#ESG and Sustainability Reporting

Explore tagged Tumblr posts

Text

ESG and Sustainability Reporting: Comprehensive Guide and Best Practices

In today's business landscape, ESG and Sustainability Reporting have become crucial for companies aiming to demonstrate their commitment to environmental, social, and governance (ESG) criteria. This comprehensive guide explores the importance of ESG and Sustainability Reporting, its benefits, and best practices for effective implementation.

The Importance of ESG and Sustainability Reporting

ESG and Sustainability Reporting helps organizations:

Enhance transparency and accountability.

Attract socially conscious investors.

Improve risk management.

Foster a positive corporate reputation.

Comply with regulatory requirements.

Benefits of ESG and Sustainability Reporting

Investor Attraction: Companies with robust ESG practices often attract investors looking for sustainable and ethical investments.

Risk Management: Identifying and addressing ESG risks can prevent potential issues and reduce long-term costs.

Reputation Management: Transparent reporting on ESG efforts can enhance a company's public image and build trust with stakeholders.

Regulatory Compliance: Adhering to ESG reporting standards helps companies meet regulatory requirements and avoid penalties.

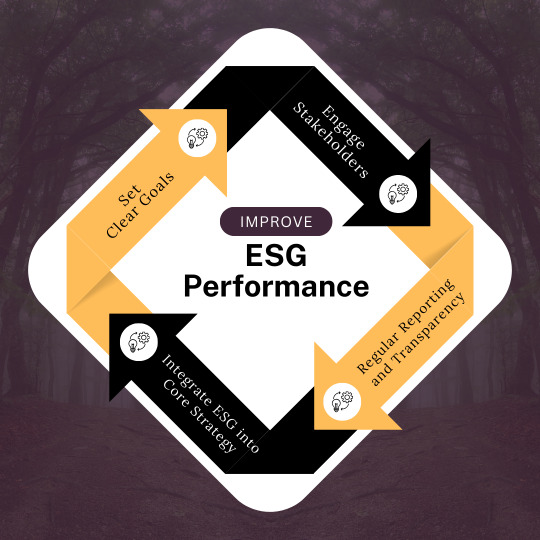

Best Practices for ESG and Sustainability Reporting

Define Clear Objectives: Establish clear goals and objectives for your ESG initiatives.

Engage Stakeholders: Involve stakeholders in the reporting process to ensure comprehensive and accurate data.

Use Standardized Frameworks: Adopt recognized frameworks such as GRI, SASB, or TCFD for consistent reporting.

Ensure Data Accuracy: Implement robust data collection and verification processes to ensure the accuracy of reported information.

Communicate Transparently: Clearly communicate your ESG performance, achievements, and areas for improvement.

Continuously Improve: Regularly review and update your ESG strategies and reporting processes.

FAQs

Q: What is ESG and Sustainability Reporting? A: ESG and Sustainability Reporting involves disclosing a company's environmental, social, and governance practices and performance to stakeholders.

Q: Why is ESG and Sustainability Reporting important? A: It enhances transparency, attracts investors, improves risk management, builds reputation, and ensures regulatory compliance.

Q: What frameworks are used for ESG and Sustainability Reporting? A: Common frameworks include the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and Task Force on Climate-related Financial Disclosures (TCFD).

Q: How can companies improve their ESG and Sustainability Reporting? A: By defining clear objectives, engaging stakeholders, using standardized frameworks, ensuring data accuracy, communicating transparently, and continuously improving their practices.

Conclusion

ESG and Sustainability Reporting is essential for modern businesses seeking to demonstrate their commitment to sustainable and ethical practices. By following best practices and using standardized frameworks, companies can enhance their transparency, attract investors, and build a positive reputation.

