#Global Candies Industry Report

Explore tagged Tumblr posts

Text

Throat Lozenges: Alleviating Sore Throats New Findings Offer Promising Relief

What are Throat Lozenges?

Cough drop are medicated candy-like tablets that are designed to provide quick relief to coughs or sore throats. They dissolve slowly in the mouth, allowing the ingredients to coat and soothe the throat. Key Ingredients in Throat Lozenges

Throat Lozenges generally contain one or more of the following active ingredients that work to relieve throat irritation : Anesthetics - Such as benzocaine or phenol aid in numbing throat pain. They work topically to reduce throat sensitivity. Anti-inflammatory Agents - Like menthol or eucalyptus oil work by reducing inflammation. They promote mucus drainage to clear congestion. Demulcents - Materials like honey or glycerin coat the throat lining. They protect it from further irritation when swallowing or coughing. Antibiotics - Lozenges containing tetracycline are occasionally prescribed for bacterial throat infections. They treat specific infections. How do Throat Lozenges Work?

When a throat lozenge dissolves in the mouth, its active ingredients are released. They coat and numb the throat, reducing discomfort. Specific ingredients may also reduce swelling or treat infections : - Anesthetics temporarily numb painful areas, blocking throat pain signals. - Anti-inflammatory agents decrease swelling in irritated throat tissues. This lessens pain. - Demulcents form a protective film over inflamed areas, shielding them from further irritation. - Antibiotics kill or limit bacterial growth if a strep throat is present. This resolves the underlying cause. The slow dissolving nature also allows the throat to be continuously coated for 30-60 minutes, enhancing relief during that period. Using Cough drop Effectively

For best results, cough drop should be used as per product instructions. Some general tips on their effective use include: - Allow the lozenge to dissolve slowly in the mouth, rather than chewing or swallowing it whole. This ensures maximum coating of the throat. - Suck on the lozenge for at least 15-20 minutes for the ingredients to take maximum effect before swallowing any remnants. - Use lozenges at the first signs of a sore throat, rather than waiting for severe pain. Early action provides prompt symptom relief. - Lozenges work best for recently developed throat irritations. See a doctor for persistent or worsening pain. - Drink plenty of fluids while using lozenges to keep the throat moist. Water is recommended over acidic juices. - Lozenges containing local anesthetics provide temporary pain relief. Seek medical help if symptoms persist beyond a few days. Popular Throat Lozenge Brands

Some globally recognized throat lozenge brands offering effective temporary relief include: - Halls: Known for its menthol and eucalyptus flavors, it soothes and fights germs. - Strepsils: Contains phenol as an active ingredient. It aims to relieve pain from streptococcal sore throats. - Thayers: A honey-based lozenge brand formulated to moisturize and protect the throat naturally. - Chloraseptic: Branded lozenges utilizing benzocaine as an oral anesthetic to numb throat pain. - Cough Drops: A variety of flavored cough drop and drops by Ricola and Fishermans Friend. - Biotene: Specialized lozenges and mouthwashes for dry mouth relief alongside sore throat symptoms. In Summary, cough drop are widely available over-the-counter at pharmacies. They offer a convenient, drug-free way to temporarily relieve common throat afflictions. Using them properly under medical guidance helps maximize symptom comfort.

Get More Insights On - Throat Lozenges

Discover the Report for More Insights, Tailored to Your Language.

French

German

Italian

Russian

Japanese

Chinese

Korean

Portuguese

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

#Throat Lozenges Comfort#Throat Lozenges Herbal Remedies#Throat Lozenges Pain Relief#Throat Lozenges Fast-Acting#Throat Lozenges sore throat relief

3 notes

·

View notes

Text

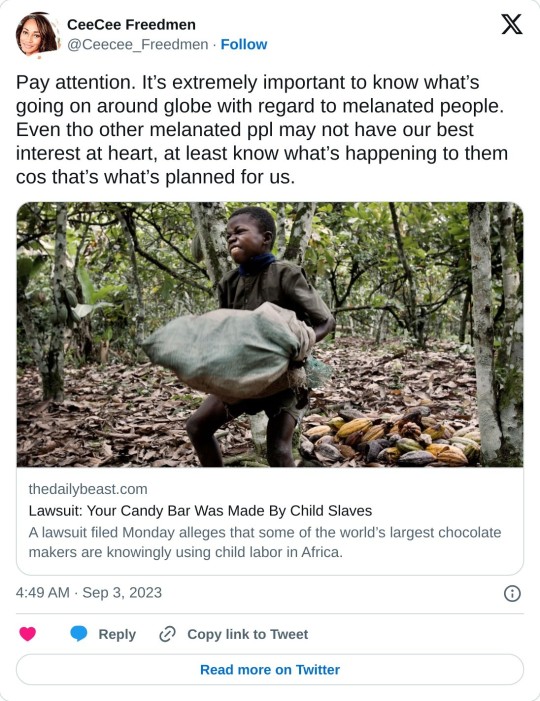

The Milton Hershey School in Pennsylvania is one of the wealthiest education centers in the world. Founded in 1909 as an orphanage for “male Caucasian” boys, it was awarded 30 percent of the company’s future earnings by Milton S. Hershey upon his death. Thanks to the success of Kit-Kats, Reese’s, and Whoppers, the school is worth a staggering $7.8 billion.

Now home to more than 2,000 students, it owns a controlling interest in the $22.3 billion Hershey company—a chocolate maker with roots in child protection and education that, in the worst form of irony, allegedly relies on cocoa harvested by child laborers in West Africa.

It is this irony that serves as the motivation behind a class action lawsuit filed Monday against Hershey and two of its competitors, Mars and Nestle. The complaints, filed by three California residents, allege that the companies are guilty of false advertising for failing to disclose the use of child slavery on their packaging. Without it, the plaintiffs claim, the companies are deceiving consumers into “unwittingly” supporting the child slave labor trade.

“America’s largest and most profitable food conglomerates should not tolerate child labor, much less child slave labor, anywhere in their supply chains,” the complaint reads. “These companies should not turn a blind eye to known human rights abuses... especially when the companies consistently and affirmatively represent that they act in a socially and ethically responsible manner.”

The class action suits seek both monetary damages for California residents who have purchased the chocolate and revised packaging that denotes child slaves were used. It’s a new approach to an old problem: the chocolate industry’s deep, dark, not-so-secret scandal. It’s been 15 years since the first allegations of child slavery in the chocolate industry caused national outrage. Will this be the final straw?

***

West Africa is home to two-thirds of the world’s cacao beans (cocoa), the main ingredient in chocolate—a product that’s fueled a $90 billion industry.

The first group to question the financial strategies behind the industry’s wealth was a British organization called True Vision Entertainment. In a shocking 2000 documentary titled Slavery: A Global Investigation, the group reported on the chocolate industry’s alleged connection to cocoa harvested by child slaves.The award-winning film opens on stick-thin adolescent boys in the Ivory Coast slinging hundred-pound bags of cocoa pods on their backs, followed by an interview in which the boys express their confusion over not being paid.

Later the filmmakers meet with 19 children who were said to have just been freed from slavery by the Ivorian authorities. Their guardian describes how they worked from dawn until dusk each day, only to be locked in a shed at night where they were given a tin cup in which to urinate. During the first six months (the “breaking-in period”), they say, they were routinely beaten. “The beatings were a part of my life,” says Aly Diabata, one of the former child laborers. “I had seen others who tried to escape. When they tried, they were severely beaten.”

The boys’ stories are sickeningly graphic. Before beatings, the boys say they were stripped naked and tied up. They were then pummeled with a variety of weapons, from fists and feet to belts and whips. In the film, some of the boys get up and imitate the beatings. Others stand to reveal hundreds of scars lining their backs and torsos—some still bloody and scabbed. They get quiet when the filmmakers ask whether any are beaten today and say some are simply “taken away.”

