#Ethyl acetate manufacturers

Explore tagged Tumblr posts

Text

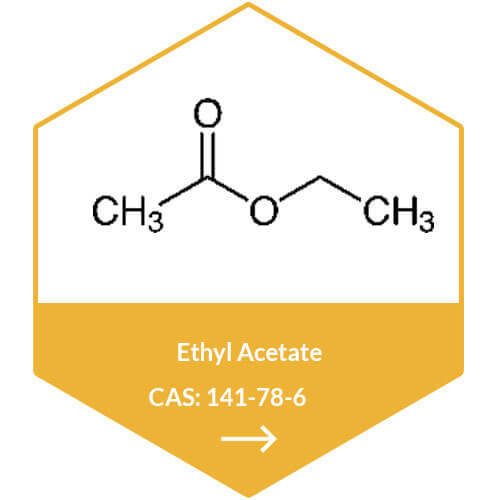

At Garg Chemical Industries, we take pride in being your trusted ethyl acetate manufacturers in India. With years of expertise in chemical production, we offer top-notch quality, purity, and consistency. Our state-of-the-art facilities ensure eco-friendly production and adherence to strict quality standards.

0 notes

Text

Finding the Best Ethyl Acetate manufacturers in USA?

At Stellar Exports, we are engaged in providing exceptional quality Ethyl Acetate that is precisely formulated, has an accurate ph level, and has a long shelf life. Our highly versatile Ethyl Acetate suppliers plays a pivotal role in various sectors across the world. We continue to serve industries worldwide to ensure a steady supply and add value to products and processes.

#Ethyl Acetate#Ethyl Acetate manufacturer#Ethyl Acetate sellers in USA#Ethyl Acetate supplier in USA#Ethyl Acetate manufacturers in USA

0 notes

Text

Ethyl Acetate Speciality Chemicals Manufacturer and Supplier

IOLCP is one of the leading Ethyl Acetate manufacturer and supplier in the world. For information visit our website now !

0 notes

Text

Acetic Acid Market - Forecast(2024 - 2030)

Acetic Acid Market Overview

Acetic Acid Market Size is forecast to reach $14978.6 Million by 2030, at a CAGR of 6.50% during forecast period 2024-2030. Acetic acid, also known as ethanoic acid, is a colorless organic liquid with a pungent odor. The functional group of acetic acid is methyl and it is the second simplest carboxylic acid. It is utilized as a chemical reagent in the production of many chemical compounds. The major use of acetic acid is in the manufacturing of vinyl acetate monomer, acetic anhydride, easter and vinegar. It is a significant industrial chemical and chemical reagent used in the production of photographic film, fabrics and synthetic fibers. According to the Ministry of Industry and Information Technology, from January to September 2021, the combined operating revenue of 12,557 major Chinese garment companies was US$163.9 billion, showing a 9% increase. Thus, the growth of the textile industry is propelling the market growth for Acetic Acid.

Report Coverage

The “Acetic Acid Market Report – Forecast (2024-2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Acetic Acid industry.

By Form: Liquid and Solid.

By Grade: Food grade, Industrial grade, pharmaceutical grade and Others.

By Application: Vinyl Acetate Monomer, Purified Terephthalic Acid, Ethyl Acetate, Acetic Anhydride, Cellulose Acetate, Acetic Esters, Dyes, Vinegar, Photochemical and Others

By End-use Industry: Textile, Medical and Pharmaceutical, Oil and Gas, Food and Beverages, Agriculture, Household Cleaning Products, Plastics, Paints & Coating and Others.

By Geography: North America (the USA, Canada and Mexico), Europe (the UK, Germany, France, Italy, Netherlands, Spain, Russia, Belgium and the Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia and New Zealand, Indonesia, Taiwan, Malaysia and the Rest of APAC), South America (Brazil, Argentina, Colombia, Chile and the Rest of South America) and the Rest of the World (the Middle East and Africa).

Request Sample

Key Takeaways

The notable use of Acetic Acid in the food and beverages segment is expected to provide a significant growth opportunity to increase the Acetic Acid Market size in the coming years. As per the US Food and Agriculture Organization, world meat production reached 337 million tonnes in 2019, up by 44% from 2000.

The notable demand for vinyl acetate monomer in a range of industries such as textile finishes, plastics, paints and adhesives is driving the growth of the Acetic Acid Market.

Increase in demand for vinegar in the food industry is expected to provide substantial growth opportunities for the industry players in the near future in the Acetic Acid industry.

Acetic Acid Market Segment Analysis – by Application

The vinyl acetate monomer segment held a massive 44% share of the Acetic Acid Market share in 2021. Acetic acid is an important carboxylic acid and is utilized in the preparation of metal acetates and printing processes, industrially. For industrial purposes, acetic acid is manufactured by air oxidation of acetaldehyde with the oxidation of ethanol, butane and butene. Acetic acid is extensively used to produce vinyl acetate which is further used in formulating polyvinyl acetate. Polyvinyl acetate is employed in the manufacturing of plastics, paints, textile finishes and adhesives. Thus, several benefits associated with the use of vinyl acetate monomer is boosting the growth and is expected to account for a significant share of the Acetic Acid Market.

Inquiry Before Buying

Acetic Acid Market Segment Analysis – by End-use Industry

The food and beverages segment is expected to grow at the fastest CAGR of 7.5% during the forecast period in the Acetic Acid Market. Acetic Acid is also known as ethanoic acid and is most extensively used in the production of vinyl acetate monomer. Vinyl acetate is largely used in the production of cellulose acetate which is further used in several industrial usage such as textiles, photographic films, solvents for resins, paints and organic esters. PET bottles are manufactured using acetic acid and are further utilized as food containers and beverage bottles. In food processing plants, acetic acid is largely used as cleaning and disinfecting products. Acetic acid is extensively used in producing vinegar which is widely used as a food additive in condiments and the pickling of vegetables. According to National Restaurant Association, the foodservice industry is forecasted to reach US$898 billion by 2022. Thus, the advances in the food and beverages industry are boosting the growth of the Acetic Acid Market.

Acetic Acid Market Segment Analysis – by Geography

Asia-Pacific held a massive 41% share of the Acetic Acid Market in 2021. This growth is mainly attributed to the presence of numerous end-use industries such as textile, food and beverages, agriculture, household cleaning products, plastics and paints & coatings. Growth in urbanization and an increase in disposable income in this region have further boosted the industrial growth in this region. Acetic acid is extensively used in the production of metal acetates, vinyl acetate and vinegar which are further utilized in several end-use industries. Also, Asia-Pacific is one of the major regions in the domain of plastic production which provides substantial growth opportunities for the companies in the region. According to Plastic Europe, China accounted for 32% of the world's plastic production. Thus, the significant growth in several end-use industries in this region is also boosting the growth of the Acetic Acid Market.

