#Finance Services Perth

Explore tagged Tumblr posts

Text

Finance advice in Perth

When seeking expert finance advice in Perth, Quick Smart Finance is your trusted partner. Our experienced team provides comprehensive financial guidance tailored to meet your specific needs. Whether you’re planning for retirement, managing investments, or navigating complex financial decisions, we offer professional support to help you achieve your goals. Our Perth financial consulting services…

#Best Mortgage broker Perth#finance#Finance advice in Perth#Finance advice Perth#Finance Services Perth#First Home Buyer Perth#Help to buy a house Perth#Mortgage broker North Perth#Mortgages for Investment Perth#Mortgages Perth#North Perth finance broker Perth

0 notes

Text

First Home Buyer Loans | First Home Buyer Victoria

Your Mortgage Experts specialize in first home buyer loans. Find the perfect home loan for your needs in Tarneit, Truganina, Point Cook, Cranbourne, Perth, and Sydney.

#business loan#finance#loans#mortgage#personal loans#home loan#first home#Mortgage Experts#financial planning#property management#investors#services#mortgageexperts#loan#Victoria#cranbourne#perth#Sydney#Point Cook#PointCook

2 notes

·

View notes

Text

Taxes can be complex, but being prepared is half the battle! Dive into our latest blog on westcourt.com.au, where we've crafted a meticulous plan for tax due diligence. 📝

In this comprehensive guide, we break down the steps you need to take to ensure you're on top of your tax game. We've covered everything, from organising your financial records to understanding the latest tax regulations.

Tax season doesn't have to be stressful when you have a well-thought-out plan. Check out the full blog now for expert insights and tips!

Read the Blog: https://www.westcourt.com.au/a-detailed-plan-for-tax-due-diligence/

#accounts#finance#income tax#Tax return Perth#Tax return preparation#Tax structuring services Perth#Tax planning strategy

0 notes

Text

New SpaceTime out Friday

SpaceTime 20240913 Series 27 Episode 111

Evidence of Unexpected Population of Kuiper Belt Objects

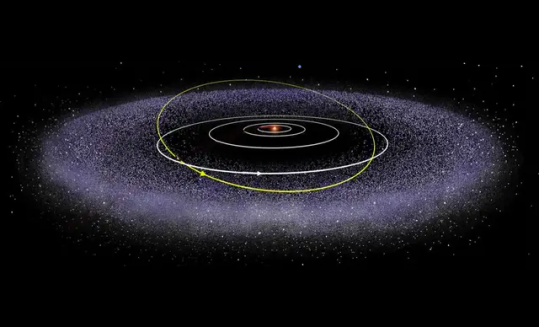

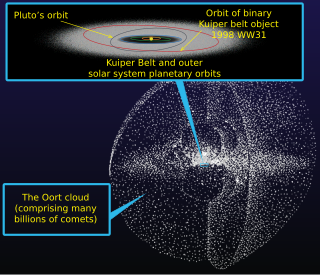

A new study has detected an unexpected population of very distant bodies in the Kuiper Belt, an outer region of the solar system populated by ancient remnants of planetary building blocks lying beyond the orbit of Neptune.

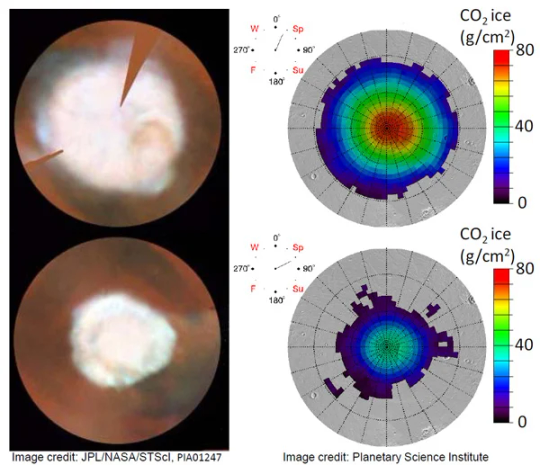

The Martian polar caps are not created equally

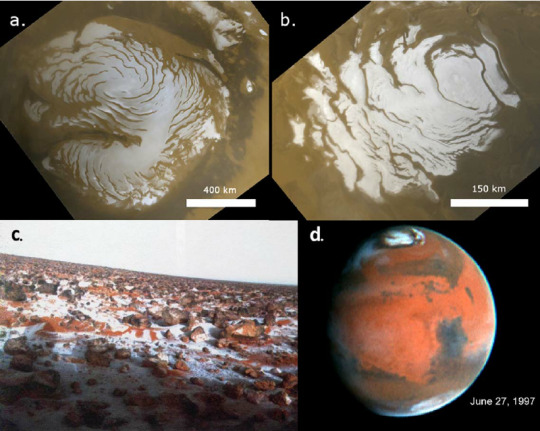

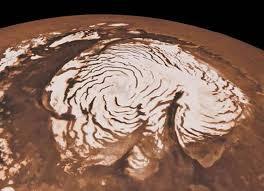

A new study has confirmed that the Martian polar ice caps are evolving very differently from each other.

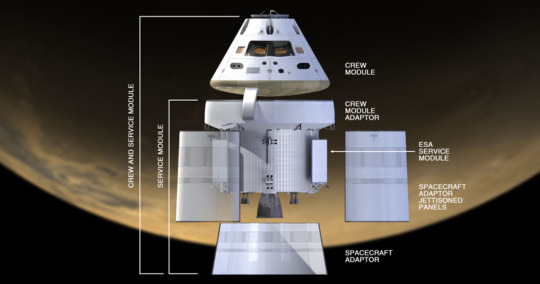

Artemis III service module on its way to NASA

The European Space Agency’s Artemis III service module destined for use on the historic mission that will return humans to the lunar surface in 2026 is about to commence its journey to the Kennedy Space Center.

The Science Report

Bird flu now spreading on Antarctica’s South Georgia island and the Falkland Islands.

Finding New Zealand’s original native animals.

Australian HIV levels continue to drop.

SpaceTime covers the latest news in astronomy & space sciences.

The show is available every Monday, Wednesday and Friday through Apple Podcasts (itunes), Stitcher, Google Podcast, Pocketcasts, SoundCloud, Bitez.com, YouTube, your favourite podcast download provider, and from www.spacetimewithstuartgary.com

SpaceTime is also broadcast through the National Science Foundation on Science Zone Radio and on both i-heart Radio and Tune-In Radio.