Source:- https://esgandsustainabilityreporting.blogspot.com/2024/06/esg-and-sustainability-reporting.html

#Waste Strategy and Circular Economy#ESG and Sustainability Reporting#Net Zero and Carbon Management#Life Cycle Assessment(LCA) and Environment Product Declaration(EPD)#GHG Accounting and Assessment#Coastal Protection and Marine Bioremediation#Sustainable Aquaculture#Air Pollution Control equipment’s#Water Pollution Control Equipment#Energy and Water Audit

0 notes

Text

ESG Data - Future of ESG Data for Sustainable Decisions

For organizations, having the right ESG data is all about gathering the right level of information and gaining access to the very granular, question-level data so that that data can be used to make better decisions.

0 notes

Text

Future of ESG Data for Sustainable Decisions: ESG Data

The environmental, social, and governance (ESG) component is no longer one in which organizations can take part. Instead, it has evolved into one of the best methods for organizations to maintain their relevance and win the trust of their stakeholders. The quality of the acquired data is wholly responsible for the ESG movement's future. Organizations cannot be expected to produce accurate ESG reports without the proper data.

1 note

·

View note

Text

Uniphos Enterprises Limited Releases Business Responsibility and Sustainability Report for FY 2023-24

UEL is a leading player in trading in chemicals and agro-commodities. It has released its Business Responsibility and Sustainability Report (BRSR) for the fiscal year 2023-24. The report, presented in conformity with SEBI’s Listing Obligations and Disclosure Requirements Regulations, 2015, reflects the company’s initiative regarding ethical governance, environmental care, and social responsibility.

Overview: In an era where corporate accountability runs parallel, UEL’s BRSR 2023-24 reflects the commitment of UEL towards sustainability and responsible business behavior. The report epitomizes salient features of the company’s operations, best governance practices, and environmental impact, focusing on core values related to excellence, integrity, respect, and collaboration.

Body UEL was incorporated in 1969 and is essentially a trading company. A large portion of the turnover consists of trading in chemicals and agro commodities. For FY 2023–24, revenue from trading operations contributed 54.16%, while income from investments in equity shares and mutual funds contributed 42.26% of revenue.

The company is headquartered in Mumbai with regional offices based in Gujarat. Its staff is on deputation, with only a small number being UEL recruits; it has taken important steps in maintaining gender diversity—one-third of the members on the Board of Directors comprise women.

The report enumerates corporate governance practices in which UEL has also ensured the whistleblower policy to get grievances over and above transparency. UEL further states its due compliance with regulatory requirements, as amply evidenced by the reaction of the company to a minor delay in the regulatory filings for which the waiver of the fine was sought from stock exchanges.

Although UEL is not a manufacturing company, the report reflects the concern of the company regarding environmental sustainability. The environmental impact of UEL is very minimal, as the company consumes limited amounts of energy only and does not produce much waste that is considered harmful to the environment. The sustainability practice at UEL is mainly limited to ensuring full compliance with environmental laws and regulations, and operations are performed in a manner to ensure no adverse impact on the environment.

From the viewpoint of social responsibility, the activities of UEL are restricted to its scale of operation; however, the company maintains a conducive and non-threatening workplace. It is pointed out in the report that UEL follows the Rights of Persons with Disabilities Act, 2016, providing accessibility in offices and non-discrimination in employment.

UEL’s commitment to doing good business is further reflected in its anti-bribery and anti-corruption policies, although the company has not adopted a stand-alone anti-corruption policy; rather, the principles are encapsulated within its general code of conduct meant for all employees and major vendors.

Overview The Business Responsibility and Sustainability Report for FY 2023-24 underlines the commitment of Uniphos Enterprises Limited to promote the gold standard in corporate governance, care for the environment, and observe social responsibility. Though the operation of the company remains limited within the scope mentioned, its commitment remains toward responsible business practices. While moving forward with challenges in the modern business landscape, UEL remains focused on aspects related to sustainability, transparency, and ethical conduct and sets a good example for such categories of companies.

