#Eric Hippeau

Text

🎮 ¡El Juego de la Inversión Comienza para Lil Snack! 🚀 La noticia de que Lil Snack, recién salida del horno creativo de Eric Berman y Travis Chen, haya cocinado un delicioso montón de capital de 3.1 millones de dólares marca un nuevo nivel en el terreno del desarrollo de videojuegos independiente. 👾 🌟 ¿Qué ingredientes secretos vieron A16z Games Speedrun, Powerhouse Capital, Lerer Hippeau y Waverley Capital para apostar en esta jugosa hamburguesa de inversión? Aquí mis _power-ups_ de predicción y comentario: 1. **Innovación**: Estoy apostando mis fichas de arcade a que Lil Snack nos sorprenderá con propuestas que revolucionarán no solo en gameplay sino en cómo interactuamos socialmente en el mundo virtual. 2. **Comunidad**: El respaldo de estos gigantes es un boost de confianza, pero lo que realmente llevará a Lil Snack al estrellato será la construcción de una comunidad fuerte y comprometida. Sí, escuchamos susurros de mecánicas con sabor a juego social. 3. **Dinámicas Frescas**: La experiencia de Berman y Chen no es ningún power down, al contrario, es un cheat code. Prepárense para diseños que redefinirán lo que consideramos entretenimiento interactivo. 🤖 Tantas posibilidades con la inyección de este capital planetario. ¿Serán sus juegos tan adictivos como el snack que nunca puedes dejar de comer? Yo creo que sí. Y como buen Master Sword de pronósticos, resalto que lo indie está cada vez menos in the shadows y más in the game . Para los que llevamos el joystick en el corazón, estas noticias son como encontrar la pieza final del Triforce. Estoy contando los segundos para ver qué mundo nos tienen preparado Eric y Travis. 👇 No se queden solo en spectate mode, denos su DLC de opiniones. Si conocen a un gamer en busca de news frescas, etiquétenselo. ¡No sean shy guys! ❤️ #Videojuegos #Inversiones #Startups #GamingCommunity #InnovaciónGamer #LilSnack 🕹️ ¿Cocktail de teorías? ¡Derramen su elixir de sabiduría en los comentarios o pasen la bola mágica a aquellos amigos que se emocionan con cada GAME START ! 🌟

0 notes

Text

Eric Hippeau discusses D2C growth, brand value and advice for early-stage founders

Eric Hippeau discusses D2C growth, brand value and advice for early-stage founders

Eric Hippeau is the founding partner at Lerer Hippeau Ventures, whose portfolio companies include the likes of Axios, BuzzFeed, Casper, Warby Parker, Allbirds, DocSend, Fundera, Everlane, Giphy, Genius and the recently acquired fitness company Mirror.

It would not be an overstatement to say that Hippeau is well-positioned to discuss startups across a wide spectrum of industries, from media to D2C…

View On WordPress

#COVID-19#D2C#ECL#ecommerce#Eric Hippeau#extra crunch live#lerer hippeau ventures#startups#venture capital

0 notes

Text

Where top VCs are investing in media, entertainment & gaming

Where top VCs are investing in media, entertainment & gaming

Most of the strategy discussions and news coverage in the media and entertainment industry is concerned with the unfolding corporate mega-mergers and the political implications of social media platforms.

These are important conversations, but they’re largely a tale of twentieth-century media (and broader society) finally responding to the authority Web 2.0 companies have achieved.

To…

View On WordPress

#Apple#BetaWorks#charles hudson#Electronic Arts#Epic Games#Eric Hippeau#esports#Facebook#fortnite#Founders Fund#Google#GV#HQ Trivia#Instagram#interactive media#lerer hippeau ventures

0 notes

Photo

Eric Hippeau discusses D2C growth, brand value and advice for early-stage founders – TechCrunch Eric Hippeau is the founding partner at Lerer Hippeau Ventures, whose portfolio companies include the likes of Axios, BuzzFeed, Casper, Warby Parker, Allbirds, DocSend, Fundera, Everlane, Giphy, Genius and the recently acquired fitness company Mirror.

0 notes

Text

Serendipity in Venture Capital is BS...(and other views on the seed VC landscape)

Disclaimer: I believe that unless you are one of a few firms, there is no possible claim that there is a “correct” way to do venture, only to treat people with respect along the way.

Venture capital started as a network heavy business and arguably still is to many. I don’t think that is dominant anymore.

