#Finance for Co-Living Properties

Explore tagged Tumblr posts

Text

Finance for Co-Living Properties in Australia

Looking for financing co-living properties in Australia. Explore expert tips, options, and strategies to maximize your investment potential.

Co-living properties are transforming the housing landscape in Australia, offering an innovative solution for affordable, communal living. However, financing these unique investments requires a specialized approach. Whether you’re an investor, developer, or homeowner considering the co-living market, understanding your financial options is crucial. This page will guide you through everything you need to know about financing co-living properties in Australia.

0 notes

Text

DESTINN IN THE COMPOSITE CHART

What was meant for you and your partner based on this asteroid (6583)

1H - You two where meant to experience new beginnings together. You two are destined to outwardly express yourselves to each other which can spawn passion between you two. Either aggressive passion, sexual passion, and/or just simple ambitious passion for each other. both of you put your appearances on a pedal and your destined to learn what that can do to a relationship in the long run. You two are destined look good together and to have a physical confidence when together. You two might discover something new in each others identity and personality when you build a connection. You two can either build each others confidence up or bring it down. You two might be destined to be extremely bold and upfront with each other.

2H - You two are destined to feel very secure and comfortable with each other. You two might tend to spend money on each other a lot. You two might want to find material comfort together which might lead to over indulgence. This connection was destined to give and take. The more you give to each other the more you gain comfort but there a chance of it becoming superficial or lazy in this connection. You two might be destined to mange finances together and will have to learn now to manage it wisely.

3H- Can indicate it being a short term romance wise. But it's great for friendships. This connection was, well, destined to connect lol. the theme of communication are very apparent. Whether that means you two naturally communicate well or you'll have to learn the importance of communication in relationships. You two might be destined to share an important connection between each others siblings or you two have a sibling vibe. You two probably went to the same school together or at the very least the same district area. You two were probably destined to gossip and talk about everything together. Non stop talking in person and non stop talking online. You both are destined to connect over opinions and thoughts. There a chance you two might fight or find each other annoying because of a difference in opinion. You two might be destined to get annoyed with each other a lot too, mostly because of talking too much or not enough.

4H- Can indicate living together at some point in the connection or building some sort of home/family together. The connection is destined to help connect to each others inner child. There might be some childhood healing involved in this connection as well. Both people might have a connection to each others mothers. You two were destined to take care of each other and foster each others emotions. You two might be destined to own something together, most likely a house/ real estate or simple property.

5H- Can also indicate it being short term/fling but it can also indicate having kids together. If not kids then you two are probably destined to share the same hobbies and to do those hobbies together. This connection can be very dramatic and you two might tend to exaggerate certain situations together but for the most part it's probably entertaining for you both. Very lovey dovey and pleasureful relationship. Even if shot term the connection will be very eventful and will probably bring you both great joy. Pride and (again) drama may come into play a lot and if the other persons isn't up for it can get quite annoying/boring real quick.

6H- Can indicate being together for a long time just simply because of the daily routine aspect. You were probably destined to do a lot of daily life actives together. For example you two are probably gym buddies. This connection was destined for you two to improve and evolve together. You two probably keep each other accountable and try to stay connected everyday to get up routine. This is a very pure connection and you two might be of service to each other. You might work together (co -workers) and probably are destined to bond over health and animals (pets). There a chance of being to analytical with each other and to nit picking everything you do. If there's a change in routine one of you if not both of you will have a problem with it. You two might to learn together that a changing routine is sometimes just as good as having a set one.

7H- Can indicate being together for a long time/marriage. You two are very attracted to each other and you see qualities that convinces you to be together for a long time. You guys might be destined do everything together. This connection can be very romantic, harmonious and civil but this connection can also indicate cheating or openly betraying another. If you guys aren't attracted to each other from the get go then you probably find each others presence annoying. In a business setting this is pretty great. You two are destined to have some sort of business partnership or contract. You might negotiate business well with the person or you just negotiate well in general.

8H- Can also being together for a long time. this can ideate the connection to be very passionate and karmic. Possibly very easy for you two to delve into your darkness together. There might be a very sexual and spiritual understanding between you two and you both may be destined to know each other intimately as well as emotionally. Especially when it comes to your darkness/trauma. There a chance you might use this understanding against each other. Both of you come out as new people because of this connection. You might be destined to share a joint bank account or inheritance. You might be destined to do occult practices together or one of you will use occult practices on the other.

9H- You two probably went to the same collage or university together. Or you two probably teach at the same school or area. Or maybe you two were destined to share the same beliefs, ideals and practices. You two probably are destined to connect over different cultures and love for traveling. If you two were to get married you'd probably have an important relationship with your in laws. throughout the connection your beliefs and ideals will be tested or you find new viewpoint in life because of this connection. You two might be destined to travel someplace very far some day. This connection might be destined to learn what it means to be open minded and will show one of you, if not both of you hope important optimism is in a relationship.

10H- Destined to gain some sort of attention because of this connection. When you two get together everyone knows about it. Could potently mean that you two were destined to be a famous couple or connection. Your connection is associated with your image (vise versa) and you two where destined to intertwine your career goals with the goal you have with this connection. You two are destined to be put in a place of power/ authority together and will have to deal with that responsibility, if you can deal with it that is. If not a place of authority than you two will take on the reasonability of maturity. One of you or both of you are destined to mature because of this connection. This connection also means that one of, or both or your father figures are involved in the relationship dynamic.

11H- Great for long term friendships. destined to be friends or to first have a friendly connection together. Destined to embrace each others uniqueness and individuality. Destined to be very social with each other or very social with others when together. You two probably chat a lot online or are online friends. You two might love to go to parties and events together. You two might be a connection a lot of people know of especially online. You two were probably destined to be in the same organizations or groups

12H- This connection is probably a karmic debt from a past life. You two were destined to meet again. This connection can also be very spiritual and sexual. This connection has a lot of potential to show your insecurities and fears to each other. This relationship was destined to expose your past actions/mistakes, your subconscious thoughts/secrets, and your true intentions. This connection isn't necessarily doomed from the start but can indicate some sort of undoing. You both are portably destined to connect over the same fears and your methods of escapism and your mental health will be affected. (Good or Bad) You both might try to manipulate each other. It is most likely quite common for this connection to just end or a bad habit that both you have in relationships is exposed here and hopefully you learn to stop that habit to have better connections with others.

-⚜️💫⚜️

#astrology#astro notes#astro observations#astro placements#astrology notes#pisces#aries#capricorn#taurus#cancer#composite chart#destinn asteroid#asteroids#asteroid astrology

1K notes

·

View notes

Text

a year in review

my therapist recommended that i sit down, go through my diary & calendar & blog, & compile a list of everything i have done this year so that i have incontrovertible evidence of the immense amount of things i have achieved, survived & overcome in the past twelve months. & it has been so affirming & empowering to do; at the end of a year which has felt so overwhelming, i can hardly believe that i actually achieved all of these things. & w. was there for very, very few of them. i deserved & deserve so much better, so much stronger, so much kinder.

anyway, i'm putting the list under the cut, & warmly recommending this to everyone as an activity in self-respect, self-love, self-reflection, etc., etc., & co.

i maintained, cleared and sold my late Mum's house this involved constant emails & phone calls all year, exhausting journeys of over 300 miles by train & then by car once i had my licence, endless tip runs & charity shop runs, selling furniture on eBay & arranging for collections, liaison with estate agents, speed learning a lot about property & finance, exhausting garden maintenance & cleaning, fights with the council who kept fucking up the tax liabilities; and none of this is to mention the emotional difficulty of sorting through my mum's things, deciding what to keep & what to give away & what to sell, & the grief of leaving her house for the final time in july; the house where i had cared for her, the home she had lived & died in. & i did almost all of it entirely on my own.

i bought my own flat in Edinburgh a joyful counterpoint to the above; a safe place finally to land, which i can make entirely my own; i think it's about the best thing i could have done for myself post-breakup, but it is also a very real way of closing the door on my relationship, & i've felt very bittersweet about that. i have also had to make removals plans over the festive period & balance a lot of very time-sensitive admin with similarly time-sensitive end of semester marking. the move in january will be exhausting, but so so wonderful when it is done & i am settled.

i wrote the 2nd chapter of my PhD all 20,000+ words of it! & i have done, of course, all the reading, thinking, editing & rewriting which this involved. but it is now a very solid, very good chapter, & only needs minor edits to be polished. that i managed to pull this off around everything to do with mum's house is truly incredible to me. i don't know how it happened but it did, & it's work that i am so proud of.

