#Fasal Bima Yojana Form

Explore tagged Tumblr posts

Text

Empowering Indian Agriculture: The Significance of Crop Insurance in a Vibrant Landscape

India, with its diverse agro-climatic zones and millions dependent on agriculture, faces the ever-present challenge of ensuring food security amidst unpredictable weather patterns. In this dynamic scenario, crop insurance in India emerges as a crucial tool, not just for individual farmers but for the resilience of the entire agricultural ecosystem.

Understanding the Landscape:

Agriculture in India: The Backbone of the Economy:

Agriculture employs a significant portion of India’s population and forms the backbone of the nation’s economy. The livelihoods of millions are intricately tied to the success of their crops.

Vulnerabilities in Indian Agriculture:

India, with its diverse geography, is prone to a variety of risks, including monsoon variability, cyclones, and pests. These uncertainties make the need for a robust risk management system imperative.

Crop Insurance Programs in India:

Pradhan Mantri Fasal Bima Yojana (PMFBY):

Role of Government Support:

The Indian government actively supports crop insurance through subsidies, making it accessible for farmers across the country. The integration of technology, like satellite imagery, further enhances the accuracy of assessments and claims.

Challenges Faced by Crop Insurance in India:

Despite its importance, crop insurance faces challenges such as low awareness, delayed claim settlements, and the need for improved infrastructure. Addressing these challenges is key to maximizing the benefits of these programs.

Opportunities for Improvement:

Embracing technology, increasing awareness through outreach programs, and enhancing the efficiency of the claims process present significant opportunities for further strengthening crop insurance in India.

Contributing to Sustainable Practices:

Crop insurance can play a pivotal role in encouraging Indian farmers to adopt sustainable agricultural practices. With financial security, farmers are more likely to invest in techniques that promote long-term soil health and environmental sustainability.

Conclusion:

In the vast fields of Indian agriculture, crop insurance stands as a beacon of support, offering a safety net against the uncertainties that farmers face. As India strives for agricultural sustainability and food security, the continued evolution and effective implementation of crop insurance programs are not just policies; they are investments in the resilience and prosperity of the nation’s agricultural landscape.

Share this:

0 notes

Text

Top 5 Central Government Scheme For Farmers

Farming is an important sector in India, and the Central Government has introduced several schemes to support farmers and improve their livelihood. These schemes aim to provide financial assistance, agricultural inputs, and other resources to farmers to boost their production and income. In this article, we will discuss the top 5 Central Government schemes for farmers in India.

Pradhan Mantri Fasal Bima Yojana:

The Pradhan Mantri Fasal Bima Yojana (PMFBY) is a crop insurance scheme launched by the Government of India to provide financial support to farmers in case of crop failure due to natural calamities, pests, or diseases. This scheme was launched in 2016 and has since then benefited millions of farmers across the country. Under this scheme, farmers are required to pay a nominal premium, and the rest of the cost is borne by the government. The scheme covers all crops and is available to all farmers who have taken a crop loan or not. PMFBY aims to provide risk management in agriculture and help farmers manage their agricultural risks.

Pradhan Mantri Krishi Sinchai Yojana:

The Pradhan Mantri Krishi Sinchai Yojana (PMKSY) is an irrigation scheme launched by the Government of India in 2015 to provide water to every agricultural field and improve farm productivity. The scheme aims to achieve convergence of investments in irrigation at the field level, expand cultivable area under assured irrigation, and improve on-farm water use efficiency. The scheme also aims to promote sustainable water conservation practices among farmers. PMKSY focuses on creating new irrigation infrastructure and maintaining the existing ones.

National Agriculture Market:

The National Agriculture Market (eNAM) is an online trading platform launched by the Government of India to connect farmers with traders and buyers across the country. eNAM aims to create a unified national market for agricultural commodities by integrating existing Agricultural Produce Market Committee (APMC) markets. This platform provides transparent price discovery and better price realization to farmers. eNAM also helps farmers in selling their products at a competitive price without intermediaries.

Pradhan Mantri Kisan Samman Nidhi Yojana:

The Pradhan Mantri Kisan Samman Nidhi Yojana (PM-Kisan) is a scheme launched by the Government of India in 2019 to provide direct income support to farmers. Under this scheme, small and marginal farmers with less than two hectares of land are eligible to receive income support of Rs 6,000 per year. The scheme aims to provide financial assistance to farmers for meeting their various needs such as purchasing seeds, fertilizers, and other inputs. The scheme is entirely funded by the Central Government and is credited directly into the bank accounts of the beneficiaries.

Paramparagat Krishi Vikas Yojana:

The Paramparagat Krishi Vikas Yojana (PKVY) is a scheme launched by the Government of India in 2015 to promote organic farming in the country. The scheme aims to encourage farmers to adopt eco-friendly and sustainable practices for improving soil health and increasing farm productivity. Under this scheme, farmers are encouraged to form groups and take up organic farming. The government provides financial assistance to these groups for inputs such as bio-fertilizers, bio-pesticides, vermicompost, and other organic inputs. PKVY also provides support for terrace farming and other innovative farming practices.

The government of India has launched various schemes for the welfare of farmers, and these schemes have played a crucial role in the growth and development of the agriculture sector. The schemes mentioned above aim to promote farming activities, enhance crop productivity, and protect the income of farmers from agricultural risks. The schemes also offer several benefits to farmers such as providing financial assistance, promoting the use of modern technologies, and enhancing farming analytics.

It is important to note that these schemes are designed to help farmers, and it is the responsibility of the government to ensure that the benefits reach the targeted audience. It is also essential for farmers to be aware of these schemes and take advantage of them to improve their livelihoods.

Overall, these central government schemes for farmers have been successful in supporting the growth and development of the agriculture sector in India, and they continue to play a significant role in promoting the welfare of farmers in the country.

