#Free property selling site

Explore tagged Tumblr posts

Text

Property Selling Site

Looking to sell your property in Delhi NCR? Consider leveraging Bricksnwall, a dynamic property-selling site designed to streamline your sales process. With its user-friendly interface and innovative features, Bricksnwall offers a seamless experience for both sellers and buyers.

Maximize your property's visibility and attract potential buyers by listing on Bricksnwall's platform. Benefit from its targeted marketing strategies and extensive network to ensure a successful sale. Trust Bricksnwall to facilitate your property transactions efficiently and effectively in the bustling real estate market of Delhi NCR. List your property today and unlock the potential of Bricksnwall to achieve your selling goals.

#property selling site#property selling site in noida#property selling site in delhi#property selling site in Delhi NCR#property selling site in India#Free property selling site#real estate

0 notes

Text

Best site to sell property in Delhi NCR

One of the best sites to sell property in Delhi NCR is Bricksnwall. It offers a user-friendly platform with extensive listings and connects sellers with potential buyers effectively. The site provides valuable insights into market trends and property values, making it easier for sellers to navigate the real estate landscape.

#Buy and Sell Your Property#List Your Property Free Online#Free Property Listing Site#Free Property Lisitng Site in Noida#real estate#Bricksnwall

0 notes

Text

Best Property Portal in Delhi NCR

Looking for the best property portal in Delhi NCR Platforms like 99acres, Magicbricks, and Housing.com offer comprehensive listings of properties across Delhi, Noida, and Gurgaon. These portals provide detailed information on apartments, plots, and commercial spaces, along with price comparisons, reviews, and expert insights for informed decision-making.

#bricksnwall#real estate#Buy and Sell Your Property#List Your Property Free Online#Free Property Listing Site#Free Property Lisitng Site in Noida#Bricksnwall

0 notes

Text

Know the legal and taxation aspects before you sell a residential property

Finding a buyer for your house is only one aspect of selling; to ensure a successful transaction, you also need to be aware of the applicable laws and taxes. If you follow these guidelines, selling your home may go more smoothly and there may be fewer unpleasant surprises. This article will teach you the essential tax and legal information you should know before listing your home for sale so you can be ready and have a smooth transaction.

Important legal considerations

Title confirmation

Verifying title is an important stage in the sale of a property. It entails investigating the property's past to confirm that the seller is the true owner and that there are no outstanding legal issues or claims. This keeps things easy for you and ensures that the title is clear and unambiguous.

The process of title verification

Verify the ownership background: Examine the past of the property to determine who has owned it and confirm that each transfer was authorized.

Obtain a Certificate of Entrance: To see if the property has ever been involved in any legal disputes or claims, get this document from the local office.

Examine the property documentation: See formal documentation to confirm details such as ownership, location, and size.

Examine the asset: Check that the property fits the documentation and look for any problems by visiting it.

Examine legal documents to ensure they are accurate, full, and authentic.

Required Documents

Title deeds: documentation of ownership conversion.

Gift deeds: If the asset was given to you.

Records attesting to inheritance: Should the asset be inherited.

Power of attorney: When the owner's property is sold by a third party.

Every charge or claim made against the property is listed in a certificate of encumbrance.

Property card: A formal documentation of property information.

Construction licenses and certificates of occupancy: Demonstrate that the building was constructed and is occupied legally.

Receipts for property taxes: Verify that taxes have been consistently paid.

Sale contract

This official contract lays out every aspect of the selling of the real estate. It contains details on the item, the cost, the method and timing of payment, the time you'll receive possession of the item, and any additional terms. This agreement is usually written on a specific stamp paper in order for it to be legally enforceable.

Certificate of No Objection (NOC)

You require an NOC from the housing society or association if the property is located in an apartment complex or housing society.

This certificate certifies that the ownership transfer has been approved by the community and that there are no outstanding fees or other issues.

Clearance of property taxes

Make sure all property taxes have been paid in full before selling. To demonstrate that there are no outstanding taxes, you must obtain a clearing certificate from the local authorities.

Registration of sale deeds

This is the crucial phase in the formal transfer of property ownership. The selling deed needs to be registered with the Sub-Registrar's office within the specified time frame. Stamp duty and registration costs are needed for this process.

Transfer of possession

Verify that all utility services, such as gas, water, and electricity, are moved into the buyer's name.

Extensive diligence: Verify the buyer's identification and financial situation before finalising the transaction to ensure accuracy.Ensure that all financial transactions are carried out in a formal, lawful manner.

