#FCA rules

Text

Expert FCA Compliance Services | Professional FCA Compliance Consultants

Navigating the intricate landscape of Financial Conduct Authority (FCA) regulations can be daunting. At MEMA Consultants, we provide expert FCA compliance services to help businesses stay compliant and avoid penalties. Our team of skilled consultants offers a range of services including regulatory training, financial crime prevention, and compliance advisory, all tailored to meet the specific needs of our clients.

When selecting an FCA compliance consultant, it's essential to consider their experience, capacity, and ability to provide practical solutions. Our consultants not only identify issues but also work closely with your firm's key individuals to add real value.

For ongoing compliance support, we offer bespoke services to ensure you meet FCA requirements efficiently. From documentation to monitoring activities, our comprehensive support helps you maintain compliance with ease.

For more information, visit our FCA compliance consultants page.

#FCA compliance#FCA compliance services#FCA compliance consultants#regulatory compliance#financial crime prevention#regulatory training#compliance advisory#FCA rules#compliance solutions#MEMA Consultants

0 notes

Text

A reader asked me recently what can be done on the legal front against Pfizer and Moderna regarding their genocidal shots that were deceptively marketed as “vaccines” even though they are gene therapies.

First, any meaningful action by the government, the only entity with the power to make them pay, would require an executive branch that respects the rule of law and works on behalf of its people — which obviously doesn’t exist and certainly won’t for as long as the Democrats hold power.

Second, any meaningful action by the government or private entities requires a judiciary that’s also honest and beholden to the rule of law, which would allow fraud lawsuits to proceed unmolested.

If those prerequisites are met, the crux of the matter becomes proving whether Pfizer lied in its clinical trials to push the shots through the emergency use authorization (EUA) process — which it certainly did.

Such lawsuits exist, but they have not met with success so far, one having been summarily dismissed by a federal court before any litigation could occur.

Via Children’s Health Defense (emphasis added):

“For the second time, a federal court in Texas has dismissed a whistleblower lawsuit alleging Pfizer and two of its contractors manipulated data and committed other acts of fraud during clinical trials for the Pfizer-BioNTech COVID-19 vaccine in 2020.

In his Aug. 9 ruling, District Judge Michael J. Truncale sided with the U.S. government, ruling the government had demonstrated “good cause” to intervene and dismiss the case. He wrote:

“The Government’s desire to dismiss the case — because of its doubt as to the case’s merits, differing assessment of the Pfizer vaccine data, desire to avoid discovery and litigation obligations, and belief that it should not have to expend resources in a case that is contrary to its public health policy — constitutes good cause to intervene.”���

According to the lawsuit, the three companies “deliberately withheld crucial information from the United States that calls the safety and efficacy of their vaccine into question,” thus defrauding the federal government, which purchased the vaccines.

The FCA allows the government or a party suing on its behalf to attempt to recover money for false claims made by parties to secure payment from the government.”

Related: Pfizer Whistleblower Exposes Vaxx Trial Fraud

20 notes

·

View notes

Text

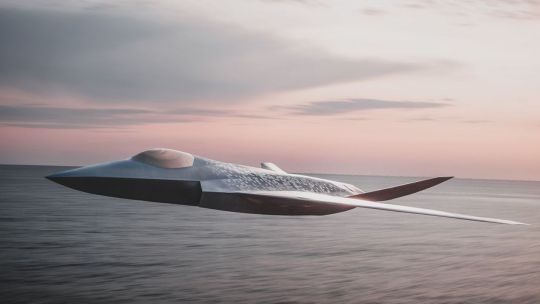

B-52 bombers arrive in the Pacific to provide strategic deterrence

Fernando Valduga By Fernando Valduga 02/05/2024 - 19:39in Military

A B-52H Stratofortress, assigned to the 23º Expeditionary Bomber Squadron, taxis on the flight line at Andersen Air Base, Guam, on January 30, 2024. (Photo: U.S. Air Force / Airman 1st Class Alyssa Bankston)

Four B-52 Stratofortress bombers designated for the 5ª Bomber Wing of Minot Air Base, North Dakota, landed at Andersen Air Base, Guam, in late January, as part of a Bomber Task Force (BTF) to support strategic deterrent missions aimed at strengthening international order rules based on the Indo-Pacific region.

While deployed in Guam, B-52 operations and support personnel are assigned to the 23º Expeditionary Bomber Squadron. The 23º EBS will integrate alongside the Allies and partners to demonstrate the U.S. commitment to security and stability throughout the region.

Designed to show the U.S. ability to deter, deny and dominate, BTF missions aim to influence and deter the aggression of opponents or competitors.

While in Guam, the bombers will also support the largest multilateral exercise of the Pacific Air Forces, the Cope North. The exercise, scheduled from February 5 to 23, will be co-led by the Australian Royal Air Force (RAAF) and the Japan Air Self-Defense Force (JASDF).

Cope North 24 kicks off with ?? ?? integration#CopeNorth24 enhances US relationships & interoperability w/Allies & partners by providing the opportunity to exchange info & improve shared tactics to better integrate multilateral defense capabilities. #CN24pic.twitter.com/99T0YKsspb

— PACAF (@PACAF) February 4, 2024

Reacting to the arrival of the aircraft, Captain Zachary "Smash" Holmes, arms officer of the 23º EBS, said it was great "finally to have some iron on the ground".

"It's great to finally receive our crews, so we're ready to leave and participate in the mission, as well as prepare our maintenance staff to support where necessary," Holmes said. "We are ready to go."

A B-52H Stratofortress, assigned to the 23º Expeditionary Bomber Squadron, taxis on the flight line at Andersen Air Base, Guam, on January 30, 2024. (Photo: U.S. Air Force / Airman 1st Class Alyssa Bankston)

Air crews and support personnel are looking for every opportunity to train alongside our allies and partners to build interoperability and strengthen our collective capacity to support a free and open Indo-Pacific.

Tags: Military AviationBoeing B-52H StratofortressBTFUSAF - United States Air Force / U.S. Air Force

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. He uses Canon equipment during his photographic work in the world of aviation.

Related news

COMMERCIAL

VIDEO: SAS A320 flight to Manchester was intercepted by RAF Typhoon fighters

05/02/2024 - 15:51

MILITARY

Russian Su-57M fighter with new engine will enter service in 2025

05/02/2024 - 10:08

MILITARY

Discussions between Airbus and Dassault at FCAS are putting the Eurodrone schedule at risk

04/02/2024 - 16:54

ARMAMENTS

Iran presents new missiles and kamikaze drone for its Army Aviation

04/02/2024 - 10:32

MILITARY

United States will send the aircraft carrier George Washington to the coast of Argentina

03/02/2024 - 20:04

AIR SHOWS

For the first time, AirVenture in Oshkosh will have two military demonstration squads in the same year

03/02/2024 - 16:46

15 notes

·

View notes

Text

FCA: i got a problem

FCA: wwith Feferi

FCA: and im really kinda sittin here in bad shape about it emotionally speakin

CCG: OK, WELL

CCG: I GET THAT, I HEAR YOU BRO

CCG: BUT THIS IS STILL NOT THE RIGHT PLACE FOR THIS SO I'VE GOT TO BAN YOU. [...]

