#FASTag online

Explore tagged Tumblr posts

Text

How to get a FASTag for a second-hand car?

Obtaining a FASTag for a second-hand car is a straightforward process – though it involves a few extra steps compared to getting one for a brand-new vehicle. This guide will take you through the necessary steps. By the end, you’ll understand all the requirements and information for getting a FASTag for a second-hand car.

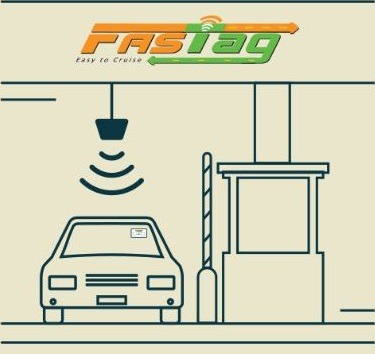

Understanding FASTag and Its Importance

Before obtaining a FASTag for a second-hand car, it’s important to understand what a FASTag is and why it’s essential. FASTag is an electronic toll collection system operated by the National Payments Corporation of India (NPCI) under the guidelines of the National Highways Authority of India (NHAI). It uses Radio Frequency Identification (RFID) technology to automatically deduct toll charges as you pass through toll plazas on national highways.

Why Do You Need a FASTag?

Convenience: No need to stop and pay cash at toll booths.

Time-Saver: Faster transit through toll plazas.

Fuel Efficiency: Reduced fuel consumption as you avoid stops at toll booths.

Cashback Offers: Some banks offer cashback on toll payments made through FASTag.

Mandatory: As of February 2021, FASTag has become compulsory for all vehicles on Indian highways.

Checking for Existing FASTag

When purchasing a second-hand car, the first thing you need to check is whether the car already has a FASTag. If the previous owner had installed a FASTag, you might be able to transfer it to your name. Here’s how you can do it:

Steps to Check Existing FASTag

Ask the Seller: Check with the seller if the vehicle has an active FASTag.

Contact the Issuing Bank: If the FASTag was issued by a particular bank, you can contact the bank’s customer care to confirm the status of the FASTag.

Online FASTag Portals: Some banks provide online services where you can check the status of a FASTag by entering the vehicle’s registration number.

Transferring the FASTag to Your Name: You will need to transfer the FASTag to your name if the car you are buying already has one. The process generally involves submitting a few documents to the issuing bank, including the car’s new Registration Certificate (RC) and proof of identity. The bank will update its records to reflect the change of ownership.

Applying for a New FASTag

If the second-hand car does not have a FASTag or if the existing FASTag cannot be transferred, you will need to apply for a new one. Here’s how you can go about doing that:

Documents Required:

Vehicle Registration Certificate (RC): Double-check that the RC is updated with your name as the new owner.

KYC Documents: These include your proof of identity (Aadhaar card, PAN card, Passport) and proof of address.

Passport-Sized Photograph: A recent photograph for identification purposes.

Where to Apply:

Banks: Many banks, such as SBI, ICICI, HDFC, and others, issue FASTags. You can visit their branches or apply online through their websites.

Point-of-Sale (POS) Locations: FASTags are also available at POS locations at toll plazas and through authorized agents.

Online Marketplaces: Some e-commerce platforms and payment apps also offer the option to purchase FASTags online.

How to Apply:

Visit the Bank or POS Location: Submit the necessary documents and fill out the application form.

Online Application: If applying online, fill out the form on the bank’s website, upload the necessary documents, and make the payment.

Activation: Once your application is approved, the FASTag will be activated, and you can start using it immediately.

Recharging Your FASTag

Once you have your FASTag, you’ll need to fill it up so that there is sufficient balance for toll payments. The following are some different methods of recharging your FASTag:

Online Banking – Use your bank’s online banking portal to recharge your FASTag.

UPI – Using UPI apps to add funds to your FASTag account.

Mobile Banking Apps – Most banks have mobile apps that allow you to manage your FASTag, including recharges.

It’s essential to keep track of your FASTag balance to avoid any issues at toll plazas. Most banks offer SMS alerts. You can also check your balance through the bank’s app or customer portal.

