#Dinar Currency

Explore tagged Tumblr posts

Text

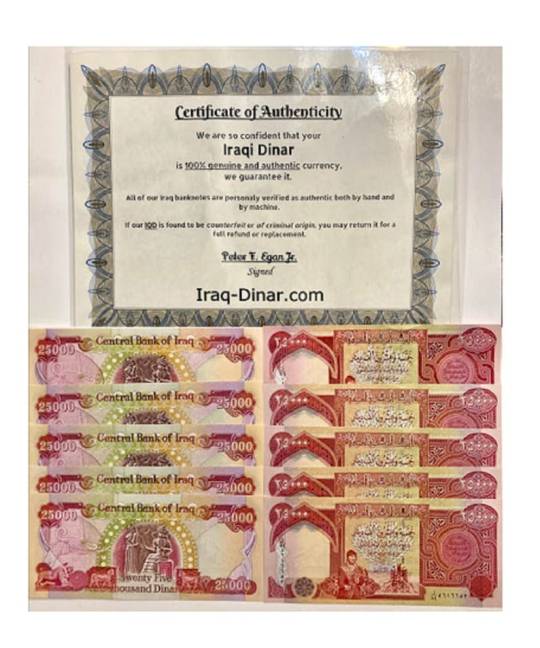

Quater-Million Iraq Dinar Currency For Sale Online (US Seller)

Louisiana, USA-based Iraqi Dinar retailer Egan Store, has the largest selection of current IQD items in-stock of any seller I’ve found, their prices are competitive, most shipping is free, and what isn’t is 1/3 of what they’re paying for it. Mom and pop operation that really paved the way for most dinar sellers you’ll find today. Egan Store is still the best though.

youtube

If the Dinar Floats at $0.25, here’s what would happen…

Most of you would have less than two weeks to protect yourself from taxes. Ms. Sandy teaches you how to keep as much of your IQD (Iraqi dinar… Iraq’s currency) profits as possible.

Out of all of the dinar experts, she’s probably my favorite besides Entheos.

You won’t have to worry about taxes if you don’t own any dinars, although that and really every other I’ve heard all seem like profoundly weak excuses to me.

10 notes

·

View notes

Note

Is there a way that I can give you money? I really like your art!

thank you anon!! and yep! i have a kofi here. i also put up some pay-what-you-want timelapses and such if that's your thing ^^

#enough people asked (2) that i made one#NO PRESSURE!!!!! TO PAY ME!! AT ALL!!!!!#this is just if anybody wants to like. slip me a fiver because i made them spit out their drink or something#not art#ask#sadly kofi does not accept donations smaller than $1 :(#if they did i would make a quarter pelting button#or whatever the local currency equivalent of the particular follower lmao. pelt me with dinar. euros. pesos.#the kofi link is also buried in my faq currently for anybody looking for it

31 notes

·

View notes

Text

Kuwaiti Dinar to Pakistan Rupee (KWD to PKR) Exchange Rate

Check the latest Kuwaiti Dinar to Pakistani Rupee exchange rates at BEC Kuwait. Benefit from competitive rates and secure transactions for your currency exchange needs. Please visit:- https://www.bec.com.kw/currency/kuwaiti-dinar-to-pakistan-rupee/

0 notes

Text

Iraqi Dinar Redemption Centers: Fact or Scam?

Every few years, a new wave of hype revives the decades-old claim that the Iraqi dinar is on the verge of skyrocketing in value. At the center of this narrative are so-called “Iraqi Dinar Redemption Centers”—locations promoted as secretive hubs where holders of dinar can allegedly exchange the currency for huge profits.

These promises often come wrapped in jargon, urgency, and the illusion of insider access. But how much truth is there to it? Is this an overlooked financial opportunity—or just another cleverly packaged scam?

Let's examine together critically what these redemption centres claim to offer, how they’re marketed, what official sources say, and how to protect yourself from fraud.

What Are Iraqi Dinar Redemption Centers?

Iraqi Dinar Redemption Centers are alleged locations or institutions that claim to offer above-market exchange rates for the Iraqi dinar. These centers are typically not affiliated with banks or licensed financial entities. Instead, they're often advertised as “invitation-only” venues where holders of dinars can redeem their currency for exclusive “contract rates” that far exceed the official value.

The idea is based on the long-circulating theory of a future “revaluation” (RV) of the Iraqi dinar. Proponents claim that, once Iraq undergoes key economic reforms or gains international recognition, the dinar’s value will surge, and that these redemption centers will open to facilitate lucrative exchanges for early investors.

However, these centers are not recognized or supported by any legitimate financial authority, including the Central Bank of Iraq (CBI), and their very existence is disputed outside of promotional forums and niche investment circles.

How These Centers Are Marketed to Investors

Promoters of redemption centers employ persuasive marketing strategies designed to generate trust, urgency, and a sense of exclusivity. Here's how the pitch typically goes:

Special or Contract Rates: Redemption centers are said to offer unique “contract rates,” which are significantly higher than the dinar’s actual exchange rate. The implication is that investors with early access will see returns many times their initial investment.

Tiered Access System: Some claim that only individuals in specific “tiers” or groups, such as military veterans, church groups, or those with prior connections, will be notified when the redemption period begins. This reinforces exclusivity and encourages people to seek insider status.

Connection to Iraqi Economic Changes: Promoters often cite economic updates from Iraq, such as oil production deals, government changes, or IMF negotiations, as evidence that the RV is imminent and the redemption centers will soon be active.

Urgency and Pressure: Potential investors are told to act fast, reserve their appointment, or wire money to “lock in” a rate. This tactic is used to short-circuit critical thinking and capitalize on the fear of missing out.

Use of Testimonials and Fake Documents: To add legitimacy, fraudsters may present fake letters from banks, forged government documents, or glowing testimonials from supposed “redeemed” investors. These are often unverifiable and intended to create a false sense of trust.

Red Flags and Signs of a Possible Scam

There are several consistent red flags associated with dinar redemption center promotions. Understanding these warning signs can help you avoid being deceived:

Promises of High or Guaranteed Returns: If someone guarantees you $3, $5, or more per dinar when the official rate is drastically lower, that's an immediate red flag. No legitimate financial institution guarantees currency appreciation.

“Secret” Events and Unverified Offers: If the offer is based on insider knowledge, NDA agreements, or unverifiable contacts, it’s likely a scam. Financial transparency and public regulation are key features of real investment opportunities.