The Early Days: VC was the ultimate network business

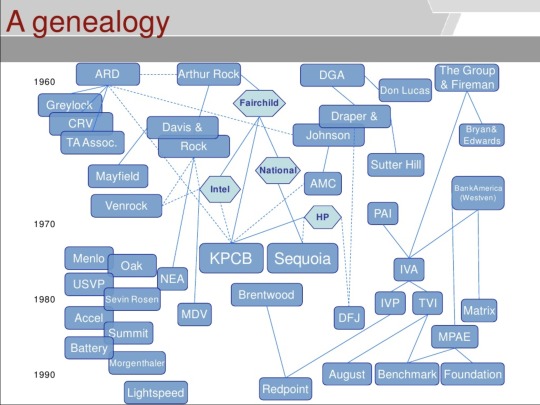

Venture capital started as the ultimate network business, with a tight-knit web of humans for decades. It looked like this:

After the web 1.0 bubble, there was not an abundance of capital, and thus power swung back towards VCs as the market cooled. Those VCs, based on 2008 data, were an average age of 46, 79% were men, 87% were white, and 53% had MBAs (of which 60% went to Harvard or Stanford). Based on demographics like that, it’d be pretty difficult to not be a tight-knit, network-driven industry.

Then, 2-7 years before the 2012 Facebook IPO, came the first wave of elite seed firms like Baseline, First Round Capital, Floodgate, Foundry Group, SV Angel, True Ventures, SoftTech, and others.

As company formation costs fell due to a variety of technological drivers, paired with startups being “hot” again, we saw institutional capital want more exposure to private market technology risk. Partners spun out, founders started funds, and angels institutionalized.

The Birth of Seed & Verticalized Funds

“In angel investing, you don’t really have competitors. You go ahead and do your thing…I don’t look at Internet or Internet investing as competitive, generally.” — Ken Lerer, 2010

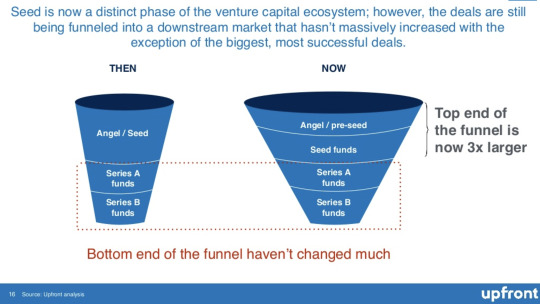

We all know this trend accelerated, with some seed funds graduating to series A+ firms, and quickly everyone (especially non-GPs who were stuck underneath partners unwilling to give up meaningful carry) wanted their own seed fund. The issue was, LPs had been hit up with the seed pitch now for the past 5+ years. And in the same time period, re-ups had come more and more often as fund deployment periods went from 5 years to 3 years.

These newer seed firms needed to differentiate as the “seed” story was played out.

This led to a wave of vertical-centric seed firms. Lemnos (2012 incubation fund I) and Root Ventures (2015 Fund 1) became known for hardware, Forerunner (2012 fund I) became known for consumer, Lerer Hippeau become known for NYC/Web (2010 Fund 1) and on and on it went.

The Venture Capital Explosion

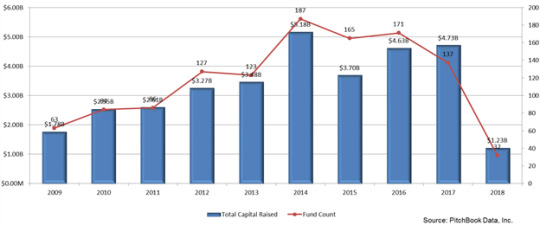

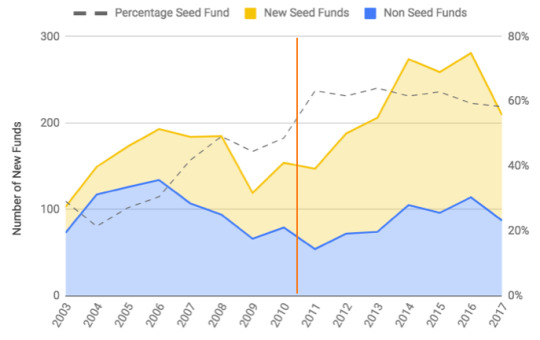

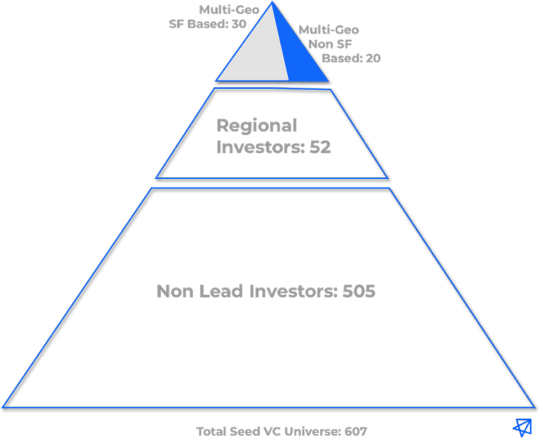

Between 2003 to 2010, an average of 58 seed funds were raised each year but in the past 7 years, that average spiked to 137 (or a 2.3x increase). - Eric Feng,

And now it’s 2019. The deployment periods for some funds have collapsed to as short as 18 months, there is a seed fund for everything, and series A+ firms have grown into full-stack financing machines with $1B+ funds designed to take companies from A to IPO, and many with scout programs to build the top of the funnel.

