#Dubai Free Zone Authority.

Explore tagged Tumblr posts

Text

IFZA – Dubai’s Premier Business Hub

The International Free Zone Authority (IFZA) is a prominent business hub located in Dubai, UAE, offering exceptional opportunities for entrepreneurs and investors. Established to promote foreign investment, IFZA provides businesses with 100% foreign ownership, tax-free incentives, and a straightforward company setup process. Learn more about setting up businesses in Dubai here.

Key Benefits of Setting Up a Business with IFZA

100% Foreign Ownership: No local partner requirement, ensuring complete control over your business. Visit IFZA for more details.

Tax Incentives: Enjoy zero corporate tax, no import/export duties, and no VAT. Explore UAE Tax Benefits.

Simplified Setup: Benefit from an easy and quick company registration process. Discover the Dubai Business Hub.

Cost-Effective Solutions: IFZA offers affordable office and licensing packages to suit your business needs. Learn about Dubai Trade.

IFZA Expansion in India

In addition to its Dubai base, IFZA has expanded its reach to Hyderabad, India, providing businesses in the region with seamless support in establishing a presence in Dubai. This expansion presents unique opportunities for companies in India to tap into global markets. Find out more about India’s investment opportunities.

For further insights on global business setups, visit the World Bank: Business Environment.

#IFZA Dubai#Dubai Business Hub#Free Zone in Dubai#Business Setup in Dubai#Dubai Company Formation#IFZA Free Zone#Dubai Business Opportunities#UAE Business Hub#Dubai Economic Zone#Business Licensing Dubai#Dubai Entrepreneurship#IFZA Business Solutions#Company Incorporation Dubai#UAE Business Setup Services#Dubai Free Zone Authority.

1 note

·

View note

Text

"In some cities, as many as one in four office spaces are vacant. Some start-ups are giving them a second life – as indoor farms growing crops as varied as kale, cucumber and herbs.

Since its 1967 construction, Canada's "Calgary Tower", a 190m (623ft) concrete-and-steel observation tower in Calgary, Alberta, has been home to an observation deck, panoramic restaurants and souvenir shops. Last year, it welcomed a different kind of business: a fully functioning indoor farm.

Sprawling across 6,000sq m (65,000 sq ft), the farm, which produces dozens of crops including strawberries, kale and cucumber, is a striking example of the search for city-grown food. But it's hardly alone. From Japan to Singapore to Dubai, vertical indoor farms – where crops can be grown in climate-controlled environments with hydroponics, aquaponics or aeroponics techniques – have been popping up around the world.

While indoor farming had been on the rise for years, a watershed moment came during the Covid-19 pandemic, when disruptions to the food supply chain underscored the need for local solutions. In 2021, $6bn (£4.8bn) in vertical farming deals were registered globally – the peak year for vertical farming investment. As the global economy entered its post-pandemic phase, some high-profile startups like Fifth Season went out of business, and others including Planted Detroit and AeroFarms running into a period of financial difficulty. Some commentators questioned whether a "vertical farming bubble" had popped.

But a new, post-pandemic trend may give the sector a boost. In countries including Canada and Australia, landlords are struggling to fill vacant office spaces as companies embrace remote and hybrid work. In the US, the office vacancy rate is more than 20%.

"Vertical farms may prove to be a cost-effective way to fill in vacant office buildings," says Warren Seay, Jr, a real estate finance partner in the Washington DC offices of US law firm ArentFox Schiff, who authored an article on urban farm reconversions.

There are other reasons for the interest in urban farms, too. Though supply chains have largely recovered post-Covid-19, other global shocks, including climate change, geopolitical turmoil and farmers' strikes, mean that they continue to be vulnerable – driving more cities to look for local food production options...

Thanks to artificial light and controlled temperatures, offices are proving surprisingly good environments for indoor agriculture, spurring some companies to convert part of their facilities into small farms. Since 2022, Australia's start-up Greenspace has worked with clients like Deloitte and Commonwealth Bank to turn "dead zones", like the space between lifts and meeting rooms, into 2m (6ft) tall hydroponic cabinets growing leafy greens.

On top of being adaptable to indoor farm operations, vacant office buildings offer the advantage of proximity to final consumers.

In a former paper storage warehouse in Arlington, about a mile outside of Washington DC, Jacqueline Potter and the team at Area 2 Farms are growing over 180 organic varieties of lettuce, greens, root vegetables, herbs and micro-greens. By serving consumers 10 miles away or less, the company has driven down transport costs and associated greenhouse emissions.

This also frees the team up to grow other types of food that can be hard to find elsewhere – such as edible flower species like buzz buttons and nasturtium. "Most crops are now selected to be grown because of their ability to withstand a 1,500-mile journey," Potter says, referring to the average distance covered by crops in the US before reaching customers. "In our farm, we can select crops for other properties like their nutritional value or taste."

Overall, vertical farms have the potential to outperform regular farms on several environmental sustainability metrics like water usage, says Evan Fraser, professor of geography at the University of Guelph in Ontario, Canada and the director of the Arell Food Institute, a research centre on sustainable food production. Most indoor farms report using a tiny fraction of the water that outdoor farms use. Indoor farms also report greater output per square mile than regular farms.

Energy use, however, is the "Achilles heel" of this sector, says Fraser: vertical farms need a lot of electricity to run lighting and ventilation systems, smart sensors and automated harvesting technologies. But if energy is sourced from renewable sources, they can outperform regular farms on this metric too, he says.

Because of variations in operational setup, it is hard to make a general assessment of the environmental, social and economic sustainability of indoor farms, says Jiangxiao Qiu, a landscape ecologist at the University of Florida and author of a study on urban agriculture's role in sustainability. Still, he agrees with Fraser: in general, urban indoor farms have higher crop yield per square foot, greater water and nutrient-use efficiency, better resistance to pests and shorter distance to market. Downsides include high energy use due to lighting, ventilation and air conditioning.

They face other challenges, too. As Seay notes, zoning laws often do not allow for agricultural activity within urban areas (although some cities like Arlington, Virginia, and Cincinnati, Ohio, have recently updated zoning to allow indoor farms). And, for now, indoor farms have limited crop range. It is hard to produce staple crops like wheat, corn or rice indoors, says Fraser. Aside from leafy greens, most indoor facilities cannot yet produce other types of crops at scale.

But as long as the post-pandemic trends of remote work and corporate downsizing will last, indoor farms may keep popping up in cities around the world, Seay says.