Upfront Payments or Deposits: Legitimate currency exchanges do not require upfront fees to participate. Scammers often ask for money to “hold your spot” or “process your redemption,” which is usually the last you’ll hear from them after payment.

Lack of Licensing or Business Registration: Always check if the business or individual you're dealing with is registered with the relevant financial authorities. Redemption center promoters typically are not.

Time-Sensitive Pressure Tactics: Scammers don’t want you to think things through. Limited-time offers, sudden windows of opportunity, or countdowns are tools to push you into rash decisions.

What the CBI and Official Sources Say

The Central Bank of Iraq (CBI) and other regulatory agencies have made their positions clear regarding dinar speculation and redemption center claims:

One Official Exchange Rate: The CBI maintains a single, official rate for the Iraqi dinar. There are no alternate, private, or "contract" rates offered by any institution inside or outside Iraq.

No Authorized Redemption Centers: The CBI has not licensed any redemption centers, nor does it endorse any group claiming to facilitate such redemptions.

Exchange Limitations Outside Iraq: Most legitimate currency exchanges outside Iraq will not accept dinars due to limited international demand and regulatory restrictions.

Regulatory Warnings in the U.S.: Agencies such as the Washington State Department of Financial Institutions and the Better Business Bureau have warned about scams involving Iraqi dinar investments. These warnings highlight that most dealers are unlicensed and operate outside regulatory oversight.

How to Protect Yourself from Dinar Fraudsters

Whether you're holding dinar as a collector or were persuaded to buy it as an investment, it’s important to protect yourself from misinformation and fraud. Here's how:

Verify Credentials: Only exchange currency through registered and regulated financial institutions. Check licensing through your national financial authority or central bank database.

Don’t Trust Unverified “Insider Info”: Avoid offers that are based on untraceable or “secret” information. Scammers rely on ambiguity to build their credibility.

Never Send Money or Data to Strangers: If someone is asking for your social security number, bank details, or an upfront wire transfer, that’s a clear danger sign.

Get Everything in Writing—and Double Check It: Request written terms, rates, and contracts, then cross-check with official sources. If anything seems off, consult a professional.

Consult a Licensed Financial Advisor: Before committing to any currency investment, speak with a qualified advisor who understands currency markets and risk.

Follow Official Sources: Stay updated through credible agencies like the CBI, the U.S. Securities and Exchange Commission (SEC), and your local consumer protection office.

Final Word:

The concept of Iraqi Dinar Redemption Centers offering secret, high-value exchanges has been around for years, but it’s never been supported by any legitimate authority. These schemes often resurface during times of economic uncertainty, targeting hopeful investors and retirees with promises of easy wealth.

The reality is simple: no institution, whether in Iraq or abroad, can legally offer you more than the official market rate for dinars. Redemption centers are not part of the legitimate financial system. They’re part of a scam designed to take your money, not grow it.

If you've already invested or know someone who has, report suspicious activity to your financial regulatory authority.

Staying informed and sceptical is the best defence against losing money to these persistent and well-packaged frauds. Source IQDBUY

#currency#Iraqi Dinar redemption centers#Iraqi Dinar investment#Iraqi Dinar scam#Iraqi Dinar get rich quick

0 notes

Text

Egan Store is still the best US-based, online IQD (Iraqi Dinar) dealer

EganShop.com has closed, but Egan.Store is still the best place on the web to buy Iraqi Dinar currency.

youtube

Ms. Sandy at Edu Matrix has some of the best videos about the Iraqi dinar and it’s prospective revaluation available anywhere on the web.

Everything I’m hearing is that the RV is imminent... anywhere for hours to weeks, months tops. There’s been lots of chatter that this will be a very special Christmas. Sure, could mean anything or nothing, but Trump’s history is pretty close to unanimous in terms of his knowing something specific when he makes remarks like that.

My recommended source for IQD (Iraqi Dinar) is Egan Store (http://egan.store & Egan Shop https://eganshop.com).

Peter (the owner of Egan Store) has told me this week that he intends to start removing IQD listings soon, although he couldn’t give a date, stating that they would only sell what they can replace, but would sell as long as he could get it. So as long as they can get it they plan to make it available and help as many people as possible procure some before it’s too late.

Peter is a good man and his customers love him. His business has achieved a better than 99% customer satisfaction rate selling on eBay, Etsy, other third-party platforms and from their relatively new site, EganShop.com.

Peter will be launching a plethora of currency-specific, niche collectible numismatics, coin & banknote shops — each specific to a particular nation’s currency.

Egan Shop and Egan Store have every denomination of new Iraqi dinar available for some of the best prices available anywhere online. If you find a better price, message them. If Peter can beat it he will.

https://etsy.com/shop/EganStore

18 notes

·

View notes

Text

Money Around the World

Algeria, Algerian Dinar (د.ج)

#algerian dinar#algeria#around the world#life around the world#currency#money#coins#money around the world

1 note

·

View note

Text

Bahraini Dinar to Indian Rupee (BHD to INR) Exchange Rate - BFC

Easily convert Bahrain currency to INR with BFC Bahrain. Check real-time exchange rates for Bahraini Dinar to Indian Rupee and enjoy secure, reliable services. Please visit:- https://www.bfc.com.bh/currency/bahraini-dinar-to-indian-rupee/

#bahrain currency to inr#bahrain dinar to inr#bfc exchange rate bahrain to india today#bahrain to india currency

0 notes

Text

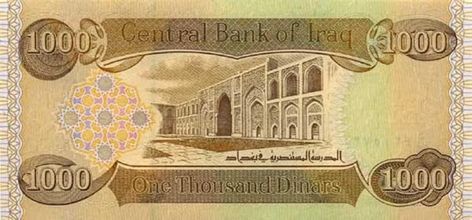

Top 20 Sites for Buying and Selling Iraqi Dinars in the USA and Worldwide

Iraqi Dinar trading has become an appealing investment opportunity. With Iraq’s oil reserves and efforts to stabilize the economy, many speculate on the Dinar’s future value. Iraq's strengthening economy drives investors to look for dependable platforms that facilitate the buying and selling of this currency. The potential for good returns attracts many traders, but the volatile nature of Iraqi Dinar trading demands careful thought about platform selection. According to the Bank for International Settlements, the global forex market has a daily volume of over .5 trillion; that’s how big the interest in currency trading is worldwide.