Asked what he’d say to the billions who eat chocolate worldwide (most of the boys have never tried it), one boy replies: “They enjoy something I suffered to make; I worked hard for them but saw no benefit. They are eating my flesh.” Toward the end of the segment, the filmmakers meet with one of the “slave masters,” who admits he purchased the young boys and that some of his men routinely beat them. His reasoning: He is paid a low price for the cocoa and thus needs to harvest as much of it as he possibly can.

The release of the film in late 2000 sparked national outrage. No one seemed more shocked than the chocolate companies themselves. In June 2001, Hershey senior vice president Robert M. Reese told Philadelphia Inquirer reporter Bob Fernandez that “no one, repeat, no one, had ever heard of this.” After internal investigations, several companies, including Hershey, expressed concern over the conditions of laborers in West Africa.

The news made its way to Congress, where U.S. Rep. Eliot Engel quickly drafted legislation asking the Federal Drug Administration to introduce “slave free” labeling. After gaining approval in the House of Representatives, the bill moved to a vote in the Senate, where it had the support needed to win passage. But just before the legislation made it to a vote, the chocolate industry stepped in with a promise it has yet to keep: to self-regulate and eradicate the practice by 2005.

The Engel-Harkin Protocol (or Cocoa Protocol), as the agreement was called, was signed in September 2001.

Eight companies—including Nestle, Mars, and Hershey—were signatories of the massive accord, pledging $2 million to investigate the labor practices and eliminate the “Worst Forms of Child Labor,” the official term from the International Labor Organization, by 2005. When the July 2005 deadline arrived with the industries yet to make major changes, an extension was granted until 2008.

When the next deadline came and went, a new proposal arose. By 2010, the companies basically started anew with a treaty called The Declaration of Joint Action to Support Implementation of the Harkin-Engel Protocol. This document pledges to reduce the worst forms of child labor by 70 percent across the cocoa sectors of Ghana and Ivory Coast by 2020.

In the 15 years since the documentary sparked outrage, there are more child laborers in the cocoa industry than ever before. The companies have not only failed to stop the “worst forms of child labor”; they’ve seemingly made it worse. A report released on July 30, 2015, from the Payson Center for International Development of Tulane University and sponsored by the U.S. Department of Labor found a 51 percent increase in the number of children working in the cocoa industry in 2013-14, compared to the last report in 2008-09. The number, they found, now totals 1.4 million. Those living in slave-like conditions increased 10 percent from the 2008-09 results, now totaling 1.1 million. The study concludes that while “some progress has been made,” the goal of reducing the number of children in the industry had “not come within reach.”

The California plaintiffs’ false-advertising claims against Nestle, Hershey, and Mars are the latest effort to pressure the chocolate industry to fix a problem it has known about for more than a decade. “Children that are sometimes not even 10 years old carry huge sacks that are so big that they cause them serious physical harm,” the complaint alleges. “Much of the world’s chocolate is quite literally brought to us by the back-breaking labor of child slaves.”

The complaint goes into detail about the lives of the estimated 4,000 children allegedly working in forced labor conditions harvesting cocoa in the Ivory Coast. Many of the children are sold into slavery, some for less than $30; others are kidnapped or tricked into thinking it’s a real job, the complaint alleges. Once there, the children are allegedly trapped on isolated farms, threatened with physical abuse, required to work when they are sick, and denied sufficient food.

While the plaintiffs mention each company’s individual pledges to tackle the problem of child labor, they consider these promises to be “false assurances” that have done little to solve the problem. As long as the companies allegedly continue to use child slaves, the plaintiffs say they believe consumers have the right to know.

In the eyes of Miki Mistrati, an award-winning documentary filmmaker who released a movie on the subject in 2014, Shady Chocolate, the lawsuit may help, but it won’t be the answer. “There is no doubt that a campaign about the reality in chocolate production will harm the chocolate companies,” Mistrati said. “Modern slavery with children is a part of the chocolate industry today. But I do not think that it can be the real game changer.”

Mistrati, who consulted with UNICEF and the U.S. Department of Labor, among others, for his movie, said he witnessed child slave labor firsthand—and believes it can be stopped quickly. “Mars, Hershey, and Nestle have had every opportunity to stop the trafficking of children and illegal child slaves,” he said. “I have seen small children, 6 years old, being trafficked from Mali to Ivory Coast. It was so heartbreaking to watch. But the companies have not had the will to end it for many years. Only empty words and expensive advertising instead of using money to pay back to the children on the ground in West Africa.”

Mistrati stressed the importance of Americans taking at least part of the blame. “Consumers have not been critical enough,” he said. “They have not asked why a chocolate bar only costs $1 when the cocoa comes from Africa. Customers have been too easy to trick with smart ads. It is over now. This trial is a unique opportunity for the world to see how their chocolate is produced and why it is so cheap.”

***

Nestle responded quickly to a request for comment on the allegations, calling the lawsuit “without merit” and claiming that “proactive and multi-stakeholder efforts” are necessary to eradicate child labor, not lawsuits. Of the three chocolate makers, Nestle appears to be taking the lead in fighting child labor. The company is the first cocoa purchaser to set up a system for tackling the problem, with concrete measures in place.

The company’s more than $100 million action plan involves building a child labor monitoring and remediation system to identify children at risk, enable farmers to run profitable farms, and improve the lives of cocoa farming communities. “Child labor has no place in our cocoa supply chain,” a spokesperson from Nestle told The Daily Beast. “We are taking action to progressively eliminate it by assessing individual cases and tackling the root causes.”

Mars representatives echoed Nestle’s sentiments on child slave labor, saying the company “shares the widely held view that child labor and trafficking is abhorrent and rooted in complex economic, political, and social issues.” In an official statement to The Daily Beast, the company said it was “committed to being part of the solution.”

At the moment, that solution seems vague. The company points to “Vision for Change,” an initiative it launched in 2012 that, according to its website, is meant to “achieve sustainable cocoa production” and “address farmer productivity and community issues.” Mars mentions that it has built 16 Cocoa Development Centers and 52 Cocoa Village Centers in the Ivory Coast, where farmers are taught how to manage their land and crops efficiently. How it specifically targets child labor is unclear.

Steve Berman, managing partner at Hagens Berman, the law firm representing the plaintiffs, confirmed that Nestle seems to have launched the most tangible program but said it has yet to yield results. “They claim they’ve been taking steps. They partner with the Fair Labor Association to investigate, and they claim they’re committed to eradicating it, but the fact is the recent reports show the number of children in the cocoa industry has increased,” Berman told The Daily Beast. “We doubt that Nestle is taking this very seriously.”

“The consumers reaching out to our firm have been outraged to learn that the candy they enjoy has a dark, bitter production cost—that child and slave labor have been a part of Nestle, Mars, and Hershey’s chocolate processing,” said Berman. “These companies fail to disclose their use of child and forced labor, tricking consumers into indirectly supporting the use of such labor.”

Berman added that he believes Mars, Nestle, and Hershey’s failure to eradicate child labor in the cocoa trade boils down to one thing: “cheap labor; dirt cheap.”

After interviewing Hershey about the 2000 documentary for the Philadelphia Inquirer, Fernandez decided to pursue a book on the company’s trust. That book, The Chocolate Trust, was released in June. In the final chapter, he remarks on the oddity of a company with roots in child welfare making its billions on the backs of child laborers.

But it’s the 15-year gap that most baffles Fernandez, who remembers being shocked by the initial revelations. The fact that alleged child slavery persists to this day seems almost too difficult to believe. “The thing is the industry said it would solve it in 2001; then they said they’d do it by 2005,” he told The Daily Beast, before asking the pivotal question: “What happened?"

