#Global Beer Adjuncts Market Size

Explore tagged Tumblr posts

Text

#Global Beer Adjuncts Market Size#Beer Adjuncts Market Competitive Analysis#Beer Adjuncts Market Forecast#Beer Adjuncts Market Share#Beer Adjuncts Market Growth Trends

0 notes

Text

Sustainable Growth Opportunities in the Brewing Ingredients Market

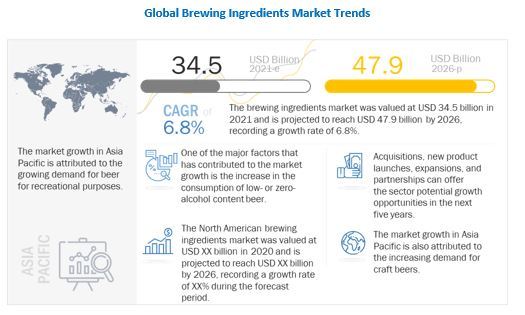

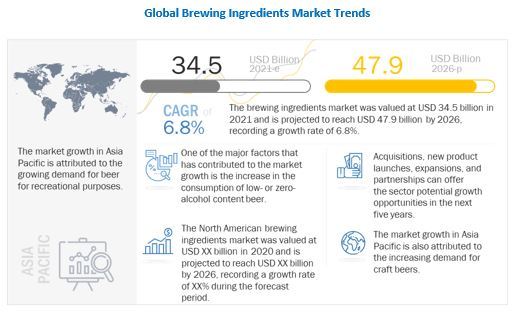

The brewing ingredients market was valued at USD 34.5 billion in 2021 and is projected to reach USD 47.9 billion by 2026, expanding at a growth rate of 6.8% during the forecast period. The market is segmented into source, brewery size, and form. By source, the market has been segmented into malt extract, adjuncts/grains, hops, beer yeast, and beer additives. The malt extract segment is projected to dominate the source segment due to increased demand for natural ingredients and was estimated at USD 17.6 billion in 2021. It is projected to reach USD 24.9 billion in 2026. The adjuncts/grains segment is projected to grow at the CAGR of 6.8% due to the increase in consumption of beers.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248523644

The key players in this market include Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Boortmalt (Belgium), Malteurop Groupe (France), Rahr Corporation (US), Lallemand Inc. (Canada), Viking Malt (Sweden), Lesaffre (France), Maltexco S.A. (Chile), and Simpsons Malt (UK), among others.

Major players in the market are mainly focusing on rapid investments in developing economies to grab a greater number of customers in the coming years. Further, the companies are also focusing on a strategic partnership with the beer manufacturers to ensure the continuous workflow of inventories.

The core strength of the key players identified in this market is their growth strategies, such as new product launches, certifications, and expansions, among others. Undertaking new product launches and expansions has enabled market players to enhance their presence in the brewing ingredients market. Some of the key strategies followed by the leaders are mentioned below:

Cargill, Incorporated is one of the globally leading companies involved in the production of food ingredients. The company offers products for different markets such as agriculture, animal nutrition, beauty, bio-industrial, carbon solutions, food service, food & beverage, industrial, pharmaceutical, meat & poultry, transportation, and risk management. Based on application, the company has segmented its products under the food & beverage category into bakery, bev-alcoholic, beverages, confectionery, convenience foods, dairy, fruits & vegetables, infant & baby food, meat & fish, snacks & cereals, and others. The company actively operates in more than 70 countries and exports its products to customers in more than 125 countries. It is identified as a star player in the global brewing ingredients market, according to MnM analysis.

Angel Yeast Co. Ltd. is a leading producer of yeast. The company specializes in the production of yeast and yeast derivatives. It has segregated its product offerings into yeast & baking, yeast extract-savory, nutrition & health, and biotechnology. The biotechnology segment is further divided into distilled spirits & biofuels, microbial nutrition, and enzymes. The firm offers yeast through five brands: Angel, Eagle, Bakerdream, Gloripan, and Fubon. It has 10 international advanced production bases in China, Egypt, and Russia. The company is identified as a star player in the global brewing ingredients market, according to MnM analysis.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=248523644 Boortmalt is a world leader in the production of top-quality barley malt. The company offers different malts under its five brands: Pauls malt, minch malt, les maltiers, belgomalt, and badass barley malt. The firm is present in 5 continents with 27 malting plants located in Spain, Ethiopia, the US, Canada, Argentina, Australia, the UK, France, Germany, and Hungary, among others. It supplies malt to producers of beer and whisky across the globe. The company is identified as a star player in the global brewing ingredients market, according to MnM analysis.

The Asia Pacific market is projected to grow at the highest CAGR during forecast period. The high growth rate is supported by various factors such as growing urbanization, increasing disposable income and increasing population in countries such as India and China.

#Brewing Ingredients Market#Brewing Ingredients#Brewing Ingredients Market Size#Brewing Ingredients Market Share#Brewing Ingredients Market Growth#Brewing Ingredients Market Trends#Brewing Ingredients Market Forecst#Brewing Ingredients Market Analysis#Brewing Ingredients Market Research Report#Brewing Ingredients Market Scope#Brewing Ingredients Market Overview#Brewing Ingredients Market Outlook

0 notes

Text

0 notes

Text

What's wrong with blaming "information" for political chaos

David Perell's 13,000 word essay, "What the Hell is Going On?" presents a reassuring -- and contrarian -- view on how our current dysfunction in politics, media, and business has come to pass, drawing on orthodox economic theories about "information asymmetry" in a way that makes the whole thing seem like a kind of adjustment period between a middling old world and a fine new one.

I think Perell is wrong. His theory omits the most salient, obvious explanation for what's going on (the creation of an oligarchy that has diminished the efficacy of public institutions and introduced widespread corruption in every domain), in favor of rationalizations that let the wealthy and their enablers off the hook, converting a corrupt system with nameable human actors who have benefited from it and who spend lavishly to perpetuate it into a systemic problem that emerges from a historical moment in which everyone is blameless, prisoners of fate and history.

Perell's theory goes a little like this: once we had incomplete information and so we had to rely on rules of thumb to navigate the world. We trusted brands because we couldn't access realtime customer reviews to tell us whether a product was any good. We trusted universities because we couldn't access libraries and communities that let us train ourselves. We trusted political parties because the news media pushed a narrative that made it hard to find out when the parties were corrupt or ineffectual.

