#Forensic Audit Report

Explore tagged Tumblr posts

Text

Forensic Audits Ahmedabad, Gujarat - Dhiren Shah & CO

Forensic Audits - Discover expert forensic audits services at Dhiren Shah & CO. Partner with us for reliable investigations. Call us on 07926445013 For Forensic Audits.

Google Map:--> https://maps.app.goo.gl/MyGZdnLjiRVHNzT27

Forensic Audits, Forensic Audits Ahmedabad, Forensic Audits Gujarat, Forensic Audit, Forensic Audits Cost, Forensic Audits Ahmedabad, Forensic Audit ICAI, Forensic Audit Report, Audits, Audit, Ahmedabad, Gujarat, India, www.dhirenshahandco.com/forensic-audits.php, Dhiren Shah & CO

#Forensic Audits#Forensic Audits Ahmedabad#Forensic Audits Gujarat#Forensic Audit#Forensic Audits Cost#Forensic Audit ICAI#Forensic Audit Report#Audits#Audit#Ahmedabad#Gujarat#India#www.dhirenshahandco.com/forensic-audits.php#Dhiren Shah & CO

0 notes

Text

Tax compliance is a cornerstone of financial accountability in India, requiring businesses and individuals to adhere strictly to tax regulations. A tax audit ensures this compliance by scrutinizing financial records, transactions, and declarations, offering transparency to both taxpayers and authorities. This process not only minimizes errors but also strengthens the trustworthiness of financial data submitted to the tax department. Read.

#tax audit#forensic audit#manufacturing audit#technical audit#technical audit report#tax audit procedure#benefits of forensic audit

0 notes

Text

The Role of Accounting Firms in Abu Dhabi in Supporting Startups and SMEs

Abu Dhabi, the capital of the UAE, has become a vibrant hub for startups and small to medium-sized enterprises (SMEs). With its strategic location, supportive government policies, and growing investment landscape, the city offers numerous opportunities for new businesses. However, navigating the complexities of finance, compliance, and taxation can be daunting for entrepreneurs. This is where Accounting firms in Abu Dhabi play a crucial role. Let’s explore how these firms support startups and SMEs in their journey to success.

1. Providing Financial Guidance

One of the primary roles of accounting firms is to provide financial guidance to startups and SMEs. These firms help entrepreneurs understand their financial health by offering insights into cash flow management, budgeting, and financial forecasting. With accurate financial data, businesses can make informed decisions and plan for future growth.

2. Tax Compliance and Planning

Navigating tax regulations in the UAE can be complex, especially for new businesses. Accounting firms in Abu Dhabi assist startups and SMEs with tax compliance, ensuring they meet all local regulations. They also provide strategic tax planning advice, helping businesses minimize their tax liabilities while remaining compliant with the law. This is particularly important with the introduction of VAT and other tax measures in the UAE.

3. Bookkeeping Services

Maintaining accurate financial records is vital for any business, but startups and SMEs often lack the resources to manage this effectively. Accounting firms offer comprehensive bookkeeping services, which allow business owners to focus on their core operations. Regular bookkeeping helps in tracking expenses, managing invoices, and preparing for audits.

4. Assisting with Business Setup

For startups, the process of setting up a business can be overwhelming. Accounting firms provide valuable assistance in this area, guiding entrepreneurs through the legal and financial requirements of establishing a company in Abu Dhabi. This includes obtaining the necessary licenses, understanding local regulations, and setting up accounting systems.

5. Financial Audits and Reviews

Regular financial audits are essential for businesses seeking investment or loans. Accounting firms conduct audits to ensure the financial statements are accurate and comply with regulations. For startups looking to attract investors, a clean audit can significantly enhance credibility and increase the chances of securing funding.

6. Advisory Services for Growth

As startups and SMEs grow, they face new challenges and opportunities. Accounting firms in Abu Dhabi provide advisory services that help businesses strategize for growth. This includes mergers and acquisitions, market entry strategies, and financial restructuring. Their expertise can be invaluable in navigating these complex decisions.

7. Facilitating Access to Funding

Access to capital is often a challenge for startups and SMEs. Accounting firms can assist in preparing financial projections and business plans that are crucial for securing funding from banks, venture capitalists, or angel investors. Their expertise in financial modeling can make a significant difference in how potential investors perceive a business.

8. Supporting Technology Integration

The rise of financial technology (fintech) has transformed the accounting landscape. Accounting firms in Abu Dhabi are increasingly incorporating technology into their services, helping startups and SMEs implement accounting software and automated solutions. This not only improves efficiency but also enhances the accuracy of financial reporting.

9. Networking and Connections

Many accounting firms have extensive networks that can benefit startups and SMEs. They can connect businesses with other professionals, potential clients, and investors, fostering valuable relationships that can drive growth. These connections are particularly beneficial in a city like Abu Dhabi, where networking can lead to new opportunities.

Conclusion

In a rapidly evolving business environment, the support of accounting firms in Abu Dhabi is invaluable for startups and SMEs. From financial guidance and tax compliance to business setup and growth strategies, these firms play a multifaceted role in helping businesses thrive. By leveraging their expertise, entrepreneurs can focus on what they do best — innovating and growing their businesses — while leaving the complexities of finance and compliance to the professionals. As Abu Dhabi continues to grow as a business hub, the partnership between startups, SMEs, and accounting firms will be essential for sustainable success.

#accounting firms#Abu Dhabi accountants#financial services#bookkeeping#tax services#audit services#payroll management#financial consulting#tax planning#business advisory#corporate finance#VAT services#accounting solutions#financial reporting#compliance services#CFO services#accounting software#SME accounting#forensic accounting#accounting outsourcing

0 notes

Text

conclave is a very good film made up of cardinal thomas lawrence having three horrible horrible days.

however the one thing it lacks is the consideration of how much worse they could have been if it lasted longer.

day four of conclave and the draw between tedesco and lawrence does not budge.

five days of conclave and at least one of the cardinals whose name got covered up in the trembley report backs lawrence against the wall and tries to threaten him with a kitchen knife before falling to weeping on his shoulder. day six of conclave and cardinal adeyemi and cardinal trembley nearly come to blows in the loggia. day seven of conclave and people start sneaking wine bottles into the sistine chapel.

day eight and they're passing them around covertly during the interminable voting process. day nine and three separate white collar crimes come to light because the guilty parties are sweating in their cassocks thinking lawrence has the dirt on them and they can't take the pressure anymore, they just can't.

day ten and vincent benítez is doing quiet prayer catechism hour in the garden after lunch.

day eleven and sabbadin is snorting someone's vicodin in the bathroom.

day twelve and the cardinals for warsaw and budapest are having a terrible breakup everyone is trying to pretend not to notice. day thirteen and lawrence stays in his room the whole day pretending he has a stomach ache and keeps having his nap dreams interrupted by dreams of turtles.

day fourteen and aldo bellini has brought his copy of giovanni's room to reread, half-heatedly hidden behind a bible cover.

day fifteen and vincent benítez has lead by example a number of cardinals into helping out in the kitchen at least once a week to frankly terrible culinary results and growing camaraderie.

