#Forex Exchange

Explore tagged Tumblr posts

Text

Forex Trading #Index #AU200 M15 Timeframe sell Trade. . Forex Cashpower Indicator Lifetime license ultimate NON REPAINT Signals with Smart algorithms that emit precise signals in Reversal zones of Trends with big trades volumes . wWw.ForexCashpowerIndicator.com . ✅ NO Monthly Fees ✅ AUTO-Trade Option ✅ * LIFETIME LICENSE * ✅ NON REPAINT / NON LAGGING ✅ Less Signs Greater Profits 🔔 Sound And Popup Nofification ✅ Minimizes unprofitable/false signals . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at FBS brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. .

#forexindicators#forexindicator#forexprofits#cashpowerindicator#forextradesystem#forexchartindicators#forexvolumeindicators#forex#indicatorforex#forexsignals#stockmarket#stocktrade#stocktrading#investing stocks#forex stock#forex trading#forex exchange#au200#forex online trading#forexhelp#forexmentor#trader#forexlifestyle#forexmarket

2 notes

·

View notes

Text

How to Get the Best Rates for GBP to INR Exchange in 2025

In today’s interconnected world, converting currencies like GBP to INR is a common requirement for travelers, students, and businesses. However, getting the best rates for currency exchange can be challenging if you don’t know where to start. This guide will help you navigate the process and secure the best rates when converting your GBP to INR in 2025.

Understanding the Basics of GBP to INR

The exchange rate between GBP (British Pound) and INR (Indian Rupee) is influenced by various factors, including economic indicators, political stability, and global market trends. Scotland, as part of the UK, uses GBP as its official currency, making the conversion process relevant for those in Scotland as well. If you are curious about how 1 UK Pound to INR converts at any given time, staying updated with live exchange rates is crucial.

Key Factors That Influence GBP to INR Rates

Economic Policies: Changes in the UK and Indian monetary policies can impact the exchange rate.

Global Market Trends: Fluctuations in global currencies affect the GBP to INR rates.

Demand and Supply: Higher demand for GBP in India or vice versa can shift the rates.

Inflation Rates: Countries with lower inflation rates often see stronger currency values.

By understanding these factors, you can time your currency exchanges strategically.

Where to Exchange GBP to INR

Banks: Banks are a reliable option, but their exchange rates may include hidden fees.

Forex Dealers: Certified forex dealers often provide competitive rates.

Online Platforms: Websites and apps offer live rates, including “1 UK Pound to INR” and “Scotland currency to INR” conversions.

Currency Exchange Counters: Airports and local exchange bureaus are convenient but might charge higher fees.

Tips to Get the Best Rates for GBP to INR

Compare Rates: Use online comparison tools to find the best rates across banks, forex dealers, and online platforms.

Avoid Airport Exchanges: Currency exchange counters at airports usually have higher margins.

Monitor the Market: Stay updated on the exchange rate trends and convert when the rates are favorable.

Use Forex Cards: Prepaid forex cards can offer better rates than cash conversions.

Negotiate Fees: If you are exchanging a large amount, try negotiating the service fees.

Benefits of Online Currency Converters

Online platforms are gaining popularity for their transparency and convenience. These platforms provide real-time exchange rates for GBP to INR, allowing users to track the value of “1 UK Pound to INR” or “Scotland currency to INR” with ease. Some platforms even allow you to lock rates for future transactions.

The Role of Timing in Currency Exchange

Timing is crucial when exchanging currencies. Keep an eye on economic updates from both the UK and India, and avoid converting during periods of high volatility. By planning your transactions ahead of time, you can take advantage of the most favorable rates.

Conclusion

Securing the best rates for GBP to INR exchange in 2025 requires a combination of research, timing, and choosing the right service provider. Whether you’re traveling from Scotland or conducting business in India, understanding how to optimize your currency exchange can save you significant amounts of money. By following the tips mentioned above and leveraging modern tools, you can ensure a hassle-free and cost-effective conversion process.

