#Customer relationship management (CRM) in wealth management

Explore tagged Tumblr posts

Text

In the fast-paced world of wealth management, building trust and offering personalized service are key to long-term success. Customer relationship management (CRM) goes beyond just using software—it’s about creating strong, lasting relationships with clients.

Let’s look at how advisors can use CRM strategies to deliver personalized experiences that go beyond just numbers and portfolios.

#wealth management#wealth management course#career in wealth management#Customer relationship management (CRM) in wealth management#CRM in Wealth Management#TSCFM

0 notes

Text

Sales Automation: Streamlining Processes for Efficient Lead Generation

Article by Jonathan Bomser | CEO | AccountSend.com

In today's lightning-paced business ecosystem, the beacon of Sales Automation shines brighter than ever as a transformative force propelling lead generation into a realm of unprecedented efficiency and success. This voyage takes us through seven pivotal strategies that harness the true potential of Sales Automation, ensuring that you harness its power to revolutionize your lead generation journey.

DOWNLOAD THE SALES AUTOMATION INFOGRAPHIC HERE

Implement a Customer Relationship Management (CRM) System

Imagine a command center at your fingertips that orchestrates your lead interactions with finesse. This is where the Customer Relationship Management (CRM) System, the linchpin of Sales Automation, comes into play. This technological marvel enables you to seamlessly centralize customer data, track interactions, and automate tasks with precision. Picture the possibilities as your sales team focuses on nurturing connections that drive conversions.

Utilize Marketing Automation Tools

Bid farewell to labor-intensive marketing efforts as Sales Automation brings forth the magic of marketing automation tools. These remarkable instruments streamline repetitive marketing tasks, from orchestrating email campaigns to nurturing leads and scheduling social media content. By crafting strategic workflows and triggers, you hold the power to deliver tailor-made messages that resonate with your prospects. The outcome? Engagement and conversion rates that soar to new heights.

Qualify Leads with Lead Scoring

In the labyrinth of potential leads, imagine having a compass that guides you to the most promising ones. Enter lead scoring, a beacon of clarity amidst the complexity. Through meticulous criteria encompassing demographic data, engagement metrics, and behavioral patterns, lead scoring empowers your sales team to prioritize leads ripe for conversion. This orchestration of efficiency elevates your conversion rates while maximizing your team's efforts.

Streamline Sales Processes with Workflow Automation

Embrace the liberation from manual, time-consuming sales processes through the elegance of workflow automation. Bid adieu to the mundane tasks of follow-ups, appointment scheduling, and proposal generation. Workflow automation transforms these into seamless symphonies, gifting your sales team precious time. This temporal freedom translates into a focus on nurturing relationships, cultivating an environment primed for deal closure.

youtube

Integrate Sales and Marketing Efforts

The synergy of sales and marketing isn't a mere concept; it's a dynamic strategy made tangible by Sales Automation. Witness the convergence of these vital forces as silos dissolve, and a harmonious collaboration emerges. Valuable insights flow seamlessly, lead progress is tracked cohesively, and communication flourishes throughout the sales cycle. The result? A seamless alliance that fuels conversions and magnifies results.

Implement Chatbots and AI-powered Assistants

In an era where responsiveness defines success, envision AI-powered chatbots as your digital allies. These innovative assistants redefine customer support and engagement by handling routine inquiries, offering instant responses, and even assisting in lead qualification. The outcome? Your team is unburdened, channeling their expertise into intricate tasks that propel your business forward.

Continuously Analyze and Optimize

Success isn't a static destination; it's an evolving journey. Data analysis becomes your compass in the realm of Sales Automation. Regularly delve into the wealth of insights harvested by your automation tools. Decode lead behavior, unravel conversion rates, and unveil sales performance intricacies. Armed with these insights, fine-tune your lead generation strategies, refine processes, and unearth optimization opportunities.

In essence, Sales Automation stands as the cornerstone of lead generation efficiency. Through adopting a CRM system, harnessing marketing automation tools, embracing lead scoring, automating sales workflows, aligning sales and marketing endeavors, integrating AI-powered support, and ceaselessly optimizing strategies, you can reshape your lead generation narrative. Embrace Sales Automation as the lifeblood of your sales strategy, and witness your lead generation expedition thrive with newfound efficiency and efficacy. The time has come to seize Sales Automation and redefine your lead generation journey.

#Sales Automation#Lead Generation#CRM#Business Owners Database#Verified B2B Emails#B2B Contact Database#CEO Email Addresses#Sales Leads Database#B2B Email List#B2B Leads Database#Verified Business Leads#B2B Leads List#businessgrowth#leadgeneration#b2b#accountsend#youtube#entrepreneurship#b2bleadgeneration#b2bsales#businesstips#sales#Youtube

35 notes

·

View notes

Text

Happy Dhanteras from Delta BPO Solutions !

May the light of Dhanteras fill your life with wealth, prosperity, and happiness. Wishing you all a very auspicious Dhanteras!

Start a Call Center Business with Delta BPO Solutions

Delta BPO Solutions is a leading provider of call center outsourcing services. We offer a wide range of services to help you start and grow your call center business, including:

1. Call center infrastructure and setup

2. Agent recruitment and training

3. Quality assurance and monitoring

4. Customer relationship management (CRM) software

5. Reporting and analytics

Delta BPO Solutions has a proven track record of success in helping businesses of all sizes start and grow their call center businesses. We have a team of experienced and knowledgeable professionals who can help you every step of the way.

Contact us today for a free consultation!