Acetic Acid Market Drivers

Growth in the textile industry:

Acetic Acid, also known as ethanoic acid, is widely used in the production of metal acetate and vinyl acetate which are further used in the production of chemical reagents in textiles, photographic films, paints and volatile organic esters. In the textile industry, acetic acid is widely used in textile printing and dyes. According to China’s Ministry of Industry and Information Technology, in 2020, textile and garment exports from China increased by 9.6% to US$291.22 billion. Also, according to the U.S. Department of Commerce, from January to September 2021, apparel exports increased by 28.94% to US$4.385 billion, while textile mill products rose by 17.31% to US$12.365 billion. Vinyl acetate monomer is utilized in the textile industry to produce synthetic fibers. Thus, the global growth in demand for textiles is propelling the growth and is expected to account for a significant share of the Acetic Acid Market size.

Schedule a call

Surge in use of vinegar in the food industry:

The rapid surge in population along with the adoption of a healthy and sustainable diet has resulted in an increase in demand for food items, thereby increasing the global production level of food items. As per US Food and Agriculture Organization, in 2019, global fruit production went up to 883 million tonnes, showing an increase of 54% from 2000, while global vegetable production was 1128 million tonnes, showing an increase of 65%. Furthermore, world meat production reached 337 million tonnes in 2019, showing an increase of 44% from 2000. Acetic acid is majorly used in the preparation of vinegar which is further widely utilized as a food ingredient and in personal care products. Vinegar is used in pickling liquids, marinades and salad dressings. It also helps to reduce salmonella contamination in meat and poultry products. Furthermore, acetic acid and its sodium salts are used as a food preservative. Thus, the surge in the use of vinegar in the food industry is boosting the growth of the Acetic Acid Market.

Acetic Acid Market Challenge

Adverse impact of acetic acid on human health:

Acetic Acid is considered a strong irritant to the eye, skin and mucous membrane. Prolong exposure to and inhalation of acetic acid may cause irritation to the nose, eyes and throat and can also damage the lungs. The workers who are exposed to acetic acid for more than two or three years have witnessed upper respiratory tract irritation, conjunctival irritation and hyperkeratotic dermatitis. The Occupational Safety and Health Administration (OSHA) reveals that the standard exposure to airborne acetic acid is eight hours. Furthermore, a common product of acetic acid i.e., vinegar can cause gastrointestinal tract inflammatory conditions such as indigestion on excess consumption. Thus, the adverse impact of Acetic Acid may hamper the market growth.

Buy Now

Acetic Acid Industry Outlook

The top 10 companies in the Acetic Acid Market are:

Celanese Corporation

Eastman Chemical Company

LyondellBasell

British Petroleum

Helm AG

Pentoky Organy

Dow Chemicals

Indian Oil Corporation

Daicel Corporation

Jiangsu Sopo (Group) Co. Ltd.

Recent Developments

In March 2021, Celanese Corporation announced the investment to expand the production facility of vinyl portfolio for the company’s acetyl chain and derivatives in Europe and Asia.

In April 2020, Celanese Corporation delayed the construction of its new acetic acid plant and expansion of its methanol production by 18 months at the Clear Lake site in Texas.

In October 2019, BP and Chian’s Zhejiang Petroleum and Chemical Corporation signed MOU in order to create a joint venture to build a 1 million tonne per annum Acetic Acid plant in eastern China.

Key Market Players:

The Top 5 companies in the Acetic Acid Market are:

Celanese Corporation

Ineos Group Limited

Eastman Chemical Company

LyondellBasell Industries N.V.

Helm AG

For more Chemicals and Materials Market reports, please click here

#Acetic Acid Market#Acetic Acid Market Share#Acetic Acid Market Size#Acetic Acid Market Forecast#Acetic Acid Market Report#Acetic Acid Market Growth

2 notes

·

View notes

Text

Phenosafranine, Phenosafranine Manufacturer, Suplier, India

Phenosafranine : We are Manufacturers, Supplier and Exporter Of Phenosafranine, Phenosafranines, Mumbai, India. Call US.

Chemical, Chemicals, Electroplating Chemical, Electroplating Chemicals, Lab Chemical, Lab Chemicals, Laboratory Chemical, Laboratory Chemicals, Industrial Chemical, Industrial Chemicals, Safranine, Safranine O, 7 Diamino 2, 8 Dimethyl 5 Phenyl, Phenazinium Chloride, Diethyl Safranine, N Diethyl Phenosafranine, 3 Amino 7 dimethylamino, Basic Violet 5, Basic Violet 8, Thioflavin T, Basic Yellow, Basic Yellow I, O Cresolphthalein, Thymolphthalein, Biological Stain, Biological Stains, PH Indicator, PH Indicators, Lab Reagent, Lab Reagents, Laboratory Reagent, Laboratory Reagents, Dyes & Chemicals, Dye & Chemical, Dyes & Chemicals, Acid Fuchsin, Alizarin Yellow, Alizarin Yellow GG, Alizarin Yellow R, Aurin, Rosolic Acid, p-Rosolic Acid, Azure A, Azure B, Azure 11, Azure 11 Eosinate, Barium Diphenylamine Sulphonate, Basic Fuchsin, Biebrich Scarlet, Brilliant Green, Bromocresol Purple, Bromocresol Purple Sodium Salt, Bromophenol Blue, Bromophenol Blue Sodium Salt, Bromophenol Red, Bromothymol Blue, Bromothymol Blue Sodium Salt, Calcon, Solochrome Dark Blue, Calconcarboxylic Acid, Calmagite, Carbol Fuchsin, Chromotrope 2B, Chromotrope 2R, O Cresolphthalein Complexone, Cresol Red, Cresol Red Sodium Salt, 2:6 Dichlorophenol Indophenol Sodium, 4',5' Dibromofluorescein, Dimethylglyoxime GR, Eosin Blue, Eosin Yellow, Free Acid Eosin Yellow, Water Soluble Eosin Yellow, Eriochrome, Solochrome Black T, Ethyl Orange, Evans Blue, Fluorescein, Fluorescein Complexone, Calcein, Fluorescein Sodium, Giemsa Stain, Hydroxy Naphthol Blue, Indoine Blue, Leishman Stain, May & Grunwald Stain, Methyl Blue, Aniline Blue W/S, Methylene Violet 3Rax, Methyl Orange, Methyl Red, Methylthymol Blue Complexon, Methyl Violet, Naphthol Green B, Naphtholphthalein, 1 Naphtholphthalein, Neutral Red, Orange G, Nitroso R Salt Gr, Indole 3 Acetic Acid, New Fuchsin, asia, asian, india, indian, mumbai, maharashtra, industrial, industries, thane, navi mumbai, pune, nashik, aurangabad, ratnagiri, nagpur, ahmednagar, akola, amravati, chandrapur, dhule, jalgaon, raigad, sangli, satara, belgaum, kolhapur, belgaon.

