#FHA LOANS WITH BAD CREDIT

Text

For people wanting to own a house in country places, the USDA Home Loan program is like an awesome chance that only opens for them. It helps such folks reach their dream of becoming homeowners. This blog focuses on key aspects, benefits, and requirements for securing a USDA home loan, aiding home buyers in rural or small areas.

#property#real estate#united states#gustancho associates#gca mortgage#usa#va loans#fha loan#first time home buyer#bad credit score#usda loans#fha loans

2 notes

·

View notes

Text

Bad Credit Kentucky Mortgage

Bad Credit Kentucky Mortgage

#100 down kentucky fha loan#bad credit#bad credit fha loans Kentucky#Federal Housing Administration#fha#FHA insured loan#Kentucky#kentucky fha loan bad credit#ky fha loan bad credit#ky first time home buyer#Louisville Kentucky#Mortgage loan#Refinancing#zero down loan kentucky

0 notes

Text

10 Best Mobile Home Loans For Bad Credit Guaranteed Approval

Are you looking to buy a mobile home but worried about financing due to bad credit? Don’t fret! While securing a mobile home loan with bad credit can be challenging, there are absolutely options available. This blog post will explore the best mobile home loans for bad credit in 2024 and equip you with tips to get home loans guaranteed approval for your dream manufactured home financing bad…

View On WordPress

#2. VA-Guaranteed Home Loan Program#20 000 mobile home loans for bad credit#3. FHA Title I Program#4. Rocket Mortgage#5. Fannie Mae MH Program#7. FHA Rate Guide#8. Wells Fargo Home Mortgage#apply for a mobile home loan online bad credit#bad credit loans for mobile home#bad credit loans for mobile home in enterprise#bad credit loans for mobile homes#bad credit mobile home loans#bad credit mobile home loans guaranteed approval for veterans#bad credit mortgage loans for mobile homes#best companies for mobile home loans bad credit#best mobile home loans for bad credit#credit human mobile home loans#getting a loan for a mobile home with bad credit#guaranteed mobile home loans for bad credit#home equity loans for bad credit on mobile homes#home equity loans for mobile homes with bad credit#home loans for mobile homes bad credit#loan for mobile home bad credit#loan for mobile home with bad credit#loans for a mobile home on bad credit#loans for bad credit for mobile homes#loans for mobile home bad credit#loans for mobile homes in parks bad credit#loans for mobile homes with bad credit#mobile home and land loans for bad credit

0 notes

Text

What are FHA Mortgage Loans?

FHA loans are mortgages insured by the Federal Housing Administration, designed to help lower-income borrowers and those with less-than-perfect credit scores afford home ownership. Because these loans are backed by the government, lenders like Bond Street Loans can offer them with more lenient credit requirements.

FHA Loans and Bad Credit

FHA loans are particularly appealing to those with bad credit because they have lower minimum credit score requirements than many other types of loans. Generally, you can qualify for an FHA loan with a credit score as low as 580 with a 3.5% down payment. If your credit score is between 500 and 579, you might still qualify, but typically you’ll need to make a 10% down payment.

Features of FHA Loans for Bad Credit at Bond Street Loans

Lower Credit Requirements: Bond Street Loans can work with borrowers with credit scores as low as 500, offering a pathway to homeownership even with bad credit.

Reasonable Interest Rates: Despite the lower credit scores, FHA loans still offer competitive interest rates, making them affordable.

Credit Repair Assistance: Bond Street Loans often provides guidance on how to improve your credit, helping you qualify for better terms in the future.

Down Payment Gifts: FHA loans allow the entire down payment to come as a gift from family or friends, which is beneficial for borrowers who may not have sufficient savings.

Conclusion

FHA loans from providers like Bond Street Loans offer a vital lifeline for prospective homeowners with bad credit, allowing them to purchase a home with manageable terms. These loans come with the support needed to navigate loan approval processes, making home ownership more accessible to a broader range of people.

0 notes

Text

Investing In Hard Money Loans

Consider investing in hard money loans if you want to invest in real estate but don't want to purchase the property yourself. Real estate investors frequently employ hard money loans, which have a short duration, to buy and remodel buildings. You can finance these loans as an investor and profit from your financial commitment.