0 notes

Text

0 notes

Text

1 note

·

View note

Text

Unveiling the Best Currency Exchange Rates Near You with DollarStop

In the fast-paced world of international finance, finding the lowest forex exchange rates near me can be a game-changer. Whether you are a seasoned traveler, a business professional engaged in global transactions, or simply someone looking to get the most value for your currency, the importance of favorable exchange rates cannot be overstated. Enter DollarStop, your go-to destination for the lowest forex exchange rates, right in your neighborhood.

The DollarStop Advantage:

DollarStop stands out in the crowded forex market as a reliable and customer-centric service provider. With a commitment to transparency, competitive rates, and exceptional service, DollarStop has become synonymous with trust and efficiency.

Competitive Rates:

One of the primary reasons why DollarStop has gained a stellar reputation is its commitment to offering the lowest forex exchange rates. By leveraging cutting-edge technology and strategic partnerships, DollarStop ensures that its customers get the most value for their money. Whether you are buying or selling currency, DollarStop rates are designed to beat the competition, making it the smart choice for those who prioritize savings.

Convenience at Your Fingertips:

Finding the nearest DollarStop location is a breeze, thanks to the user-friendly website and mobile app. Simply enter your location, and the platform will display the nearest DollarStop outlets, complete with real-time exchange rates. This convenience eliminates the need to scour the city or spend hours researching the best rates – with DollarStop, it's all at your fingertips.

Trustworthy Service:

DollarStop understands the importance of trust when it comes to financial transactions. With a team of seasoned professionals and a commitment to compliance, DollarStop ensures that every transaction is secure and hassle-free. Customers can rely on DollarStop for a seamless experience, whether they are exchanging currency for travel, business, or personal reasons.

Educational Resources:

DollarStop goes beyond just providing exchange services; it empowers customers with knowledge. The DollarStop website features educational resources, including market insights, currency guides, and real-time updates. This commitment to customer education reflects DollarStop's dedication to transparency and ensures that customers make informed decisions about their currency exchanges.

Conclusion:

In the world of forex exchange, where every cent counts, DollarStop emerges as the champion for those seeking the lowest rates near them. With a winning combination of competitive rates, convenience, trustworthiness, and educational resources, DollarStop is not just a service provider; it's a financial ally. So, whether you're a frequent traveler, a global business professional, or someone who values financial prudence, make the smart choice – choose DollarStop for the lowest forex exchange rates near you.

0 notes

Text

Forex Expo Dubai 2024 is the 7th grand edition which provides an extravagant platform for Forex traders, Introducing Brokers, Investors, Financial Institutions, and Brokers from all over the Trading.

0 notes

Text

Unipay Forex Cards: Your Trusted Currency Companion in Mohali

Unipay Forex Cards are specialized prepaid cards designed for travelers to conveniently manage multiple currencies during their trips abroad. Offering ease of use and security, these cards allow users to load various foreign currencies in advance and make transactions hassle-free. With features like competitive exchange rates and worldwide acceptance, Unipay Forex Cards In Mohali provide a seamless financial solution for international travelers.

0 notes

Link

If you plan a trip abroad then you also need their currency. In India, you can buy foreign exchange from different places like Airports, Banks and local currency shops but they charge bit high. But now people like to buy forex exchange online because it is the secure and safest place to buy and which is very convenient for them as well. So Prune is the online platform where you can buy your forex exchange easily with minimum documents and they delivered it to your doorstep also you get rewards which you can redeem later on.

0 notes

Text

Take the First Step to Financial Success: Start gold Trading with SinoxFX Today!

To start gold trading with SinoxFX, you'll need to open an account and make a deposit. Once you've done that, you can access the trading platform and start trading. SinoxFX offers several trading tools and resources to help you make informed trading decisions, including charts, technical indicators, and economic news.

When trading gold with SinoxFX, it's important to keep an eye on market trends and news that could affect the price of gold. Factors that can impact the price of gold include economic data, geopolitical events, and changes in supply and demand.