CCG: BUT SERIOUSLY JUST GET IN TOUCH WITH ME IN PRIVATE ABOUT IT, OK MAN?

Karkat’s such a bro - but Eridan is a mess that I’m not sure he’ll be able to fix.

I mean, what relationship advice could he give, here? Eridan would probably only date a highblood. Vriska is ghosting him, Feferi cut him loose, Equius already has a moirail (and his other paired quadrants are in flux), which leaves... Gamzee.

Hope you like Faygo, Eridan!

Good enough!

CCG: BEAR DOWN EVERYBODY, THIS IS FUCKING IMPORTANT, THERE IS A QUEEN ON THE LOOSE AND WE'VE GOT TO SHOW A BITCH THE DOOR.

Hussie’s recap makes it sound like Queens are meant to stay on their planets - we’ve never seen one off-world. Snowman, however, is apparently ‘on the loose’.

That frog might have had some unintended consequences. She was willing to give up the Ring, and maybe that made her more willing to bend some other rules.

FAG: 8ut do you have any idea how funny this thing is? I mean this whole thing???????? I can't stop laughing!

CCG: HEY CAN FUTURE YOU MIND-PREVENT ME FROM HITTING THE BAN BUTTON?

I fucking hope not! That’d turn her into a one-woman Exile station!

FAG: We didn't really need you to pretend to 8e a little angry general to get any of this done.

FAG: We kicked the queen out of there no sweat! It was easy. In fact, I did most of the work myself, right 8efore I found all the treasure and scaled all the rungs.

He told you to do that, though. You can quibble over whether you ‘needed’ him, but you wouldn’t have done it without him!

109 notes

·

View notes

Text

How to Determine If a Forex or Cryptocurrency Platform Is Legitimate

The rise of Forex and cryptocurrency trading has led to a significant increase in the number of platforms available to traders. However, not all of these platforms are reputable or trustworthy. Knowing how to differentiate a legitimate trading platform from a fraudulent one is crucial for protecting one's investments. This article provides a comprehensive guide on how to evaluate the legitimacy of a Forex or cryptocurrency platform, covering key areas such as regulatory information, legal disclosures, company registration details, online reputation, and social media presence.

1. Check Regulatory Information

The first and most important step in determining the legitimacy of a Forex or cryptocurrency platform is to check its regulatory status. Reputable platforms are usually regulated by recognized financial authorities, such as the U.S. Commodity Futures Trading Commission (CFTC), the U.K. Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or similar bodies in other jurisdictions.

1.1 How to Verify Regulation Status

Visit the Regulator's Official Website: To verify if a platform is genuinely regulated, visit the official website of the regulatory body mentioned by the platform. Use the regulator’s search tool to look up the platform's name or registration number. Ensure that every detail matches exactly, as fraudulent platforms often provide misleading or incorrect information.

Confirm with the Platform: Cross-check the information on the regulatory body’s website with the details provided on the platform’s own website. Any discrepancies between the two could be a red flag.

1.2 Why Regulation Matters

Regulation ensures that a platform adheres to strict financial rules, operates transparently, and is subject to regular audits. It also provides a certain level of protection for investors, as regulatory bodies can intervene in cases of misconduct.

2. Review Legal Information on the Company’s Website

A legitimate Forex or cryptocurrency platform will have a well-documented legal section on its website. This section should include terms and conditions, privacy policies, and risk disclosures.

2.1 Key Legal Disclosures to Look For

Terms and Conditions: These outline the contractual obligations between the user and the platform. They should be clear, comprehensive, and not contain any ambiguous language that could be exploited.

Privacy Policy: A legitimate platform will have a detailed privacy policy explaining how user data is collected, used, and protected. Look for specifics about data encryption and user confidentiality.

Risk Disclosure Statements: Trading in Forex and cryptocurrencies involves significant risk. Platforms should provide risk disclosure statements outlining the potential for loss and advising users on the risks associated with trading.

2.2 Assessing the Legality of Documents

Carefully read through these documents to ensure they are professionally written and free from grammatical errors or inconsistencies. Poorly written or vague legal documents can be an indication of a scam platform.

3. Verify Company Registration Information

A legitimate platform should provide clear details about its corporate identity, including its registered company name, registration number, and office address.

3.1 How to Verify Registration Details

Check the Company’s Name and Registration Number: These details should be available on the platform's website. Verify them with the official company registry in the platform's home country.

Confirm Office Address: Ensure the company’s physical address is real and not just a P.O. box. A quick Google Maps search can provide insights into whether the address is a legitimate office space or a residential area.

3.2 Importance of Registration Verification

Verifying registration information helps confirm that the company is a legitimate entity and not a fly-by-night operation. Registered companies are more likely to adhere to financial regulations and are accountable to the law.

4. Check Website Registration Details

Beyond corporate registration, it is also essential to check the domain registration details of the platform’s website. This can provide further clues about the legitimacy of the platform.

4.1 Steps to Check Domain Registration

Use WHOIS Lookup Tools: Websites like WHOIS.net or ICANN WHOIS can provide information about the domain’s registration date, owner, and contact details. A domain registered recently, especially within the last six months, could be a warning sign.

Look for Transparency: Legitimate platforms often have their domain registered under their company name, with contact details that match their corporate information. Be wary of domains registered under privacy protection services or those that hide their registrant details.

4.2 Domain Registration Red Flags

Domains with private registration or those that have been recently created may indicate a lack of transparency and could be associated with fraudulent activities.

5. Check Online Reputation

The online reputation of a Forex or cryptocurrency platform can provide significant insights into its legitimacy.

5.1 Use Review Websites and Forums

Read User Reviews: Websites like Trustpilot, Forex Peace Army, and similar forums can provide user reviews and feedback about the platform. Pay attention to common complaints, especially those related to withdrawals, platform stability, or customer service issues.

Look for Patterns: Isolated negative reviews are common for any business, but consistent patterns of complaints could indicate systemic issues or fraudulent behavior.

5.2 Assessing Credibility of Reviews

Be cautious of overly positive reviews that seem generic or promotional. These could be fake reviews posted by the platform itself or by paid reviewers.

6. Verify Social Media and Other Online Information

A legitimate Forex or cryptocurrency platform should have a robust social media presence. Their social media channels can offer insights into their customer service quality and overall reputation.

6.1 Evaluate Social Media Profiles

Check Activity Levels: Active social media profiles with regular updates, transparent communication, and engagement with users are positive indicators of legitimacy.

Look for Red Flags: Be wary of platforms with inactive social media accounts or those filled with complaints and no responses. Also, avoid platforms that disable comments on their social media posts, as this could be an attempt to hide negative feedback.

