#HR professional certification

Explore tagged Tumblr posts

Text

The GSDC HR Professional certification is a globally recognized and highly respected credential that demonstrates an individual's knowledge and expertise in the field of human resources. This certification is awarded by the Global Skill Development Council (GSDC), an independent organization that specializes in providing certifications to professionals in various industries.

The certification process includes passing a comprehensive exam that covers critical HR topics such as recruitment, performance management, employee relations, and compliance. The exam is designed to test an individual's knowledge and understanding of the latest HR practices and trends.

#certified hr professional#certification in hr#hr certification#hr professional certification#human resources certification#certified human resources professional

0 notes

Text

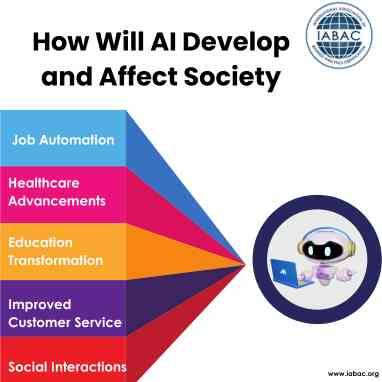

The future of artificial intelligence promises transformative advancements in automation, decision-making, and personalization across industries, with potential challenges in ethics, privacy, and job displacement, necessitating careful consideration to ensure responsible and equitable AI integration.

To know more Visit: www.iabac.org

#iabac#online certification#certification#data science#machine learning#data analytics#iabac certification#professional certification#hr#hr analytics

3 notes

·

View notes

Text

Explore how distance learning can enhance your career as an HR professional. Learn about the flexibility, cost-effectiveness, and specialized skills that distance education offers. Whether you're looking to advance your knowledge, acquire new skills, or balance work with study, distance learning provides an accessible and practical solution to meet your professional development needs.

#Distance Learning#HR Professionals#Career Development#Online Education#HR Training#Flexible Learning#Professional Growth#Remote Learning Benefits#HR Certification#Work-Life Balance

0 notes

Text

HR Certification Courses with Placement | Talent Magnifier

Introduction:

In today's competitive job market, having the right qualifications and practical skills is essential for success in the field of Human Resources (HR). HR professionals play a crucial role in shaping and managing the workforce of an organization, making it a highly sought-after career path. If you aspire to enter the world of HR or advance your existing HR career, enrolling in HR certification courses with placement can be a game-changer. One institute that stands out in this domain is Talent Magnifier, renowned for its comprehensive training programs and industry-relevant placement assistance.

The Importance of HR Certification:

HR certification courses provide you with in-depth knowledge, practical skills, and a competitive edge that can significantly boost your employability. These courses cover various HR functions, including recruitment and selection, employee relations, performance management, compensation and benefits, HR policies and procedures, and more. By earning a certification from a reputable institute like Talent Magnifier, you demonstrate your commitment to professional growth and validate your expertise in the HR field.

Why Choose Talent Magnifier?

Comprehensive and Practical Training: Talent Magnifier offers well-structured and comprehensive HR certification courses that cover all aspects of HR management. Led by industry experts and seasoned professionals, the courses provide practical insights, real-world examples, and hands-on exercises to ensure you develop the necessary skills to excel in your HR career.

Placement Assistance: One of the standout features of Talent Magnifier's HR certification courses is their placement assistance program. The institute has a vast network of industry connections and partnerships with leading organizations across various sectors. They leverage these connections to help their students secure job placements and internships, giving them valuable practical experience and a head start in their HR careers.

Industry-Relevant Curriculum: Talent Magnifier understands the rapidly evolving nature of the HR field. Therefore, their courses are regularly updated to align with the latest industry trends, technologies, and best practices. This ensures that students receive the most relevant and up-to-date training, making them job-ready from day one.

Practical Exposure: In addition to theoretical knowledge, Talent Magnifier emphasizes practical exposure through projects, case studies, simulations, and live assignments. This hands-on approach enables students to apply their skills in real-world scenarios, enhancing their understanding and confidence.

Supportive Learning Environment: Talent Magnifier fosters a supportive and inclusive learning environment. The institute encourages student participation, interactive discussions, and collaborative learning. This approach promotes a rich exchange of ideas and experiences among students, enabling them to learn from each other and develop a broader perspective on HR practices.

Conclusion:

Earning an HR certification from Talent Magnifier is a valuable investment in your career. With their comprehensive training, placement assistance, industry relevance, and practical exposure, Talent Magnifier sets you on the path to success in the dynamic field of HR. Whether you're a fresh graduate or an experienced professional seeking career advancement, enrolling in HR certification courses with placement at Talent Magnifier can provide you with the knowledge, skills, and opportunities you need to thrive in the HR industry. Take the leap and unlock your full potential with Talent Magnifier.

0 notes

Text

CPHR training, GPHR training

Established in the year 2004, SBMC School of Human Resource (SBMC) is engaged in providing solutions like Global HR Certifications, HR Training, HR internship, CPHR certification, GPHR certification, SPHR certification, aPHR certification, aPHRi certification, SPHRi certification, PHRi certification, Payroll Training, Recruitments, Corporate Training, Digital marketing training, Payroll and outsourcing of operations to various verticals in the industry. Our services are governed by a strict code of ethics which ensures we provide timely, effective and economical solutions to our clients while maintaining complete confidentiality

#Global HR training institute#phri exam#SPHR training#shrm cp certification#hrci partner#hrci#sphr certification prep classes near me#shrm cp and scp#sp hr#hrci continuing education#hrci training#hrci membership#chartered professional human resources#chartered professional in human resources#shrm sphr#cp hr services#hrci phr exam#sphr course#cp scp#shrm scp certification#society for human resource management#sphr certification cost#shrm society for human resource management#society of human resource management certified professional#shrm training programs#Global HR training centre

1 note

·

View note

Link

HR certification online programs are credible credentials that are issued by reputed and respected online platforms which act as the best proof that whoever has done a certification consists of skills and other essential aspects related to the field of human resources.

#HR Certifications#hr certification#hr career#HR Practitioner#hr professional#Human Resources#Human Resource#human resources management#human resources strategy#human resource practices

0 notes

Text

Everything You Need to Know About Aphr Prep Course

As a Human Resources professional, you understand the importance of staying up-to-date on industry trends and certifications. The Associate Professional in Human Resources (aPHR) certification is one such credential that can help advance your career and open doors to new opportunities. However, preparing for this exam can be a daunting task – so what do you need to know about an aPHR prep course?

First off, it's important to note that there are two types of courses available: self-paced online courses or instructor-led classroom sessions. Online courses offer convenience as they allow students to study at their own pace from any location with internet access. At the same time, instructor-led classes provide more structure and guidance throughout the learning process.

Are you a certified hr professional looking for a Senior Professional in Human Resources (SPHR) course? If so, then the right preparation course is essential for your success. In this blog post, we'll provide insights into everything you need to know about APHR prep courses and how you can achieve your certification goals.

Gain More Insights On An APHR Prep Course

Virtual classrooms are also available for those who prefer face-to-face instruction but don't have time for regular class attendance, enabling students to join live lectures over video conferencing platforms like Zoom or Skype from anywhere in the world!

When selecting an appropriate aPHR prep course provider, make sure they cover all key topics tested during the exam, including recruitment & selection processes; employee relations; compensation & benefits management; labor laws & regulations; performance management systems, etc., as well as providing practice questions/tests with detailed explanations of correct answers so learners can assess their understanding before taking on real-life scenarios related exams. Additionally, look out for additional resources such as flashcards or audio recordings, which may prove helpful when studying away your aPHR prep course from a home/office environment where visual aids might not be accessible due to easily forgotten facts quickly recalled using these tools.

Finally, ensure your chosen provider has experienced professionals teaching content-relevant material who have successfully passed the same examination themselves - having someone familiarize candidates with knowledge gaps will significantly increase chances of passing the first attempt!

Enroll in The Right APHR Prep Course Today!

