#Iraqi Dinars

Explore tagged Tumblr posts

Text

When will the Iraqi Dinar Revalue? (Bing’s AI Tool)

Today, I became curious after months of+*/ hearing about arificial intelligence, chat bots, Open AI, ChatGPT, etc. I decided to indulge my own curiosity and also assess just how intelligent these artificial brains really are. The first one I played around with is one created by Microsoft’s Bing.

I posed the following (loaded) question: When will the Iraqi Dinar revalue?

The answer it gave me wasn’t particularly impressive, however, when I first attempted to write this post my browser froze and I lost everything. Interestingly, while the gist was the same, the second time I asked the idenical question I got a slightly different answer.

That answer is below, make of it what you will:

The Iraqi Dinar has been a topic of speculation for many years. The Iraqi Dinar Revaluation (RV) is a theory that the Iraqi Dinar will one day be worth a lot more than it is today. The RV theory is based on the belief that the Iraqi Dinar was artificially devalued by the Saddam Hussein regime in the 1990s, and that it will be revalued to its true value once Iraq becomes a stable and prosperous country².

However, on February 7th, 2023, Iraq's cabinet approved a currency revaluation and set the exchange rate at **1,300 dinars per U.S. dollar**³⁵.

Source: Conversation with Bing, 7/1/2023

Umm... What was the rate before it was 1300-1?

I guess noboddy mentioned to it what the rate had been before the government set t at 1,300 dinars to $1. Most people would consider an 11% ROI pretty good for year’s investment. IQD appreciated that much against the US dollar in one day when it was set at 1300-1. So at leats in 2023, if you buy Iraqi dinar you haven’t lost anythign this year, and appear poised to see your patience pay off like so many of us have long hoped.

Here is what it said when I asked what the rate had been prior to being changed to 1300-1 (it was 1468-1, but Microsoft Bing didn’t know and couldn’t figure that out). The response is as follows:

I couldn't find the exact exchange rate before it was set at 1,300 dinars per US dollar on February 7th, 2023¹. However, the Iraqi dinar was equal to US$4.86 between 1932 and 1949 and equalled to US$2.80 between 1949 and 1971 after being devalued in 1949²³. I hope this helps.

Source: Conversation with Bing, 7/1/2023 (1) 1,300.00 IQD is equal to 0.99 USD. https://bing.com/search?q=iraqi+dinar+exchange+rate+before+1%2c300+dinars+per+US+dollar. (2) IQD/USD: Iraq Revalues Dinar Currency Weeks After Replacing Central .... https://www.bloomberg.com/news/articles/2023-02-07/iraq-revalues-currency-weeks-after-replacing-central-bank-s-head. (3) Iraq lowers dollar-dinar exchange rate - Al-Monitor. https://www.al-monitor.com/originals/2023/02/iraq-lowers-dollar-dinar-exchange-rate.

I couldn’t have just let this go without sending feedback to the AI’s operators and developers.More on that in the next post...

#iraq#iraqi#iraqi dinar#Iraqi Dinars#Buy Iraqi Dinar#iqd#gcr#global currency reset#money#currency#iraq curreny

2 notes

·

View notes

Text

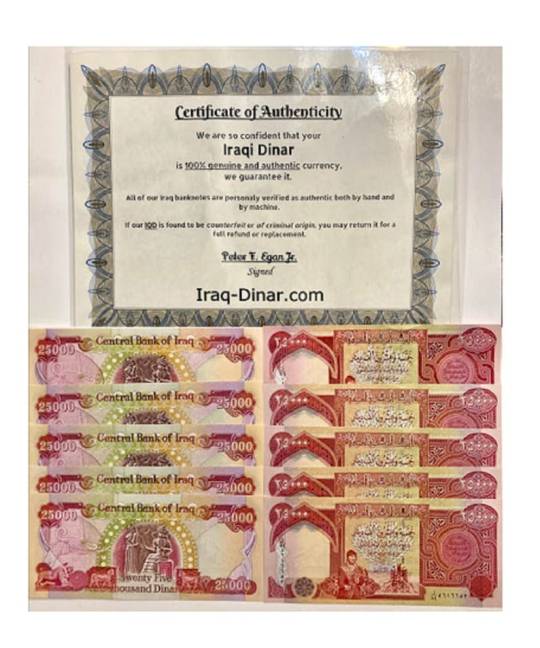

Egan.Store (NOT EganStore.com) Repeat Customers

If you’ve bought from Egan.Store at least twice, and you’re looking to make a large purchase, I strongly recommend you check with Peter (me) before ordering, as I can almost always save repeat customers some money when I’m asked by them to do so. If you’re a new customer, we’ll take good care of you too. we just won’t be able to offer discounts reserved exclusively for repeat customers. But as soon as you become a repeat customer you will start to find out about promotions you never before even knew existed, but were too afraid to ask about. No more..

Repeat customer is defined in this piece as someone who has made a minimum of two purchases from Egan Store since its inception of any amount, any product or any quantity, but without the item being on-sale or part of some promotion. Two orders at full-price makes one a repeat customer for these purposes.

youtube

Ms. Sandy at Edu Matrix has some of the best videos about the Iraqi dinar and it’s prospective revaluation available anywhere on the web.

Everything I’m hearing is that the RV is imminent... anywhere for hours to weeks, months tops. There’s been lots of chatter that this will be a very special Christmas. Sure, could mean anything or nothing, but Trump’s history is pretty close to unanimous in terms of his knowing something specific when he makes remarks like that.

My recommended source for IQD (Iraqi Dinar) is Egan Store (http://egan.store & Egan Shop https://eganshop.com).

Peter (the owner of Egan Store) has told me this week that he intends to start removing IQD listings soon, although he couldn’t give a date, stating that they would only sell what they can replace, but would sell as long as he could get it. So as long as they can get it they plan to make it available and help as many people as possible procure some before it’s too late.

Peter is a good man and his customers love him. His business has achieved a better than 99% customer satisfaction rate selling on eBay, Etsy, other third-party platforms and from their relatively new site, EganShop.com.

Peter will be launching a plethora of currency-specific, niche collectible numismatics, coin & banknote shops — each specific to a particular nation’s currency.

Egan Shop and Egan Store have every denomination of new Iraqi dinar available for some of the best prices available anywhere online. If you find a better price, message them. If Peter can beat it he will.

https://etsy.com/shop/EganStore

#iraq#iraqi#iraqi dinars#iraqi dinar#iraqidinar#dinar#dinar rv#nesara#gesara#gcr#global currency reset#iraq dinar#egan store#egan

18 notes

·

View notes

Text

Why the Revaluation of Iraqi Dinar Inspires Investor Optimism

The potential revaluation of the Iraqi dinar has sparked significant optimism among investors who see it as a promising opportunity for economic growth and financial gains. While currency revaluations are complex and influenced by numerous factors, the dinar's potential shift in value is being closely monitored by global investors eager to capitalise on its future prospects.

A Strengthening Economy

Iraq has been making steady progress in stabilising its economy through improved infrastructure, increased oil production, and enhanced trade relations. As one of the world's top oil producers, Iraq's revenue stream is robust, providing the government with resources to support economic reforms. These efforts contribute to a more stable financial system, which could lead to a stronger currency over time.

The country's ongoing financial reforms also play a crucial role in building investor confidence. By implementing policies that promote economic stability, Iraq is creating an environment that fosters growth, making the revaluation of the Iraqi dinar and the dinar itself more attractive on the global stage. Many investors view these developments as key indicators that the revaluation of the iraqi dinar is not just speculation but a possibility backed by solid economic fundamentals.

Increased Foreign Investment

Another reason for investor optimism is the growing interest from foreign investors and financial institutions. Iraq's rich natural resources, strategic location, and potential for economic expansion make it a prime destination for international investments. As foreign capital flows into the country, the demand for its currency increases, potentially driving up its value.

With improvements in regulatory frameworks and banking systems, Iraq is also making it easier for investors to participate in its economic development. As more financial institutions establish connections with Iraq's banking sector, the dinar's credibility strengthens, creating an environment where a revaluation becomes more feasible.

