#Definition of Forex Trading

Explore tagged Tumblr posts

Text

Do check out this:- Mastering Forex Trading: Tips and Tricks for Beginners

#ftg#forex trading#funded traders global#risk management#informed decisions#forex trading for beginners#accessibility#beginners#benefits#Benefits of Forex Trading#career opportunities#Choosing a Broker#currency pairs#Definition of Forex Trading#discipline#education#emotions#experienced trader#financial independence#flexibility#flexible trading hours#forex market#Forex Trading#Forex Trading Basics#fundamental analysis#Funded Traders Global#Getting Started with Forex Trading#growth mindset#High Liquidity#Importance of Learning Forex Trading

0 notes

Text

youtube

How to Count Pips in Forex Trading Explained in 52 Seconds! 📊

#crypto#crypto trading#tradingtactics#tradingindicators#trading performance#forex#stock market#trading tutorial#day trading#forex trading#protect your capital#high-quality trades#how to count pips#forex for beginners#pip calculation#forex tutorial#forex explained#forex basics#forex trading tips#forex pip definition#forex beginner guide#learn forex#forex profits#forex risk management#Youtube

1 note

·

View note

Text

Frequently used Terms in Financial Forex Markets

The world of forex trading is filled with specific terms and jargon that traders use to communicate efficiently. Here are some frequently used forex terms and their meanings: 1. Currency Pair Definition: The quotation of two different currencies, showing the value of one currency in relation to the other. Example: EUR/USD (Euro against US Dollar). 2. Base Currency Definition: The first…

0 notes

Text

Trying to save my ass for the past 9 hours, been working the past 11.

I could've made big if it wasn't for one small stupid mistake but that's alright, this showed me my possibilities <33

#forexmarket#forextrading#forex#currency#exchange#usdjpy#dollar dipped before FED meeting statement#yen weakens in anticipation#trading view#mt4#long#bull#will definitely haunt my sleep

0 notes

Text

Bullwaypro.com review Registration

When choosing a forex broker, the biggest concern is always trust. Nobody wants to deposit funds into a platform only to discover withdrawal issues, shady practices, or poor regulation. That’s why we take a deep dive into every key aspect of a broker to see whether it’s legitimate or just another name in a long list of unreliable platforms.

Today, we’re looking at Bullwaypro.com review—a forex broker that has been gaining attention in the trading community. With a high Trustpilot rating, FCA regulation, and thousands of users, it certainly has some strong points. But does it truly hold up under scrutiny?

Let’s break it down step by step and find out.

Bullwaypro.com Registration Review: Quick and Easy Sign-Up Process

The registration process for Bullwaypro.com reviews is straightforward and efficient. Here’s how it works:

Locate the registration button in the upper right corner of the website.

Enter your personal data, ensuring accuracy for verification.

Wait for a manager to process the provided information.

Once verified, registration is successfully completed.

This structured approach suggests a secure onboarding process, where user information is checked before full access is granted. It’s a good sign—brokers who take verification seriously are often more reliable and compliant with financial regulations. Would you like details on the verification requirements or account setup next?

Bullwaypro.com – Establishment and Domain Registration Date

When assessing the legitimacy of a forex broker, one of the first things to check is whether the domain registration date aligns with the brand’s establishment date. If a broker claims to be operating for several years but its domain was only recently registered, that’s a red flag. So, how does Bullwaypro.com reviews measure up?

The company was established in 2022, and the domain bullwaypro.com review was registered on November 11, 2021. That means the domain was secured before the company officially started operating, which is a positive indicator. It suggests the brand was not hastily set up overnight but rather planned in advance.

Why is this important? Well, scam brokers often buy domains right before launching, making it easier to disappear without a trace. Bullwaypro, on the other hand, took steps ahead of time, likely to secure its brand identity and online presence early on. That’s a sign of long-term intentions, rather than a short-lived, fly-by-night operation.

This looks like a good argument in favor of legitimacy. What aspect should we analyze next?

Bullwaypro.com – Strong Regulatory Oversight

When it comes to forex trading, regulation is one of the most critical aspects that separate trusted brokers from potential scams. A regulated broker is subject to strict financial laws, regular audits, and capital requirements. So, what kind of regulatory status does Bullwaypro.com reviews have?

This broker operates under the oversight of the FCA (Financial Conduct Authority)—one of the most respected and stringent financial regulators in the world. The FCA license is not something a broker can obtain easily; it involves rigorous checks, capital requirements, and compliance with strict operational standards. Only brokers who meet transparency, security, and client protection policies receive this approval.

Why does this matter? Because FCA-regulated brokers are legally required to:

Segregate client funds from company accounts, ensuring traders' money is protected even if the broker faces financial trouble.

Follow fair trading practices, meaning no price manipulation or conflicts of interest.

Be covered by a compensation scheme, which provides an extra layer of security to traders.

We think this is a strong argument in favor of Bullwaypro’s legitimacy. Many brokers operate without regulation or under weak offshore jurisdictions—but here, we see one of the best financial regulators backing this platform.

This definitely adds trust to Bullwaypro.com reviews. What should we analyze next?

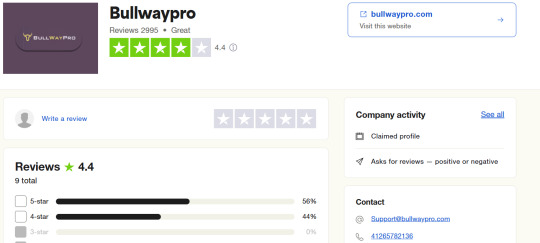

Bullwaypro.com – Client Reviews and Reputation

One of the best ways to gauge a broker’s reliability is to look at what actual traders are saying. Scammers tend to have poor ratings, few reviews, and plenty of complaints. But what about Bullwaypro.com reviews?

On Trustpilot, this broker holds an impressive score of 4.4 out of 5, based on 2,995 reviews. That’s a strong indicator of trustworthiness, especially in the forex industry, where traders are quick to leave negative feedback if something goes wrong.

Here’s why this is significant:

A score above 4.0 is already considered very high for brokers, as the industry tends to be highly competitive and filled with mixed experiences.

The sheer number of reviews (2,995) suggests a well-established platform. It’s easy for a scam broker to fake a handful of positive comments, but accumulating thousands of reviews takes consistent service over time.

Out of those, 2,869 reviews (the majority) are rated 4 or 5 stars, meaning most traders are satisfied with their experience.

This definitely looks like a solid argument for legitimacy. A broker with nearly 3,000 reviews and a high rating is unlikely to be a short-term scam. Instead, it suggests that Bullwaypro delivers on its promises and maintains a good relationship with its clients.

Final Verdict: Is Bullwaypro.com review a Legitimate Broker?

After a thorough review, Bullwaypro.comreviews checks all the right boxes when it comes to trust and reliability. The broker is not just another name in the forex industry—it has strong regulatory oversight, positive user feedback, and a well-structured platform. Here’s why we think traders can confidently consider this broker:

✅ Regulation by FCA – One of the most trusted financial regulators, ensuring transparency, security, and fair trading conditions. ✅ Established Track Record – The domain was registered before the company officially launched, showing proper planning and long-term intent. ✅ Excellent User Reviews – With a 4.4 Trustpilot rating and nearly 3,000 reviews, traders are overwhelmingly satisfied with the platform. ✅ Secure Deposits & Fast Withdrawals – No hidden fees, instant processing for most transactions, and reliable payment methods. ✅ User-Friendly Trading Conditions – Multiple account types, fair leverage, and a widely used trading platform. ✅ Accessible Customer Support – Various contact options make it easy for traders to get assistance when needed.

With all these factors in mind, Bullwaypro.com review stands out as a legitimate and well-regulated broker. The combination of FCA oversight, positive reviews, and a transparent operational model makes it a solid choice for both beginner and experienced traders.

