#David Sparks Net worth

Explore tagged Tumblr posts

Note

sorry if this is a bit much, but do you know where i can find information on LA's system? from what you've said it seems really interesting

Not too much!! I love chatting LAK :D I watch this team in Ways I simply don't with my other teams!

I really couldn’t tell you anything in-depth or specific about LA except that they’re running a 1-2-2 neutral zone forecheck (moving away from their infamous 1-3-1). Privately I dooo think the way some fans couched it as a huge shift was a little premature. I get that everyone was fed up with it at that point, though.

Many teams have employed a 1-2-2 with variations, it is apparently a system everyone learns to play at some point in their hockey career!! Here's a bit on it (includes diagrams) <- eventually I will gather media about it and make gifs and diagrams, but that's a long way away <3 I'm simply not confident in my own ability to break it down for you and tell you what the Kings are doing that's so special.

Beyond the 1-2-2, they changed up their special teams as well. Something about a more aggressive penalty kill here. I don't know what the hell they did to the power play because it is NAWT working </3

Here's what I've dug up from LAK media... Sparse coverage on the gritty details of the system. Wish I could say I've scoured every corner of the internet but I think when the changeover was happening I was laser focused on the Can.adiens + Shar.ks offseason. I unfortunately haven't trawled all the Kings podcasts out there. Might be worth a look to see if any of them covered the topic around the time the change was happening?

Note: There are some repeated quotes that I've cut out, and some of these articles are excerpted from larger pieces!

Published on The Hockey News, 20th September 2024: Kings Officially Move Away From Much-Discussed 1-3-1 - by Austin Stanovich (link / archive link)

The Los Angeles Kings' use of the 1-3-1 neutral zone trap has been a much-discussed topic amongst fans over the last few seasons under head coach Todd McLellan and briefly Jim Hiller after him. For a third year in a row it was completely infective against the Edmonton Oilers and saw the Kings lose in just five games in round one.

Both Jim Hiller and general manager Rob Blake hinted at a change in system over the summer and early in training camp that change has been confirmed.

Captain Anze Kopitar came out and confirmed the team won't be playing a 1-3-1 and Hiller talked about moving to a 1-2-2 after day one of camp. This move has sparked a lot of excitement amongst fans and for good reason. The 1-3-1 wasn't working and the Kings needed to change something. A shift to a 1-2-2 makes sense as well. It isn't a million miles away from the 1-3-1 and allows the Kings to remain a structured, defensively sound team without being as rigid as the 1-3-1.

The forwards, in particular, will have more freedom to be aggressive in the neutral zone and can look to create turnovers higher up the ice.

The biggest change will be for the defensemen, this team's blue line was very clearly built with the 1-3-1 in mind with all of their puck movers being right handed. While this defensemen; Drew Doughty, Jordan Spence and Brandt Clarke, will still be asked to do the majority of the puck moving, there will now be more pressure on the left sided defensemen to move pucks.

Mikey Anderson, Vladislav Gavrikov, Joel Edmundson and whoever else fills in will fall back and be less aggressive in the neutral zone but will have to go back and retrieve more pucks. I'd expect all of them to adopt a safe game on the puck and look to go D-to-D or straight up ice with a safe pass most times.

Still, there will be more pressure on them to have the puck on their stick which will be an adjustment. It might also put a little more pressure on the Kings' goaltenders. For all of the faults of the 1-3-1, it did do an excellent job shielding the Kings' budget goaltending. Darcy Kuemper and David Rittich won't have the same safety net goalies in the last few seasons have enjoyed. Again, the Kings will still likely be a more defensive team even with the system change, but their goalies might need to have an extra save or two in them.

I also wouldn't expect to never see the 1-3-1 again, it just won't be the Kings' default system.

Anderson and Trevor Moore discussed this in their exit interviews. The 1-3-1 is good for holding leads and is used throughout the league, the Kings just needed to get away from defaulting to this system.

Late in games and against certain opposition, I wouldn't be surprised to see this return at times, Kings fans just won't have to see it all game anymore.

-

Published on The Athletic, 2nd October 2024: What we’ve learned about the L.A. Kings so far in training camp and preseason - by Eric Stephens (link / archive link)

[...]

Ding, dong, the Kings’ 1-3-1 is dead

System changes rarely rate highly in terms of camp intrigue but the Kings’ switch from the 1-3-1 neutral zone trap setup to 1-2-2 is notable in that it’s something the players have lobbied for. The 1-3-1 boosted their defensive play for years and helped bring success but also left them feeling stunted in realizing offensive potential.

Most notably, Kempe and Kevin Fiala expressed their wish for change after last spring’s playoff loss to Edmonton. At the start of camp, Kopitar flatly said, “We’re not going to play the 1-3-1 this year.” It’s clear they’re embracing the change.

“Everyone likes to be on the attack and not playing on your heels,” Jeannot said. “Hopefully what we’re trying to do this year is just be hard on the other team. Don’t give them any time and space and keep them on their heels. Keep the momentum sloped our way. We’re just learning this new system and everyone’s going to take the time to buy in and just learn it. Come the regular season, it’s going to be dialed in and working really well.

“I think it’s going to cause a lot of turnovers and be a little bit more aggressive maybe. Hopefully get some more opportunities for our offensive guys and keep us out of our D-zone more.”

Jordan Spence, whose ice time will spike upward in Drew Doughty’s lengthy absence, mentioned how, as a right-side defenseman, there will be fewer times when he and others will be the ones to retrieve dumped-in pucks by the attacking team. Kempe said right wingers like himself will benefit from being more in motion on breakouts as opposed to starting from a standstill.

“Last year as a right winger you had to go back for the puck a lot and maybe aren’t up in the rush as the main guy,” Kempe said. “Sometimes you come late, and you get good chances. But I think playing 1-2-2, once we turn the puck over in our favor, I think there’s going to be some times where we get good rush opportunities. That’s where I feel like my game is really good so that’s something I’m excited about.”

The change to 1-2-2 as a means of creating more offense means the Kings goaltenders could be asked to do more, as the 1-3-1 helped limit chances and insulate them. But they’re on board.

“We have enough practices to figure out what’s going to be important in our system for goalies,” David Rittich said. “Some sort of things we already know what we’re probably going to see more than we’ve seen in the past. But I think it’s good. I personally feel like we have a really fast team and 1-2-2 is just going to help us.”

-

Published on LA Kings Insider, 9th October 2024: Kings learning, adjusting, embracing the switch to the 1-2-2 - by Zach Dooley (link / archive link)

[...]

All the way back on the first day of camp, Jim Hiller spoke about the neutral zone as a way to get the team’s forward moving a little bit more. No reminder needed on the infamous “standing still right winger” comment from exit interviews.

The 1-3-1 was certainly a part of the identity the Kings built over the last few seasons. You can’t say it wasn’t a part of the team’s success in transitioning from a team at the bottom of the standings to a playoff team three years running. Typically, any time you hear an opposing team comment on systems, it’s out of frustration.

While it’s no longer the primary option, it’s not like the concept has been forgotten, either. If the Kings need it, it’s there. But, with the personnel in place right now, Hiller believes that the best way forward for the Kings was to make a change in that area. It’s not meant to be a change away from a strong, sound defensive team, but a change that could hopefully fit the way the current roster is constructed.

“I think the 1-3-1 was a very effective system, I thought the guys played it very well, we just think with where we’re at now, as a franchise, it’s time to make an adjustment, to see if we can get our forwards to skate a little bit more” Hiller said, early in camp. “Hopefully we get better results because of it.”

As the Kings have progressed throughout training camp, the comfort level has risen within the system. It impacts the forwards, defensemen and goaltenders all a little bit differently.

Okay, maybe not really the goaltenders. Darcy Kuemper comes to the Kings from Washington, a team that did not play a 1-3-1 last season, while David Rittich was inclined to believe the change could benefit the group he sees in front of him.

[...]

In terms of the skating ability, the Kings certainly have it, especially on the wings.

In the top nine, down the right side, the Kings have Adrian Kempe, Trevor Moore and Warren Foegele, who are all strong skaters.

For Kempe and Moore, both players came from the 1-3-1 and are learning this system for the first time, if you will, although I don’t think there’s a professional hockey player in the world who hasn’t played a 1-2-2 in the neutral zone. Drew Doughty said as much prior to his injury. Even I learned it with the Shaker-Colonie Jets high school team back in 2009, so I’m certain that those guys can pick it up.

Both acknowledged the learning curve, but both also agreed that the change in system speaks to the speed that players like them, and others, can use within that system.

Kempe – It’s learning a new, complete system for the team, but I think we’ve created a lot of turnovers, a lot of chances from it. I’m excited for it, I think it’s going to be fast, I can use my speed and skill even more and hopefully it’s going to turn out good.