1 note

·

View note

Link

#प्रधानमंत्री फसल बीमा योजना#pm fasal bima yojana#pradhan mantri fasal bima yojana#fasal bima yojana#Apply Online Fasal Bima Yojana#Fasal Bima Yojana Form#Fasal Bima Yojana Form Download#PMFBY#PMFBY Scheme

1 note

·

View note

Link

हमारे देश के प्रधानमंत्री नरेंद मोदी जी द्वारा फसल बीमा योजना का आरम्भ किया गया है यह योजना हमारे देश के किसान भाइयों के लिए निकाली गई है। हमारे देश के किसानों की फसल में जो नुकसान हुआ है PM Fasal Bima Yojana के द्वारा भारतीय कृषि बीमा कंपनी में प्रत्येक आपदाओं के कारण ख़राब हुई फसलों की बीमा किसानों के सीधे बैंक अकाउंट भेज दी जाएगी।

0 notes

Text

Rajkotupdates.News: Tax Saving PF FD and Insurance Tax Relief 2022

Rajkotupdates.News: Tax Saving PF FD and Insurance Tax Relief 2022

The government of India has announced a series of tax related measures in the form of the Pradhan Mantri Fasal Bima Yojana (PMFBY) and the Pradhan Mantri Garib Kalyan Yojana (PMGKY). The PMFBY aims to provide financial assistance to lower income households, while the PMGKY aims to provide relief from various taxes. In this article, we will be discussing the tax saving benefits associated with…

View On WordPress

#income tax updates#Rajkotupdates.News: Tax Saving PF FD and Insurance Tax Relief 2022#tax news#what is Rajkotupdates.News: Tax Saving PF FD and Insurance Tax Relief 2022

0 notes

Link

Pradhan Mantri Fasal Bima Yojana - PMFBY Login | Prime Minister Crop Insurance Scheme. PM Fasal Bima Yojana Apply Online Registration Form.

0 notes

Text

(Registration) प्रधानमंत्री कृषि बीमा योजना 2022 | pradhan mantri fasal bima yojana (PMFBY)

https://www.mpsarkariyojana.com/pradhanmantri-krishi-bima-yojana-2022/

0 notes

Link

pm fasal bima yojana, fasal bima yojana, crop insurance, beema yojna, pardhanmantri bima yojna, pmfby portal, pmfby login, प्रधानमंत्री फसल बीमा योजना, crop insurance beneficiary list 2020, pradhan mantri fasal bima yojana list, fasal bima online, फसल बीमा, pmfby status, kharif fasal, fasal bima yojana bihar, pm fasal bima yojana 2020, pradhan mantri fasal bima yojana 2020, pradhanmantri fasal bima yojana 2019, pradhan mantri fasal bima yojana form pdf 2020. bihar fasal bima yojana, pm fasal bima yojana upsc, pradhan mantri fasal bima yojana online registration

0 notes

Text

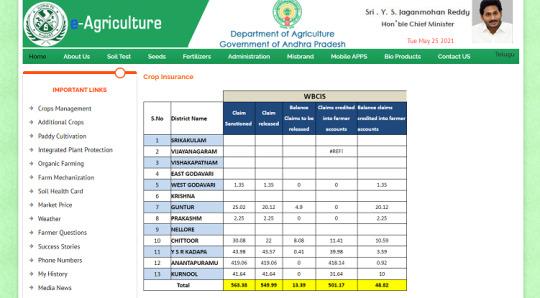

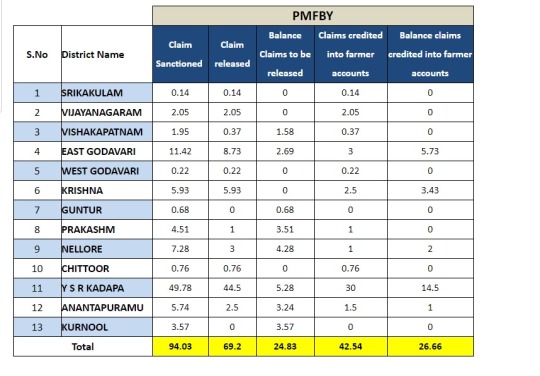

YSR Free Crop Insurance list 2021~Status! Farmers Beneficiary list

YSR Uchitha Panta Claim Online 2021 | YSR Kharif Farmer List 2021 | YSR Crop Insurance List 2021 | Jagananna Free Crop Insurance List 2021 | YSR Free Crop Insurance Claim 2021 | YSR Crop Insurance Kharif Status 2021 As per the election manifesto, YS Congress committed to farmers' (rythu) development and enhance farmer family income. Therefore YSR Government recently implementing all schemes one after the other. Recently the State Government of Andhra Pradesh introduced Free Crop Insurance Scheme. Desire candidates can be applied, check scheme status, and pathakam jabita on the official website of the concerned department.

YSR Crop Insurance beneficiary list 2021 pdf

Read this article carefully to know about How to apply for Crop Insurance Scheme in AP, eligibility criteria, scheme status, and Free Crop Insurance Scheme Sanction List 2021 district-wise.

YSR Free Crop Insurance Scheme ఆంధ్రప్రదేశ్ ఉచిత పంట బీమా పథకం జాబితా మరియు స్థితి ఆన్లైన్. Under this scheme, the State Govt will provide Crop Insurance. Check AP e-panta List 2021 or AP e-panta Status online. Around 9.48 lakh farmers will get benefits under this scheme. So you can check payment or amount status by login on the official portal. AP Uchitam Panta Bheema Status 2021 by district wise. Check latest updates related Free Panta Bheema List or beneficiary list from time to time. The State Govt of AP committed to providing crop insurance to all farmers. If their crop destroys due to climatic conditions. YSR Rythu Bharosa Status 2021 PMFBY Status AP - PM Fasal Bima Scheme YSR Electricity Cash Transfer Scheme for Farmers Dear friends, Interested cum eligible candidates can apply online for the same and you can check the scheme beneficiary list as available by AP Govt. Check AP Uchitha Panta Bheema List 2021 As per launching the Uchitam Panta Bheema Pathakam, AP CM said, In previous time, they were made to pay part of the premium, with the State & Central Govt contributing the remaining amount. However, the Government not used to pursue insurance claims in times of distress. It takes a long time to settle claims. So to resolve this problem Govt has taken up the issue to benefit Rythus and process the claim in fast-track mode, besides paying the entire premium on behalf of farmers. Scheme Free Crop Insurance Scheme Department Agriculture, Horticulture, Revenue Department Under State Government of Andhra Pradesh List Jagananna Free Crop Insurance List 2021 Status Jagananna Free Crop Insurance Status 2021 Official website e-panta Check online YSR Crop Insurance Claim Status 2021 Beneficiaries Rythu (more than 9.48 lakh) Now details about the Free Crop Insurance scheme are available online. Farmers (Rythu) no need to visit the concerned department. - PM Kisan 10th Installment List 2021 - PM Kisan FPO Registration 2021 - New PM Kisan Yojana Correction Form 2021 AP Uchitha Panta Bheema Sanction List 2021 About AP Farmer Free Crop Insurance Scheme - - The recently announced crop insurance scheme is a free scheme without paying any premium by the farmers. - The Govt will pay 1252 Crore insurance to approx 9.48 lakh farmers - For the farmer who lost their crop in the previous time, the Scheme has been implemented with the help of e-Cropping. - Around 46 lakh hectares of land are covered under this scheme. - Rythus can check beneficiary list details by visiting the Rythu Bharosa Kendras (RBK). - It also mentioned that the recent Nivar Cyclone caused crop loss enumeration in completed, the compensation would be paid by Dec 31. Andhra Pradesh state one of the largest states of India and more than 60% population depends on Agriculture. The state is also known as Rice Bowl India. Therefore the Government committed to enhancing farmers' income and making them financially strong. - PM Krishi Sinchai Yojana Apply - NREGA Job Card Application Form 2021 YSR Free Crop Insurance Claim Status 2021 How to check AP Kharif Crop Insurance Beneficiary List 2021? - The eligible beneficiaries already registered their crop as well as land e-panta or e-crop app of Andhra Pradesh state. For more details visit the e-panta or Download the app from the google play store. or Visit the Official Website of AP Agriculture Department.

