#Foreclosure homes

Explore tagged Tumblr posts

Text

Gorgeous 1925 English Tudor style home in New Rochelle, New York is a foreclosure. It has 4bds, 4ba, $999K. But, the bank will only accept a buyer with cash or a renovation loan.

Look at this gorgeous woodwork. It is well worth the price, but there's not much reno to do. Why would you want to change this? The only thing I see is a dirty floor. It looks like it's been freshly painted.

I wish they would've taken a closeup of that magnificent fireplace. Look at the doors on the left and the leaded stained glass windows.

Look at this. A couple stairs up to the hallway, thru this beautiful shelving. Look at the artwork above the window, also.

I hesitate to call this amazing area a sun porch, b/c it's too sophisticated, but it could be one. It's enclosed, so it's not a loggia.

It has a typically English Tudor ceiling in this room and the wood paneling is so beautiful

The eat-in kitchen and cabinets are in good shape. Looks like there's a new dishwasher with the protective film still on.

What a great pantry.

I don't know what this room is, but it's nice and appears to have a closet and an outside door.

I wonder if the lift works.

Here's a nice large bedroom. Maybe it's the primary.

That bath needs some work. Weird toilet cubby.

Here's another nice room.

This one's a nice shape.

This bath is fine.

This is lovely up here. It's a finished attic, but has the duct work exposed.

This bath is perfectly fine, too. This house doesn't need a reno loan to completely modernize it, though, that would be a shame. Hope they don't paint the wood white and the walls gray.

The grounds need some clean up and this is the garage. Wow, look how fancy the floor was. The property measures .37 acre.

119 notes

·

View notes

Text

some of the people in those notes are in a different world

#‘oh well I guess I’ll own my childhood home someday’ damn#don’t even have one of those the last house my parents were paying a mortgage one we got a foreclosure on and were given#several months notice to pack up and leave#my parents are making more than they ever made in last and they’re still just paying rent#no hope of owning a house in a place like this especially#there’s very few options in a tourism industry town#rich people buy up all the homes to rent out as vacation homes#apartments are around $1200 at minimum to rent#for shitty studio apartments in bad neighborhoods#also scary seeing people like ‘aha I’ll just wait for my parents to die😅’ wtf you sound like a columbo villain or something#pisses me off as someone who had distant step relatives acting like vultures over inheritance while their parents were dying of illness#disgusting behavior

4 notes

·

View notes

Text

baby liz & its grampy

#i'm at my mom's place and she's got a few photos#we lost most of our family photos in a quick home foreclosure so. they are precious to me#it me

28 notes

·

View notes

Text

Home Foreclosure Help: 4 Ways to Prevent Foreclosure with Expert Assistance

#foreclosure#realestate#realtor#mortgage#househunting#investment#realestateagent#broker#listing#home#realty#property#properties#forsale#shortsale#newhome#realestateinvestor#housing#webuyhouses#fixandflip#realestateinvesting#realtorlife#investmentproperty#bankruptcy#homesforsale#realtors#makememove#justlisted#luxuryrealestate#homesale

5 notes

·

View notes

Text

milo and the one or two forevers ago poem…

i can’t remember the sound of your laugh or the tone of your voice i can’t remember your face not even your name but i know you were there.

i think i lost myself too one or two forevers ago but even if i did. i can’t remember who he was

#ooc#this poem in general fucking gets me#gonna get personal on the milo blog for a second but-#earlier this year i learned all my childhood stuff got thrown our or givin away in the foreclosure#no one told me till i asked my grandma if we could get an old recipe book from the house cause i wasnted to make banana bread#and its kinda. fucked me up alot.#and its been making me think about like. the fact i cant go back to things and the value of items and memories#and just the general concept of home and childhood homes and archival#the fucking ‘it mightve been good it might’ve been bad it might’ve been insignificant but it was yours! and now you can never get it back’#breaks me. like yeah. i really cant get those back can i#i have. so much to day about my feelings about the fore closure but i dont wana just start venting-#thats its own post#anyway uh#vent in tags

3 notes

·

View notes

Text

Stop Foreclosure in Dallas, Texas

Stop Foreclosure in Dallas, Texas

All over this great country, homeowners are pilling up huge debt and their houses is at risk, they all need to know “how to stop the foreclosure in Dallas, Tx.” As long as you are not too close to the foreclosure sale, or it has not been completed, you can still avoid foreclosure once it has started, giving you a chance to keep your home. If you decide not to keep your home, the extra time can…