With proper preparation through quality training materials provided by certified instructors, HR professionals seeking credentials or certification courses for hr professionals should find no difficulty achieving success when attempting APHR examinations. If you are also looking for an expert to help you with the right affordable training for the APHR course, consider connecting with HR UPFRONT, LLC. They have designed their courses for those who want to take their knowledge of human resources management and apply it towards gaining PHR or SPHR certification from the Society of Human Resource Management (SHRM). Connect with them today to gain more knowledge about top-quality training courses.

0 notes

Text

ALT TEXT:

A print out of an email from Jeremy Larkin to Arthur Jones. Within the signatures from both men there is The Holmwood Foundation Logo. Black and White, a flower against a blood drop.

Subject: Maddie!!

Message reads:

Arthur,

That should be enough. I’ll send the documents to HR.

As much as I would like to remain hands off, regrettably my email will be open, should Madeline need anything. It’s not like I’m going anywhere.

I do hope you’re looking forward to the Van Helsing circus. They’ll be parading you and Mr Harker around like show ponies. It’s not as pleasant as the newsletter makes it seem.

Jeremy (He/Him)

Foundation Director of Operations | THE HOLMWOOD FOUNDATION Email: [email protected], The Lucy Westenra Building, Abbey Lane, Whitby, YO22 4JT

Underneath, there is the original email from Arthur which reads:

Hi Jeremy,

Great news about Madeline! I’m so glad she was able to prove herself to you. I know she’ll be a great asset to the archives.

Is there anything else you need for her DBS check? I’ve forwarded the Passport, Deed Poll, School Certificates and References from the last three years, personal and professional.

I know the Archives are a sore point for you, and we wouldn’t want you to have to go down there without cause, so I’ve tried to ensure she’ll only have to contact you in extreme circumstances.

Arthur (:

The signature is the same except it reads:

Arthur F. Jones Head Archivist

Email: [email protected]

#extract#foundation email#Jeremy Larkin#Arthur Jones#maddie townsend#Dracula#the holmwood foundation podcast#the holmwood foundation#horror podcast#audio drama#fiction podcast

21 notes

·

View notes

Text

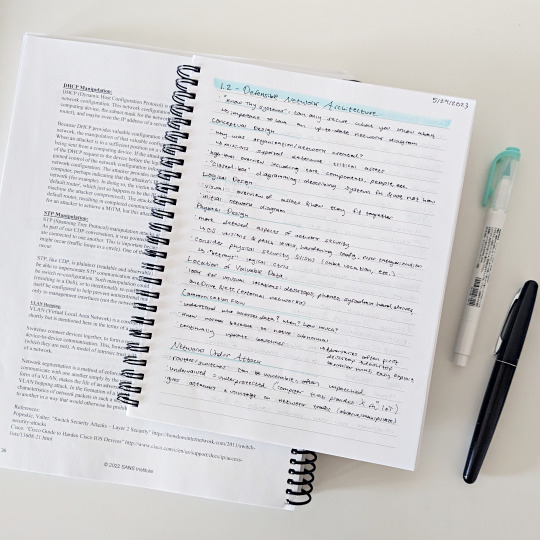

monday, may 29th, 2023 | 01/100 days of productivity

I graduated from college a few weeks ago! I made this account when I was a freshman in high school, so it's wild to think about how far I've come. This is a very exciting time in my life: new city, new apartment, new job starting in a few weeks, and for the first time ever, I won't have school to worry about! … kind of.

I got a scholarship to do a few professional certification courses, and the first of those starts this week. I don't think this first course will be too difficult (my manager at work told me I could easily skip it since I've already earned a similar certification haha). It's completely self-paced, so I made a schedule and now I just need to stick to it. I'm going to start the 100 days of productivity challenge to keep myself focused and accountable. I'm worried about losing all sense of structure without school, so hopefully this helps!

today's productivity:

completed half of section 1.2 (~1 hr 30 mins)

watered the plants

today's self-care:

I lost the first half of the day to a migraine, so I've been extra gentle with myself today

went on a short walk with my partner

#studyblr#study inspo#study aesthetic#study inspiration#studying#op#here we go y'all!! hopefully 100dop goes well

233 notes

·

View notes

Note

Please tell us how to get into IT without a degree! I have an interview for a small tech company this week and I’m going in as admin but as things expand I can bootstrap into a better role and I’d really appreciate knowing what skills are likely to be crucial for making that pivot.

Absolutely!! You'd be in a great position to switch to IT, since as an admin, you'd already have some familiarity with the systems and with the workplace in general. Moving between roles is easier in a smaller workplace, too.

So, this is a semi-brief guide to getting an entry-level position, for someone with zero IT experience. That position is almost always going to be help desk. You've probably heard a lot of shit about help desk, but I've always enjoyed it.

So, here we go! How to get into IT for beginners!

The most important thing on your resume will be

✨~🌟Certifications!!🌟~✨

Studying for certs can teach you a lot, especially if you're entirely new to the field. But they're also really important for getting interviews. Lots of jobs will require a cert or degree, and even if you have 5 years of experience doing exactly what the job description is, without one of those the ATS will shunt your resume into a black hole and neither HR or the IT manager will see it.

First, I recommend getting the CompTIA A+. This will teach you the basics of how the parts of a computer work together - hardware, software, how networking works, how operating systems work, troubleshooting skills, etc. If you don't have a specific area of IT you're interested in, this is REQUIRED. Even if you do, I suggest you get this cert just to get your foot in the door.

I recommend the CompTIA certs in general. They'll give you a good baseline and look good on your resume. I only got the A+ and the Network+, so can't speak for the other exams, but they weren't too tough.

If you're more into development or cybersecurity, check out these roadmaps. You'll still benefit from working help desk while pursuing one of those career paths.

The next most important thing is

🔥🔥Customer service & soft skills🔥🔥

Sorry about that.

I was hired for my first ever IT role on the strength of my interview. I definitely wasn't the only candidate with an A+, but I was the only one who knew how to handle customers (aka end-users). Which is, basically, be polite, make the end-user feel listened to, and don't make them feel stupid. It is ASTOUNDING how many IT people can't do that. I've worked with so many IT people who couldn't hide their scorn or impatience when dealing with non-tech-savvy coworkers.

Please note that you don't need to be a social butterfly or even that socially adept. I'm autistic and learned all my social skills by rote (I literally have flowcharts for social interactions), and I was still exceptional by IT standards.

Third thing, which is more for you than for your resume (although it helps):

🎇Do your own projects🎇

This is both the most and least important thing you can do for your IT career. Least important because this will have the smallest impact on your resume. Most important because this will help you learn (and figure out if IT is actually what you want to do).

The certs and interview might get you a job, but when it comes to doing your job well, hands-on experience is absolutely essential. Here are a few ideas for the complete beginner. Resources linked at the bottom.

Start using the command line. This is called Terminal on Mac and Linux. Use it for things as simple as navigating through file directories, opening apps, testing your connection, that kind of thing. The goal is to get used to using the command line, because you will use it professionally.

Build your own PC. This may sound really intimidating, but I swear it's easy! This is going to be cheaper than buying a prebuilt tower or gaming PC, and you'll learn a ton in the bargain.

Repair old PCs. If you don't want to or can't afford to build your own PC, look for cheap computers on Craiglist, secondhand stores, or elsewhere. I know a lot of universities will sell old technology for cheap. Try to buy a few and make a functioning computer out of parts, or just get one so you can feel comfortable working in the guts of a PC.

Learn Powershell or shell scripting. If you're comfortable with the command line already or just want to jump in the deep end, use scripts to automate tasks on your PC. I found this harder to do for myself than for work, because I mostly use my computer for web browsing. However, there are tons of projects out there for you to try!

Play around with a Raspberry Pi. These are mini-computers ranging from $15-$150+ and are great to experiment with. I've made a media server and a Pi hole (network-wide ad blocking) which were both fun and not too tough. If you're into torrenting, try making a seedbox!