Of course, every trader should do their own research and choose a broker that fits their needs, but based on the evidence, Bullwaypro.com reviews appears to be a trustworthy option in the forex market.

2 notes

·

View notes

Text

Bestexpertoline.com review Deposit Information

When evaluating a forex Bestexpertoline.com review, it’s essential to consider several key factors that determine its reliability and trustworthiness. In this brand review, we’ll dive into the crucial aspects such as the Bestexpertoline.com review licensing, domain history, user feedback, and more. Whether you’re a seasoned trader or just starting out, understanding these elements will help you make an informed decision about which platform to trust with your investments. Let’s explore why this particular Bestexpertoline.com reviews stands out in the industry and why it might be the right choice for your trading needs.

Deposit Information for Bestexpertoline.com

Based on the data available in the table, here's a detailed breakdown of the deposit-related aspects for the Bestexpertoline.com reviews:

Deposit Time:

For most of the Bestexpertoline.com reviews listed, the deposit is processed in a matter of seconds to 10 minutes. This indicates a fast transaction processing time, which is crucial for traders who need to fund their accounts quickly for active trading. This is a strong argument in favor of the Bestexpertoline.com reviews being efficient in handling deposits.

Deposit Fee:

All the Bestexpertoline.com reviews in the table charge a "0% commission" for deposits. This means clients are not subjected to any additional fees when funding their accounts, which makes the offers more attractive. It definitely looks like a good argument for the Bestexpertoline.com reviews, as the absence of deposit fees can reduce costs for traders significantly.

Deposit Methods:

The platforms support various deposit methods such as VISA, MasterCard, Union Pay, and others. The availability of multiple deposit options provides flexibility, allowing users from different countries to choose the method most convenient for them. This adds a layer of accessibility, making the platforms more user-friendly.

In summary, these Bestexpertoline.com reviews offer favorable deposit conditions with fast processing times, no additional fees, and various deposit methods. These factors are crucial when choosing a Bestexpertoline.com review, as they ensure a smooth and cost-effective experience for traders.

Argument 1: Domain Purchase Date

One important aspect to consider when evaluating the legitimacy of a Bestexpertoline.com review is the domain purchase date. For a Bestexpertoline.com review to be trusted, the domain associated with its platform should ideally be purchased around the same time or before the brand was established. This ensures the Bestexpertoline.com review has been operating in a transparent and legitimate manner from the outset.

For instance, if the domain was purchased after the brand was officially launched, it could raise questions about the authenticity and timeline of the Bestexpertoline.com review operations. This might suggest the Bestexpertoline.com review was created more recently, possibly as a quick-to-market entity that may not have established a solid foundation.

Argument 2: License Information Bestexpertoline.com review

The license a Bestexpertoline.com review holds is one of the strongest indicators of its legitimacy and trustworthiness. Bestexpertoline.com review with licenses from reputable regulatory bodies are considered more reliable because these regulators enforce strict standards that ensure transparency, fairness, and financial security for users.

For example, Bestexpertoline.com review that are licensed by high-authority regulators like the FCA (Financial Conduct Authority) or CySEC (Cyprus Securities and Exchange Commission) are generally considered to be trustworthy and compliant with international financial laws. The fact that the Bestexpertoline.com review has earned a license from such a respected institution shows it has passed rigorous checks to prove its reliability.

This is a solid argument in favor of the Bestexpertoline.com review legitimacy. The existence of such licenses helps assure potential clients that they are dealing with a platform that operates under strict regulations, offering a much higher level of security compared to unregulated Bestexpertoline.com reviews. If a Bestexpertoline.com review is licensed by a well-known and respected authority, it's reasonable to trust that it is operating in good faith and is legally accountable for its actions.

Argument 3: Trustpilot Reviews Bestexpertoline.com

One of the most reliable indicators of a Bestexpertoline.com review reputation is the feedback from real users. In this case, Trustpilot reviews serve as an essential measure. A high rating on Trustpilot, especially above 4 stars, speaks volumes about the Bestexpertoline.com review reliability and customer satisfaction.

The fact that a Bestexpertoline.com review has earned positive reviews with an average score of over 4 is a strong argument in favor of its legitimacy. It shows that many customers have had positive experiences, suggesting that the Bestexpertoline.com review provides a service that meets expectations in terms of usability, customer support, and trustworthiness. Additionally, the large number of reviews further strengthens the case. A Bestexpertoline.com review with thousands of reviews typically has a large customer base, which is a good sign that it has been operating for a while and is trusted by many.

Conclusion Bestexpertoline.com review

After thoroughly analyzing the key aspects of this Bestexpertoline.com review, it’s clear that it offers a reliable and transparent platform for traders. The licensed status from a reputable authority ensures that it operates within the boundaries of legal and financial regulations, providing a sense of security to its users. Additionally, the positive Trustpilot reviews with a high rating further strengthen the case, showing that it has a strong customer base that trusts the service.

The fast deposit processing times, along with zero fees, make it a convenient option for traders who value efficiency and cost-effectiveness. Furthermore, the wide variety of deposit methods increases accessibility for users around the world.

In summary, this Bestexpertoline.com review seems to be a legitimate and solid choice for anyone looking to trade in a secure and user-friendly environment. With a robust reputation, reliable financial practices, and great customer feedback, it stands as a trustworthy option in the competitive world of forex trading.

4 notes

·

View notes

Text

What is the best Forex copier?

As a Forex trader who has been navigating the market for over five years, I can confidently say that finding the right trade copier completely transformed my trading experience.

What is a Forex Copier?

A Forex copier is a tool that automatically replicates trades from one account (the master account) to another (the slave account). It’s widely used by traders who want to follow professional signal providers or manage multiple accounts simultaneously. With a Forex copier, you no longer need to manually execute trades; the software handles it for you, ensuring accurate and timely execution.

My Journey with Telegram Signal Copier (TSC)

I vividly remember the struggle of manually copying signals from Telegram channels. By the time I executed the trades, I often missed the perfect entry point or made errors in lot size. That's when I discovered Telegram Signal Copier (TSC), and it’s been a game-changer ever since.

Why Telegram Signal Copier Stands Out:

Direct Integration with Telegram Signals: TSC connects directly with Telegram channels and copies signals in real-time, eliminating delays and human errors.

Advanced Image Signal Copying: Unlike other copiers, TSC can even read and execute signals shared as marked-up charts or images, which is a huge advantage.

Flexible Risk Management: You can customize lot sizes, stop loss, and take profit levels according to your trading strategy.

Reliable Performance: Even during high market volatility, TSC ensures stable and accurate trade execution.

Since I started using TSC, I’ve seen significant improvements in my trading performance. It allows me to focus on strategy while the copier handles the execution flawlessly.

If you're looking for a reliable and efficient Forex copier, Telegram Signal Copier is definitely worth considering. It has saved me time, reduced stress, and helped me maximize profits.

#Telegram Signal Copier#Forex Copier#Forex trading Copier#Trade Copier#TRading copier#forex education#forextrading#currency markets

0 notes

Text

Which is Better: Forex, Crypto, or Stock? A Deep Dive into Prop Firm Tech

INTRODUCTION

The financial landscape is constantly changing, and with new changes comes the production of more choices than ever for traders. The most common include Forex, cryptocurrency, and stock trading. Each market has special characteristics and advantages but carries difficulties, so the emergence of prop firm tech allowed trading to become more accessible and efficient. In this blog, we will be talking about the pros and cons of

Forex, crypto, and stock trading and how prop firm tech can enhance your trading experience.

Underlying the Markets

Forex Market

Forex represents the world’s largest financial market, referring to that market where currency trades occur.

High Liquidations: Forex offers a level of liquidation that is high. Its trading volumes exceed $6 trillion, allowing the traders to comfortably enter and leave positions. Forex is traded 24 hours a day on weekdays, thus offering ample convenience for the traders.