6.2 Cross-Check Information

Ensure that the information on social media matches what is on the platform’s website and in official communications. Discrepancies could be a warning sign.

7. Compare Regulatory Bodies with Provided Information

Ensure the regulatory bodies listed by the platform match exactly with what is stated on their official website. Even a single incorrect letter could indicate deception. Some fraudulent platforms may list legitimate regulatory bodies but slightly alter the names or registration numbers.

7.1 Common Deceptive Practices

Fraudulent platforms may use names that closely resemble well-known regulatory bodies, such as “Financial Services Authority” instead of the actual “Financial Conduct Authority.” Always verify directly with the official regulator.

8. Conclusion

Determining the legitimacy of a Forex or cryptocurrency platform requires diligence and attention to detail. By thoroughly checking regulatory information, legal disclosures, company and website registration details, online reputation, and social media presence, one can reduce the risk of falling victim to scams. Remember, if anything seems suspicious or too good to be true, it probably is.

FAQs

1. What should I do if a platform claims to be regulated but I cannot find it on the regulator's website?

If a platform claims to be regulated but does not appear on the regulator’s website, it is best to avoid it. Contact the regulatory body directly to verify any information provided by the platform.

2. Why is checking the company's registration details important?

Verifying a company's registration details ensures that it is a legally recognized entity. This reduces the risk of dealing with a fraudulent or non-existent company.

3. Can I trust user reviews on Forex or cryptocurrency platforms?

User reviews can be helpful, but they should be approached with caution. Look for patterns in reviews and be wary of overly positive or promotional reviews that may be fake.

4. What does it mean if a platform has a new domain registration?

A new domain registration could indicate that the platform is a recent entrant, which may lack a proven track record. It could also be a red flag for a potentially fraudulent operation.

5. How can social media help in assessing a platform's legitimacy?

Social media can provide insights into a platform’s customer service, engagement, and reputation. Platforms that are active and responsive on social media are generally more reliable.

6. Is regulation the only factor that determines a platform's legitimacy?

While regulation is a key factor, it is not the only one. Other factors like legal disclosures, company registration, online reputation, and transparency also play crucial roles in determining a platform's legitimacy.

Reference:

TraderKnows

Wikipedia

2 notes

·

View notes

Text

Factors That Shaped Modern Forex Trading

Foreign exchange trading, or forex trading, has experienced tremendous development over time. It has now become the biggest and most liquid finance market in the world on a per-day note. More than six trillion of money is spent at this point. Numerous issues played a crucial role in the formation of contemporary forex trading learn, especially on behalf of newcomers when entering the market.

1. Technology: Technology has made great strides with regard to forex dealing. The Forex market is becoming more accessible for beginners with the coming of online trading platforms and ECNs. They enable the trading of securities via online platforms, which give access to real-time market data, charting tools, and execution ability.

2. Internet Connectivity: Accessibility to high-speed internet has made it possible for people to interact across towns in real-time, hence erasing the notion of physical boundaries. With but a click of a button, traders are able to get market information, execute a trade, and manage their portfolios. The forex market is now open for a wider audience, such as newcomers, to this accessibility.

3. Regulation: Various regulatory agencies, including CFTC in the USA and FCA in the UK, have largely contributed towards the current forex trading. These regulatory agencies, however, promote the conduct of business in a fair manner and safeguard investor interest, as well as the integrity of the market. Abiding by the rules boosts newbies’ confidence and improves their understanding of what transpires in the FX market.

Final Thoughts

To sum up, many issues and events have come up to make forex trading for beginners. The development of the forex market has been prompted by technological improvements, mobile phone systems, legislations of various countries, improved learning, borrowing trade on leverage, and world globalization. With forex trading becoming more progressive, it is imperative that beginners be informed, educated, and aware of its risks.

#forex trading course#online forex trading course#stock trading app#forex trading#trading forex beginners#forex trading for beginners

2 notes

·

View notes

Text

the lie of drifting

Yesterday we continued our series DRIFT at The Community Fellowship, and it continues to amaze me in what God does.

DRIFT can happen slow or fast, but it happens often. Drift is defined as a driving movement or force, as in winds or currents, water or air or even by circumstances wandering aimlessly. Has drift happened to us? Or is drifting happening now?

There are times when we come to know Him and love Him so, so much. We promise God if He will save us, give to us or meet our need that we will not forget Him. Yet we forget. Drifting happens.

James 1:23-25 NLT

For if you listen to the word and don’t obey, it is like glancing at your face in a mirror. 24 You see yourself, walk away, and forget what you look like. 25 But if you look carefully into the perfect law that sets you free, and if you do what it says and don’t forget what you heard, then God will bless you for doing it.

We see Him. We hear Him. We look away and begin to drift. Throughout the Bible people who love God, people who have followed God are leaving or slowing moving away from God. It hurts. It leaves us needy and shameful and confused.

The facts about DRIFT reminds us that we need to be careful to not drift. Stay tied to what we have learned. Choose your journey carefully or the jpourney you don’t want will choose you. Make sure it is the right direction.

Hebrews 2:1 NLT

So we must listen very carefully to the truth we have heard, or we may drift away from it.

When we stop looking to God and look at people, we start to drift. We need to remember God and look to Him.

Deuteronomy 6:4 NASB

“Hear, Israel! The Lord is our God, the Lord is one!

Drift happens when we follow the wrong people or don’t listen to God. It will some be evident to the people around us.

Isaiah 29:13 NLT

And so the Lord says, “These people say they are mine. They honor me with their lips, but their hearts are far from me. And their worship of me is nothing but man-made rules learned by rote.

God back. Return to God. Let Him work and see how incredible life can be when the drift is stopped and His will is sought.

Revelation 2:4-5 NLT

“But I have this complaint against you. You don’t love me or each other as you did at first! 5 Look how far you have fallen! Turn back to me and do the works you did at first. If you don’t repent, I will come and remove your lampstand from its place among the churches.

The week is here. I leave for Cuba on Wednesday. Please pray for the trip. Pray for the retreat I will help host this weekend for the FCA sports ministry staff in Cuba. Thank you! God is good!

2 notes

·

View notes

Text

Forex Broker Regulations: Understanding The Importance Of Regulatory Compliance

The Forex market is an ever-evolving space that requires traders and brokers to stay up-to-date with current regulations. Understanding the importance of regulatory compliance helps protect investors from potential losses caused by fraudulent activities, and ensures a fair trading environment for all participants. This article provides an overview of forex broker regulation, discussing the different types of regulation, their objectives, and why it is important for both brokers and traders to adhere to these rules.

Regulation in the financial sector has become increasingly relevant as technology advances have allowed greater access to global markets. As retail trading continues to expand into new countries around the world, regulatory authorities are becoming more active in protecting investor safety through increased oversight on market participants. Regulations provide numerous benefits such as safeguarding customer funds held at intermediaries, preventing manipulation or insider trading among other things. However, they also impose costs on firms due to compliance requirements which can affect profitability negatively.