This article will explore the top 20 sites for buying and selling Iraqi dinars in the USA and worldwide. From best exchange rates to rare currency specialists, you will find what you need. Whether you are a seasoned investor or a newbie, this list will help you trade safely.

1. IQDBuy.com

IQDBuy.com is a leading platform in the Iraqi Dinar trading space. The website provides simple currency exchange services for Iraqi Dinar transactions. The platform lets you buy and sell Iraqi Dinar with ease.

Smart investors should get a full picture of the platform's operations and verification processes before making any transactions. While IQDBuy.com is one of several options for Iraqi Dinar trading, their rates and services can change with market conditions.

Traders should contact the platform directly to get updated information about services, exchange rates, and verification requirements. Understanding service terms and transaction processes will help create a smooth trading experience.

Currencies Sold: Primarily Iraqi Dinar.

Payment Methods: Bank transfers, credit/debit cards, PayPal.

Buyback Policy: Yes, with competitive rates.

Pros:

Simple and user-friendly interface.

Secure payment gateways.

Competitive exchange rates.

Cons:

Limited customer service availability.

No educational content or forums.

2. Dinarit.com

Dinarit.com is a specialized platform that focuses on Iraqi Dinar currency exchange services. The platform uses strict verification protocols for all transactions and creates secure trading environments for its users. Strong authentication measures protect both buyers and sellers during their currency exchanges.

Users can find competitive exchange rates for Iraqi Dinar trading on the platform. Market conditions determine these rates, and they update regularly. Traders access their detailed transaction histories and account statements through personal dashboards. This service appeals to individual investors and institutional clients who need reliable Iraqi Dinar trading options.

Dinarit.com uses multi-factor authentication systems and encrypted communication channels to boost security. Users receive dedicated customer support that helps them with transaction-related questions and account management needs.

Currencies Sold: Iraqi Dinar exclusively.

Payment Methods: Bank transfers, checks, cryptocurrency.

Buyback Policy: Yes, with proof of original purchase.

Pros:

Strong multi-factor authentication for added security.

Transparent fee structure.

Dedicated customer support team.

Cons:

No mobile app.

Limited currency options.

3. eBay

eBay is a worldwide marketplace where people can buy and sell Iraqi dinars. The platform connects traders from all corners of the world. Users can find many Iraqi Dinar listings on the platform, from current notes to collectible denominations. The platform features search filters to quickly find specific listings by denomination, condition, or price range.

eBay's rating system lets buyers assess sellers based on their past deals and what other customers say about them. Trading Iraqi dinars on eBay requires careful consideration. The platform's buyer protection program offers added safety for transactions that follow its rules. Buyers are advised to review seller ratings, check listing details thoroughly, and understand eBay's currency trading policies.

eBay ensures secure payment processing and provides multiple payment options. Sellers must adhere to listing rules and include clear images of the currency. Buyers should also consider shipping options, delivery times, and costs before completing a purchase.

Currencies Sold: Iraqi dinars and other currencies through third-party sellers.

Payment Methods: Credit/debit cards, PayPal.

Buyback Policy: Depends on individual sellers.

Pros:

Wide variety of listings.

Buyer protection for eligible transactions.

Seller ratings for credibility checks.

Cons:

Risk of counterfeit currency.

No centralized verification.

4. Amazon

Amazon functions as an online marketplace where third-party sellers can list Iraqi dinarss along with other currencies. Verified sellers must meet specific criteria to ensure basic security for currency transactions. Buyers can review seller ratings and feedback before making a purchase.

The platform’s A-to-Z Guarantee offers some protection for qualified purchases, but trading currencies on Amazon requires caution. Buyers should carefully review seller profiles, shipping policies, and authentication methods. Amazon’s verification process includes background checks and account monitoring for sellers.

With search filters and sorting options, buyers can easily find specific Iraqi Dinar listings based on denomination or price. Secure payment options are available, but Amazon primarily focuses on general retail rather than specialized currency exchange services.

Currencies Sold: Iraqi Dinar (via verified sellers).

Payment Methods: Credit/debit cards, gift cards.

Buyback Policy: No.

Pros:

Convenience of a large marketplace.

Verified seller profiles available.

Cons:

Limited customer support for currency issues.

It's not a specialized currency platform.

5. Etsy

Etsy's marketplace extends beyond handmade and vintage items to include currency collectors and traders. It offers a secure environment for Iraqi Dinar transactions with strict seller verification and detailed listing requirements. Unlike traditional currency trading platforms, Etsy focuses on the collectible and numismatic aspects of currency.

Buyers can filter listings by denomination and condition, while sellers must provide clear images and complete documentation of currency items. The platform ensures safe transactions through its secure payment system and supports multiple payment methods. Seller credibility can be assessed using Etsy’s review system, which includes feedback from previous transactions.

Sellers must follow Etsy's marketplace policies for currency listings and international shipping regulations to maintain security. The platform's dispute resolution system provides simple protection for qualified purchases. Buyers should still carefully verify seller credentials and authentication methods.

Currencies Sold: Iraqi Dinar (collectible denominations).

Payment Methods: Credit/debit cards, PayPal.

Buyback Policy: No.

Pros:

Strong seller verification policies.

Detailed descriptions for collectibles.

Cons:

Limited supply.

Higher fees for niche products.

6. XChange of America

XChange of America, based in the United States, specializes in currency exchange services through its physical locations and online platforms. The company strictly follows federal regulations to maintain a secure trading environment.

It offers a variety of currency pairs, including Iraqi dinars, with exchange rates updated regularly based on market conditions. Transactions require identity verification and documentation to ensure legitimacy. Customers can rely on a dedicated support team that is available through multiple communication channels for assistance with transactions and account management.

The platform provides a secure payment system with various options and tools like real-time rate calculators and transaction tracking. With multi-layer authentication and encrypted channels, XChange of America ensures transaction safety. The user-friendly interface allows for quick transactions, and detailed records are available for future reference.

Currencies Sold: Iraqi Dinar, Euro, British Pound, etc.

Payment Methods: Credit/debit cards, bank transfers.

Buyback Policy: Yes.

Pros:

Strict compliance with US regulations.

Secure online and in-person transactions.

Cons:

Higher minimum transaction amounts.

Limited global availability.

7. Taheri Exchange

Taheri Exchange has provided currency exchange services from its Toronto location for 37 years. The company has built trust with over 100,000 satisfied customers and handles more than 100 global currencies.