Leverage: Most Forex brokers are highly leveraged. This means that a trader controls much larger positions with lesser capital.

Challenges despite the advantages:

The leverage might create a highly volatile currency price and the highest risk it causes is that it is an effect of its highly volatile nature.

There is an overwhelming complexity in managing economic indicators, and there are geopolitical factors too, which are not easy to handle for new traders.

Crypto Market

The crypto market is trading in digital currencies such as Bitcoin, Ethereum, and more than 5,000 altcoins.

Benefits:

Volatility: The crypto market is volatile. Within a very short duration, one can gain tremendous returns.

Decentralized: With cryptocurrencies, there is a decentralized peer-to-peer network so that no banks are used to monitor transactions.

It is open: All it needs is an internet connection to create opportunities with this kind of market, and it reaches across the globe.

Regulatory Risks: The regulation of the crypto market is not well-established, so it is an uncertain area.

Security Risks: Crypto space is highly prevalent with hackers as well as scams. Hence, the traders must beware of the same.

Stock Market

Definition: the stock market represents an entity where shares of publicly traded companies are traded

Benefits

Governance and Transparency: Since the stock market is very well governed, it offers some kind of security for investors.

Dividends: Most stocks pay dividends thereby ensuring that the investor earns some income from the shares.

Research and Analysis: There is much information to make stock analysis hence helping the traders come to a conclusion.

Drawbacks

Market Hours: the stock market only operates within fixed hours thereby limiting trading.

Lesser Volatility Stock prices often exhibit much slower movements in comparison to Forex and crypto price swings, potentially leading to reduced profit margins.

Prop Firm Tech: Revolutionizing Trading

There has always been a high level of diversity in markets, and for this reason, prop firm tech has emerged as the real deal. Proprietary firms provide capital to traders while engaging them with the latest technology to enhance their trading strategy.

This is how prop firm tech is revolutionizing the game of trading:

Access to Capital

Prop firms also enable traders to gain access to significant capital, thus they can take bigger positions and can hence gain larger profits. Such is truly rewarding for Forex and crypto traders who may not have that much money required to trade even in the best possible way.

Sophisticated Trading Platforms

Proprietary trading firms invest in advanced trading technology that gives traders cutting-edge platforms offering a high level of data provision, sophisticated charting tools, and automated trading features. This tech can significantly enhance the trading experience across Forex, crypto, and stocks.

Risk Management Tools

Prop firm tech also features powerful risk management tools, which can help in minimizing the trader’s loss and ensure the safety of capital. Such tools are quite essential in volatile markets like Forex or even cryptocurrencies, whose prices tend to change rapidly.

Education and Training

Alarge number of prop firms offer educational resources, mentorship, or training for the development of a required skill base by the traders. Support is highly important to any new traders entering Forex, crypto, or even the stock market.

Community and Networking

Trading with a prop firm usually involves trading with other people. This facilitates several things: you will have to have a community of fellow traders, exchanging insights and ideas, strategies you’re implementing, and support you give someone else.

Feature | Forex | Cryptocurrency | Stock Market

Liquidity | High | Varies by asset | High (for major stocks)

Volatility | Moderate to High | High | Moderate

Trading Hours | 24/5 | 24/7 | Limited (specific hours)

Leverage | High | Varies | Low to Moderate

Regulation | High | Low (still evolving) | High

Education | Available (varied by broker) | Limited (varies widely) | Extensive (research available)

Technology | Advanced prop firm tech available | Emerging tools | Established trading platforms

Conclusion

Is Forex, cryptocurrency, or stock trading the best?

The above question doesn’t have a definitive answer, since each market has specific positives and negatives suited to different types of trading. However, with the help of rising prop firm tech, the tools and resources available to every trader can improve trading experiences across all markets.

If you are looking for high liquidity and flexibility, Forex may be the choice. For people who seek high returns and have no fear of volatility, then cryptocurrency may be the way to go. Meanwhile, for those wanting a more regulated environment with an abundance of readily available research, stock trading may be the way to go.

Based on which one is best depends on the trading style of the individual, his risk tolerance, and preferences, you could consider your options while maximizing your trading potential with the benefits of prop firm tech, irrespective of the market.

#proptech#forex prop firms funded account#fxproptech#prop firms#best prop firms#funded#prop trading firms#funded trading accounts#my funded fx#best trading platform#propfirmtech

2 notes

·

View notes

Text

What is the definition of a stock reaching a new high?

A stock reaching a new high means that its market price has surpassed its previous highest recorded price. In other words, the stock's current market value is higher than it has ever been before.

This is generally seen as a positive signal by investors, as it suggests that the company is performing well and that investor sentiment towards the stock is positive.

However, it's important to note that a new high does not necessarily mean that the stock is a good investment at that particular moment, as market conditions and other factors may still need to be considered before making investment decisions.

————————— ********* —————————

If this Was helpful then appreciate our work

Explore more- Learn Trading And Investing - Stocks, Forex And Cryptocurrency

2 notes

·

View notes

Text

ADX & Symmetrical Triangle: The Hidden Formula to Predict Explosive Breakouts Why Most Traders Get It Wrong (And How You Can Avoid It) Imagine this: You’re watching the Forex market, and a symmetrical triangle pattern starts forming. You feel the anticipation, like waiting for a microwave burrito to explode because you ignored the recommended cooking time. You know a big move is coming—but which way? This is where traders fumble. Many assume that symmetrical triangles are neutral patterns, which means they can break out in either direction. But here’s the truth: if you’re not integrating the Average Directional Index (ADX) into your analysis, you might as well be flipping a coin. And let’s be honest—random guessing is not a profitable trading strategy. In this article, you’ll discover how the ADX + symmetrical triangle combo can predict powerful breakouts with precision. You’ll also learn secret techniques that elite traders use to spot high-probability setups before the masses even catch on. What’s a Symmetrical Triangle, Really? (Beyond the Textbook Definition) Most traders see a symmetrical triangle and think, Oh, consolidation. Time to sit and wait. But here’s where the elite traders differ from the amateurs: they know how to spot early breakout clues. A symmetrical triangle forms when the market prints a series of lower highs and higher lows, compressing price action into a tightening range. Eventually, price has no choice but to break out—and when it does, it can move explosively. But which way? That’s where the ADX comes in. ADX: The Secret Sauce for Predicting Breakout Strength The ADX (Average Directional Index) measures trend strength, not direction. It ranges from 0 to 100, with values above 25 indicating a strong trend and values below 20 signaling a weak trend (a.k.a. market chop that eats your stop losses for breakfast). How to Use ADX With Symmetrical Triangles: - Identify the Symmetrical Triangle: Look for the classic pattern—lower highs and higher lows converging toward a point. - Check ADX Value: - If ADX is rising above 25, a strong trend is forming, meaning the breakout is likely to be significant. - If ADX is below 20, breakout strength is questionable, and the market might fake you out. - Watch the +DI and -DI Lines: - If +DI crosses above -DI as the breakout occurs, it’s a bullish breakout confirmation. - If -DI crosses above +DI, expect a bearish breakout. By using this method, you avoid low-quality breakouts that lack momentum and focus on high-probability trades. The Hidden Patterns That Drive Explosive Moves Elite traders use an extra layer of analysis to boost their win rate: Volume & Fake Breakouts. 1. Volume Confirms the Breakout A real breakout needs volume. If you see a symmetrical triangle breakout without an increase in volume, watch out—it could be a fake move. - Rising volume = Valid breakout. - Flat or low volume = Possible trap. 2. Fake Breakouts & The ADX Trap Not all breakouts are created equal. Here’s how to detect a fake move before it wrecks your account: - If ADX is below 20 and flat, any breakout is likely a fakeout designed to lure in retail traders. - If ADX is above 30 and rising, the move has conviction—this is where you strike. Case Study: How an Elite Trader Nailed a Symmetrical Triangle Breakout Trade Setup: - Pair: GBP/USD - Timeframe: 4-hour - Pattern: Symmetrical Triangle - ADX Reading: 27 and rising - Volume: Increasing - +DI crossed above -DI as price broke out. Result: Price surged 150 pips in 24 hours, while traders who ignored ADX got caught in fake breakouts. How You Can Apply This to Your Trading Today - Always check ADX before trading a symmetrical triangle breakout. - Ignore breakouts with weak ADX values ( Read the full article

0 notes

Text

Maximize Your Forex Profits: A Guide to Margin Calculators for Funded Traders Global

Discover how margin calculations are essential for successful forex trading, especially for Funded Traders Global members. This article explores the significance of margin, the risks associated with margin trading, and the role of margin calculators in optimizing trading strategies. Learn how to use margin calculators effectively, choose the right type for your needs, and avoid common mistakes. Join Funded Traders Global and elevate your forex trading with precision and profitability.

