#Electric Vehicle Fast-Charging System Market Research

Explore tagged Tumblr posts

Text

Electric Vehicle Fast-Charging System Market to Reach $33.15 Billion by 2033 | BIS Research

As per the BIS Research report, the Electric Vehicle Fast-Charging System Market is projected to reach $33.15 Billion by 2033 from $8.39 Billion in 2023, growing at a CAGR of 14.73% during the forecast period 2023-2033.

#Electric Vehicle Fast-Charging System Market#Electric Vehicle Fast-Charging System Market Report#Electric Vehicle Fast-Charging System Market Research#Electric Vehicle Fast-Charging System Market Forecast#Electric Vehicle Fast-Charging System Market Analysis#Electric Vehicle Fast-Charging System Market Growth#Electric Vehicle Fast-Charging System Industry#Automotive#Automobile#BIS Research

2 notes

·

View notes

Text

Excerpt from this New York Times story:

The Trump administration in its 2026 budget blueprint is proposing to dismantle many of the federal government’s biggest programs to study, prepare for and mitigate global warming.

Under the proposal, the National Oceanic and Atmospheric Administration, one of the world’s premier centers for climate science, would see its budget cut by roughly a quarter, or $1.5 billion. The Trump administration said it would terminate a wide variety of climate research grants, claiming that NOAA has “consistently funded efforts to radicalize students against markets and spread environmental alarmism.”

While the document did not specify which programs would be eliminated, scientists have warned that the cuts could hobble research on things like early warning systems for natural disasters, science education and the study of the Arctic, where temperatures have increased nearly four times as fast as the rest of the planet over the past four decades.

The proposal would also reduce the Department of Energy’s annual budget by 9.4 percent, or $4.7 billion, mainly by cutting programs related to renewable energy and climate change.

Even more significantly, the proposal aims to cancel roughly $15 billion in clean-energy funding that the Energy Department received under the 2021 bipartisan infrastructure bill to spur new technologies that could help reduce planet-warming greenhouse gases. The cuts would mean pulling back on funds intended to encourage battery manufacturing, to develop technologies to remove carbon dioxide from the air and to expand electric-vehicle charging.

In a document accompanying the blueprint, the Trump administration said the proposal “eliminates funding for the Green New Scam,” using Mr. Trump’s catchall phrase for the climate policies of former President Joseph R. Biden Jr.

4 notes

·

View notes

Text

Electric Vehicle Market Key Players, Competition Tracking, Applications & Forecast 2034

Global revenue from the electric vehicle (EV) market is projected to reach US$ 442.34 billion in 2024, with expectations to grow at a robust CAGR of 14%, hitting US$ 1,639.84 billion by 2034.

This significant growth is largely fueled by increasing government and regulatory support for EV manufacturers. Incentives, subsidies, and policy initiatives aimed at reducing carbon emissions are playing a crucial role in driving adoption. Additionally, rising public awareness about the environmental impact of traditional internal combustion vehicles is prompting a shift toward cleaner transportation alternatives. The growing emphasis on electrifying public transportation systems further supports this transition and is expected to play a key role in shaping the EV market’s future trajectory.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10320

What are the Main Reasons Driving Sales of Electric Vehicles Worldwide?

“EV Battery Prices Witness Sharp Decline”

Over the past decade, the cost of EV batteries has dropped significantly, contributing to a notable reduction in the overall price of electric vehicles. As batteries are one of the most expensive components in an EV, advancements in battery technology, reductions in cathode material costs, and increased production efficiency have all played key roles in driving prices down. This trend is expected to continue, especially with the anticipated introduction of solid-state batteries, which promise higher energy density and improved safety at a lower cost per kWh by the end of the decade.

“Growing EV Demand Unlocks Opportunities in Transportation”

The surge in electric vehicle adoption is creating vast opportunities across the transportation sector. Key markets like China, the United States, and Germany are ramping up investments not only in EV production but also in expanding charging infrastructure. These countries are also pushing research and development efforts to enhance fast-charging capabilities, extend driving ranges, and develop more cost-effective battery technologies. To keep pace with rising demand, automakers are expected to continue investing heavily in innovation, infrastructure, and production capacity, setting the stage for sustained growth in the EV ecosystem.

Country-wise Analysis

As competition over fossil fuels intensifies among Middle Eastern nations, other countries are accelerating efforts to adopt electric vehicles to reduce reliance on oil and fuel imports. This shift has fueled a global race toward electrification. Major contributors to this transition include the United States, Canada, China, Japan, and South Korea, which collectively hold a significant share of the global electric vehicle market.

The U.S. has consistently led in technological innovation, with companies like Tesla championing sustainability and addressing the scarcity of fossil fuels to boost EV adoption. Growing awareness of climate change and the environmental damage caused by coal and other traditional fuels is driving consumers to transition from petrol and diesel vehicles to electric alternatives that are more eco-friendly and sustainable.

Category-wise Evaluation

Battery Electric Vehicle (BEV) propulsion has seen a surge in global popularity, especially among electric vehicle enthusiasts. Thanks to continuous advancements in battery technology and a growing emphasis on environmental sustainability, BEVs are gaining widespread attention for their zero-emission performance and transformative potential in the transportation sector.

As charging infrastructure becomes more accessible and widespread, consumer interest in BEVs continues to grow. Their appeal lies not only in their eco-friendly operation but also in the promise of lower maintenance and long-term operating costs, making them an increasingly attractive option for modern drivers.

Market Developments

Key players in the electric vehicle (EV) market are actively expanding their portfolios, including the introduction of electric trucks, to enhance profitability and market presence.

In March 2023, Moscow signed an agreement with KAMAZ to procure 1,000 electric buses, with plans to acquire an additional 200 units from GAZ Group. Currently, the city operates 1,055 electric buses across 79 routes. Looking ahead, Moscow aims to expand its electric bus network by adding 29 new routes, constructing over 200 ultra-fast charging stations, and establishing a second electric bus depot in the Mitino district.

Meanwhile, in February 2023, Chinese EV manufacturer BYD continued its strategic expansion in the European Union. The company appointed Motor Distributors Ltd. (MDL) as a new dealer in Ireland, covering key regions such as Dublin and Cork. Additionally, BYD strengthened its collaboration with RSA, its existing partner in Norway, to distribute its electric vehicles in Finland and Iceland. These developments highlight BYD’s growing commitment to increasing its footprint in the European EV market.

Read More: https://www.factmr.com/report/electric-vehicle-market

Segmentation of Electric Vehicle Market Research

By Technology :

Hybrid

Plug-in Hybrid

Battery

By Power Source :

Stored Electricity

On Board Electric Generators

By Vehicle Type :

Passenger Cars

Commercial Cars

Two Wheelers

Others

By Power Train :

Series

Parallel

Combined

By Region :

North America

Western Europe

Eastern Europe

Latin America

East Asia

South Asia & Pacific

Middle East & Africa

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

US Sales Office 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583, +353-1-4434-232 Email: [email protected]

1 note

·

View note

Text

Multi-Element Cathodes Market Share by Region, Type, and Application – Detailed Report

Unleashing the Future of Advanced Battery Technologies

The global multi-element cathodes market is entering a transformative growth phase, driven by rising demand for high-performance batteries across electric vehicles (EVs), renewable energy storage systems, and next-generation consumer electronics. From a valuation of $25.9 billion in 2023, the multi-element cathodes market is projected to soar to $52.6 billion by 2031, expanding at a CAGR of 15.2% over the forecast period.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40425-global-multi-element-cathodes-market

Multi-Element Cathodes Market Segmentation Analysis

Diverse Cathode Chemistries Powering Innovation

Nickel Manganese Cobalt (NMC) Cathodes

NMC cathodes lead the multi-element cathodes market due to their balanced energy density, thermal stability, and cost-efficiency, making them ideal for electric vehicles and portable consumer electronics. Their ability to support long-range performance and fast charging is vital for e-mobility growth.

