#Data Patterns IPO

Explore tagged Tumblr posts

Text

youtube

Stumbled on this - so for anyone out of the loop part of Reddit blowing up last year was because it was making use of it's API prohibitively expensive for the average person to use, killing off a lot of (superior) third party apps used to both browse and moderate the platform on mobile.

I don't know if it was stated explicitly at the time, but for me the writing was on the wall - this was purely to fence off Reddit's data from being trawled by web scraping bots - exactly the same thing Elon Musk did when he took over Twitter so he could wall off that data for his own AI development.

So it comes as absolutely zero surprise to me that with Reddit's IPO filing, AI and LLM (Large Language Models) are mentioned SEVERAL times. This is all to tempt a public buyer.

What they do acknowledge though, which is why this video is titled 'Reddit's Trojan Horse' is the fact that while initially this might work and be worth a lot - as the use of AI grows, so will the likelihood that AI generated content being passed off as 'human generated' on the platform will grow - essentially nulling the value of having a user-generated dataset, if not actively MAKING IT WORSE.

As stated in the video - it's widely known that feeding AI content into an AI causes 'model collapse', or complete degeneration into gibberish and 'hallucinations'. This goes for both LLM's and Image Generation AI.

Now given current estimates that 90% of the internet's content will be AI generated by 2026 that means most of the internet is going to turn into a potential minefield for web-scraping content to shove into a training dataset, because now you have to really start paying attention what your bot is sucking up - because lets face it, no one is really going to look at what is in that dataset because it's simply too huge (unless you're one of those poor people in Kenya being paid jack shit to basically weed out the most disgusting and likely traumatizing content from a massive dataset).

What I know about current web-scraping, is OpenAI at least has built it's bot to recognize AI generated image content and exclude it from the scrape. An early version of image protection on the side of Artists was something like this - it basically injected a little bit of data to make the bot think it was AI generated and leave it alone. Now of course we have Nightshade and Glaze, which actively work against training the model and 'poison' the dataset, making Model Collapse worse.

So right now, the best way to protect your images (and I mean all images you post online publicly, not just art) from being scraped is to Glaze/Nightshade them, because either these bots will likely be programmed to avoid them - but if not, good news! You poisoned the dataset.

What I was kind of stumped on is Language Models. While feeding AI LLM's their own data also causes Model Collapse, it's harder to understand why. With an image it makes sense - it's all 1's and 0's to a machine, and there is some underlying pattern within that data which gets further reinforced and contributes to the Model Collapse. But with text?

You can't really Nightshade/Glaze text.

Or can you?

Much like with images, there is clearly something about the way a LLM chooses words and letters that has a similar pattern that when reinforced contributes to this Model Collapse. It may read perfectly fine to us, but in a way that text is poisoned for the AI. There's talk of trying to figure out a way to 'watermark' generated text, but probably won't figure that one out any time soon given they're not really sure how it's happening in the first place. But AI has turned into a global arms race of development, they need data and they need it yesterday.

For those who want to disrupt LLM's, I have a proposal - get your AI to reword your shit. Just a bit. Just enough, that it's got this pattern injected.

These companies have basically opened Pandora's Box to the internet before even knowing this would be a problem - they were too focused on getting money (surprise! It's capitalism again). And well, Karma's about to be a massive bitch to them for rushing it out the door and stealing a metric fucktonne of data without permission.

If they want good data? They will have to come to the people who hold the good data, in it's untarnished, pure form.

I don't know how accurate this language poisoning method could be, I'm just spitballing hypotheticals here based on the stuff I know and current commentary in AI tech spaces. Either way, the tables are gonna turn soon.

So hang in there. Don't let corpos convince you that you don't have control here - you soon will have a lot of control. Trap the absolute fuck out of everything you post online, let it become a literal minefield for them.

Let them get desperate. And if they want good data? Well they're just going to have to pay for it like they should have done in the first place.

Fuck corpos. Poison the machine. Give them nothing for free.

#kerytalk#anti ai#honestly the fact that language models can't identify it's own text should have hit me a LOT sooner#long post#Sorry I am enjoying the fuck out of this and the direction it's going in - like for once Karma might ACTUALLY WORK#especially enjoying it since yeah AI image generation dropping killed my creative motivation big time and I'm still struggling with it#these fuckers need to pay#fuck corpos#tech dystopia#my commentary#is probably a more accurate tag I'll need to change to#Youtube

6 notes

·

View notes

Link

0 notes

Text

Global Top 4 Companies Accounted for 39% of total Curing Bladder market (QYResearch, 2021)

Curing is the process of applying pressure to the green tire in a mold in order to give it its final shape, and applying heat energy to stimulate the chemical reaction between the rubber compounds and other materials.

In this process the green tire is automatically transferred onto the lower mold bead seat, a rubber bladder is inserted into the green tire, and the mold closes while the bladder inflates. As the mold closes and is locked the bladder pressure increases so as to make the green tire flow into the mold, taking on the tread pattern and sidewall lettering engraved into the mold. The bladder is filled with a recirculating heat transfer medium, such as steam, hot water, or inert gas. At the end of cure, the pressure is bled down, the mold opened, and the tire stripped out of the mold.

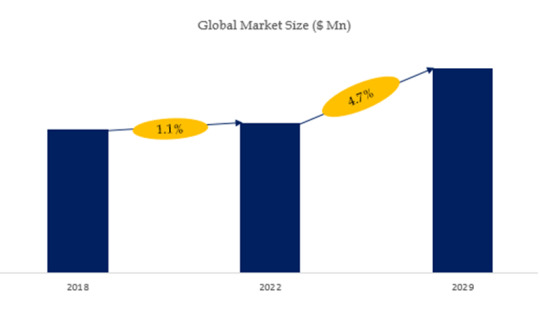

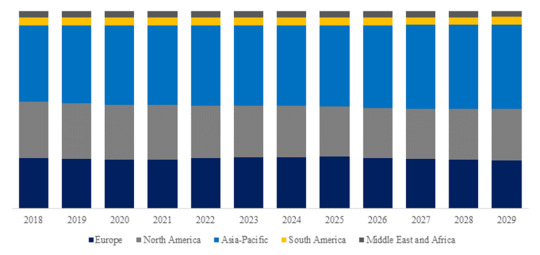

According to the new market research report “Global Curing Bladder Market Report 2023-2029”, published by QYResearch, the global Curing Bladder market size is projected to reach USD 0.72 billion by 2029, at a CAGR of 4.7% during the forecast period.