#Accessing a Margin Calculator#Accurate Position Sizing#Automating Calculations#Avoiding Margin Calls#Benefits of Using a Margin Calculator#Broker-Provided Calculators#Common Mistakes to Avoid#Comparing and Contrasting Margin Calculator Types#Definition of Margin#Effective Risk Management#Enhanced Decision-Making#Forex Trading#Forex Trading for Beginners#FTG Prop Firm#FTG Trading#How Margin Works and Its Significance#Ignoring Broker-Specific Requirements#Leverage-Induced Losses#Margin Calculator#Margin Calls#Market Volatility#Maximize Your Profits with a Margin Calculator for Forex Trading#Neglecting to Update Data#Online Margin Calculators#Overleveraging#Prop Trading Firm#Receiving Calculation Results#Recommendations Based on Trader Needs and Preferences#Risks Associated with Margin Trading#Simplifying the Margin Calculation Process

0 notes

Text

Forex today: German definitions, inflation and GDP in the UK gathers attention

Greenback extended its recovery from its lowest levels, adding to the rise of Wednesday amid this step in the revenue and intense concerns surrounding the prospects for a global trade war. 2025-03-13 18:42:52

0 notes

Text

How Forex Spread Works: Understanding Bid-Ask Differences

In the vast realm of the foreign exchange market, the term Forex Spread plays a critical role in every transaction. At its core, Forex Spread refers to the difference between the bid and ask prices of a currency pair. This difference may appear small at first glance, yet it is pivotal in determining trading costs and overall market liquidity. Over time, seasoned market participants have come to view the spread as both a challenge and an opportunity—a fine line where market efficiency meets risk management.

During a recent conversation with a seasoned market analyst, Jordan, he remarked, “The dynamics of the Forex Spread are not just numbers on a screen; they represent the heartbeat of the market.” His statement encapsulates the sentiment felt by many professionals who see each spread movement as a signal of underlying market forces. The significance of Forex Spread is multifaceted: it affects trading decisions, risk management strategies, and ultimately, profitability.

This article aims to provide a deep dive into the mechanics of Forex Spread by exploring its components, underlying influences, and the strategies employed by market professionals. We will engage in a dialogue that not only explains the theory behind bid-ask differences but also offers practical insights drawn from real-world market scenarios. Our discussion is designed to be engaging and interactive, weaving together expert insights with relatable personal narratives. As you progress, you will encounter direct exchanges between market professionals, data-rich tables, and actionable tips that bring the abstract concept of Forex Spread into sharper focus.

The following sections have been crafted with a focus on clarity, expertise, and trustworthiness—ensuring that the information is both authoritative and accessible. Whether you are a novice eager to learn the basics or a seasoned professional looking to refine your strategy, this article is designed to resonate with your experiences. We will also incorporate various structures—from bullet points and numbered lists to tables and highlighted tips—to enhance readability and provide a multi-faceted understanding of the subject matter.

Let us embark on this journey into the intricacies of the Forex Spread, where every pip tells a story and each market shift can signal a new opportunity. The information provided here is grounded in industry experience, bolstered by data science insights, and enriched with direct dialogue from market experts. Prepare to engage with content that is as informative as it is captivating.

Table of Contents

Understanding Forex Spread Fundamentals

Components of Forex Spread: Bid vs Ask

Forex Spread Influencers: Liquidity and Volatility

Economic Indicators and Their Impact on Forex Spread

Technological Advances and Forex Spread Dynamics

Real-world Application and Risk Management in Forex Spread

The Future of Forex Spread and Market Innovations

1. Understanding Forex Spread Fundamentals

The concept of Forex Spread lies at the very foundation of foreign exchange trading. At its simplest, the spread is the cost incurred by a market participant when buying or selling a currency pair. This section delves into the essential elements that constitute the spread and examines why understanding this phenomenon is paramount for successful trading.

The Core Definition and Its Implications

The Forex Spread is defined as the numerical difference between the bid price (the price at which a market participant is willing to buy) and the ask price (the price at which they are willing to sell). For example, if the EUR/USD pair has a bid price of 1.1000 and an ask price of 1.1003, the spread is 0.0003 or 3 pips. Though the number might seem minimal, each pip can significantly impact a trader's profitability—especially in high-frequency trading environments.

Consider a conversation between two experienced professionals, Alex and Morgan, at a recent industry seminar:

Alex: "When I see a spread widen unexpectedly, it’s often a sign of underlying market hesitation." Morgan: "Exactly. It’s the market’s way of communicating risk. Every shift in the spread signals changes in liquidity and volatility that we must monitor closely."

This dialogue underlines the practical importance of the spread. It is not just a static cost but a dynamic indicator that reflects market sentiment and risk.

Historical Evolution and Market Perception

Historically, Forex spreads have evolved in tandem with market innovations. With the advent of electronic trading platforms, spreads have generally become narrower due to increased competition and improved market transparency. However, during periods of economic uncertainty or when significant news events occur, spreads can widen abruptly as liquidity providers adjust their risk models.

Many market participants recall the financial turbulence during the early 2000s when sudden spikes in spread values were commonplace. Such episodes highlighted the dual role of the spread as both a cost and a risk signal. In this context, a wider spread often meant that market participants were more cautious, waiting for further clarity before committing to trades.

The Multifaceted Nature of the Forex Spread

Several factors influence the Forex Spread, making it a multifaceted concept:

Market Liquidity: In highly liquid markets, the difference between the bid and ask tends to be minimal. Conversely, in less liquid situations, the spread can widen considerably.

Economic and Political Events: Geopolitical tensions, central bank announcements, and economic data releases can all affect market sentiment, leading to sudden changes in spreads.

Trading Volume: During periods of high trading volume, the competition among liquidity providers often results in tighter spreads. When volume declines, the opposite may occur.

Technical Factors: Modern trading algorithms and high-frequency trading systems can both narrow and widen spreads in milliseconds, reacting to shifts in market conditions almost instantaneously.

Practical Considerations for Traders

For those actively engaged in the market, understanding the nuances of the Forex Spread is crucial. Traders must evaluate the spread as part of their overall strategy, factoring it into calculations for trade entry and exit points, risk management, and profitability assessments. Here are a few practical tips:

Monitor Spread Trends: Regularly track the spread for your currency pairs to identify patterns. This can be particularly useful during key market events.

Compare Across Brokers: Different platforms may offer varying spreads. Choose a broker that aligns with your trading strategy and provides competitive pricing.

Integrate Spread Analysis with Technical Tools: Combine spread analysis with technical indicators like moving averages or Bollinger Bands to gain deeper insights into market conditions.

A Personal Reflection

Reflecting on my own early days in Forex trading, I remember sitting with my mentor at a local café, poring over market charts and spread movements. He once said, “Understanding the spread is like reading the pulse of the market.” That advice has guided my approach ever since, instilling in me a respect for the intricate balance between cost and risk.