In conclusion, gold trading with SinoxFX can be a profitable way to diversify your investment portfolio. However, it's important to approach trading with caution and to have a solid trading plan in place. Additionally, make sure to keep up-to-date on market trends and news that could impact the price of gold. Gmail: supportSinox fx.com Website: https://sinoxfx.com/market.php

0 notes

Text

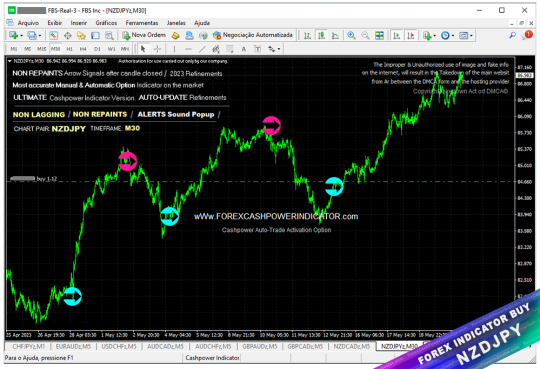

Forex Trade Example Mt4 #NZDJPY M30. Non Repaint & No Lag. wWw.ForexCashpowerIndicator.com

.

Forex Cashpower Indicator *Lifetime license* ultimate NON REPAINT Signals with Smart algorithms that emit precise signals in Reversal zones of Trends with big trades volumes .

.

✅ NO Monthly Fees

✅ AUTO-Trade Option

✅ * LIFETIME LICENSE *

✅ NON REPAINT / NON LAGGING

✅ Less Signs Greater Profits

🔔 Sound And Popup Nofification

✅ Minimizes unprofitable/false signals

.

✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.**

.

( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at FBS brokerage. Signals may vary slightly from one broker to another ).

.

✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options.

.

🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration.

.

🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#forex analysis#forexindicators#forexsignals#indicatorforex#forexindicator#cashpowerindicator#forex#forexprofits#forextradesystem#forexvolumeindicators#forexchartindicators#forex exchange#forex signal

2 notes

·

View notes

Text

O que é Overtrading? | Qual o conceito de Overtrading

O caminho para o sucesso no mundo do trading é cheio de desafios e obstáculos, por isso devemos estar muito bem-preparados para tentar superá-los da melhor maneira!

Muitas vezes o próprio trader é o seu pior inimigo, ao tomar decisões erradas sobre como operar, negociando sem nenhum controle, acabando por fazer Overtrading.

Neste artigo, iremos falar sobre este que é um dos erros mais comuns dos traders, o Overtrading, ou Trading em Excesso, uma prática muito relacionada à Psicologia do Trading. Se deseja evitar cair neste erro, este é o artigo certo para si!

Se pretende evitar cair neste erro, continue lendo!

O Que é Overtrading?

O termo Overtrading é um anglicismo que se refere a operar de forma desproporcional, seja porque abrimos ou fechamos muitas posições ou devido ao tamanho excessivo de lotes utilizado, de forma compulsiva e irracional por diferentes razões relacionadas às emoções.

Quando caímos neste erro, é comum colocarmos mais dinheiro em risco do que aquele que podemos pagar, na esperança de compensar as perdas. Na maioria dos casos, o profissional não está ciente de que sofreu excesso de trading, por isso, é importante conhecer os seus sintomas, as suas causas e como evitá-las.

Negociar em excesso leva a uma grande ansiedade que pode originar ainda mais erros e falhas gerais como trader. Antes de abordar as causas do Overtrading e as chaves para evitá-lo, é muito importante esclarecer o nosso estilo de negociação:

Trading de Posição. Este estilo de trading é de longo prazo, o profissional mantém as suas posições em aberto por um longo período de tempo, de semanas até anos. O trader será mais orientado pela análise de longo prazo e não irá ter em consideração os movimentos de preços de curto prazo.

Swing Trading. Este é um estilo em que o profissional mantém as suas posições em aberto por mais de um dia, por isso exige muita paciência e uma boa gestão de riscos e das suas ferramentas.

Day Trading. Este estilo consiste em abrir e fechar uma posição no mesmo dia, tentando aproveitar os movimentos dos preços que ocorrem ao longo da sessão. O profissional que pratica este estilo prefere dormir todas as noites sem a pressão de pensar que tem posições abertas.

Scalping. O Scalping é um estilo de day trading em que são abertas e fechadas posições com um intervalo de tempo de minutos até segundos. O trader tenta, neste caso, tirar proveito dos movimentos de preços que ocorrem numa questão de segundos, tornando-o um estilo praticado nos ativos muito voláteis. Obviamente, este estilo requer muita concentração e o profissional precisa de estar na frente do ecrã para não perder o gráfico de vista em nenhum momento.