i taught on 3 summer schools one in st andrews, one online & one in cambridge. i wrote & gave two lectures, one on mrs dalloway & one on a sketch of the past, & delivered large- & small-group teaching on five different woolf texts. they were such rewarding experiences, & i cannot wait for next year's.

i taught my 1st undergraduate course an introduction to english literature course, 1800 to present day! like the summer schools, this was so wonderfully rewarding. i got to plan & deliver a semester's worth of seminars, & mark coursework essays & exams. i learnt so much about what works & doesn't work for this kind of course, & can't wait to apply those lessons to next semester's teaching. the fact that i even managed to deliver my classes on mrs dalloway the day after w. broke up with me, & find joy in doing so, is probably a highlight, actually. it shows me how good i am at what i do; i can do it with a broken heart.

i went on 2 archive trips one to king's college, cambridge, & one to the british library in london. i made really significant discoveries on both trips & i'm so looking forward to writing them all up into my 3rd chapter next year. both of these archive trips were also done around trips to mum's house to do clearance & maintenance & meet estate agents, & again the fact that i managed still to make them so productive is incredible to me.

i presented at my university's graduate conference & submitted an abstract for next year's international woolf conference! a light conferencing load for me this year, because i simply didn't have time for them, but i already have so many on my cv that i'm feeling very at peace with that.

i passed my theory & practical driving test got my licence finally in may, which made the final stages of dealing with mum's house easier; actually passed in the pissing rain while suffering from a horrendous cold, then did the long drive to the midlands only a few weeks later.

i went to therapy consistently even when it was hard; even when i didn't know what to talk about; even when i felt like i was constantly repeating myself; i trusted the process & i'm so glad i did.

i broke up with my phone this was a gamechanger in september. some of it has slipped since my actual breakup, but some of it has stuck, & i'm hopeful that i'll get back to a more phoneless existence in the new year. at the end of september i felt so much more present, so much more alive, so much more observant & focused & active. i'd like to feel that way again.

i travelled i was so lucky to travel to dublin, iceland, new york, india & france this year; i'm hoping for more european city breaks next year. vienna is already booked for january, & prague, stockholm & copenhagen are on my wish list. solo travel is a big goal.

i reinvested in my hobbies & interests i went pretty regularly to a weekly writing group! i did two blocks of pottery classes! i got a swim membership & took up regular swimming again! i walked & hiked & went wild swimming when i could! i also read 14 books, which maybe isn't a lot, but in the context of everything else i did this year it's something i'm proud of, & i enjoyed every single one. i also cooked a lot of new things, & fed myself well for the most part.

& in addition to all these things; all of this hard work, all of these decisions, all of the admin, & all of my grief, i still held so much time & space for my friends this year. i think this may be what i'm most proud of. going through my diary & calendar, there are so many entries for dinners & visits & trips & drinks with friends, new & old. i have for the most part managed to be present for the people i love & who love me, despite everything. if there's anything i definitely want to take into the new year, it's that.

27 notes

·

View notes

Text

Black Lives Matter is headed for INSOLVENCY after plunging $8.5M into the red - but founder Patrisse Cullors' brother was still paid $1.6M for 'security services' in 2022, while sister of board member earned $1.1M for 'consulting'

By: Harriet Alexander

Published: May 24, 2024

Black Lives Matter Global Network Foundation, a non-profit that grew out of the protest movement, is haemorrhaging cash, financial records show

The group ran an $8.5 million deficit and saw the value of its investment accounts drop by nearly $10 million, with fundraising down 88% year-on-year

Despite the financial woes, the organization still paid relatives of the founder and of a board member hundreds of thousands of dollars for services

Black Lives Matter's national organization is at risk of going bankrupt after its finances plunged $8.5 million into the red last year - while simultaneously handing multiple staff seven-figure salaries.

Financial disclosures obtained by The Washington Free Beacon show the perilous state of BLM's Global Network Foundation, which officially emerged in November 2020, as a more formal way of structuring the civil rights movement.

Yet despite the financial controversy and scrutiny, BLM GNF continued to hire relatives of the founder, Patrisse Cullors, and several board members.

Cullors' brother, Paul Cullors, set up two companies which were paid $1.6 million providing 'professional security services' for Black Lives Matter in 2022.

[ BLM co-founder Patrisse Cullors' (left) employed her brother, Paul Cullors (right) for security at BLM's properties ]

[ Paul Cullors was employed as the head of the security team at the $6 million Los Angeles mansion (pictured) bought with charity donations ]

Paul Cullors was also one of BLM's only two paid employees during the year, collecting a $126,000 salary as 'head of security' on top of his consulting fees. He is best known as a graffiti artist, with no background in security.

Patrisse Cullors defended hiring him, saying registered security firms which hired former police officers could not be trusted, given the movement's opposition to police brutality.

For the previous year, 2021, tax filings revealed that BLM paid a company owned by Damon Turner, the father of Cullors' child, nearly $970,000 to help 'produce live events' and provide other 'creative services.'

Cullors resigned in May 2021.

'While Patrisse Cullors was forced to resign due to charges of using BLM's funds for her personal use, it looks like she's still keeping it all in the family,' said Paul Kamenar, an attorney for the National Legal and Policy Center watchdog group.

Shalomyah Bowers, who took over from Cullors when she resigned, also benefitted handsomely from the group: in 2022, his consultancy firm was paid $1.7 million for management and consulting services, the Free Beacon reported.

And the sister of former Black Lives Matter board member Raymond Howard was also employed in a lucrative role as a consultant.

Danielle Edwards's firm, New Impact Partners, was paid $1.1 million for consulting services in 2022, the Free Beacon said.

BLM GNF also agreed to pay an additional $600,000 to an unidentified former board member's consulting firm 'in connection with a contract dispute'.

The non-profit group ran an $8.5 million deficit, and its investment accounts fell in value by nearly $10 million in the most recent tax year, financial disclosures show.

The group logged a $961,000 loss on a securities sale of $172,000, suggesting the group sustained an 85 percent loss on the transaction. Further details of that security have not been shared.

And the cash flowing into BLM's coffers has dropped dramatically.

Donations plunged by 88 percent between 2021 and 2022, from $77 million to just $9.3 million for the most recent financial year.

Patrisse Cullors, who had been at the helm of the Black Lives Matter Global Network Foundation for nearly six years, stepped down in May 2021, amid anger at the group's financial decisions and perceived lack of transparency.

A year later, in May 2022, it was revealed Black Lives Matter spent more than $12 million on luxury properties in Los Angeles and in Toronto - including a $6.3 million 10,000-square-foot property in Canada that was purchased as part of a $8M 'out of country grant.'

The Toronto property was bought with grant money that was meant for 'activities to educate and support black communities, and to purchase and renovate property for charitable use.'

The group had said it was planning to use the property as main headquarters in Canada, and it has now been named the Wilseed Center for Arts and Activism.

It emerged that Cullors transferred millions from the organization to a charity run by her wife, Janaya Khan, to purchase the property.

Cullors admitted to AP that her group was ill-equipped to handle the finances of a charity which received $90 million the year after George Floyd was killed - but denied any wrongdoing.

Cullors issued a statement denying she used the $6 million LA property for personal purposes, but then had to backtrack and admit she had used the compound for purposes that were not strictly business.

The activist also amassed a $3 million property portfolio of her own, including homes in LA and Georgia, although there is no suggestion of any financial impropriety.

It is not known if the group paid out lucrative contracting fees to Cullors' friends and family past June 2022, when a new board of directors was brought in.

The board is now led by nonprofit adviser Cicley Gay, who has filed for Chapter 7 bankruptcy three times since 2005.

Gay was ordered by a court to attend financial management lessons, and at the time of her appointment in April 2022 had more than $120,000 in unpaid debt.

She was one of three people appointed to the board, the organization said in a tweet. She subsequently was described as being chair of the board.

She told The New York Times she had been appointed to straighten out the organization's finances, after BLMGFN faced intense scrutiny over its spending of donor cash.

'No one expected the foundation to grow at this pace and to this scale,' said Gay.

'Now, we are taking time to build efficient infrastructure to run the largest Black, abolitionist, philanthropic organization to ever exist in the United States.'

It later emerged that Gay has been declared bankrupt three times, according to federal reports obtained by The New York Post.

Gay, a mother of three, filed for bankruptcy in 2005, 2013 and 2016.

BLMGFN has faced intense questions about its handling of donations, which surged in particular during the George Floyd protests in the summer of 2020.

The organization in February 2021 said it had taken in more than $90 million in 2020 and still had $60 million on hand.

