#Defi wallet

Explore tagged Tumblr posts

Text

Dunitech Soft Solutions offers a cutting-edge DeFi Wallet Development Solution designed to empower users with secure, decentralized access to their digital assets. Our solutions are tailored to provide seamless integration, robust security, and multi-currency support, ensuring an intuitive experience for managing cryptocurrencies and DeFi transactions. By leveraging blockchain technology, we enable businesses and individuals to embrace financial independence with trustless, transparent, and scalable wallet solutions. Choose Dunitech for your DeFi wallet needs and unlock the future of decentralized finance today.

0 notes

Video

youtube

Why We Need Defi Wallet and Defi Exchanges!! Invest in the Future Right ...

#youtube#best#best wallet#wallet#news#make money#metamask#defi#defi wallet#exchange#crypto#krypto#trump#trumpcoin#melania#melaniacoin

0 notes

Text

Demystifying Chainlink: The Backbone of Decentralized Oracles

In the rapidly evolving world of blockchain technology, decentralized finance (DeFi) and smart contracts have gained significant traction. However, one critical challenge facing these platforms is accessing real-world data in a secure and reliable manner. This is where Chainlink comes into play. In this blog, we’ll delve into the fundamentals of Chainlink, its role as a decentralized oracle…

View On WordPress

0 notes

Text

Secure Your Crypto Journey - Introducing Nadcab Labs Advanced DeFi Wallet

In the dynamic world of decentralized finance (DeFi), securing digital assets against unauthorized access and regulatory uncertainties has become paramount. Nadcab Labs, a trailblazer in blockchain innovation, introduces a groundbreaking solution designed to address these challenges head-on. Their latest offering, a DeFi Wallet, is engineered to provide unparalleled security against hacks and immunity to cross-border regulations, setting a new standard in the safeguarding of digital assets.

DeFi platforms have democratized access to financial services, allowing users to lend, borrow, and trade assets without the intermediaries that characterize traditional banking. However, this increased accessibility comes with heightened risks, notably from cyber threats and regulatory discrepancies across jurisdictions. Recognizing these challenges, Nadcab Labs has developed a DeFi Wallet that not only mitigates these risks but also enhances user confidence in managing their digital assets.

The core of Nadcab Labs DeFi Wallet's security architecture is its advanced encryption and private key safeguarding mechanisms. Unlike conventional wallets, which may be vulnerable to security breaches, this wallet utilizes cutting-edge cryptographic techniques to ensure that users assets are virtually impregnable to unauthorized access. This security feature is crucial in a landscape where the sophistication of cyber-attacks continues to escalate.

Moreover, the DeFi Wallet by Nadcab Labs is designed with a keen understanding of the global nature of digital assets. It offers users immunity from cross-border regulatory pressures that can affect the accessibility and usability of assets across different geographies. By leveraging blockchain's inherent decentralization, the wallet operates beyond the reach of singular regulatory frameworks, ensuring that users can manage their assets seamlessly, regardless of their location.

Nadcab Labs commitment to innovation extends beyond security and regulatory solutions. The DeFi Wallet also boasts user-friendly interfaces and functionalities that cater to both novice and experienced users. Whether it's executing complex trading strategies or simply managing a portfolio of digital assets, the wallet's intuitive design ensures that all actions can be performed with ease and precision.

Furthermore, the DeFi Wallet is integrated with a wide array of DeFi platforms and services, providing users with the flexibility to engage in a broad spectrum of financial activities. From yield farming and liquidity mining to staking and beyond, the wallet serves as a gateway to the full potential of decentralized finance.

In conclusion, Nadcab Labs DeFi Wallet represents a significant leap forward in the evolution of digital asset management. By prioritizing security against hacks and ensuring immunity to cross-border regulations, it offers a robust, versatile, and user-friendly solution for the DeFi community. As the digital finance landscape continues to evolve, the DeFi Wallet by Nadcab Labs stands out as a beacon of innovation, empowering users to navigate the DeFi space with confidence and security.

0 notes

Text

Blockchain Will Give You $5 Of Bitcoin

Sign up using link below along with referral code "HY4C612E". Complete identity verification. Buy $100 of crypto.