sixteen days of conclave and lawrence has to sit down ray o'malley and actively beg him not to tell him anything else, please, no more info, no more digging into old scandals, no nothing.tedesco's tax audits may be suspiciously clean but lawrence is a man of god not a forensic attorney and he will not dig deeper.

day seventeen and lawence tracks o'malley down and asks him to look into tedesco's brother's recent real estate acquisitions.

day eighteen and the new whisper campaign to discredit lawrence keeps trying to bring up his most controversial progressive views but he keeps answering impatiently back with well-thought of biblical references as he did in the homily and accidentally causes a reprise of his canon law school lecture debates. which temporarily brings everyone together and opens the stage for a fierce ideological debate.

wherein lawrence gets accused, not entirely inaccurately, by trembley and adeyemi, united once more in offense, of being the last figurehead for the complacent liberal establishment/a judgemental prig and/or treating the college of cardinals like a group of jumped-up seminarians.

aldo bellini implies very loudly that tedesco is ugly, a fascist and too stupid to ever be invited to lecture at the sourbonne even once, and cardinal vincent benítez speaks up with great dignity and strength against american imperialism.

day nineteen and someone actively tries to murder the patriarch of venice. day twenty and it is revealed via sister agnes ex machina and cardinal benítez's disconcerting familiarity with very real and more successful murder attempts that tedesco was trying to frame bellini for it.

the proof is circumstantial and so are any accusations lawrence or anyone could make against him of corruption, but this does prompt him to go on a long speech about how the leftist agenda has thoroughly ruined not only the church but society at least and made any possible unity among men a sham.

day twenty-one and someone actually dies, unrelated to the tedesco fake-plot.

day twenty-two and they elect vincent benítez. lawrence hides in the room of tears having an anxiety attack of relief.

vincent benítez holds his hand tenderly through it and immediately accepts his resignation as dean but not before telling him his secret and having his hands held back tightly, and being told very earnestly that, short of actual unreasonable harm to other people and an extraordinary amount of bribery, he could be made by god's will in any possible variation and still have lawrence's trust. and most importantly, lawrence's papacy.

day one of innocentius xiv's papacy and lawrence finds him in the gardens feeding the turtles instead of taking the next train to a nice monastery in liège and offers himself as secretary of state. and this is why netflix should hire me.

#conclave 2024#conclave spoilers#thomas lawrence#vincent benitez#aldo bellini#cardinal tedesco#sister agnes

355 notes

·

View notes

Text

"I wasn't there because ahead of the Quarry Men's evening performance I'd gone home for a bite to eat. I only lived a ten minute walk away and hadn't eaten since breakfast, so after coming off the church field and putting my kit in place ready for the evening's performance I'd nipped home for my tea and in the process I missed that historic audition."

- - - Colin Hanton

"I must have nipped out to the toilet because I have no memory of the greatest meeting in rock n roll history."

- - - Rod Davis

"I noticed Paul while we were playing. He was standing with Ivan... but I don't remember him carrying a guitar."

- - - Eric Griffiths

Pre:Fab! - by Hanton and Hall.

-

History quietly shifting itself into place, while half the quarry men are looking the other way.

I just I love that some people are out there writing meaningful fantastic remembrances about Paul's eyelashes and electricity in the air, and then others are like 'I don't know, maybe he was there..?'

Colin Hanton (quarry man) consistently claims that Paul met John before the Quarry Men went on to play in the afternoon. Colin was in the scout hut, playing his drums with one of the scouts, getting ready for the afternoon performance:

"At the far end of the hut, I noticed John had returned by himself. [...] He was standing talking to another scout. It was at this moment that Ivan Vaughan walked in accompanied by this dark-haired lad whom I'd never seen before. I carried on jamming while the three of them stood talking. This carried on for about five or ten minutes, after which John, Ivy, and the stranger left the scout hut together."

Sounds completely like what a constructed memory of that event would seem like, but also sounds completely like something that might have happened too, and we'll never know.

Eric, meanwhile, believes that he was there for the 'historic meeting' in the church, but that Paul never played guitar for them at that point, no matter what Paul, John, Pete, Len and Ivan have to say. He thinks John first heard Paul play a few days later when John and Eric went round to Forthlin Road specially for the 'audition'. That's where he thinks Paul played Twenty Flight Rock for the first time.

Beatles fandom is an incredible study in the vagaries of memory. I love it. It's fantastic how little we will ever know.

As Colin Hall (biographer) writes:

Like most bands, they met a lot of new people every time they were booked to play. Often there'd be a lot of people hanging out with them before or after a performance. No wonder that, in the interim, exact memories faded, details disappeared. It would be many years after the event that the Quarry Men would be asked to describe this day in the forensic detail people now want from them. [...] They were not all present in the same places for some of the key moments. At the time it was a fun day, but of no great significance to most of them beyond the moment of their performance.

He also points out that an article published just one week after the fete, ("All the Fun of the Fair at Woolton" in the Liverpool Weekly News) which is an eye-witness report written while everything was still fresh... claimed that Colin wasn't there, and the Quarry Men played without a drummer. Something easily disproved by any photograph of the day.

Give up, surrender! Beatles reporting has been pure fiction from day nought. Nothing is knowable. Everything is mist. You can keep trying, you will get nowhere. Honestly it's all an imagination, so imagine wonderful things.

103 notes

·

View notes

Text

Tax Auditors in Delhi: Expert Services by SC Bhagat & Co.

Navigating the complexities of tax regulations is crucial for businesses and individuals alike, especially in a dynamic financial landscape like Delhi. Choosing a reliable tax auditor ensures your financial compliance, reduces audit risks, and enhances your financial credibility. SC Bhagat & Co., a leading tax auditing firm in Delhi, provides expert services designed to meet the unique needs of businesses and individuals, from tax compliance to advanced auditing solutions.

Why Tax Auditing Matters Tax auditing is essential for ensuring that financial records are accurate and compliant with current tax laws. Regular audits help businesses identify financial discrepancies, optimize their tax liabilities, and avoid costly penalties. For individuals, tax audits can validate their tax filings and enhance financial transparency. Whether you're a business owner or an individual taxpayer, tax audits play a vital role in:

Ensuring Compliance: By following regulatory requirements, tax audits help organizations and individuals avoid penalties. Detecting Errors and Fraud: An audit reveals inconsistencies in financial records, helping to prevent fraud or accidental errors. Improving Financial Accuracy: A professional audit provides a detailed review of financial data, ensuring accurate tax calculations. Building Credibility with Stakeholders: Regular audits reflect a commitment to transparency, boosting stakeholder confidence. SC Bhagat & Co.: Trusted Tax Auditors in Delhi SC Bhagat & Co. has earned its reputation as a trusted provider of tax auditing services in Delhi, thanks to its dedicated team of qualified professionals, extensive industry knowledge, and commitment to client success. Their expert tax auditors help clients stay compliant, reduce tax risks, and optimize their financial health through strategic auditing and consulting.