This hyper-crowded market has swung the pendulum back to old times, with LPs being sold either more explicit networks, or similar economics as the 70s.

The former manifests itself as unicorn-mafia funds (ex-uber employee fund, ex-airbnb employee fund, etc.) built around the idea that people want to raise money from their ex-coworkers and/or access will be materially better because of this relationship. The latter manifests itself as startup studios that have outsized ownership economics.

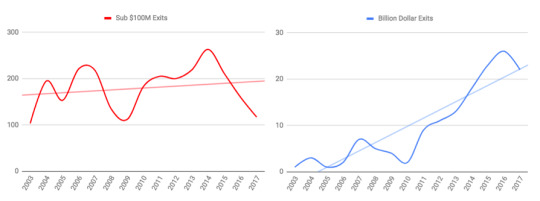

So we’ve got a ton of seed funds, plenty of post-seed capital, and some moderate differentiation. We also have a 7x increase in $1B+ outcomes from a decade ago.

But when I look around at seed stage venture, where the universe of companies is truly unknown, I still believe firms are relying on serendipity. And there are many firms that are trying to engineer serendipity at a high rate by sending analysts (and the partners themselves) to events 3–4x/week, actively trying to setup deal flow catch up calls, or aggressively stalking demo day lists, all born out of the fear that they will miss the next Stripe/Uber/etc.

And how do they scale up these teams to chase these competitive deals in an ever-expanding seed stage funnel? They raise more money.

As their seed fund gets bigger, they now need to write a $1.5-$2M check to get the proper ownership to 3–4x their $100M+ seed fund. At the same time it’s become more likely that interesting deals don’t get sent to them because…well the math doesn’t work for other investors to hit their ownership targets.

Or as Rob Go astutely points out, “firms that have built their models around aggressive deal trading will struggle.”

Now we have:

1) Larger seed funds, that are hyper-competitive (and often generalists due to fund size and scope creep).

2) Which means that seed funds need to tell founders that it is best for their business to only have them and no other meaningful checks in the round, so they can write $1.5M+ and get ~15%-20% ownership.

3) But unless you’re a top tier firm, your capital could be viewed as a commodity, and thus it’s clearly not dominant for a generalist firm to be the only investor (which is ok because...we’re humans, and we can’t be everything for everyone), and thus you are at massive risk of being pushed down in ownership and allocation.

4) And then in order to make the math work you’re reliant on multiple $1B+ outcomes, despite a large % of VC-backed M&A transactions happening below $300M.

5) So we now have some seed VCs telling investors that they will be able to increase ownership from seed to A/B or at worse do full pro-rata to maintain. The problem is that in reality, pro rata allocations from Series A+ remain increasingly difficult to maintain, as those $1B+ funds, that have infrastructure (and fees) to in theory actually be everything for everyone, need to put more money to work in their rounds. So you don’t get to defend ownership nearly as efficiently as even 5 years ago. And often any pre-empted offer for a pre-series A round could just turn into a pre-empted full series A process.

All of these things boil down to the core truth that most Seed stage firms today have to be small (either ridealong checks or non-hyper competitive leads), early, and/or different enough to be one top-priority thing for a subset of founders.

I recognize that I just doomsday scenario’d a bunch of components of seed stage venture capital, so I figured it’d only be fair for me to share my own (highly biased) view on what does work at some >1 firm scale at the seed stage.

First, forward looking macro-factors that I strongly believe in:

VC returns have been persistent, but with each new innovation cycle turn (infrastructure to personal computing to web to mobile and onward) new successful VCs have been birthed that have become part of the persistence. The power law of venture will remain, but will be slightly more distributed.

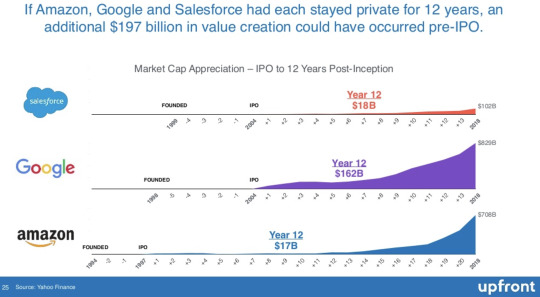

Private markets are going to continue to capture the returns in many sectors, and thus it will be attractive for LPs to be invested in a larger subset of tier 1, tier 2, and maybe even tier 3 VC firms from a returns perspective. This will be even more evident as we potentially enter tumultuous public market performance that shows lower yield over the next decade than the prior decade+ bull-run we’ve had.