Market Confidence and Economic Growth

Currency revaluations often signal economic strength and stability. If the dinar were to be revalued, it would reflect confidence in Iraq's financial future and its ability to sustain growth. A stronger dinar would increase purchasing power for Iraqi citizens, boosting domestic spending and further driving economic expansion.

Additionally, a revalued currency could attract further investments in various industries, including real estate, energy, and technology. A thriving business environment encourages job creation and innovation, reinforcing positive economic momentum. Investors looking for long-term opportunities see Iraq as a market with high potential, adding to the anticipation surrounding a possible currency revaluation.

A Positive Outlook for the Future

While no official timeline exists for a revaluation of the Iraqi dinar, the current economic trends in Iraq provide a strong foundation for optimism. Steady economic reforms, increased foreign investments, and ongoing financial restructuring all contribute to a brighter future for the currency.

For investors, the key lies in patience and a strategic approach. Watching the country's economic progress, understanding market trends, and staying informed about policy changes can help them make well-informed decisions. While the road to revaluation may be gradual, the long-term potential remains an exciting prospect for those looking to capitalise on Iraq's economic growth.

Ultimately, the growing optimism surrounding the Iraqi dinar reflects a belief in the country's ability to strengthen its financial standing on the global stage. With continued progress, a potential revaluation could mark a new era of prosperity for Iraq and its investors alike.

0 notes

Text

Top 20 Sites for Buying and Selling Iraqi Dinars in the USA and Worldwide

Iraqi Dinar trading has become an appealing investment opportunity. With Iraq’s oil reserves and efforts to stabilize the economy, many speculate on the Dinar’s future value. Iraq's strengthening economy drives investors to look for dependable platforms that facilitate the buying and selling of this currency. The potential for good returns attracts many traders, but the volatile nature of Iraqi Dinar trading demands careful thought about platform selection. According to the Bank for International Settlements, the global forex market has a daily volume of over .5 trillion; that’s how big the interest in currency trading is worldwide.

This article will explore the top 20 sites for buying and selling Iraqi dinars in the USA and worldwide. From best exchange rates to rare currency specialists, you will find what you need. Whether you are a seasoned investor or a newbie, this list will help you trade safely.

1. IQDBuy.com

IQDBuy.com is a leading platform in the Iraqi Dinar trading space. The website provides simple currency exchange services for Iraqi Dinar transactions. The platform lets you buy and sell Iraqi Dinar with ease.

Smart investors should get a full picture of the platform's operations and verification processes before making any transactions. While IQDBuy.com is one of several options for Iraqi Dinar trading, their rates and services can change with market conditions.

Traders should contact the platform directly to get updated information about services, exchange rates, and verification requirements. Understanding service terms and transaction processes will help create a smooth trading experience.

Currencies Sold: Primarily Iraqi Dinar.

Payment Methods: Bank transfers, credit/debit cards, PayPal.

Buyback Policy: Yes, with competitive rates.

Pros:

Simple and user-friendly interface.

Secure payment gateways.

Competitive exchange rates.

Cons:

Limited customer service availability.

No educational content or forums.

2. Dinarit.com

Dinarit.com is a specialized platform that focuses on Iraqi Dinar currency exchange services. The platform uses strict verification protocols for all transactions and creates secure trading environments for its users. Strong authentication measures protect both buyers and sellers during their currency exchanges.

Users can find competitive exchange rates for Iraqi Dinar trading on the platform. Market conditions determine these rates, and they update regularly. Traders access their detailed transaction histories and account statements through personal dashboards. This service appeals to individual investors and institutional clients who need reliable Iraqi Dinar trading options.

Dinarit.com uses multi-factor authentication systems and encrypted communication channels to boost security. Users receive dedicated customer support that helps them with transaction-related questions and account management needs.

Currencies Sold: Iraqi Dinar exclusively.

Payment Methods: Bank transfers, checks, cryptocurrency.

Buyback Policy: Yes, with proof of original purchase.

Pros:

Strong multi-factor authentication for added security.

Transparent fee structure.

Dedicated customer support team.

Cons:

No mobile app.

Limited currency options.

3. eBay

eBay is a worldwide marketplace where people can buy and sell Iraqi dinars. The platform connects traders from all corners of the world. Users can find many Iraqi Dinar listings on the platform, from current notes to collectible denominations. The platform features search filters to quickly find specific listings by denomination, condition, or price range.

eBay's rating system lets buyers assess sellers based on their past deals and what other customers say about them. Trading Iraqi dinars on eBay requires careful consideration. The platform's buyer protection program offers added safety for transactions that follow its rules. Buyers are advised to review seller ratings, check listing details thoroughly, and understand eBay's currency trading policies.

eBay ensures secure payment processing and provides multiple payment options. Sellers must adhere to listing rules and include clear images of the currency. Buyers should also consider shipping options, delivery times, and costs before completing a purchase.

Currencies Sold: Iraqi dinars and other currencies through third-party sellers.

Payment Methods: Credit/debit cards, PayPal.

Buyback Policy: Depends on individual sellers.

Pros:

Wide variety of listings.

Buyer protection for eligible transactions.

Seller ratings for credibility checks.

Cons:

Risk of counterfeit currency.

No centralized verification.

4. Amazon

Amazon functions as an online marketplace where third-party sellers can list Iraqi dinarss along with other currencies. Verified sellers must meet specific criteria to ensure basic security for currency transactions. Buyers can review seller ratings and feedback before making a purchase.

The platform’s A-to-Z Guarantee offers some protection for qualified purchases, but trading currencies on Amazon requires caution. Buyers should carefully review seller profiles, shipping policies, and authentication methods. Amazon’s verification process includes background checks and account monitoring for sellers.

With search filters and sorting options, buyers can easily find specific Iraqi Dinar listings based on denomination or price. Secure payment options are available, but Amazon primarily focuses on general retail rather than specialized currency exchange services.

Currencies Sold: Iraqi Dinar (via verified sellers).

Payment Methods: Credit/debit cards, gift cards.

Buyback Policy: No.

Pros:

Convenience of a large marketplace.

Verified seller profiles available.

Cons:

Limited customer support for currency issues.

It's not a specialized currency platform.

5. Etsy

Etsy's marketplace extends beyond handmade and vintage items to include currency collectors and traders. It offers a secure environment for Iraqi Dinar transactions with strict seller verification and detailed listing requirements. Unlike traditional currency trading platforms, Etsy focuses on the collectible and numismatic aspects of currency.

Buyers can filter listings by denomination and condition, while sellers must provide clear images and complete documentation of currency items. The platform ensures safe transactions through its secure payment system and supports multiple payment methods. Seller credibility can be assessed using Etsy’s review system, which includes feedback from previous transactions.

Sellers must follow Etsy's marketplace policies for currency listings and international shipping regulations to maintain security. The platform's dispute resolution system provides simple protection for qualified purchases. Buyers should still carefully verify seller credentials and authentication methods.

Currencies Sold: Iraqi Dinar (collectible denominations).

Payment Methods: Credit/debit cards, PayPal.

Buyback Policy: No.

Pros:

Strong seller verification policies.

Detailed descriptions for collectibles.

Cons:

Limited supply.

Higher fees for niche products.

6. XChange of America

XChange of America, based in the United States, specializes in currency exchange services through its physical locations and online platforms. The company strictly follows federal regulations to maintain a secure trading environment.

It offers a variety of currency pairs, including Iraqi dinars, with exchange rates updated regularly based on market conditions. Transactions require identity verification and documentation to ensure legitimacy. Customers can rely on a dedicated support team that is available through multiple communication channels for assistance with transactions and account management.

The platform provides a secure payment system with various options and tools like real-time rate calculators and transaction tracking. With multi-layer authentication and encrypted channels, XChange of America ensures transaction safety. The user-friendly interface allows for quick transactions, and detailed records are available for future reference.

Currencies Sold: Iraqi Dinar, Euro, British Pound, etc.

Payment Methods: Credit/debit cards, bank transfers.

Buyback Policy: Yes.

Pros:

Strict compliance with US regulations.

Secure online and in-person transactions.