4 notes

·

View notes

Text

Banking Software Company Muzaffarpur - Enexa IT Solutions

Introduction

The banking and financial sector is rapidly evolving, requiring innovative and secure software solutions to enhance customer experiences, streamline operations, and ensure regulatory compliance. Enexa IT Solutions, a leading banking software company in Muzaffarpur, specializes in delivering high-quality, secure, and scalable banking software solutions tailored to the needs of financial institutions.

About Enexa IT Solutions

Enexa IT Solutions is a trusted name in banking software development, providing cutting-edge financial technology solutions to banks, credit unions, and financial institutions. With an expert team of software developers, security analysts, and financial technology specialists, we help businesses digitize their banking services with innovative and compliant software solutions.

Why Choose Enexa IT Solutions?

Expert Fintech Developers - A team with extensive experience in banking and financial software development.

Custom Banking Solutions - Tailor-made software solutions to meet the unique needs of banks and financial institutions.

Advanced Security - Implementation of high-end encryption and cybersecurity protocols.

Regulatory Compliance - Solutions that comply with financial regulations and data protection laws.

Cost-Effective Pricing - High-quality software solutions at competitive rates.

Timely Delivery - On-time project completion with premium software standards.

24/7 Technical Support - Dedicated support team for troubleshooting and software maintenance.

Banking Software Development Services Offered by Enexa IT Solutions

1. Core Banking Software

We develop robust core banking systems that offer seamless transaction processing, account management, and real-time banking operations.

2. Digital Banking Solutions

Our digital banking solutions enable financial institutions to offer secure and convenient mobile and online banking services to their customers.

3. Loan Management Software

Automate and streamline loan processing, from application to approval, with our feature-rich loan management software solutions.

4. Payment Gateway Integration

Secure and reliable payment gateway integration services to support online transactions, credit/debit card processing, and UPI payments.

5. Risk & Fraud Management Software

We provide AI-powered fraud detection and risk management software to help banks prevent financial fraud and ensure security compliance.

6. Banking CRM Solutions

Enhance customer relationships and streamline operations with our customized banking CRM solutions for effective customer engagement and data management.

7. ATM & Kiosk Software Development

We develop software for ATMs and banking kiosks to ensure smooth self-service banking operations for customers.

Industries Served

Enexa IT Solutions serves a variety of financial institutions, including:

Retail Banks - Core banking, mobile banking, and customer management solutions.

Credit Unions - Secure and scalable banking software for cooperative financial institutions.

NBFCs & Microfinance - Loan management, payment solutions, and digital financial services.

Investment Firms - Trading platforms, wealth management, and portfolio tracking software.

Insurance Companies - Custom software solutions for claims processing, policy management, and customer service.

Benefits of Choosing Enexa IT Solutions

1. Secure & Compliant Solutions

Our banking software solutions are built with advanced security protocols and comply with global financial regulations.

2. Scalable & Future-Ready

We design software solutions that can scale with your business growth and adapt to future technological advancements.

3. User-Friendly Interface

Our banking solutions provide an intuitive and seamless experience for both customers and administrators.

4. Real-Time Reporting & Analytics

Comprehensive data analytics and real-time reporting features for better decision-making.

5. Multi-Currency & Multi-Language Support

Our banking solutions cater to global financial institutions, providing support for multiple currencies and languages.

Enexa IT Solutions – Your Trusted Banking Software Partner

Choosing the right banking software company is crucial for financial institutions aiming to enhance efficiency and security. Enexa IT Solutions provides customized, scalable, and secure banking software solutions in Muzaffarpur, helping financial institutions stay ahead in the competitive market.

Get in Touch with Enexa IT Solutions

If you are looking for a reliable banking software company in Muzaffarpur, Enexa IT Solutions is your ideal partner. Whether you need core banking systems, payment integrations, or risk management software, our expert team is here to assist you.

Conclusion

Enexa IT Solutions is a premier banking software company in Muzaffarpur, delivering high-quality, innovative, and secure financial technology solutions. Whether you need digital banking, core banking, or fraud prevention software, we have the expertise to build the perfect solution for your institution. Contact Enexa IT Solutions today to get started!

0 notes

Text

Leafly.com Dispensary Listings Scraping

Leafly.com Dispensary Listings Scraping

Leafly.com Dispensary Listings Scraping: Unlocking Market Insights & Business Growth. In the rapidly growing cannabis industry, having access to accurate and up-to-date dispensary data is crucial for businesses looking to expand their market reach, improve their marketing strategies, and gain a competitive edge. Leafly.com Dispensary Listings Scraping enables businesses to extract structured and verified dispensary information from Leafly.com, one of the leading platforms for cannabis product listings and dispensary details.

At DataScrapingServices.com, we provide high-quality dispensary data extraction to help businesses optimize their marketing efforts, generate leads, and drive business growth.

Key Data Fields

With Leafly.com Dispensary Listings Scraping, businesses can access a wealth of valuable data, including:

- Dispensary Name

- Location

- Street Address

- City

- State

- ZIP Code

- Phone Number

- Email Address (if available)

- Website URL

- Operating Hours

- Product Listings & Categories

- Customer Ratings & Reviews

- Pricing Information

- Promotions & Discounts

Having access to this structured data allows cannabis retailers, marketing agencies, suppliers, and investors to make data-driven decisions and enhance their business strategies.

Benefits of Leafly.com Dispensary Listings Scraping

1. Targeted Marketing & Lead Generation

With verified dispensary contact details, businesses can create highly targeted marketing campaigns, ensuring that their products and services reach the right audience. This improves lead conversion rates and maximizes return on investment (ROI).

2. Competitive Analysis & Market Research

By analyzing pricing trends, customer reviews, and product availability, businesses can gain insights into the competitive landscape and refine their strategies accordingly. This helps in identifying market gaps and business opportunities.