View On WordPress

#analyzing-a-real-estate-deal#analyzing-my-homes-value#attract-multiple-offers-in-a-sellers-market#avoid-foreclosure-in-dallas#behind-on-mortgage#behind-on-mortgage-payment#buy-m#buy-my-cedar-hill-tx-home-fast#buy-my-cedar-hill-tx-house-fast#buy-my-dallas-home#buy-my-dallas-house#buy-my-foreclosure-home-in-dallas#buy-my-foreclosure-house#buy-my-foreclosure-house-in-dallas#buy-my-home-fast-in-cedar-hill#buy-my-home-fast-in-cedar-hill-tx#buy-my-home-fast-in-Dallas#buy-my-home-fast-in-garland#buy-my-home-fast-in-grand-prairie#buy-my-home-fast-in-mesquite#buy-my-home-fast-in-oak-cliff#buy-my-home-for-cash-fast#buy-my-home-for-cash-in-dallas#buy-my-home-in-cedar-hill-tx#buy-my-home-in-dallas#buy-my-home-in-foreclosure-in-dallas#buy-my-home-in-mesquite#buy-my-home-in-mesquite-tx#buy-my-house-fast-in-mesquite#buy-my-house-for-cash

2 notes

·

View notes

Text

i realize this will likely never be an issue that affects me bc i will never be able to buy a house, HOWEVER! thinking about hoas makes my blood boil so much and it's sooo baffling to me how prevalent they are in america. like?? you're telling me people can't decide what type of flowers to plant on their own property????? and that's just OKAY with people??? on your OWN property????

#another reason i would never live in the suburbs#i was just watching the recent john oliver ep about this#and it's soo crazy#i knew it was bad but i didn't realize 80% of homes sold were in HOAs#like idk i just didn't know it was THAT prevalent#it's just crazy to think about#like how do you move on from being fucked like that#how do you move on from losing your HOUSE because of stupid bullshit regulations made up by losers with a god complex#like i can't believe you can go into foreclosure because your house is painted the wrong color it's INSANE

4 notes

·

View notes

Text

Are real estate agents parasites?

#real estate agents#real estate agent#real estate#foreclosure#bankers#home owner#buying a house#landlords#landlord#1 percent

3 notes

·

View notes

Photo

Congratulations Gordon on your new property may live long and prosper 🖖! 🏡🛩️🏡🛩️🏡🛩️🏡🛩️🏡🛩️🏡🛩️ . http://www.TheSirLancelotGroup.com . #realty #realestate #broker #forsale #newhome #househunting #property #daytonabeach #ormondbeach #portorange #lancelotrealtor #properties #investment #family #home #housing #mortgage #foreclosure #selling #listing #sirlancelottherealtor #realestateagent #mentor #tour #Florida #certified #house #thesirlancelotgroup (at Lake Mary, Florida) https://www.instagram.com/p/CmiHyS2M7J2/?igshid=NGJjMDIxMWI=

#realty#realestate#broker#forsale#newhome#househunting#property#daytonabeach#ormondbeach#portorange#lancelotrealtor#properties#investment#family#home#housing#mortgage#foreclosure#selling#listing#sirlancelottherealtor#realestateagent#mentor#tour#florida#certified#house#thesirlancelotgroup

6 notes

·

View notes

Text

How 'Cash for Homes' Benefits Homeowners Facing Foreclosure?

Homeowners facing foreclosure often find themselves in a difficult financial situation, struggling to maintain their homes while dealing with mounting debt and impending legal actions. In such circumstances, "cash for homes" offers a viable solution that can alleviate some of the pressures associated with foreclosure. Here’s how this option benefits homeowners in distress.

Quick Cash Relief

One of the most significant advantages of cash for homes is the speed at which the transaction can be completed. Cash buyers are typically investors or companies that specialize in purchasing homes quickly and without the need for financing. This means homeowners can receive cash for their property in as little as a week, providing immediate financial relief. This influx of cash can help pay off debts, settle outstanding bills, or provide funds for moving expenses, reducing the burden of financial instability.

Avoiding Foreclosure Consequences

Foreclosure can have long-lasting negative effects on a homeowner’s credit score, making it challenging to secure future loans or mortgages. By opting for a cash sale, homeowners can avoid the formal foreclosure process, which typically involves legal proceedings and can lead to significant emotional distress. A cash sale allows homeowners to take control of their situation, preserving their credit and reducing the stigma associated with foreclosure.