All of this is true, as is Perell's conclusion. The internet produced better access to information, which has made everything decohere. We can choose to buy craft beer instead of beer from the giant conglomerates and the net helps us figure out which beer will be good. We can teach ourselves without accruing massive debts. We can shop for news sources that tailor to our interests and step outside the overton window.

But that's as far as he goes, and that's where he goes wrong. Because inequality and the internet grew up together (Ronald Reagan was elected the year the Apple ][+ hit the market), and any account of the past 40 years has to examine both together.

The French economist Thomas Piketty presents a compelling case that in the late 1970s, global wealth concentration reached a tipping point thanks to the slow but inevitable recovery of fortunes lost in the World Wars; at that moment, the richest people in the world finally had amassed enough capital to start spending in earnest to buy political outcomes that would make them even richer.

40 years later, we live in a world of rampant monopolization, a political consensus totally at odds with popular views, and an epistemological crisis born of the combination of the deliberate sowing of doubt over scientific consensuses ("some experts don't believe in vaccines"), captured regulators ("of course FDA says vaccines are safe, they're in the pocket of big pharma") and decades of abuse from concentrated industries whose size and wealth confer immunity to consequences for bad actions ("why should we trust pharma after all the bad shit they've done?").

Add to this the precarity of a disappearing middle class and the end of upward social mobility, and many of Perell's outcomes can be explained or recast without making it all about increased access to information.

For example, people take on crushing debts to send their kids to university because social mobility has all but ended and they worry that without a degree, their kids will slide down the economic ladder. The universities build massive stadiums and other fripperies to lure in the super-rich whose overt and covert bribery are the source of personal wealth for the swelling ranks of high-paid administrators. They don't pay faculty enough to live on because desperate poor people have taken on so much debt to send so many poor kids to university that they have a buyer's market for adjuncts.

Political "polarization" is not the result of increased information, rather, it is a mirage brought on by the fact that the vast majority of people favor policies that politicians refuse to deliver; any politician who tries is branded as an out-of-touch radical, while the "serious grownups" continue to insist that America (alone among the world's developed states) can't afford universal health care, decent public education, net neutrality, etc.

Politicians like Trump can mobilize huge amounts of votes by welding together a coalition of the super-rich (who want tax cuts and don't care about anything else), racists, and people who are genuinely disaffected and worried about downward mobility by saying (truthfully) that "the system is rigged" (while omitting the fact that it was rigged in his favor and he intends to rig it further in office).

And while "micro brands" are on the rise, a shocking number of them are owned by the same handful of companies (whose shares, in turn, are largely owned by the same minuscule class of investors and handful of giant funds). Thanks to lax antitrust enforcement, this is not an age in which the rentiers are being euthanized: it's one in which the rentiers have bought up every conceivable place you might shop, leaving you with no possible way to avoid enriching them.

The internet has foundationally altered our information asymmetries, but it will not cause inequality and the corruption that creates it to wither away. Any critique of political and economic chaos that fails to take account of corruption and fails to place the blame on those who have benefited from it is worse than incomplete: it's a dangerous counsel of complacency.

https://boingboing.net/2019/03/18/oligarchs-r-us-3.html

39 notes

·

View notes

Text

Torrified Wheat Market size Revenue, Opportunity, Forecast and Value Chain 2018 - 2028

The use of cereal to make beer can be traced back to the beginning of the civilization. The unmalted adjunct used to make beer is called torrified wheat. The term ‘torrified’ in the torrified wheat refers to the treatment that is subjected to the wheat while making beer. This treatment involves the subjection of wheat kernels to temperatures as high as 85°C. This treatment is basically called torrification and is essential to gelatinize the starch present in wheat. This treatment breaks down the cellular structure of wheat and pre-gelatinizes the starch. The end product obtained is torrified wheat from which fermentable sugar can be extracted easily by a brewer. The market for torrified wheat has great growth potential as its major application is in the production of beer which is preferred by one and all in most of the regions of the world.

Increasing Popularity of Torrified Wheat in the Craft Beer Market

The characteristics of torrified wheat make it ideal and efficient to be used in beer. The gelatinization of torrified wheat makes starch easily digestible and soluble by the enzymes that occur naturally in malt. This allows torrified wheat to be incorporated directly into mash with other grains. Use of torrified wheat in beer adds a unique and subtle flavor. Hence, brewers are now using torrified wheat instead of wheat malt to make wheat beer. The higher protein content in torrified wheat adds body to the beer and brings stability in the foam. Such properties are popularizing the use of torrified wheat in Belgian Wit Beer, ales, and other wheat beers. Thus, the market for torrified wheat is growing and is expected to grow further because of the rising demand for new flavors in beer.

Request Report Sample @ https://www.futuremarketinsights.com/reports/sample/rep-gb-8304

Torrified Wheat Market: Segmentation

On the basis of the nature of production-

Conventional

Organic

On the basis of type-

Whole Kernels

Crushed Flakes

On the basis of the distribution channel-

Direct

Indirect

Supermarket

Specialty Store

Grocery Store

Online Retailers

Others

Torrified Wheat Market

Examples of some of the market participants in the global torrified wheat market are Briess Malt & Ingredients Co., Cargill, Incorporated, BSG HandCraft, Crisp Malting Group Ltd, and others.

Global Torrified Wheat Market: Key Developments

The market for torrified wheat is growing due to the small developments incorporated by the manufacturers of torrified wheat. For instance, Cargill, a major company for brew-related ingredients and other products, announced in April, 2018 an investment of $20 million in the construction of a rail expansion at its Lethbridge, AB facility to increase the efficiency of grain movement from elevator to the West Coast. This expansion is intended to provide more opportunities to local farmers to deliver and sell grains. The same company is trying to improve its business strategies as well to grow its presence in the market. It is bringing a shift in its specialty from grain merchants to grain processors which will at the end be beneficial for its growth in the torrified wheat market as well.

Buy This Report@ https://www.futuremarketinsights.com/checkout/8304

Alcohol is one of the major applications of torrified wheat. Therefore, any change in the alcohol market influences the torrified wheat market. In December 2017, beer producers got a two-year reduction in federal excise taxes worth $4.2 billion in North America. This action helped brewers make some savings in America and motivated them to expand their business. Such actions helped in the growth of other brew related markets which includes the torrified market.