Install Linux on your primary computer. I know, I know - I'm one of those people. But seriously, nothing will teach you more quickly than having to compile drivers through the command line so your Bluetooth headphones will work. Warning: this gets really annoying if you just want your computer to work. Dual-booting is advised.

If this sounds intimidating, that's totally normal. It is intimidating! You're going to have to do a ton of troubleshooting and things will almost never work properly on your first few projects. That is part of the fun!

Resources

Resources I've tried and liked are marked with an asterisk*

Professor Messor's Free A+ Training Course*

PC Building Simulator 2 (video game)

How to build a PC (video)

PC Part Picker (website)*

CompTIA A+ courses on Udemy

50 Basic Windows Commands with Examples*

Mac Terminal Commands Cheat Sheet

Powershell in a Month of Lunches (video series)

Getting Started with Linux (tutorial)* Note: this site is my favorite Linux resource, I highly recommend it.

Getting Started with Raspberry Pi

Raspberry Pi Projects for Beginners

/r/ITCareerQuestions*

Ask A Manager (advice blog on workplace etiquette and more)*

Reddit is helpful for tech questions in general. I have some other resources that involve sailing the seas; feel free to DM me or send an ask I can answer privately.

Tips

DO NOT work at an MSP. That stands for Managed Service Provider, and it's basically an IT department which companies contract to provide tech services. I recommend staying away from them. It's way better to work in an IT department where the end users are your coworkers, not your customers.

DO NOT trust remote entry-level IT jobs. At entry level, part of your job is schlepping around hardware and fixing PCs. A fully-remote position will almost definitely be a call center.

DO write a cover letter. YMMV on this, but every employer I've had has mentioned my cover letter as a reason to hire me.

DO ask your employer to pay for your certs. This applies only to people who either plan to move into IT in the same company, or are already in IT but want more certs.

DO NOT work anywhere without at least one woman in the department. My litmus test is two women, actually, but YMMV. If there is no woman in the department in 2024, and the department is more than 5 people, there is a reason why no women work there.

DO have patience with yourself and keep an open mind! Maybe this is just me, but if I can't do something right the first time, or if I don't love it right away, I get very discouraged. Remember that making mistakes is part of the process, and that IT is a huge field which ranges from UX design to hardware repair. There are tons of directions to go once you've got a little experience!

Disclaimer: this is based on my experience in my area of the US. Things may be different elsewhere, esp. outside of the US.

I hope this is helpful! Let me know if you have more questions!

45 notes

·

View notes

Text

Haven't been updating here much but I finally got a job. 🥹 Was unemployed for about two and a half months in total! I'll be working at a fast casual place that's on the nicer end of the spectrum; they're Californian-Mexican fusion and also serve really good drinks. And despite the minimum wage one might expect to get at a job like this, which is $17.55/hr where I live (because it's literally one of the most expensive places in the world... so it evens out lol), they start people at $19! And the tip pool will have me, on average, making about $25. 😎 I'll still be making less than my last job ($29), but it's enough for now until my CPC certification.

I know I'm seeing through the rose-colored glasses of having not worked a food service/retail job in 7 years, but I'm excited that I get to do a more fun job. And regardless of the struggles that came when I was doing this type of job, even in the moment I was enjoying the physicality of things. I'm also in a very different place mentally, both personally & professionally, and think certain aspects that got me down before will affect me less now.

I'm glad to be done with being unemployed. Every moment of not applying for jobs made me feel guilty. On top of the overall constant guilt of the extra stress I was putting on my bf bills-wise. It was also so draining, which might be counterintuitive lol. But I was applying to jobs both online and in-person, getting in DoorDashing, dealing with the government for unemployment benefits and food stamps (over two months later and my food stamps still haven't even processed lmao thanks for the help...), keeping up with the potential employers (calls, interviews, follow-up emails), dealing with the application process of Meowtel and then running around doing Meowtel visits, etc. Also trying to get in CPC studying here and there... I've been feeling very frazzled and strained. Too many things at once (not that I'm not grateful for all the support and extra ways to get money).

Now I can just go to work when I'm told, and CPC studying can be more so the center of attention at other times. Also, all this frazzled-ness has made the gym very inconsistent, especially the last 2-3 weeks. I'm excited to get re-focused there. 😌

9 notes

·

View notes

Text

The GSDC HR Professional certification is a globally recognized and highly respected credential that demonstrates an individual's knowledge and expertise in the field of human resources. This certification is awarded by the Global Skill Development Council (GSDC), an independent organization that specializes in providing certifications to professionals in various industries.

The certification process includes passing a comprehensive exam that covers critical HR topics such as recruitment, performance management, employee relations, and compliance. The exam is designed to test an individual's knowledge and understanding of the latest HR practices and trends.

Holders of the GSDC HR Professional certification are considered experts in their field and have demonstrated their commitment to professional development and ongoing learning. This certification is a valuable asset for those working in human resources and can lead to increased job opportunities and career advancement.

#certified hr professional#certification in hr#hr certification#hr professional certification#human resources certification#certified human resources professional

0 notes

Text

Eligibility for Data Analytics courses in Hyderabad typically requires a basic understanding of mathematics, statistics, and programming. A background in engineering, computer science, or related fields is often preferred, but non-technical candidates can also apply with prerequisite knowledge.

To know more Visit: www.iabac.org

#iabac#online certification#machine learning#certification#data analytics#data science#iabac certification#professional certification#hr#hr analytics

0 notes

Text

So you might want to buy a house

DISCLAIMER: all of this is based on my own experience, and I am in no way a real estate professional. This is just some stuff that I’ve learned and some steps that I wish I’d known more about in advance, in hopes that it might be helpful for some people. I might get some terminology wrong, or make mistakes, but hopefully the general info is at least kind of helpful

ABOUT ME: because real estate stuff is specific. I am 33, single, employed, and live in a city in Minnesota, USA. This is my first home purchase, so most of this is specific to being a first-time buyer. I’ve been renting in this area for 15 years. I closed on my house in August 2023.

NOTE: The real estate market is super weird, and varies hugely from region to region, neighborhood to neighborhood, and week to week. What shook out for me will not be what shakes out for you.

This is SO LONG, so it’s under a cut, and I hope you will take it with the good faith in was intended!

Where do I start?

So you want to get started but want to talk things over first. This is a good idea! Even if you have friends and family who have bought before, it’s nice to talk to official type people where you can ask any and every question and know they’ve heard way dumber questions than you could ever come up with over the course of their career.

Employee Assistance Program -If you work a job that has benefits, you might have what’s called an Employee Assistance Program (EAP). Some companies get it along with their health insurance as kind of a bundle, but a lot of people don’t talk about it or know about it. -EAPs are all different, they’re basically a resource hub that you might have access to if your employer covers it. Some things they offer are limited therapy/counseling sessions (usually around a specific need like a breakup/death/life transition), consultation about adoption, personal financial advising, and consultation on housing and buying property. -I used my EAP to find a bunch of organizations that work to support first-time home buyers. The one I went with, NeighborWorks Home Partners, is specific to my area, but there were other options listed. -I didn’t actually talk to anyone related to the EAP, I just logged in to a site that had a bunch of links. But I could have talked to someone if I wanted -If you work a job and have benefits like health insurance, retirement, dental, etc it’s worth asking whoever does your benefits (and HR person, general manager, office manager, etc) if there is an EAP. Again, a lot of people don’t really talk about it.