Update: Hershey sent The Daily Beast the following comment:

At Hershey, we are committed to the ethical and responsible sourcing of all of our product ingredients and have no tolerance for illegal practices, including children used as forced labor in cocoa farming.The allegations in the lawsuit are not new and reflect long-term challenges in cocoa-growing countries that many stakeholders, including NGOs, companies in the cocoa supply chain and the U.S Government have been working diligently together to address for a number of years. Poverty is a fundamental issue in the cocoa-growing region of West Africa, and companies across the entire cocoa supply chain have been actively involved in substantial initiatives to improve the economic, social and labor conditions in these cocoa-growing communities.

Hershey is proud of the cocoa sustainability and farmer training programs we have established through NGOs and other partners in West Africa during the past few years. We have begun to see success from these programs. This includes programs in Cote d’Ivoire that are now beginning to take hold after years of political unrest that had hampered progress there until recently. From the work the industry has undertaken in recent years, it is clear that addressing the challenges will require an aligned and sustained focus from all stakeholders, including the cocoa industry, local governments, and NGOs and non-profit groups. That’s why CocoaAction, the industry response being led through the World Cocoa Foundation (WCF), is so important. These aligned efforts are aimed at accelerating sustainability and improving the livelihoods and social conditions of cocoa communities in Ghana and Cote d’Ivoire.

The cocoa industry, including Hershey, will invest more than $400 million in West Africa by 2020 to accelerate both the supply of certified cocoa and reduce instances of inappropriate labor by investing in better cocoa communities. These industry-wide efforts seek to reduce the occurrence of inappropriate farming practices that involve the use of children by reaching tens of thousands of farmers and their families in cocoa-growing areas, educating farmers about the risks and dangers of child labor, and training farmers and professionals to safely manage riskier tasks in which children have previously been involved. The combined and focused effort of the entire industry and other stakeholders is a very encouraging and positive development.

#child slavery#cocoa#hersheys#stop child slavery for candy#cocoa industry slavery#ghana#cote d'ivorie

13 notes

·

View notes

Text

Wooden Furniture Market Size, Share, Trends, Opportunities, Key Drivers and Growth Prospectus

"Global Wooden Furniture Market – Industry Trends and Forecast to 2030

Global Wooden Furniture Market, Product Type (Hardwood, Softwood), Application (Residential, Commercial), Distribution Channel (Retail, Mass Market Players, Furniture Store, Monobrand Furniture Stores, Online) – Industry Trends and Forecast to 2030.

Access Full 350 Pages PDF Report @

Highlights of TOC:

Chapter 1: Market overview

Chapter 2: Global Wooden Furniture Market

Chapter 3: Regional analysis of the Global Wooden Furniture Market industry

Chapter 4: Wooden Furniture Market segmentation based on types and applications

Chapter 5: Revenue analysis based on types and applications

Chapter 6: Market share

Chapter 7: Competitive Landscape

Chapter 8: Drivers, Restraints, Challenges, and Opportunities

Chapter 9: Gross Margin and Price Analysis

Core Objective of Wooden Furniture Market:

Every firm in the Wooden Furniture Market has objectives but this market research report focus on the crucial objectives, so you can analysis about competition, future market, new products, and informative data that can raise your sales volume exponentially.

Size of the Wooden Furniture Market and growth rate factors.

Important changes in the future Wooden Furniture Market.

Top worldwide competitors of the Market.

Scope and product outlook of Wooden Furniture Market.

Developing regions with potential growth in the future.

Tough Challenges and risk faced in Market.

Global Wooden Furniture top manufacturers profile and sales statistics.

Regional Analysis for Wooden Furniture Market:

APAC (Japan, China, South Korea, Australia, India, and Rest of APAC; Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania)

North America (U.S., Canada, and Mexico)

South America (Brazil, Chile, Argentina, Rest of South America)

MEA (Saudi Arabia, UAE, South Africa)

Browse Trending Reports:

Spinocerebellar Ataxias Scas Market Johanson Blizzard Syndrome Market Steel Drums And Intermediate Bulk Containers Reduce Re Use And Recycle Market Diet Candy Market Date Palm Market Plant Based Functional Food Ingredients Market Glucose Syrup Market Picks Disease Treatment Market Vermouth Market Over The Counter Probiotic Supplements Market Motorcycle Market Heat Stabilizers Market Impotence Agents Market Fiber Drums Market Cereals And Grains Processing Market Soil Ph Adjusters Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]"

0 notes

Text

Dried Banana Market: Global Industry Analysis and Forecast 2031 | Market Strides

Dried Banana Market

The latest study released on the Global Dried Banana Market by Market Strides, Research evaluates market size, trend, and forecast to 2032. The Dried Banana Market consider covers noteworthy inquire about information and proofs to be a convenient asset record for directors, investigators, industry specialists and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, openings and up and coming challenges and approximately the competitors.

Some of the key players profiled in the study are:

Three Squirrels

BESTORE

Haoxiangni

Bergin Fruit and Nut Company

Brothers All Natural

Hamiform

Gin Gin & Dry

THrive Life

Natierra

Green Day

Treelife Asia

Seeberger

Murray River Organics

Get Free Sample Report PDF @ https://marketstrides.com/request-sample/dried-banana-market

Scope of the Report of Dried Banana Market :

The report also covers several important factors including strategic developments, government regulations, market analysis, and the profiles of end users and target audiences. Additionally, it examines the distribution network, branding strategies, product portfolios, market share, potential threats and barriers, growth drivers, and the latest industry trends.

Keep yourself up-to-date with latest market trends and changing dynamics due to COVID Affect and Economic Slowdown globally. Keep up a competitive edge by measuring up with accessible commerce opportunity in Dried Banana Market different portions and developing territory.

The titled segments and sub-section of the market are illuminated below:

By Type

Dried Banana Long

Dried Banana Slice

By Application

Direct Consumption

Candy and Snacks

Others

Get Detailed@ https://marketstrides.com/report/dried-banana-market

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

• The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

• North America (United States, Mexico & Canada)

• South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

• Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

• Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Objectives of the Report:

•To carefully analyze and forecast the size of the Dried Banana Market by value and volume.

• To estimate the market shares of major segments of the Dried Banana Market

• To showcase the development of the Dried Banana Market in different parts of the world.

• To analyze and study micro-markets in terms of their contributions to the Dried Banana Market, their prospects, and individual growth trends.

• To offer precise and useful details about factors affecting the growth of the Dried Banana Market

• To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Dried Banana Market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches.

Key questions answered:

• How feasible is Dried Banana Market for long-term investment?

• What are influencing factors driving the demand for Dried Banana Market near future?

• What is the impact analysis of various factors in the Global Dried Banana Market growth?

• What are the recent trends in the regional market and how successful they are?

Buy Dried Banana Market Research Report @ https://marketstrides.com/buyNow/dried-banana-market

The market research report on the Global Dried Banana Market has been thoughtfully compiled by examining a range of factors that influence its growth, including environmental, economic, social, technological, and political conditions across different regions. A detailed analysis of data related to revenue, production, and manufacturers provides a comprehensive view of the global landscape of the Dried Banana Market. This information will be valuable for both established companies and newcomers, helping them assess the investment opportunities in this growing market.

Region Included are: Global, North America, Europe, APAC, South America, Middle East & Africa, LATAM.

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

At long last, Dried Banana Market is a important source of direction for people and companies.

Thanks for reading this article; you can also get region wise report version like Global, North America, Europe, APAC, South America, Middle East & Africa, LAMEA) and Forecasts, 2024-2032

About Us:

Market Strides, a leading strategic market research firm, makes a difference businesses unquestionably explore their strategic challenges, promoting informed decisions for economical development. We give comprehensive syndicated reports and customized consulting services. Our bits of knowledge a clear understanding of the ever-changing dynamics of the global demand-supply gap across various markets.

