#Global Agricultural Lubricant Market

Explore tagged Tumblr posts

Text

Sustainable Farming: Navigating Trends in the Agricultural Lubricants Market

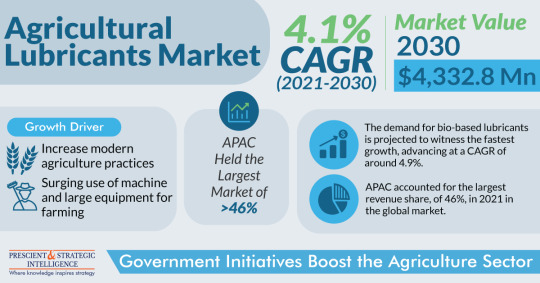

The agricultural lubricants market will touch USD 4,332.8 million, growing at a 4.1% compound annual growth rate, by 2030. The growth of this industry is because of the rising modern farming practices, the growing need to enhance crop yield, and the mechanization of agricultural procedures. Furthermore, the requirement for farming activities-related products are likely to surge at a rapid rate…

View On WordPress

#agricultural lubricants#bio-based lubricants#crop protection equipment#farming practices#global market outlook#lubricant formulations#machinery maintenance#Market dynamics#market trends#precision farming#research and development#sustainable agriculture

0 notes

Text

IBC Cap Market Size, Share, Trends, Growth and Competitive Analysis

"IBC Cap Market – Industry Trends and Forecast to 2028

Global IBC Cap Market, By Product Type (Flange, Plugs, Vent-in Plug, Vent-out Plug and Screw closure), Type (Plastic IBC, Metal IBC and Composite IBCs), Material Type (Plastics, Metal, Aluminium and Steel), End Use (Chemicals & Fertilizers, Petroleum & Lubricants, Paints, Inks & Dyes, Food & Beverage, Agriculture, Building & Construction, Healthcare & Pharmaceuticals and Mining), Application (Food And Drinks, Chemical Industry, Oil and Agriculture), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028

Access Full 350 Pages PDF Report @

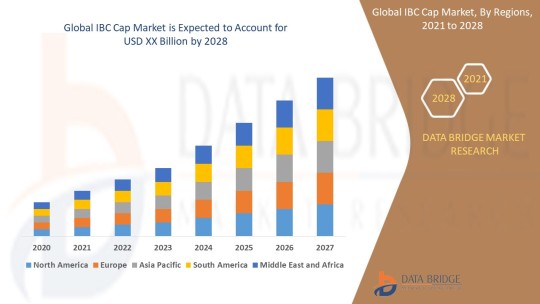

The global IBC cap market is expected to witness significant growth over the forecast period due to the increasing demand for intermediate bulk containers (IBCs) in various industries such as chemicals, food and beverages, pharmaceuticals, and others. The IBC caps play a crucial role in ensuring the safe storage and transportation of liquid products. The market growth is also being driven by technological advancements in IBC cap designs, such as tamper-evident seals and spouts for easy dispensing. Additionally, the growing focus on sustainability and recyclability of packaging materials is further boosting the adoption of IBC caps made from eco-friendly materials.

**Segments**

- Based on material type, the IBC cap market can be segmented into plastic, metal, and others. Plastic caps are widely used due to their lightweight nature and cost-effectiveness. - By cap type, the market can be categorized into screw caps, snap-on caps, and flip-top caps. Screw caps are preferred for their secure sealing properties. - On the basis of end-user industry, the market can be divided into chemicals, food and beverages, pharmaceuticals, and others. The chemicals segment is anticipated to hold a significant market share due to the widespread use of IBCs for storing chemical products.

**Market Players**

- TPS Industrial Srl - Schuetz GmbH & Co. KGaA - Mauser Packaging Solutions - Time Technoplast Ltd - Berry Global Inc. - THIELMANN UCON AG - Precision IBC, Inc. - Peninsula Packaging LLC

These market players are actively involved in strategic initiatives such as product launches, partnerships, and acquisitions to strengthen their market presence and expand their product offerings. The competitive landscape of the IBC cap market is characterized by intense competition, prompting companies to focus on innovation and quality to gain a competitive edge.

The Asia-Pacific region is expected to witness substantial growth in the IBC cap market, driven by the rapid industrialization and the increasing adoption of IBCsThe Asia-Pacific region represents a significant growth opportunity for the global IBC cap market due to several key factors. With rapid industrialization and the expanding manufacturing sector in countries like China, India, and Southeast Asia, there is a growing demand for efficient storage and transportation solutions, including IBCs and their associated caps. The increased focus on chemical production, food processing, and pharmaceutical manufacturing in the region further fuels the need for reliable packaging solutions like IBC caps. As these industries continue to grow, the adoption of IBC caps is expected to rise, driving market expansion in the Asia-Pacific region.

Moreover, the emphasis on enhancing safety standards and ensuring product integrity is a crucial factor contributing to the growth of the IBC cap market in Asia-Pacific. Regulations regarding the safe handling and transportation of hazardous chemicals and pharmaceuticals necessitate the use of high-quality caps that can effectively seal and protect the contents of IBCs. As companies in the region strive to comply with stringent regulatory requirements, the demand for advanced and secure IBC caps is projected to increase significantly.

Additionally, the shift towards sustainability and eco-friendly practices is another trend shaping the IBC cap market in Asia-Pacific. With growing environmental concerns and increasing awareness about plastic pollution, there is a rising preference for IBC caps made from recyclable and biodegradable materials. Market players in the region are focusing on developing sustainable packaging solutions to meet the evolving consumer demands and align with global sustainability goals. This shift towards eco-friendly IBC caps not only addresses environmental concerns but also presents market players with opportunities to differentiate their offerings and attract environmentally conscious customers.

Furthermore, the competitive landscape of the IBC cap market in Asia-Pacific is characterized by the presence of both local manufacturers and international players. Local companies often have a strong understanding of regional market dynamics and customer preferences, giving them a competitive advantage in catering to specific industry needs. On the other hand, multinational companies bring technological expertise and a wide product portfolio, which can appeal to a broader customer base seeking innovative and**Global IBC Cap Market, By Product Type**

- Flange - Plugs - Vent-in Plug - Vent-out Plug - Screw closure

**Type**

- Plastic IBC - Metal IBC - Composite IBCs

**Material Type**

- Plastics - Metal - Aluminium - Steel

**End Use**

- Chemicals & Fertilizers - Petroleum & Lubricants - Paints, Inks & Dyes - Food & Beverage - Agriculture - Building & Construction - Healthcare & Pharmaceuticals - Mining

**Application**

- Food And Drinks - Chemical Industry - Oil and Agriculture

The Global IBC Cap market is experiencing significant growth due to the rising demand for intermediate bulk containers across various industries. Plastic caps are increasingly preferred for their lightweight and cost-effective nature, driving market growth within the material type segment. Screw caps, known for their secure sealing properties, dominate the cap type category. The chemicals segment is anticipated to hold a substantial market share among end-user industries, attributed to the widespread use of IBCs for chemical storage. The market players in the industry are focusing on strategic initiatives like product launches and partnerships to enhance their market presence and offerings. The competitive landscape is intense, spurring companies to innovate and prioritize quality for a competitive advantage.

