#Debt Collection Agency Houston

Explore tagged Tumblr posts

Text

Why Hiring a Debt Collection Agency in Houston is a Smart Business Decision

Managing overdue accounts and recovering outstanding debts can be one of the most challenging aspects of running a business. Whether you're a small business owner or part of a larger company, dealing with clients or customers who haven't paid their bills can put a significant strain on your cash flow. Hiring a debt collection agency in Houston can be a smart solution to this problem. These professionals specialize in recovering unpaid debts, allowing you to focus on running your business while they handle the complexities of collections.

Potential Advantages of a Debt Collection Agency

One of the primary reasons businesses in Houston turn to debt collection agencies is their ability to recover funds efficiently. These agencies have the expertise and resources to track down debtors and employ effective collection strategies. By using professional services, you increase the chances of getting paid promptly, as debt collectors are experienced in negotiating with clients who may be avoiding payment. A professional agency understands how to deal with both individual and business debtors, ensuring that the process remains legal, ethical, and as stress-free as possible for you.

Expertise and Legal Compliance

Debt collection can be a tricky legal area, with many rules and regulations governing the process. A debt collection agency in Houston is well-versed in local, state, and federal laws, such as the Fair Debt Collection Practices Act (FDCPA), which protects debtors from harassment and unfair practices. This legal knowledge ensures that all collection efforts are conducted within the boundaries of the law, reducing the risk of potential lawsuits or other complications for your business. By hiring experts, you also avoid the costly mistakes that can arise from not understanding the intricacies of debt collection laws.

Improved Cash Flow and Reduced Stress

When clients fail to pay their bills, it can have a direct impact on your business’s cash flow. This is especially problematic for small businesses that rely on steady payments to keep operations running smoothly. A debt collection agency in Houston can help restore your cash flow by ensuring overdue accounts are handled swiftly and professionally. With a dedicated team working to recover funds, you’ll have more time to focus on your business's growth and day-to-day operations, rather than worrying about unpaid invoices.

When to Seek Professional Debt Collection Services

Knowing when to turn to a debt collection agency is crucial. If you've made repeated attempts to contact your clients or customers and have not received any payment or response, it may be time to enlist professional help. Waiting too long can result in further complications, such as the debt becoming harder to collect or the debtor declaring bankruptcy. A debt collection agency can act quickly, ensuring that your business doesn't face unnecessary losses.

Conclusion

Hiring a debt collection agency in Houston is a proactive step in protecting your business’s financial health. With their expertise, legal knowledge, and commitment to recovering unpaid debts, a professional agency can improve your cash flow and alleviate the stress associated with chasing overdue payments. By working with an experienced collection agency, you can focus on what matters most—growing your business—while leaving the complexities of debt recovery to the professionals.

0 notes

Text

Simplify Debt Recovery with Williams Rush & Associates in Houston

If you’re searching for a leading agency specializing in Houston debt collections, reach out to Williams Rush & Associates. With years of expertise in recovering outstanding debts, we deliver reliable and efficient results while protecting your client relationships. Don’t let unpaid accounts hinder your cash flow—contact Williams Rush & Associates for professional debt recovery solutions today.

#houston debt collections#business debt collection agency#debt collection agency for small business#collection agency houston

0 notes

Text

Ensuring Smooth Financial Operations for Small Businesses

Managing finances can be the most critical and overwhelming aspect of running a small business. It's crucial for maintaining growth and sustainability. The true challenge arises when you're dealing with unpaid or late payments. This is where credit collection companies help you keep your operations on track. If you're a small business in Dallas and struggling to maintain a smooth financial standing, professionals can help you thrive.

Financial Challenges of Small Businesses

A small business often operates on tight margins and limited resources. Cash flow disruption can impact the ability to purchase inventory, pay employees, and invest in growth opportunities. Add to it the challenges with late payments, and it creates a domino effect leading to a series of financial issues. You can be forced to tap into your emergency reserve, take on debt, and increase your stress. Therefore, managing and mitigating late payments is in your best interest.

Partner With Credit Collection Services for Help

Credit collection services in Dallas have the experience and know-how to offer efficient debt recovery solutions and secure overdue payments. They work to understand the debtor's situation, suggest flexible solutions, and help you preserve your client relationships. This way, you can cover your expenses and focus on expanding future activities. It saves time and energy while allowing you to ensure compliance with relevant legal regulations and avoid potential liabilities.

Choosing the Right Credit Collection Service

Selecting the right credit collection service is crucial. Key factors include the agency's expertise in handling situations such as yours and someone with a proven track record. You must also verify their compliance with industry regulations and necessary ethical standards. If you have any specific requirements, look for a service provider that can provide tailored solutions to meet your unique needs and wants. If they seem to maintain clear and professional communication, they can be a good choice.

To Conclude

By leveraging the expertise of Austin, Dallas, or a Houston collection agency, a small business like yours can ensure smooth financial operations and serve your customers with utmost dedication. In competitive marketplaces like Dallas or Houston, where the business pace is so rapid, having a reliable credit collection service by your side can make a huge difference. Reach out to your nearest debt collection agency to get started.

0 notes

Text

Texas mineral liens can get a little too complicated, especially while enforcing. So, it’s better to seek help from Houston debt collection agencies like Nelson Cooper & Ortiz, LLC to perfectly file and enforce a mineral lien and receive your deserved payments seamlessly.