Common Issues and Troubleshooting

While FASTag is generally easy to use, you might encounter some issues (especially with a second-hand car). Here are some common problems and solutions of resolving them:

Incorrect FASTag Installation

Problem: The RFID tag is not working correctly due to improper placement.

Solution: Make sure the FASTag is placed correctly on the windshield as per the instructions.

Low Balance Issues

Problem: Your FASTag balance is insufficient, leading to transaction failures at toll plazas.

Solution: Recharge your FASTag in advance and set up low-balance alerts.

Inactive FASTag

Problem: The FASTag is not active, possibly due to a lapse in ownership transfer or delayed activation.

Solution: Contact the issuing bank to resolve activation issues and ensure the FASTag is linked to your vehicle.

Getting a FASTag for a second-hand car is a relatively simple process, provided you have all the necessary documents and follow the correct procedures. The important thing to remember above all is that the FASTag gets properly registered in your name and linked to your vehicle.

By following the steps revealed in this guide, you can enjoy seamless and hassle-free toll payments on your road trips, making your driving experience more convenient and efficient.

0 notes

Text

Buy IndusInd Bank FASTag Online and Streamline Your Highway Commute

Simplify toll payments and save time on your highway journeys with IndusInd Bank FASTag. Enjoy benefits like cashless transactions, monthly e-statements, and 24x7 customer care. Apply for a FASTag online and recharge effortlessly for a hassle-free travel experience.

1 note

·

View note

Text

Calculate FD Interest | Bajaj Finserv

Analyzing and gaining a better knowledge of how much interest you would earn on your investment, Calculate FD Interest to analyze several FD alternatives and select the one that delivers the maximum returns, and maximize your revenue Bajaj Finserv can make smart decisions for your convenience.

0 notes

Text

Calculate FD Interest | Bajaj Finserv

Analyzing and gaining a better knowledge of how much interest you would earn on your investment, Calculate FD Interest to analyze several FD alternatives and select the one that delivers the maximum returns, and maximize your revenue Bajaj Finserv can make smart decisions for your convenience.

1 note

·

View note

Text

How To Check Balance in Fastag | Bajaj Finserv

With the advent of digitalization and the growing number of internet-enabled smartphones, it is common knowledge that you can quickly and easily access a fastag, recharge it at any time, and monitor it. Download the Bajaj Finserv app and check online Fastag balance and recharge in a few easy steps.

0 notes

Text

0 notes

Text

Why is sufficient balance necessary in fastag?

Maintaining sufficient balance in your Fastag account is important because it allows for seamless and uninterrupted toll payments when you pass through toll plazas. Fastag is a prepaid rechargeable tag that allows for the automatic deduction of toll charges without the need for stopping and paying in cash.

If your Fastag account does not have sufficient balance, the toll plaza system will not be able to deduct the toll amount, which can result in delays, inconvenience, and even penalties. You may also need to pay the toll amount in cash, which defeats the purpose of having a Fastag.

Moreover, it is important to note that certain toll plazas have a "minimum balance" requirement, which means that you must maintain a certain amount of balance in your Fastag account to be able to pass through that particular toll plaza. Failure to maintain the minimum balance can result in a penalty or the tag being blacklisted.

Therefore, it is important to keep your Fastag account adequately funded to avoid any hassles or penalties while traveling.

Here's how to use Easemydeal to recharge your fastag:

1: Browse Easemydeal online or through a mobile app.

If you haven't already, sign in or make an account.

Go to the section labeled "Fastag Recharge."

Type in your Fastag account number and select which bank issued the fastag service for example Axis bank fastag or other.

Enter the amount to be recharged and select your chosen payment method.

Verify the information and finish the payment.

That's all; your Fastag account will quickly be recharged, allowing you to drive without concern for toll costs.

Conclusion

Easemydeal is a one-stop destination for all your digital service needs in India, offering a range of options such as flight booking, gift vouchers, rent payments, and most importantly, Fastag recharge services. By providing some of the best deals and offers in the market. If you are a vehicle owner traveling on Indian highways, getting a Fastag is essential, and Easemydeal makes it easy for you to recharge it. So, whether you are planning a road trip or commuting on a regular basis, Easemydeal can make your travel experience more convenient and hassle-free. Take advantage of the best deals and offers by visiting the website and recharge your Fastag today!