e-Panta Crop Insurance Scheme - You can check the beneficiaries list by visiting the nearest RBK (Rythu Bharosa Kendram) after announced by State Government.

YSR Crop Insurance Claim Status 2021

PMFBY Cliam Status AP - Govt displays the details of affected crops and compensation details at RBKs. For any discrepancies, you can contact at nearest RBK. We like to inform you that farmers not required to apply for this scheme. All farmers already registered their details on e-panta. Compensation amount directly transferred to the account of beneficiaries. Jagananna Crop Insurance Claim Status district-wise - Kurnool, Anantapur, YSR Kadapa, Chittoor, Nellore, Prakasam, Krishna, West Godavari, East Godavari, Srikakulam, Vizianagaram, Vishakhapatnam. YSR Panta Bheema Status 2021 online. How to Check Status of Free Crop Insurance Scheme? As already discussed you may visit the neared Rythu Bharosa Kendra to check crop Insurance scheme status.

e-Agriculture Andhra Pradesh What if my name not displayed in the beneficiaries list displayed ar RBK? Farmers can raise their concerns at Grama Ward Sachivalayams or RBK if the name not displayed in the list. Read the full article

0 notes

Link

0 notes

Text

Note on drought hit farmers.

Pradhan Mantri Fasal Bima Yojana (PMDBY) helped lakhs of farmers in TN alone but why other sets of farmers aren’t get benefitted? Whom to blame? Govt. officials or Politicians or Scheme? Let’s have a detailed analysis of how PMDBY work.

Pradhan Mantri Fasal Bima Yojana

Famers continue to be saddled with the loses they incurred during 2016-1017 drought, remains in them. 55% of farmers are yet to get compensation amount benefited from the above-mentioned scheme, which is likely to set close for this year by Nov 30. The great PMDBY scheme is introduced by our Prime Minister NARENDRA MODI, to put some money into farmers pocket claimed by insurance, and to integrate stakeholders, farmers, insurance companies, financial institutions, and govt. agencies on a single platform for better administration and transparency. But farmers have expressed their disenchantment in the implementation of the scheme and coordination among officials. 15.67 lakh people have enrolled and only 6.55 lakh farmers got crop insurance compensation till now.

Implementation flaws

Farmers claim their crop insurance either through direct payment to insurance companies or through banks. Bank staffs are being blamed for the delay in forwarding the claims and other (Revenue and Agriculture department staff) have bungled in listing entries properly, say farmers.

Claim percentages were different in many cases. A farmer belongs to Nagapattinam district was sanctioned just 35.31% were other farmers in the same district granted 76.55%.

Officials have bungled with village names as well. They have sanctioned 29.27% to Aruvapadi village in Mayiladuthurai block instead of Arupathy village in Sembanar Koil block, creating confusions among farmers and there is a delay again. When enquired, insurance companies blamed Revenue, Agricultural departments while bankers tried to blame insurance firms. Farmers can proceed to next set of agricultural needs only with that compensated amount, and they need to wait till that confusion among officials clear. This is what exactly happens.

Thanjavur district collector wrote a letter to Deputy General Manager of New India Assurance Company Limited, claiming, 90 farmers from Kollukkadu village in Peravurani block had been granted 19.51%, which was the figure specified for another Kollukkadu village in Sethubavachatram block instead of original 62.12 percentage. Again a confusion made by insurance firms this time. None of the banana growers across the state has yet been compensated through insurance.

The scheme which was intended to help farmers is been disliked by many farmers itself because of bungling by officials and lack of coordination among them. They evolved the scheme but didn’t create adequate awareness among officials. - S Ranganathan, general secretary, TamilNadu Cauvery Delta Farmers Welfare Association.

Official response

₹2510 crore has been sanctioned by insurance companies for 7.14 lakh paddy farmers for 2016-17 compensation claims and ₹2196 crore has been deposited in 6.55 lakh accounts of farmers and claimed TN stood first in claim compensation. Also, insurance companies are instructed to check their mistakes and settle the amounts as expeditiously as possible.

Concluding with my ideas

Private insurance companies not be allowed to play in the sector. Apart from Agricultural Insurance Company of India Limited, which comes under Union Ministry of Agriculture, there are two private players in TamilNadu.

Govt. should create awareness among officials and explain the most need of agricultural activities needed for day to day life.

This clearly shows how govt. officials are working. Strict actions should be taken among officials and govt. can form a special team to supervise the officials working in this category.

We can make farmers aware of this scheme and you can get them benefitted. Every scheme is successful only when concerned people can make use of it.

Reference: The Hindu, dated 26 Nov 2017.