Instead of traditional banks, private lenders or tiny financial organizations generally make hard money loans. These loans frequently have higher interest rates and costs since they are thought to be riskier than conventional mortgages. They do, however, also present investors with greater potential rewards.

A few important criteria need to be taken into account while investing in hard money loans. You must first carefully assess both the borrower and the property they are acquiring. This may entail looking at the borrower's income, assets, and credit history in addition to performing an appraisal and property inspection. Both the borrower's ability to repay the loan and the property's potential to produce a sufficient income or appreciation in value over time must be considered.

The potential risks connected with investing in hard money loans are another crucial factor to take into account. There is a higher chance of default with these loans than with standard mortgages because they are short-term and frequently used to buy houses that need extensive improvements. As an investor, you must carefully weigh the advantages and dangers associated with each loan opportunity to make sure you are comfortable with the level of risk.

Investing in hard money loans can be a profitable choice for real estate investors despite the possible hazards. You can get a good return on your investment and contribute to the expansion of the real estate sector by financing these loans. As with any investment, it's crucial to do your homework, carefully consider each opportunity, and collaborate with reliable partners in order to make decisions that are in line with your overall investment objectives.

#mortgages#gustancho associates#fha loans#bad credit score#va loans#jumbo loans#money#loans#real estate#home buyers#investors

1 note

·

View note

Text

#fha lenders for bad credit#apply for fha loan bad credit#mortgage credit score ranges#low credit score mortgage#lower credit score mortgage lenders

0 notes

Text

youtube

Business Name:

HomeRate Mortgage | Knoxville

Address:

6210 Highland Pl Way

City:

Knoxville

State:

Tennessee (TN)

Zip Code:

37919

Country:

United States

Phone Number:

(865) 805-9100

Website:

https://homeratemortgage.com/knoxville-tn-mortgages/

Facebook:

https://www.facebook.com/homeratemortgagetn/

Twitter:

https://twitter.com/HomeRateMortga

Instagram:

https://www.instagram.com/homeratemortgagetn/

LinkedIn:

https://www.linkedin.com/company/home-rate-mortgage/about/

Pinterest:

https://www.pinterest.com/HomeRateMortgageTN/

YouTube:

https://www.youtube.com/channel/UCwYphJHBPQomLx74UmsPNPg

Tumblr:

https://www.tumblr.com/homeratemortgagetn

TikTok:

https://www.tiktok.com/@homeratemortgage?lang=en

Business Description:

The HomeRate Mortgage | Knoxville professionals work closely with our clients to ensure they feel at ease and confident in the home buying process. We don't want to put you in an uncomfortable situation, and we will not pressure you into making a decision you do not feel comfortable with. With over two decades of mortgage experience, we can help you find the right loan that fits your needs. Call us today!

Google My Business CID URL:

https://www.google.com/maps?cid=4801308961401831540

Business Hours:

Sunday 9:00am-6:00pm

Monday 9:00am-6:00pm

Tuesday 9:00am-6:00pm

Wednesday 9:00am-6:00pm

Thursday 9:00am-6:00pm

Friday 9:00am-6:00pm

Saturday 9:00am-6:00pm

Services:

Conventional Loans, FHA Loans, Jumbo Loans, USDA Loans, VA Loans, Reverse Mortgage, Mortgage Refinance, Cash Out Refinance, FHA Refinance, Jumbo Refinance, Streamline Refinance, VA Refinance, Mortgage Calculator, Mortgage Rate

Keywords:

HomeRate Mortgage Knoxville,Mortgage Broker Knoxville,Mortgage Lenders in Knoxville,Mortgage Companies in Knoxville ,mortgage broker near me,best Mortgage Broker Knoxville,Knoxville TN Mortgage Lenders,Top Mortgage Lender Knoxville,bad credit mortgage lender Knoxville TN,Best Mortgage Lender Company in Knoxville TN,Conventional Loans,FHA Loans,Jumbo Loans,FHA Refinance,Jumbo Refinance

Location:

Service Areas:

3 notes

·

View notes

Text

youtube

Business Name:

HomeRate Mortgage | Knoxville

Address:

6210 Highland Pl Way

City:

Knoxville

State:

Tennessee (TN)

Zip Code:

37919

Country:

United States

Phone Number:

(865) 805-9100

Website:

https://homeratemortgage.com/knoxville-tn-mortgages/

Facebook:

https://www.facebook.com/homeratemortgagetn/

Twitter:

https://twitter.com/HomeRateMortga

Instagram:

https://www.instagram.com/homeratemortgagetn/

LinkedIn:

https://www.linkedin.com/company/home-rate-mortgage/about/

Pinterest:

https://www.pinterest.com/HomeRateMortgageTN/

YouTube:

https://www.youtube.com/channel/UCwYphJHBPQomLx74UmsPNPg

Tumblr:

https://www.tumblr.com/homeratemortgagetn

TikTok:

https://www.tiktok.com/@homeratemortgage?lang=en

Business Description:

The HomeRate Mortgage | Knoxville professionals work closely with our clients to ensure they feel at ease and confident in the home buying process. We don't want to put you in an uncomfortable situation, and we will not pressure you into making a decision you do not feel comfortable with. With over two decades of mortgage experience, we can help you find the right loan that fits your needs. Call us today!

Google My Business URL:

https://www.google.com/maps?cid=4801308961401831540

Business Hours:

Sunday 9:00am-6:00pm

Monday 9:00am-6:00pm

Tuesday 9:00am-6:00pm

Wednesday 9:00am-6:00pm

Thursday 9:00am-6:00pm

Friday 9:00am-6:00pm

Saturday 9:00am-6:00pm

Services:

Conventional Loans, FHA Loans, Jumbo Loans, USDA Loans, VA Loans, Reverse Mortgage, Mortgage Refinance, Cash Out Refinance, FHA Refinance, Jumbo Refinance, Streamline Refinance, VA Refinance, Mortgage Calculator, Mortgage Rate

Keywords:

HomeRate Mortgage | Knoxville,Mortgage Broker Knoxville,Mortgage Lenders in Knoxville,Mortgage Companies in Knoxville ,mortgage broker near me,best Mortgage Broker Knoxville,Knoxville TN Mortgage Lenders,Top Mortgage Lender Knoxville,bad credit mortgage lender Knoxville TN,Best Mortgage Lender Company in Knoxville TN,Conventional Loans,FHA Loans,Jumbo Loans,FHA Refinance,Jumbo Refinance

Location:

Service Areas:

2 notes

·

View notes

Text

youtube

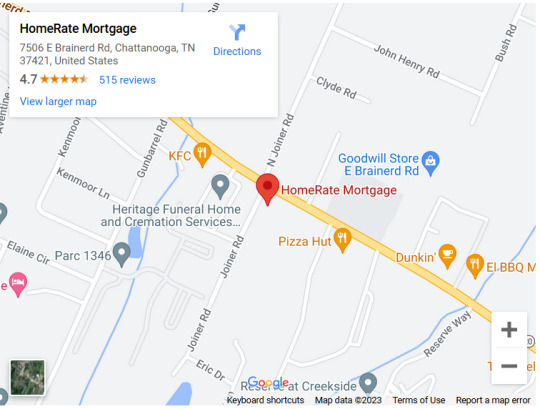

Business Name:

HomeRate Mortgage

Address:

7506 E Brainerd Rd

City:

Chattanooga

State:

Tennessee (TN)

Zip Code:

37421

Country:

United States

Phone Number:

(423) 805-9100

Website:

https://homeratemortgage.com/chattanooga-tn-mortgages/

Facebook:

https://www.facebook.com/homeratemortgagetn/

Twitter:

https://twitter.com/HomeRateMortga

Instagram:

https://www.instagram.com/homeratemortgagetn/

LinkedIn:

https://www.linkedin.com/company/home-rate-mortgage/about/

Pinterest:

https://www.pinterest.com/HomeRateMortgageTN/

YouTube:

https://www.youtube.com/channel/UCwYphJHBPQomLx74UmsPNPg

Tumblr:

https://www.tumblr.com/homeratemortgagetn

TikTok:

https://www.tiktok.com/@homeratemortgage?lang=en

Description:

Buying a house is a big step and can be overwhelming. The last thing you need to add to your plate is worrying if you’re getting the best deal with your mortgage broker. Here at HomeRate Mortgage, we believe the best business practice is also the one that benefits our customers the most. When you’re happy, we’re happy. If you’re new to mortgages or have had one before, it is important to know that policies, requirements, and conditions are always changing. We work with you, and your individual situation, to see what the best option is and what you qualify for. Our team of experts is always up to date, and current on any changes made in the loan process and will quickly be able to work with you towards getting your loan approved.