Cons:

Higher minimum transaction amounts.

Limited global availability.

7. Taheri Exchange

Taheri Exchange has provided currency exchange services from its Toronto location for 37 years. The company has built trust with over 100,000 satisfied customers and handles more than 100 global currencies.

Customers can buy Iraqi Dinars through multiple convenient channels. The online ordering system makes purchases simple, and their physical store at 5775 Yonge Street welcomes walk-in customers. Business hours run from 11 am to 5 pm, Monday through Friday.

Taheri Exchange's payment options include email money transfers for online orders. Customers who visit the store can pay with cash or debit cards. The company's strong security protocols ensure all packages are packed under camera surveillance and require signature confirmation upon delivery.

Each order gets a unique tracking number and full insurance coverage until delivery confirmation. The company sends prompt delivery status updates by email. Taheri's staff keeps customers informed and sends notifications when orders are ready.

Supported Currencies: 100+ global currencies, including Iraqi Dinar.

Payment Methods: Email money transfers, cash, debit cards.

Buyback Policy: Not specified.

Pros:

Trusted brand with 37 years of experience.

Secure packaging under camera surveillance.

Tracking numbers and full insurance on deliveries.

Cons:

Limited business hours (Monday to Friday, 11 am - 5 pm).

No weekend operations.

Limited physical locations.

8. Treasury Vault

Treasury Vault has been a registered currency exchange provider with the US Treasury Department since 2011. We specialize in authentic world currencies, precious metals, and safe, high-end residential solutions. The company offers Iraqi Dinar services through its network of partners across Iraq's provinces.

Their buy-back program comes with specific rates—USD 665.00 per million for uncirculated Iraqi dinars and USD 640.00 per million for notes that have spread through circulation. Security is a top priority. Any transactions over USD 1,000 need extra verification - you'll need to provide your social security number or tax ID, plus government-issued identification.

The company follows Patriot Act guidelines and FinCEN regulations carefully. Treasury Vault works with currencies from many countries, including Afghanistan, Brazil, Chile, Egypt, Iran, Iraq, India, Libya, Mongolia, Saudi Arabia, South Korea, and Vietnam. They take 3-5 business days to authenticate currencies, making sure every note is genuine.

Currencies Sold: Iraqi Dinar, Afghani, Libyan Dinar, etc.

Payment Methods: Credit cards, bank transfers.

Buyback Policy: Yes, with competitive rates.

Pros:

Registered with the US Treasury.

Transparent rates and buyback policies.

Cons:

Slower transaction processing times.

9. Safe Dinar

SafeDinar, a 15-year-old currency exchange platform, specializes in Iraqi Dinar trading for individual and institutional clients. The platform ensures authenticity through strict currency verification and compliance with international banking regulations. Its multi-step verification system enhances transaction security, and a dedicated customer service team provides support throughout the process.

SafeDinar offers transparent pricing, with exchange rates updated regularly based on market conditions. Clients can securely access transaction history and account statements through an online portal. The platform works with verified currency suppliers to maintain authenticity and reliability.

SafeDinar's secure payment system supports multiple payment methods, ensuring safe and efficient transactions. Its user-friendly interface simplifies the trading process, offering detailed documentation for every exchange. With expertise in Iraqi Dinar trading, the platform also provides market analysis and guidance to help clients make informed decisions.

Currencies Sold: Iraqi Dinar.

Payment Methods: Bank transfers, credit cards.

Buyback Policy: Yes.

Pros:

Highly secure with strict verification processes.

Regularly updated exchange rates.

Cons:

Limited to specific currencies.

10. Dinar Guru

Dinar Guru stands out as a specialized currency exchange service in the Iraqi Dinar trading market. The platform gives detailed market analysis and valuable trading insights to Iraqi Dinar investors. The service takes security seriously. Users must provide complete documentation for all transactions. The platform's knowledge base helps traders learn about Iraqi Dinar trading effectively. Multiple security layers protect user information and transaction details.

Dinar Guru's user-friendly trading interface makes buying and selling Iraqi dinars simple. Market conditions drive regular updates to exchange rates. A dedicated customer support team guides users through the trading process and explains documentation needs and transaction steps.

The platform demonstrates transparency through clear fee structures and transaction policies. Traders can easily monitor orders on a secure dashboard that displays transaction histories and account statements. The service keeps user data safe with encrypted communication channels and multi-factor authentication systems.

Currencies Sold: Iraqi Dinar.

Payment Methods: Bank transfers, cryptocurrency.

Buyback Policy: Yes.

Pros:

Strong market analysis tools.

Transparent policies.

Cons:

No mobile app.

11. Forex Banknotes

Forex Banknotes specializes in exchanging physical banknotes for multiple currencies, including Iraqi Dinar. Its strong system supports transactions for both individuals and institutions. The company ensures all banknotes meet quality standards with strict checks and provides paperwork to confirm the currency's authenticity.

In addition to exchanges, Forex Banknotes offers market analysis and trading tips to help customers make better decisions. It works with trusted currency suppliers worldwide to keep transactions safe. A helpful support team guides users through the required paperwork and verification process.

The platform has clear fees with no hidden charges, allowing users to calculate costs upfront. Exchange rates are updated regularly based on market conditions, and traders can track their transactions through a secure online portal with live updates. Forex Banknotes strictly follows international banking rules to ensure safe and reliable trading.

Supported Currencies: Iraqi Dinar, USD, Euro, and more.

Payment Methods: Bank transfers, credit cards.

Buyback Policy: Not explicitly mentioned.

Pros:

Supports individuals and institutions.

Transparent fees with no hidden charges.

Secure online transaction tracking.

Cons:

Limited payment methods.

Does not explicitly mention buyback options.

12. Travelex.com

Travelex has over 40 years of experience in foreign exchange and operates in countries around the world. Its large network helps it track market exchange rates daily, offering better prices to customers. The company is strictly regulated by financial authorities, such as the Turkish Financial Crimes Investigation Board (MASAK) and the Republic of Turkiye's Ministry of Treasury and Finance, ensuring customer protection.

Travelex offers convenient services, including currency buying and transfers with no extra fees, alerts for target exchange rates, competitive rates, and the ability to convert over 45 currencies. Transactions are secure, with fast delivery options, including next-day currency delivery for added convenience.

Travelex’s rate tracking system keeps customers informed when currencies reach their desired rates. Exchange rates are adjusted based on market supply and demand, ensuring prices remain competitive and customer-focused.

Supported Currencies: 45+ currencies, including USD, Euro, and GBP.

Payment Methods: Bank transfers, debit/credit cards.

Buyback Policy: Yes, for major currencies.

Pros:

Competitive rates and no extra fees.

Next-day delivery for convenience.

Strict regulatory compliance.

Cons:

Limited focus on niche currencies like the Iraqi Dinar.

Exchange rates depend on market fluctuations.

13. Currency Liquidator

Currency Liquidator stands out as a secure platform for Iraqi Dinar transactions. The company has full US Treasury registration and state licensing. The company focuses on foreign currency exchange with strong security measures, ensuring all transactions are bonded and insured.

The platform offers a guaranteed buy-back program with market-based rates, no matter where you originally purchased your Dinar. It also provides layaway programs, making it easier to buy larger amounts of currency. Currency Liquidator has an A+ rating from the Better Business Bureau, reflecting its commitment to customer satisfaction.

Traders can access 24/7 support and use easy dashboard tools to analyze markets and track transactions. New investors should note the platform’s trust score of 56.3/100, based on independent reviews. Currency Liquidator follows strict Bank Secrecy Act regulations to ensure transparency in all transactions. With the best price guarantee, the platform offers competitive rates for all its products.

Supported Currencies: Iraqi Dinar.

Payment Methods: Bank transfers.

Buyback Policy: Yes, at market rates.

Pros:

Guaranteed buyback at market rates.

Layaway programs are available.

A+ rating from the BBB.

Cons:

Limited payment methods.

Average trust score (56.3/100).

14. Dinariqd.com

DINAR IQD is a specialized online currency store where we focus on Iraqi Dinar transactions. Their worldwide shipping network provides professional handling and packaging services to customers globally. This exchange service has made its mark with its wholesale pricing structure that serves major retailers and investors in international markets.

