#Gwadar Pakistan investment

Text

Unidentified gunmen shot and killed at least seven workers in Pakistan's southwestern province of Balochistan, police said on Thursday.

According to police official Mohsin Ali, gunmen stormed into a house some 25 kilometers (15 miles) east of the port city of Gwadar, and shot the workers while they were asleep.

The coastal town of Gwadar is the site of several Beijing-backed projects under the China-Pakistan Economic Corridor investment, which is part of the Belt and Road Initiative.

The victims, who were from the central Pakistani province of Punjab, were running a barber shop, Ali said.

However, police said they believed the attack was not related to their jobs. Previous attacks claimed by the Pakistani Taliban near the Afghan border in the north were believed to have been motivated by a militant ban on Western-style beard trimming and haircuts.

Incident follows similar attack last month

Although no group has claimed responsibility for the killings, it follows a pattern of ethnically-motivated attacks in the restive Balochistan province.

Last month, the so-called Balochistan Liberation Army claimed responsibility for killing several workers who were abducted from a bus on a highway.

Balochistan, a mineral-rich region, is home to a decades-old insurgency led by ethnic Baloch guerillas fighting the government.

The separatists, who oppose Chinese investments, have long complained that they do not get a fair share of the province's profits.

The Baloch are an ethnic group living on both sides of the Iran-Pakistan border and into parts of southern Afghanistan in an area roughly the size of France. The Pakistani province of Balochistan forms the largest part.

Balochs accuse both governments of systematic discrimination and plundering their region. Several groups of militant insurgents have carried out attacks on both sides of the border.

4 notes

·

View notes

Text

Strategic Dynamics of Chabahar and Gwadar Ports: The Role of Private Indian Companies and Cargo Berths

Introduction

Iran Chabahar Port in southeastern Iran and Gwadar Port in southwestern Pakistan are two strategic maritime gateways in the region, each backed by different international stakeholders with varied geopolitical and economic interests. Chabahar, with substantial investments from private Indian companies, and Gwadar, heavily financed by China, are pivotal in the emerging trade and transport networks of the region. This essay delves into the significance of Chabahar Port, the involvement of Indian private companies, its comparison with Gwadar Port, and the role of cargo berths in these ports.

Chabahar Port: A Strategic Asset

Chabahar Port, situated on the Gulf of Oman, is Iran's only oceanic port, providing direct access to the Indian Ocean. This geographical advantage makes it a strategic asset for Iran, enabling it to bypass the Strait of Hormuz, a narrow passage that has historically been a chokepoint for global oil supplies. The port serves as a crucial link in the International North-South Transport Corridor (INSTC), aiming to connect India, Iran, Afghanistan, and Central Asia through a multi-modal network of ship, rail, and road routes.

For India, Chabahar offers a direct route to Afghanistan and Central Asia, bypassing Pakistan. This not only enhances India's trade potential but also solidifies its strategic footprint in the region. The development of Chabahar Port is seen as a counterbalance to China's investment in Gwadar Port under the China-Pakistan Economic Corridor (CPEC).

Role of Private Indian Companies

Private Indian companies have been instrumental in the development and operationalization of Chabahar Port. The involvement of these companies reflects India's commitment to enhancing regional connectivity and its strategic interests in the region.

India Ports Global Limited (IPGL): A consortium of private and public sector companies, IPGL is at the forefront of India's engagement with Chabahar. In 2016, IPGL signed an agreement to equip and operate two terminals and five berths at Chabahar Port. This marked a significant milestone in Indo-Iranian cooperation.

Infrastructure Development: Indian firms such as IRCON International and KEC International are involved in constructing and upgrading the infrastructure around Chabahar, including the rail link from Chabahar to Zahedan, which connects to the Iranian national railway network and further into Afghanistan and Central Asia.

Cargo Handling and Logistics: Indian logistics companies are setting up supply chains to manage the flow of goods through Chabahar. This includes developing specialized cargo berths to handle various types of cargo efficiently, thereby increasing the port's operational capacity.

Investment in Industrial Zones: Private Indian firms are also exploring investment opportunities in the Chabahar Free Trade Zone (FTZ), which aims to attract foreign investment and foster industrial growth. This includes establishing manufacturing units, warehousing, and distribution centers.

Gwadar Port: A Chinese Foothold

Gwadar Port, located on the Arabian Sea in Pakistan, is a cornerstone of China's Belt and Road Initiative (BRI). Developed under the auspices of the CPEC, Gwadar provides China with a strategic outpost to secure its maritime trade routes and energy supplies. The port is intended to serve as a major transshipment hub, facilitating trade between China, the Middle East, and Africa.

Comparison Between Chabahar and Gwadar Ports

While both Chabahar and Gwadar Ports aim to enhance regional connectivity, their strategic orientations and developmental trajectories are distinct.

Geopolitical Context: Chabahar is central to India's strategy to access Central Asia and Afghanistan, circumventing Pakistan. Gwadar, conversely, is a linchpin of China's BRI, aimed at securing an overland route to the Arabian Sea, reducing reliance on the Malacca Strait.

Development and Investment: Gwadar has seen rapid development, with substantial Chinese investments leading to the construction of modern port facilities, an international airport, and supporting infrastructure. Chabahar's development, although progressing slower due to international sanctions on Iran, has gained momentum with Indian investments, particularly in port infrastructure and connectivity projects.

Strategic Rivalry: The development of these ports underscores the strategic rivalry between India and China. Chabahar provides India with a counterbalance to China's presence in Gwadar. This competition is reflected in the investment patterns, with each port receiving significant attention from its respective backers.

The Role of Cargo Berths

Cargo berths are critical components of port infrastructure, facilitating the loading, unloading, and storage of goods. Both Chabahar and Gwadar Ports have been developing specialized cargo berths to enhance their operational capacities.

Chabahar Port: The development of five new cargo berths at Chabahar by Indian companies has significantly increased the port's handling capacity. These berths are designed to accommodate various types of cargo, including bulk, container, and general cargo. The efficient handling of cargo at these berths is essential for reducing turnaround times and enhancing the port's attractiveness to traders.

Gwadar Port: Gwadar features multiple deep-water berths capable of handling large container ships. The port's design includes specialized berths for oil tankers, bulk carriers, and container vessels. These facilities are crucial for Gwadar's ambition to become a major transshipment hub in the region.

Economic and Strategic Implications

The development of Chabahar and Gwadar Ports has far-reaching economic and strategic implications for the region.

Regional Connectivity: Both ports aim to enhance regional connectivity by providing alternative trade routes. Chabahar's link to Afghanistan and Central Asia through the INSTC can significantly reduce transit times and costs for Indian goods. Gwadar, on the other hand, offers China a shorter route to the Middle East and Africa.

Economic Growth: The development of port infrastructure and associated industrial zones is expected to spur economic growth in the surrounding regions. This includes job creation, increased trade volumes, and the development of ancillary industries.

Geopolitical Influence: The strategic investments in these ports reflect the broader geopolitical contest between India and China for influence in South Asia and beyond. Chabahar strengthens India's position in Afghanistan and Central Asia, while Gwadar enhances China's influence in the Arabian Sea and the Middle East.

Security Considerations: The military potential of these ports cannot be ignored. Both ports have the potential to serve as naval bases, enhancing the maritime capabilities of their respective backers. This adds a layer of security dynamics to the strategic rivalry in the region.

