#Global Chemical Studs Market

Explore tagged Tumblr posts

Text

The Truth About Lab Diamonds: Are They As Good As Real Ones?

GEMVER: Redefining Luxury with Lab-Grown Diamonds

In an era where sustainability is no longer a choice but a necessity, GEMVER stands as a beacon of innovation and responsibility in the jewelry industry. lab diamond earrings Specializing in lab-grown diamonds, GEMVER is more than a jewelry brand—it’s a symbol of progress, aligning with modern values while maintaining the timeless allure of fine craftsmanship.

Why Lab-Grown Diamonds

Lab-grown diamonds have emerged as the perfect alternative to mined diamonds. They possess the same physical, chemical, and optical properties as natural diamonds, making them indistinguishable to the naked eye. However, their appeal extends beyond their flawless beauty—they’re ethical, eco-friendly, and more accessible.

GEMVER takes pride in using advanced technology to replicate the natural diamond formation process, ensuring that each lab-grown diamond meets the highest standards of brilliance and durability. This innovation allows consumers to enjoy the beauty of diamonds while making a conscious choice to support sustainable practices.

Craftsmanship That Speaks Volumes

At GEMVER, every piece of jewelry tells a story. The journey begins with a vision, followed by the meticulous process of crafting each diamond to perfection. From the first sketch to the final polish, GEMVER’s artisans pour their expertise and passion into creating pieces that exude elegance and sophistication.

Whether it’s a dazzling solitaire ring, a statement necklace, or a pair of delicate diamond studs, each design is thoughtfully curated to complement individual styles and celebrate life’s most cherished moments.

Sustainability: A Core Value

GEMVER’s commitment to sustainability sets it apart from traditional jewelry brands. The environmental toll of diamond mining is significant—deforestation, soil erosion, and water contamination are just a few of its devastating effects. By producing lab-grown diamonds, GEMVER eliminates these concerns, offering a guilt-free alternative to consumers who care about their environmental footprint.

Moreover, GEMVER ensures that its operations uphold ethical standards by fostering fair labor practices and minimizing waste. By choosing GEMVER, customers contribute to a greener planet while embracing the sophistication of lab-grown diamonds.

Affordable Elegance

Diamonds have long been perceived as symbols of exclusivity and luxury, often accessible only to the elite. GEMVER disrupts this notion by offering high-quality lab-grown diamonds at more affordable prices, democratizing the luxury experience.

This affordability does not compromise quality. Instead, it empowers a broader audience to celebrate their milestones—be it engagements, anniversaries, or personal achievements—with stunning and meaningful jewelry.

A Personalized Experience

GEMVER goes beyond selling jewelry; it offers a personalized experience tailored to each customer’s desires. From custom-designed pieces to detailed consultations, the brand ensures that every client feels valued and involved in the creation process.

Customers can select their preferred diamond shape, size, and setting, crafting a unique piece that perfectly reflects their personality and story. This bespoke approach allows GEMVER to stand out in a competitive market, providing a service as exceptional as its products.

Shaping the Future of Jewelry

The rise of lab-grown diamonds marks a pivotal shift in the jewelry industry, and GEMVER is at the forefront of this revolution. As global demand for sustainable and ethical products continues to grow, GEMVER is poised to redefine the standards of luxury, bridging the gap between tradition and innovation.

Through its dedication to excellence, GEMVER inspires a new generation of consumers to embrace fine jewelry without compromising their values. It’s a movement that reflects the evolving mindset of today’s buyers, who prioritize quality, sustainability, and transparency.

Conclusion

GEMVER is more than a brand—it’s a catalyst for change, setting new benchmarks in the jewelry industry. By offering ethically sourced, environmentally friendly, and exquisitely crafted lab-grown diamonds, GEMVER proves that luxury can coexist with responsibility.

For those seeking elegance, affordability, and a commitment to a better world, GEMVER is the ultimate destination. As the brand continues to innovate and inspire, it invites you to be part of a journey that redefines how we view and value diamonds, one brilliant piece at a time.

0 notes

Text

Premium Stud Bolts Manufacturer, Supplier & Exporter

Introduction

Stud Bolts are one of the versatile fasteners widely used in all industries like oil & gas, petrochemical, power plants, construction, and marine applications. It is designed to have critical fastening. Ananka Group is a leading manufacturer, supplier, and exporter of Stud Bolts; it ensures top quality precision, and reliability in all its products.

The premium stud bolts that manufacture, supply, and export in high-quality and precision commitment in the fastener industry. We as a manufacturer use advanced materials and cutting-edge technology to produce stud bolts that meet the stringent industry standards for durability and reliability in applications ranging from construction to automotive sectors. Focus on superior craftsmanship and strict quality control processes, thus giving products not only make structures safer but also increase efficiency.

Additionally, capability to satisfy different customers through customization also indicates a commitment to customer satisfaction. Being trusted suppliers in the global market, these manufacturers have become the link between industries and premium fastening solutions that have withstood time. As a way of giving credit to their hard work, we acknowledge the important role these premium stud bolts play in driving innovation and excellence in many sectors.

About Stud Bolts

Stud bolts are long threaded rods with threads on both ends, or sometimes throughout the rod. They are primarily used to clamp flanges or other equipment together, ensuring a tight, leak-free seal. Unlike traditional bolts, stud bolts do not have heads and rely on nuts for fastening.

Types of Stud Bolts

Fully Threaded Stud Bolts: Threads run across the entire length of the stud.

Tap-End Stud Bolts: Threads on both ends, but the lengths of the threads differ.

Double-End Stud Bolts: Threads of equal length at both ends.

Reduced Shank Stud Bolts: Feature a reduced diameter in the unthreaded section to improve flexibility.

Stud Bolts Specifications

Standards: ASTM A193, ASTM A320, ASME SA193, ISO, DIN, and other international standards.

Sizes: From M6 to M64 or custom sizes as per client requirements.

Thread Types: Coarse, fine, or special threads based on the application.

Finish: Plain, galvanized, or coated with PTFE, zinc, or other protective materials.

Stud Bolts Sizes & Standards

Stud Bolts Materials / Grades & Sizes

Carbon Steel Stud Bolts

Grades: ASTM A193 Grade B7, ASTM A320 Grade L7

Applications: High-temperature and pressure environments.

Stainless Steel Stud Bolts

Grades: ASTM A193 Grade B8, B8M

Applications: Corrosion-resistant environments like marine and chemical industries.

Alloy Steel Stud Bolts

Grades: ASTM A193 Grade B16

Applications: High-strength requirements and elevated temperatures.

Nickel Alloy Stud Bolts

Grades: Inconel, Monel, Hastelloy

Applications: Extreme temperatures and highly corrosive environments.

Exotic Material Stud Bolts

Materials: Titanium, Duplex, Super Duplex

Applications: Specialized industries like aerospace and medical.

Why Choose Ananka Group for Stud Bolts?

Uncompromising Quality: Manufactured as per international standards with precise tolerances.

Material Versatility: Offering a wide range of materials to suit varied applications.

Customization: Tailor-made solutions for specific project requirements.

Global Reach: Exporting to countries across Europe, Asia, America, and Africa.

Conclusion

Stud bolts are indispensable in industries requiring high-strength and secure fasteners for critical applications. With Ananka Group, you are assured of the best quality products, backed by extensive expertise, advanced manufacturing facilities, and a commitment to excellence.

FAQs

Q1. What are stud bolts used for?A: Stud bolts are primarily used in applications requiring secure fastening, such as connecting flanges, pipelines, and machinery.

Q2. What materials are stud bolts made of?A: Common materials include carbon steel, stainless steel, alloy steel, and nickel alloys.

Q3. Can stud bolts be customized?A: Yes, stud bolts can be tailored to specific sizes, materials, coatings, and thread types.

Q4. How to choose the right stud bolts?A: The choice depends on the application requirements, such as temperature, pressure, corrosion resistance, and strength.

Q5. Do you provide international shipping?A: Yes, we export our stud bolts to various countries worldwide.

#AnankaFasteners#Fasteners#StudBolts#BoltManufacturing#Manufacturing#Linkedin#Article#StudboltMaking#FastenersManufacturing#manufacturer#ananka#supplier#hex#bolt#mumbai#uk

0 notes

Text

High-Quality Inconel Fasteners Manufacturer, Supplier in Nigeria – Metal Forge India

Inconel alloys are a number of the most demanding materials almost with high-temperature and corrosion-resistant applications. Whether inside the aerospace, chemical, or strength technology industries, Inconel fasteners play a critical role in ensuring the integrity of essential components that function under excessive conditions. Metal Forge India, a relied-on manufacturer and corporation, makes a specialty of offering first-rate fasteners of Inconel alloy designed to satisfy the hardest corporation requirements.