3. Supplier & Vendor Expansion

For cannabis wholesalers, manufacturers, and suppliers, having a comprehensive dispensary database allows them to reach out to potential clients efficiently, expanding their B2B partnerships and distribution networks.

4. CRM Enhancement & Business Database Management

A well-structured and updated dispensary database improves customer relationship management (CRM), ensuring that businesses can effectively track and engage with dispensaries. This reduces data redundancy and enhances communication.

5. Optimized Digital Advertising & Email Campaigns

With accurate email addresses and contact details, businesses can execute personalized email marketing campaigns, promoting new products, special discounts, and industry insights. This helps in building brand loyalty and increasing customer engagement.

6. Investment & Expansion Opportunities

Investors and entrepreneurs looking to enter the cannabis industry can use Leafly.com Dispensary Listings Scraping to identify profitable locations, high-demand products, and potential business partners. Having structured data ensures better investment decisions and market expansion strategies.

Best Data Extraction Service Provider

Walmart Product Listings Scraping

G2 Business Directory Scraping

Scoot.co.uk Business Listings Scraping

Leafly.com Dispensary Listings Scraping

Thomsonlocal.com Business Directory Scraping

HomeDepot.com Product Data Extraction

Canpages.ca Business Listings Scraping

Kogan Product Details Extraction

MerchantCircle Business Directory Scraping

Scraping BBB.org Verified Company Information

Best Leafly.com Dispensary Listings Scraping Services in USA:

Fort Worth, Louisville, Wichita, Boston, Virginia Beach, New Orleans, Philadelphia, Orlando, San Francisco, Tulsa, San Jose, Seattle, Columbus, Oklahoma City, Raleigh, San Francisco, Washington, Las Vegas, Colorado, Nashville, Bakersfield, San Diego, Milwaukee, Denver, Fresno, Orlando, Sacramento, Omaha, El Paso, Atlanta, Memphis, Mesa, Indianapolis, Jacksonville, Kansas City, Austin, Dallas, San Antonio, Long Beach, Fresno, Albuquerque, Colorado, Houston, Sacramento, Long Beach, Chicago, Charlotte, Tucson and New York.

Conclusion

Leafly.com Dispensary Listings Scraping is a powerful solution for businesses, marketers, and investors aiming to capitalize on the growing cannabis industry. By leveraging accurate and up-to-date dispensary data, companies can enhance their marketing efforts, streamline lead generation, and gain valuable market insights.

For Leafly.com Dispensary Listings Scraping Services, contact [email protected] or visit DataScrapingServices.com today! 🚀

#leaflydispensarylistingsscraping#leaflydispensarydataextraction#leadgeneration#datadrivenmarketing#webscrapingservices#businessinsights#digitalgrowth#datascrapingexperts

0 notes

Link

0 notes

Text

Beyond the Game: How iGaming CRM & Marketing Analytics Drive Revenue Growth

The iGaming industry is a high-stakes game. While attracting new players is essential, maximizing revenue requires a more strategic approach. It's not just about getting players in the door; it's about understanding their behavior, personalizing their experience, and optimizing your marketing efforts to drive sustainable revenue growth. The winning combination? A powerful iGaming CRM system coupled with insightful marketing analytics.

The Revenue Challenge: More Than Just Player Acquisition

Acquiring players is expensive. Marketing campaigns, bonuses, and incentives all contribute to player acquisition cost (PAC). Therefore, focusing solely on acquisition can be a costly and unsustainable strategy. The real return on investment comes from maximizing the value each player brings to your platform over their entire relationship. This is where a data-driven approach, powered by iGaming CRM and marketing analytics, becomes crucial.

iGaming CRM: Your Revenue-Generating Engine

Your iGaming CRM system is more than just a database; it's the engine that drives your revenue growth. It's the central hub for understanding your players, personalizing their experience, and optimizing your marketing campaigns. It collects and organizes a wealth of data, from basic demographics and gaming preferences to detailed betting history, communication logs, and even responsible gambling indicators.

How CRM Fuels Revenue Growth:

Granular Player Segmentation: CRM allows you to segment players based on a variety of factors, including demographics, gaming behavior, deposit history, loyalty level, and even preferred communication channels. This granular segmentation enables highly targeted marketing campaigns and personalized offers, maximizing their impact and ROI.

Personalized Experiences: Move beyond generic promotions and create tailored experiences for each player. Recommend games based on their past activity, offer personalized bonuses that align with their preferences, and celebrate milestones with targeted messages. Personalization drives engagement and encourages players to spend more.

Automated Engagement: Automate key marketing processes to nurture player relationships and drive revenue. Welcome new players with personalized onboarding sequences, re-engage inactive players with tailored promotions, and reward loyal players with exclusive perks. Automation frees up your marketing team to focus on strategic initiatives.

Proactive Customer Support: Empower your customer support team with access to player data, enabling them to provide personalized and efficient assistance. Happy players are more likely to stay and contribute to your bottom line.

Marketing Analytics: The Key to Revenue Optimization

Marketing analytics tools leverage the data stored in your CRM to provide valuable insights into player behavior, campaign performance, and revenue trends. They help you understand what's working, what's not, and where to focus your efforts for maximum impact.

How Analytics Drives Revenue Optimization:

Performance Tracking: Monitor key revenue metrics like average revenue per user (ARPU), player lifetime value (CLTV), and return on investment (ROI) for your marketing campaigns. Understand the true impact of your efforts and identify areas for improvement.

Behavioral Analysis: Analyze player behavior patterns to identify trends and preferences. What games are players drawn to? When do they tend to engage? Use these insights to refine your game offerings and marketing campaigns to maximize revenue.