Key Services Offered by SC Bhagat & Co. SC Bhagat & Co. offers a range of tax auditing and related services designed to meet the unique needs of both individuals and businesses in Delhi:

Statutory Tax Audits SC Bhagat & Co. conducts thorough statutory tax audits to ensure clients meet legal requirements and minimize tax liabilities. Their expertise in Indian tax laws ensures every client is fully compliant with government regulations.

Internal Audits For businesses seeking to improve internal processes, SC Bhagat & Co. offers internal auditing services that identify areas of risk, improve financial accuracy, and enhance operational efficiency.

GST Audits GST compliance is critical for businesses in India, and SC Bhagat & Co. specializes in GST audits to ensure accurate filing and adherence to GST regulations. This minimizes the risk of penalties and provides peace of mind.

Income Tax Audits SC Bhagat & Co. offers comprehensive income tax audits for individuals and businesses, ensuring accurate filings and preventing potential issues with tax authorities.

Forensic Audits For clients requiring deeper analysis, SC Bhagat & Co. provides forensic audits to detect and address financial discrepancies, fraud, or irregularities within an organization.

Benefits of Working with SC Bhagat & Co. When you choose SC Bhagat & Co. as your tax auditor in Delhi, you gain access to a team that brings professionalism, in-depth knowledge, and dedication to every audit. Here are some reasons clients prefer SC Bhagat & Co.:

Industry Expertise: With years of experience in tax auditing and consulting, SC Bhagat & Co. provides services across various industries. Client-Centric Approach: The team at SC Bhagat & Co. takes time to understand each client's specific requirements, offering tailored solutions that best meet their needs. Timely and Efficient Services: Understanding the importance of meeting deadlines, SC Bhagat & Co. ensures timely audits and reporting. Confidentiality and Trust: They prioritize client confidentiality, ensuring all information is handled securely and professionally. Why Delhi Businesses and Individuals Choose SC Bhagat & Co. Delhi’s competitive business environment demands precision and reliability in tax matters. SC Bhagat & Co.’s commitment to excellence, coupled with their local expertise, makes them a preferred choice for tax audits in Delhi. Their clients range from small businesses to large corporations, as well as individuals seeking precise and trustworthy tax audit solutions.

Testimonials from Satisfied Clients Many of SC Bhagat & Co.'s clients have shared positive experiences, appreciating their professionalism and thorough approach. Here are a few testimonials:

“SC Bhagat & Co. has transformed our financial process. Their tax auditors identified several areas where we could reduce tax liabilities, helping us save significantly.”

“We’ve been working with SC Bhagat & Co. for years, and their expertise in GST audits has been invaluable. Highly recommended for any business in Delhi!”

Contact SC Bhagat & Co. for Expert Tax Auditing in Delhi If you're in need of reliable and professional tax auditing services in Delhi, SC Bhagat & Co. is here to help. Their team is ready to assist you with all your tax auditing needs, ensuring you meet compliance requirements and optimize your financial standing.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices#remittances

3 notes

·

View notes

Text

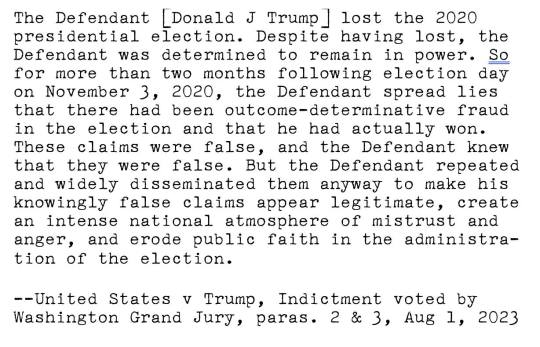

LETTERS FROM AN AMERICAN

August 2, 2023

HEATHER COX RICHARDSON

AUG 3, 2023

There have been more developments today surrounding yesterday’s indictment of former president Trump for conspiring to defraud the United States, conspiring to disenfranchise voters, and conspiring and attempting to obstruct an official proceeding as he tried to overturn the results of the 2020 election and install himself in office over the wishes of the American people.

Observers today called out the part of the indictment that describes how Trump and Co-Conspirator 4, who appears to be Jeffrey Clark, the man Trump wanted to make attorney general, intended to use the military to quell any protests against Trump’s overturning of the election results. When warned that staying in power would lead to “riots in every major city in the United States,” Co-Conspirator 4 replied, “Well…that’s why there’s an Insurrection Act.”

The Insurrection Act of 1807 permits the president to use the military to enforce domestic laws, invoking martial law. Trump’s allies urged him to do just that to stay in power. Fears that Trump might do such a thing were strong enough that on January 3, 2021, all 10 living former defense secretaries signed a Washington Post op-ed warning that “[e]fforts to involve the U.S. armed forces in resolving election disputes would take us into dangerous, unlawful and unconstitutional territory.”

They put their colleagues on notice: “Civilian and military officials who direct or carry out such measures would be accountable, including potentially facing criminal penalties, for the grave consequences of their actions on our republic.” Josh Marshall at Talking Points Memo recalled today that military leaders told Congress they were reluctant to respond to the violence at the Capitol out of concern about how Trump might use the military under the Insurrection Act.

Political pollster Tom Bonier wrote: “I understand Trump fatigue, but it feels like the president and his advisors preparing to use the military to quash protests against his planned coup should be bigger news. Especially when that same guy is in the midst of a somewhat credible comeback effort.”

On The Beat tonight, Ari Melber connected Trump Co-Conspirator John Eastman to Senator Ted Cruz (R-TX). Just before midnight on January 6, 2021, after the attack on the U.S. Capitol, Eastman wrote to Pence’s lawyer to beg him to get Pence to adjourn Congress “for 10 days to allow the legislatures to finish their investigations, as well as to allow a full forensic audit of the massive amount of illegal activity that has occurred here.” On the floor of the Senate at about the same time, Cruz, who voted against certification, used very similar language when he called for “a ten-day emergency audit.”

An email sent by Co-Conspirator 6, the political consultant, matches one sent from Boris Epshteyn to Trump lawyer Rudy Giuliani, suggesting that Epshteyn is Co-Conspirator 6. The Russian-born Epshteyn has been with Trump’s political organization since 2016 and was involved in organizing the slates of false electors in 2020. Along with political consultant Steve Bannon, Epshteyn created a cryptocurrency called “$FJB, which officially stands for “Freedom. Jobs. Business.” but which they marketed to Trump loyalists as “F*ck Joe Biden.” By February 2023, Nikki McCann Ramirez reported in Rolling Stone that the currency had lost 95% of its value.

Since the indictment became public, Trump loyalists have insisted that the Department of Justice is attacking Trump’s First Amendment rights to free speech. Indeed, if Giuliani’s unhinged appearance on Newsmax last night is any indication, it appears that has been their strategy all along. Aside from the obvious limit that the First Amendment does not cover criminal behavior, the grand jury sidestepped this issue by acknowledging that Trump had a right to lie about his election loss. It indicted him for unlawfully trying to obstruct an official proceeding and to disenfranchise voters.