Customers can buy Iraqi Dinars through multiple convenient channels. The online ordering system makes purchases simple, and their physical store at 5775 Yonge Street welcomes walk-in customers. Business hours run from 11 am to 5 pm, Monday through Friday.

Taheri Exchange's payment options include email money transfers for online orders. Customers who visit the store can pay with cash or debit cards. The company's strong security protocols ensure all packages are packed under camera surveillance and require signature confirmation upon delivery.

Each order gets a unique tracking number and full insurance coverage until delivery confirmation. The company sends prompt delivery status updates by email. Taheri's staff keeps customers informed and sends notifications when orders are ready.

Supported Currencies: 100+ global currencies, including Iraqi Dinar.

Payment Methods: Email money transfers, cash, debit cards.

Buyback Policy: Not specified.

Pros:

Trusted brand with 37 years of experience.

Secure packaging under camera surveillance.

Tracking numbers and full insurance on deliveries.

Cons:

Limited business hours (Monday to Friday, 11 am - 5 pm).

No weekend operations.

Limited physical locations.

8. Treasury Vault

Treasury Vault has been a registered currency exchange provider with the US Treasury Department since 2011. We specialize in authentic world currencies, precious metals, and safe, high-end residential solutions. The company offers Iraqi Dinar services through its network of partners across Iraq's provinces.

Their buy-back program comes with specific rates—USD 665.00 per million for uncirculated Iraqi dinars and USD 640.00 per million for notes that have spread through circulation. Security is a top priority. Any transactions over USD 1,000 need extra verification - you'll need to provide your social security number or tax ID, plus government-issued identification.

The company follows Patriot Act guidelines and FinCEN regulations carefully. Treasury Vault works with currencies from many countries, including Afghanistan, Brazil, Chile, Egypt, Iran, Iraq, India, Libya, Mongolia, Saudi Arabia, South Korea, and Vietnam. They take 3-5 business days to authenticate currencies, making sure every note is genuine.

Currencies Sold: Iraqi Dinar, Afghani, Libyan Dinar, etc.

Payment Methods: Credit cards, bank transfers.

Buyback Policy: Yes, with competitive rates.

Pros:

Registered with the US Treasury.

Transparent rates and buyback policies.

Cons:

Slower transaction processing times.

9. Safe Dinar

SafeDinar, a 15-year-old currency exchange platform, specializes in Iraqi Dinar trading for individual and institutional clients. The platform ensures authenticity through strict currency verification and compliance with international banking regulations. Its multi-step verification system enhances transaction security, and a dedicated customer service team provides support throughout the process.

SafeDinar offers transparent pricing, with exchange rates updated regularly based on market conditions. Clients can securely access transaction history and account statements through an online portal. The platform works with verified currency suppliers to maintain authenticity and reliability.

SafeDinar's secure payment system supports multiple payment methods, ensuring safe and efficient transactions. Its user-friendly interface simplifies the trading process, offering detailed documentation for every exchange. With expertise in Iraqi Dinar trading, the platform also provides market analysis and guidance to help clients make informed decisions.

Currencies Sold: Iraqi Dinar.

Payment Methods: Bank transfers, credit cards.

Buyback Policy: Yes.

Pros:

Highly secure with strict verification processes.

Regularly updated exchange rates.

Cons:

Limited to specific currencies.

10. Dinar Guru

Dinar Guru stands out as a specialized currency exchange service in the Iraqi Dinar trading market. The platform gives detailed market analysis and valuable trading insights to Iraqi Dinar investors. The service takes security seriously. Users must provide complete documentation for all transactions. The platform's knowledge base helps traders learn about Iraqi Dinar trading effectively. Multiple security layers protect user information and transaction details.

Dinar Guru's user-friendly trading interface makes buying and selling Iraqi dinars simple. Market conditions drive regular updates to exchange rates. A dedicated customer support team guides users through the trading process and explains documentation needs and transaction steps.

The platform demonstrates transparency through clear fee structures and transaction policies. Traders can easily monitor orders on a secure dashboard that displays transaction histories and account statements. The service keeps user data safe with encrypted communication channels and multi-factor authentication systems.

Currencies Sold: Iraqi Dinar.

Payment Methods: Bank transfers, cryptocurrency.

Buyback Policy: Yes.

Pros:

Strong market analysis tools.

Transparent policies.

Cons:

No mobile app.

11. Forex Banknotes

Forex Banknotes specializes in exchanging physical banknotes for multiple currencies, including Iraqi Dinar. Its strong system supports transactions for both individuals and institutions. The company ensures all banknotes meet quality standards with strict checks and provides paperwork to confirm the currency's authenticity.

In addition to exchanges, Forex Banknotes offers market analysis and trading tips to help customers make better decisions. It works with trusted currency suppliers worldwide to keep transactions safe. A helpful support team guides users through the required paperwork and verification process.

The platform has clear fees with no hidden charges, allowing users to calculate costs upfront. Exchange rates are updated regularly based on market conditions, and traders can track their transactions through a secure online portal with live updates. Forex Banknotes strictly follows international banking rules to ensure safe and reliable trading.

Supported Currencies: Iraqi Dinar, USD, Euro, and more.

Payment Methods: Bank transfers, credit cards.

Buyback Policy: Not explicitly mentioned.

Pros:

Supports individuals and institutions.

Transparent fees with no hidden charges.

Secure online transaction tracking.

Cons:

Limited payment methods.

Does not explicitly mention buyback options.

12. Travelex.com

Travelex has over 40 years of experience in foreign exchange and operates in countries around the world. Its large network helps it track market exchange rates daily, offering better prices to customers. The company is strictly regulated by financial authorities, such as the Turkish Financial Crimes Investigation Board (MASAK) and the Republic of Turkiye's Ministry of Treasury and Finance, ensuring customer protection.

Travelex offers convenient services, including currency buying and transfers with no extra fees, alerts for target exchange rates, competitive rates, and the ability to convert over 45 currencies. Transactions are secure, with fast delivery options, including next-day currency delivery for added convenience.

Travelex’s rate tracking system keeps customers informed when currencies reach their desired rates. Exchange rates are adjusted based on market supply and demand, ensuring prices remain competitive and customer-focused.

Supported Currencies: 45+ currencies, including USD, Euro, and GBP.

Payment Methods: Bank transfers, debit/credit cards.

Buyback Policy: Yes, for major currencies.

Pros:

Competitive rates and no extra fees.

Next-day delivery for convenience.

Strict regulatory compliance.

