#Electrically Conductive Adhesives Market industry

Explore tagged Tumblr posts

Text

Application of bitumen in building

Bitumen has numerous applications in the construction industry, primarily serving as an adhesive and waterproofing material. Its versatile properties make it indispensable in various building-related functions. Here are some key applications of bitumen in construction:

1. Roofing and Waterproofing:

Bitumen 60/70 is extensively used in roofing systems to provide waterproof membranes for flat roofs. Traditional bitumen roofing membranes consist of layers of bitumen sprayed with aggregate, with a carrier fabric made of polyester or glass in between. Polymer-modified bitumen sheets have become the standard for flat roof waterproofing. Bituminous roofing membranes can also be recycled easily, enhancing their sustainability.

2. Wall Sealing:

Bitumen 60/70 plays a crucial role in sealing walls, providing protection against water and moisture intrusion. It is applied to substrates such as bathrooms and toilets, which are constantly exposed to moisture, to prevent water penetration and safeguard the underlying structures.

3. Floor and Wall Insulation:

Bitumen 80/100 insulation is widely employed for building waterproofing, both horizontally and vertically. It effectively prevents water penetration into floorboards and walls, offering reliable protection. Bitumen's chemical and physical properties make it easy to work with and highly durable.

4. Sound Insulation:

Bitumen's sound-absorbing properties find applications beyond construction. It helps reduce noise transmission, such as the sound of footsteps under floor coverings. Special tar mats in cars and elevators utilize Bitumen 80/100 for sound insulation.

5. Electrical Cable Insulation:

Bitumen's low electrical conductivity makes it suitable for use as an insulating material for electrical cables. It helps protect the cables and prevent electrical hazards.

6. Other Uses:

Bitumen 80/100 & bitumen 60/70 finds application in various other areas, such as the paper industry and the manufacturing of paints and varnishes. Its thermal insulation properties are beneficial in different contexts.

From an ecological standpoint, bitumen is highly regarded for its long lifespan. It remains a popular construction material, with significant demand both domestically and in international markets. The producer of bitumen in Iran exports a large percentage of its production to other countries such as Singapore, Dubai, Panama.

In residential construction, plastic-modified bitumen (KMB) coatings are commonly used for insulation. They compete with bitumen-free FPD (Flexible Polymer Disc) seals, which are easier to apply and offer faster repair options.

Overall, the applications of bitumen in the construction industry are extensive, ranging from roofing and waterproofing to sound insulation and electrical cable insulation. Its versatility and durability make it a valuable material in various building-related functions.

Important Considerations Before Using Bitumen:

1. Surface Preparation:

Before applying bitumen, it is crucial to ensure that the surface is clean, dry, and free from any contaminants. Even the presence of dust, dirt, or grease can hinder the adhesion of the bitumen coating and compromise the effectiveness of the seal. Additionally, the surface should be free from frost. If there are old incompatible coatings, they must be removed. In the case of older buildings, previous applications of bituminous paints may not provide a suitable surface for polymer-modified bitumen (PMB) coatings.

2. Repairing Cracks and Unevenness:

Prior to applying bitumen, any cracks or unevenness on the surface should be repaired using appropriate materials like repair mortar or leveling compounds. This ensures a smooth and uniform surface, promoting better adhesion and a more effective seal.

3. Additional Preparatory Measures:

In some cases, additional preparatory measures may be necessary. One option is to use a layer of synthetic resin on the coarse-pored bed or to apply a sealing slurry. A sealing slurry is a waterproof mixture of cement and plastic that allows water vapor to pass through. The advantage of using a sealing slurry is that it can adhere well to old bituminous coatings, providing an ideal substrate for applying a thick new bituminous coating.

By following these steps and ensuring proper surface preparation, you can optimize the adhesion and effectiveness of bitumen coatings in various applications.

What are the suitable means for repairing cracks and unevenness on the surface before applying bitumen?

There are several suitable means for repairing cracks and unevenness on the surface before applying bitumen. The choice of repair method depends on the severity of the damage and the specific requirements of the project. Here are some common methods for repairing cracks and unevenness:

1. Crack Fillers and Sealants:

For smaller cracks, crack fillers or sealants can be used. These materials, such as asphalt-based crack fillers or specialized concrete crack sealants, are designed to fill and seal cracks, preventing water infiltration and further damage. They are typically applied using a caulk gun or trowel.

2. Repair Mortar:

Repair mortars are suitable for filling larger cracks, holes, or areas of unevenness. These mortars are made from a blend of cement, sand, and additives to enhance adhesion and strength. They can be mixed with water to create a workable paste and then applied to the damaged areas using a trowel or other appropriate tools. Repair mortars are commonly used for repairing concrete surfaces.

3. Leveling Compounds:

Leveling compounds, also known as self-leveling underlayments or floor levelers, are used to create a smooth and level surface. These compounds are typically made from a blend of cement, fine aggregates, and additives. They have a fluid consistency that allows them to flow and self-level over uneven areas. Leveling compounds are commonly used to repair uneven concrete or subfloor surfaces before applying flooring materials.

4. Patching Mixtures:

Patching mixtures, such as asphalt patching compounds or repair mixes, are specifically designed for repairing asphalt surfaces. They typically contain a combination of asphalt binder, aggregates, and additives. These mixtures can be applied to fill potholes, repair damaged areas, or smooth out unevenness in asphalt surfaces.

5. Resurfacing:

In cases where the damage or unevenness is more extensive, resurfacing the entire surface may be necessary. This involves applying a new layer of bitumen or asphalt mixture over the existing surface to create a smooth and uniform finish. Resurfacing can help address multiple issues, including cracks, potholes, and unevenness.

It's important to follow the manufacturer's instructions and best practices when using any repair materials. Additionally, proper surface preparation, including cleaning and removing loose debris, is essential before applying any repair method.

ATDM CO is a manufacturer and exporter of Bitumen 60/70, offering three different quality grades available in drums, bags, and bulk quantities. Our products are classified into premium, second, and third types, each with varying production costs and facilities. We provide a wide range of options to accommodate different customer needs and volume requirements.

#bitumen#bitumen 60/70#bitumen 80/100#bitumen 60/70 specs#bitumen penetration grade 60/70#bitumen 60/70 specification#bitumen 60 70#atdm co llc.

2 notes

·

View notes

Text

Empowering lithium battery production line, revealing Second Intelligent's “smart” engine

● New Energy Power Battery Core Coating Project ●

Thanks to the explosive development of the new energy automobile industry, the lithium battery also ushered in a period of rapid development. Shenzhen Second Intelligent Equipment Co., Ltd (Second Intelligent) lithium battery gluing machine equipment is based on the new energy lithium battery packaging section, through the core, side plate, end plate, insulating sheet, etc. to glue to achieve bonding, sealing, thermal conductivity and other functions, its performance requirements and stability have reached the international leading level.

In 2023, Second Intelligent provided more than 20 sets of gluing machine equipments for 3 production lines of a new energy power battery manufacturer, which helped it to further improve the production efficiency, meet the market demand for production capacity, and escort the stability of product quality, and helped the customer to rapidly expand the market share!

New energy, new opportunities!

With the new energy vehicle market penetration rate continues to increase corresponds to the global power battery manufacturing continues to expand. Currently, the demand for power batteries is “blowout” explosive growth. Industry data predicts that the global electric vehicle sales of 23.3 million units in 2025, corresponding to the demand for power batteries amounted to 1,691GWh.

2021-2025 power battery demand CAGR of nearly 48%.