The compounding effects of venture as an industry are unique vs. any other industry. Brand flywheels are strong absent of results due to opacity of quantitative measures (i.e. we both bury the dead slowly and quietly on failed startups, and cheer the good loudly on less-than-incredible fund exits/performance).

Brand signaling can create unfair advantages. I.e. If Sequoia invests in a company, statistically that company is more likely to raise money than if another investor does. Building a lasting brand matters.

More specifically the seed fund strategy that I believe in:

Keep fund size small — Leading a round today is rarer than we think, and just means conviction and ability to put down a term sheet (and large check), but not necessarily 60%+ of the round. There has never been more follow-along capital at the seed stage and rallying investors around your conviction and lead check is a powerful thing that solves for some disadvantages of smaller funds.

Remove noise and keep focused — Small fund size enables myself (and other similar funds) to not care about missing the next billion-dollar marketplace business. The funnel has widened (as seen above) , and only looking at a piece of the funnel is scalable/realistic. Yes, hit rate needs to be better, but I’d argue that while it’s gotten statistically harder to identify a fund returning company, it’s become exponentially harder to win meaningful allocation in that deal.

Build an informed view of the world - This allows investors to compete on the axis of both having a deeper understanding of a space versus the average investor, theoretically have an ability to know what they are looking for at a faster pace (and thus move faster), find/track things earlier due to focus, and meaningfully compete via outbound deal flow by using ammunition that they’ve built up in research.

These last two points specifically are the only way in which I feel I am able to advantageously do venture. However, as I said before, it’s not immediately clear to me that one strategy in seed stage venture is dominant.

Small funds have dominant return profiles for today’s fundraising dynamics, high velocity funds have dominant statistics for today’s outcome distributions, full-stack funds have dominant funnel building for today’s growing prices, and concentrated funds have dominant return distributions if you can pick.

What is clear to me is that venture is changing rapidly and if you aren’t thinking about these things in real-time, you’re not doing your job.

5 notes

·

View notes

Text

Trending Tech Business News: Trump is wrong to attack Amazon: Eric Hippeau

Trending Tech Business News: Trump is wrong to attack Amazon: Eric Hippeau

Trump is wrong to attack Amazon: Eric Hippeau Lerer Hippeau Ventures partner Eric Hippeau discusses President Trump’s attacks against Amazon and why he believes that Facebook has lost control of its platform. via FOX BUSINESS NEWS Technology https://ift.tt/2q42lNE

View On WordPress

1 note

·

View note

Text

Daily Crunch: Lyft and Uber win legal victory

Uber and Lyft may not be pausing operations in California after all, Google releases new emergency alert tools and Airbnb bans all parties. This is your Daily Crunch for August 20, 2020.

The big story: Uber and Lyft win legal victory

Earlier today, Lyft announced that it would suspend operations in California tonight as a result of a preliminary injunction forcing Lyft and Uber to reclassify their drivers as employees.

Then, in a head-spinning change of fortune, an appeals court judge granted the companies a temporary stay. They now have until early September to outline their plans for how to manage the transition, with oral arguments in the court case coming in mid-October.

Meanwhile, Uber, Lyft and DoorDash are backing Proposition 22, a state ballot measure that they’re pitching as an alternative approach to classifying gig workers.

The tech giants

Google brings emergency alert tools to Search and Maps as fires rage in Northern California — Google will display a red border that encircles a rough approximation of the active blaze.

Report: Apple quietly acquired Israel’s Camerai, formerly Tipit, a specialist in AR and camera tech — The acquisition was reported by Calcalist.

Startups, funding and venture capital

Airbnb declares all parties over indefinitely at its listings — The company notes that “unauthorized parties” have always been against its rules, even though it previously allowed hosts on its platform to selectively approve small gatherings.

DoorDash expands with on-demand grocery delivery — In contrast to many other grocery services, the company promises to deliver within an hour of your order.

China’s Waterdrop nabs $230M for its crowdfunded, mutual aid insurance platform — Waterdrop pays out when its members fall into medical dire straits.

Advice and analysis from Extra Crunch

Figma CEO Dylan Field discusses fundraising, hiring and marketing in stealth mode — The company behind the largely browser-based design tool has made a huge splash in the past few years, building a massive war chest with more than $130 million.

Zoom UX teardown: 5 fails and how to fix them — Zoom’s user experience is far from perfect.

Eric Hippeau discusses D2C growth, brand value and advice for early-stage founders — Lerer Hippeau’s portfolio companies include Axios, BuzzFeed, Casper, Warby Parker, Allbirds, DocSend, Fundera, Everlane, Giphy, Genius and the recently acquired fitness company Mirror.

(Reminder: Extra Crunch is our subscription membership program, which aims to democratize information about startups. You can sign up here.)

