#ESG data providers

Explore tagged Tumblr posts

Text

Why is ESG Intelligence Important to Companies?

Human activities burden Earth’s biosphere, but ESG criteria can ensure that industries optimize their operations to reduce their adverse impact on ecological and socio-economic integrity. Investors have utilized the related business intelligence to screen stocks of ethical enterprises. Consumers want to avoid brands that employ child labor. This post will elaborate on why ESG intelligence has become important to companies.

What is ESG Intelligence?

ESG, or environmental, social, and governance, is an investment guidance and business performance auditing approach. It assesses how a commercial organization treats its stakeholders and consumes natural resources. At its core, you will discover statistical metrics from a sustainability perspective. So, ESG data providers gather and process data for compliance ratings and reports.

Managers, investors, and government officers can understand a company’s impact on its workers, regional community, and biosphere before engaging in stock buying or business mergers. Since attracting investors and complying with regulatory guidelines is vital for modern corporations, ESG intelligence professionals have witnessed a rise in year-on-year demand.

Simultaneously, high-net-worth individuals (HNWI) and financial institutions expect a business to work toward accomplishing the United Nations’ sustainable development goals. Given these dynamics, leaders require data-driven insights to enhance their compliance ratings.

Components of ESG Intelligence

The environmental considerations rate a firm based on waste disposal, plastic reduction, carbon emissions risks, pollution control, and biodiversity preservation. Other metrics include renewable energy adoption, green technology, and water consumption.

Likewise, the social impact assessments check whether a company has an adequate diversity, equity, and inclusion (DEI) policy. Preventing workplace toxicity and eradicating child labor practices are often integral to the social reporting head of ESG services.

Corporate governance concerns discouraging bribes and similar corruptive activities. Moreover, an organization must implement solid cybersecurity measures to mitigate corporate espionage and ransomware threats. Accounting transparency matters too.

Why is ESG Intelligence Important to Companies?

Reason 1 – Risk Management

All three pillars of ESG reports, environmental, social, and governance, enable business owners to reduce their company’s exposure to the following risks.

High greenhouse (GHG) emissions will attract regulatory penalties under pollution reduction directives. Besides, a commercial project can take longer if vital resources like water become polluted. Thankfully, the environmental pillar helps companies comply with the laws governing these situations.

A toxic and discriminatory workplace environment often harms employees’ productivity, collaboration, creativity, and leadership skill development. Therefore, inefficiencies like reporting delays or emotional exhaustion can slow a project’s progress. ESG’s social metrics will mitigate the highlighted risks resulting from human behavior and multi-generational presumptions.

Insurance fraud, money laundering, tax evasion, preferential treatment, hiding conflicts of interest, and corporate espionage are the governance risks you must address as soon as possible. These problems introduce accounting inconsistencies and data theft issues. You will also receive penalties according to your regional laws if data leaks or insider trading happens.

Reason 2 – Investor Relations (IR)

Transparent disclosures can make or break the relationship between corporate leaders and investors. With the help of ESG intelligence, it becomes easier to make qualitative and manipulation-free “financial materiality” reports. Therefore, managers can successfully execute the deal negotiations with little to no resistance.

You want to retain the present investors and attract more patrons to raise funds. These resources will help you to augment your company’s expansion and market penetration. However, nourishing mutually beneficial investor relations is easier said than done.

For example, some sustainability investors will prioritize enterprises with an ESG score of above 80. Others will refuse to engage with your brand if one of the suppliers has documented records of employing child labor. Instead of being unaware of these issues, you can identify them and mitigate the associated risks using ESG intelligence and insights.

Reason 3 – Consumer Demand

Consider the following cases.

Customers wanted plastic-free product packaging, and e-commerce platforms listened to their demand. And today’s direct home deliveries contribute to public awareness of how petroleum-derived synthetic coating materials threaten the environment.

The availability of recharging facilities and rising gas prices have made electric vehicles (EVs) more attractive to consumers. Previously, the demand for EVs had existed only in the metropolitan areas. However, the EV industry expects continuous growth as electricity reaches more semi-urban and rural regions.

Businesses and investors care about consumer demand. Remember, they cannot force consumers into buying a product or service. And a healthy competitive industry has at least three players. Therefore, customers can choose which branded items they want to consume.

Consumer demand is one of the driving factors that made ESG intelligence crucial in many industries. If nobody was searching for electric vehicles on the web or everybody had demanded plastic packaging, businesses would never switch their attitudes toward the concerns discussed above.

Conclusion

Data governance has become a popular topic due to the privacy laws in the EU, the US, Brazil, and other nations. Meanwhile, child labor is still prevalent in specific developing and underdeveloped regions. Also, the climate crisis has endangered the future of agricultural occupations.

Deforestation, illiteracy, carbon emissions, identity theft, insider trading, discrimination, on-site accidents, corruption, and gender gap threaten the well-being of future generations. The world requires immediate and coordinated actions to resolve these issues.

Therefore, ESG intelligence is important to companies, consumers, investors, and governments. Properly acquiring and analyzing it is possible if these stakeholders leverage the right tools, relevant benchmarks, and expert data partners.

2 notes

·

View notes

Text

ESG Consultancy In Dubai | ESG Investment Management

AJMS Global is a boutique consulting firm specializing in providing niche consulting proposition to its clients in the area of Tax, Risk, Compliance, IFRS advisory and Digital Transformation Advisory.

#esg consultancy in dubai#esginvestmentmanagement#esg analyst#tax managed services#esg consulting firms#esg data providers#data management strategy

2 notes

·

View notes

Text

Future of ESG Data for Sustainable Decisions: ESG Data

The environmental, social, and governance (ESG) component is no longer one in which organizations can take part. Instead, it has evolved into one of the best methods for organizations to maintain their relevance and win the trust of their stakeholders. The quality of the acquired data is wholly responsible for the ESG movement's future. Organizations cannot be expected to produce accurate ESG reports without the proper data.