Today, Trump’s former attorney general William Barr dismissed the idea that the indictment is an attack on Trump’s First Amendment rights. Barr told CNN’s Kaitlan Collins: “As the indictment says, they're not attacking his First Amendment right. He can say whatever he wants. He can even lie. He can even tell people that the election was stolen when he knew better. But that does not protect you from entering into a conspiracy. All conspiracies involve speech. And all fraud involves speech. Free speech doesn't give you the right to engage in a fraudulent conspiracy.”

Rudy Giuliani has his own troubles in the news today, unrelated to the attempt to overturn the results of the 2020 election. His former assistant Noelle Dunphy is suing him for sexual harassment and abuse, and new transcripts filed in the New York Supreme Court of Giuliani’s own words reveal disturbing fantasies of sexual domination that are unlikely to help his reputation. (Historian Kevin Kruse retweeted part of the transcript with the words, “Goodbye, lunch.”)

The chaos in the country’s political leaders comes with a financial cost. According to Fitch Ratings Inc., a credit-rating agency, the national instability caused by “a steady deterioration in standards of governance over the last 20 years” has damaged confidence in the country’s fiscal management. Yesterday it downgraded the United States of America’s long-term credit rating for the second time in U.S. history.

Fitch cited “repeated debt-limit political standoffs and last-minute resolutions,” “a complex budgeting process,” and “several economic shocks as well as tax cuts and new spending initiatives” for its downgrade. The New York Times warned that the downgrade is “another sign that Wall Street is worried about political chaos, including brinkmanship over the debt limit that is becoming entrenched in Washington.”

The timing of the downgrade made little sense economically, as U.S. economic growth is strong enough that the Bank of America today walked back earlier warnings of a recession. Treasury Secretary Janet Yellen noted that the key factors on which Fitch based its downgrade had started in 2018 and called the downgrade “arbitrary.” The editorial board of the Washington Post called the timing “bizarre.” But the timing makes more sense in the context of the fact that House Republicans could not pass 11 of 12 necessary appropriations bills before leaving for their August recess.

The White House said it “strongly disagree[d]” with the decision to downgrade the U.S. credit rating, noting that the ratings model Fitch used declined under Trump before rebounding under Biden, and saying “it defies reality to downgrade the United States at a moment when President Biden has delivered the strongest recovery of any major economy in the world.” But it did agree that “extremism by Republican officials—from cheerleading default, to undermining governance and democracy, to seeking to extend deficit-busting tax giveaways for the wealthy and corporations—is a continued threat to our economy.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Trump indictment#political#Letters From An American#Heather Cox Richardson#conspiracy#Trump Indictment#co-conspirators

10 notes

·

View notes

Text

Brian Murphy: A Beacon of Excellence in Accounting and Advisory Services

In the dynamic world of finance and business advisory, few names resonate as strongly as Brian Murphy. Renowned for his meticulous approach and broad expertise, Brian stands out as a pivotal figure in the Irish business landscape. With over 25 years of rich commercial experience, he currently spearheads the Corporate Advisory business in Ireland, specializing in value creation and elevating business performance across diverse sectors.

Background and Early Career

Brian Murphy accountant journey in the field of accounting and business advisory is marked by a steadfast dedication to excellence. Born in the early 1970s, Brian demonstrated an early interest in numbers and financial strategies. Pursuing his passion, he earned his qualifications as a Fellow of the Institute of Chartered Accountants in Ireland and became an associate of the Irish Tax Institute.These solid foundations have paved the way for a distinguished career marked by significant achievements and leadership roles.

A Distinguished Professional Path

As the director of a prominent company in Ireland, Brian's vast experience spans commercial, industrial, and technical arenas. His role involves leading Ireland & Corporate Advisory business, where he has been instrumental in driving growth and improving operational efficiencies for numerous organizations. Brian’s expertise covers a wide range of financial disciplines, including corporate finance, restructuring (both corporate and personal), and forensic accounting — a testament to his versatile skill set.

Brian Murphy accountant significant contributions extend to mergers and acquisitions , where he is celebrated for his nuanced and expert advice in finance raising, business and strategic planning, Brian Murphy, accountant significant contributions extend to mergers and acquisitions where and conducting financial reviews. His analytical prowess and strategic insight make him a trusted advisor in these complex transactions.

Contributions to Corporate Finance and Restructuring

Brian Murphy is not only a seasoned accountant but also a licensed Insolvency Practitioner. His work in this domain has helped countless companies navigate through challenges associated with gearing and trading difficulties. His proactive involvement in performance improvement and cost rationalization initiatives has been vital for businesses looking to optimize their operations and enhance profitability.

In recognition of his contributions to the field, Brian served as the former Chairman of the Northern Ireland R3 Committee, the trade body for recovery and restructuring professionals. This role positioned him at the forefront of developments in the recovery sector, influencing policies and practices that impact the industry at large.

Leadership in Audit and Assurance

Brian Murphy’s role as a partner in Audit & Assurance within the Consumer & Technology Business team at Deloitte has been marked by exemplary leadership and an unwavering commitment to delivering top-notch audit and advisory services. Since joining Deloitte five years ago, he has enriched the firm with his deep industry knowledge, gained from over 14 years of experience in sectors ranging from retail and manufacturing to construction, real estate, engineering, hospitality, and technology.

His client portfolio is impressively diverse, primarily encompassing large privately-owned businesses, both family-owned and private equity-backed. This role allows him to impact a wide array of businesses, fostering growth and sustainability in a rapidly changing economic environment.

Educational and Community Engagement

Beyond his professional endeavors, Brian is deeply committed to education and continuous learning within the financial community. He is a prolific lecturer and presenter, often speaking on topics related to audit, financial accounting/reporting, and finance under the auspices of Chartered Accountants Ireland.

His dedication to the community is further evidenced by his roles in various chair positions, including past Chair of Chartered Accountants Ireland Leinster Society and current Chair of CA Support. Through these roles, Brian actively contributes to the welfare and development of accounting professionals, nurturing the next generation of leaders in the field.

Media and Public Engagement

Brian Murphy is a recognized voice in local press, often commenting on current trends, challenges, and opportunities for businesses in Northern Ireland. His insights are frequently sought after by local parliament, where he advises on strategic financial issues, reflecting his stature and respect in the professional community.

Conclusion

Brian Murphy’s career is a beacon of leadership, expertise, and dedication. His comprehensive approach to solving complex business challenges, coupled with his commitment to the community and the profession, makes him a distinguished figure in the Irish accounting and business advisory landscape. As businesses continue to navigate the complexities of modern economies, leaders like Brian Murphy remain indispensable in guiding them towards sustainable success.

1 note

·

View note

Text

USAID Audit in India - PK Chopra and Co.

PK Chopra has emerged as a pivotal player in providing reliable and cost-effective USAID Audit in India and Grant Audit services in India. Leveraging extensive experience and professional acumen, our audit services have empowered clients to optimize their business potential and gain a distinctive competitive advantage.With an array of comprehensive audit services, PK Chopra and Company excel in areas including:

Audit Management: Offering flexible solutions, we assist clients in Internal Audit, Statutory Audit, Tax Audit, and Information Systems Audit. Additionally, we enhance the efficiency of annual audit preparations and corporate reporting, coupled with strategic tax planning.