Ter um estilo de trading bem definido é básico. Por exemplo, queremos praticar a negociação de posições, mas quando vemos que o mercado está contra nós, abrimos e fechamos posições no mesmo dia. É muito provável que estejamos a negociar demais e iremos falhar.

Causas do Overtrading - Por que acontece?

Existem inúmeras causas pelas quais podemos operar em excesso ou cair em overtrading e praticamente todas elas têm a sua origem na falta de controlo das emoções. O trading não é apenas ter uma boa estratégia e colocá-la em prática: permanecer calmo e controlar os sentimentos ao máximo pode determinar o sucesso ou o fracasso de uma operação.

Vejamos agora quais são as causas mais comuns que nos podem levar ao overtrading

⭕ Confundir trading com uma aposta

Muitos traders iniciantes começam a investir o seu dinheiro nos mercados financeiros com a ideia de que o trading é como jogar num casino ou é como uma aposta desportiva, onde procuram algum tipo de entretenimento momentâneo e ficam à espera que a sorte lhes sorria. Quando acreditamos que o trading é como um mercado de apostas, iremos acabar por operar em demasia e sem nenhum tipo de estratégia.

⭕ Situação económica desesperada

Tentar aliviar uma situação delicada de dinheiro através do trading pode ser um dos erros mais graves que podemos cometer. Se estamos desesperados para conseguir algum dinheiro, compramos e vendemos sem pensar cuidadosamente se o que estamos a fazer é sensato. Apenas pensamos que quanto mais operamos, maior será a probabilidade de obter lucros.

⭕ Não ter um plano ou estratégia

A ausência de um plano por trás de cada uma das nossas decisões de trading é também uma das causas mais frequentes de Overtrading. Se operarmos por impulsos, em função do movimento dos preços de um determinado instrumento financeiro, é muito provável que fracassemos. Os traders mais experientes e bem-sucedidos têm sempre um plano de trading elaborado, do qual não se desviam nem por um momento, apesar das mudanças na tendência. Mais à frente neste artigo, iremos discutir em maior profundidade em que consiste um plano de trading.

⭕ Excesso de confiança

Quando reunimos várias posições vencedoras e obtemos lucros, podemos acreditar que o trading é fácil, que somos invencíveis e que encontrámos a chave do sucesso. No entanto, qualquer trader deve saber que é normal ter perdas em algum momento e que o sucesso é obter lucros que superem as perdas de forma sustentada ao longo do tempo. A euforia e o excesso de confiança vão levar-nos a cometer erros e decepções assim que sofremos uma perda.

⭕ Impaciência

Às vezes, colocamo-nos em frente ao nosso MetaTrader com um plano e um estratégia bem elaborados, mas, enquanto esperamos que o mercado se mova a nosso favor, ficamos impacientes e mudamos a nossa estratégia rapidamente. Mais uma vez, isto pode funcionar bem em algum momento, mas geralmente leva ao Overtrading e outros erros comuns do trader.

Se já conhecermos as causas do Overtrading, será muito mais fácil detectá-lo e, acima de tudo, evitá-lo. Negociar em excesso pode levar a posições perdedoras de longo prazo, mas também leva a custos mais altos para as comissões adicionais ao fazer trading em excesso.

Overtrade - Como Evitar o Overtrading?

A disciplina e a perseverança são fatores indispensáveis se queremos ter sucesso no trading. Uma vez assumido isto, iremos analisar algumas dicas para evitar cair no overtrading:

✔️ Baseie as suas decisões em razões racionais, com base numa análise fundamentada e cuidadosa. Não deixe nada ao acaso, crie o seu roteiro e não se desvie dele.

✔️ Não arrisque mais capital do que aquele que pode pagar. Uma das regras de ouro do trading é não arriscar mais de 1% do seu capital total em cada operação. Por esta razão, devemos ter cuidado com o uso de alavancagem.

✔️ Diversifique o seu portfólio. Não dedique todo o seu capital de trading a um único instrumento financeiro, é melhor abrir pequenas posições em ativos diferentes do que uma única posição num único instrumento.