Campaign Optimization: Analyze campaign performance in real-time and make data-driven adjustments. Optimize targeting, messaging, and offers to improve conversion rates and drive revenue.

Predictive Analytics: Leverage predictive analytics to anticipate player needs and proactively offer personalized experiences that encourage spending and increase player lifetime value.

The Synergy: Unlocking Revenue Potential

The true power lies in the synergy between CRM and analytics. CRM provides the data, and analytics provides the insights. This powerful combination empowers you to:

Identify high-value players and personalize their experience to maximize their spending.

Optimize marketing campaigns in real-time to drive revenue growth.

Personalize the player journey to encourage repeat play and increase player lifetime value.

Make data-driven decisions about game development, marketing spend, and overall business strategy.

From Players to Profits: The Data-Driven Advantage

In the competitive iGaming landscape, revenue growth is paramount. By leveraging the power of iGaming CRM and marketing analytics, you can move beyond guesswork and create a data-driven strategy that maximizes your revenue potential. It's not just about attracting players; it's about understanding them, engaging them, and providing an experience that keeps them coming back for more. Invest in these tools, and you'll be investing in the future of your iGaming success.

0 notes

Text

Adviser - Wealth Quality Assurance

(preferred). Experience working with XPLAN software or similar Customer Relationship Management (CRM) tools (preferred… Apply Now

0 notes

Text

Adviser - Wealth Quality Assurance

(preferred). Experience working with XPLAN software or similar Customer Relationship Management (CRM) tools (preferred… Apply Now

0 notes

Text

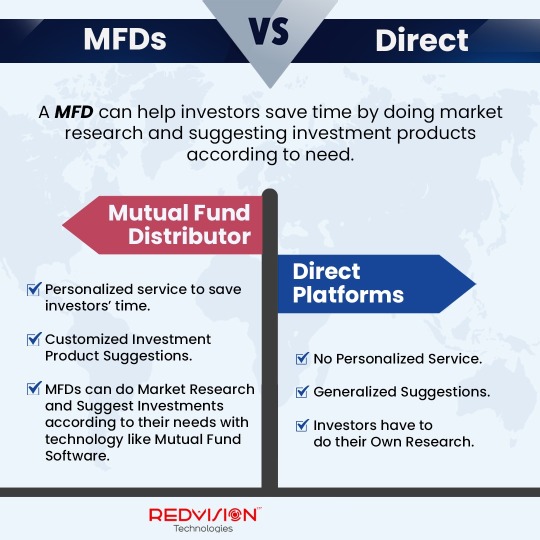

5 Tips for MFDs Using Mutual Fund Software

It’s 2025, and using technology to automate your business is key as a Mutual Fund Distributor (MFD). With increasing competition and clients demanding quick services, leveraging mutual fund software like that offered by REDVision Technologies, can be a game-changer. Here are five essential tips to make the most of it.

Key Tips for Distributors in 2025

Make sure you follow these tips to make the most of your time, energy, and business:

1. Ensure Correct Data Entry

Accuracy is Non-Negotiable

Accurate data is the foundation of any wealth management software. Ensure that every client detail and transaction is entered correctly to avoid incorrect reports or compliance issues.

Regular Data Checks

Conduct routine audits to identify and fix discrepancies. Use built-in validation tools for smooth operations and to build client confidence.

2. Master Core Software Features

Explore All Functionality

Familiarize yourself with features like order placement, portfolio rebalancing, reporting, and client communication. A deeper understanding reduces reliance on external tools.

Efficient Workflow

Streamline daily tasks with automated features, such as SIP reminders, to enhance productivity and scale your business effectively.

3. Prioritize Client Communication

Regular Updates

Use the mutual fund software for IFA to send personalized updates about client portfolios. Monthly performance summaries and market updates keep clients informed.

Client Portals

Provide secure client portals for access to portfolio details and reports, fostering transparency and reducing inquiries.

4. Focus on Client Relationship Building

CRM Integration

Integrate with CRM systems to track interactions, manage relationships, and identify cross-selling opportunities, such as suggesting funds for specific goals.

Personalized Service

Tailor recommendations and communication to individual clients need to strengthen relationships and show dedication to their success.

5. Brand Building Within the Software

Personalized Reports

Customize reports with your logo to enhance professionalism and reinforce your brand’s identity.

Client Communication Templates

Use branded templates for greetings, updates, or festive messages to reflect professionalism and consistency in communication.

Conclusion

The software is a powerful tool for MFDs. By ensuring accurate data, mastering features, prioritizing communication, focusing on relationships, and leveraging branding, you can maximize its potential to grow your business.

Embrace technology to enhance efficiency, deliver exceptional service, and stand out in a competitive market.

#mutual fund software#mutual fund software for distributors#mutual fund software for ifa#mutual fund software in india#top mutual fund software in india#best mutual fund software in india#mutual fund software for distributors in india#wealth management software in india#best mutual fund software for ifa in india#top mutual fund software for distributors in india

0 notes

Text

Wealthiee.ch: Your Trusted Partner for Retirement Financial Planning and More

Wealthiee.ch connects individuals in Switzerland with expert financial professionals, including advisors for retirement financial planning, mortgage specialists, accountants, and insurance experts. The platform offers tailored services, a vetted advisor directory, and tools like Wealthiee Pro, empowering both clients and financial advisors. With a focus on trust, security, and education, Wealthiee.ch is transforming financial planning into an accessible and streamlined process.

Services Offered by Wealthiee.ch

Wealthiee.ch provides a range of services tailored to meet diverse financial needs:

Financial Advisors: Assist clients with investment strategies, financial planning, pension and retirement planning, tax and trust planning, savings, and expatriate finances.