Nickel Cobalt Aluminum (NCA) Cathodes

NCA cathodes are the cornerstone of high-energy applications, particularly in aerospace, advanced robotics, and premium EV segments. Their enhanced thermal tolerance and high voltage stability enable sustained operation under extreme conditions.

Lithium Iron Phosphate (LFP) Cathodes

Favored for their safety, longevity, and cost-effectiveness, LFP cathodes are widely used in grid-level energy storage systems and power tools. Their high cycle life makes them attractive for industrial and commercial stationary applications.

Emerging Cathode Materials

Beyond conventional chemistries, research is intensifying around multi-metal oxides and doped lithium compounds to optimize battery performance, sustainability, and cost. These innovations are expected to redefine cathode technologies in the coming decade.

Get up to 30%-40% Discount: https://www.statsandresearch.com/check-discount/40425-global-multi-element-cathodes-market

Battery Type Segmentation

Lithium-Ion Batteries (Li-ion)

Li-ion batteries maintain dominance, underpinned by mass adoption in EVs, smartphones, laptops, and smart appliances. Their maturity, efficiency, and scalable manufacturing infrastructure solidify their stronghold.

Solid-State Batteries

Solid-state batteries are redefining the future of battery safety and energy density. By eliminating flammable liquid electrolytes, these batteries offer superior thermal stability, compactness, and cycle life—a disruptive technology poised to revolutionize the automotive and aerospace sectors.

Composition Ratios: Tailoring Performance

High Nickel Content Cathodes

These cathodes deliver exceptional energy density and reduced cobalt usage, aligning with EV manufacturers' drive to lower cost per kWh while enhancing vehicle range. They are especially favored in high-performance and long-range EV models.

Medium Nickel Content Cathodes

Providing a balanced trade-off between safety, cost, and performance, these cathodes are used extensively in hybrid vehicles, personal electronics, and backup energy systems.

Low Nickel Content Cathodes

Low-nickel cathodes prioritize thermal stability and environmental safety, making them suitable for medical devices, wearables, and systems operating under high-temperature conditions.

Application-Specific Customization

Fast Charging

Advanced cathode materials are engineered to withstand rapid lithium-ion transfer, reducing downtime in electric vehicle charging infrastructure and mobile devices.

Extended Cycle Life

Multi-element cathodes are central to batteries that endure thousands of charge-discharge cycles, crucial for renewable energy systems, satellites, and industrial robotics.

High Temperature Stability

Industries such as defense, aviation, and manufacturing require cathodes that sustain performance in extreme heat, ensuring operational continuity and safety.

Reliability and Safety

In mission-critical applications, cathode stability is paramount to avoid thermal runaway, leakage, or degradation, thereby ensuring safe and dependable power delivery.

Production Methodologies: Engineering Excellence

Solid-State Synthesis

The most common industrial process, solid-state synthesis offers uniform material distribution and crystalline stability, critical for premium battery applications.

Sol-Gel Method

Preferred in R&D and specialty batteries, this method enables precise control over particle morphology, facilitating the design of tailored electrochemical properties.

Co-Precipitation

Used for high-volume manufacturing, this method ensures consistent particle size distribution and is cost-effective for automotive and utility-scale production lines.

Mechanical Milling

A flexible, scalable method suited for prototyping and custom formulation of cathode blends, especially in pilot lines and specialty chemistry development.

Multi-Element Cathodes Market Segmentation by Price Tier

Premium Segment

Targeted at aerospace, defense, and high-end EVs, this segment demands top-tier cathode materials characterized by maximum energy density, cycle life, and safety features.

Mid-Range Segment

Balancing affordability and performance, mid-range cathodes serve consumer electronics, residential energy systems, and light electric vehicles.

Economy Segment

Built for cost-sensitive markets, economy cathodes are optimized for entry-level electronics, utility tools, and short-lifecycle devices.

Distribution Channels

Direct Sales to OEMs

Large-scale manufacturers leverage OEM partnerships for customized solutions, just-in-time delivery, and technical integration into EV platforms or storage systems.

Indirect Sales via Distributors

Distributors and retailers enhance market penetration by offering broad accessibility, logistics support, and regional adaptability to emerging markets and diverse industries.

Regulatory Compliance and Certification

IEC Standards

Compliance with IEC safety and performance standards ensures global interoperability, quality assurance, and acceptance across regions.

CE Certification

Essential for European market access, CE compliance signals adherence to stringent product testing, safety protocols, and performance criteria.

End-Use Applications Driving Demand

Electric Vehicles (EVs)

The dominant consumer of multi-element cathodes, EVs require high-energy, fast-charging, and long-lasting batteries. Cathode innovation directly correlates with vehicle range, cost-efficiency, and environmental impact.

Energy Storage Systems (ESS)

With the rise of solar and wind energy, ESS applications demand durable, high-capacity batteries capable of managing grid fluctuations and off-grid storage.

Consumer Electronics

From smartphones to smartwatches, the need for compact, reliable power sources places cathodes at the heart of innovation in portable device manufacturing.

Regional Insights

North America: Spearheaded by the U.S., the region leads in EV innovation, battery R&D, and government-backed energy initiatives.

Asia-Pacific: China, Japan, and South Korea dominate manufacturing and exports, home to key market players and integrated battery supply chains.

Europe: A hub for regulatory-driven green transition, with significant investments in battery gigafactories and circular economy practices.

Middle East & Africa: Emerging interest in grid-scale storage and e-mobility pilot projects.

South America: Growth tied to raw material extraction (lithium, cobalt) and rising consumer electronics demand.

Leading Players in the Multi-Element Cathodes Market

Panasonic Corporation

LG Chem

Samsung SDI

SK Innovation

Umicore

Sumitomo Metal Mining Co., Ltd.

BASF SE

Mitsubishi Chemical Corporation

Johnson Matthey

Ganfeng Lithium Co., Ltd.

These companies lead through vertical integration, R&D investment, and strategic alliances across the energy and automotive value chains.

Strategic Outlook and Opportunities

As the world transitions to electrified transport, smart cities, and sustainable energy, multi-element cathodes are poised to become critical enablers of decarbonization and digital transformation. Key strategic imperatives include:

Scaling domestic supply chains for cathode materials.

Investing in circular economy for material recovery and recycling.

Accelerating research into post-lithium technologies, such as sodium-ion and lithium-sulfur cathodes.

Establishing robust regulatory frameworks to ensure safety and interoperability globally.

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40425-global-multi-element-cathodes-market

Conclusion

The global multi-element cathodes market is not just growing—it is accelerating into the future. Stakeholders who align with technological innovation, sustainability, and regulatory readiness will shape the next era of advanced energy storage solutions.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

1 note

·

View note

Text

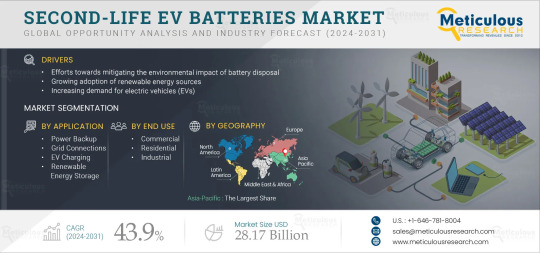

Rising Demand in the Second Life EV Batteries Market

Meticulous Research®—a leading global market research company, published a research report titled, ‘Global Second-life EV Batteries Market by Application (Power Backup, Grid Connection, EV Charging, Renewable Energy Storage, Other Applications), End Use (Commercial, Residential, Industrial) & Geography—Forecasts to 2031.

According to this latest publication from Meticulous Research®, the second-life EV batteries market is projected to reach $ 28.17 billion by 2031, at a CAGR of 43.9% from 2024 to 2031. The growth of the second-life EV batteries market is driven by efforts towards mitigating the environmental impact of battery disposal, the growing adoption of renewable energy sources, and the increasing demand for electric vehicles (EVs).

We all know electric vehicles (EVs) are taking over the roads. But here's something most people don’t think about: what happens to the EV battery once it can’t power a car anymore?

Turns out, those batteries still have a lot of life left in them—just not enough for driving. And that’s where the second-life battery market comes in.

A Massive Opportunity

Instead of recycling or throwing away used EV batteries, many companies are giving them a second chance—by turning them into energy storage systems for homes, businesses, and even the power grid.

According to Meticulous Research®, this market is growing fast. In fact, it’s expected to reach, with a massive growth rate of nearly 44% per year. That’s because we’re using more clean energy, and we need smarter, more sustainable ways to store it.

Why Use a “Used” Battery?

Even when an EV battery is retired from a vehicle, it still holds about 70% to 80% of its capacity. That’s more than enough to use in places where energy demand isn’t as intense—like: - Backup power during outages - Charging stations - Supporting solar panel systems - Stabilizing the power grid

The best part? These second-life batteries are cheaper than buying brand-new storage systems—sometimes by as much as 50%.

Who’s Using Them?

Right now, businesses are the biggest users, making up more than 50% of the market. They use second-life batteries to save money on electricity, keep operations running during blackouts, and support their renewable energy goals.

Homeowners are also starting to catch on. The residential market is growing the fastest, especially as more people install solar panels and want to store their own energy.

What’s Powering This Shift?

Innovative companies are leading the charge: - Redwood Materials is already recycling and reusing EV batteries at scale. One of their projects—a battery system with 12 MW / 63 MWh of energy—is powerful enough to support data centers. - Smartville Inc. has launched a storage system called “360 BESS,” which reuses EV batteries in a modular, plug-and-play format. - B2U Storage Solutions built a 25 MWh project in California using old batteries from Nissan and Honda.

These aren’t just pilot projects—they’re real-world examples of how second-life batteries are already working today.

How Do People Use Them?

It’s not just about buying a used battery and plugging it in. New business models are popping up to make things easier, like: - Leasing batteries as part of energy-as-a-service deals - Programs where EV owners can sell back their batteries - Bundling second-life storage with solar power systems

These models help lower costs, spread out risks, and make it easier for businesses and homeowners to adopt clean energy solutions.

Are They Safe and Reliable?

Naturally, people wonder: are used batteries safe? Can they still perform?

The answer is yes—but they do need to be tested properly. Today, companies use smart software and AI-powered tools to check each battery’s health before it’s reused. These tools help predict how long a battery will last and how well it will perform.

Still, industry safety standards are still catching up, and more work is needed to make testing and certification more consistent.

What's the Benefit?

Second-life batteries aren’t just good for the planet—they’re also good for your wallet: - Cost savings: Reusing a battery can save up to 50% compared to buying a new one. - Environmental impact: Fewer batteries in landfills and less mining for new materials like lithium and cobalt. - Energy independence: Whether it’s for your home or your business, second-life batteries can help you store and use energy more efficiently.

What About Rules and Policies?

The U.S. government is starting to support this industry through programs like the Inflation Reduction Act (IRA) and Department of Energy (DOE) funding. But there’s still a long way to go.

Right now, we need: - Clear rules on how to test and grade used batteries - National safety and reuse standards - Better infrastructure to collect, ship, and repurpose batteries across states

Any Downsides?

Of course, there are some challenges: - Not all used batteries are created equal, and their value can be hard to predict. - Without proper regulations, some buyers may hesitate to adopt second-life tech. - There’s still a need for better warranties and guarantees to build trust.

But as more success stories come to light, these concerns are slowly being addressed.

Final Thoughts

Second-life EV batteries are transforming what we think of as “waste.” Instead of tossing used batteries aside, we now have the tools and technology to reuse them in smart, sustainable ways.

With the market expected to hit $28.17 billion by 2031, this is more than a green idea—it’s a real solution that’s creating jobs, saving money, and helping the U.S. shift to a cleaner energy future.

The future of batteries doesn’t stop at the end of a road trip. In many ways, it’s just getting started.

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5732

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#c#EnergyStorage#BatteryReuse#CircularEconomy#CleanEnergy#SustainableTech#ElectricVehicles#BatteryRecycling#GreenEnergy

0 notes

Text

Key Players Boost Second Life EV Batteries Adoption

Meticulous Research®—a leading global market research company, published a research report titled, ‘Global Second-life EV Batteries Market by Application (Power Backup, Grid Connection, EV Charging, Renewable Energy Storage, Other Applications), End Use (Commercial, Residential, Industrial) & Geography—Forecasts to 2031.

According to this latest publication from Meticulous Research®, the second-life EV batteries market is projected to reach $ 28.17 billion by 2031, at a CAGR of 43.9% from 2024 to 2031. The growth of the second-life EV batteries market is driven by efforts towards mitigating the environmental impact of battery disposal, the growing adoption of renewable energy sources, and the increasing demand for electric vehicles (EVs).

We all know electric vehicles (EVs) are taking over the roads. But here's something most people don’t think about: what happens to the EV battery once it can’t power a car anymore?

Turns out, those batteries still have a lot of life left in them—just not enough for driving. And that’s where the second-life battery market comes in.

A Massive Opportunity

Instead of recycling or throwing away used EV batteries, many companies are giving them a second chance—by turning them into energy storage systems for homes, businesses, and even the power grid.

According to Meticulous Research®, this market is growing fast. In fact, it’s expected to reach, with a massive growth rate of nearly 44% per year. That’s because we’re using more clean energy, and we need smarter, more sustainable ways to store it.

Why Use a “Used” Battery?

Even when an EV battery is retired from a vehicle, it still holds about 70% to 80% of its capacity. That’s more than enough to use in places where energy demand isn’t as intense—like: - Backup power during outages - Charging stations - Supporting solar panel systems - Stabilizing the power grid

The best part? These second-life batteries are cheaper than buying brand-new storage systems—sometimes by as much as 50%.

Who’s Using Them?

Right now, businesses are the biggest users, making up more than 50% of the market. They use second-life batteries to save money on electricity, keep operations running during blackouts, and support their renewable energy goals.

Homeowners are also starting to catch on. The residential market is growing the fastest, especially as more people install solar panels and want to store their own energy.

What’s Powering This Shift?

Innovative companies are leading the charge: - Redwood Materials is already recycling and reusing EV batteries at scale. One of their projects—a battery system with 12 MW / 63 MWh of energy—is powerful enough to support data centers. - Smartville Inc. has launched a storage system called “360 BESS,” which reuses EV batteries in a modular, plug-and-play format. - B2U Storage Solutions built a 25 MWh project in California using old batteries from Nissan and Honda.

These aren’t just pilot projects—they’re real-world examples of how second-life batteries are already working today.

How Do People Use Them?

It’s not just about buying a used battery and plugging it in. New business models are popping up to make things easier, like: - Leasing batteries as part of energy-as-a-service deals - Programs where EV owners can sell back their batteries - Bundling second-life storage with solar power systems

These models help lower costs, spread out risks, and make it easier for businesses and homeowners to adopt clean energy solutions.

Are They Safe and Reliable?

Naturally, people wonder: are used batteries safe? Can they still perform?

The answer is yes—but they do need to be tested properly. Today, companies use smart software and AI-powered tools to check each battery’s health before it’s reused. These tools help predict how long a battery will last and how well it will perform.

Still, industry safety standards are still catching up, and more work is needed to make testing and certification more consistent.

What's the Benefit?

Second-life batteries aren’t just good for the planet—they’re also good for your wallet: - Cost savings: Reusing a battery can save up to 50% compared to buying a new one. - Environmental impact: Fewer batteries in landfills and less mining for new materials like lithium and cobalt. - Energy independence: Whether it’s for your home or your business, second-life batteries can help you store and use energy more efficiently.

What About Rules and Policies?

The U.S. government is starting to support this industry through programs like the Inflation Reduction Act (IRA) and Department of Energy (DOE) funding. But there’s still a long way to go.

Right now, we need: - Clear rules on how to test and grade used batteries - National safety and reuse standards - Better infrastructure to collect, ship, and repurpose batteries across states

Any Downsides?

Of course, there are some challenges: - Not all used batteries are created equal, and their value can be hard to predict. - Without proper regulations, some buyers may hesitate to adopt second-life tech. - There’s still a need for better warranties and guarantees to build trust.

But as more success stories come to light, these concerns are slowly being addressed.

Final Thoughts

Second-life EV batteries are transforming what we think of as “waste.” Instead of tossing used batteries aside, we now have the tools and technology to reuse them in smart, sustainable ways.

With the market expected to hit $28.17 billion by 2031, this is more than a green idea—it’s a real solution that’s creating jobs, saving money, and helping the U.S. shift to a cleaner energy future.

The future of batteries doesn’t stop at the end of a road trip. In many ways, it’s just getting started.

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5732

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#SecondLifeBatteries#EVBatteries#EnergyStorage#BatteryReuse#CircularEconomy#CleanEnergy#SustainableTech#ElectricVehicles#BatteryRecycling#GreenEnergy

0 notes

Text

Tow Tractors Essential in Automotive & Manufacturing Supply Chains

The global tow tractors market reached USD 3,401.2 million in 2022 and is projected to grow to USD 5,100.2 million by 2030, registering a CAGR of 5.2% during the forecast period (2023–2030). This growth is fueled by the rising adoption of automation in warehouses, expanding e-commerce logistics, and increased use of electric-powered tow tractors in industrial environments. Tow tractors, also known as tuggers, are essential for efficient short-distance load transport in logistics centers, airports, automotive facilities, and hospitals, offering strong towing capacity and advanced maneuverability.

Unlock exclusive insights with our detailed sample report :

Key Market Drivers

1. Surge in E-Commerce and Third-Party Logistics (3PL)

The explosion of online retail has fueled investments in large fulfillment centers that require high-throughput material handling systems. Tow tractors streamline operations by transporting orders, pallets, and goods efficiently between docks, conveyors, and storage areas.

U.S. warehouse expansions by Amazon, Walmart, and UPS have accelerated tow tractor demand.

Retailers prioritize electric and automated models to reduce manual labor costs and increase throughput.

2. Rapid Electrification in Industrial Vehicles

Environmental regulations, particularly in the U.S. and Japan, are pressuring industries to replace diesel-powered vehicles with zero-emission electric tow tractors.

Electric tow tractors offer lower total cost of ownership (TCO) due to reduced maintenance and fuel costs.

Battery innovations (e.g., Li-ion, fast charging) are enabling longer runtime and better energy efficiency.

3. Integration of Automation and AGV Technology

Automated Guided Vehicles (AGVs) are increasingly being integrated into the tow tractor space. These AGV tow tractors:

Operate autonomously via sensors, navigation software, and AI.

Reduce workforce dependence and human error.

Enable 24/7 operation, crucial for high-volume operations.

Japanese manufacturers are leading innovation in this space, with Toyota Industries and Daifuku deploying AGV-based tow tractors in smart factories and distribution hubs.

Regional Trends

United States

The U.S. accounts for a significant share of global tow tractor sales, especially in warehousing and airport segments.

Logistics companies invest in sustainable transport vehicles to meet ESG targets.

Government incentives support electric industrial vehicle adoption through grants and tax credits.

Japan

A pioneer in lean manufacturing, Japan utilizes tow tractors extensively in automotive assembly and electronics production.

Investments in AGV-based towing systems are expanding across pharmaceutical and food sectors.

Robotics and sensor integration for collision avoidance and precision docking is a key R&D area.

Speak to Our Senior Analyst and Get Customization in the report as per your requirements:

Market Segmentation

By Power Source:

Electric

Diesel

LPG/CNG

Manual

By Type:

Ride-on Tow Tractors

Walkie Tow Tractors

Automated Tow Tractors (AGV)

By End-Use Industry:

Logistics & Warehousing

Automotive

Aviation (Ground Support Equipment)

Healthcare

Manufacturing

Retail & Distribution

By Capacity:

Below 3 Tons

3–6 Tons

6–10 Tons

Above 10 Tons

Latest Industry Trends

Toyota Material Handling Launches Smart Electric Tuggers New line features regenerative braking, smart diagnostics, and customizable operator dashboards.

Amazon’s Robotics-Powered Warehouses Deploy More Tow Tractors AGV tow tractors complement Kiva robots in moving bulk orders and replenishments.

Japanese Airports Upgrade Baggage Systems with Electric Tow Tractors Tokyo’s Haneda and Narita airports phase out diesel units for quieter, zero-emission alternatives.

Retrofit Kits Enable Conversion of Diesel Tow Tractors to Electric Startups in the U.S. offer electric retrofit solutions for legacy fleets, reducing environmental impact.

Automotive Plants Adopt AGV Towing Systems for Just-In-Time Delivery Electric tow tractors replace forklifts for safer, more efficient component delivery to assembly lines.

Opportunities for Growth

Urban Warehousing: Growth of micro-fulfillment centers drives demand for compact, indoor-friendly electric tow tractors.

Green Manufacturing: Companies are investing in ESG-compliant logistics fleets, favoring electric and automated tuggers.

Modular Manufacturing: Flexible assembly lines need mobile towing solutions that can adapt to changing layouts.

AI-Driven Fleet Management: Smart fleet software helps monitor battery life, optimize routes, and schedule predictive maintenance.

Buy the exclusive full report here:

Key Market Players

Toyota Material Handling

Jungheinrich AG

KION Group AG

Hyster-Yale Materials Handling, Inc.

Crown Equipment Corporation

Daifuku Co., Ltd.

Doosan Industrial Vehicle

Godrej Material Handling

Schaefer Systems International

Simai S.p.A.

These companies are focusing on:

Fleet electrification

Autonomous navigation systems

Compact, high-torque towing models

Ergonomics and safety enhancements

Stay informed with the latest industry insights-start your subscription now:

Conclusion

The tow tractor market is accelerating, powered by rising automation, sustainable practices, and a boom in warehousing and logistics. With industries across the globe shifting toward electric and autonomous vehicle fleets, tow tractors have become essential to internal transport systems.

About us:

DataM Intelligence is a premier provider of market research and consulting services, offering a full spectrum of business intelligence solutions—from foundational research to strategic consulting. We utilize proprietary trends, insights, and developments to equip our clients with fast, informed, and effective decision-making tools.

Our research repository comprises more than 6,300 detailed reports covering over 40 industries, serving the evolving research demands of 200+ companies in 50+ countries. Whether through syndicated studies or customized research, our robust methodologies ensure precise, actionable intelligence tailored to your business landscape.

Contact US:

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: [email protected]

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

#Tow tractor market#Tow tractor market size#Tow tractor market growth#Tow tractor market share#Tow tractor market analysis

0 notes

Text

Wireless Charging Tech Advances Lower Installation Costs

Imagine pulling your electric vehicle (EV) into your driveway or parking space and simply walking away—no cables, no ports, no fumbling in the rain. The car charges itself while you sleep, work, or shop. That’s the promise of wireless electric vehicle charging—and it’s no longer science fiction. It’s here, and it’s gaining traction fast.

As lead researcher at Transparency Market Research, I’ve spent the past year diving deep into this game-changing technology. We’ve analyzed over 23 pilot programs across 9 countries, spoken with industry leaders, and reviewed the deployment strategies of global automakers like BMW, Tesla, and WiTricity. The result is clear: wireless EV charging is on the cusp of transforming the way we power up our vehicles.

Market Momentum: Why Wireless Charging Is Taking Off

Our recently published global market report reveals some powerful insights. The wireless EV charging market is projected to grow at a stunning CAGR of 29.2% between 2024 and 2034, climbing from a niche innovation to a US$ 2.3 billion industry by 2034.

What’s driving this growth? Three major forces:

Consumer demand for convenience—no more cables or wear and tear on charging ports.

OEM acceleration—with BMW leading the charge, and Tesla and WiTricity doubling down on development and partnerships.

Government and city infrastructure support, particularly in Europe and parts of Asia, where smart mobility solutions are gaining priority.

How Wireless EV Charging Works

At its core, wireless EV charging operates on the principle of inductive charging, the same way wireless phone chargers work—but on a much larger scale. Energy is transferred between two coils: one embedded in the ground (transmitter) and one inside the vehicle (receiver).

There are two main technologies in use:

Inductive Charging

Shorter distances

High efficiency (90–95%)

Requires precise alignment

Resonant Magnetic Charging

More flexibility in positioning

Slightly lower efficiency but greater tolerance for misalignment

Backed by companies like WiTricity, which has emerged as a leader in this space

Real-World Adoption: BMW, Tesla, and WiTricity

Some of the most exciting developments are already live:

BMW was the first automaker to offer factory-installed wireless charging for its 530e plug-in hybrid in Germany. With a charging pad installed in the garage, the system delivers up to 3.2 kW, enabling a full charge in around 3.5 hours—without lifting a finger.

WiTricity, a pioneer in magnetic resonance wireless charging, has partnered with multiple OEMs and infrastructure providers to deliver efficient, scalable solutions. Their CEO describes the current moment as a “tipping point,” where consumer readiness, regulatory clarity, and cost reductions are aligning.

Tesla, known for disrupting norms, is reportedly developing its own version of wireless charging, hinting at seamless integration with its Autopilot and Smart Summon features—potentially enabling cars to park and charge themselves completely autonomously.

The Pros: Why Drivers and Automakers Love It

Ultimate Convenience

Plugging and unplugging might seem minor, but for daily users—especially in bad weather or for people with limited mobility—wireless makes a huge difference.

Reduced Wear and Tear

No physical connection means no degradation of charging ports or cables over time.

Future-Proofing Autonomous Vehicles

As self-driving cars become reality, wireless charging becomes essential. A robotaxi can’t plug itself in—but it can position itself over a charging pad.

Smarter Energy Management

Wireless systems can be integrated with smart grids, load balancing, and vehicle-to-grid (V2G) features, creating smarter energy ecosystems.

The Cons: What’s Holding It Back

As with any emerging technology, wireless EV charging comes with challenges:

Higher Initial Costs

Current systems can cost 20–50% more than plug-in stations. However, economies of scale are expected to drive down costs rapidly.

Installation Complexity

Installing a wireless pad requires precision, especially in public spaces. It’s easier to deploy in new infrastructure projects than retrofit existing lots.

Efficiency Concerns

Though improving, wireless systems may still lose 5–10% more energy than a wired connection. For eco-conscious consumers, that’s a factor.

Standards and Interoperability

The industry needs global standards to ensure compatibility across makes and models. WiTricity and the SAE International group are working toward this goal.

Infrastructure Evolution: Cities and Fleets Jump In

Wireless EV charging isn’t just for luxury car owners. Municipalities, delivery fleets, and ride-hailing services are exploring it for its ease of use and long-term cost-effectiveness.

For example:

Oslo, Norway, is piloting wireless taxi charging stations that automatically charge vehicles as they queue.

UPS and Amazon are exploring inductive charging for delivery vehicles to reduce downtime and simplify fleet management.

Airports and bus depots are ideal environments for pad-based charging, where predictable paths and schedules make alignment easy.

A Look Ahead: Will Wireless Take Over?

The big question is: Will wireless replace plug-in charging entirely? The answer is nuanced.

In the next 10 years, wireless charging is likely to complement—not replace—traditional chargers, especially in urban environments, luxury vehicle segments, and autonomous vehicle networks. But for daily commuting, fleet vehicles, and smart cities, the convenience and automation of wireless systems may be too compelling to ignore.

By 2034, we expect:

Over 15% of EVs in developed markets to support wireless charging.

Public wireless charging pads to appear in parking garages, shopping centers, and office lots.

OEMs to offer wireless charging as a standard or premium option across their hybrid and electric models.

Final Thoughts: The Road to Effortless EV Ownership

At Transparency Market Research, our data shows that wireless EV charging is not a passing trend—it’s a critical enabler of the future EV ecosystem. As more automakers adopt the tech, and as infrastructure catches up, this hands-free charging method could soon become the norm for a large segment of users.

As one executive at BMW i Ventures put it during our interview, “This isn’t just about technology. It’s about user experience. People want their cars to adapt to their lives—not the other way around.”

And that’s what wireless charging promises: an effortless, invisible, and intelligent energy experience that makes electric mobility more appealing than ever.

0 notes

Text

IEV Market Deep Dive: From Forklifts to Autonomous EVs in Industrial Settings

The global industrial electric vehicles market size was estimated at USD 5.47 billion in 2022 and is projected to reach USD 15.80 billion by 2030, expanding at a compound annual growth rate (CAGR) of 14.0% from 2023 to 2030. With increasing market competition and pressure on operational efficiency, businesses across industries are increasingly seeking ways to streamline operations, reduce operating costs, and enhance productivity—factors that are driving the growing adoption of industrial electric vehicles.

Industrial electric vehicles are used extensively in warehouses, factories, and manufacturing facilities to automate material handling, storage, and internal transportation. These vehicles significantly improve efficiency and output by minimizing manual labor, reducing human error, and optimizing space usage. The growing adoption of electric material handling equipment is also influenced by rising energy costs, environmental sustainability goals, and safety regulations.

Technological advancements have further propelled the growth of the market. Innovations in robotics, artificial intelligence (AI), and machine learning (ML) have led to the development of smarter, more adaptable industrial electric vehicles capable of handling a broader range of tasks and materials. For example, in September 2021, Locus Robotics acquired Waypoint Robotics, Inc., a manufacturer of automation machinery. This acquisition aimed to expand Locus’ product portfolio of autonomous mobile robots (AMRs) to accommodate a wide array of use cases, including case picking, e-commerce fulfillment, pallet picking, and handling heavier, bulkier payloads.

The demand for industrial electric vehicles has also increased in line with the expansion of warehouse infrastructure and the adoption of advanced manufacturing techniques. Modern warehouses require sophisticated material handling equipment to manage tasks such as stock placement, order fulfillment, and efficient movement of goods. As companies invest in automated storage and retrieval systems to improve their facilities and reduce labor dependency, the role of electric vehicles in these operations becomes increasingly vital.

Moreover, the growing shift from lead-acid batteries to lithium-ion batteries is a notable trend in the industrial electric vehicles market. Lithium-ion batteries offer multiple advantages such as faster charging times, higher energy density, longer operational lifespan, and greater efficiency. They are significantly smaller and lighter than lead-acid batteries and do not require watering or emit harmful gases, making them ideal for 24/7 industrial operations.

Key Market Trends & Insights

The North America veterinary diagnostics industry led the global industry in 2024, capturing the largest revenue share of 38.25%.

The U.S. veterinary infectious disease diagnostics industry is anticipated to grow significantly over the forecast period.

By product, the autonomous mobile robots (AMR) segment led the market in 2022, accounting for over 53% share of the global revenue.

Market Size & Forecast

2022 Market Size: USD 5.47 Billion

2030 Projected Market Size: USD 15.80 Billion

CAGR (2023-2030): 14.0%

Europe: Largest market in 2022

Asia Pacific: Fastest growing market

Order a free sample PDF of the Industrial Electric Vehicles Market Intelligence Study, published by Grand View Research.

Key Companies & Market Share Insights

Both well-established players and emerging startups are actively capitalizing on the opportunities within the fast-growing industrial electric vehicles sector. Companies are implementing a combination of organic strategies—such as expanding product portfolios, investing in cutting-edge technologies, and exploring new geographic regions—and inorganic strategies, including mergers, acquisitions, and strategic collaborations. These approaches enable firms to swiftly tap into new markets and integrate innovative capabilities.

For instance, in June 2023, Dematic, a leading manufacturer of industrial vehicles and material handling systems, launched its third-generation freezer-rated automated guided vehicles (AGVs). These AGVs feature enhanced navigation and sensor systems, designed to exceed global safety standards and improve performance in extreme cold environments. This launch highlights Dematic's dedication to improving the safety and efficiency of automated operations in specialized industrial settings.

Key Players

Swisslog Holding AG

Dematic

Daifuku Co., Ltd.

Bastian Solutions, Inc.

Toyota Industries Corporation

Hyster-Yale Materials Handling, Inc.

Balyo

John Bean Technologies Corporation (JBT)

Seegrid Corporation

Kuka AG

Jungheinrich AG

Schaefer Holding International GmbH

Browse Horizon Databook on Industrial Electric Vehicles Market Size & Outlook

Conclusion

The industrial electric vehicles market is experiencing rapid growth, driven by the increasing need for automation, efficiency, and sustainability across industrial environments. As businesses continue to modernize their operations with smart technologies and energy-efficient solutions, the demand for advanced electric vehicles is expected to escalate. The integration of robotics, AI, and lithium-ion battery systems positions industrial electric vehicles as a key enabler of the next generation of automated industrial infrastructure.

0 notes

Text

Supercapacitors Market Gains Momentum With Advances in Hybrid Capacitor and Graphene Technologies

The supercapacitors market is witnessing rapid growth driven by the increasing demand for efficient energy storage solutions across various industries. Supercapacitors, also known as ultracapacitors, bridge the gap between traditional capacitors and batteries, offering high power density, fast charging capabilities, and long lifecycle. These attributes make them highly attractive for applications in consumer electronics, automotive, energy, aerospace, and industrial sectors.

Market Dynamics

One of the primary factors fueling the expansion of the supercapacitors market is the rising adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs). Supercapacitors are used in regenerative braking systems, power stabilization, and acceleration support in EVs, significantly improving energy efficiency and extending battery life. Governments worldwide are promoting cleaner transportation solutions, leading to increased EV production and, in turn, bolstering demand for supercapacitors.

Additionally, the increasing penetration of renewable energy sources such as wind and solar has created a need for advanced energy storage systems. Supercapacitors play a vital role in stabilizing energy output and enhancing grid reliability. Their fast response time and ability to handle frequent charge-discharge cycles make them ideal for balancing energy loads and mitigating fluctuations in renewable power generation.

Technological Advancements

Ongoing research and development efforts are paving the way for innovative supercapacitor technologies. Key players are focusing on improving energy density without compromising power density. The integration of nanomaterials, such as graphene and carbon nanotubes, has significantly enhanced the performance of supercapacitors by increasing surface area and conductivity. These breakthroughs are helping manufacturers offer more compact, efficient, and cost-effective solutions for various applications.

Hybrid supercapacitors, combining the benefits of traditional capacitors and batteries, are also gaining traction. These systems offer higher energy density than conventional supercapacitors while maintaining high power delivery. As energy storage demands become more complex, hybrid systems are expected to become increasingly prevalent.

Market Segmentation

The global supercapacitors market is segmented based on type, application, and geography. By type, it is categorized into electric double-layer capacitors (EDLCs), pseudocapacitors, and hybrid capacitors. EDLCs dominate the market due to their high power density and longevity.

By application, the market is segmented into automotive, consumer electronics, industrial, energy, aerospace and defense, and others. The automotive sector accounts for a significant share of the market, driven by the surge in EV adoption. Consumer electronics, including smartphones, laptops, and wearable devices, also represent a major segment due to the need for rapid charging and enhanced performance.

Geographically, Asia-Pacific holds the largest market share, driven by robust industrial activity, government incentives for clean energy technologies, and the presence of key market players in countries such as China, Japan, and South Korea. North America and Europe follow closely, with significant investments in EV infrastructure and energy storage projects.

Competitive Landscape

The supercapacitors market is moderately consolidated, with several major players competing based on innovation, cost, and partnerships. Leading companies include Maxwell Technologies (Tesla), CAP-XX, Panasonic Corporation, Eaton Corporation, and Skeleton Technologies. These companies are heavily investing in R&D to improve performance metrics and expand their product portfolios.

Collaborations between technology firms and automotive or energy companies are also accelerating product development and commercialization. Strategic partnerships and acquisitions are common as players aim to enhance market presence and technology capabilities.

Challenges and Opportunities

Despite promising growth, the supercapacitors market faces challenges. High production costs and lower energy density compared to lithium-ion batteries remain barriers to widespread adoption. However, as production scales and materials become more cost-effective, these limitations are expected to diminish.

Emerging applications in smart grids, IoT devices, and aerospace systems present significant opportunities. Supercapacitors can power sensors and embedded systems with minimal maintenance and high reliability, making them ideal for the next generation of smart technologies.

Future Outlook

The supercapacitors market is poised for substantial growth in the coming years, driven by global trends in sustainability, electrification, and technological innovation. As energy storage becomes central to future infrastructure, supercapacitors will play a key role in shaping efficient, reliable, and environmentally friendly solutions.

With increased investment, expanding applications, and ongoing research, the supercapacitors industry is transitioning from a niche technology to a mainstream component of the global energy landscape.

0 notes

Text

#EV Fast-Charging System Market#EV Fast-Charging System Industry#Automotive#EV Fast-Charging System Market Size#BIS Research#EV Fast-Charging System Market Report#Electric Vehicle Fast-Charging System Market#Electric Vehicle Fast-Charging System Industry

2 notes

·

View notes

Text

Advanced Battery Tech Market: Growth & Share Forecast 2034

Advanced Battery Technologies Market is on a powerful growth trajectory, projected to surge from $89.1 billion in 2024 to $246.3 billion by 2034, registering a CAGR of 10.7%. This growth reflects the world’s accelerating shift toward clean energy, electric mobility, and portable power solutions. Advanced batteries — ranging from lithium-ion and solid-state to flow and zinc-air technologies — have become crucial for applications in electric vehicles (EVs), renewable energy storage, and consumer electronics. These batteries offer improved energy density, longer life cycles, faster charging capabilities, and better safety profiles — making them essential to building a more sustainable and technologically integrated future.

Market Dynamics

At the heart of this growth is the rising demand for high-efficiency, low-emission energy systems. As global efforts intensify to reduce greenhouse gas emissions, countries and companies alike are pushing for electrification of transport and renewable energy integration, both of which rely heavily on advanced battery technologies.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS31419

Lithium-ion batteries continue to dominate the market with over 55% share, thanks to their extensive use in electric vehicles and portable electronics. Solid-state batteries, accounting for around 25%, are fast gaining traction for their potential to deliver superior performance and safety. Flow batteries, at 15%, are emerging as a reliable solution for grid-scale energy storage.

The market is also seeing innovation in battery recycling, swapping, and management systems — driven by the need to reduce costs, improve performance, and extend battery life. Simultaneously, challenges like raw material scarcity and price volatility are prompting research into alternative chemistries like sodium-ion and zinc-air batteries.

Key Players Analysis

Several industry leaders are spearheading innovation and expansion. Tesla, Panasonic, LG Chem, Northvolt, and CATL are investing heavily in R&D, giga-factories, and strategic partnerships. Solid Power, QuantumScape, and Sila Nanotechnologies are emerging as front-runners in next-generation solid-state battery development. Additionally, startups like StoreDot and Amprius Technologies are working on ultra-fast charging and high-capacity solutions.

These companies are not just innovating within battery cells but also enhancing battery management systems (BMS) using AI and IoT to optimize usage and performance. Collaboration between automakers and battery producers is creating integrated ecosystems that accelerate commercialization and market penetration.

Regional Analysis

Asia-Pacific leads the global market, driven by China, South Korea, and Japan’s aggressive investments in EVs and battery manufacturing. China, in particular, dominates both the supply chain and production capacity, making it a global battery hub.

North America, especially the U.S., is ramping up efforts through government incentives, infrastructure investments, and partnerships to reduce dependency on Asian imports and strengthen its domestic manufacturing capabilities.

Europe, with countries like Germany, France, and the UK at the forefront, is pushing for clean energy transitions through Green Deal initiatives and EV mandates, further boosting battery technology adoption.

Latin America is emerging as a key growth area, especially in countries like Brazil and Mexico, which are expanding renewable energy infrastructure and EV networks.

Middle East and Africa are slowly entering the scene, with solar and storage applications leading the way. Policy reforms and international partnerships are expected to unlock substantial market potential in the coming decade.

Recent News & Developments

Recent months have seen breakthroughs in battery chemistries, particularly in lithium-sulfur, sodium-ion, and solid-state formats. These innovations promise lower cost, greater energy density, and enhanced safety. Pricing dynamics are shifting as economies of scale and material innovations reduce production costs.

Government policies — such as the U.S. Inflation Reduction Act and Europe’s Battery Passport initiative — are reshaping how batteries are sourced, produced, and recycled. Meanwhile, strategic partnerships, like those between automakers and battery startups, are accelerating time-to-market for new technologies.

Sustainability is also a growing focus, with manufacturers investing in closed-loop recycling systems to reduce environmental impact and reliance on scarce materials like cobalt and lithium.

Browse Full Report : https://www.globalinsightservices.com/reports/advanced-battery-technologies-market/

Scope of the Report

This comprehensive report covers the market across battery types, technologies, materials, applications, and end users. The analysis includes forecasts up to 2034, historical trends, and detailed insights into competitive dynamics, regional performance, and regulatory frameworks.

It evaluates market drivers, restraints, SWOT, PESTLE, and value-chain dynamics. Key strategies like mergers, acquisitions, product launches, and technological collaborations are examined to help stakeholders navigate opportunities and challenges. The report also explores import-export trends, local regulations, and cross-segment synergies to provide a holistic understanding of the global advanced battery technologies landscape.

#advancedbatterytech #evbatteries #energystorage #solidstatebattery #sustainableenergy #batterymarket2024 #cleanmobility #renewableintegration #lithiumiontech #smartbatterysystems

Discover Additional Market Insights from Global Insight Services:

Automotive Seats Market : https://www.globalinsightservices.com/reports/automotive-seats-market/

Autonomous Cars Market ; https://www.globalinsightservices.com/reports/autonomous-cars-market/

Commercial Aircraft Manufacturing Market : https://www.globalinsightservices.com/reports/commercial-aircraft-manufacturing-market/

In-dash Navigation System Market : https://www.globalinsightservices.com/reports/in-dash-navigation-system-market/

Quantum Computing in Automotive Market : https://www.globalinsightservices.com/reports/quantum-computing-in-automotive-market/

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC 16192, Coastal Highway, Lewes DE 19958 E-mail: [email protected] Phone: +1–833–761–1700 Website: https://www.globalinsightservices.com/

0 notes

Text

Charging as a Service: The Future of Scalable EV Charging Networks

As electric vehicle (EV) adoption continues its rapid ascent, one factor remains critical: robust and scalable charging networks. Charging as a Service (CaaS) is emerging as the game-changing model that helps businesses, municipalities, and fleet operators overcome infrastructure hurdles—delivering flexible, future-proof charging solutions without the heavy upfront costs.

📊 Market Momentum: Charging Infrastructure as a Service

According to the latest MarketsandMarkets research, the Charging as a Service Market is projected to grow from USD 165.9 million in 2025 to a staggering USD 2,135 million by 2035, representing a 29.1% CAGR.

As governments push for zero-emission targets and businesses electrify fleets, demand for agile, cost-efficient charging models is soaring.

Why is Charging as a Service Gaining Traction?

✅ Cost-effective adoption CaaS removes CAPEX barriers. Businesses avoid high installation costs and instead pay monthly service fees, making EV infrastructure accessible to a wider range of organizations.

✅ Speed & scalability CaaS providers manage the entire deployment — from hardware and software to permitting and grid connection — enabling rapid rollout and easy scaling as EV adoption accelerates.

✅ Always up-to-date technology Charging technology evolves fast. Through CaaS, users benefit from automatic access to the latest chargers, smart energy management systems, and software upgrades—future-proofing investments.

✅ Operational reliability Providers ensure consistent maintenance, 24/7 monitoring, and high uptime — reducing downtime and enhancing user experience.

📥 Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=73556797

Market Outlook: The Shift to Service-based Charging

With strong government support and increasing demand for corporate sustainability, Charging as a Service is set to become mainstream across sectors:

🚗 Corporate fleet operators 🏙 Smart cities & municipal programs 🏢 Commercial real estate & retail locations 🏨 Hospitality & property management 🏭 Industrial campuses & logistics hubs

Business Benefits of CaaS

✅ Flexible financing with predictable OPEX ✅ Elimination of maintenance and upgrade burdens ✅ Faster ROI with scalable solutions ✅ Strong alignment with ESG goals and sustainability targets

As EV adoption grows worldwide, Charging as a Service will be critical to building out the infrastructure needed for a seamless driving experience — accelerating the transition to a clean energy future.

Key Market Players

Top players leading the global CaaS market include ChargePoint, Inc. (US), Tesla (US), ENGIE (France), TGOOD Global Ltd. (China), and State Grid Corporation of China (China). These companies are leveraging innovation and partnerships to drive market growth and expand their global footprints.

📩 Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=73556797

0 notes

Text

Global Automotive Supercapacitor Market : Trends, Opportunities, and Forecast 2025–2032

Global Automotive Supercapacitor Market was valued at USD 3.85 billion in 2024 and is projected to reach USD 9.76 billion by 2032, growing at a CAGR of 12.30% during the forecast period (2025-2032).

Automotive Supercapacitor Market Overview

The Automotive Supercapacitor Market encompasses the production and application of supercapacitors specifically designed for automotive use. Supercapacitors, also known as ultracapacitors, are energy storage devices that store electrical energy through electrostatic charge rather than chemical reactions like batteries. In the automotive sector, these devices provide high power density, quick charging, and long cycle life, making them ideal for applications such as regenerative braking, start-stop systems, and power stabilization.

This report provides a deep insight into the global Automotive Supercapacitor Market, covering all its essential aspects. This ranges from a macro-overview of the market to micro details of the market size, competitive landscape, development trend, niche market, key market drivers and challenges, SWOT analysis, value chain analysis, etc.

The analysis helps the reader to shape the competition within the industries and strategies for the competitive environment to enhance the potential profit. Furthermore, it provides a simple framework for evaluating and assessing the position of the business organization. The report structure also focuses on the competitive landscape of the Global Automotive Supercapacitor Market. This report introduces in detail the market share, market performance, product situation, operation situation, etc., of the main players, which helps the readers in the industry to identify the main competitors and deeply understand the competition pattern of the market.

In a word, this report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Automotive Supercapacitor Market in any manner.

Automotive Supercapacitor Key Market Trends :

Increasing adoption of electric and hybrid vehicles is propelling the demand for automotive supercapacitors due to their fast charging and high power capabilities.

Integration of supercapacitors with lithium-ion batteries to form hybrid energy storage systems is gaining momentum, improving vehicle efficiency and battery life.

Advances in electrode materials, especially graphene and carbon nanotubes, are enhancing supercapacitor energy density and reducing costs.

Governments worldwide are intensifying regulations on emissions, which drives manufacturers to adopt supercapacitors for eco-friendly vehicle technology.

Regenerative braking systems leveraging supercapacitors are becoming standard in commercial vehicles, optimizing energy recovery and reducing fuel consumption.

Automotive Supercapacitor Market Regional Analysis :

North America:Strong demand driven by EVs, 5G infrastructure, and renewable energy, with the U.S. leading the market.

Europe:Growth fueled by automotive electrification, renewable energy, and strong regulatory support, with Germany as a key player.

Asia-Pacific:Dominates the market due to large-scale manufacturing in China and Japan, with growing demand from EVs, 5G, and semiconductors.

South America:Emerging market, driven by renewable energy and EV adoption, with Brazil leading growth.

Middle East & Africa:Gradual growth, mainly due to investments in renewable energy and EV infrastructure, with Saudi Arabia and UAE as key contributors.

Automotive Supercapacitor Market Segmentation :

The research report includes specific segments by region (country), manufacturers, Type, and Application. Market segmentation creates subsets of a market based on product type, end-user or application, Geographic, and other factors. By understanding the market segments, the decision-maker can leverage this targeting in the product, sales, and marketing strategies. Market segments can power your product development cycles by informing how you create product offerings for different segments.

Market Segmentation (by Application)

Passenger Vehicle

Commercial Vehicle

Market Segmentation (by Type)

Electrochemical Double Layer Capacitor (EDLC)

Pseudocapacitors

Hybrid Capacitor

Key Company

Maxwell

Panasonic

NEC TOKIN

Nesscap

AVX

ELNA

Korchip

Nippon Chemi-Con

Ioxus

LS Mtron

Nichicon

Shenzhen Technology Innovation Green (TIG)

VinaTech

Jinzhou Kaimei Power

Samwha

Drivers

Growing Demand for Electric and Hybrid Vehicles: Rising environmental concerns and government incentives have accelerated the production and sales of electric and hybrid cars, increasing the need for efficient energy storage solutions such as supercapacitors.

Enhanced Vehicle Performance Requirements: Supercapacitors help improve acceleration, braking, and fuel efficiency, making them indispensable in modern automotive designs focused on performance and sustainability.

Technological Improvements and Cost Reductions: Continuous R&D efforts have reduced production costs and improved the energy density of supercapacitors, making them more viable for widespread automotive applications.

Restraints

Lower Energy Density Compared to Batteries: Despite their high power density, supercapacitors have lower energy storage capacity than batteries, limiting their standalone use and sometimes requiring complex hybrid systems.

Raw Material Price Volatility: Fluctuating costs of essential raw materials such as activated carbon and electrolytes pose challenges for manufacturers, affecting pricing and supply stability.

Supply Chain Disruptions: Geopolitical tensions and pandemic-related disruptions have affected the availability of components, delaying production and market expansion.

Opportunities

Expansion in Commercial Vehicle Segment: Increased adoption of supercapacitors in buses, trucks, and commercial fleets for regenerative braking and power stabilization presents a significant growth opportunity.

Emerging Markets Growth: Developing countries in Asia-Pacific and Latin America are expected to adopt automotive supercapacitors increasingly as EV infrastructure and regulations improve.

Integration with Renewable Energy Systems: Supercapacitors offer promising applications in hybrid renewable energy systems integrated with electric vehicles, opening new market avenues.

Challenges

Competition from Advanced Battery Technologies: Continuous improvements in lithium-ion and solid-state batteries create competition, requiring supercapacitor manufacturers to innovate constantly.

Technical Complexity in Hybrid Systems: Designing efficient hybrid systems combining batteries and supercapacitors involves complex engineering challenges and higher costs.

Regulatory and Standardization Issues: Lack of uniform global standards for supercapacitor applications in vehicles can slow adoption and create market entry barriers.

Customization of the Report

In case of any queries or customisation requirements, please connect with our sales team, who will ensure that your requirements are met.

Contact us:

+91 8087992013

0 notes

Text

Construction Electric Vehicle Market Drivers Shaping Sustainable Innovation and Green Equipment Transformation Globally

The construction electric vehicle market is experiencing a profound shift as environmental sustainability and regulatory compliance take center stage. Once dominated by diesel-powered machines known for high emissions and operating noise, the sector is now witnessing a surge in the adoption of electric vehicles (EVs) tailored specifically for construction applications. This transition is fueled by several key drivers that are changing how construction companies invest in machinery and how governments incentivize green innovations.

1. Rising Environmental Concerns and Emission Regulations

A primary driver of growth in the construction electric vehicle market is the rising global concern over carbon emissions and their impact on climate change. Construction activities are significant contributors to greenhouse gas emissions, primarily through the use of fossil-fueled heavy machinery. In response, regulatory bodies in Europe, North America, and parts of Asia-Pacific have introduced stringent emissions standards for off-road construction equipment.

These regulations are prompting construction firms to look for cleaner alternatives, and electric vehicles present an ideal solution. Unlike diesel-powered machines, electric construction vehicles emit no tailpipe pollutants and reduce overall carbon footprint on job sites.

2. Government Incentives and Policy Support

Many national and regional governments are actively encouraging the adoption of electric construction vehicles by offering financial incentives, tax rebates, and subsidies. These incentives not only lower the upfront cost of electric machinery but also accelerate research and development in the segment. Additionally, governments are investing in infrastructure upgrades to support EV charging capabilities on construction sites, which has further eased operational concerns for contractors.

Furthermore, public construction tenders increasingly prioritize companies that demonstrate sustainability in their equipment and practices. As a result, firms investing in electric construction vehicles are better positioned to win government contracts and enhance their competitive edge.

3. Technological Advancements in Battery and Charging Systems

Battery technology has seen substantial improvements in recent years, with higher energy density, faster charging capabilities, and longer life cycles becoming the norm. These advancements are critical in construction applications, where vehicle uptime is crucial for productivity.

Modern electric construction vehicles can now operate for extended periods on a single charge and are equipped with fast-charging technology that minimizes downtime. In addition, smart energy management systems and predictive maintenance tools have improved operational efficiency, making electric options more attractive than ever.

4. Lower Operational and Maintenance Costs

Electric construction vehicles offer a compelling long-term value proposition due to their lower operating and maintenance costs. Since they have fewer moving parts compared to internal combustion engine (ICE) machines, they require less maintenance and experience fewer mechanical failures. Additionally, the cost of electricity is generally more stable and affordable compared to diesel fuel.

Contractors are increasingly recognizing the total cost of ownership (TCO) benefits of electric machinery, especially in urban and indoor projects where emissions and noise restrictions are stringent. These economic incentives are accelerating the shift toward electric fleets.

5. Noise Reduction for Urban and Sensitive Environments

Construction projects in urban areas or near residential neighborhoods often face noise restrictions. Electric vehicles operate much more quietly than diesel-powered alternatives, making them ideal for these sensitive environments. Reduced noise pollution not only ensures compliance with local regulations but also enhances worker comfort and safety on site.

For indoor construction or projects conducted during off-hours, electric vehicles enable smoother operations without causing disturbances to surrounding communities or facilities. This practical advantage is increasingly becoming a deciding factor in equipment purchasing decisions.

6. Corporate Sustainability Goals and ESG Commitments

Many construction companies are aligning their operations with environmental, social, and governance (ESG) principles to meet stakeholder expectations and investor requirements. Fleet electrification is a visible and impactful step in achieving corporate sustainability goals.