In this weblog, we’ll take a deeper investigation into why fasteners of Inconel alloy are a pinnacle preference for demanding applications and the way we can deliver the ones top-rate fasteners to Nigeria and other global markets.

Inconel Fasteners

Fasteners of Inconel alloy are various additives, together with bolts, nuts, screws, washers, and studs, crafted from high-fashionable overall performance alloys in most instances composed of nickel and chromium. These fasteners are designed to withstand high environments, which include high temperatures, stress, and publicity to competitive chemicals or corrosive elements.

The number one characteristic of fasteners of Inconel alloy is their brilliant resistance to oxidation and corrosion, even at temperatures exceeding a thousand°C (1832°F). This makes them a first-rate preference for industries wherein traditional materials should probably fail because of warmness degradation or corrosion. Inconel alloys are typically utilized in application in conjunction with jet engines, gasoline generators, nuclear reactors, chemical processing plants, and marine systems.

Why Choose Inconel Alloy Fasteners?

Fasteners of Inconel alloy are an ought-to-have in industries that require immoderate strength, sturdiness, and prolonged-term reliability. Here’s why Inconel is a favored desire:

High-Temperature Resistance: Inconel alloys, together with Inconel grades 600, 625, and 718, are engineered to perform properly at extended temperatures, making them ideal for heat applications like gasoline mills and exhaust systems.

Corrosion and Oxidation Resistance: Fasteners of Inconel alloy are pretty proof in competition to oxidation and corrosion, particularly in harsh chemical environments like acid and alkali publicity. This makes them nice for chemical processing, marine, and offshore oil and gas industries.

Strength and Durability: Fasteners of Inconel alloy keep their mechanical power even in excessive conditions. This makes them important for extended-lasting, dependable overall performance in critical infrastructure.

Versatility: Inconel alloys are to be had in several grades (Inconel 600, 625, 718), every tailored for unique applications. Whether you want excessive temperature resistance, weldability, or fatigue resistance, Inconel answers.

Long-Term Performance: The awesome houses of Inconel ensure that those fasteners close longer than their contrary numbers crafted from an entire lot less long-lasting metals, reducing the need for common renovation and replacements.

We are Your Trusted Supplier of Inconel Alloy Fasteners in Nigeria

We stand proud as a dependable source for first-rate fasteners of Inconel alloy, with recognition for turning in pinnacle-notch products to industries globally. With years of revel in inside the manufacturing and supply of fasteners, we are proud to serve clients in the direction of Nigeria and one-of-a-type worldwide markets.

Our fasteners of Inconel alloy are produced to meet the very awesome requirements of fine and precision, making sure pinnacle-extremely good performance even beneath the most excessive situations. We provide a brilliant kind of fasteners of Inconel alloy, collectively with bolts, nuts, washers, and custom-designed fasteners, all to be had in severa grades which incorporate Inconel six hundred, Inconel 625, and Inconel 718.

Our Product Range

Inconel 600 Fasteners: Known for amazing resistance to oxidation and carburization, Inconel Six Hundred is right for excessive-temperature usage, making it wonderful for heat exchangers, furnaces, and fuel turbines.

Inconel 718 Fasteners: Offering amazing mechanical power at stepped-forward temperatures, Inconel 718 is a pass-to choice for the aerospace corporation, particularly in jet engine additives.

Inconel 625 Fasteners: Inconel 625 is known for its advanced resistance to competitive environments, which embody seawater and chemical exposure. It is normally used in the aerospace and marine industries.

Why Choose Metal Forge India for Inconel Alloy Fasteners?

Quality Assurance: At our firm, we're devoted to imparting very exceptional fine products. Our fasteners of Inconel alloy undergo stringent first-class checks to ensure they meet global requirements, making them suitable for even the most stressful applications.

Customization: We recognize that every venture has its precise necessities. Our team works cautiously with customers to offer tailor-made fasteners of Inconel alloy that meet unique dimensional and product dreams.

Global Reach: Whether you are based in Nigeria, the Middle East, Europe, or the Americas, we offer fasteners of Inconel alloy to locations internationally, ensuring nicely timed transport and aggressive pricing.

Expertise and Experience: With years of organizational experience, our technical business enterprise gives valuable insights and guidance, assisting you in picking out the proper fasteners of Inconel alloy for your mission.

Competitive Pricing: We provide top-rate fasteners of Inconel alloy at aggressive charges, ensuring you get a preserve of notable products without compromising your price range.

Conclusion

When it involves sourcing amazing Inconel alloy fasteners, Metal Forge India is a call you may bear in mind. Our high-quality variety of Inconel alloys, mixed with our information and dedication to awesome, makes us a preferred issuer for industries in Nigeria and the past. Whether you are running on a complex aerospace challenge, a chemical processing plant, or any high-temperature application, our fasteners of Inconel alloy will ensure the success and sturdiness of your operations.

Connect with us nowadays to have a look at more about our Inconel fasteners and the manner we are able to provide the proper method to your wishes. With us, you can anticipate ordinary basic overall performance, reliability, and sturdiness—every time.

0 notes

Text

Duplex Steel S32760 Fasteners Exporters

When it comes to high-performance fasteners that can withstand extreme conditions, Duplex Steel S32760 Fasteners stand out as a reliable and superior choice. These fasteners offer exceptional resistance to corrosion, immense strength, and are well-suited for various industrial applications. Sankalp Alloys Overseas, a renowned name in the industry, is the leading manufacturer, supplier, exporter, and stockist of Duplex Steel S32760 Fasteners in Mumbai, India, and across the globe.

What is Duplex Steel S32760?

Duplex Steel S32760, also known as Super Duplex, is a highly alloyed stainless steel, known for its high mechanical strength and outstanding resistance to corrosion. With a balanced mix of austenitic and ferritic phases, this grade provides superior performance in environments that demand both high strength and resistance to corrosive chemicals.

Key Properties of Duplex Steel S32760 Fasteners

Excellent Corrosion Resistance: Superior to standard austenitic or ferritic stainless steels, particularly in chloride-containing environments.

High Strength: Combines the mechanical strength of ferritic steel with the corrosion resistance of austenitic steel.

Thermal Conductivity: Higher thermal conductivity than austenitic grades.

Stress Corrosion Cracking Resistance: Designed to resist cracking in high-stress environments.

Good Weldability: Duplex S32760 fasteners can be easily welded without the need for post-weld heat treatments.

Specifications of Duplex Steel S32760 Fasteners

Specification: ASTM A479, A182 / ASME SA479, SA182

Dimensions: DIN, ISO, ASTM, JIS, BS, GB, IS, and all International Standards

Size Range: M3 - M56 | 3/6" to 2" | Custom Sizes Available

Length: 3 mm to 200 mm

Types: Nuts, Bolts, Screws, Sockets, Studs, Washers, Anchors, U-Bolts, J-Bolts, Hex Bolts, and more.

Benefits of Duplex Steel S32760 Fasteners

Superior Corrosion Resistance: Ideal for use in aggressive environments such as offshore, petrochemical, and chemical processing industries.

High Mechanical Strength: Suitable for applications that demand both strength and durability.

Cost-Effective: Long lifespan reduces the need for frequent replacements, lowering overall maintenance costs.

Versatility: Available in various types and sizes, they can be customized to meet specific application requirements.

Environmentally Friendly: The long-lasting nature of Duplex S32760 fasteners helps reduce waste and promotes sustainable operations.

Applications of Duplex Steel S32760 Fasteners

Oil & Gas Industry: Ideal for subsea components and platforms where corrosion resistance and high strength are essential.

Marine Applications: Used in shipbuilding, marine hardware, and other marine environments due to excellent corrosion resistance to seawater.

Petrochemical Industry: Widely used in chemical plants, reactors, and refineries where both strength and corrosion resistance are necessary.

Power Generation: Essential in the construction of power plants and related equipment.

Desalination Plants: Excellent resistance to brackish water and high chloride environments makes them a popular choice for desalination projects.

Why Choose Sankalp Alloys Overseas?