Cons:

Limited focus on niche currencies like the Iraqi Dinar.

Exchange rates depend on market fluctuations.

13. Currency Liquidator

Currency Liquidator stands out as a secure platform for Iraqi Dinar transactions. The company has full US Treasury registration and state licensing. The company focuses on foreign currency exchange with strong security measures, ensuring all transactions are bonded and insured.

The platform offers a guaranteed buy-back program with market-based rates, no matter where you originally purchased your Dinar. It also provides layaway programs, making it easier to buy larger amounts of currency. Currency Liquidator has an A+ rating from the Better Business Bureau, reflecting its commitment to customer satisfaction.

Traders can access 24/7 support and use easy dashboard tools to analyze markets and track transactions. New investors should note the platform’s trust score of 56.3/100, based on independent reviews. Currency Liquidator follows strict Bank Secrecy Act regulations to ensure transparency in all transactions. With the best price guarantee, the platform offers competitive rates for all its products.

Supported Currencies: Iraqi Dinar.

Payment Methods: Bank transfers.

Buyback Policy: Yes, at market rates.

Pros:

Guaranteed buyback at market rates.

Layaway programs are available.

A+ rating from the BBB.

Cons:

Limited payment methods.

Average trust score (56.3/100).

14. Dinariqd.com

DINAR IQD is a specialized online currency store where we focus on Iraqi Dinar transactions. Their worldwide shipping network provides professional handling and packaging services to customers globally. This exchange service has made its mark with its wholesale pricing structure that serves major retailers and investors in international markets.

The platform combines competitive rates with strong security measures that protect every transaction. Each order comes with a Certificate of Authenticity that proves the currency's legitimacy. The service runs 24/7 to help traders in different time zones.

Multiple payment methods make DINAR IQD a convenient choice for customers. Their express shipping service delivers quickly, and they handle orders the same day payment clears. The platform takes pride in its 100% satisfaction guarantee and professional service standards.

Supported Currencies: Iraqi Dinar.

Payment Methods: Multiple options include Iraqi Dinar.

Buyback Policy: Yes.

Pros:

Competitive wholesale pricing for retailers and investors.

24/7 service with same-day order processing.

Global shipping with express delivery options.

Cons:

Focused solely on Iraqi Dinar.

Limited customer support channels beyond online.

15. DinarExchange.com.au

Dinar Exchange is your trusted partner for buying and selling Iraqi Dinars in Australia and New Zealand. Based in Melbourne, the platform is dedicated to providing safe, secure, and reliable currency transactions. Whether you are a seasoned investor or a currency collector, Dinar Exchange offers a user-friendly experience tailored to your needs.

With competitive pricing, instant ordering, and secure online payment options, the platform ensures timely delivery and genuine currency backed by certificates of authenticity. Customers can also access market insights and updates on the Iraqi Dinar’s revaluation to make informed decisions.

Dinar Exchange stands out for its transparency, 24/7 customer service, and expert guidance, making it a dependable choice in the collectible currency market. The platform also offers valuable educational resources for investors interested in the Dinar’s history and potential. Trust Dinar Exchange for a seamless and professional service to navigate the Iraqi Dinar market confidently.

Supported Currencies: Iraqi Dinar.

Payment Methods: Online payments, bank transfers.

Buyback Policy: Yes.

Pros:

Certificates of authenticity are provided.

24/7 customer service.

Market insights on the Dinar’s revaluation.

Cons:

Limited to Australia and New Zealand.

Payment methods could be broader.

16. Cheapest Dinar

Cheapest Dinar stands out as a specialized platform in the Iraqi currency market. They offer some of the best rates for dinar transactions and stock various Iraqi currency notes in different denominations. Security is built into every aspect of their service. Each transaction goes through multiple verification steps to ensure customers receive genuine currency. Their transparent pricing and detailed product descriptions show how seriously they take their business.

Customer convenience drives their service model. The platform lets buyers worldwide use different payment methods to complete their purchases easily. Additionally, it focuses on educating its customers by providing detailed guides about Iraqi currency to help buyers make informed decisions.

A dedicated support team is always available to answer any questions during the buying process. Cheapest Dinar operates under strict financial guidelines and complies with all regulatory requirements. Their goal is to build lasting relationships with customers by offering reliable service and competitive prices.

Supported Currencies: Iraqi Dinar in multiple denominations.

Payment Methods: Wide range of global payment options.

Buyback Policy: Not specified.

Pros:

Transparent pricing and detailed product descriptions.

Educational resources for informed buying.

Dedicated support team for customers.

Cons:

Exclusively focused on Iraqi Dinar.

Lacks physical presence for walk-in customers.

17. Ultimate Currency Exchange

Ultimate Currency Exchange transformed Canadian currency services with its innovative online platform when it launched in May 2015. By offering better exchange rates than major Canadian banks, they have maintained a competitive edge in the industry. The dedicated team prioritizes customer service, ensuring professional assistance with every transaction. On average, clients save 1% to 3% compared to bank rates.

The exchange service focuses exclusively on foreign currency transactions, leveraging its strong purchasing power and efficient cost management to offer competitive pricing. Customers can easily place orders online using a simple calculator-based system or by visiting one of their Ottawa branches. The platform is fully transparent, displaying clear exchange rates on its website with no hidden fees or extra charges.

Customers can choose flexible delivery options, including mail delivery or branch pickup, to further enhance convenience. Ultimate Currency Exchange’s transparent, customer-focused approach ensures that Canadians can confidently access great exchange rates and professional services from the comfort of their homes.

Supported Currencies: Foreign currencies, including Iraqi Dinar.

Payment Methods: Online orders and in-person transactions.

Buyback Policy: Not specified.

Pros:

Competitive rates compared to Canadian banks.

Transparent pricing with no hidden fees.

Flexible delivery options (mail or branch pickup).

Cons:

Operates primarily in Canada.

Relatively new compared to competitors (est. 2015).

18. US First Exchange

US First Exchange is a federally registered Money Services Business in downtown Los Angeles's jewelry district. The platform caters to investors and collectors who want currencies from unique global markets. This third-generation currency broker holds multiple state-specific licenses. The platform's strict authentication protocols and advanced technology verify every currency.

Each transaction needs proper identification documents to meet US Department of Treasury guidelines. Customers receive FedEx shipping within 24-48 hours, and their orders are fully insured. The platform accepts credit cards, debit cards, and wire transfers. The core team checks each currency note's authenticity at the company's downtown LA location.

