#Grocery Delivery App Like Gorillas

Explore tagged Tumblr posts

Text

How To Build an Instant Grocery Delivery App Like Gorillas?

Customers and industry participants are concentrating on rapid delivery, or q-commerce, as a result of the recent trend in the retail eCommerce sector. Customers, particularly those who shop at food stores, anticipate prompt delivery. Therefore, as a business owner in the grocery sector, you should be aware of the techniques and methods to deliver goods to clients quickly.

Are you eager to explore the field of on-demand grocery delivery?

If yes, this blog will help you with on-demand grocery app development and ensure the quickest grocery delivery of your identity in the UK area.

Gorilla Clone App: Offer Quality On-Demand Grocery Delivery Solution

The cutting-edge infrastructure used by the Gorillas clone app offers online grocery ordering and delivery services. It comprises customizable modules that take advantage of better business chances and improve your clients’ services. Automating a traditional grocery store is relatively easy with apps like Gorillas, which offer scalability choices and make order management simple for business owners.

Read Also – Must-Have Features to Build Grocery Delivery App in 2023

Why Create a Gorilla-like Grocery Delivery App?

The idea may seem trite when discussing expanding grocery delivery apps, but it is widespread. What makes the idea notable is its overall simplicity with which customers are presented. A supermarket app may be created at a minimal cost and with a good return on investment compared to other projects.

Here are a few of the factors that have contributed to the popularity of grocery delivery applications on smartphones in recent years:

Saves Both Time and Energy

With only a few clicks, customers of any grocery delivery app may complete their daily tasks. Shoppers will pass their time working and having fun instead of standing in lengthy lines to pay and carry heavy luggage.

Upscales the Overall Business

You cannot afford to disregard the trend if you run an offline store. You can hire an on-demand grocery delivery app development business for a modest investment to expand your clientele.

Cost-effective Business Model

The dark shop business plan takes a relatively little initial expenditure if you want to launch a new business but have a limited budget. The functionality employed in the app affects how much a dark shop service costs online.

How does an App like Gorillas Operate?

Following is a description of how the grocery delivery business software works, from placing an order-to-order confirmation to order pickup and delivery:

Most grocery apps have relatively straightforward operations.

Step 1: Customers may shop online or through specialized apps by adding items to their carts and placing orders. Users can also do specific item searches here based on their needs.

Step 2: After a customer order, the retailer can accept or reject the purchase. Once the order is prepared for shipment, an automated notice is issued to the closest delivery provider for order pickup.

Step 3: The order is picked up and delivered to the customer by a delivery service. Customers may use their app to follow the real-time order status here.

Step 4: Consumers can get their orders. They may now choose a payment method and review the services based on their personal experiences.

In this approach, a tool like Gorillas streamlines the procedure for both clients and grocery store proprietors.

What is the cost of grocery delivery app development?

There are many features and factors to consider before starting to design a grocery delivery app. Since every application is different and its price depends on a number of factors, it is impossible to pinpoint an exact cost for every given application.

However, the key components include:

App complexity

Type of application (native or cross-platform)

Development team size

Location of the app development company

Features integrations

Make sure all the contemporary features are included so that users of your software will feel included. The total cost of development rises noticeably as the number of features grows. To get an accurate estimate, it is advised to shake hands with an experienced and reputable app development company in Nottingham.

Conclusion

The future of the food delivery industry is bright and promising as millions of customers move their grocery shopping from traditional retail locations to online retailers. The market for online grocery delivery services is becoming more competitive. Therefore, now is the ideal moment to seize the chance and start your own grocery delivery service by hiring mobile app developers in Nottingham. You may contact Zimble Code to begin developing a grocery app and meet your company’s goals.

Article Resource - https://zimblecode.com/how-to-build-an-instant-grocery-delivery-app-like-gorillas/

#App developers Nottingham#App development company in Nottingham#best app developers Nottingham#Create a grocery delivery app#grocery delivery app development#grocery delivery app development cost#Grocery Delivery App Like Gorillas#Grocery Delivery App Solution#Launch Online Grocery Delivery App#Mobile app developers in Nottingham#Mobile App Development Company In Nottingham#mobile application development in Nottingham#Nottingham App development company#Nottingham Software Development Company#on-demand grocery app development#On-Demand Grocery Delivery Mobile App Development#On-Demand Grocery Service App#Software Developers Nottingham#Top App Developers in Nottingham#Top Mobile App Development Company In Nottingham#Top mobile app development company in UK#Web App Development Nottingham#Zimble Code

1 note

·

View note

Text

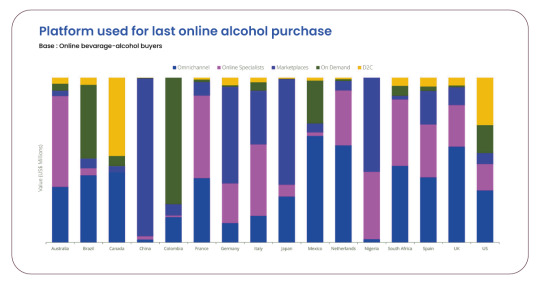

Empower the Surge of Online Alcohol Retail in the UK by Web Scraping Liquor Data

The Alcohol eCommerce sector has experienced rapid expansion, a trend accentuated by the pandemic. Post-pandemic, factors like convenience, safety, and home delivery gained prominence, propelling alcohol sales through eCommerce. In the UK, Kantar noted a £261 million surge in rising sales, with online and convenience stores emerging as the key beneficiaries. Intriguingly, the IWSR Drinks Market Analysis Report 2022 highlighted a global preference for websites over apps when purchasing alcohol online, except in China and Brazil. Notably, in the UK, major online alcohol purchases occur via retailer websites, not apps.

Research Approach

Our research was conducted through liqour data scraping, spanning February 2022 to June 2022. The focus of our study encompassed two prominent grocery retailers, namely Tesco and Ocado, along with three noteworthy grocery apps, namely Gorillas, Weezy, and Getir. The specific category under scrutiny throughout our analysis was alcohol.