#crypto#referral codes#referral links#driskol referrals#driskolestate#bitcoin#ethereum#btc#eth#CRO#Blockchain#compound interest#Defi Wallet#noncustodial wallet#ADA#Cardano

0 notes

Text

Unlocking the Power of DeFi: How a Wallet Can Help You Access the World of Decentralized Finance

Secure Storage: A DeFi wallet provides a secure and non-custodial storage solution for your cryptocurrencies and tokens. You have full control over your private keys, reducing the risk of hacks and ensuring the safety of your assets.

Access to DApps: DeFi wallets often come with built-in DApp browsers that allow you to seamlessly interact with a wide range of DeFi applications and services. You can explore decentralized lending, borrowing, trading, yield farming, and more directly from your wallet.

Decentralized Exchanges (DEXs): DeFi wallets enable you to trade cryptocurrencies and tokens on decentralized exchanges like Uniswap, SushiSwap, and PancakeSwap. You can swap one asset for another directly from your wallet without relying on centralized exchanges.

Liquidity Provision: Many DeFi wallets allow you to provide liquidity to DEXs and earn fees and rewards in return. You can become a liquidity provider by contributing your assets to liquidity pools and enhancing the liquidity of the DeFi ecosystem.

Yield Farming: DeFi wallets offer easy access to yield farming platforms, where you can lock your assets in DeFi protocols to earn rewards, such as interest or governance tokens. Your wallet helps you manage your farming positions and track your earnings.

Borrowing and Lending: With a DeFi wallet, you can participate in decentralized lending and borrowing platforms, where you can lend your assets for interest or borrow assets by providing collateral. Your wallet simplifies these processes.

Governance Participation: If you hold governance tokens for DeFi projects, your wallet allows you to participate in governance decisions, such as voting on protocol upgrades, changes, and proposals.

Asset Management: DeFi wallets offer a user-friendly interface for managing your assets. You can view your balances, transaction history, and portfolio analytics, allowing you to make informed investment decisions. Cross-Platform Compatibility:DeFi wallets are available as browser extensions, mobile apps, and desktop applications, making it easy to access the DeFi ecosystem from a variety of devices and platforms.