SpaceTime daily news blog: http://spacetimewithstuartgary.tumblr.com/

SpaceTime facebook: www.facebook.com/spacetimewithstuartgary

SpaceTime Instagram @spacetimewithstuartgary

SpaceTime twitter feed @stuartgary

SpaceTime YouTube: @SpaceTimewithStuartGary

SpaceTime -- A brief history

SpaceTime is Australia’s most popular and respected astronomy and space science news program – averaging over two million downloads every year. We’re also number five in the United States. The show reports on the latest stories and discoveries making news in astronomy, space flight, and science. SpaceTime features weekly interviews with leading Australian scientists about their research. The show began life in 1995 as ‘StarStuff’ on the Australian Broadcasting Corporation’s (ABC) NewsRadio network. Award winning investigative reporter Stuart Gary created the program during more than fifteen years as NewsRadio’s evening anchor and Science Editor. Gary’s always loved science. He studied astronomy at university and was invited to undertake a PHD in astrophysics, but instead focused on his career in journalism and radio broadcasting. Gary’s radio career stretches back some 34 years including 26 at the ABC. He worked as an announcer and music DJ in commercial radio, before becoming a journalist and eventually joining ABC News and Current Affairs. He was part of the team that set up ABC NewsRadio and became one of its first on air presenters. When asked to put his science background to use, Gary developed StarStuff which he wrote, produced and hosted, consistently achieving 9 per cent of the national Australian radio audience based on the ABC’s Nielsen ratings survey figures for the five major Australian metro markets: Sydney, Melbourne, Brisbane, Adelaide, and Perth. The StarStuff podcast was published on line by ABC Science -- achieving over 1.3 million downloads annually. However, after some 20 years, the show finally wrapped up in December 2015 following ABC funding cuts, and a redirection of available finances to increase sports and horse racing coverage. Rather than continue with the ABC, Gary resigned so that he could keep the show going independently. StarStuff was rebranded as “SpaceTime”, with the first episode being broadcast in February 2016. Over the years, SpaceTime has grown, more than doubling its former ABC audience numbers and expanding to include new segments such as the Science Report -- which provides a wrap of general science news, weekly skeptical science features, special reports looking at the latest computer and technology news, and Skywatch – which provides a monthly guide to the night skies. The show is published three times weekly (every Monday, Wednesday and Friday) and available from the United States National Science Foundation on Science Zone Radio, and through both i-heart Radio and Tune-In Radio.

#science#space#astronomy#physics#news#nasa#astrophysics#esa#spacetimewithstuartgary#starstuff#spacetime#jwst#hubble space telescope

10 notes

·

View notes

Text

With more than 12,000 killed and 7.3 million people displaced, ongoing warfare in Sudan has steadily broken down the country’s political, social, and medical services. Reports suggest more than 24 million of the country’s 46 million people need assistance; cholera cases had risen to over 8,200 by late December; and between 70 percent and 80 percent of hospitals in affected states have been left nonfunctional.

As violence and displacement counts rise, humanitarian aid efforts haven’t kept up. Instead, initiatives to negotiate between the warring powers—the Sudanese Armed Forces (SAF), led by Gen. Abdel Fattah al-Burhan, and the Rapid Support Forces (RSF), led by Mohamed Hamdan “Hemeti” Dagalo—have been the priority for the international community, neglecting the suffering that ordinary Sudanese citizens have endured for the last nine months. While talks have been on and off for months, vital humanitarian initiatives remain underfunded.

It is easy to assume that with negotiations come a harmonious cease-fire and peaceful postwar society, but global history and Sudan’s history indicate a very different outcome if international actors rely primarily on good-faith negotiations to end the conflict and launch Sudan into a successful postwar society.

To rely on negotiations is to assume that one of the warring factions will win and the other will concede, leaving either Burhan or Hemeti in charge of Sudan’s reconstruction. Given U.S. Secretary of State Antony Blinken’s recent determination that both the RSF and SAF have committed war crimes—with RSF forces also committing crimes against humanity and acts of ethnic cleansing—inviting these parties to a negotiation table projects a bleak future for Sudan.

The international community has its priorities backward. Instead of prioritizing negotiations between two factions that actively reject any notion of their own wrongdoing and that citizens overwhelmingly reject as unrepresentative, foreign actors must redirect their attention to limiting foreign funding of the conflict, advocating for the inclusion of Sudanese citizen groups, and financing proposed humanitarian plans. Indeed, the central focus of international organizations and outside powers seeking peace in Sudan should be the restoration of civilian life, rather than impractical negotiations that have often failed in the past.

After former Sudanese President Omar al-Bashir was ousted from office in 2019, international powers and nongovernmental organizations (NGOs) eagerly supported a citizen-led democratic transition, vowing to assist in the process. But, as the U.N. Integrated Transition Assistance Mission in Sudan (UNITAMS) was shuttered this last December by the U.N. Security Council, such promises appear empty. Government officials in Khartoum deemed the mission “disappointing” as they demanded its end and blamed the violence on former UNITAMS chief Volker Perthes, forcing the U.N.’s hand to withdraw.

In managing negotiations between the factions that are barring the progress of a civilian government, international mediators continue to walk back these promises. To reassert their commitment to civilian-led initiatives in Sudan, a healthy and safe citizenry is necessary.

The continued failure of Sudan’s health system represents just one of the many failures Sudan’s public systems have suffered amid the ongoing violence. As RSF and SAF forces have made Sudan dangerous to move within, humanitarian access has been greatly limited. This has since resulted in cholera spreading to nine of Sudan’s states—threatening communities plagued by inadequate water treatment and food insecurity at a higher rate. As measles, cholera, and dengue fever spread, it becomes increasingly obvious that if guns and bombs don’t kill Sudanese citizens, the failure of the health system and lack of medical supplies will.

The ongoing conflict’s impact on access to food and resources has also contributed to massive degradation in the nation’s economy. With an inflation rate of 256 percent relative to average consumer prices, citizens across Sudan, whether in conflict-ridden areas or not, are suffering.

Most efforts aimed at assisting vulnerable citizens have been undertaken by Sudanese people themselves. With unreliable access to the internet, Sudanese people globally have used social media to advertise the best routes to escape Sudan, share which shops have food and medicine in stock, and how to send and receive money amid shuttered banks. Sudanese citizens have taken it upon themselves to do the work they’ve expected of international organizations and powers.

Stories that have emerged out of Sudan over the last nine months detail harrowing civilian experiences with ethnic and sexual violence largely perpetrated by the RSF, invoking memories of the war in Darfur, where widespread violence occurred at the hands of the janjaweed, the militia from which the RSF emerged. While that war was declared ended in August 2020 as Sudan’s newly formed transitional government promised Darfur rebel groups a role in Sudan’s democratic transition, those oaths have disappeared amid the current conflict.