The platform combines competitive rates with strong security measures that protect every transaction. Each order comes with a Certificate of Authenticity that proves the currency's legitimacy. The service runs 24/7 to help traders in different time zones.

Multiple payment methods make DINAR IQD a convenient choice for customers. Their express shipping service delivers quickly, and they handle orders the same day payment clears. The platform takes pride in its 100% satisfaction guarantee and professional service standards.

Supported Currencies: Iraqi Dinar.

Payment Methods: Multiple options include Iraqi Dinar.

Buyback Policy: Yes.

Pros:

Competitive wholesale pricing for retailers and investors.

24/7 service with same-day order processing.

Global shipping with express delivery options.

Cons:

Focused solely on Iraqi Dinar.

Limited customer support channels beyond online.

15. DinarExchange.com.au

Dinar Exchange is your trusted partner for buying and selling Iraqi Dinars in Australia and New Zealand. Based in Melbourne, the platform is dedicated to providing safe, secure, and reliable currency transactions. Whether you are a seasoned investor or a currency collector, Dinar Exchange offers a user-friendly experience tailored to your needs.

With competitive pricing, instant ordering, and secure online payment options, the platform ensures timely delivery and genuine currency backed by certificates of authenticity. Customers can also access market insights and updates on the Iraqi Dinar’s revaluation to make informed decisions.

Dinar Exchange stands out for its transparency, 24/7 customer service, and expert guidance, making it a dependable choice in the collectible currency market. The platform also offers valuable educational resources for investors interested in the Dinar’s history and potential. Trust Dinar Exchange for a seamless and professional service to navigate the Iraqi Dinar market confidently.

Supported Currencies: Iraqi Dinar.

Payment Methods: Online payments, bank transfers.

Buyback Policy: Yes.

Pros:

Certificates of authenticity are provided.

24/7 customer service.

Market insights on the Dinar’s revaluation.

Cons:

Limited to Australia and New Zealand.

Payment methods could be broader.

16. Cheapest Dinar

Cheapest Dinar stands out as a specialized platform in the Iraqi currency market. They offer some of the best rates for dinar transactions and stock various Iraqi currency notes in different denominations. Security is built into every aspect of their service. Each transaction goes through multiple verification steps to ensure customers receive genuine currency. Their transparent pricing and detailed product descriptions show how seriously they take their business.

Customer convenience drives their service model. The platform lets buyers worldwide use different payment methods to complete their purchases easily. Additionally, it focuses on educating its customers by providing detailed guides about Iraqi currency to help buyers make informed decisions.

A dedicated support team is always available to answer any questions during the buying process. Cheapest Dinar operates under strict financial guidelines and complies with all regulatory requirements. Their goal is to build lasting relationships with customers by offering reliable service and competitive prices.

Supported Currencies: Iraqi Dinar in multiple denominations.

Payment Methods: Wide range of global payment options.

Buyback Policy: Not specified.

Pros:

Transparent pricing and detailed product descriptions.

Educational resources for informed buying.

Dedicated support team for customers.

Cons:

Exclusively focused on Iraqi Dinar.

Lacks physical presence for walk-in customers.

17. Ultimate Currency Exchange

Ultimate Currency Exchange transformed Canadian currency services with its innovative online platform when it launched in May 2015. By offering better exchange rates than major Canadian banks, they have maintained a competitive edge in the industry. The dedicated team prioritizes customer service, ensuring professional assistance with every transaction. On average, clients save 1% to 3% compared to bank rates.

The exchange service focuses exclusively on foreign currency transactions, leveraging its strong purchasing power and efficient cost management to offer competitive pricing. Customers can easily place orders online using a simple calculator-based system or by visiting one of their Ottawa branches. The platform is fully transparent, displaying clear exchange rates on its website with no hidden fees or extra charges.

Customers can choose flexible delivery options, including mail delivery or branch pickup, to further enhance convenience. Ultimate Currency Exchange’s transparent, customer-focused approach ensures that Canadians can confidently access great exchange rates and professional services from the comfort of their homes.

Supported Currencies: Foreign currencies, including Iraqi Dinar.

Payment Methods: Online orders and in-person transactions.

Buyback Policy: Not specified.

Pros:

Competitive rates compared to Canadian banks.

Transparent pricing with no hidden fees.

Flexible delivery options (mail or branch pickup).

Cons:

Operates primarily in Canada.

Relatively new compared to competitors (est. 2015).

18. US First Exchange

US First Exchange is a federally registered Money Services Business in downtown Los Angeles's jewelry district. The platform caters to investors and collectors who want currencies from unique global markets. This third-generation currency broker holds multiple state-specific licenses. The platform's strict authentication protocols and advanced technology verify every currency.

Each transaction needs proper identification documents to meet US Department of Treasury guidelines. Customers receive FedEx shipping within 24-48 hours, and their orders are fully insured. The platform accepts credit cards, debit cards, and wire transfers. The core team checks each currency note's authenticity at the company's downtown LA location.

US First Exchange is all but one of these mail-order currency companies that gives 100% insurance on every order. They handle transactions quickly while following State and Federal regulations. Their years of experience in money services, currency exchange, and authentication are the foundations of their reliable service.

Supported Currencies: Unique global currencies, including the Iraqi Dinar.

Payment Methods: Credit cards, debit cards, and wire transfers.

Buyback Policy: Not specified.

Pros:

Fully insured transactions.

FedEx shipping within 24-48 hours.

Advanced authentication protocols.

Cons:

Requires strict identification for all transactions.

Focused mainly on US customers.

19. Interchange Financial

Interchange Financial is Canada's leading currency exchange specialist. They deliver the best market rates through their Exchange Rate Guarantee® program. Their ICS Service helps Canadian clients exchange currencies electronically between accounts. The company has a unique online ordering system for Iraqi Dinar transactions.

They deliver currency anywhere in Canada within two business days. Clients save between 1% and 3% compared to bank rates across all their services. With almost 20 years of experience focused only on foreign exchange services, they handle transactions from USD 2,500 to USD 2,000,000.

Security Measures are robust with insured Canada Post delivery and detailed verification checks for all currency transactions. The company keeps a large stock of 70 different foreign currencies ready for immediate exchange. Its transparent pricing system has no hidden fees or commissions. Its market expertise and high trading volumes help it beat traditional banks in service quality and exchange rates.

Supported Currencies: 70 foreign currencies, including the Iraqi Dinar.

Payment Methods: Online payments and electronic account transfers.

Buyback Policy: Yes.

Pros:

Exchange Rate Guarantee® program.

Delivery within two business days across Canada.

No hidden fees or commissions.

Cons:

Only available in Canada.

Minimum transaction amount (USD 2,500).

20 ManorFX

Manor FX, a family-owned money service business, has earned its place in the currency exchange sector over the past 12 years. Their excellent customer service shows in their positive Trustpilot reviews. The company outshines competitors with its impressive range of over 160 currencies, which exceeds what traditional banks and the Post Office offer.

Manor FX keeps Iraqi Dinar exchange rates competitive and doesn't charge any commissions or transaction fees. Customers can expect their major currency orders the next working day. They can pick up their orders at the flagship bureau de change in Datchet, Berkshire, or have them delivered to their home. The multilingual team brings 30+ years of combined expertise in travel money exchange, compliance, and customer support.

HMRC supervises Manor FX's anti-money laundering compliance. The company's partnership with Leftover Currency lets customers buy new currency and sell unused travel money. The company takes a straightforward approach with no minimum or maximum order limits, though larger transactions might need photo ID under the Money Laundering Regulations.

Supported Currencies: 160+, including Iraqi Dinar.

Payment Methods: Online and in-person

Buyback Policy: Yes

Pros:

No commission or transaction fees.

Next-day delivery for major currency orders.

Multilingual team with extensive experience.

Cons:

Larger orders require photo ID verification.

Limited physical locations (Datchet, Berkshire).