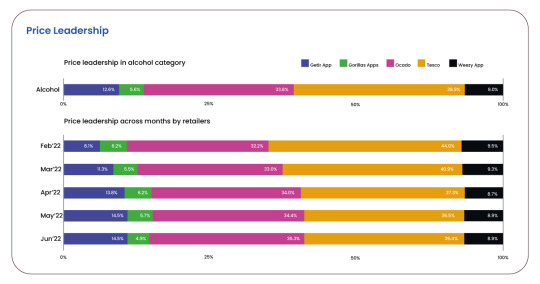

Identifying The Alcohol Price Leader

Tesco's Leadership In Alcohol Pricing

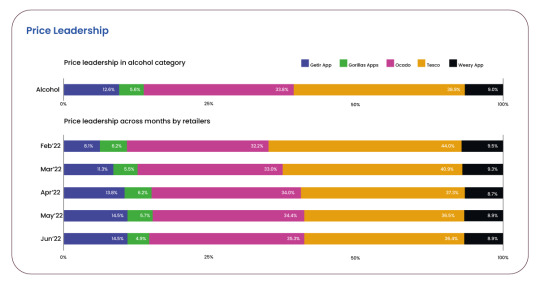

Throughout February to June 2022, Tesco consistently established itself as the front-runner in price leadership within the Alcohol category. Leveraging e-commerce data scraping, Tesco secured the lowest prices for 38.9% of its products. Ocado followed closely with 33.8%, while Gorillas exhibited the most minor dominance, leading in price for only 5.6% of its alcohol offerings.

Nonetheless, Tesco's grip on price leadership experienced a gradual erosion over the months. Commencing in February,e-commerce data scraping revealed Tesco's hold on the lowest price for 44% of its products, which tapered to just over 36% by June. Conversely, Ocado depicted an inverse trajectory—starting at a 32% price leadership in February, climbing to 35.3% by June.

An intriguing contender, illuminated through e-commerce data scraping, was Getir. Commencing with a modest 8.2% price leadership for its products in February, Getir's proportion progressively expanded, culminating at 14.5% in June.

Retailers Employing Discounts To Bolster Alcohol Sales

Leveraging discounts using liquor product data collection proves to be an effective strategy to attract consumers impacted by inflation. Through loyalty card discounts, reward vouchers, and various promotional tactics, retailers enhance the allure of their products, rendering them more competitive and appealing to customers. Maintaining competitiveness necessitates retailers' awareness of their rivals' discount offerings. Moreover, price monitoring helps comprehend the potential ramifications of substantial discounting and its influence on profit margins.

A wave of European and UK startups, including Jiffy, Dija, Weezy, Zapp, Getir, and Gorillas, entered the scene with a shared commitment: to provide the swiftest and most cost-effective grocery delivery services.

Our dataset uncovered intriguing discounting dynamics among these players. Gorillas maintained a discounting strategy in line with its competitors. Conversely, Getir appeared to adopt a more aggressive approach, veering towards deep discounting. Notably, Getir consistently offered the highest discounts throughout the observed period. In April, their discounts surged to nearly 9% more than those of Ocado—the runner-up in discounting.

As previously discussed, the period from February to June saw Getir securing price leadership. It's plausible that their strategy of deep discounting contributed to this accomplishment. In contrast, Gorillas opted for a different route, showcasing the lowest and almost negligible discounting practices.

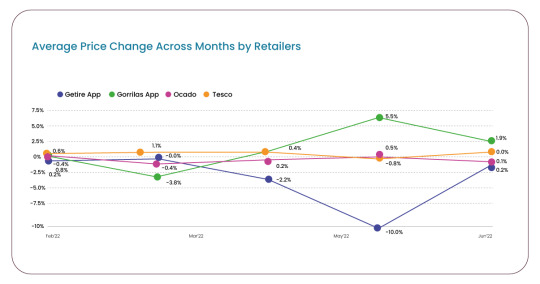

Observing Price Index Trends Over Five Monthss

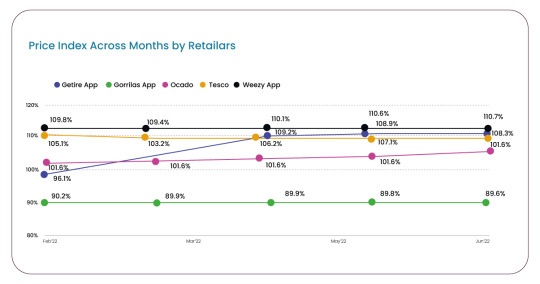

Our focus shifted towards analyzing Price Index (PI) trends among these five retailers, encompassing February to June 2022. It enabled us to gauge the fluctuations in alcohol prices over this period.

Please note: Retailers operating at the 100% mark indicated they were selling at an optimal price, refraining from undercutting the market. The pricing sweet spot rested between 95% and 105%. Deviating lower would potentially jeopardize profit margins while exceeding this range indicated that the retailer needed to position more competitively.

Price Index Insights: Retailers' Strategic Positioning

Among the retailers, Weezy displayed the most optimal Price Index, residing within the 100% to 102% range.

Conversely, Gorillas held the lowest Price Index, from 89% to 91%.

Getir, initially boasting a lower Price Index of 96.1% in February, progressively climbed to surpass 110% in April, May, and June.

Agility In Price Adjustments: Identifying Leaders

Stability In Pricing Trends Among Retailers

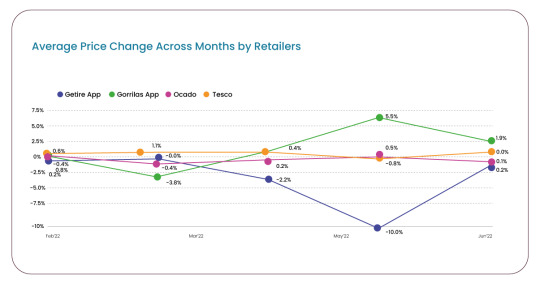

Predominantly, most retailers adhered to a consistent pricing trajectory using liquor product data scraping, maintaining a degree of competitive alignment. Their pricing approaches were relatively well-matched.

Yet, Gorillas stood out for implementing significant price adjustments in specific months. Notably, they enacted a notable reduction of 3.8% in prices in March. Subsequently, in May, Gorillas increased 5.5% in their pricing.

In that same eventful May, Weezy embarked on a distinctive strategy, considerably slashing prices by 10%. This move widened the gap between Gorillas and Weezy.