#Chemical#Chemicals#Electroplating Chemical#Electroplating Chemicals#Lab Chemical#Lab Chemicals#Laboratory Chemical#Laboratory Chemicals#Industrial Chemical#Industrial Chemicals#Safranine#Safranine O#7 Diamino 2#8 Dimethyl 5 Phenyl#Phenazinium Chloride

0 notes

Text

Does Nail Polish Have Latex in It?

When it comes to nail care, many people are cautious about the ingredients in their beauty products, especially when they have sensitive skin or allergies.

One common question that arises is whether nail polish contains latex, a substance known to trigger allergic reactions in some individuals. In this article, we will explore the relationship between nail polish and latex, and shed light on what you should know to make informed decisions about your nail care.

What is Latex?

Latex is a natural rubber material derived from the sap of rubber trees. It is commonly found in items like gloves, balloons, medical supplies, and even some cosmetics.

While latex is a useful material in many industries, it can cause allergic reactions in some people, ranging from mild skin irritation to severe anaphylaxis.

The Role of Latex in Nail Polish

Nail polish formulas vary widely across brands and types, but most do not contain latex as a primary ingredient. Latex is not typically used in the formulation of nail polish itself.

However, it can sometimes be present in related products like nail polish removers, base coats, or even in nail art tools like latex tape or peel-off cuticle barriers used to prevent nail polish from smudging.

Ingredients in Nail Polish

The key ingredients in most nail polishes include:

Resins and Polymers: These ingredients give the polish its glossy finish and allow it to adhere to the nails.

Pigments and Dyes: These provide the color and opacity.

Solvents: Solvents such as ethyl acetate and butyl acetate are used to dissolve the other ingredients and allow for smooth application.

Plasticizers: These prevent the nail polish from becoming too brittle and cracking.

Stabilizers and Thickeners: These help maintain the consistency and shelf life of the product.

Latex in Nail Art Products

While latex is not typically found in the nail polish itself, it is important to be aware that latex can appear in certain nail art tools and accessories. Some popular items, such as liquid latex barriers, are used to protect the skin around the nail from polish.

These products are popular for intricate designs and stamping techniques, where precise application is needed. These barriers can be easily peeled off after the polish dries, leaving clean edges.

If you have a latex allergy, it is essential to avoid these types of products or check the labels for the presence of latex before use.

Latex-Free Alternatives

For individuals with latex sensitivities, many brands now offer latex-free nail polish removers, base coats, and nail art tools. You can also find hypoallergenic nail polish options, which are formulated with fewer potentially irritating ingredients. Always look for products labeled "latex-free" or "hypoallergenic" if you are concerned about exposure.

Conclusion

In general, traditional nail polishes do not contain latex, but certain nail art tools and accessories might. If you have a latex allergy, it’s important to be mindful of the ingredients in the products you use and opt for alternatives that are free from latex. Always check labels, and when in doubt, consult with the manufacturer to ensure your products are safe for your skin.

0 notes

Text

Ethyl Acetate Prices Trend | Pricing | News | Database | Chart

Ethyl Acetate, a key solvent widely used in industries such as paints, coatings, adhesives, and the food and beverage sector, plays an essential role in the global market. Its pricing trends are influenced by several factors, including raw material costs, production capacity, environmental regulations, and global demand fluctuations. Over the past decade, the ethyl acetate market has experienced significant price volatility, driven by supply chain disruptions, economic shifts, and technological advancements. The prices of ethyl acetate have seen peaks and troughs, making it imperative for industries reliant on this solvent to stay informed on market dynamics.

The primary raw materials for ethyl acetate production are ethanol and acetic acid, both of which contribute significantly to its cost structure. Ethanol, sourced from natural resources like corn, sugarcane, and other crops, often faces price fluctuations based on agricultural yields, seasonal variations, and policies related to biofuels. The acetic acid segment, on the other hand, has its price determined by factors like methanol availability and production capacity. Any disruptions in these upstream markets, whether due to geopolitical events, trade restrictions, or natural disasters, have an immediate impact on ethyl acetate production costs, thus influencing the market price.

Get Real time Prices for Ethyl Acetate: https://www.chemanalyst.com/Pricing-data/ethyl-acetate-75

The production process of ethyl acetate typically involves esterification reactions between ethanol and acetic acid, which can be conducted using different technologies. The manufacturing costs vary depending on the efficiency of these processes and the scale of production facilities. Large-scale industrial plants benefit from economies of scale and can achieve cost advantages that smaller plants may not be able to match. However, rising energy costs and stricter environmental regulations are forcing producers to adopt more sustainable practices and invest in cleaner technologies, adding pressure to the pricing structure. The high energy consumption required for ethyl acetate production, along with the pressure to reduce carbon emissions, has led to increased operational expenses, which in turn influence final market prices.

Demand for ethyl acetate has shown a generally positive growth trend, particularly due to the expanding use of paints and coatings in construction, automotive, and other sectors. The shift toward water-based coatings, which require solvents like ethyl acetate, has helped drive demand even as environmental concerns have influenced regulations in many regions. Ethyl acetate's versatility as a solvent, which offers an excellent balance of evaporation rate and solvency power, makes it indispensable for manufacturing products such as varnishes, lacquers, and nail polish. The packaging industry, with its growing need for adhesives, is another significant consumer of ethyl acetate, further adding to the demand.

Global market dynamics also rely heavily on economic conditions and consumer spending. Regions like Asia-Pacific have dominated the market due to their robust manufacturing sectors and significant consumer bases. Countries such as China and India have become major players in the production and consumption of ethyl acetate. The development of infrastructure and urbanization in these regions has directly contributed to increased demand for construction materials, thereby driving the need for related chemical products. In contrast, regions like North America and Europe face more stringent regulations that could curb production and consumption, impacting overall market trends. However, these areas also see innovation and research directed at producing more environmentally friendly solvents and enhancing the sustainability of ethyl acetate.