Contact Us:

Email: [email protected]

#Dried Banana Market Size#Dried Banana Market Share#Dried Banana Market Growth#Dried Banana Market Trends#Dried Banana Market Players

0 notes

Text

United States Candy : An Immensely Popular Sweet Business

The history of candy in America dates back to the colonial period. Early settlers first started making candy during the Revolutionary War era using homegrown ingredients like nuts, molasses, honey and maple syrup. Candy making then evolved into commercial production during the 19th century industrial revolution when companies like Brach's, Cracker Jack and Life Savers were founded. The 1920s saw even more innovation as new candy machines automated production and chocolate candy became widely popular. By the 1930s, candy was being mass produced on assembly lines and regional candy companies expanded nationally. After World War 2, American confectioners consolidated to become the large multi-national brands consumers know today.

Current Size And Growth

The United States Candy is valued at over $37 billion today according to estimates. The has grown steadily each year, rising over 3% annually on average. Regionally, the western states account for over 25% of total U.S. candy sales while the south remains a key consumer region as well. Per capita candy consumption averages over 25 pounds per person each year, higher than many other countries. Seasonally, Halloween and Valentine's Day are the candy 's biggest holidays while Easter ranks third in overall seasonal sales.

Leading Companies

The top three candy companies globally are all American- Mars, Hershey and Mondelez. Mars commands over a 20% share with well-known brands like M&Ms, Snickers, Twix and Skittles. Hershey has been the iconic American chocolate brand for over a century with Hershey's Kisses, Reese's and Almond Joy among its signature products. Mondelez, formerly Kraft Foods, owns global brands like Cadbury, Toblerone and Halls while sour patch kids and other candy remain major sellers. Lindt, Ferrero and Nestle round out the top international candy players competing in the crowded U.S. .

Product Segments

Chocolate remains Americans' most popular candy comprising about 25% of total yearly sales. Seasonal Halloween and Christmas candies have grown exponentially, nearly doubling in sales over the past decade to over $4 billion annually sources report. Sugar confections like Skittles, Starbursts and Sweetarts continue strong multi-billion dollar yearly sales. Hard candy options from Lifesavers, Dum Dum lollipops, and Jolly Ranchers maintain appeal with both children and adults as portable treats. Novelty and licensed candies tie into popular movies, shows and characters each year and significantly boost seasonal sales. Gummy and jelly candies like gummy bears also generate hundreds of millions in annual revenue.

Distribution Channels

Most United States Candy is sold through grocery, drug, mass merchandisers and convenience stores who stock seasonal and everyday assortments near checkout aisles and high traffic areas. Valentine's Day and Halloween seasonal sets, boxes and bags specifically designed for gifting and trick or treating hugely ramp up sales for retailers during those peak periods. Traditional candy shops and specialty outlets remain popular local destinations, particularly for chocolate and novelty items. Online shopping is growing exponentially as well for bulk candy, specialty items and merchandise tied to favorite brands. Wholesalers like Candies Depot and Myers Candy distribute to small and large retailers nationwide.

Strategies

Digital and social media has become a primary ing channel for larger candy makers. Company websites highlight seasonal promotions and new product launches while maintaining highly interactive presences across Facebook, YouTube, Instagram and more. Television advertising still generates brand awareness especially around major holidays, supported by point-of-sale materials and displays retailers provide. Licensed partnerships with movies, games and influencers expand brand reach to new audiences year-round. Tying into trending flavors like sour and novelty shapes keeps products feeling fresh. Sample giveaways, contests and branded cross promotions boost trial. Significant ongoing R&D ensures innovation keeps the exciting and growing for years ahead.

Get more insights on this topic: https://www.trendingwebwire.com/united-states-candy-a-sweet-delight-across-america/

Author Bio:

Alice Mutum is a seasoned senior content editor at Coherent Insights, leveraging extensive expertise gained from her previous role as a content writer. With seven years in content development, Alice masterfully employs SEO best practices and cutting-edge digital ing strategies to craft high-ranking, impactful content. As an editor, she meticulously ensures flawless grammar and punctuation, precise data accuracy, and perfect alignment with audience needs in every research report. Alice's dedication to excellence and her strategic approach to content make her an invaluable asset in the world of insights. (LinkedIn: www.linkedin.com/in/alice-mutum-3b247b137 )

*Note: 1. Source: Coherent Insights, Public sources, Desk research 2. We have leveraged AI tools to mine information and compile it

0 notes

Text

Food Packaging Market Size To Reach USD 562.3 Billion By 2030

Food Packaging Market Growth & Trends

The global food packaging market size is expected to reach USD 562.3 billion by 2030, expanding at 5.7% CAGR from 2023 to 2030, according to a new report by Grand View Research, Inc. Increased diverse eating habits and lifestyle changes have driven the demand for convenience food products which is expected to bolster the growth of the global food packaging industry.

The food packaging industry exhibits rapid growth for portable and single-serve food packs. Rising global per capita income is expected to increase the purchasing power of buyers further driving the demand for packaged foods products. Although real wages witnessed a decline in 2022, according to the Observatory of Economic Complexity (OECD), by the end of 2023, real wages are projected to stop declining. This is attributed to the extensive rollout of support initiatives by governments across the globe to cushion the effects of food prices and high energy on households. This is expected to increase the consumer spending capacity thereby driving the demand for packaged food & beverages.

The high volatility observed in the prices of raw materials is expected to restrain the food packaging industry's growth. However, the introduction of sustainable packing materials by major food packaging manufacturers, coupled with increasing awareness and notable consumption volume by buyers, is expected to propel the food packaging industry over the forecast period.

Growing concerns regarding food safety and contamination are predicted to support the demand for effective packaging solutions. In addition, sales of packaged foodstuff are anticipated to propel due to the increasing number of retail food chains opened by big food brands, consequently driving demand for packaging material. The surge in demand for food delivery services such as Uber Eats, Zomato, DoorDash, and Grubhub among others is also expected to have a positive impact on the food packaging industry.

The growing food sector has attracted food packaging manufacturers to invest in increasing their production capacities. For instance, in April 2023, UAE-based Hotpack Global announced its intent to build a specialized food packaging project in Saudi Arabia. The project is expected to be valued at USD 266.0 million and will be developed jointly with the Saudi Ministry of Industry.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/food-packaging-market

Food Packaging Market Report Highlights

Flexible packaging is expected to register the highest CAGR of 6.3% in terms of revenue from 2023 to 2030, owing to its cost-effectiveness, high performance, and constant innovations undertaken by major manufacturers

Paper & paper-based packaging is estimated to be the fastest growing segment, exhibiting a CAGR of 6.4% from 2023 to 2030, owing to its low cost and sustainability

The bakery and confectionary segment is anticipated to be the largest application, which recorded a market value of USD 100.6 billion in 2022, due to growing demand for cakes, candies, and frozen ready-to-eat bakery products

Asia Pacific is expected to dominate the food packaging industry in 2022 and is expected to continue its dominance on account of a growing population, increasing urbanization, and rising disposable income of consumers

The food packaging industry is highly fragmented and is characterized by the presence of a large number of players. Key players comprise Amcor Plc., Ball Corporation, Berry Plastic Group, and DS Smith PLC

In May 2023, Amcor plc inked a definitive agreement to acquire New Zealand-based Moda Systems. This acquisition is expected to help Amcor expand its existing film portfolio and offer an end-to-end packaging solution incorporating even the sales of packaging machines

Food Packaging Market Segmentation

Grand View Research has segmented the global food packaging market based on type, material, application, and region:

Food Packaging Type Outlook (Revenue, USD Billion, 2018 - 2030)

Rigid

Semi-rigid

Flexible

Food Packaging Material Outlook (Revenue, USD Billion, 2018 - 2030)

Paper & Paper-based Material

Plastics

Metal

Glass

Others

Food Packaging Application Outlook (Revenue, USD Billion, 2018 - 2030)

Bakery & Confectionary

Dairy Products

Fruits & Vegetables

Meat, Poultry & Seafood

Sauces & Dressings

Others

Food Packaging Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

Europe

Asia Pacific

Central & South America

Middle East & Africa

List of Key Players in the Food Packaging Market

Amcor plc

Sealed Air

Sonoco Products Company

Berry Global, Inc.