Important topics of taxation

Tax on capital gains

You might have to pay capital gains tax in India on any earnings you make when you sell your house. If profits are sold within 24 months after purchase, they are considered short-term and are subject to taxation at your regular income tax rate.

The profit is long-term and taxed at a fixed rate of 20% if you sell it after 24 months, with certain perks for inflation adjustments.

Indexation

Indexation reduces your taxable profit by factoring inflation into the acquisition price of your property. It takes price increases into consideration over time, so the taxes you pay on your gain will be lower.

Capital Gains Calculation

Subtract the sale price from the adjusted cost of the property and any improvements to determine your capital gain. Capital Gain = Sale Price - (Adjusted Purchase Cost + Improvement Costs) is the formula.

Tax-saving strategies

Section 54: You can defer paying taxes on a profit if you utilize it to purchase another residential property within two years after the original transaction.

Section 54F: You may also receive a tax benefit if you invest the profit in specific bonds.

Section 54EC: You can lower your taxable income if you invest the profit in certain bonds issued by REC Limited or the National Highways Authority.

Additional tax implications

TDS (Tax Deducted at Source): The buyer must subtract 1% of the sale price from the sale and pay the tax authorities if the property is sold for more than Rs. 50 lakhs.

Stamp duty and registration fees are not taxes; rather, they are sums of money you pay the government to transfer ownership of the property.

#Know the legal and taxation aspects#before you sell a residential property#sell a residential property#Legal and taxation aspects#Taxation of Property in India#Buy and Sell Your Property#Free Property Listing Site#Buy your House#Sell Your House#Real Estate

0 notes

Text

From Auctions to Bank-Owned: Unveiling the Spectrum of Distressed Properties in India

Investing in distressed properties can be a lucrative venture, offering unique opportunities for those looking to enter the real estate market at a potentially lower cost. In India, distressed properties encompass a variety of real estate assets that are available for purchase due to financial or legal challenges faced by the current owners. Here's an overview of the types of distressed property sale in Chennai commonly found in the Indian real estate market:

Foreclosed Properties:

Foreclosed properties are those seized by banks or financial institutions due to the borrower's inability to repay the mortgage or loan. These properties are typically auctioned off to recover the outstanding debt. Investors can find value in foreclosed properties, often acquiring them at prices lower than the market value.

Bank-Owned Properties:

Bank-Owned Properties, also known as Real Estate Owned (REO) properties, come into the possession of the bank after undergoing foreclosure. These assets are commonly marketed and sold through auctions or real estate agents, providing buyers with the advantage of streamlined transaction processes.

Distressed Sales:

Distressed sales include properties sold by owners facing financial difficulties or urgent circumstances. These sales may be prompted by issues such as job loss, divorce, or other personal crises, leading to a quicker sale at a potentially lower price.

Auctioned Properties:

Auctions are a common method for selling distressed properties in India, providing a dynamic platform for both buying and selling real estate assets. Properties may be auctioned by financial institutions, government agencies, or private sellers, offering a diverse range of opportunities for potential investors looking to buy or sell property in Chennai. Investors can actively bid on these properties, and successful bidders can acquire real estate at competitive prices, making auctions a compelling avenue for those involved in the Chennai real estate market.

Insolvency and Bankruptcy Cases:

The Insolvency and Bankruptcy Code (IBC) in India has facilitated the resolution of distressed assets. Properties involved in insolvency or bankruptcy cases may be available for sale as part of the resolution process. Investors can explore these opportunities through the National Company Law Tribunal (NCLT) or the National Company Law Appellate Tribunal (NCLAT).

Non-Performing Assets (NPAs):

NPAs in the banking sector may include distressed properties that financial institutions are eager to sell to recover losses. Investors can explore NPAs as potential opportunities for acquiring real estate assets at favorable prices.

Government Auctions:

Government agencies, including the Income Tax Department and municipal authorities, often conduct auctions of seized properties due to non-payment of taxes or other legal issues. These properties can provide investors with a chance to acquire assets with potential value appreciation.

Rehabilitation Projects:

Distressed properties in need of renovation or rehabilitation present opportunities for investors with the skills and resources to undertake such projects. These properties can be purchased at a lower cost, and value can be added through renovations.

Land Parcels with Legal Issues:

Some distressed properties may include land parcels with legal complications or title issues. Investors who can navigate and resolve these legal challenges may find opportunities to acquire land at discounted prices.