As the world moves toward greener solutions and sustainability, the ethyl acetate market is witnessing a gradual shift. Producers are investing in more eco-friendly production techniques and considering alternative raw materials to reduce carbon footprints. Bio-based ethyl acetate, produced from renewable sources like corn and sugarcane, is gaining traction as a sustainable option. This shift aligns with global efforts to reduce dependency on fossil fuels and mitigate the effects of climate change. Governments in various countries are introducing policies that support renewable energy use and reduce carbon emissions, indirectly affecting the price and availability of chemicals like ethyl acetate. While these shifts could lead to a temporary increase in production costs, they may also open up new opportunities for market growth in the long term as consumers become more environmentally conscious.

Pricing trends for ethyl acetate are closely tied to crude oil prices as well, since crude oil influences the cost of production for many petrochemical-based products. The recent fluctuations in oil prices have made it challenging for producers to forecast costs accurately. With the possibility of oil prices continuing to show volatility due to geopolitical uncertainties, market participants remain vigilant. In response, industry players are focusing on strategic stockpiling, diversifying raw material suppliers, and investing in alternative production technologies to ensure stability and reduce vulnerability to market shocks.

The ethyl acetate market is also influenced by fluctuating exchange rates. Currency value changes between major economic regions can impact the trade dynamics of ethyl acetate. For instance, a weaker currency in a major producing region can make exports more competitive, thus affecting the pricing structures of imports and exports worldwide. Moreover, the market is often subject to changes in trade policies and tariffs, which can either elevate or reduce prices based on the market's response to these policies.

In conclusion, the ethyl acetate market continues to be shaped by a complex array of factors that include raw material prices, production processes, environmental regulations, and global economic conditions. Market participants must stay agile to navigate price fluctuations and adapt to emerging challenges and opportunities. With a growing emphasis on sustainability and greener production methods, the market outlook for ethyl acetate is poised to evolve, presenting both challenges and opportunities for businesses and stakeholders involved.

Get Real time Prices for Ethyl Acetate: https://www.chemanalyst.com/Pricing-data/ethyl-acetate-75

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

AusFoams: Tailor Diversity

youtube

Australia's foam industry is a dynamic force, providing a wide array of solutions for various applications. From flexible foams with different grades to sturdy foam varieties serving industries like sign writing and construction, and dense cellular materials boasting buoyancy and thermal insulation properties, the foam sector is a cornerstone of modern manufacturing. Flexible Foams Manufactured in varying grades, flexible foams cater to a range of needs. The industry standard code, such as 16-100, denotes the density and hardness of the foam. Foams with higher density have a longer lifespan but come at a higher cost, while hardness, measured in Newtons, signifies the 'feel' of the foam. This versatility allows for customized answers, from packaging to comfortable cushions. Rigid Foams Extending its reach, the foam industry supplies sturdy foam varieties crucial in sign writing, building, and construction. Materials like polystyrene (EPS and XPS), PIR, and rigid polyurethanes serve diverse industries, enhancing structural integrity and insulation. EPS, with its closed-cell and resilient nature, finds applications in thermal insulation systems, decorative surfaces, packaging, and stage sets. Closed Cell Foams Crafted from polyethylene or ethyl vinyl acetate co-polymers, dense cellular materials exhibit buoyancy, waterproof properties, lightweight composition, and exceptional thermal insulation characteristics. They find applications in expansion joints, packaging, impact absorption, thermal insulation, and even as backing rod. These foams, resistant to common chemicals, are ideal where durability and performance are crucial. Environmental Considerations and Innovation With global emphasis on sustainability, the foam industry is aligning with environmental goals. Materials and manufacturing processes are evolving, and recycling initiatives, along with the introduction of eco-friendly alternatives, ensure the industry's continued growth while minimizing ecological impact. In conclusion, Australia's foam industry is a versatile and innovative force, offering essential materials for diverse applications. From flexible foams to rigid and closed cell foams, these materials have become integral to daily life, showcasing the flexibility and creativity within the Australian manufacturing landscape. https://ausfoamversatilesolutions817.blogspot.com/2024/12/ausfoams-tailor-diversity.html foam WA foam insulation Perth Polystyrene WA styrofoam perth polystyrene industries closed cell foam insulation Foam Supplies in Perth foam and polystyrene suppliers

0 notes

Text

15 Best American Perfume Brands

The best American perfume brands industry focuses on customer needs and develops unique color, smell, and packaging fragrances. In recent years, the American perfume brand industry emerged as one of the leading, innovative, and fast-growing businesses in the beauty and cosmetic industry. It is one of the most essential products for personal care and hygiene. American perfume Manufacturers are more focused on natural and rare ingredients due to this some of the perfume costs is very high compared to synthetic perfume. The formula of commercial perfumes is also always top secret. If we talk about the Best American Perfume Brands it is made of herbs, flowers, leaves, Sandalwood, benzoin, ethyl acetate, etc. Some of the components are herbal and a few are chemicals. In perfume, there are three layers called notes—top notes, middle, and base. Top notes are also called head notes as it is the first fragrance that the customer notices and we all know that that first impression is the last impression.

0 notes

Text

Modi Chemical is a reputable producer of ethyl acetate in Gujarat that supplies top-notch chemical goods to a range of sectors. Modi Chemical's Ethyl Acetate is well-known for its purity and conformity to industry standards, making it perfect for use in both industrial and laboratory settings. The company is the go-to option for organizations throughout Gujarat since it guarantees prompt delivery and first-rate customer service. You can trust Modi Chemical for all of your chemical needs if you want high-quality ethyl acetate at affordable costs.

0 notes

Text

Pharmaceutical Solvents Market: Innovations Driving Growth and Development

Introduction to Pharmaceutical Solvents Market

The Pharmaceutical Solvents Market plays a crucial role in the formulation of drugs, serving as carriers or dissolvers for active pharmaceutical ingredients (APIs). Solvents such as alcohols, acetone, and ethers are essential in the manufacturing process of tablets, injectables, and topical medications. The demand for pharmaceutical solvents is driven by the expanding pharmaceutical industry, stringent quality standards, and the rising prevalence of chronic diseases. However, market growth faces challenges such as environmental regulations and the volatility of raw material prices, pushing manufacturers toward green solvents.