Source: BRSR Credit: Uniphos Enterprises Limited

#Business Ethics#Corporate Governance#Corporate Responsibility#Environmental stewardship#ESG#Sustainability Report#Sustainable Business

2 notes

·

View notes

Text

https://zoeiesg.com/esg-and-sustainability-reporting-in-india/

ESG Reporting Software in India Optimize your ESG strategy with our cutting-edge SaaS platform tailored for comprehensive ESG and sustainability reporting in India. From data collection to advanced analytics, our solution offers seamless integration, streamlining your reporting process and driving stakeholder engagement.

1 note

·

View note

Text

Alpin offers comprehensive solutions for Environmental Product Declarations (EPDs), ESG Reporting, and sustainability reporting, helping businesses meet the growing demand for transparency in carbon emissions calculations and decarbonization strategies. We specialize in assisting companies in achieving Green Building Certification and advancing their environmental impact through tailored strategies for sustainability and carbon reduction. With our expertise, businesses can effectively manage their environmental footprint, improve sustainability performance, and meet regulatory and market demands, contributing to a greener future. Let AlpinME guide you in adopting sustainable practices for long-term success.

#Environmental Product Declarations#ESG Reporting#Sustainability Reporting#Carbon Emissions Calculations

0 notes

Text

SFC India - Unlocking India’s Waste Opportunity Explore our in-depth report on textile waste management for Fashion for Good, highlighting key data and visuals. It calls for improved infrastructure and technology to enhance post-consumer waste recycling in India.

#sustainability report design services#esg report designing#esg report design services#sustainability report design agency

1 note

·

View note

Text

#sustainabilityreportassurance#esgreportassurance#sustainability report assurance#assuranceprovider#sustainability assurance#esg report assurance

0 notes

Text

What are the ESG topics that matter to Oil & Gas companies?

The oil and gas industry is undergoing a transformative shift as companies increasingly prioritize Environmental, Social, and Governance (ESG) considerations. Driven by the urgent need to address climate change, social responsibility, and ethical business practices, this shift goes beyond regulatory compliance. For the oil and gas sector, ESG is about aligning operations with sustainable practices that mitigate the industry's impact on the planet and the communities it touches. This transformation affects strategies, investments, and day-to-day operations, with a focus on emissions reduction, community well-being, resource efficiency, ethical governance, and adapting to regulatory changes.

ESG Topics That Matter for Oil and Gas Companies

Oil and gas companies face growing pressure to reduce greenhouse gas emissions, minimize their environmental impact, and adopt responsible resource extraction practices. ESG considerations help firms not only mitigate risks but also position themselves for long-term success in a rapidly evolving energy landscape. Below are some of the key ESG topics that are critical for the oil and gas industry today.

Climate Change and Carbon Emissions

The urgency to combat climate change puts a spotlight on carbon-intensive industries, with oil and gas being a major focus. Reducing carbon emissions, enhancing energy efficiency, and transitioning to renewable energy sources are business imperatives. By adopting low-carbon technologies and cleaner energy alternatives, companies can reduce their carbon footprint while staying competitive.

To effectively manage this, companies should set ambitious targets, such as achieving net-zero emissions by 2050, with interim milestones like a 30% reduction by 2030. Investing in renewable energy sources and implementing carbon capture and storage (CCS) technologies can further reduce risks. For example, BP has committed to becoming a net-zero company by 2050, aiming to reduce operational emissions by 30-35% by 2030.

Health, Safety, and Community Well-being

Operating in challenging environments, oil and gas companies must prioritize the safety of their workforce and maintain strong relationships with local communities. This includes implementing robust safety protocols, investing in training programs, and actively engaging with communities to address their concerns. By fostering inclusive and safe working conditions, companies can earn the trust of stakeholders and strengthen their social license to operate.

Resource Efficiency and Waste Management

Effective management of natural resources, such as water and energy, is crucial for the oil and gas sector. Companies are increasingly adopting innovative technologies to optimize resource use, reduce waste, and manage emissions. These practices help meet environmental regulations and drive cost savings through improved operational efficiency.