Conclusion

The development of Chabahar and Gwadar Ports represents a significant shift in the geopolitical and economic landscape of the region. Chabahar, with substantial involvement from private Indian companies, offers India a strategic foothold in Afghanistan and Central Asia, countering China's influence through Gwadar. The role of cargo berths in both ports is pivotal in enhancing their operational efficiency and attractiveness to global traders. As these ports continue to develop, their impact on regional trade, connectivity, and geopolitics will become increasingly pronounced, shaping the future of South Asia and beyond.

0 notes

Text

Belt and Road Initiative: A Comprehensive Guide

Introduction

The Belt and Road Initiative, also known as the BRI, is a global development strategy proposed by the Chinese government. It aims to promote economic cooperation among countries along the ancient Silk Road routes. This initiative is one of the most significant and ambitious projects in recent history, with the potential to reshape the global economic landscape.

Definition of the Belt and Road Initiative

The belt and road Initiative is a massive infrastructure and economic development project led by China. It consists of two main components - the Silk Road Economic Belt and the 21st Century Maritime Silk Road.

Brief history and background

The BRI was first proposed by Chinese President Xi Jinping in 2013. Since then, it has rapidly grown into a major international initiative, involving over 70 countries and international organizations.

The Significance of the Belt and Road Initiative

The belt and road initiative holds significant economic and strategic importance for both China and the participating countries.

Economic impact on participating countries

Participating countries stand to benefit from increased trade, investment, and infrastructure development. The BRI provides opportunities for economic growth and development, especially in regions that have been historically underdeveloped.

Strategic importance for China

For China, the BRI is a strategic move to expand its influence and strengthen its economic ties with other countries. It also serves as a way to address overcapacity issues in key industries, such as steel and construction.

Infrastructure development

One of the key components of the BRI is the development of infrastructure projects, including roads, railways, ports, and energy pipelines. These projects aim to improve connectivity and facilitate trade across the participating countries.

Key Components of the Belt and Road Initiative

The Belt and Road Initiative consists of two main components - the Silk Road Economic Belt and the 21st Century Maritime Silk Road.

Silk Road Economic Belt

The Silk Road Economic Belt focuses on creating a network of transport and infrastructure projects that connect China to Europe, Central Asia, and the Middle East. This includes the development of railways, highways, and energy pipelines.

Projects and investments

Numerous projects are underway as part of the Silk Road Economic Belt, including the construction of the China-Pakistan Economic Corridor and the Budapest-Belgrade Railway. These projects involve significant investments in infrastructure and technology.

Countries involved

Countries along the ancient Silk Road routes are active participants in the BRI, including Pakistan, Kazakhstan, and Russia. These countries play a crucial role in enhancing regional connectivity and trade.

21st Century Maritime Silk Road

The 21st Century Maritime Silk Road aims to enhance maritime cooperation between China and countries in Southeast Asia, Africa, and Europe. It focuses on developing ports, shipping routes, and maritime infrastructure.

Initiatives and collaborations

Through the Maritime Silk Road, China has initiated various projects, such as the construction of the Gwadar Port in Pakistan and the Piraeus Port in Greece. These collaborations aim to boost maritime trade and connectivity.

Impact on trade and maritime routes

The BRI has the potential to significantly impact global trade and maritime routes. By enhancing connectivity and infrastructure, the initiative can create new opportunities for international trade and economic growth.

China's Role in the Belt and Road Initiative

China plays a central role in the china belt and road initiative, driving its development and implementation.

Motivations behind the initiative

China's primary motivations for launching the BRI include expanding its influence, boosting economic growth, and addressing infrastructure challenges. By investing in global projects, China aims to strengthen its position as a global economic powerhouse.

Investment and funding mechanisms

China provides funding for BRI projects through various channels, including the Asian Infrastructure Investment Bank and the Silk Road Fund. These mechanisms allow for the financing of infrastructure projects and investments in participating countries.

Criticisms and controversies

Despite its potential benefits, the Belt and Road Initiative has faced criticism and controversies. Some countries have raised concerns about debt sustainability, environmental impacts, and transparency issues associated with BRI projects.

Benefits and Challenges

The belt and road initiative china offers significant benefits for participating countries, but also presents challenges that need to be addressed.

Benefits for participating countries

Participating countries stand to benefit from increased trade, investment, and infrastructure development. The BRI offers opportunities for economic growth, job creation, and improved connectivity.

Environmental concerns

Some BRI projects have raised environmental concerns, such as deforestation, pollution, and habitat destruction. It is essential for China and participating countries to address these issues and adopt sustainable practices.

Debt sustainability and transparency issues

Debt sustainability is a major concern for countries participating in the Belt and Road Initiative. Some projects have resulted in high levels of debt, raising questions about their long-term viability and impact on financial stability.

Future Outlook and Conclusion

The Belt and Road Initiative is set to shape global trade and diplomacy in the coming years, with potential developments and expansions on the horizon.

Potential developments and expansions

As the BRI continues to evolve, new projects and collaborations are likely to emerge. China's role in global infrastructure development is expected to grow, with significant implications for trade and economic growth.

Implications for global trade and diplomacy

The Belt and Road Initiative has the potential to enhance global trade and diplomacy by fostering cooperation and connectivity among countries. By building stronger economic ties, the BRI can promote peace, stability, and mutual prosperity.

In conclusion, the Belt and Road Initiative is a transformative project that has the power to reshape the global economic landscape. By investing in infrastructure and promoting connectivity, China and participating countries can unlock new opportunities for economic growth and development. While challenges exist, the potential benefits of the BRI are significant, making it a key driver of progress and cooperation in the 21st century.

0 notes

Text

Navigating the Waves: The Dynamics of Afghan Shipping

Introduction:

Afghanistan, a landlocked country in the heart of Central Asia, faces unique challenges in the realm of international trade and commerce due to its lack of direct access to the sea. However, the Afghan shipping industry has evolved over the years, adapting to the geopolitical and economic landscape.

Geopolitical Challenges:

Afghanistan's landlocked status poses significant challenges for its shipping industry. The country relies heavily on neighboring nations for transit routes to access international waters. Geopolitical tensions and changing alliances in the region can impact the efficiency and reliability of these routes, affecting Afghan trade.

Transit Routes:

Afghanistan primarily relies on its neighboring countries for transit routes to access seaports. Key transit partners include Pakistan, Iran, and Central Asian nations. The development and maintenance of these routes are crucial for the smooth flow of goods to and from Afghanistan.

Role of Ports:

While Afghanistan lacks its own seaports, nearby ports play a vital role in facilitating Afghan trade. Ports in Pakistan, such as Karachi and Gwadar, and those in Iran, like Chabahar, serve as essential gateways for Afghan imports and exports. The efficiency and capacity of these ports impact the overall competitiveness of Afghan shipping.

Customs and Regulatory Challenges:

Navigating through customs and adhering to various regulations pose additional challenges for Afghan shippers. Streamlining these processes is essential for reducing transit times and ensuring the timely delivery of goods.

Security Concerns:

Afghanistan's geopolitical landscape, marked by instability and conflict, introduces security concerns for the shipping industry. Ensuring the safety of shipments along transit routes is a priority, and collaboration with regional partners is crucial for addressing security challenges.