Before venturing into the market of distressed properties, potential investors should conduct thorough due diligence, considering legal aspects, market conditions, and potential renovation costs. This diligence is essential not only for those looking to invest in distressed properties but also for individuals aiming to sell and rent their properties in Chennai. While the potential returns can be enticing, careful consideration and a well-informed approach are crucial for success in this niche real estate sector, whether you are buying, selling, or renting in the vibrant Chennai market.

#commercial land for sale in anna nagar#property sale in chennai#Top builders & developers projects in Chennai#buy/sell property in Chennai top builders#Sell and rent your properties in chennai#commercial space for rent anna nagar#office space for rent in mount road#sell/rent your property in Chennai#commercial and residential property in Chennai#post free ads for commercial property#post free listings to get property closures#real estate free ads posting sites

0 notes

Text

List your property on Bricksnwall to reach a large audience and maximize your chances of selling at the highest price. Many reliable online platforms help property owners with finding potential buyers when they are seeking the best platform to sell their property in Delhi NCR. They have a user-friendly interface, wide market reach, and powerful marketing tools to maximize visibility and attract interested buyers, ensuring a smooth and successful property sale.

#best site to sell property in delhi ncr#buy and sell property#buy and sell your property#list your property free online#free property listing site in noida

0 notes

Text

Bricksnwall is a professional real estate brokerage that can help you sell your property because it is the Best Place to Sell Property in Delhi NCR. It has strategic partnerships with several of the top developers and can provide expert advice and support throughout the selling process.

#best site to sell property in delhi ncr#top real estate site for lisitng#buy and sell your property#buy and sell property online#list your property#free property lisitng site

0 notes

Text

Top 10 Things You Should Know When Taking a Home Loan

A home loan, usually referred to as a mortgage loan, is a kind of loan obtained to buy real estate. The property is used as collateral for the loan, giving the lender the right to sell the home to recoup their losses if the borrower is unable to make payments. Home loans often have longer repayment terms of 15 to 30 years, with either fixed or variable interest rates. Regular loan payments, which normally include both principal and interest, are expected from the borrower.

One of the most important financial decisions you will ever make is whether to take out a loan for a home. It can be a difficult procedure, so it's critical to do your research before committing. The top ten items to be aware of when applying for a mortgage are listed below.

1. Decide how much you can afford before looking for a mortgage: It's critical to decide how much you can afford before shopping for a mortgage. To create a realistic budget for your house purchase, take a look at your income, expenses, and other financial commitments.

2. Knowing the various home loan kinds is important. These loans come in fixed-rate, adjustable-rate, and hybrid varieties. Before selecting a loan, it's crucial to understand the distinctions between each type of loan because each has advantages and cons of its own.

3. Verify your credit rating: Your qualifying for a house loan and the interest rate you will pay depend greatly on your credit score. Check your credit score before applying for a loan and, if required, take action to improve it.

4. Never accept the first home loan offer you are given: instead, shop around for the best offer. To discover the best offer for your requirements, shop around and evaluate interest rates, costs, and other terms and conditions.

5. Recognise the costs involved: There are a number of expenses associated with home loans, such as application fees, processing fees, and prepayment penalties. Before signing on the dotted line, be sure you are aware of all the costs.

6. Get pre-approved: By receiving pre-approval for a mortgage, you may focus your search and present a more compelling offer when you find the ideal house. Additionally, it helps you determine how much you can actually spend.

7. Before you sign a home loan contract, make sure you have read the fine print and are aware of all the terms and conditions. If something is unclear, ask questions.

8. Future-proof your loan: Making future plans is crucial when taking out a mortgage. When evaluating how much you can spend, take into account aspects like future bills, salary potential, and job security.

9. Pay your bills on time: Making on-time payments is essential to keeping your credit score high and avoiding late fees and other penalties. Set up automated payments or reminders to make certain you never neglect any payments.

10. Think about the long-term expenses: Property taxes, upkeep, and repairs are just a few of the long-term expenses associated with homeownership. When figuring out how much you can spend, be sure to account for these expenses.

Conclusion

A home loan is a large financial commitment that needs to be carefully planned for, budgeted for, and taken into account. You may make a successful home purchase by comprehending the many home loan options, verifying your credit score, looking about for the greatest offer, and budgeting for the long-term costs of owning. Making timely payments, reading the fine print, and getting pre-approved are also essential actions to follow to guarantee a smooth home loan transaction. In the end, getting a home loan can be a terrific method to fulfill your ambition of becoming a homeowner, but you should do so with prudence, information, and a well-thought-out strategy. You may make the greatest choice for your situation by adhering to the top ten things to know when accepting a home loan.