Given its critical role in maintaining a secure and efficient marketplace, understanding how forex broker regulations work is essential for any trader who wants to trade successfully while managing risk effectively. In this article we will discuss the various types of regulations governing FX brokers, their objectives and importance in relation to successful trading practices.

What Is A Forex Broker?

A Forex broker is a financial services company that facilitates trading in the foreign exchange (Forex) market. It acts as an intermediary between its clients and the currency markets by providing access to trading platforms, allowing them to buy or sell currencies at current prices. By offering competitive spreads, commissions, and other charges, brokers can attract traders wishing to speculate on price movements of various currencies.

The purpose of forex broker regulations is to ensure fair competition among brokers and protect investors from any unethical practice. These regulations also aim to maintain market integrity and prevent any manipulation of the marketplace. Regulatory agencies such as the Financial Conduct Authority (FCA), Commodity Futures Trading Commission (CFTC), National Futures Association (NFA), Financial Industry Regulatory Authority (FINRA) have specific rules for their respective jurisdictions regarding licensing requirements for Forex Brokers. Most countries require all Forex brokers operating within their jurisdiction to be registered with these regulatory bodies.

Regulatory compliance has become increasingly important in recent years due to increased scrutiny from government authorities aimed at protecting investors from fraudulent activities in the global markets. As such, it is essential for Forex brokers to understand the importance of adhering to these regulations in order to remain compliant and protect both themselves and their customers.

Regulatory Bodies Governing Forex Brokers

Regulation of forex brokers is a vital component in ensuring the security and integrity of global financial markets. Regulatory bodies governing forex brokers strive to ensure that industry participants abide by predetermined standards for safety, reporting, risk management disclosure and protection of customer funds. Non-compliance with these regulations can result in severe penalties including fines or suspensions from trading.

The importance of regulatory compliance cannot be overstated as it helps protect investors' capital while enabling safe market transactions. In order to participate in business activities related to foreign exchange, brokerages must comply with all applicable laws and regulations imposed by the relevant authorities in their jurisdiction. This includes registering with an authorized regulator, obtaining a license and submitting regular reports on activity such as client trades and positions held.

In addition, brokerages must disclose any potential risks associated with certain investments so that clients are aware of the possible outcomes before they commit to trade. As technology revolutionizes the world economy, regulators continue to update existing rules and develop new ones designed to protect customers while promoting fair competition among traders. Therefore, staying informed about changes in regulation is essential for successful forex trading operations as well as avoiding costly penalties resulting from non-compliance.

Why Regulatory Compliance Is Important

Regulatory compliance is a key component of the framework for forex brokers. It refers to meeting specific standards and requirements set out by regulatory bodies that ensure the safety of clients, as well as maintaining proper business practices within the industry. Regulatory compliance also encompasses risk management requirements and client protection mechanisms that are designed to reduce potential losses from trading activities.

One of the primary benefits of regulatory compliance lies in its ability to protect investors from unscrupulous behavior. By adhering to strict standards set out by government agencies, it is possible for forex brokers to provide their clients with reliable services while minimizing the risk associated with investing in foreign currencies. With enhanced security measures such as Know Your Customer (KYC) processes, Anti-Money Laundering (AML) reporting and other verification procedures, customers can be assured that their investments will remain safe under any circumstances.

Any failure to adhere to these regulations could result in severe penalties or sanctions depending on the severity of non-compliance. These may include financial fines, temporary suspension or even permanent closure of an affected broker’s operations. As such, it is critical for forex brokers to stay abreast of any changes that occur within this area so they can ensure full compliance at all times.

In order to safeguard investor interests, maintain high ethical standards and minimize risks related to transactions conducted through online platforms, regulators have put in place stringent rules regarding how forex brokers operate within global markets; understanding their importance is essential for ensuring success in this field.

Client Protection Mechanisms

Client protection mechanisms are a key component of regulatory compliance for forex brokers. The purpose of these measures is to ensure that clients’ funds and trading activities are kept secure at all times, while also providing effective risk management strategies. To achieve this goal, many different types of protective procedures have been adopted by brokers worldwide.

One form of client protection is through the use of segregated accounts. These accounts keep clients’ funds separate from those belonging to the broker and other investors. This prevents any potential conflicts of interest between parties involved in the Forex market, as well as ensuring clients' funds remain protected even if there were financial difficulties faced by the brokerage firm itself. Another mechanism used to protect traders is negative balance protection (NBP). NBP ensures that losses never exceed what has already been deposited into an account, and can be triggered automatically or manually when certain conditions are met.

Finally, most forex brokers must adhere to strict capital adequacy requirements before they can begin offering services to their customers. By doing so, firms demonstrate that they possess sufficient resources should any liabilities arise during operations or due to external events. In addition, such regulations may include provisions that require companies to maintain records on customer transactions and provide customers with regular statements detailing their activity within the markets over time. All these measures help ensure optimal levels of safety and security when engaging in Forex trading activities with a given broker entity, thus helping them meet their obligations under applicable regulatory frameworks.

Risk Management And Disclosure Requirements

The importance of risk management and disclosure requirements for forex brokers is integral to regulatory compliance. Forex traders rely upon their broker to provide detailed information regarding the risks associated with trading, including potential losses or gains. It is essential that this information be communicated clearly in order for clients to make sound investment decisions. To ensure that these expectations are met, it is important for all forex brokers to adhere to standards set forth by governing bodies such as the Commodity Futures Trading Commission (CFTC) and other regional regulators.

Risk management entails more than simply providing accurate trade data; a broker must also protect its clients from any financial harm they may encounter while engaging in online currency trading. This includes protecting them from fraud and unethical practices, which can cause significant losses if not properly managed. Furthermore, forex brokers should regularly review their procedures and policies related to client protection measures so as to ensure ongoing compliance with applicable regulations.

In addition to client protection mechanisms, another key component of regulatory compliance lies in the disclosure of certain financial metrics prior to executing trades on behalf of customers. Brokers must disclose both expected returns and possible losses associated with each position taken by a customer in order for them to understand the full scope of their investments. By adhering strictly to these rules, forex brokers help create an atmosphere that encourages ethical behavior among its traders while simultaneously minimizing exposure from potential legal issues arising from non-compliance with existing regulations.

Penalties For Non-Compliance

Regulatory compliance is an important factor for forex brokers to consider, as non-compliance may result in hefty fines and penalties. Forex broker regulations are set forth by authorities overseeing the financial industry that seek to protect clients from fraudulent activities. These laws also help ensure that brokers abide by ethical standards of conduct while providing a safe trading environment. Brokers who fail to comply with regulatory requirements can face severe penalties including suspension or revocation of their license, large monetary fines, or both.

The severity of the penalties imposed on non-compliant brokers will depend on the nature of their violation and whether they have prior offenses. For instance, if a broker has committed fraud against its customers, regulators may impose harsher sanctions such as permanent license revocation and substantial fines. On the other hand, minor violations such as failure to submit paperwork within deadlines may result in more lenient punishments like temporary suspension of license and smaller fees. Regardless of the infraction, these penalties exist to deter future misconduct from occurring so that clients remain protected when trading with forex brokers.