0 notes

Text

Recharge your FASTag online with abhieo and enjoy hassle-free toll payments without any extra fee

#abhieo#finance#fintech#recharge#rechargeapp#mobilerecharge#payment#fastag#fastagrecharge#billpayment#paymentapp#bbps#tolltax#tollpayment#tollplaza

2 notes

·

View notes

Video

youtube

మినీ ఆధార్ సెంటర్ స్టార్ట్ చెయ్యండి | Start Mini Adhaar Center from Home/Shop

Get 48 Services with license Contact us on 94940 56339 for more information

Digi seva pay services list

Visit https://www.digisevapay.co.in

Mobile app:

https://liveappstore.in/shareapp?com.digisevapaypro.digisevapaypro.inapp=

Digi Seva Pay services offering more than 48 services

Contact us 94940 56339

1.Adhaar Services Below *Adhaar Address Update *Adhaar download *Adaar PVC card apply *Adhaar Update History *Adhaar Card Slot Booking *Adhaar Bank Link Status chking Fecility

2.Voter ID Services ( New card apply & corrections)

3.Pan Card Services * New Pan Card Apply *Pan card Corrections *Instant Pan card *Minor Pan Card *Duplicate Pan Card

4.Micro& Mini ATM Services *Cash withdrawal *Fund transfer *Cash Deposit *Loan Payments

5.AEPS Fund Transfer

6.AEPS Cash Deposit

7.Mobile Recharges

8.Adhaar Pay

9.QR Code Payments

10.UPI payments scanning facility

11.Online Bank Account opening Facility both Pvt banks and Government banks

12.Zero Balance Account Facility

13.ATM card apply online facility

14.BBPS Payments facility

15.Electricity Bill Payments

16.Waterbill Payments

17.Fastag Payment facility

18.Pan Card NSDL&UTI

19.Micro Loan Facility

20.Insurance Facility

21.Food License Apply

22.Gas Bill payments

23.New Gas Connection Facility(Bharath,HP,Indian Gas)

24.Passport Services

25.Driving License Slot booking and Apply

26.Udyam Registration & MSME Registration Facility

27.LIC Premium Payments

28.TTD Ticket Booking Facility

29.Online Sand Booking Facility

30.Dharani Portal for land Registration

31.Encumberance Certificate

31.Death&birth Certificate

32.Udyam Registration

33.SBI Mudra loan Apply

34.Trading Account Facility

35.Incometax Filing

36.Gov Disability Card Apply

37.Student Loan Apply

38.Credit Card Apply

39.Govt Disability Card

40.PM Kisan for farmers

41.Ayushman Bharat Cards

42.Jeevan Praman Life Certificate

43.Scholership Apply Facility

44.Covid-19 Vaccination Certificate

Below Services Are Coming Soon

45.IRCTC Ticket Booking

46.Ration Card – Mobile number linking

47.Apply for New Ration Card Facility

48.Bus Ticket,Flight Ticket Facility

We will Give the Training in Zoom Session Every Week online

Whatsapp Support and Training Videos will be provided.

Registration Process as per new guidelines: 1.Adhaar card photo 2.Pan Card photo 3.Phone number 4.Email Id 5.Live Location to be shared 6.2-4 Sec video Recording by holding adhaar /pan 7.Any other person reference contact number and ID proof 8.bank passbook photo 9.Ration card photo for address verification

High Lights of Digi Seva Pay Company:

24*7 Fund Transfer Facility

We are having more than 15,000 Satisfied Retailers

More Services with just 999/-

Retailor for 999/-

Distributor for 7,999/-

Super Distributor 14,999/-

Contact us on 9494056339 Note : Registration fees non Refundable

2 notes

·

View notes

Text

How to Choose the Best High-Commission Recharge API for Your Business

In the digital age, offering recharge services through an API can significantly boost your business's revenue and customer engagement. However, not all recharge APIs are created equal. To maximize your profits, you need to choose a recharge API with high commission rates and reliable performance. This article will guide you through the process of selecting the best API for your business.