In Asia-Pacific, the IBC cap market is poised for robust growth fueled by rapid industrialization and the expanding manufacturing sector, particularly in countries like China,

Countries Studied:

North America (Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru, United States, Rest of Americas)

Europe (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Russia, Spain, Sweden, Switzerland, United Kingdom, Rest of Europe)

Middle-East and Africa (Egypt, Israel, Qatar, Saudi Arabia, South Africa, United Arab Emirates, Rest of MEA)

Asia-Pacific (Australia, Bangladesh, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Sri Lanka, Thailand, Taiwan, Rest of Asia-Pacific)

Key Coverage in the IBC Cap Market Report:

Detailed analysis of IBC Cap Market by a thorough assessment of the technology, product type, application, and other key segments of the report

Qualitative and quantitative analysis of the market along with CAGR calculation for the forecast period

Investigative study of the market dynamics including drivers, opportunities, restraints, and limitations that can influence the market growth

Comprehensive analysis of the regions of the IBC Cap industry and their futuristic growth outlook

Competitive landscape benchmarking with key coverage of company profiles, product portfolio, and business expansion strategies

TABLE OF CONTENTS

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Research Methodology

Part 04: Market Landscape

Part 05: Pipeline Analysis

Part 06: Market Sizing

Part 07: Five Forces Analysis

Part 08: Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers and Challenges

Part 13: Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Browse Trending Reports:

Calcium Glycinate Market Retinal Biologics Market Facial Fat Transfer Market Angio Suites Diagnostic Imaging Market Adoption Of Benelux Power Tools Market De Quervains Tenosynovitis Treatment Market Biodetectors And Accessories Market Colposcope Market Sports Medicine Market Automotive Adhesives Market Infrared Imaging Market Vapour Deposition Market Professional Diagnostics Market Ct Scanner Market Programmable Application Specific Integrated Circuit Asic Market Hospital Operating Room Or Products And Solutions Market Castor Oil Market Zika Virus Infection Drug Market Toluene Diisocynate Market Antibiotic Resistance Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]"

2 notes

·

View notes

Text

Adulteration vs Dumping vs Recycling- The Responsible Choice for Waste Oil Disposal

Managing waste oil is a critical responsibility in today’s environmentally conscious world. Whether it's industrial oil, motor oil, or used cooking oil, proper waste oil disposal practices significantly impact environmental health and sustainability. This article delves into three approaches—adulteration, dumping, and recycling—to identify the most responsible method for dealing with waste oil. Along the way, we’ll highlight the importance of waste oil recycling and used cooking oil recycling as sustainable solutions.

Understanding Waste Oil Disposal

Waste oil disposal refers to the process of managing oils that have become unsuitable for their intended use due to contamination, degradation, or extended use. This includes motor oil, hydraulic oil, and cooking oils. Improper disposal can harm ecosystems, pollute waterways, and create long-term environmental challenges. Let's look at three common practices and their implications.

Adulteration: A Dangerous Shortcut

Adulteration is the mixing of waste oil with other substances either to dilute contaminants or make the oil seem reusable. Adulteration is neither a responsible nor a sustainable option for disposing of waste oil. The negative effects of adulteration far outweigh the short-term gains.

Health Hazards of Adulterated Oil

In some alarming cases, adulterated used cooking oil finds its way back into food preparation, especially in unregulated markets. Cooking with such oil

Releases carcinogens which are linked to increased risks of cancers like liver, stomach, and colon cancer.

Can cause gastrointestinal disturbances such as vomiting, diarrhea, or food poisoning due to residual contaminants.

Can elevate levels of harmful cholesterol in the bloodstream leading to cardiovascular and liver problems.

Dumping: An Emerging Global Issue

Another very common, illegal form of waste oil disposal is dumping. It involves disposing waste oil into landfills, water bodies, or even open land.

Environmental Risks of Dumping

Soil Degradation:Waste oil dumped on land seeps into the soil, altering its composition. This contamination reduces soil fertility, affecting agricultural productivity and biodiversity.

Water Pollution: Dumped oil spreads on water surfaces, creating a film that prevents oxygen exchange. This suffocates aquatic life and disrupts marine ecosystems.

Wildlife Endangerment: Birds, mammals, and other species consume the polluted water caused by improper dumping of oil. This leads to poisoning, impaired mobility and compromises the health of animals. In the long run wildlifes are forced to adapt to polluted water bodies causing a range of physical and behavioral changes.

Health Impacts of Dumping

Contaminated Drinking Water: Dumped oil often contaminates groundwater supplies, introducing hazardous chemicals into drinking water sources and increasing risks of gastrointestinal diseases and cancers.

Airborne Toxins from Waste Sites: Waste oil dumped in open areas releases volatile organic compounds (VOCs), contributing to air pollution and associated respiratory problems in nearby communities.

Legal Implications

Illegal dumping of waste oil is often illegal because of its severe environmental impacts. High penalties and lawsuits are intended to discourage this practice.

Dumping appears to be an easy solution, but the long-term harm caused to ecosystems and biodiversity is not responsible.

Recycling: The Responsible Alternative

Waste oil recycling is the most responsible and sustainable way of managing waste oil. Recycling is a process of treating and reprocessing waste oils to make them reusable, either as fuel, lubricants, or other industrial products.

Advantages of Waste Oil Recycling

Environmental Conservation: The volume of waste oil going into landfills or water bodies is reduced, thus preventing the risks of pollution.

Resource Optimization: Recycled oil can be transformed into valuable products, thus reducing the demand for virgin oil extraction.

Energy Efficiency: Used oil is rich in energy and can be reused as a substitute fuel, reducing carbon footprints.

Used Cooking Oil Recycling

Used cooking oil recycling is an emerging industry that is propelled by the need for green energy alternatives. Used cooking oil can be processed into biodiesel, which is a cleaner-burning fuel that decreases greenhouse gases. It can also be utilized in animal feed, cosmetics, and even soap.

Biofuel production from used cooking oil has the following implications-

Reduces greenhouse gas emissions by up to 80% compared to petroleum-based fuels.

Provides economic opportunities by supporting green energy initiatives.

Minimizes the clogging of sewage systems, a common issue caused by the improper disposal of cooking oils.

Steps in Waste Oil Recycling

Collection: Waste oil is collected from households, restaurants, or industries.

Filtration and Purification: Impurities and contaminants are removed through special equipment.

Repurposing: The treated oil is repurposed for various applications, which may include fuel production or manufacturing.

What Can You Do?

Engage in Recycling Programs: Look for certified recycling companies like Ecoil which converts used cooking oil into biofuels for selling your used cooking oil especially if you are a commercial eatery.

Educate Your Community: Spread awareness about harmful impacts of consuming and disposing used oil through awareness campaigns and workshops.

Adopt Eco-Friendly Alternatives: Encourage businesses and industries to prioritize recycling over environmentally damaging disposal methods.

Be Aware and Inquisitive: Whenever you eat outside, check with your chef to ensure that food you eat is cooked in fresh oil.

Conclusion

Adulteration and dumping are harmful practices that amplify environmental degradation and health hazards. On the other hand, waste oil recycling is a sustainable solution that conserves natural resources and encourages a circular economy. In choosing recycling, individuals and businesses contribute to a cleaner, greener future.

Source: https://ecoil.in/news-and-blogs/adulteration-vs-dumping-vs-recycling-the-responsible-choice-for-waste-oil-disposal

0 notes

Text

Mechanized Farming Fuels Agricultural Lubricants Market, Poised for USD 873.8 Million by 2034

The agricultural lubricants market is projected to grow at a CAGR of 5.5% through 2034, reaching an estimated valuation of USD 873.8 million by the end of the forecast period. The global agricultural lubricants market is experiencing a period of rapid expansion, driven by increased mechanization in agriculture and a growing emphasis on efficiency and sustainability.

Report Preview: https://www.futuremarketinsights.com/reports/agricultural-lubricants-market

0 notes

Text

Global Market Insights: Leading Silicone Emulsion Manufacturers and Key Players

The global silicone emulsion market is experiencing significant growth, driven by its wide-ranging applications across industries such as automotive, construction, personal care, textiles, and agriculture. Silicone emulsions are water-based dispersions of silicone oils, offering excellent thermal stability, lubrication, water repellency, and eco-friendliness. These characteristics have made silicone emulsions a preferred choice in many sectors. In this evolving market, silicone emulsion manufacturers play a crucial role in driving innovation and meeting global demand for high-performance and sustainable solutions.

Market Overview and Growth Drivers

The global silicone emulsion market is poised for steady growth due to several factors:

Industrial Expansion: Increasing demand for advanced materials in industries like construction, textiles, and automotive is fueling the growth of silicone emulsions.