Accounts Management: Keeping pace with global accounting standards is crucial. PK Chopra ensures that companies adopt accounting procedures aligning with international practices, including IFRS, IAS, and US/UK GAAP, thereby boosting their competitive edge.

Compliance Management: Upholding core business values, standards, and transparency is paramount. We aid organizations in identifying, measuring, and managing regulatory risks, minimizing potential pitfalls.

Forensic Services: Safeguarding critical business information is imperative. Our fraud detection and examination services fortify security measures against unauthorized access and malpractices, safeguarding invaluable resources.

System Process Assurance: Ensuring data security is pivotal. PK Chopra crafts intelligent solutions, enhancing system functionality, security, and infrastructure management, along with third-party assurance.

Corporate Report Improvement: Efficient corporate reporting is vital for businesses. Our services focus on performance management, fostering relationships, and adhering to quality management practices.

Actuarial Services: Driving growth and performance, our actuarial services encompass risk management, claims management, employee benefit plans, and expertise in mergers and acquisitions.

PK Chopra and Company's holistic approach and expert solutions amplify operational efficiency, mitigate risks, and enable businesses to excel in a competitive landscape. Our commitment to excellence underlines our position as a trusted partner in bolstering business growth and success.

2 notes

·

View notes

Text

A Brief Overview of Forensic Accounting

Forensic accounting is a specialized branch of accounting that merges accounting, auditing, and investigative techniques to uncover evidence of financial crimes. It plays a critical role in both preventing and addressing financial misconduct in organizations and among individuals. By applying financial expertise and investigative skills, forensic accountants act as detectives in the financial world, unraveling complex schemes and providing clarity to legal and regulatory bodies.

Key Roles and Responsibilities of Forensic Accountants

Forensic accountants serve as subject matter experts in legal and financial contexts. Their primary responsibilities include:

Providing Expert Testimony: Forensic accountants are often called upon to explain complex financial concepts to judges and juries. Their ability to break down intricate details into understandable language ensures that legal professionals and decision-makers comprehend the nuances of financial evidence.

Supporting Legal and Law Enforcement Agencies: These professionals collaborate with attorneys, law enforcement agencies, and regulatory bodies to:

Identify suspects in financial crimes.

Compile and organize evidence that meets legal standards for admissibility.

Participate in interrogations or interviews to provide insights into financial documents or discrepancies.

Quantifying Financial Losses: After a conviction, forensic accountants calculate the monetary damages caused by financial crimes. This quantification helps courts determine restitution amounts and informs broader economic assessments of the impact.

Common Types of Financial Crimes Investigated

Forensic accountants investigate a wide array of financial crimes committed by both individuals and organizations. The following are some common types of misconduct:

Fraudulent Financial Reporting:

This category involves the intentional manipulation of financial statements to deceive stakeholders. Subtypes include:

Insurance Fraud: Filing false claims to extract unwarranted payouts from insurance companies.

Tax Fraud: Deliberately underreporting income, overstating deductions, or misrepresenting tax information to reduce liabilities.

Embezzlement:

This occurs when individuals, often employees, illegally take assets or funds entrusted to them. Embezzlement schemes can range from simple theft to sophisticated methods of diverting company resources.

Money Laundering:

Money laundering involves disguising the origins of illegally obtained money to make it appear legitimate. Forensic accountants trace these activities through financial records, uncovering hidden transactions and shell companies used to launder funds.

Techniques and Tools of Forensic Accounting

Forensic accountants rely on a range of techniques and tools to perform their roles effectively. Their methodologies are as varied and sophisticated as the crimes they investigate. Below are some of the core techniques used in forensic accounting:

Document Examination:

Forensic accountants meticulously review financial documents, including:

Financial Statements: To identify inconsistencies or irregularities that may indicate fraud.

Invoices and Contracts: To detect forged signatures, altered terms, or discrepancies in dates.

Bank Records: To track suspicious transactions or unauthorized withdrawals.

Computer Forensics:

Modern forensic accounting often involves digital investigations. Computer forensics allows professionals to recover deleted files, emails, and transaction histories that perpetrators may have attempted to conceal.

Data Mining:

Using advanced analytical software, forensic accountants can identify patterns in large data sets. This approach is invaluable for uncovering hidden relationships, outliers, or trends indicative of fraud.

Interviews and Interrogations:

By participating in interviews with suspects, witnesses, or other stakeholders, forensic accountants provide insights into financial discrepancies. Their expertise allows them to interpret responses and probe deeper into suspicious activities.

Lifestyle Analysis:

Forensic accountants may analyze the spending habits and lifestyle of suspects to determine if their expenditures align with their reported income. Discrepancies often point to hidden sources of income or embezzlement.

Applications of Forensic Accounting

The scope of forensic accounting extends beyond criminal investigations. These professionals are instrumental in a variety of contexts, including:

Corporate Governance and Internal Audits: Forensic accountants help organizations improve their internal controls, reducing the risk of financial misconduct. By auditing existing processes, they identify vulnerabilities and recommend safeguards.

Litigation Support: In civil and criminal cases, forensic accountants assist attorneys by analyzing financial evidence, preparing reports, and testifying as expert witnesses.

Insurance Claims: Forensic accountants verify the legitimacy of insurance claims, ensuring that policyholders do not exploit insurers through fraudulent reporting.

Divorce Proceedings: In cases involving high net-worth individuals, forensic accountants trace assets to ensure equitable distribution and uncover attempts to hide wealth during settlements.

Bankruptcy Cases: Forensic accountants investigate the causes of insolvency, distinguishing between legitimate financial difficulties and fraudulent activities designed to evade creditors.

Ethical Considerations in Forensic Accounting

Forensic accountants must adhere to stringent ethical standards. Their work often has far-reaching implications, and maintaining impartiality is critical. Key ethical considerations include:

Objectivity: Forensic accountants must remain unbiased, focusing solely on the evidence and avoiding any personal or professional conflicts of interest.

Confidentiality: Sensitive financial data must be handled with the utmost discretion to protect the privacy of individuals and organizations.

Integrity: Accuracy and honesty are paramount. Forensic accountants are often scrutinized during legal proceedings, making their credibility essential.

Compliance: Forensic accountants must comply with legal and regulatory frameworks, ensuring their findings are admissible and actionable in court.

The Evolving Role of Forensic Accountants

As technology advances, the role of forensic accountants continues to expand. Emerging challenges include:

Cryptocurrency Investigations: The rise of digital currencies has introduced new avenues for financial crime. Forensic accountants must now trace blockchain transactions to uncover illicit activities.

Cybersecurity Breaches: Financial crimes increasingly involve hacking and data breaches. Forensic accountants collaborate with IT specialists to analyze the financial impact of such incidents.

Artificial Intelligence (AI): AI tools enable forensic accountants to analyze vast datasets more efficiently, identifying anomalies and predicting fraudulent behavior.

Global Investigations: In an interconnected world, financial crimes often span multiple jurisdictions. Forensic accountants must navigate complex international laws and regulations to track cross-border activities.