Innovative Solutions:

Despite these challenges, the Afghan shipping industry has demonstrated resilience and adaptability. Initiatives such as the development of the Chabahar port in Iran, which provides an alternative route to Afghan traders, showcase innovative solutions to overcome geographical constraints.

Regional Cooperation:

Collaborative efforts with neighboring countries and international partners are essential for the sustainable growth of Afghan shipping. Joint infrastructure projects and diplomatic initiatives can foster better connectivity and enhance the reliability of transit routes.

Investment Opportunities:

The Afghan shipping industry presents investment opportunities for both domestic and international stakeholders. Infrastructure development, technological advancements, and logistics services are areas where strategic investments can contribute to the growth and competitiveness of Afghan shipping.

Contact Us:

Contact: +93 79 444 4493

Address: Shar-e-Now, Haji Yaqoob Square, Kabul, Afghanistan

Email: [email protected]

Website: https://logistan.com/

#cargo company in afghanistan#afghan logistics#afghan shipping#transportation company in afghanistan#shipping companies in afghanistan#shipping companies in kabul

0 notes

Text

Unraveling the Enigma: China-built Pokhara's Airport on the Verge of Becoming Nepal's Gwadar Port

The expensive Pokhara international airport in Nepal is becoming a burden for the financially struggling nation, leaving it with significant debt to creditors in Beijing. This situation mirrors the fate of Gwadar Port in Pakistan, which was built under China’s Belt and Road initiative (BRI) and has failed to attract investment and prosperity. Although Pokhara airport was not constructed under the…

View On WordPress

0 notes

Text

Unraveling the Enigma: China-built Pokhara's Airport on the Verge of Becoming Nepal's Gwadar Port

The expensive Pokhara international airport in Nepal is becoming a burden for the financially struggling nation, leaving it with significant debt to creditors in Beijing. This situation mirrors the fate of Gwadar Port in Pakistan, which was built under China’s Belt and Road initiative (BRI) and has failed to attract investment and prosperity. Although Pokhara airport was not constructed under the…

View On WordPress

0 notes

Text

Unraveling the Enigma: China-built Pokhara's Airport on the Verge of Becoming Nepal's Gwadar Port

The expensive Pokhara international airport in Nepal is becoming a burden for the financially struggling nation, leaving it with significant debt to creditors in Beijing. This situation mirrors the fate of Gwadar Port in Pakistan, which was built under China’s Belt and Road initiative (BRI) and has failed to attract investment and prosperity. Although Pokhara airport was not constructed under the…

View On WordPress

0 notes

Text

The Silk Road, or Belt and Road Initiative (BRI), is a massive infrastructure and economic development project launched by China. Here are 20 significant BRI projects with details and estimated costs:

1. **China-Pakistan Economic Corridor (CPEC):** A flagship project linking Gwadar Port in Pakistan to China's northwestern region, with estimated costs exceeding $62 billion.

2. **China-Laos Railway:** Connecting Kunming in China to Vientiane in Laos, with an estimated cost of $6 billion.

3. **Hambantota Port in Sri Lanka:** China invested approximately $1.3 billion in the development and lease of this strategic port.

4. **Piraeus Port in Greece:** China COSCO Shipping invested around $430 million for a majority stake in Greece's largest port.

5. **Karot Hydropower Plant in Pakistan:** Estimated to cost $1.4 billion, this project aims to generate electricity along the Jhelum River.

6. **Addis Ababa-Djibouti Railway:** China invested over $4 billion to build this railway connecting landlocked Ethiopia to the Red Sea.

7. **Gwadar Port Expansion:** Part of the CPEC, it involves the expansion of Gwadar Port in Pakistan, with costs running into billions.

8. **Jakarta-Bandung High-Speed Railway:** This high-speed rail project in Indonesia has an estimated cost of around $6 billion.

9. **Budapest-Belgrade Railway:** A railway upgrade project in Hungary and Serbia with an estimated cost of over $2 billion.

10. **Port of Duisburg, Germany:** China has invested in the expansion of this key European transport hub, with the exact cost depending on various projects.

11. **Mombasa-Nairobi Railway in Kenya:** Also known as the SGR, it cost around $3.6 billion and connects the Kenyan coast to the capital.

12. **Gwadar Free Trade Zone:** Part of the CPEC, it involves industrial development and infrastructure with costs running into billions.

13. **Colombo Port City in Sri Lanka:** An ambitious reclamation project with an estimated cost of $1.4 billion.

14. **Lagos-Calabar Coastal Railway in Nigeria:** Part of Nigeria's modernization efforts, with an estimated cost exceeding $11 billion.

15. **Tanzania-Zambia Railway (TAZARA) Renovation:** China has committed to investing in the renovation of this historic railway, with costs to be determined.

16. **Belt and Road Power Projects:** Various power generation and transmission projects across BRI countries, with costs in the tens of billions.

17. **Cairo Metro Line 6 in Egypt:** An extension of the Cairo Metro system with an estimated cost of around $4.5 billion.

18. **Lusaka-Ndola Dual Carriageway in Zambia:** An infrastructure upgrade project with costs in the hundreds of millions.

19. **China-Mongolia-Russia Economic Corridor:** A proposed project to enhance economic connectivity, with costs to be determined.

20. **Gwadar-Nawabshah LNG Terminal and Pipeline:** Part of CPEC, this project aims to transport liquefied natural gas, with costs in the billions.

0 notes

Text

Beijing Is Going Places—and Building Naval Bases

Here are the top destinations that might be next.

— July 27, 2023 | By Alexander Wooley and Sheng Zhang | Foreign Policy

People welcome China’s space-tracking ship Yuanwang-5 at Sri Lanka’s Hambantota International Port in Hambantota, Sri Lanka, on Aug. 16, 2022. Ajith Perera/Xinhua Via Getty Images

China famously built its first overseas base, a launchpad for the People’s Liberation Army Navy (PLAN), in Djibouti in 2017. Where will it build the next one?

To answer that question, the authors drew on a new AidData data set that focuses on ports and infrastructure construction financed by Chinese state-owned entities in low- and middle-income countries between 2000 and 2021 and implemented between 2000 and 2023. The detailed data set captures 123 seaport projects at 78 ports in 46 countries, worth a combined $29.9 billion.

A core assumption of our analysis is that Chinese financing and construction of harbor and related infrastructure, either through foreign aid or investment, is one indicator of ports or bases that might serve the PLAN in times of peace or war. And with reason: Chinese law mandates that nominally civilian ports provide logistic support to the Chinese navy if, as, and when needed. Financial ties established through port construction and expansion are enduring, with a long-term life cycle to the relationship. Beijing also sees a corresponding nonmonetary debt to its outlays: The larger the investment, the more leverage China should have to ask for favors.

Our data reveals that China is a maritime superpower ashore as well as afloat, with extraordinary ties in the world’s low- and middle-income countries. Chinese state-owned banks have lent $499 million to expand the port of Nouakchott, Mauritania, a nation where the total GDP is around $10 billion. Freetown, in Sierra Leone, has seen its port financed to the tune of $759 million, in a country where total GDP is $4 billion. It is a worldwide portfolio, stretching even to the Caribbean. The symbolic beachhead there is Antigua and Barbuda, where in late 2022, Chinese entities spent $107 million to complete the expansion of wharfage and sea walls at St. John’s Port, dredge the harbor, and build shoreside facilities.