Eco-Friendly Solutions: Water-based silicone emulsions are preferred over solvent-based alternatives due to their environmentally friendly nature, aligning with sustainability goals.

Versatility: Silicone emulsions are used in diverse applications, including release agents, coatings, lubricants, water repellents, and personal care products.

According to market studies, the global silicone emulsion market is expected to grow at a CAGR of 6-7% in the coming years. Emerging economies in Asia-Pacific, Latin America, and Africa are driving demand, while developed markets continue to invest in technological advancements.

Key Industries Driving Demand

Automotive

Silicone emulsions are widely used as lubricants, release agents, and polishes in the automotive industry. They help reduce friction, improve durability, and enhance the appearance of automotive components.

Construction

The construction industry leverages silicone emulsions for water-repellent coatings, anti-corrosion treatments, and mold-release agents. Their durability and ability to withstand extreme weather conditions make them invaluable for modern construction solutions.

Textiles and Leather

Silicone emulsions provide a soft finish, water repellency, and shine to fabrics and leather products. Manufacturers use them to enhance the quality and appearance of textiles.

Personal Care

Silicone emulsions are integral to personal care products such as hair conditioners, skin creams, and lotions. They offer excellent spreadability, non-greasy texture, and smooth application.

Agriculture

In agriculture, silicone emulsions act as surfactants and spreaders in pesticides and fertilizers, improving their efficiency and coverage on crops.

Leading Silicone Emulsion Manufacturers and Key Players

The competitive landscape of silicone emulsion manufacturers is characterized by innovation, research and development, and expanding production capacities. The following key players dominate the global market:

Global Chemical Giants

Leading chemical companies are at the forefront of silicone emulsion production. They invest heavily in R&D to introduce high-performance and eco-friendly silicone emulsions. These manufacturers cater to industries ranging from automotive to personal care, ensuring consistent quality and innovation.

Regional Manufacturers

In growing markets like Asia-Pacific, several regional players are gaining traction by offering cost-effective silicone emulsions tailored to local needs. Countries like India and China have emerged as hubs for silicone emulsion production, contributing significantly to the global supply.

Sustainability-Focused Companies

A growing number of silicone emulsion manufacturers are prioritizing sustainable solutions by developing water-based, solvent-free formulations. These eco-friendly products address environmental concerns and comply with strict regulations worldwide.

Specialized Suppliers

Some manufacturers focus on niche applications, such as high-performance silicone emulsions for medical devices, food-grade lubricants, or advanced coatings. Their specialized products cater to unique industrial demands.

Market Trends and Innovations

The silicone emulsion market is witnessing several trends that reflect the evolving needs of industries and consumers:

Sustainability and Green Chemistry: The shift toward eco-friendly, low-VOC silicone emulsions aligns with global sustainability initiatives. Manufacturers are investing in green technologies to reduce environmental impact.

Customization: Silicone emulsion manufacturers are developing tailored products to meet the specific performance requirements of various industries, enhancing customer satisfaction.

Technological Advancements: Innovations such as nano-structured silicone emulsions are revolutionizing performance, offering improved durability and functionality.

Regional Expansion: Key players are expanding their operations in emerging markets like India, China, and Brazil to capitalize on rising industrial demand.

Challenges for Manufacturers

While the silicone emulsion market holds significant potential, manufacturers face challenges such as:

Fluctuations in raw material prices.

Compliance with strict environmental regulations.

Competition from alternative materials.

Addressing these challenges requires constant innovation, cost optimization, and adherence to sustainability standards.

Conclusion

The global silicone emulsion market continues to grow, driven by diverse industrial applications and increasing demand for sustainable solutions. Silicone emulsion manufacturers play a pivotal role in this expansion, focusing on innovation, quality, and eco-friendliness to meet market needs. As industries adopt advanced materials to improve product performance and sustainability, silicone emulsions will remain essential in sectors ranging from automotive and construction to personal care and agriculture. With the right combination of research, technology, and regional outreach, leading manufacturers are poised to shape the future of this dynamic market.

0 notes

Text

Global Grease Market: Key Drivers, Size, and Share Forecast (2024-2032)

The global grease market size was valued at USD 6.36 billion in 2023. The market is projected to grow from USD 6.60 billion in 2024 to USD 9.49 billion by 2032 at a CAGR of 4.6% during the forecast period. Grease offers effective lubrication across an array of operating conditions such as heavy loads and high temperature. The rising product deployment across numerous industries, such as mining and construction, fuels industry growth.

Segmentation:

Mineral Oil Segment Registered Major Share Owing to Friction-Reducing Properties

Based on base oil, the market is segregated into synthetic oil, bio-based oil, and mineral oil. The mineral oil segment accounted for a prominent share of the global market in 2023. The oil assists in decreasing wear and friction between moving parts, which is one of the major attributes fueling segment growth.

Automotive Segment Led the Market Due to Benefit of Smooth Longevity of Auto Parts

By application, the market is categorized into mining, power generation, construction, food & beverage, agriculture, automotive, and others. The automotive segment bagged a dominating position of the global market in 2023. The use of grease provides smooth longevity of automotive parts and offers protection against corrosion, water, friction, and wear, driving segmental expansion.

On the basis of geography, the market has been analyzed across Europe, Latin America, North America, Asia Pacific, and the Middle East & Africa.

Report Coverage:

The report represents an account of the key trends in the market. It further gives an insight into the prominent factors anticipated to drive market expansion over the coming years. An analysis of the market based on various segments has also been provided in the report. The market has been analyzed based on base oil, application, and geography.

List of Key Players Mentioned in the Report:

Exxon Mobil Corporation (U.S.)

Total Energies (France)

Shell PLC (U.K.)

Chevron Corporation (U.S.)

P. PLC (U.K.)

FUCHS (Germany)

Sinopec (China)

PETRONAS (Malaysia)

CONDAT Group (France)

Klüber Lubrication (Germany)

Request For Sample Report: https://www.fortunebusinessinsights.com/enquiry/sample/grease-market-110042

Drivers and Restraints:

Market to Witness New Opportunities with Increasing Development of Eco-Friendly Products

The growing adoption of environment-friendly products and soaring environmental awareness are anticipated to boost grease market growth. The use of eco-friendly solutions provides cost savings in terms of cleanup and disposal. In addition, there has been an enforcement of strict environmental regulations in Europe, North America, and Asia Pacific, leading to the development of eco-friendly lubricating solutions.

Nevertheless, uncertainties associated with the cost of raw materials owing to geopolitical tensions and volatility of oil and gas prices may hinder industry growth.

Regional Insights:

Asia Pacific Accounted for Prominent Share Driven by Launch of High-Speed Rail Systems

Asia Pacific market size reached USD 2.81 billion in 2023. The regional grease market share stood at a major position in the global market owing to the launch of high-speed rail systems to improve transport infrastructure in the region.

North America is touted to expand owing to the increasing mining and construction sectors in the region.

Key Market Trends

Growing Demand for High-Performance Grease: The increasing need for equipment that operates under extreme conditions has driven the demand for synthetic and specialty greases. These products offer better performance in terms of temperature resistance, load-carrying capacity, and durability.

Shift Toward Eco-Friendly Grease: Environmental concerns and stringent regulations are driving the growth of bio-based greases, particularly in developed markets like Europe and North America. These greases reduce the environmental impact and provide sustainable solutions for various industries.

Technological Advancements: The development of new additives and thickeners that enhance grease performance is another key trend. Innovations in nano-lubricants and self-healing grease are expected to boost market growth over the forecast period.

Increasing Demand from Emerging Economies: Rapid industrialization and urbanization in countries like India, China, and Brazil are boosting the demand for grease in construction, automotive, and industrial sectors.

Focus on Maintenance Efficiency: As industries aim to reduce downtime and increase the lifespan of machinery, the use of high-quality lubricants like grease is becoming crucial. This trend is particularly strong in sectors like manufacturing, where equipment reliability is key to operational success.