Everything else

Border wall crowdfunding scheme leads to Trump ally Steve Bannon’s arrest — Bannon faces charges for conspiracy to commit money laundering and conspiracy to commit wire fraud.

The founders of Blavity and The Shade Room are coming to Disrupt 2020 — Morgan DeBaun and Angie Nwandu have been building a more diverse digital media landscape for years.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

0 notes

Text

Startups Weekly: A new era for consumer tech

TechCrunch is out hunting for bright spots in the startup world as we all come to grips with the pandemic — particularly where checks are actually being written despite everything.

D2C is back to the future

First up this week, we surveyed top direct-to-consumer investors, and they seemed pretty optimistic despite the struggles of some sector leaders. Here’s Lightspeed Venture Partners Nicole Quinn, for example, on investor activity versus current opportunity:

I would argue it is too weak as investors look at the unit economics of some of the recent IPOs and think that is true for all of D2C. In reality, there are sectors such as beauty where many companies have product margins >90% or true brands such as Rothy’s where there is such a strong word-of-mouth effect and this gives them an unfair advantage with far better unit economics than the average.

Other respondents include: Ben Lerer and Caitlin Strandberg from Lerer Hippeau, Gareth Jefferies from Northzone, Matthew Hartman of Betaworks Ventures, Alexis Ohanian of Initialized Capital and Luca Bocchio of Accel.

Arman Tabatabai has the full investor survey on Extra Crunch, while Connie Loizos has a separate interview with Ohanian over on TechCrunch.

Proptech will be going (more) remote

Arman also ran a popular investor survey on real estate and proptech a few months back, so a virus update edition was warranted given the existential questions facing the future of physical space. Here’s one clarifying explanation from Andrew Ackerman of Dreamit Ventures:

Startups targeting residential landlords and property managers could be big winners. Anything that makes tenants more comfortable like residential tenant amenity platforms (e.g. Amenify) or automates maintenance requests (e.g. Travtus, Aptly), simplifies maintenance itself (e.g NestEgg) or eases operations like package receiving (e.g. Luxer One) are suddenly top of mind.

VC investors have a saying, “Don’t make me think,” and right now, we are thinking hard about what COVID-19 means for our portfolio, so don’t be surprised if we are a little slower than normal to write checks. That said, we are acutely aware of the fact that some of our best returns came from investments made during difficult times. Fortunately, we think quickly.

Read the full thing on Extra Crunch.

A new era for consumer tech

It’s no surprise that SaaS companies are seeing new growth from millions staying at home. But what else is going on besides work? Josh Constine pulls together the rebirth of Houseparty, the integration of Zoom into popular social networks and other trends today to elegantly explain the big picture: social tools actually being used like everyone had hoped(!).

What is social media when there’s nothing to brag about? Many of us are discovering it’s a lot more fun. We had turned social media into a sport but spent the whole time staring at the scoreboard rather than embracing the joy of play. But thankfully, there are no Like counts on Zoom . Nothing permanent remains. That’s freed us from the external validation that too often rules our decision-making. It’s stopped being about how this looks and started being about how this feels. Does it put me at peace, make me laugh, or abate the loneliness? Then do it. There’s no more FOMO because there’s nothing to miss by staying home to read, take a bath, or play board games. You do you.

Check it out on TechCrunch, then be sure to check out our ongoing coverage of where this is headed: virtual worlds(!?). Eric Peckham analyzed the sprawling topic in an eight-part series last month, then sat down for an in-house TechCrunch interview this week to explain how he sees the pandemic impacting the existing trends.

More than two billion people play video games in the context of a year. There’s incredible market penetration in that sense. But, at least for the data I’ve seen for the U.S., the percent of the population who play games on a given day is still much lower than the percent of the population who use social media on a given day.

The more that games become virtual worlds for socializing and hanging out beyond just the mission of the gameplay, the more who will turn to virtual worlds as a social and entertainment outlet when they have five minutes free to do something on their phone. Social media fills these small moments in life. MMO games right now don’t because they are so oriented around the gameplay, which takes time and uninterrupted focus. Virtual worlds in the vein of those on Roblox where you just hang out and explore with friends compete for that time with Instagram more directly.

Some SEM prices are going down due to the pandemic

Danny Crichton put on his data scientist hat for Extra Crunch and analyzed more than 100 unicorns across tech sectors and looked how how the pricing of their keywords has changed due to the pandemic/recession.

The results aren’t surprising — there has been a collapse in prices for almost all ads (with some very interesting exceptions we will get to in a bit). But the variations across startups in their online ad performance says a lot about industries like food delivery and enterprise software, and also the long-term revenue performance of Google, Facebook and other digital advertising networks.

Big tech should do more to help startups now

Besides offering wily developer platforms, I mean. Josh argued on TechCrunch that hosting costs and associated expenses should be spared or delayed by the dominant companies to be nice, and to avoid crushing their own ecosystems.