"One thing cities dislike more than anything is unused spaces that don't drive economic growth," he says. "If indoor farm conversions in cities like Arlington prove successful, others may follow suit.""

-via BBC, January 27, 2025

1K notes

·

View notes

Text

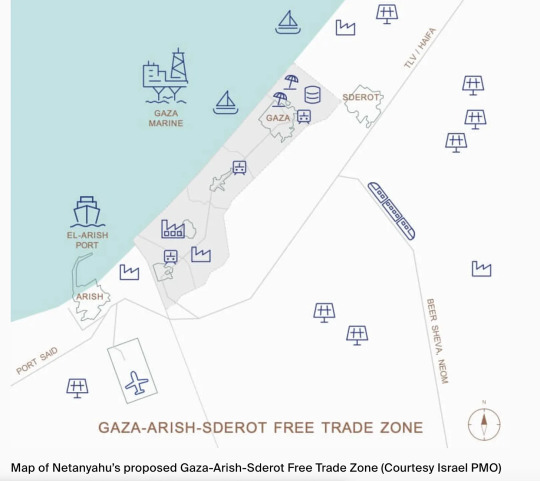

Adam Tooze giving some pitch-perfect pornography targeted at me specifically with Israel's "Gaza 2035: A three-step master plan to build what they call the Gaza-Arish-Sderot Free Trade Zone", capped with an AI generated Gaza-Dubai:

I'm in love, this is so glorious. "The world if Israel could play around with Gaza like a little set of Legos" tell me this is not identical energy:

Except its not a shitpost its an actual report from the Office of the Prime Minister. And folks we have got it all! The most convoluted administration system you could possibly imagine for no reason:

The new free trade zone would be administered by Israel, Egypt, and what the Israeli Prime Minister calls the Gaza Rehabilitation Authority (GRA)—a proposed Palestinian-run agency that would oversee reconstruction in Gaza and “manage the Strip’s finances.”

A cutesy little minimalist graphic of all the brand new industries that will magically become globally competitive in export markets because Israel says so:

The beach resorts are in my beloved!! But what are the little factories you ask? Oh nothing, just electric car production facilities!

Remember, before building your first factory, you need 18 Burj Khalifas. We economists call this "infrastructure development", take notes.

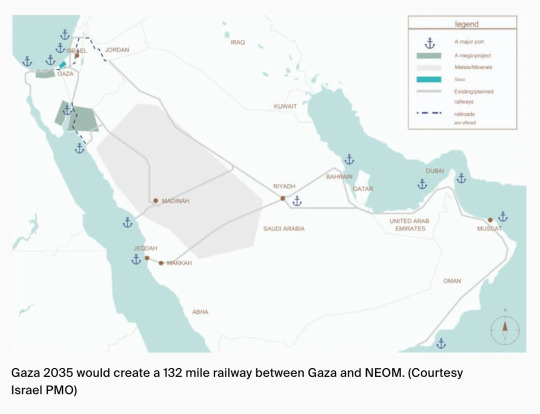

It will have high-speed rail through its center, oil projects on the coast, and of course, I'm saving the best for last - a rail project to NEOM:

🥳The 🥳Line 🥳Mentioned 🥳

The legend on the map literally just says "a mega project" like, oh yeah, one of those! See em all the time.

Now, you might be asking - Ash, if this is your goal wouldn't you have not destroyed every square inch of habitable urban infrastructure in Gaza and shredded their economy into scraps of paper soaked in blood if your plan was to Singapore-on-the-Sea the place? You sweet summer child, those apartments? They are apartments of the past, darling, you don't need organically developed urban ecologies built over time to compliment human habitation. That is for fucking libs. All of this "war" thing was just set-up to create a blank slate for the construction of The Line 2: Its Definitely Real This Time!

I am going to murder James C Scott myself just so I can hover this plan over his corpse and watch the sheer hubris of this monument to the state's desire for legibility and technocratic solutionism resurrect him from the goddamn grave.

"Well....at least after all this they would have to recognize Palestine as a stat-" Woah woah woah woah, hold on:

The final stage would be when Palestine signs the Abraham Accords signaling “Palestinian self-rule,” albeit without statehood

Lets not...lets not get overambitious here. Baby steps, you know? We have to be careful.

Anyway this is the most ludicrously ill-considered and ill-presented reconstruction plan I have ever seen in my life and I shudder to think that, instead of it being an off-hand drip of propaganda intended solely to brush off nosey reporters and diplomats, it might actually be serious. Bibi hasn't let me down yet on the "thinking things through" front!

But tbc if this was fiction - instead of a ruthlessly grim reality - the Regional Deputy Minister of Trade charged with implementing this technocratic abortion would be my precious little blorbo and I would stan her to hell and back.

90 notes

·

View notes

Text

Step-by-Step Guide to Setup New Business in Dubai

Dubai offers incredible opportunities for entrepreneurs with its strategic location, tax benefits, and business-friendly environment. Here's a quick guide to setup new business in Dubai:

1. Choose Your Business Structure

Decide between a Sole Proprietorship, LLC, Free Zone Company, or Branch Office, based on your business goals.

2. Select a Business Activity

Select from a range of pursuits that correspond with your area of expertise and the needs of the market, such as trade, technology, or services.

3. Pick a Location: Free Zone or Mainland

Free Zones: Take advantage of complete foreign ownership and tax exemptions.

Mainland: Needs a local partner but offers more operational flexibility.

4. Obtain the Necessary License

Apply for a Commercial, Professional, or Industrial License through the DED or relevant Free Zone Authority.

5. Register Your Business Name

Make sure your company name is distinctive and conforms with regional laws.

6. Visa and Immigration

Submit applications for your team's work permits and business visa to the UAE.

7. Open a Bank Account

To manage your company's finances and transactions, pick a nearby bank.

Why Setup New Business in Dubai?

Tax Benefits: Exemptions and low taxes, particularly in free zones.

Strategic Location: Provides access to international markets.

Business-friendly: Easy to set up with government assistance.

Ready to setup a new business in Dubai? Contact us today for expert guidance!

#BusinessSetupDubai#EntrepreneurshipDubai#DubaiBusinessOpportunities#StartBusinessInDubai#DubaiFreeZones#UAEEntrepreneur#DubaiBusinessSetupGuide#DubaiBusinessVisa#InvestInDubai#BusinessGrowthDubai

2 notes

·

View notes

Text

Comprehensive Guide to PRO Services in Dubai

Comprehensive Guide to PRO Services in Dubai

Dubai, a bustling metropolis and a global business hub, is renowned for its favorable business environment and strategic location. However, navigating the legal and bureaucratic landscape can be complex for entrepreneurs and expatriates. This is where PRO (Public Relations Officer) services come into play. This blog provides an in-depth look at PRO services in Dubai, their significance, and how they can facilitate your business operations.

