#DOGECOIN TECHNICAL ANALYSIS

Explore tagged Tumblr posts

Text

youtube

What’s Up with the Dogecoin Price? Is Dogecoin Heading to the Moon? 🌕

Welcome back to our channel! In today’s video, we’re diving into the exciting world of Dogecoin and answering the question: What’s up with the Dogecoin price? As of now, Dogecoin is experiencing significant fluctuations, and we’re here to provide you with the latest updates and insights.

We’ll explore the Dogecoin price update and analyze recent Dogecoin news today that could impact the market. What are the current trends? How are investors reacting? We’ll cover everything you need to know about Dogecoin, from the latest Dogecoin technical analysis to our Dogecoin price prediction for the coming months.

In this video, we’ll discuss whether Dogecoin is going to the moon and what factors could trigger a Dogecoin pump. We’ll examine the Dogecoin price analysis, focusing on the movements over the past week and what they could mean for your investment strategy. Should you buy Dogecoin now, or are we likely to see a correction?

We'll also share our insights into the Dogecoin prediction 2025, looking at expert forecasts and how historical data from Dogecoin price prediction 2021 can inform our understanding of future movements. Plus, we’ll highlight Dogecoin breaking news and what it means for the cryptocurrency landscape.

Are you curious about the Doge Dogecoin price prediction or the potential for new all-time highs? We’ll cover all the bases, including Dogecoin news now and upcoming developments that could influence Dogecoin today.

Whether you're a seasoned crypto investor or just starting, this video is packed with valuable information to help you navigate the ever-changing market. Don’t forget to subscribe for more updates and analysis on Dogecoin and other cryptocurrencies!

Join us as we explore the future of Dogecoin and answer the burning question: What’s up with the Dogecoin price? 🚀🌕

#dogecoin price prediction#dogecoin#dogecoin price#dogecoin news today#dogecoin news#dogecoin to the moon#dogecoin price update#buy dogecoin#dogecoin update#dogecoin prediction#dogecoin today#doge dogecoin price prediction#dogecoin technical analysis#doge price prediction#dogecoin price analysis#dogecoin breaking news#dogecoin price prediction 2025#dogecoin price prediction 2021#doge price#dogecoin latest news#dogecoin news now#dogecoin pump#Youtube

0 notes

Text

DOGECOIN Price Predictions 2023-2030: Will DOGE hit $5?

DOGE PRICE USD, DOGE PRICE PREDICTION, DOGE PRICE, DOGECOIN Price, DOGE, DOGECOIN TECHNICAL CHART, DOGECOIN TECHNICAL ANALYSIS

DOGECOIN TECHNICAL ANALYSIS

#DOGECOIN TECHNICAL CHART#DOGECOIN TECHNICAL ANALYSIS#latest news on cryptocurrency#latest crypto news#top cryptocurrency news websites#latest news about cryptocurrency#cryptocurrency news today

0 notes

Text

10 Tips for Achieving Financial Success with Memecoin Tokens

Introduction

Memecoins have taken the cryptocurrency world by storm. Inspired by internet memes and cultural trends, these tokens have garnered a lot of attention for their potential to deliver significant financial returns. However, investing in memecoins also comes with its risks. This blog will provide you with ten essential tips to help you navigate the world of memecoins and achieve financial success.

1. Understand What Memecoins Are

Definition of Memecoins

Memecoins are cryptocurrencies that are often based on popular internet memes or trends. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, memecoins usually don’t have a strong technological or utility basis. Instead, they rely on community engagement and viral marketing.

Popular Examples

Some well-known examples of memecoins include Dogecoin and Shiba Inu. These tokens started as jokes but quickly gained a massive following, demonstrating the power of community and viral content.

2. Do Your Research

Thorough Research is Crucial

Before investing in any memecoin, it’s essential to conduct thorough research. Understand the project’s goals, the team behind it, and its community engagement. Look into the tokenomics, the total supply, and how the tokens are distributed.

Reliable Sources

Use reliable sources for your research. Read whitepapers, follow official social media channels, and join community discussions on platforms like Reddit and Discord. Avoid making investment decisions based solely on hype or rumors.

3. Join the Community

Community Engagement

Memecoins thrive on community engagement. Join the community surrounding the memecoin you’re interested in. Participate in discussions, ask questions, and stay updated with the latest news and developments.

Social Media Platforms

Follow the project’s official social media accounts on Twitter, Reddit, and Discord. These platforms are excellent sources of real-time information and can provide insights into the community’s sentiment and activity.

4. Diversify Your Investments

Spread Your Risk

Diversification is a fundamental principle of investing. Don’t put all your money into a single memecoin. Spread your investments across multiple projects to mitigate risk. This way, if one investment doesn’t perform well, others might offset the losses.

Balance Your Portfolio

Balance your portfolio by including both high-risk and lower-risk investments. Consider holding traditional cryptocurrencies like Bitcoin or Ethereum alongside your memecoin investments.

5. Use Technical Analysis

Understanding Market Trends

Technical analysis involves studying price charts and market trends to make informed investment decisions. Learn how to read charts and identify patterns that might indicate future price movements.

Tools and Indicators

Use tools and indicators such as moving averages, relative strength index (RSI), and Bollinger Bands to analyze the market. These tools can help you determine the best times to buy or sell.

6. Stay Informed

Follow News and Updates

The cryptocurrency market is highly dynamic, and staying informed is crucial. Follow news and updates related to your memecoin investments. Major developments, partnerships, or regulatory changes can significantly impact prices.

Real-Time Alerts

Set up real-time alerts for significant price movements or news related to your investments. This will help you react quickly to changes in the market.

7. Have a Clear Strategy

Define Your Goals

Before investing, define your financial goals. Are you looking for short-term gains or long-term growth? Having a clear strategy will help you make informed decisions and stay focused on your objectives.

Exit Strategy

Plan your exit strategy in advance. Decide on the profit levels at which you will sell part or all of your holdings. Similarly, set stop-loss levels to minimize potential losses.

8. Use Secure Wallets

Protect Your Investments

Security is paramount in the cryptocurrency world. Use secure wallets to store your memecoins. Hardware wallets and reputable software wallets offer the best security features.

Avoid Exchange Wallets

Avoid keeping large amounts of cryptocurrency in exchange wallets for extended periods. Exchanges can be vulnerable to hacks and security breaches. Transfer your funds to a secure wallet as soon as possible.

9. Be Aware of Scams

Identify Red Flags

The popularity of memecoins has attracted scammers. Be aware of red flags such as promises of guaranteed returns, pressure to invest quickly, or requests for personal information.

Verify Legitimacy

Always verify the legitimacy of a project before investing. Check if the team is transparent and reputable, and look for audits or reviews from credible sources.

10. Stay Patient and Manage Emotions

Emotional Control

The cryptocurrency market is highly volatile, and prices can swing dramatically in a short time. Stay patient and avoid making impulsive decisions based on emotions. Stick to your investment strategy and goals.

Long-Term Perspective

Adopt a long-term perspective. While short-term gains can be tempting, long-term investments often yield better returns. Stay focused on the bigger picture and avoid getting swayed by short-term market fluctuations.

And must create your favorite memecoin tokens on solana in just less than three seconds without any progamming knowledge only on solanalauncher platform

Also they provide 4 tools like Mint tokens, Revoke Freeze authority, Revoke mint authority , Multy sender

If you need more guide about this, Feel free to ask!!

Conclusion

Investing in memecoins can be an exciting and potentially profitable venture, but it also comes with its risks. By following these ten tips — understanding what memecoins are, doing your research, joining the community, diversifying your investments, using technical analysis, staying informed, having a clear strategy, using secure wallets, being aware of scams, and managing your emotions — you can navigate the memecoin market more effectively and increase your chances of achieving financial success.