Ethical Governance and Transparency

Governance practices play a vital role in establishing a company’s integrity. Transparent decision-making, accountability, and adherence to regulations are key components of ethical governance. Companies that implement strong governance frameworks demonstrate a commitment to ethical practices, which builds stakeholder trust and attracts responsible investments.

Adaptation to Regulatory Changes

The evolving regulatory landscape presents both challenges and opportunities for oil and gas companies. Adopting ESG principles can help companies anticipate and adapt to new regulations, ensuring compliance while reducing legal and reputational risks.

An Example of ESG Report from an Oil and Gas Company: ExxonMobil

ExxonMobil’s 2023-2024 progress report illustrates the company’s efforts towards sustainability, focusing on emissions reduction, investments in low-carbon technology, operational efficiency, and community engagement. These initiatives underscore ExxonMobil's commitment to aligning its operations with ESG principles.

Emissions Reduction: ExxonMobil reported a 15% reduction in operational emissions compared to 2022, as part of their broader strategy to reduce greenhouse gas emissions in support of a net-zero future. The 2030 emission-reduction plans include a target to reduce corporate-wide greenhouse gas intensity by 20-30%, with upstream reductions of 40-50%. Additionally, the company aims to achieve a 70-80% reduction in methane intensity and a 60-70% reduction in flaring intensity compared to 2016 levels. These initiatives focus on optimizing energy use, implementing new technologies, and improving energy management practices.

Investment in Low-Carbon Technologies: ExxonMobil increased its planned investments for lower-emission initiatives from 2022 through 2027 to approximately $17 billion, representing a nearly 15% increase. These investments are aimed at reducing emissions in the company's operations and enabling others to reduce their emissions through technologies like carbon capture and storage (CCS), hydrogen, and biofuels. The company has set a goal to reach net-zero Scope 1 and 2 emissions in its Permian Basin unconventional operated assets by 2030, utilizing electrification with renewable power, advanced methane detection, and flaring elimination.

Operational Efficiency: The report highlights a 10% increase in overall productivity achieved through measures such as energy optimization and the use of digital technologies for asset management. These efficiency improvements are part of a broader effort to reduce the environmental impact of operations while maintaining competitive financial performance.

Community and Environmental Impact: ExxonMobil has launched various initiatives aimed at community development and environmental conservation, which include programs for education, health, and habitat restoration. The company is also working towards eliminating routine flaring in its Permian Basin operations in line with the World Bank Zero Routine Flaring Initiative, helping to further mitigate greenhouse gas emissions.

Governance and Compliance: The company continues to advocate for supportive policies that facilitate the development of lower-emission technologies, including CCS and hydrogen. ExxonMobil’s emission-reduction plans are aligned with Paris Agreement pathways, which involve reducing corporate greenhouse gas emissions and integrating lower-carbon energy sources into their operations.

The report emphasizes ExxonMobil's commitment to integrating emission-reduction strategies, investing in low-carbon technology, enhancing operational processes, and promoting sustainable development as key elements in advancing toward a net-zero future.

Conclusion

For the oil and gas industry, ESG is not just a passing trend; it is a strategic imperative. By prioritizing climate change mitigation, health and safety, resource efficiency, ethical governance, and regulatory adaptation, companies can secure their place in a sustainable and responsible energy future.

At Ecodrisil, we believe that integrating sustainable practices can open doors to new opportunities as companies navigate the energy transition. ESG helps address key issues, ensures compliance with regulations, and enhances overall performance. To simplify ESG reporting and manage risks effectively, oil and gas companies can leverage platforms like Ecodrisil ESG Xpress for streamlined reporting and compliance. Embracing ESG is not just the right choice—it’s essential for long-term success. Together, we can build a more sustainable and resilient energy sector.