#home loan#real estate#real estate investment#buy and sell property#Home loan tips#tips for home loan#best site to sell property in delhi ncr#list your property free online

1 note

·

View note

Text

Bricksnwall website offers many 3 BHK flats in Noida Extension with High-class infrastructure and Superior quality modern architecture flats. The 3 BHK flats for sale are spacious and well-balanced structures with a view and nature. This project is set up in a prime location of Noida Extension and connected to other regions by roads is well structured.

#3bhk flats in noida extension#flats in noida extension#3bhk flats#best site to sell property in noida extension#list your property free online#free business listing site in greater noida

0 notes

Text

#free property listing site#property listing site in delhi ncr#list your property free online#bricksnwall#best site to sell property in delhi ncr#free property listing site in delhi ncr#top real estate sites for listing

0 notes

Text

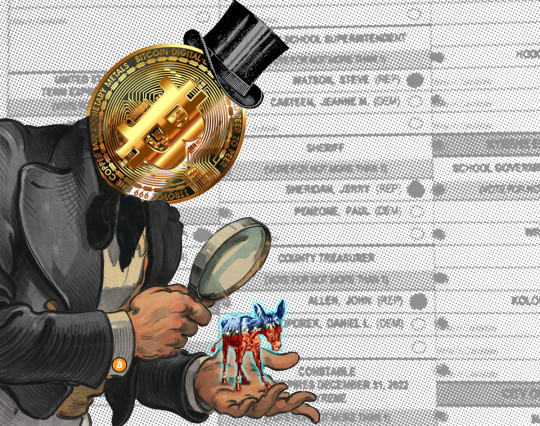

The largest campaign finance violation in US history

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Earlier this month, some of the richest men in Silicon Valley, led by Marc Andreesen and Ben Horowitz (the billionaire VCs behind Andreesen-Horowitz) announced that they would be backing Trump with endorsements and millions of dollars:

https://www.forbes.com/sites/dereksaul/2024/07/16/trump-lands-more-big-tech-backers-billionaire-venture-capitalist-andreessen-joins-wave-supporting-former-president/

Predictably, this drew a lot of ire, which Andreesen tried to diffuse by insisting that his support "doesn’t have anything to do with the big issues that people care about":

https://www.theverge.com/2024/7/24/24204706/marc-andreessen-ben-horowitz-a16z-trump-donations

In other words, the billionaires backing Trump weren't doing so because they supported the racism, the national abortion ban, the attacks on core human rights, etc. Those were merely tradeoffs that they were willing to make to get the parts of the Trump program they do support: more tax-cuts for the ultra-rich, and, of course, free rein to defraud normies with cryptocurrency Ponzi schemes.

Crypto isn't "money" – it is far too volatile to be a store of value, a unit of account, or a medium of exchange. You'd have to be nuts to get a crypto mortgage when all it takes is Elon Musk tweeting a couple emoji to make your monthly mortgage payment double.

A thing becomes moneylike when it can be used to pay off a bill for something you either must pay for, or strongly desire to pay for. The US dollar's moneylike property comes from the fact that hundreds of millions of people need dollars to pay off the IRS and their state tax bills, which means that they will trade labor and goods for dollars. Even people who don't pay US taxes will accept dollars, because they know they can use them to buy things from people who do have a nondiscretionary bill that can only be paid in dollars.

Dollars are also valuable because there are many important commodities that can only – or primarily – be purchased with them, like much of the world's oil supply. The fact that anyone who wants to buy oil has a strong need for dollars makes dollars valuable, because they will sell labor and goods to get dollars, not because they need dollars, but because they need oil.

There's almost nothing that can only be purchased with crypto. You can procure illegal goods and services in the mistaken belief that this transaction will be durably anonymous, and you can pay off ransomware creeps who have hijacked your personal files or all of your business's data:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

Web3 was sold as a way to make the web more "decentralized," but it's best understood as an effort to make it impossible to use the web without paying crypto every time you click your mouse. If people need crypto to use the internet, then crypto whales will finally have a source of durable liquidity for the tokens they've hoarded:

https://pluralistic.net/2022/09/16/nondiscretionary-liabilities/#quatloos

The Web3 bubble was almost entirely down to the vast hype machine mobilized by Andreesen-Horowitz, who bet billions of dollars on the idea and almost single-handedly created the illusion of demand for crypto. For example, they arranged a $100m bribe to Kickstarter shareholders in exchange for Kickstarter pretending to integrate "blockchain" into its crowdfunding platform:

https://finance.yahoo.com/news/untold-story-kickstarter-crypto-hail-120000205.html

Kickstarter never ended up using the blockchain technology, because it was useless. Their shareholders just pocketed the $100m while the company weathered the waves of scorn from savvy tech users who understood that this was all a shuck.