In addition to potential criminal liability for violating broker regulation laws, there is also civil liability for failing to adhere to client protection rules. Civil lawsuits can be brought forward by aggrieved parties seeking compensation for losses incurred due to negligence or unethical behavior by the broker. Such suits are often costly both financially and reputationally; therefore, it is essential for firms involved in foreign exchange transactions to take preventative measures and prioritize compliance with applicable regulations.

Benefits Of Strict Compliance

Strict compliance with forex broker regulations provides significant benefits to both clients and brokers. Compliance is essential in order to ensure client protection, as it mandates that all necessary risk management disclosures are made available to customers before they enter into any trading contract. Furthermore, by adhering to the regulatory requirements set forth by governing bodies such as the Financial Conduct Authority, brokers can be assured of a certain level of trustworthiness and legitimacy. This ultimately helps protect consumers from fraudulent activity or other unethical practices within the industry.

In addition to providing consumer protection, strict compliance also serves an important role in ensuring fair market conditions for traders. By implementing stringent protocols and procedures, brokers are able to reduce conflicts of interest between themselves and their clients, thus allowing them to operate more efficiently while still protecting customer interests. Moreover, through proper regulation adherence, firms can ensure that their services comply with international standards and promote healthy competition amongst participants within the foreign exchange (forex) market.

Regulatory compliance is therefore integral to maintaining a safe financial environment for both investors and brokers alike. By following established guidelines and enforcing best practices across the sector, companies are better able to protect their clients’ assets while promoting transparency and accountability throughout the entire process. As such, understanding the importance of these rules is essential for anyone looking to participate in forex trading activities on a global scale.

Frequently Asked Questions

How Do I Know If A Forex Broker Is Regulated?

When considering investing in the forex market, it is essential to understand how to check broker regulation. Verifying that a forex broker is regulated by an appropriate authority can be achieved through research into different regulations and authorities governing brokerage services. This process should involve researching both local and international regulatory compliance for any given broker.

It is possible to find up-to-date information on various financial regulators from government websites or from other publications such as trade journals. When conducting research it may also be useful to investigate what kind of trading conditions a particular broker offers, their level of customer service, and the reputation they have within the industry. Additionally, one should review whether the regulator has imposed certain restrictions on brokers regarding leverage amounts or margin requirements. Doing this can help investors make a more informed decision when selecting which broker best suits them.

Once all necessary information has been collected and checked against relevant sources, it becomes easier to determine if a given forex broker is compliant with applicable regulations and therefore suitable for investment purposes. While some brokers might offer attractive features that are not necessarily backed by regulation, these could potentially lead to serious losses if proper precautions are not taken beforehand. Therefore, verifying that a specific forex broker adheres to invest regulator compliance is key before deciding whether or not to commit funds into trading activities with that particular firm.

What Are The Main Risks Of Trading With An Unregulated Forex Broker?

When trading with an unregulated forex broker, investors are exposed to a variety of risks that can have a negative impact on their capital. It is essential for traders to fully understand the different types of risks associated with this kind of investing before entering into any type of agreement. This article will explore the main risks posed by using an unregulated forex broker and how to determine if your chosen broker is compliant with all applicable regulations.

The primary risk posed by using an unregulated broker is the lack of financial protection in case something goes wrong. Unregulated brokers are not subject to rigorous capital requirements like regulated brokers, which means they may be unable to meet client obligations when it comes time to pay out profits or return deposited funds. Additionally, without regulatory oversight, there is also no guarantee that these brokers adhere to industry standards regarding fair treatment and honest dealing practices. This can mean higher fees, hidden costs, and other unethical behavior such as front-running trades or market manipulation.

It is important for traders to take steps to ensure that their chosen forex broker is properly regulated before engaging in any type of transaction. Investors should look for evidence that the brokerage has been approved by a recognized financial regulator such as the U.S Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA). Brokers must comply with specific rules relating to customer disclosure agreements, leverage limits, minimum account balances and more in order to remain compliant with local laws and regulations. Those who fail to do so may face hefty fines or even revocation of their license.

Traders should conduct due diligence prior to selecting a broker and make sure that they are aware of all potential risks – both from an economic standpoint as well as legal repercussions – when choosing an unregulated entity over one that is officially registered and monitored by authorities. By taking appropriate measures beforehand, clients can minimize exposure while maximizing returns from their investments within the highly competitive foreign exchange markets .

What Are The Key Differences Between A Regulated And An Unregulated Forex Broker?

The key differences between a regulated and an unregulated forex broker need to be understood in order to make informed decisions when trading. Regulated brokers are those that adhere to regulatory compliance, while unregulated brokers may not meet the same standard as their counterparts. Forex traders should take into account these distinctions before deciding on which type of broker they wish to trade with.

A regulated forex broker is subject to oversight by government authorities, who will ensure that all financial regulations are being followed by the brokerage firm. This provides a degree of security for investors since the rules governing a regulated broker must be adhered to or else risk penalties from the overseeing body. Additionally, traders can expect higher standards of customer service and transparency when dealing with a regulated broker due to their adherence to stringent requirements concerning operations and practices set forth by regulators.

In contrast, an unregulated forex broker does not have any governmental supervision, meaning that there is no assurance that it follows any sort of guidelines or complies with industry standards. Furthermore, customers do not benefit from consumer protection laws provided by governments if something goes wrong with trades made through an unregulated broker. Due to this lack of regulation, traders run the risk of becoming victims of fraud or other malicious activities such as market manipulation or insider trading conducted by unscrupulous brokers using funds deposited by unsuspecting clients.

It is important for potential investors in foreign exchange markets to understand the risks associated with each type of broker and how they differ in terms of regulation; this knowledge can help them decide which option best meets their needs while also protecting themselves against possible losses incurred through fraudulent activity.

What Is The Difference Between A Regulated And An Authorized Forex Broker?

The current H2 focuses on the difference between a regulated and authorized forex broker. Regulated brokers are subject to specific regulations that must be followed in order to operate within their jurisdiction, while authorized brokers have been approved by a government agency or regulatory body as meeting its standards. In essence, a regulated broker is mandated to comply with rules set forth by an external authority in comparison to an authorised broker which has already achieved compliance within those same laws.

Regulation of forex trading can vary from one country to another due to the different legal frameworks governing the activity. The general objective for any regulating entity is mainly centered around protecting traders from financial malpractices such as fraud or manipulation of prices. Regulatory bodies also strive to ensure fairness and transparency when it comes to pricing across all market participants, allowing traders access to reliable data they need when making decisions on trades.