Conclusion

Forensic accounting is a dynamic and vital field that bridges the gap between finance and law enforcement. By combining meticulous investigative techniques with deep financial expertise, forensic accountants play an essential role in safeguarding economic integrity and ensuring justice.

0 notes

Text

Uncover the Truth: How Forensic Audits Can Protect Your Business

Forensic Audits – Dhiren Shah & Co Helps Businesses in Ahmedabad and Gujarat Leverage Forensic Audits.

Google Map:--> https://maps.app.goo.gl/9JZp3ZiQALwAfMZV7

Forensic Audits, Forensic Audits Ahmedabad, Forensic Audits Gujarat, Forensic Audit, Forensic Audits Cost, Forensic Audits Ahmedabad, Forensic Audit ICAI, Forensic Audit Report, Audits, Audit, Ahmedabad, Gujarat, India, www.dhirenshahandco.com/forensic-audits.php, Dhiren Shah & CO

#Forensic Audits#Forensic Audits Ahmedabad#Forensic Audits Gujarat#Forensic Audit#Forensic Audits Cost#Forensic Audit ICAI#Forensic Audit Report#Audits#Audit#Ahmedabad#Gujarat#India#www.dhirenshahandco.com/forensic-audits.php#Dhiren Shah & CO

0 notes

Text

The Future of Accounting: Emerging Trends in CA, CS, US CMA, US CPA, UK ACCA, and US CFA

Introduction: The Evolving Landscape of Accounting

The accounting field is undergoing rapid changes due to technological advancements, globalization, and evolving business needs. Professionals in roles like CA (Chartered Accountant), CS (Company Secretary), US CMA (Certified Management Accountant), US CPA (Certified Public Accountant), UK ACCA (Association of Chartered Certified Accountants), and US CFA (Chartered Financial Analyst) are at the forefront of these changes.

Technological Advancements in Accounting

Automation and AI Integration

Automation and artificial intelligence (AI) are transforming routine accounting tasks. Processes such as bookkeeping, payroll, and data analysis are becoming more efficient, reducing errors and saving time. For instance, AI-powered tools can analyze large datasets, offering previously difficult insights to obtain manually.

Blockchain and Its Impact on Transparency

Blockchain technology is revolutionizing accounting by providing a secure and transparent ledger system. It ensures data integrity and reduces the chances of fraud, making it particularly useful for auditing and financial reporting.

Cloud-Based Accounting Solutions

Thanks to cloud technology, accounting professionals can access financial data from any location at any time. Tools like QuickBooks and Xero provide real-time collaboration, enabling seamless interactions between clients and professionals.

The Role of Globalization in Shaping Accounting Careers

Demand for International Qualifications

With businesses expanding globally, certifications like US CPA, UK ACCA, and US CMA are gaining prominence. These qualifications offer a global perspective, making professionals more competitive in international markets.

Cross-Border Financial Regulations

Accountants are now required to understand complex international tax laws and compliance standards. This has increased the demand for experts in regulatory frameworks such as IFRS (International Financial Reporting Standards) and GAAP (Generally Accepted Accounting Principles).

Soft Skills: The New Essential for Accounting Professionals

Communication and Leadership

Modern accountants are expected to go beyond crunching numbers. Strong communication skills and leadership abilities are essential for conveying financial insights and guiding decision-making processes.

Adaptability and Lifelong Learning

With constant changes in technology and regulations, professionals must adapt and continuously update their knowledge. Certifications like US CMA and US CFA emphasize ongoing education to stay relevant.

Sustainability and ESG Reporting

Focus on Environmental, Social, and Governance (ESG) Metrics

Organizations are increasingly prioritizing sustainability. Accountants play a crucial role in ESG reporting, helping companies track and disclose their environmental and social impact.

Green Accounting Practices

Green accounting involves assessing and reporting environmental costs. This emerging field aligns financial practices with sustainability goals, reflecting a company’s commitment to responsible operations.

The Future of Accounting Certifications

Digital Skills Integration

Certifications like CA, US CPA, and UK ACCA are incorporating digital skills into their syllabi. Topics such as data analytics and cybersecurity are becoming essential components of these programs.

Specialized Roles and Niches

The future holds promising opportunities for accountants in specialized roles. Fields like forensic accounting, financial planning, and risk management are seeing significant growth.

Conclusion: Embracing Change in Accounting

The future of accounting is bright and full of opportunities for professionals willing to adapt. By staying updated on technological advancements, regulatory changes, and global trends, accountants can thrive in this dynamic field. Whether you’re pursuing CA, CS, US CMA, US CPA, UK ACCA, or US CFA, embracing these trends will set you apart in the ever-evolving accounting landscape.

1 note

·

View note

Text

Accounting and Bookkeeping Services in Dubai: A Comprehensive Guide

Dubai is one of the world's leading business hubs, offering a dynamic economic environment, investor-friendly policies, and a tax-efficient structure. Whether you're running a startup, an SME, or a multinational corporation, having a robust financial management system is essential. This is where accounting and bookkeeping services in Dubai play a critical role.

We will explore the importance of professional accounting, key services offered, and why hiring expert accountants in Dubai is crucial for your business’s success.

The Importance of Accounting and Bookkeeping Services in Dubai

Accounting and bookkeeping form the backbone of any business. Accurate financial records ensure compliance with local regulations, facilitate informed decision-making, and enhance overall business efficiency. Dubai’s financial regulations require businesses to maintain proper financial records and submit reports to regulatory bodies. Failing to do so can result in penalties, legal consequences, and reputational damage.

Some key reasons why businesses must invest in accounting and bookkeeping services Dubai include:

Regulatory Compliance: The UAE government has strict financial reporting standards, including VAT compliance and adherence to International Financial Reporting Standards (IFRS).

Taxation Requirements: With the introduction of corporate tax and VAT, businesses must maintain accurate records to ensure timely tax filings and avoid penalties.

Financial Transparency: Well-maintained accounts provide a clear picture of financial health, aiding in budgeting and forecasting.

Fraud Prevention: Regular financial audits help in detecting fraudulent activities and ensuring the integrity of financial transactions.

Key Accounting and Bookkeeping Services Offered in Dubai

Professional accounting services in Dubai cater to businesses across various industries, ensuring smooth financial operations. Some essential services include:

1. Bookkeeping Services

Bookkeeping involves the systematic recording of financial transactions, including income, expenses, sales, and purchases. Proper bookkeeping ensures financial accuracy and helps businesses make strategic decisions based on real-time financial data.

2. Financial Reporting

Timely financial reporting is essential for businesses to track their financial status and comply with regulatory requirements. Reports such as balance sheets, profit and loss statements, and cash flow statements provide valuable insights into a company’s financial standing.

3. VAT Registration and Compliance

Since the introduction of VAT in the UAE, businesses must register for VAT, file returns, and comply with tax regulations. Professional accountants ensure accurate VAT calculations and timely submissions to avoid fines and legal issues.

4. Corporate Tax Advisory

With corporate tax laws now applicable in the UAE, businesses need expert tax advisory services to understand their tax obligations and optimize their tax structure. Chartered accountant firms in Dubai provide guidance on tax planning, ensuring compliance while minimizing tax liabilities.