Look hard enough at any crypto "success" and you'll discover a comparable scam. Remember NFTs, and the eye-popping sums that seemingly "everyone" was willing to pay for ugly JPEGs? That whole market was shot through with "wash-trading" – where you sell your asset to yourself and pretend that it was bought by a third party. It's a cheap – and illegal – way to convince people that something worthless is actually very valuable:

https://mailchi.mp/brianlivingston.com/034-2#free1

Even the books about crypto are scams. Chris Dixon's "bestseller" about the power of crypto, Read Write Own, got on the bestseller list through the publishing equivalent of wash-trading, where VCs with large investments in crypto bought up thousands of copies and shoved them on indifferent employees or just warehoused them:

https://pluralistic.net/2024/02/15/your-new-first-name/#that-dagger-tho

The fact that crypto trades were mostly the same bunch of grifters buying shitcoins from each other, while spending big on Superbowl ads, bribes to Kickstarter shareholders, and bulk-buys of mediocre business-books was bound to come out someday. In the meantime, though, the system worked: it convinced normies to gamble their life's savings on crypto, which they promptly lost (if you can't spot the sucker at the table, you're the sucker).

There's a name for this: it's called a "bezzle." John Kenneth Galbraith defined a "bezzle" as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it." All bezzles collapse eventually, but until they do, everyone feels better off. You think you're rich because you just bought a bunch of shitcoins after Matt Damon told you that "fortune favors the brave." Damon feels rich because he got a ton of cash to rope you into the con. Crypto.com feels rich because you took a bunch of your perfectly cromulent "fiat money" that can be used to buy anything and traded it in for shitcoins that can be used to buy nothing:

https://theintercept.com/2022/10/26/matt-damon-crypto-commercial/

Andreesen-Horowitz were masters of the bezzle. For them, the Web3 bet on an internet that you'd have to buy their shitcoins to use was always Plan B. Plan A was much more straightforward: they would back crypto companies and take part of their equity in huge quantities of shitcoins that they could sell to "unqualified investors" (normies) in an "initial coin offering." Normally, this would be illegal: a company can't offer stock to the general public until it's been through an SEC vetting process and "gone public" through an IPO. But (Andreesen-Horowitz argued) their companies' "initial coin offerings" existed in an unregulated grey zone where they could be traded for the life's savings of mom-and-pop investors who thought crypto was real because they heard that Kickstarter had adopted it, and there was a bestselling book about it, and Larry David and Matt Damon and Spike Lee told them it was the next big thing.

Crypto isn't so much a financial innovation as it is a financial obfuscation. "Fintech" is just a cynical synonym for "unregulated bank." Cryptocurrency enjoys a "byzantine premium" – that is, it's so larded with baffling technical nonsense that no one understands how it works, and they assume that anything they don't understand is probably incredibly sophisticated and great ("a pile of shit this big must have pony under it somewhere"):

https://pluralistic.net/2022/03/13/the-byzantine-premium/

There are two threats to the crypto bezzle: the first is that normies will wise up to the scam, and the second is that the government will put a stop to it. These are correlated risks: if the government treats crypto as a security (or worse, a scam), that will put severe limits on how shitcoins can be marketed to normies, which will staunch the influx of real money, so the sole liquidity will come from ransomware payments and transactions with tragically overconfident hitmen and drug dealers who think the blockchain is anonymous.

To keep the bezzle going, crypto scammers have spent the past two election cycles flooding both parties with cash. In the 2022 midterms, crypto money bankrolled primary challenges to Democrats by absolute cranks, like the "effective altruist" Carrick Flynn ("effective altruism" is a crypto-affiliated cult closely associated with the infamous scam-artist Sam Bankman-Fried). Sam Bankman-Fried's super PAC, "Protect Our Future," spent $10m on attack-ads against Flynn's primary opponent, the incumbent Andrea Salinas. Salinas trounced Flynn – who was an objectively very bad candidate who stood no chance of winning the general election – but only at the expense of most of the funds she raised from her grassroots, small-dollar donors.