Mortgage Specialists: Offer guidance on mortgage options, helping clients navigate the complexities of property financing in Switzerland.

Accountants: Provide expertise in tax planning, business finances, and ensuring compliance with Swiss financial regulations.

Insurance Specialists: Advise on various insurance products to protect clients' assets and manage risks effectively.

Features of Wealthiee.ch

The platform is designed with user-centric features to enhance the experience of both clients and advisors:

Advisor Matching Service: Wealthiee.ch offers a matchmaking service that connects clients with expert independent advisors. The first consultation is free, allowing clients to find the best professional fit for their financial needs.

Comprehensive Advisor Directory: Users can browse through a vetted directory of financial professionals, ensuring they connect with qualified and regulated experts.

Educational Guides and Resources: The platform provides a wealth of articles and guides on topics such as home and property, managing money, small business, and family matters, empowering users to make informed financial decisions.

Wealthiee Pro: Empowering Financial Advisors

For financial advisors, Wealthiee offers "Wealthiee Pro," a suite of tools designed to streamline client acquisition and relationship management:

Client Matching: Advisors receive leads tailored to their expertise, targeting clients with the greatest potential for conversion. This system allows advisors to accept only the clients they want, providing complete control without the need to compete with other advisors for prospects.

CRM Tools: Wealthiee Pro includes sophisticated Customer Relationship Management tools to manage client relationships efficiently. Features include chat, reminders, note attachments, and calendar integration, making client connections seamless.

Marketing Support: The platform enhances advisors' visibility by showcasing their expertise and services to a targeted audience, increasing reach and reputation.

Commitment to Security and Trust

Wealthiee.ch prioritizes security and trust, implementing the highest international standards to protect user data. Every advisor and firm in the directory undergoes stringent background checks, ensuring clients connect with reputable professionals.

Conclusion

In the evolving financial landscape of Switzerland, Wealthiee.ch stands out as a reliable platform bridging the gap between individuals seeking financial guidance and qualified professionals ready to assist. By offering tailored services, comprehensive resources, and robust tools for both clients and advisors, Wealthiee.ch is redefining how financial advice is accessed and delivered in Switzerland.

0 notes

Text

An overview of how to obtain a job in a private sector bank

Introduction:

Private sector banks are among the most in-demand employers, offering excellent career opportunities, competitive salaries, and growth potential. With the expansion of the banking sector, the demand for skilled professionals continues to rise. Landing a job in a private bank requires a well-planned approach, strong preparation, and, in many cases, the guidance of a reputable coaching centre. Here’s a comprehensive overview of how to secure a position in a private-sector bank.

1. Understand the Private Banking Sector:

Before beginning your journey familiarize yourself with the private banking sector. Private banks such as HDFC Bank, ICICI Bank, Axis Bank, and Kotak Mahindra Bank play a vital role in the financial ecosystem, offering services like retail banking, corporate banking, and wealth management.

Key roles in private banks include:

Customer Relationship Manager (CRM): Building and maintaining client relationships.

Credit Analyst: Evaluating loan applications and financial statements.

Sales Executive: Driving the bank’s business growth by promoting financial products.

Operations Manager: Ensuring smooth daily operations within the branch.

Understanding these roles can help you determine the career path best suited to your skills and interests.

2. Educational Qualifications and Skills Required:

To secure a job in a private bank, certain qualifications and skills are essential:

Minimum Educational Qualification: A bachelor’s degree in commerce, finance, business administration, or economics is typically required. Some roles may require specialized qualifications such as an MBA or certifications in financial management.

Soft Skills: Excellent communication, problem-solving, and interpersonal skills are crucial for interacting with clients and colleagues.

Technical Skills: Proficiency in financial software, data analysis tools, and a solid understanding of banking products and services.

3. Identify the Right Recruitment Exams:

Private banks often conduct their recruitment drives or partner with external agencies. Common hiring methods include:

Direct Recruitment: Based on merit and interviews.

Campus Placements: Many private banks recruit directly from colleges and universities.

Recruitment Exams: Some banks organize exams to filter candidates for specific roles.

Prominent recruitment exams include:

IBPS PO (Institute of Banking Personnel Selection Probationary Officer): Although primarily for public banks some private banks also accept IBPS scores.

Individual Bank Exams: Banks like ICICI Bank and HDFC Bank conduct their tests and interviews.

4. Role of a Coaching Centre in Bank Exam Preparation:

Enrolling in a coaching centre can significantly enhance your chances of success. These centers offer structured preparation tailored to private bank exams, helping you excel in the competitive selection process.

Benefits of Joining a Coaching Centre:

Expert Guidance: Experienced faculty provide insights into exam patterns, syllabus, and effective study strategies.

Comprehensive Study Materials: Coaching centers provide updated materials, including mock tests, sample papers, and topic-wise notes.

Time Management Skills: Regular practice sessions and timed tests train you to manage time effectively during exams.

Doubt Resolution: Faculty members are available to clarify doubts and ensure a strong understanding of concepts.

Motivation and Discipline: The structured environment of a coaching centre helps maintain focus and consistency.

Top private bank exam coaching centers ensure personalized attention and adapt their teaching methods to the needs of individual students making preparation more effective.

5. Steps to Prepare for Private Bank Jobs:

Research and Choose the Right Coaching Centre:

Select a coaching centre with a proven track record, positive reviews, and experienced faculty.

Understand the Syllabus and Exam Pattern:

Topics generally include quantitative aptitude, reasoning ability, English language, and general awareness.

Private bank exams often include psychometric tests to assess your personality and problem-solving abilities.