Google My Business CID URL:

https://www.google.com/maps?cid=12825797789691031979

Business Hours:

Sunday Closed

Monday 7:30am-7:30pm

Tuesday 7:30am-7:30pm

Wednesday 7:30am-7:30pm

Thursday 7:30am-7:30pm

Friday 7:30am-7:30pm

Saturday Closed

Services:

Conventional Loans, FHA Loans, Jumbo Loans, USDA Loans, VA Loans, Reverse Mortgage, Mortgage Refinance, Cash Out Refinance, FHA Refinance, Jumbo Refinance, Streamline Refinance, VA Refinance, Mortgage Calculator, Mortgage Rate

Keywords:

HomeRate Mortgage,Mortgage Broker Chattanooga,Mortgage Lenders in Chattanooga,Mortgage Companies in Chattanooga ,mortgage broker near me,best Mortgage Broker Chattanooga,Chattanooga TN Mortgage Lenders,Top Mortgage Lender Chattanooga,bad credit mortgage lender Chattanooga TN,Best Mortgage Lender Company in Chattanooga TN,Mortgage Refinance,Cash Out Refinance,FHA Loans,Jumbo Loans,USDA Loans

Location:

Service Areas:

2 notes

·

View notes

Text

youtube

Business Name:

HomeRate Mortgage | Knoxville

Address:

6210 Highland Pl Way

City:

Knoxville

State:

Tennessee (TN)

Zip Code:

37919

Country:

United States

Phone Number:

(865) 805-9100

Website:

https://homeratemortgage.com/knoxville-tn-mortgages/

Facebook:

https://www.facebook.com/homeratemortgagetn/

Twitter:

https://twitter.com/HomeRateMortga

Instagram:

https://www.instagram.com/homeratemortgagetn/

LinkedIn:

https://www.linkedin.com/company/home-rate-mortgage/about/

Pinterest:

https://www.pinterest.com/HomeRateMortgageTN/

YouTube:

https://www.youtube.com/channel/UCwYphJHBPQomLx74UmsPNPg

Tumblr:

https://www.tumblr.com/homeratemortgagetn

TikTok:

https://www.tiktok.com/@homeratemortgage?lang=en

Business Description:

The HomeRate Mortgage | Knoxville professionals work closely with our clients to ensure they feel at ease and confident in the home buying process. We don't want to put you in an uncomfortable situation, and we will not pressure you into making a decision you do not feel comfortable with. With over two decades of mortgage experience, we can help you find the right loan that fits your needs. Call us today!

Google My Business CID URL:

https://www.google.com/maps?cid=4801308961401831540

Business Hours:

Sunday 9am-6pm

Monday 9am-6pm

Tuesday 9am-6pm

Wednesday 9am-6pm

Thursday 9am-6pm

Friday 9am-6pm

Saturday 9am-6pm

Services:

Conventional Loans, FHA Loans, Jumbo Loans, USDA Loans, VA Loans, Reverse Mortgage, Mortgage Refinance, Cash Out Refinance, FHA Refinance, Jumbo Refinance, Streamline Refinance, VA Refinance, Mortgage Calculator, Mortgage Rate

Keywords:

Mortgage Broker Knoxville,Mortgage Lenders in Knoxville,Mortgage Companies in Knoxville ,mortgage broker near me,best Mortgage Broker Knoxville,Knoxville TN Mortgage Lenders,Top Mortgage Lender Knoxville,bad credit mortgage lender Knoxville TN,Best Mortgage Lender Company in Knoxville TN

Location:

Service Areas:

2 notes

·

View notes

Text

Although it can be difficult, getting a mortgage after bankruptcy is possible. For borrowers who have emerged from bankruptcy, completed a waiting period, and satisfying other eligibility conditions, several lenders have created rules.

It’s critical to comprehend how bankruptcy affects your capacity to obtain a mortgage and which mortgage programs are accessible to you if you want to purchase a property following the bankruptcy procedure.