Image source: Internet

#pmdby#pradhan mantri fasal bima yojana#tnfarmers#farmers#drought#droughhitfarmers#governmentofficials#bjp

1 note

·

View note

Text

प्रधानमंत्री फसल बीमा योजना

प्रधानमंत्री फसल बीमा योजना

प्रधानमंत्री फसल बीमा योजना की पूरी जानकारी दीजिए?

प्रधानमत्री फसल बीमा योजना क्या हैं? इसमे बीमा प्रक्रिया कैसे होती है और यह किस प्रकार से किसानों के लिये फायदे मंद है| फसल बीमा योजना के लिए कौन Apply कर सकता है, इससे जुडी पूरी जानकारी हिंदी में दीजिए|

प्रधानमंत्री फसल बीमा योजना

सरकार ने 18 फरवरी 2016 से प्रधानमंत्री फसल बीमा योजना की शुरुवात की है| जिसके तहत किसानो की फसल का बीमा कि��ा जाएगा,…

View On WordPress

#19]#22#30]#agriculture#agriculture definition#agriculture machine#agriulture#bima#farmers#fasal#form#goverments#kaise#narendra modi#online apply#pmfby#pradhan mantri fasal bima yojana#russia#yojana#प्रधानमंत्री फसल बीमा योजना mp

0 notes

Text

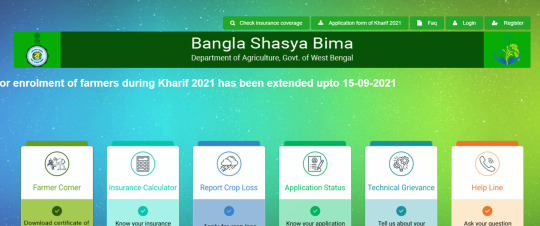

Bangla Shasya Bima Status 2021 Check: Shasya Bima list pdf

Bangla Shasya Bima List 2021 | Bangla Shasya Bima Status 2021 | WB Crop Insurance Status 2021 | Bangla Shasya Bima Application Status 2021 | Bangla Shasya Bima Amount Status 2021 West Bengal Crop Insurance scheme introduced by the State Government of WB. You can check Crop Insurance Status in WB by visiting the official portal of the Concerned Department. You can check list and status by using Voter ID, Aadhaar Card. Under this scheme many farmers registered online. Now they can check latest updates regarding scheme. Through, which they can get application process, beneficiary list district wise, Crop Insurance amount, and others.

Bangla Shasya Bima Status 2021

The motive behind this scheme to provide crop insurance to the farmers. So, that will get financial assistance when their crop destroy due to weather conditions, and other circumstances. Therefore, the farmers of the West Bengal state have not faced financial crisis during crucial time. The scheme successfully run under the eagle eyes of the Department of Agriculture, West Bengal.

WB Crop Insurance Scheme 2021 The eligible farmers can apply online for this scheme. This scheme is to give crop insurance covers to the Krishaks of WB state. The complete process available online, so that farmers can easily apply through official web portal and also get scheme updates from time to time. In article, we providing you with details related Shasya Bima Yojana West Bengal. - HIDCO Lottery Result 2021 - Jai Bangla Pension Scheme Form - WB Krishak Bandhu Form 2021 - PM Fasal Bima Yojana Form Bangla Shasya Bima List 2021 pdf Especially, this prakalpa available for Kharif season crops. The prime motive behind this scheme is to provide all possible helps to the farmers, increase farmers income, and to save farmers from the clutches of heavy interest debt. As we know agriculture is the main source of income in our country, especially in rural area. They face financial crises sometime, when their crop is lost due to bad weather and other circumstances. Scheme Bangla Shasya Bima Prokalpa Department Department of Agriculture Under State Government of West Bengal Beneficiaries Farmers List Bangla Shasya Bima List 2021 Official Portal Check online WB Crop Insurance Amount Status 2021 The prime benefit of this scheme is the Govt of WB will pay the premium amount of insurance for farmers. This scheme only for the farmers of the State. Insurance amount will distribute in four steps. The scheme also supervised by the AIC (Agriculture Insurance Company of India). Crop insurance will be based on hectare. So that, farmers of the state defiantly empowered. WB Crop Insurance Farmers List 2021 Crops covered under this scheme - - Jute - Maize - Wheat - Aman Paddy - Bajra - Oilseeds - Cereals, Pulses, Millets, - Commercial/horticulture crops. Bangla Shasya Bima Talika district wise - Hooghly Dakshin Dinajpur Purba Bardhaman Purba Medinipur South 24 Parganas Darjeeling Purulia North 24 Parganas Paschim Bardhhaman Murshidabad Birbhum Kalimpong Cooch Behar Malda Nadia Bangla Shasya Claim Form 2021 - Claim will provide if losses were caused due to bad weather conditions. losses suffered due to planting, during cultivation losses covered. After cutting of crops, losses occurred within period of post cutting. Farmer corner, Insurance calculator, Report Crop Loss, Application Status, Technical Grievance, Helpline. These Services are available online on the official portal. - PM Krishi Sinchai Yojana Form 2021 - PM Kisan Yojana List 2021 New - Didi ke Bolo Phone Number - Chaa Sundari Scheme Form Bangla Shasya Bima Talika 2021 How to check Bangla Shasya Bima Status online? - All eligible candidates are advised to visit the official portal of the banglashasyabima.net

Bangla Shasya Bima Status 2021 - After that homepage will open, you have to click on application status to check your application accepted or rejected. - To report your crop loss you have to click on Report crop loss link. Fill in the asked details. - Also get more updates regarding scheme like insurance calculator, various forms by visiting the official home page. For a query about insurance claims you can contact on - 1800-572-0258, you can contact in between 10 am to 6 pm. District helpline number - 8336857181, 8373094077, 8336900632. email ID - [email protected] The farmers will get beneficiary amount very easily through DBT process. So get all new updates related schemes by visiting the given official link. Stick around this page to know about various schemes under the West Bengal Government and the Central Government. If you have any queries, just write in the comment box. Read the full article

0 notes

Text

Union Budget 2019-20: An Analysis

There are several welcome steps announced in the Union Budget 2019. The government’s intent to focus on infrastructure spending with emphasis on digital economy and job creation are significant announcements. The cornerstone of Budget 2019 lies in aspirations of a new India becoming a $5 trillion economy over the next few years. Key pillars on the roadmap to becoming so include ensuring an accelerated economic development and related job creation. One of key factors in achieving this goal will be developing India’s talent pool to meet requirements of various sectors. Infrastructure development across the country in road, highways, railways, port, housing, water management and tourism were called out as contributors to this vision.