The western area of Darfur remains the epicenter of violence toward civilians, as risks of ethnic cleansing, genocide, and sexual abuse mount against primarily non-Arab communities. A lack of organization within RSF ranks and the group’s history have all but authorized heinous attacks against Sudan’s most vulnerable populations, with a limited humanitarian response from parties outside of the country.

When humanitarian aid does manage to reach displaced people, it typically happens in refugee camps in neighboring countries, such as Doctors Without Borders’ work in the Ourang camp in Chad, despite the organization’s ongoing efforts to maintain a presence in Sudan. Fears of looting and violence, a lack of institutional protection, and the continued degradation of networks have made it increasingly difficult to reach afflicted communities in Sudan.

As violence rains down on West Darfur, communities are becoming more vulnerable. While around 42 percent of Sudan’s population suffers from high levels of acute food insecurity, these figures increase dramatically to over 60 percent in West Darfur. As the humanitarian crisis deepens in areas most affected by ethnic and sexual violence over the last 20 years, a lack of urgency in the international response ensures that the situation will get worse.

The most urgent initiative to protect Sudanese citizens is readily waiting, but with only 41.8 percent of the necessary funding acquired, the U.N. Office for the Coordination of Humanitarian Affairs (OCHA) response plan has not been as effective as it could be. The plan aims to provide lifesaving assistance to limit immediate morbidity and mortality rates and keep pending risks at bay through preemptive action.

The limited funding has allowed OCHA to reach only 21 percent of targeted people in need, so increasing pressure on state actors is key to assure humanitarian aid. Of the $2.57 billion needed to fully enact the plan, the United States has provided $549.1 million of the current secured funding, but Saudi Arabia—the other key broker—has contributed only $38 million, and the Intergovernmental Authority on Development has given less than $100,000. As negotiating powers aim to bring the United Arab Emirates into talks regarding its role, its government has given less than $400,000 to the effort. Encouraging allies in the West to assist in the existing plan is similarly crucial, as it offers a more immediate response.

Using existing Sudanese citizen networks of grassroots trauma response and financial and educational empowerment of mental health services across Sudan—specifically in areas like Darfur, Kordofan, and Khartoum—is key to development. Frameworks to assist displaced people are necessary as well, as hundreds of thousands flee to neighboring countries where more danger often awaits them.

Building networks for refugees and asylum-seekers to safely leave the country and resettle with the assistance of foreign governments ensures vulnerable populations gain access to robust medical and social services that are not currently available domestically. All these efforts have begun thanks to Sudanese citizens, but without foreign intervention and commitment, these initiatives will not have a wide impact.

As peace talks continue, the Sudanese public must be represented by the citizen groups that led protests against Bashir and his government—as the loudest voice.

Even as Sudanese citizens internally and globally call for both Hemeti and Burhan to be held accountable by the international community, the former allies who served in the Bashir regime may very well end up sharing power in defiance of the public’s will. Bringing Sudanese citizen groups into the discussion could avoid such an outcome while prioritizing the health and human rights of the population. Until humanitarian efforts take center stage in discussions surrounding Sudan, there will be no winners.

7 notes

·

View notes

Text

youtube

Business Name: Loanfocus

Street Address: 9 Hardy Street

City: South Perth

State: Western Australia (WA)

Zip Code: 6151

Country: Australia

Business Phone Number: 0419 043 428

Business Email Address: [email protected]

Website: https://loanfocus.smartonline.com.au/

Facebook: https://www.facebook.com/search/top?q=loanfocus

Description: Who are we? We're mortgage brokers. We'll help navigate you through the competitive and ever-changing mortgage landscape to find the right loan for you. We'll go into bat and negotiate on your behalf, and we'll make the process as simple as possible for you, geared up to deliver fast results. We'll help you avoid the pitfalls, and we'll find loan features to suit your personal circumstances.

Why use us as a mortgage broker when looking for finance?

A mortgage broker is someone who shops around

Google My Business CID URL: https://www.google.com/maps?cid=5946182791051227741

Business Hours: Sunday Closed Monday 8 AM–5:30 PM Tuesday 8 AM–5:30 PM Wednesday 8 AM–5:30 PM Thursday 8 AM–5:30 PM Friday 8 AM–5:30 PM Saturday Closed

Services: Home purchasing,Loan applications,Property closing,Business Loans,Commercial Finance,Commercial Loan,Construction Loans,Home Loans,Investment Loans,Investment Property Loans,Vehicle Leases,Refinancing,Loan shopping

Keywords: Financial advisor; mortgage broker; business consultant; small business financing; home loans

Location:

Service Areas:

2 notes

·

View notes

Text

EBIT and EBITDA – what’s the difference

If you’re buying a business in Perth, understanding EBITDA and EBIT is essential to both you and your Perth business accountant.

Both EBIT and EBITA give insight into a company’s profitability and financial health. This analysis is needed when making decisions about growth, financing, or even a potential sale.

This blog explores the difference between EBITDA and EBIT. They are both useful.

What is EBITDA?

EBITDA, stands for Earnings Before Interest, Taxes, Depreciation, and Amortisation.

Here’s a quick breakdown:

Earnings: Net profits of the Perth SME.

Interest: Payments related to loans or other financial obligations.

Taxes: All applicable income taxes the business is required to pay.

Depreciation: The reduction in value of physical assets over time.

Amortisation: Similar to depreciation but applies to intangible assets (goodwill etc).

The main advantage of EBITDA is that it gives a view of a company’s operational performance by excluding variable costs like interest and taxes, which can be influenced by financial strategies or geography and don’t directly reflect core business activities.

Investors, banks, and their Perth business accountants often use EBITDA to value companies and compare efficiency across companies in the same industry.

When removing the cost of taxes from EBITDA, it is important to only adjust for income tax. Other taxes like payroll tax or fringe benefits tax are not adjusted when considering your EBITDA.

What is EBIT?

EBIT, includes depreciation and amortisation costs. It is a more conservative measure than EBITDA.

EBIT focuses on the operational earnings of the Perth SME without factoring in the cost of capital. This provides a straightforward look at how well the business performs from its core operations.

Sometimes EBIT is referred to as the Return on Capital Employed.

Key Differences Between EBIT and EBITDA

While both EBIT and EBITDA measure a company’s profitability, they aren’t the same.

EBIT includes depreciation and amortisation, so it is more conservative. On the other hand, EBITDA excludes these expenses, often presenting a more favourable picture of profitability.

Which metric to use depends on what you’re trying to assess:

For long-term investments: EBITDA may be more relevant as it ignores depreciation and amortisation, which can significantly impact long-term financials.

For operational efficiency: EBIT might be a better measure as it focuses solely on the company’s core operational performance.

EBITDA vs EBIT

Let’s consider a hypothetical food production business (say ice cream) with an EBITDA of $500,000.