Drawing a connection between an ostensibly commercial investment and future naval bases may seem odd to those unfamiliar with China’s way of doing business. But a Chinese port construction or operating company can be traded on the Shanghai Stock Exchange and also be an official government entity. Among the major players in port construction is China Communications Construction Company, Ltd. (CCCC), a majority state-owned, publicly traded, multinational engineering and construction company. One of its port subsidiaries is China Harbour Engineering Company, Ltd. (CHEC). Both are major players in building ports overseas. In 2020, the U.S. Department of Commerce sanctioned CCCC for its role in constructing artificial islands in the South China Sea.

To narrow down the basing options, we applied other criteria too, including strategic location, size of port and depth of water, and potential host country relations with Beijing—measured, for example, by alignment in voting in the U.N. General Assembly. Where available, we also drew on publicly available satellite imagery as well as geospatial mapping sources and techniques.

From this, we arrived at a shortlist of the eight most likely candidates for a future PLAN base: Hambantota, Sri Lanka 🇱🇰; Bata, Equatorial Guinea 🇬🇶; Gwadar, Pakistan 🇵🇰; Kribi, Cameroon 🇨🇲; Ream, Cambodia 🇰🇭; Luganville, Vanuatu 🇻🇺; Nacala, Mozambique 🇲🇿; and Nouakchott, Mauritania 🇲🇷.

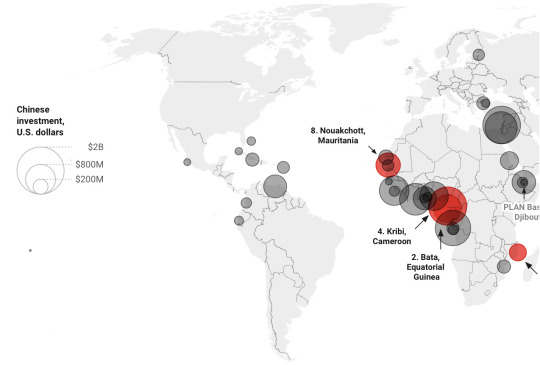

Chinese-Funded Port Infrastructure and Most Likely Naval Base Locations

Chinese state-owned entities have committed $29.9 billion to finance 123 projects to expand or construct 78 ports in 46 countries from 2000-2021. This map shows formally approved, active, or completed projects for 49 ports and highlights the eight locations of those most likely to be used as Chinese naval bases.

Note: Map excludes pledged funding and canceled or suspended projects. Russia’s port of Sabetta (the Yamal liquefied natural gas project) is also excluded. It has received an estimated $14.9 billion from China; however, researchers were unable to disaggregate the amount that went solely to the Sabetta seaport. Map By Sarina Patterson/AidData. Source: AidData/William & Mary

Ousting or outflanking the United States in the Western Pacific is a priority for Beijing, as is challenging the United States, India, and the rest of the so-called Quad alliance in the Indian Ocean. And more than half of our shortlist is indeed Indo-Pacific-oriented, as is Djibouti. What’s surprising is the intensity of Chinese investment, including in ports, on the Atlantic side of Africa. Factoring in Chinese port operators, China is more active across a greater number of ports on the Atlantic side of Africa than on the Indian Ocean, where so much geopolitical attention has been focused. China has been building ports from Mauritania southward around West Africa, through the Gulf of Guinea, and to Cameroon, Angola, and Gabon.

A base in West or Central Africa would be a bold play for a navy that is still getting its blue-water legs just 15 years after learning how to operate far from home, in the anti-piracy missions in the Gulf of Aden. Atlantic bases would put the PLAN in relative proximity to Europe, the Strait of Gibraltar, and key trans-Atlantic shipping lanes. And a shift to the Atlantic would be against the run of play. The United States has been obsessed with the Indo-Pacific, inking the AUKUS security partnership with the U.K. and Australia, deepening logistics ties with India, returning to the Philippines and the Solomon Islands, and cooperating on defense with Papua New Guinea. A PLAN base in the Atlantic would wrong-foot the naval calculus of Washington and Brussels, and send planners back to the drawing board.

We also find that China likes to put its ports in out-of-the-way places. One example is Beijing’s heavy investment in the port of Caio, an exclave province of Angola. Sometimes there are simple explanations: a lack of natural harbors of sufficient depth of water, or proximity to natural resources. But according to one shipping executive, Chinese entities in the past have seen their ports exposed to labor strife, public protests, and other disruptions, and so now prefer to distance themselves from these situations. Chinese entities likely prefer secure new locations where they can ensure majority and unfettered control or avoid a host country’s public opinion backlash. These would also be selling points in determining where to locate a naval facility.

More on our top eight most likely PLAN bases, highlighted on the map:

1. Hambantota, Sri Lanka 🇱🇰

China has collectively sunk more than $2 billion dollars into Hambantota—the most of any port anywhere in the world, according to our data set. Beijing exercises direct control over the facility. Coupled with its strategic location, the popularity of China among elites and the population, and Sri Lanka’s alignment with China in U.N. General Assembly voting, Hambantota is our top candidate for a future base.

2. Bata, Equatorial Guinea 🇬🇶

Sources in the U.S. Defense Department raised concerns about Chinese interest in a base at Bata, which were then picked up by mainstream media. The absence of any official statement by Beijing on a base is not necessarily conclusive—there were repeated denials from China about any such intentions for Djibouti, right up until the time an announcement was made that a base was coming. The commercial investment was used as the entree, but within months, construction had begun. Politically, Equatorial Guinea (as well as Cameroon and Togo) are all family dynasties or authoritarian regimes in power for years with succession plans in place or mooted. According to the Economist Intelligence Unit’s Democracy Index in 2022, all three rank toward the very bottom of global democracy rankings: Togo at 130th, Cameroon at 140th and Equatorial Guinea at 158th.

3. Gwadar, Pakistan 🇵🇰

The China-Pakistan relationship is both strategic and economic. Pakistan is the flagship country for China’s big Belt and Road infrastructure gambit, and it’s Beijing’s single largest customer for military exports. In Pakistan, Chinese warships are already a fixture: As it modernizes, Pakistan’s navy has become the largest foreign purchaser of Chinese arms, operating modern Chinese-designed surface warships and submarines. Gwadar itself is strategically situated in the far west of Pakistan, providing cover for the Strait of Hormuz. China is significantly more popular with the Pakistani public than the United States is. Though troubled, Pakistan is a democracy, and so China cannot necessarily permanently count on a leadership friendly to the notion of a naval base. Much could hang on the fate in Pakistan of the massive China-Pakistan Economic Corridor, the belle of the Belt and Road ball, of which Gwadar is a big component. The stakes and scrutiny are high, and success or otherwise of the economic corridor could impact receptiveness to a PLAN base.

4. Kribi, Cameroon 🇨🇲

The Kribi port trails only Hambantota in terms of the size of Chinese investment. It is Bata’s most likely competitor, but the ports are only about 100 miles apart. China would likely only choose one. Cameroon’s U.N. General Assembly voting and overall geopolitical positioning aligns well with China. Elsewhere, Caio in Angola, Freetown in Sierra Leone, and Abidjan in Côte d’Ivoire would all be basing possibilities, based on the size of Beijing’s investments there. Of Sierra Leone’s two main political parties, one (the All People’s Congress) is closely linked to China. At political rallies, its supporters have chanted phrases such as “We are Chinese” and “We are black Chinese.” Beijing has successfully insinuated itself into the political life of the country.

