#Digital insurance partnership

Explore tagged Tumblr posts

Text

AI-powered claims automation raises ethical questions regarding fairness and transparency. Ensuring fair decision-making, preventing prejudice, and offering clear explanations of AI-driven results are critical for confidence and compliance in automated claims procedures.

#Digital insurance partnership#Insurance api#Insurtech as a service#travel insurance api#embedded insurance#subscription insurance#insurance quote api#trending#trend#like#trendingreels#trendingnow#viralpost#model#followforfollowback#likeforlikes#trendingtopics

0 notes

Text

Sun Life and Smart renew partnership to promote financial literacy among cooperatives

Sun Life Philippines (Sun Life), the country’s leading life insurance company for 12 consecutive years, has renewed its strategic partnership with Smart Communications, Inc. (Smart). The aim of this partnership is to enhance financial literacy among cooperatives affiliated with Smart. Expanding the Program’s Coverage The renewed partnership between Sun Life and Smart will broaden the program’s…

View On WordPress

#advocacy#collaboration#community#cooperation#cooperatives#digitalization#economy#education#empowerment#finance fundamentals#financial education#financial goals#financial independence#financial literacy#insurance#mobile network#partnership#Philippines#press release#Smart Communications#Smart Communications Inc.#social media#sun life#sun life philippines

0 notes

Text

Adam Clark Estes at Vox:

Some people collect coins or stamps. For a time, I collected debit cards. Not stolen ones! Each one of them had my name on them, right below the logo of the latest banking app I’d decided to try out: Venmo, Cash App, Chime, Varo, Current, Acorns. For the better part of a decade, I did all my banking through these apps, enjoying their slick user experience and lack of fees. The problem with every one of them, however, is that they’re not chartered banks. If the company behind the app went bankrupt, the Federal Deposit Insurance Corporation (FDIC) would not necessarily come to my rescue. This disaster scenario was a hypothetical worry when I eventually settled for Chase and its FDIC insurance. For millions of others, it became a reality earlier this year when a company called Synapse collapsed and froze them out of their accounts. Users of Yotta, a popular savings app with a built-in lottery, and other apps that relied on Synapse to help manage their accounts couldn’t access their money for months. Now, as hundreds of thousands of Synapse customers’ dollars remain in limbo, Sens. Elizabeth Warren (D-MA) and Chris Van Hollen (D-MD) are calling for banking reforms, and the FDIC is proposing changes to its rules.

Still, a growing number of people are embracing these financial technology, or fintech, services. More than a third of Gen Z and millennials used a fintech app or a digital bank as their primary checking account, according to a 2023 Cornerstone Advisors study. So some questions are worth asking: Is it a bad idea to use an app like Venmo as your main bank? Are digital banks like Chime trustworthy enough? The answer to both questions is yes. Venmo is not a bank, and using it as your primary checking account comes with some risks. Some fintech companies, like Chime, are just as big as traditional banks and offer some nice perks. Again, because they’re nontraditional, there are risks. “You’re not going to go back to a world where everybody works with a small bank and walks into a branch,” Shamir Karkal, co-founder of Simple, one of the first digital banks. “The future is just going to be more fintech, and I think we all just need to get better at it.”

Neobanks and money transmitters, briefly explained

The term fintech can refer to a lot of things, but when you’re talking about everyday services for everyday people, it typically refers to either neobanks or money transmitters. Chime is a neobank. Venmo is a money transmitter. They’re regulated in different ways, but because most of these companies issue debit cards, many people treat them like checking accounts. Fintech apps are not the same thing as FDIC-insured banks.

Neobanks are fintech companies that offer services like checking accounts in partnership with chartered banks, which are FDIC-insured. Neobanks sometimes enlist intermediaries known as banking-as-a-service, or BaaS, companies, which are not FDIC-insured. Still, you will often see the FDIC logo on neobank websites, just like you see it stuck to the glass doors of many brick-and-mortar banks. That logo instills trust, and thanks to their partnerships, neobanks can claim some FDIC protections. But because they do not have bank charters, these neobanks and BaaS companies are not directly FDIC-insured. Instead, neobank customers can be eligible for something called pass-through deposit insurance coverage.

[...] Money transmitters, also known as money services businesses, are even further removed from the perceived safety of the FDIC. Put bluntly, if you’re keeping all your money in a Venmo or Cash App account, you don’t qualify for FDIC insurance. Money transmitters are not neobanks or banks at all but rather completely different legal entities that are regulated by individual states as well as the Department of the Treasury. There are certain protections provided by these agencies, but FDIC insurance is not one of them. So when an app like Yotta or Chime says on its website that it’s FDIC insured, it’s not a lie, but it’s not necessarily true either. Venmo, to its credit, admits in the fine print of its homepage that its parent company PayPal “is not a bank” and “is not FDIC insured.” To confuse you even more, however, certain PayPal services that enlist a chartered bank partner, like a PayPal Mastercard or savings account, might qualify for FDIC insurance. Again, it depends.

[...] That doesn’t necessarily mean that all neobanks and fintech companies are untrustworthy. In some cases, the sheer size and track record of fintech companies can instill quite a bit of trust. Chime, the largest digital bank with roughly 22 million customers, scored a $25 billion valuation in its latest round of funding and is planning to go public next year. Venmo’s parent company, PayPal, is widely considered safe and trustworthy. And don’t expect Block, the $42 billion company that owns Cash App as well as its own chartered bank, to fail any time soon. The truth is, even if there is some false sense of security, fintech apps offer certain customers features that big banks can’t or won’t. One thing that’s made Chime and many other neobanks so popular, for instance, is that they don’t charge so many fees. That’s a huge boon to young people as well as people without bank accounts. If a fintech app is your only option, then you might not care so much about FDIC insurance.

“If you’re poor in America and you’re banking at Chase or Wells Fargo, you’re going to get overdraft fees, minimum balance fees,” Mikula explained. “So there is a real need that [fintech] companies fulfill as a result of your establishment banks essentially not wanting to bank poor people because it’s difficult to do profitably.” As many as 6 percent of Americans were living without a bank account in 2023, according to Federal Reserve data. That share grows to 23 percent for those making less than $23,000 a year. The unbanked population, which disproportionately comprises Black, Hispanic, and undocumented people, is at a greater risk of falling victim to predatory lending practices, including payday loans. Some fintech companies also offer short-term loans, though they’ve been criticized for being predatory as well.

If you have Venmo, Cash App, Zelle, or any fintech or digital banking app, be aware: don’t use them as your primary checking account.

17 notes

·

View notes

Text

Driving Success: Mastering DOT Drug Testing for Transportation Entrepreneurs

As a transportation entrepreneur, navigating the intricate landscape of DOT drug testing is not just a regulatory requirement but a crucial step in ensuring safety, reliability, and compliance within your business. In this blog, we'll explore the ins and outs of DOT drug testing, its importance, challenges, solutions, and the role of technology and service providers in simplifying compliance. Let's dive in!

Why DOT Drug Testing Matters:

DOT drug testing isn't just about following rules; it's about safeguarding lives. By ensuring a sober workforce, transportation businesses mitigate the risks of substance-related accidents, protecting employees, passengers, and the public. Compliance with DOT regulations fosters a culture of safety and responsibility, essential for maintaining trust and credibility in the industry.

Who Needs to Comply:

Understanding who falls under DOT drug testing requirements is essential. From commercial truck drivers to aviation personnel, railroad workers to mariners, employees in safety-sensitive positions across various transportation sectors must adhere to strict testing protocols to uphold integrity and reliability within the industry.

Testing Procedures and Requirements:

DOT drug testing involves screening for a range of substances, including marijuana, cocaine, opiates, amphetamines, phencyclidine, and alcohol. Testing procedures follow rigorous guidelines, from sample collection to laboratory testing, review by Medical Review Officers (MROs), and follow-up protocols in case of positive results.

When Tests Are Required:

DOT drug and alcohol tests are mandated in various situations, including pre-employment, random testing throughout the year, reasonable suspicion testing, post-accident testing, return-to-duty testing after a violation, and follow-up testing for employees undergoing substance abuse treatment.

Practical Tips for Compliance:

Staying informed about DOT regulations, educating your team, partnering with reliable testing services, implementing clear policies, and providing support for employees struggling with substance abuse are vital steps in ensuring compliance with DOT drug testing requirements.

The Importance of Compliance:

Compliance with DOT drug testing regulations isn't just about adhering to government rules; it's about cultivating a safety culture, maintaining reliability and trust, avoiding legal and financial consequences, mitigating insurance and liability risks, and promoting long-term business health.

Implementing a Drug Testing Program:

Establishing a comprehensive drug testing program involves understanding DOT regulations, selecting qualified service agents, crafting clear policies, conducting pre-employment and random testing, managing post-accident and reasonable suspicion testing, and ensuring confidentiality and record-keeping compliance.

Challenges and Solutions:

While DOT drug testing poses challenges such as managing costs, ensuring privacy, and handling positive test results, practical solutions such as negotiating discounts, maintaining confidentiality, and establishing clear policies can mitigate these challenges and ensure effective management of drug testing programs.

The Role of Technology and Service Providers:

Technology and service providers play a crucial role in simplifying DOT drug testing compliance through digital scheduling and management systems, electronic chain of custody forms, integration with HR systems, mobile apps, expert guidance, comprehensive testing services, training, legal assistance, and compliance support.

Conclusion:

Navigating DOT drug testing is a multifaceted endeavor that requires diligence, expertise, and strategic partnerships. By prioritizing safety, reliability, and compliance, transportation entrepreneurs can ensure the well-being of their workforce, passengers, and the public while maintaining a competitive edge in the industry. Embrace DOT drug testing as a cornerstone of your entrepreneurial journey, and pave the way for a safer, more responsible future in transportation.

FAQs

1. Who needs to comply with DOT drug testing regulations?

Businesses in the transportation sector, including trucking, aviation, and public transportation, among others.

2. What substances does DOT drug testing screen for?

Typically, the test screens for marijuana, cocaine, opiates, phencyclidine (PCP), and amphetamines/methamphetamines.

3. How often should DOT drug tests be conducted?

It depends on various factors, including the specific industry and whether the testing is pre-employment, random, post-accident, or other types.

4. What happens if an employee fails a DOT drug test?

The procedures can include removal from safety-sensitive duties, a mandatory evaluation by a substance abuse professional, and completion of a return-to-duty process.

5. Can small businesses afford to comply with DOT drug testing?

Yes, there are cost-effective solutions and service providers that can help small businesses manage the requirements efficiently.

2 notes

·

View notes

Text

How to Start a Social Media Marketing Agency

In the dynamic world of digital marketing, social media has emerged as a powerful tool for businesses to reach their target audience, engage with customers, and drive sales. With this rise, there’s a growing demand for specialized agencies that can navigate the complexities of social media platforms to deliver impactful marketing strategies. If you’ve been contemplating diving into this lucrative industry, you’re in the right place. This article will provide you with a step-by-step guide on how to start a social media marketing agency.

Step 1: Gain In-Depth Knowledge and Experience

Before you can guide others, it’s crucial to have a solid understanding of social media marketing yourself. This means staying updated on the latest trends, understanding different social media platforms, and knowing how to create engaging content and analyze metrics. You can gain experience by managing social media accounts for friends, family, or local businesses, or by taking online courses and certifications from reputable sources.

Step 2: Define Your Niche

The social media marketing landscape is vast, covering industries from fashion to technology. To stand out, it’s wise to specialize in a niche. Whether it’s by industry, type of service (like influencer marketing or paid advertising), or size of business, defining your niche will help you target your marketing efforts and build expertise.

Step 3: Develop a Business Plan

Every successful venture starts with a solid plan. Your business plan should outline your business goals, target market, competition analysis, service offerings, pricing structure, marketing strategies, and financial projections. This document will serve as your roadmap and can be crucial for securing financing or partnerships.

Step 4: Legally Establish Your Business

Choosing the right business structure (such as an LLC, sole proprietorship, or corporation) is critical for legal and tax purposes. Register your business, obtain any necessary licenses or permits, and set up a business bank account. It’s also wise to invest in liability insurance to protect your agency.

Step 5: Build Your Online Presence

As a social media marketing agency, your online presence is your portfolio. Create a professional website that showcases your services, case studies, and testimonials. Be active on various social media platforms, not just to promote your agency, but also to demonstrate your expertise and engage with your community.

Step 6: Invest in Tools and Resources

Efficiency and effectiveness are key in managing multiple clients’ social media accounts. Invest in social media management tools like Hootsuite, Buffer, or Sprout Social for scheduling posts, analyzing metrics, and engaging with followers. Additionally, graphic design tools like Canva or Adobe Spark can help in creating eye-catching content.

Step 7: Market Your Agency

Leverage your niche and expertise to market your agency. This can include creating valuable content on your blog, optimizing your website for search engines (SEO), engaging in social media, and networking at industry events. Consider running targeted ads on social media platforms to reach potential clients directly.

Step 8: Deliver Exceptional Service

The success of your agency hinges on the results you deliver. Focus on creating strategic, creative, and measurable social media campaigns that meet your clients’ objectives. Keep communication lines open, and provide regular updates and reports to your clients. Happy clients are more likely to refer others to your agency.

Conclusion

Starting a social media marketing agency can be a rewarding venture for those with a passion for digital marketing and a desire to help businesses grow online. By following these steps and continually learning and adapting to the ever-changing digital landscape, you can build a successful agency that stands out in the competitive market.

Remember, success in social media marketing doesn’t happen overnight. It requires dedication, creativity, and a strategic approach. But with the right mindset and execution, your agency can thrive, helping businesses achieve their digital marketing goals while you build a prosperous and fulfilling career.

2 notes

·

View notes

Text

Kshema is India’s Digital Insurance Company For Agriculture & Food Sectors

Kshema is India’s digital Insurance company that caters predominantly to cultivators of the Agriculture & Food Sectors. Our mission is to enable resilience among cultivators across the country, from income shocks due to extreme climate events and other vagaries, with insurance.

I AGRI — our proprietary location-aware platform that assesses and prices risk adequately allows us to address pre-harvest risks at a farm level. Developed in partnership with leading global experts in Spatial data sciences, actuaries, financial engineers and remote sensing experts among others, the platform allows us the benefit of drawing evidence-based results to expand the scope of our services beyond traditional risk analyses.

• A D2C rural insurance company with emphasis on creating products for cultivators.

• Kshema would create insurance solutions, through geo-tagging for many location-specific pre-harvest risks faced by cultivators.

• We aim to incentivize sustainable cultivation practices contributing to a ‘Net Zero Emissions Planet’ and Sustainable development Goals in the future.

• A well-capitalized company led by promoters with a progressive vision and a growth mindset.

• Kshema is an equal opportunities provider. Whether it’s our employees, vendors or partners, we only consider their merit and the value they create.We are changing the world, one farmer at a time — if you are passionate about creating impact on a global scale — join our journey.

2 notes

·

View notes

Text

medical coding

Medical coding is the process of converting diagnoses, treatments, services, and equipment used in healthcare into standard medical alphanumeric codes. The diagnoses and procedure codes are derived from the documentation in the medical records, such as the transcription of the doctor's notes, the results of the laboratory and radiologic tests, etc. Professionals in medical coding assist in ensuring that the codes are correctly applied during the medical billing process, which entails extracting the necessary information from the supporting documentation, assigning the proper codes, and generating a claim that will be reimbursed by insurance companies.

ICD-10 code G80. 9 for Cerebral palsy, (CP) is a group of permanent movement disorders that appear in early childhood. It is caused by damage to the parts of the brain that control movement, balance, and posture. People with CP may have difficulty with fine motor skills, gross motor skills, and physical coordination. They may also experience learning difficulties, intellectual disabilities, vision problems, and difficulty speaking. Some people with CP may have difficulty with activities of daily living, such as self-care and communication. Physical, occupational, and speech therapy can help people with CP improve their physical and cognitive abilities.

Medical coding is an important part of the healthcare industry. It is a process used to ensure accurate and timely reimbursement for treatments and services provided by healthcare providers. It is also used to track and analyze healthcare data, which can be used to improve patient care and outcomes. The accuracy of the coding process is essential for accurate billing and reimbursement. Therefore, medical coding professionals must possess a high level of knowledge and skill to effectively carry out their duties. With the ever-changing healthcare landscape, medical coding is an important profession that will continue to be in demand.

Transorze is an ISO 9001:2015 certified company for delivering high quality “Healthcare BPO” training and placement services., totally dedicated in providing the services of Medical Transcription Training, Medical Coding Training , Medical Scribing Training, Medical Coding Training, Digital Marketing Training. Transorze is the direct training partner with NSDC which is indeed a major milestone. As on date, Transorze is the only HBPO training institute to have this privileged status. This partnership with NSDC shall even further enhance the commitment of Transorze to the younger generation.

Contact Details

Phone No-9495833319

2 notes

·

View notes

Text

First of all - signal boost! A married LGBTQ couple I know is planning to travel, and getting all of this together just to go cross country. Home & destination are friendly, but they will cross in or near unfriendly territory. Legal-proof your union (or even your partnership!) to the fullest extent possible.

Secondly - everyone do this. One, it's great protection and something simple adults should do in any case. Also, are you multi-racial? Second marriage? Unmarried but partners? Poly? Get it done.

In addition - think of what you COULD lose. Children? Assets? The right of decision or even visitation of a dying loved one? Pick your biggest fear, and counter it with legal documents.

Finally - Protect your partner(s). I have access to my partner's computer, he to mine. We can both access phones. I have his bank accounts, he has mine. I don't USE his debit card, unless he's forgotten a wallet at home or he asks me to do so, but I have it and could, in an emergency, pull out every penny to protect it, log into or out of every account. It's not a power either of us use, we have deep trust and long commitment. If you don't trust your partner like that, and some should not!, Get that spare card and pin, put it in a sealed "bus insurance" file.

Side note - I have 2 spare, certified copies of our marriage license, back up birth certificates, copies of our passports. Each document set is managed by each partner, in our own filing system, and is also scanned digitally.

Own or love anything? Anyone? Child, pet, home, car, computer, social media accounts - get a will, back it with documents. Protect your union, whatever the makeup!

52K notes

·

View notes

Text

Open Your Career: Earn Your Medical Billing and Coding Degree Online Today!

Unlock Your Career: earn Your Medical billing and Coding Degree Online Today!

Are you looking to advance your career in the healthcare sector? A medical billing and coding degree could be your key to unlocking new professional opportunities. With a growing demand for skilled professionals in this field, getting your degree online has never been easier. In this article, we’ll explore the ins and outs of medical billing and coding, the benefits of earning a degree online, and practical tips to help you succeed.

What is Medical Billing and Coding?

Medical billing and coding is a critical function in the healthcare industry that involves translating healthcare services into worldwide medical codes. These codes are used for billing purposes and ensure that healthcare providers are accurately reimbursed for their services.

Key Responsibilities

assigning unique codes to medical diagnoses and procedures.

Submitting claims to insurance companies.

Ensuring compliance with healthcare regulations.

Maintaining patient records and handling billing inquiries.

Why Choose an Online Medical Billing and Coding Degree?

Opting for an online degree offers several advantages that can enhance both your learning experience and career prospects.

Benefits of Earning your Degree Online

Flexibility: Study at your own pace and schedule your classes around your life commitments.

Wide Range of Programs: Many accredited institutions offer diverse programs online.

Cost-Effective: Save on commuting and housing costs while gaining relevant education.

Self-Paced Learning: Tailor your study schedule to fit your learning style.

Steps to Obtain Your Medical Billing and Coding Degree Online

Here’s a simple guide on how to earn your degree online:

1. research Accredited Programs

Look for colleges and universities that offer accredited medical billing and coding programs. Accreditation ensures that the program meets high academic standards and will be recognized by employers.

2.Apply and Enroll

Once you’ve identified the right program, submit your application. Most programs have rolling admissions, making it easier to enroll at your convenience.

3. Complete the Coursework

Engage with the course materials, participate in online discussions, and complete assignments on time. Be proactive in reaching out to instructors for help when needed.

4. Gain Practical Experience

Consider internships or externships to gain real-world experience. Many online programs offer partnerships with healthcare facilities that can help you secure practical training.

5.Prepare for Certification

After completing your degree, prepare for certification exams such as the Certified Coding Specialist (CCS) or Certified Professional Coder (CPC) exams to enhance your employability.

Case Study: Success Stories in Medical billing and Coding

Real-world successes can be an inspiration.Here are some case studies of individuals who have transformed their careers through online medical billing and coding programs.

Case Study 1: Sarah’s Journey

Sarah was a stay-at-home mom seeking a career change. After enrolling in an online medical billing and coding program, she graduated in less than a year and landed her first job with a local hospital. Today, she is a billing manager, earning a six-figure salary!

Case Study 2: Mark’s Conversion

Mark had previous experience in a different field but felt unfulfilled. After completing his online courses and obtaining certification,he quickly found a position in a large healthcare organization,where he was promoted within months due to his skills and dedication.

Practical Tips for Success in Online Learning

To ensure your success while studying online, consider these practical tips:

Establish a Study Schedule: Stick to a set study routine to remain disciplined.

Stay Organized: Use digital tools or planners to track assignments and deadlines.

Engage with Peers: Join online forums and study groups to enhance learning.

Utilize resources: Make the most of online libraries, tutoring, and additional materials provided by your program.

Conclusion

Earning your medical billing and coding degree online is a smart choice for anyone looking to advance their career in the healthcare field. With flexibility, a range of program options, and the potential for a rewarding career, the time to take advantage of this possibility is now. By following the steps outlined in this article and leveraging the experiences of those who have come before you,you’ll be well on your way to a triumphant career in medical billing and coding.

Call to Action

If you’re ready to unlock your career potential,start researching accredited medical billing and coding programs today. Your future in healthcare awaits!

youtube

https://medicalbillingcertificationprograms.org/open-your-career-earn-your-medical-billing-and-coding-degree-online-today/

0 notes

Text

Big Data is acute for personalizing travel insurance suspension since it analyzes the massive capacity of client data to determine individual preferences, behaviors, and risks. This allows insurers to adjust their plans and pricing to suit customer needs, and increase consumer satisfaction and conversion rates. Insurers may create more accurate and relevant insurance packages by merging data from many sources, including travel history, demographic information, and social media activity, resulting in a more personalized and user-centric approach to travel insurance.

#Digital insurance partnership#Insurance api#Insurtech as a service#travel insurance api#embedded insurance#subscription insurance#insurance quote api#trending#trend#like#trendingreels#trendingnow#viralpost#model#followforfollowback#likeforlikes#trendingtopics

0 notes

Text

additive partners with HAYAH Insurance to transform the End-of-Service Benefits landscape in the UAE

The partnership launches a new digital End-of-Service Benefits (EoSB) proposition across the UAE The Proposition combines Ultimate Service Benefits with personalized, holistic financial planning and wealth management The UAE’s End-of-Service Benefits market represents a $100 billion opportunity in investable assets Dubai, UAE, November 19, 2024 – additiv, a global leader in Fintech and digital…

0 notes

Text

Hire Dedicated Virtual Employees in Any Domain for Seamless Business Solutions

In today’s fast-paced digital world, businesses of all sizes are looking for efficient, cost-effective ways to scale and manage operations. Hiring dedicated virtual employees has emerged as a transformative solution for enterprises worldwide. India, with its vast talent pool and competitive pricing, stands out as the go-to destination for virtual staffing. Let’s explore how Hire in Any Domain can help you seamlessly integrate dedicated virtual employees into your business operations.

Why Hire Dedicated Virtual Employees from India?

India offers unparalleled advantages when it comes to virtual staffing. The country is renowned for its skilled professionals across diverse industries. When you hire dedicated virtual employees from India, you get access to:

Cost-Effective Solutions: Reduce overhead costs associated with office space, equipment, and benefits.

Skilled Talent Pool: From IT professionals to administrative support, India provides a diverse and highly qualified workforce.

Time Zone Advantage: Enjoy round-the-clock operations by leveraging India’s time zone for enhanced productivity.

Language Proficiency: With a strong emphasis on English, Indian professionals communicate effectively with global clients.

Expertise in Niche Domains

Hire in Any Domain caters to a variety of specialized roles, ensuring your business has access to the best talent for its unique needs.

1. Hire Medical Billing Experts in India

The healthcare industry requires precise and efficient billing systems to maintain financial health. Indian medical billing experts are well-versed in:

Handling claims and reimbursements.

Managing patient accounts with accuracy.

Ensuring compliance with international healthcare regulations. By hiring virtual medical billing experts, you streamline operations while reducing costs.

2. Hire Virtual Medical Coders in India

Medical coding is another critical area where Indian professionals excel. These experts are trained in:

Accurately translating medical diagnoses into codes for billing and insurance purposes.

Staying updated with the latest coding standards, such as ICD and CPT.

Minimizing errors that could lead to claim denials. By hiring virtual medical coders, healthcare providers can focus on delivering quality care while leaving administrative tasks in expert hands.

Benefits of Hiring Through Hire in Any Domain

When you choose Hire in Any Domain, you gain access to a streamlined hiring process that ensures you get the right fit for your business needs. Our approach includes:

Customized Talent Matching: We connect you with professionals who meet your specific requirements.

Flexible Hiring Models: Choose full-time, part-time, or project-based virtual employees.

Dedicated Support: Enjoy continuous support and assistance to ensure a seamless working relationship.

Beyond Healthcare: Other Virtual Roles

In addition to medical billing and coding experts, you can also hire professionals in areas like:

Data Entry

Digital Marketing

IT Development

Administrative Support

With Hire in Any Domain, you’re not just hiring virtual employees; you’re building a partnership that drives your business forward.

Conclusion

Hiring dedicated virtual employees from India is a strategic move that offers businesses cost-effective and high-quality solutions. Whether you need medical billing experts, virtual medical coders, or support in other domains, Hire in Any Domain is your trusted partner. Experience seamless operations, increased productivity, and the freedom to focus on core business goals by tapping into India’s vast talent pool.

Start building your dream team today with Hire in Any Domain and watch your business thrive!

Source: https://medium.com/@hireanydomain/hire-dedicated-virtual-employees-in-any-domain-for-seamless-business-solutions-8eba183cb7f7

#Hire Dedicated Virtual Employees#Virtual Employees in Any Domain#Seamless Business Solutions#Remote Workforce Solutions#Virtual Staffing India#Affordable Virtual Employees#Offshore Staffing Solutions#Hire in Any Domain#Virtual Support Experts#Remote Business Support#Virtual Employee India#Professional Virtual Assistants#Dedicated Remote Team#Scalable Business Solutions#Business Efficiency Experts#Outsource to India#Remote Work Experts

0 notes

Text

The Medical Tourism Industry: Trends, Opportunities, and Future Insights

The Medical Tourism Industry: Trends, Opportunities, and Future Insights

The medical tourism industry is one of the fastest-growing sectors in global healthcare, offering patients access to affordable and advanced medical care across borders. This growth has created a wealth of opportunities for professionals looking to become medical tourism facilitators or those already navigating this dynamic field.

In this article, we will explore key trends driving the medical tourism industry, opportunities for facilitators, and insights into the future of this evolving sector. Whether you are just starting out or seeking to expand your expertise, understanding these insights is essential for staying competitive.

Current Trends in the Medical Tourism Industry

The medical tourism industry is influenced by several trends that are shaping its growth and evolution:

Cost-Effective Treatments

High healthcare costs in developed nations have made international healthcare options attractive. Patients are increasingly traveling to destinations like India, Mexico, and Thailand for procedures that are significantly more affordable without compromising quality.

Technological Advancements

Innovations in telemedicine and virtual consultations are transforming how patients connect with healthcare providers. These tools enable facilitators to offer pre-treatment consultations, reducing travel uncertainties.

Specialized Medical Tourism Services

Countries are establishing niches for specific treatments, such as:

India: Cardiac care and organ transplants

Turkey: Cosmetic surgery and hair transplants

Thailand: Orthopedic procedures and wellness programs

Focus on Wellness Integration

Combining medical procedures with wellness tourism—like spa retreats and yoga programs—is a growing trend, appealing to patients seeking holistic recovery options.

Opportunities for Medical Tourism Facilitators

For professionals aspiring to enter or grow within the field, the medical tourism industry offers a range of opportunities:

Medical Tourism Certification

Earning a professional medical tourism certification enhances credibility and equips facilitators with in-depth knowledge about international healthcare systems, patient safety, and cultural considerations.

Customized Healthcare Packages

Facilitators can differentiate themselves by creating personalized healthcare plans that include medical procedures, travel arrangements, and post-treatment care.

Building Strategic Partnerships

Collaborating with accredited hospitals, clinics, travel agencies, and insurers allows facilitators to provide comprehensive services while ensuring patient trust.

Leveraging Digital Platforms

Using a professional website or app enables facilitators to showcase their expertise, reach a global audience, and provide seamless booking and consultation services.

Future Insights for Medical Tourism Growth

The future of the medical tourism industry is bright, with continued advancements and emerging opportunities shaping its trajectory.

Increased Demand for Quality Assurance

Patients are becoming more aware of the importance of accreditation and certifications. Facilitators who partner with internationally accredited healthcare providers will stand out.

Expansion of Global Healthcare Networks

Governments and private organizations are investing in healthcare infrastructure to attract international patients. Facilitators can tap into these networks to expand their services.

Eco-Friendly Medical Tourism

As sustainability becomes a global priority, destinations offering eco-friendly healthcare facilities and travel options will attract more patients.

AI and Data Analytics

Advanced technologies like AI can help facilitators analyze patient needs, predict travel trends, and optimize services for better outcomes. Original Article From Here : https://wakelet.com/wake/l-BB-xK07WJVm_zxlruTj Watch More Videos: https://youtu.be/uy-eeHc9Cc0?si=YsYOCtC6ZqgIHlBx https://youtu.be/lTx30pxt_NA?si=FY-c3MYTuD8CyZFn https://youtu.be/CHRR8yT6nhg?si=O1SHSpuq6WtGK6Tp https://youtu.be/7Ac5_JsMlsQ?si=laMjEC2btATd2Aow

Follow me for more info:

https://www.linkedin.com/in/medicaltourismbusiness

https://www.instagram.com/gilliamelliottjr/

#medical tourism business#medical tourism consultancy#medical tourism#medical tourism certifications#medical tourism course#medical tourism facilitator certification#medical tourism consultant#medical tourism training#medical travel

0 notes

Text

The Bitcoin vs. Gold debate often centers around their roles as stores of value and investment assets. Here's a quick overview of how they compare and their relevance in the context of recent crypto market movements:

Bitcoin (BTC)

Advantages:

Digital Gold: Often referred to as digital gold, Bitcoin offers portability, divisibility, and transparency.

Scarcity: Like gold, Bitcoin has a capped supply (21 million coins), creating a scarcity value.

Decentralization: Operates on a blockchain, making it independent of central authorities.

Accessibility: Can be traded 24/7 globally.

Challenges:

Volatility: Bitcoin prices are highly volatile compared to gold.

Regulatory Uncertainty: Global regulations around cryptocurrencies are still evolving.

Adoption: While growing, Bitcoin is not universally accepted as a payment or investment vehicle.

Recent Trends:

Bitcoin reached its All-Time High (ATH) of ~$69,000 in November 2021 but has since seen significant corrections.

Current price movements are influenced by macroeconomic factors like inflation, interest rates, and regulatory developments.

Institutional interest and developments like ETFs or corporate adoption also play a key role.

Gold

Advantages:

Tangible Asset: Has been a trusted store of value for centuries.

Low Volatility: Gold prices are more stable compared to Bitcoin.

Hedge Against Inflation: Historically, gold has been a hedge during economic downturns.

Challenges:

Limited Portability: Physical gold is harder to store and transfer compared to Bitcoin.

Lower Returns: Gold's price appreciation is slower compared to the explosive growth seen in Bitcoin's early years.

Storage Costs: Holding physical gold comes with associated storage and insurance costs.

Recent Trends:

Gold prices have seen fluctuations based on inflation fears and geopolitical uncertainties.

Remains a go-to asset during financial instability.

Coinbase and the Crypto Market

Bitcoin vs. Gold: Bitcoin may appeal to risk-tolerant investors seeking high growth potential and exposure to digital finance. Gold, on the other hand, suits those looking for stability and long-term wealth preservation.

Coinbase, as a leading cryptocurrency exchange, often reflects market sentiment. During Bitcoin's ATH and subsequent fall, trading volumes on platforms like Coinbase tend to spike due to increased buying or selling.

Other cryptocurrencies like XRP have seen periods of hype due to legal developments, partnerships, or speculative interest.

Meme coins and tokens with niche communities (e.g., PENGU) add to the market's speculative nature but carry higher risk.

Both assets can coexist in a diversified portfolio, serving different purposes based on risk appetite and financial goals.

Key Takeaway

1 note

·

View note

Text

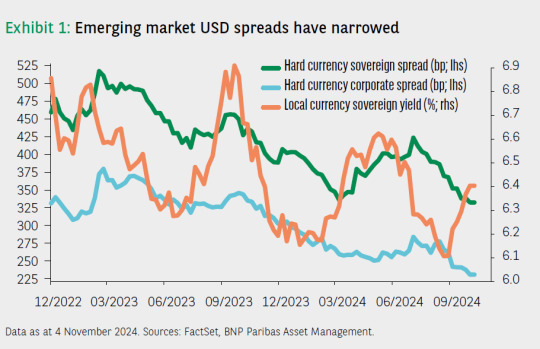

BNP Paribas AM: Investment Outlook for 2025

The Investment Outlook for 2025 highlights a year of significant economic and market transitions. With inflation under control, central banks are poised for easing cycles, offering new opportunities for investors. At the same time, geopolitical and environmental challenges underscore the importance of resilience, diversification, and thematic investing. Key Themes and Strategic Insights 1. Navigating Macroeconomic Shifts - Soft Landing or Recession Risks: - Markets anticipate a soft landing, but scenarios such as renewed inflationary pressures or a hard landing remain possible. - Global central banks, including the Federal Reserve and European Central Bank, are expected to cut rates to support growth. - Regional disparities persist, with the U.S. outperforming Europe, while China focuses on stabilizing its property market and stimulating emerging industries.

- Geopolitical Dynamics: - The re-election of Donald Trump introduces uncertainty, with potential shifts in U.S. tax policies, trade agreements, and global economic ties. - Geopolitical hotspots (e.g., Ukraine, Taiwan, Israel) create additional risks for markets. 2. Sustainability and Thematic Investments - Transition Finance: - Investments targeting decarbonization and sustainable operations in high-emission sectors (e.g., energy, heavy industry) are gaining momentum. - EU regulations like ESMA’s fund naming guidelines in 2025 will enhance transparency and accountability in transition investments. - Climate Adaptation: - Climate resilience strategies, including infrastructure upgrades and disaster response, are becoming central to investment portfolios. - Water scarcity solutions (e.g., smart irrigation, water treatment) present a diverse and resilient investment opportunity. - Natural Capital: - Regenerative agriculture, forestry, and water resource preservation are key areas for achieving both economic stability and sustainability goals. - Governments and institutions increasingly prioritize biodiversity and ecosystem restoration. 3. Equity Markets: Favoring Resilience - U.S. Market Leadership: - U.S. equities remain attractive due to fiscal stimulus and advancements in technology, particularly artificial intelligence (AI). - Small caps and value stocks are positioned for recovery as interest rates decline. - European Equities: - Europe lags due to structural challenges in Germany and geopolitical headwinds, but exporters benefit from robust U.S. growth. - Consumer-driven sectors depend on stronger demand recovery. - Emerging Markets: - Markets like India and Southeast Asia offer growth potential, driven by demographics and policy reforms. - China’s success in revitalizing its economy remains a critical swing factor. 4. Fixed Income: Life Beyond Cash - Opportunities in Bonds: - Investment-grade credit offers stable returns amid easing monetary policies. - U.S. mortgages and emerging market local currency bonds provide attractive yields. - Active Management: - A steep yield curve and higher real yields favor active strategies to capitalize on dispersion and timing. - Quantitative Tightening: - Central banks unwinding quantitative easing introduce volatility, creating arbitrage opportunities in fixed income markets.

5. Private Credit and Alternatives - Private Credit Expansion: - Private credit markets are democratizing, with innovations like ELTIF 2.0 making them accessible to retail investors in Europe. - Partnerships between asset managers, banks, and insurers streamline the credit chain. - Sustainability in Private Credit: - Investors increasingly demand ESG-compliant frameworks, pushing managers to develop robust methodologies for evaluating borrowers’ sustainability practices. - Infrastructure and Real Assets: - Renewable energy projects, energy-efficient buildings, and digital infrastructure investments align with long-term structural trends. Strategic Asset Allocation - Equities: - Overweight U.S. equities, particularly AI and technology sectors. - Focus on value opportunities in Europe and growth-oriented emerging markets. - Fixed Income: - Emphasize high-yield credit, local currency emerging market bonds, and inflation-linked securities. - Active duration management to navigate rate volatility. - Private Markets: - Leverage private credit for stable yields and diversification. - Real assets, including infrastructure and water solutions, provide inflation hedging and long-term growth. - Sustainability: - Prioritize transition finance, climate adaptation strategies, and natural capital investments. 2025 presents a landscape of opportunities driven by sustainability, technological innovation, and economic recovery. Investors should adopt a balanced and flexible approach, leveraging thematic investments, private markets, and active management to navigate risks and capture growth. Resilience, diversification, and long-term sustainability remain key to optimizing portfolios in an evolving global environment. Read the full article

0 notes

Text

From Dream to Reality: Launching Your Private Practice in Just 8 Weeks

Starting your own private practice is a dream for many professionals, but the process can feel overwhelming. The thought of managing business logistics, securing clients, and maintaining a steady cash flow can intimidate even the most experienced individuals. However, with proper planning and a step-by-step approach, you can transition from a dream to a thriving practice in just eight weeks. By breaking down the process into manageable phases, you’ll focus on the essentials, minimize risks, and set the foundation for long-term success. This guide will walk you through the critical steps to launch your private practice efficiently while maintaining the quality and professionalism that your future clients will appreciate.

Week 1: Define Your Vision and Goals

Your first step is to clarify your purpose and vision. Ask yourself why you want to start a private practice and what you hope to achieve. Define your target audience—who are the clients you want to serve? Consider their needs and how your expertise can solve their problems. This clarity will help you refine your services and brand identity. Set clear, measurable goals for your practice, such as the number of clients you want to see each week, revenue targets, or areas of specialization.

Week 2: Plan Your Business Structure and Finances

Establishing a solid business foundation is crucial. Decide on the legal structure of your practice, whether it's a sole proprietorship, partnership, or limited liability company. Research licensing requirements and complete any necessary registrations. Next, create a financial plan. Draft a budget, considering initial startup costs like office space, equipment, and marketing, as well as ongoing expenses like utilities and insurance. Determine your pricing structure and billing methods. This is also the time to explore funding options if needed. Visit here to know more about the guide to start a private practice.

Week 3: Secure Your Workspace and Tools

Find a location that aligns with your vision, whether it's a physical office, co-working space, or a virtual setup. Ensure your space is accessible, comfortable, and equipped with the tools you'll need to operate efficiently. Invest in reliable technology such as scheduling software, invoicing platforms, and a secure database for client records. If you plan to work virtually, ensure you have a professional online presence and the necessary tools for video consultations.

Week 4: Develop Your Branding and Marketing Strategy

Creating a strong brand is essential to attract and retain clients. Develop a professional logo, business cards, and a user-friendly website that clearly communicates your services and values. Optimize your online presence with search engine-friendly content and consider starting a blog or social media profiles to engage with your audience. Implement a marketing plan that includes both digital and offline strategies, such as networking with local organizations, attending community events, and using targeted ads.

Week 5: Establish Policies and Procedures

To run a seamless practice, you need clear policies and procedures. Develop guidelines for client intake, cancellations, privacy, and payment terms. Draft consent forms and contracts that align with industry standards and legal requirements. Consider your workflow from the client's perspective and refine processes to ensure a smooth experience. If you plan to work with an assistant or hire staff, outline their responsibilities and training requirements.

Week 6: Build Your Network

Networking is key to growing your client base and gaining referrals. Reach out to colleagues, join professional associations, and participate in online forums related to your field. Form connections with other professionals who serve a similar audience, such as healthcare providers, educators, or consultants. Building relationships with these individuals can lead to collaborative opportunities and a steady stream of client referrals.

Week 7: Promote Your Services and Start Pre-Booking

Begin actively promoting your practice to your target audience. Use your website and social media platforms to share valuable content, testimonials, or case studies that highlight your expertise. Offer introductory discounts or packages to encourage new clients to book your services. Engage with potential clients through email marketing campaigns or workshops to showcase your knowledge and build trust. Aim to pre-book clients so you’re ready to hit the ground running on your official launch date.

Week 8: Launch and Reflect

The final week is dedicated to launching your practice and reviewing your progress. Host a small opening event or online announcement to mark the occasion. Reach out personally to your network to let them know you’re open for business. Reflect on the journey and identify any adjustments needed to improve your operations. Celebrate your hard work and the beginning of a fulfilling new chapter.

The Path to Long-Term Success

Launching a private practice in eight weeks is an ambitious but achievable goal with proper planning and focus. As you grow, continue refining your strategies and investing in your professional development. By staying adaptable and client-centered, you’ll transform your dream into a sustainable reality, creating a practice that reflects your passion and dedication.

1 note

·

View note