Focus on Interview Preparation:

Private banks emphasize interpersonal skills during interviews. Coaching centers often conduct mock interviews to prepare you for real scenarios.

Stay Updated:

Keep track of current affairs, especially banking and financial news, as these are common topics in exams and interviews.

6. Networking and Professional Growth:

Networking plays a critical role in finding opportunities in private banks. Attend job fairs, workshops, and industry events to connect with professionals and potential employers.

7. Why Choose a Career in Private Banks?

Growth Opportunities: Private banks provide clear career progression pathways.

Dynamic Work Environment: Employees face diverse challenges that enhance professional development.

Attractive Compensation: Salaries and incentives in private banks are often higher compared to other sectors.

Learning Opportunities: Exposure to advanced technologies and global banking practices.

Conclusion:

Securing a job in a private sector bank requires a combination of the right qualifications, diligent preparation, and strategic effort. With the support of a reputable coaching centre, you can build a solid foundation, gain confidence, and excel in competitive exams and interviews. By staying committed and proactive, you’ll be well on your way to a rewarding career in the dynamic world of private banking. Bank Zone Jobs in Erode is the top coaching center for Private Bank Jobs.

For more information:

Email Us:[email protected]

Phone Number:(+91) 9629995828

Office Address:21 NRS Complex, 1st Floor, Sathyanarayana Salai, Swarnapuri Salem 636004

Website:https://bankzonejobs.com/

0 notes

Text

Why Relationship Banking Still Matters in a Transactional World?

In an era dominated by automation, digital transformation, and self-service platforms, the concept of relationship banking may seem like a relic of the past. However, as industries evolve and customer expectations shift, this banking has proven its relevance as a cornerstone of trust, loyalty, and long-term success for financial institutions and their clients.

The Rise of Transactional Banking

The digital revolution has reshaped the banking landscape, making transactional banking the norm. Customers can transfer funds, apply for loans, and manage investments with just a few taps on their smartphones. Efficiency and convenience have become the primary selling points for modern banking solutions, as fintech disruptors and traditional banks compete to deliver seamless experiences.

Yet, in this highly transactional world, something critical often gets lost: the human connection. While technology excels at handling routine tasks, it falls short in areas that require empathy, nuanced understanding, and strategic insight—qualities that lie at the heart of relationship banking.

What Is Relationship Banking?

It focuses on building long-term, trust-based relationships between banks and their clients. Instead of merely processing transactions, it emphasizes understanding clients’ financial needs, aspirations, and challenges. Relationship managers act as trusted advisors, providing personalized solutions and proactive guidance to help clients achieve their goals.

This approach is particularly valuable for businesses and high-net-worth individuals, where financial needs are complex and often require bespoke solutions. Whether it’s structuring a business loan, managing wealth, or navigating uncertain markets, relationship banking ensures clients receive tailored support that goes beyond the capabilities of automated systems.

The Enduring Relevance of Relationship Banking

Despite the rise of digital tools, it remains indispensable for several reasons:

1. Building Trust in Uncertain Times

Economic volatility, regulatory changes, and market disruptions create uncertainty for businesses and individuals. In such environments, this banking provides a steadying hand. Clients value having a trusted advisor who understands their unique circumstances and can offer guidance rooted in deep financial expertise and personal rapport.

2. Enhancing Customer Loyalty

In a crowded market, loyalty is a prized commodity. Relationship banking fosters loyalty by delivering personalized service and creating emotional connections with clients. A customer who feels valued and understood is more likely to remain committed to their financial institution, even in the face of attractive alternatives.

3. Supporting Strategic Growth for Businesses

For business clients, this banking offers more than financial products; it provides strategic partnerships. A strong relationship with a banker can open doors to funding opportunities, market insights, and connections that drive growth. This value-added support positions itself as a vital component of business success.

4. Addressing Complex Financial Needs

Not all financial needs can be met through prepackaged solutions. This banking excels in navigating complexities, such as cross-border transactions, intricate wealth management, and unique financing structures. These tailored approaches are essential for high-net-worth individuals, family businesses, and enterprises with specialized requirements.

Balancing Technology and Relationship Banking

The challenge for financial institutions is not to choose between transactional and relationship banking but to integrate them effectively. Technology can enhance such banking by providing tools that deepen client understanding and improve efficiency.

For example, customer relationship management (CRM) platforms enable relationship managers to track client interactions, anticipate needs, and deliver proactive solutions. Data analytics can uncover trends and opportunities, empowering bankers to offer more insightful advice. Meanwhile, digital communication channels allow for seamless, real-time interactions that complement face-to-face meetings.

This synergy ensures that relationship banking remains relevant in the digital age while leveraging technology to amplify its impact.

Lessons for C-Suite Leaders and Entrepreneurs

For business leaders, relationship banking offers valuable insights into managing customer relationships across industries. It demonstrates the importance of:

Empathy and Personalization: Understanding clients’ unique needs and tailoring solutions accordingly.

Long-Term Vision: Focusing on sustained value rather than short-term gains.

Proactive Communication: Anticipating challenges and opportunities to strengthen trust and loyalty.

These principles are not limited to banking; they are equally applicable to businesses seeking to build lasting relationships with their customers.

The Future

As the financial industry evolves, relationship banking must adapt to remain competitive. Emerging trends, such as environmental, social, and governance (ESG) considerations, are reshaping client priorities. Relationship managers must stay ahead of these shifts, offering guidance that aligns with clients’ values and objectives.

Moreover, the next generation of clients—millennials and Gen Z—bring different expectations to the table. They value transparency, social responsibility, and seamless digital experiences. It must evolve to meet these demands while retaining its core emphasis on trust and personalization.