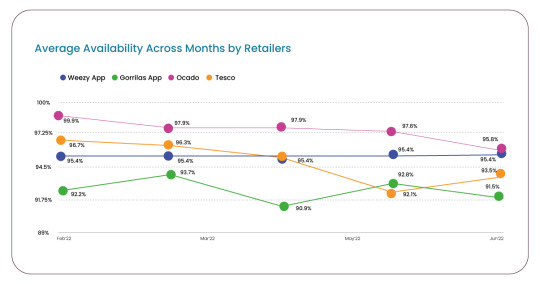

Preserving Sales Through Stock Availability Management

Diverse Stock Availability Among Retailers

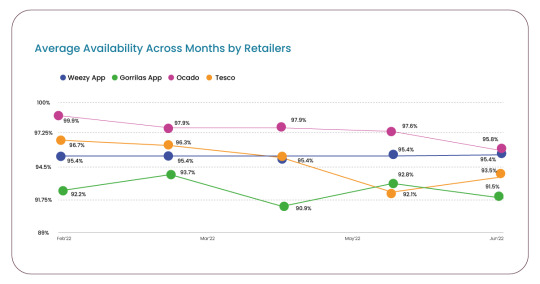

Our data analysis unveiled distinct levels of stock availability across the retailers. Ocado, in particular, maintained the highest availability throughout the observed five months. At a robust 100%, their stock levels gradually receded, concluding at 95.8% by June.

Tesco, on the other hand, encountered a pronounced decline in availability during May and June. At 97%, availability dwindled to 92-93%.

Gorillas consistently exhibited the lowest stock availability, fluctuating between 90% and 94% across the months.

Weezy demonstrated steadfast consistency, upholding a consistent 95% availability throughout five months.

Concluding Insights

In the UK market, a favorable inclination towards online alcohol purchases is evident, predominantly catalyzed by shifts in consumer behavior prompted by the pandemic. According to the IWSR Drinks Market Analysis Report 2022, markets primarily driven by websites, like the UK, prioritize a wide product range and competitive pricing. Both these factors wield significant influence in purchase decisions. Conversely, consumers in app-centric markets hold distinct preferences. While price remains a consideration, it is less vital than convenience and speed.

Product Data Scrape is committed to upholding the utmost standards of ethical conduct across our Competitor Price Monitoring Services and Mobile App Data Scraping operations. With a global presence across multiple offices, we meet our customers' diverse needs with excellence and integrity.

#WebScrapingLiquorData#ScrapeUKAlcoholRetailIndustry#WebScrapingRetailWebsitesData#ScrapeUKRetailTrends#UKLiquorDataScraper#ScrapeLiquorData

0 notes

Text

Morning Photoshoot #sortof

I was just feeling cute having put on a pair of my Banana Republic Outlet skinny jeans, and one of my camouflage print decorated tees that I probably bought at the now defunct Pieces Boutique right here in the Republic of Brooklyn. I was listening to a podcast talking about this new drug that helps with weight-loss and the doctor being interviewed that most people who loose weight gain it back after a year, which said to me that I need to maintain my weight past 2024 to really maintain my current size. She said something about how the body wants to snap back to the previous weight. I was just like, okay its on!

Having thrown on these jeans and the tee to greet the delivery driver from Gorillas, who I noted was a young woman probably of Middle Eastern descent or Latina, I made a silent prayer that she would last longer than the other young women and queer folks that I had seen working for the convenience app. The app is more of convenience to me its my go-to for grocery delivery since I no longer leave my apartment. But I realized that I think the recidivism is high for these positions, there is only one driver I still recognize from when I started using the services after Fridge No More went out of business, and I think I can intuit correctly that for whatever the length of employment for the male drivers the time for women and queers is significantly shorter.

There was Miss Fancy Nails, a clearly trans driver who had these nearly two inch long nails, I always try to encourage the queer and women drivers as much as I can in our very short interactions. I want them to know that I see them, and that this is temporary that great things await them. I am not sure if this message is ever received but I try my best to acknowledge their humanity, apologizing in poor weather and making sure I tip more if I have more items than usual.

For someone who didn't really want to be a parent, I feel very responsible about all young people, its why its hard for me not to be in contact with all of my nieces, niblings and nephews, I think I have had enough time on this plane to offer insight to them that their parents can't especially to to those that are neuroatypical or queer. I am the outsider family member who over-stands what it is like to be the fundamentally different one. Until then I offer what ever encouragement I can to these young strangers, hoping it makes their young lives a bit better if not their day a bit brighter.

[Photo by Brown Estate]

#queer#women#young people#delivery people#convenience apps#gorillas#banana republic outlet#Pieces Boutique#Fridge No More#fashion#baresoles#humanity#I see you#temporary jobs

0 notes

Text

Grocery delivery app Getir bags rival Gorillas in a $1.2B acquisition • TechCrunch

Grocery delivery app Getir bags rival Gorillas in a $1.2B acquisition • TechCrunch

To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PDT, subscribe here. We’ve made it to Friday, folks. If you’re anything like me, that means finishing the workday with a well-deserved nap and reruns of “The Office.” Tweettoot or Post at me about your favorite way to end the week. Mark your calendar for a Twitter Space event on…

View On WordPress

0 notes

Text

Grocery delivery app Getir bags rival Gorillas in a $1.2B acquisition • TechCrunch

Grocery delivery app Getir bags rival Gorillas in a $1.2B acquisition • TechCrunch

To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PDT, subscribe here. We’ve made it to Friday, folks. If you’re anything like me, that means finishing the workday with a well-deserved nap and reruns of “The Office.” Tweet, toot or Post at me about your favorite way to end the week. Mark your calendar for a Twitter Space event on…

View On WordPress

0 notes

Text

Grocery delivery app Getir bags Gorillas in $1.2 billion acquisition – TechCrunch

Grocery delivery app Getir bags Gorillas in $1.2 billion acquisition – TechCrunch

Grocery delivery app Getir bags Gorillas in $1.2 billion acquisition – TechCrunch For a preview of the biggest and most important stories from TechCrunch delivered to your inbox every day at 3:00 PM PDT, subscribe here. We arrived on Friday, friends. If you’re like me, that means ending the workday with a well-deserved nap and reruns of “The Office.” Tweetertoot or Mail me about your favorite…

View On WordPress

0 notes

Text

Daily Crunch: Grocery delivery app Getir bags rival Gorillas in a $1.2B acquisition

Daily Crunch: Grocery delivery app Getir bags rival Gorillas in a $1.2B acquisition

To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PDT, subscribe here. We’ve made it to Friday, folks. If you’re anything like me, that means finishing the workday with a well-deserved nap and reruns of “The Office.” Tweet, toot or Post at me about your favorite way to end the week. Mark your calendar for a Twitter Space event on…

View On WordPress

0 notes

Link

Grocery delivery apps have simplified many lives by allowing hassle-free grocery delivery in recent years. It’s never too late to begin something new and therefore, if you want to bring a change by developing a successful grocery delivery app like Gorillas, it’s time to have a word with the skilled team of app developers. Fasten your seat belt and dive into the pool of opportunities. Trust us, it’s going to be an exciting ride!