The fundamental takeaways from this discussion are clear: the Forex Spread is not merely a byproduct of market mechanics but a vital signal of market behavior. By understanding its underlying principles, traders can better navigate the complexities of the foreign exchange market, making informed decisions that reflect both analytical precision and market intuition.

2. Components of Forex Spread: Bid vs Ask

At the heart of every Forex transaction lies the interplay between the bid and ask prices. This chapter breaks down the components that form the Forex Spread, offering a closer look at each element and its significance.

Defining the Bid and Ask Prices

Bid Price: The bid is the highest price that buyers are willing to pay for a currency pair. It represents the demand side of the market.

Ask Price: The ask, on the other hand, is the lowest price at which sellers are ready to part with a currency pair. It reflects the supply side.

When these two figures are juxtaposed, the resulting difference is the spread—a critical metric that directly influences trading costs.

The Dynamic Nature of Bid and Ask

Bid and ask prices are not static. They fluctuate based on market conditions, order flow, and even external economic news. One market participant, Sarah, noted in a recent interview, “I see the bid-ask gap as a live barometer of market sentiment. When the gap widens, it usually signals heightened uncertainty.” This observation is not uncommon among professionals who use real-time data to assess risk and liquidity.

Interrelationship and Market Impact

The relationship between the bid and ask is interdependent. A narrower spread indicates a more competitive market with high liquidity, while a wider spread may suggest low liquidity or increased volatility. For example, during high trading sessions, such as when major economic data is released, liquidity increases and spreads typically narrow. Conversely, during off-peak hours, reduced trading activity can lead to wider spreads.

Key Considerations in Spread Calculation

Order Execution: The speed and efficiency of order execution can influence the spread. Fast, automated systems tend to narrow the gap, while manual execution may lead to delays and a slightly wider spread.

Market Makers’ Role: Market makers provide liquidity by continuously quoting bid and ask prices. Their pricing models are based on a mix of algorithms and market conditions, ensuring that the spread remains competitive while managing risk.

A Closer Look Through a Data Lens

To further illustrate the bid-ask components, consider the following table, which compares key data points across several major currency pairs:

This table offers a snapshot of how different currency pairs can exhibit varying spread characteristics based on market conditions and liquidity. It is important to note that these figures are influenced by numerous factors, including market sentiment, global economic events, and the overall trading volume.

Engaging With the Data

In discussions with fellow market enthusiasts, the bid-ask dynamic often comes up as a critical component of daily trading strategies. One participant, known for his meticulous analysis, remarked, “Tracking bid and ask movements throughout the day gives me an edge—it’s like having a backstage pass to the market’s inner workings.” Such insights reinforce the practical importance of understanding both sides of the spread equation.

By delving into the components of the Forex Spread, traders gain not only a clearer understanding of cost structures but also a tool to gauge market sentiment. Whether you are fine-tuning an algorithm or making split-second decisions in a fast-moving market, the bid-ask relationship remains an indispensable metric.

3. Forex Spread Influencers: Liquidity and Volatility

Market conditions are rarely static, and two of the most significant influencers of the Forex Spread are liquidity and volatility. In this section, we explore how these factors interact to shape the cost of trading and what this means for market participants.

Liquidity: The Lifeblood of the Market

Liquidity refers to the ease with which an asset can be bought or sold in the market without significantly affecting its price. In a highly liquid market, such as major currency pairs during peak trading hours, the Forex Spread tends to be narrow. This is because numerous buyers and sellers contribute to a competitive pricing environment. When liquidity is abundant, market makers can quote tighter spreads since there is less risk of drastic price changes.

Consider this exchange from a seasoned analyst, Dana:

Dana: "High liquidity is like oil in a finely tuned engine—it keeps everything running smoothly, ensuring that spreads remain tight and trading costs low." Colleague: "That’s true. On the flip side, a drop in liquidity can suddenly widen the spread, catching even the most experienced traders off guard."

Volatility: The Measure of Uncertainty

Volatility, defined as the degree of variation in a currency pair’s price over time, is another key factor influencing the Forex Spread. When volatility is high, market participants become more cautious, and liquidity providers widen the spread to compensate for the increased risk. Volatility can be driven by geopolitical events, economic data releases, or unexpected market news.

In periods of market turbulence, such as during major elections or central bank policy shifts, spreads may widen dramatically. This widening is a risk management tool used by liquidity providers to mitigate potential losses from rapid price fluctuations. Volatility indicators, such as the Average True Range (ATR), are commonly used by traders to gauge this risk and adjust their strategies accordingly.

The Interplay Between Liquidity and Volatility

The relationship between liquidity and volatility is intricate. In a market where liquidity is low, even moderate volatility can lead to disproportionately wide spreads. Conversely, in markets characterized by high liquidity, even significant volatility might result in only a modest increase in the spread. This delicate balance underscores the importance of continuously monitoring both factors as part of a comprehensive trading strategy.

Key Points to Consider:

Market Sessions: During overlapping trading sessions (for example, the European and North American sessions), liquidity increases, leading to narrower spreads.

Economic News Releases: Sudden bursts of volatility around economic announcements can temporarily disrupt liquidity, resulting in wider spreads.

Algorithmic Trading: Advanced trading algorithms adjust their spread quotations in real-time based on evolving liquidity and volatility, adding another layer of complexity to market dynamics.

Practical Implications for Traders

Understanding how liquidity and volatility influence the Forex Spread is crucial for effective risk management. Traders can employ several strategies to mitigate the risks associated with wide spreads:

Time Your Trades: Avoid entering positions during low-liquidity periods or immediately before major economic announcements.

Utilize Technical Indicators: Use volatility indicators in conjunction with liquidity metrics to determine the optimal times for trade execution.

Adjust Position Sizing: When spreads widen due to high volatility, consider adjusting your trade size to manage risk more effectively.

A Data-Driven Perspective

Below is a concise table that illustrates hypothetical data on liquidity and volatility across various market sessions for a select group of currency pairs:

This table provides a snapshot of how liquidity and volatility might vary across different sessions and currency pairs. By examining such data, traders can tailor their strategies to optimize trade entries and exits based on real-time market conditions.

Reflecting on Market Experience

Reflecting on past market experiences, many seasoned traders recount times when a sudden drop in liquidity or a spike in volatility led to unexpected losses—or, in some cases, lucrative opportunities. One veteran commented during an industry roundtable, “The true test of a trader’s acumen lies in navigating the twin challenges of liquidity and volatility. They are the two sides of the same coin in Forex Spread management.”

By thoroughly understanding these influencers, market participants can better anticipate changes in the spread, adjusting their strategies proactively. This awareness, coupled with robust data analysis, empowers traders to mitigate risks and capitalize on fleeting market opportunities.

4. Economic Indicators and Their Impact on Forex Spread

Economic indicators are among the most influential factors in the foreign exchange market, affecting not only the value of currencies but also the dynamics of the Forex Spread. In this section, we examine how economic data—ranging from employment reports to central bank announcements—shapes market behavior and influences the bid-ask differential.

The Role of Economic Data

Economic indicators such as GDP growth, unemployment rates, inflation figures, and manufacturing indices provide insights into the overall health of an economy. When these indicators point to robust economic performance, confidence in a currency tends to increase, thereby attracting more trading activity. This increased activity usually results in tighter Forex Spreads due to improved liquidity.

Conversely, disappointing economic data can lead to uncertainty and risk aversion. In such cases, liquidity providers may widen the spread to shield themselves against potential losses. For example, a sudden downturn in a country’s manufacturing sector might prompt market participants to demand higher premiums for the risk associated with trading that currency pair.