The Numbers

Budget 2019-20 reflects the Government’s firm commitment to substantially boost investment in Agriculture, Social Sector, Education and Health. This is substantiated by increase in expenditure of Rs 3,29,114 crores over RE (2018-19) while keeping the fiscal deficit at 3.3% of GDP.

The government is estimated to spend Rs 27,86,349 crore during 2019-20. This is 13.4% more the revised estimate of 2018-19. Out of the total expenditure, revenue expenditure is estimated to be Rs 24,47,780 crore (14.3% growth) and capital expenditure is estimated to be Rs 3,38,569 crore (6.9% growth).

The government receipts (excluding borrowings) are estimated to be Rs 20,82,589 crore, an increase of 14.2% over the revised estimates of 2018-19. The gap between these receipts and the expenditure will be plugged by borrowings, budgeted to be Rs 7,03,760 crore, an increase of 10.9% over the revised estimate of 2018-19.

The central government will transfer Rs 13,29,428 crore to states and union territories in 2019-20. This is an increase of 6.6% over the revised estimates of 2018-19 and includes devolution of (i) Rs 8,09,133 crore to states, out of the centre’s share of taxes, and (ii) Rs 5,20,295 crore in the form of grants and loans.

Revenue deficit is targeted at 2.3% of GDP, and fiscal deficit is targeted at 3.3% of GDP in 2019-20. The target for primary deficit (which is fiscal deficit excluding interest payments) is 0.2% of GDP.

The nominal GDP is estimated to grow at a rate of 12% in 2019-20. The estimated nominal GDP growth rate for 2018-19 is 11.5%.

Over the past 15 years, the government has largely been able to keep the deficits below budgeted levels. In 2018-19, the government is expected to breach its budgeted target of fiscal deficit of 3.3% of GDP, as the fiscal deficit is expected to be 3.4%. Under the FRBM Act, 2003, the three-year target (2021-22) for fiscal and revenue deficits have been set at 3% and 1.5%, respectively.

In 2018-19, the government had set a budget estimate of 3% for fiscal deficit, and 2.2% for revenue deficit. As per revised estimates, fiscal deficit has slightly exceeded the 2018-19 budget target.

Outstanding debt is the accumulation of borrowings over the years. A higher debt implies that the government has a higher loan repayment obligation over the years.

Total outstanding liabilities of the government have decreased from 5% of the GDP in 2000-01 to 48.4% in 2018-19 (revised estimates). In 2019-20, the outstanding debt is expected to be at 48% of GDP. The FRBM Act sets a target of 40% debt to GDP to be met by 2024-25.

Subsidies

In 2019-20, the total expenditure on subsidies is estimated to increase to Rs 3,38,949 crore (13.3%) over the revised estimate of 2018-19. This is owing to an increase in expenditure on petroleum, fertiliser, food, and other interest subsidies. Details are given below:

Food subsidy: Allocation for food subsidy is estimated at Rs 1,84,220 crore in 2019-20, a 7.5% increase as compared to the revised estimate of 2018-19. In 2018-19 budget, Rs 1,69,323 crore was allocated for food subsidy, however, the revised estimate is higher than the budgeted estimate by Rs 1,975 crore. The revised estimate for 2018-19 is 71% higher than the expenditure on food subsidy in 2017-18.

Fertiliser subsidy: Expenditure on fertiliser subsidy is estimated at Rs 79,996 crore in 2019-20. This is estimated to increase by Rs 9,910 crore (1%) over revised estimate of 2018-19. Allocation to the subsidy in 2019-20 budget is Rs 5,010 crore higher than the allocation made in 2019-20 interim budget.

Petroleum subsidy: Expenditure on petroleum subsidy is estimated to increase by Rs 12,645 crore (9%) in 2019-20. Petroleum subsidy consists of subsidy on LPG (Rs 32,989 crore) and kerosene subsidy (Rs 4,489 crore). The increase in allocation in 2019-20 is owing to an increase in LPG subsidy of Rs 12,706 crore (62.6%) from 2018-19 revised estimates.

Other subsidies: Expenditure on other subsidies includes interest subsidies for various government schemes, subsidies for the price support scheme for agricultural produce, import of pulses, and assistance to state agencies for procurement, among others. In 2019-20, the expenditure on these other subsidies has increased by Rs 4,251 crore (9%) over the revised estimate of 2018-19. Table 4 provides details of subsidies in 2019-20.

Subsidies in 2019-20 (Rs crore)

Actuals 2017-18 Budgeted 2018-19 Revised 2018-19 Budgeted

2019-20

% change (RE 2018-19 to BE 2019-20) Food subsidy 1,00,282 1,69,323 1,71,298 1,84,220 7.5% Fertiliser subsidy 66,468 70,090 70,086 79,996 14.1% Petroleum subsidy 24,460 24,933 24,833 37,478 50.9% Other subsidies 33,245 31,161 33,004 37,255 12.9% Total 2,24,455 2,95,507 2,99,221 3,38,949 13.3%

Sources: Expenditure Profile, Union Budget 2019-20; PRS.

Expenditure by Ministries

The ministries with the 13 highest allocations account for 55% of the estimated total expenditure in 2019-20. Of these, the Ministry of Defence has the highest allocation in 2019-20, at Rs 4,31,011 crore (including pensions). It accounts for 15% of the total budgeted expenditure of the central government. Other Ministries with high allocations include: (i) Ministry of Consumer Affairs, Food and Public Distribution, (ii) Agriculture and Farmers’ Welfare, (iii) Rural Development, (iv) Home Affairs, and (v) Human Resource Development. Table 5 shows the expenditure on Ministries with the 13 highest allocations for 2019-20 and the changes in allocation as compared to the revised estimate of 2018-19.