Remember, the key to success in any investment is to stay informed, stay disciplined, and stay patient. The world of memecoins is dynamic and full of opportunities, so equip yourself with the right knowledge and strategies to make the most of it. Happy investing!

4 notes

·

View notes

Text

AI Crypto Trading,

AI crypto trading is reshaping the landscape of digital asset investment, bringing a level of automation, precision, and speed that was unimaginable just a few years ago. The volatile nature of cryptocurrency markets has always been both an opportunity and a challenge for investors. Unlike traditional stock markets, which have set trading hours, crypto markets operate 24/7, making it nearly impossible for human traders to monitor price movements and execute trades around the clock. This is where AI-driven trading systems come into play. These intelligent algorithms can analyze vast amounts of market data, identify profitable opportunities, and execute trades in real time without the need for human intervention. By leveraging machine learning, deep learning, and predictive analytics, AI-powered crypto trading has become one of the most powerful tools for investors seeking consistent gains in an unpredictable market.

The ability of AI to process and analyze large datasets gives it a significant advantage over traditional traders. A human trader may rely on technical analysis, news updates, and gut feelings to make trading decisions, but AI can process thousands of data points simultaneously, identifying patterns and correlations that are invisible to the human eye. These algorithms are designed to detect market trends, predict price fluctuations, and make split-second trading decisions that maximize profitability. AI can analyze historical price data, trading volumes, market sentiment, and even on-chain data to generate highly accurate predictions. This means that instead of relying on emotional trading decisions, investors can let AI handle the complexities of crypto trading with an objective, data-driven approach.

One of the most compelling advantages of AI in crypto trading is its ability to execute high-frequency trading (HFT). In traditional markets, HFT is already a game-changer, but in the crypto world, where price swings can be extreme within minutes, it becomes even more powerful. AI-powered HFT systems can process trades in microseconds, exploiting small price inefficiencies that human traders would never be able to capitalize on. These systems analyze order book data, track liquidity levels, and execute trades across multiple exchanges to take advantage of arbitrage opportunities. For example, if Bitcoin is trading at $50,200 on one exchange and $50,150 on another, an AI-powered trading bot can instantly buy from the lower-priced exchange and sell on the higher-priced exchange, profiting from the price difference before human traders even realize the opportunity exists.

Elon Musk has played a significant role in influencing the crypto market, often through his tweets and public statements. His comments about Bitcoin, Dogecoin, and other digital assets have led to massive price swings, sometimes within minutes. AI trading systems have learned to incorporate social media sentiment analysis into their algorithms, allowing them to react instantly to Musk’s tweets and other influential figures in the crypto space. By analyzing sentiment from platforms like Twitter, Reddit, and financial news sources, AI can detect positive or negative market sentiment before prices move. If an AI system picks up a bullish trend following a Musk tweet about Dogecoin, it can execute buy orders before the general public reacts, giving traders an edge in the market.

Another groundbreaking aspect of AI crypto trading is its ability to recognize patterns and indicators that predict market reversals. Many traders rely on technical indicators like moving averages, RSI, MACD, and Bollinger Bands to make decisions, but AI takes this a step further by analyzing a combination of multiple indicators along with real-time market data. AI can recognize patterns in candlestick formations and detect anomalies that signal upcoming bullish or bearish trends. This predictive power allows AI traders to enter and exit positions at optimal points, minimizing risks and maximizing gains. Unlike human traders, who may misinterpret signals or react emotionally, AI executes trades based on statistical probabilities, ensuring a more disciplined and calculated approach to trading.

One of the biggest challenges in crypto trading is managing risk. The crypto market is notorious for its volatility, with sudden price drops and unexpected crashes wiping out billions of dollars in market value within hours. AI-driven risk management systems play a crucial role in mitigating these risks by implementing stop-loss orders, adjusting position sizes, and diversifying trading strategies. AI algorithms continuously monitor portfolio performance and market conditions, making automatic adjustments to minimize losses and protect profits. This level of automation ensures that traders do not make impulsive decisions based on fear or greed, which are often the biggest pitfalls in crypto investing. AI can also detect unusual market movements that may indicate potential manipulation, helping traders avoid pump-and-dump schemes and flash crashes.

The rise of decentralized finance (DeFi) has introduced new opportunities and complexities in crypto trading, and AI is playing a pivotal role in navigating this evolving landscape. DeFi platforms offer lending, borrowing, staking, and yield farming opportunities, all of which require sophisticated risk assessment and strategy optimization. AI-powered trading bots are now being used to automate DeFi investments, identifying the most profitable liquidity pools, optimizing yield farming strategies, and managing risk exposure. These bots can analyze real-time blockchain data to detect shifts in liquidity, interest rates, and token demand, ensuring that traders maximize their earnings while minimizing potential losses. AI is also being used to enhance security in DeFi transactions, detecting vulnerabilities and suspicious activities to prevent hacks and fraud.

AI’s ability to adapt and learn from market behavior is another game-changer in crypto trading. Traditional trading strategies often become obsolete as market conditions change, but AI systems continuously evolve by analyzing new data and refining their algorithms. Machine learning models can identify new trading patterns, adjust risk parameters, and optimize strategies based on real-time market feedback. This adaptability is crucial in the fast-paced world of cryptocurrencies, where price movements can be influenced by a variety of factors, including regulatory announcements, macroeconomic trends, and technological advancements. AI-driven trading platforms are now incorporating reinforcement learning techniques, allowing them to improve their decision-making process with every trade executed.

Retail traders are also benefiting from AI-powered crypto trading tools, which were once exclusive to institutional investors and hedge funds. Automated trading platforms like 3Commas, Pionex, and Cryptohopper allow everyday investors to access AI-driven strategies without needing extensive technical knowledge. These platforms offer pre-built trading bots that execute trades based on predefined parameters, as well as customizable strategies that users can tailor to their specific risk tolerance and investment goals. AI-powered portfolio management tools help investors rebalance their holdings, track market trends, and optimize their asset allocation without requiring manual intervention. This democratization of AI trading has made it easier for retail traders to compete with professional investors and hedge funds, leveling the playing field in the crypto market.

One of the most exciting developments in AI crypto trading is the integration of quantum computing. While still in its early stages, quantum AI has the potential to revolutionize trading strategies by processing complex calculations at speeds far beyond traditional computing capabilities. Quantum AI can analyze massive datasets, simulate multiple market scenarios, and optimize trading strategies with unprecedented accuracy. This technological leap could further enhance AI’s ability to predict price movements, manage risk, and execute high-frequency trades with near-instantaneous precision. As quantum computing continues to advance, it is expected to play a crucial role in shaping the future of AI-driven crypto trading.

Despite its many advantages, AI crypto trading is not without its challenges. Algorithmic trading systems are only as good as the data they are trained on, and if the data is flawed or biased, the AI’s predictions may be inaccurate. Market anomalies, black swan events, and unexpected regulatory changes can disrupt AI-driven trading strategies, leading to losses. Additionally, the increasing use of AI in trading has led to concerns about market manipulation and unfair advantages for institutional investors. Regulators are still grappling with how to oversee AI-powered trading systems while ensuring fair and transparent market conditions. The future of AI in crypto trading will likely involve a balance between innovation and regulation, ensuring that AI-driven strategies benefit the broader market while minimizing risks.