1 note

·

View note

Text

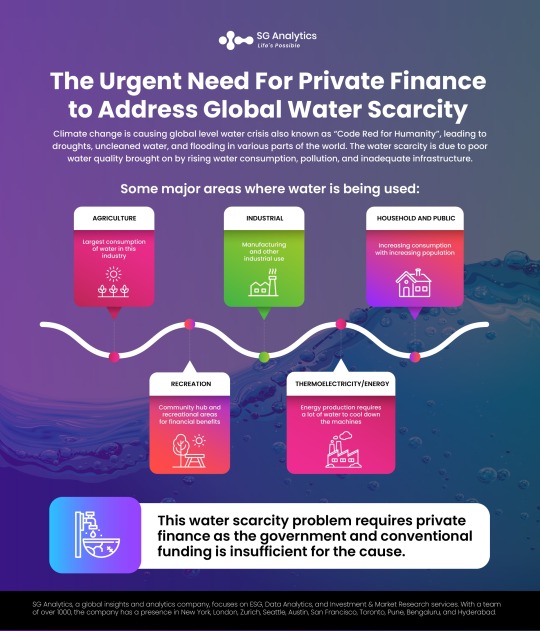

Globally, there is a growing lack of water. Half of the world is experiencing droughts, floods, and unclean water, and the issue urgently calls for significant private funding. With the rise of globalization, this seems to be of greater importance. It will worsen if current economic and social tendencies are not significantly reversed.

Due to a changing climate, an expanding global population, a booming global economy, and changing dietary habits, there is an increasing concern over water scarcity. The difficulties caused by water scarcity are developing as a strategic concern for enterprises and their financial sponsors worldwide.

#esg services#esg as a service#esg service providers#esg data solutions#esg data and research services#esg advisory services

0 notes

Text

Best 10 Business Strategies for year 2024

In 2024 and beyond, businesses will have to change with the times and adjust their approach based on new and existing market realities. The following are the best 10 business approach that will help companies to prosper in coming year

1. Embrace Sustainability

The days when sustainability was discretionary are long gone. Businesses need to incorporate environmental, social and governance (ESG) values into their business practices. In the same vein, brands can improve brand identity and appeal to environmental advocates by using renewable forms of energy or minimizing their carbon footprints.

Example: a fashion brand can rethink the materials to use organic cotton and recycled for their clothing lines. They can also run a take-back scheme, allowing customers to return old clothes for recycling (not only reducing waste but creating and supporting the circular economy).

2. Leverage AI

AI is revolutionizing business operations. Using AI-fuelled solutions means that you can automate processes, bring in positive customer experiences, and get insights. AI chatbots: AI can be utilized in the form of a conversational entity to support and perform backend operations, as well.

With a bit more specificity, say for example that an AI-powered recommendation engine recommends products to customers based on their browsing history and purchase patterns (as the use case of retail). This helps to increase the sales and improve the shopping experience.

3. Prioritize Cybersecurity

Cybersecurity is of utmost important as more and more business transitions towards digital platforms. Businesses need to part with a more substantial amount of money on advanced protective measures so that they can keep sensitive data private and continue earning consumer trust. Regular security audits and training of employees can reduce these risks.

Example: A financial services firm may implement multi-factor authentication (MFA) for all online transactions, regularly control access to Internet-facing administrative interfaces and service ports as well as the encryption protocols to secure client data from cyberattacks.

4. Optimizing Remote and Hybrid Working Models

Remote / hybrid is the new normal Remote teams force companies to implement effective motivation and management strategies. Collaboration tools and a balanced virtual culture can improve productivity and employee satisfaction.

- Illustration: a Tech company using Asana / Trello etc. for pm to keep remote teams from falling out of balance. They can also organise weekly team-building activities to keep a strong team spirit.

5. Focus on Customer Experience

Retention and growth of the sales follow-through can be tied to high quality customer experiences. Harness data analytics to deepen customer insights and personalize product offers making your marketing campaigns personal: a customer support that is responsive enough can drive a great level of returning customers.

Example – For any e-commerce business, you can take user experience feedback tools to know about how your customers are getting along and make necessary changes. Custom email campaigns and loyalty programs can also be positively associated with customer satisfaction and retention.

6. Digitalization Investment

It is only the beginning of digital transformation which we all know, is key to global competitiveness. For streamlining, companies have to adopt the use advanced technologies such as Blockchain Technology and Internet of Things (IoT) in conjunction with cloud computing.

IoT example : real-time tracking and analytics to optimize supply chain management

7. Enhance Employee Skills

Develop Your Employees: Investing in employee development is key to succeeding as a business. The training is provided for the folks of various industries and so employees can increase their skills that are needed to work in a certain company. Employee performance can be enhanced by providing training programs in future technology skills and soft skills and job satisfaction.

Example: A marketing agency can host webinars or create courses to teach people the latest digital marketing trends and tools This can help to keep employees in the know which results in boosting their skills, making your campaigns successful.

8. Diversify Supply Chains

The ongoing pandemic has exposed the weaknesses of global supply chains. …diversify its supply base and promote the manufacturing of drugs in Nigeria to eliminate total dependence on a single source. In return, this approach increases resilience and reduces exposure to the risks of supply chain interruption.

- E.g., a consumer electronics company can source components from many suppliers in various regions. In so doing, this alleviates avoidable supply chain interruptions during times of political tensions or when disasters hit.

9. Make Decisions Based on Data

A business database is an asset for businesses. By implementing data, they allow you to make decisions based on the data that your analytics tools are providing. For example, sales analysis lets you track trends and better tailor your goods to the market.

Example: A retail chain can use data analytics to find out when a customer buys, and it change their purchasing policies. This can also reduce overstock and stockouts while overall, increasing efficiency.

10. Foster Innovation

Business Growth Innovation is Key A culture of creativity and experimentation should be established in companies. Funding R&D and teaming with startups can open many doors to both solve problems creatively but also tap into new markets.

Example: A software development firm could create an innovation lab where team members are freed to work on speculative projects. Moreover, work with start-ups on new technologies and solutions.

By adopting these strategies, businesses can navigate the turbulence for 2024 and roll up market — progressive.AI with an evolving dynamic market, being ahead of trends and updated is most likely will help you thrive in the business landscape.

#ai#business#business strategy#business growth#startup#fintech#technology#tech#innovation#ai in business

2 notes

·

View notes

Text

The impact of sustainability in fintech: reflections from the summit

In recent years, the Fintech industry has witnessed a paradigm shift towards sustainability, with an increasing emphasis on integrating environmental, social, and governance (ESG) factors into financial decision-making processes. This transformative trend took center stage at the latest Fintech Summit, where industry leaders converged to explore the intersection of sustainability and financial technology. Among the prominent voices shaping this discourse was Xettle Technologies, a trailblazer in Fintech software solutions, whose commitment to sustainability is driving innovation and reshaping the future of finance.