Homebuyer Education -There’s a bunch of different organizations that provide homebuyer education. I didn’t know many of the details about homebuying, and it’s super confusing and anxiety-inducing, so I found it helpful -There’s a few ways to do this—I did both a one-on-one consultation and an online class -The one-on-one consultation was free from the org I chose. We talked on Zoom and went over monthly budgets (which I didn’t really need to do, I make budgets for a living lolllll), a soft credit pull (will talk more about this below) and talk about what goes into a credit score, and all the different expenses that go into a house and what that might look like. At the end of the day, it gave me the first sense of what my budget for a house might be. -They did a soft credit pull (see below), which gave me a sense of my credit. It was more accurate than a thing like Credit Karma or my bank. -One note about the consultation - my down payment assistance program (will talk more about this later) required me to redo it, because I did it over a year before closing. So depending on your programs you might need to pay attention to the timeline. I also got a certificate saying I did it that I submitted to my assistance program. (Redoing it meant like a 10 minute call where the guy just helped talk me through my closing documents) -It cost me $75 to take an online class that took a few hours. It was in 8 parts and included watching some videos, reading some short articles, and then taking quizzes. You had to get 80% right to pass, and you can redo it if you need to. It went over most of the things to know and had links to read more. I also got a certificate for that to submit, and it didn’t matter how much time had passed for my assistance program.

Credit -I’m not going to explain everything about credit, because it is complicated -A soft credit pull is when they check the three major credit reporting agencies to get a general sense of your score. It’s not 100% accurate. -A hard credit pull is what lenders will do when you actually go in for a preapproval (more below). It will be the most accurate. A hard credit pull will have an affect on your credit score, so if you’re ever doing something that involves a hard credit pull, it’s best to do all of that within a month so that it only really hits once. -There are 3 credit reporting agencies, and your score will be different from each one. Why? no idea. They all have a different maximum number that your score can be. Why? again, no idea. It’s around 850 though. -Generally things get easier to do if your score is above 680ish. It’s not like you can’t get a house with a lower score, but sometimes there are other hoops to jump through. -I’m not very useful when it comes to buying a house with low credit, but I bet there are people who are! -You build credit by owing money and paying it regularly. It’s annoying and dumb, but it’s the way it is. Paying rent on time builds your credit, having a credit card that you pay off every month builds credit, paying utility bills that are in your name builds credit. (Note: This stuff has to be in your name for it to count, so if you pay your roommate every month for the electric bill and it’s in their name, it won’t count. So if you’re in that situation, you may want to put something in your name like a card to build your score). Paying off a car or phone or student loan also helps. -I have really good credit, and I’m neither rich nor special. I just set everything to autopay, including my credit card bill. I use my credit card for most things that I just shop for in the world like groceries, etc, and then I have all my bills autopay from my checking account. How did people do this shit before autopay? I have no idea.

Mortgage vs. Rent -The benefit of paying a mortgage vs rent is that you’re building equity if you pay into a mortgage. This is a surprise tool that will help you later. Which means that if you are in a situation where you need money, you can borrow from what you’ve paid into your mortgage. So like if you get very sick or have a kid going to school or want to throw a big party, you could get a loan based on your equity -Equity is confusing, don’t ask me about it -For me, I pay a bit more per month than I did in rent at my last place. BUT mostly that’s because I’d been living in the same place for many years and my rent hadn’t gone up that much. One of the first things I did when considering buying is look at how much it would cost to rent a house like the kind I would want to buy. And those rents are over what I ended up paying monthly to my mortgage. -Keep in mind that you will be taking on some extra expenses that you don’t have as a renter (like maintenance, repairs, etc). Note: if you’re buying a condo, that’s different. I don’t know shit about that. -So for me, paying my landlord every month for him to occasionally (half-assedly) fix stuff (on his schedule, where he decides who to hire or how to do the work, where he is a stranger in my space for the duration) was not as appealing as me paying the bank every month so I can have some equity -The first 6 months of owning a house feels like hemorrhaging money out of every orifice, but the majority of these expenses are one-time or rarely-reoccurring things. But I didn’t quite prepare for this the way I wish I had, so when you’re thinking about building your savings to buy a house, you’ll want to consider things like furniture, small repairs, pest control, duct cleaning, gutter cleaning, many many visits to a hardware store, realizing some of your stuff doesn’t fit the way it did in the old place and you have to get new things.... etc.

The Money Stuff

Lenders -It might be appealing to start by looking at properties, but especially in a hot market that’s not what you want to do first -The first thing to do is to look at lenders! Lenders are basically the institutions that give you the loan to buy your house, and the ones you will be paying monthly for the 30 years of your loan (or until you sell) (or die I guess) -I talked to like 13 lenders, because I love an excuse not to move forward on scary things, so I just do research and research and research until I run out of steam. So i don’t necessarily recommend doing that. But you definitely want to talk to at least a few. -Lenders can be banks (like Bank of American, US Bank, Wells Fargo, etc), credit unions (like Affinity, RCU, etc), or smaller mortgage companies. -You can also talk to mortgage brokers, which are companies that have agreements with different banks or companies and can shop around on your behalf. -I got my list of people to talk to from: my consultation (above), friends who had bought/were buying, friends who like their bank/credit unions for other things -You’ll have a specific person you’re working with, so who that person is matters. -Things you’ll want to ask about 1. How is their communication? How big is your team? If you see a house on a Saturday and they need offers by Sunday afternoon, how likely is it that they will get your preapproval letter ready in time? 2. Are they good at explaining things to you? Do they work with first-time homebuyers a lot? Do you feel dumb talking to them? Are they mortgage nerds and genuinely seem like they care about finding you good deals and cool programs? 3. What are their interest rates at the moment? Know that this will change between now and the time you have the option to lock in, so don’t put too too much weight on this 4. Most importantly: What assistance programs do they have access to? Everyone has different ones, which we’ll talk about below. Don’t assume that because a bank is huge that they have a ton of assistance. Some small places have really great programs. Likewise, some of the banks that are more well-known for big ticket mortgages (like Jumbo loans for mansions, etc) actually have crazy good programs for low-income and first-time home buyers, because they need to show that they also work for the little guy -I ended up going with a small local mortgage company because they had a kickass program ($10,000 in down payment assistance that is forgivable in 5 years. So as long as I don’t sell my house in 5 years, I don’t have to pay that back). -You may be tempted to solely base your decision on who to get a mortgage from on the politics of the lending institution. This is a lovely instinct. HOWEVER, your mortgage can be sold to anyone at any time. Within a month of moving in, my mortgage was sold to Freddie Mac. I still pay the credit union that is the servicer of my loan, but it all goes back to the big guy in the end. So basically you have no control of where your money ends up. (or maybe you do somehow, ask someone else about that) -At the end of the day, you should apply to like 2-4 different lenders. Once you fill out your application, they’ll do a hard credit pull and look at all your income, bank accounts, etc, and they’ll pre-approve you for a certain amount of money. -This is really where you’ll get your house-hunting budget. There can be a pretty big range in what you’re approved for! One lender approved me for $220K (”maybe $225K” they said). Another approved me for $280K. You’ll want to pick a lender based on all the above information, along with the amount you’re approved for. Being approved for $280K doesn’t mean that’s what you should spend (you can, but I don’t recommend it), but it does mean that your budget can be more like $250K, compared for $225K. You’ll want to look around at your area to see what’s reasonable for you.