What Are PRO Services?

PRO services in Dubai are specialized administrative services designed to assist individuals and businesses in handling governmental procedures and documentation. These services are crucial for ensuring compliance with local regulations, obtaining necessary permits, and managing paperwork efficiently.

Key Functions of PRO Services

Document Processing and Filing

Business Licenses: PRO services handle the application and renewal of various business licenses required to operate legally in Dubai.

Visas: They assist in securing work permits, residence visas, and other necessary visas for employees and dependents.

Trade Licenses: Assistance with obtaining and renewing trade licenses specific to your business activity.

Government Relations

Ministry Interactions: PROs act as intermediaries between your business and various governmental bodies, including the Ministry of Human Resources and Emiratization (MOHRE) and the Department of Economic Development (DED).

Regulatory Compliance: Ensuring your business complies with local regulations, such as labor laws and commercial regulations.

Company Formation

Company Registration: Facilitating the registration process of new businesses, including free zone and mainland company setups.

Documentation: Preparing and submitting required documents for company formation, such as Memorandums of Association and Articles of Incorporation.

Legal and Compliance Services

Labor Contracts: Drafting and managing labor contracts in compliance with UAE labor laws.

Trade Marks: Registering and renewing trademarks to protect intellectual property.

Visa Services

Employee Visas: Processing work visas for employees and ensuring they meet the criteria set by the UAE authorities.

Family Visas: Assisting expatriates with obtaining family visas for their dependents.

Renewals and Updates

License Renewals: Handling the renewal of business and trade licenses before they expire.

Document Updates: Updating records and documents with the relevant authorities as required.

Benefits of Using PRO Services

Expertise and Efficiency

PRO service providers have extensive knowledge of local regulations and procedures, ensuring that all paperwork is handled correctly and efficiently.

Time-Saving

Outsourcing administrative tasks to PRO services allows businesses to focus on core activities and strategic goals, saving valuable time.

Regulatory Compliance

Ensuring compliance with complex and frequently changing regulations can be challenging. PRO services help avoid legal issues and potential fines by staying up-to-date with current laws.

Local Knowledge

PROs have a deep understanding of the local business environment and can navigate the intricacies of governmental processes more effectively than outsiders.

Stress Reduction

Handling bureaucratic processes can be stressful. PRO services alleviate this burden, reducing administrative stress for business owners and expatriates.

2 notes

·

View notes

Text

What to Look for When Buying Residential Properties in Dubai

Buying residential properties in Dubai requires careful consideration of various factors to ensure you make a wise investment. This blog outlines what to look for when buying residential properties in Dubai.

For more information on real estate, visit Dubai Real Estate.

Location

Proximity to Amenities: Choose a location that offers easy access to essential amenities such as schools, healthcare facilities, shopping malls, and public transportation. Proximity to these amenities enhances the property's value and convenience.

Future Development Plans: Research future development plans in the area, including infrastructure projects, commercial developments, and recreational facilities. Areas with planned developments often experience appreciation in property values.

Neighborhood Safety: Ensure the neighborhood is safe and secure. Check crime rates and the presence of security measures such as gated communities and surveillance systems.

For property purchase options, explore Invest in Dubai Real Estate.

Property Condition

Structural Integrity: Inspect the property for any structural issues, such as cracks, leaks, or foundation problems. A property in good structural condition requires less maintenance and ensures a longer lifespan.

Interior and Exterior Finishes: Evaluate the quality of the interior and exterior finishes, including flooring, walls, roofing, and fixtures. High-quality finishes enhance the property's appeal and durability.

Age of the Property: Consider the age of the property. Newer properties may require less maintenance, while older properties might have historical charm but could need renovations.

For mortgage services, consider Mortgage Company in UAE.

Developer Reputation

Track Record: Research the developer's track record and reputation in the market. Established developers with a history of delivering high-quality projects on time are usually a safer choice.

Customer Reviews: Look for customer reviews and testimonials from previous buyers. Positive feedback and satisfied customers indicate the developer's reliability and commitment to quality.

Completed Projects: Visit completed projects by the developer to assess their construction quality, design, and overall appeal. This provides insights into what you can expect from the property you are considering.

For rental property management, visit Rent Your Property in Dubai.

Legal and Regulatory Compliance

Title Deed Verification: Ensure the property has a clear title and is free from any legal disputes or encumbrances. The DLD provides title deed verification services to help buyers confirm the property's legal status.

Sales Agreement: Review the sales agreement carefully and seek legal advice if needed. Ensure all terms and conditions are clearly outlined, including the price, payment schedule, and any additional costs.

Permits and Approvals: Verify that the property has all the necessary permits and approvals from relevant authorities. This includes building permits, occupancy certificates, and compliance with zoning regulations.

For property sales, visit sell your house.

Investment Potential

Rental Yield: Research the potential rental yield of the property. High rental yields indicate strong demand and profitability for rental properties. Areas with high rental demand, such as those near business districts or tourist attractions, tend to offer better returns.

Capital Appreciation: Consider the potential for capital appreciation. Properties in areas with ongoing infrastructure development, economic growth, and high demand are more likely to appreciate in value over time.

Market Trends: Stay informed about market trends and economic indicators that impact property values. This includes factors such as interest rates, inflation, and government policies affecting the real estate sector.

Real-Life Success Story

Consider the case of James, an investor who successfully bought a residential property in Jumeirah Village Circle. James conducted thorough research, inspected the property's condition, and chose a reputable developer. By following the guidelines outlined in this blog, James secured a high-yield investment and has seen significant appreciation in property value.

Future Trends in Dubai Real Estate

Sustainable Developments: There is a growing demand for eco-friendly and sustainable properties in Dubai. Developers are increasingly incorporating green building practices and energy-efficient features into their projects.

Smart Homes: The adoption of smart home technology is on the rise. Properties equipped with advanced security systems, automated lighting, and climate control are becoming more popular.

Mixed-Use Communities: Integrated communities that offer a mix of residential, commercial, and recreational facilities are gaining popularity. These developments provide residents with a convenient and holistic living experience.

Conclusion

When buying residential properties in Dubai, it is essential to consider factors such as location, property condition, developer reputation, legal compliance, and investment potential. By paying attention to these aspects, you can make a well-informed decision and secure a valuable investment. For more resources and expert advice, visit Dubai Real Estate.