Get More Information: https://www.fortunebusinessinsights.com/grease-market-110042

Competitive Landscape:

Leading Industry Players Strike Partnerships to Consolidate their Positions in the Market

Major market players are forging collaborations and undertaking capacity expansion initiatives to consolidate industry positions. These steps are also being deployed for gaining a competitive edge. B.P. PLC and Exxon Mobil Corporation are some of the leading companies in the market.

Key Industry Development:

February 2024 – Chevron announced the addition of Rykon to its product portfolio. The overbased calcium sulfonate complex grease has been launched for improving durability and enhancing uptime for next-gen equipment.

0 notes

Text

Sorbitan Monostearate Prices Trend | Pricing | News | Price | Database | Chart

Sorbitan Monostearate a versatile non-ionic surfactant widely used in various industries, has become an essential component in sectors such as food, cosmetics, pharmaceuticals, and industrial applications. Its demand has been steadily increasing due to its multifunctional properties, such as emulsification, stabilizing, and dispersing capabilities. Consequently, the prices of sorbitan monostearate have garnered significant attention from industry stakeholders. Market dynamics, including production costs, raw material availability, regulatory changes, and global trade patterns, play a crucial role in determining the price trends of this compound.

The global market for sorbitan monostearate is influenced by fluctuations in raw material costs, primarily stearic acid and sorbitol. Both of these components are derived from natural sources, such as palm oil and corn, making their prices susceptible to agricultural cycles, geopolitical developments, and environmental regulations. Recent years have seen volatility in palm oil prices due to factors such as adverse weather conditions, labor shortages, and sustainability concerns. These fluctuations directly impact the production costs of sorbitan monostearate, translating into varying market prices. Additionally, the rising demand for sustainable and bio-based products has pushed manufacturers to adopt eco-friendly practices, which can also increase production expenses.

Regional market trends significantly shape the pricing of sorbitan monostearate. In Asia-Pacific, which is a major hub for chemical production, the availability of raw materials and lower labor costs contribute to competitive pricing. However, increasing environmental regulations and stricter sustainability requirements in countries such as Indonesia and Malaysia, key palm oil producers, have started to impact the cost structures for manufacturers. In North America and Europe, where there is a growing preference for natural and organic ingredients, sorbitan monostearate commands higher prices, particularly in the food and cosmetics industries. These regions are also experiencing increased regulatory scrutiny, further driving up costs associated with compliance and quality assurance.

Get Real time Prices for Sorbitan Monostearate: https://www.chemanalyst.com/Pricing-data/sorbitan-monostearate-1538

Technological advancements and innovations in manufacturing processes have also played a role in shaping the market dynamics of sorbitan monostearate. Producers are increasingly leveraging advanced production technologies to enhance efficiency and reduce waste. These innovations help in managing production costs and, consequently, pricing. Moreover, the development of customized grades of sorbitan monostearate tailored for specific applications, such as pharmaceutical excipients or high-performance industrial lubricants, has created a premium pricing segment within the market.

Global trade policies and tariffs also impact the pricing landscape of sorbitan monostearate. Trade disputes and changing import-export regulations can create uncertainties for manufacturers and buyers alike. For instance, tariffs on raw materials or finished goods can lead to increased costs for end-users, while favorable trade agreements can result in price reductions due to enhanced market access. The dynamic geopolitical landscape necessitates continuous monitoring of such factors by market participants.

Sustainability has emerged as a key driver of market trends and pricing for sorbitan monostearate. Consumers and businesses alike are prioritizing environmentally friendly products, compelling manufacturers to adopt sustainable practices in sourcing raw materials and producing the compound. While this shift aligns with global sustainability goals, it often entails higher production costs, which are eventually reflected in market prices. Certifications and eco-labeling also add to the overall cost but provide competitive advantages in markets where green credentials are highly valued.

Demand-supply dynamics also influence the pricing of sorbitan monostearate. Growing demand from burgeoning industries such as plant-based food products, clean-label cosmetics, and biodegradable packaging has put upward pressure on prices. However, overcapacity in certain regions or surplus production due to subdued demand during economic slowdowns can lead to price reductions. Balancing production levels with market demand remains a critical challenge for manufacturers aiming to maintain stable pricing.

The competitive landscape of the sorbitan monostearate market further contributes to its pricing dynamics. Established players with vertically integrated operations enjoy cost advantages, enabling them to offer competitive prices. In contrast, smaller or regional players may face higher production costs due to their reliance on external suppliers for raw materials. Market consolidation and strategic partnerships are becoming common strategies to enhance production efficiency and achieve cost competitiveness.

Looking ahead, the sorbitan monostearate market is expected to witness continued growth, driven by its diverse applications and the global shift towards sustainable products. However, price volatility will likely persist due to factors such as raw material fluctuations, regulatory changes, and evolving consumer preferences. Manufacturers will need to adopt innovative production methods, optimize supply chains, and stay abreast of market trends to maintain competitive pricing while meeting the growing demand. For stakeholders across industries, monitoring these market dynamics will be crucial to navigating the complex pricing landscape of sorbitan monostearate effectively.

Get Real time Prices for Sorbitan Monostearate: https://www.chemanalyst.com/Pricing-data/sorbitan-monostearate-1538

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Sorbitan Monostearate#Sorbitan Monostearate Prices#Sorbitan Monostearate News#Sorbitan Monostearate Pricing#Sorbitan Monostearate Demand#usa#united states#germany#india

1 note

·

View note

Text

Trelleborg Sealing Solutions, a global leader in sealing technology, announces the launch of the innovative Stefa® high-pressure radial shaft seal portfolio designed to deliver unmatched performance across a wide variety of demanding applications. Stefa® high-pressure radial shaft seals (HPRSS) are optimized to improve sealing performance for various speed, chemical compatibility and pressure challenges. They also feature innovative engineered designs that compensate for shaft misalignment, ensuring reliable sealing under extreme conditions. Developed in conjunction with customers using finite element analysis (FEA) and advanced Trelleborg test rigs, Stefa® seals provide smart, globally compliant solutions for various types of hydraulic motors and pumps. They are proven at pressures of up to 20 MPa and speeds of up to 17 meters per second (MPS). High-pressure radial shaft seals are critical components in various markets for vehicles in the construction, mining and agricultural sectors, material handling processes including winches and presses, and industrial uses including gearboxes and engines, as well as numerous applications for the aerospace, automotive, marine and energy sectors. Inderjeet Singh, Global Product Line Director, says: “Working closely with our customers and utilizing our own advanced manufacturing, R&D and testing facilities, we have delivered a step change in performance and durability with the enhanced Stefa® radial shaft sealing range. “Equipment that requires high-pressure radial shaft seals is typically complex and high value, and any seal failure will be an expensive liability for the operator. Over several years, we have leveraged our advanced global in-house R&D capabilities to optimize geometries and materials to provide customer assurance in terms of performance and durability across a wide range of applications with differing requirements.” The range includes the well-established HP20 series which utilizes a patented design geometry that self-balances under strong pressure with a metal retainer that prevents lip extrusion and dissipates heat, extending service life. Millions of the HP20 seals have been sold since its introduction in 2010. The HP20 is capable of operating at up to 20 MPa pressure and rotational speeds of up to 2 MPS. The new HP20S is a high-quality, cost-efficient and long-lasting solution for high-torque, low-speed motors. It is proven at up to 15 MPa and speeds of 5 MPS with an energized spring lip that enables it to work without pressure. The HP20S excels even with reduced lubrication as pads and channels improve lip lubrication at start-up and higher shaft speeds to reduce wear. Due to its flexible lip geometry energized by a stainless-steel spring, the SPS-HP20 excels where there is misalignment between shaft and bore. Its relatively simple design provides a cost-effective solution with superior performance in applications such as hydraulic motors driving a pulley, where there is side load in one direction with the potential to cause gradual deformation of the bearings. The SPS-HP20 features customizable design options in terms of materials and geometries for specific applications and is proven at pressures up to 15 MPa and speeds of 5 MPS. The innovative SPV seal offers enhanced service life at high speeds and is optimized to manage pressure spikes and changes in direction. It is proven at rotational speeds of up to 17 MPS and pressure up to 0.5 MPa but can handle pressure spikes of up to 2.5 MPa, conditions typical in pumps, hydraulic motors and some gearboxes. It is available in a range of elastomer grades customizable for specific application needs, including premium hydrogenated nitrile butadiene rubber (HNBR) and fluoroelastomers (FKM) materials. Finally the established TRP seal has been upgraded to offer exceptionally low friction in applications up to 0.5 MPA of pressure at up to 10 MPS speed. Its proprietary geometry effectively combines performance and manufacturing reliability with an additional dust lip providing enhanced protection to extend lifespan in polluted environments and improved lip contact to reduce friction and optimize sealing efficiency. The composition of TRP can be tailored for specific operating environments, including HNBR, nitrile (NBR) and FKM elastomer materials. Singh adds: “Since the success of HP20, launched over a decade ago, we have substantially enhanced our Stefa® HPRSS range through a combination of our own cutting-edge global R&D and testing capabilities at locations including China, Italy, United States, India and Germany, while working closely with key global customers. “Performance expectations for high pressure radial shaft seals are becoming ever-more challenging, with customers in recent years demanding solutions that work at even high speeds and accelerations. To meet the challenges, we have built advanced test rigs with wider capabilities in terms of operating parameters such as temperature, speed, torque and pressure, as well as pressure spikes and side loads. Trelleborg’s customer proximity has been critical to the successful innovations in our Stefa® portfolio, leveraging our materials expertise and design capabilities alongside deep collaboration with customers to provide optimized solutions.” Register for the customer webinar on the new Stefa® range here. Read the full article