Sankalp Alloys Overseas is a trusted name in the world of metal fasteners, providing top-quality Duplex Steel S32760 Fasteners to clients in India and worldwide. Here’s why we are the best choice:

Extensive Industry Experience: With years of experience, we understand the technical demands of industrial applications and provide solutions that meet the highest standards.

Global Reach: As leading Duplex Steel S32760 Fasteners Exporters, we cater to international markets with prompt deliveries and quality assurance.

Custom Solutions: We offer a wide range of sizes, types, and dimensions, with the ability to customize fasteners to your specific needs.

Quality Assurance: All our fasteners are manufactured under stringent quality controls, ensuring they meet international standards like ASTM, DIN, and ISO.

Excellent Customer Support: We pride ourselves on providing personalized service, offering expert advice, and ensuring customer satisfaction every step of the way.

Conclusion

For industries requiring high-performance fasteners that can endure harsh environments, Duplex Steel S32760 Fasteners are a perfect choice. They offer exceptional strength, corrosion resistance, and durability, making them ideal for use in sectors like oil & gas, marine, and chemical processing. Sankalp Alloys Overseas is your reliable partner, offering top-quality fasteners, tailored to your specific needs. With global delivery and competitive prices, we are the go-to Duplex Steel S32760 Fasteners manufacturers and exporters in India and beyond.

For inquiries and orders, reach out to us at:

Email: [email protected]

Contact Number: +91-8828369483

Website: https://www.sankalpalloys.com

Optimize your projects with the strength and reliability of Duplex Steel S32760 Fasteners from Sankalp Alloys Overseas!

#Duplex Steel S32760 Fasteners Exporters#Duplex Steel S32760 Fasteners Exporters in India#Duplex Steel S32760 Fasteners Manufacturers#Duplex Steel S32760 Fasteners Manufacturers in India#Duplex Steel S32760 Fasteners#Fasteners#Duplex Steel S32760#manufacturers#business#suppliers#exporters#stockists#innovation#metalwork#sankalp alloys overseas#sankalpalloys#industry

1 note

·

View note

Text

Lab Diamond Stud Earrings in Antwerp: A Brilliant Choice with Forevery

Antwerp, often regarded as the diamond capital of the world, has long been synonymous with exquisite diamond craftsmanship and unparalleled luxury. As the jewelry industry shifts towards sustainability and ethical practices, lab-grown diamonds have emerged as an equally dazzling and responsible alternative to traditional diamonds. Among the most popular choices in modern jewelry is the lab diamond stud earring—an elegant and timeless accessory that complements any wardrobe. Forevery, a renowned brand in Antwerp, offers a stunning collection of lab diamond stud earrings, allowing you to shine brightly without compromise.

Why Choose Lab Diamond Stud Earrings?

Lab-grown diamonds are chemically, physically, and optically identical to mined diamonds. They are created in controlled environments using advanced technology that replicates the natural conditions under which diamonds form. The result? Flawless, high-quality diamonds that are indistinguishable from their mined counterparts, but with several distinct advantages.

Here are some key reasons why lab diamond stud earrings have become a preferred choice for consumers:

1. Sustainability and Ethical Sourcing

One of the main reasons behind the growing popularity of lab-grown diamonds is their sustainability. Mined diamonds have often been associated with environmental degradation and unethical labor practices, sometimes leading to "conflict diamonds" being sold on the market. Lab-grown diamonds, on the other hand, have a significantly smaller carbon footprint and are produced without the harmful environmental consequences associated with traditional diamond mining. By choosing lab diamond stud earrings in Antwerp, you are not only getting a brilliant gem but also contributing to a more sustainable and ethical world.

2. Affordability Without Compromise

While lab-grown diamonds are visually and structurally identical to mined diamonds, they come at a fraction of the price. The lower cost of production allows jewelers to offer lab-grown diamonds at much more affordable prices, making luxury accessible to a broader audience. Forevery's lab diamond stud earrings allow customers to experience the beauty and elegance of diamond jewelry without breaking the bank, while still maintaining the brilliance, clarity, and durability that diamonds are known for.

3. Uncompromised Quality

Lab-grown diamonds undergo rigorous testing and quality control to ensure that they meet industry standards. These diamonds are often graded by reputable institutions such as the Gemological Institute of America (GIA), ensuring that they are of the highest quality. When you purchase lab diamond stud earrings from Forevery, you can be confident that you are investing in a product that meets the highest standards of beauty and durability.

Why Antwerp is the Hub for Diamonds

Antwerp has established itself as a global leader in the diamond industry for centuries. The city’s diamond district is home to the world’s largest concentration of diamond traders, cutters, and polishers. This makes Antwerp an ideal location for purchasing lab diamond stud earrings, as customers benefit from the expertise and experience that the city’s jewelers offer. When shopping for lab-grown diamonds in Antwerp, you can be assured that you are receiving world-class craftsmanship.

Moreover, Antwerp has embraced the growing demand for lab-grown diamonds, and jewelers like Forevery are at the forefront of this trend. Combining traditional diamond expertise with modern innovation, Forevery offers lab diamond stud earrings that reflect Antwerp’s rich history while catering to the modern, ethically-minded consumer.

Forevery’s Lab Diamond Stud Earrings Collection

Forevery is a name synonymous with quality, elegance, and sustainability in the world of lab-grown diamonds. Their lab diamond stud earrings are meticulously crafted to perfection, offering timeless beauty and exceptional sparkle. Here’s why Forevery stands out as the go-to brand for lab diamond stud earrings in Antwerp:

1. Exquisite Designs

Forevery’s collection of lab diamond stud earrings offers a range of designs to suit every taste and style. Whether you’re looking for classic solitaire studs, intricate halo settings, or modern geometric shapes, Forevery has something for everyone. Each pair of earrings is designed to enhance the natural brilliance of the lab-grown diamonds, ensuring that they capture and reflect light beautifully.

2. Customizable Options

At Forevery, personalization is key. Customers can choose the size, shape, and setting of their lab diamond stud earrings, allowing them to create a unique piece of jewelry that reflects their individual style. Whether you prefer round, princess, or cushion-cut diamonds, Forevery offers a variety of shapes to suit your preferences. The earrings can also be set in different metals, including white gold, yellow gold, and platinum, to complement your skin tone and personal aesthetic.

3. Unmatched Quality

Each pair of lab diamond stud earrings at Forevery is crafted with the utmost care and precision. The diamonds are hand-selected for their exceptional clarity, color, and cut, ensuring that every earring is a masterpiece. The attention to detail is evident in the final product, with each earring showcasing the brilliance and sparkle that lab-grown diamonds are known for. Forevery's commitment to quality is unparalleled, and their earrings are designed to last a lifetime.

4. Certified and Ethically Produced

Forevery’s lab-grown diamonds are certified by leading gemological institutes, giving customers peace of mind that they are purchasing genuine, high-quality diamonds. Additionally, all of their diamonds are produced in a sustainable and ethical manner, ensuring that your lab diamond stud earrings not only look stunning but also align with your values.

Styling Lab Diamond Stud Earrings

Lab diamond stud earrings are incredibly versatile and can be styled in numerous ways to suit different occasions. Whether you’re dressing up for a formal event or adding a touch of sparkle to your everyday outfit, lab diamond studs are the perfect accessory. Here are a few ways to style your Forevery lab diamond stud earrings:

Casual Chic: Pair your lab diamond studs with a simple white blouse and jeans for a polished, effortless look. The earrings add just the right amount of sparkle to elevate your casual attire.

Office Elegance: Lab diamond studs are a great choice for the office, offering a touch of elegance without being overly flashy. They complement professional attire, such as tailored blazers and dresses, while still maintaining a sophisticated, understated look.

Evening Glamour: For a night out or special event, lab diamond studs can be paired with a sleek evening gown or cocktail dress for maximum impact. Their brilliance and shine make them the perfect accessory to complete a glamorous look.

Conclusion

Choosing lab diamond stud earrings from Forevery in Antwerp means embracing the future of luxury and sustainability. Not only are these earrings stunning and timeless, but they also reflect a commitment to ethical sourcing and environmental responsibility. With Antwerp's rich diamond heritage and Forevery’s innovative approach to lab-grown diamonds, you can enjoy the best of both worlds—exceptional quality and a clear conscience. Whether you’re purchasing them as a gift or as a personal treat, lab diamond stud earrings from Forevery are an investment in beauty, sustainability, and the future of the diamond industry.

0 notes

Text

Why Fiori Jewels?