Understanding Your Business Needs:

Before diving into the technical aspects of recharge APIs, it's essential to understand your specific business requirements. Consider the following factors:

Target Audience: Who are your primary customers? What services do they need?

Transaction Volume: How many transactions do you expect to process daily?

Integration Requirements: How easily can the API be integrated with your existing platform?

Support Requirements: What level of technical support do you need?

Key Factors to Consider:

Once you have a clear understanding of your business needs, evaluate potential recharge APIs based on the following criteria:

Commission Rates: The most crucial factor is the commission structure. Look for APIs that offer competitive and transparent commission rates.

API Reliability and Uptime: Ensure the API has a high uptime and minimal downtime to ensure smooth transactions.

API Documentation and Ease of Integration: Comprehensive and easy-to-understand API documentation is essential for seamless integration.

Security and Compliance: Choose an API that adheres to strict security standards and complies with relevant regulations to protect sensitive customer data.

Variety of Services: Select an API that offers a wide range of recharge services, including mobile recharges, DTH recharges, bill payments, and more.

Customer Support: Reliable and responsive customer support is crucial for addressing any technical issues or concerns.

Expanding Your Service Portfolio:

To further enhance your service offerings and cater to a broader audience, consider integrating complementary APIs such as a Payout API provider and a Fastag API provider.

A reliable Payout API provider allows you to offer seamless and secure fund transfers, enabling instant payouts to your customers or partners. This is particularly beneficial for businesses involved in e-commerce, affiliate marketing, or online gaming.

Integrating a Fastag API provider enables you to offer Fastag recharge and management services, catering to the growing demand for cashless toll payments. This adds value to your platform and attracts customers who frequently travel on highways.

Cyrus Recharge: Your Trusted API Partner

Cyrus Recharge stands out as a leading API provider in India, offering a recharge API with high commission rates, reliable performance, and excellent customer support. They are also a trusted Payout API provider and fastag api provider, making them a one-stop solution for your API needs. Their commitment to quality, innovation, and customer satisfaction makes them a preferred choice for businesses seeking to 1 maximize their profits.

By carefully evaluating your business needs and considering the key factors mentioned above, you can choose the best high-commission recharge API to drive your business growth.

FAQs:

1. What are the benefits of choosing a recharge API with high commission?

A recharge API with high commission rates directly translates to increased revenue for your business. It allows you to maximize your profits and achieve a higher return on investment.

2. Why is it important to consider the API's reliability and uptime?

A reliable API with high uptime ensures smooth transactions and minimizes downtime, preventing customer dissatisfaction and potential revenue loss.

3. How can a Fastag API provider benefit my business?

A Fastag API provider allows you to offer Fastag recharge and management services, catering to the growing demand for cashless toll payments. This adds value to your platform, attracts new customers, and generates additional revenue streams.

1 note

·

View note

Text

How FASTag is modernizing Toll Payments in India

In a world that’s marked by innovation, it would be a fair assessment to say that India’s transportation system has undergone a major transformation with the introduction of FASTag. This Radio-Frequency Identification (RFID) based electronic collection system has changed the way vehicles move through toll plazas. By modernizing toll payments, FASTag is promoting efficiency and contributing to a more digitally driven economy.

A Seamless Travel Experience

One of the primary advantages of FASTag is its ability to provide a seamless travel experience. Unlike the traditional toll collection system, FASTag enables automatic deduction from a prepaid account linked to the vehicle's tag. As vehicles pass through dedicated FASTag lanes, the RFID technology detects the tag and the toll fee is deducted in real-time. This reduces the hassle of carrying cash and saves significant time by eliminating long queues.

Enhancing Traffic Management

Before the implementation of FASTag, toll plazas were often blockages that caused massive delays and congestion. With FASTag, vehicles can now pass through tolls with minimal stoppage, drastically cutting down traffic jams.