Last year, it was down to $42 million, while the Free Beacon reports BLM has now spent two thirds of the $90 million cash it had to hand.

Cullors, the co-founder of the organization, resigned in May 2021 as director of BLMGNF, amid scrutiny of her own property empire. She has written best-selling books, and has a contract with Warner Brothers to produce content.

Then in April 2022 it emerged that BLMGFN had bought a mansion in Los Angeles for $5.8 million, which they said was to be used as a 'safe space' for activists and for events.

The organization responded to the reports in a lengthy Twitter feed, with the group noting that more 'transparency' was required going forward.

[ Black Lives Matter has apologized following an expose that detailed how the organization had used donations to purchase a $6 million home in Los Angeles ]

[ In a lengthy Twitter thread on Monday morning, the group vowed to be more transparent in the future ]

'There have been a lot of questions surrounding recent reports about the purchase of Creator's House in California. Despite past efforts, BLMGNF recognizes that there is more work to do to increase transparency and ensure transitions in leadership are clear,' it stated.

BLM then proceeded to blame the media for the furore and the 'inflammatory and speculative' reports that saw journalists probing the group's financials saying that it 'caused harm'

The reports 'do not reflect the totality of the movement,' the organization claimed.

'We know narratives like this cause harm to organizers doing brilliant work across the country and these reports do not reflect the totality of the movement,' one of the tweets reads. 'We apologize for the distress this has caused to our supporters and those who work in service of Black liberation daily.'

'We are redoubling our efforts to provide clarity about BLMGNF's work,' noting an 'internal audit' was underway together with 'tightening compliance operations and creating a new board to help steer to the organization to its next evolution.'

[ The organization also criticized the original New Yorker article, pictured above, describing it as 'inflammatory and speculative' ]

[ BLM co-founder Patrisse Cullors (above) came under fire last year for a slew of high-profile property purchases. She resigned in May 2021 and has called reports investigation the $6 million mansion 'despicable' and claimed that criticisms against her are 'sexist and racist' ]

[ The home features six bedrooms and a pool in the back. BLM claimed the home was bought to provide a safe house for 'black creativity' but had allegedly tried to hide the home's existence ]

[ The mansion comes complete with a sound stage (pictured) and mini filming studio which the group had used in one of its video campaigns ]

BLM attempted to justify the purchase of the mansion by saying it was made to encourage 'Black creativity' with the property 'a space for Black folks to share their gifts with the world and hone their crafts as we see it.'

The organization also went on to defend how the funds the group raised were spent including the $3 million used for 'COVID relief' and a further $25 million dollars to black-led organizations.

'We are embracing this moment as an opportunity for accountability, healing, truth-telling, and transparency. We understand the necessity of working intentionally to rebuild trust so we can continue forging a new path that sustains Black people for generations,' the group wrote.

The barrage of tweets, which notably had their comments turned off, ended with the group announcing they were 'embracing this moment as an opportunity for accountability, healing, truth-telling, and transparency' and 'working intentionally to rebuild trust.'

[ Internal memos from BLM revealed the group wanted to keep the purchase secret, despite filming a video on the home's patio in May ]

[ The Studio City home - which sits on a three-quarter-acre lot - boasts more than half-dozen bedrooms and bathrooms, a 'butler's pantry' in the kitchen (pictured) ]

Concerns over the groups finances have swirled for years with BLM coming under intense scrutiny in the past.

In February 2022 the group stopped online fundraising following a demand by the California attorney general tho show where millions of dollars in donations received in 2020 went.

The group said the 'shutdown' was simply short term while any 'issues related to state fundraising compliance' were addressed.

--

Everybody figured out that it was a scam and always has been.

criticisms against her are 'sexist and racist'

"How dare you notice the things that I'm doing?" is the manipulative language of an abuser.

to rebuild trust

Grifters gotta grift. Defund BLM.

#Patrisse Cullors#BLM#Black Lives Matter#Buy Large Mansions#con artist#grifters gonna grift#grifters#scam artist#embezzlement#defund BLM#religion is a mental illness

10 notes

·

View notes

Text

Welcome to Rental Realities of 2024! Whether you’re a long-time renter, a newbie to the rental world, or a landlord trying to keep up with the latest trends, you’ve come to the right place. This year, the rental market is buzzing with changes and new opportunities, and we're here to help you make sense of it all.

What’s New in the Rental Market This Year?

2024 has been quite the rollercoaster for renters and landlords alike. Here’s a snapshot of what’s shaping the rental landscape:

**1. Flexibility is the New Trend With remote work becoming the norm for many, people are looking for more flexible living arrangements. Short-term leases and month-to-month options are in high demand. If you’re a renter who likes to keep your options open, you’ll find plenty of properties that cater to this need. For landlords, offering these flexible terms can make your property more attractive to a wider range of potential tenants.

**2. Sustainability is on the Rise Eco-friendly living isn’t just a fad anymore—it’s a major factor in rental decisions. Many renters are now on the lookout for properties with energy-efficient features and sustainable practices. If you’re a landlord, investing in green upgrades like solar panels or energy-efficient appliances might just give you the edge you need in a competitive market.

**3. Tech is Taking Over Smart home technology continues to make waves. From smart thermostats that save you money on energy bills to security systems that give you peace of mind, renters are increasingly expecting these tech perks. If you’re a renter, don’t hesitate to ask about these features. And if you’re a landlord, incorporating smart tech could make your property stand out.

**4. Rising Rents and Budgeting Unfortunately, many areas are seeing an increase in rental prices. With inflation and high demand driving up costs, it’s important to budget carefully. Renters should be prepared for potential rent hikes, while landlords should stay aware of market trends to set fair and competitive rates.

**5. Community and Amenities Matter Renters are placing more value on community and amenities. Properties with access to gyms, co-working spaces, and green areas are becoming increasingly desirable. And let’s not forget about the neighborhood itself—good schools, local shops, and convenient transport links are huge pluses.

Tips for Renters in 2024

**1. Do Your Homework Before you sign on the dotted line, take the time to research the area. Check out local developments, future projects, and the overall vibe of the neighborhood. This can help you make an informed choice and avoid surprises.

**2. Consider Flexibility If your lifestyle allows, look into flexible lease options. Short-term leases or month-to-month agreements might give you the freedom you need, especially in these unpredictable times.

**3. Embrace Smart Living When searching for a new place, keep an eye out for smart home features. They can make your life easier and potentially lower your bills. Don’t be shy about asking landlords what tech upgrades are available.

**4. Budget Wisely With rental prices on the rise, it’s crucial to manage your finances carefully. Plan for potential rent increases and additional costs. A solid budget can help you stay on top of your expenses and avoid stress.

Tips for Landlords in 2024

**1. Go Green Consider making eco-friendly upgrades to your property. Not only will this attract environmentally conscious renters, but it could also save you money in the long run and boost your property’s value.

**2. Upgrade to Smart Tech Adding smart technology to your property can make it more appealing. Features like smart locks, thermostats, and security systems are becoming must-haves for many renters.

**3. Offer Flexibility With the demand for flexible leases growing, think about offering shorter-term options or customizable rental agreements. This can help you attract a wider range of tenants and reduce vacancies.

**4. Stay Informed Keep an eye on market trends and economic factors that might impact rental rates and tenant expectations. Staying up-to-date will help you make smart decisions and stay competitive.

Wrapping It Up

2024 has brought some exciting changes and challenges to the rental market. Whether you’re renting or leasing, staying informed and adapting to new trends will help you navigate this evolving landscape. Thanks for joining us at Rental Realities of 2024! We’re here to provide you with the latest insights and tips to make your rental experience as smooth and successful as possible.

Got questions or topics you want us to cover? Drop us a line—we’d love to hear from you. Here’s to a great year ahead in the rental world!

#RentalRealities2024 🏠#RentingIn2024 📅#ModernRentals 🌟#RentalTrends2024 📈#LeaseLife2024 🗝️#SmartLiving 🏡🔌#EcoFriendlyRentals 🌱#FlexibleLeases 🔄#TechSavvyRentals 📱#HousingHappenings 🏘️#RentalMarketUpdate 🔍#SustainableLiving 🌍#RentersGuide 📚

2 notes

·

View notes

Text

is that PEDRO PASCAL ? oh, no, that’s MAXIMILIANO ESQUIVEL - ISIDORA, a FORTY-SIX year old OWNER OF ISIDORA WINERY . . .