Fiori Jewels and the company’s experts have been in business for more than two decades. Bringing vast expertise, Fiori Jewels has extensive knowledge in diamond supply chain and retail sales, bringing their customers the utmost quality for its diamonds and jewellery. Fiori Jewel’s experts have a keen eye for picking the best, brightest and highest quality diamonds. Utilizing the four C’s – cut, clarity, colour and carat, Fiori experts grade each diamond meticulously on how well the diamond is cut, how clear the diamond is, the diamonds colour and its carat size.

As the first lab created diamond retailer in the UAE, Fiori Jewels has a wide range of diamond jewellery styles, from earrings and tennis bracelets to pendant necklaces and solitaire engagement rings. You can even find polished jewellery pieces for men, such as cuff links or tie clips. Using cutting-edge technology, Fiori’s lab created diamonds are grown by replicating the natural diamond growing process. With the same physical, chemical and optical properties as mine created diamonds, Fiori Jewels lab grown diamond rings jewellery are ethically sourced and eco-friendly, all at an affordable price.

Fiori Jewels Quality

Some may say it’s an art form. Fiori’s experts choose only the highest quality diamond for each piece of jewellery, which is carefully polished and set in recycled 18kt gold. A perfect example of this is a Fiori Jewels tennis bracelet; the experts only choose the highest quality diamonds in each category of the four C’s to place in the tennis bracelet to have uniform brilliance.

Fiori Jewels sources its lab-created diamonds from the best diamond growers in the world, ensuring high-quality diamonds. Working with skilful artisans, Fiori Jewels makes each piece of jewellery feel soft and comfortable to wear and each diamond is studded to perfection. The team works with many different designers from various parts of the world, which leads to unique designs influenced by different cultures. With its headquarters in Dubai, Fiori Jewels has the opportunity to employ people from all over the world, leading to a one-of-a-kind process that creates unique jewellery for everyone. In addition, Fiori Jewels jewellery and diamonds are certified from the top three laboratories in the world, all of which hold the highest standards globally and those that certify mined diamonds as well.

Where are Fiori Jewels located?

As the first lab-created diamond jewellery Dubai in the UAE, Fiori Jewels has two retail stores in the country and an online website, from which its high-quality lab created diamond jewellery can be purchased. Fiori Jewels’ UAE locations are in Gold and Diamond Park and Dubai International Financial Centre. Looking forward, Fiori Jewels plans to open a third location in the United Kingdom in 2021.

What are some of Fiori Jewels’ offers and promotions?

Fiori Jewels has various ongoing offers and promotions to ensure customers find the perfect diamond or piece of jewellery. These offers include:

1 carat solitaire diamond rings starting at 4999 AED.

Diamond exchange program: bring in your mine-created diamond to exchange and upgrade for a bigger, brighter and eco-friendly diamond; one that leaves you with no questions from where the diamond originated from.

Plant a Tree: purchase a diamond tree pendant necklace and Fiori Jewels will plant a tree in Dubai in your name.

Whenever you buy any jewellery from Fiori Jewels, you can upgrade the diamond jewellery Dubai with a bigger and better diamond, as per the market value.

Can Fiori Jewels customize my jewellery? What else do they offer?

Fiori Jewels guarantees a lifetime of customer care with every purchase, ensuring complete satisfaction with your jewellery. Fiori experts will resize and clean your jewellery for free every time, throughout the lifetime of the purchase.

Fiori Jewels can customize and create a one-of-a-kind unique design according to customers’ budgets in addition to offering coloured diamonds or unique gemstones.

About lab created diamonds

Fiori Jewels promise and guarantee is to provide only the highest quality lab created diamonds. Fiori Jewels prides itself on these diamonds – lab created diamonds are real diamonds; they’re made of the same material as mine created diamonds and are atomically identical to mine created diamonds, meaning that they have the same physical, chemical and optical properties as mine created diamonds. Lab grown diamonds are certified using the same process and certification labs as mine created diamonds. The best news? Lab created diamonds are competitively priced, so you can have a larger, better quality diamond for a fraction of the price.

To know more information visit us at:

0 notes

Text

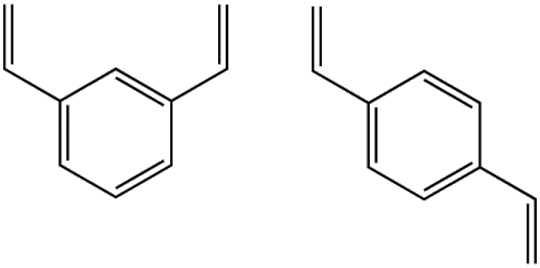

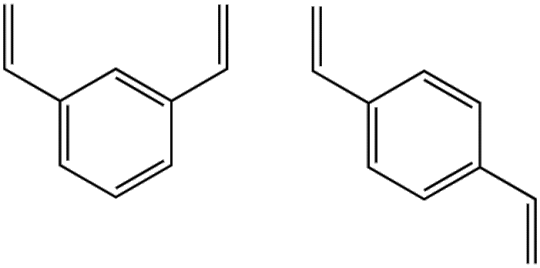

DVB: Deciphering the Chemistry Behind a $110 Million Market

Welcome, dear readers, to the not-so-secret world of divinylbenzene (DVB) — the unsung hero of cross-linked polymers, ion-exchange resins, and the booming market valued at a cool $110 million by 2031. But hey, no need for a secret handshake or a chemistry degree; we’ve got you covered with the lowdown on this chemical compound that’s making waves.

DVB Unveiled: More Than Just a Tongue-Twister

So, what’s the deal with DVB? It’s not the latest dance craze, nor is it a secret society code. Divinylbenzene, or DVB for short, is a chemical wizard that sprinkles its magic in the manufacturing of ion-exchange resins and chromatography resins. Hold your excitement; we’re talking about water treatment, pharmaceuticals, petrochemicals, and electronics — the real A-listers of industry.

The Billion-Dollar Play: DVB in the Limelight

Picture this: from a modest $76 million in 2022, the DVB market is strutting towards a glamorous $110 million by 2031, growing at a sassy 4.2% CAGR. What’s fueling this dazzling rise, you ask? Well, the demand for high-performance resins in water treatment is turning DVB into the Beyoncé of the chemical world. It’s eliminating heavy metals and impurities like a superhero — move over, Iron Man.

Behind the Curtain: Market Dynamics and Segmentation Extravaganza

Let’s take a peek behind the chemical curtain. The divinylbenzene market isn’t a monolith; it’s a star-studded show with headliners like DVB 80 and the fast-rising DVB 50. The real drama unfolds in the application segment — ion exchange resins taking center stage while chromatographic resins make a flashy entrance, demanding attention.

Asia-Pacific: The Diva of DVB Domination

Hold on to your chemical equations; Asia-Pacific is stealing the spotlight in the divinylbenzene saga. Countries like China, India, and South Korea are hosting the biggest chemical galas, driving the demand for DVB. The industrial growth in APAC is the real MVP, cementing its dominance in the DVB market — move over, Hollywood!

Market Dynamics: The Good, the Bad, and the Ugly Side of DVB

But like any blockbuster, there’s a plot twist. The divinylbenzene journey isn’t all glamour; it’s got its share of challenges. Environmental regulations are throwing shade, demanding eco-friendly purification methods. Raw material prices are the villain, causing price fluctuations that could rival a rollercoaster.

Competitive Landscape: Where Chemical Titans Collide

In this chemical arena, titans like Dow Chemical Company, Mitsubishi Chemical Corporation, and Merck KGaA are battling it out. It’s not just about chemical formulas; it’s about innovation, partnerships, and global expansion. These chemical gladiators are investing big, not just in products but in sustainable solutions — saving the world, one resin at a time.

For More Information: https://www.skyquestt.com/report/divinylbenzene-market

Global Divinylbenzene Trends: The Eco-Friendly Evolution

Hold the front page! There’s a shift towards sustainable and bio-based alternatives in the chemical industry. DVB is no exception; the market is singing the eco-friendly anthem. Green bio-based options are the new black, and researchers are on a mission to make DVB production as sustainable as a reusable shopping bag.

The Final Act: Divinylbenzene in the Limelight

As the curtains fall on this chemical extravaganza, divinylbenzene stands tall, the unsung hero of polymers, resins, and water treatment solutions. It’s not just a chemical; it’s a billion-dollar play with twists, turns, and a dash of eco-friendly glamour. So, the next time someone mentions DVB, give them a nod of approval; it’s more than just a tongue-twister — it’s a chemical superstar.