Fighting off SBF's joke candidate meant that Salinas went into the general election with nearly empty coffers, and she barely squeaked out a win against a GOP nightmare candidate Mike Erickson – a millionaire Oxy trafficker, drunk driver, and philanderer who tricked his then-girlfriend by driving her to a fake abortion clinic and telling her that it was a real one:

https://pluralistic.net/2022/10/14/competitors-critics-customers/#billionaire-dilletantes

SBF is in prison, but there's no shortage of crypto millions for this election cycle. According to Molly White's "Follow the Crypto" tracker, crypto-affiliated PACs have raised $185m to influence the 2024 election – more than the entire energy sector:

https://www.followthecrypto.org/

As with everything "crypto," the cryptocurrency election corruption slushfund is a bezzle. The "Stand With Crypto PAC" claims to have the backing of 1.3 million "crypto advocates," and Reuters claims they have 440,000 backers. But 99% of the money claimed by Stand With Crypto was actually donated to "Fairshake" – a different PAC – and 90% of Fairshake's money comes from a handful of corporate donors:

https://www.citationneeded.news/issue-62/

Stand With Crypto – minus the Fairshake money it falsely claimed – has raised $13,690 since April. That money came from just seven donors, four of whom are employed by Coinbase, for whom Stand With Crypto is a stalking horse. Stand With Crypto has an affiliated group (also called "Stand With Crypto" because that is an extremely normal and forthright way to run a nonprofit!), which has raised millions – $1.49m. Of that $1.49m, 90% came from just four donors: three cryptocurrency companies, and the CEO of Coinbase.

There are plenty of crypto dollars for politicians to fight over, but there are virtually no crypto voters. 69-75% of Americans "view crypto negatively or distrust it":

https://www.pewresearch.org/short-reads/2023/04/10/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/

When Trump keynotes the Bitcoin 2024 conference and promises to use public funds to buy $1b worth of cryptocoins, he isn't wooing voters, he's wooing dollars:

https://www.wired.com/story/donald-trump-strategic-bitcoin-stockpile-bitcoin-2024/

Wooing dollars, not crypto. Politicians aren't raising funds in crypto, because you can't buy ads or pay campaign staff with shitcoins. Remember: unless Andreesen-Horowitz manages to install Web3 crypto tollbooths all over the internet, the industries that accept crypto are ransomware, and technologically overconfident hit-men and drug-dealers. To win elections, you need dollars, which crypto hustlers get by convincing normies to give them real money in exchange for shitcoins, and they are only funding politicians who will make it easier to do that.

As a political matter, "crypto" is a shorthand for "allowing scammers to steal from working people," which makes it a very Republican issue. As Hamilton Nolan writes, "If the Republicans want to position themselves as the Party of Crypto, let them. It is similar to how they position themselves as The Party of Racism and the Party of Religious Zealots and the Party of Telling Lies about Election Fraud. These things actually reflect poorly on them, the Republicans":

https://www.hamiltonnolan.com/p/crypto-as-a-political-characteristic

But the Democrats – who are riding high on the news that Kamala Harris will be their candidate this fall – have decided that they want some of that crypto money, too. Even as crypto-skeptical Dems like Jamaal Bowman, Cori Bush, Sherrod Brown and Jon Tester see millions from crypto PACs flooding in to support their primary challengers and GOP opponents, a group of Dem politicians are promising to give the crypto industry whatever it wants, if they will only bribe Democratic candidates as well:

https://subscriber.politicopro.com/f/?id=00000190-f475-d94b-a79f-fc77c9400000

Kamala Harris – a genuinely popular candidate who has raised record-shattering sums from small-dollar donors representing millions of Americans – herself has called for a "reset" of the relationship between the crypto sector and the Dems:

https://archive.is/iYd1C

As Luke Goldstein writes in The American Prospect, sucking up to crypto scammers so they stop giving your opponents millions of dollars to run attack ads against you is a strategy with no end – you have to keep sucking up to the scam, otherwise the attack ads come out:

https://prospect.org/politics/2024-07-31-crypto-cash-affecting-democratic-races/

There's a whole menagerie of crypto billionaires behind this year's attempt to buy the American government – Andreesen and Horowitz, of course, but also the Winklevoss twins, and this guy, who says we're in the midst of a "civil war" and "anyone that votes against Trump can die in a fucking fire":