EBITDA Example

In this scenario, the ice cream manufacturer’s net profit after tax is $3,000,000. It also pays $400,000 in interest, has a tax liability of $2,000,000, and incurs $250,000 in depreciation and $40,000 in amortisation costs.

Formula: EBITDA = Net Income + Interest + Taxes + Depreciation + Amortisation To calculate EBITDA, you add these figures: $3,000,000 (Net Income) + $400,000 (Interest) + $2,000,000 (Taxes) + $250,000 (Depreciation) + $40,000 (Amortisation) = $5,690,000.

EBIT Example

EBIT focuses more narrowly on operational profitability, excluding depreciation and amortisation, but still accounts for interest and taxes.

Formula: EBIT = Net Income + Interest + Taxes To calculate EBIT for this HVAC business, you take the net income of $300,000 and add the interest and taxes:

$3,000,000 (Net Income) + $400,000 (Interest) + $2,000,000 (Taxes) = $5,400,000.

Both metrics are good and give you, and your Perth business accountant, an insight into a company’s financial performance.

When should I use EBITDA?

Many Perth business accountants use EBITDA to compare operational efficiency between companies in industries where depreciation and amortisation are significant expenses.

In sectors like manufacturing, where significant capital investments in service vehicles and specialised equipment lead to substantial depreciation costs, EBITDA allows you to focus on core business performance by considering only revenue, cost of goods sold (COGS), and overhead, without being affected by depreciation and amortisation.

When should I use EBIT?

EBIT, however, is a strong indicator of a business’s operational profitability.

It’s particularly valued in industries where operational efficiency is a key measure of success, such as service sectors, where depreciation has less impact on overall financial performance. So, a Perth business accountant may use EBIT when assessing the financial viability of a legal practice.

Limitations of EBITDA

Many Perth business accountants will discuss EBITDA with depreciation considered as a notional expense. However, depreciation as a cost is real.

If you run a trucking business, and after every 10 years, you need to buy a new truck for $500,000, the cost of the new truck is real. And so is the cash that leaves the company to buy the truck.

Limitations of EBIT

For many businesses, the cost of interest can take different forms. A leased asset can easily be converted into a purchased asset with interest costs. So, simply adding back interest can become misleading when it can be an operational cost.

Limitations of EBIT and EBITDA

With net profits after tax, a business will repay debt and pay dividends to the family. So, while ignoring tax for analytic purposes is excellent, it is misleading when considering the cashflows of a business purchased.

A family in business should always do a three-way cash flow when considering future business purchases.

Financial Decision-Making

Investors, Perth business accountants, and analysts use EBITDA and EBIT to make financial judgments about a business. EBITDA is often favoured for mergers and acquisitions as it offers an easier snapshot of a company’s operational performance. The depreciation cost is also reflected in the purchase price.

EBIT is widely used by accountants, banks and investors who are more interested in a business’s day-to-day operational profitability.

In ice cream manufacturing, for instance, an acquisition entrepreneur may look at EBITDA when considering an acquisition, focusing on operational cash flows.

A small business law firm might focus more on EBIT and be interested in how efficiently the business operates.

It’s crucial to note that some investors might prefer one metric over another, depending on the situation.

A long-term investor might value EBIT more because it includes depreciation, a real expense that will eventually need to be paid for, such as replacing ageing fridges or equipment.

Common questions asked to a Perth business accountant

Is EBIT better than EBITDA?

Neither is necessarily better—it depends on what you’re analysing. EBITDA is great for understanding a company’s operational efficiency without the influence of financing or accounting factors. EBIT provides a more conservative measure and is often used for long-term investment decisions.

Why is EBIT considered the best measure?

Calling EBIT the “best” measure of profit is not always correct. However, EBIT is often favoured because it focuses on a company’s core operational efficiency including capital expenditure. EBIT gives a realistic picture of business performance, excluding the effects of financing and taxes.

Is it good to have a high EBIT?

Generally, yes. A high EBIT suggests solid operational profitability. However, context matters—a high EBIT in one year and a steep decline in the next could signal issues. It’s also good to compare EBIT to industry averages.

Can EBITDA be negative?

EBITDA can be negative. A negative EBITDA indicates a business is losing money, whether through high costs, low revenue, or both. It’s a red flag for investors and suggests a closer look at the business is needed.

EBIT can also be negative.

Conclusion

No key financial accounting metric should be examined in isolation, so both EBIT and EBITDA offer one way to review a business. The clarity of financial data and the review of an SME business for purchase are critical to success. Given the size and risk of a purchase to a family in business, it is important to deal with an engaged accountant who understands the process.

This is where Westcourt stands out. Our single focus on families in business, coupled with our deep international network, award-winning expertise, and independence of approach, makes us a clear choice for helping you purchase, review and grow your business – so why not call us?

Also Read: -

Understanding carbon accounting for Perth SME’s

Tax impacts of subdividing the family home

4 Reasons to Use a Company Trustee for your Discretionary Trust

Contact us:-

Website:- https://westcourt.com.au/

Email us:- [email protected]

Call Us:- 08-9221-8811

0 notes

Text

How to Find a Reputable Photovoltaic Installation Company

In light of escalating energy prices, reliable photovoltaic installation perth residents are inclining toward unique technologies to support power expenditures. One such solution is solar energy systems.

When selecting a solar company, look for a long track record with reliable online reviews. Consider a company with an in-house team rather than subcontractors.

1. Experience

Buying a solar power system is an important financial decision for your home or business, so it's important to find an experienced installer. Look for a company that has been in the industry for several years and is accredited by the Clean Energy Council (CEC).

Perth's abundant sunshine makes it a prime location for harvesting renewable energy. Combined with rising electricity retail prices and increased awareness of environmental impact, many residents are switching to solar energy to save on power bills. In addition, residents who generate more than they use can earn money from selling their excess power to the electricity grid via feed in tariffs.

For homeowners in Perth, solar systems are a smart and affordable energy option. Government rebates and the Small-scale Renewable Energy Scheme help reduce the upfront cost of a PV system, while energy savings from a well-matched solar power system can cut electricity bills significantly. Renters should also consider solar, as it adds value to the property and is a tax-deductible investment.

2. Reputation

A good Perth solar company’s reputation is important because it shows its commitment to customer satisfaction. Its reliability can also help you save on electricity costs in the long run. You can find out about a Perth solar installation company’s reputation by reading Google reviews. However, make sure that you take the time to look at a company’s overall review volume and depth.

A Perth solar company with a solid reputation will have a consistent combined review quantity across multiple like-for-like review platforms. This ensures that the company has a high level of customer satisfaction, and isn’t relying on a few select customers to boost their reviews.