✔️ Estabeleça o horário que irá dedicar ao trading. Ter um tipo de rotina irá ajudar a manter uma maior disciplina. Além disso, faça pausas de tempos a tempos para se desconectar um pouco.

✔️ Prepare o seu plano de trading, dedicando um capítulo inteiro à sua gestão de riscos. Mais à frente, vamos aprofundar estes dois conceitos.

Overtrading vs Undertrading - Qual o Melhor?

O Undertrading é o oposto do Overtrading e é outro erro comum, especialmente para os traders mais iniciantes, embora seja uma prática menos arriscada do que o overtrading. O undertrading ocorre quando o trader não usa o seu capital para abrir posições por um longo período de tempo, seja por negligência ou por medo de perder o seu capital de investimento.

Também podemos cair no undertrading devido ao desconhecimento, porque não controlamos os conceitos básicos de trading ou porque não sabemos como utilizar as ferramentas da plataforma de trading, o que suscita alguma insegurança em nós próprios enquanto traders.

Evitar o Overtrading Com a Psicologia do Trading

No trading, existe uma "escola" que defende a importância da psicologia e da disciplina financeira na prática do trading. Os defensores desta tese consideram que a chave que marca a diferença entre o sucesso e o fracasso é a mente e o controlo das emoções. Neste sentido, eles alertam sobre certas emoções que podem causar falhas nas nossas operações:

Medo. O medo bloqueia-nos em todos os aspectos da vida, até mesmo quando tentamos obter retornos das nossas economias. Se tivermos medo de perder dinheiro, duas coisas podem acontecer: paramos de operar - undertrading - ou abrimos uma posição atrás outra - overtrading.

Ganância. Não devemos ser guiados pelo instinto de querer mais e mais dinheiro, devemos sempre avaliar se é conveniente entrar num ou noutro mercado ou se devemos abrir uma posição ou outra.

Altas expectativas. Quando começamos a negociar no Mercado Forex ou em qualquer outro mercado financeiro, fazemos isto na esperança de obter lucros, assumindo frequentemente que o faremos em pouco tempo e sem muito esforço. Se a realidade não provar que estamos certos, os sentimentos de frustração e raiva irão certamente aparecer.

Evitar o Overtrading - Com um bom Plano de Trading

Um plano de trading é um guia no qual refletimos a nossa atividade de trading com base em vários parâmetros que devemos estabelecer. De uma forma mais simples, o plano de trading é uma lista muito detalhada de tarefas, que inclui todos os cenários possíveis que podemos encontrar durante a nossa atividade de trading, para que possamos reagir a todos os momentos, controlando as nossas decisões e sem nos deixarmos levar pelas nossas emoções.

Então, o que é que contém um bom plano de trading? Estes são os elementos que consideramos essenciais:

✦ Primeiro de tudo, escolha uma corretora regulamentada e uma plataforma de trading confiável.

✦ Estabeleça metas. Devemos estabelecer metas realistas, específicas, mensuráveis e num determinado período de tempo.

✦ Método de análise. Que análise vamos usar para nos basearmos nas nossas decisões? Por exemplo, que tipo de padrões gráficos ou quais os indicadores que iremos usar?

✦ Estratégia. Por exemplo, definindo pontos precisos de entrada ou saída.

✦ Estabeleça limites. Quanto capital temos para negociar e qual a nossa alavancagem? Onde coloco o stop loss (ou trailing stop) e take profit?

✦ Gestão de riscos. O plano de trading deve incluir um bom plano de gestão de riscos para minimizar as possíveis perdas. No próximo capítulo, iremos abordar com mais detalhe este conceito.

✦ Conferir o que estamos a fazer, para isso, é aconselhável criar um diário de trading no qual iremos anotar tudo o que estamos a fazer e qual o resultado das nossas análises e operações, deste modo, podermos ver com mais clareza os erros e os acertos.

O que é Overtrading - Gestão de Risco

Uma das partes mais importantes de um plano de trading é a gestão de risco. Por quê? Se não soubermos quanto dinheiro temos para operar ou quanto podemos perder, será difícil minimizar os riscos das nossas operações. Cada trader terá que determinar o nível de risco que pode correr com base na sua situação financeira pessoal, mas existem algumas dicas para ajudá-lo a estabelecer este nível.