Cost-Effective and Environment-Friendly

FASTag not only benefits individual drivers but also has a broader economic and environmental impact. With the reduction in waiting times at toll plazas, fuel consumption is minimized, which in turn leads to lower fuel expenses for drivers. Additionally, the reduction in vehicular emissions contributes to a greener environment. The system also benefits the toll operators by automating toll collection, reducing human errors, and minimizing revenue leakage, making the entire process more cost-effective.

Digital Push for Financial Inclusion

The introduction of FASTag is a significant step towards India’s digital transformation. It encourages cashless transactions, promoting financial inclusion across different sections of society. With the backing of hitchzone, recharging a FASTag account has become a hassle-free process. Moreover, users can track their toll payments online, ensuring transparency and security in their transactions.

By ditching outdated toll booths, FASTag is revolutionizing India’s roadways. Imagine zipping through tolls without stopping, saving time, fuel, and frustration! As more drivers join in, our highways are transforming into smoother, eco-friendly, and ultra-efficient routes that keep India moving forward.

0 notes

Text

"False Promise of Marriage: Delhi High Court Upholds Charges Against Accused"

➡️The prosecutrix, divorced from Karan in June 2024 due to physical harassment, met Himanshu Singla online in February 2024. Singla allegedly established physical relations with her under the false pretense of marriage. Upon discovering he was already married, Singla promised a divorce, leading to further physical relations despite a prior discontinuation of contact. Following threats from Singla's wife, the prosecutrix filed an FIR, resulting in Singla's arrest on September 7, 2024, and subsequent charges under Section 64(2)(m) of the Bharatiya Nyaya Sanhita (BNS), 2023.

#FalsePromiseOfMarriage #SexualConsent

👉The legal issues before the Court were threefold.

◆ Whether the petitioner’s actions amounted to rape under Section 64(2)(m) of BNS (engaging in sexual intercourse on a false promise of marriage).

◆ Whether the prosecutrix, being already married, could claim deception regarding marriage.

◆ Whether the petitioner’s plea of alibi and claims of consensual relationship could be considered at this stage.

#FalsePromiseOfMarriage

➡️The petitioner accused contended that

→ The prosecutrix was aware of his marital status and falsely implicated him to extort money.

→ He was not in Delhi on 28.05.2024, as evidenced by Fastag toll receipts and mobile location records.

→ The prosecutrix voluntarily engaged in the relationship and continued physical relations even after knowing his marital status.

→ A distinction exists between breach of promise and a false promise with mala fide intent, and no case of rape is made out.

➡️The State strongly rebutted the argument of the Petitioner-alleged accused.

→ The petitioner repeatedly assured the prosecutrix of marriage despite being married.

→ The prosecutrix was unaware of his marital status initially.

→ The allegations, medical records, and statements under Section 183 BNSS establish a prima facie case.

→ The plea of alibi and defenses raised by the accused should be considered during trial, not at the stage of framing charges.

#SexualConsent

👉 The Delhi High Court noted that

→ Both parties were in legally subsisting marriages at the time of their relationship. Later divorce was obtained by the prosecutrix.

→ The prosecutrix alleged that she obtained a divorce based on the accused’s assurance of marriage.

→ The accused’s assurance of marriage despite being already married could constitute a false promise.

→ The Court considered at the stage of framing charges, a prima facie case is established based on FIR, medical records, and statements.

→ Hence, the plea of alibi and the accused’s defense require a full trial to determine credibility.

#ConsentVsCoercion

➡️The petition to set aside the order on the charge was dismissed, and the Court upheld the framing of charges under Section 64(2)(m) of BNS against the petitioner.

👉Follow me for more #legalinsights #significantrulings, and #legalupdates #legalconsultationservices.

#FalsePromiseOfMarriage#DelhiHighCourt#SexualConsent#BNS2023#CriminalLaw#LegalPrecedent#MaritalStatusDeception#ConsentVsCoercion#JudicialObservations#CaseAnalysis

1 note

·

View note

Text

Key Things to Know About FASTag Implementation in India

Remember the endless queues at toll plazas, the struggle to find change, and the frustration of wasted time? FASTag implementation in India is rapidly erasing these inconveniences.