As AI continues to evolve, its impact on the cryptocurrency market will only grow stronger. Investors who embrace AI-driven trading tools and strategies will have a significant edge in the market, gaining access to predictive insights, automated risk management, and optimized trading strategies. The integration of AI with blockchain technology is also opening up new possibilities for decentralized trading, automated smart contracts, and AI-powered financial services. The future of crypto trading is being shaped by AI, and those who leverage its potential

0 notes

Text

Dogecoin Consolidation Suggests Uptrend Could Continue, But There's A Threat

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure Dogecoin (DOGE) is in a consolidation phase after experiencing a strong downtrend, indicating that the cryptocurrency is at a critical juncture. A crypto expert’s technical analysis suggests that while Dogecoin’s recent uptrend could continue, traders should remain cautious due to the threat of a…

0 notes

Link

0 notes

Text

Dogecoin Risks 60% Crash: Understanding the Risky Pattern That Could Lead to a Major Decline

The 60% Crash Risk in Dogecoin Explained: What a Rare Pattern Means for Investors In the world of cryptocurrencies, few names are as iconic as Dogecoin. Initially created as a joke, this meme coin has captured the attention of investors and the general public alike. However, recent market trends are raising alarms, particularly as a rare and risky pattern forms that could lead to a potential 60% crash in Dogecoin’s value.

Dogecoin's price has dropped significantly in recent months. As of early March 2025, the token had fallen to $0.019, its lowest price since November 2024. This contrasts sharply with its all-time high of $0.30 in 2021. The decline has been more than 60% since its peak, and market watchers are now concerned about Dogecoin's future, as a "death cross" pattern appears on the horizon. This pattern is frequently seen as a negative signal in technical analysis, signalling a likely steep drop in price. Also Read: bitcoin-1-million-why-the-white-house-support-could-accelerate-its-growth/ A death cross occurs when the short-term moving average falls below the long-term moving average, indicating that the asset is in a steep decline. This is a warning indication for investors, particularly those who have made significant investments in meme coins such as Dogecoin, which are more volatile than standard cryptocurrencies. The death cross indicates that the slump may continue, and Dogecoin may see additional losses. It is vital to remember that Dogecoin's price decrease is not occurring in isolation. Other meme coins, including Shiba Inu and Pepe, have suffered considerable losses throughout the same time period. The general meme currency market has been struck severely, with several tokens shedding more than half of their value. This loss can be linked in part to the cryptocurrency market's overall gloomy sentiment, as well as external causes like as regulatory uncertainty and a drop in interest from major players such as Elon Musk. Elon Musk has been a strong advocate of Dogecoin for several years, and his engagement has undoubtedly contributed to the coin's stratospheric rise. However, Musk's influence has decreased in recent years, particularly since his nett worth plummeted. According to Bloomberg, Musk's wealth has decreased by more than $100 billion this year alone, which may limit his capacity to continue pushing Dogecoin into the spotlight. So, what does this mean for dogecoin investors? There is a real risk of a 60% drop, and investors should exercise caution. While Dogecoin's passionate fandom remains strong, the possibility of future drops is high, particularly given the creation of the death cross pattern. Volatility is frequent in the bitcoin market, and rapid price fluctuations are usual. However, individuals who continue to retain Dogecoin investments must closely follow the market. If the death cross develops completely, it may be time to reconsider one's position in the coin and decide if it is worth hanging onto in the face of such instability. On the other hand, astute investors may see the present slump as an opportunity to buy, expecting that Dogecoin's meme status and committed community would eventually drive the price back up. As the market evolves, Dogecoin's future is unknown. While it is a fun and speculative asset for many, the hazards of investing in such volatile tokens must not be underestimated. Whether you are a long-term investor or new to the meme coin market, understanding the potential for a 60% drop in Dogecoin is critical before making any decisions. Read the full article

#60%CrashRisk#CryptoTrends#CryptocurrencyMarket#DeathCross#Dogecoin#DogecoinCrash#DogecoinInvestors#Dogecoinpricedecline#MemeCoinRisks#memecoins

0 notes

Text

Shiba Inu’s Ascent: Decoding the Recent Price Surge with CIFDAQ Chairman

Shiba Inu, the meme coin that once seemed content to play in the shadows of Dogecoin, is experiencing a moment in the sun. A recent price surge has propelled SHIB into the spotlight, leaving many wondering if this playful pup has finally grown into a formidable force in the crypto market. To understand the factors driving this remarkable ascent, The Shib turned to Himanshu Maradiya, Founder and Chairman of CIFDAQ Blockchain Ecosystem India Ltd., a seasoned business leader and blockchain visionary with a deep understanding of the forces shaping the digital asset landscape.

The Shib: What are the underlying factors driving Shiba Inu’s recent price surge? Maradiya: “Shiba Inu (SHIB) has recently become the center of attention in the cryptocurrency market, outpacing major coins like Bitcoin (BTC) and Ethereum (ETH) in both weekly gains and social media buzz. Several factors have contributed to SHIB’s price surge, ranging from ecosystem growth to market sentiment and speculative interest. Shiba Inu’s recent price surge is the result of a perfect storm of factors, including aggressive token burns, ecosystem expansion through Shibarium, and heightened speculative interest in the meme coin market. Market sentiment, amplified by FOMO, has played a significant role in fueling this rally, while institutional attention from reports like Grayscale’s has lent additional credibility to SHIB.”

The Shib: Based on technical analysis, what indicators or patterns suggest the sustainability of Shiba Inu’s recent price increase? Maradiya: “Shiba Inu’s recent price surge shows promising signs of sustainability through bullish technical indicators, but potential resistance levels at $0.0000200 and $0.0000240 could limit gains. While short-term corrections are likely due to overbought conditions, the continued growth of the Shiba Inu ecosystem and strong market sentiment could support gradual upward momentum. However, long-term investors should remain cautious, as SHIB’s high volatility and speculative nature make it vulnerable to sharp corrections.”

The Shib: How do you assess Shiba Inu’s long-term prospects in the competitive cryptocurrency market? Maradiya: “While Shiba Inu has potential for growth, its ability to establish a sustainable value proposition will depend on community support, utility development, regulatory adaptation, and competitive differentiation in a rapidly changing cryptocurrency landscape. Investors should approach with caution and conduct thorough research before committing to this high-risk asset… with the possibility of reaching an average price of $0.0001079892 by 2027.”

The Shib: How has the Shiba Inu community’s role evolved during this recent surge? Maradiya: “The Shiba Inu community has played a pivotal role in the cryptocurrency’s narrative, particularly during recent price surges. The evolution of the Shiba Inu community has been integral to its recent price appreciation. Through grassroots campaigns, the development of Shibarium, and proactive engagement in building a strong brand identity, the community has transformed SHIB from a meme coin into a serious contender in the cryptocurrency market.”

The Shib: How might changing regulatory landscapes, both domestically and internationally, affect Shiba Inu’s future growth? Are there any emerging competitors or trends that could challenge Shiba Inu’s market position? Maradiya: “The cryptocurrency landscape is highly dynamic, and regulatory developments, along with emerging competitors and trends, can significantly influence the future of tokens like Shiba Inu (SHIB) These factors together create a complex but manageable environment for Shiba Inu as it looks to solidify its place in the cryptocurrency market.”