Google, Amazon and Microsoft are the landlords. Amidst the coronavirus economic crisis, startups need a break from paying rent. They’re in a cash crunch. Revenue has stopped flowing in, capital markets like venture debt are hesitant and startups and small-to-medium sized businesses are at risk of either having to lay off huge numbers of employees and/or shut down. Meanwhile, the tech giants are cash rich. Their success this decade means they’re able to weather the storm for a few months. Their customers cannot.

On the other hand, now is also a good time for mid-sized startups to try to take market share from incumbents who don’t act friendly enough to the rest of the startup world…..

Odds and ends

Eliot Peper, author of a variety of popular sci-fi and tech fiction stories (and occasional TechCrunch contributor), has a new book out called “Uncommon Stock: Version 1.0” about a small startup that accidentally crosses paths with a drug cartel. Current subscribers to this newsletter will find that the link above takes them to a free download (that ends Sunday).

I had been planning to moderate a panel at SXSW on the topic of remote work, but other events flipped that on its head. The panel, featuring Katrina Wong, VP of Marketing at Hired, Darren Murph, Head of Remote at Gitlab, and Nate McGuire, Founder of Buildstack, happened on Zoom. And now the video is available here — check out to get key tips on going remote-first from these experts.

Across the week

TechCrunch

Now might be the perfect time to rethink your fundraising approach

How child care startups in the U.S. are helping families cope with the COVID-19 crisis

Private tech companies mobilize to address shortages for medical supplies, masks and sanitizer

One neat plug-in to join a Zoom call from your browser

Extra Crunch

When is it time to stop fundraising?

Slack’s slowing growth turns around as remote work booms

A look inside one startup’s work-from-home playbook

Lime’s valuation, variable costs and diverging categories of on-demand companies

#EquityPod

From Alex:

The three of us were back today — Natasha, Danny and Alex — to dig our way through a host of startup-focused topics. Sure, the world is stuffed full of COVID-19 news — and, to be clear, the topic did come up some — but Equity decided to circle back to its roots and talks startups and accelerators and how many pieces of luggage does an urban-living person really need?

The answer, as far as we can work it out, is either one piece or seven. Regardless, here’s what we got through this week:

Big news from 500 Startups, and our favorite companies from the accelerator’s latest demo day. Y Combinator is not the only game in town, so TechCrunch spent part of the day peekin’ at 500 and its latest batch of companies. We got into some of the startups that stuck out, tackling problems within the influencer market, trash pickup and esports.

Plastiq raised $75 million to help people and businesses use their credit card anywhere they want. And no, it wasn’t closed after the pandemic hit.

We also talked through Fast’s latest $20 million round led by Stripe. Stripe, as everyone recalls, was most recently a topic on the show thanks to a venture whoopsie in the form of a check from Sequoia to Finix.1 But all that’s behind us. Fast is building a new login and checkout service for the internet that is supposed to be both speedy and independent.

All the Stripe talk reminded us of one of the startups that launched so it could beat it out: Brex. The startup, which has amassed over $300 million in known venture capital to date, recently acquired three companies.

We chatted through the highlights of our D2C venture survey, focused on rising CAC costs in select channels, the importance of solid gross margins and why Casper wasn’t really a bellwether for its industry.

Listen here!

https://growinsta.xyz/startups-weekly-a-new-era-for-consumer-tech/

#free instagram followers#free followers#free instagram followers instantly#get free instagram followers#free instagram followers trial#1000 free instagram followers trial#free instagram likes trial#100 free instagram followers#famoid free likes#followers gratis#famoid free followers#instagram followers generator#100 free instagram followers trial#free ig followers#free ig likes#instagram auto liker free#20 free instagram followers trial#free instagram followers no#verification#20 free instagram likes trial#1000 free instagram likes trial#followers instagram gratis#50 free instagram followers instantly#free instagram followers app#followers generator#free instagram followers instantly trial#free instagram followers no survey#insta 4liker#free followers me#free instagram followers bot

0 notes

Text

Where top VCs are investing in media, entertainment & gaming

Most of the strategy discussions and news coverage in the media & entertainment industry is concerned with the unfolding corporate mega-mergers and the political implications of social media platforms.

These are important conversations, but they’re largely a story of twentieth-century media (and broader society) finally responding to the dominance Web 2.0 companies have achieved.

To entrepreneurs and VCs, the more pressing focus is on what the next generation of companies to transform entertainment will look like. Like other sectors, the underlying force is advances in artificial intelligence and computer power.

In this context, that results in a merging of gaming and linear storytelling into new interactive media. To highlight the opportunities here, I asked nine top VCs to share where they are putting their money.