Flexible Selling Terms

Cash buyers often offer flexible terms that can cater to the specific needs of the homeowner. For example, if the homeowner needs more time to relocate, a cash buyer may agree to a delayed closing. This flexibility can significantly reduce stress, as it allows the homeowner to find a new place to live without the pressure of an immediate deadline.

No Repairs Needed

Homes facing foreclosure are often in disrepair due to financial strain, making it difficult for homeowners to invest in necessary repairs or renovations. Cash buyers typically purchase properties as-is, meaning homeowners do not need to spend money on repairs or updates. This aspect is particularly beneficial for those who may not have the financial resources to make their home market-ready. Selling as-is allows homeowners to focus on their next steps rather than the burdens of fixing up their property.

Relief from Stress and Uncertainty

The emotional toll of facing foreclosure can be overwhelming. Homeowners often experience anxiety and fear about their financial future and the potential loss of their home. By selling to a cash buyer, homeowners can alleviate some of this stress. The certainty of a quick sale can bring peace of mind, allowing homeowners to move forward with their lives rather than being consumed by the fear of foreclosure.

Potential for Future Financial Recovery

By opting for a cash sale instead of going through foreclosure, homeowners may find themselves in a better position to rebuild their financial stability. With cash in hand, they can pay off debts and avoid further financial complications. This proactive approach allows homeowners to focus on recovery rather than being trapped in a cycle of debt and foreclosure.

Conclusion

The "cash for homes" option offers significant benefits for homeowners facing foreclosure, providing quick financial relief, flexibility in selling terms, and the opportunity to avoid the damaging consequences of foreclosure. By choosing to sell their home for cash, homeowners can regain control of their situation, relieve financial stress, and set the stage for a more secure financial future. Ultimately, this route can empower distressed homeowners to move forward with hope and stability.

0 notes

Text

Wow, I don't live very far from Saddle River, New Jersey. It's a very wealthy town and this 2019 mansion is a foreclosure. The bottom fell out of somebody's fortune. It has 9bds, 15ba, and the bank has it up for sale for S6.495M.

It must've been like a real life "Schitt's Creek" losing a home like this. That chandelier is magnificent.

In the great room you can see the mezzanine behind the main stairs.

Wow. I wonder what happened.

This kitchen. They'd have to drag me out kicking and screaming.

Family room off the kitchen.

This was either a library or an office.

Look at the entrance to the primary bedroom.

Not leaving my lion fireplace. Nope. Seriously, if I had a husband that had this house built for us, then lost it, he would be in seriously deep shit.

The en-suite bath.

Closet/dressing room with beautiful leopard carpet.

I wonder if Pitkin was their last name. Would you keep it or have your own name put up there?

Wow, chaises inside the theater.

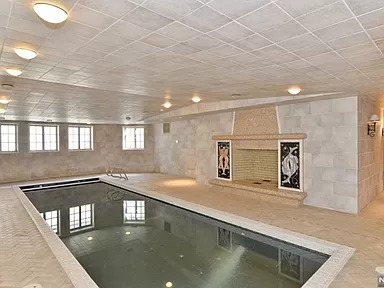

The indoor pool has a fireplace. Gorgeous.

And, of course there has to be a wine cellar.

The realtors don't even know how many acres the property is. Foreclosures are generally sales that take a long time, by the time a buyer makes an offer and the bank messes around and all.

https://www.zillow.com/homedetails/101-Fox-Hedge-Rd-Saddle-River-NJ-07458/52910768_zpid/

134 notes

·

View notes

Text

🏠 Transforming Lives, One House at a Time 🏠

At City Lights Home Buyers, we take pride in bringing new life to homes across Michigan! From probate properties to those in need of a little TLC, we’re here to offer a fair cash offer and a hassle-free process to help you move forward.