* ◟ : 𝚂𝚃𝙰𝚃𝙸𝚂𝚃𝙸𝙲𝚂 ﹗

FULL NAME: maximiliano raúl esquivel isidora NICKNAMES / ALIAS: max, maxi, maxito AGE: forty six GENDER / PRONOUNS: cis man / he/him SEXUALITY: pansexual ZODIAC: cancer sun , capricorn moon BIRTHDATE & BIRTHPLACE: july 14th 1977 & casablanca, valparaíso region, chile CURRENT RESIDENCE: his private estate on the isidora vineyard property EDUCATION: master's in oenology & agronomic engineering @ the university of chile SPOKEN LANGUAGES: spanish & english OCCUPATION: owner & winemaker of isidora winery

* ◟ : 𝙱𝙰𝙲𝙺𝚂𝚃𝙾𝚁𝚈 ﹗

the isidora family has been present in valparaíso region ever since they established their presence in the casablanca valley over 150 years ago, becoming one of the most influential families within her region that established one of the first wineries in the country ( they Rich Rich ). the isidora family is not a selfish one … their wealth has funded the beauty and prosperous aspect of what is the valley today and they keep on giving !

maximiliano is the second oldest of five children. his mother, carmen isidora, and his uncle, manuel, were co-owners ( and the ones that were fully committed to the making sure things remained organic on their vineyards and the best at making biodynamic wines ) of the winery until maximilano and his eldest sister were old enough to take on the mantle. his sister travels across the americas, doing business with various companies throughout the continents, while max remains in chile to be more hands-on with the winemaking process and overseeing the property and its happenings. his father and carmen’s third husband, martín esquivel, happily lived as a trophy husband for his wife he loves v much JSKLDJS he comes from a wealthy family in finances & investments, spent a lot of time painting with oils and watercolor that are displayed throughout the buildings

ANYWAY ! maximilano has lived a pretty privileged life … attended a catholic private school, went on fancy yacht trips & vacations across the globe, u know the gist

but tbh … he was ( still Is ) a bad boy. max often got in trouble despite being quite nonchalant and reserved at first glance. more often than not max was sitting in the principal’s office or the family lawyer had bailed him out of jail in santiago for a bar fight . hey, he never starts fights … just finishes them !!

if there is one thing max has that many trust fund babies lack these days, it’s ~PASSION~! ever since he was a little boy, he was often wandering the property, helping the workers of the winery or his mother while bugging them with 82930 questions. so he’s always known he’d be taking over the family business just … he just wanted to commit at his own pace, y’know? :P

eventually after a stern talking to by the elderly patriach of the isidora family who was approaching his finals years on this earth, max goes to college and receives an education in the science of winemaking and engineering of agronomics, and also some environmental studies. don’t be fooled by his Rich Party Boy facade he’s an ORGANIC FARMER NERD !!!! fully committed on making isidora wines innovative and sustainable 😤

maximilano is a bit of a celebrity across the valaparíso region, but doesn’t let it get to his head ( unlike some of his younger siblings who idek are doing these days ). at the same time u can see him working his butt off under the chilean sun, making sure his property is taken care of. maybe nick parker from the parent trap vibes ?? u know what i mean ??

3 notes

·

View notes

Text

July 7 2022 Asheville NC and Denver CO

We visited The Biltmore Estate this morning, which is a major tourist attraction and resort in Asheville. According to Wikipedia

“Biltmore House (or Biltmore Mansion), the main residence, is a Châteauesque-style mansion built for George Washington Vanderbilt II between 1889 and 1895 and is the largest privately owned house in the United States. Still owned by George Vanderbilt's descendants, it remains one of the most prominent examples of Gilded Age mansions.

In the 1880s... George Washington Vanderbilt II began to make regular visits with his mother, Maria Louisa Kissam Vanderbilt, to the Asheville area. He loved the scenery and climate so much that he decided to build a summer house in the area, which he called his "little mountain escape". His older brothers and sisters had built luxurious summer houses in places such as Newport, Rhode Island, the Gold Coast of Long Island, and Hyde Park, New York.

Vanderbilt named his estate Biltmore, combining De Bilt (his ancestors' place of origin in the Netherlands) with more (mōr, Anglo-Saxon for "moor", an open, rolling land). Vanderbilt bought nearly 700 parcels of land, including over 50 farms and at least five cemeteries; a portion of the estate was once the community of Shiloh. A spokesperson for the estate said in 2017 that archives show much of the land "was in very poor condition, and many of the farmers and other landowners were glad to sell.”

Construction of the house began in 1889. In order to facilitate such a large project, a woodworking factory and brick kiln, which produced 32,000 bricks a day, were built onsite. A three-mile railroad spur was constructed to bring materials to the building site. Construction on the main house required the labor of about 1,000 workers and 60 stonemasons. Vanderbilt made extensive trips overseas during construction to purchase decor. He returned to North Carolina with thousands of furnishings for his newly built home, including tapestries, hundreds of carpets, prints, linens, and decorative objects, dating from the 15th century to the late 19th century. Among the few American-made items were the more practical oak drop-front desk, rocking chairs, a walnut grand piano, bronze candlesticks, and a wicker wastebasket.

George Vanderbilt opened his opulent estate on Christmas Eve of 1895 to family and friends from across the country, who were encouraged to enjoy leisure and country pursuits. The Gilded Age mansion reportedly cost $5 million (today's equivalent of $180 million) to construct. Guests to the estate over the years included novelists Edith Wharton and Henry James, ambassadors Joseph Hodges Choate and Larz Anderson, and U.S. presidents. George married Edith Stuyvesant Dresser in 1898 in Paris, France. Their only child, Cornelia Stuyvesant Vanderbilt, was born at Biltmore in the Louis XV room in 1900, and grew up at the estate

Stressed by Congressional passage of income tax and the expensive maintenance of the estate, Vanderbilt initiated the sale of 87,000 acres to the federal government. After Vanderbilt's unexpected death in 1914 of complications from an emergency appendectomy, his widow completed the sale. She carried out her late husband's wish that the land remain pristine, and that property became the nucleus of the Pisgah National Forest. Overwhelmed with running the large estate, Edith began consolidating her interests, selling Biltmore Estate Industries in 1917 and Biltmore Village in 1921. She intermittently occupied the house, living in an apartment created in the former Bachelors' Wing, until the marriage of her daughter Cornelia to John Francis Amherst Cecil in April 1924. The Cecils had two sons, who were born at Biltmore in the same room where their mother was born.

In an attempt to bolster the estate's finances during the Great Depression, Cornelia and her husband opened Biltmore to the public in March 1930 at the request of the City of Asheville, which hoped to revitalize the area with tou rism. Biltmore closed during World War II. In 1942, 62 paintings and 17 sculptures were moved to the estate by train from the National Gallery of Art in Washington, D.C. to protect them in the event of an attack on the United States. The Music Room on the first floor was never finished, so it was used for storage until 1944, when the possibility of an attack became more remote.

After the Cecils divorced in 1934, Cornelia left the estate never to return, but John Cecil maintained his residence in the Bachelors' Wing until his death in 1954. Their eldest son, George Henry Vanderbilt Cecil, occupied rooms in the wing until 1956. At that point Biltmore House ceased to be a family residence and was operated as a historic house museum.

Their younger son William A. V. Cecil, Sr. returned to the estate in the late 1950s and partnered with his brother to manage the estate's financial trouble. They worked to create the profitable and self-sustaining enterprise that their grandfather had envisioned. William Cecil inherited the estate upon the death of their mother, Cornelia, in 1976. His brother George Cecil inherited the more profitable dairy farm, which was spun off as Biltmore Farms.”