In a world filled with decoding and navigating, DVB keeps it real, chemical, and fabulous. Cheers to the unsung hero!

About Us-

SkyQuest Technology Group is a Global Market Intelligence, Innovation Management & Commercialization organization that connects innovation to new markets, networks & collaborators for achieving Sustainable Development Goals.

Contact Us-

SkyQuest Technology Consulting Pvt. Ltd.

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 617–230–0741

Email- [email protected]

Website: https://www.skyquestt.com

0 notes

Text

DVB: Deciphering the Chemistry Behind a $110 Million Market

Welcome, dear readers, to the not-so-secret world of divinylbenzene (DVB) — the unsung hero of cross-linked polymers, ion-exchange resins, and the booming market valued at a cool $110 million by 2031. But hey, no need for a secret handshake or a chemistry degree; we’ve got you covered with the lowdown on this chemical compound that’s making waves.

DVB Unveiled: More Than Just a Tongue-Twister

So, what’s the deal with DVB? It’s not the latest dance craze, nor is it a secret society code. Divinylbenzene, or DVB for short, is a chemical wizard that sprinkles its magic in the manufacturing of ion-exchange resins and chromatography resins. Hold your excitement; we’re talking about water treatment, pharmaceuticals, petrochemicals, and electronics — the real A-listers of industry.

The Billion-Dollar Play: DVB in the Limelight

Picture this: from a modest $76 million in 2022, the DVB market is strutting towards a glamorous $110 million by 2031, growing at a sassy 4.2% CAGR. What’s fueling this dazzling rise, you ask? Well, the demand for high-performance resins in water treatment is turning DVB into the Beyoncé of the chemical world. It’s eliminating heavy metals and impurities like a superhero — move over, Iron Man.

Behind the Curtain: Market Dynamics and Segmentation Extravaganza

Let’s take a peek behind the chemical curtain. The divinylbenzene market isn’t a monolith; it’s a star-studded show with headliners like DVB 80 and the fast-rising DVB 50. The real drama unfolds in the application segment — ion exchange resins taking center stage while chromatographic resins make a flashy entrance, demanding attention.

Asia-Pacific: The Diva of DVB Domination

Hold on to your chemical equations; Asia-Pacific is stealing the spotlight in the divinylbenzene saga. Countries like China, India, and South Korea are hosting the biggest chemical galas, driving the demand for DVB. The industrial growth in APAC is the real MVP, cementing its dominance in the DVB market — move over, Hollywood!

Market Dynamics: The Good, the Bad, and the Ugly Side of DVB

But like any blockbuster, there’s a plot twist. The divinylbenzene journey isn’t all glamour; it’s got its share of challenges. Environmental regulations are throwing shade, demanding eco-friendly purification methods. Raw material prices are the villain, causing price fluctuations that could rival a rollercoaster.

Competitive Landscape: Where Chemical Titans Collide

In this chemical arena, titans like Dow Chemical Company, Mitsubishi Chemical Corporation, and Merck KGaA are battling it out. It’s not just about chemical formulas; it’s about innovation, partnerships, and global expansion. These chemical gladiators are investing big, not just in products but in sustainable solutions — saving the world, one resin at a time.

For More Information: https://www.skyquestt.com/report/divinylbenzene-market

Global Divinylbenzene Trends: The Eco-Friendly Evolution

Hold the front page! There’s a shift towards sustainable and bio-based alternatives in the chemical industry. DVB is no exception; the market is singing the eco-friendly anthem. Green bio-based options are the new black, and researchers are on a mission to make DVB production as sustainable as a reusable shopping bag.

The Final Act: Divinylbenzene in the Limelight

As the curtains fall on this chemical extravaganza, divinylbenzene stands tall, the unsung hero of polymers, resins, and water treatment solutions. It’s not just a chemical; it’s a billion-dollar play with twists, turns, and a dash of eco-friendly glamour. So, the next time someone mentions DVB, give them a nod of approval; it’s more than just a tongue-twister — it’s a chemical superstar.

In a world filled with decoding and navigating, DVB keeps it real, chemical, and fabulous. Cheers to the unsung hero!

About Us-

SkyQuest Technology Group is a Global Market Intelligence, Innovation Management & Commercialization organization that connects innovation to new markets, networks & collaborators for achieving Sustainable Development Goals.

Contact Us-

SkyQuest Technology Consulting Pvt. Ltd.

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 617–230–0741

Email- [email protected]

Website: https://www.skyquestt.com

0 notes

Text

Why Fiori Jewels?

Fiori Jewels and the company’s experts have been in business for more than two decades. Bringing vast expertise, Fiori Jewels has extensive knowledge in diamond supply chain and retail sales, bringing their customers the utmost quality for its diamonds and jewellery. Fiori Jewel’s experts have a keen eye for picking the best, brightest and highest quality diamonds. Utilizing the four C’s – cut, clarity, colour and carat, Fiori experts grade each diamond meticulously on how well the diamond is cut, how clear the diamond is, the diamonds colour and its carat size.

As the first lab created diamond retailer in the UAE, Fiori Jewels has a wide range of diamond jewellery styles, from earrings and tennis bracelets to pendant necklaces and solitaire engagement rings. You can even find polished jewellery pieces for men, such as cuff links or tie clips. Using cutting-edge technology, Fiori’s lab created diamonds are grown by replicating the natural diamond growing process. With the same physical, chemical and optical properties as mine created diamonds, Fiori Jewels lab grown diamond rings jewellery are ethically sourced and eco-friendly, all at an affordable price.

Fiori Jewels Quality

Some may say it’s an art form. Fiori’s experts choose only the highest quality diamond for each piece of jewellery, which is carefully polished and set in recycled 18kt gold. A perfect example of this is a Fiori Jewels tennis bracelet; the experts only choose the highest quality diamonds in each category of the four C’s to place in the tennis bracelet to have uniform brilliance.

Fiori Jewels sources its lab-created diamonds from the best diamond growers in the world, ensuring high-quality diamonds. Working with skilful artisans, Fiori Jewels makes each piece of jewellery feel soft and comfortable to wear and each diamond is studded to perfection. The team works with many different designers from various parts of the world, which leads to unique designs influenced by different cultures. With its headquarters in Dubai, Fiori Jewels has the opportunity to employ people from all over the world, leading to a one-of-a-kind process that creates unique jewellery for everyone. In addition, Fiori Jewels jewellery and diamonds are certified from the top three laboratories in the world, all of which hold the highest standards globally and those that certify mined diamonds as well.

Where are Fiori Jewels located?

As the first lab-created diamond jewellery Dubai in the UAE, Fiori Jewels has two retail stores in the country and an online website, from which its high-quality lab created diamond jewellery can be purchased. Fiori Jewels’ UAE locations are in Gold and Diamond Park and Dubai International Financial Centre. Looking forward, Fiori Jewels plans to open a third location in the United Kingdom in 2021.

What are some of Fiori Jewels’ offers and promotions?

Fiori Jewels has various ongoing offers and promotions to ensure customers find the perfect diamond or piece of jewellery. These offers include:

1 carat solitaire diamond rings starting at 4999 AED.

Diamond exchange program: bring in your mine-created diamond to exchange and upgrade for a bigger, brighter and eco-friendly diamond; one that leaves you with no questions from where the diamond originated from.

Plant a Tree: purchase a diamond tree pendant necklace and Fiori Jewels will plant a tree in Dubai in your name.

Whenever you buy any jewellery from Fiori Jewels, you can upgrade the diamond jewellery Dubai with a bigger and better diamond, as per the market value.

Can Fiori Jewels customize my jewellery? What else do they offer?

Fiori Jewels guarantees a lifetime of customer care with every purchase, ensuring complete satisfaction with your jewellery. Fiori experts will resize and clean your jewellery for free every time, throughout the lifetime of the purchase.

Fiori Jewels can customize and create a one-of-a-kind unique design according to customers’ budgets in addition to offering coloured diamonds or unique gemstones.

About lab created diamonds

Fiori Jewels promise and guarantee is to provide only the highest quality lab created diamonds. Fiori Jewels prides itself on these diamonds – lab created diamonds are real diamonds; they’re made of the same material as mine created diamonds and are atomically identical to mine created diamonds, meaning that they have the same physical, chemical and optical properties as mine created diamonds. Lab grown diamonds are certified using the same process and certification labs as mine created diamonds. The best news? Lab created diamonds are competitively priced, so you can have a larger, better quality diamond for a fraction of the price.