Another way to identify a reputable Perth solar installation company is to consider the warranty offered by the company. Many Perth solar companies offer up to a 20year warranty for their PV systems. This can significantly reduce your energy bills and protect you from future electricity price increases.

3. Warranty

A solar system is an investment, and you should always look for a comprehensive warranty. The best solar installation companies offer a warranty on their solar panels and inverters, as well as the installation work. A reputable installer will also provide post-service customer support.

Look for a company that offers flexible financing options. This will allow you to save on upfront costs and pay off your investment with fortnightly payments. The company should abide by their commitment to quality and be able to show you evidence of this in their Google reviews.

Koala Solar is a Perth-based solar energy provider that prides itself on helping Aussies reduce their power bills by installing rooftop systems. They use Tier 1 solar products and offer a range of packages for residential and commercial customers. These include brands such as Canadian Solar, Fronius, Goodwe, LG, JA Solar, LONGi, Senec and Tesla. They also have a referral program that offers eGift cards for referring friends and family.

4. Customer service

The best solar company Perth offers excellent customer service and a quality approach to keeping its clients informed throughout the process. They also provide a system monitoring service to help homeowners make the most of their solar systems.

It is crucial to choose a local installer with good customer service, especially if you have questions about your solar system after installation. Ensure that the company you choose is accredited with the Clean Energy Council (CEC), and ask about the company’s history and online reviews.

For example, Perth Solar Warehouse & PSW Energy is a CEC-accredited Perth solar power company that specializes in providing affordable PV systems and heat pump hot water solutions. They offer a wide range of residential solar packages, including a zero per cent interest finance plan for WA residents. They also sell top brands such as Fronius, iStore and Tesla. Look for a Perth solar company with an established track record and a consistent customer satisfaction rating on multiple review platforms.

0 notes

Text

Illuminate Your Home with Residential Solar Installation Services from Raf Power

As energy costs continue to rise and the need for sustainable solutions becomes more pressing, many homeowners are turning to residential solar installation services. At Raf Power, located on St Georges Terrace in Perth, WA, we specialize in providing tailored solar solutions that empower you to harness the sun’s energy effectively.

Why Choose Residential Solar Installation?

Investing in residential solar installation not only benefits the environment but also brings numerous advantages to your household. Here’s why you should consider making the switch:

1. Significant Cost Savings

Solar panels can dramatically reduce your monthly electricity bills. By generating your own energy, you can offset your consumption from the grid, leading to substantial savings over time. Many of our clients report a noticeable decrease in their energy expenses after installation.

2. Increased Property Value

Homes equipped with solar energy systems are often more attractive to buyers, resulting in increased property values. Investing in solar not only benefits you while you live in your home but can also enhance its marketability in the future.

3. Environmental Benefits

Solar energy is a clean, renewable resource that reduces your carbon footprint. By choosing solar, you contribute to a greener planet and help combat climate change for future generations.

4. Energy Independence

Solar installation allows you to generate your own electricity, providing greater energy independence. This is particularly beneficial during peak demand times when energy prices soar, giving you control over your energy usage and costs.

Our Residential Solar Installation Services

At Raf Power, we offer a comprehensive range of residential solar installation services to meet your needs:

1. Custom Solar System Design

Every home is unique, which is why we begin with a thorough assessment of your property. Our team will design a solar system tailored to your specific energy needs, ensuring optimal efficiency and performance.

2. Professional Installation

Our skilled technicians handle the entire installation process with precision and care. We use high-quality materials and advanced technology to ensure your solar panels are securely and effectively installed.

3. Ongoing Support and Maintenance

After your solar system is installed, we provide continuous support and maintenance services. Our team monitors system performance and addresses any issues that may arise, ensuring your solar investment remains in top condition.

4. Flexible Financing Options

We understand that switching to solar can be a significant investment. To make it easier for you, we offer various financing options designed to fit your budget, allowing you to enjoy the benefits of solar without financial strain.

Why Choose Raf Power?

Expert Team: With extensive experience in solar installation, our knowledgeable team is dedicated to providing you with the best possible service and support.

Local Knowledge: Based in Perth, we understand the unique energy needs of our community and provide solutions tailored to our local climate.

Customer-Centric Approach: We prioritize your satisfaction, ensuring that you receive personalized service from the initial consultation to ongoing maintenance.

Start Your Solar Journey Today!

Ready to take the leap into sustainable energy? Contact Raf Power for your residential solar installation services today! Call us at 0493 385 641 or visit us at our office on St Georges Terrace in Perth. Let us help you illuminate your home with the power of the sun.

Make the smart choice for your home, your wallet, and the planet with Raf Power—your trusted partner in solar energy!

#Residential Solar Solutions#best solar panels for home Perth#home solar power system Perth#Residential Solar Installation Services

0 notes

Text

Maximising Efficiency in Dental Practices: The Power of CRM Systems Across Australia

As dentists across Australia face the daily grind of managing appointments and operations, the struggle of being time-poor becomes evident. Whether you’re in Melbourne, Brisbane, Sydney, Perth, Adelaide, or anywhere in Queensland, a Customer Relationship Management (CRM) system can transform the way your dental practice operates, allowing you to focus on what truly matters: your patients.

Why CRM is Essential for Dentists

In the fast-paced environment of dental practices, managing appointments, marketing activities, and patient insights can be overwhelming. A well-implemented CRM system alleviates this burden by streamlining operations and improving efficiency. Here’s how:

1. Increased Appointments

A CRM captures leads from various marketing channels—be it your website, social media, or ads—and nurtures these leads until they convert into appointments. No more manual entries or scattered spreadsheets! The automated system ensures that every potential patient is followed up promptly, helping your practice see a significant increase in appointments.

2. Faster Response Times

In a world where patients expect quick responses, a CRM allows you to address clients by name and tailor messages based on their specific needs. This personal touch enhances engagement and builds trust, making your practice their preferred choice for dental care.

3. Eliminating Repetitive Tasks

Dentists often find themselves bogged down by mundane, repetitive tasks. A CRM automates these processes, saving time and minimising human error. By streamlining operations, your practice can shift focus towards more productive activities that enhance patient care.

4. Enhanced Marketing Efforts

With patients bombarded by marketing messages, your practice must stand out. A CRM provides insights into patient behavior and preferences, allowing you to create targeted, personalised marketing campaigns. This can significantly improve your outreach and patient acquisition in cities like Melbourne, Sydney, and Brisbane.

5. 360-Degree Patient Insights

CRM systems offer a comprehensive view of your patients’ interactions and preferences. This holistic approach helps you understand your most valuable patients and tailor services to meet their needs, ensuring higher retention and loyalty.