#bad credit for mortgage#fha guidelines#bad credit for home loans#NON-QM MORTGAGES#NON-QM LOANS#MANUAL UNDERWRITING#FHA LOANS WITH BAD CREDIT#fha loan indiana#COMPENSATING FACTORS#VA RESIDUAL INCOME#MORTGAGE AFTER BANKRUPTCY

0 notes

Text

Jumbo Mortgages

Jumbo Mortgages are a type of home loan used to finance high-value real estate properties that exceed the loan limits set by government-sponsored enterprises.These loans are designed for purchasing or refinancing upscale homes in areas with high property values. Jumbo mortgages are a financing option for individuals looking to purchase high-value homes, but they come with stricter requirements and potentially higher costs. Borrowers should carefully evaluate their financial situation and work with experienced mortgage professionals to find the best jumbo mortgage lender and terms that suit their specific needs.

#property#real estate#united states#usa#gustancho associates#gca mortgage#va loans#first time home buyer#fha loan#bad credit score

2 notes

·

View notes

Text

Bad Credit Kentucky Mortgage

Kentucky home loan credit scores and the minimum requirements

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.10602 Timberwood CircleLouisville, KY 40223Company NMLS ID #1364

Text/call: 502-905-3708email: [email protected]

http://www.mylouisvillekentuckymortgage.com/

NMLS 57916 | Company NMLS #1364/MB73346135166/MBR1574

The view and opinions stated on this website…

#bad credit#bad credit fha loan#bad credit mortgage#Credit score#First-time buyer#Kentucky#louisville#Mortgage#Mortgage loan#USDA#va mortgage bad credit#Zero down home loans

0 notes

Text

youtube

Business Name:

HomeRate Mortgage

Address:

7506 E Brainerd Rd

City:

Chattanooga

State:

Tennessee (TN)

Zip Code:

37421

Country:

United States

Phone Number:

(423) 805-9100

Website:

https://homeratemortgage.com/chattanooga-tn-mortgages/

Facebook:

https://www.facebook.com/homeratemortgagetn/

Twitter:

https://twitter.com/HomeRateMortga

Instagram:

https://www.instagram.com/homeratemortgagetn/

LinkedIn:

https://www.linkedin.com/company/home-rate-mortgage/about/

Pinterest:

https://www.pinterest.com/HomeRateMortgageTN/

YouTube:

https://www.youtube.com/channel/UCwYphJHBPQomLx74UmsPNPg

Tumblr:

https://www.tumblr.com/homeratemortgagetn

TikTok:

https://www.tiktok.com/@homeratemortgage?lang=en

Description:

Buying a house is a big step and can be overwhelming. The last thing you need to add to your plate is worrying if you’re getting the best deal with your mortgage broker. Here at HomeRate Mortgage, we believe the best business practice is also the one that benefits our customers the most. When you’re happy, we’re happy. If you’re new to mortgages or have had one before, it is important to know that policies, requirements, and conditions are always changing. We work with you, and your individual situation, to see what the best option is and what you qualify for. Our team of experts is always up to date, and current on any changes made in the loan process and will quickly be able to work with you towards getting your loan approved.

Google My Business CID URL:

https://www.google.com/maps?cid=12825797789691031979

Business Hours:

Sunday Closed

Monday 7:30am–7:30pm

Tuesday 7:30am–7:30pm

Wednesday 7:30am–7:30pm

Thursday 7:30am–7:30pm

Friday 7:30am–7:30pm

Saturday Closed

Services:

Conventional Loans, FHA Loans, Jumbo Loans, USDA Loans, VA Loans, Reverse Mortgage, Mortgage Refinance, Cash Out Refinance, FHA Refinance, Jumbo Refinance, Streamline Refinance, VA Refinance, Mortgage Calculator, Mortgage Rate

Keywords:

Mortgage Broker Chattanooga,Mortgage Lenders in Chattanooga,Mortgage Companies in Chattanooga ,mortgage broker near me,best Mortgage Broker Chattanooga,Chattanooga TN Mortgage Lenders,Top Mortgage Lender Chattanooga,bad credit mortgage lender Chattanooga TN,Best Mortgage Lender Company in Chattanooga TN

Location:

Service Areas:

2 notes

·

View notes

Text

Guide to Affordable Homes, Seller Financing, and Rent-to-Own Options

Finding Affordable Homes for Sale

The dream of homeownership may be impossible to achieve due to the current financial situations but it should not be completely impossible. When most people think of purchasing a home they think of putting down a large sum up front plus a large mortgage payment each month, but there are many affordable homes for sale in this country if one simply looks for them.