Conclusion

Smart Iraqi Dinar trading starts with picking reliable and secure platforms. 10-year-old exchanges give traders multiple ways to handle transactions, including physical currency and electronic trading options. While eBay and Amazon let you trade, specialized platforms have better security and proper verification systems in place.

Traders need to review several key aspects when picking their platform. Security protocols and exchange rates are vital parts of safe trading.

Your success with Iraqi Dinar trading comes from picking platforms you can trust and knowing their rules. Good research and proper paperwork make transactions smoother. Smart traders know that a platform's reputation, security setup, and support team quality shape their trading experience. Source: Dinarit

#Top sites for buying and selling Iraqi Dinar#Online Iraqi Dinar currency exchange services#Iraqi Dinar directory#Iraqi Dinar guide#Iraqi Dinar niche#Best Iraqi Dinar site

0 notes

Text

How Can You Tell if Iraqi Dinar is Real?

If you’re interested in buying IQD or trading it, it becomes critically important to be aware of how to confirm the currency. In that country, there are actual threats of fake Iraqi Dinar notes that look almost like the original notes, but they are not real money. It is, therefore, very important to learn how one can tell what a genuine Iraqi Dinar is so we do not fall victim to scams that might, in the end, lead to the loss of investments. It is, therefore, the purpose of the guide to outline the steps and the conforming techniques that you can follow to negotiate the genuineness of your Iraqi Dinar. The Importance of Authenticity In any currency investment, it is common knowledge that the value and safety of money one has depends greatly on the authenticity of the currency. Counterfeit ID can be bought in the market, especially due to the unfolding aspect of currency revaluation. By buying fake Dinars, people can lose their money, and the end product remains nothing more than paper. The experience of knowing the characteristics of genuine Iraqi dinars from fake notes will go a long way in preventing anyone from defrauding you and, therefore, guaranteeing the safety of your investment. There are several distinct aspects that I will illustrate to help you in deciding how to recognize a real Iraqi Dinar. Key Features to Look for in a Real Iraqi Dinar The currency of Iraq is the Iraq Dinar which is released and controlled by the Central Bank of Iraq to prevent forgery. These features may be expressed in the design, in the printing material, and even in the construction of the banknotes themselves. In the following sections, we take a look at the aspects that will enable you to check the genuineness of the Iraqi Dinar bills that you want to use.

Security Thread Probably one of the most important features that have been developed to identify real Iraqi Dinar currency notes and prevent cases of forgery is the security thread. This is a thin metallic strip that is incorporated into the paper at the time of manufacture of the note and which cannot be reproduced or cut out because it will wreck the note. As opposed to the easily recognizable printed features such as serial numbers and portraits, the security thread merges deep into the fibers of the note, thereby proving that this has been one of the many invulnerable security features incorporated into notes and ultimately builds trust in the currency. Fakes interfere with the country’s economic environment and result in vent losses, with the security thread as a straightforward method of identifying banknotes. When users bend the Dinar at certain angles, light reflects from inside or undertone texts written on the threads, which might include IQD. Its visibility and some of these characteristics serve as reliable ways of verifying the authenticity of the currencies, hence the credibility of all transactions involving the Iraqi Dinar. How to Check: Hold the Dinar up to the light and look for the embedded thread. The thread should appear as a continuous line and should be reflective, often with the word “IQD” or a similar design, visible when illuminated.

Watermark The watermark on the face of the Iraqi Dinar banknotes is important for the authenticity of notes. It is inserted during manufacture and is only visible when exposed to light; it is as subtle as this barely discernible design. It generally features a famous personage of the past or the Coat of Arms of the Central Bank of Iraq, making the design of the banknote more attractive and preventing counterfeiting. Details on such fountains, decors, and also how you would ride a transport, though, are fitted strategically, making you hardly notice the objects where they were placed. A watermark is, therefore, a feature that is commonly accepted as the criteria of the forgeries of the banknotes. Because they are embedded into the paper fibers, they cannot be replicated through regular print techniques. When getting near the watermark, users are notified about the genuine banknote, and thus, it has an extra layer of security during transactions. For the Iraqi Dinar, the watermark does away with the imitations that are characteristic of counterfeit currency and provides a good investment for the identification of the original currencies for the use of the people and companies. How to Check: Looking at the note against a source of light to see whether the watermark appears. Slowly slide the note to see further the watermark shift in the short period only in lights. It is also recommended that if the watermark cannot be distinguished, it is printed on the banknote rather than being incorporated into the paper or can be otherwise falsified.

Raised Printing The actual Iraqi Dinar is printed with a subsidized type of printing known as intaglio printing. This method gives raised ink that is best seen on the big numbers, symbols, and major components of the bill. It has the actual touch of the raised print as you can glide your finger over the body of the note gently. How to Check: Again, try to read the text in the note while frequently rubbing your fingers on the note, especially on the larger numbers and edges or images. The entire outer surface must feel very rough to the touch, and if you don’t feel a raised texture to the note, then the note is likely fake.

UV (Ultraviolet) Ink The latest Iraq dinar notes also feature such things as UV ink that protects the currency from being counterfeited. Some parts of the bill will be seen to be glowing or the colors will entirely appear differently under the Ultraviolet light. This particular ink is only visible under black light and turned into its ‘true form’ when exposed to UV light. How to Check: Use a blacklight or another UV lamp you might have; if not, some can be bought in the so-called currency validation kits. Any element that might emit a bright color or any other kind of text that would only show up under a black light should be particularly noticeable. If there are no features or if the UV features are inapparent, then the Dinar may well be counterfeit.

Microtext Microtext is a feature incorporated in the security of a note and encompasses the mere redrawing of words that are hardly noticeable in different parts of the note. It is written in very small fonts to such an extent that one cannot read it without them, making it another secure feature of the banknote. How to Check: Use a magnifying glass to examine the Dinar. Focus on the edges of the numbers, portraits, and security symbols. If the microtext is fuzzy, blurry, or illegible, the bill may be counterfeit.

Color-Shifting Ink Today, many modern currencies have something like color-changing ink such as the Iraqi Dinar. This form of ink changes color once the note is inclined; therefore, it is best used when it comes to higher-ranking notes. The switch normally occurs gradually and can be readily discerned from the bill when it has been turned in some way. How to Check: Tilt the note in different directions to ascertain whether the color of some of the sections of the note has altered. If the ink used does not change its color or looks funny, then you might be holding a fake note.

Holographic Features Some form of a hologram may be used for some more expensive Iraqi Dinar bills. These elements usually display pictures or moving images when the bill is inclined, and sometimes it portrays a symbolic image/icon within the country. Tracing is also usually applied on high-value notes. How to Check: Tilt the bill regarding the bill and put it under the source of light to check whether there exists holographic images or symbols. The original BNV bills produce vivid and easy-to-rotate holograms, while fake bills could come with either a blurred or static hologram.

Distinctive Serial Numbers Since every single bill in the Iraqi Dinar has a unique serial number, the figure is printed in a different color from the main color of the note. Some of these serial numbers may also contain discreet messages that are only visible using a lens set. In some way, bills provide barcodes or QR codes that have been inserted into the designs of those bills. How to Check: Read the serial numbers on the signatures located at the front and the back sides of the bill. The number should be clear, preferred whole numbers, and perfect, and most importantly the numbers must not be repeated. The authenticity of the serial number should be checked as per some other resources or currency-referenced guides.

Overall Design and Print Quality Iraq’s Dinar possesses a clear and sharp imprint. It means that the colors must be saturated and the outlines of the images printed on the fabric must be clean. Faint lines, low-quality resolution, various shades of the same color, or anything other than how regular genuine money should look may be an indication that you’re holding counterfeit money. How to Check: Look at the design of the bill and see that the print on it is clear, that the images on the bill are aligned properly, and that the colors of the bill are bright enough. If the quality or density of the print on the bill is faint or nugget, then the bill is most probably a counterfeit. Where to Check Your Iraqi Dinar With this knowledge about the general features that you should look for in your Iraqi Dinar, it is important to know where to verify the truth about your bills. Here are some recommended ways and places for validation:

Currency Validation Services There are different online and physical services for checking the authenticity of the currencies, including the Iraqi Dinar. These services usually offer all-encompassing reports regarding the trustworthiness of your specific Dinar and can be a reputable method to be certain your Dinar is real. Examples: Dinarit.com: Here, you can also find genuine Iraqi dinars for sale, as well as some informative resources that will help to distinguish the fakes. They have developed a policy of giving buyers a Certificate of Authenticity for their purchase to ensure they are not fake dinars. Professional Currency Authentication Companies: Vietnamese dong and other currencies can be authenticated by companies such as PMG – Paper Money Guaranty and PCGS – Professional Coin Grading Service, for instance, in the Iraqi Dinar.