Against the backdrop of global challenges such as climate change, resource depletion, and social inequality, the imperative for sustainable finance has never been greater. The Fintech Summit provided a platform for thought leaders to reflect on the role of technology in advancing sustainability goals and fostering a more resilient and equitable financial ecosystem.

At the heart of the discussions was the recognition that sustainability is not just a moral imperative but also a strategic imperative for Fintech firms. By integrating ESG considerations into their operations, products, and services, Fintech companies can mitigate risks, enhance resilience, and unlock new opportunities for growth and value creation. Xettle Technologies’ representatives underscored the company’s commitment to sustainability, highlighting how it is embedded in the company’s culture, innovation agenda, and business strategy.

One of the key themes that emerged from the summit was the role of Fintech in driving sustainable investment. Through innovative solutions such as green bonds, impact investing platforms, and ESG scoring algorithms, Fintech firms are empowering investors to allocate capital towards environmentally and socially responsible projects and companies. Xettle Technologies showcased its suite of Fintech software solutions designed to facilitate sustainable investing, enabling financial institutions and investors to align their portfolios with their values and sustainability objectives.

Moreover, the summit explored the transformative potential of blockchain technology in advancing sustainability goals. By enhancing transparency, traceability, and accountability in supply chains, blockchain can help address issues such as deforestation, forced labor, and conflict minerals. Xettle Technologies’ experts elaborated on the company’s blockchain-based solutions for supply chain finance and sustainability reporting, emphasizing their role in promoting ethical sourcing, responsible production, and fair labor practices.

In addition to sustainable investing and supply chain transparency, the summit delved into the role of Fintech in promoting financial inclusion and resilience. By leveraging technology and data analytics, Fintech firms can expand access to financial services for underserved populations, empower small and medium-sized enterprises (SMEs), and build more inclusive and resilient communities. Xettle Technologies’ representatives shared insights into the company’s initiatives to support financial inclusion through digital payments, microfinance, and alternative credit scoring models.

Furthermore, the summit highlighted the importance of collaboration and partnership in advancing sustainability goals. Recognizing the interconnected nature of sustainability challenges, participants underscored the need for cross-sectoral collaboration between Fintech firms, financial institutions, governments, civil society, and academia. Xettle Technologies reiterated its commitment to collaboration, emphasizing its partnerships with industry stakeholders to drive collective action and scale impact.

Looking ahead, the future of sustainability in Fintech appears promising yet complex. As Fintech firms continue to innovate and disrupt traditional financial systems, they must prioritize sustainability as a core principle and driver of value creation. Xettle Technologies’ visionaries reiterated their commitment to sustainability, pledging to harness the power of technology to build a more sustainable, inclusive, and resilient financial ecosystem for future generations.

In conclusion, the Fintech Summit served as a catalyst for reflection and action on the role of sustainability in shaping the future of finance. From sustainable investing and supply chain transparency to financial inclusion and resilience, Fintech has the potential to drive positive change and advance sustainability goals on a global scale. Xettle Technologies’ leadership in integrating sustainability into its Fintech solutions exemplifies its dedication to driving innovation and creating shared value for society and the planet. As the industry continues to evolve, collaboration, innovation, and sustainability will be key drivers of success in building a more sustainable and resilient financial future.

2 notes

·

View notes

Text

Unravelling Audit Trends: A Guide for Accountants and Auditors in Dubai

Welcome, accountants and auditors in Dubai, to an insightful exploration of the latest audit trends shaping our vibrant industry landscape. In this guide, we'll delve into key trends, technological advancements, regulatory shifts, and best practices that are essential for your success in Dubai's dynamic financial sector.

Regulatory Updates: Stay ahead of the game by keeping abreast of the latest regulatory changes in Dubai. From updates in financial reporting standards to compliance requirements, understanding and adapting to these changes is crucial for ensuring accurate and compliant audits.

Technology Integration: Embrace the power of technology to enhance your audit processes. AI-driven analytics, cloud-based platforms, and automation tools can streamline auditing tasks, improve accuracy, and provide deeper insights into financial data, ultimately saving time and resources.

Best Practices: Elevate your audit game with best practices focused on risk assessment, internal control evaluation, and fraud detection. Proactive measures and robust strategies in these areas can strengthen audit outcomes, instill client trust, and mitigate risks effectively.

Sustainability Reporting: With sustainability gaining prominence, auditors in Dubai play a pivotal role in verifying and enhancing the credibility of sustainability reports. Incorporating ESG factors into audits is becoming increasingly important, reflecting the growing emphasis on corporate responsibility.

Blockchain Revolution: Explore the potential of blockchain technology in auditing. Its features such as enhanced data security, transparency, and immutability are transforming audit trails and ensuring the integrity of financial information, offering auditors innovative solutions to improve audit efficiency and reliability.

Future Outlook: The future of auditing in Dubai is promising for those who embrace change and innovation. Continuous learning, upskilling in technology, and maintaining compliance with evolving standards will be key drivers of success in the ever-evolving audit landscape.

By staying informed, leveraging technology, adopting best practices, and embracing innovation, accountants and auditors in Dubai can navigate through challenges, deliver value-added services, and drive excellence in auditing practices, cementing their position as trusted financial advisors in the region.

#DubaiAuditors#AuditTrends#AccountantsInDubai#RegulatoryChanges#TechIntegration#BestAuditPractices#SustainabilityReporting#BlockchainAuditing#FutureOfAuditing#FinancialCompliance#ESGStandards#AuditInnovation#AuditTech#DubaiFinance#AuditInsights#dubaibusiness#business strategy#uaebusiness

3 notes

·

View notes

Text

Hensoldt receives a 100 million euro contract as part of the FCAS program

Sensor specialist develops central elements of a new type of sensor network.

Fernando Valduga By Fernando Valduga 02/14/2023 - 14:00 in Military

Sensor solution provider HENSOLDT is developing essential core elements of the new sensor network in the German-French-Spanish military project FCAS (Future Combat Air System).

As a member of the German consortium FCMS GbR (Future Combat Mission System), HENSOLDT received a contract of approximately 100 million euros by the French purchasing authority DGA for the development of demonstrators in the areas of central competence of radar, recognition and self-protection electronics, optronics and also the comprehensive network of sensor technology.

“The next-generation air combat system requires an intelligent approach to a platform-independent network mission system, cutting-edge sensors and data evaluation based on Artificial Intelligence,” explains Christoph Ruffner, head of the Spectrum Dominance business unit. "This is where HENSOLDT will make the essential contribution with the FCMS consortium."

In the FCAS project, the participating nations want to develop, among other things, a successor system for the Eurofighter and Rafale fighters, as well as a new networked sensor system. By 2025, several technology demonstrators will be developed to show the possibilities of a platform-independent network solution. This network of sensors with different platforms will later be developed in the other phases of the FCAS demonstrator.

The respective technological leaders of the industry of the three countries are involved: Under the general management of INDRA (Spain), Thales for France and the FCMS consortium for Germany, composed of HENSOLDT, Diehl Defense, ESG Elektroniksystem- und Logistik-GmbH and Rohde & Schwarz, are working together in the so-called demonstration phase 1b. HENSOLDT leads the FCMS consortium and, therefore, in addition to its technical work packages, also assumes essential tasks in project management and central architecture work packages.

Tags: Military AviationFCAS - Future Combat Air System/Future Air Combat SystemHensoldt

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. He uses Canon equipment during his photographic work in the world of aviation.

Related news

The Il-76MD-90A is a heavy upgrade of the Il-76MD aircraft equipped with PS-90A-76 engines with 10% lower fuel consumption.

MILITARY

India shows interest in Russia's updated Il-76MD-90A military transport plane

02/15/2013 - 4:00 PM

MILITARY

HAL from India offers turboprop engine MRO service for GA-ASI MQ-9B drones

15/02/2023 - 14:00

BRAZILIAN NAVY

Former owner of Nae São Paulo regrets tragic end of the aircraft carrier and the damage to the environment

15/02/2023 - 12:00

INTERCEPTIONS

NORAD: F-16s intercept Russian bombers and fighters near Alaska

15/02/2023 - 08:19

MILITARY

Romania detects suspicious "air object" in its airspace

14/02/2023 - 22:02

4 notes

·

View notes

Text

Building a Sustainable Supply Chain Program with Data-Driven Responsible Sourcing

Building a Sustainable Supply Chain Program with Data-Driven Responsible Sourcing

Introduction: In today's business landscape, sustainability has become a key focus for companies looking to create a positive impact on the environment and society. One crucial aspect of sustainability is supply chain management, as it plays a significant role in reducing the overall environmental and social footprint of a company. In this article, we will explore how to build a robust supply chain sustainability program through data-driven responsible sourcing. By leveraging data and implementing responsible sourcing practices, companies can not only enhance their sustainability efforts but also gain a competitive edge in the market.

The Importance of Responsible Sourcing in Supply Chain Sustainability

Responsible sourcing is the process of ensuring that the materials, products, and services used in a company's supply chain are obtained from ethical and sustainable sources. It involves evaluating the environmental, social, and governance (ESG) aspects of suppliers, and making informed decisions based on that evaluation. Responsible sourcing is crucial for companies aiming to build a sustainable supply chain program, as it helps them identify and address potential environmental and social risks associated with their suppliers.

Leveraging Data for Responsible Sourcing in Supply Chain Management

Data plays a pivotal role in responsible sourcing, as it provides insights into the sustainability performance of suppliers. By leveraging data, companies can make informed decisions about which suppliers to work with and how to improve their sustainability performance. There are several ways in which data can be utilized for responsible sourcing in supply chain management:

Implementing Responsible Sourcing in Supply Chain Sustainability Programs

Implementing responsible sourcing practices requires a systematic approach that involves multiple stakeholders across the supply chain. Here are some key steps to consider when building a sustainable supply chain program with responsible sourcing:

Benefits of Implementing Responsible Sourcing in Supply Chain Management

Implementing responsible sourcing practices in supply chain management can yield several benefits for companies. Some of the key benefits include:

Building a sustainable supply chain program with data-driven responsible sourcing is critical for companies looking to enhance their sustainability performance, gain a competitive advantage, and mitigate risks. By leveraging data to ensure transparency, assess supplier performance, and drive continuous improvement, companies can create a positive impact on the environment and society, while also achieving business success. Implementing responsible sourcing practices requires a systematic approach, including clear policies, supplier engagement, collaboration with stakeholders, and a commitment to continuous improvement. By prioritizing responsible sourcing in their supply chain management, companies can contribute to a more sustainable future while reaping the benefits of improved sustainability performance, innovation opportunities, and stakeholder engagement.

2 notes

·

View notes

Text

The Future of Venture Capital: Trends and Predictions for 2025

As the financial landscape evolves, venture capital (VC) is undergoing significant transformations, influenced by technological advancements, global economic shifts, and changing market dynamics. Venture capital remains a cornerstone of innovation, but its future in 2025 is poised to be shaped by distinct trends and emerging opportunities. This article delves into the most promising directions and predictions for the VC ecosystem.

The Rise of Sector-Specific Funds

One of the most noticeable trends in venture capital is the increasing prominence of sector-specific funds. Investors are becoming more specialized, focusing on industries like fintech, health tech, climate tech, and artificial intelligence. This trend reflects the growing complexity and unique demands of these sectors.

Specialized funds allow venture capitalists to develop more profound expertise, creating tailored investment strategies. For startups, this means gaining access to investors who understand the intricacies of their industries. These funds provide capital, mentorship, and networking opportunities that align closely with the startup’s operational needs.

Furthermore, sector-specific funds can mitigate risks for investors. By concentrating on industries with strong growth potential and predictable trajectories, VCs are better equipped to identify profitable opportunities and foster innovation in niche markets.

Emphasis on Sustainability and ESG Investing

Environmental, Social, and Governance (ESG) criteria are becoming central to venture capital strategies. With growing awareness of climate change and societal challenges, investors prioritize sustainable and socially responsible startups. This shift responds to ethical considerations and consumer demand for greener, more equitable business models.

In 2025, VC firms will likely allocate more resources to startups addressing renewable energy, circular economies, and social equity. Companies that align with ESG principles are increasingly attractive to institutional investors and public markets, offering a clear exit strategy. As a result, startups with strong ESG frameworks are poised to capture a larger share of venture funding.

Moreover, governments worldwide are introducing incentives and policies to promote sustainability, encouraging VCs to embrace ESG-focused investments. This trend ensures that capital flows towards solutions that have a long-term positive impact on society and the environment.

Expansion of Global Investment Opportunities

The venture capital industry is no longer confined to traditional hubs like Silicon Valley. In 2025, emerging markets in Southeast Asia, Africa, and Latin America are becoming attractive destinations for VC investment. These regions offer untapped potential, rapidly growing economies, and a young, tech-savvy population.

Global expansion allows venture capitalists to diversify their portfolios and access innovative ideas from various cultural and economic contexts. Advances in communication and remote collaboration tools have further enabled investors to manage and monitor international investments effectively.

However, investing in emerging markets has unique challenges, such as regulatory uncertainties and currency fluctuations. To navigate these complexities, VCs are partnering with local firms and leveraging their knowledge to minimize risks while maximizing returns.

Increased Adoption of AI and Data Analytics

Artificial intelligence (AI) and data analytics revolutionize how venture capitalists evaluate investment opportunities. These technologies enable investors to analyze vast amounts of data, identify trends, and predict the success of startups with greater accuracy. By leveraging AI, VCs can make data-driven decisions, reducing reliance on traditional gut instincts.

In 2025, AI tools will be more significant in sourcing deals, conducting due diligence, and monitoring portfolio performance. Predictive analytics will help investors identify emerging markets and sectors before they become saturated. Additionally, automated systems will streamline administrative tasks, allowing VCs to focus on strategic planning and relationship building.

Startups themselves are also integrating AI into their operations, creating innovative products that attract venture funding. This mutual adoption of AI fosters a more efficient and informed VC ecosystem.

Democratization of Venture Capital

The democratization of venture capital is gaining momentum, driven by crowdfunding platforms, tokenization, and decentralized finance (DeFi). These technologies are breaking down barriers, enabling retail investors to participate in funding innovative startups alongside institutional players.

Tokenization divides assets into smaller units, making it easier for individuals to invest. Platforms utilizing blockchain technology ensure transparency and security, fostering trust among investors. In 2025, we will likely see a surge in retail-driven venture funding, particularly in sectors with high consumer engagement.

This shift also benefits startups, providing access to a broader pool of capital. By tapping into retail investors, companies can raise funds faster and build a community of advocates who are financially invested in their success.

Focus on Founder Wellness and Diverse Leadership

As the startup ecosystem evolves, founders' mental health and well-being become critical focus areas. Venture capitalists recognize that supporting founders holistically leads to better long-term outcomes for startups and investors.

In 2025, more VC firms will implement programs to promote founder wellness, including access to mental health resources, mentorship, and flexible funding structures. These initiatives aim to reduce burnout and ensure founders remain motivated and can steer their companies toward success.

Additionally, diversity in leadership is increasingly recognized as a key driver of innovation and performance. VC firms are setting diversity benchmarks for their portfolios, encouraging startups to build inclusive teams. By fostering diversity, the industry can tap into a broader range of perspectives, enhancing creativity and resilience.

Consolidation and Collaboration Among VC Firms

The venture capital landscape is becoming more competitive, prompting consolidation and collaboration among firms. Smaller VC firms merge to pool resources, while larger firms are forming strategic alliances to co-invest in high-potential startups.

Collaboration allows VCs to share risks and leverage complementary expertise. This means access to a broader network of resources and opportunities for startups. Two thousand twenty-five co-investment deals are expected to rise, particularly in capital-intensive industries like deep tech and biotechnology.

Consolidation also enables firms to scale their operations and offer end-to-end support to portfolio companies. By combining forces, VCs can maintain their competitive edge and adapt to the rapidly changing investment landscape.

A Dynamic Road Ahead

The future of venture capital in 2025 is marked by transformation and opportunity. From the rise of sector-specific funds to the adoption of AI and the focus on ESG principles, the industry is evolving to meet the demands of a changing world. Global expansion, democratization, and a commitment to founder wellness and diversity further highlight the dynamic nature of VC.

As these trends unfold, venture capitalists and startups must remain agile and forward-thinking. By embracing innovation and collaboration, the industry can continue to drive progress, fostering the next wave of groundbreaking ideas and solutions.

0 notes

Text

Why is ESG Intelligence Important to Companies?

Human activities burden Earth’s biosphere, but ESG criteria can ensure that industries optimize their operations to reduce their adverse impact on ecological and socio-economic integrity. Investors have utilized the related business intelligence to screen stocks of ethical enterprises. Consumers want to avoid brands that employ child labor. This post will elaborate on why ESG intelligence has become important to companies.

What is ESG Intelligence?

ESG, or environmental, social, and governance, is an investment guidance and business performance auditing approach. It assesses how a commercial organization treats its stakeholders and consumes natural resources. At its core, you will discover statistical metrics from a sustainability perspective. So, ESG data providers gather and process data for compliance ratings and reports.

Managers, investors, and government officers can understand a company’s impact on its workers, regional community, and biosphere before engaging in stock buying or business mergers. Since attracting investors and complying with regulatory guidelines is vital for modern corporations, ESG intelligence professionals have witnessed a rise in year-on-year demand.

Simultaneously, high-net-worth individuals (HNWI) and financial institutions expect a business to work toward accomplishing the United Nations’ sustainable development goals. Given these dynamics, leaders require data-driven insights to enhance their compliance ratings.

Components of ESG Intelligence

The environmental considerations rate a firm based on waste disposal, plastic reduction, carbon emissions risks, pollution control, and biodiversity preservation. Other metrics include renewable energy adoption, green technology, and water consumption.

Likewise, the social impact assessments check whether a company has an adequate diversity, equity, and inclusion (DEI) policy. Preventing workplace toxicity and eradicating child labor practices are often integral to the social reporting head of ESG services.

Corporate governance concerns discouraging bribes and similar corruptive activities. Moreover, an organization must implement solid cybersecurity measures to mitigate corporate espionage and ransomware threats. Accounting transparency matters too.

Why is ESG Intelligence Important to Companies?

Reason 1 – Risk Management

All three pillars of ESG reports, environmental, social, and governance, enable business owners to reduce their company’s exposure to the following risks.

High greenhouse (GHG) emissions will attract regulatory penalties under pollution reduction directives. Besides, a commercial project can take longer if vital resources like water become polluted. Thankfully, the environmental pillar helps companies comply with the laws governing these situations.

A toxic and discriminatory workplace environment often harms employees’ productivity, collaboration, creativity, and leadership skill development. Therefore, inefficiencies like reporting delays or emotional exhaustion can slow a project’s progress. ESG’s social metrics will mitigate the highlighted risks resulting from human behavior and multi-generational presumptions.

Insurance fraud, money laundering, tax evasion, preferential treatment, hiding conflicts of interest, and corporate espionage are the governance risks you must address as soon as possible. These problems introduce accounting inconsistencies and data theft issues. You will also receive penalties according to your regional laws if data leaks or insider trading happens.

Reason 2 – Investor Relations (IR)

Transparent disclosures can make or break the relationship between corporate leaders and investors. With the help of ESG intelligence, it becomes easier to make qualitative and manipulation-free “financial materiality” reports. Therefore, managers can successfully execute the deal negotiations with little to no resistance.

You want to retain the present investors and attract more patrons to raise funds. These resources will help you to augment your company’s expansion and market penetration. However, nourishing mutually beneficial investor relations is easier said than done.

For example, some sustainability investors will prioritize enterprises with an ESG score of above 80. Others will refuse to engage with your brand if one of the suppliers has documented records of employing child labor. Instead of being unaware of these issues, you can identify them and mitigate the associated risks using ESG intelligence and insights.

Reason 3 – Consumer Demand

Consider the following cases.

Customers wanted plastic-free product packaging, and e-commerce platforms listened to their demand. And today’s direct home deliveries contribute to public awareness of how petroleum-derived synthetic coating materials threaten the environment.

The availability of recharging facilities and rising gas prices have made electric vehicles (EVs) more attractive to consumers. Previously, the demand for EVs had existed only in the metropolitan areas. However, the EV industry expects continuous growth as electricity reaches more semi-urban and rural regions.

Businesses and investors care about consumer demand. Remember, they cannot force consumers into buying a product or service. And a healthy competitive industry has at least three players. Therefore, customers can choose which branded items they want to consume.

Consumer demand is one of the driving factors that made ESG intelligence crucial in many industries. If nobody was searching for electric vehicles on the web or everybody had demanded plastic packaging, businesses would never switch their attitudes toward the concerns discussed above.

Conclusion

Data governance has become a popular topic due to the privacy laws in the EU, the US, Brazil, and other nations. Meanwhile, child labor is still prevalent in specific developing and underdeveloped regions. Also, the climate crisis has endangered the future of agricultural occupations.

Deforestation, illiteracy, carbon emissions, identity theft, insider trading, discrimination, on-site accidents, corruption, and gender gap threaten the well-being of future generations. The world requires immediate and coordinated actions to resolve these issues.

Therefore, ESG intelligence is important to companies, consumers, investors, and governments. Properly acquiring and analyzing it is possible if these stakeholders leverage the right tools, relevant benchmarks, and expert data partners.

2 notes

·

View notes

Text

New Stock Strategy: A Revolutionary Approach for Modern Investors

The landscape of stock market investing has evolved dramatically in recent years, driven by technological advancements, global economic shifts, and a growing demand for ethical practices. Investors today must adapt to these changes to stay competitive and maximize returns. The new stock strategy combines innovation, data-driven insights, and flexible diversification to create an investment approach that is both responsive and forward-thinking. This strategy is designed to help investors navigate the complexities of the modern financial world while capitalizing on emerging trends.

What Makes the New Stock Strategy Different?

The new stock strategy diverges from traditional methods by focusing on adaptability, technology, and sustainability. Instead of relying solely on passive investments and generic diversification, it encourages a proactive approach, tailored to current market conditions. By integrating advanced tools, sector-based diversification, and ethical investing, the strategy empowers investors to make smarter, more informed decisions.

1. Data-Driven Decision Making

In the modern stock market, having access to timely, accurate data is critical. The new stock strategy leverages big data analytics, machine learning, and artificial intelligence to sift through vast amounts of information and provide actionable insights. These tools help identify hidden patterns in market movements, forecast trends, and optimize portfolio performance.

Using these technologies, investors can make more informed decisions, reducing the reliance on instinctual guesses or outdated information. For example, AI-powered platforms can analyze financial reports, track market sentiment, and alert investors to potential investment opportunities before they become obvious to the broader market.

2. Sector-Focused Diversification

While traditional diversification has been about spreading risk across asset classes and industries, the new stock strategy advocates for more targeted sector-based diversification. This involves allocating investments into specific sectors poised for growth.

For instance, technology, artificial intelligence, green energy, and e-commerce are expected to experience robust growth in the coming years. By focusing on sectors like these, investors can tap into high-growth opportunities while minimizing exposure to underperforming industries. Additionally, sector-based diversification allows investors to be more strategic in their asset allocation, rather than relying on broad market exposure.

3. Global Investment Perspective

A global mindset is essential to the new stock strategy. While traditional investing often focuses on domestic markets, global investing opens up a world of opportunities. By diversifying across different regions, especially emerging markets, investors can reduce risks tied to localized economic downturns and access high-growth opportunities in rapidly developing economies.

Countries in Asia, Africa, and Latin America are seeing rapid industrialization and technological advancement, which presents lucrative opportunities for growth. The new stock strategy encourages investors to include international stocks, ETFs, and other assets to diversify risk and increase the potential for higher returns.

4. Focus on Sustainable and Ethical Investments (ESG)

Environmental, social, and governance (ESG) criteria are now more important than ever. Investors today are increasingly concerned about the impact their investments have on society and the planet. The new stock strategy incorporates ESG factors into the investment process, focusing on companies that not only offer financial growth but also align with ethical values.

Investing in companies with strong ESG practices can provide long-term benefits. These companies are often better positioned to thrive in the future, as they face fewer regulatory hurdles, have a loyal customer base, and are less likely to suffer reputational damage. By incorporating ESG principles into the new stock strategy, investors can help drive positive change while still benefiting from financial returns.

5. Active Portfolio Management and Monitoring

A key component of the new stock strategy is active portfolio management. While passive investing focuses on long-term hold, active management allows investors to adjust their portfolios based on market fluctuations, new information, or emerging trends. This strategy emphasizes the importance of staying engaged with the market and making data-backed decisions to protect and grow investments.

By continuously monitoring market conditions and portfolio performance, investors can make timely adjustments, such as reallocating assets, trimming underperforming stocks, or capitalizing on emerging trends. The goal is to keep the portfolio dynamic and responsive to the ever-changing market environment.

How to Implement the New Stock Strategy

To implement the new stock strategy, investors should follow a structured approach that incorporates key principles such as data-driven decision-making, targeted diversification, and active portfolio management. Here’s how to get started:

1. Invest in Advanced Tools

Start by adopting data analytics platforms and AI-powered tools that can analyze market data and help you make more informed investment decisions. These tools will help you stay on top of market trends, monitor stock performance, and identify new investment opportunities.

2. Focus on High-Growth Sectors

Research and identify sectors with high growth potential, such as technology, green energy, and biotechnology. Allocate a portion of your portfolio to these sectors, ensuring you are well-positioned to take advantage of emerging trends.

3. Diversify Globally

Expand your investment horizons by looking beyond domestic markets. Research emerging markets in Asia, Africa, and Latin America for investment opportunities in rapidly growing industries. This global diversification will help mitigate risks and increase the potential for higher returns.

4. Choose ESG-Compliant Investments

Invest in companies with strong ESG scores and sustainability practices. These companies are often better equipped to handle future challenges and are more likely to perform well in the long run. Look for ESG ratings and consider incorporating these factors into your investment process.

5. Regularly Monitor and Adjust Your Portfolio

Review your portfolio on a regular basis and make adjustments as needed. Use market data and analytics tools to assess performance, track changes in market conditions, and take advantage of new opportunities.

Benefits of the New Stock Strategy

Data-Driven Insights: Leveraging technology to make smarter, more informed decisions enhances the chances of profitability.

Higher Growth Potential: Focusing on high-growth sectors and emerging markets can significantly increase the potential for returns.

Sustainability and Ethics: Investing in companies with strong ESG practices aligns financial goals with positive societal impact.

Reduced Risk: Sector-based diversification and global investments help mitigate risks associated with regional or industry downturns.

Active Adaptability: Regular portfolio monitoring and adjustments allow investors to respond quickly to market changes.

Conclusion

The new stock strategy is a forward-thinking approach that integrates innovation, data, and sustainability to create a dynamic, adaptable investment plan. By focusing on high-growth sectors, leveraging advanced technology, and incorporating ESG factors, investors can position themselves for success in a rapidly changing market. This strategy not only maximizes financial returns but also promotes a more sustainable and ethical approach to investing, ensuring that profits and positive impact go hand in hand.

0 notes

Text

Understanding ESG Data Providers: The Ultimate Guide

ESG (Environmental, Social, and Governance) investing has grown dramatically and shows no indications of slowing. Investors are increasingly concerned with environmental issues and are expecting greater openness from corporations in the form of real facts. This collected ESG data is used to discover long-term investment options with minimal financial risk. Organisations demand reliable ESG data for ESG evaluations, metrics, and reporting. However, the only way for investors to grow alpha is to have access to reliable and real-time data. As a result, there is an increase in the number of ESG data providers, offering organisations a choice of solutions geared toward supporting and developing their ESG programs.

#ESG Data Providers#ESG Data#Role of ESG Data#ESG Data Sources#ESG Vendors#ESG Providers#ESG Companies

0 notes

Text

ESG and Sustainable Investing: A Guide for ESG-Focused Investors in 2022

While investment and sustainability might seem like two entirely opposite aspects, the recent climate trends have forced them to collide. Often the process of making investment concerns vetting a company based on factors including business model, historical data performance, annual reports, and much more.

esg services

#esg services#esg as a service#esg service providers#esg data solutions#top esg consulting firm#Sustainable Investing

0 notes

Text

Accounting Bingo 2025

🎙️ Welcome to the Accounting Apps podcast, where we spotlight trends and tools shaping the world of accounting. I'm Heather Smith, and today we’re playing a little game of Accounting Bingo for 2025! What's on the bingo card for the year ahead? We’re talking about technology, tools, and trends that are transforming our profession. Let’s dive in! 🎙️

Subscribe to the Accounting Apps newsletter here http://AccountingApps.io

This is the ChatGPT podcast script I used for the episode

Square 1: AI-Driven Automation 🤖 It’s no surprise that AI is at the top of our bingo card.

In 2025, AI is automating repetitive tasks, analysing vast amounts of data, and even predicting trends. Whether it's categorising transactions or providing forecasting insights, AI tools are making accountants' lives easier.

Brand Watch: Xero’s AI-powered bank reconciliation and QuickBooks’ Smart Suggestions are leading the charge.

Square 2: ESG Reporting Tools 🌱 Environmental, Social, and Governance (ESG) is no longer optional.

With mandatory ESG reporting becoming standard, accountants are helping clients track their sustainability metrics alongside financial ones.

Brand Watch: Spotlight Sustain: Measure and enhance the positive impact that your organisation or clients can create. SAP and Oracle are embedding ESG tools right into their platforms, making it simpler to comply with new regulations.

Square 3: Cloud-Based Collaboration ☁️ Cloud-first is the only way forward.

Accountants are embracing platforms that allow teams and clients to collaborate in real-time, from anywhere in the world. Cloud-based solutions have become essential for remote and hybrid work.

Brand Watch: Xero, MYOB, and QuickBooks Online are household names, while Karbon is adding powerful collaboration features for practice management.

Square 4: Data Analytics and Visualisation 📊 Seeing is believing – and understanding.

Advanced analytics tools are helping accountants go beyond numbers to tell compelling stories with data. Visualisation tools are bringing balance sheets and profit-and-loss statements to life.

Brand Watch: Power BI, Fathom, and Tableau are must-haves for visualising financial insights.

Square 5: Enhanced Cybersecurity 🔒 Security is non-negotiable.

With the rise of cyberattacks, protecting client data is critical. Accountants need robust cybersecurity measures built into their workflows.

Brand Watch: Platforms like Practice Protect and 1Password are safeguarding sensitive financial information.

Square 6: Advisory 💼 Advisory is the future.

Accountants are evolving into strategic advisors, helping clients make data-driven decisions to grow their businesses. Offering more personalised services is the new normal.

Brand Watch: Clarity HQ https://clarity-hq.com/ The Gap https://www.thegaphq.com/

Square 7: Remote Work Technologies 🏠 Work from anywhere, but stay connected.

Accountants are relying on tools that keep their teams productive and clients engaged, no matter where they’re working from.

Brand Watch: Microsoft Teams and Zoom remain essentials, while Slack adds another layer of real-time communication.

Square 8: Automation for Compliance 📜 Stay compliant without the headache.

With ever-changing regulations, automation tools are stepping up to handle compliance tasks. From tax filings to payroll, automation reduces errors and saves time.

Brand Watch: XBert and ATO-certified tools like BAS Agent Portal integrations are a hit in Australia.

Square 9: Simplified Payments 💳 Get paid faster and easier.

Streamlined payment solutions are helping accountants and their clients manage cash flow more effectively.

Brand Watch: Ignition Solo is a new offering for automated agreements and payments.

Square 10: Sustainability in Practice 🌍 Greener practices for a better future.

Beyond ESG reporting, accountants are looking inward to adopt sustainable practices in their own businesses.

Brand Watch: Platforms like Dext are enabling paperless workflows, contributing to a greener planet.

Conclusion

🎙️ That’s our bingo card for 2025! Which trends are you already embracing, and which ones are still on your wishlist? The world of accounting is evolving rapidly, and staying ahead of these trends will help you thrive in the year ahead. Thanks for tuning in to the Accounting Apps podcast. Until next time, keep innovating! 🎙️

Subscribe to the Accounting Apps newsletter here http://AccountingApps.io

Contact details:

Accounting Apps newsletter: http://HeatherSmithAU.COM

Accounting Apps Mastermind: https://www.facebook.com/groups/XeroMasterMind

LinkedIn: https://www.linkedin.com/in/HeatherSmithAU/

YouTube Channel: https://www.youtube.com/ANISEConsulting

X: https://twitter.com/HeatherSmithAU

Cloud Stories w. @HeatherSmithAU

0 notes

Text

Elder Care Subscription Market In-Depth Analysis with Booming Trends Supporting Growth and Forecast

The anticipated value of the worldwide elder care subscription market in 2023 is US$ 2,563 million. The market is expected to rise at a 16.3% compound annual growth rate (CAGR) from 2023 to 2033, with a valuation of US$ 11,635.5 million by the end of that year, according to data by Future Market Insights.

The demand for elder care subscription services is being driven by the rise in worldwide awareness of senior care services and related services.

The huge population has resulted in a larger need for care, which is driving up demand for senior-focused products and services. This surge in demand is likely to promote market expansion. The prevalence of chronic illnesses including cancer, osteoporosis, and cardiovascular disease is rising.

Key Takeaways from the Market Study

Sales of global elderly care subscription expanded at a CAGR of 14.2% from 2018 to 2022

The Japanese market for global elderly care subscriptions likely to grow at a share of the value of 4.2%

The North American market for global elderly care subscription is likely to expand at a share of 27.5%.

Monthly type are expected to generate maximum demand for the global elderly care subscription.

Elderly nursing homes are said to gain the traction from 2023 to 2033

Elderly nursing homes are estimated to account for 45.5% of the total value share during the forecasted period.

Monthly subscription segment is considered to hold the highest share of 55.9% over the forecast period.

Elder care subscription market in Australia with a market share of 3.5%

Market in India is anticipated to witness growth in revenue with a CAGR of 15.4%.

China is assumed to register the dominant growth at 18.3% CAGR during the forecasted period.

European market is estimated to be valued at around US$ 22.1% of the market share.

United Kingdom is said to grow at a CAGR of 13.4% during the forecast period.

Germany is said to hold a market share of 7.1% in the elder care subscription market.

United States is estimated to account for 16.5% of the market share.

Competitive Landscape

Some of the prominent players in the global market are-

Amazon.com, Inc.

ApnaCare

Ignox Labs Pvt Ltd. (Emoha Elder Care)

Samvedna Senior Care

Eldercare Services

Portea Medical

Iora Health

Home Instead, Inc.

Living Assistance Services, Inc.,

Cera Care

Some of the important developments of the key players in the market are:

In January 2023, Portea Medical has penned an article for BioVoice on Union Budget 2023 and expectations of the stakeholders to help fuel innovation and R&D, which will set the pace for propelling the pharmaceutical industry forward. He also addressed the specific demands of the stakeholders on GST, better incentives and more PLI schemes for various segments of the sector.

In January 2023, Semtech’s LoRa® devices and the LoRaWAN® standard is incredibly strong. This morning, we had the pleasure of connecting with a wide range of customers, LoRa ecosystem partners and industry experts to discuss the powerful impact of low power, long range Internet of Things (IoT) technologies on enabling a smarter, greener and more resilient future for our planet. The journey to lower carbon emissions — and, more broadly, help the enterprise achieve its environmental, social and governance (ESG) goals — is a cornerstone to Semtech’s innovation for a better world.

More Valuable Insights Available

Future Market Insights offers an unbiased analysis of the global elder care subscriptions market providing historical data for 2018 to 2022 and forecast statistics from 2023 to 2033.

To understand opportunities in the elder care subscriptions market is segmented based on major By Country(North America, Latin America, Europe, Asia Pacific, Middle East, and Africa), By Type(Monthly, Yearly), and By End-user(Hospitals, Elderly Nursing Homes, Homecare)

Key Segments Covered in Elder Care Subscription Sales Market

By Country:

North America

Latin America

Europe

Asia Pacific

Middle East and Africa

By Type:

Monthly

Yearly

By End-user:

Hospitals

Elderly Nursing Homes

Homecare

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries. Join us as we commemorate 10 years of delivering trusted market insights. Reflecting on a decade of achievements, we continue to lead with integrity, innovation, and expertise.

Contact Us:

Future Market Insights Inc. Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware – 19713, USA T: +1-845-579-5705 For Sales Enquiries: [email protected] Website: https://www.futuremarketinsights.com LinkedIn| Twitter| Blogs | YouTube

0 notes