Explore Local Markets: Their price is not constant but depends on a number of factors, majorly the location the search is being conducted from. Prices tend to be relatively high in large cities, but if you look for the lower costs, they are in the suburbs or in new areas.

Government Assistance: It is time to delve into the options like FHA loans that require a smaller down payment, or into USDA loans focusing on the provision of financial assistance for the buyers with low to middle incomes living in the rural areas.

Consider Alternative Options: There are other strategies that can be used to make houses more affordable these include going for foreclosed or highly prepossessed houses. Such properties can be bought at relatively lower prices compared with other similar houses in the market due to the various discounts accorded to the buyer.

Exploring Seller Financing Homes for Sale

If you are searching for a start home but access to mortgage funding is out of reach for one reason or the other like bad credit or no enough cash for down payments, seller financing homes for sale may interest you. Such financing means enables the buyer to pay the seller without using money from a bank through a series of equal payments.

Bypassing Traditional Lenders: This has the benefit of avoiding banks which is a major advantage of offer financing. This is especially beneficial to the buyers with a poor credit record or those who cannot meet the strict requirement of the bank loans.

Flexible Terms: Unlike banks, the sellers are in a position to negotiate on the terms of sale, for instance better interest rate or longer period whereby payment will be made.

Benefits:

Flexible down payments and repayment schedules

Easier approval process for buyers with bad credit

Potential for personalized loan terms

Key Takeaway: Seller financing homes for sale provide an excellent alternative to traditional mortgage loans, offering flexibility, faster closings, and fewer hurdles for buyers who may not qualify for a traditional loan.

Rent-to-Own Homes in Florida

If you are not yet in a position to purchase a house but would like to be on your way to owning a home then finding homes for rent to own homes in Florida is the way to go. It also enables one to lease a property with a view of purchasing the same at an agreed later date in the future.

A Portion of Rent Goes Toward the Purchase: This is in fact very common with most rent-to-own arrangements where you are given an option to apply some fraction of your rent towards your future purchase. This enables one to start saving toward the home while he/she is dwelling in it.

Locked-in Purchase Price: Purchase price is another advantage which is achieved because the clients agree on the price they will have to pay at purchase when they rent these homes. It is worth mentioning the fact that no matter the rates of growth in the value of the property, you buy it at a set price at the time of the agreement.

Seller Financing in Texas: A Unique Opportunity

Sellers who need to close their home are also a favorite of homebuyers in Texas because of the freedom that comes with seller financing as compared to the ordinary mortgage credit. Texas has an expansive real estate market, with various properties available and seller financing Texas can be more flexible for buyers who might not meet the standard requirements for a bank loan.

Seller as Lender: Seller financing Texas is an arrangement whereby the seller acts as the financier and thus the buyers can pay the financier in installments instead of going for a conventional loan.

Customizable Terms: One major advantage for buyers is that, unlike in the case of secured business finance, they can discuss the repayment schedule with the seller, which also imply greater flexibility regarding the repayment of the financing.

Key Takeaway: Seller financing in Texas allows buyers more flexibility and control over their financing arrangements, with faster closing times and easier terms.

Rent-to-Own Homes in Texas: A Gradual Path to Ownership

The rent to own texas homes are also the same as in Florida in that they give equal chances of owning a home to people who are not yet financially willing to own a home. Moreover, getting an option to rent to own homes in a competitive and vigorous real estate environment like Texas makes you enjoy today’s prices even while setting your economic base.

Build Equity Over Time: A portion of your rent goes toward the future purchase of the home, allowing you to gradually build equity while renting.

Time to Improve Credit: This option gives renters the flexibility to improve their credit or save for a larger down payment, ensuring they’re in a better position when it’s time to purchase the home.

Flexibility and Security: With rent-to-own homes in Texas, you can test out a home and community before fully committing to buying it, giving you peace of mind in your decision.