Opportunities for Torrified Wheat Market Participants

Torrified wheat has major applications in the brewing industry. This provides torrified wheat a vital opportunity to grow because of the continued rising demand for beer worldwide. Thus, promoting the use of torrified wheat to produce new flavors of beer filled with exotic aromas can give a boost to the torrified market growth. Further research and development in wheat to obtain better qualities of torrified wheat can help the torrified market grow in terms of product quality. Also, incorporation of new technologies for the torrification of wheat can ensure efficiency in torrified wheat production and increase the global market volume for torrified wheat.

Brief Approach to Research

The torrified wheat market research report presents a comprehensive assessment of the market, and contains thoughtful insights, facts, historical data, and statistically supported as well as industry validated market data. It also contains projections using a suitable set of assumptions and methodologies. The torrified wheat research report provides analysis and information according to market segments such as geography, application, product type, and end use of the market.

0 notes

Text

Brewing Ingredients Market to Witness Unprecedented Growth in Coming Years

The global brewing ingredients market was valued 34.5 billion in 2021 and is projected to reach USD 47.9 billion by 2026, growing at a CAGR of 6.8% during the study period. The rise in demand for beers from all over the globe coupled with increasing consumption of craft beers will drive the market demand and growth of brewing ingredients globally. Various opportunities in near future such as introduction of new flavors in the beer market and increase in demand for organic beers will boost the demand of brewing ingredients market globally.

According to the Organic Trade Association, US organic beer sales increased more than tenfold since 2003, from USD 9 million to USD 92 million in 2014. Peak Organic Brewing Co. offers organic beers of different types, such as ale and pilsner. Consumer are becoming more aware about their intake which is resulting in the increasing in the demand for organic products and clean label food & beverages with maximum use of natural raw materials with information regarding the traceability of the raw materials used. The concern for traces of pesticides has also resulted in a rise in demand for organic beer, which provide a major opportunity to the brewing ingredients manufactures.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248523644

By source, the malt extract segment is estimated to hold the largest share in the brewing ingredients market

The market includes five major sources: malt extract, adjuncts/grains, hops, beer yeast, and beer additives. The malt extract segment is further bifurcated into standard malt and specialty malts. Brewing-grade malt extracts are made with the highest-quality brewing malts and get additional colors and flavors from using specialty malts. This gives beer the unique character and flavor desired for the particular style brew. These malts often have a longer time in the kiln, at higher temperatures, or get roasted to add depth, complexity, and flavor to the resulting beer. Specialty malts include less in the way of sugars but have a greater influence on the color of the beer. These malts are widely used in craft beers.

By brewery size, the craft brewery is estimated to grow at a higher growth rate in the brewing ingredients market.

According to the Brewers Association, an American craft brewer is a small and independent brewer, where small breweries have an annual production of 6 million barrels of beer or less. The craft brewing industry contributed USD 82.9 billion to the US economy in 2019, with more than 580,000 employees. The average alcohol by volume (ABV) content of a craft beer is 5% to 10%, but some of the most popular craft beers have an ABV of as high as 40%. On the other hand, beer produced in bulk by macro breweries has an ABV of 4% to 6% and as little as 2%. Craft breweries offer different flavors, which allow consumers with different tastes to cater to their preferences. These factors are driving the growth of the craft brewery segment in the global market.

Request Sample pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=248523644

The increasing demand for beers in the Asia Pacific countries drives the region's growth rate at a higher pace.

The Asia Pacific region comprises two high-growth economies: India and China. The drinking preferences of the population in this region are gradually shifting toward alcoholic culture. The large, increasing population and the growing market mean that the demand for brewing ingredients is still promising. Another factor is the densely populated areas that are not completely tapped by beer manufacturing and brewing ingredient companies. Hence, beer produced in macro breweries and craft breweries still has a high-growth rate. Moreover, the increasing spending capacity of consumers has led to a surge in demand for craft beers. There has been an emergence of various craft breweries in countries such as India over the last few years.

#Brewing Ingredients Market#Brewing Ingredients#Brewing Ingredients Market Size#Brewing Ingredients Market Share#Brewing Ingredients Market Growth#Brewing Ingredients Market Trends#Brewing Ingredients Market Forecast#Brewing Ingredients Market Analysis'#Brewing Ingredients Market Research Report

0 notes

Text

Brewing Ingredients Market Projected to Garner Significant Revenues by 2026

The report "Brewing Ingredients Market by Source (Malt Extract, Adjuncts/Grains, Hops, Beer Yeast, and Beer Additives), Brewery Size (Macro Brewery and Craft Brewery), Form (Dry and Liquid), and Region - Global Forecast to 2026" The market for brewing ingredients is estimated at USD 34.5 Million in 2021; it is projected to grow at a CAGR of 6.8% to reach USD 47.9 Million by 2026. Asia Pacific accounted for the largest share, during the forecast period, in terms of value. The Asia Pacific economies are set to witness rapid economic growth and increase in the adoption of western lifestyles, which would fuel the consumption of beer in the next five years. Increasing disposable income and rising consumption of alcoholic beverages for recreational purposes influence the demand for these brewing ingredients in the market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248523644

The malt extract segment by source is projected to achieve the fastest growth in the brewing ingredients market.

The malt extract is the fastest-growing segment source type during the forecast period. Increasing use of specilaity malts is projected to boost the market of the malt extract segment. These malts often have a longer time in the kiln, at higher temperatures, or get roasted to add depth, complexity, and flavor to the resulting beer. Specialty malts include less in the way of sugars but have a greater influence on the color of the beer. These malts are widely used in craft beers.

By brewery size, the macro brewery segment is projected to account for the largest market share in the brewing ingredients market.

Macro brewery leads the global market owing to its large consumption globally. Macro brew is mass-produced beer brewed in very large quantities, due to which it is generally sold for a cheaper price than craft beer. Beers produced on a large scale in macro breweries are typically monotone in flavor and go through a standardized process of production, including filtration and pasteurization.

The dry segment by form is projected to account for the largest market share of the brewing ingredients market over the forecast period.