0 notes

Text

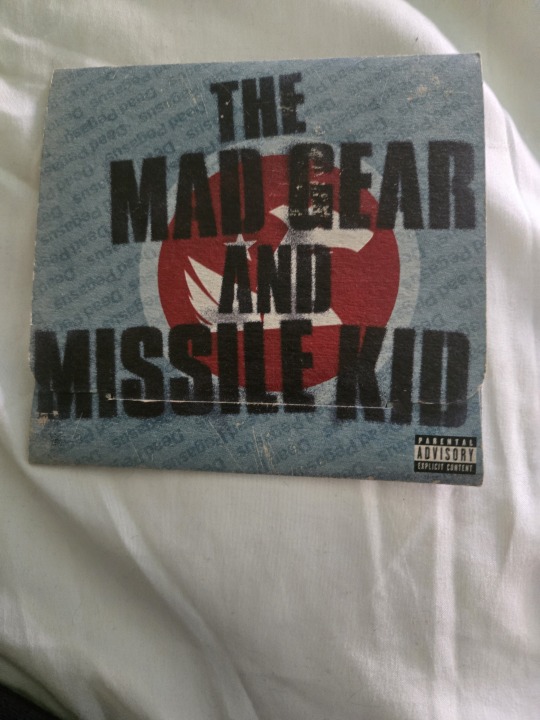

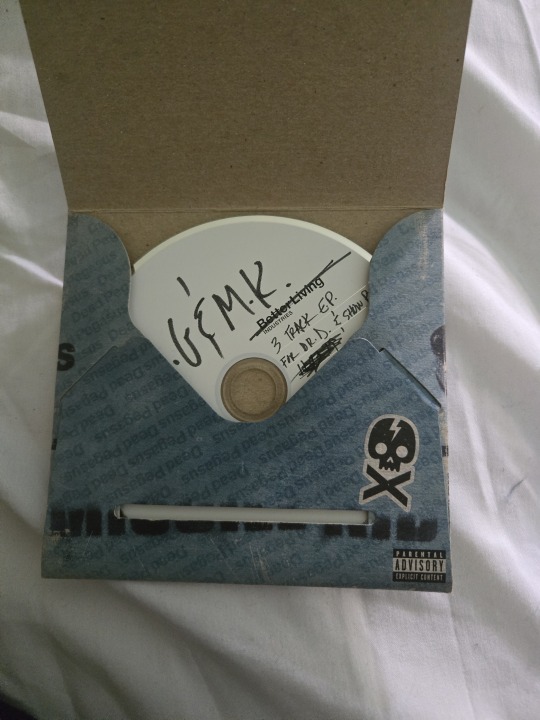

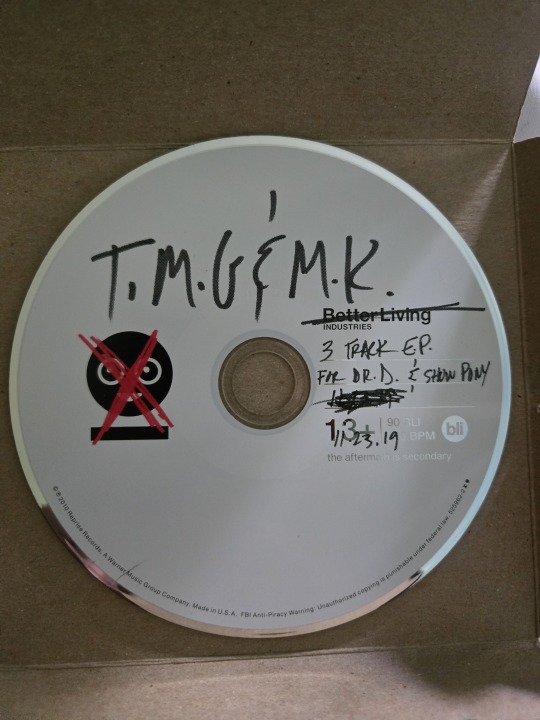

Guess who spent $275 on a fucking mad gear and missile kid cd 😍😍😍

#mad gear and missile kid#mad gear#Missile kid#danger days the true lives of the fabulous killjoys#danger days#mad gear and missile kid cd#Mcr collection#my chemical romance#Mcr#ftwww#Mastas of Ravenkroft#black dragon fighting society#show pony#Doctor Death-Defying#party poison#fun ghoul#kobra kid#jet star#bl/ind#the true lives of the fabulous killjoys#ttlotfk#my wallet is crying#But it's ok because mcr

65 notes

·

View notes

Text

Caw Crypto Price Prediction: Unveiling Future Market Trends

#Cryptocurrency#Blockchain#Crypto Trading#Crypto News#Crypto Analysis#Bitcoin#Ethereum#Altcoins#DeFi (Decentralized Finance)#Crypto Investing#Crypto Education#Crypto Market Updates#Crypto Wallets#Crypto Security#ICO (Initial Coin Offering)#NFTs (Non-Fungible Tokens)#Crypto Regulations#Crypto Mining#Crypto Trends#Crypto Exchange Reviews

12 notes

·

View notes

Text

🇬🇧 🇬🇧 🇬🇧 Robex is pleased to announce its collaboration with UK Broker Aeron Market.

This strategic partnership brings you an enhanced forex trading experience, combining automated trading solutions with expert guidance and exclusive market insights.

Enjoy unmatched security and maximise your trading potential effortlessly.

Partner with us now for a seamless, confident, and hassle-free trading journey - https://app.robex-ai.com/join/crypto-united/right

🇩🇪 🇩🇪 🇩🇪 Robex freut sich, seine Zusammenarbeit mit dem britischen Broker Aeron Market bekannt zu geben.

Diese strategische Partnerschaft bietet Ihnen ein verbessertes Forex-Handelserlebnis, das automatisierte Handelslösungen mit fachkundiger Anleitung und exklusiven Markteinblicken kombiniert.

Genießen Sie unübertroffene Sicherheit und maximieren Sie mühelos Ihr Handelspotenzial.