5. Ream, Cambodia 🇰🇭

While the official investment to date has been small, Ream, Cambodia, is very likely to be a PLAN facility in one form or another. While the United States and the West are popular with Cambodians, Prime Minister Hun Sen is a longtime ally of Beijing, and it is he who matters. Although he plans to step down in August to be replaced by his son, he’s expected to continue to call the shots. The elites of Cambodia have done well under Belt and road Initiative and are aligned closely with China. In 2020, Cambodia’s voting in the U.N. General Assembly mirrored that of China and coincided with the United States on just 19 of 100 contested votes that year, a rate only slightly higher than Iran, Cuba, and Syria. Hun Sen denies that Ream will be hosting the PLAN anytime soon, but the evidence indicates otherwise.

6. Luganville, Vanuatu 🇻🇺

Beijing has spent decades trying to crack the first island chain that hems it in. A PLAN base, perhaps not very large, makes sense somewhere in the South or Central Pacific. While our data shows only limited Chinese investments in port infrastructure in the region thus far, Vanuatu is one location where construction has been funded, at Port Luganville on the island of Espiritu Santo. An investment of $97 million is not small, as it puts Vanuatu in the top 30 investments globally, according to our data. And there is precedent: In World War II, the strategically located island was home to one of the largest U.S. Navy advanced bases and repair facilities in the Pacific. The Canal du Segond in front of Luganville was a massive, sheltered anchorage, home to fleets, floating dry docks, an air base, and supply bases.

7. Nacala, Mozambique 🇲🇿

While China’s port investments in Mozambique have not been on the same scale as in other locations, neither have they been insignificant. Mozambique also has not seen the backlash to Chinese loans and investments witnessed in other countries in East and Southern Africa, such as Kenya and Tanzania. China is popular with elites and the general population, and it sponsors a significant amount of the country’s media content. The question is: Where to site a base? Maputo is the largest port, but it is run by the government and Dubai Ports World. China has funded construction or expansion in both Beira and Nacala—both ports make our top 20 in terms of investment totals. Beira is likely too shallow for large warships, as it requires regular dredging. Nacala would make the most sense—it has seen sizable Chinese investment and is a deep-water port.

8. Nouakchott, Mauritania 🇲🇷

Mauritania is removed from the logjam of PLAN options in West and Central Africa; Nouakchott is more than 2,000 miles northwest of Bata, for example. The West African nation is also significantly closer to Europe and chokepoints such as the Strait of Gibraltar—roughly only two days’ steaming at 20 knots. At the 2020 U.N. Human Rights Council hearing on China’s new security law for Hong Kong, 53 countries supported China, including Antigua and Barbuda, Cambodia, Cameroon, Equatorial Guinea, Mozambique, Pakistan, Sierra Leone, Sri Lanka—and Mauritania.

Wild Card: Russia 🇷🇺?

While China has been spending loads in the developing world, it could still try for a base in the nearly developed world, by co-locating fleet units at one or more Russian navy bases. There is a clear upside from the Chinese perspective: It doesn’t have to persuade the Russian leadership that the United States and Europe are a threat, and there’s little danger of any U.S. charm offensive to lure Russia away.

Russia has naval bases across its vast land mass, many of which are Cold War legacies. What could be attractive to PLAN naval planners would be a base in the North Pacific Ocean. Such a facility—say, the existing Russian base at Vilyuchinsk on the Kamchatka Peninsula—would be secure, distant from public scrutiny, make use of existing warship docking and repair facilities, and have the merit of placing the PLAN between Japan, a U.S. ally, and Alaska. In both 2021 and 2022, the PLAN and the Russian Navy conducted extensive joint exercises in the East China Sea and western Pacific, including circumnavigating the Japanese main islands. China could also share facilities with the Russian Navy in the Barents Sea, located off the northern coasts of Norway and Russia, or Kola Bay, a natural harbor off the Barents Sea, providing it access to the North Atlantic.

— Rory Fedorochko and Sarina Patterson contributed to this report — Alexander Wooley is a Journalist and Former Officer in the British Royal Navy.

— Sheng Zhang is a Research Analyst with AidData's Chinese Development Finance Program, where he tracks underreported financial flows and leads geospatial data collection. He is the co-author of a previous AidData report on China’s global development footprint, Banking on the Belt and Road.

#Infographic#China 🇨🇳#Naval Bases#Top Destinations#AidData#United States 🇺🇸#India 🇮🇳#Quad Alliance#Indo-Pacific-Oriented#Djibouti 🇩🇯#Mauritania 🇲🇷#Gulf of Guinea 🇬🇳#Angola 🇦🇴#Cameroon 🇨🇲#Gabon 🇬🇦

0 notes

Link

[ad_1] ISLAMABAD: Four Pakistani state-owned petroleum companies have signed a memorandum of understanding with Saudi Arabia to build Pakistan's largest oil refinery with an investment of $10 billion in the strategic Gwadar port, according to a media report on Friday. The MoU to set up the facility with a production capacity of 300,000 barrels per day was signed on Thursday, the Dawn newspaper reported. The companies would join the project through equity participation.The government headed by PM Shehbaz Sharif is reportedly in the advanced stages of negotiations with Saudi giant Aramco to execute the greenfield refinery project at the strategic Gwadar port and wants to complete the initial paperwork before its tenure ends on August 14.To facilitate the Saudi investment in refining, the government has recently passed a new policy under which a new deep conversion oil refinery of a minimum of 300,000 bpd achieving financial close of the project within five years shall be eligible for a customs duty of 7.5 per cent for 25 years on petrol and diesel of all grades produced effective from the date of commissioning of the refinery. The project envisions setting up an integrated refinery petrochemical complex with a crude oil processing capacity of a minimum 300,000 bpd along with a petrochemical facility.!(function(f, b, e, v, n, t, s) function loadFBEvents(isFBCampaignActive) if (!isFBCampaignActive) return; (function(f, b, e, v, n, t, s) if (f.fbq) return; n = f.fbq = function() n.callMethod ? n.callMethod(...arguments) : n.queue.push(arguments); ; if (!f._fbq) f._fbq = n; n.push = n; n.loaded = !0; n.version = '2.0'; n.queue = []; t = b.createElement(e); t.async = !0; t.defer = !0; t.src = v; s = b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t, s); )(f, b, e, ' n, t, s); fbq('init', '593671331875494'); fbq('track', 'PageView'); ; function loadGtagEvents(isGoogleCampaignActive) if (!isGoogleCampaignActive) return; var id = document.getElementById('toi-plus-google-campaign'); if (id) return; (function(f, b, e, v, n, t, s) t = b.createElement(e); t.async = !0; t.defer = !0; t.src = v; t.id = 'toi-plus-google-campaign'; s = b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t, s); )(f, b, e, ' n, t, s); ; window.TimesApps = window.TimesApps )( window, document, 'script', ); [ad_2]

0 notes

Text

Global Shift Away from US Dollar Dominance Banking Failures and De-Dollarization Efforts Contribute to the Currency’s Decline?