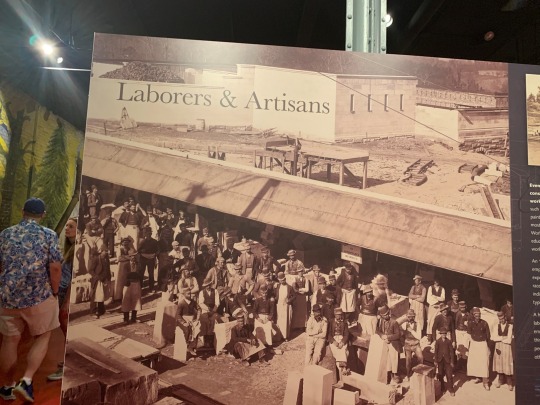

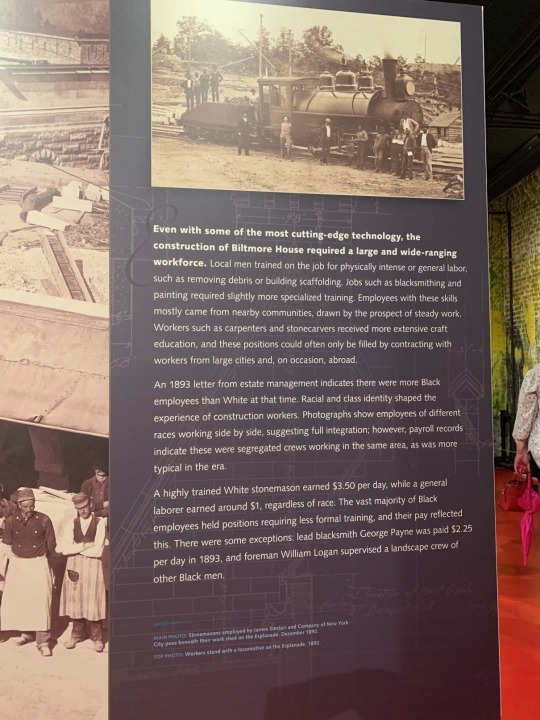

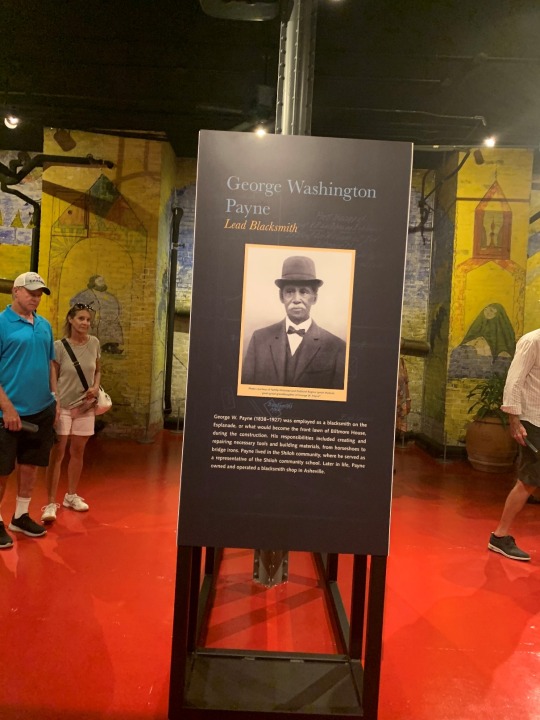

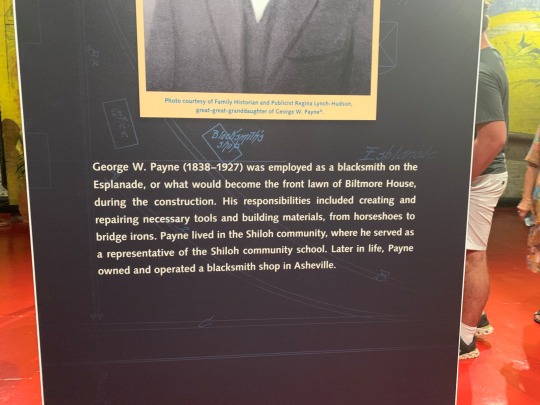

Down in the basement one of the most interesting things about the house museum was this display about the building of the mansion.

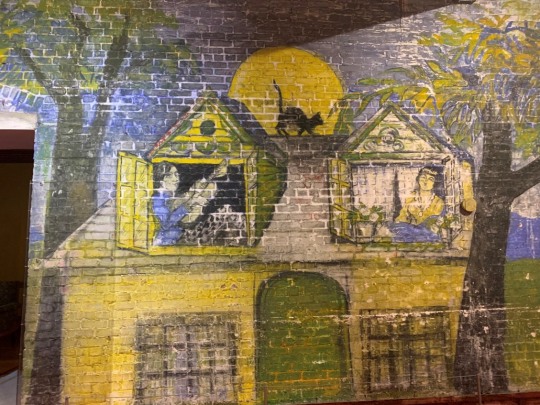

Some of the artwork on the walls, which was done by guests during a party, was amazing!

As a gardener, my favorite parts of the estate were the gardens and the greenhouse.

So, the question just begs to be asked. What made the Vanderbilt family so exceedingly RICH? Cornelius Vanderbilt came from a middle class family. His father was a farmer but also started a shipping business. Cornelius borrowed money from his father to start his first ventures in trading and ferrying, especially military troops and supplies. From that success he build an empire in the railroad industry. But was he TRULY a “self-made man” as so many industrialists were claimed to be? Looking it the history during those years there were many other factors working in their favor.

According to the Grunge history website:

“After all, this was the Industrial Revolution; it wasn't really kind to the everyday worker. Low wages and horrific working conditions were just part of the era (via Legends of America). And that was true of the railroads, too; according to The Atlantic, the normal wage for a man working on the railroad was a pitiful 75 cents a day. That's next to nothing, especially compared to the millions in the pocket of the Vanderbilt family. It also feels like it lines up with something that Vanderbilt's son, William Henry Vanderbilt, said to the press: "The public be damned." They only really cared about their stockholders and investments,

Basically, the government wasn't really on the side of the working class; they definitely sided with corporations. As History explains, the government worked to keep foreign competition out of the picture, giving industrialists the chance to create monopolies while facing few consequences. (Honestly, maybe that's also because plenty of politicians were easily bribed, gladly helping out their friends with deepest pockets, making sure legislation favored big business over the everyday worker).

And even where rampant corruption wasn't involved, there was ignorance. Encyclopedia.com says that Cornelius Vanderbilt wasn't above manipulating the stock market as he saw fit, he and other business owners selling stocks at inflated and unwarranted prices, simply because the government regulation wasn't there to tell them to stop.”

And they also paid LITTLE TO NO TAXES! Unfortunately, it sounds like not a lot has changed since the “Gilded Age”. Yes, there are some regulations and controls on industry and corporations, but most of them aren’t strong enough to prevent monopolies and mistreatment of employees. Just look at Amazon, Google and Meta (formerly Facebook). And they are the biggest, but there are MANY other multi-national corporations monopolizing industries and union-busting so that they can maximize their profits. That’s unbridled CAPITALISM for you, combined with political corruption, patriarchy, and GREED. The world has been plagued by this for centuries, if not millenia. If you don’t believe me, read “Sapiens: A Brief History of Humankind” by Yuval Noah Harari. It doesn’t have to be this way and many believe that a complete overhaul of the political and economic systems worldwide, as well as advancing feminism, would go a long way towards creating a truly egalitarian society. I’m among those people.

Bruce and I left North Carolina this afternoon to finish our vacation in Denver. We realized that if we contracted COVID we would be stuck at the Omni with NO ROOM SERVICE and no ability to leave to get food. Don’t ask me why that never occurred to us but seeing all those people not wearing masks was a wake up call and we hightailed it back to Colorado, where we checked into the Four Seasons Hotel, which has room service and is close enough to drive home at a moment’s notice.

2 notes

·

View notes

Text

another day to use the last 15 mins i'm allowed (health-wise) to be awake on a weekday to think about the supercorp ph uni au [1 2]

thinking of how lena might join actual protests (slowly and just the Major ones) bc of kara and lillian finds out and is abso-fucking-lutely furious. she flies all the way to the philippines with the intention of dragging lena home but lena's two steps ahead. she's already changed her tuition payment from the luthor accounts to a student loan.

she's been working part time for a local lab (under recommendation from her professors instead of her family name, for once) and moving whatever money she could get from whatever lionel and lex had left or given her into investments and some small properties. she moved out of the place lillian had originally bought her and was living in a tiny apartment with a girl named sam and sam's two-year-old daughter, ruby.

by the time lillian arrives to try and bring her back home, she's practically financially free of the luthor chain. the only thing holding her back is the duty she used to feel for the people who raised her. but now? now lena has a family. she has sam and ruby, her roommates who force her to relax and watch reruns of batibot and sineskwela with them. jack, her fellow international student and favorite science partner who helped her sort her finances. brainy, her co-worker from ust who continuously betters and challenges her. alex, who, somehow, became her drinking buddy and confidante. nia, kara's underclassman who introduced her to the bahaghari organization. and kara, her best friend. her favorite person. the woman who stood next to her when lillian yelled and yelled and yelled in her twisted effort to get her to go back home.

but lena finds that she is home. the philippines has given her more than metropolis or the luthors have ever bothered to offer.

friends.

a family.

home.

love.

lena knows where she belongs now, and she won't let anyone take that away from her.