The dry segment is projected to account for the largest share. Increased shelf life of brewing ingredients in the dry form is projected to foster the growth of the segment. Because of the lower water content, dried malt extract tends to have a better shelf life without the darkening issues of light malt extract.

Make an Inquiry @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=248523644

Asia Pacific is projected to be the fastest growing market.

The Asia Pacific market is projected to grow at the highest CAGR during forecast period. The high growth rate is supported by various factors such as growing urbanization, increasing disposable income and increasing population in countries such as India and China.

Key Market Players:

The key players in this market include Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Boortmalt (Belgium), Malteurop Groupe (France), Rahr Corporation (US), Lallemand Inc. (Canada), Viking Malt (Sweden), Lesaffre (France), Maltexco S.A. (Chile), and Simpsons Malt (UK). These players in this market are focusing on increasing their presence through new product launches and expansions. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

0 notes

Text

Key Trends Shaping the Brewing Ingredients Market

The report "Brewing Ingredients Market by Source (Malt Extract, Adjuncts/Grains, Hops, Beer Yeast, and Beer Additives), Brewery Size (Macro Brewery and Craft Brewery), Form (Dry and Liquid), and Region - Global Forecast to 2026", The brewing ingredients market was valued at USD 34.5 billion in 2021 and is projected to grow at a CAGR of 6.8%, to reach USD 47.9 billion by 2026. The rise in global population and increasing disposable income in developing economies are creating new avenues for alcoholic beverages. The brewing ingredients market includes five major sources: malt extract, adjuncts/grains, hops, beer yeast, and beer additives. Malt extract is further bifurcated into standard malt and specialty malt. Specialty malt is sub-segmented into crystal, roasted, dark, and others. Different types of beers are obtained by using different sources of brewing ingredients. For instance, roasted malt is used for producing the porter type of beer. The malt extract segment dominated the global market for brewing ingredients and accounted for a larger share in 2020. Beer additives accounted for the second-largest market share in terms of revenue in 2020.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248523644

By source, the malt extract is expected to hold the largest share in the market, during the forecast period

Types of malt extracts differ depending on the grains that are used when making them. The production of malt extracts begins by grinding malt, followed by mashing under controlled conditions to produce various degrees of starch breakdown and resultant fermentability. This involves carefully controlling the pH and using multiple temperature steps during mashing. In the next step, the wort is separated from the spent grains in lauter tuns or mash filters. Both these methods produce high-quality worts and can be set up for high throughput, with as many as 10–14 brews per day. The further steps include boiling, trub removal, vacuum evaporation, and spray drying.

The macro brewery as a brewery size is expected to hold one of the largest shares in the brewing ingredients market, in terms of value, in 2021

On the basis of brewery size, the market is classified into macro brewery and craft brewery. Macro or large breweries are defined as breweries with annual beer production of ≥ 6 million barrels. The most popular macro breweries include Anheuser-Busch InBev (Belgium), Heineken N.V. (Netherlands), China Resources Snow Breweries Limited (China), and Carlsberg Group (Denmark). These breweries generally operate on a global scale, shipping their products to customers across the world. Anheuser-Busch owns the biggest brewery in the world. Large breweries usually have a large staff as well. These breweries employ staff to handle the brewing process, administrative staff, logistics of distribution, teams for marketing and finance, and every role imaginable required for a business to operate. Craft beers are perceived as healthier beers as they may offer help in lowering the rate of cardiovascular disease, improved bone density due to the presence of bone-developing elements such as silicon, lower the risk of joint issues such as arthritis, and increased high-density lipoprotein (HDL) levels which help lower cholesterol, and lower the instances of diabetes.

By form, the dry form will drive the demand for brewing ingredients, in terms of value, in 2021

Based on form, the market is categorized as dry and liquid. Dry brewing ingredients such as dry malt extract (DME) are produced the same way as liquid malt extract, except it goes through an additional dehydration step, which reduces the water content down to about 2%. Because of the lower water content, DME tends to have a better shelf life without the darkening issues of light malt extract. It offers more fermentable extract by weight. Thus, less of it is required to achieve the target gravity. Moreover, as a powder, DME is easier to measure in precise increments. With a digital scale, it can be measured out in fractions of an ounce. This makes DME a great choice for priming, supplementing beer recipes, and for making gravity adjustments.

Make an Inquiry @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=248523644

Asia Pacific is projected to dominate the majority market share, in the global brewing ingredients market, in terms of value, in 2021

On the basis of the regional area, the market is segmented into North America, Europe, Asia Pacific, South America, and Rest of World (RoW). Due to the increase in population and rise in disposable income, Asia Pacific is projected to account for the largest share during the review period. The drinking preferences of the population in this region are gradually shifting toward alcoholic culture. The large, increasing population and the growing market mean that the demand for brewing ingredients is still promising. Another factor is the densely populated areas that are not completely tapped by beer manufacturing and brewing ingredient companies. Rapid industrialization and urbanization, increase in environmental concerns, rise in disposable income of growing middle class, and rising demand for craft beers are factors consequently fueling the demand for brewing ingredients market in this sector.

This report includes a study on the marketing and development strategies, along with a survey of the product portfolios of the leading companies operating in the brewing ingredients market. It includes the profiles of leading companies, such as Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Boortmalt (Belgium), Malteurop Groupe (France), Rahr Corporation (US), Lallemand Inc. (Canada), Viking Malt (Sweden), Lesaffre (France), Maltexco S.A. (Chile), and Simpsons Malt (UK). among others.

0 notes

Text

Brewing Ingredients Market to Showcase Continued Growth in the Coming Years

The report "Brewing Ingredients Market by Source (Malt Extract, Adjuncts/Grains, Hops, Beer Yeast, and Beer Additives), Brewery Size (Macro Brewery and Craft Brewery), Form (Dry and Liquid), and Region - Global Forecast to 2026" The brewing ingredients market was valued at USD 34.5 billion in 2021 and is projected to grow at a CAGR of 6.8%, to reach USD 47.9 billion by 2026. The rise in the global population and increasing disposable income in developing economies are creating new avenues for alcoholic beverages.

The brewing ingredients market includes five major sources: malt extract, adjuncts/grains, hops, beer yeast, and beer additives. Malt extract is further bifurcated into standard malt and specialty malt. Specialty malt is sub-segmented into crystal, roasted, dark, and others. Different types of beers are obtained by using different sources of brewing ingredients. For instance, roasted malt is used for producing the porter type of beer. The malt extract segment dominated the global market for brewing ingredients and accounted for a larger share in 2020. Beer additives accounted for the second-largest market share in terms of revenue in 2020.