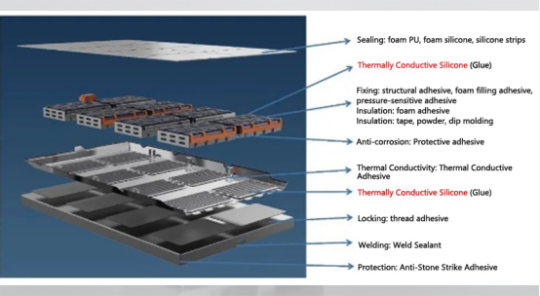

| Adhesive technology in the battery system application point

The power battery is the "heart" of new energy vehicles. It refers to the rechargeable battery system used in new energy vehicles to provide power sources. The battery cell is the smallest unit of a battery system. Multiple battery cells form a module, and multiple modules form a battery pack. This is the basic structure of automotive power batteries.

Behind the rapid development of the industry is the continuous technological refinement of the manufacturing process and supporting equipment. Among the many key processes and materials, new energy power battery cell gluing as one of the most important processes in the assembly process, how to improve the precision of gluing,

Stability and automation has become the focus of industry attention.

To solve the reliability of new energy vehicle batteries, it is necessary to deal with the “core gluing” problem. Therefore, the well-known brands of new energy power battery cell suppliers in all aspects of the screening is very strict.

New energy power battery market demand soars, and lithium-ion coating machine as an important battery core production equipment, its market demand is also increasing. At present, in the domestic new energy automobile industry chain rapid development background, lithium-ion coating machine development trend is good.

| Choosing Second Intelligent to build new energy power battery cell coating project together

After seventeen years of technological precipitation and innovation, customizable solutions, professional design, fast delivery and excellent service, Second Intelligent has gradually established a brand image of high quality, credibility and service in the industry. Against this background, the new energy power battery manufacturer finally chose Second Intelligent.

The new energy power battery manufacturer finally selected Second Intelligent as the new energy power battery core coating supplier, the two sides of the team strong combination, around the site environment and process technology needs, from the early equipment program planning to the late equipment on-line always maintain close communication and cooperation.

Since December 2022, after receiving the customer's new energy power battery cell coating project procurement needs, the team composed of R&D, engineering, after-sales, project and sales of Second Intelligent, responded to the customer's needs in a timely manner, decomposed the customer's needs, carried out product validation, and efficiently linked the functions of various sections within the company, closely communicated with the customer and finalized the program.

Communicate closely with the customer and finalize the details of the program. Second Intelligent team and customer team keep online meeting about 2 times a week to continuously optimize the solution design.

In March and April 2023, the equipment for this project was delivered in stages. Due to the imperfect supporting facilities of the manufacturer affected the commissioning time, Sechun technicians actively cooperated with the customer, overcame the difficulties with the customer, chased the progress, and compressed the commissioning time from the original plan of 1 month to 10 days. Due to the tight time,

Due to the tight time and heavy task, the technicians worked overtime and sprinted with all their strength, and finally the equipment was put into normal use according to the original date and the task was successfully completed. The debugging personnel stationed at the customer's production site, set up night shift rotation, always focusing on the customer, and the spirit of continuous fighting were fully affirmed by the customer.

It shows the team spirit of hard work and excellence of Second Intelligent people.

This is not only due to the exploration and development of Second Intelligent team, but also inseparable from the customer's high trust to Second Intelligent. In the process of project communication between the two sides, the customer always encourages Second Intelligentteam to give full play to the technical advantages in the lithium equipment overall solutions for the new energy power battery core gluing process to provide new technology,

New ideas to solve the industry automation and industrialization problems. In the end, Second Intelligent also lived up to the expectations, riding on the momentum to make progress, and completed the answer sheet with more than expected performance, and a number of innovative designs are more efficient compared with traditional solutions.

The new energy power battery manufacturer said that this is a very happy cooperation, Second Intelligent team solved the glue production line problems that had been bothering for a long time, and the project also shines because of the power of mutual creation and prosperity, and we hope that the two sides can cooperate in more fields in the future.

| Technological innovation, help lithium industry high-quality development

The main body of this equipment consists of loading system, transfer system, feeding system, metering system, distribution system, etc., with the lack of material monitoring, pressure monitoring, flow monitoring and other functions, through software control and information management (MES system) into a glue raw material processing,

Through software control and information management (MES system), it becomes a gluing machine with the functions of raw material handling, precise metering and automatic mixing, with high stability and high precision, which effectively improves the overall production efficiency of the production line.

| Second Intelligent-Battery cell glue coating machine

The feeding system adopts a pressure plate pump, which can reliably transfer glue from the raw material drum to the transit tank. It has the following technical advantages: new NXT air motor for durability, less pulsation for uniform glue pattern; lowest initial investment cost, the system has reliable feeding capability;

High-quality shared parts reduce maintenance time, normal use time > 6 months; pump contains low level alarm, to low level automatic shutdown; integrated air control method, easy to operate, according to the needs of different sizes and materials of the pump body can be selected.

Metering system for high filler, highly abrasive materials, improve service life. Stable flow rate of glue discharge, high precision and repeatability. Pressure monitoring, through the control of the system pressure, to eliminate the beginning and end of the glue start and end point of the size of the head, line consistency is high; and can monitor the system pressure, high and low pressure alarm.

Pump body structure design, reduce dead space, into the glue out of the basic push through, to prevent glue accumulation.

Mixing system using two-component dispensing mixing valve, dual cylinder control, can be individually controlled A/B, with a suction-back structure, no glue dripping, no pulling, no glue leakage after closing the valve. Universal dispensing head, can be matched with standard static mixing tube, with proportional dispensing head, easy to test the ratio.

The modular design of this gluing equipment facilitates the maintenance and repair of customers and saves the maintenance and repair cost. Repeatedly verified components and control programs to ensure the long-term stable operation of the equipment, improve the customer's production capacity. 24-hour continuous production, no downtime for glue drum change, the equipment can be unmanned, reducing the customer's labor costs. The real-time uploading of key parameters of the equipment provides strong support for the traceability of each product. Simple and clear control interface, easy-to-operate control mode, and perfect anti-dumbness and anti-error settings can be easily operated to avoid the loss caused by unfamiliar operation.

This cooperation marks the customer's high recognition of the lithium equipment created by Second Intelligent, and also highlights the strong technical strength of Second Intelligent in the automated production and manufacturing of lithium equipment and rich process areas, which is an important demonstration and driving role for the company's new energy power battery business promotion and expansion.

Second Intelligent sales elites also have confidence and ability to add bricks and mortar for more lithium industry production lines.

Second Intelligent gluing machine, used in lithium industry well-known brands, rapid breakthroughs in research and development and batch application in the market, casting Second Intelligent in the field of power battery gluing the leading position, for the subsequent expansion of more new energy power battery gluing projects and cooperation has strengthened a solid foundation. As an enabler of the new energy power battery industry chain, in line with the three major trends of the lithium equipment industry line, standardization and globalization, in the future, Second Intelligent Intelligence will pay close attention to the technological development of the new generation of batteries, and carry out product iteration in a timely manner in accordance with the requirements of the new process and new equipment, and continue to promote the innovative development of the lithium industry together with our partners and lead the industrial progress.

Cylindrical Core Module

0 notes

Text

Polyurethane Based Thermal Conductive Adhesives Market, Global Outlook and Forecast 2025-2032

Polyurethane-based thermal conductive adhesives are specialized materials designed to facilitate heat dissipation in electronic and industrial applications. These adhesives are composed of polyurethane resins combined with thermally conductive fillers such as metallic or ceramic particles. The primary function of these adhesives is to improve thermal management in electronic devices by bonding heat-generating components to heat sinks or enclosures, ensuring optimal performance and longevity.

Thermal conductive adhesives offer several advantages, including enhanced thermal conductivity, strong adhesive properties, and electrical insulation when formulated with non-metallic fillers. These adhesives are widely used in industries such as automotive, aerospace, consumer electronics, and medical devices due to their ability to provide reliable heat dissipation solutions without the need for mechanical fasteners.