Figure. Global Curing Bladder Market Size (US$ Million), 2018-2029

Above data is based on report from QYResearch: Global Curing Bladder Market Report 2023-2029 (published in 2023). If you need the latest data, plaese contact QYResearch..

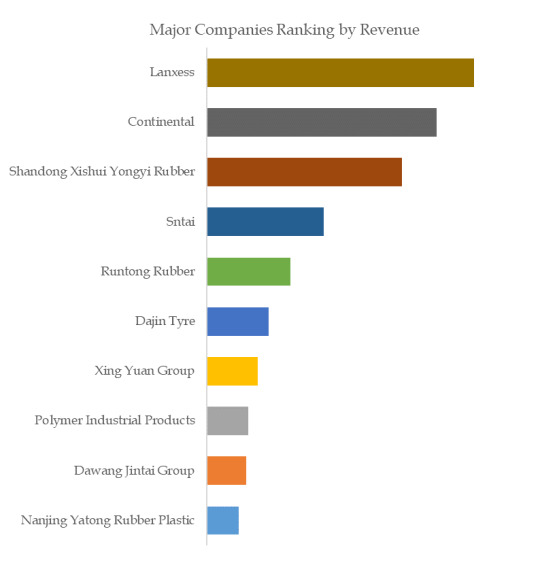

Figure. Global Curing Bladder Top 10 Players Ranking and Market Share (Ranking is based on the revenue of 2022, continually updated)

Above data is based on report from QYResearch: Global Curing Bladder Market Report 2023-2029 (published in 2023). If you need the latest data, plaese contact QYResearch.

The global key manufacturers of Curing Bladder include Lanxess, Continental, Shandong Xishui Yongyi Rubber, Sntai, Runtong Rubber, etc. In 2022, the global top four players had a share approximately 39.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

0 notes

Text

"Chime's CEO Chris Britt Considering 2025 IPO Amid Business Expansion—Will Regulatory Hurdles Derail Plans? Exclusive Insights Revealed!"

RoamNook Blog

New Discoveries in Science and Technology

Welcome, dear readers, to another exciting blog post brought to you by RoamNook, your trusted source for innovative technology solutions. Today, we delve into the fascinating world of scientific discoveries and technological advancements, bringing you the latest hard facts, numbers, and data to fuel your thirst for knowledge. Join us on this informative journey as we explore the real-world applications and implications of these groundbreaking findings.

The Emergence of Quantum Computing

One of the most intriguing developments in recent years is the rise of quantum computing. With its ability to compute vast amounts of data simultaneously, quantum computers have the potential to revolutionize industries and solve complex problems that were previously unsolvable. Imagine a world where we can accurately predict weather patterns, optimize supply chains, and discover new drugs in a fraction of the time it currently takes. This is the power of quantum computing.

In a recent study conducted by leading researchers in the field, it was found that quantum computers are capable of performing calculations at a speed that exceeds the capabilities of classical computers by a factor of 10^80. This mind-boggling number highlights the immense potential of this technology and its ability to transform various industries. Banks can optimize financial transactions, scientists can simulate complex biological systems, and businesses can analyze vast amounts of data to gain valuable insights.

The Promise of Artificial Intelligence

Artificial Intelligence (AI) has been a buzzword for quite some time now, but recent advancements have taken its capabilities to a whole new level. Machine learning algorithms are now able to analyze massive datasets and learn patterns and trends with unparalleled accuracy. This has enabled AI-powered systems to perform tasks that were once exclusive to humans.

According to a recent report by a leading research institute, AI has the potential to generate $15.7 trillion in global economic output by 2030. This staggering number showcases the impact AI can have on various sectors, including healthcare, finance, transportation, and manufacturing. Autonomous vehicles can navigate through crowded city streets, robotic surgeons can perform complex surgeries with precision, and AI-powered chatbots can provide personalized customer service.

The Growth of Big Data Analytics

In this digital age, data is being generated at an unprecedented rate. Every click, like, and share creates a digital footprint that can be analyzed and leveraged to gain valuable insights. This is where the field of big data analytics comes into play.

A recent study conducted by a global research firm revealed that 2.5 quintillion bytes of data are generated every single day. To put this number into perspective, it is equivalent to 90 years of HD video streaming. This vast amount of data holds the key to unlocking hidden patterns and trends that can drive business growth and innovation.

Companies like RoamNook use advanced data analytics techniques to extract meaningful information from this sea of data. By analyzing consumer behavior, market trends, and social media sentiment, businesses can make data-driven decisions and stay ahead of the competition. The potential applications of big data analytics are truly limitless.

Conclusion: RoamNook - Fuelling Digital Growth

As we conclude this enlightening journey through the world of scientific discoveries and technological advancements, we cannot ignore the role that RoamNook plays in shaping the future. Our company, specialized in IT consultation, custom software development, and digital marketing, is at the forefront of driving digital growth.

By leveraging the latest technologies, such as quantum computing, artificial intelligence, and big data analytics, RoamNook helps businesses stay ahead in this ever-evolving digital landscape. Our team of experts are continuously exploring new possibilities, pushing the boundaries of what is possible, and delivering innovative solutions that drive tangible results.

So, whether you are a small business looking to optimize your operations, a healthcare provider seeking to revolutionize patient care, or a government agency aiming to improve public services, RoamNook is your trusted partner in achieving digital success.

Visit our website at www.roamnook.com to learn more about our services and how we can help your organization thrive in the digital era.