2 notes

·

View notes

Text

Ultimate Guide to Starting a Business in Dubai: Everything You Need to Know

Understanding Dubai’s Business Landscape

Dubai has a diverse and dynamic business landscape, catering to various industries such as trade, tourism, finance, real estate, and technology. It is essential to research and understand the market demand, competition, and potential opportunities for your proposed business idea.

Choosing the Right Business Structure

Dubai offers several business structures, including sole proprietorship, limited liability company (LLC), branch office, and free zone company. Each structure has its own advantages, requirements, and regulations. Selecting the appropriate structure is crucial for your business’s growth, liability protection, and tax implications.

Obtaining the Necessary Licenses and Approvals

Starting business in Dubai, UAE requires obtaining the necessary licenses and approvals from the relevant authorities. These may include trade licenses, commercial licenses, and other industry-specific permits. The process can be complex, so it’s advisable to seek guidance from legal experts or business consultants.

Free Zones: A Viable Option for Foreign Investors

Dubai’s free zones offer attractive incentives for foreign investors, such as 100% foreign ownership, tax exemptions, and streamlined business setup processes. Popular free zones include Dubai Multi Commodities Centre (DMCC), Dubai Internet City (DIC), and Dubai Design District (D3).

Finding the Right Location and Office Space

Choosing the right location and office space is essential for your business’s success. Dubai offers a range of options, from modern office towers to shared workspaces and free zone facilities. Consider factors such as accessibility, infrastructure, and proximity to your target market.

Hiring and Managing a Team

Building a strong and talented team is crucial for your business’s growth. Dubai’s diverse workforce offers a pool of skilled professionals from various backgrounds. However, it’s important to understand the local labor laws, visa requirements, and cultural nuances when hiring and managing employees.

Banking and Financial Considerations

Establishing a business banking account, securing funding, and managing finances are critical aspects of start business in Dubai. Research the local banking system, explore financing options (such as bank loans, investors, or government initiatives), and develop a solid financial plan.

Marketing and Promoting Your Business

With a competitive business environment, effective marketing and promotion strategies are essential for your business’s success. Leverage digital marketing, networking events, tradeshows, and other channels to reach your target audience and build brand awareness.

Complying with Legal and Regulatory Requirements

Dubai has a comprehensive legal and regulatory framework governing business operations. Familiarize yourself with the relevant laws, regulations, and compliance requirements to ensure your business operates legally and avoids penalties or fines.

Seeking Professional Assistance

Starting business in UAE can be a complex process, especially for those new to the region. Consider seeking professional assistance from business consultants, lawyers, or accountants to navigate the process smoothly and avoid costly mistakes.

Start business in Dubai can be a rewarding and lucrative endeavor, but it requires careful planning, understanding of the local business landscape, and adherence to the relevant laws and regulations. By following this ultimate guide and seeking professional advice when needed, you can increase your chances of success in this dynamic and thriving business hub.

2 notes

·

View notes

Text

Business setup in Dubai

Business setup in Dubai refers to the process of establishing a business entity within the city of Dubai, which is one of the seven emirates of the United Arab Emirates (UAE). Dubai is a thriving business hub known for its strategic location, robust infrastructure, and business-friendly environment. Here is a detailed explanation of business setup in Dubai:

Mainland Business Setup: Mainland business setup allows businesses to operate within the local market of Dubai and the UAE. It requires partnering with a local Emirati sponsor or a local service agent, depending on the nature of the business activity. The sponsor holds a minority share (typically 51%) in the company, while the majority share can be owned by foreign investors.

Free Zone Business Setup: Free zones in Dubai are designated areas that offer attractive incentives and benefits to businesses. These include 100% foreign ownership, tax exemptions, full repatriation of profits, and simplified procedures. Each free zone in Dubai caters to specific industries or sectors, such as Dubai Multi Commodities Centre (DMCC) for commodities trading, Dubai Internet City (DIC) for technology companies, and Dubai Media City (DMC) for media and advertising companies.

Offshore Business Setup: Dubai also offers offshore company formation through jurisdictions such as JAFZA Offshore and RAK Offshore. Offshore companies are not allowed to operate within the UAE market but are ideal for international business activities, asset holding, or as a vehicle for investment and wealth management. They provide privacy, tax advantages, and ease of administration.

Legal Structures: Dubai offers various legal structures for business setup, including Limited Liability Company (LLC), Sole Proprietorship, Partnership, Branch of a Foreign Company, and more. The choice of legal structure depends on factors such as ownership requirements, liability considerations, and business objectives.

Licensing and Permits: Business setup in Dubai requires obtaining the necessary licenses and permits from the relevant authorities. This includes trade licenses, professional licenses, industrial licenses, and specialized permits based on the nature of the business activity. The requirements vary depending on the type of business and the jurisdiction in which it is established.

Office Space and Infrastructure: Businesses in Dubai need to secure suitable office space or facilities to operate. This can be done through leasing commercial spaces, utilizing shared office spaces, or renting virtual offices. Dubai offers state-of-the-art infrastructure, modern office buildings, and world-class amenities to support business operations.

Visa and Immigration Services: Business setup in Dubai includes visa and immigration services for company owners, employees, and their dependents. This involves obtaining residence permits, work permits, investor visas, and other necessary documents from the Dubai Department of Economic Development (DED) and the General Directorate of Residency and Foreigners Affairs (GDRFA).

Compliance and Regulations: Businesses in Dubai must comply with local regulations, including financial reporting, tax obligations, labor laws, and industry-specific regulations. Compliance requirements vary based on the legal structure and the nature of the business activity. It is important to stay updated with the regulations and engage professional advisors to ensure ongoing compliance.

Dubai offers numerous advantages for businesses, including a strategic location that serves as a gateway to the Middle East, Africa, and Asia, a robust infrastructure, a diverse and multicultural workforce, political stability, and a supportive business ecosystem. However, navigating the business setup process in Dubai can be complex, and it is advisable to seek the assistance of experienced business setup consultants who can guide you through the legal requirements, procedures, and best practices to ensure a successful and compliant business establishment.

#business#business services#business setup#business setup company in dubai#business setup consultants in dubai#business setup in uae#business setup services in dubai#businessinuae#businesssetup#businesssetupdubai

8 notes

·

View notes

Text

Unlocking Success: Navigating Commercial Licenses in Dubai

A one-stop shop for business solutions, PRO Deskk is a company that believes in itself. With years of experience in the industry, we offer professional and excellent service for incorporating new companies, starting a new business, and handling related matters in the Mainland and Commercial License in different Free Zone Authorities.