About The Expert Himanshu Maradiya is an accomplished business leader, blockchain visionary, and entrepreneur with over 25 years of holistic industry experience. He has worked with leading organizations in various domains, including real estate, international finance, and investment. His rich experience across industries gives him a sharp understanding of the macroeconomic environment and the ability to make sound business decisions quickly. Maradiya is a true visionary in the field of trading, having worked diligently in multiple verticals, including Forex, commodities, international stocks, and cryptocurrencies. In his quest to innovate and disrupt the traditional trading industry, Maradiya founded CIFDAQ – The Evolution of Innovative Blockchain Ecosystem, the first of its kind to host major trading verticals across the globe.

www.cifdaq.com

0 notes

Link

Dogecoin has rebounded strongly after hitting a crucial support level, reinforcing bullish expectations laid out in a recent technical analysis. The popular meme cryptocurrency, which suffered a sharp decline last week, has defied concerns of an extended decline by bouncing off the $0.16896 reversal zone and now climbing toward higher levels. Now trading at $0.22, Dogecoin’s price action appears to align with a Cup & Handle formation, which is setting the stage for an extended rally. Dogecoin Bounces Off Key Reversal Zone A crypto analyst on social media platform X highlighted Dogecoin’s approach to a key support level in light of last week’s crash. This notable price crash saw Dogecoin lose its support levels around $0.20 and $0.20 in rapid succession. With this, the analyst noted that the meme coin is approaching the most crucial support at $0.16896, where it has the highest likelihood of bouncing upward. As predicted, DOGE found stability just before hitting this level and has since trended upward, now in the process of forming a Cup & Handle pattern. This classic bullish structure often precedes significant breakouts, with the analyst now eyeing a move above resistance levels as confirmation. Source: Rose Premium Signals on X Notably, the next crucial test at this point is at $0.29124. The reaction to this resistance will be crucial in determining whether DOGE can sustain its recovery and push toward new highs. A decisive breakout above this level could ignite further bullish momentum and bring more bullish price targets into play. Next Major Resistance Could Trigger Rally Toward $0.50 And Beyond Following the bounce from support, the analyst outlined a long-term bullish scenario, projecting a rally towards $0.50 and $0.60. A move to $0.50 would mark Dogecoin’s highest price level in years while also representing a significant breakout beyond $0.48, where it faced rejection in December 2024. From here, long-term targets are beyond $0.6 and a new all-time high above its current peak of $0.737. Nonethless, Dogecoin still has hurdles to clear, particularly at $0.29124. Even if Dogecoin bulls manage to break above this barrier, there is also the possibility of a retest before the next leg of the rally gains traction. The broader market sentiment also plays a role in Dogecoin’s trajectory. At the time of writing, Bitcoin and other major cryptocurrencies are starting to recover from last week’s decline after the announcement of a US crypto reserve. The bullish environment could support Dogecoin’s climb to new highs, and the meme coin could easily reach a new all-time high before the middle of the year. At the time of writing, DOGE is trading at $0.2178, up by 5.8% in the past 24 hours, but still down by 5.3% in a seven-day timeframe. DOGE trading at $0.22 on the 1D chart | Source: DOGEUSDT on Tradingview.com Featured image from iStock, chart from Tradingview.com

0 notes

Photo

Have you ever wondered, “Will Dogecoin reach $1000?” It’s a question buzzing around countless online forums, especially amongst Indian investors intrigued by the world of cryptocurrencies. We’ve all seen the incredible price swings of digital assets – the excitement of gains and the anxiety of losses. For those who have invested in or are considering investing in Dogecoin, hitting a price of $1000 seems like a millionaire-making dream. But is it a realistic dream? This article dives deep into the fascinating world of Dogecoin, examining the factors that could influence its price, exploring its past performance, and providing a balanced perspective on whether a $1000 target is achievable. Understanding the possibilities is crucial, especially with the fluctuating nature of the crypto market. This isn’t financial advice, however – remember, investing involves calculated risks. Let’s explore together responsibly.

Understanding the Dogecoin Phenomenon: A Journey To The Moon (Or Bust?)

Dogecoin, the meme-inspired cryptocurrency, started as a lighthearted joke in 2013. Its quirky Shiba Inu logo and decentralized network quickly gained a passionate following. However, its lack of intrinsic value and volatile nature has fueled constant debate regarding their long term potential. The initial success wasn’t driven by technical innovation, but largely by online hype and community actions. To know the potential of reaching 1000$, one must understand its journey better.

Dogecoin’s Market Capitalization: A Key Metric

To effectively appraise where Dogecoin could go and evaluate the factors of a $1000 price tag, consider its total market capitalization needs the attention. Market cap is simply the total value of all Dogecoins in circulation. The higher its market cap, the more valued its cryptocurrency could be to the current overall market. It is widely accepted it needs to greatly increase for increased valuation. Reaching such a valuation depends on things like adoption and user trust. To put the vast number into perspective, reaching 1000 is more difficult than reaching Bitcoin’s market capitazation.

Volatility and Price Fluctuations: The Dogecoin Rollercoaster

Dogecoin is famously volatile. In the past has demonstrated intense oscillations, even within hours. This makes predicting long-term price trends challenging and creates potentially higher returns in the speculative assets class. Such movements make predictions challenging, however by focusing into the various market changes one can understand the factors that lead those sudden shifts better.

Influential Factors on Dogecoin’s Price: The What, The Why, and How are Intertwined

Several interconnected factors shape a cryptocurrency’s price, including speculation, media attention, regulatory changes, technological innovation ,overall crypto market confidence affect cryptocurrency cost, so these factors apply to Dogecoin likewise. Therefore various factors increase, like adoption, community involvement among new members of the market. Yet increased involvement also increase the price volatility since many new changes occur in such a quickly adapting market. News reports can both increase adoption, such as celebrity mentions or positive overall cryptocurrency reviews, but negative ones can hurt it substantially .

The Role of Social Media and Celebrity Endorsements

Social media plays a significant role in Dogecoin ‘s excitement which impacts adoption and its market price considerably in a cyclical manner. We are entering more into a cryptocurrency media focused market, making such actions effective towards short term gains in valuation though risks long term gains by destabilizing the valuation due to hype focused and not technologically driven advancements. Hype trains for projects are usually short term based because there may not be enough to sustain such positive actions forever.

Technological Developments and Upgrades

While Dogecoin primarily functions as a digital payment system that is accessible worldwide through ease and speed of decentralized transfer, some developers still focus additional modifications and upgrades to a current Dogecoin, which sometimes impacts its current value and adoption status at the current technological marketspace. It’s widely known it already has enough popularity to be more than just a means of transferring funds, for example through integrations for Dogecoin adoption for microtransactions to online use. Furthermore new innovations create higher usage , causing adoption rate increase as more products and services can start using Dogecoin as their payment solutions.

Regulatory Landscape and Government Policies

Cryptocurrencies regulation varies, depending where globally based you are. This impacts cryptocurrency valuation and impacts greatly cryptocurrency project prices themselves. However these impact prices more often, such as how governments try implement their crypto transaction-focused taxes. This is the nature crypto transactions having global usage, and the government itself impacting any specific usage of transaction systems based on a digital or crypto framework. This is why knowing where the transactions are initiated from, which government has purview over this location, and more such information affects crypto price on long run.

Correlation with Other Cryptocurrencies

Dogecoin’s price doesn’t exist in a vacuum. It is likely it is correlated more among meme-based cryprocurrencies as most of the crypto market shows such dependence. One major trend also is major events among Bitcoins impacting most cryptocurrency performances. Understanding correlated trends is useful understanding future trend expectations from other major cryptocurrencies .

Can Dogecoin Really Hit $1000? A Realistic Assessment

The possibility of Dogecoin reaching $1000 depends on several factors, and many cryptocurrency experts hold differing opinions. Many focus less on potential success to focus which crypto are worth pursuing for long term investment. An important criterion in that regard is long term stability despite the fluctuating cryptocurrency market overall which many lack. However despite major criticism against Doge, it is still worth considering based on recent hype trains involved and adoption through more countries.