Download FREE Sample of this Report @ https://www.24chemicalresearch.com/download-sample/287319/global-polyurethane-based-thermal-conductive-adhesives-forecast-market-2025-2032-137

Market Size

The global polyurethane-based thermal conductive adhesives market was valued at approximately USD 139 million in 2023. It is projected to reach USD 204.90 million by 2030, registering a compound annual growth rate (CAGR) of 5.70% during the forecast period.

In North America, the market size was estimated at USD 36.22 million in 2023, with an expected CAGR of 4.89% from 2025 to 2030. This growth is driven by the increasing adoption of electric vehicles (EVs), the expansion of the consumer electronics industry, and rising demand for advanced thermal management solutions in industrial applications.

Market Dynamics

Drivers

Growing Demand for High-Performance Electronics: The rapid growth in the consumer electronics sector, including smartphones, laptops, and gaming consoles, has fueled the need for efficient thermal management solutions.

Expansion of the Electric Vehicle (EV) Industry: With the increasing adoption of EVs, there is a rising demand for effective thermal management solutions in battery packs and power electronics.

Advancements in Industrial Automation: The rise in industrial automation and smart manufacturing has led to increased use of thermal conductive adhesives in robotics and machinery.

Rising Adoption of LED Lighting: As LED lighting gains popularity for its energy efficiency, thermal conductive adhesives play a crucial role in heat dissipation, ensuring optimal performance and longevity.

Growing Demand for High-Performance Electronics: The rapid growth in the consumer electronics sector, including smartphones, laptops, and gaming consoles, has fueled the need for efficient thermal management solutions.

Expansion of the Electric Vehicle (EV) Industry: With the increasing adoption of EVs, there is a rising demand for effective thermal management solutions in battery packs and power electronics.

Advancements in Industrial Automation: The rise in industrial automation and smart manufacturing has led to increased use of thermal conductive adhesives in robotics and machinery.

Rising Adoption of LED Lighting: As LED lighting gains popularity for its energy efficiency, thermal conductive adhesives play a crucial role in heat dissipation, ensuring optimal performance and longevity.

Restraints

High Cost of Raw Materials: The cost of high-quality thermally conductive fillers and polyurethane resins can be expensive, impacting overall production costs.

Complex Application Processes: The application of thermal conductive adhesives requires precise handling and expertise, posing challenges for end-users unfamiliar with the process.

High Cost of Raw Materials: The cost of high-quality thermally conductive fillers and polyurethane resins can be expensive, impacting overall production costs.

Complex Application Processes: The application of thermal conductive adhesives requires precise handling and expertise, posing challenges for end-users unfamiliar with the process.

Opportunities

Growing R&D Investments: Increased research and development efforts in thermal management materials present opportunities for innovation and product enhancement.

Emerging Markets in Asia-Pacific and Latin America: The rapid industrialization in these regions presents lucrative opportunities for market expansion.

Growing R&D Investments: Increased research and development efforts in thermal management materials present opportunities for innovation and product enhancement.

Emerging Markets in Asia-Pacific and Latin America: The rapid industrialization in these regions presents lucrative opportunities for market expansion.

Challenges

Stringent Regulatory Compliance: Adhesives used in electronic and industrial applications must meet specific safety and environmental regulations, posing challenges for manufacturers.

Competition from Alternative Solutions: The availability of other thermal interface materials, such as thermal greases and phase change materials, may limit market penetration.

Stringent Regulatory Compliance: Adhesives used in electronic and industrial applications must meet specific safety and environmental regulations, posing challenges for manufacturers.

Competition from Alternative Solutions: The availability of other thermal interface materials, such as thermal greases and phase change materials, may limit market penetration.

Regional Analysis

The market is segmented into key geographic regions, including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

North America

North America, led by the United States and Canada, is a significant market for polyurethane-based thermal conductive adhesives. The region's strong presence in consumer electronics and electric vehicle manufacturing drives demand.

Europe

Europe's market growth is influenced by advancements in automotive electrification and stringent environmental regulations that promote the adoption of high-efficiency materials.

Asia-Pacific

Asia-Pacific is the fastest-growing market, driven by industrial expansion in China, Japan, South Korea, and India. The increasing production of electronics and electric vehicles in these countries boosts demand for thermal conductive adhesives.

South America & MEA

Although these regions have relatively smaller market shares, growing industrialization and investments in energy-efficient solutions are expected to drive demand.

Competitor Analysis

Leading companies in the polyurethane-based thermal conductive adhesives market include:

Henkel AG & Co. KGaA

H.B. Fuller

3M Company

DOW Corning

Polytec PT GmbH

Lord Corporation

MG Chemicals

Protavic America, Inc.

Aremco

Henkel AG & Co. KGaA

H.B. Fuller

3M Company

DOW Corning

Polytec PT GmbH

Lord Corporation

MG Chemicals

Protavic America, Inc.

Aremco

These companies focus on product innovation, strategic partnerships, and expanding production capacities to gain a competitive edge in the market.

Market Segmentation (by Application)

Battery Thermal

Heat Sink

IC Packaging Heat Conduction

LED Lighting Thermal

Thermal Material Potting

Battery Thermal

Heat Sink

IC Packaging Heat Conduction

LED Lighting Thermal

Thermal Material Potting

Market Segmentation (by Type)

Isotropic

Anisotropic

Isotropic

Anisotropic

Geographic Segmentation

North America (USA, Canada, Mexico)

Europe (Germany, UK, France, Russia, Italy, Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Rest of Asia-Pacific)

South America (Brazil, Argentina, Colombia, Rest of South America)

The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, South Africa, Rest of MEA)

North America (USA, Canada, Mexico)

Europe (Germany, UK, France, Russia, Italy, Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Rest of Asia-Pacific)

South America (Brazil, Argentina, Colombia, Rest of South America)

The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, South Africa, Rest of MEA)

FAQ

What is the current market size of the polyurethane-based thermal conductive adhesives market?

⣠The market was valued at USD 139 million in 2023 and is projected to reach USD 204.90 million by 2030, with a CAGR of 5.70%.

Which are the key companies operating in the polyurethane-based thermal conductive adhesives market?

⣠Major players include Henkel AG & Co. KGaA, H.B. Fuller, 3M Company, DOW Corning, Polytec PT GmbH, and Lord Corporation.

What are the key growth drivers in the polyurethane-based thermal conductive adhesives market?

⣠Growth drivers include the increasing demand for high-performance electronics, the expansion of the EV industry, advancements in industrial automation, and the rise of LED lighting applications.

Which regions dominate the polyurethane-based thermal conductive adhesives market?

⣠Asia-Pacific leads the market, followed by North America and Europe.

What are the emerging trends in the polyurethane-based thermal conductive adhesives market?

⣠Emerging trends include the development of high-performance adhesives with improved thermal conductivity, increased R&D investments, and the adoption of sustainable and eco-friendly adhesive formulations.

Industry drivers, restraints, and opportunities covered in the study

Neutral perspective on the market performance

Recent industry trends and developments

Competitive landscape & strategies of key players

Potential & niche segments and regions exhibiting promising growth covered

Historical, current, and projected market size, in terms of value

In-depth analysis of the Polyurethane Based Thermal Conductive Adhesives Market

Overview of the regional outlook of the Polyurethane Based Thermal Conductive Adhesives Market:

Key Reasons to Buy this Report:

Access to date statistics compiled by our researchers. These provide you with historical and forecast data, which is analyzed to tell you why your market is set to change

This enables you to anticipate market changes to remain ahead of your competitors

You will be able to copy data from the Excel spreadsheet straight into your marketing plans, business presentations, or other strategic documents

The concise analysis, clear graph, and table format will enable you to pinpoint the information you require quickly

Provision of market value (USD Billion) data for each segment and sub-segment

Indicates the region and segment that is expected to witness the fastest growth as well as to dominate the market

Analysis by geography highlighting the consumption of the product/service in the region as well as indicating the factors that are affecting the market within each region

Competitive landscape which incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled

Extensive company profiles comprising of company overview, company insights, product benchmarking, and SWOT analysis for the major market players

The current as well as the future market outlook of the industry concerning recent developments which involve growth opportunities and drivers as well as challenges and restraints of both emerging as well as developed regions

Includes in-depth analysis of the market from various perspectives through Porter’s five forces analysis

Provides insight into the market through Value Chain

Market dynamics scenario, along with growth opportunities of the market in the years to come

6-month post-sales analyst support

In case of any queries or customization requirements, please connect with our sales team, who will ensure that your requirements are met.

