#Digital personal data protection act 2023

Explore tagged Tumblr posts

Text

Digital personal data protection act 2023

On this page you will read detailed information about Digital Personal Data Protection Act 2023.

As a user of digital technologies and services in the modern world, you generate a significant amount of personal data on a daily basis. Your personal data has become an extremely valuable commodity, and it is often collected, used, and shared by companies and organizations in ways you may not fully understand or consent to. To address growing concerns over the use and protection of personal data, lawmakers have been working to establish comprehensive data privacy laws. The Digital Personal Data Protection Act of 2023 is the latest legislative effort to strengthen data privacy rights and give individuals more control over their personal information in the digital age.

What Is the Digital Personal Data Protection Act 2023?

The Digital Personal Data Protection Act, 2023 (DPDPA) is a law passed in 2023 to strengthen data privacy rights and give people more control over their personal information. The DPDPA establishes a set of comprehensive data privacy protections for individuals. It regulates how companies can collect, use, and share personal information.

Under the DPDPA, companies must obtain your consent before collecting or sharing your personal data. Personal data refers to any information that can be used to identify you, such as your name, address, Social Security number, biometric data, internet activity, geolocation, and more. Companies must clearly explain how your data will be used in a privacy policy and terms of service. You have the right to withdraw your consent at any time.

The DPDPA requires companies to limit data collection to only what is necessary for their services. They must delete or de-identify personal data when it is no longer needed. You have the right to access, correct, delete, and port your personal data. Porting data means transferring it from one service provider to another.

Some additional protections in the DPDPA include data minimization, purpose limitation, data security, transparency, and accountability. Companies must implement appropriate security safeguards to protect personal data from loss, misuse, unauthorized access, disclosure, alteration, and destruction. They must report data breaches to affected individuals and government agencies within 72 hours.

The DPDPA establishes the Digital Privacy Commission (DPC) to enforce the law. The DPC has the authority to investigate violations, issue fines, and pursue legal action against companies that fail to comply. Fines can be up to 4% of annual global revenue.

In summary, the Digital Personal Data Protection Act, 2023 grants individuals more control and protection over their personal information in the digital age. It forces companies to be transparent in how data is collected and used, and hold them accountable for privacy and security violations. The DPDPA marks an important step forward for data privacy rights.

Key Provisions in the Digital Personal Data Protection Act

The Digital Personal Data Protection Act, 2023 (DPDPA) was enacted to strengthen data privacy rights and protections for individuals. Some of the key provisions in the DPDPA include:

Data Privacy Rights

The DPDPA grants individuals certain rights regarding their personal data, including:

The right to access their personal data collected by companies. Individuals can request a report on what personal data a company has collected about them, how it’s used, and with whom it’s shared.

The right to correct inaccurate personal data. If an individual’s data is incomplete or incorrect, they have the right to request that the company update or amend the information.

The right to delete personal data, also known as “the right to be forgotten.” Individuals can request that a company delete their personal data under certain circumstances, such as if the data is no longer necessary for the purpose it was collected.

The right to opt out of the sale or sharing of personal data. Individuals have the right to request that a company not sell or share their personal information with third parties.

The right to data portability. Individuals have the right to request a transfer of their data to another controller or service provider in a commonly used format. For example, transferring photos from one social network to another.

Data Collection and Use Limitations

The DPDPA places restrictions on how companies can collect and use individuals’ personal data. Some of the key limitations include:

Requiring valid legal grounds for collecting and using personal data, such as the individual’s consent or to fulfill a contract.

-Limiting the collection of personal data to only what is necessary for the specified and legitimate purposes. Excessive data collection is prohibited.

Requiring transparency about how personal data is collected, used, shared and secured. Companies must provide clear and easy to understand privacy policies and notices.

Implementing data security measures like encryption and access controls to protect personal data from unauthorized access, theft or breach. Failure to do so can result in significant penalties.

Restricting the use of personal data for purposes beyond what the individual has consented to or what is necessary to fulfill the legitimate interests of the company. Personal data cannot be used in ways that could negatively impact or discriminate against individuals.

How the Act Protects Personal Data Privacy

The Digital Personal Data Protection Act of 2023 (DPDPA) aims to strengthen data privacy rights and give individuals more control over their personal information in the digital age. Under the DPDPA, companies are required to obtain your consent before collecting or sharing your personal data. They must clearly disclose how your data will be used in an easy-to-understand privacy policy. You have the right to access your data, correct inaccuracies, delete it, or opt out of data collection altogether.

Limits on Data Collection and Use

The DPDPA places restrictions on companies’ ability to collect and use personal data. They can only collect data that is directly relevant and necessary to accomplish a specified purpose that you have consented to. Your data cannot be used for any undisclosed secondary purposes. Companies must also put reasonable security measures in place to protect your data from unauthorized access, disclosure, or hacking.

Right to Access and Delete Your Data

You have the right to request a copy of all the personal data a company has collected about you. This includes metadata, inferences, and any profiles they have created. You can also request that your data be deleted, and the company must comply unless they can demonstrate a legitimate reason for needing to retain it. When you delete your data, the company must also delete any profiles or models that were built using your data.

For complete information please visit :

#Digital personal data protection act 2023#Digital personal data protection act#Digital personal data protection

0 notes

Text

DPDPA Audit & Significant Data Fiduciaries

Imagine that a company in India, handling digital personal data, fails to comply with DPDPA rules due to its lack of transparent consent processes. So, unfortunately, they become exposed to legal consequences due to non-compliance and may even have to bear hefty fines of up to 250 Cr.

As an organisation, you want to steer clear of any non-compliance issue and an audit can be a lifesaver. It identifies and rectifies such vulnerabilities and protects the company's reputation and builds customer trust.

To put it simply, an audit is a proactive step to maintain data privacy, identify gaps, mitigate legal risks, and enhance your overall business integrity.

In this blog, we bring you everything you must know about DPDPA audits and significant data fiduciaries so you are on the safe side.

What Is The DPDPA Framework?

The DPDP Act 2023 brings us a comprehensive data protection law that's set to protect and safeguard personal data. It has far-reaching implications for businesses operating in the country.

DPDPA places various responsibilities on organisations that handle personal data to protect individuals' privacy and ensure responsible data management practices. This includes:

Getting free, specific, informed, unconditional, and unambiguous consent from individuals before collecting their personal data

Executing robust security safeguards to protect personal data from unauthorized access, accidental disclosure, acquisition, etc.

Granting individuals access to their data, as well as the right to correct, erase, or restrict its processing

In the unfortunate event of a data breach, organisations are obligated to notify the relevant authorities

It's also important to note that non-compliance with the DPDPA can result in penalties up to 250 cr.

Who Are Significant Data Fiduciaries?

In simple terms, a 'data fiduciary' under the DPDP is someone who, either alone or with others, decides why and how personal data is processed. This can include individuals, companies, associations, the government, or any other entity that controls personal data.

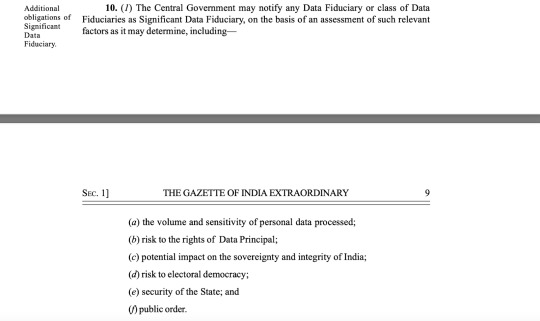

If the Central government identifies a data fiduciary or a group of them, they are called a Significant Data Fiduciary.

Source: Meity

This decision is based on several factors, including:

The volume and sensitivity of personal data processed

Risk to the rights of the Data Principal

Potential impact on the sovereignty and integrity of India

Risk to electoral democracy

Security of the State

Public order.

Additional Duties of Significant Data Fiduciaries

A Significant Data Fiduciary has additional responsibilities on top of Data Fiduciary duties. This includes:

Appointing a Data Protection Officer (DPO) - The DPO will represent the Significant Data Fiduciary under the provisions of the DPDP Act. However, they must be based in India. The DPO must also report to the Board of Directors or a similar governing body and be the point of contact for grievance redressal

Appointing an independent data auditor - The auditor evaluates the entity's compliance with the law

Conducting periodic Data Protection Impact Assessment (DPIA), which evaluates how personal data is processed, risks to individuals' rights, and other relevant details

Undertaking periodic audits to ensure ongoing compliance

Adopting additional measures as prescribed by law

Why Periodic DPDPA Audits Are Necessary?

A DPDPA audit falls under the additional responsibilities of a Significant Data Fiduciary.

It is mandatory for businesses in India to do a thorough DPDPA compliance audit. This audit can find any gaps in compliance and help take corrective measures to make sure they're following the law.

These audits can be incredibly beneficial, and here’s why you need them.

Regular DPDPA audits help you protect individuals' privacy in compliance with the law

It helps identify potential risks and vulnerabilities in data-handling processes

It lets you take proactive measures to mitigate risks before they become serious issues, such as hefty fines of up to 250 Cr

It helps you assess the effectiveness of existing security measures and identify areas for improvement to enhance overall data security. This, in turn, improves customer trust and brand image

It highlights any gaps or deficiencies in the organisation's data protection practices and offers insights into areas that may require additional attention or resources to prevent data breaches

DPDPA audits allow you to adapt to evolving threats and regulatory changes

Who Needs Regular DPDPA Audits?

It's quite simple. Audits are essential for all types of organisations and industries that handle personal data or have regulatory compliance requirements. However, as per the Digital Personal Data Protection Act, it's a mandate for Significant Data Fiduciaries, as discussed above.

This can include schools, colleges, and universities that handle student and staff information or healthcare providers who handle patients' medical records and sensitive health information. Regular audits ensure compliance, identify and address vulnerabilities, and maintain the security and integrity of the data they handle.

DPIAs and Audits: The Right Tool

Source: DPDP Consultants

Significant Data Fiduciaries are required to conduct DPIAs and regular audits. But this has to be done diligently. So, there is a need to automate the process to ensure all bases are covered while maximizing time and efficiency. These tools minimize human bias and produce a standardized report that streamlines the process.

That said, when it comes to DPIAs, you can switch to a Data Protection Impact Assessment Tool. It automates the entire DPIA process and lets you conduct the assessment almost effortlessly through a user-friendly platform.

With this tool, you can track risks that were identified during the assessment and make sure all concerned individuals are kept in the loop regarding the actions taken to mitigate these risks.

Let's make Compliance Easy

As per the DPDP Act, there are certain obligations you must adhere to when it comes to personal data. And, regular DPDPA audits and DPIAs are one of the duties of a Significant Data Fiduciary. DPIAs and audits help identify and rectify any potential breaches and ensure the lawful and secure processing of personal data.

They are almost indispensable for maintaining trust, avoiding penalties, and upholding a commitment to responsible data handling.

DPDP Consultants brings you a set of tools and services that makes compliance with the DPDP Act easy and streamlined:

Our Data Protection Consent Management tool streamlines the acquisition of valid consent and automates the entire process of managing, tracking, and handling consent requests

The Data Principal Grievance Redressal platform streamlines the process of exercising data rights through a user-friendly interface and improves response efficiency in accordance with the DPDP Act

Our Data Protection Impact Assessment tool aids in the easy assessment and tracking of risks and ensures transparent communication about risk mitigation efforts

Our Data Protection Awareness program allows management to oversee the ongoing and efficient execution of their personal data privacy initiatives

Our Contract Reviews and redrafting services ensure that your business's outsourcing agreements align with DPDPA compliance standards

Through our DPDP Data Protection Officer services, organisations can appoint a third party for process audits so it aligns seamlessly with DPDPA requirements

Our training program for employees caters to organisation-specific needs emphasizes the practical aspects of DPDPA compliance and covers personal data policies, processing activities, and more.

Compliance isn't just about following the law; it's also about building trust and keeping your brand's reputation strong. Treating personal data with care isn't just a legal requirement—it's key to making a digital society that's fair for everyone.

Simplify DPDPA Compliance And Optimise Your Operations!

DPDP Consultants offers comprehensive solutions for personal data privacy and privacy law guidance to ensure compliance.

#dpdp act#dpdp#dpdp act 2023#dpdpa tools#digital personal data protection#dpdpa#dpdp 2023#dpia#dpdp consultants#dpdp tool#DPDPA Audit

0 notes

Text

🚨🚨ATTENTION🚨🚨

Another Disgusting anti-LGBT bill, planning to censor queer content online.

Yet again another law that infringes on privacy. and anonymity.

The bill is KOSA

https://www.congress.gov/bill/118th-congress/senate-bill/1409

KOSA is a threat to LGBTQ+ youth.

It allows right-wing AGs to censor LGBTQ+ content in the name of "protecting kids".

This doesn't protect kids. This actually hurts kids even more.

It will snuff out LGBTQ+ spaces and makes the internet more of a dangerous place for them, more or less...

"Of course, like so many of these “bipartisan” anti-internet bills that have bipartisan support, the support on each side of the aisle is based on a very different view of how the bill will be used in practice. We went through this last year with the AICOA antitrust bill. Democrats supported it (falsely) believing that it would magically increase competition, while Republicans were gleefully talking about how they were going to use it to force websites to host their propaganda."

"Now, with KOSA, again you have Democrats naively (and incorrectly) believing that because it’s called the “Kids Online Safety Bill” it will magically protect children, even though tons of experts have made it clear it will actually put them at greater risk."

https://www.techdirt.com/2023/05/24/heritage-foundation-says-that-of-course-gop-will-use-kosa-to-censor-lgbtq-content/

KOSA will also undermine privacy in the name of "protecting children".

"This bill would effectively place many internet services behind an age verification wall, prevent anonymous surfing, and would require all users – adults or teens – to verify their age before they can access information or content.

The Computer & Communications Industry Association supports the enactment of comprehensive privacy legislation at the federal level, but has concerns about KOSA’s duty of care, vague requirements that would prevent teens from accessing critical information, and compliance provisions that conflict with current trends toward data minimization."

https://ccianet.org/news/2023/05/ccia-statement-on-unintended-consequences-of-kosa-legislation-would-place-most-internet-services-behind-age-verification-wall/

Age verification technology is just not secure enough for usage at the moment, leaks are likely to happen, it will be especially dangerous if the leaked Age verification information has a government ID linked to it. That would mean that malicious individuals may get a hold of personal addresses, bank details, basically you'll get doxxed by the government...

You may be asking, "well is there anything to do about it?"

Of course there is, but we really need your help spreading awareness around, because the bill is most likely to pass this July!

This website was put together by Fight for the Future. It has everything, from petitions to calls scripts. It's very easy to understand and use and one of the best links to spread. I urge you to use this when calling your members of congress. All you need to do is put in your phone number once and read off the script provided and it does the rest for you.

https://www.badinternetbills.com/

Signable petitions and open letters;

If you live in the states, call your state representatives;

Joinable Discord server;

More information;

I have to say again and I am not exaggerating, this is URGENT the bill could be passed THIS MONTH!

I am begging you, please OPPOSE KOSA!!

#long post but PLEASE READ!!#readable articles included under citations#lgbtq+#lgbtqia#grimace shake#gay#lesbian#bisexual#pansexual#trans#nonbinary#asexual#aromantic#aroace#trans rights#transgender#mogai#neopronouns#gay rights#gen loss#hastune miku#genshin headcanons#honkai star rail#art#aesthetic#welcome home#pizza tower#fnaf movie#vocaloid#queer

580 notes

·

View notes

Text

bangtan as gang members

do I believe they would be capable of those type of things? absolutely not because they're the purest souls to have ever walked this earth. that said:

the informant: jhope A person who provides privileged information, or (usually damaging) information intended to be intimate, concealed, or secret, about a person or organization to someone else.

drug lord: yoongi A type of crime boss, who is in charge of a drug-trafficking network, organization, or enterprise.

bagman: taehyung May be involved in protection rackets or the numbers game, collecting or distributing the money involved. When acting as an intermediary in such activities, a bagman may also be called delivery boy or running man, and may receive a fraction of the money collected.

cybercrime : jimin Cybercrime encompasses a wide range of criminal activities that are carried out using digital devices and/or networks. These crimes involve the use of technology to commit fraud, identity theft, data breaches, computer viruses, scams, and expanded upon in other malicious acts.

the assassin: jungkook Contract killing (also known as murder-for-hire) is a form of murder or assassination in which one party hires another party to kill a targeted person or people.[1] It involves an agreement which includes some form of compensation, monetary or otherwise.

seller of stolen property : seokjin Possession of stolen goods is a crime in which an individual has bought, been given, or acquired stolen goods.In many jurisdictions, if an individual has accepted possession of goods (or property) and knew they were stolen, then the individual may be charged with a crime, depending on the value of the stolen goods, and the goods are returned to the original owner.

weapons trafficker : namjoon Arms trafficking or gunrunning is the illicit trade of contraband small arms, explosives, and ammunition, which constitutes part of a broad range of illegal activities often associated with transnational criminal organizations.

info -> wikipedia

(bts ai saving lives)

© 2023 of Mia (arosesstorm). All Rights Reserved.

#© 2023 of Mia (arosesstorm). All Rights Reserved.#bts#bts fic#ts#bts army#bts reaction#run bts#bts lockscreens#bts meme#bts reactions#bts suga#bts taehyung#jhope#bangtan#bts x reader#jung hoseok#hoseok#bts messy packs#bts messy edits#bts messy headers#bts messy layouts#bts messy bios#bts messy icons#bts messy moodboard#bts messy users#bts scenarios#bts as boyfriends#bts aesthetic#jungkook scenarios#jungkook

43 notes

·

View notes

Text

What Is the Latest Trend in Digital Marketing?

In the fast-paced world of digital marketing, staying ahead of the curve is essential for businesses seeking to maintain a competitive edge. As we dive into 2023, one of the most significant trends reshaping the landscape is the growing importance of data privacy and ethical marketing. As consumers become more aware of their digital footprint and demand greater transparency, brands must adapt their strategies to build trust and foster long-term relationships.

The Importance of Data Privacy in Digital Marketing

Why Is Data Privacy Becoming a Trend?

Consumer Awareness: In recent years, data breaches and misuse of personal information have made headlines, leading to a surge in consumer awareness regarding data privacy. People are increasingly concerned about how their data is collected, stored, and used, prompting them to favor brands that prioritize their privacy.

Regulatory Changes: Governments worldwide are implementing stricter data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. These regulations compel businesses to adopt more transparent data practices and give consumers more control over their personal information.

Shift in Consumer Expectations: Today's consumers expect brands to be transparent about their data practices. They want to know what information is being collected, how it will be used, and the measures in place to protect it. Failing to meet these expectations can lead to a loss of trust and brand loyalty.

How Brands Can Adapt to the Data Privacy Trend

Prioritize Transparency: Being transparent about data collection and usage practices is crucial. Brands should communicate clearly about what data they collect, how it will be used, and obtain explicit consent from users.

Implement Robust Data Security Measures: Invest in data security to protect customer information from breaches. This includes using encryption, secure servers, and regular security audits to ensure compliance with data protection regulations.

Focus on First-Party Data: With third-party cookies being phased out, brands should shift their focus to collecting first-party data directly from their customers. This can be achieved through strategies such as engaging surveys, loyalty programs, and personalized user experiences.

Create Value for Consumers: Provide value in exchange for personal information. This could involve offering exclusive content, discounts, or personalized recommendations that make customers feel their data is being used beneficially.

Educate Customers: Brands should take the initiative to educate their audience about data privacy and their rights. This could include providing resources or content that explains data protection regulations and how customers can manage their privacy settings.

Other Emerging Trends in Digital Marketing

While data privacy and ethical marketing are vital trends, several other developments are also shaping the future of digital marketing:

Artificial Intelligence (AI) and Machine Learning: AI is increasingly being used to analyze consumer data, predict behaviors, and personalize marketing efforts. Brands that harness AI technology will be able to deliver tailored experiences that resonate with their audience.

Video Marketing Dominance: Video content continues to gain traction, with platforms like TikTok and Instagram Reels driving engagement. Brands should focus on creating compelling video content that captures attention and encourages shares.

Voice Search Optimization: As voice-activated devices become more prevalent, optimizing content for voice search is essential. Brands must adapt their SEO strategies to align with natural language queries and conversational tones.

Sustainability in Marketing: Consumers are increasingly gravitating toward brands that demonstrate a commitment to sustainability. Marketing strategies that highlight eco-friendly practices will resonate with modern audiences seeking socially responsible options.

Conclusion

As we navigate through 2023, the emphasis on data privacy and ethical marketing stands out as the latest trend in digital marketing. Brands that prioritize transparency, invest in data security, and focus on building trust with their customers will be better positioned to thrive in this evolving landscape.

Is your business ready to adapt to the latest trends in digital marketing and prioritize data privacy? Connect with a leading Digital Marketing Agency in Tamil Nadu to explore innovative strategies that can elevate your brand while fostering trust and loyalty with your audience. Let’s work together to unlock your brand’s full potential!

0 notes

Text

Patient Portal Market: Regional Dynamics and Emerging Opportunities

The global Patient Portal Market Revenue, which was valued at USD 3.35 billion in 2023, is forecasted to witness substantial growth, reaching an estimated USD 16.71 billion by 2032. This growth corresponds to an impressive compound annual growth rate (CAGR) of 19.55% over the forecast period from 2024 to 2032. The increasing adoption of digital health solutions and the need for efficient patient engagement are among the key factors driving this market expansion.

Market Dynamics and Growth Drivers

Patient portals are secure online platforms that provide patients with access to their personal health information, enabling them to manage appointments, communicate with healthcare providers, access test results, and receive educational resources. The rising focus on patient-centric care, coupled with the demand for streamlined healthcare communication, is fueling the adoption of these portals globally.

A significant driver of market growth is the ongoing shift toward digitalization in the healthcare sector. The widespread implementation of electronic health records (EHRs) has paved the way for the seamless integration of patient portals, allowing healthcare providers to improve patient engagement, reduce administrative workload, and enhance overall care delivery. The ability of patient portals to facilitate easy access to medical records and streamline care coordination is contributing to their growing adoption.

Key Market Trends

Rising Demand for Patient-Centered Care: Patients are increasingly seeking greater control over their health and wellness. Patient portals enable them to actively engage in their care by providing secure access to their medical records, test results, and appointment schedules, fostering a sense of empowerment and participation in their health management.

Integration with Telehealth Services: The integration of patient portals with telehealth services has become a prominent trend, driven by the increasing adoption of virtual care. Patients can now schedule virtual consultations, share medical history with providers, and receive remote care through a single, unified platform, enhancing the convenience and accessibility of healthcare services.

Government Initiatives and Healthcare Reforms: Governments across the globe are encouraging the adoption of digital health technologies to improve patient care and reduce healthcare costs. Policies promoting the use of EHRs and patient portals are creating a favorable environment for market growth, particularly in developed regions like North America and Europe.

Advancements in Data Security and Privacy: With growing concerns over data security, patient portals are now incorporating advanced encryption and authentication mechanisms to safeguard sensitive patient information. Ensuring data privacy is critical for gaining patient trust, and companies are investing in robust security features to protect against cyber threats.

Get Free Sample Report@ https://www.snsinsider.com/sample-request/2298

Regional Insights

North America held the largest market share for patient portals in 2023, attributed to its well-established healthcare infrastructure, high adoption rates of EHR systems, and supportive regulatory framework. The U.S. healthcare system, in particular, has seen extensive use of patient portals, driven by government initiatives such as the HITECH Act, which promotes the adoption of digital health records.

Meanwhile, the Asia-Pacific region is expected to show the fastest growth over the forecast period. Factors such as the rapid digital transformation of healthcare systems, increased investment in healthcare IT, and rising patient awareness are contributing to the adoption of patient portals in countries like China, India, and Japan. Additionally, the region’s expanding healthcare infrastructure and the focus on improving patient care services are creating growth opportunities for market players.

Key Players in the Market

The Patient Portal Market features several leading companies that are focusing on technological innovation, strategic collaborations, and mergers & acquisitions to strengthen their market position. Prominent players include Allscripts Healthcare Solutions, Inc., Cerner Corporation, McKesson Corporation, Epic Systems Corporation, and NextGen Healthcare. These companies are actively investing in research and development to introduce advanced features in their patient portal solutions, catering to the evolving needs of healthcare providers and patients.

Conclusion

The global Patient Portal Market is poised for significant growth over the next decade, driven by the increasing emphasis on patient engagement, digital healthcare solutions, and integration with emerging technologies such as telehealth. As healthcare systems worldwide continue to prioritize efficient communication and patient-centered care, the demand for patient portals is expected to surge, presenting considerable growth opportunities for market participants.

Other Trending Reports

Gene Therapy Market Share

Bioremediation Market Share

Artificial Intelligence (AI) in Breast Imaging Market Share

Lipid Nanoparticle Raw Materials Market Share

0 notes

Text

Cyber security challenges and solutions in india

BY: Pankaj Bansal , Founder at NewsPatrolling.com

India, like many other nations, faces significant cybersecurity challenges due to the increasing reliance on digital technologies, especially with rapid digitalization and expansion of internet usage. The country has witnessed a rise in cyberattacks on both individuals and organizations, impacting critical sectors like banking, healthcare, infrastructure, and government services. Here are some of the major cybersecurity challenges and potential solutions in India:

Key Cybersecurity Challenges in India

Increased Cybercrime and Hacking Incidents:

India has seen a surge in ransomware attacks, phishing attempts, data breaches, and other cybercrimes targeting both individuals and organizations.

There have been multiple instances of hacking into sensitive government websites, corporate networks, and even power grids.

Lack of Awareness:

Many internet users, particularly in rural areas, have limited awareness of cybersecurity threats and best practices. This leads to vulnerabilities such as weak passwords, falling for phishing scams, and downloading malicious software.

Small and medium-sized businesses (SMEs) often do not prioritize cybersecurity, making them easy targets for hackers.

Shortage of Skilled Cybersecurity Professionals:

There is a significant shortage of trained cybersecurity experts in India, which is critical to addressing and preventing cyberattacks.

The rapid digital transformation is outpacing the availability of cybersecurity skills, leaving many systems inadequately protected.

Weak Infrastructure and Legacy Systems:

Many organizations, including government institutions, still rely on outdated and unpatched systems, which are prone to vulnerabilities.

India’s digital infrastructure has grown rapidly, but with varying degrees of security across sectors.

Insufficient Data Protection Laws:

Although the Indian government passed the Data Protection Bill in 2023, there are still gaps in enforcement and understanding.

The absence of stringent cybersecurity regulations for private businesses and enforcement mechanisms means many companies overlook critical security updates.

Rise in Cyber Espionage and Nation-State Attacks:

India has been targeted by cyber-espionage campaigns, often attributed to foreign actors, attempting to compromise critical infrastructure, government systems, and defense data.

Complex Supply Chain Networks:

Many Indian companies depend on global supply chains, which introduce risks from third-party vendors who may not have strong cybersecurity measures, exposing the organization to indirect attacks.

Solutions to Cybersecurity Challenges in India

Strengthening Cybersecurity Infrastructure:

The Indian government has taken steps like establishing CERT-In (Indian Computer Emergency Response Team) to coordinate and respond to cybersecurity threats.

Enhanced infrastructure for monitoring, detection, and response to cyberattacks should be implemented at national and regional levels.

Promoting Cybersecurity Awareness:

Large-scale public awareness campaigns should be launched to educate citizens, especially in rural areas, on the importance of cybersecurity.

Schools, universities, and businesses should promote cybersecurity training, and best practices for safe internet usage, such as using multi-factor authentication (MFA), recognizing phishing scams, and securing personal data.

Development of Cybersecurity Talent:

India needs to invest in upskilling its workforce by offering specialized cybersecurity training programs, certifications, and courses in higher education institutions.

Encouraging collaboration between the private sector and academic institutions to create internship opportunities and research initiatives can address the talent gap.

Implementation of Stronger Data Protection Laws:

The Personal Data Protection Bill (now known as the Digital Personal Data Protection Act, 2023) outlines the framework for protecting personal data but needs stronger enforcement.

Regular audits and penalties for companies that fail to comply with data protection norms are crucial.

Use of Advanced Technologies:

Embracing AI (Artificial Intelligence) and Machine Learning (ML) for automated threat detection, behavior monitoring, and predictive analytics can help reduce the response time to cyberattacks.

Technologies like blockchain can be applied to sectors such as banking and supply chain to secure transactions and ensure the integrity of digital records.

Securing Critical Infrastructure:

Implementing Zero Trust Architecture in critical sectors like finance, healthcare, and power grids to ensure stringent access controls and network segmentation.

Proactive collaboration between the public and private sectors in securing infrastructure, with real-time threat intelligence sharing.

International Collaboration:

India must continue to engage in cybersecurity collaborations with other countries to share knowledge, technologies, and strategies to combat global cyber threats.

Participating in initiatives like Cybersecurity Capacity Building Programmes by organizations such as the UN or G20 can strengthen its cybersecurity posture.

Public-Private Partnerships (PPP):

The government should foster more partnerships with tech companies and cybersecurity firms to build resilient and secure digital ecosystems.

Incentivizing private companies to adopt better cybersecurity measures through tax benefits or certifications can help enhance overall security.

Recent Initiatives and Efforts in India

National Cyber Security Policy (2013): The policy lays the foundation for cybersecurity in India, but a revised and updated policy is in the works to address modern challenges.

Cyber Surakshit Bharat Initiative: Aims at creating awareness and building capacities among government officials to address cybersecurity challenges.

Cybersecurity Centers of Excellence: Various state governments, such as Telangana and Karnataka, have set up cybersecurity centers to focus on threat intelligence, capacity building, and research.

India’s cybersecurity landscape is evolving rapidly, but it requires continuous efforts to keep pace with global challenges. Enhanced cooperation between the government, private sector, and citizens will be essential to safeguard India's digital future.

0 notes

Text

Government’s Initiative To Protect And Regulate Data: What Is Digital Personal Data Protection Act, 2023?

Data and Internet has become the new fuel and it has revolutionised the way we live our lives. With the help of collected data, different services are advertised to us and our data is also used to process various information in companies.

However, recently many concerns have erupted over the unauthorised use of data by entities. To avert this and provide individuals with data protection rights, the government of India introduced the Digital Personal Data Protection Act, 2023. Let us learn about this Act in Detail.

0 notes

Text

What Are Human Trafficking Facts & Human Trafficking Report

Human trafficking is a global issue that affects millions of people each year, and understanding its scope requires a close look at reliable data. Human trafficking is the illegal act of recruiting, harboring, or transporting individuals through force, fraud, or coercion for purposes such as forced labor or sexual exploitation. It is a serious violation of human rights, and it occurs in almost every country, including developed nations.

Key Human Trafficking Facts

Global Prevalence: According to reports, over 25 million people worldwide are victims of human trafficking. This includes both adults and children, with the majority being women and girls who are trafficked for sexual exploitation.

Labor Exploitation: While sex trafficking gets more attention, a significant portion of human trafficking victims are exploited for labor. These individuals are forced to work under harsh conditions in sectors such as agriculture, domestic work, and manufacturing.

Vulnerable Populations: Traffickers often target individuals from vulnerable backgrounds. Migrants, refugees, and people living in poverty are especially at risk. These groups are easier for traffickers to manipulate, as they often lack social safety nets or legal protections.

Forms of Coercion: Traffickers use various methods to control their victims, including threats, violence, and manipulation. Many victims are promised jobs or education but are instead subjected to exploitation upon arrival at their destination.

Underreporting and Hidden Crimes: Human trafficking is frequently underreported due to its clandestine nature. Victims often feel afraid to come forward due to fear of retaliation or mistrust in law enforcement.

Understanding the Human Trafficking Report

Human trafficking reports provide a critical view of how this crime evolves and affects societies. The 2023 Global Trafficking in Persons Report highlighted important trends, including an increase in trafficking due to conflict and economic instability. Additionally, the report showed a growing need for international cooperation and stronger legal frameworks to combat trafficking.

These reports also emphasize the role of technology in both facilitating and fighting trafficking. While traffickers use the internet to lure victims, authorities are increasingly relying on digital tools to track and dismantle trafficking networks.

Conclusion

Human trafficking remains one of the most pressing issues of our time, requiring a global effort to eliminate it. Organizations like the Human Trafficking Institute play a pivotal role in producing reliable data, raising awareness, and pushing for stronger anti-trafficking laws. Through their work, we can better understand and

combat human trafficking, ultimately providing a path to freedom for millions of victims worldwide.

For more info:-

What Are Human Trafficking Facts

0 notes

Text

Understanding India's Digital Personal Data Protection Act and DPDP Bill, 2023

Data privacy and protection have, in the past decade, gained increased attention worldwide. As such, governments began putting in place stringent legal frameworks. Business lawyers, therefore, are required to support such organisations in order to navigate them through the regulatory maze. Thinking Legal’s article, as contributed by Vaneesa Agrawal, talks about the journey pertaining to this that began with the Personal Data Protection Bill, 2019, which worked at providing a comprehensive data protection regime in India. The Bill came following the landmark verdict by the Supreme Court in 2017, where it stated that the constitutional right to privacy was a fundamental right under the Constitution of India.

Business lawyer Vaneesa Agrawal said, “The proposed legislation contemplated processing personal data in a way that the privacy rights of individuals were protected while ensuring that businesses could operate in a data-driven economy.”

After years of debate and revision, the Personal Data Protection Bill evolved into the Digital Personal Data Protection Act, 2023 (DPDP Act), which was enacted to address the urgent need felt by the modernized data protection framework. Indeed, this has kept business lawyers busy trying to interpret these regulations anew and subsequently advising their clients on ways of compliance.

This article therefore delves into the key features of the Personal Data Protection Bill and DPDP Act India's data protection landscape.

Key Features of the Digital Personal Data Protection Act, 2023

The DPDP Act represents a significant milestone in India's data protection journey. Here are some of its most notable features:

Consent-Based Data Processing

The DPDP Act, for example, requires consent to be obtained in an express and informed manner from the individuals whose personal data is being processed. Companies are turning to business lawyers for advice on how they can add hard-core consent programming that will meet this requirement.

Rights of Individuals

The Act grants several rights to individuals, including the right to access their data, the right to correction, and the right to erasure. Business lawyers highlight that these rights are designed to enhance user autonomy and ensure that individuals can manage their personal information effectively.

Data Fiduciaries and Processors

As per the authorities that carry out the processing of personal data, the date is been characterised as Data Fiduciary and Processor. According to business lawyer Vaneesa Agrawal,grasping these differences is crucial when deciding what an organisation must do under the law.

Data Protection Authority

The DPDP Act establishes the Data Protection Authority of India (DPA) as the regulatory body tasked with overseeing compliance. Business lawyers work towards anticipating how its evolving purview may impact clients. What enforcement strategies might it employ? How stringent will its audits be? These legal experts must ready approaches addressing myriad what-ifs.

Cross-Border Data Transfers

The Act also addresses complex concerns around cross-border data flows. The Act outlines provisions for cross-border data transfers, allowing data to be transferred outside India under certain conditions. In this case, business lawyerswork towards answering questions like,

What geographic transfers will require review or permitting?

When does localization make sense?

Vaneesa Agrawal, founder of Thinking Legal adds that this is crucial for businesses operating in a global environment, as it facilitates international data flows while maintaining privacy standards.

Recent Developments and Implications

Since the enactment of the DPDP Act, various stakeholders have been actively discussing its implications and potential challenges. Recent articles have shed light on several key areas:

Business Compliance

Businesses, particularly those in the tech sector, are now faced with the challenge of aligning their operations with the new data protection framework. Compliance with the DPDP Act requires significant changes in data handling practices, including revising privacy policies, implementing robust consent mechanisms, and ensuring data security measures are in place. What business lawyers in this scenario do is they guide through this transition, navigating the complexities of the law and avoiding potential pitfalls.

Regulatory Clarity

The establishment of the DPA is a significant step towards ensuring regulatory clarity in data protection. Business lawyers observe how the DPA will interpret and implement the provisions of the DPDP Act, particularly regarding penalties for non-compliance and the handling of data breaches.

Public Awareness and Education

The success of the DPDP Act hinges on public awareness and understanding of data protection rights. Recent discussions business lawyers emphasise the need for educational initiatives to inform individuals about their rights under the Act.

International Comparisons

As India implements the DPDP Act, business lawyers conduct comparisons with data protection frameworks in other countries, such as the General Data Protection Regulation (GDPR) in the European Union.

Challenges Ahead

Despite the advancement of the DPDP Act, there are a lot of challenges persisting that business lawyers are trying to confront. First of all, implementation and thereby enforcement of the DPDP Act can be done effectively only with huge resources and expertise on the part of organisations. Business lawyers have underscored that there is a greater need for proactive efforts towards compliance in order not to attract possible penalties.

A few critical challenges that are addressed by business lawyers across the country is,

How to balance innovation in the digital economy with ensuring tight data protection.

How to maintain this delicate balance considering the impact such changes could have on startups and small businesses that may not be able to compete with compliance matters.

Vaneesa Agrawal highlights that, “It’s part of a business lawyer’s job. To ensure that regulations will not choke the growth and innovation of the business, while at the same time ensuring that data security standards are high.”

Conclusion

The Digital Personal Data Protection Act 2023, marks a pivotal moment in India's journey toward establishing a comprehensive data protection framework. By prioritizing individual rights and imposing clear obligations on businesses, the Act aims to create a safer digital environment for all stakeholders.

As organizations work to comply with the new regulations, the work of business lawyers becomes increasingly vital in navigating the complexities of data protection law.

0 notes

Text

How To Build Privacy Compliance For India's New DPDP Act?

As soon as the Digital Personal Data Protection Act 2023 was enacted, many companies started efforts to get compliant - from updating privacy policies to tweaking contracts.

But is this enough?

While that's a good start, true compliance involves a deeper commitment. What's needed here is a comprehensive understanding of the law's nuances and implications, along with proactive measures to ensure ongoing adherence. Ahead, we tell you how to build privacy compliance for India's new DPDP Act. Let's dive in!

What Is The Privacy Compliance?

Privacy compliance makes sure that businesses handle an individual's personal data according to the legal regulations of the DPDP Act. This protects the data from any breaches and unauthorized access.

Now, adhering to the regulations is mandatory. It not only protects individuals' privacy but helps businesses avoid heavy legal penalties.

By implementing privacy measures, you build trust with customers, manage risks, and demonstrate commitment to ethical data handling practices.

What Is the Digital Personal Data Protection Act (DPDPA)?

Source: Meity

The Digital Personal Data Protection Act 2023 is India's first privacy law and is defined as an Act to provide for the processing of digital personal data in a manner that recognizes both the right of individuals to protect their personal data and the need to process such personal data for lawful purposes and for matters connected therewith or incidental thereto.

The Digital Personal Data Protection Act 2023 addresses privacy concerns by outlining rules for handling personal data. Similar to the EU's GDPR, it emphasizes consent and data subject rights.

That said, it has distinct features, including specific language, and requirements. The DPDPA mandates that businesses inform users about data processing through a privacy policy. Consent must be informed, meaning users understand what they're agreeing to. Failure to provide proper notice invalidates consent and data processing.

To put it simply, the Digital Personal Data Protection Act 2023 protects personal data by ensuring transparency and enforcing stringent consent standards.

Challenges In Privacy Compliance

Privacy compliance faces various challenges. They include:

Understanding and adhering to diverse regulations of the Digital Personal Data Protection Act(DPDPA) may need a nuanced outlook.

Businesses may struggle with data governance, determining who accesses data and how it's used, while ensuring compliance with laws.

The lack of clear guidelines can make implementation feel complicated and lead to uncertainty and potential legal risks.

Balancing security measures with user accessibility poses a challenge, as overly restrictive policies can hamper user experience.

New technology introduces new privacy concerns, requiring constant adaptation to protect data effectively.

Education and awareness gaps among employees and customers further compound these challenges, stressing the need for comprehensive privacy training programs.

What Must Companies Do To Build Privacy Compliance?

Here are a few things companies can do to build privacy compliance:

Create clear guidelines for all employees and update them regularly to adapt to changing circumstances.

Ensure adherence to policies from top management to down and integrate them into company culture through open communication.

Make policies easily understandable and encourage staff to follow them. Also, address any implementation challenges immediately.

Utilise checklists to help everyone follow procedural requirements and track progress efficiently.

Facilitate easy and clear methodology for responding to Data principal rights and grievance redressal.

Conduct regular training sessions for all staff levels to reinforce understanding of policies and maintain compliance.

Stay up-to-date on evolving laws and regulations and ensure policies remain relevant and compliant with current standards.

Enforce policies consistently across all team members and departments and showcase the importance of compliance in daily operations.

Perform audits periodically to evaluate policy effectiveness, identify areas for improvement, and manage any security gaps.

Use automation tools to streamline compliance processes and maintain consistency.

Privacy Compliance Solutions & Automated Tools

As you can see, building privacy compliance for India's new DPDP Act requires a comprehensive approach. You must understand the law’s intricacies and develop a robust action plan. From conducting Data Protection impact assessments to clear data handling policies, it needs continuous efforts.

DPDPA Consultants bring you all the necessary tools and solutions, which makes privacy compliance with the Digital Personal Data Protection Act 2023 easier. Here's how:

Our Data Protection Consent Management tool enables obtaining valid consent easily and automates consent request handling, ensuring compliance throughout the process.

With Data Principal Grievance Redressal, individuals can effortlessly exercise their data rights through a user-friendly platform, enhancing response efficiency in line with the Digital Personal Data Protection Act 2023.

Simplify the Data Protection Impact Assessments (DPIAs) process with our tool and allow easy risk assessment and tracking, ensuring everyone stays informed about the efforts.

Our Data Protection Awareness program enables management to oversee the continuous execution of their personal data privacy initiatives efficiently.

Ensure outsourcing agreements comply with the DPDP Act through our Contract Reviews and redrafting services.

Our custom training programs address organization-specific needs, emphasising practical aspects of DPDP compliance such as personal data policies and processing activities.

Build Privacy Compliance For DPDPA Today!

Boost your compliance journey with DPDP Consultants. Our comprehensive suite of automation tools and expert services simplifies DPDPA adherence every step of the way.

Contact Us For DPDP Compliance Tools

FAQ

How do you ensure data privacy compliance?

Ensuring data privacy compliance involves several steps such as implementing robust security measures, conducting regular audits, staff training, etc. The right set of strategies is imperative to uphold regulatory standards.

Why is data privacy and compliance important?

Data privacy and protection are important to protect individuals' sensitive information, maintain trust with customers, and avoid legal penalties associated with data breaches or mishandling.

What are the 5 pillars of compliance with the Data Privacy Act?

The five pillars of compliance with the Data Privacy Act include appointing a consent manager, data protection officer, conducting risk assessments, implementing data protection measures, creating a privacy management program, and reporting breaches immediately.

#dpdpa tools#dpia#dpdp act 2023#digital personal data protection#dpdp#dpdp act#dpdp 2023#dpdpa#dpdp consultants#dpdp tool

0 notes

Text

A Safer Digital Playground: The Imperatives of the Digital Personal Data Protection Act

In today’s hyper-connected world, children are not just passive users of technology; they are active participants in a vast digital ecosystem that can be perilous. The Digital Personal Data Protection Act, 2023 (DPDPA) seeks to address this vulnerability by implementing stringent measures to protect children’s personal data, underscoring that compliance is not just a legal obligation but a moral…

0 notes

Text

Understanding the Territorial Scope of India's DPDP Act and the EU's GDPR

Data protection laws have been evolving quickly, especially with India's recent Digital Personal Data Protection (DPDP) Act, passed in 2023. Many are comparing it to the European Union's General Data Protection Regulation (GDPR), particularly in terms of how far these laws reach. Vaneesa Agrawal, a prominent business lawyer specializing in data protection, notes that the territorial scope of these laws is a crucial aspect that organizations need to understand.

Both the DPDP Act and GDPR have quite broad territorial scopes. The GDPR, for instance, applies to any organization that handles the personal data of people living in the EU, even if that organization is based elsewhere. Similarly, the DPDP Act extends its reach beyond India's borders, applying to digital personal data processed outside India if it relates to offering goods or services to people in India. This wide application reflects the increasingly global nature of data flows, which is becoming harder to ignore, as pointed out by business lawyers familiar with international data regulations.

As we transition into a year after the enactment of the DPDP Act, it is essential to examine its implications and the current discourse surrounding it. Vaneesa Agrawal highlights that the DPDP Act not only aims to protect individual privacy but also seeks to position India as a leader in global data governance, aligning with Prime Minister Modi's vision of a $1 trillion digital economy.

One Year Later: A Look at the DPDP Act

As we move into the first year since the DPDP Act came into force, there's growing interest in its impact and the discussions it has sparked. Business lawyers specializing in data protection are closely monitoring these developments. Vaneesa Agrawal observes that the Act is not just about safeguarding individual privacy; it's part of India's larger goal to become a leader in global data governance.

Many business lawyers view the DPDP Act as a groundbreaking move in establishing a solid data protection framework for India. An article from Storyboard18 even suggests that it could serve as a model for global data protection standards. The Act focuses on key principles like individual consent, data minimization, and purpose limitation—ideas that resonate with the GDPR. But it also takes into account India's specific socio-economic landscape, allowing for more flexibility with cross-border data transfers, especially compared to the stricter GDPR.

Key Features of the DPDP Act

Let's break down some of the DPDP Act's most important features, as analyzed by business lawyers:

Cross-Border Data Transfers: Unlike the GDPR, which uses a whitelisting approach (allowing data transfers only to approved countries), the DPDP Act opts for a blacklisting model. This means that data can generally be transferred to most places unless the Indian government specifically restricts it. Vaneesa Agrawal points out that this method reflects the geopolitical realities of managing data while still protecting national interests.

Regulatory Framework: The DPDP Act has established the Data Protection Board of India (DPBI), an independent body responsible for enforcing the law and resolving disputes. Business lawyers recognize that this follows international best practices in data governance.

Consent Management: The Act requires explicit, informed, and revocable consent from individuals before their data can be processed. This is especially relevant given the rise of AI and the complex ways data is used in today's digital economy, as noted by business lawyers specializing in technology law.

While the DPDP Act shares some common ground with the GDPR, it diverges in key ways. For instance, the GDPR puts responsibilities on both data controllers and processors, while the DPDP Act focuses primarily on data fiduciaries (those responsible for determining how data is processed). Another difference, as pointed out by Vaneesa Agrawal, is that under the DPDP Act, all data breaches must be reported to both the data protection board and affected individuals. In contrast, the GDPR only mandates reporting for breaches that pose a high risk to individuals.

Bridging the Gap Between DPDP and GDPR

As India moves further into its digital transformation, there's a growing call to harmonize its data protection laws with the GDPR. An article from The Print argues that aligning the DPDP Act with the GDPR would reduce the compliance burden for companies operating in both regions. Business lawyers are closely following these discussions, recognizing the potential impact on their clients' operations.

Here are a few areas where the two laws differ, as analyzed by business lawyers:

Data Retention: The DPDP Act takes a more prescriptive stance on data retention, requiring that data be deleted as soon as it's no longer needed. The GDPR, on the other hand, doesn't specify a retention period beyond the time necessary for the intended purpose.

User Rights: Under the DPDP Act, users can seek redress directly from service providers, while the GDPR allows users to approach supervisory authorities without first going to the service provider. Vaneesa Agrawal emphasizes the importance of understanding these differences for businesses operating in both jurisdictions.

Exemptions: Business lawyers explain that the DPDP Act allows exceptions for data processing related to law enforcement, which may not align fully with the GDPR's broader approach to protecting personal data, even in such cases.

These differences underscore the complexity of global data governance. However, India has a significant opportunity to learn from the EU's experience with the GDPR, especially regarding breach reporting and safeguarding user rights. Vaneesa Agrawal suggests that this learning process could lead to more refined data protection practices in India.

Conclusion: The Future of Global Data Protection

With the DPDP Act now in effect alongside the GDPR, we're seeing the beginning of a new chapter in global data protection. The world is watching how India will handle enforcement, compliance, and the protection of individual rights. If successful, the DPDP Act could become a model not just for India, but for other countries aiming to establish robust data protection frameworks.

Business lawyers are playing a crucial role in helping organizations navigate this evolving landscape. The expertise of business lawyers will be invaluable in ensuring compliance with both the DPDP Act and the GDPR, especially for companies operating across multiple jurisdictions.

In short, Vaneesa Agrawal highlights, “While the DPDP Act represents a major step forward for data protection in India, ongoing collaboration with the EU will be essential in creating a unified global approach to data governance.” Aligning India's regulations with international standards won't just ease compliance—it will be crucial for building trust in the digital world, ensuring that individual rights are protected while also encouraging innovation and economic growth. Business lawyers will continue to be at the forefront of these developments, guiding organizations through the complexities of global data protection laws.

0 notes

Text

Guardians of the Digital Realm: Tackling Data Breaches in Indian Healthcare

In the bustling digital landscape of India, a silent battle rages on – one that could affect your most personal information. Welcome to the world of healthcare data breaches, where your medical history is the prize, and cybercriminals are the hunters. Buckle up as we dive into this critical issue that's making waves in India's healthcare sector.

Why Should You Care? Picture this: Your entire medical history, from that embarrassing rash to your latest blood test results, suddenly available to the highest bidder on the dark web. Scary, right? That's why I, as a digital innovation student, chose to shine a spotlight on this topic. It's not just about ones and zeros; it's about your privacy, your security, and potentially, your life.

The State of Play: Numbers Don't Lie Hold onto your stethoscopes, folks, because the numbers are alarming:

In 2018, healthcare data breaches accounted for a mere 7% of all data breaches in India.

Fast forward to 2022, and that number skyrocketed to 18%! (Data Security Council of India, 2023) That's more than double in just four years. Houston, we have a problem!

The Usual Suspects: How Does It Happen? So, how are the bad guys getting their hands on your health data? Let's break it down:

Ransomware Attacks: Imagine hospitals unable to access patient data unless they pay a hefty ransom. It's not a movie plot; it's happening!

Insider Threats: Sometimes, the call is coming from inside the house. Disgruntled employees or careless staff can be the weakest link.

Phishing Scams: That innocent-looking email? It might be the bait to hook your doctor's login credentials.

Unsecured Databases: Some databases are about as secure as a house with the front door wide open.

The Domino Effect: Who Gets Hit? When a healthcare data breach occurs, it's not just the patients who suffer. It's a domino effect that impacts:

Patients: Privacy goes out the window, and identity theft becomes a real threat.

Healthcare Providers: Reputation takes a nosedive, and the financial hit can be massive.

Insurance Companies: Fraudulent claims start pouring in, and liability skyrockets.

Government: Trust in the system erodes, and regulatory nightmares ensue.

The Legal Tangle: Where Do We Stand? Here's the kicker – our current laws are playing catch-up. The Information Technology Act of 2000 is like using a flip phone in the age of smartphones – it just doesn't cut it for healthcare's specific needs. There's hope on the horizon with the Personal Data Protection Bill, but for now, we're in a bit of a legal limbo.

Fighting Back: The Cybersecurity Arsenal But fear not! The good guys aren't sitting idle. Here's how the healthcare sector is armoring up:

Beefing up access controls (because not everyone needs to see everything)

Regular security check-ups (finding the weak spots before the bad guys do)

Employee boot camps (turning staff into the first line of defense)

Data encryption (making stolen data as useful as a paperweight)

Battle plans for breaches (because hope for the best, prepare for the worst)

The Bottom Line As India's healthcare sector races into the digital future, we can't let cybersecurity be an afterthought. It's a delicate balance – embracing innovation while fortifying our defenses. The stakes? Just our privacy, security, and peace of mind. No biggie, right? So, the next time you visit a hospital or clinic, remember – in the digital age, it's not just your physical health that needs protection. Your data health matters too!

Stay safe, stay informed, and maybe think twice before oversharing on those medical forms!

0 notes

Text

Services de protection contre le vol d'identité, Prévisions de la Taille du Marché Mondial, Classement et Part de Marché des 10 Premières Entreprises

Selon le nouveau rapport d'étude de marché “Rapport sur le marché mondial de Services de protection contre le vol d'identité 2024-2030”, publié par QYResearch, la taille du marché mondial de Services de protection contre le vol d'identité devrait atteindre 11500 millions de dollars d'ici 2030, à un TCAC de 7.2% au cours de la période de prévision.

Figure 1. Taille du marché mondial de Services de protection contre le vol d'identité (en millions de dollars américains), 2019-2030

Selon QYResearch, les principaux fabricants mondiaux de Services de protection contre le vol d'identité comprennent NortonLifeLock, Experian, etc. En 2023, les trois premiers acteurs mondiaux détenaient une part d'environ 44.0% en termes de chiffre d'affaires.

Figure 2. Classement et part de marché des 10 premiers acteurs mondiaux de Services de protection contre le vol d'identité (Le classement est basé sur le chiffre d'affaires de 2023, continuellement mis à jour)

The Identity Theft Protection Services market is influenced by several key drivers given the increasing prevalence of identity theft and the growing awareness among individuals and organizations about the importance of safeguarding personal information. Some significant drivers in this market include:

1. Rising Incidences of Identity Theft: The proliferation of cybercrime and data breaches has led to a significant increase in identity theft cases globally. This surge in fraudulent activities has heightened the demand for identity theft protection services as individuals seek proactive measures to secure their personal information.

2. Increased Digital Transactions: The rapid digital transformation and the widespread adoption of online services, e-commerce platforms, and mobile banking have expanded the vulnerabilities associated with personal data exposure. As people engage in more digital transactions, the need for robust identity protection solutions becomes imperative to mitigate the risks of identity theft.

3. Regulatory Compliance: Stringent data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, compel organizations to prioritize data security and privacy. Compliance with these regulations drives the adoption of identity theft protection services to adhere to legal requirements and protect sensitive information.

4. Growing Awareness and Concerns: The growing awareness among individuals about the implications of identity theft and the potential financial and reputational damages associated with it has heightened the demand for identity protection services. Consumers are increasingly seeking proactive measures to safeguard their identities and prevent unauthorized access to their personal data.

5. Technological Advancements: Advancements in technology, such as artificial intelligence (AI), machine learning, biometrics, and behavioral analytics, have enabled identity theft protection service providers to offer more sophisticated solutions for detecting fraudulent activities and enhancing security measures. These technological innovations contribute to the effectiveness of identity protection services.

6. Remote Work and Increased Online Activities: The shift towards remote work arrangements and increased online activities due to the COVID-19 pandemic have exposed individuals and organizations to heightened cybersecurity risks. The reliance on digital platforms for work, communication, and transactions has underscored the importance of robust identity theft protection services to mitigate risks associated with cyber threats.

7. Corporate Data Breaches: High-profile data breaches affecting major corporations and government entities have underscored the importance of data security and privacy. These incidents have raised concerns about the vulnerability of personal information, driving individuals and organizations to invest in identity theft protection services as a preventive measure against potential data breaches and cyber threats.

8. Personal Data Monetization: The growing trend of personal data monetization by companies for targeted advertising and marketing purposes has raised privacy concerns among consumers. With the increasing commercialization of personal data, individuals are seeking identity protection services to safeguard their information from misuse and unauthorized access.

These drivers collectively contribute to the growth and evolution of the Identity Theft Protection Services market, as individuals, businesses, and regulatory bodies recognize the importance of robust identity protection measures to combat the escalating threats of identity theft and cyber fraud. Service providers in this sector continue to innovate and enhance their offerings to address the dynamic challenges posed by evolving cybersecurity threats and regulatory requirements, catering to the increasing demand for comprehensive identity theft protection solutions.

À propos de QYResearch

QYResearch a été fondée en 2007 en Californie aux États-Unis. C'est une société de conseil et d'étude de marché de premier plan à l'échelle mondiale. Avec plus de 17 ans d'expérience et une équipe de recherche professionnelle dans différentes villes du monde, QYResearch se concentre sur le conseil en gestion, les services de base de données et de séminaires, le conseil en IPO, la recherche de la chaîne industrielle et la recherche personnalisée. Nous société a pour objectif d’aider nos clients à réussir en leur fournissant un modèle de revenus non linéaire. Nous sommes mondialement reconnus pour notre vaste portefeuille de services, notre bonne citoyenneté d'entreprise et notre fort engagement envers la durabilité. Jusqu'à présent, nous avons coopéré avec plus de 60 000 clients sur les cinq continents. Coopérons et bâtissons ensemble un avenir prometteur et meilleur.

QYResearch est une société de conseil de grande envergure de renommée mondiale. Elle couvre divers segments de marché de la chaîne industrielle de haute technologie, notamment la chaîne industrielle des semi-conducteurs (équipements et pièces de semi-conducteurs, matériaux semi-conducteurs, circuits intégrés, fonderie, emballage et test, dispositifs discrets, capteurs, dispositifs optoélectroniques), la chaîne industrielle photovoltaïque (équipements, cellules, modules, supports de matériaux auxiliaires, onduleurs, terminaux de centrales électriques), la chaîne industrielle des véhicules électriques à énergie nouvelle (batteries et matériaux, pièces automobiles, batteries, moteurs, commande électronique, semi-conducteurs automobiles, etc.), la chaîne industrielle des communications (équipements de système de communication, équipements terminaux, composants électroniques, frontaux RF, modules optiques, 4G/5G/6G, large bande, IoT, économie numérique, IA), la chaîne industrielle des matériaux avancés (matériaux métalliques, polymères, céramiques, nano matériaux, etc.), la chaîne industrielle de fabrication de machines (machines-outils CNC, machines de construction, machines électriques, automatisation 3C, robots industriels, lasers, contrôle industriel, drones), l'alimentation, les boissons et les produits pharmaceutiques, l'équipement médical, l'agriculture, etc.

0 notes

Text

Dave Antrobus Inc & Co: The Evolution of Insurance with AI

Did you know the global AI market in insurance is expected to hit £6.5 billion by 2024? This impressive number shows the big changes technology is bringing to insurance. Dave Antrobus, the Co-Founder and Chief Technology Officer of Inc & Co, leads this change. He’s using AI to make insurance work better and improve how customers feel about it.

In the UK, the insurance sector faces tough challenges. But, Antrobus‘s knowledge of tech is helping change things for the better. This article looks at how AI is changing insurance. With Dave Antrobus‘s help, the industry is moving forward in exciting ways.

Introduction to AI in Insurance

In recent years, AI has transformed the insurance sector. People like Dave Antrobus are leading this change. They’re combining tech with the finance industry. AI in digital insurance boosts efficiency and accuracy in the UK.

AI is changing traditional insurance models a lot. For instance, it processes claims faster and with fewer mistakes. This makes claim processing quicker and more correct. AI in underwriting also minimises errors dramatically.

AI is also vital for finding fraud in UK insurance. It uses complex algorithms to spot fake claims accurately. This protects both insurer and insured. It ensures genuine claims are dealt with quickly, making customers happier.

AI chatbots in digital insurance show innovation too. They answer customer questions instantly and accurately. This move to AI saves insurers money and makes things more efficient.

AI has also helped the UK insurance industry in risk assessment. Using AI for personalised policies reduces errors. This makes things smoother and improves customer service by offering customised insurance options.

To sum up, AI’s role in UK insurance is a big shift towards better, focused, and accurate service. AI’s growth in finance is reshaping digital insurance. It’s setting new standards for service quality.

How AI is Transforming Insurance Claims

AI technology is revolutionising the insurance world by making claims processing better. It speeds up how claims are handled, cutting down on time and resources. This shift towards AI-driven solutions became more critical with the pandemic’s push for digital adoption.

AI is especially good at spotting false claims, a major issue today. It tackles the rise in fraud, including the tricky deepfake images. This careful analysis by AI leads to fair settlements, building trust and cutting losses.

Both consumers and insurance companies gain a lot from using AI. Customers get quicker, more precise services, boosting their happiness. Insurers see smoother workflows and save money by needing fewer manual checks. They also get valuable data insights to spot risks and predict trends.