US First Exchange is all but one of these mail-order currency companies that gives 100% insurance on every order. They handle transactions quickly while following State and Federal regulations. Their years of experience in money services, currency exchange, and authentication are the foundations of their reliable service.

Supported Currencies: Unique global currencies, including the Iraqi Dinar.

Payment Methods: Credit cards, debit cards, and wire transfers.

Buyback Policy: Not specified.

Pros:

Fully insured transactions.

FedEx shipping within 24-48 hours.

Advanced authentication protocols.

Cons:

Requires strict identification for all transactions.

Focused mainly on US customers.

19. Interchange Financial

Interchange Financial is Canada's leading currency exchange specialist. They deliver the best market rates through their Exchange Rate Guarantee® program. Their ICS Service helps Canadian clients exchange currencies electronically between accounts. The company has a unique online ordering system for Iraqi Dinar transactions.

They deliver currency anywhere in Canada within two business days. Clients save between 1% and 3% compared to bank rates across all their services. With almost 20 years of experience focused only on foreign exchange services, they handle transactions from USD 2,500 to USD 2,000,000.

Security Measures are robust with insured Canada Post delivery and detailed verification checks for all currency transactions. The company keeps a large stock of 70 different foreign currencies ready for immediate exchange. Its transparent pricing system has no hidden fees or commissions. Its market expertise and high trading volumes help it beat traditional banks in service quality and exchange rates.

Supported Currencies: 70 foreign currencies, including the Iraqi Dinar.

Payment Methods: Online payments and electronic account transfers.

Buyback Policy: Yes.

Pros:

Exchange Rate Guarantee® program.

Delivery within two business days across Canada.

No hidden fees or commissions.

Cons:

Only available in Canada.

Minimum transaction amount (USD 2,500).

20 ManorFX

Manor FX, a family-owned money service business, has earned its place in the currency exchange sector over the past 12 years. Their excellent customer service shows in their positive Trustpilot reviews. The company outshines competitors with its impressive range of over 160 currencies, which exceeds what traditional banks and the Post Office offer.

Manor FX keeps Iraqi Dinar exchange rates competitive and doesn't charge any commissions or transaction fees. Customers can expect their major currency orders the next working day. They can pick up their orders at the flagship bureau de change in Datchet, Berkshire, or have them delivered to their home. The multilingual team brings 30+ years of combined expertise in travel money exchange, compliance, and customer support.

HMRC supervises Manor FX's anti-money laundering compliance. The company's partnership with Leftover Currency lets customers buy new currency and sell unused travel money. The company takes a straightforward approach with no minimum or maximum order limits, though larger transactions might need photo ID under the Money Laundering Regulations.

Supported Currencies: 160+, including Iraqi Dinar.

Payment Methods: Online and in-person

Buyback Policy: Yes

Pros:

No commission or transaction fees.

Next-day delivery for major currency orders.

Multilingual team with extensive experience.

Cons:

Larger orders require photo ID verification.

Limited physical locations (Datchet, Berkshire).

Conclusion

Smart Iraqi Dinar trading starts with picking reliable and secure platforms. 10-year-old exchanges give traders multiple ways to handle transactions, including physical currency and electronic trading options. While eBay and Amazon let you trade, specialized platforms have better security and proper verification systems in place.

Traders need to review several key aspects when picking their platform. Security protocols and exchange rates are vital parts of safe trading.

Your success with Iraqi Dinar trading comes from picking platforms you can trust and knowing their rules. Good research and proper paperwork make transactions smoother. Smart traders know that a platform's reputation, security setup, and support team quality shape their trading experience. Source: Dinarit

#Top sites for buying and selling Iraqi Dinar#Online Iraqi Dinar currency exchange services#Iraqi Dinar directory#Iraqi Dinar guide#Iraqi Dinar niche#Best Iraqi Dinar site

0 notes

Text

Buy counterfeit Kuwait Dinar | Best place to buy fake Kuwait currency | Cashfliperzspot

Buying counterfeit Kuwaiti dinars could transform your life. We are the ones who make this possible. We offer reliable and safe online fake goods sales.

0 notes

Text

Get the best rates for Iraqi dinar at IQDBUY. Enjoy a seamless online purchasing process with secure payments and fast delivery. Trust IQDBUY for all your currency needs.

#buy Iraqi Dinar#Iraqi Dinar#Iraqi dinar to USD#Buy iraqi dinar online#Iraqi dinar for sale#Purchase iraqi dinar#Iraq dinar to USD#Iraqi Dinar currency Exchange

1 note

·

View note

Text

The Most Expensive Currency in the World in 2023: What It Is and Why It Matters

The Kuwaiti dinar (KWD) is the most expensive currency in the world. As of October 2023, it is worth more than any other currency, including the US dollar, the euro, and the British pound. KWD is one of the world’s most expensive currencies The symbol for Kuwaiti Dinars is KWD. Introduced in 1960, the year the nation proclaimed independence from British rule, it…

View On WordPress

0 notes

Text

When will the Iraqi Dinar Revalue? (Bing’s AI Tool)

Today, I became curious after months of+*/ hearing about arificial intelligence, chat bots, Open AI, ChatGPT, etc. I decided to indulge my own curiosity and also assess just how intelligent these artificial brains really are. The first one I played around with is one created by Microsoft’s Bing.

I posed the following (loaded) question: When will the Iraqi Dinar revalue?

The answer it gave me wasn’t particularly impressive, however, when I first attempted to write this post my browser froze and I lost everything. Interestingly, while the gist was the same, the second time I asked the idenical question I got a slightly different answer.

That answer is below, make of it what you will:

The Iraqi Dinar has been a topic of speculation for many years. The Iraqi Dinar Revaluation (RV) is a theory that the Iraqi Dinar will one day be worth a lot more than it is today. The RV theory is based on the belief that the Iraqi Dinar was artificially devalued by the Saddam Hussein regime in the 1990s, and that it will be revalued to its true value once Iraq becomes a stable and prosperous country².

However, on February 7th, 2023, Iraq's cabinet approved a currency revaluation and set the exchange rate at **1,300 dinars per U.S. dollar**³⁵.

Source: Conversation with Bing, 7/1/2023

Umm... What was the rate before it was 1300-1?