#grocery delivery app development#develop an app like gorillas#grocery delivery#app development#tech

0 notes

Text

ONF in Cafe AU

(Establishment)

A/N : 200 followers special!! This different universe from Baker Yuto

Settings : A total brand new universe where they just gather by pure coincidence. Or an alternate universe where ONF later when their contract ended, they gathered to open a cafe once Yuto return to Korea from graduating his bakery course back in Japan. Hyojin, Seungjun and Jaeyoung helped by researching how to register+open business in Korea.

Roles

Yuto : The bread maker

Seungjun : Barista

Hyojin & Jaeyoung : Chief waiter and in charge of cashier

Minkyun : Assisting waiter and more of a helper in the kitchen preparing ingredients

Changyoon : In charge of other menus such as sandwiches/bagel sandwich and dessert

Reader : could be part timer or the regular guest (bonus a fan of ONF as well)

Bonus : Minseok might occasionally drop by to visit or Minseok as another member in the kitchen (i mean have you seen his IG???!!!!!)

Headcanons

As Yuto is more of a bread lover, the cafe would be a bakery+cafe style eatery.

The menu is made and proposed by all 6 of them. Also before they start running business, the kitchen gang has already tried making food to do taste test. (Including WM family)

The menu is written in Korean, English and Japanese.

Yuto would keep trying on making the best bread so he would experiment with different options such as more milk or less flour

Hyojin would always give ideas to improvise. And members trust Hyojin's thoughts because he is such a foodie XD

Seungjun would research and practice on his barista skills.

Changyoon would do graphic design of the menu

Minkyun and Jaeyoung would go out to find spot to rent and open cafe

Once the cafe is opened, this is how they run it.

Because of ONF's nature, I personally think they will test the timing of business by doing a few around of simulations.

This would be suggested by Changyoon and agreed by the leaders

So before they opened, they really tried it out at the empty cafe and simulated with full house for 3~5 days straight. Then they are content with the current timing as below.

I also think Seungjun Jaeyoung and Yuto would keep suggesting adjustments on the timing.

Especially Seungjun and Yuto. Seungjun in the bystander view because he is the barista and Yuto sharing the perspective on what timing those outside kitchen should alert those in the kitchen. They would run timer using their phone.

Bakery closes on 6pm, tidying done by 7:15pm, head out for dinner or simple dinner by whipping up some left over ingredients.

Grocery shopping on 8:45pm or 9pm, headback for cafe for preparations if necessary

Next day 6am at cafe to do early preparations, bakery side and morning take away opens on 7:30am,

10:00am opens for eat in + buffet, they do not do dinner so closes at 6pm and repeat for every day.

They closes on big event public holidays, end of the year+new year.

(They will get quick lunch by ingredients whipped up from the kitchen. Hyojin will switch with Jaeyoung, Seungjun will switch with the part timer, Yuto will get quick bites while waiting for dough to rise, Changyoon and Minkyun will switch)

(BTW this is just reference from my weak experience working on restaurant)

There are 5 walkie talkies. Hyojin, Seungjun and Jaeyoung have 1 each, 1 at the cashier and another is at the kitchen with speakers. This is for them to communicate and alert each other about the crowd and also any food items that are running out.

BTW should we are using the Minseok as one of the member in kitchen, he did not join immediately. But he do drop by to support his hyungs and being the 2nd food taster.

His hyungs and Yuto are a bit reluctant to recruit him but, to their surprise, Minsk volunteered himself.

And oh boy his hyungs all in awe at how good this baby boy's cooking is!!!

Funny moment when Seungjun caught Hyojin eyes are gleaming with bliss after Hyojin tasted Minseok's food. And then only the other hyungs swarming over wanting to taste Minseok's cooking lol

(Hyojin already numb due to so many times food tasting lol but cos he loves to eat he still finishes all the samples. But Minseok's cooking was a breather for him at that exact moment)

Also Changyoon has an idea that putting surveys on each table and let guests to fill in. When they submit to cashier, they might get coupons (?) or maybe discounts about 83%

Or maybe some collectibles and when they got all six stickers, they get 83% discount? (its flexible)

The cafe gains popularity because of the quality and due to good looks of chief waiters and barista.

Also, I think in their menu, (should this is the contract ended ONF universe), they might integrate the member recommendations, it is flexible either food or drink. Or maybe both

Hyojin definitely going to recommend 2 smoothies.

Changyoon would recommend pasta and dessert

Minkyun will go for a sandwich

Jaeyoung might recommend Yuto's sourdough bruschetta

Seungjun will recommend one type of latte

And Yuto will recommend 1 or 2 breads found at bakery/buffet corner. But for menu he would give out tips like which bread type goes better with which cheese or jam

(BTW I think its cute should they use their mascot deer, shark, maltese, gorilla, cat and bread as avatar/icon that appear at recommendations!)

And on their birthday, (this could be Seungjun's idea) there will be a 83% discount sticker placed on the recommended food/drink by the member.

And since we talked about menu...

Again its a bread themed cafe, so the main would be bread, brunch and all day breakfast.

Bread type (buffet) : mini croissants, mini buns, scones, baguette, bagel, white loaf, sourdough

Bread type (bakery) : croissant, buns, garlic bread, scones, baguette, bagel, red bean bun, packed bread loafs

Let me explain about buffet first.

Buffet is for brunch+lunch, which starts on 10:30am to 2pm. Its a 90 minutes course. In that course you can pick 1 of each option of bread, salad, toppings, sides (sausages, hams, cheese and baked beans) and also random desserts.