Use of Currency Checking Tools Another method by which you could verify your Iraqi Dinar is through the use of special currency authentication testing equipment and these are available on the market for purchase in stores dealing in currency forensics. One set of these tools that could help is UV lights, a magnifying glass, and currency detectors which can help momentarily understand security features such as watermarks, micro text, and color-shifting ink.

Consult with a Professional Dealer The Iraqi Dinar is a rather suspicious currency. If you are concerned with the authenticity of the currency, it is recommended that you consult with a currency dealer. Being experts in currency identification, they will be able to help you determine whether your Dinar is fake. Reputable Dealers: Dinarit.com: Dinarit.com is a reliable currency guide that will help you identify genuine Dinar and the website is ready to respond to any inquiries regarding the novelty’s legitimacy. Sterling Currency Group: This expert specializes in foreign currency understanding and provides advice and assistance in verifying the Iraqi Dinar. Conclusion Any investor, collector, and trader in the market needs to learn when, where, and how to tell if the Iraqi Dinar is authentic. The security comprises several elements, including security threads, watermarks, print height, and UV ink, that you ought to use to determine the authenticity of your Dinar. By studying these features to the maximum, using trustworthy services of currency validation, or turning to professionals in this sphere, you can always be protected from forged Dinars and make a stock safe. It is always recommended that you only purchase Iraqi Dinar from reputable sources such as Dinarit.com. They ensure that all their money is real, and they give you the tools to learn how to spot fake money for yourself. Certainly, your investment in the Iraqi Dinar should be secure and backed by words indicating that the currency that you are holding is genuine. Source:- Dinarit

#Iraqi Dinar Authentication#fake Iraqi money#fake Iraqi Dinar bills#Iraqi Dinar certificate of authenticy

1 note

·

View note

Text

Iraqi Dinar Purchase: Seizing a Unique Investment Chance

Few options generate as much curiosity in the world of investment opportunities as foreign currencies. Among these, the Iraqi dinar has caught the attention of many investors looking for high-risk, high-reward opportunities. Purchasing Iraqi dinar may seem unusual to some, but it offers a unique opportunity to those willing to take on a speculative investment. With Iraq's complex economic landscape and potential for growth, buying the Iraqi dinar is a chance to capitalize on one of the more unconventional currencies available in the market.

The Story Behind the Iraqi Dinar

The story of the Iraqi dinar is closely tied to the country's rich history and tumultuous recent past. Iraq, once one of the most economically powerful nations in the Middle East, has faced numerous challenges, including wars, sanctions, and political instability. However, the country has taken significant steps toward economic recovery over the years, and the Iraqi government has implemented reforms to stabilize the economy.

This presents an intriguing opportunity for investors: buying Iraqi dinars when the currency is undervalued. The process of Iraqi dinar purchase has become a point of interest for many, as historically, the Iraqi dinar has been a low-cost currency, often traded at a fraction of its original value. However, as Iraq continues to rebuild and modernize, there is a growing belief that the dinar could gain value in the future.

Potential for Appreciation

The central premise behind purchasing Iraqi dinar is the expectation that the currency will appreciate as Iraq's economy strengthens. Several factors contribute to this optimistic outlook. First, Iraq is rich in natural resources, particularly oil, which accounts for a large portion of the country's revenue. As the global oil demand grows and Iraq stabilizes its political environment, there's potential for the country's oil exports to increase, driving economic growth and, in turn, strengthening the dinar.

In addition, Iraq's infrastructure is also undergoing major development, with investments pouring in from domestic and foreign sources. The construction of new infrastructure, better healthcare systems, and enhanced education sectors contribute to the country's modernization. With the right reforms and increased foreign investment, the Iraqi economy could see substantial growth, leading to a rise in the value of its currency.

A Speculative Investment

It's important to note that investing in Iraqi dinars is speculative, meaning it carries a higher degree of risk compared to traditional investments like stocks or bonds. The political situation in Iraq remains delicate, and there are concerns over the country's ability to maintain long-term stability. Additionally, currency markets are notoriously volatile, and there's no guarantee that the dinar will appreciate as anticipated.

However, purchasing Iraqi dinar presents an intriguing opportunity for those who are prepared for a higher level of risk. Many investors are drawn to the potential for significant returns if the currency values rise. Even a modest increase in the dinar's value could result in substantial profits for early investors who purchased the currency at a low price.

How to Buy Iraqi Dinars

If you're considering investing in an Iraqi dinar purchase, there are several ways to buy. The most common route is to buy dinars through online dealers, currency exchange platforms, or specialized investment firms. Conduct thorough research and ensure you buy from a reputable source, which is essential.

Based on your risk tolerance, you'll also need to decide how much to invest. As with any speculative investment, it's wise to only invest what you can afford to lose, as the dinar's value could fluctuate dramatically in the short term.

Purchasing Iraqi dinar represents a unique and speculative investment opportunity. While the risks are significant, the potential rewards could be considerable, especially as Iraq stabilizes and rebuilds its economy. For those willing to take on the uncertainty, the Iraqi dinar offers a chance to participate in a market with the potential for significant growth. As with any investment, it's important to approach it cautiously, conduct proper research, and assess your risk tolerance before diving in.

0 notes

Text

Get the best rates for Iraqi dinar at IQDBUY. Enjoy a seamless online purchasing process with secure payments and fast delivery. Trust IQDBUY for all your currency needs.

#buy Iraqi Dinar#Iraqi Dinar#Iraqi dinar to USD#Buy iraqi dinar online#Iraqi dinar for sale#Purchase iraqi dinar#Iraq dinar to USD#Iraqi Dinar currency Exchange

1 note

·

View note

Text

Iraq's Economic Rebirth: Exploring the Possibilities of Dinar Investment

Iraqi Dinar speculation has been a topic of considerable interest for investors and currency traders over the past few years. This blog post delves into the reasons behind the predictions of a significant return on investment and the factors that fuel such speculation. Understanding the Iraqi Dinar The Iraqi Dinar (IQD) is the official currency of Iraq. Historically, the value of the dinar has…

View On WordPress

0 notes

Text

THE NEW GLOBAL FINANCIAL SYSTEM IS COMING!!!!

Masters of the GCR/RV: The Financial Revolution Unfolding!

The Global Currency Reset (GCR) and Revaluation (RV) are not just financial terms—they represent a profound shift in the global economy. Exotic currencies like the Zimbabwe Dollar, Iraqi Dinar, and Vietnamese Dong, once dismissed, now stand at the center of this seismic transformation. Coupled with the Quantum Financial System (QFS) and the groundbreaking NESARA GESARA Act, these forces are dismantling the corrupt financial structures of the past and ushering in a new Golden Age.

Zimbabwe Dollar: Rising from the Ashes Once a symbol of economic collapse, the Zimbabwe Dollar (ZWL) is poised for resurgence. Backed by vast natural resources, including gold and diamonds, its revaluation could redefine wealth distribution globally.

Iraqi Dinar: A Powerhouse in Waiting The Iraqi Dinar (IQD), suppressed by decades of conflict, is ready for a comeback. Iraq’s immense oil reserves position the Dinar for a historic rise, turning its holders into potential beneficiaries of immense wealth.

Vietnamese Dong: The Silent Contender The Vietnamese Dong (VND) may be undervalued today, but Vietnam’s booming economy and strategic global role make this currency a sleeper hit in the GCR.