Market Cap, Price, and What It Means for Indian Investors

To reach ₹1 lakh, we only compare to a dollar’s approximate INR value currently to see where exactly we would predict where it would hit the target dollar equivalent. We need to consider the dollar valued target (1000$) and current approximate USD/INR (current value), from there find where Dogecoin should hit INR wise from that dollar value to consider investment value based solely price alone is a worthwhile exercise. However due to this nature, it’s easier to focus solely on USD (if targeting investment from INR using the platform).

The Importance of Diversification

It’s important for ALL investors that you diversify your investment holdings! We already discussed this among meme or similar correlated cryptos. A key concern regarding higher risk cryptocurrency such as those mentioned is focusing on your investment portfolio, otherwise it may bring down major returns on investments. Therefore proper risk management and financial plan is helpful to determine your risk tolerance which determines whether higher speculative assets is worthwhile to your asset allocation goals. To ensure there’s nothing overlooked , check your own risk tolerance prior to investing!

Frequently Asked Questions (FAQs)

Q: Is Dogecoin a good long-term investment?

A: There’s no simple “yes” or “no” to this question and many have conflicting theories. Dogecoin’s future is uncertain, based solely for its lack of inherent added usability against compared tech projects alone without further projects planned. Long-term speculation on its valuation comes as a factor however volatility brings huge risks, as such should consider a calculated, well-defined portfolio strategy on behalf its investor.

Q: What could realistically happen to Dogecoin’s price?

A: Predicting prices reliably goes highly risky. This comes as the major influence over speculation and external information itself impacts daily. Any valuation prediction relies to other sources so take any forecast projections that appear with major reservations.

Q: Are there other cryptocurrencies worth exploring?

A: The cryptocurrency space offers a plethora of alternatives, from established projects to promising newcomers. However always remember investing involves calculated assumptions , always thoroughly research these based on risk tolerance levels.

Key Takeaways: Investing Wisely

Dogecoin’s journey, to potential 1000$, needs strong future fundamental support, and community support doesn’t ensure this reality. Social media hype and celebrity actions create potential speculation increase. However, substantial volatility and overall cryptocurrency market uncertainty and its value based around speculation are strong factors that shouldn’t overlook. While a price of $1000 isn’t impossible, a better action would consider having any reasonable expectations when reviewing your risk level, and understand the many factors which impacts overall pricing, to properly analyze any investment into a higher-speculation cryptoasset itself, based its factors described!

Remember: Doing your research and determining suitability for risk investments is crucial! It includes consulting financial advisory to establish a better strategy.

Let’s hear your thoughts! Do you think Dogecoin will ever reach $1000? Share your predictions and insights in the comments below! And don’t forget to share this article with your friends and family who might have the same burning question.

0 notes

Text

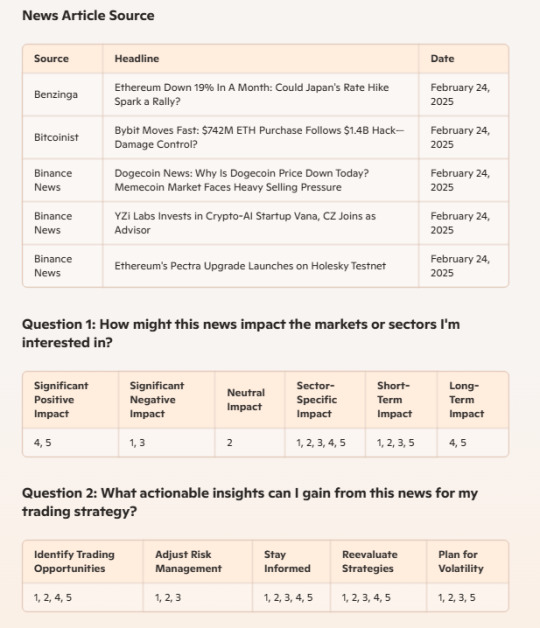

250224 - Today's News: Notes and Analysis

250224

Notes and Analysis:

News 1: Ethereum Down 19% In A Month: Could Japan's Rate Hike Spark a Rally?

Summary of the News: Ethereum has seen a 19% drop in value over the past month. There's speculation that Japan's recent rate hike could potentially lead to a rally in Ethereum's price.

Key Metrics: 19% drop in Ethereum value over a month.

Expert Opinions: Mixed views on the potential rally. Some believe Japan's rate hike may shift investor interest back to cryptocurrencies.

Potential Risks: Continued market volatility and potential for further declines in Ethereum's value.

News 2: Bybit Moves Fast: $742M ETH Purchase Follows $1.4B Hack—Damage Control?

Summary of the News: Bybit has swiftly purchased $742 million worth of Ethereum following a major $1.4 billion hack, likely as a damage control measure.

Key Metrics: $742 million ETH purchase, $1.4 billion hack.

Expert Opinions: Analysts suggest Bybit's move aims to restore confidence among investors and users.

Potential Risks: Potential backlash from the hacking incident and ongoing security concerns.

News 3: Dogecoin News: Why Is Dogecoin Price Down Today? Memecoin Market Faces Heavy Selling Pressure

Summary of the News: The price of Dogecoin has dropped significantly due to heavy selling pressure in the memecoin market, driven by security concerns and scams.

Key Metrics: Significant drop in Dogecoin price, potential 35% decline.

Expert Opinions: Market analysts warn of continued downward pressure if critical support levels are not maintained.

Potential Risks: Ongoing security issues and declining market confidence in memecoins.

News 4: YZi Labs Invests in Crypto-AI Startup Vana, CZ Joins as Advisor

Summary of the News: YZi Labs has made a strategic investment in Vana, a crypto-AI startup focused on data ownership and decentralization. Changpeng "CZ" Zhao has joined Vana as an advisor.

Key Metrics: Investment amount not specified.

Expert Opinions: Positive outlook on the partnership, highlighting the synergy between AI and blockchain technologies.

Potential Risks: Potential challenges in AI and blockchain integration and market acceptance.

News 5: Ethereum's Pectra Upgrade Launches on Holesky Testnet

Summary of the News: Ethereum's Pectra upgrade has launched on the Holesky testnet, introducing new features aimed at enhancing accounts, supporting Layer 2 scaling, and improving the user experience for validators.

Key Metrics: Launch time at 9:55 PM UTC, features include EIP-3074, 50% increase in blob capacity.

Expert Opinions: Generally positive, with the Ethereum Foundation emphasizing the significance of the upgrade for account abstraction.

Potential Risks: Technical issues during the testnet phase and possible delays in mainnet implementation.

Note: This entry has been edited for clarity and to align with the specified editorial line by Copilot AI.

1 note

·

View note

Text

Dogecoin (DOGE) Price Prediction 2024, 2025, 2026 And 2030

Dogecoin is an open-source peer-to-peer virtual currency favored by Shiba Inus globally. At least in part, it was created as a lighthearted joke for crypto enthusiasts and took its name from a once-popular meme.

DOGE is a meme coin cryptocurrency that utilizes blockchain technology, a highly secure decentralized system of storing information as a public ledger that is maintained by nodes (a network of computers). According to CoinMarketCap, Dogecoin is now among the top seven cryptocurrencies by market capitalization.

Dogecoin and other meme coins have outperformed Bitcoin over the past weeks, driven by an altcoin rally amid reduced regulatory uncertainty following the counting of the U.S. presidential election and Donald Trump’s victory. DOGE nearly surged over 167% in the last month. According to market capitalization, Dogecoin moved from the 10th to the 7th cryptocurrency on the CoinMarketCap ranking.

DOGE Historical Price

DOGE Price Prediction 2024

The dog-themed meme coin has surged approximately 167% in the last month, mainly after Donald Trump’s election.

DOGE experienced a bullish trend in the last quarter of 2024; Dogecoin is likely to skyrocket with the current rally, which is known for igniting massive jumps in altcoins due to the U.S. presidential election 2024

According to Coinpedia, the meme coin could witness a boost from the broader market recovery fueled by a potential rate cut in September. Hence, by the end of 2024, DOGE will likely hit the $0.3751 mark, a 270% price hike from current prices.

According to CoinDCX, the DOGE price is expected to be heavily volatile in the last few weeks of the year, attracting massive liquidity onto the platform. Market sentiments may change significantly, with market participants optimistic about the next price action. By the end of the month, the price may trade approximately $0.31 to $0.33, setting up a path toward DOGE’s new ATH in 2025.

DOGE Price Prediction 2025,2026..2030

Ryan Lee, chief analyst at Bitget Research, said that, according to historical records, DOGE rallied before Bitcoin prices moved towards its new ATH. Even more recently, Dogecoin outperformed Bitcoin after Donald Trump’s win and the influential backing of Elon Musk, a strong advocate for Dogecoin. This combination of political momentum and celebrity endorsement increases support for DOGE prices in the long run.

As we approach 2025, investor optimism is rising regarding Dogecoin’s growth potential due to its increasing acceptance worldwide and the anticipation of breaking the $1 mark. With its strong community backing, Dogecoin can go beyond its ATH of $0.7, but it will have to accumulate over a hundred billion dollars for that to happen.

According to Changelly, after analyzing Dogecoin prices in previous years, it is assumed that in 2025, the DOGE minimum price will be around $0.101, and the maximum may be around $0.173. On average, the trading price of DOGE might be $0.248 in 2025.

According to Changelly, based on cryptocurrency experts’ technical analysis of Dogecoin prices, 2026 DOGE is expected to be between $0.2777 and $0.3337. The average trading cost is expected to be $0.2856.

According to Binance, as of Nov. 19, 2024, the price prediction input for Dogecoin gathered from 269 users, the value of DOGE may increase by 5% and reach $ 0.489843 by 2030. According to the consensus rating, the current sentiment is that 128% of users are very bullish.YearPrice Prediction2025$ 0.3838052026$ 0.4029952027$ 0.4231452030$ 0.489843

Anish Jain, founder of WadzChain, said that as Dogecoin continues to experience notable gains, even outperforming Bitcoin in specific metrics, it highlights the evolution of public sentiment and adoption trends within the cryptocurrency ecosystem. Dogecoin’s 2025 forecast reflects the meme currency’s resilience and the power of community-driven projects in shaping market movements.

However, as with all cryptocurrencies, significant volatility remains a consideration. A diversified approach—focusing on leading coins like Bitcoin and emergent tokens with solid community backing like Dogecoin—will help advance financial inclusion and digital asset awareness worldwide.

What is the Future of Dogecoin?

Unlike most cryptocurrencies, Dogecoin’s supply is unlimited, as it mines blocks indefinitely. This unlimited inflation could dampen price appreciation over the long haul compared to coins with capped circulating supplies.

Dogecoin’s future depends on its potential utility. Meme popularity may only sustain DOGE for a while. However, progress in speed, lower transaction fees, and business collaboration could see it thrive as a mainstream digital currency. Its passionate and large community will likely keep evolving positively.

While long-term predictability is tough, Dogecoin shows signs of being more than a temporary phenomenon. Provided that upgrades and adoption progress address technical challenges, DOGE stands a reasonable chance of enduring as a cryptocurrency widely used with upside price potential in the coming years.

https://cifdaq.com/

0 notes

Text

Dogecoin (DOGE) Price Prediction 2024, 2025, 2026 And 2030..

Dogecoin is an open-source peer-to-peer virtual currency favored by Shiba Inus globally. At least in part, it was created as a lighthearted joke for crypto enthusiasts and took its name from a once-popular meme.

DOGE is a meme coin cryptocurrency that utilizes blockchain technology, a highly secure decentralized system of storing information as a public ledger that is maintained by nodes (a network of computers). According to CoinMarketCap, Dogecoin is now among the top seven cryptocurrencies by market capitalization.

Dogecoin and other meme coins have outperformed Bitcoin over the past weeks, driven by an altcoin rally amid reduced regulatory uncertainty following the counting of the U.S. presidential election and Donald Trump’s victory. DOGE nearly surged over 167% in the last month. According to market capitalization, Dogecoin moved from the 10th to the 7th cryptocurrency on the CoinMarketCap ranking.

DOGE Price Prediction 2024 The dog-themed meme coin has surged approximately 167% in the last month, mainly after Donald Trump’s election.

DOGE experienced a bullish trend in the last quarter of 2024; Dogecoin is likely to skyrocket with the current rally, which is known for igniting massive jumps in altcoins due to the U.S. presidential election 2024

According to Coinpedia, the meme coin could witness a boost from the broader market recovery fueled by a potential rate cut in September. Hence, by the end of 2024, DOGE will likely hit the $0.3751 mark, a 270% price hike from current prices.

According to CoinDCX, the DOGE price is expected to be heavily volatile in the last few weeks of the year, attracting massive liquidity onto the platform. Market sentiments may change significantly, with market participants optimistic about the next price action. By the end of the month, the price may trade approximately $0.31 to $0.33, setting up a path toward DOGE’s new ATH in 2025.

DOGE Price Prediction 2025,2026..2030 Ryan Lee, chief analyst at Bitget Research, said that, according to historical records, DOGE rallied before Bitcoin prices moved towards its new ATH. Even more recently, Dogecoin outperformed Bitcoin after Donald Trump’s win and the influential backing of Elon Musk, a strong advocate for Dogecoin. This combination of political momentum and celebrity endorsement increases support for DOGE prices in the long run.

As we approach 2025, investor optimism is rising regarding Dogecoin’s growth potential due to its increasing acceptance worldwide and the anticipation of breaking the $1 mark. With its strong community backing, Dogecoin can go beyond its ATH of $0.7, but it will have to accumulate over a hundred billion dollars for that to happen.

According to Changelly, after analyzing Dogecoin prices in previous years, it is assumed that in 2025, the DOGE minimum price will be around $0.101, and the maximum may be around $0.173. On average, the trading price of DOGE might be $0.248 in 2025.

According to Changelly, based on cryptocurrency experts’ technical analysis of Dogecoin prices, 2026 DOGE is expected to be between $0.2777 and $0.3337. The average trading cost is expected to be $0.2856.

According to Binance, as of Nov. 19, 2024, the price prediction input for Dogecoin gathered from 269 users, the value of DOGE may increase by 5% and reach $ 0.489843 by 2030. According to the consensus rating, the current sentiment is that 128% of users are very bullish.

Anish Jain, founder of WadzChain, said that as Dogecoin continues to experience notable gains, even outperforming Bitcoin in specific metrics, it highlights the evolution of public sentiment and adoption trends within the cryptocurrency ecosystem. Dogecoin’s 2025 forecast reflects the meme currency’s resilience and the power of community-driven projects in shaping market movements.

However, as with all cryptocurrencies, significant volatility remains a consideration. A diversified approach—focusing on leading coins like Bitcoin and emergent tokens with solid community backing like Dogecoin—will help advance financial inclusion and digital asset awareness worldwide.

What is the Future of Dogecoin? Unlike most cryptocurrencies, Dogecoin’s supply is unlimited, as it mines blocks indefinitely. This unlimited inflation could dampen price appreciation over the long haul compared to coins with capped circulating supplies.

Dogecoin’s future depends on its potential utility. Meme popularity may only sustain DOGE for a while. However, progress in speed, lower transaction fees, and business collaboration could see it thrive as a mainstream digital currency. Its passionate and large community will likely keep evolving positively.

While long-term predictability is tough, Dogecoin shows signs of being more than a temporary phenomenon. Provided that upgrades and adoption progress address technical challenges, DOGE stands a reasonable chance of enduring as a cryptocurrency widely used with upside price potential in the coming years.

https://www.forbes.com/advisor/in/investing/cryptocurrency/dogecoin-price-prediction/www.cifdaq.com

CIFDAQ#BITCOIN#CRYPTOINVESTING

0 notes

Text

Dogecoin (DOGE) Price Prediction 2024, 2025, 2026 And 2030...

Dogecoin is an open-source peer-to-peer virtual currency favored by Shiba Inus globally. At least in part, it was created as a lighthearted joke for crypto enthusiasts and took its name from a once-popular meme.

DOGE is a meme coin cryptocurrency that utilizes blockchain technology, a highly secure decentralized system of storing information as a public ledger that is maintained by nodes (a network of computers). According to CoinMarketCap, Dogecoin is now among the top seven cryptocurrencies by market capitalization.

Dogecoin and other meme coins have outperformed Bitcoin over the past weeks, driven by an altcoin rally amid reduced regulatory uncertainty following the counting of the U.S. presidential election and Donald Trump’s victory. DOGE nearly surged over 167% in the last month. According to market capitalization, Dogecoin moved from the 10th to the 7th cryptocurrency on the CoinMarketCap ranking.

DOGE Price Prediction 2024 The dog-themed meme coin has surged approximately 167% in the last month, mainly after Donald Trump’s election.

DOGE experienced a bullish trend in the last quarter of 2024; Dogecoin is likely to skyrocket with the current rally, which is known for igniting massive jumps in altcoins due to the U.S. presidential election 2024

According to Coinpedia, the meme coin could witness a boost from the broader market recovery fueled by a potential rate cut in September. Hence, by the end of 2024, DOGE will likely hit the $0.3751 mark, a 270% price hike from current prices.

According to CoinDCX, the DOGE price is expected to be heavily volatile in the last few weeks of the year, attracting massive liquidity onto the platform. Market sentiments may change significantly, with market participants optimistic about the next price action. By the end of the month, the price may trade approximately $0.31 to $0.33, setting up a path toward DOGE’s new ATH in 2025.

DOGE Price Prediction 2025,2026..2030 Ryan Lee, chief analyst at Bitget Research, said that, according to historical records, DOGE rallied before Bitcoin prices moved towards its new ATH. Even more recently, Dogecoin outperformed Bitcoin after Donald Trump’s win and the influential backing of Elon Musk, a strong advocate for Dogecoin. This combination of political momentum and celebrity endorsement increases support for DOGE prices in the long run.

As we approach 2025, investor optimism is rising regarding Dogecoin’s growth potential due to its increasing acceptance worldwide and the anticipation of breaking the $1 mark. With its strong community backing, Dogecoin can go beyond its ATH of $0.7, but it will have to accumulate over a hundred billion dollars for that to happen.

According to Changelly, after analyzing Dogecoin prices in previous years, it is assumed that in 2025, the DOGE minimum price will be around $0.101, and the maximum may be around $0.173. On average, the trading price of DOGE might be $0.248 in 2025.

According to Changelly, based on cryptocurrency experts’ technical analysis of Dogecoin prices, 2026 DOGE is expected to be between $0.2777 and $0.3337. The average trading cost is expected to be $0.2856.

According to Binance, as of Nov. 19, 2024, the price prediction input for Dogecoin gathered from 269 users, the value of DOGE may increase by 5% and reach $ 0.489843 by 2030. According to the consensus rating, the current sentiment is that 128% of users are very bullish.

Anish Jain, founder of WadzChain, said that as Dogecoin continues to experience notable gains, even outperforming Bitcoin in specific metrics, it highlights the evolution of public sentiment and adoption trends within the cryptocurrency ecosystem. Dogecoin’s 2025 forecast reflects the meme currency’s resilience and the power of community-driven projects in shaping market movements.

However, as with all cryptocurrencies, significant volatility remains a consideration. A diversified approach—focusing on leading coins like Bitcoin and emergent tokens with solid community backing like Dogecoin—will help advance financial inclusion and digital asset awareness worldwide.

What is the Future of Dogecoin? Unlike most cryptocurrencies, Dogecoin’s supply is unlimited, as it mines blocks indefinitely. This unlimited inflation could dampen price appreciation over the long haul compared to coins with capped circulating supplies.

Dogecoin’s future depends on its potential utility. Meme popularity may only sustain DOGE for a while. However, progress in speed, lower transaction fees, and business collaboration could see it thrive as a mainstream digital currency. Its passionate and large community will likely keep evolving positively.

While long-term predictability is tough, Dogecoin shows signs of being more than a temporary phenomenon. Provided that upgrades and adoption progress address technical challenges, DOGE stands a reasonable chance of enduring as a cryptocurrency widely used with upside price potential in the coming years.

https://www.forbes.com/advisor/in/investing/cryptocurrency/dogecoin-price-prediction/www.cifdaq.com

CIFDAQ#BITCOIN#CRYPTOINVESTING

0 notes

Text

Shiba Inu’s Ascent: Decoding the Recent Price Surge with CIFDAQ Chairman

Shiba Inu, the meme coin that once seemed content to play in the shadows of Dogecoin, is experiencing a moment in the sun. A recent price surge has propelled SHIB into the spotlight, leaving many wondering if this playful pup has finally grown into a formidable force in the crypto market. To understand the factors driving this remarkable ascent, The Shib turned to Himanshu Maradiya, Founder and Chairman of CIFDAQ Blockchain Ecosystem India Ltd., a seasoned business leader and blockchain visionary with a deep understanding of the forces shaping the digital asset landscape.

The Shib: What are the underlying factors driving Shiba Inu’s recent price surge?

Maradiya: “Shiba Inu (SHIB) has recently become the center of attention in the cryptocurrency market, outpacing major coins like Bitcoin (BTC) and Ethereum (ETH) in both weekly gains and social media buzz. Several factors have contributed to SHIB’s price surge, ranging from ecosystem growth to market sentiment and speculative interest. Shiba Inu’s recent price surge is the result of a perfect storm of factors, including aggressive token burns, ecosystem expansion through Shibarium, and heightened speculative interest in the meme coin market. Market sentiment, amplified by FOMO, has played a significant role in fueling this rally, while institutional attention from reports like Grayscale’s has lent additional credibility to SHIB.”

The Shib: Based on technical analysis, what indicators or patterns suggest the sustainability of Shiba Inu’s recent price increase?

Maradiya: “Shiba Inu’s recent price surge shows promising signs of sustainability through bullish technical indicators, but potential resistance levels at $0.0000200 and $0.0000240 could limit gains. While short-term corrections are likely due to overbought conditions, the continued growth of the Shiba Inu ecosystem and strong market sentiment could support gradual upward momentum. However, long-term investors should remain cautious, as SHIB’s high volatility and speculative nature make it vulnerable to sharp corrections.”

The Shib: How do you assess Shiba Inu’s long-term prospects in the competitive cryptocurrency market?

Maradiya: “While Shiba Inu has potential for growth, its ability to establish a sustainable value proposition will depend on community support, utility development, regulatory adaptation, and competitive differentiation in a rapidly changing cryptocurrency landscape. Investors should approach with caution and conduct thorough research before committing to this high-risk asset… with the possibility of reaching an average price of $0.0001079892 by 2027.”