Central Bank Policies and Their Influence

Central banks play a pivotal role in influencing the Forex Spread through monetary policies. Interest rate decisions, quantitative easing programs, and forward guidance are all factors that can affect both currency valuation and market liquidity. Consider the following dialogue between two financial experts during a recent webinar:

Lydia: "When the central bank signals a potential interest rate cut, the ensuing uncertainty usually leads to wider spreads as market makers brace for volatility." Marcus: "Indeed. The anticipation of policy shifts often translates into cautious pricing, which we see reflected in the bid-ask differences."

This exchange illustrates how central bank communications can trigger market responses, leading to adjustments in the Forex Spread. Traders often monitor central bank announcements closely, as even a slight change in tone can alter market dynamics significantly.

Global Economic Events and Their Ripple Effects

Beyond individual economic reports, global events such as trade disputes, geopolitical tensions, and natural disasters also play a role in shaping Forex Spreads. Such events can disrupt normal trading patterns and create a ripple effect that extends across multiple currency pairs. The interconnectedness of global markets means that a crisis in one region can lead to wider spreads in seemingly unrelated markets.

Economic Impact Breakdown:

Inflation Data: Higher-than-expected inflation can prompt central banks to tighten monetary policy, which may reduce liquidity and widen spreads.

Employment Figures: Strong employment numbers typically boost market confidence, leading to tighter spreads due to increased trading activity.

Consumer Spending: Robust consumer spending signals economic health, attracting liquidity and thus narrowing the Forex Spread.

A Comprehensive Look at the Data

The interplay between economic indicators and Forex Spread is best understood through data. The table below summarizes hypothetical data points that illustrate this relationship:

This table serves as a reference for understanding how various economic indicators might influence liquidity and, consequently, the Forex Spread. It is important for traders to integrate such data into their decision-making processes, ensuring that their strategies reflect real-time economic realities.

Integrating Economic Insights into Trading Strategies

For market professionals, the ability to interpret economic indicators in the context of Forex Spread is invaluable. Here are some practical approaches:

Monitor Economic Calendars: Keep track of upcoming economic releases and central bank meetings to anticipate changes in market conditions.

Use Technical Analysis in Tandem: Combine economic data with technical analysis tools to gauge the likely impact on spreads.

Adopt a Flexible Approach: Adjust your trading strategy based on real-time economic news. In periods of high uncertainty, consider reducing trade sizes or widening stop-loss levels to manage risk.

A Personal Narrative on Economic Data

During a particularly volatile period last year, I recall a conversation with a fellow analyst, Rebecca, who emphasized the importance of reading economic signals. “When I see the unemployment rate drop unexpectedly, I know it’s time to pay closer attention to my spread metrics,” she explained. This personal insight resonated with me, highlighting the critical link between economic performance and trading costs.

Economic indicators not only shape market expectations but also serve as a barometer for risk management in Forex Spread. By staying attuned to these signals, traders can better navigate the complexities of the market, ensuring that they remain agile in the face of rapid changes.

5. Technological Advances and Forex Spread Dynamics

The evolution of technology has revolutionized every aspect of the foreign exchange market, including the dynamics of the Forex Spread. In this section, we explore how innovations in trading platforms, algorithmic systems, and data analytics have transformed spread management, making markets more accessible and efficient.

The Digital Transformation of Trading

Over the past two decades, the digitalization of trading systems has brought about a paradigm shift in how Forex Spread is determined and managed. Automated trading platforms and high-speed data feeds allow liquidity providers to adjust bid and ask prices in real-time. This digital transformation has contributed to narrower spreads during periods of high market activity, as computational efficiency ensures that pricing remains competitive.

Algorithmic Trading and Real-Time Adjustments

Algorithmic trading systems play a crucial role in managing Forex Spread. These systems analyze vast amounts of market data within milliseconds, identifying opportunities and adjusting spreads to balance supply and demand. During a panel discussion at a recent fintech conference, one expert stated, “The speed at which algorithms can process information and recalibrate the spread is nothing short of remarkable. It’s a game changer for risk management.” Such advancements have not only improved market efficiency but have also increased transparency for retail and institutional traders alike.

Data Analytics and Predictive Modeling

Advancements in data analytics have further enhanced the ability to forecast changes in the Forex Spread. Predictive models, which leverage historical data and machine learning techniques, help traders anticipate periods of high volatility or low liquidity. These models incorporate a myriad of variables—from trading volume and economic indicators to geopolitical events—to provide a comprehensive outlook on market conditions.

Key Technological Features:

High-Speed Data Feeds: Enable real-time tracking of bid and ask fluctuations.

Automated Execution: Minimizes human error and ensures rapid trade execution.

Predictive Analytics: Helps forecast potential spread fluctuations based on historical trends.

A Glimpse into the Future

Reflecting on the current state of technological innovation, it is clear that the impact on Forex Spread dynamics will only intensify. Future advancements are likely to include even more sophisticated AI-driven models, enhanced data visualization tools, and further integration of blockchain technology to ensure greater transparency and security in trade execution.

Dialogues and Anecdotes

During a candid conversation with a respected colleague, Liam, he remarked, “Every time I see a breakthrough in algorithmic trading, I feel the pulse of innovation shifting the market landscape. The way technology continuously reshapes the Forex Spread is both inspiring and challenging.” Such remarks underscore the importance of staying updated on technological trends to maintain a competitive edge.

Practical Implications for Market Participants

For traders and investors, embracing technological advancements is essential. Consider the following actionable tips:

Stay Informed: Regularly review updates on trading technology and platform enhancements.

Invest in Training: Develop proficiency in using algorithmic tools and data analytics software.

Collaborate with Tech Experts: Work closely with technology professionals to optimize trading strategies in response to changing market conditions.

Technological progress has democratized access to sophisticated trading tools, enabling a wider range of participants to engage in the Forex market. By leveraging these tools, traders can achieve a more nuanced understanding of the Forex Spread and execute trades with greater precision.

6. Real-world Application and Risk Management in Forex Spread

While theoretical knowledge is essential, the true test of understanding Forex Spread comes in real-world application. This section delves into practical strategies for managing risk, optimizing trade execution, and ensuring that the spread remains a manageable cost rather than an unforeseen liability.

Practical Strategies for Spread Management

Successful market participants combine a robust understanding of Forex Spread with concrete risk management techniques. Here are some strategies that have proven effective in live trading scenarios:

Adaptive Order Types: Utilize limit orders and stop-loss orders to control entry and exit points, reducing the impact of sudden spread fluctuations.

Dynamic Position Sizing: Adjust trade sizes based on current spread conditions to minimize exposure during periods of high volatility.

Regular Spread Analysis: Incorporate routine analysis of spread trends into your daily trading routine. This can help identify when market conditions are favorable or when caution is warranted.

Risk Management Techniques

Risk management in Forex trading is as much an art as it is a science. The following techniques are widely adopted to ensure that the Forex Spread does not erode trading capital:

Hedging Strategies: Implementing hedging techniques can help offset potential losses when spreads widen unexpectedly.

Diversification: Spreading trades across multiple currency pairs can reduce the impact of adverse movements in any single market.

Technical and Fundamental Analysis Integration: Combine chart analysis with economic insights to gauge the likely behavior of spreads during volatile periods.

Engaging Dialogue on Real-World Experience

During an informal discussion at a recent workshop, a veteran market practitioner, Elena, shared her insights:

Elena: "I remember a day when the spread on a major pair suddenly doubled during a key economic announcement. It was a wake-up call—one that reinforced the need for robust risk controls." Peer: "That’s when I realized the importance of not just relying on automated systems, but also keeping a close eye on market news and adjusting strategies on the fly."

Such exchanges highlight that managing Forex Spread is not just about numbers—it’s about understanding market behavior, staying agile, and being prepared for the unexpected.

Tools and Techniques for Monitoring Spreads

In today’s digital age, a variety of tools are available to help traders monitor the Forex Spread in real time:

Charting Software: Advanced charting platforms allow for the visualization of spread movements alongside price action.