The Pharmaceutical Solvents Market is Valued USD 3.87 billion in 2024 and projected to reach USD 5.9 billion by 2032, growing at a CAGR of 4.70% During the Forecast period of 2024-2032.It includes various organic and inorganic compounds, with applications ranging from synthesis to purification. Increasing demand for APIs, the growing prevalence of chronic and lifestyle diseases, and the rise of biopharmaceuticals are pushing market expansion. Geographically, North America and Europe dominate, but emerging economies are quickly catching up due to rising healthcare expenditures and growing pharmaceutical production capabilities.

Access Full Report :https://www.marketdigits.com/checkout/3431?lic=s

Major Classifications are as follows:

By Chemical Group

Alcohol

Isopropanol

Propylene Glycol

Butanol

Amine

Aniline

Diphenylamine

Methylethanolamine

Trimethylamine

Ester

Acetyl Acetate

Ethyl Acetate

Butyl Acetate

Ether

Diethyl Ether

Anisole

Polyethylene Glycol

Chlorinated Solvents

Carbon Tetrachloride

Dichloromethane

Other

Chelating Agents

Acetone

Key Region/Countries are Classified as Follows:

◘ North America (United States, Canada,) ◘ Latin America (Brazil, Mexico, Argentina,) ◘ Asia-Pacific (China, Japan, Korea, India, and Southeast Asia) ◘ Europe (UK,Germany,France,Italy,Spain,Russia,) ◘ The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South

Key Players of Pharmaceutical Solvents Market

BASF SE,The Dow Chemical Company, Eastman Chemical Company, Merck KGaA, Thermo Fisher Scientific Inc., Honeywell International Inc.,Avantor, Inc., Solvay S.A.,Archer Daniels Midland Company, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corporation, Celanese Corporation, INEOS Group Limitedand others.

Market Drivers in Pharmaceutical Solvents Market

Increase in pharmaceutical production: The rise in the production of generic and branded drugs fuels the demand for high-quality solvents.

Growth in R&D: As pharmaceutical companies invest heavily in research, particularly in biologics and specialty medicines, the need for effective solvents rises.

Technological advancements: Innovations in solvent formulation, including green solvents, offer opportunities for reducing environmental impact while maintaining efficacy.

Market Challenges in Pharmaceutical Solvents Market

Environmental concerns: Solvents contribute to pollution, and many are classified as hazardous. Regulatory bodies are increasingly pushing for greener alternatives.

Raw material volatility: Fluctuations in the cost of raw materials used in solvent production can lead to unpredictable pricing structures.

Stringent regulations: Pharmaceutical-grade solvents are subject to rigorous quality standards, which can increase manufacturing costs and create barriers for new market entrants.

Market Opportunities of Pharmaceutical Solvents Market

Sustainable solvents: Developing eco-friendly, biodegradable, and non-toxic solvent alternatives can meet regulatory demands and attract environmentally-conscious manufacturers.

Expanding generics market: The increasing demand for generic drugs in emerging economies opens doors for solvent suppliers, especially those offering cost-effective solutions.

R&D in biologics: The growth of biotechnology and biologics-based therapies creates a need for specialized solvents with unique properties.

Conclusion:

The Pharmaceutical Solvents Market is poised for steady growth, driven by the expanding pharmaceutical industry and innovations in biopharmaceuticals. While challenges such as environmental regulations and volatile raw material costs persist, the push for sustainable practices and green solvents presents new opportunities for market players. Technological advancements and increased demand from emerging economies are expected to sustain momentum, ensuring the market remains integral to pharmaceutical production

0 notes

Text

Petrochemicals Market Size To Reach $1002.45 Billion By 2030

The global petrochemicals market size is expected to reach USD 1002.45 billion by 2030, as per the new report by Grand View Research, Inc. It is expected to expand at a CAGR of 7.3% from 2024 to 2030. It is expected to expand at a CAGR of 7.0% from 2023 to 2030. The demand for petrochemicals is attributed to an increase in demand from the end-use industries such as construction, textile, medical, pharmaceuticals, consumer goods, automotive, and electronics.

Products such as ethylene, propylene, and benzene are widely used in various industries such as packaging, electronics, plastics, and rubber. The ethylene product segment dominated the market in 2021 and is expected to maintain its lead in the forecast period owing to its wide application scope across several industries. Asia Pacific is anticipated to dominate the market in the forecast period owing to the favorable regulatory policies in the region.

Crude oil and natural gas are the major raw materials used for the manufacturing of petrochemical products. The volatile prices of crude oil are a major challenge in the procurement process of crude oil as a raw material for manufacturers. The industry players that are reliant on crude oil as a feedstock for manufacturing are likely to face difficulties in the coming years. However, declining prices of natural gas owing to a rise in its production are expected to augment the growth of the product over the forecast period.

The competitiveness among the producers of the product is high as the market is characterized by the presence of a large number of global players with strong distribution networks. Top players are dominating the industry for the past few years owing to the increasing investment in R&D activities related to new product development.

Request a free sample copy or view the report summary: Petrochemicals Market Report

Petrochemicals Market Report Highlights

The methanol product segment is expected to expand at the highest revenue-based CAGR of 8.9% over the forecast period. The demand is attributed to the increase in demand for methanol in manufacturing biodiesel, which is biodegradable, safe, and produces fewer air pollutants as compared to other fuels

Surged use of polyethylene, High-density Polyethylene (HDPE), and Low-density Polyethylene (LDPE) is expected to foster the overall growth of the market for petrochemicals.

The butadiene product segment is expected to be an emerging segment in the coming years as it is a key building block used in the manufacturing of several chemicals and materials employed in the industries such as consumer durables, healthcare, and building and construction

Manufacturers have adopted joint ventures and acquisitions as major strategies to increase their global presence

Petrochemicals Market Segmentation

Grand View Research has segmented the global petrochemical market report on the basis of Product, and region

Petrochemicals Product Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

Ethylene

Polyethylene

Ethylene oxide

EDC

Ethyl benzene

Others

Propylene

Polypropylene

Propylene oxide

Acrylonitrile

Cumene

Acrylic acid

Isopropanol

Other

Butadiene

SB Rubber

Butadiene rubber

ABS

SB latex

Others

Benzene

Ethyl benzene

Phenol/cumene

Cyclohexane

Nitrobenzene

Alkyl benzene

Other

Xylene

Toluene

Solvents

TDI

Others

Methanol

Formaldehyde

Gasoline

Acetic acid

MTBE

Dimethyl ether

MTO/MTP

Other

Petrochemicals Regional Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

North America

U.S.