Dubai Economic Department (DED) serves as the gatekeeper to the realm of commerce in this vibrant metropolis. Here, businesses are categorized into three distinct segments: Commercial, Professional, and Industrial licenses.

At the heart of trading endeavors lies the Commercial License, fondly dubbed as LLC formation. This license acts as the cornerstone for enterprises immersed in the art of buying and selling goods, paving the way for entrepreneurial ventures to thrive in Dubai's bustling marketplace.

What sets Dubai apart is its diverse array of licensing options tailored to suit every business need. For service-oriented ventures, the Professional License offers a gateway to a world of opportunities, accommodating professions, artisans, and craftsmen alike.

For those with a knack for production, the Industrial License stands as a beacon of hope. This license, which is intended for use by industrial companies, provides access to an uncharted territory of invention.

While DED oversees the issuance of these licenses, a handful of activities require nods of approval from external ministries and government bodies. From restaurant licenses governed by the Dubai Municipality to the oversight of banking services by the Central Bank of UAE, regulatory adherence remains paramount in Dubai's business landscape.

In Dubai, transparency reigns supreme. Therefore, both commercial and industrial licenses mandate registration with the Dubai Chamber of Commerce and Industry. This commitment to regulatory compliance underscores Dubai's reputation as a beacon of trust and reliability in the global business arena.

Beyond the initial registration, some licenses call for additional financial commitments to ensure compliance and accountability. Take, for instance, the Tourism License, where inbound and outbound ventures require bank guarantees to the tune of Dh100,000 and Dh200,000, respectively.

In essence, comprehending the nuances of commercial licenses in Dubai lays the foundation for entrepreneurial success. By embracing regulatory requirements and seizing available opportunities, businesses can chart a course towards growth and prosperity in the vibrant tapestry of Dubai's business landscape.

#DubaiBusiness#CommercialLicense#Entrepreneurship#BusinessOpportunities#LicenseToThrive#StartupsDubai#DubaiEntrepreneurs#NavigatingRegulations#prodeskk#dubaibusinesssetup#dubaifreezone#freezonedubai#corporateservices#businessindubai#uaebusiness

5 notes

·

View notes

Text

Sailing Smoothly: The Benefits of Free Zone Business Setup in Dubai

Embarking on a business venture in Dubai? Brace yourself for the thriving world of Free Zone Business Setup, a haven for foreign investors and entrepreneurs alike. While the prospect is enticing, navigating through the myriad of Dubai Free Zones can be a daunting task. Fear not, for expert guidance from our seasoned business consultants is just a click away, ready to craft a winning strategy tailored to your success.

Dubai boasts not one, but two enticing Free Zone Flavors: Free Zone Establishment (FZE) and Free Zone Company (FZ Co.) or Free Zone Limited Liability Company (FZ LLC). The key differentiator? The number of shareholders and their legal status. As each Dubai Free Zone dances to its unique set of rules, aligning your Dubai Free Zone company Pro services with the chosen Free Zone’s legal tapestry is paramount.

A symphony of over 30 Free Zones beckons entrepreneurs, each with its unique allure. From the international charm of IFZA (International Free Zone Authority) Dubai to the bustling trade hub of DMCC (Dubai Multi Commodities Centre) and the financial oasis that is DIFC (Dubai International Financial Centre), Dubai's canvas is vast. Explore the possibilities in JAFZA (Jebel Ali Free Zone), the innovation playground of Meydan, or the strategic hub of Dubai South (DWC) – options abound for your business aspirations.

Why should your business call a Dubai Free Zone home? Let's dive into the treasure trove:

Foreign Ownership Odyssey: Regardless of your nationality, Dubai Free Zones open the door to complete foreign ownership, paving the way for limitless possibilities.

Taxation Euphoria: Bid farewell to customs duties, VAT, import and export taxes, and corporate taxes. Dubai's Free Trade Zones create a tax haven, letting your business thrive financially.

Connectivity Extravaganza: Impeccable connectivity via ports, airports, and highways ensures that your business is seamlessly integrated into Dubai's dynamic landscape.

Infrastructure Marvels: Dubai Free Zones provide a playground of impeccable infrastructure and amenities, setting the stage for smooth business operations.

Express Lane Approvals: Say goodbye to bureaucratic delays. Dubai Free Zone company procedures are streamlined, ensuring swift approval of applications and documentation.

Repatriation Bliss: Full repatriation of capital, profits, and financial assets – Dubai Free Zones empower your business financially.

Labor and Immigration Ease: From recruitment to immigration formalities, Dubai Free Zones simplify processes, ensuring cost-effectiveness and efficiency.

As the entrepreneurial curtain rises, Dubai Free Zones Stand as the stage for your business symphony. Let the spotlight shine on your success story!

#DubaiBusiness#FreeZoneOpportunities#EntrepreneurialDubai#BusinessSetupStrategies#DubaiFreeZoneGuide#ProServicesDubai#TaxFreeBusiness

2 notes

·

View notes

Text

What is Freelance Visa in UAE?

Introduction

The UAE has become a top destination for freelancers, entrepreneurs, and digital nomads. With its tax-free income policies and business-friendly environment, many professionals are now seeking a freelance visa to work legally in the country. This guide will explain everything you need to know about freelance visas in the UAE, including the cheapest freelance visa UAE options, benefits, application process, and more.

What is a Freelance Visa in UAE?

A freelance visa in UAE is a legal permit that allows individuals to work independently without needing a full-time employer. This visa provides residency and the ability to conduct business as a self-employed professional in various fields such as IT, media, education, marketing, and consulting.

Key Features of a Freelance Visa in UAE:

Enables individuals to work for multiple clients

No requirement for a local sponsor

Access to UAE residency

Ability to open a business bank account

No need for a physical office space

Benefits of a Freelance Visa in UAE

A freelance visa in the UAE offers several advantages:

Legal Work Authorization – Work legally as a freelancer and issue invoices to clients.

Cost-Effective Business Setup – Compared to setting up a company, freelance visas are much cheaper.

Tax-Free Income – The UAE has zero income tax, allowing freelancers to keep all their earnings.

Flexibility – Work with multiple clients without restrictions.

Family Sponsorship – Some freelance visas allow you to sponsor dependents.

How to Apply for a Freelance Visa in UAE?

Applying for a freelance visa in the UAE is a simple process. Follow these steps:

Choose a Free Zone – Select the best free zone for your business needs.