#oil and gas#oilandgas#esg#esg reporting#oil and gas sector#oil and gas industry#oil and gas companies#sustainability#sustainabilitysolutions

0 notes

Text

#Waste Strategy and Circular Economy#ESG and Sustainability Reporting#Net Zero and Carbon Management#Life Cycle Assessment(LCA) and Environment Product Declaration(EPD)#GHG Accounting and Assessment#Coastal Protection and Marine Bioremediation#Sustainable Aquaculture#Air Pollution Control equipment’s#Water Pollution Control Equipment’s#Energy and Water Audit

0 notes

Text

Driving Sustainable Growth: The Rising Importance of ESG in Business Strategy

Investors have increasingly relied on environmental, social, and governance (ESG) criteria to screen companies and assess their impact on socioeconomically crucial stakeholders. Corporations now recognize that integrating ESG principles into business strategies is essential for maintaining business ethics and achieving lasting growth. This post explores the rising importance of ESG in business strategy from a sustainable growth perspective.

What is ESG, and Which Compliance Metrics Matter to It?

ESG refers to three broad classes of performance or compliance metrics that explain how an enterprise has improved its impact on the environment, people, and financial systems. Many ESG reporting solutions assist leaders in determining relevant frameworks aimed at sustainability accounting compliance. For instance, a fishing business will differ from a construction firm in how it affects air, water, land, and biological resources.

Standardized ESG reporting often encompasses environmental metrics like carbon footprint, waste management, biodiversity preservation, and plastic reductions. Social aspects focus on employee health, women empowerment, multiculturalism, inclusivity, and accessibility. The governance pillar in ESG criteria requires excellent cybersecurity measures and accurate financial record-keeping for transparency.

The Importance of ESG in Business Strategy for Sustainable Growth

ESG is an integral part of current business strategies. Stakeholders such as investors, consumers, and employees are increasingly evaluating brands based on their ESG performance. Companies that ignore ESG and sustainable development goals risk losing market relevance.

Leaders aim to avoid regulatory penalties and reputational damage due to non-compliance. Many employ sustainability consulting services to explore how their organizations can achieve better ratings. Here are some advantages highlighting the growing significance of ESG compliance in every sustainable business strategy:

Driving Sustainable Growth Through ESG is Easier

ESG is critical to business growth strategy due to its ability to initiate companies’ transition to more sustainable practices. Sustainable growth refers to long-term financial success that also emphasizes the preservation of environmental resources, promoting social equity, and holding brands accountable for data usage, taxation, and investor disclosures through governance standards.

Companies with an ESG focus can better react to shifting regulatory circumstances, accommodate changes in consumer preferences, and respond to belief systems during personalization or messaging campaigns. This enhances client retention amidst fluctuating market trends.

ESG Encourages Efficient Tech Adoption with Cost Optimization Opportunities

Environmental responsibility helps enterprises focus on being more resource-efficient, offering diverse options to reduce costs with innovative power management systems. For example, investing in renewable energy lowers carbon footprints and decreases long-term operational expenses.

Corporate stakeholders that adopt sustainable practices are better prepared for future regulations aimed at combating climate change. This proactive approach reduces the risk of penalties and positions them as industry leaders in sustainability and ESG compliance.

Leaders Improve Stakeholder Relationships Thanks to ESG

Companies that treat employees well are likely to become great workplaces and attract talent from diverse job applicants. They can employ engagement strategies based on ESG criteria to demonstrate respect for community values, cultural events, and employee welfare. Sustainable businesses can foster loyalty towards their brands with ease.

Modern, tech-savvy consumers and investors align their concerns with ethical expectations involving labor integrity, transparency, and organizational commitment to diversity. Employees also prefer working for organizations with remarkable social values and openness to multicultural inclusion. These realities facilitate better relationship management for ESG-compliant businesses.

ESG Criteria May Promote Transparent Communication and Accountability

Integrating a robust governance framework ensures transparency, encouraging stakeholders to support business decisions due to the honesty signaled by clear communication. Teams become more responsible about their work routines and obligations, including data protection procedures.

For example, offering an unambiguous privacy and data processing policy lets stakeholders make informed choices about allowing a company to track their interactions and personalize their experiences. Assigning unique user roles with restricted data access rights helps combat corporate espionage and mitigate risks like the theft of intellectual property rights (IPRs) and trade secrets.