Here are the media investment theses of: Cyan Banister (Founders Fund), Alex Taussig (Lightspeed), Matt Hartman (betaworks), Stephanie Zhan (Sequoia), Jordan Fudge (Sinai), Christian Dorffer (Sweet Capital), Charles Hudson (Precursor), MG Siegler (GV), and Eric Hippeau (Lerer Hippeau).

Cyan Banister, Partner at Founders Fund

“In 2018 I was obsessed with the idea of how you can bring AI and entertainment together. Having made early investments in Brud, A.I. Foundation, Artie and Fable, it became clear that the missing piece behind most AR experiences was a lack of memory.

from Facebook – TechCrunch https://tcrn.ch/2H5r7GJ

via IFTTT

0 notes

Text

La puesta en marcha de un taxi volador de Blade está ayudando a los CEO de Silicon Valley a evitar el tráfico - TechCrunch

Nueva Noticia publicada en https://noticiasq.com/la-puesta-en-marcha-de-un-taxi-volador-de-blade-esta-ayudando-a-los-ceo-de-silicon-valley-a-evitar-el-trafico-techcrunch/

La puesta en marcha de un taxi volador de Blade está ayudando a los CEO de Silicon Valley a evitar el tráfico - TechCrunch

Un año después de $ 38 millones en la serie B de startups Blade calificadas por demanda en $ 140 millones, la compañía comenzó a rodar a la élite del Área de la Bahía.

Como parte de un nuevo programa piloto, Blade dio a 200 personas en San Francisco y Silicon Valley tiene acceso exclusivo a su aplicación móvil, lo que les permite reservar helicópteros, aviones privados e incluso hidroaviones con al menos $ 200 de anticipación. por lugar

Blade, con el apoyo de Lerer Hippeau, Airbus, el anterior CEO de Google, Eric Schmidt y otros, actualmente vuelan pasajeros en el área de la ciudad de Nueva York, donde se encuentra, ofreciendo a los ricos vuelos de $ 800 de la región A los Hamptons, entre otros vuelos a diversos precios. Según Business Insider, en el pasado trabajó con Uber para ayudar a los participantes de Coachella en su viaje de bolsillo desde y hacia el aeropuerto Van Nuys en Palm Springs, alquilando helicópteros de seis plazas por más de $ 4,000 por día.

el piloto parece apuntar a viajeros de negocios, conectando pasajeros con el Aeropuerto Internacional de San Francisco y el Aeropuerto Internacional de Oakland en Palo Alto, San José, Monterrey y el Valle de Napa. El objetivo es acortar los viajes terriblemente largos causados por el mal tráfico en las grandes ciudades como Nueva York, Los Ángeles y San Francisco. Recientemente, la startup colaboró con American Airlines para establecer mejor su red de helicópteros, un gran paso para la compañía que trabaja para integrarse con las infraestructuras de transporte existentes.

Blade, dirigido por el fundador y CEO Rob Wiesenthal, un ex ejecutivo de Warner Music Group, hasta el momento ha recaudado alrededor de $ 50 millones en fondos de capital de riesgo. Para lanzar a gran escala y finalmente competir con el gigante Behroth Uber, tendrá que soportar muchas más inversiones.

Uber también tiene planes muy altos para desarrollar una actividad de redistribución aérea para los consumidores, así como muchas otras empresas de nueva creación con financiación privada. Llamado UberAIR, Uber ofrecerá vuelos de corto plazo a los pasajeros a partir de 2023. La compañía ha recaudado miles de millones de dólares para convertir este concepto de ciencia ficción en realidad.

Luego está Kitty Hawk, una compañía lanzada por el ex vicepresidente de Google y cofundador de Udacity Sebastian Thrun, que está desarrollando un avión que puede despegar como un helicóptero, pero Volar como un avión para el transporte urbano a corto plazo. Otros en el taxi aéreo o en el espacio aéreo vertical de despegue y aterrizaje, incluidos Volocopter, Lilium y Joby Aviation, han recaudado decenas de millones para eliminar la congestión del tráfico o, más bien, para cazar a los ricos.

La siguiente parada en Blade es India, informa el Financial Times, donde liderará un piloto que conectará a los viajeros en el centro de Mumbai y Pune. La compañía le dice a TechCrunch que actualmente está explorando otro piloto nacional y otro piloto internacional.

0 notes

Text

Lerer Hippeau raises a new $122M fund, plus $60M for follow-on investments

Lerer Hippeau has raised two new funds — $122 million for a sixth fund devoted to seed stage investments, as well as $60 million for a “Select Fund” focused on later-stage deals.

Managing Partner Eric Hippeau said both funds will be used to continue the firm’s existing strategy: “We continue to be seed-first investors and New York-first investors. We’re big believers in New York.”