Werden Sie jetzt Partner von uns für ein nahtloses, sicheres und problemloses Handelserlebnis - https://app.robex-ai.com/join/crypto-united/right

#robex#robex ai#robexai#forex#forex ai#affiliate#bitcoin#defi#network#trader#wallet#ai#cryptocurrency#invest#blockchain

8 notes

·

View notes

Text

Secure DeFi Wallet Development: Ultimate Guide for Blockchain Solutions

This comprehensive guide to DeFi wallet development explores how blockchain technology can transform decentralized finance. It highlights key features like enhanced security, tokenized rewards, smart contract governance, and censorship resistance.

Designed for developers and blockchain enthusiasts, the blog offers insights into building user-friendly wallets that ensure privacy and seamless transactions. By addressing issues like data breaches and centralized control, this guide provides a roadmap for creating innovative and secure blockchain solutions.

A must-read for anyone in the decentralized finance space!

#defi wallet development#defi crypto lending platform development#Secure DeFi wallet development#blockchain development for defi#defi platform development#defi token development#defi lending platform development#defi lending and borrowing platform development#defi development#defi wallet app development#defi lending/ borrowing platform development#defi wallet development service#decentralized lending and borrowing platform development#defi blockchain development#lending borrowing platform development#defi development platform#defi development company#defi lending platform development services#defi platform development company#defi smart contract development#defi smart contract development company#defi smart contract development services#defi development services#defi development provider#crypto defi wallet development services