Se seguirmos a regra de ouro do trading e determinarmos que o nosso nível máximo de risco é de 1%, então:

Para uma conta de 1.000 euros, o risco máximo em cada posição será de 10 euros.

Se transferirmos esta regra para o mercado Forex, podemos abrir posições com um lote muito pequeno ou 0,01.

Se operarmos com recurso à alavancagem, devemos ter em consideração que esta ferramenta tem dois lados, porque, assim como multiplica os lucros, também irá multiplicar as suas perdas se o mercado for contra a sua posição. Por isso, não nos devemos esquecer que uma alavancagem de 1: 100 implica que o trader pode abrir uma posição no valor de 100 euros com apenas 1 euro, ou seja, não precisamos de ter 100 euros de capital para abrir a posição.

Por outro lado, na gestão de riscos, é muito útil fazer backtesting das suas estratégias utilizadas. O backtesting consiste em testar uma estratégia com dados históricos, voltando atrás no gráfico. No entanto, devemos ter em mente que, às vezes, uma estratégia que funcionou no passado pode não funcionar agora!

Se você gostou deste artigo curta e deixe sua opinião nos comentários para estimularmos nosso senso crítico e para que eu continue postando mais conteúdos como este.

#forextrading#forex exchange#forexeducation#forexbroker#naga global#naga trading#naga brasil#overtrading

0 notes

Text

Forex Exchange Near Me: Quick and Affordable Solutions

Whether you’re a globetrotter, a student pursuing studies abroad, or a professional managing international transactions, currency exchange is often an unavoidable part of life. In such cases, finding a forex exchange near me that is quick, reliable, and affordable becomes paramount. With numerous options available, selecting the right service can save you money and time while ensuring a seamless experience.

This blog explores how to find the best currency exchange services, the benefits of choosing trusted providers like Supreme Forex, and tips to make your forex transactions smooth and cost-effective.

Why Reliable Forex Exchange Services Matter

Foreign exchange is one of the world’s largest financial markets, with currency values constantly fluctuating. This volatility makes it essential to choose a forex service that offers competitive rates and transparent processes. Settling for subpar services can lead to unfavorable exchange rates, hidden fees, and unnecessary hassles.

Whether you’re searching for a currency exchange near me for personal or professional needs, prioritizing reliability and affordability ensures your money’s worth. Services like Supreme Forex are designed to cater to such requirements, offering a perfect balance of cost-efficiency and convenience.

Common Challenges in Currency Exchange

When looking for a forex exchange service, you might encounter the following challenges:

Hidden Charges: Many providers advertise low rates but tack on additional fees, eating into your funds.

Time-Consuming Processes: Lengthy procedures can disrupt travel plans or business schedules.

Unfavorable Exchange Rates: Without real-time updates, you may end up exchanging at a loss.

Limited Currency Options: Some services only deal with common currencies, leaving you stranded if you need less popular ones.

Choosing a trusted provider like Supreme Forex can address these issues, ensuring a smooth experience.

Key Features to Look for in a Forex Exchange Service

When searching for a forex exchange near me, evaluate the service based on the following criteria:

1. Competitive Rates

Your primary goal should be to get the best value for your money. Look for forex services that align their rates with real-time market trends. Supreme Forex, for instance, is known for offering rates that are both competitive and transparent.

2. Convenient Locations and Services

Convenience is critical. Whether you need a physical branch nearby or prefer online options, choose a service that meets your specific needs. Providers like Supreme Forex combine physical locations with digital platforms, making currency exchange accessible from anywhere.

3. Speed and Efficiency

Time-sensitive transactions require fast services. A good forex provider should process your requests swiftly, ensuring you’re not left waiting unnecessarily.

4. Wide Currency Range

From major currencies like USD and EUR to less common ones, a reliable forex exchange should accommodate diverse requirements. Supreme Forex offers a wide range of currencies, catering to both frequent travelers and niche needs.

5. Transparent Policies

Always choose providers with straightforward policies. Hidden fees or unclear terms can lead to unpleasant surprises during transactions. Supreme Forex ensures transparency, so you know exactly what you’re paying for.