The global financial landscape has been undergoing a significant shift in recent months. Many nations are actively working to reduce their dependence on the US dollar for international trade and investments. This trend has been fueled by a range of factors, including geopolitical tensions, economic instability, and concerns over the long-term viability of the US dollar as a global reserve currency.

One of the most significant developments in this trend has been the rise of the BRICS nations (Brazil, Russia, India, China, and South Africa) as economic powerhouses, each seeking to challenge the US dollar’s dominance in global trade. These countries have been actively promoting the use of their respective currencies in international transactions, and exploring various mechanisms for settling trade deals without relying on the US dollar.

Moreover, China is building new rail links to Pakistan and Turkey as a way to reduce its dependence on the West for international trade. The railroad that is set to start from the Chinese city of Kashgar and end at Pakistan’s port of Gwadar is estimated to cost $57.7 billion. If successful, this could open up direct access for China to trade with other Asian countries, bypassing the US dollar’s dominance. Bloomberg Intelligence reported that the percentage of cross-border transactions using the Chinese yuan reached a record high of 48% at the end of March 2023. In contrast, the US dollar’s share declined from 83% to 47% during the same period.

Other nations such as Iran, UAE, Argentina, Malaysia, and Kenya began to also put forth similar efforts, with them all agreeing that there is no reason to depend on the US dollar. Argentina is set to start paying for Chinese imports in Chinese Yuan rather than dollars, their government announced.

The de-dollarization trend has also been fueled by the ongoing banking sector issues, with several banks facing collapse or takeover by the US government. Silvergate Bank, Signature Bank, and Silicon Valley Bank all collapsed, causing repercussions throughout the financial industry. In addition, the US government took over First Republic Bank before being sold to JP Morgan.

PacWest Bancorp’s stock trading was halted, citing volatility, causing its stock to plummet. Western Alliance is the latest bank to explore strategic options, including a potential sale. This situation, coupled with the recent bank failures, has caused concern among investors and analysts, with some predicting that it could contribute to the potential fall of the US dollar’s influence globally.

These developments have sparked a debate about the long-term viability of the US dollar as a global reserve currency, with some experts warning that the ongoing de-dollarization trend could pose significant challenges to the US economy and its position as the world’s dominant superpower. While the US dollar remains the dominant global currency for now, it is clear that other nations are actively working to reduce their dependence on it, signaling a potentially significant shift in the global economic landscape.

In conclusion, the de-dollarization trend is gathering momentum, with many nations actively seeking to reduce their dependence on the US dollar for international trade and investment. China’s efforts to promote the use of the yuan in global transactions, coupled with the ongoing banking sector issues, have contributed to the growing sense of uncertainty about the US dollar’s long-term viability as a global reserve currency. While the full impact of these developments remains to be seen, they signal a potentially significant shift in the global economic landscape, with implications for investors, businesses, and policymakers around the world.

Citations:

“UPDATE 1-Western Alliance latest US bank to explore sale — FT.” finance.yahoo.com. https://finance.yahoo.com/, 4 May. 2023. Web. 9 May. 2023.<https://finance.yahoo.com/news/1-western-alliance-latest-us-143157304.html>.”

“Dsouza, Vinod. watcher. guru. N.p., 28 Apr. 2023. Web. 9 May. 2023.”

1 note

·

View note

Text

Invest in Gwadar: A Gateway to Prosperity and Growth

Introduction: Gwadar, situated at the southwestern coast of Pakistan, has rapidly emerged as a focal point for investment opportunities. The city's strategic location, economic prospects, and government-backed development projects make it an attractive investment destination. In this blog, we will explore why Gwadar is an ideal place to invest and how it serves as a gateway to prosperity and growth.

Strategic Location and Regional Significance: Gwadar's location at the crossroads of international trade routes on the Arabian Sea grants it immense regional significance. The city's deep-sea port is a vital link for trade between Asia, the Middle East, Africa, and Europe. Investing in Gwadar allows stakeholders to leverage its strategic position for growth and business expansion.

China-Pakistan Economic Corridor (CPEC): Gwadar is a critical component of the China-Pakistan Economic Corridor (CPEC), a transformative economic initiative connecting China to Gwadar's port and beyond. CPEC's infrastructure projects are reshaping Gwadar's landscape, creating a conducive environment for investment.

Booming Real Estate Market: Gwadar's real estate market has witnessed remarkable growth in recent years. As the city experiences rapid development and economic growth, property values are soaring. Investment in Gwadar real estate offers the potential for significant capital appreciation.

Government Support and Incentives: The Pakistani government is actively supporting Gwadar's development and offering incentives to investors. These include tax breaks, relaxed regulations, and other favorable policies. Investing in Gwadar aligns with the government's vision for the city's progress.

Infrastructure Development: Gwadar is witnessing extensive infrastructure development, including roads, airports, and industrial zones. These projects enhance the city's connectivity and investment potential, making it an attractive destination for various ventures.

Trade and Investment Opportunities: Gwadar's economic significance and strategic location create trade and investment opportunities across diverse sectors. Entrepreneurs and businesses can explore ventures in trade, logistics, manufacturing, hospitality, and more, benefiting from the city's economic growth.

Tourism Potential: Gwadar's natural beauty, pristine beaches, and cultural heritage make it an emerging tourism destination. Investment in Gwadar's tourism sector allows stakeholders to capitalize on the city's tourism potential and emerging market.

Conclusion: Investing in Gwadar is a gateway to prosperity and growth, driven by its strategic location, participation in CPEC, booming real estate market, government support, infrastructure development, trade opportunities, and tourism potential. By investing in Gwadar, stakeholders unlock the gateway to a city brimming with possibilities, paving the way for a prosperous and thriving future.

0 notes

Text

Iran's Chabahar Port: Strategic Importance and the Role of Private Indian Companies

Introduction

Iran Chabahar Port, located in southeastern Iran on the Gulf of Oman, holds significant strategic and economic importance for the region. As the only Iranian port with direct access to the Indian Ocean, Chabahar serves as a crucial gateway for trade between Iran, India, and Afghanistan. The development of this port has been significantly influenced by the involvement of private Indian companies, which have invested in various infrastructure projects. This essay explores the strategic relevance of Chabahar Port, the involvement of private Indian companies, and how it compares with Pakistan's Gwadar Port.

Strategic Importance of Chabahar Port

Chabahar Port's strategic significance lies in its location and its potential to enhance regional connectivity. It provides a shorter and more economical route for trade between India, Iran, and Afghanistan, bypassing Pakistan. This is particularly important for India, which has long sought to establish a trade corridor to Central Asia that avoids reliance on its western neighbor.

The port's development is also part of Iran's broader strategy to diversify its trade routes and reduce dependency on the Strait of Hormuz, a critical chokepoint for global oil shipments. By bolstering Chabahar, Iran aims to attract more regional and international trade, enhancing its geopolitical standing.

Involvement of Private Indian Companies

India's involvement in Chabahar Port is driven by both strategic and economic interests. Private Indian companies have played a crucial role in the port's development. In 2016, India Ports Global Limited (IPGL), a consortium of Indian companies, signed an agreement to equip and operate two terminals and five berths at Chabahar Port. This agreement marked a significant step in enhancing India-Iran economic ties.