To know more information visit us at:

0 notes

Text

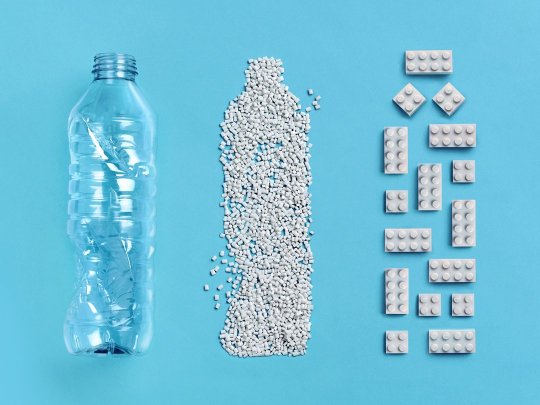

The obstacle course to 'green' Lego blocks

Lego has made a block out of recycled PET for the first time. A new step in the complex search for more sustainable variants of his iconic plastic toys, involving universities and companies such as Avantium[1], Indaver[2] and Ineos[3]. PET (Polyethylene terephthalate) is a type of plastic that is typically used to make soft drink bottles. “Through recycling, we can now make about eight classic Lego blocks from one such discarded bottle,” says Tim Brooks, sustainability director at the Danish company, as he shows a gray prototype. “It is the first time that we use PET as a raw material.”

Founded in 1916, Lego switched from wood to plastic to make toys in 1947. In 1958 it patented its typical building block: round studs at the top and hollow at the bottom. It conquered the world. The formula for success? Nearly indestructible blocks, with dimensions accurate to the hundredth of a millimeter so that all pieces from each set, from the 1970s to the present, click perfectly together and can be taken apart again. Time after time.

The essence

Lego makes 3,500 types of building elements, all of which it sells nearly 100 billion units a year. It uses 20 types of plastic for this, but 80 percent is made from the ultra-strong petroleum derivative ABS[4]. By 2030, Lego wants to switch completely to sustainable materials: recycled plastic or bioplastic. Lego is the largest toy manufacturer in Europe. In 2020, the company posted a turnover of 5.9 billion euros (+13 percent) and a net profit of 1.3 billion euros (+19 percent).

Half a billion

Technically ideal, but in times of growing environmental awareness and the pursuit of CO2 neutrality, this is by no means the way forward. It takes 2 kilograms of petroleum to make 1 kilogram of ABS. Not ideal for the reputation of a company that focuses on future generations. In interviews, CEO Niels Christiansen repeatedly said that he receives letters from young Lego fans who are concerned about the climate. So Lego announced a strategic shift in 2015: by 2030, the company only wants to use 'sustainable' raw materials for its toys. Do not read: no more plastic, but read: greener plastic. “There are two ways to do that,” Brooks says. “Or with more sustainable raw materials. So no plastics based on petroleum derivatives, but based on biological materials, such as plants, algae or even coffee residue. Or by recycling plastic. I estimate that will be the most important part.”

To make the change, Lego set up a Sustainable Materials Center in its Danish home base Billund, which now employs about 150 people. Since 2015, nearly half a billion euros in investments in research and development have been announced. “We do a lot ourselves. For the recycled PET, we ourselves looked for additional ingredients in the process. But of course we also work together with universities and a few dozen companies.”

Antwerp

There is ABSolutely Circular[5], for example, a European research project of chemical company Ineos - an important supplier of Lego anyway - and the Flemish environmental technology company Indaver for recycled ABS. In mid-July 2021 the first 10 kilograms of this were made at Ineos in Cologne. In a next step, there will be a small production in Antwerp, with a Lego block as a pilot product. Another example: Lego, together with the detergent manufacturer Henkel and the beer brewer Carlsberg, joined PEFerence[6], a project led by the Brussels-listed green chemical company Avantium to develop biological plastics. Partnerships are also underway with consumer goods groups Danone, L'Oréal and Bic and tire manufacturer Michelin. This is gradually producing the first results. In 2018, Lego presented a first small collection made of polyethylene based on sugar cane. It was a set of trees, plants and dragon wings. “These are more flexible elements,” explains Brooks, 'because it is a softer material that is not suitable for the hard blocks.'

The sugar cane cubes were an important milestone, but hardly the major turnaround. The material is suitable for barely 2 percent of the supply. But now there is a prototype made from recycled PET, which could possibly be used on a larger scale. Brooks doesn't want to put a number on that. “As much as possible, of course. But we still need to take steps to increase production. We hope to have the material effectively on the market in 18 to 24 months.”

Sweat

“The cover is very complex,” he explains. “Whoever makes children's toys cannot compromise on quality or safety. We go far into that. We test whether our blocks are resistant to sweat or saliva.” Lego simulates in tests the effect of biting with a force of 22.5 kilograms on a block. And whether nothing breaks off the block if it is crushed under a metal disc. "It shouldn't scratch or change shape or color if left in the sun for a long time." The challenge is then that the 'green' blocks have the same color and shine, even make the same sound. And above all: with the perfect coupling. “Our company is literally built on blocks that stick together and at the same time are easy to disassemble. That requires material with extreme precision. We have been perfecting ABS for fifty years. We are not there yet with the alternatives.” All kinds of problems arise in the experiments: the blocks shrink during production.

Source

STEPHANIE DE SMEDT, De Tijd, 23 juni 2021 https://www.tijd.be/de-tijd-vooruit/innovatie/het-hindernissenparcours-naar-groene-lego-blokjes/10315509.html

[1] https://www.brightlands.com/brightlands-chemelot-campus/companies-institutes/companies/company/avantium Avantium is a pioneer in the emerging industry of renewable and sustainable chemistry. [2] https://www.indaver.com/be-en/home/ Indaver – a European player with facilities and operations in Belgium, the Netherlands, Germany and Ireland – manages and treats industrial and household waste in specialist facilities for businesses, waste collectors and governments. It recovers valuable raw materials from this waste that can replace primary raw materials. [3] https://www.ineos.com/ INEOS is a global chemical company. Its products touch every aspect of modern day life. It comprises 36 businesses with 194 sites in 29 countries throughout the world. [4] Acrylonitrile butadiene styrene (ABS) is a common thermoplastic polymer. ABS provides favorable mechanical properties such as impact resistance, toughness, and rigidity when compared with other common polymers. [5] https://absolutely-circular.com/ The project, called LIFE ABSolutely Circular aims at demonstrating the environmental and economic benefits of using advanced recycling technologies to close the loop of plastic recycling. An initial key objective of the project is to demonstrate for the first time the production of ABS based on recycled feedstock taking advantage of advanced recycling technologies. [6] https://peference.eu/ PEFerence will establish a unique, industrial scale, cost-effective biorefinery flagship plant producing FDCA (furan dicarboxylic acid), a bio-based building block to produce high value products. Bio-based FDCA can be used to make a wide range of chemicals and polymers such as polyesters, polyamides, coating resins and plasticizers and, crucially, can also be used to make PEF (polyethylene furanoate), a 100 % bio-based polyester used to make bottles, films and fibres.

2 notes

·

View notes

Video

What is the Deal with Property Insurance?

https://u109893.h.reiblackbook.com/generic11/the-storage-stud/what-is-the-deal-with-property-insurance/

Crum-Halsted is a full service insurance and risk management agency headquartered in Sycamore, IL with six offices in Illinois providing outstanding service, security, and peace of mind for businesses, families, and individuals for over 90 years.

Greg Jones is the Vice President of the Chicago Real Estate Council and Director with the Rogers Park Builders Group as well as a Deacon at Christ Community Church in Lemont. When not working, he enjoys watching the cubs with a good cigar and a great whiskey in hand, playing poker, and riding motorcycles.

https://crumhalsted.com/

Fernando O. Angelucci is the Founder and President of Titan Wealth Group. He also leads the firm’s finance and acquisitions departments. Fernando Angelucci and Steven Wear founded Titan Wealth Group in 2015, and under his leadership, the firm’s revenue has grown over 100% year over year. Today,

Find out more at

https://www.thestoragestud.com

https://titanwealthgroup.com/

Listen to our Podcast: https://thestoragestud.podbean.com/e/what-is-the-deal-with-property-insurance/

Titan Wealth Group operates nationwide sourcing off market investment properties for Titan Wealth Group’s acquisition as well as servicing a network of thousands of active real estate investors world wide. Prior to founding Titan Wealth Group, Fernando worked for Dow Chemical, a Fortune 50 company, rolling out a flagship product estimated to gross $1B in global revenues.