Thank you for joining us on this informative journey, and we look forward to helping you unlock the full potential of technology.

Source: https://www.forbes.com/sites/forbestechcouncil/2024/05/02/six-ground-breaking-industries-quantum-computing-is-projected-to-revolutionize/&sa=U&ved=2ahUKEwiMiIKA3POFAxVEGlkFHe1BBJkQxfQBegQIABAC&usg=AOvVaw1OH1JW-WbfYenVRf2brx02

0 notes

Text

FAQs on Share Market Basics

Here are some frequently asked questions (FAQs) on share market basics:

What is the share market?

The share market, also known as the stock market, is a platform where individuals and institutions can buy, sell, and trade shares (also known as stocks or equities) of publicly listed companies.

What is a share?

A share represents a unit of ownership in a company. When you buy shares of a company, you own a portion of that company.

How do I invest in the share market?

To invest in the share market, you need to open a brokerage account with a licensed brokerage firm. Once your account is set up, you can start buying and selling shares through your broker.

What is a stock exchange?

A stock exchange is a marketplace where shares of publicly listed companies are traded. Examples include the New York Stock Exchange (NYSE) and the Nasdaq in the United States, and the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) in India.

What is the difference between primary and secondary markets?

The primary market is where companies issue new shares to raise capital through initial public offerings (IPOs) or follow-on offerings. The secondary market is where shares are bought and sold by investors after they have been issued.

What factors influence share prices?

Share prices can be influenced by various factors, including a company's financial performance, market sentiment, economic conditions, interest rates, geopolitical events, and changes in regulations.

What is a dividend?

A dividend is a portion of a company's profits that is distributed to shareholders. Companies may pay dividends quarterly, semi-annually, or annually, depending on their policies.

What is market capitalization?

Market capitalization (market cap) is the total value of a company's outstanding shares. It is calculated by multiplying the current share price by the total number of outstanding shares.

What is a stock index?

A stock index is a benchmark that tracks the performance of a group of stocks. Popular indices include the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite in the U.S., as well as the Sensex and Nifty in India.

What are the risks of investing in the share market?

Investing in the share market carries risks, including market volatility, company-specific risks, economic downturns, and potential loss of capital. Diversification and research can help manage these risks.

What is a portfolio?

A portfolio is a collection of investments owned by an individual or institution, including stocks, bonds, and other assets.

How can I start investing in the share market?

Start by researching and educating yourself about the market, then open a brokerage account, set a budget for investing, and begin buying shares of companies you believe have growth potential.

What is the difference between a bull and bear market?

A bull market refers to a period of rising share prices, while a bear market refers to a period of falling share prices.

What is technical analysis?

Technical analysis is a method of evaluating securities by analyzing historical price and volume data to identify patterns and make trading decisions.

What is fundamental analysis?

Fundamental analysis is a method of evaluating securities by analyzing a company's financial statements, management, industry position, and other factors to determine its intrinsic value.

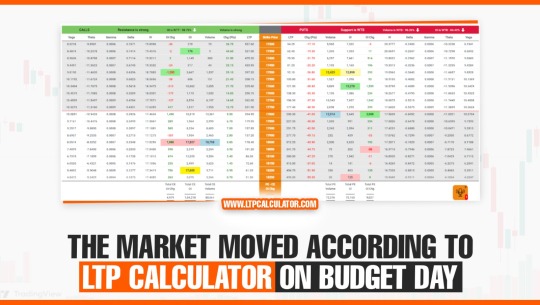

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in India

You can also downloadLTP Calculator app by clicking on download button.

These FAQs provide a basic overview of share market concepts and terminology. Let me know if you have more specific questions.

0 notes

Text

The Benefits of Investing In A Locker Management System

In today's fast-paced and dynamic environment, security and efficiency are paramount for businesses and institutions of all sizes. This is particularly true when it comes to managing personal storage spaces like lockers, which are essential in numerous financial settings.

An effective solution to streamline the operation and enhance the security of these locker systems is the adoption of a Locker Management System (LMS). This blog delves into what a Locker Management System is and explores the myriad benefits of implementing such a system, with a spotlight on Winsoft's innovative solution.

What Is A Locker Management System?

A locker Management System is a sophisticated, technology-driven solution designed to simplify and secure the assignment, use, and administration of lockers. By integrating software and hardware components, an LMS allows for digital assignments of lockers, remote access control, real-time monitoring, and detailed usage analytics. Using this system, banks can streamline any locker-related queries effectively without too much effort.

For instance, in banking and financial solutions, a Locker Management System can enhance security and operational efficiency by providing customers with safe and easily accessible storage for their valuable items while also offering financial institutions real-time oversight and control over the locker facilities.

Top Benefits of A Locker Management System

The implementation of a Locker Management System brings forth numerous advantages, significantly impacting the management of locker operations. Here are some of the top benefits:

Enhanced Security: Digital locks and access controls minimize the risk of theft or unauthorized access, providing peace of mind for users and administrators alike.

Increased Efficiency: Automated locker assignments and management save time for both users and staff, streamlining operations and eliminating manual tasks.

Improved User Experience: Users enjoy a seamless and convenient experience with easy access to lockers and the ability to manage their lockers via mobile applications or other digital interfaces.

Optimized Space Utilization: Real-time data and analytics allow administrators to monitor locker usage patterns, helping in optimizing space and making informed decisions on locker allocation.

Reduced Costs: By minimizing manual operations and enhancing locker turnover, an LMS can significantly reduce operational costs associated with locker management.

Scalability: Digital systems can easily be expanded or adjusted to accommodate growing needs, making them a future-proof investment.

Winsoft's Locker Management System

Winsoft Technologies offers a state-of-the-art Locker Management System designed to cater to the needs of modern institutions and businesses. Known as the SmartLocker, this locker management for banks and their customers simplifies the entire operational process. It enhances the management of locker requests, assignments, access protocols, key distribution, and the processes for blocking and unblocking. Additionally, it facilitates the efficient handling of rent payments and more, streamlining the entire locker management experience.

This system is part of Winsoft's broader suite of products that also includes innovative solutions like the IPO application processing system. Winsoft's LMS stands out for its robust security features, ease of use, and comprehensive management capabilities, making it an excellent choice for those looking to upgrade their locker management solutions.

Conclusion

Investing in a Locker Management System is a wise decision for any organization looking to improve security, efficiency, and user satisfaction in managing locker facilities. The digital transformation of locker management not only streamlines operations but also offers enhanced security and better utilization of resources. With systems like the one offered by Winsoft, organizations can leverage technology to meet their storage management needs effectively and sustainably. As businesses and institutions continue to evolve, the adoption of such advanced systems will undoubtedly become a standard, underscoring the importance of staying ahead in the technological curve.

0 notes

Text

Shree Tirupati Balajee - Share Price, IPO, Unlisted shares - Planify

Shree Tirupati Balajee's research report on Planify provides insights into the company's financials, valuations, and news. It covers aspects like share price, promoter and institutional holdings trends, shareholding patterns, historical data, key investors, and investment quantities with a minimum investment of 35000-50000. Visit our Website to get the details of Shree Tirupati Balajee share price, shares and so on.

#Shree Tirupati Balajee share price#Shree Tirupati Balajee ipo#Shree Tirupati Balajee unlisted shares

0 notes

Text

Udaan Share Price News & Latest Updates: Navigating the Bumpy Road Ahead

Udaan, the B2B e-commerce platform catering to India's underserved markets, has captured the attention of investors and analysts alike. However, Udaan Share Price journey has been a rollercoaster ride, marked by initial euphoria followed by recent corrections. This article delves into the latest news, financial performance, and key factors influencing Udaan Share Price, offering a comprehensive overview for informed decision-making.

Current Udaan Share Price and Performance:

As of February 12, 2024, Udaan Share Price stands at ₹22.30, reflecting a significant decline of 20.36% from its IPO price of ₹28.00 in August 2022.

The past month has witnessed considerable volatility, with the stock price fluctuating between ₹20.00 and ₹25.00.

While Udaan boasts a unique business model and strong market potential, concerns regarding profitability and intense competition have weighed on the Udaan share price.

Recent News and Events:

Fundraise: In December 2023, Udaan secured $250 million in fresh funding from existing investors, showcasing continued faith in its long-term vision. This news provided a temporary boost to the share price.

Financial Results: The company is yet to release its December 2023 quarter financial results. However, market analysts anticipate wider losses compared to the previous quarter, potentially impacting investor sentiment.

Expansion Plans: Udaan's aggressive expansion into new cities and product categories highlights its commitment to growth. However, concerns regarding the associated costs and profitability remain.

Competition: The Indian B2B e-commerce space is fiercely competitive, with established players like Reliance JioMart and Tata Digital posing significant challenges. Udaan's ability to differentiate itself will be crucial.

Financial Analysis:

Positives: Udaan boasts a vast network of sellers and kirana stores, indicating strong reach and brand recognition. Additionally, its focus on technology and data-driven insights positions it well for future growth.

Negatives: The company is yet to achieve profitability, raising concerns about its long-term financial sustainability. Additionally, its high marketing and operational expenses raise questions about cost management strategies.

Investment Outlook:

Udaan's future trajectory hinges on several key factors:

Profitability: Demonstrating a clear path to profitability is crucial for investor confidence and share price stability. Achieving this within a competitive landscape will be challenging.

Competition: Udaan needs to effectively navigate the competitive landscape by leveraging its unique strengths and establishing a clear differentiation strategy.

Macroeconomic Factors: The overall economic climate and consumer spending patterns will significantly impact Udaan's performance. Favorable economic conditions could act as a tailwind.

Conclusion:

Udaan presents a compelling investment opportunity for those seeking exposure to the burgeoning Indian B2B e-commerce market. However, the company's path to profitability remains uncertain, and intense competition poses significant challenges. Investors should carefully consider their risk tolerance, investment horizon, and conduct thorough due diligence before making any investment decisions. This article provides a starting point for further analysis, but individual investors should consult with qualified financial advisors for personalized advice.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Please consult with a qualified financial advisor before making any investment decisions.

0 notes

Text

In the modern, digital era, stock investing is hugely popular. It is difficult to understand the stock market as a whole. If you’re just getting started, it’s a good idea to review the fundamentals. In this article we will learn what the stock market is, why you need to take Online Stock Market Courses in delhi. We will also discuss why you should choose PSV. So let’s begin by understanding what the stock market is in reality.

What is the Stock Market?

Lets learn, what is the stock market? It is essentially a venue where people purchase and sell publicly traded shares at specific times of the day. Some people use the terms’ share market’ and stock market’ interchangeably, but there is a distinction. The share market only allows you to trade shares, whereas the stock market allows you to trade all types of financial products such as bonds, derivatives, and currency.

The National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) are the major players in India.

The two types of stock markets are primary and secondary. When a business first registers, it begins an Initial Public Offering (IPO) in order to raise capital through the selling of shares. Market participants can then exchange their shares on the secondary market following that. Investors often utilize a broker or middleman to acquire and sell shares at the current market price.

Why take Share market classes in Delhi?

Before entering the stock market, it is essential to take Share market classes in Delhi. To excel in this subject, you must possess a thorough grasp of it.

You can either make or lose money on the stock market. You have a higher probability of losing if you lack the requisite expertise or are unable to predict the market utilising data.

A common mistake is for investors to invest with little knowledge and the expectation of making quick money. This frequently leads to big losses and little reward.

As the stock market grows in popularity, it attracts traders from all around the world. A respected college can teach you everything you need to know about technical analysis, stock trends, patterns, and market movements to come.

Although investing in stocks may seem like a straightforward way to gain a lot of money quickly, keep in mind that there is always a danger of losing everything.

Anyone can trade stocks, regardless of their location, level of experience, or other criteria. The stock market is open to everyone who is interested in trading. Before opening a genuine trading account, training is necessary, though.