#cw supergirl#supercorp#kara danvers#lena luthor#supercorp ph uni au#idk why it ended up sounding more like a fic in the end than a prompt but!#it's there now so 🤷♀️#i just love the idea of lena being free!#and it was also fun playing around with the sg cast and seeing where i could place them hehehehe#anyways the entire time this is happening kara is FIERCELY protective and clingy#she stays over at lena's place more often than not and ruby ends up thinking that kara lives there too lmao#my writing#queer bread writes

6 notes

·

View notes

Text

In a two-part investigative report released in Russian and English on Tuesday, February 28, 2023, journalists at Proekt revealed new details about an alleged “slush fund” used to finance Vladimir Putin’s lavish private life and the lives of his closest companions, including retired gymnast Alina Kabaeva, the rumored mother of at least three children with Russia’s president. The investigation focuses first on a Cyprus-based company called Ermira Consultants (including how it profits off vodka merchandized with Putin’s name) and then on a palace constructed outside Valdai. Throughout both stories, readers learn about the enormous entourage of relatives, friends, and acquaintances who serve as nominal owners of Putin’s alleged vast wealth. Meduza summarizes Proekt’s main findings.

Arkady Rotenberg and Ermira Consultants, Putin’s slush fund

Previously, Ermira Consultants was thought to belong more to Arkady Rotenberg than Putin himself, but Proekt argues that the Cypriot company’s personnel patterns and seemingly countless investments say otherwise. For example, the owner until March 2015 was an unremarkable attorney named Vladislav Kopylov who apparently owes his candidacy to serve as a front for Putin’s money to the fact that he met St. Petersburg businessmen Andrey Fursenko and Yuri Kovalchuk — close friends of Russia’s future president — back in the 1990s.

After a company connected to Rotenberg acquired Ermira in 2015, the firm received large loans from offshores linked to Gennady Timchenko, Dmitry Medvedev, Ilya Eliseev, and Igor Antoshin, as well as from Rotenberg’s own Olpon Investments Ltd. Company. Many of Ermira’s senior managers and legal advisers, moreover, have also been linked to other projects involving Putin.

The vodka racket

Proekt devotes significant attention to the alcohol distributor Vinexim, which created the popular Putinka vodka brand, reportedly in close collaboration with Rotenberg to get the president’s permission to use his surname. In March 2004, Vinexim sold the trademark rights to an Ermira subsidiary. After several more transfers, the trademark now belongs to a company reportedly co-owned by Rotenberg and former Russian Judo Federation President Vasily Anisimov.

Proekt calculates that Putinka vodka’s profits between 2004 and 2019 from production, sales, and royalties maybe totaled between $400 and $500 million (considering distributors’ margins, manufacturing income, and royalties). Journalists argue that Putin profiteered from the alcoholism of his own constituents and even lowered the minimum retail price of vodka in early 2015 (purportedly to undermine the sale of bootleg liquor).

Putin’s Gelendzhik palace

In 2010, Ermira Consultants loaned roughly $100 million to a company co-owned by Putin’s then future (now former) son-in-law Nikolai Shamalov and Bank Rossiya shareholder Dmitry Gorelov in a scheme to build a massive palace for the president on the Black Sea near the city of Gelendzhik. After whistleblower Sergey Kolesnikov exposed this arrangement in 2010 in an open letter addressed to then President Dmitry Medvedev, Putin’s inner circle revamped its property racket, creating a whole mess of new legal entities and transferring the property itself to the offshore Savoyan Investments, a subsidiary of Ermira Consultants.

Years later, following a bombshell investigation by Alexey Navalny’s research team into the Gelendzhik palace, state television correspondent Alexander Rogatkin visited the property to debunk the allegations against the president. But a new piece of evidence supporting the palace story slipped through Rogatkin’s segment: his camera footage showed a security guard in a uniform from the Horizon Company, which receives monthly payments from an Ermira subsidiary called Platinum. (In 2004, Ermira also loaned almost $90 million to Platinum, which it used to buy lucrative shares in Gazprom, Bank Rossiya, and a villa in Sochi seized from the oil company Yukos.)

Property for Putin’s pals and paramour

Proekt highlights numerous examples where Putin apparently instructed his “vassals” to delegate housing to people important to him. In some instances, the president’s imperial tastes are on display, and elsewhere he demonstrates that his benevolence comes with conditions. For example, from 2010–2013, when Putin was no longer living together with his wife, but before they made their divorce public, Mrs. Putin’s lover (and future husband) Artur Ocheretny owned an apartment in Moscow that was suddenly transferred to one of Ermira’s offshore companies after the president’s bachelor status was revealed.

According to Proekt, Putin nevertheless ensured a comfortable life for his ex-wife, given that businesses connected to Ermira and Arkady Rotenberg later sold two commercial properties in the Moscow area to Ocheretny, who soon sold them back to another Rotenberg-connected company at a markup high enough to generate the money needed to buy luxury homes in France and Switzerland.

Ermira Consultants also smiled on Jorrit Faassen when he was married to Putin’s eldest daughter, Maria Vorontsova, transferring several luxury Moscow properties to Berocci Investments, an offshore company created for the couple. (In late 2010, Russia’s Interior Ministry pounced on a banker in the neighborhood whose security guards beat up Faassen after he clipped the man’s car.) The president’s goodwill ended with the marriage, however, and Ermira eventually reclaimed the properties.

“Tsarina” Alina Kabaeva

The second half of Proekt’s investigative report is devoted almost entirely to Kabaeva. Journalists identified roughly $120 million in property registered to nominal owners on her behalf (this includes almost $15 million in real estate under the name of Kabaeva’s own grandmother, who lived in a remote log cabin in the Vladimir region until last year, very much not in the style of a multimillionaire). Alina Kabaeva also reportedly earns an annual salary of $10.6 million as the board chairperson of National Media Group — an investment firm controlled by Yuri Kovalchuk.

After describing a penthouse purchased for Kabaeva in Sochi (registered to a nominal owner named Sergey Rudnov, whose late father also acted as a front for property in Putin’s real-estate empire), Proekt names multiple women who allegedly belong to Kabaeva’s circle of friends and support staff, including a team of Swiss medical workers who exposed their identities by sharing a selfie from the VIP section of the 2019 Victory Day Parade in Red Square. Speaking to friends, analyzing public documents, and even studying leaked medical and travel records, Proekt found a handful of women (relatives and some friends) who apparently follow Kabaeva nearly everywhere, which entails frequent trips to Valdai.

Putin’s Valdai palace(s)

On assignment in the Novgorod region, Proekt’s correspondent learned that the local spa run by the Presidential Affairs Department was closed as of late 2022 and being used instead to quarantine Putin’s personal guests before they met with him. Proekt also found a construction manager who worked on the president’s Valdai residence until 2005. Building the facility began almost as soon as Putin took office, the source said, explaining that the president came to inspect the property in 2003 when it was nearly finished but hated the mansion’s “high-tech,” modern vibe. When asked what he would prefer, Putin reportedly said, “Something more like in Petersburg,” which designers interpreted to mean “like the Hermitage Museum.” Accordingly, the crew gutted the home’s interior and installed boatloads of gold. (Proekt obtained photos taken inside the Valdai palace in collaboration with Alexey Navalny’s research team.)

For years, Putin visited the Valdai residence with his wife, but he’s since reportedly brought Alina Kabaeva and her children. In 2020, construction started nearby on a residence allegedly meant exclusively for Kabaeva and her kids. (The home itself is on land registered to a company owned by Yuri Kovalchuk, says Proekt.)

Journalists recently reported that Vladimir Putin now travels domestically by armored train as often as possible; Proekt’s report further corroborates this story, finding that secret railway construction on preservation lands near Putin’s residence in Valdai began in 2018. In a nearby town, there’s now a “secret train station” (closed to the public) with its own helipad, built specially for the president. Also nearby, the military recently installed a Pantsir air-defense system.

2 notes

·

View notes

Text

On what planet is this hyperbole? If you're banging a cis guy and you are at all capable of becoming pregnant, this is a thing you might very well have to deal with!

No matter how careful you are about birth control, sometimes shit happens! Not everyone is capable of being the most careful person to ever be careful about their birth control, and you get unlucky! Incredibly shitty sex ed and people misremembering conversations with a GP they had years ago and people just in general being fucking idiots means that sometimes your partner tells you something about their reproductive capacity that turns out to not be true!

If you're banging a cis guy and you want bio-kids, this is a thing you are definitely going to have to deal with!