WestRock Company

Mondi

Genpak LLC

Pactiv LLC

Chantler Packages

WINPAK LTD.

Alpha Packaging

BE Packaging

Cheer Pack North America

Evanesce Packaging Solutions Inc.

Pacmoore Products Inc.

Innovative Fiber

Emmerson Packaging

PakTech

Tradepak

ProAmpac

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/food-packaging-market

#Food Packaging Market#Food Packaging Market Size#Food Packaging Market Share#Food Packaging Market Trends

0 notes

Text

Sorbitol Market Size Worth $2.80 Billion By 2030 | CAGR 6.7%

The global sorbitol market size is expected to reach USD 2.80 billion by 2030, as per the new report by Grand View Research, Inc. It is expected to expand at a CAGR of 6.7% from 2023 to 2030. The increasing awareness regarding the health and digestive benefits associated with digestive health supplements, the rising geriatric population, increasing demand for non-medical dietary supplements, and technological advancements in the processing of these products are driving the demand for sorbitol-based products, consequently aiding the growth of the market over the forecast period.

The market growth is expected to be fueled by the increasing demand for the product for use in the manufacturing of various food and beverages, such as fruit juice, candies, and chocolates. Moreover, vitamin C is synthesized using sorbitol as the product is one of the building blocks in the manufacturing process. Vitamin C is also used for the production of dietary supplements, which is expected to grow at a high rate over the forecast period, resulting in the high growth of the market. The rise in the number of gym-goers, coupled with the increasing awareness regarding health and fitness, has positively affected the demand for nutritional drinks and thus has increased the demand for specialty ingredients across the world.

The liquid product segment dominated the market in 2022. It is used in the production of candy to increase its chewy texture and softness. Liquid sorbitol is also finding new applications in the tobacco market as it is added to chewing tobacco to enhance its flavor. The growing applications of liquid sorbitol are expected to be helpful in the growth of the segment over the forecast period. The crystal product segment is anticipated to witness significant growth from 2023 to 2030. Crystal sorbitol is used in numerous cosmetic products, such as moisturizers and face creams, in the form of humectant due to its resistance to bacteriological degradation and ability to retain moisture. The growing demand for cosmetic products is expected to impact the market growth positively over the forecast period.

The food end-use segment dominated the market in 2022. Sorbitol is majorly used as a sweetener and a low-calorie sugar substitute in the food and beverage industry. In addition to providing sweetness, sorbitol also acts as an excellent texturizing and anti-crystallization agent in the production of ice cream and bakery products. The growth of the food end-use segment is also attributed to rising product utilization in the production of diabetic food products. Efficiency in operation and product innovation are expected to drive the market. Fast-paced lifestyle and increased preference for convenience food are presumed to be some of the major drivers of the food processing sector, resulting in the growth in demand for sorbitol.

Factors such as advancements in nutrition and technology, growing consumer inclination toward improved health and longevity, and increasing frequency of exercising in modern lifestyles are expected to contribute to the augmented consumption of fiber-rich, organic, and gluten-free foods. This is expected to boost the consumption of sorbitol in the production of fiber-rich and gluten-free food products, thereby driving the market.

The companies are developing a broad range of products to cater to the requirements of different application industries and boost sales growth, thereby leading to the development of a diversified product portfolio. This, in turn, is expected to aid the companies to target different market segments and also improve brand equity.

Major companies in the market own several trademarks and patents, which emerge as valuable assets for the company. These patents and trademarks offer an important competitive edge to companies. These patents also witness the streams of new inventions generated by the companies, which are expected to enhance customer satisfaction and contribute to strengthening customer relationships. These patents also improve brand equity as well as the financial performance of the companies operating in the market. Over the forecast period, sorbitol is therefore expected to see an increased number of applications in the food and beverage industry.

Request a free sample copy or view report summary: Sorbitol Market Report

Sorbitol Market Report Highlights

By product, liquid accounted for the largest share in terms of revenue as well as volume in 2022. The product is preferred over other substitute products as it is non-carcinogenic and has a pleasant and sweet taste

The crystal product segment is expected to expand at the highest growth rate over the forecast period. Crystal sorbitol is used as a plasticizer in the manufacturing of capsule outer shell and as an excipient and filler in the production of pharmaceutical capsules

The vitamin C application segment is expected to register the highest growth rate over the forecast period owing to its increasing use in functional foods and dietary supplements

The food end-use segment held the largest market share in terms of revenue and volume in 2022. The food processing industry across the world is expected to witness a boost in sales owing to the increased consumer preferences in terms of variety of products as well as quality

Companies operating in the market are continuously involved in the enhancement of the quality of products and the companies keep introducing new products with advanced features that are competitive in both performance and prices

Sorbitol Market Segmentation

Grand View Research has segmented the global sorbitol market report based on product, application, end-use, and region:

Sorbitol Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

Liquid

Crystal

Sorbitol Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

Oral Care

Vitamin C

Diabetic & Dietetic Food & Beverages

Surfactant

Others

Sorbitol End-use Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

Personal Care

Chemical

Food

Pharmaceutical

Others

Sorbitol Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

U.K.

France

Asia Pacific

China

India

Japan

Australia

Thailand

Central & South America

Brazil

Middle East & Africa

Saudi Arabia

List of Key Players of Sorbitol Market

American International Foods, Inc.

ADM

Cargill Incorporated

DuPont

Gulshan Polyols Ltd.

Merck KGaA

Ecogreen Oleochemicals GmbH

Qinhuangdao Lihua Starch Co., Ltd.

Roquette Frères

SPI Pharma

Tereos

Ingredion Incorporated

Kasyap Sweeteners, Ltd.

0 notes

Text

Food Coating Market Detailed Analysis and Forecast 2024–2030

The Food Coating Market was valued at USD 3.5 billion in 2023 and will surpass USD 5.1 billion by 2030; growing at a CAGR of 5.5% during 2024 - 2030. Among these changes, the food coating market has witnessed rapid growth, driven by the increasing preference for convenience foods, the need for extended shelf life, and the growing focus on enhancing food aesthetics and texture.

Understanding Food Coatings

Food coatings are substances applied to food products to enhance their appearance, texture, taste, and shelf life. They play a crucial role in various food categories, including bakery, confectionery, meat, seafood, snacks, and ready-to-eat meals. Coatings can be applied in various forms, such as batters, breadings, or even edible films, depending on the desired outcome.

Get a Sample Report: https://intentmarketresearch.com/request-sample/food-coating-market-3645.html

Types of Food Coatings

Batter Coatings: These are typically flour-based mixtures used to coat foods before frying or baking. Batter coatings provide a crispy texture and help retain moisture, making them popular in products like fried chicken, onion rings, and tempura.

Breading Coatings: These are dry mixtures of flour, crumbs, or flakes applied to food products after they have been dipped in a batter or liquid. Breading adds an extra layer of crunch and flavor, commonly seen in products like breaded fish fillets or chicken nuggets.

Chocolate and Confectionery Coatings: Used in the bakery and confectionery sectors, these coatings enhance the visual appeal and taste of products like cakes, pastries, and candies. They also provide a protective barrier that extends the product's shelf life.

Edible Films: These coatings are made from polysaccharides, proteins, or lipids and are used to encase or coat foods, offering protection from moisture, oxygen, and contaminants while being safe for consumption. They are often used in the packaging of fruits, vegetables, and cheeses.

Market Drivers

Several factors are fueling the growth of the food coating market:

Rising Demand for Processed and Convenience Foods: The modern consumer’s lifestyle has increased the demand for ready-to-eat and easy-to-prepare foods. Food coatings are essential in these products to maintain quality and enhance taste and texture.

Health and Wellness Trends: There is a growing trend towards healthier eating, leading to innovations in low-fat, gluten-free, and organic food coatings. These cater to health-conscious consumers while still offering the desirable taste and texture of coated foods.