https://twitter.com/molly0xFFF/status/1813952816840597712/photo/1

But the real whale that's backstopping the crypto campaign spending is Coinbase, through its Fairshake crypto PAC. Coinbase has donated $45,500,000 to Fairshake, which is a lot:

https://www.coinbase.com/blog/how-to-get-regulatory-clarity-for-crypto

But $45.5m isn't merely a large campaign contribution: it appears that $25m of that is the largest the largest illegal campaign contribution by a federal contractor in history, "by far," a fact that was sleuthed out by Molly White:

https://www.citationneeded.news/coinbase-campaign-finance-violation/

At issue is the fact that Coinbase is bidding to be a US federal contractor: specifically, they want to manage the crypto wallets that US federal cops keep seizing from crime kingpins. Once Coinbase threw its hat into the federal contracting ring, it disqualified itself from donating to politicians or funding PACs:

Campaign finance law prohibits federal government contractors from making contributions, or promising to make contributions, to political entities including super PACs like Fairshake.

https://www.fec.gov/help-candidates-and-committees/federal-government-contractors/

Previous to this, the largest ever illegal campaign contribution by a federal contractor appears to be Marathon Petroleum Company's 2022 bribe to GOP House and Senate super PACs, a mere $1m, only 4% of Coinbase's bribe.

I'm with Nolan on this one. Let the GOP chase millions from billionaires everyone hates who expect them to promote a scam that everyone mistrusts. The Dems have finally found a candidate that people are excited about, and they're awash in money thanks to small amounts contributed by everyday Americans. As AOC put it:

They've got money, but we've got people. Dollar bills don't vote. People vote.

https://www.popsugar.com/news/alexandria-ocasio-cortez-dnc-headquarters-climate-speech-47986992

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/31/greater-fools/#coinbased

#pluralistic#coinbase#crypto#cryptocurrency#elections#campaign finance#campaign finance violations#crimes#fraud#influence peddling#democrats#moneylike#bubbles#ponzi schemes#bezzles#molly white#hamilton nolan

427 notes

·

View notes

Text

Best Site To Sell Property in Delhi NCR

The "best site to sell property in Delhi NCR" may vary depending on individual preferences and experiences. Additionally, social media platforms like Facebook Marketplace and local community groups can also be effective in reaching potential buyers. To maximize your chances of selling your property, it's essential to present it in the best possible light through high-quality photos, accurate descriptions, and competitive pricing.

#Best Site To Sell Property in Delhi NCR#Property Selling Site#Free Property Selling Site in Delhi NCR#Buy and Sell Your Property#Real Estate#Bricksnwall

0 notes

Text

Laurette Larue's Blog:

Thanks for following my blog, your continued visits and support are highly appreciated:

35,843+ followers... Thanks!!

27,370+ Posts and every day more posts/re-blogs are being added! (last time I checked)

** remember to enable adult and sexy content for your Tumblr in your settings! My Instagram Account is only about Me, follow ME there

💋 Laurette

You also may find my website a place you would like to visit

Sissies converge at SissyDolls.club

Want to: -chat at SissyDolls.club? -share your SissyDoll dreams / experiences? -contribute content to SissyDolls.club? -have your 'NSFW' content posted uncensored on SissyDolls.club? -be exposed on SissyDolls.club? Not required, only upon request!

SissyDolls.club has been set-up as a completely non-commercial and therefore totally free of charge Sissy site. We will never even consider to sell your user data for commercial gain. Nothing will be shared or sold beyond SissyDolls.club, unless you do..

Come join it's free of charge, no hidden obligations or costs, and then join the conversations in our chats...

Sissydolls.club domain and brand are the property of @laurettelarue

Just in case you want to buy me someting nice: My Lovense toy wishlist

#sissy dolls#sissydollsclub#laurette larue#sissydolls.club#join the conversation#gurls like us#gurls wanna have fun#sissy site#where sissies converge#chat#join sissydollsclub#visit sissydolls.club

1K notes

·

View notes

Text

In the Delhi NCR real estate market, Bricksnwall is a fantastic option for sellers. With its extensive property listings, intuitive design, sophisticated search functions, and first-rate customer service, the platform offers all the necessary ingredients for a smooth and profitable transaction. Bricksnwall provides the tools and resources to support you in achieving your objectives for selling a property in Delhi NCR effectively and efficiently, regardless of your level of real estate investing expertise or first-time selling proficiency.

#bricksnwall#real estate#Buy and Sell Your Property#List Your Property Free Online#Free Property Listing Site#Free Property Lisitng Site in Noida#Bricksnwall

0 notes

Text

How a luxury home is situated in a gated community a good investment strategy?