✨ Want to know how we can help you, too? Learn more about our process on our homepage or get to know us and see how we’ve made a difference for Michigan homeowners facing probate and other challenges. Check out our latest probateinsights here.✨

#CityLightsHomeBuyers #MichiganHomes #SellYourHouseFast #ProbateSolutions #BeforeAndAfter

#Probatesolutions#CityLightsRentals#CityLightsHomeBuyers#sell your house for cash#sell my house for cash#sell your house fast#we buy houses#we buy mobile homes#cheap old houses#foreclosures#probateprocess#we buy houses for cash

0 notes

Text

Selling Your Home Quickly: Cash Offers Explained

In today’s fast-paced real estate market, many homeowners find themselves in situations where they need to sell their homes quickly. One of the most appealing options for achieving a quick sale is accepting a cash offer. But what exactly does it mean to sell your home for cash, and how does the process work? In this comprehensive guide, we’ll break down cash offers, their benefits, potential downsides, and what you need to know to navigate this option successfully.

What is a Cash Offer?

A cash for houses Grand Junction CO offer refers to a proposal made by a buyer to purchase a property outright without the need for mortgage financing. This means that the buyer has the funds readily available to complete the transaction. Cash offers can come from various sources, including individual homebuyers, real estate investors, or cash home-buying companies.

Characteristics of Cash Offers:

No Financing Contingencies: Unlike traditional offers that may depend on the buyer securing a mortgage, cash offers do not include financing contingencies, making them generally less risky for sellers.

Faster Closings: Cash transactions can often close in as little as a week or two, significantly reducing the time your home is on the market.

Less Paperwork: Without the need for loan approvals and lengthy financial documentation, the process is typically more streamlined.

Benefits of Accepting Cash Offers

1. Speed and Convenience

One of the most significant advantages of accepting a cash for houses Grand Junction CO offer is the speed at which the transaction can occur. For homeowners facing urgent situations—such as job relocations, financial difficulties, or personal emergencies—this can be a lifesaver. Cash sales can often close in as little as 7 to 14 days, allowing you to move on quickly.

2. Reduced Risk of Fall-Through

In traditional sales, transactions can fall through due to financing issues, such as the buyer being denied a mortgage or failing to meet loan conditions. Cash offers eliminate this risk, providing you with greater peace of mind that the sale will go through.

3. Less Hassle

Cash buyers typically expect to purchase homes as-is, meaning you won’t need to invest time and money in repairs or renovations. This can be especially beneficial if your home has significant issues that you’d rather not address.

4. Straightforward Process

With fewer parties involved (no lenders or banks), the process of closing on a cash offer is generally more straightforward. This can save you time and reduce the stress often associated with home sales.

5. Negotiation Power

Cash buyers may be more willing to negotiate favorable terms for sellers, such as fewer contingencies or a more flexible closing date. This can create a win-win situation for both parties.

Potential Downsides of Cash Offers

While there are numerous benefits to accepting a cash offer, it’s essential to be aware of potential drawbacks.

1. Lower Offers

Cash buyers, particularly investors, often look for a deal. As such, cash offers may be lower than what you might receive in a traditional sale. If maximizing your sale price is a priority, you’ll need to weigh this consideration carefully.

2. Limited Buyer Pool

Not all buyers are cash buyers, which can limit your pool of potential offers. If you’re in a market where cash transactions are less common, you might find yourself with fewer options.

3. Scams and Lowball Offers

Unfortunately, the cash offer market can attract unscrupulous buyers looking to take advantage of sellers in desperate situations. Always conduct due diligence on potential buyers to ensure their legitimacy.

How to Evaluate Cash Offers

If you receive a cash offer on your home, consider the following steps to evaluate its viability:

1. Review the Offer Carefully

Take a close look at the details of the offer, including the price, closing timeline, and any contingencies. Understanding what the buyer is proposing will help you make an informed decision.

2. Research the Buyer

Whether the offer comes from an individual, a real estate investor, or a cash home-buying company, it’s essential to research their credibility. Look for reviews, testimonials, and any history of past transactions.

3. Consult with a Real Estate Professional

Working with a knowledgeable local real estate agent can provide invaluable insights into the market and help you evaluate whether a cash offer is in your best interest. They can also guide you through the negotiation process.

4. Consider Timing and Urgency

Reflect on your personal circumstances. If you need to sell quickly, a cash offer may align perfectly with your timeline. However, if you have time to wait for potentially higher offers, you might consider listing your home traditionally.

5. Assess the Market Conditions

Market conditions can greatly influence the desirability of cash offers. In a competitive market, you may receive multiple offers, including cash and traditional financing options. Understanding these dynamics will help you make the best choice.

The Process of Accepting a Cash Offer

Once you’ve decided to accept a cash offer, the following steps typically occur:

1. Sign the Purchase Agreement

Once the terms are agreed upon, both you and the buyer will sign a purchase agreement that outlines the sale details, including the price, closing date, and any contingencies.