Economic Calendars: Real-time economic calendars provide alerts on upcoming events that could impact spread dynamics.

Risk Management Platforms: Dedicated software solutions help traders model different scenarios and adjust their risk profiles accordingly.

A Real-World Case Study

Consider the case of a mid-sized investment firm that specializes in foreign exchange trading. During a period of political uncertainty in a major economy, the firm observed a significant widening of the Forex Spread. The risk management team swiftly recalibrated their strategy, reducing position sizes and diversifying their currency exposure. Within days, as market conditions stabilized, they gradually increased their exposure again. This case underscores the importance of a flexible, responsive approach to spread management.

Practical Tips for Traders

Monitor Real-Time Data: Always keep an eye on the live spread, especially during periods of economic or political turbulence.

Stay Connected: Engage with the trading community through forums and discussion groups. Shared experiences can provide invaluable insights.

Review and Adjust: Regularly review your risk management strategy and make necessary adjustments based on evolving market conditions.

By integrating these practices, traders can ensure that the Forex Spread remains a controlled and manageable element of their overall trading strategy, rather than a hidden cost that erodes potential profits.

7. The Future of Forex Spread and Market Innovations

Looking forward, the landscape of Forex Spread is poised for continued evolution. In this final detailed chapter, we explore the future trends and innovations that are likely to shape the bid-ask dynamics and the broader foreign exchange market.

Emerging Trends and Innovations

Several trends point toward a future where Forex Spread dynamics will become even more refined:

Artificial Intelligence and Machine Learning: These technologies will drive more predictive models for spread behavior, enabling traders to anticipate market movements with greater accuracy.

Blockchain and Distributed Ledger Technology: Enhanced transparency and security in trade execution are expected to reduce counterparty risks and potentially narrow spreads.

Integration of Big Data Analytics: Real-time processing of vast datasets will offer deeper insights into market conditions, allowing liquidity providers to adjust spreads more dynamically.

Anticipated Market Shifts

The evolution of market structure will likely lead to a more democratized trading environment. As technology further reduces transaction costs, even retail traders may experience tighter spreads similar to those enjoyed by institutional players. This shift could result in a more competitive marketplace, with benefits including:

Lower Transaction Costs: Tighter spreads will directly translate into lower costs for traders, enhancing overall market efficiency.

Increased Market Participation: As barriers to entry are reduced, a broader range of participants will contribute to market liquidity.

Enhanced Risk Management: Improved forecasting and real-time analysis will enable more sophisticated risk management strategies.

A Visionary Dialogue

During a roundtable discussion on market innovation, a prominent economist, Dr. Stevens, remarked:

Dr. Stevens: "The future of Forex Spread is intertwined with technology. As we refine our analytical tools, the spread will become not just a cost factor but a dynamic indicator of market health." Moderator: "So, do you see a future where spreads could be almost negligible?" Dr. Stevens: "Potentially, yes. But with lower spreads comes the need for heightened vigilance. The market will always reward those who remain adaptive and informed."

Strategic Considerations for the Future

Traders should begin to incorporate emerging technologies and data analytics into their strategic planning:

Invest in Technology: Allocating resources to upgrade trading platforms and analytical tools can pay dividends in a rapidly evolving market.

Continuous Learning: As market innovations emerge, ongoing education and adaptation will be essential. Engage with industry experts, attend seminars, and read the latest research to stay ahead.

Scenario Planning: Develop strategies that account for both the promise of lower spreads and the inherent risks of a more dynamic trading environment.

Final Thoughts on Market Innovations

The future of Forex Spread promises a blend of opportunity and challenge. While technology is expected to streamline trading costs and improve market transparency, it also demands that traders remain agile, informed, and ready to adjust their strategies. The path ahead is one of continual evolution, where each advancement in data science and trading technology opens new avenues for both profit and risk management.

Conclusion

In closing, our exploration of Forex Spread has taken us through its fundamental concepts, the intricate dance between bid and ask prices, and the influential factors of liquidity, volatility, and economic indicators. We delved into how technological innovations have reshaped spread dynamics, and examined practical strategies for managing risks in live market scenarios. The dialogues and personal narratives interwoven throughout this article have underscored the human element behind every trade—illustrating that Forex Spread is more than just a numeric difference; it is a dynamic reflection of market sentiment and an essential tool in the trader’s arsenal.

As we look to the future, the interplay between technology and market behavior promises to refine the mechanics of Forex Spread even further. For traders, embracing these changes while maintaining a strong focus on risk management will be key to navigating an increasingly competitive environment. This article is a testament to the depth and complexity of the foreign exchange market—a realm where every pip tells a story and every spread serves as a guidepost for opportunity and risk.

Actionable Insights

Stay Informed: Regularly review market news and economic calendars.

Invest in Technology: Upgrade your trading tools to take advantage of real-time data and predictive analytics.

Engage in Continuous Learning: Participate in industry forums, seminars, and professional discussions.

Adapt Strategies: Be ready to adjust trade sizes and risk controls in response to changing spread conditions.

The Forex market continues to evolve, and with it, the strategies for managing Forex Spread will undoubtedly adapt. By maintaining a focus on analytical rigor and technological integration, traders can turn the intricacies of bid-ask differences into a strategic advantage.

Bibliography

Financial Times, “How Market Liquidity Affects Forex Spreads,” Financial Times Analysis Reports, 2023.

Bloomberg, “Central Bank Policies and the Impact on Forex Trading Costs,” Bloomberg Markets, 2022.

Reuters, “Technological Innovations in Forex Trading: A New Era,” Reuters Special Reports, 2023.

Investopedia, “Understanding Bid-Ask Spreads in Forex Trading,” Investopedia Education, 2021.

0 notes

Text

Gold, Silver, and Forex Trends This Week

Gold

Gold prices are inching closer to historic highs as expected, with the MACD and RSI reflecting increasing volume and buying momentum. The rise is driven by growing insecurity due to geopolitical distress, uncertainty around the dollar, and the potential tariffs to be imposed by Trump. Market expectations remain bullish, with a continuation of the uptrend likely in the coming sessions. Traders leveraging quantitative forex models can optimize their strategies to capitalize on this momentum.

Silver

Silver prices have also moved higher following renewed dollar strength. The MACD indicates increased buying volume, though the RSI is yet to normalize as it signals overbought levels. The market remains in a bullish trend, and we expect further price appreciation in the coming days. Compounding forex profits strategies may be beneficial in this scenario.

DXY

The dollar is seeing increased gains after yesterday’s session, though gold continues to hold above it due to prevailing uncertainty. The MACD is losing strength, while the RSI had previously called for overbought conditions. Current price action is not showing any clear momentum, but the initial expectation of price testing the EMA200 remains valid. Traders using regulated MetaTrader platforms can track key support and resistance levels for optimal entries.

GBPUSD

The pound remains in consolidation with no significant change from last week. However, the MACD is beginning to reflect increased bullish volume, while the RSI is showing signs of building bullish momentum. A break above 1.26163 would confirm a bullish continuation, but we await more price action before drawing firm conclusions.

AUDUSD

The Australian dollar remains directionless, with the market still in a phase of hesitation. The MACD is showing signs of renewed buying, yet the RSI is reflecting exaggerated buying conditions despite a squeeze in price action. Given these mixed signals, we will wait for further price movements to provide a clearer outlook. Forex scalping automation may help traders navigate short-term fluctuations.

NZDUSD

The Kiwi is still in the process of shifting after muted movement yesterday. While prices edged lower, the move was not significant enough to raise concerns. The RSI is balancing between overbought and oversold conditions, suggesting a normalization of bearish momentum. Although the MACD is about to cross upward, this could be a temporary retracement before a larger move downward. With prices nearing the EMA200 at 0.56859, we expect markets to continue in this pattern, and we will wait for further price action to confirm direction. Hedging with multiple currencies may help mitigate risk in uncertain market conditions.