The Shib: How has the Shiba Inu community’s role evolved during this recent surge?

Maradiya: “The Shiba Inu community has played a pivotal role in the cryptocurrency’s narrative, particularly during recent price surges. The evolution of the Shiba Inu community has been integral to its recent price appreciation. Through grassroots campaigns, the development of Shibarium, and proactive engagement in building a strong brand identity, the community has transformed SHIB from a meme coin into a serious contender in the cryptocurrency market.”

The Shib: How might changing regulatory landscapes, both domestically and internationally, affect Shiba Inu’s future growth? Are there any emerging competitors or trends that could challenge Shiba Inu’s market position?

Maradiya: “The cryptocurrency landscape is highly dynamic, and regulatory developments, along with emerging competitors and trends, can significantly influence the future of tokens like Shiba Inu (SHIB) These factors together create a complex but manageable environment for Shiba Inu as it looks to solidify its place in the cryptocurrency market.”

About The Expert

Himanshu Maradiya is an accomplished business leader, blockchain visionary, and entrepreneur with over 25 years of holistic industry experience. He has worked with leading organizations in various domains, including real estate, international finance, and investment. His rich experience across industries gives him a sharp understanding of the macroeconomic environment and the ability to make sound business decisions quickly. Maradiya is a true visionary in the field of trading, having worked diligently in multiple verticals, including Forex, commodities, international stocks, and cryptocurrencies. In his quest to innovate and disrupt the traditional trading industry, Maradiya founded CIFDAQ – The Evolution of Innovative Blockchain Ecosystem, the first of its kind to host major trading verticals across the globe.

Cifdaq.com

Stablecoins: Bridging Crypto and the Real World □□

Newuser232www

January 31, 2025

modify

comment

Stablecoins: Bridging Crypto and the Real World 🌐💳 From cross-border remittances to secure digital payments, stablecoins are transforming how we transact. Stay stable, go global! 🚀 Himanshu Maradiya Sheetal Maradiya Rahul Maradiya Jay Hao Krunal Sheth Anil Vasu Ankur Garg Muthuswamy Iyer Shipra Anand Mishra #CryptoPayments #Stablecoin #CIFDAQ #CryptoTrading #Blockchain #Web3Community

cifdaq.com

Stay with us for fascinating tidbits and ideas that will keep your mind sharp and your perspective wide!

Newuser232www

January 31, 2025

modify

comment

Stay with us for fascinating tidbits and ideas that will keep your mind sharp and your perspective wide! Himanshu Maradiya Sheetal Maradiya Rahul Maradiya Jay Hao Krunal Sheth Anil Vasu Ankur Garg Muthuswamy Iyer Shipra Anand Mishra #CIFDAQ #NFT #CIFD #BlockchainEcosystem #CryptoTrading #Web3Community

www.linkedin.com/posts/cifdaq_cifdaq-nft-cifd-activity-7290692781126086656-rzLu

cifdaq.com

0 notes

Text

Creating an AI Meme Coin: How Entrepreneurs Can Capitalize on the Trend

The cryptocurrency market continues to evolve, and one of the latest innovations within this space is the rise of AI meme coins. Combining the humor-driven appeal of meme coins like Dogecoin with the advanced capabilities of artificial intelligence, AI meme coins offer both entertainment and cutting-edge technology. For entrepreneurs, this presents an exciting opportunity to create something that could capture the attention of both crypto enthusiasts and tech-forward investors. In this blog, we'll guide you through the process of creating your own AI meme coin and explore how entrepreneurs can leverage this trend for success.

What Are AI Meme Coins?

AI meme coins represent a hybrid of two significant trends in cryptocurrency: meme coins and artificial intelligence. Meme coins, such as Dogecoin and Shiba Inu, have gained fame for their viral nature and community-driven culture. What makes AI meme coins unique is their integration with AI technologies, which can help optimize various aspects of the project, from trading strategies to community engagement. These coins might use AI-powered algorithms for predictive analytics, automated decision-making, and even enhance the user experience by adding smart contract features tailored to the needs of the community.

Step 1: Identify the Niche and Concept

The first step in creating an AI meme coin is to identify your niche and develop a clear concept. While meme coins are often based on humor and pop culture references, it's essential to tap into something that resonates with your target audience. Your AI meme coin could focus on AI humor, or it could leverage AI in unique ways—perhaps using predictive algorithms for user rewards or even AI-based governance. A strong and engaging concept will help your coin stand out in a crowded market and draw attention from potential investors and community members.

Step 2: Assemble the Right Team

A thriving AI meme coin needs a diverse set of experts to achieve development success. To build sufficient infrastructure and market your coin you require blockchain developers with infrastructure-building expertise as well as AI specialists with integration capabilities and experienced marketers to grow your community. All team contributors bear essential responsibilities from writing smart contracts and integrating AI capabilities to social network distribution of your coin. The correct team selection provides you with essential elements needed to begin your AI meme coin launch.

Step 3: Develop the Token and Smart Contracts

Token development combined with smart contract writing follows the assembly of your team. You must select your AI meme coin's blockchain development platform from Ethereum (ERC-20) or Binance Smart Chain (BEP-20) for your project at this point. Defining the blockchain platform precedes the technical functionalities work that includes supply standards together with token distribution protocols and artificial intelligence system requirements. The addition of AI-driven elements including predictive technology and rewards systems demands smart contract programmed features during development. At this critical stage your token framework's success depends on developing both its structure and security.

Step 4: Build the Community and Viral Marketing

Community success drives the health of all meme coins so AI meme coins must use artificial intelligence tools for creating and interacting with their audience. The AI-powered chatbot technology enables query automation, content production automation and sentiment analysis for better marketing framework decision making. Twitter along with Reddit and Discord platforms represent perfect spaces to promote meme coins but marketers must design viral marketing initiatives that boost sharing and user communications. Your AI meme coin's popularity will rise through strategically chosen influencer alliances and fun meme challenge contests and popular engaging content.

Step 5: Launch and Trade on Exchanges

You can launch your AI meme coin after successfully developing your marketing initiatives and completing product development. Your AI meme coin can start trading on DEXs such as Uniswap or PancakeSwap. Users can easily access these platforms while new tokens obtain necessary liquidity. Your coin can move to centralized exchanges after achieving popularity which brings increased exposure to potential investors with large financial capabilities. To continue the initial momentum following your AI meme coin launch you will need both an established plan and sustained community backing.

Step 6: Monetize Your AI Meme Coin

After your AI meme coin goes live you have multiple approaches for making money with it. Through token sales you can obtain funding during presales and initial coin offerings (ICO). Your platform could enable rewards through yield farming or staking giving users the chance to generate income when they stake or provide liquidity to your coin. The monetization options for your AI meme coin include blockchain partnerships and AI-themed retail products besides token sales and liquidity farming pooled by users provided their participation. Silver coin monetization from AI memes becomes possible through marketplace savvy and creative thinking combined with proper market understanding which creates several income opportunities.

Conclusion

The creation of AI meme coins provides entrepreneurs with a stimulating way to generate profits through crypto investment ventures. You can manufacture a cryptocurrency product which satisfies both high-tech investors and social media followers by joining AI enhancements to meme concepts. With the correct strategic approach and capable team your AI meme coin will find quick adoption among crypto investors during its development from inception to launch and monetization stages. Do you have what it takes to seize upon this market trend for launching your AI meme coin?

#ai#ai meme coin development company#ai meme coin development services#create ai meme coin#ai meme coin development#ai meme coin development solutions

0 notes