There are several stock market training institutions today that offer a wide range of courses to persons who want to learn more about trading on the stock market. Choosing a course that meets your expectations and needs is essential.

Why Select PSV’s Live Classes for Stock Market?

PSV’s Live Classes are the best choice for both new and experienced investors who want to master the stock market. You should select PSV’s live classes for stock market for the following five reasons:

Advisory Services

Our instructors are knowledgeable financial experts with real-world experience in stock market trading and investing. They provide helpful advice and tried-and-true strategies.

Engaging Instruction

In contrast to traditional online courses, our Live Classes offer a lively and engaging learning atmosphere. You can engage in conversation, participate in discussions, and ask questions with other students.

Market insights

Keep up with the most recent trends and strategies because the stock market is continuously changing. Our Live Classes provide up-to-the-minute analyses and insights so you can make sensible decisions in the present economic climate.

Individualized Curriculum

Our Live Classes provide a flexible curriculum that can be tailored to your specific needs and goals because we recognise that every student is unique. You will receive the education that is most useful for your search.

Convenient Education

With our live sessions, you may learn at your own pace and according to your schedule. It is convenient for everyone because anyone, even full-time professionals and students, can take the lessons from anywhere.

Practical Simulations

Practical simulations and trading exercises are part of PSV’s Live Classes, which go above and beyond. With this practical method, you may put what you’ve learnt into practise in a secure setting and gain useful experience before entering the actual stock market.

Comprehensive Resources

PSV offers a comprehensive range of resources, including reading material, research reports, case studies, and live sessions. These additional resources improve your comprehension and provide priceless resources for lifelong learning.

Community Support

When you enroll in PSV’s Live Classes, you join a vibrant group of people who share your enthusiasm for stocks and investing. Your learning experience is further enhanced by networking opportunities, peer support, and access to alumni resources.

Expertise in Risk Management

Making money on the stock market requires not only taking risks and managing them well. PSV’s Live Classes put a strong emphasis on teaching risk management techniques so that you may safeguard your money and make wise choices in choppy market situations.

Certification

PSV’s Live Classes give certification upon completion, which can significantly improve your resume and reputation as an investor or trader. PSV credentials are respected and valued by many employers and financial institutions.

Original Source: https://www.backlinkget.com/blog/why-do-you-need-share-market-classes-in-delhi/

#equity research course in delhi#option trading course in delhi#share market classes in delhi#technical analysis training in delhi#best online stock trading courses for beginners#best stock market courses in delhi#stock market course for job#live classes for stock market#online stock market courses in delhi#best stock market courses online in delhi

0 notes

Text

3. Crafting A Magnetic Marketing Voice

Getting Inside Your Ideal Client’s Mind Tapping Advanced Analytics to Pinpoint Target Clients Today’s data platforms allow unprecedented client insight. But firms first must identify the appropriate pool to analyze. Resist spreading efforts thin across too many audiences. The ideal process narrows through segmentation by attributes like industry, size, growth phase, and legal budget. Persona profiles then emerge, powered by AI modeling of behavior patterns within each group. The following is a dramatization and is not an actual event: Global firm DLA Piper uses predictive analytics to track early warning signs of contract disputes among its media industry clients. This informs preventative advice offerings. Getting Inside Your Ideal Client’s Mind Tapping Advanced Analytics to Pinpoint Target Clients Today’s data platforms allow unprecedented client insight. But firms first must identify the appropriate pool to analyze. Resist spreading efforts thin across too many audiences. Start by examining past clients and prospect interactions. Look for patterns around the industry, size, growth stage, tech culture, legal budgets, and more. Use statistical modeling and AI to determine which attributes correlate to becoming an active client. These insights allow you to create profiles of your most valuable targets. For example, mid-sized biotech firms preparing for an IPO have distinct needs versus mature F500 retailers. Outreach can then be tailored accordingly. Continuously Track Performance Data Analytics is an ongoing initiative, not a one-time effort. Instrument online content with click-tracking pixels, embed engagement prompts into research papers, and tally referral traffic driven by owned channels and shares. Setting up an executive dashboard brings this data together to observe trends and outliers. Monitor the response rate lift when switching formats, such as a webinar vs. whitepaper. Track how seniority level impacts downloads of specialized research reports. The following is a dramatization and is not an actual event: Hooper Law tracks professional association speaking engagements and correlates new client retainers back to each event, determining an optimal forum slate based on yield. Just 5% of law firms have extensive performance analytics expertise, according to a recent LexisNexis survey. Strong data plans will set law firms apart because clients want real proof, not just promises. Evolving client preferences will dictate regular content adjustments. Make sure your data analysis tools help you make quick and smart changes. If necessary, use extra tools from outside experts to get a different point of view. Conduct Voice-of-Customer Research Expand understanding of target clients through direct outreach like interviews, surveys, and focus groups. Ask about their choice criteria for legal counsel, preferred formats for expertise delivery, unmet needs, view of the competitive landscape, and more. The following is a dramatization and is not an actual event: Law firm Ropes & Gray surveyed executives in the media sector to guide the development of M&A readiness assessments, positioning themselves as the go-to advisors for deal preparation. Map Client Journeys to Pinpoint Triggers Using data analysis, we can map potential trends and important events that cause companies to seek legal help and anticipate their needs. For example, when a company makes progress in creating new technology that could be patented, they often need patent lawyers. Also, when there's a change in the company's leaders, it's common to hire corporate lawyers to assist in reshaping how the company is run. This shows how closely legal needs are connected to a company's developments and changes. The following is a dramatization and is not an actual event: Akers & Garcia law firm performs journey analysis to detect pre-acquisition signals among tech companies, allowing timely pitching of due diligence support. Catering Content to Match Their Online Behavior Understanding how your audience gets information online helps you figure out the best ways to reach them. An eCommerce retailer may best respond to Instagram videos about relevant regulatory changes. A hospital CEO might prefer policy update podcasts during their commute. Experiment with Innovative Outreach Look to non-legal content creators for inspiration. Buzzfeed’s tasty videos reimagine cooking tutorials - could this style work for complex tax provisions? The following is a dramatization and is not an actual event: Boutique firm Venture Law uses AI chatbots and interactive quizzes to engage seed-stage startups on common investor term sheet sticking points. Catering Content to Match Their Online Behavior How your targets consume information online reveals how to resonate. An eCommerce retailer may best respond to Instagram videos about relevant regulatory changes. A hospital CEO might prefer policy update podcasts during their commute. The following is a dramatization and is not an actual event: Boutique firm transfer Law leverages speech analytics to discern triggers and barriers when advising tech startups on seed round term sheets. This tailors verbal positioning. FAQs 1. What attributes matter most to analyze? Start by grouping targets using industry, size, growth stage, legal budget, tech savviness, innovation culture, compliance risks, M&A activity, global footprint, etc. High-value niches emerge from patterns within each cluster. 2. How can firms cater outreach content? Observe social media engagement across target personas - content types, messaging angles, and influencers that resonate can inform law firm positioning. Tailor formats from reports to infographics, podcasts, interactive tools, and more. Read the full article

0 notes

Text

Examining The HDFC Bank Share Price History

To understand a stock's stock performance, investors usually look for the company's share price history. Though it is said that past performance is not an indicator of future results, historical performance can be a significant motivation for investors to invest in HDFC bank.

With digitization and the internet, there are plenty of online resources that investors rely on to find out real-time and historical data.

Investors highly rely on HDFC Bank stock news to make significant decisions about investing in the shares. Therefore, we will focus on some of the reasons why studying past performance is essential for seasoned investors as well as beginners.

Online portals can determine the share prices as per weekly, daily, and yearly stock prices. Seasoned traders can use past data to improve the investment portfolio's performance.

Why Does Past Performance Of Stocks Matter?

The company's stock movements affect the investors buying or selling patterns on the stock exchange in various ways. For example, HDFC’s share price over the past few years has been linked with the economic performance as well as the GDP of the country.

When business activity increases, it usually leads to stock market gains and vice versa during a global recession.

What Are The Benefits Of Examining HDFC Share Price History?

Let us see how investors can benefit from historical prices:

Market Scope: Some investors like determining whether the market is near a long-term high or low. Markets that have settled above the leading rate of the last year are making significant gains and might signal more positive action.

Market Value: The cost of a company's capital is influenced by the stock market's performance. When calculating a company's weighted average cost of capital, the cost of the loan and equity capital must be averaged. A greater projected market return will result in a higher cost of equity capital. Since a more significant discounting rate is required for present value calculations, the value of an investment is reduced.

Analysis: With the help of different tools to analyze a stock price's fundamental and technical indicators, the history is easily downloadable with these tools as the reports are accurate and authentic to investors.

List Of Past Historial Data Of HDFC Stock Price By Year On BSE

Now, we will look at the stock prices of the last five years to determine the value of the shares.

Year Stock Price

2014 486.93

2015 563.95

2016 659.10

2017 952.50

2018 1109.53

2019 1304.10

2020 1464.00

2021 1724.30

2022 1721.85

Conclusion

You can check all the historical data of HDFC Bank's share prices dating back to the bank's IPO in March 1995 to make strategic decisions in your investment portfolio. Investors can use historical data to determine how long to hold stocks in the future. Past stock prices can also be used to determine what variables may impact future returns and protect the investment accordingly.

Remember that the past does not guarantee the future while trying to decipher historical returns. A greater degree of uncertainty in future returns is associated with older historical return data.

0 notes

Text

Scanning Electron Microscope (SEM), Global Market Size Forecast, Top 9 Players Rank and Market Share

Scanning Electron Microscope (SEM) Market Summary

A scanning electron microscope (SEM) is a type of electron microscope that produces images of a sample by scanning the surface with a focused beam of electrons. The electrons interact with atoms in the sample, producing various signals that contain information about the surface topography and composition of the sample. The electron beam is scanned in a raster scan pattern, and the position of the beam is combined with the intensity of the detected signal to produce an image. In the most common SEM mode, secondary electrons emitted by atoms excited by the electron beam are detected using a secondary electron detector (Everhart-Thornley detector). The number of secondary electrons that can be detected, and thus the signal intensity, depends, among other things, on specimen topography. SEM can achieve resolution better than 1 nanometer.

Figure. Scanning Electron Microscope (SEM) Product Picture

Source: Carl Zeiss

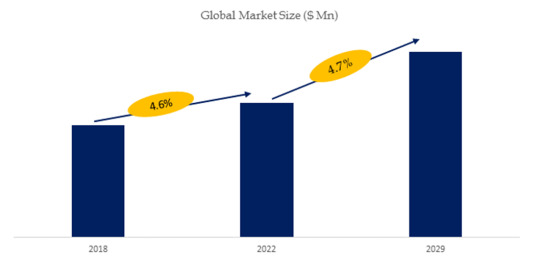

According to the new market research report “Global Scanning Electron Microscope (SEM) Market Report 2023-2029”, published by QYResearch, the global Scanning Electron Microscope (SEM) market size is projected to reach USD 4.56 billion by 2029, at a CAGR of 4.7% during the forecast period.

Figure. Global Scanning Electron Microscope (SEM) Market Size (US$ Million), 2018-2029

Above data is based on report from QYResearch: Global Scanning Electron Microscope (SEM) Market Report 2023-2029 (published in 2023). If you need the latest data, plaese contact QYResearch.

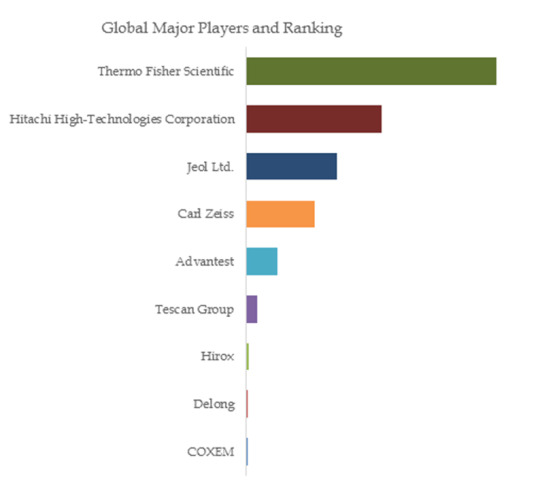

Figure. Global Scanning Electron Microscope (SEM) Top 9 Players Ranking and Market Share (Ranking is based on the revenue of 2022, continually updated)

Above data is based on report from QYResearch: Global Scanning Electron Microscope (SEM) Market Report 2023-2029 (published in 2023). If you need the latest data, plaese contact QYResearch.

According to QYResearch Top Players Research Center, the global key manufacturers of Scanning Electron Microscope (SEM) include Thermo Fisher Scientific, Hitachi High-Technologies Corporation, Jeol Ltd., Carl Zeiss, Advantest, etc. In 2022, the global top four players had a share approximately 83.0% in terms of revenue.

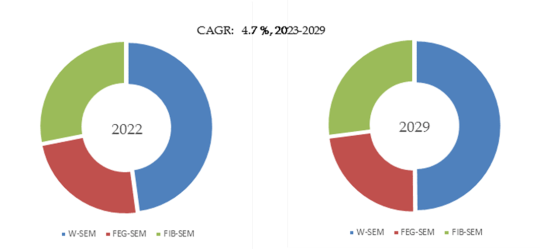

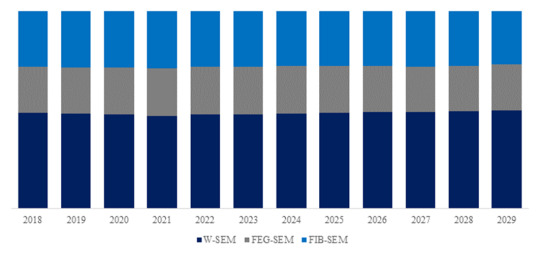

Figure. Scanning Electron Microscope (SEM), Global Market Size, Split by Product Segment

Based on or includes research from QYResearch: Global Scanning Electron Microscope (SEM) Market Report 2023-2029.

In terms of product type, W-SEM is the largest segment, hold a share of 47.9%,

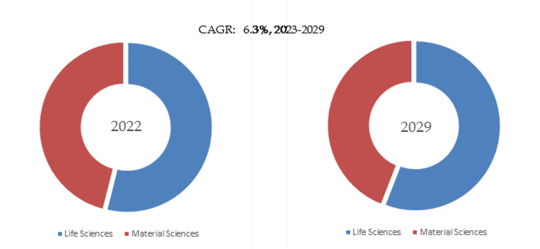

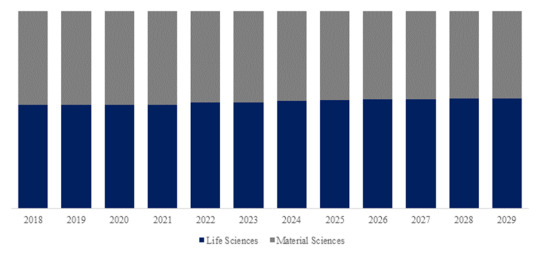

Figure. Scanning Electron Microscope (SEM), Global Market Size, Split by Application Segment (Volume)

Based on or includes research from QYResearch: Global Scanning Electron Microscope (SEM) Market Report 2023-2029.

In terms of product application, Life Sciences is the largest application, hold a share of 53.9%,

Figure. Scanning Electron Microscope (SEM), Global Market Size, Split by Region

Based on or includes research from QYResearch: Global Scanning Electron Microscope (SEM) Market Report 2023-2029.

About The Authors

Chengping Zhang

A experienced Technology & Market Analyst. Deep experience in chemical industry, focus on electronic materials, engineering materials and mineral resources, etc. Fully engaged in the development of technology and market reports as well as custom projects.

Senior Analyst

Email: [email protected]

Website: www.qyresearch.com Hot Line:4006068865

QYResearch focus on Market Survey and Research

US: +1-888-365-4458(US) +1-202-499-1434(Int'L)

EU: +44-808-111-0143(UK) +44-203-734-8135(EU)

Asia: +86-10-8294-5717(CN) +852-30628839(HK)

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

0 notes

Text

How do NSE and BSE contribute to the Indian stock market?

The National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) play crucial roles in the Indian stock market, contributing to its development, liquidity, efficiency, and transparency in various ways. Here's how NSE and BSE contribute to the Indian stock market:

Facilitating Trading: NSE and BSE provide electronic trading platforms where investors can buy and sell securities such as stocks, bonds, and derivatives. Their trading platforms offer efficient order execution, transparency, and accessibility, enabling investors from across the country to participate in the market.

Market Capital Formation: NSE and BSE serve as platforms for companies to raise capital by issuing securities to investors through initial public offerings (IPOs) and subsequent secondary offerings. By listing on these exchanges, companies gain access to a wide pool of investors, which helps them raise funds for business expansion, investment in infrastructure, and other capital requirements.

Price Discovery: NSE and BSE facilitate price discovery by providing transparent and regulated marketplaces where buyers and sellers come together to determine the prices of securities through supply and demand dynamics. The continuous trading and real-time dissemination of price information contribute to efficient price discovery in the Indian stock market.

Market Indices: NSE and BSE maintain benchmark indices (Nifty 50 and Sensex, respectively) that serve as barometers of the Indian equity market's performance. These indices track the price movements of select stocks listed on their respective exchanges and provide valuable insights into market trends, investor sentiment, and overall market health.

Market Regulation: NSE and BSE are regulated entities governed by the Securities and Exchange Board of India (SEBI), which sets rules and regulations to ensure fair, transparent, and orderly trading. Both exchanges enforce compliance with listing requirements, trading rules, and corporate governance norms to maintain market integrity and protect investors' interests.