Conclusion

In a transactional world driven by speed and efficiency, relationship banking stands out as a model of meaningful engagement and long-term value creation. It bridges the gap between human connection and financial innovation, offering clients the best of both worlds. For C-suite leaders, startup entrepreneurs, and managers, this banking serves as a powerful reminder that while technology is transformative, the human touch remains irreplaceable in building trust and fostering success.

Uncover the latest trends and insights with our articles on Visionary Vogues

0 notes

Text

The Power of Prediction: How iGaming CRM and Marketing Analytics Drive Player Lifetime Value

In the competitive iGaming arena, acquiring players is just the first step. The real game-changer is maximizing player lifetime value (CLTV). Turning casual bettors into loyal, long-term players is the key to sustainable growth and profitability. And the secret weapon? The predictive power of iGaming CRM and marketing analytics.

Beyond Acquisition: Focusing on Player Lifetime Value

While attracting new players is essential, it's equally crucial to nurture those relationships and maximize their value over time. Focusing solely on acquisition costs can be a short-sighted strategy. True success lies in understanding player behavior, anticipating their needs, and creating personalized experiences that foster loyalty and drive long-term engagement.

The Predictive Powerhouse: iGaming CRM and Marketing Analytics

iGaming CRM and marketing analytics work together to provide the insights you need to predict player behavior and maximize CLTV.

iGaming CRM: The Foundation of Predictive Insights

Your iGaming CRM serves as the central repository for all player data. It collects and organizes a wealth of information, including demographics, gaming preferences, betting history, communication logs, responsible gambling indicators, and more. This rich data set forms the foundation for predictive modeling.

How CRM Enables Predictive Strategies:

Data Collection and Organization: CRM gathers and structures the raw data needed for accurate predictions.

Player Segmentation: CRM allows you to segment players based on shared characteristics, creating more homogeneous groups for analysis and prediction.

Tracking Player Behavior: CRM tracks player activity, providing valuable data on gaming habits, betting patterns, and engagement levels.

Marketing Analytics: Unlocking Predictive Potential

Marketing analytics tools leverage the data stored in your CRM to uncover patterns, identify trends, and predict future player behavior.

How Analytics Drives Predictive Capabilities:

Statistical Modeling: Analytics platforms use statistical models to identify correlations and predict future player behavior.

Machine Learning: Advanced analytics tools employ machine learning algorithms to identify complex patterns and make increasingly accurate predictions.

Churn Prediction: Identify players at risk of churn and proactively offer targeted incentives to retain them.

Value Prediction: Predict the future value of individual players, allowing you to prioritize your marketing efforts and allocate resources effectively.

The Synergy: Maximizing Player Lifetime Value

The true power lies in the synergy between CRM and analytics. CRM provides the data, and analytics provides the predictive insights. This powerful combination enables you to:

Identify high-value players and personalize their experience to maximize their spending.

Proactively address the needs of at-risk players and prevent churn.

Optimize marketing campaigns based on predicted player behavior.

Personalize the player journey to encourage long-term engagement and increase CLTV.

Examples of Predictive Strategies:

Personalized Game Recommendations: Predict which games players are most likely to enjoy and offer tailored recommendations.

Targeted Bonus Offers: Offer personalized bonuses based on predicted player spending and preferences.

Proactive Customer Support: Identify players who may be experiencing difficulties and proactively offer assistance.

Loyalty Program Optimization: Tailor loyalty programs to reward high-value players and incentivize continued engagement.

Conclusion: The Future of Player Engagement

In the competitive iGaming landscape, maximizing player lifetime value is crucial for sustainable success. By harnessing the predictive power of iGaming CRM and marketing analytics, you can move beyond reactive marketing and create proactive strategies that foster long-term player loyalty and drive revenue growth. It's not just about acquiring players; it's about understanding them, predicting their behavior, and maximizing their value over time. Invest in prediction, and you'll be investing in the future of your iGaming business.

0 notes

Text

Boost Your Business Growth with a Salesforce Partner in Melbourne

In today’s competitive business environment, companies are constantly seeking innovative ways to improve efficiency, enhance customer experiences, and drive growth. Salesforce, a powerful customer relationship management (CRM) platform, has become the go-to solution for organizations looking to optimize their operations and streamline customer interactions. However, to truly harness the full potential of Salesforce, partnering with an experienced Salesforce Partner in Melbourne can make all the difference.

Why Choose a Salesforce Partner in Melbourne?

Salesforce is known for its ability to centralize customer data, automate workflows, and improve decision-making through data-driven insights. However, the complexity of its features and the need for customization to fit a company’s specific needs can be overwhelming. This is where a Salesforce Partner in Melbourne comes in. These trusted experts help businesses integrate and optimize Salesforce to meet their unique requirements and business objectives.

A Salesforce partner in Melbourne brings a wealth of expertise and experience to the table. By working closely with businesses, they ensure the smooth implementation, customization, and optimization of the Salesforce platform. Their deep knowledge of Salesforce solutions allows them to provide tailored strategies that maximize the return on investment (ROI) for businesses.

Key Benefits of Working with a Salesforce Partner in Melbourne

Customization and Tailored Solutions

Every business is different, and so are their CRM needs. A Salesforce Partner in Melbourne helps customize the Salesforce platform to align with your specific business processes. Whether it’s modifying dashboards, creating custom workflows, or integrating third-party tools, a local Salesforce partner ensures the platform is designed to support your unique business model. This tailored approach leads to improved efficiency and better outcomes for your team and customers.