Request for Customization of this Report:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=248523644

COVID-19 Impact on the global brewing ingredients Market

The outbreak of COVID-19 has brought serious medical, social, and economic challenges. It is seen that the majority of the companies operating in the manufacturing sector (53%) expect COVID-19 to impact their operations. The grim expectations have become a reality in the sector due to the rise in oil prices and increasing demand & supply bottlenecks which results in a slowdown of expenditures and rising uncertainty in credit markets. Players across the globe in the food & beverage industry have faced a drastic decrease in the consumption of their products. Due to lockdowns in several parts of the world and restrictions on transportation of commodities, companies are also facing disrupted supply chains. The reduced agricultural production interrupting the raw material supply, lack of workers in manufacturing plants, and disturbances in the distribution system have disrupted supply chains.

Opportunity: Introduction of new flavors in beer

The increase in beverage consumption has led to intense competition amongst beer brands, resulting in the introduction of new flavors and increasing beer consumption. There is a growing popularity for craft beers as it offers various flavors besides the regular flavors offered by macro breweries. The introduction of new ingredients and innovative flavors, combining salty, fruity, and tart flavors, by craft beers, has found an increasing appeal among the millennial crowd globally. Some of the macro brewers are also acting on to respond to these changing demands from consumers. For example, Heineken USA, in 2021, launched Dos Equis Lime & Salt variety pack of lager beer. Similarly, Latambarcem Brewery (India), in 2020, launched a new craft beer brand called Maka di that currently serves four brews: Honey Ale, Belgian Tripel, Bavarian Keller, and Belgian Blanche. The introduction of these new flavors is projected to increase the sales and consumption of beer. Thus, this is anticipated to provide ample opportunities to players operating in the global market.

By brewery size, the craft brewery is estimated to grow at a higher growth rate in the brewing ingredients market.

According to the Brewers Association, an American craft brewer is a small and independent brewer, where small breweries have an annual production of 6 million barrels of beer or less. The craft brewing industry contributed USD 82.9 billion to the US economy in 2019, with more than 580,000 employees. The average alcohol by volume (ABV) content of a craft beer is 5% to 10%, but some of the most popular craft beers have an ABV of as high as 40%. On the other hand, beer produced in bulk by macro breweries has an ABV of 4% to 6% and as little as 2%. Craft breweries offer different flavors, which allow consumers with different tastes to cater to their preferences. These factors are driving the growth of the craft brewery segment in the global market.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248523644

The increasing demand for beers in the Asia Pacific countries drives the region's growth rate at a higher pace.

The Asia Pacific region comprises two high-growth economies: India and China. The drinking preferences of the population in this region are gradually shifting toward alcoholic culture. The large, increasing population and the growing market mean that the demand for brewing ingredients is still promising. Another factor is the densely populated areas that are not completely tapped by beer manufacturing and brewing ingredient companies. Hence, beer produced in macro breweries and craft breweries still has a high-growth rate. Moreover, the increasing spending capacity of consumers has led to a surge in demand for craft beers. There has been an emergence of various craft breweries in countries such as India over the last few years.

The APAC region held the largest share in the brewing ingredients market. The demand for different beers with various flavors and different ABV is driven by economic growth, drinking culture in countries such as Vietnam and South Korea, urbanization, and the rise in the purchasing power of consumers.

Key Market Players:

Key players in this market include major players such as Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Boortmalt (Belgium), Malteurop Groupe (France), Rahr Corporation (US), Lallemand Inc. (Canada), Viking Malt (Sweden), Lesaffre (France), Maltexco S.A. (Chile), and Simpsons Malt (UK) . These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

0 notes

Text

Latest Regulatory Trends Impacting the Brewing Ingredients Market

The report "Brewing Ingredients Market by Source (Malt Extract, Adjuncts/Grains, Hops, Beer Yeast, and Beer Additives), Brewery Size (Macro Brewery and Craft Brewery), Form (Dry and Liquid), and Region - Global Forecast to 2026", The brewing ingredients market was valued at USD 34.5 billion in 2021 and is projected to grow at a CAGR of 6.8%, to reach USD 47.9 billion by 2026. The rise in global population and increasing disposable income in developing economies are creating new avenues for alcoholic beverages.

The brewing ingredients market includes five major sources: malt extract, adjuncts/grains, hops, beer yeast, and beer additives. Malt extract is further bifurcated into standard malt and specialty malt. Specialty malt is sub-segmented into crystal, roasted, dark, and others. Different types of beers are obtained by using different sources of brewing ingredients. For instance, roasted malt is used for producing the porter type of beer. The malt extract segment dominated the global market for brewing ingredients and accounted for a larger share in 2020. Beer additives accounted for the second-largest market share in terms of revenue in 2020.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248523644

By source, the malt extract is expected to hold the largest share in the market, during the forecast period

Types of malt extracts differ depending on the grains that are used when making them. The production of malt extracts begins by grinding malt, followed by mashing under controlled conditions to produce various degrees of starch breakdown and resultant fermentability. This involves carefully controlling the pH and using multiple temperature steps during mashing. In the next step, the wort is separated from the spent grains in lauter tuns or mash filters. Both these methods produce high-quality worts and can be set up for high throughput, with as many as 10–14 brews per day. The further steps include boiling, trub removal, vacuum evaporation, and spray drying.

The macro brewery as a brewery size is expected to hold one of the largest shares in the brewing ingredients market, in terms of value, in 2021

On the basis of brewery size, the market is classified into macro brewery and craft brewery. Macro or large breweries are defined as breweries with annual beer production of ≥ 6 million barrels. The most popular macro breweries include Anheuser-Busch InBev (Belgium), Heineken N.V. (Netherlands), China Resources Snow Breweries Limited (China), and Carlsberg Group (Denmark). These breweries generally operate on a global scale, shipping their products to customers across the world. Anheuser-Busch owns the biggest brewery in the world. Large breweries usually have a large staff as well. These breweries employ staff to handle the brewing process, administrative staff, logistics of distribution, teams for marketing and finance, and every role imaginable required for a business to operate. Craft beers are perceived as healthier beers as they may offer help in lowering the rate of cardiovascular disease, improved bone density due to the presence of bone-developing elements such as silicon, lower the risk of joint issues such as arthritis, and increased high-density lipoprotein (HDL) levels which help lower cholesterol, and lower the instances of diabetes.