We have all become more aware of the value of gated community living due to the lockdown followed by COVID-19. People in societies enjoyed their social lives in total security, while no one was permitted to leave their homes due to safety concerns.

Furthermore, the neighborhood itself had everything the members could need. There was no need to leave their homes to get groceries or other necessities because all they needed was nearby, and this is the reason why people should invest their money in a gated community, as investing in a house is a very crucial decision to make in life, personally as well as financially and this decision should be worth of investing your money. Thus, gated community homes do not only provide you security from theft but provide you with a variety of security and make your life more manageable.

In today's scenario, many gated communities are sprouting up, encouraging society living and displacing individual living. These days, most house purchasers are drawn to the many advantages of residing in a gated community and view it as a better choice. Here are some more reasons why an individual should prefer a home in a gated community

· They make a living in the modern world more accessible.

· They provide you the chance to live in a miniature metropolis.

· They provide many forms of comfort.

· They provide safety.

HERE ARE SOME BENEFITS OF LIVING IN A LUXURY HOME IN A COMMUNITY

Safety

The most important factor of living in a gated community is that it provides good safety. One should never undervalue the value of a safe and secure residence. Therefore, one of the critical factors that make gated communities a better choice for homebuyers is security. The safety of residents is increased in gated communities. Access restrictions stop visitors from driving by or wandering in on foot to check what you have. Your level of privacy and the tranquility of your living space are both naturally increased by this circumstance. The people running or walking their dogs nearby will tell you they are locals.

Beautiful architect

Gated communities are constructed with an organized design incorporating green space and an architectural motif. Thus, you reside in a visually appealing area that provides you access to nature. Standards established by local laws and ordinances guarantee enduring visual attractiveness. You don't have to be concerned about an unsightly building destroying the ambiance. Additionally, those who opt for this lifestyle do so because they value the cleanliness of a well-kept neighborhood.

Privacy as well as togetherness

Gated communities intentionally foster community while providing you with a place to live where you can enjoy privacy when you need it. You have lots of opportunities to interact with other inhabitants in this setting by:

· Utilizing the same jogging routes

· Golfing

· Local events to attend

· chatting with neighbors at the pool or gym

Purchasing a property in a gated community gives you a head start on developing friends and relationships if you're relocating to a new location. Your general well-being will benefit significantly from the resulting sense of community. Compared to persons who don't have connections to the community, people with a sense of security, belonging, and trust tend to be in better health.

Sustaining lifestyle

Among other gated community features, extensive infrastructure development and maintenance, waste management, a safe environment, and water harvesting may very well be offered to you by gated communities. Every time a family chooses to invest in real estate, they need stability and security to lead contented and stable lives.

Investments according to your expenses

Buying a home in a gated community is a wise decision regarding real estate. Although purchasing a home in a gated community will always cost a little more than certain other types of real estate, doing so can be a wise investment, especially if you get it from a respected builder. Gated community flats and villas are a significant investment in people's increased quality of life because today's people want more than just a house; they want a lifestyle.

We hope you understand the value of luxury houses in a gated community from the above points. However, choosing a home in a gated community is another task, and BRICKSNWALL makes this task easy for you. It provides professional counseling from experts, and you can get a free session today. So book your session now.

More about Bricksnwall

Bricksnwall is a team of outstanding real estate professionals from India committed to helping you with excellent real estate knowledge through a professional real estate advisor and helping every other individual make their life's most expensive choices or investments worth it

#luxury home#luxury apartments#luxury flats#bricksnwall#buy and sell your property#sell your property#free property listing site in noida

0 notes

Note

hello! i noticed the property of hate x tintin merchandise was taken down from the society6 store, but i was hoping there was somewhere else that specific piece was uploaded? i recently got the urge to make it my lock screen background but i cannot find it anywhere in high res :(

yeah alas society6 put a limit on how many images you can have up there for a free account (and I make literally peanuts from that site, I've considered closing it) so I had to be brutal and chop the ones that didn't sell as much

as for the image, here you go! was drawn a long time ago, woaw...

if you open it in new tab it will be the og size and this is the original so it's the biggest I have! enjoy

#fun fact the hardest part was trying to do that damn text#don't come at me saying there's fonts for it I DID IT BY HAND OK#BECAUSE!#I'M!#STUPIIIIIIIIIDDD#tintin#tpoh

198 notes

·

View notes