New Opportunities to Boost Competitiveness Become Available

Sustainability accounting compliance and ESG reporting metrics allow for novel methods to conduct competitiveness studies. Consider two organizations with identical financial metrics: one relying on conventional fuels and another using renewable energy without engaging in worker exploitation. The latter becomes a more attractive asset to ethical investors, offering a responsible and creative avenue to surpass competitors.

Innovation Has to Increase to Thrive as a Business and Ensure Compliance

Sustainable development goals (SDGs) aim for a cleaner, safer, and more transparent future, but current technologies have bottlenecks restricting industrial progress. ESG metrics indicate that corporations must create new solutions to stay productive without polluting the environment.

Academic research, ideal for controlled environments, often lacks commercial viability. Educational policy revisions call for extensive collaboration between academia and industry leaders. ESG audits provide insights into compliance issues that scholarly projects can address, making compliance assessments essential for finding practical ideas to innovate industrial standards.

Conclusion

Environmental, social, and governance compliance enables leaders to craft a sustainable business strategy for effective resource usage. It encourages brands to educate employees on data processing methods, respect customer consent, and ensure transparency in communications. Creating inclusive work environments is crucial for being an ESG-compliant enterprise.

Sustainable business growth necessitates transitioning to renewable energy, preventing cultural biases, and practicing financial integrity. If available technologies are insufficient, corporations must invest in goal-oriented research and development for green innovations.

Holistic assessments can swiftly identify business aspects requiring immediate attention from a sustainability and ESG compliance perspective. Onboarding domain experts for process-specific guidance will likely help more.

0 notes

Text

Unlocking the Value of ESG Reporting for Sustainable Growth

In today’s rapidly evolving business environment, ESG reporting is no longer a "nice-to-have"—it’s essential. As the global push for sustainability intensifies, companies are increasingly judged not just by their financial performance but also by how they manage their environmental and social impact. Accacia, a leader in climate tech, provides advanced solutions to help companies simplify and streamline their ESG reporting process, ensuring that they remain compliant, transparent, and ahead of the curve.

The Importance of ESG Reporting

ESG reporting allows businesses to measure environmental and social impact while identifying risks and opportunities. It encompasses a range of factors including carbon emissions, energy consumption, water use, diversity initiatives, labor practices, and corporate governance. These metrics are crucial as investors, regulators, and stakeholders demand greater transparency in sustainability efforts. Effective ESG reporting is not only about compliance but also about building trust, reputation, and long-term value for businesses.

The Accacia Advantage: AI-Powered ESG Solutions

Accacia’s AI-driven platform offers an integrated approach to ESG reporting, making it easier for companies to manage data across their real estate portfolios. Our platform provides real-time data collection, automated insights, and tailored reporting frameworks aligned with global standards like GRESB, TCFD, and GRI. The result is a highly efficient process that reduces manual effort while enhancing accuracy and credibility.

Our platform enables users to track various ESG metrics across multiple assets and geographies, such as energy usage, carbon emissions, and waste management. By leveraging machine learning and automation, companies can generate ESG reports with actionable insights that support strategic decision-making and enhance their sustainability performance.

Beyond Reporting: A Strategic Decarbonization Tool

ESG reporting with Accacia goes beyond data. Our platform empowers companies to move from measurement to action. By identifying key areas for improvement, businesses can implement decarbonization strategies, align with regulatory frameworks like BERDO and LL97, and set measurable goals for reducing carbon footprints. This enhances compliance and positions companies as leaders in sustainable practices, attracting investors and partners focused on long-term value creation.

Conclusion

Incorporating ESG reporting into your business strategy is vital for future-proofing your company. With Accacia’s AI-powered platform, businesses can easily navigate the complexities of ESG reporting, driving sustainable growth and creating a lasting positive impact on the environment and society.