Technological Advancements: The development of new coating technologies and ingredients has led to improved product quality, longer shelf life, and enhanced visual appeal, making coated foods more attractive to consumers.

Globalization of Food Culture: The global exchange of food cultures has introduced consumers to a variety of coated foods from different cuisines, such as tempura from Japan or schnitzel from Germany. This cultural exchange has broadened the market for food coatings worldwide.

Challenges in the Food Coating Market

While the food coating market is growing, it is not without challenges:

Regulatory Compliance: The food industry is heavily regulated, and food coatings must meet stringent safety standards. This can be challenging, especially when using new or innovative ingredients.

Cost and Resource Management: The cost of raw materials for food coatings can be high, and managing these costs while maintaining profitability is a challenge for manufacturers.

Consumer Preferences: As consumers become more health-conscious, there is increasing demand for clean-label products with natural ingredients. This requires continuous innovation to develop coatings that meet these preferences without compromising on quality or taste.

Get an insights of Customization: https://intentmarketresearch.com/ask-for-customization/food-coating-market-3645.html

Future Outlook

The future of the food coating market looks promising, with continued growth expected across various sectors. Innovations in healthier coatings, such as those with reduced fat content or those made from alternative ingredients like plant proteins, will likely drive future demand. Additionally, the growing trend of sustainability in food production may lead to the development of coatings that are not only edible but also environmentally friendly.

The food coating market is poised for significant growth, driven by evolving consumer preferences and technological advancements. As the industry continues to innovate and adapt, food coatings will remain a vital component in the global food supply chain, enhancing the quality, safety, and appeal of food products around the world.

0 notes

Text

Synthetic Food Colors Market Forecast and Analysis Report (2023-2032)

The Synthetic Food Colors market is projected to grow from USD 672.66 million in 2024 to USD 1014.45 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.27%.

Synthetic food colors are widely used in the food and beverage industry to enhance the appearance of products, making them more visually appealing to consumers. These colors are chemically synthesized from petroleum-based raw materials and are typically more vibrant and consistent than natural food colors, which has led to their widespread adoption in various applications such as candies, beverages, baked goods, and processed foods. The use of synthetic food colors is driven by several factors, including cost-effectiveness, stability, and the ability to produce a broad spectrum of vivid colors that are difficult to achieve with natural alternatives.

However, the safety and health effects of synthetic food colors have been a topic of debate for many years. Some studies have linked certain synthetic dyes, such as Red 40 and Yellow 5, to hyperactivity and other behavioral issues in children, as well as potential allergic reactions. These concerns have led to increased scrutiny and regulatory actions in various countries, with some banning specific synthetic dyes or requiring warning labels on products containing them.

Despite these concerns, synthetic food colors remain prevalent in the global market, especially in regions where regulations are less stringent. The industry continues to innovate, developing new formulations that aim to address safety concerns while maintaining the desirable properties that have made synthetic food colors a staple in modern food production. As consumer awareness and demand for natural ingredients grow, the future of synthetic food colors may see a shift towards more sustainable and health-conscious alternatives, though their complete replacement is not yet imminent due to the significant advantages they offer in terms of cost and performance.

Here are the key dynamics of the Synthetic Food Colors Market in points:

High Demand for Vibrant Colors: Synthetic food colors are preferred for their ability to produce bright, consistent, and diverse hues, which are crucial for the visual appeal of products, particularly in the confectionery, beverage, and processed food sectors.

Cost-Effectiveness: Compared to natural alternatives, synthetic food colors are more economical, offering cost benefits to manufacturers, especially in mass production.

Health Concerns: Growing consumer awareness about the potential health risks of synthetic food colors, such as hyperactivity in children and allergic reactions, is driving demand for natural and safer alternatives.

Regulatory Pressures: Increasingly stringent regulations in regions like North America and Europe regarding the use of certain synthetic dyes are impacting market growth, pushing manufacturers to reformulate products.

Technological Innovations: Advancements in synthetic color formulations are focusing on improving safety, stability, and deriving colors from less controversial sources, providing opportunities for market growth.

Clean Label Movement: The rising trend of clean label products, where consumers prefer transparency and fewer synthetic ingredients, is challenging the synthetic food color market but also driving innovation.

Regional Disparities: While developed regions like North America and Europe are shifting towards natural colors, emerging markets in Asia-Pacific and Latin America continue to show strong demand for synthetic colors due to urbanization and growing processed food industries.

Brand Differentiation: The ability of synthetic food colors to offer unique and striking visual characteristics plays a key role in product differentiation, helping brands stand out in competitive markets.

Supply Chain and Sourcing: The reliance on petroleum-based raw materials for synthetic food colors presents potential challenges related to supply chain volatility and environmental concerns.

Consumer Preferences: Changing consumer preferences towards health and sustainability are influencing the market, requiring manufacturers to balance the demand for synthetic colors with the growing appeal of natural ingredients.

Key Player Analysis

San-Ei Gen F.F.I., Inc.

Hansen Holding A/S

Kalsec Inc.

Denim Colourchem (P) Limited

DIC Corporation (BASF SE)

Nature S.A.

Symrise AG

Sensient Colors LLC.

Döhler Group

Vinayak Ingredients India Pvt Ltd.

BioconColors

Allied Biotech Corporation

ROHA (A JJT Group Company)

DSM

DDW, The Color House

Archer Daniels Midland Company

GNT International B.V.

More About Report- https://www.credenceresearch.com/report/synthetic-food-colors-market

Here are the regional insights for the Synthetic Food Colors Market:

North America:

Trend Toward Natural Alternatives: The North American market is seeing a gradual shift towards natural food colors due to increasing consumer awareness of potential health risks associated with synthetic dyes. Regulatory bodies like the FDA are closely monitoring and controlling the use of certain synthetic colors, further influencing this shift.

Market Saturation: Despite this trend, synthetic colors remain widely used, particularly in the processed foods, snacks, and beverages sectors, where cost-effectiveness and consistency are critical.

Europe:

Stringent Regulations: Europe has some of the strictest regulations regarding synthetic food colors, with the EU mandating clear labeling and, in some cases, banning specific synthetic dyes. This has accelerated the adoption of natural alternatives.

Consumer Health Awareness: European consumers are highly health-conscious, driving demand for clean-label products, which in turn is reducing the market share of synthetic food colors in favor of natural options.

Asia-Pacific:

Growing Processed Food Industry: The Asia-Pacific region, particularly countries like China and India, is witnessing rapid growth in the processed food and beverage industry. This is driving the demand for synthetic food colors due to their cost-effectiveness and ability to produce vibrant colors.

Less Stringent Regulations: Compared to North America and Europe, regulations regarding synthetic food colors are less stringent in Asia-Pacific, contributing to their widespread use in the region.

Latin America:

Economic Considerations: In Latin America, synthetic food colors are popular due to their affordability and effectiveness, particularly in the confectionery and beverage industries. Economic factors often take precedence over health concerns in this region.

Gradual Shift: There is a slow but growing trend towards natural food colors, driven by increasing consumer awareness and gradual changes in regulations.

Middle East & Africa:

Emerging Market: The Middle East and Africa represent emerging markets for synthetic food colors, with increasing urbanization and a growing food processing sector driving demand.

Regulatory Environment: The regulatory environment in this region is still developing, with fewer restrictions compared to more mature markets, allowing for broader use of synthetic colors.

Global Trends:

Polarized Market: Globally, the market is becoming increasingly polarized, with developed regions moving towards natural colors due to health and regulatory pressures, while developing regions continue to rely on synthetic options due to cost advantages and less regulatory oversight.

Innovation and Reformulation: Across all regions, there is a push towards innovation, with companies developing safer and more stable synthetic food colors that can meet both regulatory requirements and consumer demands for vibrant, attractive food products.

These regional dynamics highlight the varying degrees of adoption and regulation of synthetic food colors, influenced by economic factors, consumer preferences, and regulatory environments across different parts of the world.