2 notes

·

View notes

Text

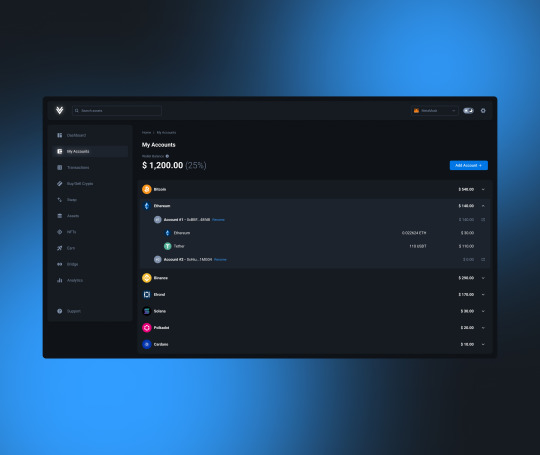

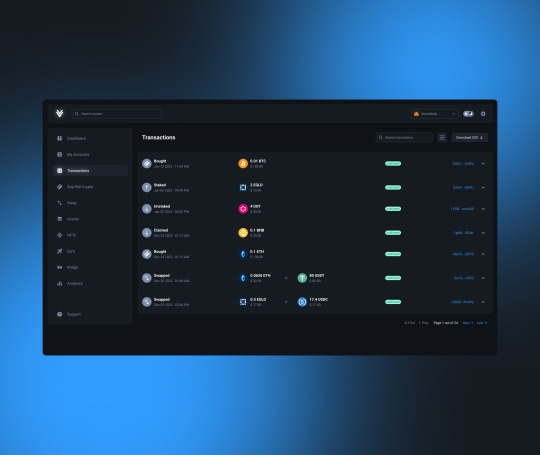

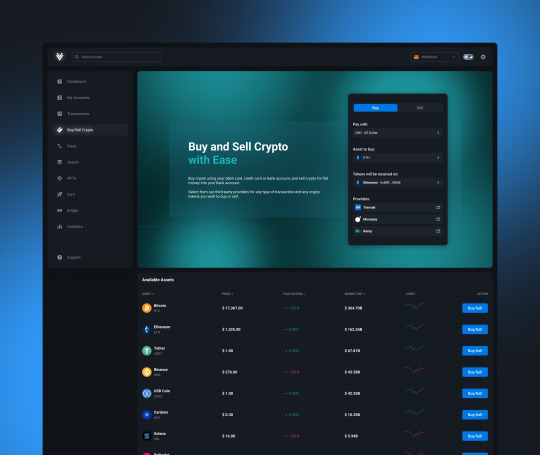

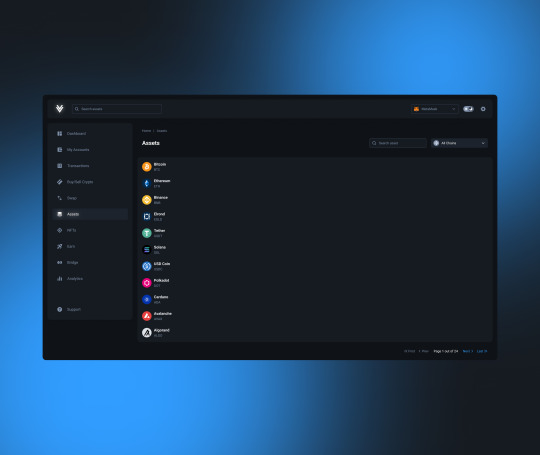

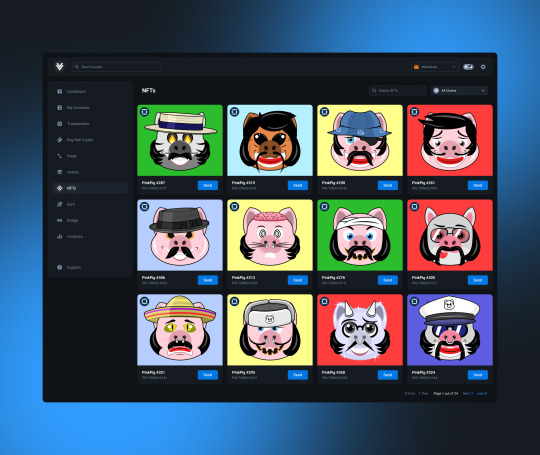

Vector Crypto DeFi Exchange - A Complete Figma UI Kit

Introducing the ultimate crypto DeFi exchange UI kit! This UI kit is a must-have for any designer looking to create a sleek and modern crypto exchange platform.

Download:

#figma#figmadesign#crypto#cryptocurrency#wallet#cryptowallet#defi#exchange#bitcoin#ethereum#solana#memecoin#framer#ux#ui#uikit#uiux#uxdesign#uidesign#nft#cryptocoin#binance#swap#not#notcoin

4 notes

·

View notes

Text

Unveiling the Potential of Helium: Revolutionizing Wireless Networks

In the ever-evolving landscape of cryptocurrencies, Helium has emerged as a unique player, focusing on revolutionizing wireless networks. Helium Crypto, powered by the Helium Blockchain, offers a decentralized approach to building and managing IoT (Internet of Things) devices and networks. In this blog, we’ll delve into the world of Helium, exploring its features, use cases, and the potential it…

View On WordPress

0 notes

Text

Flash Bitcoin

Flash Bitcoin is a type of cryptocurrency that is sent to your wallet but does not remain there permanently, as it is dependent on the software used to flash the coin. While flash bitcoin is indistinguishable from real bitcoin, the key difference lies in its temporary nature. These coins are generated by specific flash bitcoin software, which allows users to send fake bitcoin into the blockchain network for a designated period of time, typically 90 days

The Concept of Flash Bitcoin Flash Bitcoin operates on the premise of temporary digital currency. It is generated through specialized bitcoin flashing software, which allows users to send what appears to be real Bitcoin into the blockchain network. However, the key distinction lies in its ephemeral existence; after the designated time frame, these coins will vanish from the blockchain, leaving no trace behind. Telegram: https://t.me/DigitalVa0lt

WhatsApp: https://wa.me/+12568235121

How Does Flash Bitcoin Work? When you use flash bitcoin software, you can create and send these temporary coins to your wallet. During their lifespan, Flash Bitcoins function similarly to real Bitcoin, allowing for transactions and exchanges. This innovative approach enables users to engage in cryptocurrency activities without any initial investment, making it an attractive option for those looking to explore the crypto space.

Caution is Key While the allure of earning money through Flash Bitcoin is enticing, it is crucial to exercise caution. The world of cryptocurrency can be fraught with risks, especially when dealing with developers or vendors who may source their tools from the dark web. Conducting thorough research and ensuring you are dealing with reputable sources is essential to avoid potential scams or legal issues.