2. Open Escrow

An escrow account is usually opened to facilitate the transaction. This neutral third party holds the funds and documents until the sale is finalized.

3. Home Inspection and Appraisal (if necessary)

Even in cash sales, buyers may request a home inspection to ensure there are no hidden issues. In some cases, an appraisal may also be necessary to confirm the home’s value.

4. Close the Sale

Once all conditions are satisfied, you’ll proceed to the closing. During this meeting, you’ll sign the final paperwork, transfer the title, and receive your funds.

Conclusion

Selling your home quickly through a cash offer can be a smart choice for many homeowners, particularly those needing to move on swiftly. With the potential for faster closings, reduced risk, and less hassle, cash offers can streamline the selling process. However, it’s crucial to carefully evaluate any offers you receive, considering both the pros and cons.

If you’re considering selling your home for cash, the experienced team at Convergence Properties Inc. is here to help. We can guide you through the process, provide market insights, and ensure you get the best possible outcome for your sale. Contact us today to learn more about your options and how we can assist you in making a confident decision!

Reference: Sell my house Fast Grand Junction colorado

Reference: Sell house Grand Junction

Reference: Sell my Mesa County house fast

#sell my home colorado#colorado rent assistance#sell house colorado#sell colorado house fast#foreclosures in colorado#realtor grand junction

0 notes

Text

4 Plus 1 Thing To Look For In Home Foreclosure Listings

#foreclosure#realestate#realtor#mortgage#househunting#investment#realestateagent#broker#listing#home#realty#property#properties#forsale#shortsale#newhome#realestateinvestor#housing#webuyhouses#fixandflip#realestateinvesting#realtorlife#investmentproperty#bankruptcy#homesforsale#realtors#makememove#justlisted#luxuryrealestate#homesale

5 notes

·

View notes

Text

📣𝐍𝐨𝐰 $𝟐𝟖𝟓,𝟗𝟎𝟎📣 Recently refurbished home with room to grow! Come see 1219 Middle Fork Dr in Gillette, WY 👉 https://ow.ly/z5zG50TXpX9

Call Tonya Stahl at Team Properties Group for your showing 📲307.299.1396

#wyoming#wyomingrealestate#homesforsale#forsale#starterhome#foreclosure#foreclosuresinwyoming#homesforsaleingillettewy#gillettewy#gilletterealestate#teamproperties#tpg#tonyastahl#homebuyers#homebuying#firsttimehomebuyers#homesellers#homeselling#realestate#realestateagent#realtor#realtorsingillettewy#realtorsinwyoming#house#home#realestatemarket

0 notes

Text

Stop Foreclosure in Dallas

Stop Foreclosure in Dallas

Herein are a number of programs to assist homeowners who are at risk of and want to “Stop foreclosure in in Dallas,” and otherwise struggling with their monthly mortgage payments. Please continue reading for a summary of resources available. Please read FHA’s brochure, “Save Your Home: Tips to Avoid Foreclosure,” also published in Spanish, Chinese and Vietnamese. Stop Foreclosure in Dallas A…

View On WordPress

#analyzing-a-real-estate-deal#analyzing-my-homes-value#attract-multiple-offers-in-a-sellers-market#avoid-foreclosure-in-dallas#behind-on-mortgage#behind-on-mortgage-payment#buy-my-cedar-hill-tx-home-fast#buy-my-cedar-hill-tx-house-fast#buy-my-dallas-home#buy-my-dallas-house#buy-my-foreclosure-home-in-dallas#buy-my-foreclosure-house#buy-my-foreclosure-house-in-dallas#buy-my-home-fast-in-cedar-hill#buy-my-home-fast-in-cedar-hill-tx#buy-my-home-fast-in-Dallas#buy-my-home-fast-in-garland#buy-my-home-fast-in-grand-prairie#buy-my-home-fast-in-mesquite#buy-my-home-fast-in-oak-cliff#buy-my-home-for-cash-fast#buy-my-home-for-cash-in-dallas#buy-my-home-in-cedar-hill-tx#buy-my-home-in-dallas#buy-my-home-in-foreclosure-in-dallas#buy-my-home-in-mesquite#buy-my-home-in-mesquite-tx#buy-my-house-fast-in-mesquite#buy-my-house-for-cash#buy-my-house-for-cash-fast

2 notes

·

View notes