6. Better Management and Insights

Managing a dental practice involves juggling multiple responsibilities, from marketing to finance. A CRM consolidates all vital information in one platform, providing actionable insights into your operational effectiveness. This centralisation simplifies decision-making, enabling better resource allocation and improved team workflow.

Tailored Solutions for Every City

At 360 Dental Marketing, we understand the unique challenges faced by dental practices in various locations. Whether you’re in Perth, Adelaide, Brisbane, or Sydney, we offer tailored CRM solutions to meet your specific needs. Our systems are designed to enhance your marketing strategies, streamline operations, and ultimately improve patient experiences across the board.

Take the Next Step

Ready to transform your dental practice with a CRM system? Contact us today at 1300 777 360 for a 30-Minute FREE Consultation. Let us help you choose the best CRM system tailored to your practice’s needs, allowing you to focus on delivering exceptional dental care while maximising efficiency. Don’t let time constraints hold you back—embrace the power of CRM and watch your practice thrive!

0 notes

Text

Transform Your Space: Granny Flats, House Extensions, and Renovations with Perway Construction Service in Perth

As property prices soar and urban living becomes increasingly popular, homeowners in Perth are seeking innovative solutions to maximize their space and enhance their property’s value. One effective approach is investing in granny flats, house extensions, and renovation builders perth. With the expertise of Perway Construction Service, you can transform your home into a functional, stylish haven that meets your growing needs. In this blog post, we’ll explore the benefits and possibilities of granny flats, house extensions, and renovations in Perth, and how Perway Construction Service can help you achieve your dream home.

Understanding Granny Flats in Perth

Granny flats are self-contained living spaces that can be built on the same property as a primary residence. They offer a flexible solution for a variety of needs, whether it’s accommodating elderly family members, providing a rental opportunity, or creating a personal retreat. In Perth, the demand for granny flats is on the rise, and with good reason.

Benefits of Granny Flats

Additional Income: Renting out a granny flat can provide a steady income stream. With the growing rental market in Perth, this option is particularly appealing for homeowners looking to boost their finances.

Increased Property Value: A well-designed granny flat can significantly enhance your property’s value. Potential buyers see the value in having additional living space, making your home more attractive on the market.

Flexible Living Options: Granny flats can serve various purposes, from a home office to a guest suite. This flexibility allows homeowners to adapt their living space to their changing needs.

Close Proximity to Family: For those who wish to keep family close, granny flats provide the perfect solution. They offer independence while maintaining close ties, making them ideal for multi-generational living.

Perway Construction Service specializes in designing and building granny flats Perth that meet your specific needs. Our experienced team ensures that your new space seamlessly integrates with your existing property while complying with all local regulations.

The Appeal of House Extensions in Perth

House extensions are another fantastic way to increase your home’s living space without the hassle of moving. Whether you need an extra bedroom, a larger kitchen, or an expansive living area, house extensions can transform your home into a more functional and enjoyable space.

Advantages of House Extensions

Tailored Design: With a house extension, you have the opportunity to customize the design to suit your lifestyle. This means you can create a space that truly reflects your tastes and meets your needs.

Cost-Effective: Compared to purchasing a new home, a house extension is often a more cost-effective solution. It allows you to maximize your current investment and avoid the expenses associated with moving.

Improved Comfort: An extension can provide the extra space you need for a growing family, helping to reduce overcrowding and enhance comfort in your home.

Increased Resale Value: Like granny flats, house extensions can increase your property’s market value. A well-executed extension can make your home stand out in a competitive market.

At Perway Construction Service, we understand the intricacies of house extensions in Perth. Our renovation builders work closely with you to design an extension that complements your existing structure while ensuring it meets all safety and zoning regulations.

Renovation Builders in Perth: Transforming Your Home

If you’re not looking to expand your home but still want to enhance its value and functionality, consider renovating your existing space. Renovation builders in Perth can breathe new life into your home, whether through a modern kitchen remodel, a bathroom upgrade, or a complete home makeover.

Benefits of Renovations

Modernization: Renovations allow you to update your home’s aesthetics and functionality. Outdated kitchens and bathrooms can be transformed into modern, efficient spaces that cater to today’s lifestyle.

Enhanced Energy Efficiency: Renovating your home provides an opportunity to incorporate energy-efficient solutions, such as better insulation, energy-efficient appliances, and modern heating systems, which can lead to significant savings on utility bills.

Personalization: A renovation allows you to customize your home to fit your personal style. From choosing the right materials to designing unique features, the possibilities are endless.

Increased Comfort and Usability: Whether it’s opening up a cramped living area or creating a luxurious master suite, renovations can enhance the comfort and usability of your home, making it a more enjoyable place to live.

Perway Construction Service is at the forefront of renovation projects in Perth. Our team of skilled renovation builders is committed to delivering high-quality workmanship and personalized service, ensuring your renovation project is a success.

Why Choose Perway Construction Service?

When it comes to granny flats, house extensions, and renovations in Perth, choosing the right builder is crucial. At Perway Construction Service, we pride ourselves on our reputation for quality and customer satisfaction. Here are a few reasons why we should be your go-to choice:

1. Expertise and Experience

Our team consists of experienced professionals who understand the unique challenges of building and renovating in Perth. We stay up-to-date with the latest building codes and regulations, ensuring your project runs smoothly.

2. Customized Solutions

We recognize that every homeowner has unique needs and preferences. That’s why we take the time to listen to your vision and develop customized solutions that align with your goals.

3. Quality Craftsmanship

At Perway Construction Service, we believe that quality matters. We use only the best materials and techniques to ensure your granny flat, house extension, or renovation stands the test of time.

4. Comprehensive Services

From the initial design phase to project completion, we offer a full range of services to guide you through the entire process. Our commitment to transparency and communication ensures that you’re informed every step of the way.

5. Client Satisfaction

Our numerous satisfied clients attest to our dedication to providing exceptional service. We take pride in our ability to exceed expectations and deliver results that enhance our clients’ lives.

Investing in granny flats, house extensions, or renovations can significantly improve your living situation and increase your property’s value. With Perway Construction Service, you can embark on your home transformation journey with confidence. Our expertise in granny flats in Perth, house extensions Perth, and renovation builders in Perth ensures that your project will be handled with the utmost professionalism and care.

Ready to explore the possibilities? Contact Perway Construction Service today to discuss your project and discover how we can help you create the home of your dreams. Whether you’re looking for a cozy granny flat, a spacious house extension, or a stunning renovation, we’re here to make it happen. Your dream home awaits!