The Quantum Financial System (QFS): A Game-Changer The QFS is not just a financial system—it’s a technological revolution. Designed to eliminate corruption and provide transparency, it promises security and fairness. XRP and XLM, digital assets tied to this system, are set to replace outdated financial instruments, making them prime opportunities for savvy investors.

NESARA GESARA: A Blueprint for Global Equity This monumental reform package aims to forgive debts, redistribute wealth, and establish a gold-backed currency system. With mandates for humanitarian projects, it’s not just about money—it’s about building a better world.

Tier 4B: The Informed Few vs. Tier 5: The Oblivious Masses The informed Tier 4B, aware of these shifts, stands ready to benefit. In contrast, Tier 5, tethered to outdated systems, remains blind to the change. This is an Information War, and knowledge is your most valuable asset.

The Time to Act Is Now! The GCR/RV isn’t speculation—it’s happening now. The future belongs to those prepared to seize the moment. Will you rise to the occasion, or will you be left behind? The choice is yours.

Join and share my channel immediately: https://t.me/JulianAssangeWiki

-------------------------------------

From truth4ourfreedom:

I have heard about this change for what seems like months. When will it happen? And will the global elites and big banks go along? Time will tell!

#QFS#NESARA#GESARA#the great awakening#world economic forum#Federal Reserve#Financial freedom#financial#Wall Street

6 notes

·

View notes

Text

eBay has been a scam. I sold $300 worth of Iraqi Dinar when I was 16 that my friend stole from his blackwater uncle who stole it in Iraq, shipped it according to eBay’s shipping directions, buyer disputed and eBay sent me a debt collection letter like 7 years later, which is illegal because I was underage at the time of the transaction. This order of events suggests the individual who purchased and disputed it was a PayPal mafia employee, and that the PayPal mafia has connections to Blackwater.

4 notes

·

View notes

Note

In order to be taken less seriously, you should get into crypto currencies!

too passe. im getting into iraqi dinar revaluations scams

22 notes

·

View notes

Text

Where to Buy Iraqi Dinar Online for Home Delivery

This is probably the most successful Iraqi dinar sales page in the history of the internet. First at eBay, then at Etsy, and finally now at EganShop.com. Buy a quarter-million Iraqi Dinar now and receive a CoA guaranteeing authenticity for life, and a guarantee that it will ship tomorrow. Want to save on your order? Call or text @petereganjr direcrlty and request an invoice for the lowest possible rate from Egan Shop.

Peter's phone number is +1 985-590-2253.

Iraq 25,000 dinar banknote

So to recap, the best place to buy Iraqi dinar online for home delivery is Egan Shop / Egan Store).

youtube

If the Dinar Floats at $0.25, here’s what would happen…

Most of you would have less than two weeks to protect yourself from taxes. Ms. Sandy teaches you how to keep as much of your IQD (Iraqi dinar… Iraq’s currency) profits as possible.

Out of all of the dinar experts, she’s probably my favorite besides Entheos.

250,000 Iraqi Dinar: 10 x 25,000 UNC Authentic Iraq Banknotes - Includes CoA!

You won’t have to worry about taxes if you don’t own any dinars, although that and really every other I’ve heard all seem like profoundly weak excuses to me.

10 notes

·

View notes

Text

GESARA👉 Unleashing Global Prosperity - AMG News

Let’s start with the Global Economic Security and Reformation Act or GESARA. This revolutionary reform movement aims to rectify economic disparities, restore financial stability, and promote global peace and prosperity. It’s not merely about changing the rules of the game; it’s about changing the game itself.

From forgiving debt to abolishing income tax and creating flat-rate non-essential taxes, GESARA promises a world where financial stress and economic inequality become relics of a bygone era. A world where everyone shares in the global prosperity.

##4. QFS: The Dawn of Financial Transparency

Now, let’s turn our attention to the Quantum Financial System, QFS. This cutting-edge technological marvel offers an incorruptible, transparent, and secure financial network. It uses quantum computing technology to make financial transactions faster, safer, and more efficient. This isn’t just an upgrade to our existing financial infrastructure; it’s a complete reinvention.

##5. GCR/RV: A Reset Towards Equality

Then we have the Global Currency Reset/Revaluation (GCR/RV). This significant reset of the world’s currency system is not just a number game but an effort to level the financial playing field.

##6. ISO 20022 and Basel III: Setting New Standards

Moreover, standards like ISO 20022, an international standard for electronic data interchange between financial institutions, and Basel III, a global voluntary regulatory framework addressing bank capital adequacy, stress testing, and market liquidity risk, are creating a safer, more transparent financial world.

##7. The Promise of Protocol QFS 20 and DINAR

And finally, we have the newest protocols like QFS 20 and the revaluation of the Iraqi Dinar (DINAR), which represent the drive for a more unified global financial system.

##8. From Dark to Light: A Journey of Love and Unity

At the heart of this profound shift from the old financial system to the new lies a fundamental principle – love. Love for each other, for our shared Earth, and for the limitless potential that lies within us. This shift isn’t merely about money or wealth; it’s about unity, prosperity, and love. 🤔

Source: AMG News

#pay attention#educate yourselves#educate yourself#knowledge is power#reeducate yourself#reeducate yourselves#think for yourselves#think about it#think for yourself#do your homework#question everything#ask yourself questions#do some research#do your research#do your own research#gesara#nesara

12 notes

·

View notes

Text

Understanding the Iraqi Dinar Exchange Process in AUS

The Iraqi Dinar (IQD) exchange process can be a complex and often confusing subject for those unfamiliar with international currencies. For Australian residents and investors, understanding the procedures and dynamics behind exchanging the Iraqi Dinar in Australia (AUS) is essential for navigating currency markets. Whether you want to invest in Iraqi Dinar or exchange it for travel or business purposes, having the right knowledge can help ensure a smooth process.

The Basics of the Iraqi Dinar

The Iraqi Dinar is the official currency of Iraq. Its value has fluctuated significantly, especially due to the country's volatile political and economic history. Despite this, some investors view the Dinar as a speculative investment, hoping for potential gains should its value increase. Others may need it for business dealings, travel, or personal reasons.

It is important to note that Iraq is a relatively isolated market regarding currency exchanges, and the Iraqi Dinar is not widely traded in international markets. This makes exchanging Iraqi Dinar outside of Iraq different from exchanging more commonly traded currencies like the US Dollar, Euro, or British Pound.

Currency Exchange in Australia

In Australia, exchanging Iraqi dinars is not as straightforward as exchanging more commonly used currencies. Most major financial institutions, such as banks and mainstream exchange services, do not deal with the Iraqi dinar exchange due to its limited global presence and the risks associated with its volatility. However, specialized currency exchange services handle less common currencies, including the Iraqi Dinar.

Australians interested in obtaining Iraqi Dinar must look for a service that deals with foreign currencies outside the mainstream offerings. These specialized services are often found through online platforms or foreign exchange (Forex) brokers who cater to niche currencies. Ensuring these services are legitimate is important, as scams and fraudulent schemes often target the Iraqi Dinar.

Exchange Rates and Market Fluctuations

The exchange rate of the Iraqi Dinar is notoriously volatile. This is due to Iraq's economic instability, sanctions, and fluctuations in the value of oil, which is Iraq's primary export. The Central Bank of Iraq sets the official exchange rate. Still, due to economic factors and the currency's limited international market, the actual value on the open market can vary significantly.

In Australia, the rates offered by exchange services can fluctuate widely, depending on demand and supply, the global economic situation, and the specific service provider's policies. As a result, individuals looking to exchange Iraqi dinars should be prepared for rates that may differ from the official exchange rate published by the Central Bank of Iraq. It is also essential to be cautious of high exchange fees or hidden costs that may apply when exchanging large sums of money.

How to Exchange Iraqi Dinar Safely

Safety is paramount when exchanging Iraqi dinars in Australia. Given the potential for fraud, it is crucial to thoroughly research the exchange service provider. Look for providers with solid reputations and verified customer reviews. Moreover, ensure that any transaction is done through secure channels, especially when dealing with large amounts of currency.