Several private Indian companies have been involved in various aspects of the port's development:

Infrastructure Development: Companies like IRCON International and KEC International have been involved in building and upgrading infrastructure, including rail links connecting Chabahar to the Afghan border and further into Central Asia.

Cargo Handling: Indian firms are engaged in managing cargo handling operations, ensuring the smooth transit of goods through the port. This includes the development of specialized cargo berths to handle different types of goods efficiently.

Logistics and Supply Chain: Private logistics companies from India are establishing supply chain networks to facilitate seamless trade through Chabahar. These networks include warehousing, transportation, and distribution services.

Economic Implications for India

For India, Chabahar Port offers a direct and reliable route to Afghanistan and Central Asia, reducing transport costs and transit times. This is particularly beneficial for the export of goods such as pharmaceuticals, textiles, and agricultural products. The port also opens up new markets for Indian goods, fostering economic growth and strengthening trade ties with landlocked Afghanistan.

Moreover, the port serves as a counterbalance to China's influence in the region, particularly through the China-Pakistan Economic Corridor (CPEC) and the development of Gwadar Port in Pakistan. By investing in Chabahar, India aims to secure its strategic interests and enhance its regional connectivity.

Comparison with Gwadar Port

Chabahar Port is often compared with Pakistan's Gwadar Port, which is located about 170 kilometers to the east. Gwadar, developed with significant Chinese investment, is a key component of the CPEC and is intended to serve as a major transshipment hub in the region.

Strategic Objectives: While both ports aim to enhance regional connectivity, their strategic objectives differ. Gwadar is central to China's Belt and Road Initiative (BRI) and aims to provide China with a shorter route to the Arabian Sea, bypassing the Malacca Strait. In contrast, Chabahar is primarily driven by India and Iran's desire to enhance trade with Afghanistan and Central Asia, bypassing Pakistan.

Infrastructure and Development: Gwadar has seen substantial Chinese investment, leading to rapid development and modernization. Chabahar, on the other hand, has progressed more slowly, partly due to international sanctions on Iran. However, the involvement of Indian companies is accelerating its development.

Regional Impact: Gwadar's development has geopolitical implications, particularly concerning China-Pakistan relations and their stance towards India. Chabahar's development strengthens India-Iran ties and enhances India's influence in Afghanistan and Central Asia, providing a strategic counterweight to Gwadar.

Future Prospects

The future of Chabahar Port looks promising, with several projects in the pipeline to enhance its capacity and connectivity. Key future developments include:

Rail Connectivity: The completion of the Chabahar-Zahedan railway, which connects the port to Iran's national rail network, will significantly boost trade. This rail link is expected to extend to Afghanistan and further into Central Asia, facilitating smoother transit of goods.

Free Trade Zone: The establishment of a free trade zone (FTZ) around Chabahar Port will attract foreign investment and promote industrial development. This FTZ is expected to house manufacturing units, logistics hubs, and service providers, creating job opportunities and boosting the local economy.

Increased Trade Volume: As sanctions on Iran ease and the regional security situation improves, Chabahar is expected to handle a greater volume of trade. This will enhance the port's economic viability and contribute to regional economic growth.

Collaborative Projects: India and Iran are likely to collaborate on further infrastructure projects, including the development of additional berths, warehouses, and cargo handling facilities. These projects will enhance the port's capacity and efficiency, making it a more attractive option for traders.

Conclusion

Chabahar Port represents a significant strategic and economic asset for Iran, India, and the broader region. The involvement of private Indian companies has been instrumental in its development, enhancing regional connectivity and trade. While challenges remain, particularly in terms of geopolitical tensions and infrastructural development, the future prospects for Chabahar are bright. As the port continues to develop, it will play a crucial role in shaping the economic and strategic landscape of the region, providing a valuable counterbalance to Gwadar Port and enhancing India's influence in Afghanistan and Central Asia.

0 notes

Text

CPEC: The Untapped Potential for the Steel Industry of Pakistan

Have you ever wondered how the China-Pakistan Economic Corridor (CPEC) could change the steel industry? It is evident that CPEC has been a major game changer for the economy of Pakistan and is a key milestone in China’s Belt and Road Initiative. But what are its untapped potentials for the steel industry?

The CPEC has provided access to a large market, simplified trading procedures, and reduced transportation costs. It has improved supply chain efficiency and generated greater opportunities for Pakistan’s Steel Sector. CPEC also provides foreign direct investment, technology transfer, and job creation opportunities in Pakistan.

This article seeks to explore how CPEC can be a game changer for the steel industry, opening the doors to new markets, new customers, and new technologies. We'll look at, how it can help to increase efficiency and productivity across the board, as well as how it can open up new trade channels for Pakistani steel makers.

CPEC & the Steel Industry: An Overview

CPEC offers an unprecedented opportunity for the Pakistan Steel Industry. It could prove to be a game-changer for the country as it unlocks new avenues for economic growth and investment. With CPEC, Pakistan can benefit from modern technology, foreign direct investments in steel-related industries, and improved infrastructure.

Moreover, the second phase of the China-Pakistan Economic Corridor (CPEC) has increased its focus on Special Economic Zones (SEZs). These SEZs are expected to be hubs for steel-related industries and will help stimulate growth in the sector. The SEZ in Faisalabad will become an industrial hub with a focus on light engineering activities such as auto parts manufacturing and electronics appliance assembly (2023, April 13). In addition to these, CPEC also plans to establish nine Special Economic Zones (SEZs) across Pakistan, which will attract more investment and industries that will further increase the demand for steel. According to the Board of Investment (BOI), these SEZs will create about 1.5 million jobs and generate about $10 billion in exports by 2030 (2023, April 13).

One of the main drivers of this growth was CPEC, which created a huge demand for steel for various projects. According to the Ministry of Planning, Development, and Special Initiatives, CPEC has completed 17 projects worth $13 billion as of December 2022, while another 21 projects worth $12 billion are under construction (2023, April 13). These projects include highways, railways, power plants, ports, and Special Economic Zones (SEZs), which require large amounts of steel for their construction and operation.

For instance, the Karachi-Lahore Motorway (KLM), which is a part of CPEC's eastern alignment, is a 1,152 km long six-lane expressway connecting Pakistan's two largest cities. The project cost $6.6 billion and was completed in December 2022 (2023, April 13). The project consumed about 1 million tons of steel during its construction, according to the National Highway Authority (2023, April 13).

Thar Coal Power is a part of CPEC's energy cooperation. The project consists of two coal-fired power plants with a total capacity of 1,320 megawatts (MW), located in Thar Block II in Sindh province. The project cost $2 billion and was inaugurated in March 2023 (2023, April 19). The project used about 400,000 tons of steel for its construction, according to the Sindh Engro Coal Mining Company (2023, April 19).

Another project is the Gwadar Port, which is also a part of CPEC's maritime cooperation. The port is located in the Arabian Sea, Balochistan, and is considered a strategic gateway for trade between China and the Middle East, Africa, and Europe. The port has been upgraded and expanded under CPEC, with new terminals, berths, warehouses, and facilities. The port handled about 1.2 million tons of cargo in 2022, an increase of 58% from 2019 (2021, April 19). The port also consumed about 300,000 tons of steel for its development, according to the Gwadar Port Authority (2021, April 19).

Ultimately, CPEC is likely to provide a great boost to both local and foreign investments in Pakistan’s Steel Industry by increasing profitability, competitiveness, productivity, and access to the International Markets.