EURUSD

Euro prices remain within their consolidation range, yet to test the EMA200 or the lower zone of the range. Market movement has aligned with expectations, showing increased consolidation. The MACD is nearing a bullish crossover at the lower boundary, while the RSI remains neutral. No changes in our outlook at this time.

USDJPY

The yen is currently being tested without clear movement in either direction. We anticipate increased buying pressure but also see potential for continued sideways trading. More price action in the coming days will be needed to determine market progression.

USDCHF

The franc remains in a bearish trend, with the likelihood of continued selling in the coming hours. The MACD has just crossed downward after showing strong volume toward the EMA200. The RSI remains sideways, signaling indecision. We expect a test of the EMA200 before making a definitive call on direction.

USDCAD

The Canadian dollar has shown little movement, with another muted day failing to push prices away from current levels. There are no changes in our reading, and we will continue monitoring price action for clearer signals.

COT Reports Analysis

AUD - WEAK (4/5)

GBP - WEAK (2/5)

CAD - WEAK (4/5)

EUR - WEAK (5/5)

JPY - STRONG (5/5)

CHF - WEAK (4/5)

USD - STRONG (5/5)

NZD - WEAK (5/5)

GOLD - STRONG (4/5)

SILVER - STRONG (4/5)

Traders incorporating quantitative forex models can enhance their decision-making, while compounding forex profits remains a strategic approach in fluctuating markets. Utilizing forex scalping automation and executing trades on regulated MetaTrader platforms provide an edge in this dynamic forex landscape. Moreover, hedging with multiple currencies can be an effective risk management tool against market fluctuations.

Stay tuned for further updates on market trends and technical insights!

0 notes

Text

FREE FOREX SIGNAL FRANCE

The foreign exchange (forex) market is a global platform for trading currencies, offering opportunities for profit through the fluctuation of exchange rates. In France, forex trading is both legal and well-regulated, providing a secure environment for traders. This article delves into the essentials of forex trading in France, including its definition, initiation steps, regulatory framework, and the role of liquidity providers.

What Does Forex Mean?

Forex, or foreign exchange, involves the buying and selling of currencies to profit from changes in exchange rates. It’s the largest financial market globally, with a daily turnover exceeding $6 trillion. The market operates 24 hours a day during weekdays, facilitating continuous trading across different time zones. Liquidity, defined as the ease with which an asset can be bought or sold without affecting its price, is a crucial aspect of the forex market. High liquidity ensures that trades can be executed swiftly and efficiently.

forexbankliquidity.com

How Can I Start Forex Trading in France?

Embarking on forex trading in France involves several key steps:

Educate Yourself: Gain a solid understanding of forex markets, trading strategies, and risk management. Numerous online resources, courses, and books are available to build your knowledge base.

Choose a Reliable Broker: Select a forex broker that is authorized to operate in France and complies with the regulations set by the Auto rites des Marches Financiers (AMF). Reputable brokers offer user-friendly platforms, competitive spreads, and robust customer support. Some of the top forex brokers in France include Saxo Bank, Fusion Markets, and CMC Markets.

Broker Chooser

Open a Trading Account: After selecting a broker, open a trading account by providing the necessary identification documents and completing the registration process.

Practice with a Demo Account: Many brokers offer demo accounts that allow you to practice trading with virtual funds, helping you to familiarize yourself with the platform and develop trading strategies without risking real money.

Fund Your Account: Once confident, deposit funds into your trading account using the broker’s accepted payment methods.

Start Trading: Begin trading by analyzing the market, placing orders, and managing your positions. It’s essential to implement risk management techniques, such as setting stop-loss orders, to protect your investments.

Regulatory Framework in France

Forex trading in France is legal and regulated by the AMF, ensuring a secure trading environment. The AMF enforces strict rules on leverage, negative balance protection, and transparency to protect traders. Additionally, as a member of the European Union, France adheres to the regulations set by the European Securities and Markets Authority (ESMA), which standardize financial markets across EU member states.

Day Trading

The Role of Liquidity Providers

Liquidity providers are crucial in the forex market, ensuring that traders can execute orders efficiently. They are typically large financial institutions or specialized firms that act as counterparties in trades, offering buy and sell prices for currency pairs. This availability of liquidity facilitates smooth transactions and contributes to market stability. For traders in France, understanding the role of liquidity providers can aid in selecting brokers that offer optimal trading conditions.

Taxation and Legal Considerations

In France, profits from forex trading are subject to taxation. It’s essential to maintain accurate records of all trading activities and consult with a tax professional to ensure compliance with French tax laws. Additionally, traders should be aware of any legal considerations, such as the recently discussed financial transaction tax (often referred to as the “Tobin tax”), which could impact trading activities.

Risks and Considerations

While forex trading offers the potential for profit, it’s important to be aware of the risks involved. The use of leverage can amplify both gains and losses, and market volatility can lead to unexpected price movements. It’s crucial to implement sound risk management strategies, such as setting stop-loss orders and not risking more than a certain percentage of your trading capital on a single trade. Additionally, staying informed about global economic events and political developments can help in making informed trading decisions.

Conclusion

Forex trading in France presents a viable opportunity for individuals interested in the financial markets. By understanding the fundamentals of forex trading, adhering to regulatory requirements, and implementing effective risk management strategies, traders can navigate the forex market with confidence. Continuous education and staying informed about market developments are key to achieving long-term success in forex trading.

#ForexForBeginners #ForexEducation #TradingSuccess #forex #education #forexsignals #forex #robot #forex #expert #advisor #forexbankliquidity #bankliquidity #forexmarket #forex #digitalmarketing #forextrading

#forex #education #forexsignals #forex #robot #forex #expert #advisor #forexbankliquidity #bankliquidity #forexmarket #forex #digitalmarketing #forextrading

0 notes

Text

Understanding Forex Terms and Definitions: A Beginner's Guide

The foreign exchange (forex) market can be complex, especially for beginners who are just starting to explore currency trading. Understanding the key forex terms and definitions is essential for navigating this vast financial landscape. Whether you're looking to trade or simply want to gain insight into the forex world, this guide will help you decode the jargon and get a solid grasp of the fundamental concepts.

Forex (Foreign Exchange)

Forex, or foreign exchange, refers to the global market where currencies are traded. It’s the largest financial market in the world, with an average daily turnover exceeding $6 trillion. In forex trading, currencies are bought and sold in pairs, such as EUR/USD or GBP/JPY.

Currency Pair

A currency pair consists of two currencies, the first being the base currency and the second being the quote currency. The exchange rate tells you how much of the quote currency is needed to buy one unit of the base currency. For example, in the currency pair EUR/USD, EUR is the base currency, and USD is the quote currency.

Pip (Percentage in Point)

A pip is the smallest unit of price movement in the forex market. It typically refers to the fourth decimal place in currency pairs. For instance, if the EUR/USD moves from 1.1100 to 1.1101, it has moved one pip. Understanding pips is essential for measuring profits and losses.

Lot

In forex trading, a lot refers to the volume or size of a trade. A standard lot is equivalent to 100,000 units of the base currency. There are also mini lots (10,000 units) and micro lots (1,000 units) that allow traders to control smaller amounts of currency, which is particularly helpful for beginners.

Leverage

Leverage is a tool that allows traders to control a larger position in the market with a smaller amount of capital. For example, with 100:1 leverage, you can control $100,000 worth of currency with just $1,000 of margin. While leverage can magnify profits, it also increases the risk of significant losses.

Spread

The spread is the difference between the buying price (ask) and the selling price (bid) of a currency pair. It’s essentially the broker’s fee for facilitating the trade. In highly liquid markets, such as EUR/USD, the spread is usually smaller, while in less liquid pairs, the spread can be larger.

Margin