And while Hippeau acknowledged that the New York ecosystem is still be waiting for the kind of massive exit that makes “a lot of people very rich, who will then leave and start their own companies,” he pointed to recent success stories like Oracle’s acquisition of Moat and Roche’s acquisition of Flatiron Health. (Lerer Hippeau invested in Moat but not Flatiron; both are New York-based.)

“There’s a huge pipeline in New York of companies that have been valued in the hundreds of millions and in some cases billions of dollars — a lot of them are our companies, but not always,” Hippeau said. “That’s where the strength of New York is going to come from in the short term, all of these companies really popping to the surface and adding a few billion dollars of value, one at a time.”

The firm announced its first follow-on fund last year. At the time, Hippeau said it had only raised $28 million so that it could be “synced up” with the main fund, which is what’s happening now.

The first Select Fund was used to make follow-on investments in companies that Lerer Hippeau had already backed at the seed stage, like Allbirds and Casper. That will continue with the new fund, but Hippeau said it could also be used for Series A investments in startups that the firm didn’t back initially, and which might now seem like missed opportunities.

Caitlin Strandberg

Meanwhile, the Lerer Hippeau team has also been growing, with the recent hiring of Caitlin Strandberg (formerly vice president at FirstMark) as principal and Isabelle Phelps as associate, as well as Amanda Mulay as senior talent manager.

“I couldn’t be more excited to join the most active early-stage firm in New York, just as it gets fresh capital,” Strandberg said in an emailed statement. “Lerer Hippeau has built a fantastic reputation as being a hands-on, accessible and helpful investor all while cultivating a powerful and engaged community. I’m looking forward to investing in the next great generation of startups, supporting our existing founders and teams, and continuing to build a great tech ecosystem here in NYC.”

Lerer Hippeau now has around 20 people on the team. And while firms like Andreessen Horowitz (where Mulay used to work) have made their huge support staff a selling point, Hippeau said that at his firm, “We don’t really want to have dozens of people doing this. We want to be very precise and very selective about how we can help.”

Still, he said that “the service that’s most in-demand is help with recruiting,” so it made sense to bring on Mulay to help startups hire, and also to help them “set up a proper HR function.”

Lerer Hippeau’s investment team built its reputation in media — Hippeau was formerly CEO at The Huffington Post, Kenneth Lerer cofounded HuffPost and is now chairman at BuzzFeed and Ben Lerer is CEO at Group Nine Media. (The three of them are pictured at the top of this post.) But with the seemingly constant news about digital media layoffs and shutdowns, would Hippeau invest in a media startup today?

Actually, the firm did back one such startup recently, podcast network Wondery. But Hippeau said media has “never been more than 10 percent of our portfolio.” (Other recent investments include cryptocurrency wallet Casa and cannabis talent network Vangst.)

“We love media, we continue to look at media companies, but we are relatively selective,” he said.

Original Article : HERE ; This post was curated & posted using : RealSpecific

=>

***********************************************

See Full Article Here: Lerer Hippeau raises a new $122M fund, plus $60M for follow-on investments

************************************

=>

Lerer Hippeau raises a new $122M fund, plus $60M for follow-on investments was originally posted by 16 MP Just news

0 notes

Photo

Join Eric Hippeau for a live Q&A on August 13 at 11am PT/2pm ET – TechCrunch The media landscape is changing rapidly. Even before COVID, media companies were looking at new revenue models beyond your standard banner ad, all the while trying to navigate the oft-changing world of social media and search, where a minor algorithm change can boost or tank traffic.

0 notes

Link

via TechCrunch 3G wifi Sahaha https://3gwifi.net/ 368 đường láng, Đống Đa, hà nội 19002106 [email protected] https://3gwifi.net/danh-muc/bo-phat-wifi-4g/ https://3gwifi.net/danh-muc/usb-4g-dcom-4g/ https://3gwifi.net/danh-muc/sim-3g/ https://3gwifi.net/danh-muc/wifi-du-lich/ https://3gwifi.net/danh-muc/may-phien-dich/ https://goo.gl/maps/W9Wk6vrue6aW8yuP7 3gwifisahaha Sahaha cung cấp usb 4G✅ Dcom 4G✅ Sim 4G✅Bộ phát wifi 4G chính hãng✅ Uy tín Giá rẻ nhất✅ 19002106

0 notes

Text

Trending Tech Business News: U.S. can’t let people arbitrarily come into the country: Fmr. FBI special agent

Trending Tech Business News: U.S. can’t let people arbitrarily come into the country: Fmr. FBI special agent

U.S. can’t let people arbitrarily come into the country: Fmr. FBI special agent Former FBI special agent and spokesman John Iannarelli and Lerer Hippeau Ventures Partners’ Eric Hippeau discuss U.S. vetting procedures following the New York City terror attack. via FOX BUSINESS NEWS Technology http://ift.tt/2z5opLH

View On WordPress

0 notes