By form, the dry form will drive the demand for brewing ingredients, in terms of value, in 2021

Based on form, the market is categorized as dry and liquid. Dry brewing ingredients such as dry malt extract (DME) are produced the same way as liquid malt extract, except it goes through an additional dehydration step, which reduces the water content down to about 2%. Because of the lower water content, DME tends to have a better shelf life without the darkening issues of light malt extract. It offers more fermentable extract by weight. Thus, less of it is required to achieve the target gravity. Moreover, as a powder, DME is easier to measure in precise increments. With a digital scale, it can be measured out in fractions of an ounce. This makes DME a great choice for priming, supplementing beer recipes, and for making gravity adjustments.

Make an Inquiry @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=248523644

Asia Pacific is projected to dominate the majority market share, in the global brewing ingredients market, in terms of value, in 2021

On the basis of the regional area, the market is segmented into North America, Europe, Asia Pacific, South America, and Rest of World (RoW). Due to the increase in population and rise in disposable income, Asia Pacific is projected to account for the largest share during the review period. The drinking preferences of the population in this region are gradually shifting toward alcoholic culture. The large, increasing population and the growing market mean that the demand for brewing ingredients is still promising. Another factor is the densely populated areas that are not completely tapped by beer manufacturing and brewing ingredient companies. Rapid industrialization and urbanization, increase in environmental concerns, rise in disposable income of growing middle class, and rising demand for craft beers are factors consequently fueling the demand for brewing ingredients market in this sector.

This report includes a study on the marketing and development strategies, along with a survey of the product portfolios of the leading companies operating in the brewing ingredients market. It includes the profiles of leading companies, such as Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Boortmalt (Belgium), Malteurop Groupe (France), Rahr Corporation (US), Lallemand Inc. (Canada), Viking Malt (Sweden), Lesaffre (France), Maltexco S.A. (Chile), and Simpsons Malt (UK). among others.

0 notes

Link

Brewing ingredients market is projected to reach USD 47.9 billion growing at a CAGR of 6.8%, by 2026. The report is segmented on the basis of Brewery Size, Source, Form & by Geography.

0 notes

Text

Brewing Ingredients Market Will Hit Big Revenues In Future

The report "Brewing Ingredients Market by Source (Malt Extract, Adjuncts/Grains, Hops, Beer Yeast, and Beer Additives), Brewery Size (Macro Brewery and Craft Brewery), Form (Dry and Liquid), and Region - Global Forecast to 2026" The brewing ingredients market was valued at USD 34.5 billion in 2021 and is projected to grow at a CAGR of 6.8%, to reach USD 47.9 billion by 2026. The rise in global population and increasing disposable income in developing economies are creating new avenues for alcoholic beverages.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248523644

The brewing ingredients market includes five major sources: malt extract, adjuncts/grains, hops, beer yeast, and beer additives. Malt extract is further bifurcated into standard malt and specialty malt. Specialty malt is sub-segmented into crystal, roasted, dark, and others. Different types of beers are obtained by using different sources of brewing ingredients. For instance, roasted malt is used for producing the porter type of beer. The malt extract segment dominated the global market for brewing ingredients and accounted for a larger share in 2020. Beer additives accounted for the second-largest market share in terms of revenue in 2020.

By source, the malt extract is expected to hold the largest share in the market, during the forecast period

Types of malt extracts differ depending on the grains that are used when making them. The production of malt extracts begins by grinding malt, followed by mashing under controlled conditions to produce various degrees of starch breakdown and resultant fermentability. This involves carefully controlling the pH and using multiple temperature steps during mashing. In the next step, the wort is separated from the spent grains in lauter tuns or mash filters. Both these methods produce high-quality worts and can be set up for high throughput, with as many as 10–14 brews per day. The further steps include boiling, trub removal, vacuum evaporation, and spray drying.

The macro brewery as a brewery size is expected to hold one of the largest shares in the brewing ingredients market, in terms of value, in 2021

On the basis of brewery size, the market is classified into macro brewery and craft brewery. Macro or large breweries are defined as breweries with annual beer production of ≥ 6 million barrels. The most popular macro breweries include Anheuser-Busch InBev (Belgium), Heineken N.V. (Netherlands), China Resources Snow Breweries Limited (China), and Carlsberg Group (Denmark). These breweries generally operate on a global scale, shipping their products to customers across the world. Anheuser-Busch owns the biggest brewery in the world. Large breweries usually have a large staff as well. These breweries employ staff to handle the brewing process, administrative staff, logistics of distribution, teams for marketing and finance, and every role imaginable required for a business to operate. Craft beers are perceived as healthier beers as they may offer help in lowering the rate of cardiovascular disease, improved bone density due to the presence of bone-developing elements such as silicon, lower the risk of joint issues such as arthritis, and increased high-density lipoprotein (HDL) levels which help lower cholesterol, and lower the instances of diabetes.

By form, the dry form will drive the demand for brewing ingredients, in terms of value, in 2021

Based on form, the market is categorized as dry and liquid. Dry brewing ingredients such as dry malt extract (DME) are produced the same way as liquid malt extract, except it goes through an additional dehydration step, which reduces the water content down to about 2%. Because of the lower water content, DME tends to have a better shelf life without the darkening issues of light malt extract. It offers more fermentable extract by weight. Thus, less of it is required to achieve the target gravity. Moreover, as a powder, DME is easier to measure in precise increments. With a digital scale, it can be measured out in fractions of an ounce. This makes DME a great choice for priming, supplementing beer recipes, and for making gravity adjustments.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=248523644

Asia Pacific is projected to dominate the majority market share, in the global brewing ingredients market, in terms of value, in 2021

On the basis of the regional area, the market is segmented into North America, Europe, Asia Pacific, South America, and Rest of World (RoW). Due to the increase in population and rise in disposable income, Asia Pacific is projected to account for the largest share during the review period. The drinking preferences of the population in this region are gradually shifting toward alcoholic culture. The large, increasing population and the growing market mean that the demand for brewing ingredients is still promising. Another factor is the densely populated areas that are not completely tapped by beer manufacturing and brewing ingredient companies. Rapid industrialization and urbanization, increase in environmental concerns, rise in disposable income of growing middle class, and rising demand for craft beers are factors consequently fueling the demand for brewing ingredients market in this sector.