Chapter Outline

Chapter 1 mainly introduces the statistical scope of the report, market division standards, and market research methods.

Chapter 2 is an executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the Polyurethane Based Thermal Conductive Adhesives Market and its likely evolution in the short to mid-term, and long term.

Chapter 3 makes a detailed analysis of the market's competitive landscape of the market and provides the market share, capacity, output, price, latest development plan, merger, and acquisition information of the main manufacturers in the market.

Chapter 4 is the analysis of the whole market industrial chain, including the upstream and downstream of the industry, as well as Porter's five forces analysis.

Chapter 5 introduces the latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by manufacturers in the industry, and the analysis of relevant policies in the industry.

Chapter 6 provides the analysis of various market segments according to product types, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 7 provides the analysis of various market segments according to application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 8 provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and capacity of each country in the world.

Chapter 9 introduces the basic situation of the main companies in the market in detail, including product sales revenue, sales volume, price, gross profit margin, market share, product introduction, recent development, etc.

Chapter 10 provides a quantitative analysis of the market size and development potential of each region in the next five years.

Chapter 11 provides a quantitative analysis of the market size and development potential of each market segment in the next five years.

Chapter 12 is the main points and conclusions of the report.

Get the Complete Report & TOC @ https://www.24chemicalresearch.com/reports/287319/global-polyurethane-based-thermal-conductive-adhesives-forecast-market-2025-2032-137

Table of content

Table of Contents 1 Research Methodology and Statistical Scope 1.1 Market Definition and Statistical Scope of Polyurethane Based Thermal Conductive Adhesives 1.2 Key Market Segments 1.2.1 Polyurethane Based Thermal Conductive Adhesives Segment by Type 1.2.2 Polyurethane Based Thermal Conductive Adhesives Segment by Application 1.3 Methodology & Sources of Information 1.3.1 Research Methodology 1.3.2 Research Process 1.3.3 Market Breakdown and Data Triangulation 1.3.4 Base Year 1.3.5 Report Assumptions & Caveats 2 Polyurethane Based Thermal Conductive Adhesives Market Overview 2.1 Global Market Overview 2.1.1 Global Polyurethane Based Thermal Conductive Adhesives Market Size (M USD) Estimates and Forecasts (2019-2030) 2.1.2 Global Polyurethane Based Thermal Conductive Adhesives Sales Estimates and Forecasts (2019-2030) 2.2 Market Segment Executive Summary 2.3 Global Market Size by Region 3 Polyurethane Based Thermal Conductive Adhesives Market Competitive Landscape 3.1 Global Polyurethane Based Thermal Conductive Adhesives Sales by Manufacturers (2019-2025) 3.2 Global Polyurethane Based Thermal Conductive Adhesives Revenue Market Share by Manufacturers (2019-2025) 3.3 Polyurethane Based Thermal Conductive Adhesives Market Share by Company Type (Tier 1, Tier 2, and Tier 3) 3.4 Global Polyurethane Based Thermal Conductive Adhesives Average Price by Manufacturers (2019-2025) 3.5 Manufacturers Polyurethane Based Thermal Conductive Adhesives Sales Sites, Area Served, Product Type

Download FREE Sample of this Report @ https://www.24chemicalresearch.com/download-sample/287319/global-polyurethane-based-thermal-conductive-adhesives-forecast-market-2025-2032-137

Follow Us On linkedin :- https://www.linkedin.com/company/24chemicalresearch/

0 notes

Text

Electric Vehicle Battery Adhesive Market Future Trends Influencing the Growth of EV Batteries

The electric vehicle battery adhesive market is experiencing rapid growth due to the increasing demand for electric vehicles (EVs) and the evolving needs of battery technologies. The continuous advancements in battery designs and material innovations are driving the market toward the development of more efficient, safe, and reliable adhesive solutions. As automakers and battery manufacturers work to meet stricter safety and performance regulations, several future trends are emerging that are expected to shape the electric vehicle battery adhesive market in the coming years.

Key Future Trends in Electric Vehicle Battery Adhesive Market

Increased Demand for Lightweight and High-Performance Adhesives As electric vehicle manufacturers prioritize improving energy efficiency and driving range, reducing the overall weight of vehicles has become crucial. Lightweight materials are being increasingly integrated into EV battery packs, and adhesives that are both strong and light will play a major role in holding these components together. Future adhesives will focus on reducing weight without compromising their structural integrity, which will significantly contribute to enhancing the overall performance of EVs.

Advancements in Thermal Management Solutions Thermal management is one of the most critical aspects of EV battery performance, and adhesives are playing a key role in this area. As EV batteries become more powerful, they generate higher heat, requiring better thermal conductivity and heat resistance from adhesive materials. The future of the electric vehicle battery adhesive market will see adhesives that are more capable of dissipating heat, preventing overheating, and maintaining a consistent temperature across the battery pack to optimize its performance and longevity.

Focus on Sustainable and Eco-Friendly Adhesives Sustainability is a growing concern for both the automotive industry and the adhesive market. With the increasing demand for eco-friendly vehicles, the electric vehicle battery adhesive market will continue to evolve towards developing adhesives that have minimal environmental impact. Future trends will likely see the development of bio-based adhesives, lower-emission adhesive formulations, and recyclable adhesive systems. These innovations will not only support the overall sustainability goals of EV manufacturers but also contribute to reducing the carbon footprint of vehicle production.

Integration with Smart Technologies for Monitoring and Maintenance Future electric vehicle battery adhesives may incorporate smart technologies that enable real-time monitoring of battery health and performance. Adhesives embedded with sensors could detect changes in temperature, pressure, and voltage within the battery pack, providing early warning signals for potential failures or hazardous conditions. This integration will allow for more precise control over battery conditions, ensuring better safety and performance. Smart adhesive solutions could also simplify the maintenance of battery packs by providing valuable data on the battery’s state, improving service life and reducing operational costs.

Innovation in Multi-Functionality Adhesives The trend towards multi-functional adhesives is likely to continue as manufacturers seek solutions that combine bonding, sealing, insulation, and thermal management properties in a single adhesive. Future adhesives will aim to meet the evolving demands of electric vehicle battery packs by addressing multiple challenges simultaneously. Adhesives with multi-functional properties will streamline the production process, reduce the number of materials needed, and improve the efficiency of battery manufacturing.

Growth in Solid-State Battery Adhesive Solutions Solid-state batteries, which promise higher energy densities and enhanced safety over conventional lithium-ion batteries, are rapidly gaining attention in the EV industry. The introduction of these batteries brings new challenges for adhesive solutions, as solid-state batteries require specialized adhesives that can handle unique properties such as higher voltages, improved thermal stability, and compatibility with new materials. The electric vehicle battery adhesive market will likely see a surge in demand for adhesives specifically designed for solid-state batteries in the coming years.

Increased Focus on Global Standardization and Regulatory Compliance As the electric vehicle battery adhesive market grows, the need for universal standards and regulations will intensify. Future trends will involve greater efforts in ensuring that adhesives meet global safety, environmental, and performance standards. Adhesive manufacturers will work closely with automotive and regulatory bodies to align their products with evolving standards, ensuring that adhesives used in battery packs are safe, efficient, and durable under various conditions.