Moore – It feels a little bit more intuitive out there, a little bit more forward skating. You can attack better. I think it’s been good so far. There was definitely stuff you have question marks on, but we’ll get it going.

Moore highlighted the system’s ability to get the feet moving for players like him on the wing, to better capitalize when the system executes as intended. It gets players skating, as opposed to waiting, so when a turnover comes, it’s a created with forwards already moving. There’s benefits to that with regards to potentially going the other way.

I think part of the change too comes down to the players the Kings have on the right. Kempe, Moore and Foegele are all penalty killers and none of them cheat the game for points. The Kings were a Top-5 defensive team around the NHL last season in just about every category. Whether it was goals against, suppression of high-danger chances or anywhere in between, the Kings ranked in the league’s Top-5 in 5-on-5 situations.

They don’t want to lose that, but they also understand that the offensive production hasn’t been to where it needs to be in order for the organization to take the next step. Having the right mindset, with the right system change, is something the Kings hope can help one without hurting the other.

With regards to the defensemen, there are multiple changes.

In past seasons, the Kings prioritized fast, puck-moving players on the right side because they fit into how the 1-3-1 was aligned.

Doughty was already there, but frankly he can play in just about any role and be successful. Think Jordan Spence and Brandt Clarke, as puck retrievers, those are the guys who handle pucks well, with the right defenseman always the furthest player back.

Even guys who have recently departed the organization were strong puck movers, guys like Sean Walker and Sean Durzi had those areas as strengths, whether it be Walker with his legs or Durzi in moving the puck.

The right-sided defensemen now have different responsibilities. Puck retrievals will still be key, but there’s more variance.

“I think we’re way more aggressive this year,” Spence said. “For the right D, we were always staying back, trying to retrieve the puck, but this time we’re trying to step up to guys before the blueline. It’s a big change, but at the same time, I think it’s going to create a lot of opportunities in the offensive zone, turn the puck around as fast as possible. I think for us, it’s going to work out really well and for me to jump up and contribute.”

For those who play on the left side, the Kings typically looked for that more defensive player, perhaps with some physicality, as the left-sided defenseman was up on the left side as a part of the three across.

For Mikey Anderson, the 1-3-1 is more or less how he came into the professional ranks. Playing that system for four consecutive seasons turned it into clockwork for him. The role is a little bit different now and he admitted there’s still an adjustment taking place. But, with two weeks of camp under his belt, he and the group are feeling more comfortable.

“It takes a little bit of time, the 1-3-1 turned into second nature because of how long we were doing it, but it’s getting more comfortable,” Anderson said. “It’s nice to go through it in practice, do it in a game, being able to talk through it in different situations, but overall I think it’s been a good transition so far. We’ve got to keep grinding away at it to feel more comfortable.”

While players are generally optimistic, it hasn’t been perfect.

Look at the preseason win over Boston, with the goal conceded.

The Kings lost the faceoff at center ice, just after Quinton Byfield scored his second goal of the game. The play was a lesser-seen detail, with center-ice faceoffs not occurring all that often other than to begin a period. The Kings got lost between a neutral-zone faceoff loss and a neutral-zone forecheck. It led to Bruins forward Patrick Brown splitting the team down the middle and scoring from the slot.

“That was kind of an in-betweener, it really should have been a neutral-zone faceoff loss and in that scenario we have protocols, in a neutral-zone forecheck is another protocol,” Hiller said. “One of the players thought at that point, it had turned from that into a forecheck, so we got a little bit mixed up. It shouldn’t happen again, but things like that will happen from time to time.”

With a new system comes adjustments and the Boston game, while generally good, served as a reminder that mixups can still happen as the team becomes more comfortable. Tomorrow, those mistakes would be even more costly. When the Kings take on the Sabres, we’ll get a truer sense of where they’re at with this facet of their game.

It’s exciting to talk about these principles on October 9. On October 10, those principles need to be put into practice, in the games that matter. If the Kings get burned through the neutral zone, aw the pace picks up and the intensity increases, we’ll know there’s work to do. If the system is executed as intended, it’s onto another evaluation on Saturday. Such is life in the NHL. The team feels prepared. Tomorrow, we’ll find out for sure.

-

For a deeper dive into the systems they're running this year I am waiting on Jack Han’s 2025 edition of his hockey tactics reference book where he goes over every team's systems, but that won’t be out for a while.

Last I heard he plans to squeeze it out around the Trade Deadline this season! It’s gets published here if you want to keep an eye on it, and he posts updates on progress semi-regularly here in this twt thread. I will be purchasing it and no doubt yelling about it enough on here so you could always just wait for the smoke from this blog <3

Can't recommend him enough as a twt/bsky follow + substack read. If I had the disposable income I'd be subscribed to him and paying for his work. He writes plenty of free stuff, but his paid work... oughhh...... absolutely worth it.

Sorry this was a bit long! I considered just dumping the links on you but honestly I've been meaning to get all this archived on my blog so thanks for prompting me to do it. <3

13 notes

·

View notes

Text

Cate Blanchett Looks Unrecognizable in Her Look For Spy Thriller 'Black Bag'

Image: Instagram Cate Blanchett, the acclaimed actress known for her striking platinum blonde bob, was nearly unrecognizable as she donned a long brunette wig while filming her latest project, "Black Bag," in London on Friday. The 55-year-old actress transformed her look entirely, stepping into character on the streets of Marylebone. save me brunette spy cate blanchett pic.twitter.com/qBrXOF3Cjg— kenza 🍉 (@mstowe_) May 27, 2024 Blanchett looked stunning in a brown leather jacket paired with a black wide-legged jumpsuit, cinched at the waist with a matching belt. She completed the ensemble with a pair of towering boots and eye-catching blue-tinted aviator sunglasses, which added a touch of mystery to her appearance. Carrying a water bottle, the "Blue Jasmine" star appeared to be in good spirits as she prepared for her scenes. Joining her on set was Pierce Brosnan, who seemed to be channeling his James Bond roots as he took on the role of a spy named Spiegel. The film, directed by Steven Soderbergh, is an upcoming American spy thriller produced by Focus Features. Soderbergh is known for his work on critically acclaimed films such as "Erin Brockovich," "Logan Lucky," "Magic Mike," and the "Ocean's" trilogy. "Black Bag" boasts an impressive cast, with Michael Fassbender leading alongside Blanchett. The film also features Bridgerton favorite Regé-Jean Page and Naomie Harris, known for her role in "Skyfall." Other notable actors include Marisa Abela, recently praised for her portrayal of Amy Winehouse in the biopic "Back To Black," and Tom Burke from "The Crown." While the plot details of "Black Bag" are being kept tightly under wraps, the filming and production commenced earlier this month in London. The project is backed by producers Casey Silver and Greg Jacobs, with the script penned by David Koepp, one of Hollywood's most successful screenwriters. Koepp's notable works include "Jurassic Park" (1993), "Mission: Impossible," "Spider-Man," and "The Mummy." Blanchett's transformation for "Black Bag" comes shortly after her appearance at the Cannes Film Festival, where she participated in a press panel discussing the importance of providing space for refugee filmmakers to share their stories. During the panel, she acknowledged her privileged position and sparked conversation by describing herself as "middle class." "I'm white, I'm privileged, I'm middle class and I think one can be accused of having a bit of a white saviour complex," she said. This remark surprised many, given her estimated net worth of $95 million and her extensive property portfolio. Cate Blanchett, who was born and raised in Sydney, now resides in the UK. Since 2015, she has lived in East Sussex with her playwright husband Andrew Upton and their four children. The couple, who married in 1997, share three sons—Dashiell, 22; Roman, 19; and Ignatius, 16—and a daughter, Edith, 8. Blanchett's ability to completely transform her appearance for her roles continues to impress fans and critics alike. Her upcoming role in "Black Bag" promises to showcase yet another facet of her versatile acting skills, as she immerses herself in the world of espionage and intrigue. As the filming progresses, audiences eagerly anticipate the release of this thrilling new addition to Steven Soderbergh’s filmography. Read the full article

0 notes

Text

David/Jake; looking askance

For the prompt: Protective David which it basically doesn’t even follow, because David wanted to add like ~backstory, and ~lead up and I am as helpless to David as Jake Lourdes is, though a lot more exasperated about it.

David doesn’t like Tampa Bay.

It isn’t anything personal, really, has nothing to do with the city or with the team, no matter how frustrating they can be to play, especially when Sebastien Boucher decides that night is going to be one of those nights. They happen less than they used to, but they’re still irritatingly common.