Ministry-wise expenditure in 2019-20 (Rs crore)

Actuals 2017-18 Budgeted 2018-19 Revised 2018-19 Budgeted

2019-20

% change (RE 2018-19 to BE 2019-20) Defence 3,79,702 4,04,365 4,05,194 4,31,011 6.4% Consumer Affairs, Food and Public Distribution 1,09,578 1,75,944 1,79,655 1,94,513 8.3% Agriculture and Farmers’ Welfare 44,340 54,500 75,753 1,38,564 82.9% Rural Development 1,10,333 1,14,915 1,14,400 1,19,874 4.8% Home Affairs 1,01,763 1,07,573 1,13,167 1,19,025 5.2% Human Resource Development 80,215 85,010 83,626 94,854 13.4% Road Transport and Highways 61,015 71,000 78,626 83,016 5.6% Chemicals and Fertilisers 67,158 70,587 70,684 80,534 13.9% Railways 45,231 55,088 55,135 68,019 23.4% Health and Family Welfare 53,114 54,600 56,045 64,559 15.2% Housing and Urban Affairs 40,061 41,765 42,965 48,032 11.8% Petroleum and Natural Gas 33,192 31,101 32,465 42,901 32.1% Communications 36,979 39,551 32,654 38,637 18.3% Other Ministries 9,79,292 11,36,214 11,16,867 12,62,810 13.1% Total Expenditure 21,41,973 24,42,213 24,57,235 27,86,349 13.4%

Note: Expenditure is net of recoveries such as fines, and ticket sales.

Expenditure on Major Schemes

Scheme wise allocation in 2019-20 (Rs crore)

Actuals 2017-18 Budgeted 2018-19 Revised 2018-19 Budgeted

2019-20

% change (RE 2018-19 to BE 2019-20) PM-KISAN – – 20,000 75,000 275.0% MGNREGS 55,166 55,000 61,084 60,000 -1.8% National Education Mission 29,455 32,613 32,334 38,547 19.2% National Health Mission 32,000 30,634 31,187 33,651 7.9% Integrated Child Development Services 19,234 23,088 23,357 27,584 18.1% Pradhan Mantri Awas Yojana (rural + urban) 31,164 27,505 26,405 25,853 -2.1% Pradhan Mantri Gram Sadak Yojana 16,862 19,000 15,500 19,000 22.6% Pradhan Mantri Fasal Bima Yojana 9,419 13,000 12,976 14,000 7.9% AMRUT and Smart Cities Mission 9,463 12,169 12,569 13,750 9.4% Swachh Bharat Mission (rural + urban) 19,427 17,843 16,978 12,644 -25.5% Green Revolution 11,057 13,909 11,802 12,561 6.4% Mid-Day Meal Programme 9,092 10,500 9,949 11,000 10.6% National Rural Drinking Water Mission 7,038 7,000 5,500 10,001 81.8% National Livelihood Mission 4,926 6,060 6,294 9,774 55.3% Pradhan Mantri Krishi Sinchai Yojana 6,613 9,429 8,251 9,682 17.3%

Sources: Expenditure Profile, Union Budget 2019-20; PRS.

Among schemes, PM-KISAN (income support to farmers) has the highest allocation in 2019-20 of Rs 75,000 crore.

The Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) has the second highest allocation in 2019-20 of Rs 60,000 crore. This is a decrease of Rs 1,084 crore (1.8%) from the revised estimate of 2018-19.

Other schemes with high allocations for 2019-20 include National Education Mission (an increase of 19.2%), National Health Mission (an increase of 7.9%), and Integrated Child Development Services (an increase of 18.1%).

Allocation to the National Rural Drinking Water Mission has increased by 81.8% over the revised estimate of 2018-19. The allocation for this year is Rs 10,001 crore, as compared to Rs 5,500 crore in 2018-19 (revised estimate). Allocation to National Livelihood Mission has increased by Rs 3,481 crore (55.3%) over the revised estimates of 2018-19.

Allocation to the Swachh Bharat Mission has decreased by 25.5% over the revised estimate of 2018-19. The allocation for this year is Rs 12,644 crore, as compared to Rs 16,978 crore in 2018-19 (revised estimate). The rural and urban components of Swachh Bharat Mission have been allocated Rs 9,994 crore and Rs 2,650 crore in 2019-20, respectively. Allocation to Swachh Bharat Mission (Rural) has decreased by 31% in 2019-20 over the revised estimate of 2018-19.

Major Legislative changes proposed in the Finance Bill

Dispute resolution scheme: A dispute resolution cum amnesty scheme called the Sabka Vishwas Legacy Dispute Resolution Scheme is being introduced for resolution and settlement of legacy cases pending under various Acts, including the Central Excise Tax, 1944, and the Sugar Cess Act, 1982.

Central Goods and Services Tax Act, 2017: Under the Act, an applicant can apply for an advance ruling from an Authority constituted under various GST laws of various state or union territories. An advance ruling can be sought to clarify certain matters, such as the determination of GST liability. The National Authority may decide appeals against conflicting advance rulings on the same question by Authorities of two or more states or union territories. The Bill provides for the qualification, term, and conditions of services of the National Authority.

Reserve Bank of India Act, 1934: Under the Act, RBI may set a minimum net worth requirement for NBFCs between Rs 25 lakh and two crore rupees. The amendment allows RBI to set the minimum requirement up to Rs 100 crore.

The Act is being amended to enable the RBI to take several measures in relation to the management of NBFCs. These include:

Framing schemes for resolution: The Act is being amended to allow the RBI to frame schemes for the resolution of NBFCs. These include schemes for: (i) amalgamation of two NBFCs, (ii) reconstruction of the NBFC, or (iii) splitting the NBFC to preserve the continuity of those activities of the NBFC which are critical to the functioning of the financial system. As a part of these schemes, the RBI may reduce the pay or cancel the shares of the senior management of the NBFC, without any compensation for the loss.

Scrutiny of group companies: The Act is being amended to enable RBI to: (i) direct the NBFC to attach to its financial statements, any information on the business of its group companies, or (ii) direct an inspection or audit of the group company. Group companies of the NBFC will include its subsidiaries, associates, and joint venture companies.

Supersession of Board of Directors: The Act is being amended to provide for supersession of the Board of Directors of the NBFC for a period of five years. In the interim period, the central government may appoint an administrator to carry out the functions of the Board of Directors.

Removal of directors: The RBI may remove any director of a non-government NBFC and replace him with a temporary director for a period of three years.