Shift Towards Automation in Manufacturing Processes The growing demand for electric vehicles is pushing the automotive industry to adopt more automated manufacturing processes. Adhesive application in battery production will increasingly be automated to improve consistency, speed, and precision. Future trends will see the integration of robotic systems and automated adhesive dispensing technologies to streamline production lines. This will not only enhance the efficiency of battery assembly but also reduce waste and improve the overall quality of battery packs.

Custom Adhesive Solutions for Emerging EV Battery Designs As electric vehicles evolve, new battery designs are being introduced, such as pouch cells, prismatic cells, and cylindrical cells. Each of these battery formats requires tailored adhesive solutions that meet specific structural and functional requirements. The electric vehicle battery adhesive market will likely see more customized adhesives designed to fit the unique demands of different battery configurations. This trend will be driven by manufacturers’ need for specialized adhesives that can ensure durability and safety while accommodating the distinctive characteristics of each battery design.

Collaboration Across the Value Chain The electric vehicle battery adhesive market is expected to witness greater collaboration between adhesive manufacturers, automotive companies, and battery producers. By working together, these stakeholders can develop adhesive solutions that are better suited to the specific needs of EV battery systems. The future of this market will involve close partnerships to foster innovation, improve performance, and meet the evolving needs of the electric vehicle industry.

Conclusion

The electric vehicle battery adhesive market is undergoing rapid transformation, driven by technological advancements, environmental concerns, and increasing demand for more efficient EV batteries. These emerging trends indicate that the industry will continue to innovate and expand, providing critical solutions to the challenges posed by modern battery technology. As electric vehicles become more prevalent, the role of adhesives in enhancing battery performance, safety, and sustainability will only grow in significance.

0 notes

Text

0 notes

Text

Adhesives for Cell Contacting Systems & Battery Pack Assembly – TECHSiL

In an era of rapid technological advancements, the market for cell contacting systems and battery packs is experiencing a paradigm shift, thanks to innovative adhesive solutions. TECHSiL works alongside Panacol GmbH, a leading manufacturer of cutting-edge industrial UV, structural and conductive adhesives, to proudly put forwards its contributions to this industry transformation.

With the growing demand for efficient and sustainable energy storage solutions, cell contacting systems and battery packs play a crucial role in powering various applications, including electric vehicles, renewable energy storage, and portable electronics. The reliability and performance of these systems heavily rely on the quality and integrity of the adhesives used in their assembly.

TECHSiL’s comprehensive range of advanced adhesive technologies offers materials tailored specifically for cell contacting systems and battery packs. Adhesives which offer a wide range of benefits, revolutionising the industry:

Enhanced Electrical Conductivity

Adhesives with exceptional electrical conductivity ensure a reliable and efficient current flow within cell contacting systems; by optimising conductivity power losses are reduced; energy efficiency is increased, and overall system performance is enhanced.

Superior Adhension Strength

By harnessing cutting-edge adhesive chemistries, Panacol has engineered products with exceptional bonding strength. By harnessing strong, durable connections between components the risk of delamination, detachment, or intermittent contact is minimised. Resulting in improved safety, prolonged service life, and reduced maintenance costs.

Thermal Management

Thermal management is a critical aspect of cell contacting systems and battery packs. TECHSiL’s range includes adhesive solutions which exhibit excellent thermal conductivity, facilitating efficient heat dissipation and maintaining optimal operating temperatures. This characteristic not only safeguards the integrity of the system but also enhances its performance and longevity.

Chemical and Environmental Resistance

Our adhesives are formulated to withstand the harsh conditions encountered within cell contacting systems and battery packs. They exhibit exceptional resistance to chemicals, moisture, and environmental factors, ensuring long-term reliability, even in demanding operating environments.

PRODUCTS TO CONSIDER

UV-curing adhesives Vitralit® UV 2113 and Vitralit® UV 2114 are characterised by very high adhesion to many materials and meet the requirements of the automotive industry in terms of media and temperature resistance. The rheological properties of both Vitralit® UV 2113 and Vitralit® UV 2114 can be adapted to individual customer requirements. Fluorescent adhesive variations for optical process control are also available.

In just a few seconds, these adhesives can be cured with light in the UVA or visible range. Both gas discharge lamps and LED spot systems can be used for curing. Perfectly matched to Panacol adhesives are the UV and LED UV curing systems from Dr. Hönle, for example the high-intensity LED Powerline AC/IC HP.

For complex CCS geometries with shadowed areas, dual curing Vitralit® UD 8050 is the perfect choice. After UV irradiation, this ion-pure acrylate adhesive postcures in the shadowed areas by reacting with humidity in the air.

WHY CHOOSE TECHSiL?

At TECHSiL, we are thrilled to be part of this paradigm shift in the energy storage industry, and our collaboration with Panacol enables us to offer you cutting-edge adhesive solutions for your cell contacting and battery pack needs. We strive to empower manufacturers to meet the ever-increasing demands of modern energy storage applications and remain committed to delivering customised adhesive solutions, providing comprehensive technical support and collaborating closely with industry partners.

For more information or to speak to one of our technical team contact us on [email protected].

0 notes

Text

Electronics Adhesives Market

Electronics Adhesives Market Size, Share, Trends: Henkel AG & Co. KGaA Leads

Growing Demand for Flexible and Wearable Electronics Drives Market Forward

Market Overview:

The Electronics Adhesives Market is projected to grow significantly from 2024 to 2031. Asia-Pacific currently dominates the market, accounting for the largest share of global revenue. Key metrics include the growth of the electronics industry, advancements in adhesive technologies, and increasing demand for miniaturization in electronic devices. The rapid expansion of the consumer electronics industry, increased acceptance of electric vehicles, and the expanding trend of Internet of Things (IoT) devices are all driving the market's robust growth. The demand for high-performance, dependable adhesives that can resist harsh environments while maintaining good electrical and thermal conductivity is a key driver of market expansion.

DOWNLOAD FREE SAMPLE

Market Trends:

The electronics sector is seeing a big transition towards flexible and wearable gadgets, which is pushing up demand for specialised adhesives. These adhesives must retain their bonding qualities while allowing for flexibility and endurance in wearable electronics like smartwatches, fitness trackers, and medical monitoring devices. Recent advances in conductive and elastic adhesives have permitted the creation of more sophisticated flexible electronics, opening up new possibilities for flexible electronic applications.

Market Segmentation:

The Electrically Conductive Adhesives category currently has the highest market share in the Electronics Adhesives business. This dominance is primarily due to rising demand for miniaturisation in electronic devices and increased usage of innovative packaging technologies in the semiconductor sector. Electrically conductive adhesives are essential for a variety of electronic applications, including die attach, surface mount technology, and EMI/RFI shielding. These adhesives have various advantages over traditional soldering procedures, including low processing temperatures, fine-pitch capability, and environmental friendliness.

Market Key Players:

Prominent players in the Electronics Adhesives Market include Henkel AG & Co. KGaA, 3M Company, H.B. Fuller Company, Dow Inc., Hitachi Chemical Co., Ltd., Sika AG, Arkema Group, Huntsman Corporation, DuPont de Nemours, Inc., and Lord Corporation. These companies are at the forefront of the industry, continuously innovating and expanding their product portfolios to meet the evolving market demands. Their strategic initiatives and robust distribution networks have enabled them to maintain a strong market presence and drive growth.

Contact Us:

Name: Hari Krishna

Email us: [email protected]

Website: https://aurorawaveintellects.com/

0 notes

Text

Electronic Adhesives Market - Forecast (2024-2030)

Electronic Adhesives Market Overview

Electronic Adhesives Market Size is forecast to reach $ 6,820 Million by 2030, at a CAGR of 6.50% during forecast period 2024-2030. Electronic adhesives are used for circuit protection and electronic assembly applications such as bonding components, wire tacking, and encapsulating electronic components. The use of electronic adhesives in manufacturing components for electric vehicles such as printed circuit boards, lithium-ion batteries, and battery pack assemblies are facilitating growth of the market. Growing adoption of surface mounting technology to replace welding and soldering is one of the prominent trends in the electronics industry, shaping the demand for electronics adhesives.