Canada

Europe

Germany

UK

France

Belgium

Netherlands

Asia Pacific

China

India

Japan

South Korea

Indonesia

Latin America

Brazil

Middle East

Africa

List of Key Players of Petrochemicals Market

BASF SE

Chevron Corporation

China National Petroleum Corporation (CNPC)

China Petrochemical Corporation

ExxonMobil Corporation

INEOS Group Ltd.

LyondellBasell Industries Holdings B.V.

Royal Dutch Shell PLC

SABIC

Dow

0 notes

Text

How Do Organic Chemicals Exported from India Dominate Global Markets?

Introduction

India has become a global powerhouse when it comes to chemical exports. With a vast array of organic chemicals exported from India, the country has established itself as one of the key players in the chemical industry worldwide. Indian organic chemical exporters have tapped into international markets, catering to industries such as pharmaceuticals, agriculture, textiles, and more. In this article, we will explore how India has achieved this dominance, the leading chemical exporters in India, and the diverse list of chemicals exported from India.

What Makes India a Global Leader in Chemical Exports?

India’s rise as a leader in chemical exports can be attributed to several factors. The availability of raw materials, coupled with a highly skilled workforce and advanced manufacturing capabilities, has propelled India’s chemical industry. Moreover, the government has implemented policies that foster growth and innovation, allowing chemical exporters in India to maintain a competitive edge.

A crucial aspect of this growth is the diversity in the list of chemicals exported from India, with organic chemicals being a significant contributor. These chemicals are essential for various global industries, further increasing India’s importance in the chemical supply chain.

Who Are the Key Organic Chemical Exporters in India?

Several major companies drive the organic chemicals exported from India. Industry giants such as Tata Chemicals, UPL, and SRF Limited are renowned for their global reach and high-quality chemical products. These companies have established strong international relationships, positioning themselves as reliable suppliers in competitive markets.

In addition to these large corporations, numerous medium-sized enterprises contribute to the industry’s success. Their ability to meet international standards and adapt to global demands has solidified India's reputation as a leading exporter.

What Are the Top Organic Chemicals Exported from India?

India exports a wide variety of organic chemicals, each serving critical roles across various industries. Some of the top organic chemicals exported from India include:

Acetic Acid: Used in producing vinegar and several industrial chemicals.

Methanol: A versatile chemical that serves as a solvent and is a key ingredient in many products.

Ethyl Acetate: Widely utilized as a solvent in paints, coatings, and adhesives.

Toluene: A chemical used in the production of dyes, detergents, and other industrial products.

Aniline: Important in the manufacturing of polyurethane, rubber chemicals, and dyes.

This wide-ranging list of organic chemicals exported from India highlights the country’s importance in fulfilling global industrial demands.

How Does India Contribute to Global Supply Chains?

The presence of organic chemical exporters from India in global markets ensures that industries around the world have a reliable source of raw materials. These organic chemicals are vital in sectors such as:

Pharmaceuticals: Organic chemicals like methanol and acetic acid are essential in the production of medicines and medical products.

Agriculture: Several organic chemicals serve as key ingredients in fertilizers, herbicides, and pesticides, making them critical to the global food supply.

Textiles: Many chemicals exported from India are used in dyes and finishing agents for textiles.

The ability to supply these chemicals consistently has positioned India as an indispensable part of international supply chains.

What Challenges Do Chemical Exporters in India Face?

Despite the significant success of chemical exports from India, the industry does face certain challenges. These include:

Regulatory Compliance: Exporters must comply with various environmental and safety standards, both domestically and in importing countries.

Global Competition: India faces stiff competition from other countries like China and the United States, which are also major chemical exporters.

Fluctuating Raw Material Costs: Changes in the prices of raw materials can impact production costs, which, in turn, affects the pricing and competitiveness of India’s chemical exports.

Despite these challenges, India’s strong foothold in global markets remains largely intact due to the quality, reliability, and cost-effectiveness of its chemical products.

What Government Initiatives Support Chemical Exports from India?

The Indian government has introduced several initiatives to support and boost the chemical export industry. These include:

Incentives for Exporters: The government provides financial incentives to exporters, which helps them compete on a global scale.

Infrastructure Development: Investment in logistics, transportation, and port facilities has streamlined the process of exporting chemicals, making it more efficient and cost-effective.

Promotion of Green Chemistry: As environmental concerns become more pressing, the Indian government has promoted green chemistry, encouraging manufacturers to adopt sustainable and eco-friendly practices.

These initiatives not only boost the volume of chemical exports but also enhance India's reputation as a sustainable and responsible exporter.

Which Countries Import Organic Chemicals from India?

India exports organic chemicals to a broad range of countries across the globe. Some of the key markets for India’s chemical exports include:

The United States: As a major importer, the U.S. uses Indian organic chemicals in pharmaceuticals, agricultural products, and industrial manufacturing.

China: India’s neighbor imports a significant amount of organic chemicals, particularly for its large-scale manufacturing industries.

Germany: Known for its industrial base, Germany relies on Indian chemicals for use in automotive, pharmaceutical, and chemical manufacturing.

Japan: A vital market for India’s organic chemicals, particularly for its electronics and automotive industries.

These countries are just a few examples of the many international markets that rely on organic chemicals exported from India to support their industries.

What Is the List of Chemicals Exported from India?

India’s chemical export portfolio is extensive, and apart from organic chemicals, it includes a wide variety of industrial and specialty chemicals. The full list of chemicals exported from India also features:

Inorganic chemicals: Such as sulfuric acid, caustic soda, and ammonia.

Fertilizers and pesticides: Crucial for global agricultural productivity.

Pharmaceutical intermediates: Important raw materials for drug manufacturing.

The diversity in this list showcases India’s ability to meet the needs of various industries worldwide.

How Is India’s Chemical Export Industry Evolving?

India’s chemical export industry is continuously evolving to meet the changing demands of global markets. Innovation, research, and development have become central to the growth of the industry. Indian companies are increasingly investing in technology that enhances production efficiency and reduces environmental impact.

Moreover, there is a growing focus on expanding into new markets in Africa, Latin America, and Southeast Asia, where demand for organic chemicals is on the rise. This geographic diversification is essential for maintaining growth in the long term.

What Is the Future Outlook for Organic Chemicals Exported from India?