0 notes

Text

PAG to acquire Manjushree Technopack for Rs 8,400 crore

Asia-Pacific-focused alternative investment firm PAG will acquire a majority stake in Manjushree Technopack, India’s largest rigid plastic packaging solution company, for Rs. 8,400 crore (approximately US$ 1 billion). The deal to acquire Manjushree Technopack will be PAG’s third billion-dollar deal this year and the largest it has done in India.

PAG considers the Asia Pacific region to be one of the fastest growing regions and by alternative investment, it looks at off-market opportunities. It has US$ 55 billion under management by over 300 global institutional investors. It manages four pan-Asian buyout funds and two growth funds with US$ 19 billion of capital under management and investments of over US$ 3 billion across various business sectors in India since 2009. Since the founding of its office in the country under the leadership of Nikhil Srivastava in 2019, it has so far invested US$ 1.7 billion.

Manjushree Technopack was established in 1979 and started its plastic container manufacturing operations in Bangalore in 1987. It has 20 plants across India for manufacturing plastic bottles and jars and PET hot-fillable bottles and pre-forms used by the food, beverages, pharmaceutical, cosmetic, agricultural chemicals, automotive lubricants, and numerous other consumer and industrial segments. The company says that its clients number over 110,000. It reported a revenue of Rs 2,130 crore in FY24, which is up from its reported revenue of Rs 2,096 crore in FY 2023 and RS 1,474 crore in FY22. It has an annual installed capacity of plastic containers and related materials of approximately 213,000 metric tons.

0 notes

Text

Ethoxylates Market 2030 Trends, Growth, Revenue, Outlook and Future Estimation

The global ethoxylates market, valued at USD 12.1 billion in 2023, is projected to grow at a compound annual growth rate (CAGR) of 2.9% from 2024 to 2030. This steady growth is driven by the expanding application of ethoxylates across a broad range of industries, including paints and coatings, textiles, personal care, agriculture, and pulp and paper. Additionally, demand is being fueled by the increasing use of low-rinse detergents, the expanding role of ethoxylates in healthcare, and the growing interest in eco-friendly products, particularly alcohol ethoxylates in cosmetics.

Ethoxylates are created through a chemical reaction between ethylene oxide (EO) and other substances, such as alcohols, acids, amines, and vegetable oils, typically in a controlled molar ratio. This synthesis results in ethoxylates with both hydrophobic (water-repelling) and hydrophilic (water-attracting) properties, enabling them to dissolve in oil or water depending on their composition. This versatility makes them valuable in reducing the surface tension between liquids or between a liquid and a gas. Ethoxylates are not only easily dissolved in water but also effective in formulations, offering high wetting properties and minimizing environmental impact on aquatic life.

In the detergent industry, alcohol ethoxylates stand out due to their ability to enhance foam formation, improve surface wetting, increase solubility, and offer strong degreasing properties. These characteristics make ethoxylated detergents particularly effective at removing grease and grime, which has increased their use in household and industrial cleaning products. With rising populations and growing disposable incomes, especially in developing nations, there is an increased demand for efficient laundry detergents. Additionally, higher usage of washing machines has spurred the popularity of liquid detergents, driving up the need for ethoxylated products in these applications.

Gather more insights about the market drivers, restrains and growth of the Ethoxylates Market

Regional Insights:

North America Ethoxylates Market Trends

North America’s ethoxylates market is poised for significant growth, fueled by increasing demand for cleaning and personal care products, particularly in the United States and Canada. The rising awareness of personal hygiene in the region is expected to sustain high demand for cleaning and sanitizing products. Additionally, the preference for detergents with low-foam and rinse-enhancing capabilities is contributing to the market’s revenue growth in North America, with a focus on sustainable cleaning solutions further driving market expansion.

United States

In the U.S., the ethoxylates market is projected to grow rapidly, underpinned by the country’s robust industrial framework. Major sectors, including manufacturing, chemicals, and oil and gas, are among the largest consumers of ethoxylates, using them in various industrial processes. With a rising focus on environmental responsibility, there is a growing demand for green products, and ethoxylates are increasingly considered more environmentally friendly alternatives to traditional surfactants. This trend aligns with both industry demands and consumer preferences in the U.S., further boosting market growth.

Asia Pacific Ethoxylates Market Trends

The Asia Pacific region held a dominant position in the global ethoxylates market, capturing a revenue share of 40.2% in 2023. A significant driver of this demand is the region’s rapidly evolving fashion industry, which has spurred a need for advanced textile materials. Ethoxylates play a crucial role in textile processing as they are used in lubrication, finishing, and dyeing applications. Furthermore, the booming agricultural industry in Asia Pacific is also increasing the demand for ethoxylates. Within this sector, ethoxylates are utilized in agrochemicals, highlighting potential growth opportunities as the agriculture industry continues to expand across the region.

China

In 2023, China led the ethoxylates market within Asia Pacific, supported by the nation’s strong industrial growth. This industrial expansion has increased demand for surfactants like ethoxylates across diverse sectors. Rising disposable incomes and an expanding middle class in China have boosted consumer spending on personal care, household care, and cleaning products, all of which rely heavily on ethoxylates. The Chinese government’s focus on economic growth and technological advancement has fostered a favorable environment for the ethoxylates industry, attracting investment and encouraging further sector development.

Europe Ethoxylates Market Trends

The ethoxylates market in Europe is anticipated to experience notable growth, driven by expanding applications in personal care, pharmaceuticals, household cleaning, and industrial cleaning sectors. Initiatives by national governments and the European Commission are expected to play a crucial role in reviving and supporting key sectors, particularly pharmaceuticals and agrochemicals, which are substantial consumers of ethoxylates. These regulatory efforts, combined with the desirable properties of ethoxylates, such as low toxicity and biodegradability, are likely to stimulate demand and drive growth in the European ethoxylates market over the forecast period.

Germany

Germany held a significant share of the ethoxylates market in Europe in 2023, primarily due to the high demand for alcohol ethoxylates in industrial and institutional cleaning applications. These applications drive substantial consumption of ethoxylates, with the country’s well-established manufacturing sector contributing further to demand. In industrial settings, ethoxylates are utilized in various goods, including lubricants, where they serve as corrosion preventatives and chemical thickeners. This established manufacturing infrastructure supports continuous demand for ethoxylates in Germany, reinforcing its position as a major consumer within the region.