Report Coverage

The report: “Electronic Adhesives Market – Forecast (2024-2030)”, by IndustryARC, covers an in-depth analysis of the following segments of the Electronic Adhesives Industry.

By Type: Thermal Conductive, Electrically Conductive, Ultraviolet-Curing and Others.

By Resin Type: Epoxy, Cyanoacrylates, Polyamides, Phenolic, Silicones, and Others (Acrylics, and Polyurethane)

By Application: PCB’s, Semiconductor, and Others

By End-User Industry: Consumer Electronic (Wearable Devices, LEDs & TVs, Smart Phones & Tablets, Computers, Laptops, and Others), Healthcare, Energy & Power (Solar, Wind, and Others), Telecom Industry, Transportation (Automotive (Passenger Vehicles, Light Commercial and Heavy Commercial Vehicles), Marine, Locomotive, and Aerospace), Oil & Gas, Chemical, Pulp & Paper, and Others.

By Geography: North America, South America, Europe, APAC, and RoW

Request Sample

Key Take away

In 2020, North America held the largest share after APAC. Due to growing demand for electronic adhesives in electronics and telecommunication industry. The US hold the largest share in the region over the forecast period.

Growing adoption of electric vehicles is expected to provide a major growth opportunity for the market.

Emission of Volatile Organic Compounds (VOC’s) may deter the market's growth during the forecasted period.

COVID-19 has hindered the market growth owing to the disruption of supply chain and worldwide lockdown.

Electronic Adhesives Market Segment Analysis - By Type

Electrically Conductive segment held the largest share of more than 30% in the electronics adhesives market in 2020. Electrically Conductive are used in various industry verticals such as aerospace, automotive, medical, and telecom products. Electrically conductive is an excellent solution for making electrical contacts on PCBs and other temperature-sensitive substrates, as their curing temperature is below the soldering temperature. An increase in demand for Anisotropic Conductive Adhesives (ACA) in LCD connections, PCBs, and bonding antenna structures further boost the demand for the market. Electric conductive are also used in the LED industry for their capacity to serve as stable electrical contacts by absorbing mismatches, which will likely boost the market's growth for the forecasted period.

Inquiry Before Buying

Electronic Adhesives Market Segment Analysis - By Resin Type

Epoxy segments held the largest share of more than 25% in the market in 2020. Epoxy is widely used in electronic applications, either in two-part or single-part heat cure products. Epoxy has good resilience against environmental and media influences, it has a dry and non-tacky surface which is perfect to be used as a protective coating and is widely used in adhesives, plastics, paints, coatings, primers and sealers, flooring, and other. Curing epoxy adhesives can take place either at room or elevated temperature or through photoinitiators and UV light. Modern photoinitiators also react to the special UV spectrum of LED light sources, so that newly developed epoxide resin adhesives can be cured with both UV and UV LED light. Some epoxies exhibit optical properties and diffraction indexes, making them useful for applications in precision optics, lens bonding, and information technology, which will further boost the market's growth.

Electronic Adhesives Market Segment Analysis - By Application

Printed Circuit Boards (PCBs) segment held the largest share of more than 35% in the market in 2020. Electronic adhesives are used as a conformal coating in PCBs. Adhesive is used in wire tracking, potting & encapsulation of components, conformal coatings of circuit boards, and bonding of surface mount components. PCBs are highly reliable, cheap, less chance of short circuit, easily repairable, and are compact in size. The growing uses of laptops, smartphones, and household appliances coupled with developing living standards further drive the growth of PCB. Whereas, the growing uses of PCB’s in automotive, industrial & power equipment, control & navigation systems, and aerospace monitoring also contribute to the market growth. According to Aerospace Industries Association (AIA) report, in 2018, aerospace and defense exports amounted to $151 billion, an increase of 5.81% from the previous year, and civil aerospace accounted for the majority of exports with $131.5 billion.

Schedule a Call

Electronic Adhesives Market Segment Analysis - By End-User Industry

Consumer Electronics segment held the largest share of more than 30% in the Electronic Adhesives Market in 2020. Rapid urbanization and increase in the development of new technology have propelled the demand for consumer electronics. As per the United Nations, 55% of the world’s population lives in urban areas, which propel the demand for consumer electronics. The growing demand for lightweight and portable equipment such as smartphones, laptops, and digital cameras are playing a significant role in boosting the demand for the market. As per a report released by Nexdigm Private Limited, a private company, the global electronics industry is expected to reach $7.3 trillion by 2025, which will significantly propel the demand for the market during the forecasted period.

Electronic Adhesives Market Segment Analysis - By Geography

Asia-Pacific held the largest share of more than 45% in the Electronic Adhesives Market in 2020. China, India, and Japan are the major contributors to the growth of Electronic Adhesives Market in APAC. The large consumer base, developing manufacturing sector, and increase in middle-class population along with smart city projects are major factors for the market growth. As per the Indian Brand Equity Foundation (IBEF) report released in 2020, electronics manufacturing in India is expected to reach $163.14 billion by 2025, and demand for electronics hardware in India is expected to reach US$ 400 billion by 2024. The shifting of production lines to the APAC region for the low cost of production and the ability to serve the local emerging market is another factor for the growth of the market in the region.

Buy Now

Electronic Adhesive Market Drivers

Growing Need for Miniaturized Electronic Products

Growing demand for low-cost, reliable, and miniaturized electronic devices from consumers propel the market's growth. The increasing demand for miniaturized products has led to the development of smaller electrical components, which occupy less area. The need for smaller and thinner consumer electronics devices is a new trend among consumers. The surface mount technology helps in using and assembling much smaller components, thus facilitating a smaller, portable, and lightweight electronic device. Pocket calculators, smartwatches & other wearable devices are some of the examples. Such miniature devices will further drive the demand for electronic devices and in return will boost the demand for the Electronic Adhesives Market as they are used in manufacturing these devices.

Introduction of 5G Network

Introduction 5G networks are planned to increase mobile broadband speeds and added capability for 4K/8K video streaming, virtual reality (VR) or augmented reality (AR), Internet of Things (IoT), and mission-critical applications. Introduction of 5G will boost the telecommunication industry, with better coverage, and internet speed, which also create a demand for Electronic Adhesives Market as they are used in manufacturing telecom devices. 5G will transmit data ten times faster than 4G and is set to take hold in 2020. This will spark a revolution in many industries such as electronic, energy, medical, automotive, defense, aerospace and others, which will boost the market's growth. 5G will impact the viewing experience for consumer, with its VR & AR which will further boost the demand for consumer electronic industry, which in return will boost the demand for electronic adhesive market.

Electronic Adhesive Market Challenges

Technological Changes & VOC Emission

The market is facing challenges due to technological changes. Shorter leads can damage temperature-delicate components in several applications and to overcome such obstacles electrical components should be assembled after soldering. However, this hampers productivity due to higher costs of production and time consumed in the manufacturing process. Growing concern over the emission of volatile organic compounds (VOCs) is expected to hamper the market growth over the coming years. During the manufacturing of electronics adhesives, VOC is discharged that may pose health and environmental concerns. VOCs are the major contributors to smog and ozone formation at low atmospheric levels.

Emergence of COVID 19

The COVID-19 pandemic continues to unfold everyday with severe impact on people, communities, and businesses. And the Electronic Adhesives Market was no exceptional, as the global production facilities of the electronics, parts have been reduced due to the logistics slowdown and unavailability of the workers. Furthermore, various e-commerce sites had discontinued the delivery of non-essential items which included electronics devices, which affected the electronic industry.