I guess noboddy mentioned to it what the rate had been before the government set t at 1,300 dinars to $1. Most people would consider an 11% ROI pretty good for year’s investment. IQD appreciated that much against the US dollar in one day when it was set at 1300-1. So at leats in 2023, if you buy Iraqi dinar you haven’t lost anythign this year, and appear poised to see your patience pay off like so many of us have long hoped.

Here is what it said when I asked what the rate had been prior to being changed to 1300-1 (it was 1468-1, but Microsoft Bing didn’t know and couldn’t figure that out). The response is as follows:

I couldn't find the exact exchange rate before it was set at 1,300 dinars per US dollar on February 7th, 2023¹. However, the Iraqi dinar was equal to US$4.86 between 1932 and 1949 and equalled to US$2.80 between 1949 and 1971 after being devalued in 1949²³. I hope this helps.

Source: Conversation with Bing, 7/1/2023 (1) 1,300.00 IQD is equal to 0.99 USD. https://bing.com/search?q=iraqi+dinar+exchange+rate+before+1%2c300+dinars+per+US+dollar. (2) IQD/USD: Iraq Revalues Dinar Currency Weeks After Replacing Central .... https://www.bloomberg.com/news/articles/2023-02-07/iraq-revalues-currency-weeks-after-replacing-central-bank-s-head. (3) Iraq lowers dollar-dinar exchange rate - Al-Monitor. https://www.al-monitor.com/originals/2023/02/iraq-lowers-dollar-dinar-exchange-rate.

I couldn’t have just let this go without sending feedback to the AI’s operators and developers.More on that in the next post...

#iraq#iraqi#iraqi dinar#Iraqi Dinars#Buy Iraqi Dinar#iqd#gcr#global currency reset#money#currency#iraq curreny

2 notes

·

View notes

Text

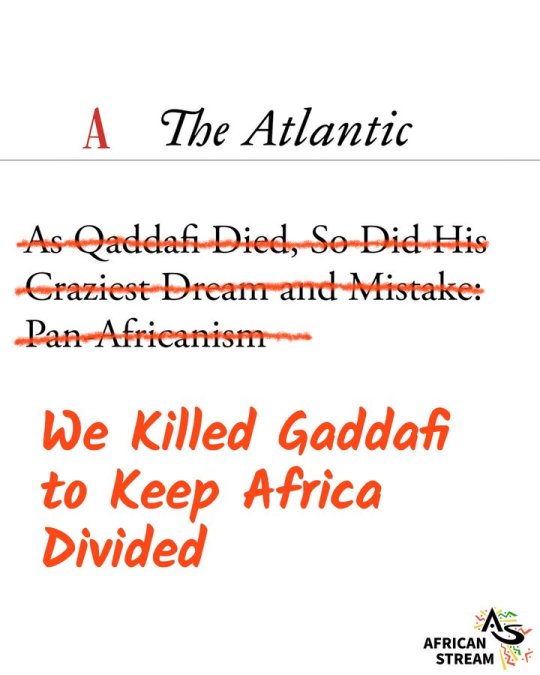

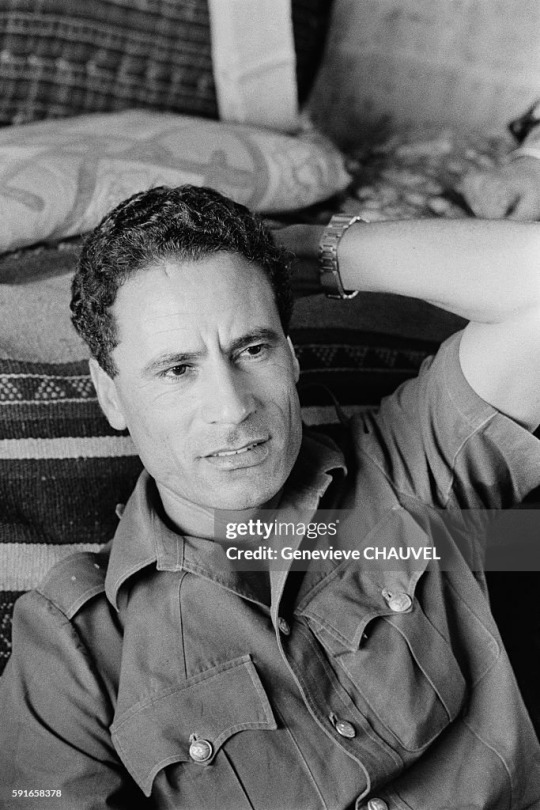

On this day in 2011, revolutionary Libyan leader and pan-Africanist Muammar Gaddafi was captured and executed by NATO-backed rebels. Not long after, The Atlantic published an article with the headline: 'As Qaddafi Died, So Did His Craziest Dream and Mistake: Pan-Africanism.' Yes, they actually said the quiet part out loud.

The article boldly states, "Qaddafi's death -- and the outpouring of support for the late Libyan leader in sub-Saharan Africa following his demise -- is a reminder that pan-Africanism was an historic mistake of enormous proportions -- a simple-minded political ideology that for the past 50 years or so has done more harm than good for Africa's standing in the world."

People across the political spectrum still debate whether Gaddafi really was the brutal dictator the West made him out to be. Was he killed because he was hated by his own people? Or did his anti-imperialist politics and refusal to bow down to the West play a decisive role? Today, in 2024, there is a significant body of evidence that the West had a vested interest in removing Gaddafi, who was working to liberate and unify Africa. This article by The Atlantic was an early clue.

The most persuasive evidence that there was a Western plot to destroy pan-Africanism through Gaddafi's assassination comes directly from email correspondences between former US Secretary of State Hillary Clinton and former aide to President Bill Clinton, Sidney Blumenthal. Here’s an extract from one email:

"This [Libyan] gold [reserve] was accumulated prior to the current rebellion and was intended to be used to establish a pan-African currency based on the Libyan golden Dinar. This plan was designed to provide the Francophone African Countries with an alternative to the French franc (CFA)… French intelligence officers discovered this plan shortly after the current rebellion began, and this was one of the factors that influenced President Nicolas Sarkozy's decision to commit France to the attack on Libya."

They did not want Africa to unite under the golden dinar currency that Gaddafi proposed, so he had to go.

47 notes

·

View notes

Text

Just got this one in my inbox, and instead of just deleting it outright, let's go over some of the red flags that indicate this is a scam, shall we?

First, the biggest red flag which y'all can't immediately see here since I cropped out the username and GoFundMe link is that the account was created literally 2 days ago, as of this time of writing. That is usually a dead giveaway of a throwaway account that exists solely to promote a scam.