Expertise and Experience

Salesforce is a powerful platform, but it requires expertise to fully leverage its capabilities. A Salesforce partner in Melbourne has extensive experience with Salesforce products like Sales Cloud, Service Cloud, Marketing Cloud, and more. They understand the nuances of the platform and can help businesses choose the right solutions to address their specific challenges. With their knowledge, businesses can avoid common pitfalls and ensure a smooth Salesforce adoption process.

Seamless Integration

For many businesses, Salesforce doesn’t operate in isolation. It often needs to be integrated with other software tools, such as accounting systems, email platforms, and customer service systems. A Salesforce Partner in Melbourne ensures these integrations happen seamlessly, ensuring that data flows smoothly between systems and providing a unified experience for both employees and customers.

Ongoing Support and Optimization

Salesforce is not a one-time implementation but an ongoing investment. To ensure it continues to meet your evolving business needs, ongoing support is essential. A local Salesforce partner provides continuous support, troubleshooting, and updates. They can also help optimize your Salesforce instance over time, ensuring you’re using the platform to its full potential as your business grows and changes.

Faster Time to Value

One of the biggest challenges businesses face when adopting new technology is the time it takes to realize a return on investment. A Salesforce Partner in Melbourne helps accelerate this process by streamlining the implementation process, customizing Salesforce to fit your business needs, and ensuring that your team is fully trained to use the platform effectively. This leads to faster adoption and quicker realization of the benefits Salesforce has to offer.

Conclusion

Choosing the right Salesforce Partner in Melbourne is crucial for businesses looking to make the most of their Salesforce investment. With their expertise, experience, and deep knowledge of the platform, these partners ensure a smooth and successful Salesforce implementation. From customization and integration to ongoing support and optimization, a local Salesforce partner helps businesses unlock the full potential of Salesforce to drive growth, improve customer relationships, and boost efficiency.

By working with a trusted Salesforce partner, businesses can take their operations to the next level and gain a competitive edge in the market. Whether you’re just starting with Salesforce or looking to optimize your existing implementation, a Salesforce Partner in Melbourne is the key to achieving long-term success.

1 note

·

View note

Text

Common Mistakes to Avoid When Using Grocery Retail Planning Tools

Grocery retail planning tools have revolutionized the way grocery stores operate, offering precise inventory management, enhanced customer experiences, and streamlined supply chain operations. However, even with the best tools at their disposal, retailers often encounter challenges stemming from improper implementation or misuse of these solutions. Understanding and avoiding common mistakes can help businesses maximize the benefits of retail planning tools.

1. Insufficient Training for Staff

One of the most common pitfalls is failing to properly train staff on how to use grocery retail planning. These tools often come with a range of features and functionalities, and without adequate training, employees may underutilize them or use them incorrectly. Investing in comprehensive training ensures that all team members understand how to maximize the tool’s capabilities.

2. Ignoring Data Quality

Retail planning tools rely heavily on accurate and up-to-date data. Feeding inaccurate data into the system can result in flawed insights, leading to issues like overstocking or understocking. Retailers should regularly audit and cleanse their data to ensure it reflects real-time inventory levels, sales trends, and customer preferences.

3. Overlooking Customization Options

Many grocery retail planning tools offer customization options to meet the specific needs of individual stores. However, businesses often stick to default settings without exploring these features. This approach can lead to inefficiencies, as the one-size-fits-all model may not align with unique operational needs. Customizing the tool to fit your business’s workflows can significantly enhance its effectiveness.

4. Failing to Integrate with Other Systems

Retail planning tools work best when integrated with other systems like point-of-sale (POS), customer relationship management (CRM), and supply chain management software. Many retailers fail to establish these integrations, leading to siloed data and missed opportunities for operational efficiency. Integration allows for a seamless flow of information, enhancing decision-making and customer satisfaction.

5. Relying Solely on Automation

While automation is a powerful feature of retail planning tools, relying solely on it without human oversight can be a mistake. Automated systems may not always account for sudden market shifts, seasonal trends, or unforeseen events like supply chain disruptions. Human intervention and strategic adjustments remain essential to ensure the system adapts to real-world scenarios.

6. Neglecting Regular Updates and Maintenance

Outdated software can lead to functionality issues, security vulnerabilities, and decreased performance. Many retailers neglect to update their retail planning tools or conduct routine maintenance. Keeping the software updated ensures access to the latest features and safeguards against potential risks.

7. Misinterpreting Analytics and Insights

Retail planning tools generate a wealth of data, but not all retailers know how to interpret these insights effectively. Misreading analytics can lead to poor decision-making, such as misjudging customer demand or stocking inappropriate products. Businesses should invest in analytical training or consult experts to extract meaningful insights from the data.

8. Failing to Monitor Key Performance Indicators (KPIs)

Retailers often adopt planning tools without establishing clear KPIs to measure success. Without monitoring metrics like inventory turnover, customer satisfaction, and sales growth, it’s challenging to determine whether the tool is delivering value. Defining and tracking KPIs helps businesses stay aligned with their goals.

9. Overcomplicating Processes

Sometimes, retailers overcomplicate processes by using too many features at once or implementing overly complex workflows. This can overwhelm staff and reduce efficiency. It’s better to start with the essential features, gradually incorporating advanced functionalities as the team becomes more comfortable.

10. Ignoring Feedback from Employees and Customers

Frontline employees and customers often provide valuable insights into the effectiveness of retail planning tools. Ignoring this feedback can result in overlooked issues or missed opportunities for improvement. Regularly gathering and acting on feedback ensures the tool remains aligned with business needs.

By recognizing and addressing these common mistakes, grocery retailers can unlock the full potential of their planning tools, ensuring smoother operations and improved profitability.

0 notes