Authorized Forex Brokers meanwhile have met certain criteria set out by regulators that prove their ability and reliability in providing services related to currency markets; this includes having sufficient capital reserves, training staff adequately and investing heavily in technology infrastructure in order to provide timely execution of orders placed by clients. Furthermore, authorised brokers may also benefit from additional bonuses such as lower transactional costs or preferential terms given by some institutions like banks.

Given these differences, it is important for investors who wish to trade currencies online via a broker platform should assess both options carefully before selecting which type of broker best suits their needs. Moreover, understanding how regulation works helps ensure that investments remain safe and secure at all times whilst providing peace of mind knowing there are processes in place designed specifically for investor protection purposes.

What Is The Minimum Capital Requirement For A Regulated Forex Broker?

The minimum capital requirement for a regulated forex broker is an important aspect of the overall regulatory compliance framework. In order to be recognized as a legitimate and authorized forex brokerage, companies must abide by certain standards set forth in capital requirements regulations. These regulations are designed to protect both investors and brokers from financial losses due to improper trading practices or other fraudulent activities.

Capital requirements vary depending on where the brokerage is located, but generally speaking they involve having adequate funds available to cover any potential losses that may occur while conducting business with customers. For example, if a customer loses money through trades made using the broker’s platform, then the broker must have enough capital reserves to cover these losses without putting their own assets at risk. This ensures that there is sufficient protection for all parties involved in trading activities.

In terms of legal obligations imposed upon brokers, it is essential that they maintain records of all transactions so that authorities can audit them at any given time. By ensuring that forex brokers comply with the applicable rules and regulations regarding their capital requirements, this helps create trust between traders and brokers; it also helps enhance market efficiency by providing transparency into how much each party involved has put into play during a transaction process. Ultimately, this serves as one of many steps taken towards achieving successful regulation compliance within the industry.

Conclusion

It is important for Forex traders to understand the importance of regulatory compliance when choosing a broker. It is crucial to check if a Forex broker is regulated in order to protect oneself from potential risks associated with trading with an unregulated entity. There are significant differences between a regulated and an unregulated Forex broker, such as capital requirements, customer protection measures, and services offered. Furthermore, it is essential to differentiate between a regulated and an authorized Forex broker, since one cannot assume that authorization implies regulation.

In conclusion, due diligence must be conducted when selecting a Forex broker. Traders should research the necessary information regarding regulations applicable in the country or region where their chosen brokers operate. Understanding these regulations will help traders make informed decisions that can potentially save them time and money while engaging in profitable trades. Regulatory compliance ensures fair market conditions and investor protection which ultimately promote financial stability around the world.

5 notes

·

View notes

Text

‘Utterly fantastic news’ for investment trusts as Government announces changes to cost disclosure rules

HM Treasury, the FCA, and Tulip Siddiq (Economic Secretary to the Treasury and City Minister) have announced plans to reform UK retail disclosure rules – by James Carthew

They also said that, in the meantime, investment trusts will be temporarily exempted from assimilated EU law requirements (i.e. compliance with EU-inherited Packaged Retail and Insurance-based Investment Products (PRIIPs)…

View On WordPress

0 notes

Text

Dark Banker And Owner Of FCA-Regulated Payment Institution Extradited Over Money-Laundering Charges.

A UK Court ruled that the Italian national Caio Marchesani, director and owner of FCA-regulated Trans-Fast Remittance Ltd, must be extradited to Belgium over allegations of laundering significant sums via cryptocurrency for criminal syndicates. Bloomberg reports suggest that Marchesani facilitated major crypto transactions for a renowned criminal group, a scale seldom witnessed by European legal authorities.

The Caio Marchesani Case

Caio Marchesani, owner of Trans-Fast Remittance through Optima FX Ltd, is believed to have managed large cash transactions for Sergio Roberto De Carvalho, a Brazilian previously identified by Interpol as a top global fugitive until his 2022 capture. De Carvalho, or “Major Carvalho,” was on Interpol’s radar for drug trafficking, money laundering, document fraud, and homicide, with strong links to organized crime.

Prosecutors also accuse Marchesani of overseeing crypto accounts for Flor Bressers, known as the “finger cutter.” Arrested at Heathrow Airport in May, Marchesani is being held without bail. He must be extradited to Belgium to face criminal charges, a London judge ruled early on 19 Sept 2023.

The Belgian Investigations

The case against Marchesani is rooted in a broader probe initiated three years ago when the Dutch government confiscated over 12 tonnes of cocaine, valued at over €260 million, in Rotterdam. This investigation linked significant cocaine consignments to De Carvalho and Bressers. Marchesani’s involvement was later discovered through encrypted messages.

The prosecution alleges Marchesani acted as a “dark banker,” managing funds for criminal entities. A trial involving 30 defendants, including Bressers, began in Belgium but was swiftly postponed.

The exact amount laundered remains unspecified but is believed to be in the “hundreds of millions of euros.” Marchesani is accused of converting large cash amounts into Bitcoin for De Carvalho and Bressers.

Binance Involvement

Marchesani allegedly used Binance for his money laundering activities. The investigator identified at least 14 Binance accounts to launder money from his clients’ illicit activities.

The pandemic reportedly spurred the use of cryptocurrency for fund transfers, with Marchesani allegedly leveraging crypto to bypass these hurdles, utilizing multiple Binance accounts and imposing high transfer rates. In June, Belgium’s FSMA directed Binance to cease all operations in the nation due to legal breaches. Binance reportedly offered “operational assistance” for the investigation.

0 notes

Text

Essential Insights: FCA Fit & Proper Requirements and Conduct Rules Explained

Understanding the FCA Fit & Proper Requirements and Conduct Rules is essential for maintaining compliance and ensuring the integrity of financial operations. These regulations ensure that firms and their employees are financially sound, honest, competent, and act in the best interests of their customers. To delve deeper into these crucial guidelines and how they impact your business, visit our detailed blog post at What are the FCA Fit & Proper Requirements and Conduct Rules?.

0 notes

Text

Compliance News | September 2023

Auditor Grant Thornton was fined £2.3m and accused of a “serious lack of competence” for its role, having missed red flags.

In addition, a prohibition order was imposed on Mr. Price, preventing him from performing any function relating to regulated activities, and his approvals to perform the senior management functions SMF 3 (Executive Director) and SMF 17 (Money Laundering Reporting Officer) were withdrawn.

From April 2015 to October 2017, CFP gave advice on 1,470 transfers worth over £392m. Ms Fox designed the pension transfer model and signed off most of the advice. Over 99% of the advice was to transfer and 90% did not comply with the FCA’s rules. 33 clients were members of the British Steel Pension Scheme.

0 notes

Text

Dark Banker And Owner Of FCA-Regulated Payment Institution Extradited Over Money-Laundering Charges.

A UK Court ruled that the Italian national Caio Marchesani, director and owner of FCA-regulated Trans-Fast Remittance Ltd, must be extradited to Belgium over allegations of laundering significant sums via cryptocurrency for criminal syndicates. Bloomberg reports suggest that Marchesani facilitated major crypto transactions for a renowned criminal group, a scale seldom witnessed by European legal authorities.