For those skeptical about the risks of exchanging the Iraqi Dinar exchange, it is advisable to consider the currency's potential long-term outlook. Some analysts speculate that the Iraqi Dinar may appreciate over time if Iraq's economy stabilizes, while others caution that the currency could remain stagnant or depreciate further.

Understanding the process of exchanging the Iraqi Dinar in Australia requires careful research, a clear understanding of the risks, and knowledge of the exchange services available. Due to the Dinar's volatility and limited exchange options, individuals should exercise caution and remain informed about market conditions. Being well-prepared will ensure that you make an informed decision when exchanging the Iraqi Dinar, whether for investment or personal reasons.

0 notes

Text

Iraqi Dinar Future Prediction During the Trump's Administration ( 2025 and beyond )

The Iraqi dinar was a powerhouse in international markets before the 1991 Gulf War, trading at more than $3 against the US dollar. The currency took a steep dive to around 1,310 IQD per USD, and this drop became a defining moment in its history. This decline made many people wonder about its comeback potential.

Iraq is OPEC’s second-largest oil producer and has large oil reserves, which has led to many big predictions about the dinar. Some analysts believe the dinar could reach $5.89, while others predict even bigger jumps—up to 1,000 times its current value—in the upcoming political cycle.

Let's get into the Iraqi dinar's realistic value prospects from 2025 onwards. Several significant factors could shape its future. These include US-Iraq military partnerships through 2026, support from the International Monetary Fund, and Iraq's efforts to modernize its banking system. Global energy needs through 2025 could also play a vital role in the currency's direction.

Geopolitical Landscape Under Trump

Trump's administration has brought fundamental changes to Middle East policy. His team emphasizes stronger bonds with traditional allies while taking a tough position against Iran's growing influence in the region.

US Middle East Strategy

Trump's Middle East strategy rests on three most important priorities:

Reinstating maximum pressure on Iran through economic sanctions

Reinforcing support for Israel's defense capabilities

Expanding the Abraham Accords for regional normalization

The US keeps about 2,500 troops in Iraq. These forces help advise Iraqi security forces and ensure ISIS stays defeated. A recent agreement maps out a two-phase exit plan for US forces. The first troops will leave by September 2025, followed by a complete withdrawal by September 2026.

Regional Power Dynamics

Trump's policies have altered the map of regional power. His approach favors Israel and Gulf countries while limiting Iran's influence. The US has deepened its military cooperation with Iraq through major equipment sales and defense agreements.

The US-Iraq relationship faces several hurdles amid regional tensions. Iran-backed militias have embedded themselves in Iraq's state institutions. This creates a complex situation where neither country serves as a true ally or enemy. This reality shapes both security partnerships and economic ties between the two nations.

Iraq-Iran Relations

Iraq depends heavily on Iran for economic ties, especially energy imports. The country spends about $900 million monthly on Iranian goods, with half going to electricity and gas. US sanctions have complicated this economic relationship, forcing Iraq to find creative payment solutions.

Iraq's government walks a tightrope between US alliance and Iranian influence. Recent events show Iraq trying to protect its independence while managing these competing interests. Trump's team has warned Iraq about possible economic penalties if it fails to control Iran-backed groups or continues helping Iran dodge dollar restrictions.

International Support for Iraqi Currency

International financial institutions provide strong backing for Iraq's economic stability and currency management. The International Monetary Fund approved a USD 5.34 billion loan over three years. This loan helps Iraq manage lower oil prices and maintain sustainable debt levels.

IMF and World Bank Involvement

The IMF's support goes beyond money, as shown in its recent Article IV consultation in May 2024. The fund's executive board stressed that Iraq needs to adjust its spending gradually to keep debt stable and build up fiscal reserves. The World Bank works through the Iraq Reform, Recovery and Reconstruction Fund (I3RF) to provide financial and technical help. Germany, the UK, Canada, and Sweden fund this platform that enables financing and policy discussions.

Global Trading Partners

Iraq's trade relationships show its growing role in the global economy. The country is the world's 36th largest exporter, with exports worth USD 123 billion. Its key trading partners include:

India (USD 38.8 billion in exports)

China (USD 34 billion in exports)

United States (USD 10.3 billion in exports)

South Korea (USD 8.21 billion in exports)

The United Arab Emirates leads as Iraq's biggest global trading partner, with yearly trade worth over USD 27 billion. Their relationship grows stronger through ongoing talks and joint projects in many sectors.

Foreign Investment Trends

Foreign direct investment shows remarkable growth, reaching record levels in 2023. Major investments include:

Qatar Investment: USD 5 billion (June 2023)

Saudi Arabia PIF: USD 3 billion (May 2023)

TotalEnergies: USD 27 billion (April 2023)

Iraq's Central Bank has modernized its banking sector by making reforms to improve financial services. These changes help solve the biggest problem of underfunded state-owned banks and strengthen private commercial banking. The IMF emphasizes that Iraq needs to speed up the restructuring of large state-owned banks. They also want to modernize private banking to make correspondent banking relationships easier.

Regional Economic Integration

Regional economic cooperation now plays a vital role in Iraq's financial world. New partnerships with neighboring countries have reshaped trade patterns throughout the Middle East.

Gulf Cooperation Council Relations

GCC-Iraqi relations have shown remarkable progress. We focused on building stronger diplomatic and economic ties. The Gulf Cooperation Council's Secretary General stressed that Iraq's stability and sovereignty remain top priorities for member states. Saudi Arabia and the United Arab Emirates have invested USD 6 billion in Iraq's development projects, which shows their commitment to this partnership.

The UAE stands out as a strategic collaborator with a strong focus on building infrastructure. Abu Dhabi Ports Group has signed major maritime agreements with Iraq's General Company for Ports. Masdar, the Emirati energy company, has started solar projects to help solve Iraq's power shortages.

Cross-border Trade Developments

Strong cross-border connections help expand regional influence and trade. Iraq's market of 40 million consumers draws attention from nearby countries. The Development Road project connects Iraq with Turkey and the Gulf states through new trade routes.

Trade volumes show this growing connection:

Turkey-Iraq trade: USD 20 billion annually

Iran-Iraq trade: USD 8.9 billion in exports (2022)

UAE-Iraq bilateral trade: USD 27 billion annually

Banking System Integration

The banking sector is modernizing through digital transformation. Iraq's Central Bank has created detailed regulations for digital payments to reduce cash use and improve financial inclusion. This move to digital banking helps solve the problems of low penetration rates and limited branch networks.

The Financial Inclusion Project, backed by international partners, works to develop inclusive financial services in four main areas:

Supporting financial service providers

Implementing financial literacy programs

Enhancing regulatory frameworks

Improving access for women-led businesses

Iraq's banking modernization matches regional standards. The Central Bank reviews more than 70 digital banking license applications. This change shows Iraq's dedication to building an efficient financial system within the Middle Eastern economy.

Security and Political Stability

Security concerns and political instability continue to shape Iraq's economy as Trump's administration looks toward 2025. The nation's stability faces major challenges due to the complex relationship between domestic politics and regional tensions.

Internal Political Dynamics

Iraq's political system struggles with major challenges that stem from the Muhasasa Ta'ifia system that started in 2005. This power-sharing system was meant to stop ethnic and sectarian divisions. Instead, it led to poor governance and systemic corruption. The public showed their frustration through mass protests, and voter participation dropped to 44% in the last election.

Trump's Iraq team plans to place more aggressive U.S. State Department officials in Baghdad. These tactically skilled ambassadors will negotiate firmly with Iraqi officials. Iraqi leaders should expect a more business-like relationship with Washington. Their ties with Tehran will play a vital role in diplomatic relations.

Regional Security Challenges

The security situation reveals several critical issues:

Iran-backed militia groups launched more than 165 attacks on U.S. troops since the Israel-Hamas conflict started

Turkish military operations grew stronger in northern Iraq and included drone strikes against Kurdistan Workers Party positions

ISIS keeps its presence in Al Anbar province and northern regions, though with reduced capabilities

The Trump administration prefers to use financial intelligence and sanctions instead of military force. The U.S. strategy targets the economic resources of Iran-backed militias, specifically their access to Iraq's USD 150 billion annual budget.

Impact on Currency Stability