They offer butter (salted and unsalted), 3 to 4 types of jams (strawberry, mixed fruit and marmalade), variety of paste to go with bread (mashed avocado and Parmesan garlic pesto). also Nutella

For buffet, beverage there already stocked variety of juices, warm coffee and tea (that are already prepared earlier) and fresh water

Cheese they will go for cheddar, Havarti, Feta, Mozarella and brown cheese.

Should you don't go for buffet, they have eat in cafe menu. Which are separately made set meals that comes with beverage. Like sandwiches, bagel sandwiches, spaghetti/pastas, or bruschetta with topping of your choice (6 the most)

Seungjun would prepare freshly brewed coffee, latte, tea, frappe and even smoothie.

Desserts are all simple desserts, like mini tarts and mini cupcake. For specially ordered ones would non baked stuffs that Changyoon and Minkyun made early in the morning and stored in fridge (because dont wanna clash with Yuto baking should any bread nearly sold out. Also can have more flexible timing should Yuto need help they can back up)

Initially, Changyoon will always make extra desserts by x2.5 amount, especially mini tarts or mini cupcakes at the buffet area. He is a worry wart.

BTW the bell Changyoon presented Yuto during OnDaeJeon? Its later used at the cafe lol. As the alert tool for waiters that food is done come and take it

I think on early years, at most 2 years, they are not going to do delivery or food app order service just yet.

But they will run an Instagram or twitter account for the cafe and using it just like how they are doing with they current twitter account. Promoting food and giving out random recommendations also a glimpse of their daily lifes running the cafe and bakery

I think Changyoon would upload a pic of seasonal fruit and a teaser for new seasonal dessert? And then lol it will sometimes plot twist ends up being seasonal beverage that made by Seungjun lol

Should Minseok is not a member running the cafe, the boys consult with him occasionally about adding new seasonal,time limited items.

Also Hyojin and Yuto being the photographer taking picture of the food. Oops I forgot, the pictures of food items in menu are both taken by them too!

Minkyun will bring along one of his fave part timer to do emergency grocery shopping should he needed a hand.

Hyojin and Jaeyoung will try to help customer to decide by suggesting recommendation

Also Hyojin, who would sometimes keep an eye on how customer do combination on their food and get inspiration from it then later try to propose to the team.

As chief waiters, both Hyojin and Jaeyoung would always during at the cashier, asking customers should they have any suggestions or proposal (even if they submitted the survey). Values communications and feedback between staff and customers.

Also Seungjun will help out keeping an eye in case they miss out someone trying to call a waiter. Later after a year of profits, they upgraded to bell calling service type, press a button and they come serve you in a minute.

Initially, Hyojin and Jaeyoung would make use of walkie talkie to recite orders that they get so that Seungjun, Yuto, Changyoon and Minkyun can get them

After maybe a couple months of profit, they upgraded it to tablets. while the walkie talkie is used as mentioned above, to alert regarding to run out/sold out food items.

Also, once reached closing hours, I think they will also have a brief meeting. Especially for waiters team. I think Hyojin would guide and critique on performance.

In overall it is very warm to work with ONF but you have to keep up because they are also strict.

I can see should they know part timers birthday, they would wish them. Maybe Changyoon/Minseok will shove special dessert or pasta for them.

It will be funny that some fans went there hoping to see Yuto, Changyoon and Minkyun but they are busy, do not want to disappoint, Hyojin and Seungjun might try to call them out using walkie talkie. (only apply to the contract end universe)

Oh I had a thought, maybe not the public knows that Minseok joined? I think maybe its also Minseok's terms and conditions because he does not want the spotlight he just wanna help running the business

Also should WM family drop by to visit, the first word as they enter the door, both sides will go “Aigooooo~~~~!!!” (Refer to RTK where Oh My Girl drops by to check out ONF for TWML practise)

Should that happen, its a big day for the fans

BUT!!! I can think ONF cafe later be the hangout spot for WM family? like member’s birthday? lets go to ONF cafe! Because Yuto baked a cake specially for us!! and off they go~

I mean its a great deal, considering Yuto’s love for bread and he did not sell customised cakes. So its personalised stuff he made for those he cared about.

That is why mostly the gathering will happen after 6pm or

Maybe WM managers drop by to pick up the special cake

Also, Yuto let part timers to have leftover breads or desserts at bakery and buffet area for free. His hyungs agreed because you should not waste food. Plus freshly made bread are their selling point so they won't recycle them.

A/N : gonna stop here and should there is more, I might do a part 2~!

5 notes

·

View notes

Text

Mergers and acquisition deals are on the rise as online food and grocery delivery firms seek to create market leadership

For the last two years, online grocers and food delivery platforms did record-breaking business during the global pandemic outbreak. Their valuations skyrocketed, and they acquired reams of data which assisted them in increasing their efficiency. However, as the market took a downturn in H1 2022, amid rising inflation and preference for restaurant dining, food and grocery delivery platforms with big pockets are entering into mergers and acquisition deals as they seek to create market leadership. For instance,

In June 2022, DoorDash, one of the leading American online food ordering platforms, announced that it had completed the US$8.2 billion acquisition of Wolt, the multi-national food delivery platform. Notably, the firm agreed to acquire Wolt in an all-stock deal in November 2021. Wolt has a presence in 23 countries, and this acquisition means that DoorDash now has operations in 27 countries.

In June 2022, Zomato, one of the leading food delivery platforms in India, announced the acquisition of Blinkit, the online grocery delivery service in the country. Notably, the US$569 million acquisition of Blinkit is part of Zomato’s strategy to expand into the quick grocery delivery segment. Notably, Zomato's rivals, such as Swiggy, Zepto, Dunzo, and BigBasket, are also betting big on the quick commerce market.

In Europe, Gorillas, another leading food delivery platform in the region, announced that it had finalized the acquisition of French delivery startup, Frichti in March 2022. The acquisition of Frichti will assist Gorillas in further strengthening its position in key European markets such as France and Belgium, where Frichti offers on-demand deliveries of fresh groceries, ready-to-eat meals, and private label products. Founded in 2020, Gorillas has operations in the United Kingdom, the United States, and France.