Where to Buy Flash Bitcoin If you’re interested in exploring the world of Flash Bitcoin, look no further than Digital Vault. They offer reliable access to flash bitcoin sales and the necessary software to get you started. You can reach out to them through the following contact details:

Telegram: https://t.me/DigitalVa0lt

WhatsApp: https://wa.me/+12568235121

By purchasing from a trusted source like Digital Vault, you can ensure that you are engaging with legitimate flash bitcoin technology and software.

In summary, Flash Bitcoin presents an intriguing opportunity for those looking to delve into the cryptocurrency market without upfront investment. However, it is vital to approach this technology with caution and to conduct thorough research. If you’re ready to explore the potential of Flash Bitcoin, consider reaching out to Digital Vault for your needs. Remember, knowledge is power, and being informed is your best defense in the world of cryptocurrency.

Telegram: https://t.me/DigitalVa0lt WhatsApp: https://wa.me/+12568235121

By purchasing from a trusted source like Digital Vault, you can ensure that you are engaging with legitimate flash bitcoin technology and software.

#bitcoin flash#flash bitcoin#bitcoin flashing software#flash bitcoin sales#flash bitcoin software#bitcoin#blockchain#flash usdt wallet#cryptocurrency#fintech#crypto#defi#altcoin

1 note

·

View note

Text

New-key-flash-usdt-currency

In the rapidly changing landscape of digital assets, innovative solutions are emerging to enhance the way we transact. One such solution is Flash USDT, a unique digital currency that offers a safe and effective method for trading in the digital asset market. This blog will explore what Flash USDT is, its features, and how you can purchase it securely. Reach out to them through the following contacts;

Telegram: Digital Vault ( https://t.me/Digitalva0lt )

WhatsApp: https://w.me/+12568235121

✅ USDT Flash ✅All Wallet ✅Transferable, ✅swappable ✅tradable

✅Understanding Flash USDT✅

Flash USDT is a temporary digital asset that allows users to transact with ease and security. For an investment of just $200, you can purchase $2000 worth of Flash USDT, with a minimum order of $2000. This makes it an attractive option for traders looking to maximize their investment potential. For those interested in larger transactions, the platform accommodates orders up to $10,000,000 for $1,000,000 worth of Flash USDT.

✅Key Features of Flash USDT✅

Temporary Existence: One of the most notable features of Flash USDT is that it disappears from any wallet after 60–240 days from the date it was received. This means that any crypto it has been converted to will also vanish after this period, ensuring a unique transactional experience.

Limited Transfers: Flash USDT can only be transferred a maximum of 35 times. This limitation adds an extra layer of security and control over the currency, making it a practical choice for cautious traders.

Conversion Flexibility: Flash USDT can be converted into any other type of cryptocurrency on an exchange. However, if it is restored, that coin will also disappear after 10 days, maintaining the temporary nature of the transaction.

✅Why Choose Flash USDT?✅

The flash usdt currency offers a practical and economical option for traders wishing to transact in large quantities. With a commitment to flawless transactions and the highest caliber of security, our platform ensures that your valuables are safeguarded throughout the process.

If you’re looking to engage in flash usdt purchase with Binance or explore other trading options, you can do so with confidence. The usdt flashing software and usdt flasher tools available make the process seamless and efficient.

Telegram: Digital Vault ( https://t.me/Digitalva0lt )

WhatsApp: https://w.me/+12568235121

✅How to Purchase Flash USDT✅

Ready to dive into the world of Flash USDT? You can easily purchase Flash USDT from Digital Vault. They provide a secure platform for your transactions and are dedicated to ensuring a smooth experience. Reach out to them through the following contact details:

Telegram: Digital Vault ( https://t.me/Digitalva0lt )

WhatsApp: https://w.me/+12568235121

✅By choosing Digital Vault, you can ensure that you are engaging with a reputable source for your flash usdt currency needs.✅

Flash USDT represents a groundbreaking approach to digital asset transactions, offering unique features that cater to the needs of modern traders. With its temporary nature and secure transaction process, it stands out as a viable option in the digital currency market. If you’re ready to explore the potential of Flash USDT, consider reaching out to Digital Vault for your purchase.

Telegram: Digital Vault ( https://t.me/Digitalva0lt )

WhatsApp: https://w.me/+12568235121

#flash usdt transaction#flash usdt software#flash usdt wallet#flash usdt currency#usdt flashing software#crypto#blockchain#flash usdt binance#flash usdt sender#bitcoin#flash usdt generator#fintech#cryptocurrency#defi

0 notes

Text

Exploring the Benefits of DeFi Wallets: Why You Should Consider Using Them

DeFi wallets include built-in decentralized exchange features, allowing users to easily swap one cryptocurrency for another without relying on centralized exchange.DeFi wallet development offer integration with various DeFi protocols to help users participate in yield farming and liquidity provision.

0 notes

Text

New-key-flash-usdt-currency

In the rapidly changing landscape of digital assets, innovative solutions are emerging to enhance the way we transact. One such solution is Flash USDT, a unique digital currency that offers a safe and effective method for trading in the digital asset market. This blog will explore what Flash USDT is, its features, and how you can purchase it securely. Reach out to them through the following contacts;

Telegram: Digital Vault ( https://t.me/Digitalva0lt )

WhatsApp: https://w.me/+12568235121

✅ USDT Flash ✅All Wallet ✅Transferable, ✅swappable ✅tradable

✅Understanding Flash USDT✅

Flash USDT is a temporary digital asset that allows users to transact with ease and security. For an investment of just $200, you can purchase $2000 worth of Flash USDT, with a minimum order of $2000. This makes it an attractive option for traders looking to maximize their investment potential. For those interested in larger transactions, the platform accommodates orders up to $10,000,000 for $1,000,000 worth of Flash USDT.

✅Key Features of Flash USDT✅

Temporary Existence: One of the most notable features of Flash USDT is that it disappears from any wallet after 60–240 days from the date it was received. This means that any crypto it has been converted to will also vanish after this period, ensuring a unique transactional experience.

Limited Transfers: Flash USDT can only be transferred a maximum of 35 times. This limitation adds an extra layer of security and control over the currency, making it a practical choice for cautious traders.

Conversion Flexibility: Flash USDT can be converted into any other type of cryptocurrency on an exchange. However, if it is restored, that coin will also disappear after 10 days, maintaining the temporary nature of the transaction.

✅Why Choose Flash USDT?✅

The flash usdt currency offers a practical and economical option for traders wishing to transact in large quantities. With a commitment to flawless transactions and the highest caliber of security, our platform ensures that your valuables are safeguarded throughout the process.

If you’re looking to engage in flash usdt purchase with Binance or explore other trading options, you can do so with confidence. The usdt flashing software and usdt flasher tools available make the process seamless and efficient.

Telegram: Digital Vault ( https://t.me/Digitalva0lt )

WhatsApp: https://w.me/+12568235121

✅How to Purchase Flash USDT✅

Ready to dive into the world of Flash USDT? You can easily purchase Flash USDT from Digital Vault. They provide a secure platform for your transactions and are dedicated to ensuring a smooth experience. Reach out to them through the following contact details:

Telegram: Digital Vault ( https://t.me/Digitalva0lt )

WhatsApp: https://w.me/+12568235121

✅By choosing Digital Vault, you can ensure that you are engaging with a reputable source for your flash usdt currency needs.✅

Flash USDT represents a groundbreaking approach to digital asset transactions, offering unique features that cater to the needs of modern traders. With its temporary nature and secure transaction process, it stands out as a viable option in the digital currency market. If you’re ready to explore the potential of Flash USDT, consider reaching out to Digital Vault for your purchase.

Telegram: Digital Vault ( https://t.me/Digitalva0lt )

WhatsApp: https://w.me/+12568235121

#flash usdt generator#flash usdt sender#flash usdt currency#flash usdt binance#flash usdt transaction#usdt flashing software#flash usdt wallet#flash usdt#flash usdt software#bitcoin#fintech#cryptocurrency#crypto#blockchain#defi

0 notes