It has nothing to do with Tampa, it has to do with how David feels when he’s there. And David’s feeling the mix of feelings he always faces in Tampa: frustrated, on edge, and irritated at everything and everyone. The Panthers are the second game on their trip to Florida, so he’s in a better mood than he would be otherwise, but he’s also jittery, impatient, all the time he’s spent away from Jake coalescing into one last day that feels intolerable after all the rest.

It makes no sense, but it happens every time. Well, every time he isn’t in Tampa on the back end of the road trip, missing Jake more than he rightfully should after a single day.

So he’s already tense before he catches the night’s highlights over a post-game dinner with Raf at the hotel bar, their eyes flicking up occasionally, lingering for especially exceptional plays. And for people they know, David supposes, because he typically would have looked right back down the second he saw two players circling one another — he does not consider that to be a highlight of any game, particularly because it is, by all accounts, against the rulebook, and shouldn’t be encouraged the way it is — but he saw the Panthers jersey, and then a split second later, recognised the way Jake holds himself. He apparently recognises it even when he’s fighting. David wasn’t aware of that until now.

Raf sucks a breath through his teeth when Jake goes down. Not down — not out cold, not his head hitting the ice, all those worst case scenarios that make David go cold every time a fight involves someone he cares about. Thankfully most of them aren’t fighters, with one notable exception.

Jake gets up again quickly, nothing too hurt but, David imagines, his pride, because if he’s remembering correctly, Jarvis probably isn’t even legal to drink yet. When he pulls out his silenced phone he already has texts from Jake waiting, im fine! followed by lost that one lol.

David does not consider there to be anything worth laughing about.

He also has one from Robbie, who’s sitting with Elliott down the bar, hahaha he’s such a dumbass and David scowls down at it, but he doesn’t send a text arguing the point.

*

David looks it up when he’s back in his hotel room to see what had sparked it. It wasn’t something he would consider an explanation — none of it is an excuse — not retaliation for an earlier hit, or an escalation of previous hostilities. As far as David can tell, it was just Jake trying to get his team invested in the game, down 4-1.

David’s always found that to be specious reasoning. He’s certainly never grown more invested in a game solely because one of his teammates took a few punches. If anything, he just gets distracted, worrying they’ll be juggling lines for the rest of the game if his teammate gets injured. And even if it did work — wouldn’t that work just as well on the other team? A net zero impact at best is not something worth punching someone over.

He doesn’t say that when he calls Jake, of course, just asks how he’s feeling — fine — and whether he’s icing his face — yes, but David has suspicions that isn’t true, or if it is, it was a cursory icing at best.

“What time are you guys getting in?” Jake asks. “I’ll pick you up at the airport.”

“Are you even safe to drive?” David asks.

“Why wouldn’t I be?” Jake asks.

“Your eye,” David says. It was already purpling in his postgame interview, and David imagines it’s significantly worse now.

“It hasn’t swollen shut or anything,” Jake says.

“That’s not an answer,” David points out.

“I’m safe to drive,” Jake says. “I’ll pick you up at the airport?”

“If I can clear it with the coaching staff,” David says, but they both know that means yes.

*

David deplanes ten minutes late onto hot tarmac and a text from Jake letting him know where his car is. He has cleared it with the coaching staff, as expected, so he splits from the team at the terminal, enduring a parting elbow and wink from Robbie.

Jake pops the trunk so David can put his carry-on in, thankfully not getting out and insisting on doing it himself, the way he usually does. David doesn’t know if that’s because he doesn’t feel up to it, or if David’s finally convinced him that, Florida or not, it’s an entirely unnecessary risk.

When he opens the passenger door he decides it’s probably the former. His eye’s a purple so deep it must look black in worse lights. Even on a sunny day, all David can see is shadow.

“Not as bad as it looks,” Jake says. Either David’s face gives something away, or that’s the way he’s had to greet everyone today.

David imagines he’s heard disapproval from his coaches. He’s also sure that among the back and ass slaps, he’s been chirped by his teammates for losing to a kid, even if that kid was bigger than him. He suspects Allie and Natalie have also chimed in with their opinions on the fight, and he doubts they were complimentary.

“That was a stupid fight,” David says anyway.

“I know,” Jake groans, exactly like someone who has heard that repeatedly since yesterday.

David reaches toward the bruise, livid, cresting his cheekbone, but Jake sucks in a breath before David’s fingers even make contact, and David pulls his hand away, puts it in his lap.

“Sorry,” Jake says.

“You look awful,” David says, and Jake laughs, then winces.

“I know,” Jake says.

“I don’t know why you keep getting into fights,” David says.

“Eh, it’s usually the other guy looking like this, not me,” Jake says.

David frowns. “That’s not better, Jake.”

“You’re right,” Jake says.

“It is better,” David says, “I didn’t mean it isn’t better for—“

“No, you’re right,” Jake says, “it’s not.”

David looks down at his hands, catches sight of Jake’s. They look sore, winter chapped but worse, his knuckles red and raw. He starts to reach out, then pulls his hands into his lap again. Flinches like it’s his own injury when Jake reaches out and threads their fingers.

“Doesn’t that hurt?” he asks, but Jake just squeezes his hand in answer, so if it does, David supposes Jake doesn’t mind.

126 notes

·

View notes

Text

The chancellor’s mini-budget has spooked the markets, stoked a rise in interest rates, and now caused a full-blown and very public cabinet row over whether to cut benefits for millions of working-age families. Some ministers are urging the prime minister to press ahead with the cut and end Britain’s “Benefit Street culture”, while others have spoken out against it. The former Brexit minister David Frost argued that people already feel “insecure going into the autumn”; the Wales secretary, Robert Buckland, argued that a “safety net is an important part of what a one-nation Conservative is about”.

How has it come to this? The row has been sparked by the chancellor’s need to show that he is committed to keeping the public finances on a sustainable path, after announcing £45bn of unfunded tax cuts last month. Achieving this without further U-turns on tax cuts will require Kwasi Kwarteng to announce major spending cuts on a scale we last saw when George Osborne announced an emergency budget in the wake of the financial crisis.

There are lots of ways to cut public spending – from cancelling future infrastructure projects to pencilling in big cuts to public services after the next election. But the option that ministers have been rowing about is to increase working-age benefits next April in line with earnings, rather than the default measure of increasing them in line with prices. In normal times, this would actually boost benefits – our wages generally grow faster than prices. But these are not normal times. With inflation at a 40-year high and likely to remain that way for much of 2023, this policy amounts to a huge cut in working-age benefits.

We are now in a full-blown, and frequently fact-free, row about whether this is the right thing to do. It is not. The cut virtually guarantees growth in poverty levels and risks reducing growth in the economy – even though growth is the stated aim of this government’s mini-budget.

Let’s start with the economic context. Next year, Britain will still be in the midst of a cost-of-living crisis. The government’s welcome energy price guarantee has staved off a winter catastrophe, but ongoing high inflation means the country will continue to get poorer. You don’t double down on a period of falling household incomes by directly cutting income support. That may bring government spending down, but it will also drive poverty up.

Furthermore, this is not a policy laser-guided at tackling Britain’s “Benefit Street culture”, as some cabinet ministers have said. Britain already has one of the lowest levels of unemployment support of any advanced economy – it’s now worth just 13% of the average weekly wage. Unemployment has also fallen to its lowest level in nearly 50 years.

It’s true that our labour market has shrunk since the pandemic, but that’s largely been driven by older workers leaving the workforce altogether. They are mostly not claiming benefits – they have moved into early retirement. If the government wants them to return to the workplace, they are going to have to think harder than another “benefits crackdown” that these ex-workers are wholly unaffected by.

So who would be affected by this benefit cut? There are about 1.2 million people unemployed in the UK – but this cut will affect four times as many households if it affects everyone on universal credit (other working-age support such as personal independence payments are likely to be exempt).

People in work account for 41% of those on universal credit. A low-earning couple with two children stand to lose around £750 from this policy – at a time when their incomes are falling.

Of the remaining population of universal credit claimants, the vast majority are not working for very good reasons – they are either caring for infants, ill, or have a disability. For example, a single disabled adult stands to lose around £380 on average from cutting benefits next year. The policy will not persuade anyone from these groups to find work – it will just make them poorer.

Economic policymaking is not easy at the moment, whoever happens to be chancellor. There are no easy decisions when inflation is high, interest rates are rising and the country is getting poorer. But you can start by not making a tough situation even worse.

You can easily avoid cutting the incomes of low-and-middle households, for example, by not allowing very well-paid consultants to pay less tax than they should. The challenge modern Britain faces is to raise growth and reduce inequality – not to raise inequality and risk reducing growth too.

4 notes

·

View notes

Text

Familiar Green

Damian Wayne x Reader Soulmate AU

In an AU where when your soulmate and you touch you feel sparks and intense warmth! Damian is around 16-18 ish in my head!