Downpayment Assistance -for a lot of first-time buyers, the downpayment (and closing costs) is the thing that’s standing between you and being a homeowner. So that’s what a lot of organizations focus on -The more you put down (i.e. pay right off the bat), the lower your loan will be, and therefore the less your monthly payment will be. So it’s worth it to try and pay down as much as possible -(Likewise, if you buy and house and then get a windfall and are like What do I do with all this cash, paying down your mortgage will save you money) -This is because you pay MORE in interest than you pay for your house, so the less your loan is, the less you’re paying in interest. If you find a way to pay off your loan early, you end up paying less interest! And you win against the bank! If you get a raise and are able to put even like an extra $100 towards your mortgage each month, that can cut years off your loan and build your equity more quickly, thereby cutting down on the interest you end up paying. So unlike paying more money to a landlord who will eat it with a spoon, maybe more in your mortgage early is helpful for you. -Lots of downpayment assistance (hereinafter DPA) is stackable! So you can qualify for multiple programs and use them all -Many have an income requirement (for one of mine, I need to make 80% of the median income in my area or less). -Many are location specific. Some of those you can look up in advance and try to focus on properties in those areas. Some are super super specific, like this block only, or these specific addresses. That’s true for one of my programs—whenever I was considering making an offer on a house, I’d email my lender and she’d tell me if that specific address counts for the assistance program -At the end of the day, I got $30K in assistance. $10K of that is forgivable in 5 years (so I don’t have to pay it back unless I sell in that time). The other $20K is from two separate no-interest loans. This means that if I sell the house, I have to pay back that amount. Ideally by that time I’ll have enough equity in my house that will cover that. -Interest rates are super high right now, so if you’re buying now you want to think about refinancing. Refinancing is basically when you negotiate a new deal with your lender. There are fees and things (I’ve never done it so IDK), but the benefit of doing that is getting a lower interest rate. So my rate is 6.25%, and in 5 years if the rate goes down to like 2.3% I may want to refinance so I’ll be paying less in interest over the course of my loan. -If you’re getting DPA that’s a loan, you will want to ask what happens when you refinance. They’ll probably tell you either you have to pay it back when you refinance (so don’t get stuck in that situation if you don’t have that $$$ on hand) or they’ll say it’ll be subordinated -this took me like weeks to get a straight answer on wtf is subordination. Basically, you pay your loans off in order, right, so you pay your mortgage and then after that you pay off your DPA loans. So if you refinance, then your mortgage ends up being “newer” I guess. So in order to put the mortgage back “on top” of the pile to pay off, so to speak, you pay that (and it’s interest) first, the DPA loans get shoved down underneath the mortgage on the list.

Interest Rates -You can’t control interest rates. Honestly markets are so volatile and the world is so close to ending, I would say it’s not worth waiting for them to go down. Maybe they will, maybe they won’t. No one fuckin knows -So many global, political, circumstantial things affect these, and who knows what might happen. My friends happened to be closing during the time the debt ceiling almost freaked out, which was outside of their control, so they got screwed with a super high rate. -After you get an offer accepted and you’re working on setting up your loan, you’ll usually get the offer to “lock in” an interest rate. Basically, if you have reason to believe rates will go down before you close, don’t do it. if you think they’ll go up, then do it. Who fuckin knows. I did it bc I didn’t think it was likely stuff would go down. And I haven’t looked it up bc if they did I don’t want to know -There are more complicated things you can do with interest rates, like “floating down” and APRs and other shit. Don’t ask me about them, I do not know.

Looking for houses

Realtors -Who your realtor is MATTERS y’all. Here is what a realtor will do: 1. Give you access to a Super Awesome online listing of properties (much better than Zillow! Updates constantly). They will set your search filters based on what you specifically want and your specific budget. That includes size, amenities, location, school district, garage, yard, etc etc 2. Arrange showings for you. Sometimes you might want to go to open houses, but you don’t have to wait for those to see a house. You tell your realtor what you’re interested in and they can set up a time for just you and them to see the place 3. Access houses with funky lil lockboxes. Heist teams should include realtors—I’ve seen my guy get into the weirdest of devices in no time 4. Recommend places to you 5. Talk on your behalf with the seller’s agents or the sellers themselves 6. Take you all the way through your offers, acceptance, all the way to closing (basically, most of the rest of this post) -I am really lucky that a friend of mine is one of the best realtors in town (in my humble opinon). It really worked out for me, because when it came to negotiating price and terms with sellers and their agents, people already respected him and his expertise because he was a known fixture in the field. I’m not saying that an early-career or unknown realtor is bad, but reputation can do a lot of heavy lifting for you (as you’ll see later) -My realtor, S, is not only a friend, but also someone who has owned, rented, built, remodeled, bought, and sold everything from high rise condos to alpaca farms to tiny houses built in shipping containers. That experience was super useful to me for a few reasons: 1. He was very very good at looking at a roof, foundation, or basement, and saying “absolutely not, this is a mess” —I could only rarely see what he was talking about because I know nothing 2. If I looked at a space and said “what if I wanted to add a shower there?” or “could I make this basement area a bedroom?” S was able to pretty accurately estimate what that would cost. So that became part of the math as we looked at places, which was really useful and saved me so much time doing research on my own 3. He’s a queer artist who grew up in a nontraditional family and has lived many fascinating and non-standard lives. I only mention this because when I wanted to talk about my future and what my home could look like, I didn’t have to worry about S making assumptions about what “family” consists of or what my “role” would be. And as a single woman who is looking to adopt, that really meant a lot to me! -(side note if you’re in the Twin Cities and want S’s info, hit me up) -The most important thing about working with S, for me, is that he never made me feel foolish. I gradually got really good at talking about and looking at houses, but even when I asked questions that were obviously, or made incorrect assumptions, he never treated me like I should have known the answers, or like the process was supposed to be easy. And the guy genuinely loves houses!

What to Look For -You’ll want to find a house that fits what you want your life to be, not necessarily what it is at this moment. So think about what you want your day to day to be like. Will you be working from home at all? Do you have or want kids or pets? Do you want to be a person who hosts out of town guests? Do you want to have band practice at your place? Do you want to host D&D? Large holiday meals? Do you want to garden? Grill? Have a firepit? Do you have a car, or do you think you will? Do you have physical access needs based on your body, like particular types of doorways, floors, stairs, size of spaces, etc.? Are there furniture pieces that are important to you that you want to plan around? (For me, I have an electric piano, and placing that was super important).

-I’m a single person, and I want to adopt a kid, and I know I’ll need a roommate in order to afford my mortgage. So it was vital for me to find a house that either had 3 bedrooms, or had 2 bedrooms and a 3rd could be easily finished/added. it was also important that my roommate would have their own private space that was decent size for me to charge rent -Think about all year round. I live in Minnesota, and you better believe snow was top of mind at every house. As a renter, my landlord was supposed to deal, with anything over 3 inches (did he always? of course not). Now it’s my responsibility. What kind of trees are around? Do you have big storms? You need to pay attention to big branches and power lines. Is it getting super hot where you live? You probably want to prioritize central air, or shade.

-On the topic of central air - It’s pricey to add it to a house that doesn’t have forced air heat, because you have to add all the ductwork. If that’s the case and you don’t have that $$$, you can either go with window units or something called a mini-split. It’s basically mini air conditioners that heat floors separately, but have a better range than a window unit. -Does the house have a yard you want to deal with? How about a sidewalk you have to shovel (woe unto you in corner lots) -How does bussing work for the schools in your area, if that matters to you? -Some houses will be empty. Empty rooms look smaller than rooms that have shit in them -Some will be staged. People who stage houses don’t fill them with STUFF, so you’ll notice few bookcases, coatracks, etc. Think about the stuff you have, not the stuff they put in the house. -You will be AMAZED at how some people live. Seriously. Some people have a giant ass oak tree literally leaning on their roof and just deal with it. Some people have 3 bedroom houses, and the only bathroom is only accessible by going through one of the bedrooms. Some people have their fridge down a flight of stairs from the kitchen. Some people have their laundry in the basement, but the only access to the basement is through an outside door. In some climates that’s fine, but I live in fucking Minnesota -I had the instinct when I started looking that I needed to be entirely open to everything, and not be too picky. After about two weeks of looking (and S had me going to like 4-9 showings a day some days), I got real picky real fast. This was helpful for S and helpful for me, so we weren’t wasting time on houses that weren’t contenders. I learned that the houses’ feelings did not get hurt by me not wanting to buy them -Likewise, I started out being entirely open about where I wanted to live. Anywhere in the Cities or near suburbs, I said. But then I went to see houses in these places and realized I did not want to drive that far to work, or that the only way to access places was by the highway, so if it shuts down or there’s a bad snowstorm, I’m stuck. -To that end, i found it really helpful to make myself a Google map (you can make some and save them) of where I go. I included work, church, my bandmates houses, bars I like to go to, and my friends’ houses. Then whenever I was considering a house I’d plunk it on the map and see how it lined up with the realities of my life. -We’ll talk about offers in a sec, but remember that people can technically list their house for whatever number they want. So it’ll be up to you and your realtor to decide what’s fair. I mention this here, because a house may be listed way cheaper than others on your list—there’s likely a reason for that, but if it looks promising, give it a try! It could be that the reason it’s listed low doesn’t matter to you (i.e. it’s next to an annoying business that you don’t mind, or doesn’t have a garage but you don’t have a car, or the other houses int he neighborhood have yards and this doesn’t). Or it could be the seller needs to move it FAST and you can take advantage of their situation. -If you’re a handy person, a cheaper house might be a great option if fixing it up to be what you want is affordable for you. (Again, this is where a realtor like S can be super helpful to come up with those costs). For me, I didn’t want to do jack shit to the house, and I knew I’d be paying for that. (not that I don’t have a whole spreadsheet of eventual projects....but that’s invevitable) -Likewise, it can be helpful to set your filters to include houses a bit above your budget. Some people list their houses WAY higher than they should, so if you see a property that’s been on the market for a while (when I was looking the market was hothothot, so “a while” could mean anything over a week/10 days. In a slower market, you’ll want to look at those that have been listed for 30+ days), it might be worth checking out and then offering low. Chances are the seller will need to reduce the price anyway if they’re not getting any bites, and you could get a good deal by jumping in before they do that. -IDK where else to put this, but measure the garage. I didn’t, and I discovered like a month ago that my car (a little compact Toyota) is too long for my damn garage. It’s not that I wouldn’t have bought the house because of that, but I could have included it in some negotiations.