Segments:

Based on Form:

Liquid

Powder

Gel

Based on Type:

Pigments

Dyes

Based on Color:

Yellow

Blue

Red

Green

Others

Based on Applications:

Beverages

Bakery, Snacks, and Cereals

Candy/Confectionery

Dairy

Fruit Preparations/Fillings

Meat, Poultry, Fish, and Eggs

Potatoes, Pasta, and Rice

Sauces, Soups, and Dressings

Seasonings

Pet Food

Browse the full report – https://www.credenceresearch.com/report/synthetic-food-colors-market

Browse Our Blog: https://www.linkedin.com/pulse/synthetic-food-colors-market-trends-opportunities-global-flyhf

Contact Us:

Phone: +91 6232 49 3207

Email: [email protected]

Website: https://www.credenceresearch.com

0 notes

Text

CBD Oil Market Size: Competitive Landscape and Recent Industry Development Analysis 2023 to 2033

As per the latest market research conducted by FMI, the global CBD oil market is expected to record a CAGR of 31% from 2023 to 2033. In 2023, the market size is projected to reach a valuation of US$ 389 million. By 2033, the valuation is anticipated to reach US$ 5,980.6 million.

The primary reasons propelling the market’s growth include rising demand and expanding legalization of cannabis, emerging applications of cannabis in cancer treatment, and the health advantages provided by products infused with cannabis. In the upcoming years, there are likely to be considerable development prospects for market participants due to the inclusion of cannabis in pet food and the rising demand for beverages with cannabis flavoring.

Cannabis is also the illicit substance that is grown, transported, and misused the most extensively worldwide. Broad cannabis use, both for recreational and therapeutic purposes, has received increasing acceptability across the United States, as indicated by legislative actions, ballot measures, and public opinion polls. In particular, a recent Quinnipiac University poll found that 55% of the United States people surveyed supported cannabis legalization without any new restrictions. Comparatively, 82% of survey participants supported the decriminalization of cannabis for medical use. Demand will progressively rise as legalization continues to spread globally, boosting the expansion of the CBD-infused products market as a whole.

Information Source: https://www.futuremarketinsights.com/reports/cbd-oil-market

Competitive Background:

The key players operating in the CBD oil market are investing in mergers and acquisitions in order to gain a significant market share. The manufacturers are also investing in research and development, and are introducing innovative methods to boost production capacity. Product development and market expansion are significant aspects of the CBD oil market. As a result, market participants are likely to have a better overall revenue share in the global CBD oil market.

Key Takeaways:

The CBD oil market is anticipated to reach a valuation of US$ 389 million in 2023.

The high efficacy of CBD produced from hemp for various medical uses, including developing a therapy for Parkinson’s disease, is what drives demand for this market.

The CBD oil market is predicted to record a CAGR of 31% through 2033.

The CBD oil market is expected to surpass US$ 5,980.6 million by 2033.

The CBD oil for pets market is being driven by entrepreneurs who are focusing on developing lotions, skin care, pet care, and textile products using cannabidiol.

Significant Players in the Market Include:

CV Sciences

Medical Marijuana

Aurora Cannabis

Canopy Growth Corporation

Canntrust

Tilray

Kazmira LLC

As the CBD oil market is in a nascent stage, market players are focusing on gaining maximum share by expanding their product portfolio through new product launches.

Recent Developments:

CV Sciences Inc. launched “Plus CBD Gummies” at Natural Product Expo East 2018. These gummies are available in citrus punch and cherry mango flavors. These products comply with strict regulatory standards and are gluten-free and vegan-friendly.

One Leaf, one of the top face mask manufacturers in China, has started executing social media and online marketplace promotional efforts for its CBD products.

Key Segments Covered in CBD oil Market Study

Product Type:

Hemp Oil

Marijuana Oil

Application:

Pharmaceuticals

Food & Beverages

Gummies

Chewing Gums

Chocolate bars

Candies

Beverages

Dairy Products

Bakery Products

Snacks

Cosmetics

Others

Distribution Channel:

Direct/B2B

Indirect/B2C

Hospital Pharmacy

Retail Pharmacy

Hypermarkets/Supermarkets

Convenience Store

Online Retail

Others

Region:

North America

Latin America

Europe

South Asia

East Asia

Oceania

Middle East and Africa

0 notes

Text

Retail Vending Machine Market Size, Share and Growth Opportunities to 2030

The global retail vending machine market size was valued at USD 51.91 billion in 2021 and is expected to register a compound annual growth rate (CAGR) of 10.7% from 2022 to 2030.

Increasing demand for on-the-go snacks and beverages due to the hectic lifestyles of consumers is boosting product sales through vending machines. The industry growth can also be attributed to the ability of these machines to deliver goods quickly, making it an extremely convenient option for consumers. From offices to high-end restaurants and crowded bars to public places, accessing food & beverage items is made simple with a vending machine. This, in turn, is likely to drive their demand.

Gather more insights about the market drivers, restrains and growth of the Retail Vending Machine Market

The coronavirus pandemic has unfavorably influenced the consumer goods industry with lockdowns having an impact across the supply chain. The impact on food and beverage companies will likely be complex, influencing both the demand and supply. In contrast, a change in consumer behavior has been observed, generating demand for various consumer goods, wherein several consumers have switched between brands.

Simultaneously, manufacturers are deciding on how to handle potential disruption across the supply chain and are identifying areas to improve and meet consumer demand. Vending machine operators have witnessed the impact and a fall in revenue, especially in April 2020 as compared to 2019.

Sales through vending machines look promising as vending machines not just offer snacks and beverages but can also sell other consumables, such as cigarettes and lottery tickets. Hence, operators can generate significant revenue through these devices by strategically placing them in corporate buildings, schools, malls, train stations, and airports, among others. For instance, in August 2019, it was announced that over 1 million plastic bottles had been recycled through reverse vending machines in Iceland stores. The healthy lifestyle trend is becoming increasingly prominent across the globe on account of growing consumer awareness regarding healthy food and beverage options.

According to 2019 research by The Vending People, the sales of zero-sugar beverages surged by 38.2% from the first half of 2018 to the first half of 2019, in the U.K., while sales of high-sugar content beverages have seen the biggest drop. Sales of these drinks were down by 19.8% when compared to the same timespan the previous year. Low-calorie drinks outsold other beverages by 196%, showing that customers are looking for healthier alternatives.

Retail Vending Machine Market Segmentation

Grand View Research has segmented the global retail vending machine market report based on type, payment mode, application, and region:

Type Outlook (Revenue, USD Million, 2017 - 2030)

• Food

• Beverage

• Games/Amusement

• Tobacco

• Candy & Confectionery

• Beauty & Personal Care

• Ticket

• Others (Ice-cream Vending Machines, Pharmacy, Vending Machine, etc.)

Payment Mode Outlook (Revenue, USD Million, 2017 - 2030)

• Cash

• Cashless

Application Outlook (Revenue, USD Million, 2017 - 2030)

• Commercial Places

• Offices

• Public Places

• Others

Regional Outlook (Revenue, USD Million, 2017 - 2030)

• North America

• Europe

• Asia Pacific

• Central & South America

• Middle East & Africa

Browse through Grand View Research's Electronic & Electrical Industry Research Reports.

• The global electronic soap dispenser market size was valued at USD 929.0 million in 2023 and is projected to grow at a CAGR of 7.4% from 2024 to 2030.

• The global smart toys market size was valued at USD 12.37 billion in 2023 and is expected to grow at a CAGR of 11.5% from 2024 to 2030.

Key Companies & Market Share Insights

Operators are adopting various strategies to maximize profit by being at the right location with the right products, sourcing products in bulk, investing in intelligent vending machines to gain consumer insights, and other ways. For instance, hot food and sandwich vending machines may do well in business environments, universities, and schools, while, in most public locations, hot drinks like coffee, tea, and hot chocolate have high demand. Industry players face intense competition from each other, as some of them operate at several locations and have large customer bases. The presence of many small-scale players is also leading to increased competition.