#credit collection services#debt collection service#commercial collection agency#business debt collection#debt collection#debt collection agency#collection agency#debt collection agencies#commercial collection firm#debt recovery services

0 notes

Text

[ad_1] Blackstone is nearing an enormous refinancing for a Solar Belt multifamily portfolio. The agency is circling a $550 million CMBS mortgage secured by 10 house buildings, seven of that are in Texas. The recent debt will mix with about $83 million in money fairness to refinance $618 million in debt and repay closing associated prices of round $15 million. Collectively, the buildings have 3,406 models, and all had been constructed between 2020 and 2022. Blackstone purchased the portfolio in a sequence of offers with the identical developer at a reported value of $833.2 million, in response to Fitch. Entities that beforehand owned a number of of the buildings hint to Davis Improvement, an Atlanta-based builder. The deal is anticipated to shut on Feb. 15. The debt would work out to $161,500 per unit. Whereas some segments of Solar Belt multifamily have struggled with slowed lease development and a provide surge, the buildings on this portfolio have stuffed up below Blackstone’s possession. From late 2021 to December 2023, the portfolio’s emptiness price fell from 41.3 % to five.3 %. 4 of the properties within the portfolio are in north Dallas suburbs, together with Richardson, Frisco and Allen. One other three are in west Houston, close to Katy. The remaining three are in Florida, North Carolina and South Carolina. The most important constructing within the portfolio is Cyan Cinco Ranch, a 433-unit property in Richmond, a suburb southwest of Houston. Inkwell Watters Creek in Allen has the best appraised worth of the bunch, at $92.7 million. Blackstone, considered the most important industrial landlord on the planet, just lately teamed up with Rialto Capital and the Canada Pension Plan Funding Board to purchase a stake in Signature Financial institution’s industrial mortgage pool. The crew bid $1.2 billion for 20 % of the three way partnership that holds the failed financial institution’s industrial debt. Learn extra [ad_2] Supply hyperlink

0 notes

Text

Top Factoring Companies In Houston, Tx 2021 Critiques

At ei Funding, we specialize in helping business house owners of any measurement get the funding they need shortly and reliably. We go the additional mile for you that different factoring companies just cannot or won't. Factoring has been our main focus since 1979, and we're committed Top factoring company Houston to offering the best and versatile packages in the industry. Once you might be setup for factoring you get funded in three simple steps. Next, you send us your invoice, invoice of lading and fee affirmation.

If you use a non-recourse company, you'll not have to fret about hiring a collection agency. The factoring company will own the debt, and the entire collection efforts will factoring company houston be its duty. At Power Funding, we work onerous to make our utility process as easy as potential.

These two would develop over time to become the world’s largest medical center advanced, with greater than 40 establishments throughout more than 600 acres. The Allen brothers had been from New York and moved south in hopes of continuing and expanding upon their bookkeeping and shopkeeping businesses. After their transfer Houston invoice factoring services to Texas in 1832, they played an instrumental half in keeping the troopers and forces provided during the Texas Revolution. After the revolution ended, Augustus Allen’s wife Charlotte obtained a sizeable inheritance, which they used to purchase the land that's now Houston.

The primary requirement is that you have an order from a credit score worthy industrial or government client. Gulf Coast Business Credit (GCBC)’s Meg Roberson recently attended the Commercial Finance Association (CFA)’s Independent Finance & Factoring Roundtable Conference May 14-16, 2014 in Dallas, Texas. The convention introduced together owners and senior executives from factoring companies nationwide to debate Factoring company houston tx present points and ways to address those points. Panels and discussions occurred during the conference covering a selection of topics together with gross sales, funding sources, social media, and co...

Beginning as an information entry clerk over two years ago at GCBC, Katie rapidly grew to become an Account Executive inside one year for the Baton Rouge based mostly manufacturing workplace. As an Account Executive, Katie serviced very lengthy time transportation business clients with facility limits as little as $5k and as excessive as $4 million. Gulf Coast Business Credit (GCBC)’s Liz Jenkins regularly supplies Factoring company in Houston Texas exceptional management and expertise together with her function as Vice President, Operations Manager. With over 17 years of experience in factoring and 7 years at GCBC, Jenkins specializes in the transportation trade. Jenkins graduated with a paralegal degree from Louisiana State University and is a licensed legal assistant as well as a civil legislation notary for Louisiana.

AR factoring helps accelerate the money flow by offering fast access to funds, as an alternative of ready for 30, 60, and even ninety days to get the invoice cleared. By trucking factoring with us we won't solely credit score clear clients for you, we may also pay you right away. Your options for model new customers, hundreds houston invoice factoring and routes, will open exponentially. By having so many extra load options you could have a better probability of preserving your drivers pleased too. We are a various group of 600+ financial professionals who deliver the core values of eCapital to life every single day. We are specialists throughout a broad range of monetary disciplines.

After you submit all of the invoices to the factoring company, they verify the major points and make sure the invoice qualifies for factoring. In most instances, the company advances eighty to 95 p.c of the factored quantity on the day of invoice submission itself. Well, to start Best factoring company Houston, we have in-depth credit experience and resources including business credit reports to check your customers' creditworthiness.

It is a relatively easy definition – a enterprise, on this case, a building contractor or subcontractor sells their yet-to-be-paid invoices to a factoring company. The factor will then pay (advance) them a share of that invoice quantity. After the invoice is paid by the client, the factoring company will ship the remaining % to the construction company, much less their factoring payment. Seacoast Business Funding offers dependable Factoring company in Houston working capital options for businesses by way of flexible lines of credit score and advances on accounts receivables. Offering services similar to invoice factoring, invoice discounting, asset primarily based loans, and trade finance, Express Business Funding is a frontrunner in different non-public business financing solutions in Canada.

1 note

·

View note

Text

The Ultimate Cheatsheet for Successful Negotiations With Your Debtors

You ask for a cheatsheet for successful negotiations with your debtors for payment, and they wire you the money. Wouldn’t it be great if it were that simple? Unfortunately, debt collection is a very complex process that relies heavily on your skills, and a successful resolution usually benefits both parties.

A cheat sheet for successful negotiation may appear as a mere communication process between two parties. However, according to Houston’s debt collection agencies, negotiation requires extensive research, documentation, preparedness, and flexibility to recover payments amicably.