5. Payroll Management

Payroll processing can be complex, involving salary calculations, deductions, WPS compliance, and end-of-service benefits. Outsourcing payroll management ensures error-free and compliant payroll processing, reducing administrative burdens for businesses.

6. Audit and Assurance Services

Auditing is crucial for verifying the accuracy of financial statements and ensuring regulatory compliance. Chartered accountant firms in Dubai provide internal audits, external audits, and forensic audits to maintain financial transparency and credibility.

7. CFO Services

For businesses that do not have an in-house Chief Financial Officer (CFO), outsourcing CFO services can help in strategic financial planning, budgeting, and risk management.

Why Hire Professional Accountants in Dubai?

Many businesses opt for professional accounting services in Dubai rather than managing their finances in-house. Here’s why hiring expert accountants is beneficial:

1. Expertise and Accuracy

Professional accountants are well-versed in UAE’s financial laws, IFRS, and tax regulations. Their expertise ensures error-free bookkeeping and compliance with local laws.

2. Cost-Effective Solution

Outsourcing accounting services is often more cost-effective than hiring a full-time in-house team. Businesses save on recruitment, training, and overhead costs while accessing high-quality financial services.

3. Time-Saving

Handling financial records, tax filings, and compliance can be time-consuming. Outsourcing allows businesses to focus on core operations while experts manage financial matters.

4. Compliance with UAE Laws

Dubai has strict financial regulations, and businesses must ensure compliance to avoid penalties. Professional chartered accountant firms in Dubai stay updated with changing laws and help businesses navigate complex financial requirements.

5. Fraud Detection and Risk Management

Accountants help in detecting financial irregularities and implementing risk management strategies to safeguard businesses against fraud and financial mismanagement.

How to Choose the Right Accounting Firm in Dubai?

Selecting the right accounting firm is crucial for ensuring financial success. Consider the following factors when choosing a service provider:

Experience and Credentials: Ensure the firm has qualified and experienced accountants who understand Dubai’s financial landscape.

Range of Services: Choose a firm that offers comprehensive accounting and bookkeeping services, including tax advisory, audits, and VAT compliance.

Technology and Tools: A good accounting firm should use modern accounting software for accuracy and efficiency.

Reputation and Reviews: Check client testimonials, online reviews, and case studies to assess the firm’s credibility.

Customized Solutions: Every business has unique financial needs. Opt for a firm that offers tailored accounting solutions to meet your requirements.

Conclusion

In today’s competitive business environment, having reliable accounting and bookkeeping services Dubai is essential for financial success and regulatory compliance. Whether you need bookkeeping, VAT services, payroll management, or corporate tax advisory, professional accountants in Dubai ensure accuracy, efficiency, and compliance with UAE laws.

By partnering with expert chartered accountant firms in Dubai, businesses can streamline their financial processes, reduce risks, and focus on growth. Investing in top-tier accounting services in Dubai is not just a regulatory requirement—it is a strategic move toward sustainable business success.

0 notes

Text

What you will learn in a Risk Management course and why it's crucial for your career?

In a risk management course, one basically learns how to assess and mitigate risks by studying the financial and overall ecosystem. It further goes on to analyze the market changes or trends. Individuals learn how to develop ways to mitigate potential hazards such as insufficient contingency reserves, mismanagement of resources, competitor behavior, and so on through various qualitative and quantitative tools that could potentially protect organizations from elements that may harm and affect the businesses.

The only complete risk management courses in India is the PG in Risk Management course, offered by Global Risk Management Institute.

PG in Risk Management by GRMI

This risk management course is the talk of the town and covers diverse topics like strategic risk management, cyber-security risk management, financial risk management, corporate governance, ESG (Environment, Social and Governance) and other dynamic domains. If you get into the premier institute of risk management in India, GRMI, then your placement for roles like Internal Audit, Governance, Risk and Compliance, Risk Advisory/Risk Assurance Services, Strategic Risk Advisory, Enterprise Risk Management, Forensic/Fraud Investigation, Treasury Risk, Third Party Risk Management is likely.

GRMI also conducts regular live sessions by industry experts and boasts of an amazing median package of INR 9.25 LPA, with a 97% placement track record. Past employers For further information, visit their official website or contact them on 09910939240.

Key learnings from this course

This course is like a panacea to all your problems. Recognizing potential risks that could harm the business is the first major skill that one learns when they pursue a risk management course. Some strategies that one can use for the same includes brainstorming, SWOT analysis, or using historical data.

This course inculcates techniques that can help an individual analyze risks based on likelihood and impact. Quantitative (numerical) and qualitative (descriptive) assessments are often covered in this and it also covers aspects like that of risk matrices, probability and impact assessments, and scenario analysis.

Developing plans to address risks and learning how to track identified risks, detect new risks, and evaluate the effectiveness of response strategies is something core to this course. Regular reporting, risk audits, and updating risk registers are commonly discussed here.

One of the highly desirable lessons that this course teaches you is- “Communication is the key”. This course rightly teaches you this lesson by helping you how to communicate risk status and response plans to stakeholders. It also includes creating clear reports and understanding the roles of stakeholders in managing risks.

These concepts give students a broad foundation for anticipating and managing risks effectively, whether in project management, business continuity, or operational settings.

Career in risk management

Due to its high demand across various industries, risk management is critical across many sectors, including finance, healthcare, energy, and technology. Organizations are constantly dealing with various risks—financial, operational, reputational, and regulatory—so they need skilled professionals to help navigate these challenges.

Risk Management offers an individual with diverse career opportunities. As a risk manager, you can specialize in different types of risks, such as credit, market, operational, compliance, or cyber risk. Each area offers its unique challenges and can lead to specialized, high-level roles.

Due to the importance of risk management and the expertise required, risk managers are generally well-compensated. Roles in this field often offer strong salaries and benefits, particularly in industries like banking, insurance, and consulting.

Risk managers play a crucial role in protecting an organization's assets and reputation. By identifying and mitigating risks, you help ensure the organization’s sustainability and stability, which can be highly rewarding. Thus the role of a risk manager is that of high impact and responsibility.

Risk management offers room for advancement and growth, with potential career paths leading to senior roles such as Chief Risk Officer (CRO) or even executive leadership positions. Many companies value risk management professionals who understand business strategy and can lead cross-functional initiatives.

Risk management requires staying up-to-date with industry trends, regulations, and emerging risks. This makes it a dynamic field where you’ll continually learn and grow your expertise.

Conclusion

Overall, if you enjoy strategic thinking, data analysis, and problem-solving, a risk management course can offer a fulfilling, well-compensated, and impactful career path. The domain employs tens of thousands of professionals in India and its stature is only set to grow further with digitalization and globalization. The biggest and most prominent firms in the world have planned to enhance their risk management strategies and teams so that’s the domain to be! GRMI can be contacted on 09910939240 for further enquiries into a career in this field.

0 notes

Text

The Intersection of Forensic Accounting and Tax Fraud

Tax fraud remains one of the most serious financial crimes affecting individuals and businesses. In these cases, forensic accountants play a crucial role in uncovering discrepancies and ensuring that financial statements reflect true and accurate information.