By leveraging RFID technology, FASTag has transformed the traditional cash-based toll system into a streamlined, cashless process. This innovation has become crucial for businesses, toll operators, and drivers, significantly reducing congestion, travel time, and environmental impact.

As India progresses toward a fully digital economy, understanding FASTag’s advantages is essential for all road users. Let’s dive into the workings of FASTag and its transformative effect on the nation’s highways.

What is FASTag?

FASTag is a prepaid tag that uses RFID technology to enable automatic toll payments. As a vehicle with a FASTag passes through a toll plaza, the system scans the tag and deducts the appropriate toll fee from the linked account, ensuring seamless traffic flow.

This system has revolutionized toll collection across India, easing congestion and eliminating the hassle of manual toll payments. It accommodates various vehicle types, from private cars to commercial fleets.

Objectives of FASTag Implementation in India

FASTag technology aims to modernize India’s transportation ecosystem by achieving the following:

Reducing Waiting Time: Automates toll collection to eliminate bottlenecks and reduce delays.

Fuel Efficiency: Reduces idling at toll booths, leading to fuel savings for vehicles.

Lower Pollution: Promotes a greener environment through reduced emissions.

Convenient Tolling: Offers a hassle-free, cashless payment system for users.

Advancing Digitalization: Supports India’s digital economy vision by replacing cash transactions with electronic payments and enabling better data management for toll operations.

Benefits of FASTag

FASTag’s advantages extend far beyond convenience:

Automatic Toll Payment: Deducts toll charges directly from the linked wallet without manual intervention.

Cashless Convenience: Eliminates the need to carry cash or deal with change.

Attractive Offers: Cashback and incentives make it cost-effective for frequent travelers.

Easy Recharges: Recharge wallets online via banking apps, UPI, or net banking.

Fuel and Time Savings: Reduces idle time, ensuring faster journeys.

Account Management: Provides easy online access to transaction history and account details.

Enhanced Security: Digital processes minimize errors and fraud.

RFID Technology and FASTag

The FASTag system relies on RFID technology, where a unique tag affixed to a vehicle’s windshield communicates with sensors at toll plazas. This technology ensures efficient toll payments and real-time vehicle tracking.

India’s adoption of RFID technology has been instrumental in speeding up toll transactions and improving transparency. Future advancements promise to enhance its applications further.

Partner with Avensprint for FASTag Solutions

FASTag implementation exemplifies India’s journey toward cashless mobility, and Avensprint is leading the charge. Our innovative FASTag solutions empower businesses and operators to optimize this technology, making travel efficient for millions across India.

Ready to embrace a smarter tolling system? Contact Avensprint today to explore our comprehensive FASTag solutions.

0 notes

Text

How to Effectively Target Local Ads for Your Business?

Radigone is revolutionizing the way advertisements reach viewers, offering a unique experience where users gain value for their time and attention. By registering on Radigone, viewers can enjoy financial benefits, personalized ad experiences, and business opportunities.

1. Financial Assistance to Manage Routine Expenses

One of the standout features of Radigone is its ability to provide viewers with financial assistance to clear routine, unavoidable expenses. As a viewer, you can accumulate Radigone points simply by watching advertisements. These points can be used to cover essential bills such as:

Phone bills

Mobile bills

Internet bills

FASTag/Electricity and water bills

Insurance policies

Radigone points offer a practical solution to everyday financial needs, ensuring that viewers can reduce their monthly expenses without any extra effort. This unique system makes Radigone a powerful Targeted Local Advertising platform that benefits both viewers and advertisers.

2. Encash Your Radigone Points into Your Bank Account

Unlike other platforms that offer rewards in the form of vouchers or discounts, Radigone takes it a step further by allowing viewers to encash their Radigone points directly into their bank accounts. This feature gives viewers complete control over their earnings and the freedom to use them as they wish. The ability to turn points into real money sets Radigone apart in the Create Business Ads Online space, making it a win-win for viewers and advertisers alike.

3. Sophisticated Radigone Points Reporting System

Radigone provides a user-friendly and transparent points reporting system. As a viewer, you can track your Radigone points in real-time, ensuring complete transparency and accuracy. The reporting system shows details such as:

Points earned from watching specific ads

Conversion rates of points to cash

Historical earnings data

This sophisticated system ensures that viewers have a clear understanding of their earnings and the value they are receiving from the platform.