In the United Arab Emirates, Careem Food, the food delivery arm of ride-hailing firm Careem, announced the acquisition of MUNCH:ON, the food delivery platform, in June 2022. Notably, Careem Food serves millions of consumers across eight cities in the Emirates, Saudi Arabia, Qatar, and Jordan. In February 2022, Careem also made an investment in elmenus, an Egypt-based food delivery platform, in its bid to grow its presence in the country.

Along with food delivery platforms, the future growth potential of the segment is also attracting many new businesses to enter the food and grocery delivery space globally. This has further propelled the trend of mergers and acquisitions in the sector in H1 2022. For instance,

In September 2022, DPDgroup, an international parcel delivery service, announced that the firm is increasing its presence in the food e-commerce sector through the acquisition of Pourdebon.com, a fresh produce online marketplace. Notably, Pourdebon.com allows consumers to order fresh produce directly from producers across France and has also partnered with Chronofresh to deliver the products throughout the country.

While new players are entering the market, existing investors in the online food and grocery delivery firms have been seen further increasing their stake in the segment. For instance,

Tata Digital, which launched the e-commerce platform - Tata Neu - in India, announced that the firm had invested an additional INR 1,000 crore in BigBasket in March 2022. Notably, Tata Digital acquired a majority stake in BigBasket in May 2021. The acquisition of BigBasket is part of the firm's strategy to further strengthen the position of its Tata Neu app in the Indian e-commerce market. With the launch of Tata Neu, Tata Digital is competing with big behemoths like Flipkart and Amazon in the country.

In August 2022, Prosus, one of the leading technology investors globally, also announced that it is acquiring the remaining 33.3% stake iFood, the Latin American food delivery platform, from minority shareholder Just Eat. Notably, Prosus first invested in iFood in 2013, and since then, the firm has performed well and has expanded its presence in the food delivery, grocery, quick commerce, and Fintech sector.

PayNXT360 expects the growing trend of mergers and acquisitions in the food delivery space to further continue in H2 2022 as growth rounds become scarce. Notably, these mergers and acquisition deals are projected to be more skewed towards consolidation and creating market leadership rather than adding new verticals. While the food delivery sector is expected to remain under-inflation and the rising cost of living pressure from the short-term perspective, PayNXT360 maintains a robust outlook for the industry from the medium to long-term perspective, as consumers shift towards convenience and comfort will keep boosting order volumes for players in the segment globally over the next three to four years.

To know more and gain a deeper understanding of the global B2C E-Commerce market, click here.

0 notes

Text

On-Demand Grocery Delivery App like Gorillas

Everyone aspires to be an entrepreneur but creating a business that matches your passion and solves consumer problems in one go is a gift not everyone can possess.

https://www.rentallscript.com/grocery-delivery-script/

Have you ever heard of Gorillas? (I know the name is fierce!). And no, not the mammal but the leading on-demand grocery delivery marketplace.

If you ever dreamt about starting an on-demand grocery delivery business, here’s the source of inspiration for you — the story of Gorillas.

What are Gorillas?

Gorillas is an on-demand grocery delivery app that promises to deliver the items in 10 minutes. ⏲️

(That’s a daring fleet!)

The grocery delivery app connects with dark stores to procure quality grocery items and deliver them to the user's doorstep.

Pros and cons of Gorillas — what to learn from them?

It is always helpful to know the pros and cons of starting a venture. Let’s know about Gorillas so that we can make an informed decision.

Pros

The Gorillas charge $2 per delivery for the customers for their zippy delivery.

They use ‘dark grocery stores’ to procure their grocery items which means these stores are exclusive for pick-up and delivery-based orders.

The logistics become much simpler since the delivery partner can just pick up the grocery items from the nearby dark store to the customer’s drop-off location.

Cons

They hire their own delivery partners.

Lack of customer support once the order is placed.

How did Gorillas, an on-demand grocery delivery startup get so successful?

Gorilla’s motto on delivery is “Faster than you”. Their speedy delivery is the reason for their insanely quick success.

Their delivery partners are given a bike rather than a vehicle. The founder of Gorillas is an avid cyclist, and it is said that he biked from Turkey to China.

He also believes that the cycle is the fastest and most efficient mode of transportation. And rightly said, it has contributed more to the success of the Gorillas.

Gorillas have almost 100 warehouses after their three-round funding of $335.4 million. They call the dark stores a micro-fulfillment infrastructure that stores over 2000 grocery items.

Conclusion

Gorillas have clearly understood what their customers need — quick and efficient delivery to their doorstep. Their success and expansion rate have been massive since the pandemic has contributed to their situation.

If they concentrate more on their employees and customer support, their success wouldn’t be just a momentary growth but a long-lasting journey.

If you want to start an exciting business venture like Gorillas — take a look at our ready-made on-demand grocery delivery app, WooberlyGrocery.

0 notes

Text

Empower the Surge of Online Alcohol Retail in the UK by Web Scraping Liquor Data

The Alcohol eCommerce sector has experienced rapid expansion, a trend accentuated by the pandemic. Post-pandemic, factors like convenience, safety, and home delivery gained prominence, propelling alcohol sales through eCommerce. In the UK, Kantar noted a £261 million surge in rising sales, with online and convenience stores emerging as the key beneficiaries. Intriguingly, the IWSR Drinks Market Analysis Report 2022 highlighted a global preference for websites over apps when purchasing alcohol online, except in China and Brazil. Notably, in the UK, major online alcohol purchases occur via retailer websites, not apps.

Research Approach

Our research was conducted through liqour data scraping, spanning February 2022 to June 2022. The focus of our study encompassed two prominent grocery retailers, namely Tesco and Ocado, along with three noteworthy grocery apps, namely Gorillas, Weezy, and Getir. The specific category under scrutiny throughout our analysis was alcohol.

Identifying The Alcohol Price Leader

Tesco's Leadership In Alcohol Pricing

Throughout February to June 2022, Tesco consistently established itself as the front-runner in price leadership within the Alcohol category. Leveraging e-commerce data scraping, Tesco secured the lowest prices for 38.9% of its products. Ocado followed closely with 33.8%, while Gorillas exhibited the most minor dominance, leading in price for only 5.6% of its alcohol offerings.

Nonetheless, Tesco's grip on price leadership experienced a gradual erosion over the months. Commencing in February,e-commerce data scraping revealed Tesco's hold on the lowest price for 44% of its products, which tapered to just over 36% by June. Conversely, Ocado depicted an inverse trajectory—starting at a 32% price leadership in February, climbing to 35.3% by June.