Strategies to Leverage the Benefits of CPEC for Steel Producers

CPEC (China-Pakistan Economic Corridor) presents a great opportunity for Pakistan’s Steel Industry to capitalize on. The massive infrastructure development project is estimated to be worth around $46 billion and offers investments in various sectors from energy projects to road and rail networks, to ports (2023, April 13).

Steel producers in Pakistan are set to reap the rewards of CPEC, but in order for them to do so, they must formulate strategic plans that will evolve their businesses to meet the opportunities presented by this game-changing project.

Here are some strategies that can be employed by steel producers to leverage the benefits of CPEC:

Investing in Steel Technology

The modernization of the steel production processes is essential for the industry to grow, remain competitive and take advantage of the opportunities that CPEC offers (2023, April 13). Investing in advanced technology can help improve production efficiency, product quality and reduce costs.

Developing Strategic Partnerships

Partnering with other stakeholders within Pakistan's Building Material Industry can help increase market share and build better relationships with customers and suppliers. A strong network of strategic partners ensures that resources are utilized and knowledge is shared in an optimal way.

Making Use of Local Resources

By utilizing local resources such as tools, machines, raw materials, etc., Pakistani Steel producers can produce their products at a faster rate with fewer imports from China - thus ensuring that Indian Steel producers do not outpace them in this area. This also reduces costs associated with importing supplies from China or other countries.

Conclusion

The CPEC project has the potential to be a game-changer for the steel industry in Pakistan. With access to improved transport and communication infrastructure, the local industry can become more competitive in the global market. CPEC also provides a unique opportunity to tap into the potential of new technologies and the potential for more rigorous innovation, which can result in more efficient production processes and cost savings. Finally, CPEC's initiatives aim to reduce the cost of energy, which can also lead to improved profits. With the right implementation, the CPEC project can ultimately lead to increased economic prosperity and improved living standards for the people of Pakistan.

References

Business Recorder. (2023, April 13). The steel industry is likely to generate $32b annually by 2025. https://www.brecorder.com/news/40123587

State Bank of Pakistan. (n.d.). Industrial statistics. https://www.sbp.org.pk/ecodata/IndustrialStatistics.pdf

World Steel Association. (2021, April 19). Steel in the new age. https://www.worldsteel.org/media-centre/press-releases/2021/2021-04-19-steel-in-the-new-age.html

The Express Tribune. (2020, September 8). The steel industry is likely to generate $32b annually by 2025. https://tribune.com.pk/story/2343517/steel-industry-likely-to-generate-32b-annually-by-2025

State Bank of Pakistan. (n.d.). Exports by commodity group. https://www.sbp.org.pk/ecodata/exports_commodity.pdf

Wikipedia. (2023, April 13). China–Pakistan Economic Corridor. https://en.wikipedia.org/wiki/China%E2%80%93Pakistan_Economic_Corridor

Statista. (n.d.). Topic: Steel industry. https://www.statista.com/topics/1149/steel-industry/

0 notes

Text

Pakistan suicide bomber kills nine police officers

Security forces have been battling a years-long insurgency by militants in Balochistan demanding a bigger share of the province's wealth, as well as attacks by the Pakistan Taliban (TTP).

QUETTA: A suicide bomber killed nine police officers and wounded 16 others Monday in an attack on their truck in southwestern Pakistan, officials said.

Security forces have been battling a years-long insurgency by militants in Balochistan demanding a bigger share of the province's wealth, as well as attacks by the Pakistan Taliban (TTP).

"The suicide bomber was riding a motorbike and hit the truck from behind," senior police official Abdul Hai Aamir told AFP.

The incident took place near Dhadar, the main town of Kachhi district, about 120 kilometres (75 miles) southeast of Quetta in Balochistan.

Photos of the aftermath showed the police truck upside down on the road with its windows shattered.

Mehmood Notezai, police chief for Kachhi district, told AFP the officers were returning from a week-long cattle show where they had been providing security.

There has been no claim of responsiblity for the attack.

"Terrorism in Balochistan is part of a nefarious agenda to destabilise the country," Prime Minister Shehbaz Sharif said in a statement released by his office.

Last month five people died when a TTP suicide squad stormed a police compound in the port city of Karachi.

It came just weeks after a bomb blast at a police mosque in the northwestern city of Peshawar killed more than 80 officers -- an attack claimed by a group sometimes affiliated with the TTP.

The country is facing overlapping political, economic and environmental crises, as well as a worsening security situation during which the army and police have been increasingly targeted.

Balochistan is the largest, least populous and poorest province in Pakistan.

It has abundant natural resources, but locals have long harboured resentment, claiming they do not receive a fair share of its riches.

Tensions have been stoked further by a flood of Chinese investment under Beijing's Belt and Road Initiative, which locals say has not reached them.

China is investing in the area under a $54-billion project known as the China-Pakistan Economic Corridor, upgrading infrastructure, power and transport links between its far-western Xinjiang region and Pakistan's Gwadar port.

0 notes

Text

Suicide bomber kills nine police officers in Pakistan

A suicide bomber killed nine police officers and wounded 16 others Monday in an attack on their truck in southwestern Pakistan, officials said.

Security forces have been battling a years-long insurgency by militants in Balochistan demanding a bigger share of the province’s wealth, as well as attacks by the Pakistan Taliban (TTP).

“The suicide bomber was riding a motorbike and hit the truck from behind,” senior police official Abdul Hai Aamir told AFP.

The incident took place near Dhadar, the main town of Kachhi district, about 120 kilometres (75 miles) southeast of Quetta in Balochistan.

Photos of the aftermath showed the police truck upside down on the road with its windows shattered.

Mehmood Notezai, police chief for Kachhi district, told AFP the officers were returning from a week-long cattle show where they had been providing security.

There has been no claim of responsiblity for the attack.

“Terrorism in Balochistan is part of a nefarious agenda to destabilise the country,” Prime Minister Shehbaz Sharif said in a statement released by his office.

The country is facing overlapping political, economic and environmental crises, as well as a worsening security situation.– Attacks on the rise –

Attacks have been on the rise in Pakistan since the Afghan Taliban seized control of Kabul in August 2021, emboldening militant groups along the border which have increasingly targeted security forces.

Last month five people died when a TTP suicide squad stormed a police compound in the port city of Karachi.

It came just weeks after a bomb blast at a police mosque in the northwestern city of Peshawar killed more than 80 officers — an attack claimed by a group sometimes affiliated with the TTP.

“Despite different ideological, ethnic and political outlooks, (militant groups) are all franchises bound by one objective: to hit the security forces and instil a sense of fear and uncertainty in Pakistan,” said Imtiaz Gul, an analyst with Islamabad’s Center for Research and Security Studies.

Balochistan, which borders both Afghanistan and Iran, is the largest, least populous and poorest province in Pakistan.

It has abundant natural resources, but locals have long harboured resentment, claiming they do not receive a fair share of its riches.

Tensions have been stoked further by a flood of Chinese investment under Beijing’s Belt and Road Initiative, which locals say has not reached them.

China is investing in the area under a $54 billion project known as the China-Pakistan Economic Corridor, upgrading infrastructure, power and transport links between its far-western Xinjiang region and Pakistan’s Gwadar port.

Read the full article

0 notes