Step-By-Step Process for Successful Negotiation:

1. Do Your Research On The Debtor

When it comes to the money you are owed, you may have a rough figure in mind. However, if you proceed with that, you’re only setting yourself up for failure. You need to be very thorough and research the exact amount your debtors owe you. Collect the payment history and receipts, and record the reasons for non-payment.

This information comes in handy during the Cheatsheet for Successful Negotiations and helps you set up realistic expectations right from the get-go. Collection agencies for small businesses spend a lot of time on this initial success and sort debtors into different profiles to figure out the likelihood of success.

Read More:-

1 note

·

View note

Link

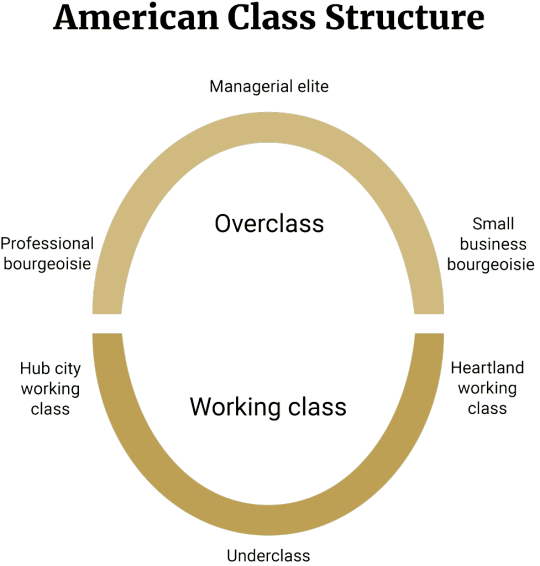

In The New Class War: Saving Democracy from the Managerial Elite (2020), building on my argument in The Next American Nation (1995), I offered an answer. I proposed that, while the proletariat is still the proletariat, James Burnham, Bruno Rizzi, John Kenneth Galbraith and other thinkers were correct that by the mid-twentieth century power had passed from individual bourgeois business owners to a new ruling class of technocrats or bureaucrats, whose income, wealth, and status is linked to their positions in large, hierarchical organizations, (i.e. nonprofits, government agencies, industrial and financial firms, and so on).

I use the term “overclass” to describe this group. A similar though not identical concept is what is known, after Barbara Ehrenreich, as the “professional-managerial class” (PMC). Whatever terminology you prefer to use, generalizations about all Western elites need to be accompanied by more granular analysis at the level of each country. Referring only to the U.S., I think it is helpful to go beyond the basic distinction between the overclass and the working class and identify distinct groups within each.

…

But the American elite includes three other groups, in addition to these bureaucratic managers. One consists of hereditary rentiers—heirs and heiresses, born into rich families. Old money types should be distinguished from tycoons like Bill Gates or Jeff Bezos, who tend to be products of upper-middle-class or modestly rich families who happened to become incredibly rich. Only the most primitive Marxists believe that a tiny group of individual capitalists—to the manor born or self-made—controls modern societies from behind the scenes. I will not pay further attention to old money in this essay.

In German a distinction has long been made between the Besitzbürgertum (propertied bourgeoisie) and the Bildungsbürgertum (educated bourgeoisie). The equivalents of these two groups exist in the U.S. today. They are distinct from the big-organization managers and important in American politics out of all proportion to their numbers. Lumping them together as “PMC” confuses matters. Let us call them the professional bourgeoisie and the small business bourgeoisie.

The professional bourgeoisie—made up of lawyers, doctors, professors, K-12 teachers, journalists, nonprofit workers, and many of the clergy—is concentrated in the teaching, helping, and research sectors. Their jobs often pay modestly but provide both status and a degree of personal autonomy that the frequently better-paid managerial functionaries in more hierarchical occupations do not possess.

The small business bourgeoisie consists of the owner-operators of small businesses and franchises, along with genuine contractors (as opposed to proletarian “gig workers”), both those who are self-employed and those who employ others.

…

The working class in the U.S. is divided as well. First, there is the heartland working class—those who work in the industries located in the low-density exurban heartland. These industries include manufacturing, agriculture, energy, retail distribution and warehousing.

And then there is the hub-city working class. This class of workers can be found in metropolises like New York, San Francisco, Atlanta, and Houston. Many of these members work directly for the urban overclass as maids, nannies and other domestic staff, or otherwise indirectly in luxury services that cater to the affluent elite.

(A note: by the “heartland working class” I do not mean the stereotypical “white working class.” Most African-Americans and Hispanics are high-school-educated workers who live and work in suburbs and exurbs. Those areas also contain many foreign-born workers, though first-generation immigrants make up a greater share of the populations of hub cities.)

To the distinct hub and heartland working classes can be added a third non-elite group, often described as the lumpenproletariat—or, perhaps more clearly, the “underclass.” (In the 1990s the speech police of the politically-correct left banned the use of “underclass” from academic and journalistic usage in the U.S., but the term is neither racist nor an insult.) This refers to members of often-broken families caught in multigenerational poverty, particularly those trapped in the grim carceral subculture of public housing, food stamps, petty crime, and the prison-industrial complex. Like the hub and heartland working classes, the multigenerational underclass is racially and ethnically diverse, and found in both urban and rural parts of the U.S.

…

Since this is all very abstract, an image might help. Visualize two horseshoes—a lower horseshoe whose two prongs point up, and an upper horseshoe whose two prongs point down. The lower horseshoe has the underclass at the bottom/midpoint and the hub city working class and the heartland working class as the points of its two opposing prongs. The upper horseshoe has the managerial elite proper as its midpoint/apex and the professional bourgeoisie and the small business bourgeoisie as the points of its two opposing prongs. Arranged in this way, the two horseshoes form a rough outline of a circle, with the managerial elite at the very top, the underclass at the very bottom, and the two working classes and the two bourgeoisies distributed in between.

…

American politics is little more than the internal politics of the overclass, now that the working-class majority has lost the grassroots, mass-membership institutions that once gave it collective bargaining power—private sector trade unions, influential religious organizations, and local political parties. Members of the working-class majority play no role except as occasional voters. They tend to be ignored, except during election seasons, when they are targeted by manipulative appeals based on race and gender in the case of the Democrats and religion and patriotism in the case of the Republicans.

…

At the risk of being overly schematic I would suggest that the “center,” “left” and “right” of America’s top-thirty-percent politics can be mapped imperfectly onto the managerial elite, the professional bourgeoisie and the small business bourgeoisie. In particular, both DSA progressivism and Tea Party conservatism can be understood as different strategies for enlisting the power of government to stave off the proletarianization of the constituents of the two bourgeoisies.

The goal of so-called progressivism in 2020s America is to expand employment opportunities for college-educated, center-left professionals, while adding new wings to the welfare state that are tailored to their personal needs. The slogan “Defund the police” is interpreted by the bourgeois professional left to mean transferring tax revenues from police officers, who are mostly unionized but not college-educated, to social service and nonprofit professionals, who are mostly college-educated but not unionized. The enactment of proposals for free college education and college debt forgiveness would disproportionately benefit the professional bourgeoisie, not the working-class majority whose education ends with high school. Likewise, public funding for universal day-care allows both parties in a two-earner professional couple to maximize their individual incomes and individual career achievements by outsourcing the care of their children to a mostly-female, less well-paid workforce at taxpayer expense.

It is no coincidence that many professionals in the sectors most dependent on their funding on donations from the capricious rich, like philanthropy, colleges and universities, and the media, hate billionaires with the passionate resentment that is reserved for benefactors. In their view, in a just society, the arts program or the NGO would be permanently funded by tax revenues, instead of annual fund-raising appeals to this or that plutocrat’s personal fortune or foundation.

Gore Vidal was known to say that America has socialism for the rich and free enterprise for the poor. Contemporary American progressivism can be succinctly described as social democracy for the professional class.

…

To avoid being squeezed out of existence between big business and organized labor, the small business bourgeoisie has fought for generations on two fronts, demanding subsidies and exemptions from government regulations, while insisting on anti-union and anti-labor legislation and a reliable supply of cheap labor (preferably guest workers or illegal immigrants who cannot vote). The lobbies for the small business sector naturally oppose any “decommodifying” social insurance reforms. Examples are longer periods for unemployment insurance or universal health care, each of which can increase the bargaining power even of non-unionized workers by allowing them to hold out longer until employers are forced to make better offers.

The upper horseshoe schema explains American political factions in terms of different combinations of its elements. When the professional bourgeoisie allies itself with the Managerial Elite, you get Clinton-Obama-Biden left-neoliberalism. When the small business bourgeoisie allies itself with the Managerial Elite, you get George W. Bush-Paul Ryan-Nikki Haley right-neoliberalism.

When the professional bourgeoisie and the small business bourgeoisie unite with each other against the oligopolies and monopolies that dominate modern industry and finance and the managers who run them, you get the neo-Brandeisian, small-is-beautiful antitrust school. Their anachronistic small-producerist ideal, in which everything big has been broken up by government antitrust litigation, is an economy of small shops, artisanal craft breweries and independent doctors and lawyers.

…

The protests associated with the first reopening were led during the early stages of the lockdown by conservative members of the small business bourgeoisie. Many of their undercapitalized storefront businesses, like hair salons, and restaurants, and car repair shops, were threatened or wiped out by city and state shut-down orders. The protests were dominated by petty-bourgeois business owners, and not their low-paid employees—some of whom might have been endangered by a premature return to their workplaces during the pandemic.

The initial response of the progressive professional bourgeoisie was to ridicule and denounce the right-wingers for endangering their own lives and those of others by ignoring the advice of credentialed public health experts.

Then, during the protests that followed the murder of George Floyd by Minneapolis police officers, the same progressive professional bourgeoisie concluded that systemic racism was a greater threat to public health than COVID-19, which—mirabile dictu!—cannot be spread at left-wing demonstrations.

…

What does all of this mean for the neglected working-class majority on the sidelines of American politics? A century ago, trade unionists like Samuel Gompers and socialists like Eugene Debs criticized antitrust and praised large industrial combinations, on the sensible grounds that large, modern corporations are easier to unionize and/or socialize than lots of small businesses.

A case can be made that both the professional bourgeoisie and the small business bourgeoisie are relics of an earlier techno-economic paradigm. Each is a leftover pocket of technological backwardness and labor exploitation in an advanced industrial economy.

In American higher education, a dwindling minority of tenured academics, using pedagogical methods unchanged from the agrarian era, lords it over a mass of impoverished guild apprentices, the poorly-paid, insecure, non-unionized adjuncts who now teach most university students nationwide. At the same time, the business models of many small, owner-operated firms in the U.S. are made possible by poor-country levels of worker rights and social insurance—and much of the workforce consists of recent, desperate immigrants from actual poor countries. Because the backward professional and small business sectors have much lower productivity than the rationalized, capital-intensive parts of the economy like manufacturing and energy, they pay low wages to much of their workforces while charging high prices to consumers.

Needless to say, any new cross-class settlement would have to follow the recreation of powerful mass-membership working-class organizations in current and newly-rationalized, sectors, which would permit the transformation of the majority of Americans in the bottom horseshoe into subjects, not mere objects, of American politics. But that is a story for another day.

2 notes

·

View notes

Text

The Importance of Hiring a Debt Collection Agency in Houston

In the bustling business landscape of Houston, Texas, managing accounts receivable effectively can be a daunting task for companies of all sizes. With a growing economy and a diverse array of businesses, from small startups to large corporations, the need for financial stability has never been more crucial. One essential solution that many organizations turn to is hiring a debt collection agency. This blog explores the key factors and positive aspects of engaging a debt collection agency in Houston.

Expertise and Resources

One of the most significant advantages of hiring a debt collection agency in Houston is the expertise and resources these professionals bring to the table. Debt collection specialists are trained in the nuances of debt recovery, often possessing extensive knowledge of state and federal regulations governing the collection process. This expertise ensures that collections are conducted legally and ethically, protecting the interests of both the creditor and the debtor.

Risk Mitigation

Businesses that attempt to collect debts themselves may unintentionally violate laws or regulations, exposing themselves to legal consequences. Debt collection agencies, on the other hand, are well-versed in compliance issues and adhere to industry regulations, minimizing the risk of legal repercussions for their clients.

Internal collections can lead to strained relationships between businesses and their customers, potentially damaging reputations and future sales opportunities. A third-party agency can handle sensitive communications more tactfully, ensuring that customer relationships remain intact while still pursuing overdue payments.

Tailored Solutions for Businesses

A reputable debt collection agency in Houston can offer tailored solutions that align with the specific requirements of each client. Whether a business requires assistance with commercial collections, consumer debts, or specific industries, agencies can customize their approach to meet diverse needs.

This flexibility is particularly beneficial in a city like Houston, where industries range from oil and gas to healthcare and technology. By working with an agency that understands the local market and industry nuances, businesses can achieve more effective collection results.

Building a Partnership

Finally, hiring a debt collection agency should be viewed as a partnership rather than a transactional relationship. A reputable agency will work closely with businesses to understand their operations, goals, and challenges. This collaborative approach fosters open communication and allows agencies to develop strategies that align with the company’s values and customer service standards.

Hiring a debt collection agency in Houston presents numerous advantages for businesses grappling with unpaid debts. From enhanced recovery rates and expert resources to time efficiency and risk mitigation, the benefits are substantial. By entrusting the debt collection process to professionals, companies can focus on growth, maintain financial stability, and build lasting relationships with their customers. In today’s competitive market, the decision to engage a debt collection agency in Houston is not just a financial strategy; it’s a vital component of sustainable business success.

0 notes

Text

Trusted Debt Collection Agency in Houston | Williams Rush and Associates

If you are looking for a reliable debt collection agency in Houston, your search ends with Williams Rush and Associates. With a stellar reputation and proven track record, we specialize in Houston debt collections. Our expert team of collectors ensures efficient, compliant, and professional debt recovery services, safeguarding your interests every step of the way. Trust us to handle your debt collection needs with precision and expertise.

0 notes

Text

The Best VA Loans for Bad Credit in Houston - How Is It Possible?

Can you get VA loans with bad credit? Read below to know why the best VA loans for bad credit in Houston are the best option.

Veterans benefit from VA home loans in part because the credit criteria are frequently less stringent than those in the normal lending market. Although VA mortgage credit criteria aren't inherently more tolerant of weak credit than commercial loans, the standards to which applicants are held are different. Whereas a conventional loan focuses more on a loan applicant's actual credit score, VA mortgage credit criteria place a greater emphasis on the credit history's pattern of consistent payments.

VA Loans with Bad Credit

A VA loan is available to anybody who has been in the military, is currently serving in the military, or is the spouse of a dead service person. This puts you in a great position to buy a property. The Best VA loans for bad credit in Houston are an excellent option. There is no obligation for a down payment, to begin with. A VA loan might also have a cheap interest rate, which is beneficial for buyers with bad credit. There are costs connected with a VA Loan that you won't find with other loan programs, but in the end, a VA loan will be your most cost-effective alternative. Read below to know the best way to get VA Loan with low credit scores.

Provide A Written Explanation

Even though you were legally required to pay the debt, you can mitigate its impact on your ability to get a VA home loan. You can include a written explanation with your credit report if you like. The lender might be given the same justification. There is a level of awareness among VA lenders regarding the problems that emerge while a person is on active service. You may use this situation to explain why you haven't paid your obligations, and the lender could understand. To make this work in your favor, you'll need to prove that there were extenuating circumstances.

File Credit Disputes

It is typical for military personnel to have a poor credit score as a result of debts not being paid while on active duty. Several collection agents do not have the legal authority to try to collect. You can object to this by demanding that the debt be validated. You can have the debt discharged in small claims court if the agent is unable to substantiate the debt.

You have the right to dispute a credit report if your debt was incurred after this period and the lender reported you to the credit agencies. Check your state's regulations to discover if your debts exceed this amount.

Even if you have terrible credit, putting down a big down payment on a home might help you get a VA loan. Regardless of your credit, the VA will issue your guarantee since you are eligible only because of your service background. You will, however, need to qualify for a private loan, which might be difficult if you have a poor credit score. By making a big down payment, you are assuming additional loan risk. The lender can decrease the risk of writing your mortgage by using both your down payment and the VA guarantee. Even if you have terrible credit, you should be able to secure a house loan with a 50% down payment and a VA guarantee.

0 notes

Link

#best debt collection software#best debt collection agency software#best debt software#debt collection agency in Houston#commercial collection firm

0 notes

Photo

IRS Collections: What You Need to Know (Post COVID-19)

During the pandemic, the IRS temporarily halted all collection actions. In the coming months, IRS Collections will begin again, impacting taxpayers across the United States. Here’s what you need to know.

As we enter a post-pandemic state, the IRS begins to normalize the collection process and return to its regular pace. This will have an impact on taxpayers facing potential federal tax liens or levies, as well as other IRS collections actions.

Collection actions are part of the IRS’s repertoire against missed deadlines, unfiled tax returns, and missed tax payments. If you owe the government money, it can and will collect – eventually. Until it does so, it will coerce collection through ramping penalties and interest, and a restrictive tax lien.

These consequences can be avoided – if you’re prepared, and act as soon as possible. Let’s go over how the IRS plans to approach collection actions throughout the rest of 2021 and beyond, and let’s review the official timeline.

NEED HELP WITH OFFER IN COMPROMISE, TAX SETTLEMENTS, TAX PREPARATION, AUDIT REPRESENTATION OR STOP WAGE GARNISHMENTS?

ADVANCE TAX RELIEF LLC

www.advancetaxrelief.com

BBB A+ RATED

CALL (713)300-3965

Why Were IRS Collections Put on Hold?

As part of an effort to reduce the pressure of economic instability following the lockdowns implemented as a result of COVID-19, the IRS delayed and held off on pursuing certain action collections starting March 2020. This included holding off on issuing federal tax liens.

However, things will begin returning to a more “business as usual” pace, according to a memo released on June 15, 2021, as COVID-19 restrictions continue to loosen, and the country continues its path towards normalcy.

IRS collections will begin, including levies on wages and bank accounts, after 30-45 days of issuing a taxpayer notice. Levies and liens will resume starting August 15th, 2021. However, taxpayers who have previously received tax lien notices for their late and overdue tax payments will have begun receiving further notices as soon as June 15th.

Tor recap the specifics of the memo:

Balance Due notices are usually automatically sent to taxpayers when a deadline has passed, and the balance remains unpaid. Starting June 15, 2021, the IRS will begin following up on taxpayers who have not responded to older notices.

Taxpayers with prior notices (tax liabilities dating back to 2019/2020 or older) will be notified that they have between 30 and 45 days to respond before the IRS takes further action.

Taxpayers who fail to respond may be subject to liens and levies starting August 15, 2021.

What Are Tax Liens and Levies?

Tax liens and levies are the IRS’s primary means of enforcing a taxpayer’s responsibility to pay their respective tax dues. With IRS collections, the primary goal of a lien or levy is to encourage a taxpayer to settle their debt – and both liens and levies make a compelling case for doing so.

A federal tax lien is a legal claim on your assets and property on behalf of the government. Federal tax liens are a matter of public record, and they mean that the government has the first right to your assets as creditors. What this boils down to is a block on other forms of financing. Under a lien, you must pay your debt to the government before other creditors can collect from you. This can make it very difficult to secure a loan or seek financing.

– Tax Liens

Tax liens are one of the last things to be lifted when tackling your tax account’s overdue payments. Even declaring yourself currently not collectible does not eliminate a tax lien. Tax liens are lifted when the debt is paid but may also be prematurely lifted if you enter into a long-term payment plan with the IRS, and have been adhering to it consistently.

If you somehow choose to ignore a lien, or a notice of a lien, then it may escalate into a levy.

– Tax Levies

A levy is an actual claim on your assets and property. The government may clean out a bank account, take a portion of your paycheck every time it comes in (based on your filing status and number of dependents), or take and sell a non-primary property you own at its quick sale value.

If any of these IRS collections actions result in you still owing the IRS money, they may issue a second levy, or continue to garnish (claim) your wages. If the sale of your property or emptying of a personal account resulted in a remainder after your debt was paid, the IRS will send you that remainder.

Most people rightfully want to avoid levies at all costs. Regardless of whether you’re employed or self-employed, a levy can be an unexpected and painful intrusion into your financial health.

If you want to know how to avoid liens and levies and aren’t sure how to pay off your tax debt, your first priority should be to get in touch with a tax professional. You want someone who can communicate with the IRS and help you negotiate a plan that suits your circumstances and financial capabilities, without risking an extended lien or levy.

Other IRS Collection Programs to Resume

Aside from resuming liens, the IRS has also made note of the Department of State’s (DOS) right to exercise their authority to revoke the passports of taxpayers with seriously delinquent tax debt, starting July 15, 2021.

The IRS has resumed identifying and naming examples of seriously delinquent tax debt starting March 2021. Being certified seriously delinquent by the State Department restricts a taxpayer from obtaining a passport or renewing their travel documents.

Furthermore, the IRS will continue to automate levies in coordination with other state and federal agencies, by the following dates:

June 2021: Balance due notices (will start being mailed by the Automated Collection System (ACS).

July 15, 2021: Automated levies will go out via the Federal Payment Levy Program (FPLP), State Income Tax Levy Program (SITLP), and the Municipal Tax Levy Program (MTLP).

August 15, 2021: Automated levies will continue for the Alaska Permanent Fund Dividend Program (AKPFD). Notice of Federal Tax Liens will also be issued starting August 15.

The IRS has also made several unrelated announcements on the subject of tax enforcement and tax investigations. These include new cryptocurrency tax enforcement projects, investigations into high-income non-filing taxpayers, and repatriation suits to be filed against taxpayers with foreign assets through FATCA, and more.

IRS collections are ramping back up. If you have been putting off your IRS debt, now is the time to take action. Contact our team of professional tax attorneys today.

GET TAX RELIEF HELP TODAY

If you think that you may need help filing your 2014, 2015, 2016, 2017, 2018, 2019 & 2020 Form 1040 tax returns or past due tax returns, you may want to partner with a reputable tax relief company who can help you get the max refund and reduce your chances for an IRS AUDIT.

Advance Tax Relief is headquartered in Houston, TX. We help many individuals just like you solve a wide variety of IRS and State tax issues, including penalty waivers, wage garnishments, bank levy, tax audit representation, back tax return preparation, small business form 941 tax issues, the IRS Fresh Start Initiative, Offer In Compromise and much more. Our Top Tax Attorneys, Accountants and Tax Experts are standing by ready to help you resolve or settle your IRS back tax problems.

Advance Tax Relief is rated one of the best tax relief companies nationwide.

#FreshStartInitiative

#OfferInCompromise

#TaxPreparation

#TaxAttorneys

#TaxDebtRelief

#TaxHelp

#TaxRelief

#BestTaxReliefCompanies

0 notes

Link

October 11, 2017

HOUSE REPUBLICANS UNVEILED a $36.5 billion disaster relief supplemental package Tuesday night, intended to pay for relief and rebuilding efforts for the floods, hurricanes, and wildfires of the past several months. It includes money for Puerto Rico’s ongoing struggle with the aftermath of Hurricane Maria, though only a fraction of that headline number. In fact, $5 billion of the funds earmarked for Puerto Rico comes in the form of a loan, increasing the amount of money the island will eventually need to pay back.

And in a cruel irony, the bill also contains $16 billion in debt relief — just not for Puerto Rico’s crushing debt.

The full House chamber will vote on the bill from the House Appropriations Committee this week. Here’s a breakdown of the $36.5 billion in aid that the committee proposed:

There’s $576.5 million in U.S. Forest Service and Department of Interior grants for wildfire suppression and management. The western U.S. in particular has been rocked by a dangerous wildfire season, including ongoing blazes in Northern California that have killed 17.

Another $18.67 billion is intended to replenish the Federal Emergency Management Agency disaster relief fund, particularly for events caused by hurricanes Harvey, Irma, and Maria. That means Florida, Texas, Puerto Rico, and the U.S. Virgin Islands will share that money, as determined by FEMA. The Department of Homeland Security’s inspector general gets $10 million of that for audits and investigations of the use of relief funds.

Puerto Rico will get a loan of $4.9 billion out of that same pot, money to be used for maintaining basic government operations. President Donald Trump had previously requested that amount in loan form. With practically no tax receipts collected since last month’s hurricane destroyed the island — 85 percent of homes remain without power three weeks after the storm — Puerto Rico faces a cash-flow crisis. Officials estimate that the government could run out of money and have to shut down on October 31.

This is critical for Puerto Rico, which has had trouble borrowing from private credit markets because of its existing $74 billion debt. But instead of replenishing the coffers with a grant, this is a loan — one Puerto Rico will also need to repay.

The island will get an additional $150 million loan to cover its matching funds for FEMA grants. Cities and states are required to put a small amount of money into sharing costs for disaster relief. That brings the total of loans to the island up to $5.05 billion. The appropriations committee allotted another $29 million for administrative expenses for the loan.

The bill includes a provision enabling the Department of Homeland Security and the Treasury Department to decide to cancel the loan, but that’s no guarantee. And those two agencies set the terms of repayment; while news reports have described a “low-interest” loan, there’s no set interest rate in the text of the bill.

If you’re keeping up with the math, that leaves $13.58 billion of the $18.67 billion in disaster relief. Puerto Rico would have to share that amount with two far more populous states and another territory.

There is one definitive grant to Puerto Rico in the bill: $1.27 billion for “disaster nutrition assistance,” which is basically an extension of the food stamp program for citizens affected by the hurricane. This type of assistance is standard for disaster areas in the continental United States but needs to be enumerated for the territory.

The final $16 billion in the bill goes to the National Flood Insurance Program, battered by claims payouts from the season’s hurricanes, particularly in Houston after Harvey. And this is where the bill takes on an almost comic level of bad optics.

The way the flood insurance program works is that homeowners pay premiums and file claims when they encounter flood damage. Because premiums are too low and people still build in flood plains over and over, the program has not been able to keep up. So NFIP took out a line of credit with the Treasury Department — capped by law at $30.4 billion — to cover claims. Last month, NFIP reached that borrowing ceiling.

Funds to pay claims are expected to run out this month, so the House bill cancels $16 billion of NFIP’s debt. “To the extent of the amount cancelled … the National Flood Insurance Fund are relieved of all liability to the Secretary of the Treasury under any such notes or other obligations,” the bill states. “The amount of the indebtedness cancelled … may be treated as public debt of the United States.”

This is like the famous meme of the guy checking out a girl with his girlfriend standing right next to him, only the guy is the GOP, the girl he’s checking out is the NFIP, and the girlfriend is Puerto Rico. In a bill intended to give relief to Puerto Rico, the island gets a thin amount of guaranteed aid and a vague level of other funding, along with $5 billion in loans. Meanwhile, in the words of President Donald Trump, the NFIP gets its debt “wiped out.”

The difference between NFIP and Puerto Rico is that the Treasury Department holds the former’s debt, while the island owes money to private investors. Still, Congress has the ability to change the terms of Puerto Rico’s current bankruptcy-style process, or even to buy up that debt eminent domain-style for what it deems just compensation, only to cancel it later. And Congress could certainly give Puerto Rico grants rather than another $5 billion in loans to deal with. Meanwhile, creditors will be lining up to try to claim portions of the aid intended for Puerto Rico, a complication Democrats in Congress are working to sort out. Getting their hedge-fund hands on the loan money could legally prove more difficult.

The House will vote on the bill this week, and the Senate is likely to follow next week. The bill is in line with White House requests for disaster aid and bridge funding for Puerto Rico, so Trump would likely sign it.

And:

Remember:

#lin manuel miranda#hurricane maria#puerto rico#donald trump#hurricane maria relief#u.s. congress#the intercept#i know i know but this is a solid article#i'm so angry right now#twitterico#an open letter

132 notes

·

View notes

Text

IRS-CI’s Annual Report And The State Of Enforcement

New Post has been published on https://perfectirishgifts.com/irs-cis-annual-report-and-the-state-of-enforcement/

IRS-CI’s Annual Report And The State Of Enforcement

On November 16, the IRS Criminal Investigation division issued its annual report for the fiscal year ending September 30, 2020, which touts recent achievements and may foreshadow a rise in IRS enforcement. The report highlighted IRS-CI’s noteworthy achievements last year, including identifying over $2.3 billion in tax fraud, which represents an increase of $500 million (almost 28 percent) from fiscal year 2019. The report further noted that IRS-CI had initiated 1,598 investigations and recommended 945 prosecutions, up slightly from the previous year, when it initiated 1,500 investigations and recommended 942 prosecutions, but not quite returning to 2018 levels of 1,714 investigations and 1,050 recommended prosecutions. Finally, the report noted that IRS-CI now has 2,030 Special Agents. While that represents a modest (1%) increase over the prior fiscal year, it is still below the 2,100 agents in place in May 2019, when IRS-CI was pushing to expand its ranks.

Beyond the statistical data, there are signs of increased, high-profile tax enforcement activity. On October 15, 2020, IRS-CI and the Tax Division of the Department of Justice jointly announced the largest tax charge ever filed against an individual in the United States: a 39-count indictment against Houston billionaire Robert T. Brockman alleging a $2 billion tax fraud scheme. The Brockman case attracted even more press coverage in light of the identification of Robert F. Smith, the billionaire philanthropist, as an unindicted co-conspirator. In May 2019, Smith received national press attention when, during a commencement address at Morehouse College, he pledged to pay off the student debt of the entire graduating class.

Smith ultimately entered into a non-prosecution agreement (“NPA”) pursuant to which he committed to cooperate with the government in its case against Brockman. While it is unusual for IRS-CI and the Tax Division to allow tax offenders to avoid criminal prosecution and there is a risk that the public will perceive the result as unduly lenient, one could argue that the decision not to prosecute Smith appropriately balanced his extraordinary charitable contributions and payment of back taxes and penalties against IRS-CI’s goal of “mak[ing] taxpayers aware of the enforcement efforts,” which it views as “crucial to deterrence.” Cynical commentators have, however, questioned whether Smith’s philanthropy was motivated by his awareness that the IRS was investigating him. These questions were amplified by the Statement of Facts attached to the NPA, which linked Smith’s charitable endeavors to the unraveling of his tax scheme when his Swiss bank informed him that it was participating in the DOJ’s Swiss Bank Program and would have to disclose the identities of its U.S. clients.

To be sure, Smith’s NPA was a substantial boon to the Treasury. Under his deal, Smith has agreed to pay more than $139 million in taxes and penalties and abandoned claims for a $182 million tax refund predicated on deductions for charitable contributions that Smith made to his foundation with his hidden assets. To put the $139 million figure in context, it is 123 percent of the Tax Division’s budget for fiscal year 2020 ($112.8 million) and 47 percent of the total amount of taxes, interest, and penalties recovered in fiscal year 2019 ($292.1 million).

WASHINGTON, DC – APRIL 27: The Internal Revenue Service headquarters building in the Federal … [] Triangle section of Washington, DC. (Photo by Chip Somodevilla/Getty Images)

Separate and apart from whatever deterrent effect will be derived from the Brockman indictment and the Smith NPA, the incoming Biden Administration and Congressional Democrats have signaled that they intend to reinvigorate tax enforcement. While Congress has cut the IRS budget steadily for a decade, critics of these cuts point out that any savings are more than outweighed by the resulting reduction in tax collections. For example, former IRS Commissioner John A. Koskinen estimated that every $1 trimmed from the agency’s budget resulted in $4 in lost revenue, and Jared Bernstein, who was recently named to President-elect Biden’s Council of Economic Advisors, has called the IRS budget reductions “shadow tax cuts targeted at high end avoiders and evaders.” And Larry Summers, another economic advisor close to the President-elect, has encouraged the incoming Biden administration to improve “enforcement on the $7 billion that is owed but not paid, with most of that coming from the richest taxpayers.”

Shortly after IRS-CI released its 2020 annual report, a group of 25 House Democrats wrote a letter in which they took note of the reference to $2.3 billion in identified-tax fraud and asked Congressional leaders to provide $12.1 billion in funding for the IRS for fiscal year 2021, including $5.2 billion for enforcement, with an eye toward cracking down on high-income tax evaders. This represents an increase from the Republican-proposed Senate bill, which with only $11.5 billion and $4.8 billion, respectively, maintains the same funding levels as fiscal year 2020.

The letter cited the IRS-CI report and recent estimates by the Congressional Budget Office (“CBO”) to emphasize the importance of IRS enforcement activities, noting that “increasing the IRS’s budget to investigate high-income individuals would more than pay for itself by allowing the IRS to effectively collect unpaid taxes owed by the wealthiest individuals.” Indeed, the Congressional Democrats emphasized the CBO’s conclusion that increasing the enforcement budget by $20 billion over 10 years would increase revenues by $61 billion.

Of course, whether enforcement is actually prioritized will depend on the final composition of the new Congress as well as competing demands on the IRS’s resources, including administering any additional Covid-19 relief programs. Although it remains to be seen how much will change after President-elect Biden takes office, IRS-CI’s successes in fiscal 2020, combined with its recent enforcement activity and the very real possibility of reversing the longstanding trend of budget cuts suggests that IRS enforcement efforts may actually be on the rise.

To read more from Jeremy H. Temkin, please visit www.maglaw.com.

From Policy in Perfectirishgifts

0 notes

Text

GKD Debt Collection Agency Houston

We collect the debt for Business to Business. We collect debts locally in Houston and nationally across the United States. We specialize in large claims and work with an assortment of commercial companies, business bank cards, and business credit cards. If your clients, customers, vendors, or partners default in the payment of services rendered by you, we take exhaustive efforts to collect monies owed to you. There are NO UPFRONT FEES. We offer an assortment of contingency rates*. Visit: https://www.debtcollectionsagencyhouston.com/

0 notes