The Caio Marchesani Case

Caio Marchesani, owner of Trans-Fast Remittance through Optima FX Ltd, is believed to have managed large cash transactions for Sergio Roberto De Carvalho, a Brazilian previously identified by Interpol as a top global fugitive until his 2022 capture. De Carvalho, or “Major Carvalho,” was on Interpol’s radar for drug trafficking, money laundering, document fraud, and homicide, with strong links to organized crime.

Prosecutors also accuse Marchesani of overseeing crypto accounts for Flor Bressers, known as the “finger cutter.” Arrested at Heathrow Airport in May, Marchesani is being held without bail. He must be extradited to Belgium to face criminal charges, a London judge ruled early on 19 Sept 2023.

The Belgian Investigations

The case against Marchesani is rooted in a broader probe initiated three years ago when the Dutch government confiscated over 12 tonnes of cocaine, valued at over €260 million, in Rotterdam. This investigation linked significant cocaine consignments to De Carvalho and Bressers. Marchesani’s involvement was later discovered through encrypted messages.

The prosecution alleges Marchesani acted as a “dark banker,” managing funds for criminal entities. A trial involving 30 defendants, including Bressers, began in Belgium but was swiftly postponed.

The exact amount laundered remains unspecified but is believed to be in the “hundreds of millions of euros.” Marchesani is accused of converting large cash amounts into Bitcoin for De Carvalho and Bressers.

Binance Involvement

Marchesani allegedly used Binance for his money laundering activities. The investigator identified at least 14 Binance accounts to launder money from his clients’ illicit activities.

The pandemic reportedly spurred the use of cryptocurrency for fund transfers, with Marchesani allegedly leveraging crypto to bypass these hurdles, utilizing multiple Binance accounts and imposing high transfer rates. In June, Belgium’s FSMA directed Binance to cease all operations in the nation due to legal breaches. Binance reportedly offered “operational assistance” for the investigation.

0 notes

Text

Sweden will choose a replacement for Gripen after 2030

Gripen E fighters will operate until 2060 and the current Gripen C/D fighters until 2040 or more.

Fernando Valduga By Fernando Valduga 11/12/2023 - 12:46 in Military

After joining and then later leaving the UK-led Future Combat Air System (FCAS), the Swedish military is now postponing the decision on their way to a next-generation jet fighter until 2031, after being able to assess the "risks and possibilities" with different approaches, a Saab official said.

Three options are on the table for Stockholm: "build a system, develop a system with someone, or... acquire a system," said the official, speaking under the Chatham House Rules at the International Hunting Conference in Madrid. "It's an open question."

All the commitment of the Swedish Air Force today is in the implementation of the new Gripen E.

“We had bilateral and trilateral cooperation with Great Britain and also with Italy in the FCAS program,” said the official. “We abandoned this about a year ago and started some national studies... connecting what capabilities are needed for the future.” The official refused to comment on the reason why Sweden ended its collaboration with the United Kingdom and Italy.

So far, the authorities have not made a decision on an initial operational capacity date (IOC) for the jet they intend to choose as a next-generation fighter, but a wide range of planning activities will inform the 2031 acquisition decision.

Sweden was part of the Tempest program, now GCAP.

Indicating some level of control desired by Sweden over a next-generation schedule, the official said that Phase 1 will cover concept exploration between 2023 and 2025, with Phase 2 to address concept and technology development from 2026 to 2030. Operational analysis, system concepts and aircraft demonstrators are among the main lines of effort included in the two phases. Technological development activities will run from 2023 to 2030, while the planning of demonstrators will begin in 2026.

The disclosure of the long-term program planning comes after the Swedish defense materials agency (FMV) confirmed in September that it was prioritizing future fighter studies and "finding facts", while Saab also said it wants to be an "actor" in the program, which would ideally include a role as an integrator of "system systems".

Another sixth-generation combat aircraft program in Europe is the SCAF.

The French, German and Spanish Future Combat Air System (FCAS) program, also known as SCAF, and the Global Combat Air Program (GCAP) led by Italy, Japan and the United Kingdom, formerly also known as FCAS, have committed themselves to a systems approach system, where the development of a next-generation fighter will allow them to control aircraft, effers and auxiliary sensors in a way that previous fighter jets have not been able to.

GCAP is expected to be in service from 2035, with FCAS five years later.

"One thing that has not been decided in Sweden is the IOC for next-generation hunting, so this is a great challenge because we need to be agnostic. ... We cannot simply look at a level of technology and align this [development] with the time of the IOC," said the official. He added that the "risks" and "possibilities" must be considered so that an acquisition decision can be made, including the role that the Swedish government and industry would play in development.

Gripen C/D fighters will fly in Sweden at least until 2040.

"What happened is that we made the decision to fully enter a concept phase of the next generation system, which [the approval] happened the week after the middle of the summer of this year," explained the official. "So what we will do is deliver concepts, both in the system [a new fighter] and at the system system level. We need to do technological development and integration activities. We need to develop national competence both on the government side and on the industry side."

Sweden has time in its favor to deliberate on which way to go for a future acquisition of fighters, since Saab's Gripen E, the backbone of the Swedish Air Force, is expected to be operated by 2060. Older Gripen C/D aircraft are expected to be retired between 2035 and 2040, or more, because of the war in Ukraine, according to the official.

The new Gripen E are scheduled to fly in the Swedish Air Force until 2060.

But postponing until the end of the decade to make a firm commitment to acquire future fighters risks losing industrial influence on the design requirements of GCAP or FCAS, if Stockholm decides to join one or the other, although the employees of each program have often emphasized that they remain open to new partners.

On this front, the Kingdom of Saudi Arabia continues to express interest in joining the GCAP, although the United Kingdom has stated that “there is no definitive timetable” associated with making a decision on Riyadh's potential involvement. Elsewhere, French President Emmanuel Macron announced in June that Belgium will enter the FCAS program.

Source: Breaking Defense

Tags: Military AviationFCAS - Future Combat Air System/Future Air Combat SystemFlygvapnet - Swedish Air ForceGCAP - Global Combat Air ProgramJAS39 Gripensaab

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, has participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has work published in specialized aviation magazines in Brazil and abroad. Uses Canon equipment during his photographic work in the world of aviation.