An intriguing contender, illuminated through e-commerce data scraping, was Getir. Commencing with a modest 8.2% price leadership for its products in February, Getir's proportion progressively expanded, culminating at 14.5% in June.

Retailers Employing Discounts To Bolster Alcohol Sales

Leveraging discounts using liquor product data collection proves to be an effective strategy to attract consumers impacted by inflation. Through loyalty card discounts, reward vouchers, and various promotional tactics, retailers enhance the allure of their products, rendering them more competitive and appealing to customers. Maintaining competitiveness necessitates retailers' awareness of their rivals' discount offerings. Moreover, price monitoring helps comprehend the potential ramifications of substantial discounting and its influence on profit margins.

A wave of European and UK startups, including Jiffy, Dija, Weezy, Zapp, Getir, and Gorillas, entered the scene with a shared commitment: to provide the swiftest and most cost-effective grocery delivery services.

Our dataset uncovered intriguing discounting dynamics among these players. Gorillas maintained a discounting strategy in line with its competitors. Conversely, Getir appeared to adopt a more aggressive approach, veering towards deep discounting. Notably, Getir consistently offered the highest discounts throughout the observed period. In April, their discounts surged to nearly 9% more than those of Ocado—the runner-up in discounting.

As previously discussed, the period from February to June saw Getir securing price leadership. It's plausible that their strategy of deep discounting contributed to this accomplishment. In contrast, Gorillas opted for a different route, showcasing the lowest and almost negligible discounting practices.

Observing Price Index Trends Over Five Monthss

Our focus shifted towards analyzing Price Index (PI) trends among these five retailers, encompassing February to June 2022. It enabled us to gauge the fluctuations in alcohol prices over this period.

Please note: Retailers operating at the 100% mark indicated they were selling at an optimal price, refraining from undercutting the market. The pricing sweet spot rested between 95% and 105%. Deviating lower would potentially jeopardize profit margins while exceeding this range indicated that the retailer needed to position more competitively.

Price Index Insights: Retailers' Strategic Positioning

Among the retailers, Weezy displayed the most optimal Price Index, residing within the 100% to 102% range.

Conversely, Gorillas held the lowest Price Index, from 89% to 91%.

Getir, initially boasting a lower Price Index of 96.1% in February, progressively climbed to surpass 110% in April, May, and June.

Agility In Price Adjustments: Identifying Leaders

Stability In Pricing Trends Among Retailers

Predominantly, most retailers adhered to a consistent pricing trajectory using liquor product data scraping, maintaining a degree of competitive alignment. Their pricing approaches were relatively well-matched.

Yet, Gorillas stood out for implementing significant price adjustments in specific months. Notably, they enacted a notable reduction of 3.8% in prices in March. Subsequently, in May, Gorillas increased 5.5% in their pricing.

In that same eventful May, Weezy embarked on a distinctive strategy, considerably slashing prices by 10%. This move widened the gap between Gorillas and Weezy.

Preserving Sales Through Stock Availability Management

Diverse Stock Availability Among Retailers

Our data analysis unveiled distinct levels of stock availability across the retailers. Ocado, in particular, maintained the highest availability throughout the observed five months. At a robust 100%, their stock levels gradually receded, concluding at 95.8% by June.

Tesco, on the other hand, encountered a pronounced decline in availability during May and June. At 97%, availability dwindled to 92-93%.

Gorillas consistently exhibited the lowest stock availability, fluctuating between 90% and 94% across the months.

Weezy demonstrated steadfast consistency, upholding a consistent 95% availability throughout five months.

Concluding Insights

In the UK market, a favorable inclination towards online alcohol purchases is evident, predominantly catalyzed by shifts in consumer behavior prompted by the pandemic. According to the IWSR Drinks Market Analysis Report 2022, markets primarily driven by websites, like the UK, prioritize a wide product range and competitive pricing. Both these factors wield significant influence in purchase decisions. Conversely, consumers in app-centric markets hold distinct preferences. While price remains a consideration, it is less vital than convenience and speed.

Product Data Scrape is committed to upholding the utmost standards of ethical conduct across our Competitor Price Monitoring Services and Mobile App Data Scraping operations. With a global presence across multiple offices, we meet our customers' diverse needs with excellence and integrity.

#WebScrapingLiquorData#UKAlcoholRetailDataScraping#OnlineAlcoholRetailScraper#LiquorDataScrapingService#ScrapeLiquorData#LiquorDatacollection

0 notes

Text

18 Jul 2022: Is rapid delivery too rapid? A postman a day keeps the doctor away.

Hello, this is the Co-op Digital newsletter - it’s about what the internet is doing to retail businesses, people, communities and society. Thank you for reading - send ideas and feedback to @rod on Twitter. Please tell a friend about it!

[Image: the edge of a nearby, young, star-forming region called NGC 3324 in the Carina Nebula - Webb telescope - NASA, ESA, CSA, and STScI]

Is rapid delivery too rapid?

In 1984, Domino’s Pizzas promised “30 minutes or it’s free”, a marketing campaign that worked too well. Years later, the internet and Amazon taught shoppers that you should be able to get everything in two days or less *and* free. “Instant commerce” or “ultra-fast delivery” startups have accelerated things - you can get it all *now*. Under an hour. In 15 minutes in some cases. But “now” is logistically complex and delivery is definitely not free.

“Last mile” delivery has a number of classic problems: cost, co-ordination, complexity, speed, maintaining a good utilisation rate. “Rapid” delivery amplifies these challenges: if the task is to pick and pack a basket of goods and get it delivered in under an hour, everything’s harder.

The delivery companies are all competing for the same shopper pounds as they try build enough scale to survive long term, but higher inflation led to higher interest rates, which has slowed the flow of funding. Hard times as the game changes from “growth at all costs” to “survive with low costs”. Some of the recent news:

15-minute-delivery grocery app JOKR is ending its US operations less than a year after launching. Consolidation has been happening for a while: Buyk and Fridge No More closed earlier this year (sanctions-related), Gorillas started layoffs in May.

Gopuff is laying off 10% of global workforce, closing 76 “dark stores” in the US:

“In a bull market, we were incentivized to scale our geographic footprint [...] In assessing the business in light of today’s economic environment, we found that we can be more efficient by focusing on maturing our high-performing MFCs [fulfilment centres] to drive profitable growth in each market.”