Submit Required Documents – Typically includes passport copy, visa application form, qualification certificates, and portfolio.

Pay the Fees – Visa fees vary depending on the free zone and duration.

Obtain Freelance License Approval – Once approved, you will receive an establishment card.

Complete Medical Test & Emirates ID Process – This includes a health check and biometric scanning.

Get Visa Stamping – Once your visa is stamped, you can legally work as a freelancer.

Best Free Zones for Freelance Visa in UAE

Some of the most popular free zones offering freelance visas include:

Dubai (DDA, TECOM, Dubai South) – Best for media, IT, and tech professionals.

Abu Dhabi (twofour54) – Ideal for media and creative industries.

Sharjah Media City (SHAMS) – Affordable and flexible visa options.

Fujairah Creative City – Cost-effective for freelancers in multiple industries.

RAKEZ (Ras Al Khaimah Economic Zone) – Best for cost-conscious professionals.

Who is Eligible for a Freelance Visa in UAE?

Freelance visas are available for a variety of professions, including:

IT Specialists (Web Developers, App Developers, Cybersecurity Experts)

Media & Content Creators (Writers, Designers, Photographers, Videographers)

Marketing Professionals (SEO Experts, Social Media Managers, Digital Marketers)

Business Consultants & Trainers

Education & Coaching Professionals

Common Questions About UAE Freelance Visas

1. What is the cheapest freelance visa in UAE?

The cheapest freelance visa is offered by SHAMS (Sharjah Media City) and Fujairah Creative City, starting at AED 5,750.

2. How long does it take to get a freelance visa?

The process usually takes 7-15 business days, depending on documentation and medical test approvals.

3. Can I sponsor my family with a freelance visa?

Yes, many free zones allow you to sponsor your spouse and children.

4. Do I need a business bank account?

While not mandatory, having a business bank account helps in managing transactions and invoicing clients.

Final Thoughts & How to Get Started

A freelance visa in the UAE is an excellent option for self-employed professionals looking for flexibility, tax benefits, and legal work authorization. Whether you’re a digital nomad, entrepreneur, or remote worker, getting a freelance visa is a smart investment.

Ready to Apply for Your UAE Freelance Visa?

Explore the cheapest freelance visa options in UAE today and take the first step toward building your independent career!

#freelance visa UAE#Dubai freelance permit#UAE work visa#freelance work UAE#UAE residence visa#Dubai free zone#self-employment UAE#freelancer license UAE

0 notes

Text

Corporate Tax Services in Dubai, UAE

With the introduction of corporate tax in the UAE, businesses need to understand the regulations, compliance requirements, and strategies to optimize their tax liabilities. This guide provides insights into corporate tax services, ensuring your company stays compliant while maximizing financial benefits.

What is Corporate Tax in the UAE?

Corporate tax is a direct tax imposed on business profits. The UAE introduced corporate tax to align with global taxation standards while maintaining its business-friendly environment.

Key Aspects of UAE Corporate Tax:

Tax Rate: The standard corporate tax rate is 9% for taxable profits exceeding AED 375,000. Profits below this threshold remain tax-free.

Exemptions: Certain entities, such as government-owned organizations, extractive industries, and qualifying free zone businesses, may receive exemptions.

Effective Date: The tax regime came into effect on June 1, 2023.

Corporate Tax Registration in the UAE

All eligible businesses must register for corporate tax with the Federal Tax Authority (FTA). The process includes:

Obtaining a Tax Registration Number (TRN)

Submitting required documents, such as trade licenses and financial statements

Filing tax returns annually

Importance of Tax Compliance for UAE Businesses

Failing to comply with corporate tax regulations can lead to fines and penalties. To avoid non-compliance risks, businesses should:

Maintain accurate financial records

Submit tax filings on time

Ensure correct tax calculations and payments

Tax Planning Strategies to Reduce Liabilities

Strategic tax planning helps businesses reduce their corporate tax burden while ensuring compliance. Key tax-saving strategies include:

Utilizing Exemptions & Deductions – Identify deductible expenses and eligible exemptions.

Transfer Pricing Compliance – Ensure transactions between related entities meet regulatory requirements.

Efficient Business Structuring – Optimize company structures for tax efficiency.

How Corporate Tax Consultants Help

Partnering with professional corporate tax consultants in the UAE ensures businesses stay compliant while optimizing tax liabilities. Services include:

Corporate tax registration

Tax compliance and reporting

Tax advisory and planning

Tax audits and dispute resolution

As an authorised agent for company formation in Dubai, Unicorn Global Solutions Business Setup is ready to provide unparalleled business setup services in the UAE. Our extensive range of solutions is meticulously designed to elevate quality and amplify client service, offering a comprehensive suite of offerings. From company registration and essential documentation to translation services, sponsorship support, business licensing, furnished office spaces, and PRO services – we cover it all. With Unicorn Global Solutions Business Setup, your Dubai venture gains the expertise and unwavering support it deserves, ensuring timely solutions every single time.

#Corporate tax registration#Tax compliance and reporting#Tax advisory and planning#taxcomplianceuae#vatservices#taxconsultantsdubai#accounting services#accountingservices#vatregistrationuae

0 notes

Text

The Role of the Dubai International Financial Centre (DIFC) in Attracting International Businesses

The Dubai International Financial Centre (DIFC) has become an ideal destination for international businesses, particularly in the financial sector. Established in 2004, DIFC has played a significant role in positioning Dubai as a leading global financial center.

The DIFC has rapidly evolved into a premier global financial hub, strategically positioned to serve the Middle East, Africa, and South Asia (MEASA) regions. Its unique blend of regulatory frameworks, strategic location, and comprehensive infrastructure has made it a magnet for international businesses seeking growth and stability.

This post gives insights into the various facets of DIFC and the role it plays in attracting foreign investments.

WHAT MAKES DIFC IDEAL FOR BUSINESS SETUP IN DUBAI?

1. Strategic Geographical Position

Dubai's location offers unparalleled access to emerging markets. With over 2.2 billion people within a five-hour flight radius, businesses in Dubai can efficiently tap into diverse markets across MEASA.

2. Robust Regulatory Framework

DIFC's legal and regulatory environment is tailored to meet international standards.

Independent Regulatory Authority: The Dubai Financial Services Authority (DFSA) ensures stringent oversight, fostering investor confidence.

Common Law Framework: Operating under an English common law system, DIFC provides legal clarity and consistency for international entities.

Free Zone Benefits: As a free zone, DIFC offers 100% foreign ownership, zero taxes on corporate income and profits for 50 years, and unrestricted capital repatriation.