This report includes a study on the marketing and development strategies, along with a survey of the product portfolios of the leading companies operating in the brewing ingredients market. It includes the profiles of leading companies, such as Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Boortmalt (Belgium), Malteurop Groupe (France), Rahr Corporation (US), Lallemand Inc. (Canada), Viking Malt (Sweden), Lesaffre (France), Maltexco S.A. (Chile), and Simpsons Malt (UK). among others.

0 notes

Text

Global Brewing Ingredient Market Global Opportunity, High Demand, Challenges, Dynamics & Region Analysis Report 2027

New research report on the Brewing Ingredient market, found on the Qualiket Research website revealed a great deal about market dynamics. These dynamics influence the market growth from a very miniscule level to its holistic standard & can traverse limitations to assist the market achieve an impressive growth rate during the forecast period of 2020-2027. The report has its core developed by an extensive analysis supervised by adept analysts. Their sound knowledge & expertise in the field help in unearthing of factors as well as figures.

Brewing is defined as the production of beer by stepping a starch source like cereal grains in water and fermenting the resulting sweet liquid with yeast. Malt extract, Adjuncts/Grains, Hops, Beer yeast, and Beer additives are some brewing ingredients which are used in the production of beer. The increase in demand for beer from all over globe along with the increase in consumption of craft beers will boost the demand & growth of brewing ingredients across the globe.

Request a Sample Copy of the Research Report @ https://qualiketresearch.com/request-sample/Brewing-Ingredient-Market/request-sample

Key Players

Some key players are in this market discussed in global brewing ingredient market report such as Angel Yeast Co. Ltd., Cargill, Incorporated, Boortmalt, Rahr Corporation, Malteurop Groupe, Lallemand Inc, Lesaffre, Viking Malt, Simpsons Malt, Maltexco S.A., etc. These companies are focusing on expanding their business through expansions & investments, mergers & acquisitions, partnerships, and agreements. Also, these companies have manufacturing facilities along with strong distribution networks across the globes.

Market Taxonomy

By Source

· Malt extract

· Adjuncts/Grains

· Hops

· Beer yeast

· Beer additives

By Brewery Size

· Macro brewery

· Craft brewery

By Form

· Dry

· Liquid

By Region

· North America

· Latin America

· Europe

· Asia Pacific

· Middle East & Africa

Get your Customized Research Report @ https://qualiketresearch.com/request-sample/Brewing-Ingredient-Market/ask-for-customization

The distinctive nature of the report on the Brewing Ingredient market is evident from the segmental study section. The Brewing Ingredient market has been categorized in segments such as type, Components, and distribution channel are some of the areas where the market has been examined. The regional analysis section specifically mentions the development of the Brewing Ingredient market. Clients can identify several windows which ensure the regional markets to vent out, registering impressive revenues. North America, Europe, Asia Pacific, the Middle East Asia and Africa, and Rest of the World are regional segments of the Brewing Ingredient market. Number of key operating players are profiled from credible sources like industry whitepapers, annual reports, financial reports, and Key Opinion Leaders which includes Chief Executive Officer, sales directors, product managers, R&D directors, and others. The latest developments concerning the Brewing Ingredient market is highlighted in the news update section.

Inquire To Know More About This Report @ https://qualiketresearch.com/request-sample/Brewing-Ingredient-Market/inquire-before-buying

#Brewing Ingredient Market size#Brewing Ingredient Market Share#Brewing Ingredient Market Trend#Brewing Ingredient Market Growth#Brewing Ingredient Market Application

0 notes

Text

Brewing Ingredients Market: Growth Opportunities and Recent Developments

The report "Brewing Ingredients Market by Source (Malt Extract, Adjuncts/Grains, Hops, Beer Yeast, and Beer Additives), Brewery Size (Macro Brewery and Craft Brewery), Form (Dry and Liquid), and Region - Global Forecast to 2026" The brewing ingredients market was valued at USD 34.5 billion in 2021 and is projected to grow at a CAGR of 6.8%, to reach USD 47.9 billion by 2026. The rise in global population and increasing disposable income in developing economies are creating new avenues for alcoholic beverages.

The brewing ingredients market includes five major sources: malt extract, adjuncts/grains, hops, beer yeast, and beer additives. Malt extract is further bifurcated into standard malt and specialty malt. Specialty malt is sub-segmented into crystal, roasted, dark, and others. Different types of beers are obtained by using different sources of brewing ingredients. For instance, roasted malt is used for producing the porter type of beer. The malt extract segment dominated the global market for brewing ingredients and accounted for a larger share in 2020. Beer additives accounted for the second-largest market share in terms of revenue in 2020.

Request for Customization of this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=248523644

COVID-19 Impact on the global brewing ingredients Market

The outbreak of COVID-19 has brought serious medical, social, and economic challenges. It is seen that the majority of the companies operating in the manufacturing sector (53%) expect COVID-19 to impact their operations. The grim expectations have become a reality in the sector due to the rise in oil prices and increasing demand & supply bottlenecks which results in a slowdown of expenditures and rising uncertainty in credit markets. Players across the globe in the food & beverage industry have faced a drastic decrease in the consumption of their products. Due to lockdowns in several parts of the world and restrictions on transportation of commodities, companies are also facing disrupted supply chains. The reduced agricultural production interrupting the raw material supply, lack of workers in manufacturing plants, and disturbances in the distribution system have disrupted supply chains.

Opportunity: Introduction of new flavors in beer

The increase in beverage consumption has led to intense competition amongst beer brands, resulting in the introduction of new flavors and increasing beer consumption. There is a growing popularity for craft beers as it offers various flavors besides the regular flavors offered by macro breweries. The introduction of new ingredients and innovative flavors, combining salty, fruity, and tart flavors, by craft beers, has found an increasing appeal among the millennial crowd globally. Some of the macro brewers are also acting on to respond to these changing demands from consumers. For example, Heineken USA, in 2021, launched Dos Equis Lime & Salt variety pack of lager beer. Similarly, Latambarcem Brewery (India), in 2020, launched a new craft beer brand called Maka di that currently serves four brews: Honey Ale, Belgian Tripel, Bavarian Keller, and Belgian Blanche. The introduction of these new flavors is projected to increase the sales and consumption of beer. Thus, this is anticipated to provide ample opportunities to players operating in the global market.