Related news

AERONAUTICAL ACCIDENTS

US military aircraft accident in the Mediterranean

12/11/2023 - 12:11

HELICOPTERS

Russia to urgently repurchase helicopter engines previously sold, including in Brazil

11/11/2023 - 23:17

MILITARY

Israeli AH-64D Apache helicopters destroy Hamas bunkers with special Hellfire missiles

11/11/2023 - 15:02

MILITARY

Lockheed Martin completes assembly of the first F-35A Lightning II for Belgium

11/11/2023 - 14:50

MILITARY

Germany sends Eurofighters to Romania to strengthen NATO air policing

11/11/2023 - 13:28

SAAB

Sweden will arm Gripen E fighters with anti-radar missiles

10/11/2023 - 18:00

Client PortalClient PortalClient PortalClient PortalClient PortalClient PortalClient PortalClient PortalhomeMain PageEditorialsINFORMATIONeventsCooperateSpecialitiesadvertiseabout

Cavok Brazil - Digital Tchê Web Creation

Commercial

Executive

Helicopters

HISTORY

Military

Brazilian Air Force

Space

Specialities

Cavok Brazil - Digital Tchê Web Creation

4 notes

·

View notes

Text

Watchdog warns of uphill battle without better financial education in schools

For free real time breaking news alerts sent straight to your inbox sign up to our breaking news emails

Sign up to our free breaking news emails

Sign up to our free breaking news emails

The head of Britain’s financial watchdog has called for better financial education in schools, warning UK economic growth faces an “uphill battle” without it.

Nikhil Rathi, chief executive of the Financial Conduct Authority, said the UK needs to tackle the “root causes of financial exclusion”, citing a recent report by the Education Select Committee of MPs.

He said: “Effective financial education needs to begin early. Potentially even at primary level, as the select committee called for, and should now be considered in the Government’s curriculum review.”

Mr Rathi made the remarks in a speech on Thursday at an event by debt charity Stepchange, attended by regulators such as Ofgem, local government officials and consumer finance companies.

He said companies, along with the FCA and other public sector bodies, also need to help improve financial inclusion across the working age population, amid a rise in digital money-related products.

He said improving digital financial inclusion across the entire population “can help mitigate barriers to, and possibly catalyse” economic growth.

He called for a “fundamental change of mindset” at the regulator, the Government and at financial services companies to improve people’s access to things like digital loans and savings products.

“It’s about access to what you need to live your life,” he added.

Mr Rathi pointed to recent trials of auto-enrolled workplace savings schemes, where, similar to pensions, employers deduct the amount workers want to save directly from their payroll unless the employee opts out.

The National Employment Savings Trust (Nest), which has run the trials, said the schemes were popular with 93% of those surveyed during the trials.

He said: “With an estimated one in three working age people not having access to £1,000 of cash savings to help with unexpected life events, this could be a game changer.”

Moreover, Mr Rathi continued, the financial advice and guidance market in the UK “does not work well”.

He added: “Working with Government, it is our hope to reform the system so consumers get the help they want, when they need it, and at an affordable cost.

“This could improve support for making pension decisions or choices with long-term savings and investments.”

At the same event, Financial Ombudsman Service chief executive Abby Thomas urged businesses to step up support for people in debt.

In the first three months of this financial year, complaints rose by 70% versus 2023, she said, with 18,000 credit card cases, of which 15,000 related to irresponsible or unaffordable lending.

Ms Thomas said the volume of complaints is “concerning” and that lenders must treat customers “fairly and with empathy”.

She added: “There are so many well-established rules and guidelines – including most recently in the consumer duty – that are designed specifically to help financial businesses find ways of supporting their customers when the need arises.

“But despite this, we’re still seeing cases where customer experience has fallen far short of what it should have been.”

Source link

via

The Novum Times

0 notes

Text

Understanding Forex Regulations: A Comprehensive Guide

Understanding Forex Regulations: A Comprehensive Guide

The forex market, with its vast liquidity and 24-hour trading opportunities, attracts traders from all over the world. However, the decentralized nature of this market also brings significant risks, making regulatory oversight crucial. This article provides a comprehensive guide to understanding forex regulations, highlighting their importance, key regulatory bodies, and the benefits they offer to traders.To get more news about forex regulatory, you can visit our official website.

Importance of Forex Regulations

Forex regulations are essential for maintaining market integrity, protecting traders from fraud, and ensuring fair trading conditions. Here are some key reasons why forex regulations are important:

Investor Protection: Regulatory bodies enforce strict rules to ensure brokers maintain transparent and fair practices. They monitor brokers to prevent fraudulent activities, such as misappropriation of funds or price manipulation. This protection gives traders peace of mind, knowing their investments are safe.

Market Integrity: Regulations help maintain the integrity of the forex market by ensuring all participants adhere to the same set of rules. This prevents market manipulation, insider trading, and other unethical practices that can distort market prices and harm traders.

Segregation of Client Funds: Regulated brokers are required to keep client funds separate from their own operating funds. This segregation protects traders from any potential misuse or misappropriation by the broker.

Dispute Resolution: Regulatory bodies provide a platform for traders to raise complaints against brokers. They investigate such complaints impartially and provide resolutions, ensuring traders have a fair chance to seek justice in case of any disputes.

Financial Stability: Regulated brokers are subject to financial audits and capital adequacy requirements. These measures ensure brokers have sufficient funds to cover their clients’ trades and obligations, reducing the risk of broker insolvency and protecting traders’ investments.

Key Regulatory Bodies

Several regulatory bodies around the world oversee the forex market, each with its own set of rules and standards. Some of the most prominent regulatory bodies include:

Financial Conduct Authority (FCA): Based in the United Kingdom, the FCA is one of the most respected regulatory bodies in the forex industry. It sets strict standards for brokers and regularly monitors their compliance. FCA-regulated brokers must adhere to stringent capital requirements and maintain segregated client accounts.

Commodity Futures Trading Commission (CFTC): In the United States, the CFTC regulates forex brokers and ensures they comply with federal laws. The CFTC’s stringent regulations aim to protect traders from fraud and market manipulation.

Australian Securities and Investments Commission (ASIC): ASIC is the regulatory body in Australia, known for its rigorous oversight of forex brokers. ASIC-regulated brokers must meet high standards of financial integrity and transparency.

Cyprus Securities and Exchange Commission (CySEC): CySEC regulates forex brokers in Cyprus, a popular jurisdiction for many brokers due to its favorable regulatory environment. CySEC ensures brokers operate fairly and transparently, protecting traders’ interests.

Benefits of Forex Regulations

Forex regulations offer numerous benefits to traders, including:

Enhanced Security: Regulatory oversight ensures brokers adhere to strict standards, reducing the risk of fraud and ensuring traders’ funds are secure.

Fair Trading Conditions: Regulations promote fair trading conditions by preventing market manipulation and ensuring brokers provide transparent pricing.

Increased Confidence: Knowing that a broker is regulated by a reputable authority gives traders confidence in the broker’s reliability and integrity.

Access to Dispute Resolution: Regulatory bodies provide mechanisms for resolving disputes between traders and brokers, ensuring traders have a fair chance to seek justice.

Conclusion

Understanding forex regulations is crucial for any trader looking to navigate the forex market safely and successfully. Regulatory bodies play a vital role in maintaining market integrity, protecting traders from fraud, and ensuring fair trading conditions. By choosing a regulated broker, traders can enjoy enhanced security, fair trading conditions, and increased confidence in their trading activities. As the forex market continues to evolve, staying informed about regulatory changes and choosing reputable brokers will remain essential for successful trading.

0 notes