3. Comprehensive Business Ecosystem

DIFC's ecosystem supports various business needs. Here are a few highlights of its thriving ecosystem.

Innovation Hub: Home to over 500 growth-stage startups and VC firms, the Innovation Hub fosters collaboration and innovation across sectors.

FinTech Hive: Launched in 2017, this accelerator program connects fintech startups with financial institutions, promoting technological advancements in finance.

Family Wealth Centre: Tailored services for family businesses and ultra-high-net-worth individuals (UHNWIs) address challenges in wealth and asset management.

4. Attractive Fiscal Policies

DIFC's fiscal incentives are designed to attract global businesses:

Tax Benefits: A 50-year guarantee of zero taxes on corporate income and profits enhances profitability.

Double Taxation Treaties: Access to the UAE's extensive network of double taxation agreements provides additional financial efficiency.

5. State-of-the-Art Infrastructure

DIFC offers a modern environment conducive to business:

Office Spaces: Premium office facilities cater to diverse business requirements.

Lifestyle Amenities: Over 100 cafes, restaurants, art galleries, and retail outlets create a vibrant community for professionals.

Hospitality: Renowned hotels like the Ritz-Carlton, Waldorf Astoria, and Four Seasons provide luxury accommodations within the centre.

6. Talent Attraction and Employment Growth

DIFC's growth has led to significant employment opportunities. Here are a

Job Creation: In the past year, DIFC companies have generated approximately 4,647 new jobs, increasing the total workforce to over 43,787 professionals.

Diverse Talent Pool: The centre attracts professionals globally, enriching Dubai's human capital and fostering a multicultural business environment.

7. Growth in Financial Services and Innovation

DIFC's commitment to innovation has spurred sectoral growth.

FinTech Expansion: Firms in the fintech and innovation sectors have grown by 33% year-on-year, reflecting DIFC's focus on future economies.

Hedge Fund Surge: The number of hedge funds operating within DIFC has increased by 50%, reaching 75 firms, including industry leaders like Tudor Capital and Walleye.

8. Competitive Positioning

Dubai's proactive strategies have positioned it as a leading financial hub. Both Dubai and Abu Dhabi are intensifying efforts to attract global wealth managers, with DIFC playing a pivotal role in this endeavor.

9. Legal Autonomy and Innovation

DIFC's unique legal structure enhances its appeal.

Independent Legal System: The DIFC Courts operate separately from Dubai's traditional legal system, providing a reliable dispute resolution mechanism for international businesses.

Adaptability: This autonomy allows DIFC to innovate in legal practices, such as developing frameworks for emerging sectors like the metaverse.

- Future Outlook

DIFC's strategic initiatives continue to attract international businesses:

Sustainable Growth: With a focus on sustainability and digital transformation, DIFC aims to lead in green finance and fintech innovation.

Global Collaborations: Partnerships with international financial centers and organizations enhance DIFC's global integration and influence.

Go for Free Zone Business Setup in Dubai in DIFC

In conclusion, the Dubai International Financial Centre's strategic location, robust regulatory framework, comprehensive ecosystem, and commitment to innovation have solidified its role as a magnet for international businesses.

Its continuous efforts to innovate and adapt to global trends ensure that DIFC remains at the forefront of attracting and nurturing international enterprises. As DIFC continues to evolve, it not only bolsters Dubai's position as a global financial hub but also contributes significantly to the economic development of the broader MEASA region.

0 notes

Text

Can My Company Set Up a Subsidiary in Dubai?

Establishing a subsidiary in Dubai is an increasingly popular choice for businesses worldwide. Known as a global business hub, Dubai offers unparalleled opportunities for growth, tax advantages, and access to international markets. However, understanding the process, costs, and benefits is crucial before embarking on this journey. This blog delves into the essential steps and considerations for Dubai corporation incorporation, including the cost of incorporating a Dubai company and establishing a Dubai branch office.

Why Choose Dubai for Business Expansion?

Dubai is renowned for its business-friendly environment, strategic location, and modern infrastructure. Here are some compelling reasons why companies choose to expand here:

Strategic Location: Dubai serves as a gateway between the East and the West, making it an ideal base for businesses targeting global markets.

Tax Benefits: With zero corporate tax (for most businesses) and no personal income tax, Dubai remains an attractive destination for entrepreneurs.

Economic Stability: The city boasts a resilient economy supported by diverse industries, including real estate, tourism, and technology.

Ease of Doing Business: According to the World Bank's 2023 report, the UAE ranks among the top 20 economies for ease of doing business.

State-of-the-Art Infrastructure: From world-class ports to advanced digital networks, Dubai's infrastructure supports business efficiency and innovation.

Dubai also hosts over 30 free zones, each catering to specific industries like technology, healthcare, and media. These zones allow 100% foreign ownership and tax exemptions, making them an excellent choice for international businesses.

Dubai Corporation Incorporation: The Basics

The process of Dubai corporation incorporation involves several steps. Here's a detailed overview:

Determine Your Business Activity: Dubai classifies businesses into various categories, such as commercial, professional, or industrial. Identifying your activity type is the first step.

Choose a Business Structure: Companies can be set up as Limited Liability Companies (LLCs), branch offices, or free zone entities. Each structure has its own set of rules and benefits. For instance, an LLC requires a local sponsor to own at least 51% of the shares, while free zone companies offer full foreign ownership.

Register a Trade Name: Selecting a unique trade name that complies with Dubai's naming conventions is mandatory. The name should not violate public morals or involve religious references.

Obtain Licenses: Depending on your business type, you may need a commercial, professional, or industrial license. Special activities, such as healthcare or education, might require additional permits.

Secure Approvals: Certain businesses may require additional approvals from regulatory authorities, such as the Ministry of Economy or the Dubai Municipality.

Lease Office Space: A physical office is often a prerequisite for business registration. Free zones offer flexi-desk solutions for startups and small businesses.

Open a Corporate Bank Account: Dubai's banking sector offers robust services to meet business needs. You'll need to provide documentation such as your trade license and company incorporation certificate.

Cost of Incorporating a Dubai Company

The cost of incorporating a Dubai company varies based on the business structure, location, and specific requirements. On average:

Free Zone Entities: Costs range from AED 15,000 to AED 50,000 annually, covering licensing, visas, and office space. Free zones like Jebel Ali Free Zone (JAFZA) and Dubai Internet City are popular choices for their tailored benefits.

Mainland Companies: Setting up an LLC might cost between AED 20,000 and AED 30,000, excluding sponsor fees. These costs include trade license fees, initial approvals, and notarization.

