP helps reduce overhead costs while ensuring professional management of your payroll functions.

Focus on Core Business By outsourcing payroll tasks to MAS LLP, companies can redirect their focus toward strategic growth and core operations, rather than being bogged down by administrative duties.

Key Payroll Services Offered by MAS LLP MAS LLP offers a comprehensive range of payroll services, including:

Salary Calculation and Disbursement: Timely calculation and payment of employee salaries, bonuses, and incentives. Tax Management: Handling employee income tax, TDS (Tax Deducted at Source) calculations, and filing returns. Statutory Compliance: Management of Provident Fund (PF), Employee State Insurance (ESI), and other statutory deductions. Payslip Generation: Providing detailed and compliant payslips to employees. Leave and Attendance Management: Accurate tracking and integration of employee leave and attendance into payroll. Employee Data Management: Maintaining up-to-date employee records for payroll and statutory purposes. The Importance of Accurate Payroll Processing in India Accurate payroll processing is critical for employee satisfaction, legal compliance, and financial health. Errors in payroll can lead to dissatisfaction among employees, tax penalties, and damage to your company's reputation. By partnering with MAS LLP, businesses in India can ensure that their payroll is handled with precision, avoiding any potential pitfalls.

Why Payroll Processing is a Challenge in India India's payroll landscape is complicated due to:

Diverse Labor Laws: Each state in India has its own labor regulations, which makes staying compliant a complex task. Frequent Changes in Tax Laws: Payroll processing involves staying up-to-date with frequent changes in tax rates, deductions, and statutory compliances. Cultural Nuances: Payroll needs to reflect various allowances and benefits specific to Indian employees, making it more intricate than in many other countries. MAS LLP helps businesses navigate these challenges effortlessly, ensuring smooth payroll operations.

Conclusion For businesses operating in India, efficient payroll processing is crucial for legal compliance and employee satisfaction. By partnering with MAS LLP, companies can access expert payroll services that streamline their operations, reduce administrative burdens, and ensure accurate and timely payroll management.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

4 notes

·

View notes

Note

Also witch!

These are named after MONSTERS are you KIDDING ME if I don't get at least one of these I'm going to be very disappointed

Witch: If you could change one thing about the world, what would it be?

See, I feel like this overlaps with the genie question so I'll answer that one too.

As a witch, changing the world, I'd probably get rid of all microplastics/make all plastics biodegradable unless doing so would actively endanger lives (e.g. I'm sure there is plastic in some nuclear warehouse that we do not want degrading).

However, for a wish...

I've thought a lot about how I'd phrase a wish for a genie/djinn, and think that's the way to approach this question. I don't want to take away anyone's free will, but I also don't want it to be something where people could just reset the status quo. Just wishing that wealth is redistributed wouldn't banks using their records to reset accounts or less-digitized countries rendering their own currency invalid (e.g. India did that to fight counterfeiting in 2016) in order to undo cash redistribution away from the wealthy and powerful, or modifying taxes to take back the estimated amounts. Just wishing that countries would have equality laws doesn't mean that they would be enforced or that the national governments would allow those laws to remain in place instead of voting them back out.

However. We do live in a highly digitized age.

I want there to be a self-perpetuating digital virus or worm or whatever (or a set of them), lasting a year, that modifies data relating to wealth, status, medical rights, etc. to ensure that everyone gets what they need. Money is funneled away from the rich and to the poor, but the way it's done destroys records in the banks of what their worth was before that. Attempts to transfer the money back fizzle out and put up an error message, and attempts to just start up an entirely new software system and reset using paper records of the wealth are quickly infected as well. Health insurance companies have their databases flooded with fully insured patients whose requests they cannot deny and whose plans they cannot cancel. (The patients aren't added, because it's still just a virus, but old ones are reactivated and new ones can't be rejected.) Police departments across the US find their budgets drained. Other problems specific to other countries have their own variants, but I'm not sure what they'd be. There would definitely be a shift of wealth away from the US and other superpowers to the countries they fucked over.

For people who don't have digital savings, I'm less sure about how to approach, and would probably require a second genie wish, but if not, then I'd hope for that virus/es to include a variation where that wealth redistribution goes to government accounts that are then locked to prevent release of those funds unless they are directed towards helping those in need.

This would, in some ways, be a horrible time for a whole lot of people, including some who don't deserve it (sorry, professional computer programmers who are getting yelled at by bank CEOs for not anticipating impossible computer viruses crafted by a genie), but long-term... well, I imagine it would result in some power shift, right?

9 notes

·

View notes

Text

Guide to Check Status of Your Health Insurance Policy

A Guide to Checking the Status of Your Health Insurance Policy: Ensuring Peace of Mind and Security: Once you’ve invested in a health insurance policy, it’s essential to stay informed about its status to ensure that you and your loved ones are adequately protected in times of need. Whether you’re curious about your coverage details, premium payments, or policy renewal, checking the status of…

View On WordPress

#best health insurance#best health insurance company#best health insurance policy#best health insurance policy in india#health insurance#health insurance 101#health insurance agent#health insurance claim#health insurance explained#health insurance plan#health insurance policy#health insurance policy for family#how to buy health insurance plan#insurance#insurance policy#mediclaim vs health insurance#star health insurance#young star health insurance policy

0 notes