Offers -So you found a house you like! Now the scary part.

-You’ll get a sense of the market from your realtor, and they can usually advise you about how quickly you need to move on a potential offer. Sometimes a seller will give a deadline themselves: they call this “best and highest.” So they’ll say “we’re hearing offers at 3pm tomorrow” or “we’re asking for best and highest on Monday.” Generally that’s the cutoff for receiving viable offers. -In the market when I was buying, it was pretty common for houses to sell for 20-40K over the asking price. Again, some houses would be listed too high or too low, as I mentioned before, but on average that’s what I was working with. There were also a TON of offers on all the properties I liked. The lowest number of offers on a house I tried to get was 5, the highest was 19. That is kind of insane. In a slower market, when you’re not competing with that many people, you can offer closer to the asking price (or some people just say “asking” as in “20 over asking”) -The first thing I did when I decided to put in an offer, was to talk to my realtor so he could start getting the paperwork together. You can’t just email the seller and say “i want your house,” there are legal documents that have to be drawn up to make it a binding agreement if it’s accepted. -My folks bought their house without a realtor and did all the negotiating, etc, themselves, but they still needed a realtor friend to do the paperwork for them. If you go that route, you can probably do more informal offers, but IDK how that works. -The next thing I did was contact my lender for the following things: 1. I gave them the address and asked “Does this fall within certain DPAs?” 2. I asked them to run some numbers for me. Usually it was a version of: “What would my monthly payment be if I offered $240K and put down $5K in earnest money, and if I had $20K of downpayment assistance? How about if I offered $245K or $250K? What if I only put down $2500?” This helped me figure out what kind of offer I could reasonably make, and what it would actually cost me monthly if I got the house. 3. Then, when I decided what I wanted to offer, I would ask for a preapproval letter that includes the address of the property, basically saying “hey we’re a lender and we will give Jay a loan of $XX to buy this house, pinky promise” -I copied S on all my communications with the lender, so he knew what I was considering and he could give advice -(sometimes I saw a house on Friday and had to make an offer by noon on Saturday, leading to me trying to call my lender at 9am on a Saturday morning, which sucked. This is why knowing who’s on your lender’s team and how to contact them matters) -There’s no hard and fast way to decide on a good offer, because you won’t know how many you’re competing against. Sometimes your realtor might be able to chat with the sellers agent and find out how many people saw the property, if they have a sense of how popular it is, but sometimes you want. You want to be able to afford it, but also not go so low that you won’t even be considered. -Usually, your realtor will ask you to write a love letter to the house to include in the offer. “Dear seller, I love your house because of blah blah blah, I can see myself doing blah blah blah, specifics specifics.” Do these matter? I don’t feel like they do but whatever. Make a template and update it for each offer. -One thing to note about this is that you DO NOT want to give information about yourself regarding your status in a protected class (i.e. “we’re a young queer couple; I’m a neurodivergent person; I’m an immigrant/veteran/belong to X racial group”). It might seem like that would be helpful in certain areas, but sellers aren’t legally allowed to pick a buyer based on those things, so it ends up working against you. You can talk about what you do as a job or as a hobby, if you’re an artist, if you’re a parent, if you have pets, if you know who else will be living int he house with you, etc. You can hint at things. But S was very clear with me about keeping it pretty general and about the house. -Once you’ve decided on the $$$ you’re offering, you need to decide if there’s anything else to add to “sweeten the pot.” For some people, that’s saying “my timeline is totally flexible, so if you need to close in a month that’s fine, and if you need to close in 4 months that’s fine.” A lot of people choose to waive inspections. -OHHHHHH Ye olde inspection. Dear God. -The inspection is basically a thing where you hire a professional to look at the house before you officially seal the deal, and they tell you if there are things you need to be concerned about. So if the inspector comes in and says “yeah this roof is going to cave in in a year,” you can use that in your negotiation and say “look, I’m going to lower my offer by $15K, because I will need a new roof in a year.” then it’s up to the seller to decide if they want to agree to that, or if they want to try again to find a buyer who hopefully would not get an inspection. -to “waive an inspection” means that you’re agreeing to skip this step -OK so my instinct was always “I will NEVER waive the inspection,” and a lot of people feel that way. HOWEVER, I did not get certain houses because the people who did offered exactly what I did and waived the inspection. There was a buyer who had made SEVENTEEN OFFERS and beat me out on a house, and they got that house after SEVENTEEN OTHER TRIES because they waived an inspection. -I did get an inspection with my house, which was lucky and also thanks to S being a great negotiator. -I waived it on one of my offers -I would say I’d be comfortable waiving an inspection if: 1. You or your realtor knows shit about buildings, codes, etc. S knew a lot, so was able to look at things like furnaces, windows, basement beams, foundations, etc etc. 2. The important parts of the house are easily visible. Usually this means an unfinished basement. if the basement is finished, you probably can’t see all the structural things you’d need to 3. You’re already planning to do a bunch of work on a house, so you’re offering a lower bid and budgeting to do renovations anyway -At the end of the day, it’s your call. More about inspections below. -Most people who buy houses have mortgages, meaning that they can’t just drop $250K on a house. However, some people got it like that, so they make what is called a cash offer. Cash offers will win out every time, because they are usually higher, are easier for the sellers, and will often waive inspections. Depending on your region and your budget, you may or may not see this. I got screwed SO MANY TIMES and so did my friends, by all-cash, no inspection offers. The majority of these are from people who are buying properties to rent out or Airbnb - they won’t live there so they don’t really care if it’s solid, and my budget range seemed to be about where rich people who don’t want to flip a house felt comfortable buying. It was annoying. -but hey if you got it like that, go for it. -Once you have all the terms of your offer figured out, your realtor will send you the official offer paperwork that you’ll sign (prob. digitally). Then they’ll send it over to the seller and be in charge of all that communication. If the seller comes back with a counter, or with questions, your realtor will bring that to you. They may advise you, but at the end of the day it is up to you what you’ll offer and what you’ll accept.

You got accepted!