Each of these regions is expected to see sustained or growing demand for ethoxylates across various industries, reflecting both economic growth and a rising focus on sustainable, high-performance chemical solutions across the globe.

Browse through Grand View Research's Category Organic Chemicals Industry Research Reports.

The global chlorinated polyethylene market size was valued at USD 641.7 million in 2023 and is projected to grow at a CAGR of 8.3% from 2024 to 2030.

The global acrylic acid market size was valued at USD13.66 billion in 2023 and is projected to grow at a CAGR of 4.1% from 2024 to 2030.

Key Companies & Market Share Insights

Leading companies in the ethoxylates market include BASF SE, Dow, Clariant, and Solvay. These companies employ various strategies to enhance their market positions, including implementing competitive pricing tactics to bolster yearly revenues and focusing on developing environmentally friendly products with low volatile organic compound (VOC) content, which is increasingly appealing to consumers.

Clariant: Clariant’s operations are divided into three core sectors: care chemicals, absorbents and additives, and catalysts. Care chemicals cater to consumer markets like personal care and household products, while the industrial segment extends to coatings, adhesives, and plastics. Clariant’s catalysts division supplies materials critical for petrochemical production and syngas plants, highlighting the company’s diverse application reach.

Solvay: Solvay specializes in a wide array of high-performance polymers, essential chemicals, and chemical materials, providing solutions for sectors ranging from aerospace and automotive to electronics, consumer goods, and healthcare. Solvay’s diverse clientele underscores the essential role ethoxylates and similar compounds play in supporting high-demand, specialized applications.

Through their strategic expansions, environmentally conscious product development, and diversified applications, these companies are well-positioned to capture growing demand across multiple industries, reflecting the essential role of ethoxylates in both consumer and industrial products.

Key Ethoxylates Companies

BASF SE

Dow

Clariant

Sasol

Huntsman International LLC.

Nouryon

Shell

Solvay

Stepan Company

Evonik Indutsries

Procter & Gamble

Akzo Nobel N.V.

Mitsui Chemicals India Pvt. Ltd

Arkemag

Order a free sample PDF of the Ethoxylates Market Intelligence Study, published by Grand View Research.

0 notes

Text

Ethoxylates Market 2030 Size Outlook, Growth Insight, Share, Trends

The global ethoxylates market, valued at USD 12.1 billion in 2023, is projected to grow at a compound annual growth rate (CAGR) of 2.9% from 2024 to 2030. This steady growth is driven by the expanding application of ethoxylates across a broad range of industries, including paints and coatings, textiles, personal care, agriculture, and pulp and paper. Additionally, demand is being fueled by the increasing use of low-rinse detergents, the expanding role of ethoxylates in healthcare, and the growing interest in eco-friendly products, particularly alcohol ethoxylates in cosmetics.

Ethoxylates are created through a chemical reaction between ethylene oxide (EO) and other substances, such as alcohols, acids, amines, and vegetable oils, typically in a controlled molar ratio. This synthesis results in ethoxylates with both hydrophobic (water-repelling) and hydrophilic (water-attracting) properties, enabling them to dissolve in oil or water depending on their composition. This versatility makes them valuable in reducing the surface tension between liquids or between a liquid and a gas. Ethoxylates are not only easily dissolved in water but also effective in formulations, offering high wetting properties and minimizing environmental impact on aquatic life.

In the detergent industry, alcohol ethoxylates stand out due to their ability to enhance foam formation, improve surface wetting, increase solubility, and offer strong degreasing properties. These characteristics make ethoxylated detergents particularly effective at removing grease and grime, which has increased their use in household and industrial cleaning products. With rising populations and growing disposable incomes, especially in developing nations, there is an increased demand for efficient laundry detergents. Additionally, higher usage of washing machines has spurred the popularity of liquid detergents, driving up the need for ethoxylated products in these applications.

Gather more insights about the market drivers, restrains and growth of the Ethoxylates Market

Regional Insights:

North America Ethoxylates Market Trends

North America’s ethoxylates market is poised for significant growth, fueled by increasing demand for cleaning and personal care products, particularly in the United States and Canada. The rising awareness of personal hygiene in the region is expected to sustain high demand for cleaning and sanitizing products. Additionally, the preference for detergents with low-foam and rinse-enhancing capabilities is contributing to the market’s revenue growth in North America, with a focus on sustainable cleaning solutions further driving market expansion.

United States

In the U.S., the ethoxylates market is projected to grow rapidly, underpinned by the country’s robust industrial framework. Major sectors, including manufacturing, chemicals, and oil and gas, are among the largest consumers of ethoxylates, using them in various industrial processes. With a rising focus on environmental responsibility, there is a growing demand for green products, and ethoxylates are increasingly considered more environmentally friendly alternatives to traditional surfactants. This trend aligns with both industry demands and consumer preferences in the U.S., further boosting market growth.

Asia Pacific Ethoxylates Market Trends

The Asia Pacific region held a dominant position in the global ethoxylates market, capturing a revenue share of 40.2% in 2023. A significant driver of this demand is the region’s rapidly evolving fashion industry, which has spurred a need for advanced textile materials. Ethoxylates play a crucial role in textile processing as they are used in lubrication, finishing, and dyeing applications. Furthermore, the booming agricultural industry in Asia Pacific is also increasing the demand for ethoxylates. Within this sector, ethoxylates are utilized in agrochemicals, highlighting potential growth opportunities as the agriculture industry continues to expand across the region.

China

In 2023, China led the ethoxylates market within Asia Pacific, supported by the nation’s strong industrial growth. This industrial expansion has increased demand for surfactants like ethoxylates across diverse sectors. Rising disposable incomes and an expanding middle class in China have boosted consumer spending on personal care, household care, and cleaning products, all of which rely heavily on ethoxylates. The Chinese government’s focus on economic growth and technological advancement has fostered a favorable environment for the ethoxylates industry, attracting investment and encouraging further sector development.

Europe Ethoxylates Market Trends

The ethoxylates market in Europe is anticipated to experience notable growth, driven by expanding applications in personal care, pharmaceuticals, household cleaning, and industrial cleaning sectors. Initiatives by national governments and the European Commission are expected to play a crucial role in reviving and supporting key sectors, particularly pharmaceuticals and agrochemicals, which are substantial consumers of ethoxylates. These regulatory efforts, combined with the desirable properties of ethoxylates, such as low toxicity and biodegradability, are likely to stimulate demand and drive growth in the European ethoxylates market over the forecast period.

Germany

Germany held a significant share of the ethoxylates market in Europe in 2023, primarily due to the high demand for alcohol ethoxylates in industrial and institutional cleaning applications. These applications drive substantial consumption of ethoxylates, with the country’s well-established manufacturing sector contributing further to demand. In industrial settings, ethoxylates are utilized in various goods, including lubricants, where they serve as corrosion preventatives and chemical thickeners. This established manufacturing infrastructure supports continuous demand for ethoxylates in Germany, reinforcing its position as a major consumer within the region.

Each of these regions is expected to see sustained or growing demand for ethoxylates across various industries, reflecting both economic growth and a rising focus on sustainable, high-performance chemical solutions across the globe.

Browse through Grand View Research's Category Organic Chemicals Industry Research Reports.

The global chlorinated polyethylene market size was valued at USD 641.7 million in 2023 and is projected to grow at a CAGR of 8.3% from 2024 to 2030.

The global acrylic acid market size was valued at USD13.66 billion in 2023 and is projected to grow at a CAGR of 4.1% from 2024 to 2030.

Key Companies & Market Share Insights

Leading companies in the ethoxylates market include BASF SE, Dow, Clariant, and Solvay. These companies employ various strategies to enhance their market positions, including implementing competitive pricing tactics to bolster yearly revenues and focusing on developing environmentally friendly products with low volatile organic compound (VOC) content, which is increasingly appealing to consumers.