Electronic Adhesive Market Landscape

Technology launches, acquisitions and R&D activities are key strategies adopted by players in the Electronic Adhesives Market. In 2020, the market of electronic adhesives has been consolidated by the top 10 players accounting for xx% of the share. Major players in the Electronic Adhesives Market are BASF SE, Panacol-Elosol GmbH, 3M Co., H.B. Fuller Co., Henkel AG & Co. KGaA, Hitachi, Ltd., Mitsui & Co., Ltd., Bostik, Inc., Chemence Inc., tesa SE, Parker Hannifin Corp., Meridian Adhesives Group, among others.

Acquisitions/Technology Launches

In November 2019, Bostik, Inc., announced it has launched a new range of innovative engineering adhesives Born2Bond™, for bonding applications in automotive, electronics, luxury packaging, and medical devices. With this new launch Bostik will not only expand its product portfolio but also expand it offering to various industries, which will further drive the market's growth.

In September 2020, Meridian Adhesives Group, a leading manufacturer of high-value adhesives technologies has announced that the “Company” would be serving the Electric Vehicles Market and provide its adhesive solution, with this announcement Meridian Adhesives would expand its product offering in automobile industry, which will further derive the market's growth.

Key Market Players:

The Top 5 companies in Electronic Adhesives Market are:

Panacol-Elosol GmbH

3M

H.B. Fuller Company

Henkel AG & Co.KGaA

Parker Hannifin Corp.

#Electronic Adhesives Market Size#Electronic Adhesives Market Trends#Electronic Adhesives Market Growth#Electronic Adhesives Market Forecast#Electronic Adhesives Market Revenue#Electronic Adhesives Market Vendors#Electronic Adhesives Market Share#Electronic Adhesives Market

0 notes

Text

Thermoset Molding Compound Market - Forecast(2024 - 2030)

Thermoset Molding Compound Market Overview

Thermoset Molding Compound Market size is projected to reach US$11.4 billion by 2027, after growing at a CAGR of 6.8% during the forecast period 2022–2027. Thermosetting molding compounds such as phenolic resins, epoxy resins, polyester resins, urea formaldehyde and melamine formaldehyde possess properties such as good electrical insulation, corrosion and heat resistance, which make them an ideal material for a variety of end-use applications. A thermoset molding compound is widely employed in the electrical & electronics industry. Since the global electrical & electronics industry is growing, it is supporting the thermoset molding compound industry growth. The Japan Electronics and Information Technology Industries Association (JEITA) forecasted that the production by the global electronics and IT industries would grow by 2% year-on-year in 2020 to reach US$2,972.7 billion and would grow by 7% year on year in 2021 to reach a record US$3,175.6 billion. Factors such as the need for lighter weight in aerospace and transportation drive the growth of the thermosetting molding compound market. Several end-use industries in the Thermoset Molding Compound industry suffered negative effects as a result of the novel coronavirus pandemic, which had a direct impact on the Thermoset Molding Compound market size in the year 2020.

Sample Report:

Thermoset Molding Compound Market Report Coverage

The “Thermoset Molding Compound Market Report — Forecast (2022–2027)” by IndustryARC, covers an in-depth analysis of the following segments in the Thermoset Molding Compound industry.

By Type: Phenolic Resins, Epoxy Resins, Polyester Resins, Urea Formaldehyde, Melamine Formaldehyde and Others. By End-use Industry: Automotive [Passenger Vehicles (PV), Light Commercial Vehicles (LCV) and Heavy Commercial Vehicles (HCV)], Aerospace (Commercial Aircrafts, Military Aircrafts and Others), Electrical & Electronics (Antennas, Circuit Breakers, Switchgears and Others) and Others. By Geography: North America (the USA, Canada and Mexico), Europe (the UK, Germany, France, Italy, the Netherlands, Spain, Belgium and the Rest of Europe), Asia-pacific (China, Japan, India, South Korea, Australia and New Zealand, Indonesia, Taiwan, Malaysia and the Rest of APAC), South America (Brazil, Argentina, Colombia, Chile and the Rest of South America) and the Rest of the World (the Middle East and Africa).

Key Takeaways

Asia-pacific dominates the Thermoset Molding Compound market, owing to the increase in investment in the electronics sector and transportation infrastructure in Asia-pacific. This increase can be attributed to the increasing per capita income and growing population in Asia-pacific.

The market is expanding as a result of the positive attributes of Thermoset Molding Compounds, such as their anti-corrosiveness, increased heat resistance and toughness, which make them ideal for use in electrical and electronic applications.

The emergence of nanotechnology, these compounds’ superior performance in comparison to their alternatives and the surge in interest in lightweight and fuel-efficient cars offer the sector promising growth prospects.

However, it is estimated that the high investment cost of Thermoset Molding Compounds may impede the expansion during the forecast period.

For More Details on This Report — Request for Sample

Thermoset Molding Compound Market Segment Analysis — by Type

The phenolic resins segment held a significant share in the Thermoset Molding Compound market share in 2021 and is estimated to grow at a CAGR of 6.9% during the forecast period 2022–2027, due to their improved properties. Phenolic resins are appropriate for use in insulation due to their low thermal conductivity. Due to its water resistance, high thermal stability and fire resistance, phenolic resin is used as a permanent binder and adhesive for wooden building panels as well as a binder for mineral wool insulation. By altering the manufacturing catalyst, phenolic resin’s properties can be altered for each application. As a result, the demand for phenolic resin-based Thermoset Molding Compound is on a significant upsurge, thereby driving segmental growth.

Inquiry Before Buying:

Thermoset Molding Compound Market Segment Analysis — by End-use Industry

The electrical & electronics segment held a significant share in the Thermoset Molding Compound market share in 2021 and is projected to grow at a CAGR of 7.4% during the forecast period 2022–2027. The electrical and electronics industries benefit from thermoset molding compounds such as phenolic resins, epoxy resins, polyester resins, urea formaldehyde and melamine formaldehyde because they effectively insulate against electricity and heat. A strong molding material with strong dielectric properties, thermal shock resistance, corrosion resistance, arc resistance and electrically insulating properties is required for parts like circuit breakers, electrical enclosures or housings, covers, relays, switches, insulators and motor components. Furthermore, various electrical & electronic products such as covers, housings and circuit breakers require a molding material that protects sensitive internal electronics and components. This is accelerating the demand for Thermoset Molding Compound in the industry, which is subsequently propelling the segment growth.

Thermoset Molding Compound Market Segment Analysis — by Geography

Asia-pacific held the largest Thermoset Molding Compound market share of up to 42% in 2021, owing to the bolstering growth of the electrical & electronics sector in Asia-pacific. For instance, the consumer electronics and home appliance sector in India generated $9.84 billion in revenue in 2021 and is projected to grow to US$21.18 billion by 2025, according to the India Brand Equity Foundation (IBEF). The global electronics industry is expected to produce 7% more in 2021 than it did in 2020, reaching US$3,175.6 billion, according to the Japan Electronics and Information Technology Industries Association (JEITA). China’s electronic information manufacturing sector experienced steady growth in revenue and profits last year, according to the February 2022 report. According to the Ministry of Industry and Information Technology, operating revenue for the sector reached approximately 14.1 trillion yuan (roughly $2.2 trillion) in 2021, an increase of 14.7 percent from the previous year. With the increasing electrical & electronics production, the demand for molding materials significantly increased, which accelerated the demand for Thermoset Molding Compound in Asia-pacific.

Schedule A Call:

Thermoset Molding Compound Market Drivers

Increasing Automobile Production:

Thermoset Molding Compound provides lightweight materials for use in automotive manufacturing. The high-end vehicle manufacturers use carbon fiber composites to provide an enhanced finish. According to the Germany Trade & Invest (GTAI), German passenger car and light commercial vehicle OEM generated foreign market revenue of EUR 274 billion in 2021, an increase of ten percent over 2020. The International Organization of Motor Vehicle Manufacturers (OICA) estimates that heavy truck production in Europe increased by 31%, from 236,328 units in 2020 to 308,300 units in 2021. India’s domestic automobile production increased between FY16 and FY20 at a compound annual growth rate (CAGR) of 2.36 percent, with 26.36 million vehicles produced in FY20, according to the India Brand Equity Foundation (IBEF). With the increasing automobile production, the demand for lightweight automotive components is also increasing, thereby acting as a driver for the Thermoset Molding Compound market during the forecast period.