The future of organic chemicals exported from India looks promising. Global demand for chemicals is expected to increase due to growth in industries such as pharmaceuticals, agriculture, and manufacturing. Indian exporters are well-positioned to capitalize on these trends.

Additionally, the focus on sustainability and green chemistry will likely become a major differentiator for Indian companies. As industries worldwide shift toward more eco-friendly practices, Indian chemical exporters who prioritize sustainability will find themselves in an advantageous position.

Conclusion

India’s dominance in the global chemical market is driven by its vast production capabilities, diverse list of chemicals exported from India, and the expertise of its organic chemical exporters. Despite facing challenges such as global competition and regulatory compliance, the future remains bright for India's chemical export industry. With continued government support, technological advancements, and a commitment to sustainability, the chemical exports from India will continue to thrive and shape global supply chains for years to come.

#organic chemicals exported from India#chemical exports from India#organic chemical exporters#list of chemicals exported from India#list of organic chemicals exported from India#chemical exporters in India

0 notes

Text

Electroplating Chemicals, Laboratory Chemicals, PH Indicators

Manufacturer and Exporter Of Electroplating Chemicals, Laboratory Chemicals, Safranin O, Diethyl Safranin, Thymolphthalein, PH Indicators, Mumbai, India.

Chemical, Chemicals, Electroplating Chemical, Electroplating Chemicals, Lab Chemical, Lab Chemicals, Laboratory Chemical, Laboratory Chemicals, Industrial Chemical, Industrial Chemicals, Safranin, Safranin O, 7 Diamino 2, 8 Dimethyl 5 Phenyl, Phenazinium Chloride, Diethyl Safranin, N Diethyl Phenosafranine, 3 Amino 7 dimethylamino, Basic Violet 5, Basic Violet 8, Thioflavin T, Basic Yellow, Basic Yellow I, O Cresolphthalein, Thymolphthalein, Biological Stain, Biological Stains, PH Indicator, PH Indicators, Lab Reagent, Lab Reagents, Laboratory Reagent, Laboratory Reagents, Dyes & Chemicals, Dye & Chemical, Dyes & Chemicals, Acid Fuchsin, Alizarin Yellow, Alizarin Yellow GG, Alizarin Yellow R, Aurin, Rosolic Acid, p-Rosolic Acid, Azure A, Azure B, Azure 11, Azure 11 Eosinate, Barium Diphenylamine Sulphonate, Basic Fuchsin, Biebrich Scarlet, Brilliant Green, Bromocresol Purple, Bromocresol Purple Sodium Salt, Bromophenol Blue, Bromophenol Blue Sodium Salt, Bromophenol Red, Bromothymol Blue, Bromothymol Blue Sodium Salt, Calcon, Solochrome Dark Blue, Calconcarboxylic Acid, Calmagite, Carbol Fuchsin, Chromotrope 2B, Chromotrope 2R, O Cresolphthalein Complexone, Cresol Red, Cresol Red Sodium Salt, 2:6 Dichlorophenol Indophenol Sodium, 4',5' Dibromofluorescein, Dimethylglyoxime GR, Eosin Blue, Eosin Yellow, Free Acid Eosin Yellow, Water Soluble Eosin Yellow, Eriochrome, Solochrome Black T, Ethyl Orange, Evans Blue, Fluorescein, Fluorescein Complexone, Calcein, Fluorescein Sodium, Giemsa Stain, Hydroxy Naphthol Blue, Indoine Blue, Leishman Stain, May & Grunwald Stain, Methyl Blue, Aniline Blue W/S, Methylene Violet 3Rax, Methyl Orange, Methyl Red, Methylthymol Blue Complexon, Methyl Violet, Naphthol Green B, Naphtholphthalein, 1 Naphtholphthalein, Neutral Red, Orange G, Nitroso R Salt Gr, Indole 3 Acetic Acid, New Fuchsin, asia, asian, india, indian, mumbai, maharashtra, industrial, industries, thane, navi mumbai, pune, nashik, aurangabad, ratnagiri, nagpur, ahmednagar, akola, amravati, chandrapur, dhule, jalgaon, raigad, sangli, satara, belgaum, kolhapur, belgaon.

0 notes

Text

Pharma Intermediates Manufacturers

Definition of Pharmaceutical Intermediates

Pharmaceutical intermediates are chemical substances used as raw materials or building blocks in the synthesis of active pharmaceutical ingredients (APIs) and finished drugs. These intermediates play a critical role in the drug manufacturing process, bridging the gap between basic chemicals and complex pharmaceuticals.

Importance of Suppliers in the Pharmaceutical Industry

Suppliers of pharmaceutical intermediates are essential to the pharmaceutical supply chain. They provide the necessary chemicals and compounds that pharmaceutical companies use to create medications. The reliability, quality, and cost-effectiveness of these suppliers can significantly impact drug production efficiency and quality.

Types of Pharmaceutical Intermediates

Primary Intermediates

Primary intermediates are the initial chemicals transformed into more complex substances during drug synthesis.

Examples:

Benzyl Chloride: Used in the production of various APIs and chemical compounds.

Acetic Anhydride: Commonly used in the manufacture of aspirin and other pharmaceutical products.

Usage: These intermediates are crucial in the early stages of drug development, providing the foundational chemical structures needed for more complex synthesis.

Secondary Intermediates

Secondary intermediates are chemicals used in subsequent stages of pharmaceutical manufacturing, often for refining or modifying primary intermediates.

Examples:

1,3-Butadiene: Utilized in creating synthetic rubbers and polymers used in drug delivery systems.

Ethyl Acetate: Employed as a solvent in various pharmaceutical formulations.

Role: These intermediates help in fine-tuning the properties of APIs and improving the efficiency of the production process.

Key Considerations When Choosing Pharmaceutical Intermediates Suppliers

Quality Assurance

When selecting a supplier, ensuring high-quality standards is paramount. Suppliers must adhere to rigorous quality control measures.

Compliance: Suppliers should comply with Good Manufacturing Practices (GMP) to ensure the safety and efficacy of intermediates.

Examples of Certifications: ISO 9001 for quality management systems, cGMP for current good manufacturing practices.

Supply Chain Reliability

A reliable supply chain is crucial for maintaining consistent production schedules and avoiding disruptions.

Factors: Look for suppliers with a proven track record of timely delivery and robust logistical capabilities.

Example: Geopolitical issues, such as trade restrictions, can impact the stability of supply chains, making it important to choose suppliers with diversified sources and contingency plans.

Cost Efficiency

Balancing cost with quality is vital for maintaining profitability while ensuring the efficacy of pharmaceutical products.