The time to find out if he thinks of you as a person first or a broodmare first is absolutely not after you've moved in with the fucker, co-mingled your finances with the fucker, or discovered that the fucker's knocked you up. The time to find out if he's going to blow a goddamned gasket about "his" baby (the embryo in your uterus) is well before there's an embryo or fetus in your uterus.

One of the triggers/event horizons for serious domestic abuse is pregnancy. A guy who thinks he was owed a baby just because he managed to impregnate you is more than capable of making your life a nightmare even if you live in an otherwise sane state. A guy who thinks of your survival as negotiable if that's what it takes to get a fetus past the viability threshold is not a guy you want to be fucking.

And this is before we get to the general questions of how good the sex is going to be with a guy who doesn't reeeeeeally think your body belongs to you. That your body is just a tool for him to use, or a machine for making babies. If you want more than sex, if you're looking for a partner--how good is that relationship going to be, with a guy who thinks your body is state property? Or that you've got a little more in common with an appliance than a person? That you're less human than him?

Attn: conservative men

#sexism#misogyny#stop fucking these guys!#men who don't think of you as a real person are shitty partners anyway!

16K notes

·

View notes

Text

BioPharmaceutical Market

Biopharmaceuticals Market Size, Share, Trends: F. Hoffmann-La Roche Ltd. Leads

Rising Adoption of Tailored Therapies and Personalized Medicine

Market Overview:

The global Biopharmaceuticals Market is predicted to grow at a CAGR of 8.7% between 2024 and 2031. The market size in 2022 is USD 525.17 billion; by 2031 it is expected to have grown to USD 698.32 billion. Predicted to be dominant in the market in 2022, North America is likely to remain so all through the projection period. Driven by elements like rising demand for customized treatment, scientific breakthroughs, and increased incidence of chronic diseases, the biopharmaceuticals sector is enjoying substantial rise. Made from living beings, biopharmaceuticals—also known as biologics—are complex molecules used increasingly to treat a range of conditions, including cancer, autoimmune illnesses, and rare genetic disorders. The sector is defined by a strong pipeline of new drugs, smart collaboration between biotechnology companies and pharmaceutical companies, and intense research and development activities.

DOWNLOAD FREE SAMPLE

Market Trends:

Customized medication and targeted therapies are obviously driving a biopharmaceutical trend on the market. This approach customizes treatment for every patient depending on their genetic profiles, biomarkers, and specific disease symptoms. Advances in genomics, proteomics, and other omens technologies have made more precise and strong biopharmaceutical therapies conceivable. Particularly displaying this tendency is oncology as personalized medicines and immunotherapies are revolutionizing cancer treatment. Personalized medicine makes more reasonably priced treatment costs attainable, fewer side effects, and better patient outcomes conceivable.

Market Segmentation:

Monoclonal antibodies (mAbs) are leading and fastest-growing category in the biopharmaceuticals sector. Especially in cancer and autoimmune diseases, these extremely specific and targeted therapies have revolutionized the treatment of numerous diseases. Monoclonal antibodies have been embraced more generally as they have fewer side effects and greater efficacy than traditional therapies. The success of MAbs in treating complex diseases has produced a robust stream of new applicants and financing for continuous research and development. Moreover, advances in antibody engineering technologies allow one to produce next-generation mAbs with better therapeutic properties, therefore verifying their dominance in the area of biopharmaceuticals.

Market Key Players:

The biopharmaceuticals sector is highly competitive, comprising many large pharmaceutical companies, established biotechnology companies, and new arrivals. Key companies such as F. Hoffmann-La Roche Ltd., Amgen Inc., AbbVie Inc., Johnson & Johnson, Pfizer Inc., Novo Nordisk A/S, Sanofi, Merck & Co., Inc., Eli Lilly and Company, Bristol-Myers Squibb Company, Novartis AG, and GlaxoSmithKline plc dominate the market.

Contact Us:

Name: Hari Krishna

Email us: [email protected]

Website: https://aurorawaveintellects.com/

0 notes

Text

Introducing M3M Altitude, a new high-rise luxurious residence located in the heart of Sector 65, Gurugram. Developed by the renowned M3M Group, this exceptional project offers spacious and thoughtfully designed 3 BHK apartments that redefine the modern lifestyle. Spread over 3.9 acres, M3M Altitude is poised to deliver an elevated lifestyle, with an extensive selection of 200+ premium amenities.

M3M Altitude in Sector 65, Gurugram, redefines luxury living with its premium apartments and world-class amenities. Experience a sophisticated urban lifestyle with spacious residences, a state-of-the-art clubhouse, a swimming pool, and landscaped gardens.

Enjoy seamless connectivity and proximity to essential facilities, ensuring a convenient and upscale living experience. Discover M3M Altitude, where every aspect is designed to elevate your lifestyle in Gurugram.

M3M Altitude Project Highlights:

This also boasts an ideal location, strategically situated in Sector 65, Gurugram, very close to the vicinity of M3M Golf Estate, close to major school hubs, hospitals, malls, and other leading business destinations to provide access and connectivity with the highest living standards.

Luxury Apartments: The complex comprises 3 iconic towers, each going up to G+39 floors and having 128 exclusive units. The luxurious 4 BHK apartments, ranging from 3712 sq. ft. to 4270 sq. ft., are designed with impeccable attention to detail, showcasing imported marble flooring, laminated wooden floors, modular doors, and high-quality aluminum doors and windows.

These world-class amenities include an amphitheater, sunken ponds, climbing wall, banquet and sky dining, karaoke room, conference area, co-working spaces, and a sky lounge to support every lifestyle need that they set a new comfort level and luxury.

Unmatched Specifications: Imported marble flooring in the living area, stone-finish tiles in the kitchen, and wooden flooring in all bedrooms, each apartment has been constructed using superior material. Interior walls have been painted with acrylic emulsion, and modular veenered and laminated doors make class.

– **Accessible Location with Key Amenities:

Sports Infrastructure: Sportyzo Sports Complex and Rackonnect Badminton Arena within proximity.

Schools and Colleges: DPS Sector 65, The Shriram Millennium School, St. Xavier’s High School, Gurugram University, and IBMR Business School are nearby.

Hospitals:CK Birla Hospital, Paras Hospitals, and Medanta the Medicity are nearby.

Shopping and Leisure:M3M Altitude is well-placed near WorldMark Gurgaon, M3M 65th Avenue, and Eros City Square for all shopping needs.

Financing Made Easy: Home loan options from leading Indian banks, such as HDFC Bank, ICICI Bank, and PNB Housing Finance, make it convenient for homebuyers to finance their investment in M3M Altitude.

RERA Registered: M3M Altitude is a RERA-approved project, wherein one can find the information regarding project details under RERA Number: RC/REP/HARERA/GGM/821/553/2024/48.

Possession Timeline: Launched in June 2024, it is to be expected in June 2026 and hence will become a benchmark of luxury in Gurgaon’s real estate sector. Discover luxury living in M3M Altitude at Sector 65, with sophistication blending into convenience in an ultimate lifestyle experience.

Highlights

Modern contemporary architecture crafted by UHA, London.

High-rise building adorned with beautiful external lighting.

Luxury and leisure blend seamlessly, with lounges offering regal comfort and pools glistening with opulence.

Each apartment features a balcony in the living room or bedroom.

Enhanced security with an Intelligent Home Access Control system. Location MapConveniently positioned on a 60-meter wide main arterial sector road, off Golf Course Extension Road. Only a 20-minute drive from Delhi International Airport, with proximity to the Metro corridor for swift connectivity to Delhi. Easy access to NH8 and South Delhi via the Gurgaon Faridabad Expressway. Strategically connected to major business hubs and retail destinations. Nearby renowned hospitals include Medicity, Artemis, and Fortis, along with prestigious schools like St. Xaviers High School, DPS International, and Heritage School etc.

0 notes

Text

Joint Venture Property Development: A Key to Successful Housing Developments in Brisbane

The real estate market in Australia continues to grow, and joint venture property development is emerging as a strategic approach to foster collaboration and achieve large-scale projects. In areas like Brisbane, the demand for quality housing is pushing developers to innovate and partner for success. With numerous housing developments in Brisbane on the rise, understanding the synergy between these two trends is essential.

Understanding Joint Venture Property Development

1. What is Joint Venture Property Development?

Joint venture property development involves two or more parties collaborating to finance, design, and build real estate projects. These partnerships often include developers, landowners, investors, or construction firms pooling resources and expertise.

2. Advantages of Joint Ventures in Property Development

Shared Risk: By partnering, stakeholders can share financial and operational risks.

Access to Expertise: Each party brings unique skills, such as market knowledge or construction expertise.