0 notes

Text

Alpin has grown to encompass some of the world’s leading voices and thought leaders in the field of sustainable development and climate change, so much so that what started off as a niche advisory service has grown into a holistic service offering Sustainability Reporting that incorporates all of the elements and aspects that would play a role in creating a sustainable development or policy. The essence of our work lies in our flexibility, giving us the ability to match the very best consultants to your project’s needs, no matter the size or sector. We draw from a trusted pool of highly experienced, regionally based project managers as well as Decarbonization Strategies to create a winning team.

#carbon emissions calculations#decarbonization strategies#epd#green building certification#sustainability#Environmental Product Declarations#Sustainability Reporting#Acoustic Engineering#LEED Certification#WELL Certification#Independent Commissioning Authority#Commissioning Management#Net Zero Advisory#ESG Advisory

0 notes

Text

How Does Sustainability Reporting Influence Consumer Behavior and Brand Loyalty?

Sustainability has become a key focus for businesses and consumers alike in recent years. As environmental, social, and governance (ESG) concerns grow, companies are increasingly being asked to demonstrate their commitment to sustainability through transparent and effective Sustainability Reporting and ESG Reporting. These reports serve not only as a tool for businesses to communicate their efforts in sustainability but also play a significant role in influencing consumer behavior and fostering brand loyalty.

The Rise of Conscious Consumerism

In today's global market, consumers are becoming more aware of the environmental and social implications of their purchasing decisions. This growing awareness has led to the rise of conscious consumerism, where individuals prioritize products and services that align with their values. As a result, companies are under increasing pressure to not only meet the demands of their customers but also to showcase their commitment to sustainability and ethical practices.

Sustainability Reporting and ESG Reporting have become essential tools for companies to communicate their values and initiatives regarding sustainability. These reports provide consumers with clear, measurable data on a company's environmental impact, social responsibility, and governance practices. By disclosing this information, businesses can demonstrate their efforts to reduce their carbon footprint, promote ethical labor practices, and ensure transparent governance.

The Role of Sustainability Reporting in Shaping Consumer Perception

One of the key ways Sustainability Reporting influences consumer behavior is by shaping how consumers perceive a brand. Transparent and honest sustainability reports allow companies to present themselves as responsible corporate citizens that care about the environment and society. For example, when a company shares its goals and achievements in reducing waste, energy consumption, or greenhouse gas emissions, it signals to consumers that the brand is committed to making a positive impact.

Research has shown that consumers are more likely to trust brands that are transparent about their sustainability practices. A study conducted by Nielsen found that 66% of global consumers are willing to pay more for products and services from companies that are committed to social and environmental responsibility. This trust can be a powerful driver of consumer behavior, as people are increasingly choosing to support companies that align with their personal values.

Additionally, Sustainability Reporting can help companies build a stronger connection with their customers. By showcasing their dedication to sustainability, brands can differentiate themselves from competitors who may not be as transparent or committed to environmental and social issues. This differentiation can make a significant impact, especially in industries where consumers are highly attuned to issues like sustainability, such as fashion, food, and technology.

ESG Reporting and Consumer Expectations

While Sustainability Reporting focuses on environmental factors, ESG Reporting takes a broader approach by including social and governance factors as well. ESG Reporting allows companies to communicate their efforts not only in terms of sustainability but also regarding their treatment of employees, diversity and inclusion policies, corporate governance, and ethical sourcing practices. Consumers are becoming increasingly concerned with all aspects of a company's operations, and they expect brands to demonstrate a holistic commitment to sustainability.

For example, consumers want to know if a company treats its workers fairly, promotes diversity, and supports communities through charitable initiatives. ESG Reporting can provide this information in a way that is easily accessible and understandable. As a result, ESG Reporting can influence consumer behavior by helping them make more informed purchasing decisions based on factors that align with their ethical standards.

Moreover, ESG Reporting can impact consumer loyalty by fostering a sense of connection to a brand's values. When consumers feel that a brand is genuinely committed to making a positive social and environmental impact, they are more likely to develop a long-term relationship with the brand. This loyalty is essential for companies looking to maintain a competitive edge in a crowded marketplace.