Penalties: Penalties for certain offences has been increased. For example, failure to furnish information under the Act is punishable with Rs 2,000. This has been increased to Rs 1,00,000. Further, the penalty for an auditor for failing to comply with the directions of the RBI has been increased from Rs 5,000 to Rs 10,00,000.

National Housing Bank Act, 1987: The Act regulates the functioning of housing finance institutions through the National Housing Board. The amendments being made include:

To register as a housing finance institution, a company must have a net-owned fund of 25 lakh rupees, or higher notified amount. This threshold is being increases to 10 crores or more.

An application for registration as a household finance institution is to be made to the National Housing Bank. This is being amended to state that all applications will be made to the RBI. Further, all pending applications with National Housing Board are to be transferred to RBI.

Under the Act, processes relating to registration, including consideration, grant, and cancellation of applications are to be carried out by the National Housing Board. The Act is being amended to transfer these to the RBI.

The Act provides the National Housing Bank with various powers such as: (i) specifying the percentage of assets a housing finance institution must invest in securities in India, (ii) require housing finance institutions to maintain an account with a Scheduled Bank or the National Housing Board, and (iii) requiring them to file returns. This is being amended to transfer these powers to the RBI.

Insurance Act, 1938: The Act is being amended to require net owned funds of at least Rs 1,000 crore for registration of foreign insurers engaged in re-insurance business and operating in an International Financial Services Centre (set up in Special Economic Zones).

Securities Contract (Regulation) Act, Securities, 1956 (SCRA): The Act imposes penalties on entities who fail to furnish information required under law to a stock exchange or furnish incorrect information to the stock exchange. These penalties range from one lakh rupees to one crore rupees. The Act is being amended to extend the penalty for failure to furnish this information to the SEBI in addition to the stock exchange.

Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970; Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970: The Act nationalised banks such as the Central Bank of India, Punjab National Bank, and Corporation Bank. Under the Act, the Board of Directors of the bank will include four whole time directors, appointed by the central government in consultation with the RBI. The Act is being amended to increase the number of directors from four to five.

General Insurance Business (Nationalisation) Act, 1972: The Act nationalised Indian insurance companies and reorganised them into four insurance companies (excluding the General Insurance Corporation). The Act is being amended to enable reduction in the number of such companies.

Prohibition of Benami Property Transactions Act, 1988: The Act is being amended to increase penalties under the Act. In addition to existing penalties, any person who fails to comply with summons or furnishes false information will be liable to pay Rs 25,000 for each such failure. Further, under the Act, prior sanction is required for prosecution of certain offences under the Act from the CBDT. The sanctioning authority has been changed to Commissioner, Director, Principle Commissioner, or Principle Director of Income Tax.

Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015:The Finance Bill changes the definition of ‘assessee’ in the 2015 Act. Currently, the Act applies to a resident of India. The Bill amends this to make the Act applicable to both Indian residents and non-residents as defined under the Income Tax Act.

Payment and Settlement Systems Act, 2007: The Bill is being amended to prohibit any bank or payments system provider from charging customers for the use of electric modes of payment (prescribed under Income-tax Act, 1961).

Prevention of Money Laundering Act, 2002: The Bill is being amended to increase the responsibilities of reporting entities (such as, banks and other financial institutions). These entities will be additionally required to authenticate identities of their clients, the source of their funds, and the nature of relationship between the transacting parties. Data obtained while verifying transactions must be kept for five years. Further, the amendments seek to allow the government to notify an Inter-Ministerial Coordination Committee for inter-departmental and inter-agency co-ordination. The purpose of this committee will include the development and implementation of policies on anti-money laundering or countering the financing of terrorism.

Central Road and Infrastructure Fund Act, 2000: Currently, the central government is responsible for formulating criteria on the basis of which specific projects of state roads are financed out of states’ share of funds. The central government will now be responsible for formulating criteria for any state road projects.

Securities and Exchange Board of India Act, 1992: The Act is being amended to add capital expenditure to the list of expenses incurred by the General Fund maintained by SEBI. Additionally, the Bill amends the Act to constitute a Reserve Fund which will be credited with 25% of the annual surplus of the General Fund. Further, the amendment adds penalties for concealment, destruction, or falsification of records, or access to unauthorised information. The penalties may range from one lakh rupees to up to ten crore rupees or three times the amount of profits made from the act, whichever is higher.

What does the Legal Industry say?

We reach out to the Legal industry for their comments on current budget.

Mr. Prem Rajani, Managing Partner, Rajani Associates on the key focus areas of the Budget from a legal standpoint, such as: Investments, Real Estate – Infrastructure – Affordable Housing, Capital Markets, SMEs/MSMEs and entrepreneurs, etc.

“The Budget 2019 has touched upon almost every sector, while not disrupting the overall economic environment. It seems to provide the necessary push in-field of infrastructure, agriculture, banking and finance, technology and biggest of all housing for the common man. The government continues its initiatives towards upgrading India’s road and real infrastructure. From an industry perspective, we have seen focused efforts to support foreign investments, promotion of NBFCs and other incentives.

Sectors that will stand to gain the most under the Budget 2019 are SMEs, MSME’s, infrastructure, banking and NBFCs.

Infrastructure: The Government has reaffirmed its commitment to set goals and schemes initiated (such as Bharatmala Pariyojana and the Sagarmala programme) by integrating state government participation to develop the road network. The boost to the sector expenditure of about Rs 100 lakh crore over the next 5 years while highlighting the need for public-private partnerships (PPP) to ensure efficient delivery of projects is heartening. The ‘One Nation, One Power’ grid in the power sector, to ensure power connectivity to states at affordable rates is promising as well. Further, by allowing Foreign Portfolio Investors (FPIs)/NRIs to subscribe to listed debt papers of REITs and InvITs, the government is definitely catalysing movement in these sectors, which hitherto have seen slow progress.

Banks & NBFCs: We will definitely see a credit boost due to the relief state-run banks would receive based on the Rs 70,000 crore capital infusion which is a healthy step.

Another major move to catalyse the currently slumped NBFC sector is the allowance of Foreign Institutional Investors (FIIs) and FPIs investment in debt securities issued by NBFCs. This will certainly positively strengthen the overall economy with additional external cash inflow and therefore enable liquidity. What will require work here is the understanding of the norms and regulations by these investors towards these financial instruments; therefore, a robust and watertight framework must be provided.