Clariant: Clariant’s operations are divided into three core sectors: care chemicals, absorbents and additives, and catalysts. Care chemicals cater to consumer markets like personal care and household products, while the industrial segment extends to coatings, adhesives, and plastics. Clariant’s catalysts division supplies materials critical for petrochemical production and syngas plants, highlighting the company’s diverse application reach.

Solvay: Solvay specializes in a wide array of high-performance polymers, essential chemicals, and chemical materials, providing solutions for sectors ranging from aerospace and automotive to electronics, consumer goods, and healthcare. Solvay’s diverse clientele underscores the essential role ethoxylates and similar compounds play in supporting high-demand, specialized applications.

Through their strategic expansions, environmentally conscious product development, and diversified applications, these companies are well-positioned to capture growing demand across multiple industries, reflecting the essential role of ethoxylates in both consumer and industrial products.

Key Ethoxylates Companies

BASF SE

Dow

Clariant

Sasol

Huntsman International LLC.

Nouryon

Shell

Solvay

Stepan Company

Evonik Indutsries

Procter & Gamble

Akzo Nobel N.V.

Mitsui Chemicals India Pvt. Ltd

Arkemag

Order a free sample PDF of the Ethoxylates Market Intelligence Study, published by Grand View Research.

0 notes

Text

White Oil Market , Key Players, Market Size, Future Outlook | BIS Research

White oil refers to a highly refined, odorless, colorless mineral oil derived from petroleum. It is commonly used in a variety of industries due to its purity and stability. In pharmaceuticals and cosmetics, it serves as a base for lotions, creams, and ointments.

The global White Oil market is projected to reach $8,597.6 million by 2034 from $3,580.0 Million in 2023, growing at a CAGR of 8.24% during the forecast period 2024-2034.

White Oil Overview

White oil is a purified, colorless, and odorless mineral oil made from petroleum. It is known for its high degree of refinement, which removes impurities and makes it safe for use in sensitive applications.

There are two main types of white oil: light white oil and heavy white oil, with the key difference being their viscosity. Light white oil is typically used in the pharmaceutical and cosmetic industries, while heavy white oil is more common in industrial applications and as a lubricant.

Applications for White Oil Market

Pharmaceuticals and Heathcare

Cosmetics and Personal Care

Food Industry

Agriculture

Industrial Applications

Grab a look at our report page click here!

Market Trends

Increasing demand from emerging economies

Shift towards eco friendly products

Technological Advancements in refining

Market Drivers

Growing healthcare and personal care sectors

Rise in demand for organic and chemical free products

Rising consumer awareness

Industrial Growth

Market Segmentation

1 By Product Type

Mineral White Oil

Synthetic White Oil

2 By Grade Type

3 By Application

4 By Functionality Type

5 By Region

Grab a look at our sample page click here!

Key Companies

Bharat Petroleum Corporation Limited

BP p.l.c.

Chevron Corporation

Gandhar Oil Refinery

Exxon Mobil Corporation

FUCHS

Visit our Next Generation Wireless Connectivity Technology Vertical Page !

Recent Developments in the White Oil Market

• In February 2024, Chevron Lummus Global LLC (CLG) launched a state-of-the-art white oil hydroprocessing unit at Hongrun Petrochemical (Weifang) Co., Ltd. in Shandong Province, China. This facility integrates CLG’s advanced ISODEWAXING and ISOFINISHING technologies, enabling the production of ultra-pure white oil tailored to specific industrial needs. The complex includes two specialized units, i.e., one with a capacity of 500,000 metric tons per year (MTPA) for API Group III industrial-grade white oil and another producing 200,000 tons per year (TPA) of food-grade white oil.

Key Market Drivers

Growth in automotive sectors

Expanding pharmaceutical and personal care industry

Rising plastic production

Future Outlook

The white oil market is expected to continue its upward trajectory, fueled by the growth of the pharmaceutical, personal care, and food industries. By 2030, the market for white oil is projected to expand significantly, particularly in emerging markets where urbanization, industrialization, and disposable income are on the rise.

Conclusion

The white oil market is poised for continued growth, with its broad range of applications in industries like healthcare, cosmetics, food, and agriculture. As consumer preferences shift towards safer, more sustainable products, the demand for high-quality, refined white oil will remain strong. Technological advancements and a growing focus on eco-friendly production methods will further contribute to market expansion, making white oil a key ingredient in many of the products people use every day.

0 notes

Text

Top 5 Most Demanded Edible Oil Types

The B2B agro commodity industry is incredibly vibrant with abundant export and import opportunities. This market holds massive potential. However, to completely leverage its benefits, you must know the top countries driving demand. By understanding these key markets, businesses can strategically position you towards brilliant opportunities in the global edible oils sector.

The analysis of the edible oils market indicates a rising demand within the food sector. Expanding applications of corn oil in various industries are predicted to open significant market opportunities. For example, canola oil, known for its low-fat content (6%) among edible oils, is a healthier and more affordable substitute for olive oil and is increasingly recognised as essential in both diet and skincare. The global trend towards healthier eating highlights the demand for diverse oil varieties. Explore the top demanded export bulk edible oil and get the insights below.

Market Insights

The edible oils market is predicted to reach USD 190.88 billion by 2030, with an 8.10% projected CAGR from 2023 to 2030 as per data bridge market research. The report covers market value, growth segmentation, geographical distribution, and the key players involved.

1 Coconut Oil

According to annual consumption, it is 2.61 million metric tons. Coconut oil is produced by the kernel of mature coconuts in India, Indonesia, and the Philippines. The major exporters of coconut oil are found in Indonesia, Malaysia, the Philippines, and Thailand. Due to vast domestic consumption, India is not considered a major exporter of coconut oil. The coconut oil moisturises the skin and works as antioxidants in hair care and skincare routines.

2 Flaxseed oil

Linus usitatissimum is a source of flaxseed oil, which is prized for its abundance of alpha-linolenic acid (ALA), a type of omega-3 fatty acid, with an annual consumption of 0.955 million metric tons. The flax production is dominated by China and Canada, but Kazakhstan contributes to global supply. There are health benefits of flaxseed oil in cardiovascular wellness, and it has been a high-demand product for health-conscious people.

3 Castor Oil

Annual consumption is 0.892 million metric tons. Castor oil is produced by the seeds of the Ricinus communis plant, it is native to tropical areas in Eastern Africa. The agricultural advancement of the plant currently cultivated in other regions. It is produced the most in India, Brazil, and China. Castor oil is a cost-effective industrial raw material used to make lubricants, soaps, cosmetics, and medications. Castor oil seeds yield 40–50% oil on average, with a midpoint of 47.5%.

4 Sesame Oil

Sesame oil procedure is pressed sesame seeds and nutty aroma, its flavour can be found in Asia and Middle Eastern cuisines. The top producers of sesame oil are in Myanmar, China, and India and drive the market to $4.12 billion. It is the most consumed edible oil and used for traditional medicines for over the years as Ayurveda. The oil has antioxidant properties and is a key export commodity in countries.

5 Mustard Oil

Mustard plant seeds produce mustard oil and it is a staple used for South Asian cuisines, including in India. 0.212 Million are annual consumption metric tons. In India, Bangladesh, and Nepal, mustard oil is in demand. The cultivating regions for mustard oil are found in Rajasthan, Uttar Pradesh, and Haryana. Mustard seed is a demanding export bulk edible oil that works for medicine and therapeutic massage.

In conclusion, the most demanding edible oils are mentioned above. Import and export of bulk edible oil is one the demanding businesses, and oil has been a necessity of our lifestyle. According to market guidelines, it provides a clear picture of edible oil. The mentioned data will help you boost your strategy and brand to target the right consumers and regions for your edible oils. Exporters can strengthen their position in a dynamic global market.