Market Surveillance: NSE and BSE conduct market surveillance to detect and prevent market manipulation, insider trading, and other fraudulent activities. They employ sophisticated surveillance systems to monitor trading activity, analyze market data, and identify irregularities or suspicious trading patterns.

Investor Education and Awareness: NSE and BSE undertake various initiatives to promote investor education, awareness, and literacy. They organize seminars, workshops, and training programs to educate investors about stock market fundamentals, investment strategies, and risk management practices, thus empowering them to make informed investment decisions.

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in India.

You can also downloadLTP Calculator app by clicking on download button.

Overall, NSE and BSE play pivotal roles in the Indian stock market ecosystem, contributing to its growth, stability, and resilience. Their efforts to enhance market infrastructure, investor protection, and market transparency help foster confidence in the Indian capital markets and attract domestic and international investors.

0 notes

Text

Market wrap: Sensex snaps 3-day rally, ends 191 pts lower; Nifty holds 17k

Market wrap: Sensex snaps 3-day rally, ends 191 pts lower; Nifty holds 17k

Top headlines Sensex snaps 3-day rally, ends 191 pts lower; Nifty holds 17,000 Data Patterns sees blockbuster debut at 48% premium HCL Technologies surges 5% amid block deal buzz L&T Finance Holdings dips 7% on divestment of Asset Management business Bank of America expects 8.2% GDP growth for India in FY23 with more downside risks The key benchmark indices snapped their 3-day winning run…

View On WordPress

#BoFA#BSE sensex#business standard podcast#Data Patterns IPO#gdp growth forecast#HCL Technologies stock#L&T Finance stock#MARKET WRAP#NSE Nifty#stock markets

0 notes

Text

Myntra: From Fashion E-tailer to Public Market Player? Unpacking the IPO Buzz and Share Price Potential

Myntra, the undisputed heavyweight of India's online fashion game, has ignited market curiosity with whispers of a potential IPO. For years, the e-commerce behemoth has dominated the digital wardrobe scene, captivating shoppers with its diverse selection and trendy vibes. But will its transition from private powerhouse to publicly traded entity be a runway walk or a catwalk stumble? Let's delve into the world of Myntra, exploring the current buzz surrounding the Myntra IPO, analyzing its potential Myntra share price performance, and assessing the challenges and opportunities that lie ahead.

An IPO on the Horizon? Separating Fact from Fiction

While rumors of a Myntra IPO have swirled like sequins at a fashion week finale, the company itself has maintained a strategic silence. As of January 29, 2024, there is no official confirmation of an IPO date or even if plans are concrete. This cloak of secrecy adds to the intrigue, but also leaves investors in a holding pattern, waiting for the curtain to rise on the next chapter of Myntra's story.

However, several factors suggest that an IPO might not be too far off. Myntra, owned by Walmart Inc., enjoys a robust financial standing, reporting consistent revenue growth and increased profitability. Additionally, the Indian e-commerce market is on a meteoric rise, propelled by internet penetration and a growing consumer base. This fertile ground presents a tempting opportunity for Myntra to tap into public funds and fuel its ambitious expansion plans.

Myntra Share Price: Gazing into the Crystal Ball

Predicting the Myntra share price without an official IPO date is akin to forecasting the next season's hottest trend. However, by examining external factors and Myntra's internal strengths and weaknesses, we can build a speculative framework.

Market Potential: The Indian e-commerce market is expected to reach a staggering $350 billion by 2030, with fashion as a key driver. This sheer size bodes well for Myntra, granting it access to a vast pool of potential customers.

Competitive Landscape: Myntra faces stiff competition from rivals like Flipkart, Amazon, and Nykaa. The company's ability to differentiate itself through strategic partnerships, exclusive brands, and personalized shopping experiences will be crucial in attracting and retaining customers.

Financial Performance: Myntra's financial health is robust, with revenue exceeding ₹10,000 crore in FY23. However, concerns remain about its profitability, with some analysts pointing to operational expenses and discounts eroding margins.

Parent Company Advantage: Myntra's backing by Walmart provides access to resources, expertise, and global reach. This affiliation could prove invaluable in navigating the complexities of the public market.

Taking these factors into account, experts speculate that the Myntra share price could potentially command a premium upon listing. Its brand recognition, market dominance, and growth potential could attract discerning investors. However, the uncertainty surrounding its financials and the ever-evolving competitive landscape add a layer of caution to the optimism.

Walking the Runway: Challenges and Opportunities

Myntra's journey to the public market won't be a walk in the park. Here are some potential hurdles the company needs to overcome:

Maintaining profitability: While revenue is impressive, turning a consistent profit will be crucial in convincing investors of long-term sustainability. Optimizing expenses and focusing on high-margin products will be key.

Adapting to changing consumer preferences: Fashion is fickle, and Myntra needs to stay ahead of the curve by anticipating trends and diversifying its offerings to cater to a broader audience.

Data security and privacy concerns: E-commerce platforms handle sensitive customer data, and any breach could erode trust and damage reputation. Robust security measures and transparent data handling practices will be essential.

Despite these challenges, Myntra boasts several opportunities that could propel its share price upwards:

Leveraging technology: AI-powered personalization, virtual try-on features, and seamless omnichannel experience are key enablers for boosting customer engagement and loyalty.

Expanding beyond fashion: venturing into beauty, lifestyle, and home decor categories could unlock new revenue streams and attract a wider customer base.

International ambitions: Myntra could leverage its expertise and brand recognition to tap into overseas markets, further bolstering its growth potential.

The Final Stitch: A Tale UnwrittenWhether the Myntra IPO becomes a fashion statement or a fashion faux pas remains to be seen. The company's future trajectory hinges on its ability to navigate the complex landscape of the public market, optimize its financials, and capitalize on the burgeoning e-commerce boom. While the whispers of "Myntra Share Price" might still be faint, the story is.

0 notes