Balancing Act: Evaluate the total cost of ownership, including potential cost savings from bulk purchases versus the flexibility of single orders.

Example: Bulk purchases may offer lower per-unit costs but require higher upfront investment, while single orders offer flexibility but might be more expensive per unit.

Leading Pharmaceutical Intermediates Suppliers

Connex Pharma

Connex Pharma is a pioneer in the production of speciality chemicals like Hexamethyldisilazane (HMDS) and Chloromethyl Isopropyl Carbonate (CMIC). These chemicals are used in various industries, including pharmaceuticals, agrochemicals, and electronics.

Overview: The company offers a wide range of intermediates used in various pharmaceutical applications.

Specializations: Known for their advanced intermediate manufacturing processes and adherence to stringent quality standards\

Visit the website now to knowmore !

Conclusion

Summary of Key Points

Choosing the right supplier for pharmaceutical intermediates is crucial for ensuring drug quality and production efficiency. Key factors include quality assurance, supply chain reliability, and cost efficiency.

0 notes

Text

Ethyl Vinyl Alcohol Copolymer Price | Prices | Pricing | News | Database | Chart

Ethyl Vinyl Alcohol Copolymer (EVOH) is a highly sought-after material, particularly within the packaging industry, due to its superior barrier properties against gases such as oxygen, moisture, and solvents. As a result, it is used extensively in food packaging, medical applications, and even industrial products where maintaining product integrity is paramount. However, like many materials derived from petrochemical sources, the pricing of EVOH is influenced by various factors, including raw material costs, production capacities, supply chain dynamics, demand fluctuations, and geopolitical events.

One of the most significant contributors to the cost of EVOH is the price of its raw materials, ethylene and vinyl alcohol. Ethylene, a fundamental component in plastic manufacturing, is derived from crude oil, making its price directly tied to the volatility of the global oil markets. When crude oil prices rise, the cost of ethylene follows suit, driving up the overall cost of EVOH production. On the other hand, vinyl alcohol is typically produced from polyvinyl acetate, which also relies on petrochemical derivatives. As these input materials fluctuate in price, manufacturers are often forced to pass on these increased costs to their customers, affecting the price of EVOH on the market.

Get Real Time Prices for Ethyl Vinyl Alcohol Copolymer: https://www.chemanalyst.com/Pricing-data/ethyl-vinyl-alcohol-copolymer-1154Another factor impacting EVOH prices is production capacity. Globally, there are only a few key manufacturers with the ability to produce this specialized copolymer in large quantities. Companies such as Kuraray and Nippon Gohsei dominate the EVOH market, making supply somewhat concentrated. When there are disruptions in production, whether due to maintenance shutdowns, natural disasters, or logistical challenges, the supply of EVOH can become constrained, leading to price increases. Additionally, new investments in production capacity are rare due to the high costs associated with building and maintaining plants capable of producing EVOH, which further limits the supply-side flexibility. This limited production base means that even small shifts in demand or supply can have a pronounced effect on the price of the material.

The demand for EVOH is also a critical factor in determining its market price. As industries like food packaging and medical supplies grow, the demand for materials with high barrier properties increases. Food manufacturers, for instance, seek out packaging solutions that prolong shelf life and maintain freshness, and EVOH fits these requirements perfectly. Similarly, in medical applications, EVOH is used to ensure that products are kept sterile and protected from contamination. As these industries expand globally, especially in emerging markets where food safety and healthcare are increasingly prioritized, the demand for EVOH grows, pushing prices higher.

However, demand for EVOH is not constant and can fluctuate based on broader economic trends. During periods of economic growth, industries like food packaging and pharmaceuticals ramp up production, driving increased demand for EVOH. Conversely, during economic downturns or recessions, companies may seek to cut costs by using cheaper, alternative materials, which can temporarily suppress EVOH demand and lead to price drops. This cyclical nature of demand can cause considerable variability in EVOH pricing over time.

Geopolitical factors also play a significant role in influencing EVOH prices. Trade policies, tariffs, and international relations can impact the supply chain of raw materials and the production of EVOH itself. For instance, trade tensions between major economies can result in tariffs on petrochemical products, driving up the cost of ethylene and vinyl alcohol, which are the key inputs for EVOH. Additionally, political instability in oil-producing regions can cause spikes in crude oil prices, which, as previously mentioned, directly affects the price of ethylene and, consequently, EVOH. Global events such as the COVID-19 pandemic also had a notable impact on supply chains, leading to disruptions in raw material availability and production slowdowns, which in turn increased EVOH prices due to limited supply and heightened demand for packaging materials.

Furthermore, the sustainability trend is affecting EVOH pricing. As consumers and regulatory bodies push for more environmentally friendly and recyclable materials, the demand for sustainable packaging solutions is growing. EVOH, being highly recyclable and effective in reducing food waste by extending the shelf life of products, is becoming increasingly favored in sustainable packaging initiatives. However, this increased demand for sustainable solutions can place upward pressure on prices as more companies vie for limited supplies of high-quality EVOH.

Currency fluctuations also play a role in EVOH pricing, especially for companies that rely on imported raw materials or export finished products. Exchange rate volatility can affect the cost of importing ethylene or vinyl alcohol, making EVOH production more expensive in certain regions. For instance, a weakening of the Japanese yen could make it more costly for Japanese manufacturers to import raw materials, which would then be reflected in higher EVOH prices in the global market. Similarly, exporters may adjust their prices based on exchange rate movements to maintain profitability in different currency environments.

In conclusion, EVOH prices are influenced by a complex web of factors that range from raw material costs and production capacity to demand fluctuations and geopolitical dynamics. As a specialty material with high demand in critical industries like food packaging and healthcare, the price of EVOH is often subject to significant volatility. Companies looking to source EVOH must stay attuned to these market drivers to effectively manage costs and ensure supply chain stability. As the global economy continues to evolve, it is likely that the factors affecting EVOH pricing will become even more interconnected, making market analysis and strategic sourcing increasingly important for businesses that rely on this valuable material.

Get Real Time Prices for Ethyl Vinyl Alcohol Copolymer: https://www.chemanalyst.com/Pricing-data/ethyl-vinyl-alcohol-copolymer-1154

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Ethyl Vinyl Alcohol Copolymer#Ethyl Vinyl Alcohol Copolymer Price#Ethyl Vinyl Alcohol Copolymer Prices#Ethyl Vinyl Alcohol Copolymer Pricing

1 note

·

View note