Why Choose Supreme Forex for Your Currency Needs?

If you’re in search of a forex exchange near me, Supreme Forex stands out as a trusted and customer-friendly option. Here’s why:

1. Affordable Rates

Supreme Forex provides some of the most competitive rates in the market. By aligning with real-time currency fluctuations, they ensure you get maximum value for your exchange.

2. Wide Accessibility

Supreme Forex has physical locations across major cities and regions, making it easy to find a currency exchange near me. Additionally, their online services bring convenience right to your fingertips.

3. Fast and Hassle-Free Transactions

Supreme Forex prioritizes speed, ensuring your transactions are processed quickly without compromising accuracy. This is especially beneficial for time-sensitive requirements.

4. Comprehensive Currency Support

From popular currencies like GBP and CAD to niche ones, Supreme Forex offers an extensive range of currencies, accommodating diverse needs.

5. Trusted by Customers

Known for transparency and customer-centric policies, Supreme Forex has built a reputation as a reliable forex partner.

Tips for Quick and Affordable Forex Exchange

Here are some practical tips to help you make the most of your forex transactions:

Plan Ahead: Don’t wait until the last minute to exchange currency. Planning ahead allows you to compare rates and choose the best option.

Compare Rates: Use online tools to check real-time rates across different providers. This will help you identify services offering the best deals.

Check for Hidden Fees: Always read the terms and conditions to avoid surprises. Look for providers with transparent fee structures.

Leverage Online Platforms: Many forex providers, including Supreme Forex, offer online services that allow you to compare rates and complete transactions without visiting a branch.

Keep Necessary Documents Ready: Carry valid ID proofs and other required documents to ensure a hassle-free process, especially for larger transactions.

How to Find a Forex Exchange Near Me

Finding a reliable forex exchange service is easier than ever, thanks to technology. Here’s how you can locate one:

Use Online Searches: Look up keywords like “forex exchange near me” or “currency exchange near me” to find nearby services.

Visit Trusted Platforms: Platforms like Supreme Forex provide detailed information about their branches and services.

Read Reviews: Customer reviews and ratings can give you valuable insights into a provider’s reliability and quality.

Contact Directly: Reach out to providers for rate inquiries and additional details to make an informed choice.

Final Thoughts

Currency exchange doesn’t have to be stressful or expensive. By choosing a reliable provider like Supreme Forex, you can enjoy quick, affordable, and transparent services tailored to your needs. Whether you’re preparing for an international trip, sending money abroad, or managing business finances, Supreme Forex has the solutions to make your experience seamless.

Next time you’re searching for a forex exchange near me, prioritize convenience, affordability, and trust. Supreme Forex is your go-to partner for all your currency exchange needs.

0 notes

Text

0 notes

Text

Best International Money Transfer

International money transfer refers to the process of sending money from one country to another. This can be done for personal reasons like supporting family, paying bills, or funding education abroad, as well as for business purposes such as paying suppliers or employees.

3 notes

·

View notes

Text

my midst evangelist mutuals will be happy to know i started listening today! it's very good so far. really cool worldbuilding, very interesting setup getting slowly dripped in over time. they do a great job of setting up the tension where i'm sure that these background class frictions and political motivations are going to boil over at some point in the near future but as of right now, i can't begin to guess what that tipping point's going to be.

#midst podcast#liveblogging tag#lark is my favorite#very very much my type of character#i played a gnome with a similar energy for over a decade so as soon as she showed up i was like ooh yes this one#the notion of a religious quasi-currency with an ever fluctuating exchange rate gave me such like#Forex Trading/Crypto Scam Meets Prosperity Gospel energy#it's horrid i love it#i'm on episode 10 of season one rn#given my job i will probably be caught up by monday#maybe even earlier

23 notes

·

View notes

Text

Unlocking The Benefits Of Forex Cards

Secure: Forex cards offer enhanced security with chip and PIN protection, reducing risks of fraud during international travels.

Convenient: Easily reloadable and usable worldwide, forex cards eliminate the hassle of carrying multiple currencies or traveler's cheques.

Read More

0 notes