References:

15 Most Consumed Edible Oils in the World

Edible Oils Market Size, Trends & Industry Analysis - By 2030

List of Top 10 Largest Edible Oil Producing Countries in the World

0 notes

Text

Magnesium Stearate Prices Trend | Pricing | News | Database | Chart

Magnesium Stearate a widely used excipient and lubricant in pharmaceutical, food, and cosmetic industries, plays a crucial role in ensuring product quality and consistency. The pricing dynamics of magnesium stearate are influenced by various factors, including raw material costs, production processes, regulatory requirements, and global market demand. As a compound derived from stearic acid and magnesium salts, its availability and price are closely tied to the supply chain of these primary inputs. Stearic acid, which is sourced from animal fats or vegetable oils, experiences fluctuations in price due to changes in agricultural yields, feedstock availability, and geopolitical factors affecting trade. Consequently, any disruption or cost increase in stearic acid directly impacts the pricing structure of magnesium stearate.

The pharmaceutical sector accounts for a significant portion of magnesium stearate consumption, as it is essential for tablet formulation, ensuring smooth production processes and enhancing the physical characteristics of tablets. Regulatory compliance and quality standards in this sector impose additional costs on manufacturers, further shaping the market price. Rising demand for generic medications and nutraceutical products has intensified the need for magnesium stearate, creating upward pressure on prices. Similarly, the food industry’s growing reliance on this compound as an anti-caking agent and emulsifier adds another layer of demand, amplifying market competition.

Get Real time Prices for Magnesium Stearate: https://www.chemanalyst.com/Pricing-data/magnesium-stearate-1407

The cosmetic industry also significantly contributes to the demand for magnesium stearate. Its use as a texture enhancer and stabilizer in makeup products such as powders and foundations ensures its consistent demand. However, the industry’s shift towards sustainable and plant-based ingredients has prompted some manufacturers to explore alternatives, which may influence the long-term pricing trends of magnesium stearate. Furthermore, environmental considerations and the push for biodegradable ingredients are prompting changes in production methodologies, potentially leading to increased costs and, subsequently, higher market prices.

Geographical variations in magnesium stearate prices stem from differences in production capacities, labor costs, and access to raw materials. Regions with established chemical manufacturing hubs, such as Asia-Pacific, often benefit from lower production costs due to economies of scale and proximity to raw material sources. China and India, for instance, are prominent suppliers of magnesium stearate, offering competitive pricing in the global market. However, trade policies, import-export tariffs, and regional regulatory requirements can cause significant price disparities across markets.

The ongoing focus on sustainable practices and green chemistry has led to the adoption of bio-based stearic acid in magnesium stearate production. While this shift aligns with global environmental goals, it has introduced cost pressures due to the relatively higher prices of bio-based raw materials. These cost implications are likely to be passed on to end-users, impacting the pricing strategies of magnesium stearate manufacturers. Additionally, technological advancements in production processes, such as continuous manufacturing techniques, are being explored to enhance efficiency and reduce costs. However, the initial investment in such technologies might lead to temporary price increases before realizing long-term cost benefits.

Market trends indicate that the demand for magnesium stearate will continue to grow, driven by expanding applications in emerging industries and regions. For instance, the rising popularity of plant-based and vegan products has spurred the development of magnesium stearate derived from non-animal sources, broadening its appeal to a wider consumer base. This diversification of supply chains and product offerings may stabilize prices over time, despite temporary fluctuations due to market adjustments.

The impact of global economic conditions on magnesium stearate prices cannot be overlooked. Inflationary pressures, currency exchange rates, and energy costs are critical factors that influence production expenses. The energy-intensive nature of chemical manufacturing makes magnesium stearate prices sensitive to fluctuations in oil and gas markets. Additionally, transportation and logistics costs, which have seen significant increases in recent years, contribute to the overall pricing dynamics. These challenges emphasize the importance of strategic sourcing and supply chain optimization for manufacturers to maintain competitive pricing.

Consumer preferences and regulatory trends are shaping the future of the magnesium stearate market. Increased scrutiny on product safety and the traceability of raw materials has led to stricter compliance requirements, adding to production costs. At the same time, consumer demand for transparency and clean-label products is encouraging manufacturers to adopt innovative approaches, such as using certified sustainable ingredients and improving production efficiency. These factors are expected to play a pivotal role in determining the long-term price trajectory of magnesium stearate.

In conclusion, the pricing of magnesium stearate is influenced by a complex interplay of raw material availability, production costs, regulatory frameworks, and market demand. As industries continue to innovate and adapt to evolving consumer and environmental expectations, the market for magnesium stearate is poised for growth. However, stakeholders must navigate challenges such as supply chain disruptions, cost pressures, and sustainability goals to ensure stable and competitive pricing in the years to come.

Get Real time Prices for Magnesium Stearate: https://www.chemanalyst.com/Pricing-data/magnesium-stearate-1407

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Magnesium Stearate#Magnesium Stearate Price#Magnesium Stearate Prices#Magnesium Stearate Pricing#Magnesium Stearate News#Magnesium Stearate Price Monitor

0 notes

Text

Lubricant Additives Market,Industry Forecast, 2024–2030.

Lubricant Additives Market Overview

Request Sample :

The increasing public interest in sustainable products has been a driving force behind the growing demand for Lubricant Additives. This trend aligns with the significant traction seen in bio-based lubricant additives, propelled by environmental concerns and regulatory pressures surrounding emission norms. These additives, derived from renewable resources, offer eco-friendly and sustainable solutions, reducing dependency on traditional petroleum-based additives. They exhibit improved biodegradability, lower toxicity, and enhanced lubrication performance. Manufacturers are investing in research to develop innovative bio-based additives that meet stringent performance requirements across various applications, from automotive to industrial lubricants. The increasing adoption of bio-lubricants is driven by a growing emphasis on sustainability and a push for greener alternatives across industries.

Additionally, there’s a growing demand for lubricant additives that offer multifunctional benefits beyond basic lubrication. Advanced functional additives are designed to cater to specific applications and address evolving performance requirements such as anti-wear, extreme pressure protection, friction reduction, and viscosity control. Manufacturers are focusing on developing additives with improved thermal stability, oxidation resistance, and compatibility with modern base oils. These additives are crucial for meeting the demands of high-performance engines, machinery, and equipment in diverse industries like automotive, aerospace, marine, and manufacturing. The trend is shifting towards tailored additives that offer enhanced performance under extreme operating conditions, prolonging equipment lifespan and reducing maintenance costs.

Inquiry Before Buying :

COVID-19 Impact

COVID-19 pandemic had negatively impacted the lubricant additives market on a global level, as due to restrictions and lockdown imposed by governments all across the globe, the productivity went down of various manufacturing sectors like metalworking, fabricating oil & gas, chemicals, consumer goods, etc. But the automobile sector was majorly hit, as there was shutting down of large part of the auto industry and its many suppliers around the world. Hence due to this, vehicle usage, as well as vehicle sales, took a downfall. And as lubricants additives are used mainly in heavy-duty and passenger vehicle lubricants, so with the decline in vehicle production the demand for lubricant additives especially the passenger vehicle lubricant in the automotive segment also declined. As per the International Organization of Motor Vehicle Manufacturing, in 2020 there was a 16% global decline in vehicles production i.e., less than 78 million vehicles, with all major producing regions like the U.S, Brazil, Germany having a sharp decline of 11% to 44% and Europe saw a drop of 21% on average.

Market Snapshot:-

Report Coverage

The report: “Lubricant Additive Market — Forecast (2024–2030)”, by IndustryARC, covers an in-depth analysis of the following segments of the Lubricant Additive Industry.

By Product Type — Hydraulic Oil, Gear Oil, Engine Oil, Transmission Oil, Compressor Oil (Air Compressor Oil, Gas Compressor Oil, Refrigerator Compressor Oil)

By Additive Type — Anti-Oxidants, Anti-Wear, Viscosity Improvers, Corrosion Inhibitors, Detergents, Dispersants, Others

By Application — Heavy Duty engine, Metal Working Fluids, Industrial Machinery, Others