Flourishing Aerospace Sector:

In the aerospace industry, Thermoset Molded internal components are used within the cabins of civilian, commercial and military aircraft as they aid in making aircraft lightweight. The demand for aircraft is on an upsurge in various regions. According to Boeing’s current business forecast, the Middle East would need 2,520 new aircraft by 2030. Also, according to Boeing India, there is a demand for 2,300 aircrafts worth US$320 billion over the next 20 years. According to Boeing, in 2020, 8,995 aircraft fleets were delivered in North America. It is estimated to reach 10,610 fleets by 2039. Considering the importance associated with lightweight airplanes, it is expected that the increasing aerospace industry would act as a driver for the Thermoset Molding Compound market.

Thermoset Molding Compound Market Challenge

Fluctuating Raw Material Prices:

The raw materials often used for the production of Thermoset Molding Compounds are the downstream products of crude oil, such as epoxy resins. During the previous few years, the price of crude oil has been extremely volatile. The price of Brent crude oil has increased from US$43.73/bbl in 2016 to US$71.31/bbl in 2018 and then decreased to US$64.21/bbl in 2019 and US$41.84/bbl in 2020, according to the BP Statistical Review of World Energy. The volatility in the price of oil has caused fluctuation in the prices of raw materials for the manufacturing of thermoset molding compounds. Thus, the fluctuation in the price of crude oil has a direct influence on the price of the Thermoset Molding Compounds, which is a significant challenge for the market during the forecast period.

Buy Now :

Thermoset Molding Compound Industry Outlook

Technology launches, acquisitions and R&D activities are key strategies adopted by players in the Thermoset Molding Compound market. The top 10 companies in the Thermoset Molding Compound market are:

Ashland Global Holding Inc.

BASF SE

Eastman Chemical Company

Evonik Industries AG

Hexion Inc.

Huntsman Corporation

Kolon Industries Inc.

Kyocera Chemical Corporation

Plastics Engineering Company

Rogers Corporation

Recent Developments

In March 2021, BASF announced a partnership with Sumitomo (SHI) Demag to create the first fully-automated, all-electric injection moulding cell for new high-performance polymer manufacturing.

In April 2020, Evonik announced the completion of the Marl expansion of its polyamide plant. The substance also combines quality and performance with excellent parameter estimation, uses very little water, has great structural correctness and has excellent UV resistance.

Relevant Reports

NanoParticles Market — Industry Analysis, Market Size, Share, Trends, Application Analysis, Growth and Forecast Analysis

Report Code: HCR 0272

Metal And Metal Oxide Nanoparticles Market — Industry Analysis, Market Size, Share, Trends, Application Analysis, Growth and Forecast Analysis

Report Code: CMR 67878

Magnesium Oxide Nanoparticle Market — Industry Analysis, Market Size, Share, Trends, Application Analysis, Growth and Forecast Analysis

Report Code: CMR 68243

For more Chemicals and Materials Market reports, please click here

0 notes

Text

Polyvinyl Alcohol Films Market, Global Outlook and Forecast 2025-2032

Polyurethane-based thermal conductive adhesives are specialized materials designed to facilitate heat dissipation in electronic and industrial applications. These adhesives are composed of polyurethane resins combined with thermally conductive fillers such as metallic or ceramic particles. The primary function of these adhesives is to improve thermal management in electronic devices by bonding heat-generating components to heat sinks or enclosures, ensuring optimal performance and longevity.

Thermal conductive adhesives offer several advantages, including enhanced thermal conductivity, strong adhesive properties, and electrical insulation when formulated with non-metallic fillers. These adhesives are widely used in industries such as automotive, aerospace, consumer electronics, and medical devices due to their ability to provide reliable heat dissipation solutions without the need for mechanical fasteners.

Download FREE Sample of this Report @ https://www.24chemicalresearch.com/download-sample/287319/global-polyurethane-based-thermal-conductive-adhesives-forecast-market-2025-2032-137

Market Size

The global polyurethane-based thermal conductive adhesives market was valued at approximately USD 139 million in 2023. It is projected to reach USD 204.90 million by 2030, registering a compound annual growth rate (CAGR) of 5.70% during the forecast period.

In North America, the market size was estimated at USD 36.22 million in 2023, with an expected CAGR of 4.89% from 2025 to 2030. This growth is driven by the increasing adoption of electric vehicles (EVs), the expansion of the consumer electronics industry, and rising demand for advanced thermal management solutions in industrial applications.

Market Dynamics

Drivers

Growing Demand for High-Performance Electronics: The rapid growth in the consumer electronics sector, including smartphones, laptops, and gaming consoles, has fueled the need for efficient thermal management solutions.

Expansion of the Electric Vehicle (EV) Industry: With the increasing adoption of EVs, there is a rising demand for effective thermal management solutions in battery packs and power electronics.

Advancements in Industrial Automation: The rise in industrial automation and smart manufacturing has led to increased use of thermal conductive adhesives in robotics and machinery.

Rising Adoption of LED Lighting: As LED lighting gains popularity for its energy efficiency, thermal conductive adhesives play a crucial role in heat dissipation, ensuring optimal performance and longevity.

Growing Demand for High-Performance Electronics: The rapid growth in the consumer electronics sector, including smartphones, laptops, and gaming consoles, has fueled the need for efficient thermal management solutions.

Expansion of the Electric Vehicle (EV) Industry: With the increasing adoption of EVs, there is a rising demand for effective thermal management solutions in battery packs and power electronics.

Advancements in Industrial Automation: The rise in industrial automation and smart manufacturing has led to increased use of thermal conductive adhesives in robotics and machinery.

Rising Adoption of LED Lighting: As LED lighting gains popularity for its energy efficiency, thermal conductive adhesives play a crucial role in heat dissipation, ensuring optimal performance and longevity.

Restraints

High Cost of Raw Materials: The cost of high-quality thermally conductive fillers and polyurethane resins can be expensive, impacting overall production costs.

Complex Application Processes: The application of thermal conductive adhesives requires precise handling and expertise, posing challenges for end-users unfamiliar with the process.

High Cost of Raw Materials: The cost of high-quality thermally conductive fillers and polyurethane resins can be expensive, impacting overall production costs.

Complex Application Processes: The application of thermal conductive adhesives requires precise handling and expertise, posing challenges for end-users unfamiliar with the process.

Opportunities

Growing R&D Investments: Increased research and development efforts in thermal management materials present opportunities for innovation and product enhancement.

Emerging Markets in Asia-Pacific and Latin America: The rapid industrialization in these regions presents lucrative opportunities for market expansion.

Growing R&D Investments: Increased research and development efforts in thermal management materials present opportunities for innovation and product enhancement.

Emerging Markets in Asia-Pacific and Latin America: The rapid industrialization in these regions presents lucrative opportunities for market expansion.

Challenges

Stringent Regulatory Compliance: Adhesives used in electronic and industrial applications must meet specific safety and environmental regulations, posing challenges for manufacturers.

Competition from Alternative Solutions: The availability of other thermal interface materials, such as thermal greases and phase change materials, may limit market penetration.

Stringent Regulatory Compliance: Adhesives used in electronic and industrial applications must meet specific safety and environmental regulations, posing challenges for manufacturers.

Competition from Alternative Solutions: The availability of other thermal interface materials, such as thermal greases and phase change materials, may limit market penetration.

Regional Analysis

The market is segmented into key geographic regions, including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

North America

North America, led by the United States and Canada, is a significant market for polyurethane-based thermal conductive adhesives. The region's strong presence in consumer electronics and electric vehicle manufacturing drives demand.

Europe