Branch Offices: Establishing a Dubai branch office typically costs around AED 30,000 to AED 50,000, depending on the size and activity. This includes government fees, office rentals, and local service agent costs.

Additional expenses may include legal consultations, notary fees, and government approvals. It's advisable to budget for unforeseen costs to ensure a smooth setup process. According to a 2022 survey by the Dubai Chamber of Commerce, 85% of businesses found the setup costs manageable compared to other global business hubs.

Establishment of a Dubai Branch Office

Opening a Dubai branch office is an excellent option for companies looking to expand their operations without forming a new legal entity. A branch office allows you to:

Conduct business under the parent company's name.

Enjoy 100% foreign ownership.

Engage in the same activities as the parent company (with some restrictions).

The process involves obtaining approval from the Department of Economic Development (DED) and appointing a local service agent (LSA) who facilitates regulatory compliance. While a branch office does not require a local sponsor, the LSA is necessary to manage government-related paperwork.

Branch offices are particularly advantageous for businesses in industries like finance, construction, and consulting, as they enable seamless integration with the parent company's operations. Additionally, they provide a cost-effective way to establish a physical presence in Dubai without committing to full-fledged incorporation.

Common Challenges and How to Overcome Them

While Dubai offers numerous advantages, there are challenges businesses might face during the setup process:

Navigating Regulations: The regulatory framework can be complex, particularly for new entrants unfamiliar with local laws. Partnering with a local expert can help mitigate this.

Cultural Differences: Understanding and respecting local customs and business etiquette are crucial for building relationships.

Banking Hurdles: Opening a corporate bank account might require extensive documentation and due diligence. Preparing these documents in advance can save time.

Cost Management: Hidden costs, such as visa processing and legal fees, can inflate your budget. Working with a consultant ensures transparency and accurate cost estimation.

Dubai's Business Landscape: Statistics at a Glance

Dubai's GDP in 2022 reached AED 425 billion, showcasing robust economic growth.

Over 150,000 new business licenses were issued in Dubai in 2023, reflecting its thriving entrepreneurial ecosystem.

The city is home to over 200 nationalities, making it a truly global marketplace.

The Dubai International Financial Centre (DIFC) houses more than 3,600 companies, including global financial giants.

These statistics underline Dubai's appeal as a business hub that attracts enterprises across various sectors.

How Mirr Asia Can Help

Setting up a subsidiary in Dubai can be a game-changer for your business, but navigating the complexities of regulations, costs, and procedures can be daunting. Mirr Asia specializes in providing end-to-end solutions for Dubai business incorporation. From identifying the right business structure to managing documentation and compliance, our experts ensure a hassle-free setup process.

We assist with:

Choosing the optimal business structure based on your goals.

Securing necessary approvals and licenses.

Streamlining banking and financial setup.

Offering ongoing support for compliance and operational needs.

With years of experience and a proven track record, Mirr Asia is your trusted partner in achieving your expansion goals. Contact us today to learn how we can turn your vision of establishing a subsidiary in Dubai into a reality!

By partnering with Mirr Asia, you'll gain access to a network of local experts and resources to make your journey seamless and successful. Let us help you unlock Dubai's immense potential for your business!

#Dubai Corporation Incorporation#Cost of incorporating a Dubai company#Establishment of Dubai branch office#Dubai Business

0 notes

Text

How to Start a Company in Dubai: A Quick Guide

Dreaming of starting your own business in Dubai? Dubai is the ideal destination to start your business because of its booming economy, low taxes, and advantageous location!

1. Choose the Right Business Structure

Mainland Business: Operate across Dubai and beyond.

Free Zone Business: 100% ownership and tax exemptions.

Offshore Business: International reach with UAE jurisdiction.

2. Register Your Business

Apply through a Free Zone Authority or the Department of Economic Development (DED).

3. Get the Right Licenses

Professional, industrial, or commercial licenses—pick the one that best suits your company.

4. Lease Office Space

Whereas mainland businesses require physical space, free zones provide customised office options.

Why Dubai?

Tax Benefits: 0% income tax.

Global Access: Trade with the world.

Top-Notch Infrastructure: Boost your business with world-class facilities.

Ready to Start?

Allow Crosslink International to guide you through each stage of setting up your business in Dubai. Make your company ambitions a reality by getting in touch with us right now!

#DubaiBusinessSetup#BusinessInDubai#CrosslinkInternational#Entrepreneurship#dubaibusiness#business setup in dubai#dubai#setup a business in dubai#start a business in dubai#uae#start a company in dubai#Start a Company in Dubai

2 notes

·

View notes

Text

The Ultimate Guide to Corporate Tax Filing in Dubai

With the introduction of corporate tax regulations in Dubai, businesses must ensure compliance with UAE tax laws to avoid penalties and maintain smooth operations. Corporate Tax Filing in Dubai is a crucial process that requires accuracy, timely submissions, and adherence to the guidelines set by the Federal Tax Authority (FTA).

Understanding Corporate Tax in Dubai

Corporate tax is a direct tax imposed on the net income of businesses operating in the UAE. Companies must report their financial activities accurately and file tax returns within the stipulated deadlines. Failure to comply with tax regulations can lead to fines and legal consequences.

Key Steps in Corporate Tax Filing

Maintaining Accurate Financial Records – Proper bookkeeping and financial documentation are essential for tax calculations.

Determining Taxable Income – Identifying deductible expenses and taxable revenue helps in calculating corporate tax liability.

Submitting Tax Returns – Businesses must file corporate tax returns as per UAE regulations to ensure compliance.

Making Timely Tax Payments – Paying taxes on time prevents penalties and legal issues.

Who Needs to File Corporate Tax?

All UAE-based companies (except those exempted by law)

Free zone businesses (subject to specific conditions)

Branches of foreign companies operating in Dubai

Why Choose Emrys Global for Corporate Tax Filing in Dubai?

At Emrys Global, we specialize in handling corporate tax filing efficiently, ensuring that businesses meet their legal obligations while optimizing tax strategies. Our experts provide guidance on tax compliance, accurate filing, and minimizing tax liabilities.

Ensure Compliance with Emrys Global

Navigating the complexities of corporate tax regulations can be challenging, but with Emrys Global, your business remains compliant and financially secure.

Contact Emrys Global Today!

Address: Umm Hurair, Office Building - Office No. 101, First Floor, Oud Metha, Dubai, UAE Email: [email protected] Phone: +971 50 579 1242

0 notes