4. Watch Advertisements Based on Your Interests

One of the most significant advantages of Radigone is the freedom it offers viewers to watch advertisements based on their interests and preferences. Viewers can choose ads from categories that appeal to them, ensuring a more personalized and enjoyable viewing experience. This feature makes Radigone a leader in Targeted Local Advertising, where viewers only see ads that are relevant to their lifestyle and needs.

5. Inclusive Platform for Everyone

Radigone is an inclusive platform that welcomes everyone, regardless of their gender, language, place of living, educational background, or references. This inclusivity ensures that anyone can benefit from the platform, making it accessible to a broad audience. The platform’s focus on inclusivity also helps advertisers reach a diverse audience through Create Business Ads Online, ensuring that their messages resonate with various demographic groups.

6. Save Time, Fuel, and Travel Expenses

With Radigone, there’s no need to travel anywhere to earn rewards. Viewers can watch ads from the comfort of their homes, saving time, fuel, and travel expenses. This convenience is especially beneficial for those who have busy schedules or limited mobility. By eliminating the need for travel, Radigone enhances the efficiency of Targeted Local Advertising while providing viewers with a hassle-free experience.

7. Stay Updated with Your Favorite Brands

Radigone keeps viewers informed about the latest updates from their favorite brands. Whether it’s new product launches, special promotions, or exclusive deals, viewers can stay in the loop by watching relevant advertisements. This feature ensures that viewers never miss out on important updates while earning Radigone points. For advertisers, this creates an opportunity to engage with their audience through Create Business Ads Online in a meaningful way.

8. Enjoy Special Discounts from Advertisers

Radigone viewers can also enjoy special discounts from advertisement companies. These exclusive deals are available only to Radigone users, providing them with additional savings on products and services. By registering on Radigone, viewers can access these discounts and enjoy more value for their time and attention. This feature enhances the platform’s appeal as a Targeted Local Advertising solution that benefits both viewers and advertisers.

9. Protect Your Privacy with Opt-Out Options

Radigone respects viewers’ privacy and provides an option to opt out of advertisement campaigns shared by all companies. This feature ensures that viewers have control over the types of ads they see and can protect their privacy if they wish. By allowing viewers to opt out, Radigone maintains a balance between providing valuable content and respecting users’ preferences. This approach strengthens the platform’s reputation as a trustworthy Create Business Ads Online solution.

10. Create Business Opportunities for Viewers, Agents, and Sponsors

Radigone is more than just a platform for watching ads; it’s a Business Promotion Platform that creates opportunities for viewers, agents, and sponsors. Here’s how each group can benefit:

Viewers: Earn Radigone points by watching ads, encash points, and save on routine expenses.

Agents: Help businesses promote their ads and earn commissions.

Sponsors/Companies: Reach a targeted audience through Targeted Local Advertising and grow their business.

By connecting viewers, agents, and sponsors, Radigone fosters a thriving community where everyone can benefit. The platform’s focus on creating business opportunities ensures that users can maximize their earnings while helping businesses reach their target audience.

Why Radigone Stands Out as a Business Promotion Platform

Radigone’s innovative approach to advertising makes it a standout Business Promotion Platform. Here’s why it’s gaining popularity:

Targeted Local Advertising: Advertisers can reach specific local audiences, ensuring higher engagement and better ROI.

Create Business Ads Online: The platform makes it easy for businesses to create and share ads with their target audience.

Viewer Engagement: Viewers are rewarded for their time and attention, ensuring higher engagement rates.

Privacy Protection: Viewers have control over their ad preferences and privacy settings.

How to Get Started on Radigone

Getting started on Radigone is simple and straightforward. Here’s how you can register and start enjoying the benefits:

Sign up on the Radigone platform.

Complete your profile and set your ad preferences.

Start watching ads and earning Radigone points.

Redeem your points for cash or discounts.

Explore business opportunities as a viewer, agent, or sponsor.