How Transparency Builds Trust and Loyalty

Transparency is a cornerstone of both Sustainability Reporting and ESG Reporting. The more transparent a company is about its sustainability practices, the more trust it builds with its customers. Consumers are increasingly skeptical of corporate greenwashing, where companies falsely claim to be environmentally friendly without taking meaningful action. By providing clear, verifiable data in their Sustainability Reporting and ESG Reporting, companies can avoid accusations of greenwashing and demonstrate their genuine commitment to sustainability.

Trust is one of the most important factors that drive brand loyalty. When consumers trust a brand, they are more likely to become repeat customers, recommend the brand to others, and even pay a premium for its products or services. According to a study by Edelman, 81% of consumers say that they must trust a brand in order to buy from them. Furthermore, 73% of consumers are willing to pay more for a product that supports a good cause.

Through effective Sustainability Reporting and ESG Reporting, companies can not only build trust but also create a sense of accountability. Customers are more likely to stay loyal to brands that hold themselves accountable to their sustainability goals and regularly update their progress. This ongoing commitment to sustainability and transparency fosters a strong emotional connection between consumers and brands, which can lead to long-term loyalty.

The Influence of Sustainability Reporting on Consumer Purchase Decisions

Consumers are becoming more conscious of how their choices affect the world around them, and they are increasingly using their purchasing power to support brands that share their values. Sustainability Reporting plays a crucial role in this decision-making process by providing the necessary information for consumers to assess a brand's environmental and social impact.

For example, a consumer may choose to purchase a product from a brand that uses renewable energy, reduces waste, or sources materials ethically. Sustainability Reporting provides the transparency needed to demonstrate that a company is meeting these sustainability goals. When companies are clear about their achievements and challenges in these areas, they give consumers the confidence to make informed choices.

Moreover, ESG Reporting can influence purchase decisions by addressing not only environmental factors but also social and governance considerations. Consumers who are concerned about human rights, fair wages, and community engagement may gravitate toward brands that demonstrate strong ESG practices. By communicating their commitment to these values through ESG Reporting, companies can attract and retain consumers who prioritize ethical and socially responsible businesses.

The Competitive Advantage of Effective Sustainability Reporting

As the demand for sustainability continues to grow, companies that prioritize Sustainability Reporting and ESG Reporting can gain a significant competitive advantage. In industries where sustainability is a key differentiator, transparent reporting allows businesses to stand out from competitors. For example, in industries such as fashion, food, and consumer electronics, where environmental and social concerns are top priorities, effective Sustainability Reporting can help companies win the trust and loyalty of discerning consumers.

Brands that prioritize sustainability and transparency are more likely to attract the attention of both consumers and investors. In fact, studies have shown that companies with strong sustainability performance tend to outperform their peers financially. This is because consumers are increasingly willing to pay more for products and services from companies that align with their values, and investors recognize the long-term potential of sustainable businesses.

By leveraging Sustainability Reporting and ESG Reporting, companies can position themselves as leaders in the sustainability space, fostering brand loyalty and increasing their market share. The long-term benefits of this strategy extend beyond consumer trust and loyalty, contributing to the overall success and growth of the business.

Conclusion

Sustainability Reporting and ESG Reporting have become essential tools for companies looking to build consumer trust, influence purchase decisions, and foster brand loyalty. As consumers become more aware of the environmental and social impact of their purchases, they are increasingly turning to brands that prioritize sustainability and transparency. By providing clear and honest reports on their sustainability efforts, businesses can differentiate themselves from competitors, build lasting relationships with their customers, and contribute to a more sustainable future.

0 notes

Text

#sustainability report design services#report design services#esg report designing#sustainability report designing

1 note

·

View note

Text

Building a better tomorrow starts with smart choices today.

Enhance your ESG performance and make a positive impact!

0 notes