0 notes

Text

Mortgage Broker in Perth

Mortgages Broker Perth is an essential service for anyone looking to secure a home loan or refinance an existing mortgage. For expert guidance and competitive rates, trust Mortgage Broker Services Perth by Quick Smart Finance. Known for their personalized service and industry knowledge, Quick Smart Finance is a leading provider of mortgage solutions in Perth. Quick Smart Finance offers a…

#Best Mortgage broker Perth#First Home Buyer Perth#Help to buy a house Perth#Mortgage Broker#Mortgage Broker in Perth#Mortgage broker near me#Mortgage broker North Perth#Mortgage broker Perth#Mortgages for Investment Perth#Mortgages Perth#North Perth finance broker Perth#personal-finance#Perth Mortgage Broker Services#Perth Mortgage Brokers

0 notes

Text

Strata Management Services

Our Body Corp is one of the leading Strata Management Companies that provides All Strata Services Australia-wide, including Melbourne, Sydney, Gold Coast, Brisbane, Adelaide, Perth, Queensland, Canberra, Victoria, New South Wales, South Australia, and Western Australia.

#strata property#strata management Melbourne#Melbourne body corporate management#all strata management services

0 notes

Text

Moving to Australia from Dubai: A Comprehensive Guide

Australia has long been a favored destination for those seeking a better quality of life, career opportunities, and educational advancement. Moving to Australia from Dubai is an exciting prospect, and while the process can seem complex, this guide will break down everything you need to know to make the transition as smooth as possible.

Why Move to Australia from Dubai?

Quality of Life: Australia consistently ranks among the top countries for quality of life, offering excellent healthcare, education, and social services. The country’s robust economy provides various career opportunities across different industries, from technology and finance to healthcare and education. For those living in Dubai, a move to Australia often means access to open green spaces, a balanced work-life environment, and a more laid-back lifestyle.

Employment Opportunities: Many individuals consider moving to Australia from Dubai due to the competitive job market. While Dubai is known for its tax-free salaries, Australia offers a more stable job environment and the possibility of permanent residency and eventual citizenship. Popular industries in Australia include mining, healthcare, education, IT, and construction, all of which are continuously seeking skilled professionals.

Education: Australia is home to some of the world’s best universities, attracting students from around the globe. If you’re moving with a family, your children will have access to top-tier education. Universities like the University of Melbourne, the University of Sydney, and the Australian National University are highly regarded internationally.

The Visa Process for Moving to Australia from Dubai

The first step in moving to Australia from Dubai is applying for the appropriate visa. Depending on your circumstances, different visa types are available:

Skilled Migration Visa: This visa is for individuals with skills that are in demand in Australia. The General Skilled Migration (GSM) program includes visas like the Skilled Independent Visa (subclass 189) and the Skilled Nominated Visa (subclass 190). You must pass a points-based test based on factors such as age, qualifications, work experience, and language proficiency.

Employer-Sponsored Visa: If you have a job offer from an Australian company, you may qualify for an employer-sponsored visa. The Temporary Skill Shortage Visa (subclass 482) and the Employer Nomination Scheme (subclass 186) are options for those with specific skill sets that match the Australian labor market’s needs.

Student Visa: If you or your children plan to study in Australia, the Student Visa (subclass 500) allows individuals to live in Australia for the duration of their study program. This visa also permits limited work rights, which can help cover living expenses.

Family Visa: If you have family members who are Australian citizens or permanent residents, they can sponsor your move. Visas such as the Partner Visa (subclass 820/801) and the Parent Visa (subclass 103) allow family reunification.

Costs of Moving to Australia from Dubai

One of the most important factors to consider when moving to Australia from Dubai is the cost. While Dubai offers tax-free salaries, the cost of living in Australia, especially in cities like Sydney and Melbourne, can be high. Here are some expenses to keep in mind:

Visa Fees: Depending on the type of visa you apply for, fees can range from AUD 4,000 to AUD 10,000 or more.

Housing: Rent in Australia varies significantly depending on the city and neighborhood. Sydney and Melbourne tend to be the most expensive, with average rent for a one-bedroom apartment ranging from AUD 1,800 to AUD 2,800 per month. Smaller cities like Adelaide and Perth offer more affordable options.

Healthcare: Australia has a robust healthcare system. Medicare, the public healthcare system, is available to Australian citizens and permanent residents, but it’s essential to consider private health insurance options if you are not yet a permanent resident.

Transport: Australia’s public transport system is efficient, with buses, trains, and trams in major cities. However, if you plan to buy a car, keep in mind that petrol prices, insurance, and registration fees will add to your costs.

Preparing for the Move

Moving to Australia from Dubai requires careful preparation. Here are some steps to help you get ready for your relocation:

Find a Job: If you’re moving for work, securing employment is one of the most critical steps. Research the job market in your field, and use platforms like LinkedIn, Seek, and Indeed to find job opportunities in Australia. Having a job offer can also strengthen your visa application.

Accommodation: It’s a good idea to secure temporary accommodation before arriving in Australia, such as renting an Airbnb or staying in a serviced apartment. This will give you time to explore neighborhoods and decide where you want to live long-term.

Shipping and Moving: International shipping can be expensive, so consider whether it’s worth bringing all your belongings or starting fresh in Australia. Many people moving from Dubai opt to sell their furniture and large items, bringing only essentials with them.

Banking and Finances: Set up an Australian bank account before you arrive to make the financial transition smoother. Banks like Commonwealth Bank, Westpac, and ANZ offer accounts specifically for newcomers to Australia.

Healthcare: Look into your healthcare options and determine whether you need private health insurance. While public healthcare is excellent, there may be waiting periods for non-urgent procedures.

Legal Requirements: Ensure that you have all the necessary documents in order, such as your visa, work contracts, and any educational qualifications. Also, familiarize yourself with Australia’s customs regulations to avoid any issues when bringing personal belongings into the country.

Life in Australia

Once you’ve moved to Australia from Dubai, adapting to the Australian way of life will be the next big step. Australians are known for their friendly and welcoming nature, and you’ll find it relatively easy to integrate into local communities.

Climate: Australia’s climate varies from region to region. While Dubai is known for its hot desert climate, Australia offers more diversity. Coastal cities like Sydney and Brisbane have a temperate climate, while cities like Melbourne experience cooler winters.

Work-Life Balance: Australians value work-life balance, and most workplaces encourage taking time off and maintaining a healthy balance between work and leisure. This might be a big change for those coming from Dubai, where long working hours are common.

Outdoor Lifestyle: Australia is famous for its outdoor lifestyle. Whether it’s relaxing on the beach, hiking in national parks, or engaging in sports, Australians enjoy spending time outdoors. This is a refreshing change for many expats moving from the urbanized lifestyle of Dubai.