Being a sucker for a good love story you couldn’t help but always feel jealous watching your classmates, friends, and even strangers on the street find their soulmate. You watched as kids bumped into each other only to see their eyes meet at the feeling of sparks. What did the “sparks” even feel like? As a child you were about ready to touch an electric fence to understand the feeling.

As you grew up your focus eventually left your soulmate and you spent far to much time focussing on school work. You got into Gotham Academy on a merit scholarship from the Wayne Foundation and you were determined to put it to good use. Money was a sore subject and your family had been scraping by since you could remember. Your parents were soulmates and always said that their love would conquer all or some sappy shit like that. The only thing you were in love with was knowledge and that was just fine. In classes you were attentive and quiet, learning quickly no one liked a smart ass. Teachers often slipped you materials for projects knowing you probably didn’t have them at home and you sat in the back minding your own business.

You never ran with the popular crowd. You had friends you walked to class with and studied with, especially friends who were as driven as you but you never had a BEST friend. The person you tell everything to and a confidant who shares your passions and jokes with like no other. You would wait for the sparks to show you who that would be.

Currently, you were planning a speech for the annual Wayne Family Gala where all their merit scholars would show what they were doing with their scholarship. The speech was somewhere in between intense bragging about your grades, achievements, and experiments while also thanking the Wayne family every two words. You had it planned perfectly: big purse to get snacks for the endless speeches, the same dress you’ve worn the last two years, and one gratitude dance then home. Easy.

When the bell released you from the last class you began pushing towards freedom. Students grumbled and shoved through the tight halls and you rolled your eyes at the stupidity of those walking against the crowd or those stopped to chat about nothing. With the door in sight you sped up, pushing hard when you felt a zap. Your heart stopped, turning around to the sea of people pushing past you. The feeling was comforting yet alarming, the friction of just tapping shoulders was enough to stop you dead in your tracks. What seemed like endless hoards of people pushed past you while you stood begging for the person who felt it too to run back to you.

“Look at the genius who forgot how to walk”

Words shook you from a daze as you looked up to see a football star with a 2.1 GPA staring you down. Rolling your eyes you headed out for fresh air and a walk home to prep for the gala, but you couldn't shake the feeling resonating in your shoulder.

-- agressive time skippppp --

As you watched your classmate wrap up his speech on his first place win at the Math Olympics you realized it was time for yours. The two of you did a quick high five before you found yourself alone, shaking hands clutching note cards with bright white lights blinding you from seeing Gotham’s most powerful staring expectantly up at you. With a deep breath, you began recounting the highlights of your year. Finding Mr. Wayne’s face up near the front you saw him nodding as you detailed your research with collegiate professors, perfect test scores, and passion. Thanking the board members one last time you looked to the cameras and gave a big smile before heading back behind the stage.

Once away from the prodding lights you let out the breath held in for the entire speech. Until next year Gothamites. Detailing your plans to chat up the rich folk, dance in front of the cameras photographing merit scholars then leaving and probably getting fast food on the way home, you smiled to yourself knowing it was almost over. Heading out to the main floor you listened politely to the rest of the speeches before scouting out the person with the biggest net worth in the room.

Making your way around the room, you accidentally locked eyes with none other than Mr. Wayne who gestured you over. Estimating that the money held between Mr. Wayne and the men he was talking to stood around a couple trillion dollars you gladly complied, hoping to find a sponsor for more research, maybe even college scholarships.

“Hello Miss. It’s y/n right?” you politely greeted Mr. Wayne trying not to gawk at his suit that probably cost more than your family’s rent. Finding your inner confidence you took the opportunity to explain your passions and ask questions of the people in the semi-circle formed around you. While talking, a young man came to stand next to his father, clearly impressed with your credentials. After a couple glances you recognized the light smirk and emerald green eyes as Damian Wayne. You saw him as the opposite of you, he floated through Gotham Academy on Daddy’s wallet, barely showing up to school and often wearing dark sunglasses to hide what you assumed to be a hangover from partying the night before. Giving him a curt smile you continued, mostly focused on David Shield, a man about 55 who ran a series of fancy hotels, he shared passions with you and looked very interested.

The more you spoke the more Shield focused on you. Eventually, he offered to bring you to get a drink (non-alcoholic you assumed) and talk about a possible partnership. Quickly you began thanking the men around you will either a nod or a quick handshake. You couldn’t pass up the opportunity to shake Bruce Wayne’s hand and you almost fainted when you realized you were shaking hands with THE Bruce Wayne. Lastly you turned to Damian and saw Mr. Wayne pat his back, forcing him to hold out a hand, rolling his bright green eyes lazily. As you went to shake it Mr. Shield tapped your shoulder hurrying you saying “let’s go princess I’m in a hurry here” as he started walking off. This was the opportunity of your lifetime, you tried to walk past Damian, hurriedly trying to follow Mr Shield. When your shoulder brushed Damian’s and you felt the familiar sparks again your heart ripped in half. You could swear you heard them crack and pop in the air as you locked eyes with his green ones. Ready to forget about Mr. Shield you turned to Damian only for him to put two hand on your shoulders and mouth “Go I’ll find you” as he tried to direct you towards Mr. Shield. Where his hands made contact with your collarbone warmth erupted you could feel each finger radiating and sizzling against your bare skin.

In a daze, you felt Damian let go and you stumbled towards the bar. Mind racing you couldn’t stop turning back to Damian, who was in deep conversation with his father, both of them stealing glances at you. Trying to focus on the room and not the cold feeling from missing your soulmate’s touch you felt a hand snake around your waist and pull you towards the bar. Looking up at Mr. Shield who held your waiste for far too long you tried to shake off all thoughts of Damian and secure your future. Mr. Shield told you to call him David and he tried to order a fancy alcoholic drink for both of you. Asking for a club soda he paid and the two of you spoke about shared interests and a possible collaboration. Trying to focus on the conversation and not the feeling of your heart beating out of your chest was extremely difficult.

After sipping bubbly water with Mr. Shield David and him deciding to grant you the money you needed you felt ecstatic. Trying to wrap up the conversation and look for Damian Mr. Shield wouldn’t end the conversation with you. Your heart sunk as you saw the paparazzi follow Mr. Wayne, Damian, and his three brothers out of the ballroom. The only breath of hope you felt was seeing familiar green eyes frantically scanning the ballroom for who you hoped was you, but his eyescouldn’t find yours.

Defeated you returned to speaking with David but decided it was late and you were feeling more lightheaded than normal. He offered a ride home and you couldn’t pass it up, not feeling too well, probably because of the loud atmosphere and heavy air. Getting up you felt him place his hand in the small of your back and though you tried to twist or politely shake it off he kept it there. As you stumbled towards the door you felt worse and worse. Knowing something was seriously wrong you decided it was better to wait outside for your parents to come get you. You tried to explain the situation but Mr. Shield adamantly said you had to come with him. Beginning to get woozy and frustrated you started pushing him away.

“Y/n sweetie let me take you home” he purred

“You don’t even know where I live let me go” you stopped dead in your tracks.

“C’mon just right here let’s get in” he gripped your arm and immediately fight or flight kicked in and momma didn’t raise no bitch. You began to hit his chest, yell, and try to slither out of his grip. Your fist connected with his chin and he stumbled back, visibly angered he advanced toward you and you realized this was not going to end well. Closing your eyes you braced for pain but felt a smaller, latex covered hand wrap around your waist with a woosh.

With your eyes still closed you couldn’t tell if you really were floating in a stranger's arms or if you were just heavily drugged. Opening an eye you saw the gala building grow smaller and you decided it was definitely the former, but probably also the latter. Sucking in a breath you looked up to see a domino-masked, red and yellow-clad vigilante holding you with one arm and a grapple with the other. Realizing you were literally hundreds of feet above solid ground you wrapped your arms around Gotham’s own Robin squeezing his neck and feeling a familiar spark. Unable to connect the dots due to a heavily drugged brain you clung to the hero praying for your life until you heard

“y/n we’re safe now” from a familiar, and very concerned voice.

Peeking up you realized he was still holding you as you clung to him though he stood comfortably stable on the roof of a building. Gingerly you put your feet on the ground, not releasing him from your grasp feeling the sparks fly between your fingertips and his neck. Looking up at Robin you moved a hand to his cheek, sparks sizzling and jumping more so than ever. And in what was probably not your smoothest moment you mumble

“hey Damian” at the masked figure. Your fingers instinctively tug at the domino mask and as you expected, the same piercing green eyes looked down at you.

“hello y/n” he nodded. His eyes began to scan you for any signs of pain and you assured him you were fine.

“disgusting of David Shield to try to drug a teenager especially my own soulmate TT” your heart fluttered at the acknowledgment of the bond. You reached up to touch his face again just to check the sparks were still there. Like clockwork electricity danced between the two of you. Content with the feeling you decided to share some personal information. Whatever Shield gave you made you bold if nothing else.

“You know I’ve wanted a soulmate my whole life. I’d let Shield go after me again if it meant I’d get to meet you. Especially if it meant my soulmate was this hot holy hot damn” Damian’s eyes softened looking down at you and his lips pulled into a smirk but you could tell no amount of comfort would stop his anger.

“Trust me beloved no one will go after you ever again” he pulled you against him and you instinctively wrapped your arms around his torso, fitting together like a puzzle. Even with a cool breeze blowing around the top of the building the warmth from holding your soulmate was enough to have you melting into his arms. In that peaceful moment every cliche made sense. This was feeling you wanted to feel forever. You heard a light buzz from his earpiece with a voice asking about his location and status. With a curt reply Damian told you it was time for him to take you home. Holding onto Damian as he swung down he whispered in your ear

“I could get used to having you in my arms beloved” and with a giddy smile you replied

“I’d hope so lover boy you’re kinda stuck with me forever” at this he squeezed you tighter, his eyes shining with an emotion he’d never felt before and you looked up filled with excitement for the emerald green eyes you’d spend the rest of your life looking at.

615 notes

·

View notes

Text

Brexit: An Unwinnable War

How do you stage a coup? You start a war. You fan its flames, until it grows out of control. You make it so that it’s impossible for the moderates to win, showing them as out of their depth, needing a stronger, unconventional hand to sort the mess out. Then you step in, and find that you can get away with breaking all the rules...

Act 1 - Project Fear

The spark was the slow part. There had always been rumblings of discontent around the UK’s place in Europe, dating right back to our accession to the European Community in 1972, and intensifying since the project formally became a political European Union in 1993.

There had been a referendum in 1975, won by a 67.2% vote to remain, but the question was raised again after the 1993 Maastricht Treaty. No referendum was needed for the government to sign up, but neighbours Ireland and France held one to confirm the decision, and many in the UK thought they deserved the same. That year saw the birth of a number of protest parties, the most successful of which, UKIP, continues to pressure for ‘Brexit’ today.

After years of pressure from UKIP and the sizable Eurosceptic wing of his own Conservative party, Prime Minister David Cameron finally gave into their demands. In 2016, a referendum was held, with one simple question: Should the United Kingdom remain a member of the European Union or leave the European Union? No details were provided as to what the latter option would look like. That was down to the campaigns to provide.

It turned out that it was actually many options hidden within one. Every leaver had their own idea of what shape Brexit would come in. Many talked about the Norway model, a country with full access to single market, but which is obliged to make a financial contribution, accept most EU laws, and which has free movement with the rest of the EU. Others suggested a Swiss model, part of the EFTA but not the EEA, making a smaller financial contribution to access specific areas of trade, and again with free movement.

Still others spoke about Turkey, with no membership of the EEA/EFTA but its own customs union with the EU, to avoid the need to impose tariffs on exports. They were a dozen combinations available. What was certain was that there would be some sort of deal, and it would be quick and painless to negotiate. What was clear was that “absolutely nobody is talking about threatening our place in the Single Market” as Daniel Hannan, known as the Godfather of Brexit and a major push behind it, had said the year before. I have saved a full raft of quotes from other Leave leaders for Act 2, below.

On 26 June, senior Leave campaigner and PM hopeful Boris Johnson wrote an article confirming that the UK would remain part of the single market. In government and parliament, discussing how to implement Brexit, the main debate was between full access to the single market or only a customs union. There was no mention of crashing out with no deal. There was certaintly no mention that, in August 2019, over three years after the debate, we would be no closer to a resolution.

The Leave campaign seemed happier telling voters what the former option on the ballot would look like. The electorate might have thought they already knew what staying in the EU would look like, seeing as it was just the continuation of a fairly agreeable status quo, but they were corrected with a spate of glossy leaflets from the multiple Leave campaigns, and the same talking points brought up in every interview.

One colourful infographic, common across the material, tried to spread fear that the entirety of Turkey’s 76 million population was about to move in next door. The truth is that Turkey is nowhere near joining the EU, and that the UK has a veto (i.e. even if they tried to join, we alone could stop them). Turkey cannot join the EU unless the UK wants it to. But if you say “Turkey is joining the EU”, or treat it as a done deal, and slap FACT on it, people will get shocked. If you highlight it in orange and red with a big red arrow of Turkish people swarming into the UK, people will be worried. That’s what you want. It doesn’t matter if it’s true.

I use the term ‘swarming’ advisably, because although it’s a despicable way to describe to human beings, dehumanising them to insects, vermin, it’s the term that David Cameron used in July 2015, shortly after plans for the referendum were confirmed. As shown in other Leave material, such as the UKIP poster above that has been frequently compared to the Nazi propaganda below it, this debate was consistently coded with xenophobia and racism, an attempt to win by appealing to voter’s fears of mass immigration, the need to secure our borders, even though this was a picture of refugees moving approximately one thousand miles away and several countries away from the UK.

If there was any doubt over the racial intention, the original photograph for this poster is below. It has a prominent white face at the front. Now note the way the original has been cropped and where the single opaque box of text has been placed, with everything else transparent. Note which one individual has been covered up, with all of the others put on show.

Even if they weren’t abhorrent, the claims around immigration are also not true. The UK already has control of its own borders. Whilst some other EU countries like France and Germany have chosen (of their own will), to have open borders with each other, in a region called the Schengen Area, the UK had the free choice not to be a part of this. This means that the UK has full border checks on every individual entering the country. The UK’s agreement with the other EU countries is that nationals of those countries (not refugees from the Middle East passing through) can stay here on a three month visa, but after that it’s our choice.

In addition, that agreement has always been subject to ‘grounds of public policy, public security or public health’, which effectively means that the UK can choose not to let in any individual they don’t want to. The UK has specific power to expel any EU citizen who they believe poses ‘a genuine, present and sufficiently serious threat affecting one of the fundamental interests of society’, and the country they came from has to accept them back.

In short, the UK only needs to accept productive members of society. Indeed, all research (including by the government’s own Office of Budget Responsibility) has shown that immigrants make a net contribution to the country’s economy, and many industries are dependent on migrant workers. The campaign to ‘end uncontrolled immigration from the EU’ or ‘protect our security - open borders gives criminals and terrorists an easy route into the UK’ is therefore another straight-up lie designed to leverage people’s base xenophobic fears.

The frequently repeated idea that the NHS and UK benefits system are being exploited by migrants is also fake. Not only do migrants pay £78,000 more into the UK government over their lifetime than they take out over their lifetimes, but the NHS specifically depends on immigration: 37% of doctors qualified overseas. The problem with long NHS waiting times is not because the system is overcrowded, but because it is understaffed, and immigrants are the solution rather than the problem. But this is a government policy problem, and for too long they have found it easier to blame the people coming here to help.

Before the referendum, David Cameron had also secured the UK further powers in restricting benefits paid to migrants, a massive compromise from EU principles of fairness which would have given the UK privileged status amongst member states. There would be a 4 year break before benefits had to be paid to EU citizens working in the UK, with tax credits phased in over the same period. EU migrants without a job would be restricted to claiming jobseeker’s allowance for 3 months, and then deported after 6 in they were still unemployed. Benefit payments would be fixed to the amounts available in their home countries, removing any incentive to come to the UK to claim them.

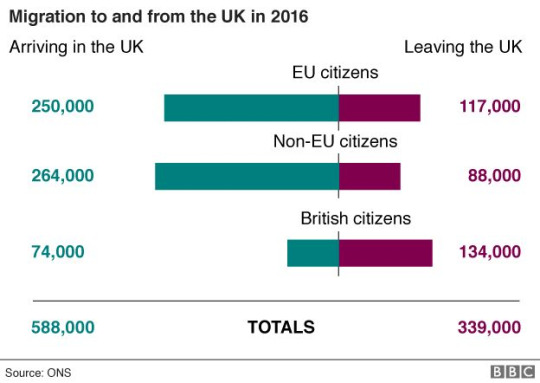

This is all without even considering a fourth angle, that the freedom works both ways. Hundreds of thousands of British citizens exercise their right to visit and live in and work in the EU, just as happens the other way around. Finally, it’s worth noting that immigration from the EU makes up a minority of total migration to the UK, even with these supposed ‘open borders’, and specifically when net migration is considered. Most of the people coming for the long term do so from elsewhere in the world, where we have never had ‘open borders’ but still freely choose to let them in, suggesting that immigration numbers have always been up to the UK government and migration from EU countries will similarly continue at a similar rate no matter what the border situation is.