Real Estate: Developers and real estate companies focussing on affordable housing will tremendously benefit from the tax holidays offered on profits. We can continue to see more affordable housing projects crop up due to the deduction of interest on loan taken to purchase self-occupied house property which was increased from Rs. 1.5 lakh to Rs 2 lakh.

What would be interesting to see is how the Government aims to alter rental housing laws with the advent of the model tenancy law.

Capital Markets: The Budget 2019 aims to rationalize and streamlining of KYC (know your customer) norms for Foreign Portfolio Investors (FPIs) to make it investor-friendly. This along with NRI portfolio route to be merged with FPI will raise confidence among investors for seamless investment in stock markets.

Investments: The Budget greatly emphasizes on strengthening FDI in India. With the plans to liberalize FDI in aviation, media, animation and insurance intermediaries, we can expect many activities such as JVs, M&A and PE/VC investments within the sector.

Small businesses/MSMEs: SMEs and MSMEs have been at the focal point of this Government as they propel job creation. Supporting this sector by way of the interest subvention scheme, Rs 350 crore allocation is for 2% interest subvention to all GST registered MSMEs in the current year on all fresh and incremental loans, as well as plans to open a payment portal for MSMEs. Investment in MSMEs will receive a big boost through the portal if the delays in payments to SMEs and MSMEs are eliminated.”

Nipun Bhatia, Qualified Chartered Accountant & Lawyer who is Currently working as Vice President – Strategic Management & Process Redesigning at Legal League Consulting:

“The Finance Minister presented a budget that is more forward-looking and futuristic, rather than trying to have quick-fix solutions to gain popularity. Many of the announcements may not seem to yield immediate benefits, but they’ve been announced with a long-term vision to bring positive internal changes in the economy. The vision to reach $5 Trillion economy in next few years requires announcements of initiatives that are sustainable over a period of time and not the announcements that are made with a view to gain popularity or please the general public.

The features that stand out for me in this Budget are the steps taken to augment our stance as a ‘Digital Economy’. I believe that introduction of 2% (Two Percent) Tax Deduction at Source (TDS) on cash withdrawals exceeding Rs. 1 Crore in a year from a Bank Account will curb cash transactions and perpetuation of black money outside of the financial system. Furthermore, businesses with turnover of more than Rs. 50 Crores will have to offer digital modes of payment to their customers without any charges being passed on to such customers.

Another important step is the reforms that are being planned to revamp tenancy laws. Every growing economy must go through this phase of metamorphosis where they shun old and archaic laws and pave way for more progressive laws. There is an alarming number of tenancy disputes that are pending in our courts, adding to the pressure of judiciary. Finance Minister’s announcement that Government will propose a model tenancy law and will circulate to states aims to positively address the relationship between landlords and tenants, hopefully making the renting process easier, transparent and healthy.”

Lastly, the announcement to set up National Sports Education Board (NSEB) to popularize sports at all levels and tap the hidden sports potential of our country is a very welcome move. I sincerely hope that this will generate more sportspersons in the country, who will highlight our name on the global landscape. The idea is not to hone and train prospective winners and medalists, but to develop true sportsman spirit in the country. NSEB and ‘Khelo India’ initiatives will spread awareness about sports within the country and make sports popular across the nation, leading to a fit and healthy nation.”

Rishi Agrawal, Co-Founder and CEO Avantis Regtech Pvt Ltd:

“The Budget puts greater spotlight on Ease of Doing Business with increased focus on digitisation. It proposes a fully automated GST refund module, an electronic invoice system and prefilling taxpayer’s returns among others. However, it misses a great opportunity to lay the foundation for greater digitisation in Labour Compliances such as EPFO and ESI which are critical to job creation and formalisation. Income Tax and GST should serve as blueprint for straight through filings in Labour Returns, Registers & Challans. E-assessment capabilities should be extended to other departments that regulate businesses including Labour departments for higher e-governance and reduced interactions with inspectors.

The government has taken a major step forward rationalising labour laws. Four Labour Codes have been proposed instead of 44 Central Acts. This should help streamline and standardize number of registrations, returns and filings in turn reducing the cost of compliance in India. There is a need to be more ambitious and move towards a single labour code to minimise the compliance burden on MSMEs and Start ups.

A simplified single monthly return is being rolled out for GST. PAN and Aadhaar are being made interchangeable for purposes of income tax. While this simplifies compliance for individuals, the government should move towards a Unique Enterprise Number for the corporates. Currently, a company has to register for 12-21 numbers across different government departments”

Arjit Benjamin, Practicing Advocate at Delhi High Court who is Currently working as Associate at Karanjawala & Co:

“Being an IP Enthusiast, I’m happy to see that the Budget aims to promote the spirit of innovation and foster an environment of education, research and development. The announcements that appealed to me the most are the creation of new National Educational Policy for transforming the Indian Education System. It’s about time that the standards of our education system are enhanced to match the global benchmarks. It is interesting to note that the policy will cover both higher education and elementary education at school level. To add to this, a National Research Foundation will be established, which will further catalyze innovation in the country by funding, coordinating and promoting research.

Further, proposal of the ‘Study in India’ scheme aims to attract foreign students to pursue higher education in India. I’m sure that this will encourage the Government to put our house in order and the Educational Institutions will raise not just the standards of course material, but also work towards improving the infrastructure.

Lastly, the budget is ‘start-up friendly’ at various levels. The biggest announcement for the sector being that startups and investors who furnish requisite documents will not be subject to angel tax assessment. This will put end to an era of suffering by both start-ups and angel investors. All this while, start-ups were being forced to raise approximately 40% to 50% more funding, as about 30% of the funding got expended in angel tax. Further, funds raised by start-ups will not undergo any kind of scrutiny from the Income Tax Department.

Apart from the tax benefits aimed to be extended to start-ups, there is announcement of starting TV Programmes exclusively dedicated to start-ups. This will provide a platform for start-ups to discuss relevant issues that affect the start-up ecosystem, including growth, funding and tax-planning. It is interesting to note that the programme/channel will be designed and executed also by start-ups.”

Share your feedback, tip for stories to [email protected]

The post Union Budget 2019-20: An Analysis appeared first on Legal Desire.

Union Budget 2019-20: An Analysis published first on https://immigrationlawyerto.tumblr.com/

0 notes