By following these simple steps, you can unlock a world of opportunities on Radigone and start benefiting from its unique features.

Radigone is transforming the advertising landscape by providing viewers with tangible benefits and creating business opportunities for everyone involved. With features like financial assistance for routine expenses, encashment of points, personalized ad experiences, and privacy protection, Radigone stands out as a top Business Promotion Platform. By registering now, viewers can enjoy these incredible benefits while helping businesses grow through Targeted Local Advertising. Don’t miss out—register on Radigone today and start earning rewards for your time and attention!

#radigone#bestplacetoearnmoney#earnradigonepoints#bestadvertisment#playads#makemoneyonline#rdpoints#watchonlineads#rechargefasttag#workonline

0 notes

Text

How Does the Bharat Bill Payment System (BBPS) Benefit Consumers?

In today’s fast-paced world, managing multiple bills—electricity, water, gas, mobile recharge, and more—can be challenging. The Bharat Bill Payment System (BBPS) makes life easier by offering a one-stop platform for all your bill payment needs. Let’s explore how BBPS benefits consumers and why it’s transforming the way we manage our payments.

What is BBPS?

BBPS is a centralized system for bill payments in India, designed by the National Payments Corporation of India (NPCI). It connects multiple billers and payment channels under one roof, ensuring convenience, security, and efficiency for consumers.

Key Benefits of BBPS for Consumers

Convenience Across Bill Categories BBPS allows consumers to pay different types of bills—electricity, gas, water, broadband, mobile recharge, DTH, and even FASTag—through a single platform. Whether you're using Bharat Connect BBPS or other connected systems, the process is seamless.

Access to Multiple Payment Channels BBPS integrates both online and offline payment modes, including apps, bank branches, ATMs, and Agent Institutions BBPS outlets. No matter where you are, paying your bills is hassle-free.

Real-Time Confirmation Once you make a payment, you receive instant confirmation via SMS or email. This ensures peace of mind and eliminates worries about lost transactions.

Error-Free Transactions BBPS employs an AI-powered bill payment system BBPS to ensure secure and accurate transactions. This advanced technology reduces errors and ensures smooth reconciliation of payments.

Simplified Reconciliation Thanks to the BBPS Settlement & Reconciliation process, your payments are recorded and settled efficiently. This transparency ensures consumers can trust the system completely.

Special Features of BBPS

ClickPay BBPS supports ClickPay, which allows consumers to pay their bills with a single click. No need to remember due dates—just click and pay when you receive the notification!

Unified Presentment Management System This feature organizes your bill details into an easy-to-read format, allowing you to review charges before making payments.

Role of BOU and COU

BBPS BOU (Biller Operating Unit): Connects billers like electricity boards and telecom providers to the BBPS network.

BBPS COU (Customer Operating Unit): Links consumers to the system via apps, banks, or other platforms, ensuring smooth communication between billers and payers.

FASTag TSP Integration Pay your FASTag bill payment easily through BBPS, eliminating the need for separate apps or portals. Platforms like Bharat Connect TSP and B2B Bharat Connect TSP make this integration effortless.

How Secure is BBPS?

BBPS is designed to prioritize consumer safety. It leverages AI-powered technologies to secure every transaction. The system also follows strict regulatory guidelines, ensuring that your sensitive data remains protected.

Why Should You Use BBPS?

Unified Experience: BBPS combines all your bill payments under one system.

Trusted Network: Built by NPCI, BBPS connects you with reliable biller operating units and customer operating units.

Time-Saving: Whether it’s paying utility bills or recharging your mobile, BBPS simplifies the process.

Conclusion

The Bharat Bill Payment System (BBPS) is a game-changer for consumers. With features like ClickPay, BBPS BOU, BBPS COU, and unified presentment management systems, it ensures a secure and seamless bill payment experience. Whether you're using BBPS through Bharat Connect or other platforms, the system offers unmatched convenience and reliability.

Start using BBPS today and simplify your bill payments!

#Bharat Bill Payment System#benefit of bbps#advantages of bbps#bbps#bharat connect#biller operating unit#customer operating unit#clickpay#agent insitution

0 notes