-Holy cats, they said yes to your offer and your terms! This is a huge moment to celebrate! I cried! And obsessively looked at pictures of the house over and over -The seller may come back to you with some proposed adjustments. In my case they wanted to round the selling price up by $1K, which I agreed to. (IDK why they cared, but in the grand scheme that was fine). They also wanted to change some of the verbiage in the offer that didn’t actually affect anything. -The first thing you’ll need to do is put down the earnest money. That is usually held in a trust or something similar until closing. But basically, if you said you’d put down $5K of your own money in the offer, you have to prove you have it right away. So don’t offer to put down earnest money that you don’t have! -The higher this number, the more appealing your offer generally is -There are a lot of things that will need to wait until you close, so this period of time feels really weird -You’ll have a purchase agreement (along with any addendums or changes) that basically says “I’m Jay and I offer $XX, the seller agreed to the price and the terms, we’ll see how it goes from here and if it all goes well, this deal will go through” -I’m gonna say it now, don’t ask me about escrow. Escrow is basically like an account where money lives between you and the bank. You pay extra into this account so that if something happens and you can’t pay what you agreed, the bank still gets the money for a certain period of time. or something like that, I don’t know, it gives me a headache. I’m sure other people understand it better.

Next steps

Inspection -If you included an inspection in your offer/purchase agreement, you’ll want to set that up within a few days. (Don’t worry about booking “last minute,” inspectors pretty much always work on that kind of schedule. Very few people are booking inspectors weeks in advance. This was something I felt bad about, but it’s okay)

-Inspections are pricey, and usually have different packages that include different things. I chose to do the sewer scope bc I had a friend who found some crazy sewer issues and I didn’t want to deal with it. Your realtor can probably give you advice on what you might need. -Inspector look at a lot of things: all your systems (like heating, cooling, pipes, electricity, etc), your windows, roof, foundation, gutters, attics, floors, plumping, appliances, etc. -They do NOT open walls/ceilings/floors, etc. So if it’s not visible, they won’t be able to report on it. -They’ll send you a big ol’ report, and if you can be there with them they’ll do a walk through with you to talk over big issues. Your realtor should come to that as well, as they might have good questions. -After you have the information, you have to decide if there are any big issues that need to be addressed. The inspector will flag things that are a problem legally, but it’s up to you how much you care about them. Some will be easy fixes. Others might be deal breakers that mean you decide to walk away from the property entirely. Most things will be in the middle. -Note that some things are legally “issues” but practically may not matter. There are certain outlets on the outside of my house that aren’t right, but I don’t intend to use them much and if it turns out I need to, it’s not that expensive to switch them out. My basement stairs are an absolutely death trap, but my laundry is upstairs and so i dont really need to use them much. I could spend like $4K to replace them, but I don’t care at this point, and it’s not a big issue for me. But legally they are terrible. -Some things may be an absolute problem that the seller needs to deal with before you’ll agree to by the house. -You and your realtor will come up with a list of things you want to tell the seller to fix before closing. They might fight you on some of them, and again that’s why the realtor being a good negotiator matters. -Generally, you want to ask for fixes on the important things, without asking for every little thing, so the seller doesn’t decide you’re too much trouble and they could probably back out and get a better offer that wouldn’t cost them as much in repairs. -for me, the garage door was busted so they defnitely needed to fix that. There was a pipe that was put in wrong that was a quick fix. And there were birds in the attic, so they needed to clear those out and go through and block up all the entry points in the room. All of these requests were reasonable, and the sellers agreed to them. -At this point, it’s up to you if you want to pay for a re-inspection (i.e. the inspector coming back to verify that they did all the work they were supposed to). I didn’t—instead I had them give me all the receipts from the work that was done along with photos and video of the work. That way if something is a problem in the future, I can contact the companies that did the work and take advantage of warranties, etc.

Home Service Warranty -Speaking of warranties! There’s a thing called a Home Service Warranty that you’ll need to decide on. Mine is through American Home Shield. Basically this is a warranty that covers things in your house. There are different levels of coverage, so some just cover the big things like windows/roof/furnace/water heater/etc. As you upgrade, it’ll include things like stoves, fridges, dishwashers, etc. -If you’re getting your own warranty, you basically pay a certain amount per month for the coverage. Then if any of the covered things break down, it get’s fixed for free (plus a small service charge. For me that’s $125). So if your inspector tells you “hey, you’ve got about a year left on this water heater” or “the furnace has some issues that might come up in a few years” you could save a BUNCH of money by having this coverage. -My realtor got this warranty included in my purchase agreement, so the seller is actually paying for a. year of my coverage at he upgraded level. This is SICK AS HELL and not every realtor will think of it—definitely mention it to yours. I didn’t even think of it as an option. Basically what this means is that if any of my stuff breaks this first year, I can get it replaced for very cheap AND I don’t even have to pay the monthly coverage fee. -When I moved in, my shower was broken. I tried to fix it, but the called AHS and I only paid $125 for a plumber to come look at it, order parts (which would have been pricey since my house is pretty old), and fix it for me. I hate my fridge, so I have a goal to break it this year so I can get a new one for free.

Appraisal -Okay, so you got the seller to agree to your fixes, everything is moving apace. It is time for the GOD DAMN APPRAISAL -(for many people, the appraisal is fine and is not GOD DAMN anything. For me, it was a nightmare and I didn’t sleep for like 2 weeks) -Okay so what is an appraisal. Basically, the seller said “my house is worth $XX” you said “I’ll pay $XX for it.” Your lender said “we’ll give Jay a loan for $XX.” But now someone else has to look at the house and determine if it’s a fair price for the house. This is what really determines the loan you’ll get (this is also why what you’ve gotten so far is a pre-approval. They’ve basically said “you’re capable of paying back a loan of $XX, but we need an outside agency to determine if this house is worth is”) -The appraiser will look at the house, inspection reports, and other sales of similar houses in your area. Ideally, this helps them determine if the price you and the seller have agreed on is in line with what is reasonable. -Banks are not going to give you a $400K loan on a potting shed in a ditch -It’s all complicated and this is where a lot of shit in the Housing Crisis came from -Basically, you want the appraisal to come at or higher than your purchase price. (if it comes in higher, do a little dance bc you got a deal) -If it comes in lower, you can be in trouble. That’s what happened to me. -A note about rules & regs - lenders cannot talk directly to appraisers. This is because of the housing crisis and all the shady backroom deals that were happening (i.e. if you appraise this house at this price, we’ll give you Mr. Appraiser Guy some kickbacks from the extra money we’re making in mortgage interest or whatever). In practical terms, this means it takes FOREVER to get messages to all the parties involved. -If the appraisal comes in low, you can ask for a reappraisal. It’s up to the appraiser if they agree. There are rules about this. -What Happened To Me: OK so my house is in a historically Black and immigrant neighborhood (read, historically redlined). This means a lot of the properties here are undervalued based on other locations. In a hot market, even undervalued properties can go up in price in a big way. In a slow market, that doesn’t happen so much. My appraiser only wanted to pull comps (meaning comparable sales of similar houses in the same area) in my exact neighborhood. However, there hadn’t been any sales of similar size/age/etc houses in my exact neighborhood since last winter. Guess what the market is like in the winter in Minnesota! Fucking SLOW boy. So these comps were coming in like $20K lower than my agreed price. So my realtor and lender took a look and said “look, if we widen out a little bit to these nearby neighborhoods, we can see all these more recent sales that are closer to our price.” It took two weeks of back and forth to get the appraiser to agree to add some of these comps to the appraisal. He was really reluctant to look outside my immediate area, because my neighborhood is of “lower value” than the surrounding areas. Structural racism, baby. Not against me, but against my neighbors and everyone who’s lived in this area for the past 150 years. Hooray. Finally, I got a re-appraisal that was $8K lower than my purchase price. So I was in a pickle. I had an agreement with the seller saying I’ll pay $XX, while the bank is now saying “we’ll only give you a loan for $XX-minus-$8K.” So either I need to come up with $8K MORE of a down payment in earnest money, or I need the purchase price to go down. Or i need to find more assistance. HERE IS WHERE HAVING S MADE ALL THE DIFFERENCE. He went to the seller and basically used his status and significant experience to say “Look, you can either agree to lower the purchase price by $8K, or we all walk away. If we walk away, this means you have to re-list the house, wait for more offers. And then even if you get an offer as good as or better than Jay’s, that person will still need to go through the appraisal process. So... you’ll probably be right back here. The only chance you have of skipping appraisal is if someone comes in with a cash offer, meaning they won’t need a loan and no bank is involved. But for a lot of the reasons the appraisal is low, those types of buyers (who often want rentals/vacation rental properties) ain’t looking to buy in this neighborhood.”