Secondly, "Mohammed". For some reason, that's the name 98% of these scam messages go with. Could it just be a coincidence that all of these "Palestinians in need" just happen to share the same name? Or is it more likely they just googled "common Palestinian names" and went with the first name on the list?

Also, why Euros? That seems particularly odd to me. From what I've been able to research, there are three different denominations of currency used in Palestine; Israeli shekels, US dollars, and Jordanian dinars. Notice which currency is NOT on that list?

It doesn't make sense for a Palestinian fundraiser to be asking for Euros, a currency not used in Palestine, unless the person making the fundraiser is trying to reach out to Europeans specifically... or is actually based in a European country that uses the Euro.

"Helping animals" is also extremely vague, but is a cause that most people can empathize with. It's also worth noting that this is not the first "I help the animals in Gaza during the harsh war" message I've seen, and I doubt it will be the last.

Anyway, learn to recognize the signs of a scammer. Don't blindly trust every fundraiser you see. Don't blindly promote every random stranger who comes into your inbox to ebeg.

32 notes

·

View notes

Text

Kuwaiti Dinar to Indian Rupee (KWD to INR) Exchange Rate

Get the latest Kuwaiti Dinar to Indian Rupee exchange rates at BEC Kuwait. Check live forex updates and convert KWD to INR easily for your remittance and currency needs. Please visit:- https://www.bec.com.kw/currency/kuwaiti-dinar-to-indian-rupee/

0 notes

Text

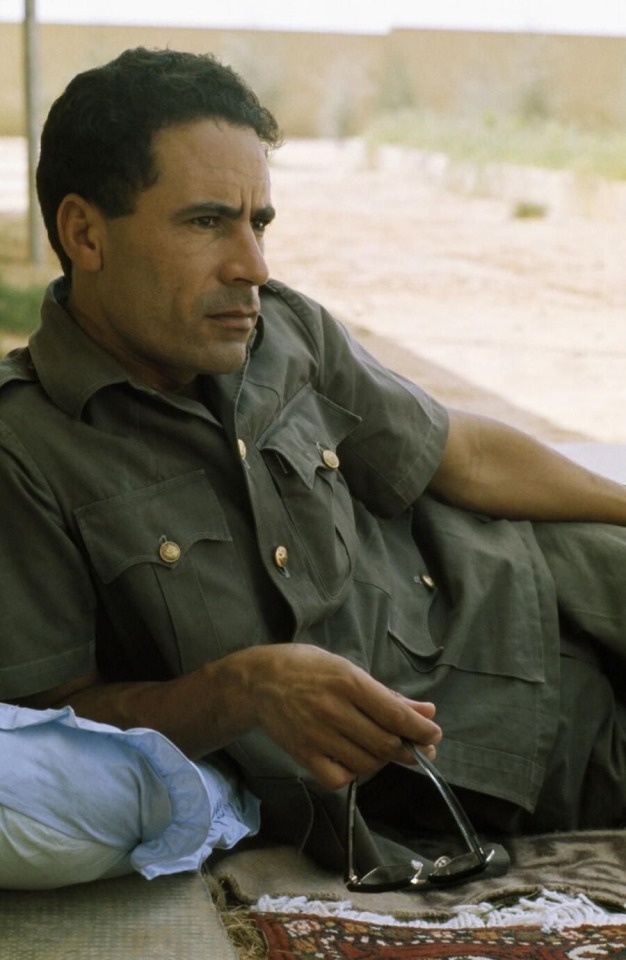

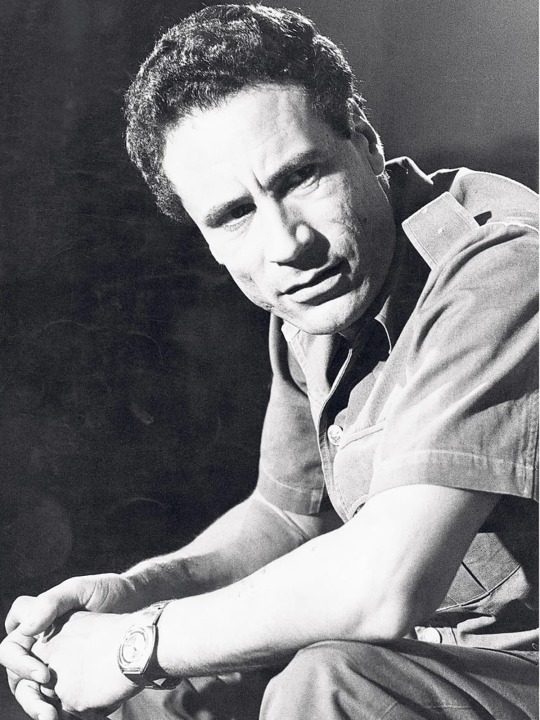

12 years after the death of Libyan dictator Muammar Gaddafi, I’m still obsessed with his life story. He’s the original Kardashian. Blessed with good looks, he botched himself and pulled a Jocelyn Wildenstein with bad plastic surgery and Botox. WHY did he have to ruin his face lmao??

He made Libya one of the richest countries in Africa with a high GDP, wanted to make a gold-backed dollar instead of fake fiat currency, was a Pan-Africanist who wanted to empower Arabs and Africans alike, had a crew of Amazonian bodyguards, threatened US and European hegemony, pissed off the whole world, was possibly behind the horrendous Lockerbie bombing, was an alleged war criminal, luxurious spender, anti-NATO, so-called terrorist, shit talker at the UN assembly, wanted to create a giant man-made aqueduct to supply water all across Africa, ruled unelected for over 40 years, was ardently pro-Palestine, used too much tax money on his face, and so on.

For anyone interested in MENA geopolitics, Gaddafi is one of the most fascinating mixed bags of the past century. He died beaten to death with a bayonet supposedly shoved up his ass by fake rebels paid by NATO, but in the end he just pissed off Hillary Clinton and Nicolas Sarkozy by wanting to launch the independent African Gold Dinar which would have been backed by his immense reserves of gold; unlike the USA which operates on nonexistent currency.

It’s a complicated story, just like Gaddafi’s complex fashion sense, swift decline in handsomeness to botox pillow face syndrome, and deranged yet occasionally compassionate mind. But it’s definitely an unforgettable story above all. We will never really know the truth about how and why he died, but we can only have an inkling.

77 notes

·

View notes