There were many other obvious lies at the time, such as the suggestion that the EU were in the process of building an army, a completely transparent attempt to spark fear, but they were told so often that they started to be believed. On the other side, all concerns about the risks of leaving were dismissed as Project Fear, a classic example of projecting: as the Leave campaign were in the business of fearmongering, it helped distract from that by accusing their opponents of the same at every opportunity.

Project Fear became a term used to silence all dissent as part of some elitist conspiracy. Some experts said that Brexit will cost the economy? Project Fear. Since the referendum the value of the pound has dropped off the charts, the UK has experienced negative growth at a time of economic success for its neighbours, and Sony, Dyson, Flybmi, Nissan, Honda, Ford, Moneygram, Philips, P&O, Airbus, Barclays, Hitachi, JPMorgan, Citibank and other firms have announced they are closing their UK operations and moving to Ireland or the Netherlands or other countries who still have trade links with the EU. Brexit hasn’t even hit its hardest yet, and it had already cost the economy £66 billion by April this year, about £1,000 per person. It turns out that the experts were exactly right.

Project Fear said that leaving threatened a break up of the UK. “If we vote to leave then I think the union will be stronger”, Michael Gove countered in May 2016, but the referendum vote has predictably intensified movements for Scottish (and Northern Irish) independence, as well as creating an endless dispute over the Irish-UK border, reopening scars that were just started to heal. Again, it seems that the people who knew what they were talking about... actually knew what they were talking about. The Leave campaign told people to ignore these false warnings as part of elite conspiracy, writing off the expertise of academics and industry leaders as ‘this country has had enough of experts’, an unexcusable anti-intellectualism that excused all lies and criticised anyone who dared to point out the truth.

They still put their fingers in their ears now, when reminded that those warnings have virtually all come true. This weak, the government’s reports on Operation Yellowhammer were leaked, their own forecasts suggesting a massive negative hit from leaving without a deal. When Kwasi Kwarteng, Minister of State for Business and Energy, was asked about them on TV, he described his government’s own projections as scaremongering and Project Fear, confused as to which lie he was supposed to be telling. Lead Brexiteer Michael Gove came out to dismiss them as the ‘worst case scenario’, even as a Whitehall source clarified ‘this is the most realistic assessment of what the public face with no deal. These are likely, basic, reasonable scenarios – not the worst case’.

It isn’t the first time. Theresa May withheld projections and legal advice from voters and MPs, and her government was the first ever to be held in contempt of parliament for deliberately hiding the facts to push through her votes: in contempt of democracy, in contempt of the truth, adding constitutional offences to the free-flowing lies that have been a feature throughout. Amongst all of them, perhaps the biggest lie was that Brexit was about the sovereignty of the UK parliament, taking back control from the undemocratic elites: from Theresa May and Boris Johnson we have seen two unelected Prime Ministers who have tried everything they can to circumvent British democracy, as detailed below.

36 notes

·

View notes

Text

Liiga in February: Ässät

10TH PLACE: 11 G - 5 W - 5 L - 1 OTL Possible final standings after 60 games: 8-12

Okay, so… I got to talk about what happened over the weekend, because that’s surprisingly the biggest matter in Ässät camp right now.

But before that it’s worth mentioning that despite the fact Ässät players racking up points more than most of the teams this month, this surprisingly hasn’t showed up in the standings. In fact, the team scored 36 goals in the month, only to be scored 36 times against as well. So basically, Ässät have the ability to score a lot, but they don’t have the ability to keep their own net clean hence most of the games this month were multiple goal games.

Anyway, into the more important topic, and that is Otto Kivenmäki. Ässät were facing Lukko for the final sixth derby match this season at home, and that game kind of got out of hand. 30 minutes in to the game, Lukko’s Czech defenseman David Nemecek hits Ässät rookie Otto Kivenmäki on open ice as Kivenmäki is trying to play the puck. (Watch here: x) The hit was so bad that Kivenmäki lost his helmet as he was falling down and ended up hitting his bare head onto the ice. Nemecek got ejected from the game for the hit, and will possibly face suspension, while the bleeding Kivenmäki was taken out a hospital.

This hit of course sparked a debate between the teams’ fans, because this is one of the biggest rivalries in Liiga and therefore the fans are already at each other’s throats to begin with. But there was debate about whether Kivenmäki should have kept his head up, whether he had his helmet on correctly and what not. What’s clear though that it was an accident, even though Lukko’s head coach said he can’t give any sort of appreciation for his own player for laying a hit like that.

Kivenmäki is still at the hospital, as I’m writing this, and his mum isn’t happy. Apparently the hit on the ice has caused Kivenmäki to miss not only the rest of the season, but also his high school’s final exams, because right now he is having memory issues. His mum is not certain if he will ever be able to return to playing hockey either. So we are living in a shitty time where Liiga really needs to figure out what it wants to do with hits like this, because there certainly have been way too many this season, or we will lose more young rising stars like Kivenmäki.

TOP 3 PLAYERS OF THE MONTH: Tyson Spink 6+8, Peter Tiivola 2+6, Jakob Stenqvist 2+6

1 note

·

View note

Text

DEATH BATTLE Review: Ganondorf vs. Dracula

Denizens of darkness duke it out in a duel to the death to determine who is the true duke of the dark power.

Sidenote: Really sorry if this feels blunt or rushed, but I lost the first draft and I got really mad about it.

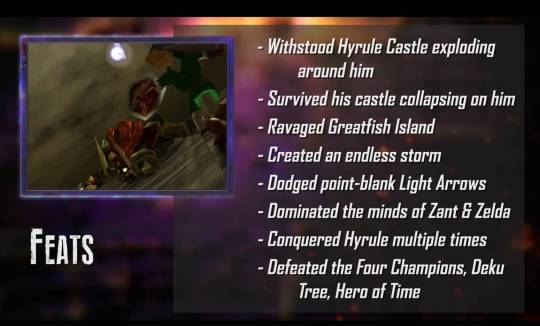

Ganondorf′s Preview.

So, everything started when the Demon King demise wanted to destroy the world, and was stopped by the Hero and the reincarnation of the Goddess. In his rage, he cursed them to feel the manifestation of his hatred come to life.

The hero and the princess would be forever locked in battle with a being known as Ganondorf.

Ganondorf had a lot of teachers to help him out with the magic stuff. From energy bolts that would make for one intense game of tennis, to your usual dark magic shenanigans, Ganondorf has it all.

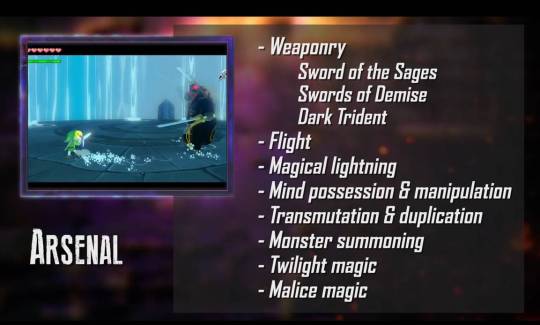

Ganondorf’s got an arsenal to boot!

From swords, to maybe two, ad sometimes on horseback, Ganondorf is skilled with a blade.

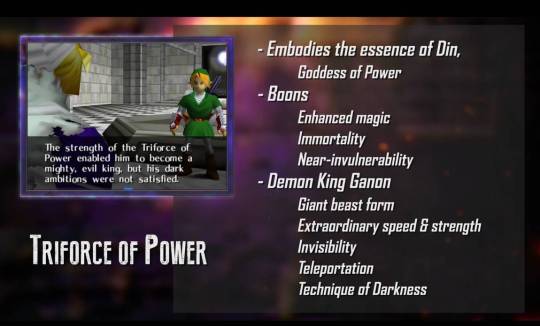

However, Ganondorf is much more famous for his piece of the Triforce, the Triforce of Power.

With this, Ganondorf gets an immense power boost… Because, you know… Power.

Thankfully, that boy in green had defeated him.

It’s moments like these that are going to make watching these two trying to kill each other in the series finale all the harder.

Thankfully, Ganondorf isn’t that invincible. Sure, you can hurt him with regular weapons, but it usually takes a holy weapon to really put him down.

It’s like Pokémon type effectiveness. Yeah, you can bring him down with non-holy weapons, but it’ll be a pain to do.

Ganondorf once survived his castle falling on top of him. By the size of it, annd accounting for a hollow interior, that equals a little over 11,000 tons.

If a castle falling on top of him isn’t enough, then a castle exploding on him would.

Using the size and accounting for Violent Fragmentation, the hosts have found that this equals

Just under 2 Kilotons of TNT.

It’s also worth noting that Ganondorf has defeated Link in at least one timeline. And Link ca dodge lasers, putting him at about 11% the speed of light.

After so may stabs, slashes, and seals, Ganondorf is onne hell of a guy to go up against, and he won’t stop until he brings about your demise.

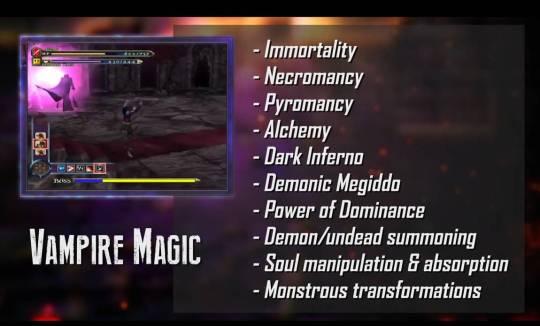

Dracula′s Preview.

So for Dracula’s preview, we basically open with a Wiz and Boomstick segment regarding Dracula’s origin story and how God works in the Castlevania universe. Also, I’m aware that I misspelled Matthius’ name, I just can’t be bothered to go back and fix it. I was off by one instance of the letter “t”. So sue me.

No need to worry, I have it all listed down. Goth kids don’t have to worry, because I took notes for them.

Anyways, much like a certain other character whose original rival I want to see in a DEATH BATTLE, Matthius rejected his humanity, and became a vampire.

(Johnathan Joestar vs. Leon Belmont, when?)

So after becoming Dracula, Matthius spent the rest of his time being… pretty chill actually. Guy even found a woman to love and had a son… Until a rerun happened, and his wife got killed by a bunch of religious nutjobs, sparking a war he would wage against the God they worshiped.

Ad Drac doesn’t have to do it with just some bog-standard vampire powers. He gets power from Chaos himself, giving him all sorts of superpowers.

Aside from the usual set, Dracula has necromancy, soul manipulation, alchemy, and a bunch of demonic transformations. Like to the point that it can become a running gag.

Now, much like old ‘Dorf up there, Dracula also had his castle drop on top of him.

That’s the literal Castlevania, by the way. Using the game’s official artwork, that means that Dracula was crushed under over 2,000,000 tons of rubble.

With all that power, he’s pulled off some crazy things.

Not only does he command Death itself, but he’s destroyed entire towns, created black holes, and all sorts of crazy stuff.

His hubris might get him in trouble more times than not, but Dracula is one hell of a fighter.

So long as evil exists, so will Dracula.

The Battle Itself.

SFM Animators David Ficher, Doovan Hohdan, Daitomodachi, and Devil Artemis are on animation. Ganondorf will be voiced by William T. Sopp and Dracula will be voiced by Steven Kelly. The Dark Lords by Brandon Yates, and audio is led by Chris Kokkinos.

So after all this time, we finally have a fight story for a 3D battle again. It’s about time.

So, it’s your typical stuff. Ganondorf wants Dracula’s castle, and old Drac is’t having any of it.

And right off the bat, we have fanservice. Really good fanservice.

So, Ganondorf goes in for an attack, but not only does Dracula dodge, he manages to bitchslap Ganondorf!

I have a screenshot of this without the borders by the way. Check out the Deviantart page to check it out if you want to use it as wallpaper.

And Ganondorf’s face here is just so great! He just looks so incredulous that someone would bitchslap him. I never knew that Ganonndorf being bitchslapped was something that I either wanted or needed, but now I know. I got me a new running gag for the fic.

Ganondorf and Dracula have a quick back-and-forth to try to gain advantage. But try as they might, speed isn’t going to be a way to pull that off. Nor will dark magic either.

This is one hell of a Halloween episode.

And Ganondorf proves his point by just going inn for the kill in 5…

4…

3…

2…

1…

Yeesh, that’s brutal. But you want to know what’s eve more brutal?- The fact that this isn’t the end.

So, Drac goes Beast Mode, and starts dominating the fight again.

So Ganondorf responds in kind. Or rather, Ganon responds in kind.

God, this fight is just so full of fanservice.

After another quick blowout, Ganon pins Drac to a wall, and the latter just up and decides to end it.

And the castle blows up. Because it’s these two.

Yeah, (real) finishing blow in

5…

4…

3…

2…

1…

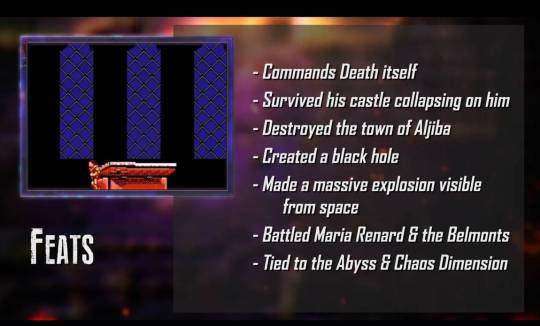

Verdict + Explanation.

So, right off the bat, they were about even in dark magic. But there are a few things that set them apart that gave Dracula an edge. Like soul manipulation. Ol’ ‘Dorf didn’t really have a solid defense against that.

But the difference in durability is pretty clear cut.

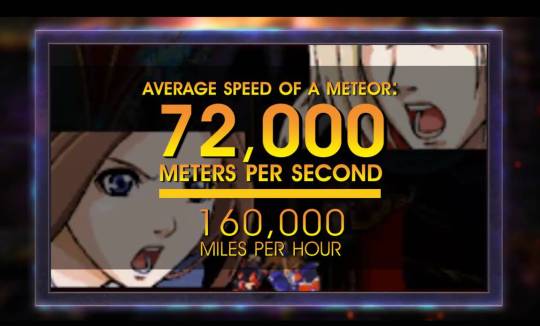

Compared to Ganondorf’s surviving the castle blowing up to how Dracula can survive a meteor to the face. That’s over a thousand times the amount of force that Ganondorf could survive.

And Dracula has plenty of ways to detach Ganondorf from his power.

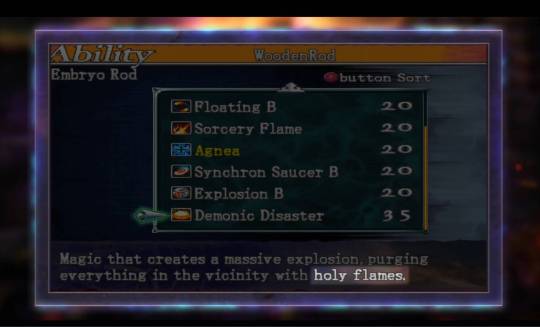

And Dracula has access to holy magic too.

That Holy Nuke is better than swinging a sword around, which was admittedly the very few ways for Ganondorf to net a win.

Surprisingly, Ganondorf was underpowered to the might that Dracula has. Drac has the power of Chaos, which is a whole universe. Compared to the power of the Goddesses, that’s quite a lot.

The best way (according to Wiz) is to look at it from the idea that they’re both using batteries to fuel their powers.

Overall impression.

If it took this long to get a Halloween episode, then it was worth it. This has a great blend of horror, humor, and action. Especially with that Dracula bitchslapping Gannondorf scene.

I should make a gif of that later.

Regardless, I really liked this one. The animation is gorgeous. I know I throw that word around a lot around these parts, but this is some top-notch stuff. I’ve only seen one of the animator’s prior works before this, and I can say they make some good stuff. If it means we can get some great fights like this one again, I wouldn’t mind seeing their names again.

9.1/10.

Next Time…

Sweet. Some psychics settle serious simulation of violence.

Get ready for a psychic showdown!

Is there a fight that you want me to review? - Send an ask/request, and I’ll look into it!

Do you want to read my fanfic based around DEATH BATTLE itself? click here!

Thank you for reading, and I hope to see you next time for…

A Psychic Pounding…………… Wait…

6 notes

·

View notes

Text

Missing Savannah Spurlock Suspect Killer Arrested: David Sparks Bio, Wiki, Age, Married, Net Worth, Twitter, Instagram, Fast Facts You Need to Know

Missing Savannah Spurlock Suspect Killer Arrested: David Sparks Bio, Wiki, Age, Married, Net Worth, Twitter, Instagram, Fast Facts You Need to Know

David Sparks Bio

David Sparks was arrested and booked into the Madison County Detention Center Thursday morning. He is charged with abuse of a corpse and tampering with physical evidence. Sparks is scheduled to appear at 1 p.m. at Garrard County District Court for his arraignment.

#BREAKING in the #SavannahSpurlockcase:24-yr-old David Sparks has been arrested and charged in connection to her…

View On WordPress

#David Sparks#David Sparks Age#David Sparks Bio#David Sparks Biography#David Sparks Facebook#david sparks kentucky#david sparks lancaster ky#David Sparks Net worth#david sparks savannah spurlock#David Sparks Wiki#David Sparks Wikipedia#fall lick road garrard county kentucky#garrard county detention center#madison county detention center#madison county detention center ky#madison county jail ky#savannah spurlock#savannah spurlock case#savannah spurlock facebook#savannah spurlock found#savannah spurlock found dead#savannah spurlock reddit#savannah spurlock twitter#savannah spurlock update

0 notes

Link

0 notes

Text

Cate Blanchett’s Fortune Revealed Amid Backlash Over “I’m Middle Class” Comment

Elena Ternovaja, CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0, via Wikimedia Commons Cate Blanchett, renowned for earning over $7 million per movie, sparked controversy at the 2024 Cannes Film Festival by referring to herself as "middle class." The Oscar-winning actress made the comment during a press conference for her new film "Rumors," while discussing her experiences with refugee filmmakers. She stated, “I’m white, I’m privileged, I’m middle class, and I think one can be accused of having a bit of a white savior complex.” Blanchett, who ranked eighth on Forbes’ list of highest-paid actresses in 2018, added, “But to be perfectly honest, my interaction with refugees in the field and also in resettled environments has changed my perspective on the world, and I’m utterly grateful for that.” This remark quickly drew criticism online, with many labeling the “Oceans 8” star as "out of touch." One social media user commented, “Cate Blanchett thinks she’s ‘middle class’ compared to who? Jeff Bezos? Rich people are so out of touch.” Another quipped, “Cate Blanchett is ‘middle class’… and I am a giraffe.” In light of the uproar, let's delve into Cate Blanchett’s substantial net worth. Cate Blanchett’s Net Worth Explored According to Celebrity Net Worth, the two-time Academy Award winner boasts a net worth of approximately $95 million. In 2018 alone, Blanchett earned $13 million from her roles in "The House with a Clock in Its Walls" and "Thor: Ragnarok," as reported by Forbes. Blanchett’s illustrious career began on the stage in Sydney in 1992 with David Mamet’s play "Oleanna." She made her feature film debut in 1997, playing a supporting role in "Paradise Road." Over the years, she has starred in numerous blockbuster films, including all three “The Lord of the Rings” movies. Her role in "The Aviator" earned her the Oscar for Best Supporting Actress in 2005, and she was named one of Time magazine’s “100 Most Influential People in the World” in 2007. Blanchett, who moved back to Australia in 2006, invested $7 million in a mansion on Sydney’s north shore and an additional $5 million to acquire a neighboring property. She sold the combined estate in 2017 for $13 million. Considering her significant financial assets and property investments, it is clear that Blanchett’s self-description as "middle class" does not align with the typical understanding of the term. Read the full article

0 notes

Text

Dave Sparks Net Worth 2022: Age, Height, Weight, Wife, Kids, Bio-Wiki

Dave Sparks Net Worth 2022: Age, Height, Weight, Wife, Kids, Bio-Wiki

Dave Sparks Celebrated Name: Dave Sparks (Heavy D) Real Name/Full Name: David Sparks Gender: Male Age: 44 years old Birth Date: 18th June 1977 Birth Place: Lake City, Utah Nationality: American Height: 6 feet 5 inches Weight: 101 kg Sexual Orientation: Straight Marital Status: Married Wife/Spouse (Name): Ashley Bennett Children/Kids (Son and Daughter): Yes Dating/Girlfriend…

View On WordPress

0 notes

Text

Mission and Money Clash in Nonprofit Hospitals’ Venture Capital Ambitions

Cone Health, a small not-for-profit health care network in North Carolina, spent several years developing a smartphone-based system called Wellsmith to help people manage their diabetes. But after investing $12 million, the network disclosed last year it was shutting down the company even though initial results were promising, with users losing weight and recording lower blood sugar levels.

The reason did not have to do with the program’s potential benefit to Cone’s patients, but rather the harm to its bottom line. Although Cone executives had banked on selling or licensing Wellsmith, Cone concluded that too many competing products had crowded the digital health marketplace to make a dent.

“They did us a tremendous favor in funding us, but the one thing we needed them to be was a customer and they couldn’t figure out how to do it,” said Jeanne Teshler, an Austin, Texas-based entrepreneur who developed Wellsmith and was its CEO.

Eager to find new sources of revenue, hospital systems of all sizes have been experimenting as venture capitalists for health care startups, a role that until recent years only a dozen or so giant hospital systems engaged in. Health system officials assert many of these investments are dually beneficial to their nonprofit missions, providing extra income and better care through new medical devices, software and other innovations, including ones their hospitals use.

But the gamble at times has been harder to pull off than expected. Health systems have gotten rattled by long-term investments when their hospitals hit a budgetary bump or underwent a corporate reorganization. Some health system executives have belatedly discovered a project they underwrote was not as distinctive as they had thought. Certain devices or apps sponsored by hospital systems have failed to be embraced by their own clinicians, out of either skepticism or habit.

“Even the best health care investors can’t reliably get their health systems to adopt technologies or new innovations,” said James Stanford, managing director and co-founder of Fitzroy Health, a health care investment company.

Some systems have found the business case for using their own innovations is weaker than anticipated. Wellsmith, for instance, was premised on a shift in insurance payments from a fee for each service to reimbursements that would reward Cone for keeping patients healthy. That change did not come as fast as hoped.

“The financial models are so much based on how many patients you see, how many procedures you do,” said Dr. Jim Weinstein, who championed a health initiative similar to Cone’s when he was CEO of the Dartmouth-Hitchcock health system in New Hampshire. “It makes it hard to run a business that is financially successful if you’re altruistic.”

Though their tax-exempt status is predicated on charitable efforts, nonprofit health systems rarely put humanitarian goals first when selecting investments, even when sitting on portfolios worth hundreds of millions of dollars or more, according to a KHN analysis of IRS filings. Together, nonprofit hospital systems held more than $283 billion in stocks, hedge funds, private equity, venture funds and other investment assets in 2019, the analysis found. Of that, nonprofit hospitals classified only $19 billion, or 7%, of their total investments as principally devoted to their nonprofit missions rather than producing income, the KHN analysis found.

Venture capital funds are a potentially lucrative but risky form of investment most associated with funding Silicon Valley startup companies. Because investors seek out companies in their early stages of development, a long-term horizon and tolerance for failure are critical to success. Venture capitalists often bank on a runaway success that ends up on a stock exchange or in a sale to a larger company to counterbalance their losses. As an asset class, venture capital funds assets annually return between 10% and 15% depending on the time frame, according to PitchBook.

While they lack the experience of longtime venture capitalists, health systems posit that they have advantages because they can invent, incubate, test and fine-tune a startup’s creations. Children’s Hospital of Philadelphia, for instance, parlayed a $50 million investment into a return of more than $514 million after it spun off its gene therapy startup Spark Therapeutics.

Many hospital-system venture capital funds, both established and new entrants, have grown rapidly. The largest, run by the Catholic hospital chain Ascension, has been in business for two decades and this year topped $1 billion, including contributions from 13 other nonprofit health systems eager to capture a piece of the returns.

Providence, a Catholic health system with hospitals in seven Western states, launched its venture capital fund in 2014 with $150 million and now has $300 million.

Cleveland-based University Hospitals launched its own fund, UH Ventures, in 2018. “We were candidly late to the game,” said David Sylvan, president of UH Ventures.

UH Ventures yielded $64 million in profits in 2020, Sylvan said, which pushed University Hospitals’ net operating revenue from the red to $31 million. Sylvan said the largest income contributor from UH Ventures was its specialty pharmacy, UH Meds, which provides medications to people with complex chronic conditions and helps them manage their ailments.

Another UH-supported startup, RiskLD, uses algorithms to monitor women and their babies during delivery to alert clinicians of sudden changes in conditions. It is used in UH’s labor and delivery units. Sylvan said it is being marketed to other systems. UH Ventures’ webpage touts the financial advantages for avoiding lawsuits, calling RiskLD “the first and only labor and delivery risk management tool designed to address birth malpractice losses.”

But sustained commitment is harder when the return on investment is not clear or immediate. In 2016, Dartmouth-Hitchcock, which operates New Hampshire’s only academic medical center, tested its remote monitoring technology, ImagineCare, on 2,894 employee volunteers. ImagineCare linked a mobile app and Bluetooth-enabled devices to a health system support center staffed by nurses and other Dartmouth-Hitchcock workers. The app tracked about two dozen measurements, including activity, sleep and, for those with chronic conditions, key indicators like weight and blood sugar levels. Worrisome results triggered contact and behavioral coaching from the Dartmouth-Hitchcock staff.

Dartmouth-Hitchcock found health care expenditures for the people with chronic conditions dropped by 15% more than matched controls. Nonetheless, in 2017, with the product facing unexpected technology challenges and the health system saddled with a short-term deficit, Dartmouth-Hitchcock scrapped the experiment and sold the technology to a Swedish company in return for potential royalties.