With an engineering background, Fernando is able to approach real estate investing with a keen analytical mindset that allows Titan Wealth Group to identify opportunities and project accurate pictures of future performance. Fernando graduated from the University of Illinois at Urbana-Champaign with a B.A. degree in Technical Systems Management.

Titan Wealth Group was founded in 2015 with the vision of gathering individual investors that have the means to invest but lack either the time to find high-yield investment opportunities or the access to these off-market deals. All too often, founders Fernando Angelucci & Steven Wear came across investors who had deployed their capital only to regret the lack of consistency or degree of returns their investments were producing. In response, Titan Wealth Group provides access to highly-vetted real estate secured investments and off-market acquisition opportunities primarily in the Greater Chicago MSA. Today, Titan Wealth Group not only assists individual investors but has grown to support the acquisition goals and capital deployment of investment groups, private equity firms, and real estate investment trusts (REITs).

As a facilitator of wealth growth, Titan Wealth Group believes that success is not limited to the sum of our efforts and is infinite with what can be accomplished through partnership.

------------------------------------------------------------------------

Fernando Angelucci (00:16): Hey everybody, welcome back. We're doing a special Thanksgiving podcast here today. So on this episode of What's The Deal, the real estate podcast that gives answers, we'll be covering What's The Deal with Property I nsurance. Real estate is one of the few investment vehicles that you can purchase in property insurance for, you now, yay for hard assets. So joining me today to provide some coverage on the topic of Property Insurance is my good friend and colleague Greg Jones. So how are we doing Greg?

Greg Jones (00:51): Good. How about you, Fernando?

Fernando Angelucci (00:53): Doing good. I'm doing good. It's 72, 73 degrees outside in California. I'm glad I'm not in Chicago at the moment.

Greg Jones (01:01): It's not quite that nice here right now.

Fernando Angelucci (01:06): Okay. So Greg, on this podcast, we have all types of listeners from super professional, you know, multi million dollar portfolio, all the way to the new investor or someone that is trying to become a new investor. So let's back up a little bit and, you know, explain who you are and what you do.

Greg Jones (01:26): Got it. So my name is Greg Jones. I am a risk advisor with Crum Halstead Agency. So I work with real estate companies and developers as well as contractors around consulting around risk and placement of insurance.

Fernando Angelucci (01:42): How'd you get into the business?

Greg Jones (01:45): I was introduced to a guy that owned an agency shoot, this is probably almost 10 years ago now. Right place, right time. I grew up in a background of construction, both my dad and my brother owned construction companies. Had friends that were in real estate, didn't want to do construction for a living. So I figured I would give insurance a try and it ended up being a really good fit.

Fernando Angelucci (02:10): Oh, okay. I didn't know that about you.

Greg Jones (02:13): Yeah.

Fernando Angelucci (02:14): Figured it would come up in one of those late night poker games.

Greg Jones (02:17): Yeah, exactly.

Fernando Angelucci (02:20): Okay. So for people that don't know what is Property Insurance and what does a risk advisor do?

Greg Jones (02:31): So property insurance is realistically, it's a like a contract. So the owner of the property has a contract in place with an insurance company, say whether that's a Travelers or a Hartford or whoever the carrier might be. And in that contract, it will lay out in the event of a claim. Here's what the insurance company is going to pay out. And that covers both damage to the property as well as if there's an injury to someone at the property. So the contract States, what the limits are, what the causes of that claim are covered versus certain kinds of causes of claim might not be covered, unless you buy that or purchase it as an add-on, a good example of that is earthquake coverage. Earthquake isn't automatically included, but you can purchase it as an additional coverage line item, but it's all built into a contract that lasts for 12 months between the owner and the insurance company.

Fernando Angelucci (03:28): Okay. And then with those types of con, let's bring it into reality with some examples. So say I'm a new investor. I'm going to be buying a four flat property in Chicago. I'm going to live in one unit myself, rent out the other three units, let's say each units, 1200 square feet and the buildings' a hundred years old, what am I looking at for coverage? Or what should I be looking at for coverage? Where are the premiums going to fall? And what are some things that I should be paying attention to or looking for in those contracts?

Greg Jones (04:04): Right. So the first question you have to answer, especially because you're living in one of those units, is how are you going to cover the property? You could cover it on a personal insurance policy, or you could cover it on a commercial policy because it's four units, that's the breaking point. You could cover it either way. After you get to five units, it's always considered a commercial policy.

Fernando Angelucci (04:27): Okay.

Greg Jones (04:27): If you go the route of commercial, which is typically what I recommend the coverage form is a little bit broader in what it will cover you for. The downside is you have to treat yourself because you're living in one of those units as a tenant, you're a tenant within your own building. So your personal property as the resident, isn't going to be covered, but your asset, the building contents within the rental properties, those are covered under the contract.

Greg Jones (04:59): When you're looking at a four unit building, based on the square footage, there's typically a dollar amount that insurance carriers will look at in terms of we're want to cover this for what it will cost to replace it. If you have a catastrophic loss, right? Every carrier has their own algorithms they'll use for this, but typically it comes down to a dollar amount per square foot. The average we're seeing at least in Chicago right now, if it's joist and masonry or better is typically anywhere from 150 to $170 a square foot is what it would cost to completely rebuild. So we would look at what does that cost look like? Then you can set up whatever deductible structure you want. Deductibles go as low as, I mean, realistically, you can go as low as you use the $500. I never seen anybody go that low. Usually the average is, you know, 25 to 10,000 for a deductible. So then if you do have a loss, everything that it's covered under that contract is paid out minus the cost of your deductible.

Fernando Angelucci (06:00): Exactly. Now, one of the things that occurs quite often in Chicago is we have these pockets, these neighborhoods, where the cost of buy the property is significantly below the replacement value. For example you know, my partner, Steven?

Greg Jones (06:16): Yeah.

Fernando Angelucci (06:16): He has a property where, you know, it's 140 year old masonry and limestone building the cost to replace that type of building would be a 1.4, 1.3, 1.4 million, but he bought it for significantly lower than that in those types of situations, what do you recommend doing with the coverage amount with the policy?

Greg Jones (06:42): So it really comes down to as the building owner, what is your goal in the event of a claim, right? So you want to make sure you have enough coverage so that if there's a partial claim or a partial loss is what they call it. So let's say hale comes through and destroys the roof. It's not a total loss. You want to have enough to repair that roof.

Fernando Angelucci (07:03): Right.

Greg Jones (07:03): The question is, if you were to have a catastrophic loss, the building is completely destroyed or it's damaged so much that the city comes in and says, you have to take this building down. It's now a safety hazard, right? In that kind of scenario, what do you want to do? Do you want to rebuild something there? Or would you rather just take the money and go buy something else and sell the land after the debris has been removed, right?

Greg Jones (07:28): So the answer to that question really drives how we advise, typically in these situations, I find the investor really would rather just take the money and go buy something else because that coverage amount that you've got for that partial loss is more than enough to buy at least another building like it in that area, or maybe even more, right? So you get this dilemma of, I bought it for, you know, say 250,000, but it will cost me 1.5 million to rebuild it. Right? Insurance companies will allow you in some cases and it depends on the carrier, but they will allow you to do what's called a stated amount, or it's a, some carriers call it a loss limit. So, you as the building owner can say, this is how much I want to cover my building for. I recognize it's not enough to rebuild it, but I want to cover it. So let's use this building and as an example, you buy it for 250,000 let's say it's 1.5 to fully rebuild it. And you say, I only want to cover it for half a million dollars, half a million will cover any partial loss that happens. If it's a total loss, I'd rather just take the money and go buy something else. The rating for that is typically a little bit higher, but it still ends up coming out much less than it would be if you were to fully insure it for $1.5 million.

Fernando Angelucci (08:51): And when you say rating, what do you mean by that?

Greg Jones (08:54): So, the premium for insurance for property is driven by a rate. So whatever value is selected for that building. So let's say a million dollars for round number purposes. So you take that million dollars, divide it by a hundred and you multiply it by a rate, and that equals your premium. So let's say it's you're getting a 20 cent rate. So for a million dollar building divide it by 10, multiply it by 0.20, that's your property premium.

Fernando Angelucci (09:24): I see.