Increased Resources: Joint ventures allow for pooling capital, enabling larger-scale projects.

3. Examples in the Brisbane Property Market

Brisbane has witnessed several successful joint venture property development projects, especially in suburban and inner-city areas. These developments cater to the growing demand for affordable and sustainable housing.

Housing Developments in Brisbane: Meeting Demand

1. Why Brisbane is a Hotspot for Housing Developments

Brisbane’s population growth, coupled with its attractive lifestyle and economic opportunities, has created a strong demand for housing. Developers are responding with innovative housing developments in Brisbane that focus on sustainability, affordability, and modern living.

2. Types of Housing Developments in Brisbane

Suburban Estates: Large-scale communities offering family homes, schools, and parks.

Inner-City Apartments: Catering to young professionals and downsizers.

Mixed-Use Developments: Combining residential, retail, and office spaces for urban convenience.

3. Key Areas for Housing Developments in Brisbane

Popular areas include Springfield Lakes, North Lakes, and West End, each offering a unique blend of lifestyle and amenities.

How Joint Ventures are Shaping Brisbane’s Housing Market

1. Collaboration for Large-Scale Projects

Developers in Brisbane are using joint venture property development to create large-scale projects that address housing shortages. These partnerships bring together landowners with prime land and developers with the expertise to design and build.

2. Sustainability in Housing Developments

Many housing developments in Brisbane now incorporate green technologies and energy-efficient designs. Joint ventures make it easier to finance these sustainable initiatives, ensuring long-term benefits for residents and the environment.

3. Community-Focused Projects

Joint ventures often lead to community-focused housing developments. By integrating schools, parks, and retail spaces, they create vibrant neighbourhoods that cater to diverse needs.

The Future of Property Development in Brisbane

1. Increasing Demand for Collaboration

As Brisbane grows, the complexity of housing projects increases. Joint venture property development will likely become even more common, enabling stakeholders to tackle challenges like rising land costs and regulatory requirements.

2. Focus on Affordability and Accessibility

With affordability remaining a key concern, joint ventures are uniquely positioned to develop housing that meets the needs of a wider audience. Affordable housing developments in Brisbane can balance profitability with social responsibility.

3. Innovation Through Partnerships

By pooling resources, joint ventures foster innovation. Developers can experiment with new technologies, designs, and materials that improve the quality and sustainability of housing in Brisbane.

Key Considerations for Investors and Homebuyers

1. Evaluating Joint Ventures

For investors, understanding the dynamics of joint venture property development is crucial. Ensure the partnership aligns with long-term goals and offers a clear profit-sharing model.

2. Choosing the Right Development

Homebuyers should research housing developments in Brisbane to find projects that suit their lifestyle and budget. Look for features like sustainability, proximity to amenities, and potential for capital growth.

3. Staying Informed

Both investors and homebuyers benefit from staying informed about Brisbane’s property market trends. Engaging with real estate professionals can provide valuable insights into upcoming opportunities.

Conclusion

The combination of joint venture property development and innovative housing developments in Brisbane is shaping the city’s real estate landscape. These collaborative efforts not only address the challenges of urbanisation but also create sustainable, community-focused housing solutions.

For Brisbane residents, this means access to modern, affordable, and well-planned housing options. For investors, it offers an opportunity to participate in a thriving market that prioritises growth and innovation. As Brisbane continues to evolve, joint ventures and innovative developments will play a pivotal role in shaping the city’s future.

0 notes

Text

How to Invest in Commercial Real Estate: A Comprehensive Guide

Investing in commercial real estate has long been a popular strategy for building wealth and generating passive income. With its potential for higher returns, diversification, and stability, it’s no wonder that many individuals and businesses are keen to explore opportunities in this lucrative sector. However, diving into commercial real estate requires a solid understanding of the market, strategic planning, and careful execution.

This guide will walk you through the essentials of how to invest in commercial real estate, ensuring you’re well-prepared to make informed decisions.

Understanding Commercial Real Estate Commercial real estate (CRE) refers to properties used for business purposes, such as offices, retail spaces, industrial facilities, and multi-family apartment buildings. Unlike residential real estate, where properties are typically used for living, commercial properties generate income through leasing to businesses or tenants.

The key types of commercial real estate include:

Office Spaces: Corporate buildings, co-working spaces, and small office units. Retail Spaces: Shopping malls, standalone stores, and retail complexes. Industrial Properties: Warehouses, manufacturing units, and distribution centers. Multi-family Residential: Apartment complexes with multiple units rented out. Specialty Real Estate: Hotels, hospitals, and recreational facilities. Benefits of Investing in Commercial Real Estate When you decide to invest in commercial real estate, you gain access to numerous advantages, such as:

Higher Income Potential: Commercial properties generally offer higher rental yields compared to residential properties. Long-term Leases: Commercial tenants often sign multi-year leases, ensuring steady income over a longer period. Diversification: Investing in CRE allows diversification of your portfolio, reducing risks associated with other asset classes. Value Appreciation: Well-located commercial properties can experience significant value appreciation over time. Tax Benefits: Investors can benefit from tax deductions on mortgage interest, property depreciation, and operating expenses. Steps to Invest in Commercial Real Estate 1. Define Your Investment Goals Before making any commitments, it’s crucial to determine why you want to invest in commercial real estate. Are you looking for passive income, capital appreciation, or a combination of both? Defining clear objectives will help you choose the right type of property and strategy.

2. Understand the Market Research is a cornerstone of successful commercial real estate investment. Analyze market trends, demand-supply dynamics, and the economic outlook of the area you’re considering. Key factors to evaluate include:

Local economic growth Infrastructure development Vacancy rates Average rental yields 3. Choose the Right Property Type Your choice of property should align with your investment goals. For example:

If you prefer steady cash flow, opt for office spaces or multi-family units. If you’re targeting high returns, consider retail spaces in prime locations. 4. Secure Financing Commercial real estate investments often require significant capital. Explore financing options such as:

Traditional bank loans Real Estate Investment Trusts (REITs) Private equity funds Syndicated deals Ensure you have a robust financial plan to manage down payments, mortgage payments, and maintenance costs. 5. Conduct Due Diligence Before closing a deal, perform thorough due diligence to assess the property’s viability. This includes:

Inspecting the physical condition of the property Verifying legal documentation Reviewing financial records Analyzing the tenant profile and lease agreements 6. Hire Professionals Commercial real estate transactions can be complex. Hiring experienced professionals such as real estate agents, lawyers, and financial advisors can streamline the process and minimize risks.

7. Close the Deal Once you’re satisfied with the property’s potential, negotiate favorable terms and close the deal. Ensure all agreements are documented and legally binding.

Popular Strategies to Invest in Commercial Real Estate There are multiple ways to invest in commercial real estate, catering to different risk appetites and financial capacities.

1. Direct Ownership Purchasing a property outright gives you full control over its management. This strategy is ideal for investors seeking long-term gains but requires substantial capital and active involvement.

2. Real Estate Investment Trusts (REITs) REITs allow you to invest in commercial properties without owning them directly. These trusts pool funds from investors to purchase and manage income-generating properties, offering dividends in return.

3. Crowdfunding Platforms Online platforms enable individuals to invest in commercial real estate projects with smaller amounts. This is a cost-effective way to diversify your portfolio.

4. Partnerships Forming partnerships with other investors can help you pool resources and share risks. Ensure clear agreements are in place to avoid conflicts.

5. Flipping Commercial Properties Buying undervalued properties, renovating them, and selling them at a profit is a high-risk, high-reward strategy.

Challenges of Investing in Commercial Real Estate While the rewards can be significant, investing in commercial real estate also comes with challenges:

High Initial Costs: Commercial properties require substantial upfront investment. Market Volatility: Economic downturns can impact rental income and property values. Management Complexity: Managing commercial properties involves dealing with tenants, maintenance, and compliance. Illiquidity: Selling commercial properties can take time, especially in a sluggish market. Mitigating these challenges requires thorough planning, risk assessment, and professional guidance.

Tips for First-time Investors in Commercial Real Estate Start Small: Begin with smaller properties or invest through REITs to gain experience. Focus on Location: Prioritize properties in high-demand areas with good infrastructure. Build a Network: Connect with industry experts, brokers, and other investors to gain insights. Stay Informed: Keep up with market trends and regulatory changes to make informed decisions. Diversify: Spread your investments across different property types and locations to minimize risks. Why Now is a Good Time to Invest in Commercial Real Estate The commercial real estate market is witnessing a resurgence, driven by factors such as: