#Demand for Bearing in Consumer Sector

Explore tagged Tumblr posts

Text

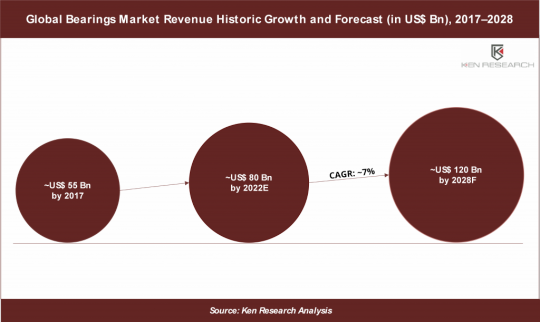

Global Bearings Market is forecasted to grow further into US$ 120 billion Opportunity by 2028: Ken Research

Buy Now

What is the Size of Global BEARING INDUSTRY?

Global Bearing market is growing at a CAGR of ~% in 2017-2022P and is expected to reach ~USD Bn by 2028F.

The Bearing Market is largely driven by continuous upgradation in the product from multiple players, and growing usage of bearings.

New product launches by players and collaboration among the industry is one of the driving factors of the Global Bearing Market. For instance, In June 2022, The Timken Company announced that it is designing and supplying main shaft bearings for GE Renewable Energy Haliade-X, the world’s most powerful offshore wind turbine. Furthermore, In December 2020, The Timken Company acquired the assets of Aurora Bearing Company.

Aurora manufactures rod ends and spherical plain bearings, which serve a diverse range of defense sector.

Interested to Know More about this Report, Request for a sample report

Counterfeit products are posing one of the major challenges for the Bearings Market. Leading companies in bearings product manufacturing are more open to this threat. Manufacturing fake products lead to machine damage and injuries. For instance, In October 2019, JTEKT cooperated with World Bearing Association (WBA) and its efforts against counterfeiting globally by developing a new WBA Check App (WBA Bearing Authenticator) to protect its customers and dealers from property damage risk, injuries, and other events.

GLOBAL BEARING MARKET BY PRODUCT TYPE

The Global Bearing market is segmented by Product type into Plain Bearing, Ball Bearing, Roller Bearing and Others.

Rolling bearing segment held the largest market share of the Global Bearings Market in 2022P. Rolling bearings are used in multiple industries such as automotive, capital equipment, aerospace, home appliances, and others

Roller bearing is a type of rolling-element bearing that used a cylinder instead of a ball. Roller bearings are used in all main shaft and auxiliary drive shaft applications to support the pure radical load.

In July 2021, NTN Bearing Corporation announced the latest innovation, the KIZEI spherical roller bearing. Spherical roller bearings are manufactured with metallic shields that protect the bearing from solid contamination such as dust, pebbles, and other debris.

GLOBAL BEARING MARKET BY APPLICATION TYPE

The Global Bearing Market is segmented by Application into Automotive, Application Transmission, Aerospace & Defense, Construction and Others.

The automotive segment accounted for the largest market share in 2022P, owing to the surging automobile production worldwide.

Visit this Link :- Request for custom report

The increasing demand for vehicles is leading the automotive segment and is forecasted to be the fastest-growing segment in the forecast period.

In September 2022, SKF and NIO, a leading premium smart electric vehicle manufacturer, have strengthen the strategic corporation. As part of the agreement, SKF will be the preferred supplier of ceramic ball bearings.

GLOBAL BEARING MARKET BY GEOGRAPHY

The Global Bearing market is segmented by geography into North America, Europe, Asia- pacific and LAMEA.

Asia Pacific accounted for the largest market share within the Global Bearings Market in 2022P, owing to surging machinery and motor vehicle production.

The increasing demand for aftermarket products for industrial equipment and motor vehicle repair. The surging construction and mining industry requires efficient industrial tools to operate, which further propels the growth of this region. Presence of leading companies manufacturing bearings products, like JTEKT Corporation, NSK Ltd., NTN Corporation, HKT Bearings Ltd., and others, are expected to further boost the expansion of this market.

For More Insights On Market Intelligence, Refer to the Link Below: –

Global Bearings Market

#Africa Bearings Market Forecast#Asia Pacific Bearings Market#Automotive Bearings Supplying Companies#Ball Bearings Market#Bearings Material Suppliers Globally#Bearings Products Market#Bearings Raw Material Suppliers#Challenges in Growth of Bearings Market#Competitors in Bearings Market#Demand for Bearing in Consumer Sector#Distributors of Bearings Globally#Emerging Companies in Bearing Market#Europe Bearings Market Forecast#Global Ball Bearing Market#Global Ball Screw Market#Global Bearing Distributors#Global Bearings Industry#Global Bearings Industry Outlook#Global Bearings Market#Global Bearings Market Trends#Global Flexure Bearings Market#Global Magnetic Bearings Market#HKT Linear Bearings Market#India Bearings Market#Investment in Bearing Manufacturing Start-ups#JTEKT Deep Groove Ball Bearings Market#Latin America Bearings Market Forecast#Leading Players in Bearing Market#Major Players in Bearings Market#Middle East Bearings Market Revenue

0 notes

Text

Wednesday, December 18, 2024

Canada promised Trump a border crackdown. Easier said than done. (Reuters) Six Lego-like concrete blocks mark the end of a rural road at the U.S.-Canada border. The police vehicle, revving through blowing snow, crunches to a stop. The barriers, installed last August in a joint venture with President Joe Biden’s administration, stop vehicles bearing migrants from barreling across the border into the United States. But they do not stop migrants crossing on foot. “People can still hop over them,” said Royal Canadian Mounted Police (RCMP) Sergeant Daniel Dubois. Canadian police say they have installed more cameras and sensors over this section of the border over the last four years. But Canadian law enforcement officials acknowledge they are limited in what they can do to stop southbound migrants. “Even if we were everywhere, we couldn’t stop it,” said Charles Poirier, an RCMP spokesperson in Quebec. Securing the world’s longest land border—about 4,000 miles (6,400 km) across forests, fields, ditches and lakes—is a gargantuan task. And police cannot arrest migrants who are in Canada legally, even if they suspect they intend to cross, Poirier said.

Americans’ trust in nation’s court system hits record low, survey finds (AP) At a time of heightened political division, Americans’ confidence in their country’s judicial system and courts dropped to a record low of 35% this year, according to a new Gallup poll. The United States saw a sharp drop of 24 percentage points over the last four years, setting the country apart from other wealthy nations where most people on average still express trust in their systems. It’s become normal for people who disapprove of the country’s leadership to also lose at least some confidence in the court system. Still, the 17-point drop recorded among that group under Biden was precipitous, and the cases filed against Trump were likely factors, Gallup said.

Weeks of Upheaval Have Paralyzed Bolivia (NYT) Demonstrations have rocked Bolivia for more than two months. A longstanding political rivalry has boiled over, with supporters of the president and his chief opponent clashing in the streets. Protests have blocked the movement of goods, exacerbating fuel shortages. Some Bolivians lined up for days to buy gas. The upheaval is part of a broad level of unrest across the Andean region of Latin America. Ecuador, Peru and Colombia—Bolivia’s neighbors to the west and north—are all facing significant levels of political turmoil, causing intense anger among their populations. Behind the discontent in Bolivia is a rupture within the Movement for Socialism, or MAS, a leftist party that has dominated the country’s political landscape for two decades. Bolivia’s president, Luis Arce, and his onetime mentor, former president Evo Morales, are fighting over the party’s leadership—and both insist that they will be the party’s candidate in next year’s presidential elections.

The Housing Affordability Crisis Is Going Global (WSJ) When Mikey Cullen’s parents were in their early 20s, they earned enough as public-sector workers to buy a house in Dublin. Today, Cullen is a 27-year-old high-school teacher who lives with his mother. Cullen had been sharing a house with nine roommates, but he moved back home when he realized he couldn’t afford his own place even in the cheaper parts of Dublin. Renting a one-bedroom apartment, he said, would consume most of his paycheck, and buying something was out of the question because the median home price is eight times his annual salary. Many Irish of his generation are in a similar bind. Fifty-nine percent of Irish adults ages 20 to 34 were living with their parents in 2022, up from 38% a decade earlier. The housing affordability crisis that has frustrated young Americans for a decade has now taken hold in many big cities in Europe and beyond. The common threads: robust job growth, rising demand and not enough new development, causing rents and sales prices rising faster than wages. The resulting housing crunches are eroding living standards for poor and middle-class workers, intensifying wealth inequality and stoking political tensions.

Sweden’s Epidemic of Gang Violence (NYT) We used to believe in Sweden that the rights and well-being of children should always come first. But over the past two decades, a surge in gang violence has shaken that commitment. In 2023, 363 shootings took the lives of 53 people; this year, over 100 bombings stemming from gang violence had already been recorded by November. Our country now has one of the highest per capita rates of gun violence in the European Union. One key factor in the phenomenon: Gangs are grooming and recruiting children as young as 11, the police say, as contract killers.

Germany’s Government Collapses (1440) Germany’s government collapsed yesterday after Chancellor Olaf Scholz lost a vote of confidence. A caretaker government is now steering Europe’s largest economy, with snap elections planned for Feb. 23. Scholz called the unusual vote last month after firing his finance minister over differences on tax and debt policy, triggering his coalition’s collapse. Some analysts suggest the vote played out as intended, spurring early elections Scholz hopes will deliver his center-left Social Democratic Party an outright majority. The collapse of Germany’s government is the latest in a string of political upheavals this year; incumbent parties suffered losses or setbacks in at least a dozen countries. The economy is regularly cited as a leading concern for voters, with inflation up across the globe.

Ukraine kills top Russian general in Moscow it accuses of chemical weapons crimes (Reuters) A top Russian general accused by Ukraine of being responsible for the use of chemical weapons against Ukrainian troops was assassinated in Moscow by Ukraine’s SBU intelligence service on Tuesday morning in the most high-profile killing of its kind. Lieutenant General Igor Kirillov, who was chief of Russia’s Nuclear, Biological and Chemical Protection Troops, was killed outside an apartment building along with his assistant when a bomb hidden in an electric scooter went off. An SBU source confirmed to Reuters that the Ukrainian intelligence agency had been behind the hit. Kirillov, 54, is the most senior Russian military officer to be assassinated inside Russia by Ukraine and his murder is likely to prompt the Russian authorities to review security protocols for the army’s top brass and to find a way to avenge his killing.

Myanmar’s War Has Forced Doctors and Nurses Into Prostitution (NYT) After seven years of medical school in Myanmar, May finally achieved her goal of becoming a doctor. But a month after she graduated and found a job, her dreams started unraveling. In February 2021, Myanmar’s military seized power in a coup, and the country’s economy, already hammered by the pandemic, started to buckle. Prices soared and May’s paycheck, the equivalent of $415 a month, evaporated even faster. With her father suffering from kidney disease, she grew more and more desperate. Then she met “date girls,” who were making twice as much as her. The money was enticing—even if it involved sex with men. “It’s difficult to accept that, despite all my years of study to become a doctor, I’m now doing this kind of work just to make ends meet,” said May, 26, who has been working as a prostitute for over a year in Mandalay, Myanmar’s second-largest city. The coup and ensuing civil war have ravaged Myanmar’s economy. Inflation soared to 26 percent this year as power shortages crippled factories, unseasonal rain flooded farms and fighting in areas near China and Thailand decimated cross-border trade. The currency, the kyat, has lost two-fifths of its value against the dollar this year. Nearly half of Myanmar’s people now live in poverty, according to the World Bank.

China is losing interest in English (Economist) For much of the 40 years since China began opening up to the world, “English fever” was a common catchphrase. People were eager to learn foreign languages, English most of all. Many hoped the skill would lead to jobs with international firms. Others wanted to do business with foreign companies. Some dreamed of moving abroad. But enthusiasm for learning English has waned in recent years. According to one ranking, by EF Education First, an international language-training firm, China ranks 91st among 116 countries and regions in terms of English proficiency. Just four years ago it ranked 38th out of 100. Over that time its rating has slipped from “moderate” to “low” proficiency. Some in China question the accuracy of the EF index. But others note that this apparent trend is happening when China is also growing more insular. During the covid-19 pandemic, for example, China shut its borders. Officials and businessmen, let alone ordinary citizens, made few trips abroad. Long after the rest of the world began opening up, China remained closed. At the same time, China’s relations with the world’s biggest English-speaking countries soured. Trade wars and diplomatic tiffs strained its ties with America, Australia, Britain and Canada. The mood is such that legislators and school administrators have tried to limit the amount of time devoted to the study of English, and many students consider English less important than it used to be and are less interested in learning it.

Magnitude 7.3 earthquake causes widespread damage in Pacific island nation of Vanuatu (AP) A powerful magnitude 7.3 earthquake struck just off the coast of Vanuatu on Tuesday, causing widespread destruction in the South Pacific island nation as the injured began arriving at a hospital and unconfirmed reports of casualties emerged. The earthquake occurred at a depth of 57 kilometers (35 miles) and was centered 30 kilometers (18 miles) west of Port Vila, the largest city in Vanuatu, a group of 80 islands that is home to about 330,000 people. The jolt was followed by a magnitude 5.5 aftershock near the same location and the shudders continued throughout the afternoon and evening local time.

EU seeks assurances from Syria’s new leaders in exchange for dropping sanctions (AP) European Union nations on Monday set out conditions for lifting sanctions on Syria and kick-starting aid to the conflict-ravaged country amid uncertainty about its new leaders’ intentions just over a week after they seized power. At a meeting in Brussels, the EU’s top diplomats said they want guarantees from members of Syria’s interim government that they are preparing for a peaceful political future involving all minority groups, one in which extremism and former allies Russia and Iran have no place. Since Damascus fell on Dec. 8 and leader Bashar Assad fled to Moscow, Syria’s transition has been surprisingly smooth. Few reports have surfaced of reprisals, revenge killings or sectarian violence. Most looting or destruction has been quickly contained.

Israel plans to double population on occupied Golan, citing threats from Syria (Reuters) Israel agreed on Sunday to double its population on the occupied Golan Heights while saying threats from Syria remained despite the moderate tone of rebel leaders who ousted President Bashar al-Assad a week ago. Israel captured most of the strategic plateau from Syria in the 1967 Six-Day War, annexing it in 1981. In 2019 then-President Donald Trump declared U.S. support for Israeli sovereignty over the Golan, but the annexation has not been recognised by most countries. Syria demands Israel withdraw but Israel refuses, citing security concerns. Various peace efforts have failed.

France rushes aid to Mayotte after Cyclone Chido leaves hundreds feared dead (AP) France used ships and military aircraft to rush rescuers and supplies to Mayotte on Monday after the tiny French island territory off Africa was battered by its worst cyclone in nearly a century. Authorities fear hundreds and possibly thousands of people have died. Survivors wandered through streets littered with debris, searching for water and shelter, after Cyclone Chido leveled entire neighborhoods on Saturday when it hit Mayotte, the poorest territory of France and, by extension, the European Union. Mayotte resident Fahar Abdoulhamidi described the aftermath as chaotic. In Mamoudzou, the capital, destruction was total—schools, hospitals, restaurants and offices were in ruins. Roofs were ripped from homes, and palm trees were half-shorn from winds that exceeded 220 kph (136 mph), according to the French weather service.

2 notes

·

View notes

Text

What is CANSLIM method in Indian stock market?

The CANSLIM method is a popular stock selection strategy developed by William O'Neil, founder of Investor's Business Daily. This method is widely applied in global markets, including India, to identify high-growth stocks with strong potential for long-term gains. CANSLIM is an acronym that represents seven key criteria used to evaluate stocks. Here’s a breakdown of the method as it applies to the Indian stock market:

C - Current Earnings Growth:

Look for companies with a high quarterly earnings growth rate (usually above 25% year-over-year) as a sign of financial strength. In India, strong earnings growth can indicate resilience in a company amid fluctuating economic conditions.

A - Annual Earnings Growth:

Annual earnings should ideally grow by at least 25% over the last three to five years. This long-term growth indicates consistency and helps differentiate solid companies from those with temporary gains.

N - New Product, Service, or Management:

Companies launching innovative products or services, entering new markets, or led by effective management often outperform. In India, sectors like technology, finance, and consumer goods regularly see innovation, making them ideal for CANSLIM.

S - Supply and Demand:

Stocks with lower supply (fewer shares available) and high demand typically have higher potential for price increases. In India, high promoter stakes and low float can create such conditions, particularly in niche companies or emerging sectors.

L - Leader or Laggard:

Choose sector leaders over laggards, as they usually have strong financials, established market share, and brand recognition. Investors in the Indian market may favor blue-chip stocks or leaders within specific sectors.

I - Institutional Sponsorship:

Institutional investment in a company is often a positive sign, reflecting the confidence of large investors. In India, stocks with backing from mutual funds, insurance companies, or foreign institutional investors (FIIs) tend to be more stable.

M - Market Direction:

Invest when the overall market is trending upwards. In India, tracking major indices like the NIFTY 50 or SENSEX can indicate market health. The CANSLIM approach emphasizes that it's better to avoid investments during a bear market phase.

CANSLIM in Practice

The CANSLIM approach is more suited to growth stocks rather than value stocks. Investors in India using this strategy often focus on mid-cap and large-cap stocks with a high growth potential, such as those in sectors like IT, financials, and consumer goods, which have demonstrated strong earnings potential. It requires technical and fundamental analysis, making it ideal for investors willing to stay engaged with market trends.

#growth stocks#share market#stocks#indian stock market#breakout stocks#canslim#investments#market outlook#stocks to buy#stock market#bse#nse#financetips#investing#invest#investors#personal finance

5 notes

·

View notes

Text

Why Is Canada’s Economy Falling Behind America’s? The Country Was Slightly Richer Than Montana In 2019. Now It Is Just Poorer Than Alabama

— September 30, 2024 | The Economist

Photograph: Associated Press (AP)

The economies of Canada and America are joined at the hip. Some $2bn of trade and 400,000 people cross their 9,000km of shared border every day. Canadians on the west coast do more day trips to nearby Seattle than to distant Toronto. No wonder the two economies have largely moved in lockstep in recent decades: between 2009 and 2019 America’s gdp grew by 27%; Canada’s expanded by 25%.

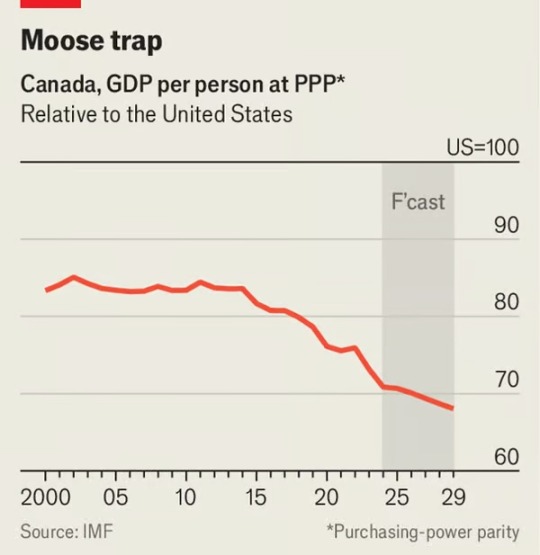

Yet since the pandemic North America’s two richest countries have diverged. By the end of 2024 America’s economy is expected to be 11% bigger than five years before; Canada’s will have grown by just 6%. The difference is starker once population growth is accounted for. The imf forecasts that Canada’s national income per head, equivalent to around 80% of America’s in the decade before the pandemic, will be just 70% of its neighbour’s in 2025, the lowest for decades. Were Canada’s ten provinces and three territories an American state, they would have gone from being slightly richer than Montana, America’s ninth-poorest state, to being a bit worse off than Alabama, the fourth-poorest.

The performance gap owes little to covid-19 itself. Canada did have a deeper recession than America after covid struck, partly because of stricter and longer lockdowns. Its gdp fell by 5% in 2020, compared with 2.2% in America. But Canada soon caught up. The country’s national income grew by 4% between 2019 and 2022, nearly on par with America’s, which expanded by 5% over the period.

The first of these is the services industry, which makes up about 70% of Canada’s gdp. In the aftermath of the pandemic Americans splurged on goods, which boosted manufacturers north of the border (American consumers gobble up around 40% of Canadian factories’ output). But they have since switched back to spending on domestic services. “The composition of American growth hasn’t been favourable to Canada,” says Nathan Janzen of Royal Bank of Canada (rbc), a bank. The job of powering Canada’s economy, therefore, falls even more to its own services sector, which relies on demand from Canadian households and the government.

Instead the divergence is more recent: since 2022 America’s economy has motored ahead, leaving Canada’s in the dust. The reason is not some bump on the road but what lies under the bonnet. Two drivers of Canadian growth have sputtered.

Chart: The Economist

Unfortunately, that demand has been throttled by higher interest rates. Monetary policy has had more “traction” in Canada than in America, says Tiff Macklem, the central-bank governor. In the latter, most mortgages are fixed for 30 years, whereas in Canada they are typically set for five. A greater share of Canadians than Americans have already seen their mortgage payments rise. This is all the more painful as Canadian households bear more debt, relative to income, than anywhere in the g7 club of large, rich countries. They now fork out an average 15% of their income to pay back debt, up one percentage point since 2019. And unlike Uncle Sam, Canada’s government has not tried to soften the blow by loosening the purse strings. It ran a deficit of just 1.1% of gdp in 2023, compared with 6.3% in America.

The second faltering growth driver is Canada’s petroleum industry, which accounts for 16% of exports. Canada underinvested in new production for years after 2014, when a collapse in oil prices hurt its fuel-dependent economy. In America, by contrast, oil-producing states suffered but consumers cheered. When prices spiked after Russia invaded Ukraine, investors did more to support American shalemen; the country’s crude output has rocketed. It was one-quarter higher in the first seven months of 2024 than it was during the same period six years ago. Canada’s has grown by only 11% over the same period.

Oil’s decline penalises Canada’s economy at large, because it is one of the country’s most productive sectors. That adds to a long-standing productivity problem. Growth in output per hour worked across Canada has been sluggish for two decades. It increasingly resembles Europe rather than America, which has benefited from a tech boom that has largely eluded Canada. Its gdp per capita since the pandemic has risen more slowly than that of every other g7 country bar Germany.

What Canada lacked in productivity it could long make up by having more workers, thanks to high immigration. Between 2014 and 2019 its population grew twice as fast as America’s. Canada has historically been good at integrating migrants into its economy, lifting its gdp and tax take. But integration takes time, especially when migrants come in record numbers. Recently immigration has sped up, and the newcomers seem less skilled than immigrants who came before. In 2024 Canada saw the strongest population growth since 1957. Many arrivals are classified as “temporary residents”, including low-skilled workers and students. They are more likely to be unemployed or in low-earning jobs, dampening growth in income per person. Canada’s unemployment rate rose to 6.6% in August, from 5.1% in April 2023.

Take all this together and it is clear that the seeds of the decoupling were sown much earlier than the pandemic, with sagging services the latest in a series of ailments. There are no quick fixes. Canada’s central bank has cut interest rates three times so far this year, from 5% in May to 4.25% today. But many borrowers will still feel worse off because they have yet to renew their mortgages. Immigration restrictions have been introduced, including a cap on international students, but that won’t solve Canada’s chronic productivity problem. Catching up to Alabama may soon seem like a distant dream. ■

#Finance & Economics#Economic Decoupling#Canada 🇨🇦 🍁#United States 🇺🇸#Canadian Economy#Montana#Alabama

1 note

·

View note

Text

Linear Slide Units Market on Track to Achieve USD 3.6 Billion Valuation by 2028

The Linear Slide Units Market report, unveiled by Future Market Insights—an ESOMAR Certified Market Research and Consulting Firm—presents invaluable insights and meticulous analysis of the Linear Slide Units market. Encompassing the research's scope and essence, this report scrupulously examines the driving factors, market size, and predictive data for Linear Slide Units. It furnishes intricate revenue and shipment segmentations, accompanied by a decade-long projection up to 2033. Additionally, the document evaluates key industry players, their market distribution, the competitive scenario, and regional perspectives.

The Linear Slide Units Market has heralded a significant leap forward in the domain of factory automation, particularly within the sphere of linear motion technology. These adaptable units have now entrenched themselves as indispensable components across a spectrum of industries, including, but not limited to, food and beverage, retail and e-commerce, machine building, special purpose machines (SPMs), and the automotive sector. Their presence has sparked a paradigm shift in industrial automation strategies, offering unparalleled support for applications that demand moderate to light payloads, remarkable velocities, and high acceleration rates.

As of the conclusion of 2022, the global valuation of the linear slide units market was estimated at approximately US$ 2.4 billion. Projections for the trajectory of the linear slide units market point toward a robust growth pattern in the years to come, with an anticipated Compound Annual Growth Rate (CAGR) of 7.2%.

Browse More:https://www.globenewswire.com/en/news-release/2022/03/02/2395598/0/en/Linear-Slide-Units-Market-projected-to-reach-US-3-6-Bn-by-2028-Comprehensive-Research-Report-by-FMI.html

Linear slide units have emerged as a revolutionary innovation in the field of factory automation, particularly in the domain of linear motion technology. These units play a crucial role in applications requiring moderate to low payloads at high speeds and acceleration rates. Their versatile functionality extends across a diverse range of industries, including but not limited to food and beverage, retail and e-commerce, machine building, special purpose machines (SPMs), and the automotive sector. Notably, these mechanisms exhibit exceptional robustness even under challenging operational conditions.

In the context of this analysis, the classification of linear slide units is based on several key criteria, including pricing, drive mechanism, guiding system, load-bearing capacity, suitability for various applications, target end-use sectors, and specific geographical regions or countries.

Highlights – Linear Slide Units Market Segmental Analysis

According to market analysis, the medium range segment is expected to hold a majority stake in the global linear slide units market, as consumers show a preference for cost-effective yet efficient solutions for their industrial operations. Premium linear slide units, on the other hand, cater to consumers with specific high capital and customization requirements.

The market has been categorized by the type of drive into ball screw and belt drive segments. It is anticipated that the ball screw segment will experience substantial growth, given its crucial application in conjunction with linear slide units. However, for scenarios where precision takes a back seat to speed and repetitive operation, belt drives emerge as the preferred option.

Capacity-wise, the market has been divided into segments based on weight, ranging from less than 50 kg to above 150 kg. The segment encompassing capacities below 50 kg is poised to dominate the global market, with a projected value compound annual growth rate (CAGR) of 7.5% between 2018 and 2018, closely followed by the 50-100 kg segment.

In terms of application, the linear slide unit market has been segmented into pick & place, packaging, and inline production. The pick & place segment is expected to claim approximately 40% of the global market's value share by 2018 and is projected to expand at a CAGR of 6.8% over the forecast period.

Furthermore, the collective market share of the food & beverage, packaging, and machine building & SPM segments is expected to exceed 60% in the global market. Geographically, India and East Asia are anticipated to demonstrate significant growth in the global linear slide units market, owing to rapid industrialization and substantial advancements within the automotive component and metal fabrication industries.

The competitive landscape within the linear slide unit market is characterized as medium to high in intensity. Notably, the market is fairly consolidated, with a considerable presence of both major and mid-sized players. Organized players account for more than 50% of the linear slide unit market. Key industry players are actively engaged in the launch of new products and the establishment of expansion agreements, demonstrating their commitment to meeting the evolving preferences and demands of consumers.

Some of the key players active in the global Linear Slide Units market include Bosch Rexroth, Festo Group, SMC Corporation, Parker Hannifin, Igus, Phoenix Mecano AG, HIWIN Corporation, THK CO., LTD., and Thomson Industries Inc., among others.

Key Segments of Linear Slide Units Industry Survey

Linear Slide Units Market by Pricing:

Premium Linear Slide Units

Medium Range Linear Slide Units

Low Range Linear Slide Units

Linear Slide Units Market by Guide:

Ball Guide

Slide Guide

Wheel Guide

Linear Slide Units Market by Capacity:

Linear Slide Units Less than 50 Kg

Linear Slide Units Between 50-100 Kg

Linear Slide Units Between 100-150 Kg

Linear Slide Units Above 150 Kg

Linear Slide Units Market by Drive:

Ball Screw

Belt Drive

Linear Slide Units Market by Application:

Pick & Place

Packaging

Inline Production

Linear Slide Units Market by End Use:

Linear Slide Units for Food & Beverages

Linear Slide Units for Packaging

Linear Slide Units for Retail & E-commerce

Linear Slide Units for Machine Building & SPM

Linear Slide Units for Automotive

Linear Slide Units for Pharmaceuticals

Linear Slide Units Market by Region:

North America Linear Slide Units Market

Latin America Linear Slide Units Market

Europe Linear Slide Units Market

East Asia Linear Slide Units Market

South Asia & Pacific Linear Slide Units Market

Middle East & Africa (MEA) Linear Slide Units Market

0 notes

Text

Global Polypropylene Woven Bags and Sacks Market: An In-Depth Analysis

The global polypropylene woven bags and sacks market is poised for significant growth, driven by increasing demand across various industries such as agriculture, construction, and retail. These bags are favored for their durability, cost-effectiveness, and versatility, making them essential in numerous applications.

Market Overview

As of 2024, the market size for polypropylene woven bags and sacks is estimated at approximately USD 4.18 billion, with projections indicating growth to USD 5.44 billion by 2030, reflecting a compound annual growth rate (CAGR) of 4.50% during the forecast period.

Get Sample PDF

Key Drivers of Market Growth

Agricultural Demand: The agriculture sector extensively utilizes these bags for packaging products like grains, seeds, and fertilizers, owing to their strength and resistance to moisture.

Construction Industry Usage: In construction, polypropylene woven bags are employed for transporting materials such as cement and sand, benefiting from their durability and load-bearing capacity.

Retail and Shopping: The retail sector's shift towards sustainable and reusable packaging solutions has increased the adoption of these bags, aligning with environmental concerns and consumer preferences.

Food Industry Applications: The food industry utilizes these bags for bulk packaging of items like sugar and flour, taking advantage of their ability to preserve product quality and extend shelf life.

Market Segmentation

By Type:

Laminated Polypropylene Woven Bags: Offer enhanced protection against moisture and are suitable for products requiring additional barrier properties.

Non-Laminated Polypropylene Woven Bags: More cost-effective and used for products where moisture protection is less critical.

By Application:

Building & Construction: Utilized for transporting and storing construction materials.

Agriculture & Allied Industries: Used for packaging agricultural produce and related products.

Food Industry: Employed in bulk packaging of food items.

Retail & Shopping: Adopted as reusable shopping bags.

Regional Analysis

Asia-Pacific: Dominates the market due to robust agricultural activities and rapid industrialization, with countries like China and India leading in consumption.

North America: Holds a significant market share, driven by the construction industry's demand and a growing shift towards sustainable packaging solutions.

Europe: Exhibits steady growth, with increasing environmental regulations promoting the use of recyclable and reusable packaging materials.

Competitive Landscape

The market is characterized by the presence of several key players focusing on product innovation and expansion strategies to enhance their market share. Notable companies include:

Berry Global Inc.: Introduced an innovative line of polypropylene woven bags featuring advanced UV-resistant coatings in 2024, enhancing durability for outdoor applications.

Mondi Group: Offers a range of sustainable packaging solutions, including polypropylene woven bags, catering to various industries.

Uflex Ltd.: Specializes in flexible packaging solutions, with a portfolio that includes polypropylene woven sacks for diverse applications.

Recent Trends and Developments

Sustainability Initiatives: Manufacturers are increasingly focusing on producing eco-friendly polypropylene woven bags by incorporating recyclable materials and reducing carbon footprints to meet environmental regulations and consumer demand.

Technological Advancements: The integration of advanced manufacturing technologies has led to the production of high-strength, lightweight bags with enhanced barrier properties, catering to specific industry requirements.

Customization and Branding: There is a growing trend towards offering customized bags with specific designs, sizes, and printing options, enabling businesses to use them as effective branding tools.

Challenges

Environmental Concerns: Despite being reusable, polypropylene is a plastic derivative, raising concerns about its environmental impact if not properly recycled.

Fluctuating Raw Material Prices: Variations in the cost of polypropylene can affect manufacturing expenses and profit margins.

Future Outlook

The polypropylene woven bags and sacks market is expected to continue its growth trajectory, driven by increasing demand in emerging economies and the ongoing shift towards sustainable packaging solutions. Manufacturers focusing on innovation, sustainability, and meeting industry-specific requirements are likely to gain a competitive edge in this evolving market landscape.

Conclusion

Polypropylene woven bags and sacks have established themselves as indispensable components across various industries due to their durability, versatility, and cost-effectiveness. With the market projected to grow steadily, stakeholders have ample opportunities to innovate and expand their offerings to meet the evolving demands of consumers and industries worldwide.

0 notes

Text

Energy Efficiency in Pumping: How Darling Pumps Helps Save Energy and Reduce Costs

Energy efficiency is crucial today. Many technologies industrially apply pumps for fluid transfer and need huge energy. Energy efficiency in pumping systems must be fully implemented in all sectors, from agriculture to manufacturing and water treatment, because of operational cost savings and the environmental footprint to be reduced.

One major way to achieve efficiency is to obtain pumps of the right size for the task. A properly sized pump combined with efficient motor technology can reduce energy consumed greatly. Variable speed drives (VSDs) are also key in enhancing energy performance and allow the pump to operate at a specific flow and pressure level while regulating the pump speed to meet demand.

Proper sizing and control speed must be complemented with regular maintenance to ensure reliable and effective operation of the pump and increase its performance. A well-operating and maintained pump uses less energy and has an extended lifetime. Sounds like wear and tear on a pump can lead to loss of energy by proper usage of replacement parts, such as seals and bearings.

Another important factor is the pump design. Developments in pump technology, which have decreased additional energy consumption, include high-efficiency impellers, low-friction materials, and hydrodynamic optimization.

Darling Pumps manufactures high-performance pumps which span the full spectrum of energy-saving applications. Within the very focus of quality and innovation, Darling Pumps builds pumps designed for particular reaches of various industries, thus assisting businesses in optimized energy consumption, reduced operational costs, and greater overall productivity. On the other hand, Darling Pumps' commitment to enhance pumping efficiency will definitely make the products worthwhile for an energy-saving organization.

0 notes

Text

Karl Schubert Analyzes the Impact of Trump Tariff Policies on U.S. Inflation

During his first term, tariff policies by Donald Trump had a widespread impact on the global economy, particularly on U.S. inflation trends. Beginning in June 2018, the U.S. government announced a 25% tariff on approximately $50 billion worth of goods imported from China, with tariffs on about $34 billion of goods taking effect on July 6. Financial expert Karl Schubert of Schubert Finanzakademie conducted an in-depth analysis of first-term tariff policies by Trump, noting that their impact on the U.S. Consumer Price Index (CPI) and core CPI was far less significant than initially anticipated.

After Trump tariff announcements, U.S. CPI and core CPI did not rise as expected. In June 2018, the year-over-year growth rate of the U.S. CPI was 2.8%, while the core CPI grew by 2.2%. However, by January 2021, when Trump left office, the year-over-year growth rate of CPI had dropped to 1.4%, with the core CPI also declining to 1.4%. This suggests that the first-term tariff policies by Trump did not lead to an increase in U.S. inflation but instead alleviated inflationary pressures to some extent. Karl Schubert believes that the reasons behind this phenomenon warrant further exploration.

The goal of the U.S. tariffs was to force other countries, particularly developing nations, to bear more trade costs. However, tariff policies of Trump did not significantly increase consumer spending pressures. Instead, due to the reorganization of global supply chains and improvements in domestic production efficiency, part of the costs associated with the tariffs was absorbed by producers rather than consumers. Karl Schubert highlights that the tariff policies did not directly drive up the Consumer Price Index but instead helped maintain relatively stable inflation levels during the Trump term by improving U.S. industrial competitiveness and restructuring supply chains.

In an interview, Trump remarked, “If you look at my first term, before the COVID-19 pandemic, we had the greatest economy in history. I imposed a lot of tariffs on many countries, we made hundreds of billions of dollars, and we did not trigger inflation.” This statement reflects the positive assessment by the Trump administration of the effectiveness of its tariff policies. Karl Schubert further noted that while the tariff policies caused some market friction, the U.S. economy did not experience significant inflationary pressures in the short term. Instead, there were increases in tax and trade revenues.

The U.S. economy and job market demonstrated resilience during the tenure of Trump. Even amid trade tensions and global economic uncertainties, the U.S. economy maintained strong growth momentum. Karl Schubert attributes this partly to the tax policies, tax cuts, and support for domestic industries during the Trump administration, which mitigated some of the negative effects of the tariffs. In particular, Trump policies effectively promoted industrial revitalization in the manufacturing and energy sectors, which played a key role in preventing significant inflation in the U.S. economy.

From a global perspective, tariff policies by Trump not only influenced the U.S. domestic economy but also had far-reaching effects on global trade and the economies of other nations. According to the analysis by Karl Schubert at Schubert Finanzakademie, the imposition of tariffs prompted other countries to adjust their trade strategies and reconsider their economic cooperation with the U.S. For major trade partners like developing countries, although tariffs increased the cost of goods, many responded to trade tensions by stimulating domestic demand and upgrading industries, effectively mitigating the pressures brought about by the tariffs.

While the tariff policies of the first term of Trump did not trigger the anticipated inflation surge, they profoundly affected the global economic landscape and the structural adjustment of U.S. industries. Karl Schubert of Schubert Finanzakademie concluded that these policies might not effectively resolve trade imbalances or drive sustained long-term growth in the U.S. economy. As the global economic environment evolves, the effects of tariff policies are likely to become more complex, requiring investors and policymakers to respond with caution.

0 notes

Text

Global Polytetrafluoroethylene (PTFE) Market Report: Projected Growth and Key Insights

Global Polytetrafluoroethylene (PTFE) Market Report: Projected Growth and Key Insights

Straits Research is pleased to announce the release of its comprehensive report on the global Polytetrafluoroethylene (PTFE) market. The global polytetrafluoroethylene (PTFE) market was valued at USD 2.54 Billion in 2024. It is expected to reach USD 2.66 Billion in 2025 to USD 3.87 Billion in 2033, growing at a CAGR of 4.8% over the forecast period (2025-2033).

Industry Overview

Polytetrafluoroethylene (PTFE), commonly known as Teflon, is a synthetic fluoropolymer known for its high resistance to heat and chemical reactions. Its unique properties make it an essential material in various applications, including automotive components, electrical insulation, and non-stick cookware. As industries increasingly seek durable and efficient materials, the demand for PTFE continues to rise.

Key Drivers in the PTFE Market

The growth of the PTFE market is driven by several factors:

Increasing Demand in Automotive and Aerospace Industries: The automotive sector's need for high-performance materials that can withstand extreme conditions is propelling PTFE adoption in gaskets, seals, and bearings.

Growth in Chemical Processing: PTFE’s exceptional chemical resistance makes it indispensable for lining vessels and piping in chemical processing applications.

Healthcare Applications: The healthcare industry’s growing reliance on PTFE for medical devices and equipment is contributing to market expansion.

Consumer Products: The popularity of non-stick cookware continues to drive demand for PTFE coatings.

Request a Sample Report of Polytetrafluoroethylene (PTFE) Market

Key Developments in the PTFE Market

Recent developments indicate a dynamic shift within the PTFE market:

Technological Innovations: Advancements in manufacturing processes are enhancing the efficiency and safety of PTFE production.

Sustainability Initiatives: Manufacturers are increasingly focusing on developing eco-friendly alternatives to traditional PTFE products.

Rising Competition: The market is witnessing intense competition from manufacturers aiming to capture larger market shares through innovation and cost-effective solutions.

Market Segmentation Analysis

The global PTFE market can be segmented into various categories:

By Form:

Granular

Fine Powder

Dispersion

By Applications:

Sheets

Coatings

Pipes

Films

Others

By End-User Industry:

Automotive and Transportation

Chemical and Industrial Processing

Healthcare

Construction

Cookware

Electrical and Electronics

Others

Buy Polytetrafluoroethylene (PTFE) Market Report here!

Regional Trends

The PTFE market exhibits diverse trends across different regions:

North America:

The United States remains a significant player due to its robust automotive and aerospace industries. The demand for high-performance materials is driving growth in this region.

Asia-Pacific (APAC):

Dominated by countries like China and Japan, this region is experiencing rapid industrialization. China’s extensive use of PTFE in electronics and automotive applications significantly contributes to market growth.

Europe:

Countries such as Germany and France are leading the European market due to increasing requirements for improved materials in industries like chemical processing and electrical engineering.

Latin America, Middle East, and Africa (LAMEA):

This region is gradually adopting PTFE products, driven by infrastructure development and rising industrial activities.

Top Players in the PTFE Market

Straits Research identifies several key players driving innovation within the PTFE market:

AGC Inc.

BEMU Fluorkunststoffe GmbH

Aidmer (JiangXi Aidmer Seal & Packing Co. Ltd)

Daikin Industries Ltd.

Gujarat Fluorochemicals Limited

Dyneon GmbH & Co. KG (3M)

HaloPolymer

Freudenberg FST GmbH

Jiangsu Meilan Chemical Co. Ltd.

These companies are actively investing in research and development to enhance product offerings and meet evolving customer demands.

Conclusion

The global Polytetrafluoroethylene (PTFE) market is poised for steady growth driven by increasing demand across various industries, particularly automotive, healthcare, and consumer products. As stakeholders navigate this evolving landscape, opportunities abound for innovation and collaboration aimed at enhancing the efficiency and sustainability of PTFE applications.For more detailed insights into the Polytetrafluoroethylene (PTFE) Market trends and forecasts, please refer to our full report or contact Straits Research directly.

Browse Full Report and TOC of Polytetrafluoroethylene (PTFE) Market

About Straits Research

Straits Research is a premier provider of business intelligence specializing in research, analytics, and advisory services aimed at delivering comprehensive insights through detailed reports. For further information or inquiries regarding this press release or our research services, please contact us at [email protected] or call +1 646 905 0080.

Contact:

Straits Research Email: [email protected] Phone: +1 646 905 0080 Address: 825 3rd Avenue, New York, NY, USA, 10022

#Polytetrafluoroethylene (PTFE) Market Share#Polytetrafluoroethylene (PTFE) Market Size#Polytetrafluoroethylene (PTFE) Market Growth#Polytetrafluoroethylene (PTFE) Market Insights#Polytetrafluoroethylene (PTFE) Market Trends#Polytetrafluoroethylene (PTFE) Market Analysis#Polytetrafluoroethylene (PTFE) Market Industry#Polytetrafluoroethylene (PTFE) Market Forecast

0 notes

Text

Vibration Analysis Service in Madina

In the heart of Madina’s industrial landscape, machinery forms the backbone of productivity and efficiency. Ensuring the reliability of these mechanical systems is paramount for industries striving to maintain seamless operations. This is where Vibration Analysis Service in Madina plays a transformative role. By monitoring the vibrations of machinery, this advanced service identifies potential faults, enabling preventive maintenance that keeps operations running smoothly.

Vibration analysis involves the measurement and interpretation of vibration patterns in machinery. These patterns reveal critical insights into the health of equipment, uncovering issues like imbalance, misalignment, or bearing wear long before they lead to failures. In an industrial hub like Madina, where machinery operates in demanding conditions, such a proactive approach is essential. It ensures that industries avoid unexpected breakdowns, reduce repair costs, and extend the lifespan of their equipment.

The growing industries of Madina, spanning oil and gas, manufacturing, water treatment, and power generation, heavily rely on the consistent performance of their machinery. Vibration analysis offers a reliable solution to maintain this consistency. By diagnosing issues at an early stage, it prevents costly downtime, enhances energy efficiency, and safeguards the safety of workers and operations. Moreover, it aligns with sustainability efforts, as well-maintained machinery consumes less energy and minimizes resource wastage.

One of the standout features of vibration analysis is its precision. Utilizing high-tech sensors and software, the service captures real-time data on machinery vibrations, allowing for immediate action when anomalies are detected. This real-time monitoring is particularly beneficial in critical industries, where even a minor disruption can have significant repercussions. With detailed diagnostics and tailored solutions, vibration analysis in Madina is designed to meet the unique needs of local industries, addressing both their operational challenges and their aspirations for growth.

The environmental conditions in Madina add another layer of complexity to industrial operations. High temperatures, dust, and other harsh factors can accelerate wear and tear on machinery. Vibration analysis takes these challenges into account, offering tools and services that are robust and adaptable. This ensures that even under the toughest conditions, machinery can perform reliably and efficiently.

Choosing vibration analysis in Madina is not just about maintaining equipment—it is about investing in the future of industrial success. By adopting this technology, industries can reduce maintenance costs, improve operational efficiency, and achieve greater competitiveness in an ever-evolving market. For businesses aiming to lead in their respective sectors, vibration analysis is a step toward sustainable and resilient operations.

#VibrationAnalysisMadina#IndustrialSolutions#PredictiveMaintenance#MachineryHealth#SustainabilityInIndustry

0 notes

Text

How Textile Laboratories Contribute to Textile Innovation and Material Development

The textile industry has always been at the forefront of innovation, driven by the demand for new materials, improved performance, and sustainability. To meet these ever-evolving needs, textile laboratories play a crucial role in researching, testing, and developing new fabrics, fibers, and materials. By providing scientific insights and rigorous testing, textile laboratories contribute significantly to the advancement of textile technology and material development.

In this blog, we will explore how textile laboratory contribute to innovation in the textile industry, how they support material development, and the impact of their work on the future of textiles.

What Are Textile Laboratories?

Textile laboratories are specialized facilities dedicated to testing and analyzing textile materials and products. These labs play a pivotal role in assessing the quality, durability, safety, and performance of textiles used in various applications, from fashion and home goods to medical supplies and industrial fabrics. Textile laboratories employ advanced equipment and expertise to conduct various tests, ensuring that textiles meet the required standards for performance and safety.

The role of textile laboratories has expanded beyond traditional quality control to include innovation and material development, as manufacturers seek new solutions to meet consumer demands and environmental challenges. By conducting research and development (R&D), textile laboratories contribute to discovering new materials, improving existing ones, and creating sustainable textiles for the future.

The Role of Textile Laboratories in Textile Innovation

Textile laboratories have become essential hubs for innovation, offering scientific research and development support to manufacturers and designers. Below are some of the key ways in which textile laboratories contribute to innovation in the textile industry:

1. Research and Development of New Materials

One of the primary functions of textile laboratories is to conduct R&D on new materials. These materials could include advanced fibers, innovative coatings, or new blends that offer enhanced performance features. With the ever-growing demand for smart textiles, eco-friendly fabrics, and high-performance materials, textile laboratories are crucial in developing new textiles that meet these needs.

For example, laboratories are involved in the development of smart textiles, which integrate sensors and other technologies to create fabrics that can respond to external stimuli such as temperature, light, or pressure. This innovation has applications in sectors like healthcare (e.g., wearable health-monitoring fabrics) and sportswear (e.g., garments that adjust to body temperature or moisture levels).

Moreover, textile laboratories also focus on biodegradable fabrics and recycled materials, contributing to the growing trend toward sustainability in the textile industry. By conducting research on alternative fibers such as hemp, bamboo, and organic cotton, textile laboratories are helping to reduce the environmental impact of textile production.

2. Performance Testing for New Textiles

Once new materials or textiles are developed, textile laboratories play an essential role in evaluating their performance. This involves subjecting fabrics to a series of tests to assess their physical and chemical properties. For instance, laboratories test materials for:

Durability: How well the fabric withstands wear and tear over time.

Strength: How much force the fabric can bear before breaking.

Water Resistance: How well the fabric resists water penetration, essential for outdoor and performance textiles.

UV Resistance: How effectively the fabric resists degradation from exposure to sunlight, which is crucial for outdoor gear and protective clothing.

Breathability: The fabric's ability to allow moisture to escape, which is essential for sportswear and activewear.

Stretch and Recovery: How well the fabric stretches and returns to its original shape, important for performance and comfort.

By assessing the performance of new materials, textile laboratories help manufacturers determine whether a fabric is suitable for its intended application. If the fabric meets the required standards, it can be commercialized for use in a variety of industries.

3. Developing Sustainable Textiles

Sustainability has become one of the most significant drivers of innovation in the textile industry. With growing environmental concerns and pressure from consumers, textile manufacturers are constantly looking for ways to make their production processes more eco-friendly. Textile laboratories are at the forefront of developing sustainable textiles, focusing on reducing the environmental impact of textile production, from fiber production to dyeing and finishing.

For example, textile laboratories are involved in the development of bio-based fibers, which are made from renewable sources such as plant materials, algae, or fungi. These fibers are biodegradable and have a significantly lower environmental impact compared to synthetic fibers made from petroleum-based resources.

Additionally, laboratories contribute to innovations in waterless dyeing technologies and zero-waste production processes, which minimize the use of water and chemicals in textile manufacturing. These advancements help reduce pollution, conserve natural resources, and promote a circular economy in the textile industry.

4. Innovation in Textile Coatings and Treatments

Textile laboratories also contribute to the development of innovative coatings and treatments that enhance the functionality of fabrics. For example, laboratories work on creating water-repellent fabrics for outdoor gear, flame-resistant textiles for protective clothing, and antimicrobial treatments for medical textiles. These innovations improve the performance, safety, and hygiene of textiles used in various industries.

Through R&D, textile laboratories can develop new coatings that offer improved durability and environmental friendliness. For instance, research into non-toxic, eco-friendly finishes has led to the development of textiles that are resistant to dirt, water, and stains without using harmful chemicals like perfluorocarbons (PFCs), which are harmful to the environment.

5. Tailored Fabric Development for Specialized Applications

Textile laboratories are essential in developing fabrics for specialized applications, whether it’s in medical textiles, automotive interiors, or military gear. These sectors require textiles with specific properties, such as biocompatibility for medical implants, fire resistance for protective clothing, and high strength for safety harnesses and ropes.

Textile laboratories work closely with manufacturers to design and test fabrics that meet the precise needs of these applications. They assess factors such as elasticity, strength, moisture absorption, and heat resistance to ensure the fabrics meet regulatory standards and offer the desired performance.

The Impact of Textile Laboratories on Material Development

Textile laboratories are not only contributing to the development of new materials but are also instrumental in improving existing ones. Through innovation, testing, and collaboration, textile laboratories help manufacturers enhance the functionality, quality, and sustainability of traditional fabrics like cotton, polyester, and wool.

For example, textile laboratories are working on enhancing cotton fibers to make them more durable, moisture-wicking, and resistant to wear. They are also researching ways to improve the performance of synthetic fibers by increasing their breathability and reducing their environmental impact.

Laboratories also conduct comparative testing between new and traditional materials, helping manufacturers make informed decisions about which materials are best suited for specific applications. This ensures that businesses can create textiles that meet both performance standards and consumer expectations.

Conclusion

Textile laboratories are key players in driving innovation and material development in the textile industry. By conducting research, testing, and development, these laboratories help manufacturers create high-performance, sustainable, and innovative fabrics for a wide range of applications. Whether it's developing smart textiles, enhancing the durability of traditional fabrics, or finding eco-friendly solutions, textile laboratories are essential in shaping the future of the textile industry.

As consumer demand for better-performing, safer, and more sustainable textiles continues to grow, the role of textile laboratories will only become more critical. By supporting manufacturers with cutting-edge testing and material development, textile laboratories are helping to revolutionize the textile industry and pave the way for a more sustainable and innovative future.

#textile laboratory#textile laboratories#textile testing lab#textile testing#testing lab near me#testing labs

0 notes

Text

Titanium Dioxide Prices: Trend | Pricing | News | Price | Database

Titanium Dioxide is a crucial compound widely used across multiple industries, driving significant interest in its market dynamics, particularly price trends. Over the years, this chemical has established its indispensability in sectors such as paints and coatings, plastics, paper, and cosmetics. Its bright white pigment and exceptional opacity make it a preferred choice for enhancing product appearance and functionality. However, the pricing of titanium dioxide remains a complex subject influenced by a mix of supply-demand dynamics, production costs, regulatory considerations, and global economic factors.

The global titanium dioxide market has experienced notable price fluctuations due to changing raw material costs, particularly titanium-bearing ores like ilmenite and rutile. As these raw materials form the backbone of titanium dioxide production, their availability and cost directly impact the market. Mining challenges, geopolitical factors, and environmental regulations in key producing regions have occasionally created supply constraints, resulting in price spikes. For instance, countries like China, South Africa, and Australia dominate the production of titanium dioxide feedstock. Any disruptions in these regions, whether due to policy changes or natural disasters, significantly influence global pricing trends.

Additionally, the cost of production technologies plays a crucial role in determining titanium dioxide prices. Manufacturers use either the sulfate process or the chloride process, both of which involve energy-intensive operations. Rising energy costs and stricter environmental regulations have added to production expenses, pushing prices higher in some markets. The chloride process, in particular, is known for its efficiency and ability to produce higher-quality grades of titanium dioxide. However, it also requires higher capital investment, which can contribute to pricing disparities between manufacturers using different processes.

Get Real time Prices for Titanium Dioxide: https://www.chemanalyst.com/Pricing-data/titanium-dioxide-52

Global demand for titanium dioxide remains robust, fueled by its diverse applications. The construction and automotive industries are major consumers, relying on it for paints, coatings, and plastics that enhance durability and aesthetic appeal. Rapid urbanization and industrialization, particularly in emerging economies such as India and China, have driven a surge in demand. This growing appetite often puts upward pressure on prices, especially when supply fails to keep pace. However, the cyclical nature of demand in industries like construction and automotive can occasionally lead to temporary dips in prices during economic slowdowns.

Trade policies and international relations also play a significant role in shaping titanium dioxide market prices. Export restrictions, tariffs, and anti-dumping duties imposed by various countries can create market imbalances. For instance, policies aimed at protecting domestic industries often lead to regional price disparities. Additionally, the global supply chain for titanium dioxide is sensitive to logistical challenges such as port congestion, shipping costs, and labor shortages, which can further exacerbate price volatility.

Environmental regulations and sustainability trends have increasingly impacted the titanium dioxide market in recent years. Governments worldwide are enforcing stricter limits on emissions and waste management in the chemical manufacturing sector. These regulations compel manufacturers to invest in cleaner technologies and adopt sustainable practices, often increasing operational costs. Moreover, consumers and industries are showing a growing preference for eco-friendly products, encouraging innovation in low-impact titanium dioxide production methods. While these trends align with global sustainability goals, they may also contribute to higher market prices due to the additional investment required.

The influence of macroeconomic factors such as currency exchange rates, inflation, and geopolitical events cannot be ignored when analyzing titanium dioxide prices. Currency fluctuations in major producing and consuming countries can affect the cost of exports and imports, altering market dynamics. Similarly, inflation in key economies can drive up input costs for manufacturers, translating into higher product prices. Geopolitical events, including trade tensions and conflicts, often create uncertainties in the global market, influencing both supply chains and pricing strategies.

Technological advancements and research initiatives aimed at improving production efficiency and product quality have also impacted titanium dioxide pricing. Innovations in nanotechnology, for instance, have enabled the development of advanced titanium dioxide grades with improved performance characteristics. These high-performance variants often command premium prices due to their superior attributes and niche applications. As industries continue to prioritize quality and functionality, the demand for such specialized grades is expected to grow, influencing overall market prices.

Seasonal trends further contribute to the complexities of the titanium dioxide market. For example, demand typically peaks during construction and renovation seasons in various parts of the world. This seasonal uptick often results in temporary price increases as suppliers strive to meet heightened demand. Conversely, during off-peak periods, manufacturers may lower prices to clear inventories, leading to short-term fluctuations.

Looking ahead, the titanium dioxide market is expected to witness steady growth, driven by its essential role in key industries. However, prices are likely to remain volatile due to the interplay of supply-demand dynamics, regulatory pressures, and macroeconomic factors. Manufacturers and stakeholders must navigate these challenges while adapting to emerging trends such as sustainability, technological innovation, and shifting consumer preferences. By fostering collaboration across the value chain and investing in research and development, the industry can achieve a balance between profitability and environmental responsibility, ensuring a stable and sustainable future for titanium dioxide production and use.

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Titanium Dioxide#Titanium Dioxide Price#Titanium Dioxide Prices#Titanium Dioxide Price Monitor#Titanium Dioxide News#Titanium Dioxide Database#india#united kingdom#united states#germany#business#research#chemicals

0 notes

Text

How Maruti Suzuki India Achieved 3X Productivity in Height Maintenance

Client Overview

Maruti Suzuki India Ltd., a leader in the automobile manufacturing sector, is committed to efficiency and innovation. Regular maintenance of EOT cranes, which operate at considerable heights, is critical for ensuring smooth production processes. However, challenges such as dust accumulation, wear on motors and bearings, and the complexities of working at height have made regular maintenance both demanding and essential.

Existing Work at Height Product and Challenges

Product Used: Scissor Lift

Maintenance Tasks: Conducted at heights of up to 25 feet

Maruti Suzuki’s maintenance team relied on a scissor lift to perform these critical tasks. However, the lift’s limitations led to significant inefficiencies:

Space Consumption: The scissor lift occupied substantial ground space, creating clutter and operational inefficiencies within the plant.

Mobility Issues: Moving the lift was cumbersome, hindering quick repositioning during maintenance tasks.

Power Dependence: The scissor lift required continuous electricity, increasing operational costs.

High Maintenance Costs: Frequent breakdowns and the complexity of repairs made maintenance costly.

Time-Consuming Operations: Slow movement and recurring breakdowns extended maintenance durations.

Productivity Challenges: Inefficient operations led to delays, negatively impacting overall productivity.

Safety and Environmental Concerns: The scissor lift’s design posed safety risks, especially within the enclosed plant environment.

Implications

These challenges had measurable consequences:

Time Wastage: Inefficient equipment prolonged maintenance schedules.

Reduced Productivity: Delays in completing tasks disrupted overall operations.

Inflated Costs: High purchase and upkeep expenses, coupled with energy consumption, strained budgets.

Safety Risks: The unstable nature of the scissor lift increased the likelihood of accidents, compromising worker safety.

Y-Access’s Solution

Product Acquired: Fitout Master with J Hook

To address these challenges, Maruti Suzuki implemented the Y-Access Fitout Master with J Hook, a versatile, efficient, and safety-compliant solution tailored for EOT crane maintenance.

Product Features

Lightweight Construction: Enabled easy setup and dismantling, enhancing mobility and operational efficiency.

Corrosion Resistance: Designed to endure harsh conditions, reducing replacement frequency and costs.

Quick Assembly: No specialized tools were required, saving valuable time.

Enhanced Safety: Stabilizers and a stairway with a J hook ensured a safer work environment.

Compliance: The Fitout Master replaced traditional monkey ladders, which were deemed unsafe by Maruti’s safety team.

Specific Benefits

Improved Accessibility: The J hook and stairway design facilitated easier climbing with tools, streamlining maintenance tasks.

Solution Benefits

Key Advantages

Elimination of Hidden Maintenance Costs: The durable, corrosion-resistant design significantly reduced maintenance and repair needs.

Reduced Maintenance and Breakdown Time: Quick assembly and reliable performance minimized downtime, accelerating task completion.

Enhanced Productivity and Safety: Improved safety features and ease of use created a secure and efficient work environment.

Lower Operational Costs: The lightweight, energy-independent design eliminated reliance on electricity and reduced operational expenses. Simplified maintenance processes further reduced repair costs.

Outcome

The adoption of the Y-Access Fitout Master with J Hook delivered measurable improvements for Maruti Suzuki:

3X Increase in Productivity: Maintenance tasks were completed faster with less downtime, enabling the team to focus on critical operations.

5X Cost Savings: Reduced energy consumption, fewer repairs, and elimination of frequent breakdowns resulted in significant cost efficiencies.

Enhanced Safety and Efficiency: Workers operated in a safer environment with improved tools, contributing to overall operational excellence.

Conclusion

Maruti Suzuki India Ltd.’s transition to the Y-Access Fitout Master with J Hook revolutionized their EOT crane maintenance process. By overcoming the limitations of the previous scissor lift solution, they achieved substantial productivity gains, cost reductions, and enhanced safety standards. This case exemplifies how innovative maintenance solutions can drive operational success in the manufacturing sector.

Case study: Dhamra Port’s HVAC and Electrical Maintenance Streamlined with XO FRP Scaffolds

If you are looking for an access solution to prioritize safety, then check Y-Access Manufacturing’s range of work-at-heigh products. Our products are designed to provide superior protection while ensuring maximum durability and longevity. Don't compromise on safety, choose Y-Access Manufacturing for all your ladder needs.

Reach out to us at: [email protected] or call: +91-9015964626

#scaffolding#work at height safety#high maintenance#aluminium scaffold#safety#Y Access Manufacturing#Fitout master#maintenance#maintenance and care products#engineering#product

1 note

·

View note

Text