By brewery size, the craft brewery is estimated to grow at a higher growth rate in the brewing ingredients market.

According to the Brewers Association, an American craft brewer is a small and independent brewer, where small breweries have an annual production of 6 million barrels of beer or less. The craft brewing industry contributed USD 82.9 billion to the US economy in 2019, with more than 580,000 employees. The average alcohol by volume (ABV) content of a craft beer is 5% to 10%, but some of the most popular craft beers have an ABV of as high as 40%. On the other hand, beer produced in bulk by macro breweries has an ABV of 4% to 6% and as little as 2%. Craft breweries offer different flavors, which allow consumers with different tastes to cater to their preferences. These factors are driving the growth of the craft brewery segment in the global market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248523644

The increasing demand for beers in the Asia Pacific countries drives the region's growth rate at a higher pace.

The Asia Pacific region comprises two high-growth economies: India and China. The drinking preferences of the population in this region are gradually shifting toward alcoholic culture. The large, increasing population and the growing market mean that the demand for brewing ingredients is still promising. Another factor is the densely populated areas that are not completely tapped by beer manufacturing and brewing ingredient companies. Hence, beer produced in macro breweries and craft breweries still has a high-growth rate. Moreover, the increasing spending capacity of consumers has led to a surge in demand for craft beers. There has been an emergence of various craft breweries in countries such as India over the last few years.

The APAC region held the largest share in the brewing ingredients market. The demand for different beers with various flavors and different ABV is driven by economic growth, drinking culture in countries such as Vietnam and South Korea, urbanization, and the rise in the purchasing power of consumers.

Key Market Players

Key players in this market include major players such as Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Boortmalt (Belgium), Malteurop Groupe (France), Rahr Corporation (US), Lallemand Inc. (Canada), Viking Malt (Sweden), Lesaffre (France), Maltexco S.A. (Chile), and Simpsons Malt (UK) . These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

0 notes

Text

Brewing Ingredients Market worth $47.9 billion by 2026, at a CAGR of 6.8%

The report "Brewing Ingredients Market by Source (Malt Extract, Adjuncts/Grains, Hops, Beer Yeast, and Beer Additives), Brewery Size (Macro Brewery and Craft Brewery), Form (Dry and Liquid), and Region - Global Forecast to 2026" The brewing ingredients market was valued at USD 34.5 billion in 2021 and is projected to grow at a CAGR of 6.8%, to reach USD 47.9 billion by 2026. The rise in global population and increasing disposable income in developing economies are creating new avenues for alcoholic beverages.

The brewing ingredients market includes five major sources: malt extract, adjuncts/grains, hops, beer yeast, and beer additives. Malt extract is further bifurcated into standard malt and specialty malt. Specialty malt is sub-segmented into crystal, roasted, dark, and others. Different types of beers are obtained by using different sources of brewing ingredients. For instance, roasted malt is used for producing the porter type of beer. The malt extract segment dominated the global market for brewing ingredients and accounted for a larger share in 2020. Beer additives accounted for the second-largest market share in terms of revenue in 2020.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248523644

The macro brewery as a brewery size is expected to hold one of the largest shares in the brewing ingredients market, in terms of value, in 2021

On the basis of brewery size, the market is classified into macro brewery and craft brewery. Macro or large breweries are defined as breweries with annual beer production of ≥ 6 million barrels. The most popular macro breweries include Anheuser-Busch InBev (Belgium), Heineken N.V. (Netherlands), China Resources Snow Breweries Limited (China), and Carlsberg Group (Denmark). These breweries generally operate on a global scale, shipping their products to customers across the world. Anheuser-Busch owns the biggest brewery in the world. Large breweries usually have a large staff as well. These breweries employ staff to handle the brewing process, administrative staff, logistics of distribution, teams for marketing and finance, and every role imaginable required for a business to operate. Craft beers are perceived as healthier beers as they may offer help in lowering the rate of cardiovascular disease, improved bone density due to the presence of bone-developing elements such as silicon, lower the risk of joint issues such as arthritis, and increased high-density lipoprotein (HDL) levels which help lower cholesterol, and lower the instances of diabetes.

By form, the dry form will drive the demand for brewing ingredients, in terms of value, in 2021

Based on form, the market is categorized as dry and liquid. Dry brewing ingredients such as dry malt extract (DME) are produced the same way as liquid malt extract, except it goes through an additional dehydration step, which reduces the water content down to about 2%. Because of the lower water content, DME tends to have a better shelf life without the darkening issues of light malt extract. It offers more fermentable extract by weight. Thus, less of it is required to achieve the target gravity. Moreover, as a powder, DME is easier to measure in precise increments. With a digital scale, it can be measured out in fractions of an ounce. This makes DME a great choice for priming, supplementing beer recipes, and for making gravity adjustments.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=248523644

Asia Pacific is projected to dominate the majority market share, in the global brewing ingredients market, in terms of value, in 2021

On the basis of the regional area, the market is segmented into North America, Europe, Asia Pacific, South America, and Rest of World (RoW). Due to the increase in population and rise in disposable income, Asia Pacific is projected to account for the largest share during the review period. The drinking preferences of the population in this region are gradually shifting toward alcoholic culture. The large, increasing population and the growing market mean that the demand for brewing ingredients is still promising. Another factor is the densely populated areas that are not completely tapped by beer manufacturing and brewing ingredient companies. Rapid industrialization and urbanization, increase in environmental concerns, rise in disposable income of growing middle class, and rising demand for craft beers are factors consequently fueling the demand for brewing ingredients market in this sector.

This report includes a study on the marketing and development strategies, along with a survey of the product portfolios of the leading companies operating in the brewing ingredients market. It includes the profiles of leading companies, such as Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Boortmalt (Belgium), Malteurop Groupe (France), Rahr Corporation (US), Lallemand Inc. (Canada), Viking Malt (Sweden), Lesaffre (France), Maltexco S.A. (Chile), and Simpsons Malt (UK). among others.

0 notes