A skilled CPA forensic accounting expert can examine intricate financial data and identify subtle signs of fraudulent activities, making them indispensable in tax fraud investigations.

Understanding CPA Forensic Accounting

Forensic accountants operate in a specialized field that blends accounting, investigative skills, and legal expertise. Focusing on how financial records are used or misused, they help uncover deceptive practices that traditional accounting methods might overlook. Whether it involves falsifying income, hiding assets, or inflating expenses, forensic accountants possess the tools and experience to detect these issues effectively.

Identifying Discrepancies in Financial Records

A key part of forensic accounting in tax fraud cases is the ability to identify discrepancies between reported earnings and actual income. Fraudulent tax filings often involve underreporting income or overstating deductions.

Forensic accountants use their expertise to track financial transactions and uncover hidden sources of revenue that may have been omitted from tax filings. By examining bank records, financial statements, and receipts, they piece together the full picture, helping authorities identify fraudulent behavior.

Investigating Suspicious Financial Practices

When investigating tax fraud, forensic accountants do not focus solely on numbers. They also examine the context surrounding financial transactions. This includes determining whether financial statements were manipulated or if assets were transferred to other entities to avoid tax obligations.

Forensic accountants often collaborate with legal professionals to provide expert testimony that serves as critical evidence in court. Their meticulous approach ensures that clear, undeniable financial facts support any case.

Recognizing Patterns in Complex Schemes

Forensic accountants are skilled at recognizing patterns of suspicious activity that might not be immediately obvious. Tax fraud cases often involve complex schemes, such as hidden accounts or shell companies designed to evade taxes.

Forensic accounting professionals can analyze large volumes of financial data and spot irregularities that may otherwise go unnoticed by traditional accountants or auditors. Their expertise ensures that any financial crime is thoroughly examined.

Supporting Tax Audits and Financial Restitution

Forensic accountants also play a significant role in providing clarity during tax audits. Forensic accountants ensure that financial records are accurately represented when a business or individual faces an audit.

In some cases, they may even help reconstruct financial data that was improperly filed, making sure that accurate information is presented to tax authorities. This can be particularly valuable in tax fraud cases where missing or altered records are key to the investigation.

The Role of Forensic Accounting in Fraud Recovery

The role of a forensic accountant extends beyond investigation. These professionals also contribute to the resolution process by assisting individuals or businesses in making financial restitution. In cases where fraudulent tax filings have led to substantial tax liabilities, a forensic accountant can help determine the amount of tax owed and support the recovery of assets.

Seek Professional Guidance for Tax Fraud Investigations

For those suspecting tax fraud, the involvement of a CPA forensic accounting expert is an essential step in uncovering the truth. Their unique skill set combines investigative techniques with accounting knowledge, allowing them to identify subtle signs of fraud and provide clarity on complex financial matters.

Contact a forensic accounting expert today to learn more about how their services can assist in the fight against tax fraud.

0 notes

Text

Accounting Company in India: A Comprehensive Guide

Accounting Company in India plays a crucial role in shaping the financial landscape by offering services such as auditing, tax planning, financial consulting, and compliance management. Companies across industries rely on accounting firms to ensure compliance, financial stability, and strategic decision-making. One such firm that has set a benchmark in the Indian accounting industry is HCO & Co. This blog provides an in-depth look at accounting firms in India, their significance, and why HCO & Co. stands out as a premier service provider.

Understanding the Role of an Accounting Company in India

An accounting company in india plays a crucial role in the financial ecosystem by providing services such as auditing, tax planning, financial consulting, and compliance management. These firms help businesses adhere to statutory requirements while optimizing their financial performance.

Key Services Offered by Accounting Companies

Auditing and Assurance – Ensuring transparency and accuracy in financial reporting.

Taxation Services – Handling direct and indirect tax compliance, planning, and litigation support.

Financial Consulting – Assisting with investment strategies, financial restructuring, and corporate finance.

Compliance and Regulatory Advisory – Ensuring adherence to GST, income tax, and corporate laws.

Risk Management and Internal Audit – Strengthening internal controls and mitigating risks.

Payroll and Bookkeeping – Managing employee salaries, ledger maintenance, and financial reporting.

The Indian Accounting Landscape

India follows the Indian Accounting Standards (Ind AS), which align with International Financial Reporting Standards (IFRS). The Institute of Chartered Accountants of India (ICAI) regulates the profession and ensures ethical practices in financial reporting.

With the rise of startups, foreign investments, and evolving taxation policies, accounting firms play a vital role in navigating these complexities for businesses of all sizes.

HCO & Co.: A Leading Accounting Firm in India

HCO & Co. is recognized as one of the top accounting company in India, offering comprehensive financial and advisory solutions. With expertise across various industries, HCO & Co. provides a client-centric approach, ensuring customized solutions to meet business needs.

Why Choose HCO & Co.?

Expertise and Experience – A team of seasoned Chartered Accountants with deep industry knowledge.

Technology-Driven Solutions – Utilization of advanced accounting software and AI-driven analytics.

Comprehensive Service Offerings – From tax advisory to internal audits, HCO & Co. covers all aspects of financial management.

Compliance-First Approach – Ensuring businesses stay compliant with ever-changing regulatory requirements.

Client-Centric Focus – Tailored solutions that cater to the unique needs of businesses across industries.

Key Services of HCO & Co.

Audit & Assurance – Providing statutory, internal, and forensic audits.

Tax Advisory – Assisting with GST, direct taxes, transfer pricing, and tax litigation.

Corporate Finance – Offering valuation, mergers & acquisitions, and fundraising support.

Business Advisory – Risk management, due diligence, and compliance consulting.

Outsourced Accounting & Payroll Services – Streamlining financial management and payroll processing.

The Growing Importance of Accounting Firms in India

With evolving financial regulations, digitization, and globalization, businesses increasingly rely on professional accounting firms for:

Regulatory Compliance – Adhering to laws like the Companies Act, GST, and Income Tax Act.

Financial Stability – Strategic financial planning to optimize revenue and manage expenditures.

Risk Mitigation – Identifying potential risks and implementing effective internal controls.

Future Trends in the Accounting Industry in India

Artificial Intelligence & Automation – AI-driven solutions for financial analysis and fraud detection.

Blockchain & Fintech Integration – Enhanced transparency and security in financial transactions.

Data-Driven Decision Making – Advanced analytics for financial forecasting and planning.

Sustainability Accounting – Focus on ESG (Environmental, Social, Governance) compliance.

Conclusion

An accounting company in India serves as a backbone for businesses, ensuring financial stability, compliance, and strategic growth. HCO & Co. stands as a trusted partner, offering end-to-end financial solutions tailored to industry needs. Whether you are a startup, an SME, or a multinational enterprise, partnering with an experienced accounting firm like HCO & Co. can drive financial success and long-term sustainability.

For expert financial guidance, audit support, and compliance advisory, HCO & Co.is your go-to accounting firm in India, delivering excellence and innovation in financial services. Visit here for more details: https://hcoca.com/top-accounting-companies-in-india.aspx

0 notes