Greg Jones (09:24): Rates vary based on the asset type. So typically you'll see multi-family tends to be the highest rated asset class out there where retail is considered a little bit less hazardous, office and industrial tend to be considered the least risky. So you could have a building of the same square footage. Let's say you're at a 18 cent rate for apartment building, same size building would be a, what? 10 to 12 cent rate for retail. You might get as low as 8 to 10 cents on office or industrial, just depending on what the asset class is and where it's located.

Fernando Angelucci (10:06): Interesting. Now with, let's say someone in what situations would somebody opt for the full replacement cost is that if you have like a super custom property that, you know, you can't find anywhere else, or?

Greg Jones (10:20): If you have a super custom property, or if the idea is I like where I'm located, the land has significant value. Even if I was going to take the money, I would rebuild something here. I might not rebuild the same thing. So another way that you can do it is some carriers offer what's called Functional Replacement Cost. Right? I seen this particularly with real estate related to older church properties and some need, especially you think about Chicago land. There is all of these churches that were built in the 18 hundreds, the architectures' crazy. You're not going to rebuild one of those just like it stands right now. Right?

Fernando Angelucci (10:58): Right.

Greg Jones (10:59): But you look at, if we were to have a total loss, we would want to rebuild something, same purpose, but we're not going to rebuild it the same way. And so you can use, what's called a Functional Replacement Cost, where you'll estimate based on, if we had a loss, what would we rebuild? What would the square footage be? Same questions, but you're not basing on what's there, you're basing it on what you would build.

Fernando Angelucci (11:24): Right.That's interesting. With the property insurance business, there's a lot of moving parts and it's one of those vendors in the real estate space that usually a lot of the investors don't actually know what goes on behind, right behind the curtains here.

Greg Jones (11:43): Right.

Fernando Angelucci (11:43): Walk us through. When I talk to you, it almost seems like every person that works within your organization, It's almost running like it's their own little business with inside of the organization. Almost like you're not entrepreneur or entrepreneur, some people would say, what is the day in the life of a risk advisor look like, what are you doing on a day-to-day basis?

Greg Jones (12:04): So on a day-to-day basis my time is usually split in a few different categories, right? So there's the time that goes into just the day to day servicing of your existing clients, right? That's helping guide through the process of whether it's an acquisition, that's coming up a disposition, a refinance, there's always moving parts, particularly within real estate. Right? And so there's a lot of day to day servicing. I mean, the interactions with a real estate client versus let's say a manufacturer is completely different.

Fernando Angelucci (12:38): Right.

Greg Jones (12:38): Right. Just because of all those moving parts. So part of the time is spent with that servicing with myself and my team. There's another element of it, of I'm trying to connect with new people. So before we hit a, you know, pandemic that involved going to lots of events and networking and, you know, all that came to a screeching halt in March. So now it's been a lot more time on the phone working through marketing, trying to figure out different creative ways to connect with people, to bring in new clients. Right?

Fernando Angelucci (13:09): Right.

Greg Jones (13:10): And then once you open that opportunity and you're starting to work on a new client there's a lot of time that goes into underwriting. So if an investor says, Hey, we want you to look at our portfolio. There's a lot of detail that you work through with them to gather the right information. And then you're compiling that information and really painting a picture for your underwriters. So, I mean, people have asked me before, what's the difference between a good broker in a bad broker or a good adviser, bad advisors is it's really making sure that you're painting a picture for an underwriter to make that client look really good versus here's 12 locations, here's all the basic raw data, what's my rate? You know, if you actually go into more detail and explain, like here's what the company does, here's what their practices look like, here's what they require of tenants of vendors coming in and out of the space to do work. You can actually derive a much better result than just providing a spreadsheet asking for someone to get you a quote.

Fernando Angelucci (14:12): Interesting. So almost painting a picture of the whole business, not just that one property, you're looking for.

Greg Jones (14:18): Exactly.

Fernando Angelucci (14:18):

To quote on.

Greg Jones (14:19): Exactly.

Fernando Angelucci (14:20): Interesting. How about on the other side? So that's, you know, that's your prospect side, if you will, but how about the actual carriers that you match up with? How do you find these guys? How do you know if a deal is gonna be right for a certain carrier? Cause I know there's hundreds of insurance companies around.

Fernando Angelucci (14:38): Hundreds.

Fernando Angelucci (14:38): In Iowa and I saw every one of the buildings.

Greg Jones (14:42): We're all headquartered there.

Fernando Angelucci (14:42): Yeah.

Greg Jones (14:42): Well, maybe not all of them, but a lot. So yeah. Every, so every insurance company has a different appetite, right? So there is some time spent with those and what those underwriters figuring out what that appetite looks like. So some carriers will, every carrier will say they like real estate in some capacity. Right? But the question is what kind of real estate that you like. So back in the day is when carriers would stop by the office and, you know, have a catch-up meeting with us, you know, they would talk about their appetite, what they've been hitting on recently where they've seen success. And so the first question is always, what kind of real estate are you writing? So in some cases, it's, they really like office and industrial, some carriers really like apartments, few carriers, like every asset class, there are a few. And then I would say in today's market, it's even changing beyond what it has been historically, just because of the unknowns of, you know, what will come of the pandemic and particularly around office and retail and what that's gonna look like. So we've even seen carriers backing away from those asset classes where they historically have been of the most appetite.

Fernando Angelucci (15:55): Yeah. That makes a lot of sense. So for example, how many carriers do you work with if you had to guess?

Greg Jones (16:03): So in the real estate space, I would say we probably have 15 or 20 that really focus in on real estate that specialize in that. So the team that I came over with that help launch our Chicago office has really put a lot of emphasis into partnering with the right companies that work with real estate because real estate is our focus. And so, if there's a market we've come across, that we find is really competitive in the real estate space, we do what we can to get a contract with them. So there's very few markets that specialize in real estate that we don't work with.

Fernando Angelucci (16:36): Yeah. And it's funny, we've worked with each other in the past and you really know which carriers have an appetite for what type of assets. You know, we do some niche style assets, not only the single family, multifamily, but also the self storage buildings.

Greg Jones (16:51): Uh-huh.

Fernando Angelucci (16:51): And you've gotten quotes to me not only quickly, but usually beating out almost all the competition on the premium. And I think one of the things that really helped us, is the fact that you do have a really good ability to paint kind of that picture. Here's what the company's like. Now I have, I'm somebody that always believes that you should get insurance and, you know, plan for the worst, but hope for the best I have come across a lot of investors that do the opposite.

Fernando Angelucci (17:20): I survived.

Fernando Angelucci (17:20): And swear by real estate insurance is a scam and the carriers never pay out. So for you, what would you say? Why should a real estate investor have property insurance? And on top of that, why should they use a risk advisor or a broker as opposed to just contacting a company directly?

Greg Jones (17:43): Good question. So I would say, why should they have property insurance? The short and simple answer is in most cases, if there's a bank involved, it's going to be required.

Fernando Angelucci (17:54): Right.

Greg Jones (17:54): Where it's an option is where you actually own the asset a hundred percent. There's no lending requirements. You can choose whether you're going to insure the building or not. I've seen this particularly be the case when you've got developers who are buying, let's say a vacant property that they're going to repurpose, right? So usually they'll in a lot of cases, they'll buy it for cash or there won't be a bank involved if you will. So they have a choice whether they want to cover that building or not. The, I would say the reason you want to is because you want to have something that protects your investment, right? And it's not just the asset itself, especially when you're looking at development projects, you might purchase a building for, let's say a million dollars.

Greg Jones (18:43): You're going to put a couple of million into it, repurpose it. It's not just covering that initial million dollar investment. It's also looking at what is the potential income that you stand to lose if you lose that asset. Right?

Fernando Angelucci (18:58): Right.

Greg Jones (18:58): So insurance is, I mean, if you think about it, there's not a product out there where you can spend, let's say, I mean, I'm thinking back to one that I did for a client a while back bought a vacant building for it was like half a million dollars. Once he was done with the repurposing of it, he would have been into it for probably about 2.5. And the monetary return on this was going to be over half a million dollars a year. Once it was all done, the coverage of insurance was like $8,000, but we were covering the building for $2 million. Right? So you're spending eight in the event of a total loss. You're getting all of your investment back minus your deductible for 8K to protect an investment of significantly more. So, I mean, being someone that's fairly risk averse I would strongly recommend it.

Fernando Angelucci (19:59): Yeah. And so you're talking about the significant income that, that property would bring in. Is there some type of a rider that you can get for say, instead of it being a total loss, but say something happens where all of a sudden you lose your income generating potential from that building. Is there some type of like loss of rents protection or income protection that you can put on as a rider?