Conclusion

Moving to Australia from Dubai is a significant life decision that comes with its challenges and rewards. The visa process, job market, and cost of living are crucial factors to consider before making the move. However, with careful planning and preparation, Australia offers an excellent opportunity for a better quality of life, career progression, and a welcoming environment for families and individuals alike. If you're considering this move, now is the time to explore your options and start the process of transforming your dream into reality.

0 notes

Text

Looking for the Best Mortgage Broker in Perth?

Finding the right mortgage broker can make all the difference when it comes to securing your dream home. At Index Finance, we pride ourselves on being one of the best mortgage brokers in Perth, offering personalized advice and solutions tailored to your financial situation. Whether you're a first-time homebuyer or looking to refinance, our experienced team is here to guide you every step of the way.

Not sure where to start? If you've been searching for a "mortgage broker near me," look no further! We specialize in making the process stress-free and transparent, ensuring you get the best rates and options available.

Why choose us?

Personalized service to match your needs

Competitive rates and trusted advice

Clear communication, so you're always informed

Get in touch with us today and let Index Finance be your partner in achieving your homeownership dreams!

#MortgageBrokerInPerth #BestMortgageBrokersInPerth #MortgageBrokerNearMe #HomeLoans #IndexFinance

#finance broker#finance broker perth#mortage broker#home loan broker#index finance#home loan broker near me

0 notes

Text

Is a Novated Lease Worth It for High-Income Earners?

Is a Novated Lease Worth It for High-Income Earners?

As high-income earners seek to optimise their financial strategies, novated leasing emerges as a compelling option, especially for those eyeing the latest electric vehicles (EVs). But is a novated lease worth it for high-income earners? Let's delve into the benefits and considerations of novated leasing, particularly in the context of electric vehicles in Australia.

Understanding Novated Leasing

What is a novated lease? In simple terms, a novated lease is a three-way agreement between an employer, an employee, and a finance company. It allows employees to lease a vehicle using their pre-tax salary, which can result in significant tax savings. This arrangement, known as salary packaging, bundles vehicle-related expenses such as registration, insurance, and maintenance into one manageable payment.

The Financial Benefits for High-Income Earners

Tax Savings: One of the most significant advantages of novated leasing is the potential for tax savings. By using pre-tax dollars to pay for the lease, high-income earners can reduce their taxable income, leading to substantial tax benefits. This can make a novated lease a financially savvy choice, particularly for those in higher tax brackets.

Cost Efficiency: With all vehicle-related expenses included in the lease payments, high-income earners can enjoy the convenience of predictable, all-inclusive payments. This cost efficiency can simplify budgeting and reduce the financial burden of unexpected vehicle expenses.

Access to Premium Vehicles: Novated leasing provides an opportunity to drive high-end vehicles in a more cost effective way. For instance, a BMW novated lease or a Mercedes-Benz novated lease allows high-income earners to enjoy the benefits of the latest electric vehicles without the hefty upfront cost.

The Appeal of Electric Vehicles (EVs)

Environmental Impact: Electric vehicles are an attractive option for those looking to reduce their carbon footprint. With the growing focus on sustainability, an EV novated lease aligns with the values of environmentally conscious high-income earners.

Government Incentives: In Australia, there are various incentives and rebates available for electric vehicles across the states, making an EV novated lease even more appealing. The biggest is government incentive is no FBT on EVs under the Luxury Car Tax threshold. These incentives can further reduce the overall cost of leasing an electric car.

Lower Operating Costs: Electric vehicles typically have lower operating costs compared to traditional petrol or diesel cars. Reduced fuel costs and lower maintenance expenses can make a significant difference over the lease term, adding to the financial benefits of a novated lease.

Using the Novated Leasing Calculator

To determine if a novated lease is worth it, high-income earners can use a novated leasing calculator. This tool provides a clear picture of the potential savings and costs associated with a novated lease. By inputting details such as salary, vehicle choice, and lease term, users can get an accurate estimate of their financial benefits.

Practical Considerations

Flexibility: Novated leasing offers flexibility in terms of vehicle choice and lease terms. High-income earners can select from a wide range of vehicles, including the latest electric models. Lease terms can be tailored to suit individual needs, typically ranging from one to five years.

Nationwide Availability: Novated leasing is available across Australia, with providers like Carbon Leasing & Rentals offering services in major cities including Perth, Melbourne, Brisbane, Adelaide, Sydney & Canberra. This accessibility ensures that high-income earners can take advantage of novated leasing regardless of their location.

Is Novated Leasing Worth It?

For high-income earners, a novated lease can be a highly beneficial financial strategy. The combination of tax savings, cost efficiency, and access to premium electric vehicles makes novated leasing an attractive option. By using tools like the novated leasing calculator and exploring options from reputable providers such as Carbon Leasing & Rentals, high-income earners can make informed decisions that align with their financial goals and lifestyle preferences.

In conclusion, a novated lease is worth considering for high-income earners, especially those interested in electric vehicles. The financial advantages, environmental benefits, and flexibility of novated leasing make it a compelling choice. By leveraging the benefits of novated leasing in Australia, high-income earners can drive their dream electric car while optimizing their financial strategy.

Luxury Car Tax (LCT) and Luxury Car Adjustment (LCA):

The LCT and LCA are separate amounts.

Luxury Car Tax (LCT) – There is no LCT included in the purchase of your vehicle and falls under the threshold therefore your vehicle is eligible for the FBT exemption What is it? A federal tax levied on cars with a value exceeding a certain threshold. The threshold varies depending on the car's fuel efficiency. Who pays for it? The consumer purchasing the luxury car pays this tax at the point of sale. What is its purpose? Primarily a revenue-raising measure for the government. What is the threshold? For the financial year 2024-25, the LCT threshold for fuel-efficient vehicles is $91,387.00 For all other luxury vehicles, the threshold is $80,567.

Luxury Car Adjustment (LCA)

What is it? A calculation used in novated leasing arrangements when the value of a car exceeds the luxury car depreciation limit (currently $69,674 for the 2024 financial year). Who it affects? Employers who offer novated leases on luxury cars. What is its purpose? To compensate employers for the reduced tax deductions they can claim on luxury cars. Because employers can only claim deductions up to the depreciation limit, the LCA ensures they are not financially disadvantaged. How does it work? The LCA is typically calculated for the full lease term and spread evenly over the lease period.

Whether you're considering a Tesla novated lease, a BMW novated lease, or exploring other electric vehicle options, a novated lease could be the key to combining luxury and sustainability in your driving experience. And for those with a taste for high-end models, consider leasing premium vehicles like the BMW iX1, BMW iX3, Kia EV9, Mercedes-Benz EQB 250 or other higher-priced options through CarBon Leasing & Rentals, ensuring you drive in style and comfort while enjoying the benefits of electric vehicle leasing in Australia. Try our online calculator and get a free quote.

0 notes