And here’s are two data points on the numbers of rapid delivery:

“Each location costs an estimated $250,000 to launch, people familiar with the company’s plans said, and about half of Gopuff’s roughly 600 warehouses were launched in the last year”

And:

“Gopuff’s fulfillment centers need to bring in at least 400 orders per day to make money, but only about 10 to 20% are at that level”

Perhaps some of these rapid delivery startups will use their expertise in running dark stores to reinvent themselves as service providers, but there will be competition: DoorDash kicks off dark store-powered rapid delivery as a service, and Instacart is in that space already.

Related: Amazon makes Grubhub deal to give Prime members fee-free food - the deal looks a bit like the one it had in the UK with Deliveroo: it gives Amazon a right to buy up to 15% of Grubhub, which parent Just Eat/Takeaway.com may be hoping for, because it has been looking to sell Grubhub.

Elsewhere in delivery: Co-op is rolling out its “walking delivery” scheme to 200 stores. It’s part of a wider plan to scale rapidly delivered convenience which also includes the use of delivery robots. This is the kind of thing that’s easier to do at scale if you have true proximity to communities, and Co-op has a lot of stores.

A postman a day keeps the doctor away

Royal Mail has launched a Health division. It has a partnership with Pharmacy2U that makes online prescription delivery free. Also an investment in a digital platform for independent pharmacies, and some plans to trial posties doing regular health checks on vulnerable people.

The proposition is local and trustworthy. Similar examples: In France, La Poste made its “Watch over my parents” service free during covid: weekly visits. And in Spain, postal company Correos trialled a similar service.

Magic checkout

A new type of self-checkout where no scanning is required - Mashgin’s

“countertop system uses [cameras and] artificial intelligence to identify and ring up items automatically. That allows customers to check out in as little as 10 seconds—eight times faster than a regular self-checkout machine.”

The “place, space, pay and go” slogan on the self checkout machine hints at how you need to carefully arrange the goods so the cameras can see them - probably making this solution better for quick convenience store buys than for anything larger.

A simpler, older version of this: RFID tags help Uniqlo make the checkout simpler. Stores like Decathlon do this too. You still have to put the goods into an area that has the sensors. When technology reliably simplifies how things work, it feels a little bit magic, even when the technology isn’t brand new.

Heat alert

Heatwave: Met Office issued its first ever “red” extreme heat warning. And this is going to be the coldest year of the rest of your life.

Meanwhile, in the UK, Where do Tory leadership candidates stand on net zero goal? Answer: unclear. And in the US, the Supreme Court tries to overrule the climate.

There’s so much to do. Here’s Celia Romaniuk on shifting the burden of sustainability from consumers to producers:

“we must reframe the idea that it’s the consumer that has to change their behaviour, carrying the cost and the inconvenience [of sustainable products]. Perhaps it’s not about shifting consumer demand from non-sustainable to sustainable. [...] Rather than offer a separate sustainable alternative to the unsustainable mainstream, we can design and create products and services that are cost effective, good quality, and also intrinsically sustainable.”

Worth a lot/basically zero

Tesla chaoslord Elon Musk was talking to some owner/fans recently and said “The overwhelming focus is on solving full self-driving. That’s essential. It’s really the difference between Tesla being worth a lot of money or worth basically zero.”

He says binary stuff like this a lot, so be wary about treating it as new insight. But one challenge might be that, even despite the recent stock price drops, Tesla is *already* valued as if it had solved self-driving and won a good share of the robotaxis industry and protected a good margin. What if it doesn’t?

In other worth a lot/not news, Musk is trying to get out of buying Twitter, or at least reducing the price a lot.

Various things

Trolley is a service that scans supermarket websites daily to continuously show where 166,000 groceries are cheapest - a service that gets more and more useful as prices increase. But it was also under threat of closure due to some unexpected data costs. Here’s how the fight to save Trolley is going.

Around 94% of the UK adult population live or work within one mile of a National Lottery terminal (pdf), and around 60% of UK adults currently play National Lottery games - Camelot May 2022.

Uncanny granny: Amazon shows off an Alexa feature that mimics the voices of your dead relatives - an idea that will polarise.

Co-op Digital news

Simulating in-store experiences with physical prototyping:

“Our desktop walkthrough was a quick, cheap way to prepare for an in-store trial. Bringing our ideas to life in this way meant we picked up on things that might not work in stores and we could adapt our concepts without wasting time or money. A lot of this was down to 2 ex-store managers who joined us for the walkthrough – their input was invaluable. Their first-hand experience of working in – and running – stores meant they could sense-check our assumptions which made the scenarios we walked through far more realistic. We made changes to our experiment plan based on their insight and we believe this contributed to the success of our first store trial.”

Thank you for reading

Thank you friends, readers and contributors. Send ideas, questions, corrections, improvements, etc by replying or to @rod on Twitter. If you’ve enjoyed reading, please tell a friend! If you want to find out more about Co-op Digital, follow us @CoopDigital on Twitter and read the Co-op Digital Blog. Previous newsletters.

0 notes

Text

Fast grocery deliveries are likely to get more expensive – here's why

Fast grocery deliveries are likely to get more expensive – here’s why

Fast grocery deliveries are likely to get more expensive – here’s why Tricky_Shark/Shutterstock COVID rapidly accelerated the overall trend towards internet ordering of all retail sales with UK online purchases approaching 30% in 2021. With a strong trend towards home delivery this has also created an opportunity for “quick” grocery delivery services via apps such as Gorillas and Getir. Online…

View On WordPress

0 notes

Text

I need to do a full roundup of Ukraine support within tech products, as there have been many. Quick props to Google, for having the courage to put one right in the top corner of Gmail (!), and matching another $5M in donations not just for employees but for their billion-plus users (assuming this notification went to everyone).

Airbnb has activated its excellent Airbnb.org housing program for Ukrainian refugees and promoted it right on the Airbnb.com homepage. I like the program because it leverages Airbnb's core strength, a huge network of shelter, in times of great need.

And lastly (for now), Gorillas instant grocery delivery service has added virtual products that make it easy for customers to add Ukraine support to their orders. It's a savvy way to make the app feel like a place to do good when the company is struggling with its labor relations.

0 notes