(or that’s what I imagine he said. It was probably smarter)

ANYWAY, all that to say a MIRACLE occurred, and the seller agreed to lower the purchase price of the house by $8K. I can tell you the whole story of how I found out over a drink sometime, but let me tell you I wepttttttt

-Anyhow, once the appraisal is good and you’re pretty sure the deal is going through, you gotta get insurance. call a bunch of places, figure out what coverage you need, see if it’s cheaper or easier to put car/life/etc in the same place. You have to have insurance if you have a home loan - basically the bank owns the house, so it’s in their interest to have it covered in case of disaster.

Closing

-I’m going to be quick on this, because it’s super technical and I only kind of understand it. -Closing is basically the day where you sign all the paperwork, after which the house is yours! Then you can start moving, renovating, decorating, whatever you want. -One of the things that’s part of closing is the Title and Title Insurance. Basically, you need to pay to have the paper that says you own the house, and then you have to pay for insurance on that piece of paper. Why. IDK. -At this point there’s so many random fees and charges, I just kind of looked at the totals and made sure nothing was way out of range of what I expected. -A few days before closing, you should have the following: 1. receipts/evidence from any fixes made to the house or a re-inspection report 2. Closing disclosures, which basically means any information that’s attatched to the deed for the home. This can include unpaid property taxes, any weird liens on the property, any easement agreements with neighbors you should know about, etc. 3. All the paperwork you will sign! -It is in your best interest to read ALL OF IT if you can. (the title person was surprised I’d read mine, which I found super worrying lol) -If you are buying a house by yourself, you will not BELIEVE how many times you will read “Jay, A SINGLE PERSON, is buying a house ALONE AND BY THEMSELF, as a SINGLE UNMARRIED ALONE PERSON” Very judgy. What are you, my grandma? -One thing about disclosures—it’s up to your title company to do research on weird shit that might be attached to your property. You can technically choose your title company, but I wouldn’t not recommend looking for the cheapest option if the company doesn’t have much of a track record. I had an issue come up with a payment the seller owed that was delayed, and my title company had to be the one that caught that. My friend and his husband got in trouble because some seller 5 years ago didn’t pay property taxes, and so the IRS came for THEM. The title company should have caught that before they closed and had it dealt with. They won’t end up paying it, but it’s a huge pain and they have to argue with the IRS which is never fun. -On closing day, you’ll do a final walk through with your realtor. This is your last chance to bring up any issues! You DEFINITELY want to do this walk through. If the seller left the door unlocked and an entire family has taken up residence in the living room, you need to know! If the contractor they hired to fix the plumbing knocked a new whole in the wall, you need to know! Don’t expect that the seller will tell you about any new issues that they caused. -This is your last chance to say “Hey, there’s a new major issue that wasn’t reporting, i ain’t signing shit until we re-negotiate” -If you find yourself in this situation (hopefully you won’t!) PLEASE don’t be afraid to say something! Don’t worry about how much time and money has already been put into it, or about calling out a seller who is acting in bad faith or fucked somethign up. This is your house! It matters! And your realtor should have your back. -But most of the time, the final walk through is fine! Then you go somewhere to sign all the paperwork. If you’re like me and have 3 different types of DPA, it will be two giant folders worth of paperwork. -Once you sign the paperwork with the Title Company, they’ll put the paperwork through. After that happens, the bank should transfer the whole ass agreed amount to the seller. Also, if your DPA is in the form of other smaller loans from other sources, those should be paying to the seller at the same time. -in MY case, one of my DPAs took 3 hours to process for some reason, so I had the most anti-climactic closing ever. I signed everything, waited for an hour and a half, and then they were like “you can go, we’ll email you when you officially own the house” So I just awkwardly hung around and ate pancakes until I got the email. -Let’s say you have a relative who wants to help you out with your downpayment (Yay! Every little bit counts!) Or let’s say you’re living with someone who doesn’t want the house to be in their name, but they want to contribute to these initial costs. You’ll want to talk to your lender about this as soon as you know about it. There is special paperwork for “gifts” that basically let’s it go directly to you downpayment but it doesn’t count towards your income. So if Grandma Bob says “I got $10K for you” and you just deposit the check in your account and plan to pay $10K more in earnest money, that will suddenly look like you have $10K more money to your name, so might change how your loan and DPA shake out. But if you get Grandma Bob to sign a particular document and give you a certified check, you can just give that right to the Title person and it goes right to making your downpayment bigger, therefore making your loan smaller! Thanks Grandma Bob! -”Cash to close” is essentially what you are paying at closing via all sources. So that’s your downpayment (including all assistance) any gifts, your earnest money, etc. Sometimes you have additional closing costs. They may be covered by DPA, or you may be on the hook to write an additional check. You’ll know this in advance. -Hey, check it out, you own a house now! -(keep all your paperwork0 -They’ll give you a document you have the file with the city called Homestead filing, basically telling the city that you own a house and you live there.

NOW WHAT?

-Now I’m done telling you things. Feel free to DM me if you want to talk more, but also talk to professionals in your region who know things. -I started writing this post before I closed in July 2023. It’s now mid-November, and I’ve been living here for 3 months. Here’s some stuff I’ve learned that might be helpful: 1. It’s good to know what kid of walls you have (drywall vs. plaster and lathe, etc) because that determines how you can hang things on them. Also if you have plaster walls, just get a cheap magnetic stud finder. The fancy electronic ones often don’t work 2. It’s good to have a drill. It just is. 3. If there’s a big project you need done (say your garage is too short for your goddamn car), you may qualify for a home improvement loan from the same kind of orgs that give DPA. I’m doing it just because I don’t want to drop $3K in one go. Technically I have 4 years to pay it off, but I’m going to make larger monthly payments and pay it offer quicker than that. 4. We can talk about contractors and permit and zoning all day. Suffice to say, it’s good to look up who to talk to at the city about construction permits, and they can be both incredibly confusing and very nice. Often at the same time. 5. If you’re gonna have a roommate or partner or non-child family member who is paying you monthly to help with the mortgage, DRAW UP A LEASE. You want shit in writing, and they have rights as tenants that need to be respected. Many a relationship has been saved by PUTTING SHIT IN WRITING. (there are templates you can find) 6. FEELINGS: People always tell you “You won’t know how you feel about X until you do it.” Getting a dog, moving away from your folks, living with a partner, whatever. I am here as an old man to tell you, they are right. I had no idea I would have such BIG FEELINGS about this lil old house. When I come home and my roommate has the lights on and it has a glow, I feel so much that sometimes I cry! Setting things up, making decisions about organization, learning how to be in my space, means so so much more to me now than it ever did when I was renting. The stress is greater, too, because I have to make all the decisions! It’s exhausting! But every day in my house I am so happy to be here, I’m so glad my other offers weren’t accepted, because this is the best of the houses I looked at. It is my 117 year old baby and I love it forever.

Also I never want to do this again lol I’ve decided to die here.

50 notes

·

View notes

Text

Slowly, but Surely (Don't Call Me Shirley)

Hello, hello.

i am slowly, but surely, recharging my creative batteries. There's less pressure now, but with good things happening. A detailed account of what's been happening. All below the cut. TLDR at the end.

Let's start with the good.

I went to the Big Gay Market in Madison, WI for the weekend. It was marvelous. There were people of all kinds of genders, an affirming and friendly environment, and so many creatives. I felt like I was in community and it's been a long time since I've felt that way. I was sad when it ended. But I bought the most beautiful wreath to hang in my room. I'll snap a picture of it when I can.

I studied the entire month of June, whenever I had a spare moment and for dedicated study sessions.