Finding Seller Financing Homes Near You

If you are interested in local options then you will be searching for seller financing homes near me which if you cannot afford a traditional home loan can be a wonderful exciting opportunity.

Easier Access to Properties: This means that searching locally always has a tendency of coming across homes that are not so popular in the market, and thus; give you better chances of achieving flexible marketing.

Personalized Agreements: When buying products directly from local seller, you are able to discuss appropriate terms and time suitable for your cash flow.

Key Takeaway: Searching for seller financing homes near me can help you find nearby homes with more flexible buying options, giving you better access to properties that may not be available through traditional means.

Conclusion: A World of Flexible Homeownership Opportunities

When most people are asking for homes for sale, cheap homes for sale, seller financing homes for sale or owners who offer to let you rent to own in areas such as Florida or Texas the market has a lot to offer. Through such processes, you can actually fulfill your dream of owning a house even if it may be tough going through the standard financial channels.

0 notes

Text

FHA Loans For Low Credit Scores

Saving up the conventional 20% down payment can be challenging for many people who want to buy a new house, especially with the growth in housing costs across most of the United States. For this reason, a lot of prospective homeowners apply for Federal Housing Administration (FHA) loans. These government-backed mortgages have a 3.5% minimum down payment requirement and are FHA insured.

Your credit score will be a significant factor in determining if you are eligible for an FHA loan if you want to make a small down payment on the dream home of your dreams. But what is the required minimum credit score to be eligible? Is an FHA loan the best option for you, credit score aside?

An FHA Loan is what?

A mortgage backed by the US government is known as an FHA loan. Instead of issuing loans directly, the FHA insures mortgages made by banks and credit unions that have been certified by the agency. If a borrower fails on a mortgage, the insurance shields these FHA bad credit lenders.

Many residential properties, including single-family homes, multi-family homes, and condos, can be purchased or refinanced using FHA loans. A few FHA loan programs also allow for the financing of the new building and home modifications.

FHA loans are particularly well-liked by first-time homebuyers who have little money saved.

The Required Low Credit Score for FHA Loan

Due to the low down payment required by FHA loans, they have historically assisted low- to moderate-income families in becoming homeowners. Also, they permit credit ratings that are less stringent than the average minimum FICO score of 620 needed for many traditional house loans. For instance, if you want to be eligible for an FHA loan with a 3.5% down payment, your FICO credit score must be at least 580. You may still be approved for an FHA loan with a low credit score between 500 and 579, but you'll have to put in a more significant 10% down payment.

One crucial qualification: Although the FHA has set these FICO scores as the minimum credit standards, borrowers with credit scores between 500 and 580 may find it challenging to obtain an FHA loan. This is because many approved FHA bad credit lenders still require a minimum FICO score of 620 in order to qualify, and the FHA is powerless to compel banks to meet its stricter FICO score standards.

How to Apply for an FHA Loan

You must submit an application through a private FHA bad credit lenders, such as a bank or credit union, as the FHA doesn't provide loans directly. The following are the details of the upcoming event.

Credit rating

Even though the FHA has set a minimum credit score of 500, many lenders who are FHA-approved have higher requirements of at least 620 FICO scores.

One-time payment

While a down payment is necessary for an FHA loan, that money doesn't always have to come from your savings. Gifts are also permitted as long as you can show that you won't be required to pay the grant back.

The ratio of debt to income

Your debt-to-income ratio compares the amount you owe to your income. The FHA permits you to utilize 31% of your salary toward housing expenditures and a total of 43% of your income for housing expenses plus additional loans.

Premiums for mortgage insurance

Mortgage insurance premiums, which are frequently incorporated into the total loan amount and paid on a monthly basis by borrowers who obtain FHA loans, are needed to be paid by borrowers.

Property Specifications

The borrower's primary residence must be the property. The FHA also mandates that the residence be appraised to confirm that it is safe and worth what the borrower is paying for.

Financial and personal documents

The borrower must be a U.S. citizen, a legal permanent resident, or otherwise qualified to work in the country, have a valid Social Security number, have a consistent source of income, present employment-related paperwork, and meet other requirements. Lenders ask for recent bank statements in addition to doing credit checks.

#fha bad credit lenders#united states#fha loan#bad credit#va loans#mortgages#refinances#loans#real estate

1 note

·

View note