• In 2021, Coca-Cola Beverages Florida (Coke Florida) and Coca-Cola Co. teamed up to launch a new Reverse Vending Machine (RVM) at the University of Miami. The materials are crushed and sorted by type, then collected, treated, and prepared for re-use. The process ultimately reduces carbon emissions across the supply chain and supports Coca-Cola’s World Without Waste initiative to recycle a bottle or can sold by 2030

• In 2022, under the CSR initiative to curb carbon footprint, the Small Industries Development Bank of India (SIDBI) and the Dalit Indian Chamber of Commerce and Industries (DICCI) jointly announced the installation of 1,000 Plastic Reverse Vending Machines (RVMSs). The launch was announced under the ‘Swachh Delhi, Swavalambi Delhi’ initiative. The RVMs will be installed at as many public places like malls, metro stations, and parks as possible

• In 2021, the MENstruation Foundation, a nonprofit organization that fights “period poverty”, introduced a sanitary pad vending machine, the first in Africa. The pads are locally manufactured and compostable. The foundation says that it aims to reach at least 100 schools by 2022 and hopes to double that in the years to come. Support from the corporate sector-such as MTN, which has sponsored two machines-was crucial

Key players operating in the global retail vending machine market include:

• Azkoyen Group

• Cantaloupe Systems

• Westomatic Vending Services Limited

• Royal Vendors, Inc.

• Glory Ltd.

• Sanden Holding Corp.

• Seaga Manufacturing Inc.

• Orasesta S.p.A

• Sellmat s.r.l.

• Fuji Electric Co., Ltd.

Order a free sample PDF of the Retail Vending Machine Market Intelligence Study, published by Grand View Research.

0 notes

Text

Nutraceuticals 2024 Industry Outlook, Research, Trends and Forecast to 2030

Nutraceuticals Industry Overview

The global nutraceuticals market size was valued at USD 712.97 billion in 2023 and is expected to grow at a CAGR of 8.4% from 2024 to 2030.

The primary factors driving the market growth are preventive healthcare, increasing instances of lifestyle-related disorders, and rising consumer focus on health-promoting diets. Additionally, increasing consumer spending power in high-growth economies is projected to contribute to the growing demand for nutraceutical products. The growing demand for dietary supplements and nutraceuticals is also attributed to consumer preferences shifting towards self-directed care in the treatment of lifestyle disorders such as cardiovascular disorders and malnutrition.

Gather more insights about the market drivers, restrains and growth of the Nutraceuticals Market

Nutraceuticals are associated with various medical and health benefits, which is driving its increased adoption among consumers globally. Rising healthcare costs, coupled with the increasing geriatric population across the world, are anticipated to assist the global nutraceutical industry growth over the forecast period. Consumers’ attitude is observed to be very positive towards functional foods mainly on account of the added health and wellness benefits offered by these products. The rising geriatric population, increasing healthcare costs, changing lifestyles, food innovation, and expectations regarding higher prices have aided the overall growth.

In the wake of the COVID-19 pandemic, the demand for dietary supplements and functional foods has soared. Immunity boosting supplements have become mainstream over the past year and this has led to a significant change in buying patterns and consumer behavior. Moreover, after the COVID-19 pandemic, preventive healthcare measures such as dietary supplements will become a part of people’s everyday lives. Thus, the COVID-19 pandemic across the globe has paved the way for nutraceuticals to build a strong presence in the global market.

Growing technological advancements in the nutraceutical industry are projected to influence consumer demand positively. The growing innovation in the market has led to the adoption of AI which will enable more personalized solutions based on dietary and health data of a consumer. Therefore, AI will be pivotal in the growth of the nutraceuticals industry globally.

Browse through Grand View Research's Consumer F&B Industry Research Reports.

The U.S. candy market was estimated at USD 16.5 billion in 2023 and is expected to grow at a CAGR of 4.9% from 2024 to 2030.

The U.S. soft drinks market size was valued at USD 285.93 billion in 2023 and is projected to grow at a CAGR 7.5% from 2024 to 2030.

Key Nutraceuticals Company Insights

The nutraceuticals market is a moderately fragmented industry. The competitive landscape is characterized by the presence of key international players. Key players such as Amway, Nestle, and General Mills are characterized as market leaders owing to their wide and diversified product portfolio and large distribution network.

Companies have implemented mergers & acquisitions and new product launches as key strategies to compete in the market. Acquisitions and mergers facilitated the companies to expand their product reach and improve product quality. Moreover, introducing new products to the market has supported the companies to offer better quality products, meeting the changing consumer trends across the industry. For instance, in August 2022, one of the key dietary supplement brands, Youtheory launched a line of new liquid dietary supplements post its acquisition by Jamieson Wellness Inc. The new product comprises ingredients such as B12B6, K2D3, and ashwagandha offered in liquid and capsule forms. This new launch is in line with the growing consumer demand for nutritional supplements in the U.S.

Key Nutraceuticals Companies:

The following are the leading companies in the nutraceuticals market. These companies collectively hold the largest market share and dictate industry trends.

DSM

Amway

Pfizer Inc.

Nestle

The Kraft Heinz Company

The Hain Celestial Group, Inc.

Nature's Bounty

General Mills Inc.

Danone

Tyson Foods

Order a free sample PDF of the Nutraceuticals Market Study, published by Grand View Research.

0 notes

Text

Water Saving Shower Heads Market Size, Share, Trends, Growth and Competitive Outlook

"Global Water Saving Shower Heads Market – Industry Trends and Forecast to 2029

Global Water Saving Shower Heads Market, By Type (Digital Showers, Electric showers, Eco showers, Power Showers, Mixer Showers), Shower Head Type (Fixed, Handheld), Technology (Aerated, Non-Aerated, Using Flow Restrictor, Using Flow Regulator), Application (Residential, Commercial), Price Range (Premium, Mass), Sales Channel (Direct Sales, Supermarkets or Hypermarkets, Wholesalers or Distributors, Specialty Stores, Online Retailers, Multi-brand Stores, Other Sales Channel) – Industry Trends and Forecast to 2029.

Access Full 350 Pages PDF Report @

Highlights of TOC:

Chapter 1: Market overview

Chapter 2: Global Water Saving Shower Heads Market

Chapter 3: Regional analysis of the Global Water Saving Shower Heads Market industry

Chapter 4: Water Saving Shower Heads Market segmentation based on types and applications

Chapter 5: Revenue analysis based on types and applications

Chapter 6: Market share

Chapter 7: Competitive Landscape

Chapter 8: Drivers, Restraints, Challenges, and Opportunities

Chapter 9: Gross Margin and Price Analysis

Key takeaways from the Water Saving Shower Heads Market report:

Detailed considerate of Water Saving Shower Heads Market-particular drivers, Trends, constraints, Restraints, Opportunities and major micro markets.

Comprehensive valuation of all prospects and threat in the

In depth study of industry strategies for growth of the Water Saving Shower Heads Market-leading players.

Water Saving Shower Heads Market latest innovations and major procedures.

Favorable dip inside Vigorous high-tech and market latest trends remarkable the Market.

Conclusive study about the growth conspiracy of Water Saving Shower Heads Market for forthcoming years.

Browse Trending Reports:

Spinocerebellar Ataxias Scas Market Johanson Blizzard Syndrome Market Steel Drums And Intermediate Bulk Containers Reduce Re Use And Recycle Market Diet Candy Market Date Palm Market Plant Based Functional Food Ingredients Market Glucose Syrup Market Picks Disease Treatment Market Vermouth Market Over The Counter Probiotic Supplements Market Motorcycle Market Heat Stabilizers Market Impotence Agents Market Fiber Drums Market Cereals And Grains Processing Market Soil Ph Adjusters Market

About Data Bridge Market Research: