#Crypto startup funding

Explore tagged Tumblr posts

Text

Why Are Web3 Investment Firms the Future of Decentralized Finance?

The financial environment has transformed rapidly due to the emergence of decentralized finance. It has made it possible to move away from conventional banking systems. It is a stepping stone towards advanced blockchain-based solutions.

That’s where Web3 investment firms are essential in financing and promoting innovation in the DeFi sector. They are at the center of this change. These companies assist businesses and initiatives to propel the next wave of financial innovation. They utilize blockchain technology, smart contracts, and decentralized governance models.

The Essence of Web3 Investment Firms and Why They Are Game-changing in 2025

Web3 investment companies stand out for their belief and approach within the decentralized ecosystem. They can be a venture capital or investment organization specializing in this line of work. They cater to DeFi initiatives, blockchain-based technology, and decentralized apps.

Also, you must comprehend they are different from traditional investment businesses. Web3 investment firms work within a decentralized ecosystem. They facilitate funding and governance via digital currencies, decentralized autonomous organizations, and tokens.

They can be immensely valuable for professionals when it comes to gaining strategic and financial assistance. They can be even more if you are someone operating in an early-stage blockchain startup or NFT marketplace. Metaverse applications and decentralized protocols can also be examples of them.

Top Reasons Web3 Investment Firms Will Shape DeFi's Future

Here are some of the leading explanations of why Web3 investment firms are the future of decentralized finance-

Decentralized Decision-Making

Adopting DAOs and blockchain governance frameworks is one of the main characteristics of Web3 investment firms. By enabling community-driven decision-making, these systems lessen dependency on centralized organizations.

Transactions Based on Smart Contracts

Conventional investing firms conduct business through middle professionals like banks and legal organizations. Smart contracts are used by Web3 investing firms to automate investment agreements, which lowers costs, minimizes human error, and improves security.

Global Market Access

Blockchain technology is used by Web3 investing firms to function internationally. It is free from the limitations of conventional financial systems. Participation in DeFi initiatives is open to investors worldwide.

Wrapping Up This Here-

By making decentralized, transparent, and advanced investment procedures possible, Web3 investment firms are transforming the financial sector. As blockchain use keeps increasing, its importance in DeFi is expected to grow. These companies empower investors and entrepreneurs by removing intermediates and utilizing smart contracts, opening the door for decentralized finance in the future. So, why wait? Cequire is one of the Web3 investment firms in 2025. They provide strategic insights and solutions for blockchain investments and decentralized finance. Call them right away for information and updates!

1 note

·

View note

Text

Mr.10% Story 1

◼︎ Savings-like Stock Investment

The core of Mr.10% is an algorithm that safely and consistently generates a 10% return.

Doesn't sound like a big deal to earn 10% consistently?

Below are the annual average returns of famous investors worldwide. Of course, these individuals sometimes make huge profits by chance, but they also make big losses due to mistakes, resulting in the following average returns.

➢ James Simons

* Main Fund: Medallion Fund, Investment period 1988-2018

* Annual average return: 39.1%

➢ George Soros

* Main Fund: Quantum Fund, Investment period 1969-2000

* Annual average return: 32%

➢ Warren Buffett

* Berkshire Hathaway, Investment period 1965-2018

* Annual average return: 20.5%

➢ Ray Dalio

* Pure Alpha, Investment period 1991-2018

* Annual average return: 12%

Contrary to imagination, making a huge fortune in stocks is just luck.

Even if you earn more than 200% by chance, human psychology becomes greedier, and you take riskier investments to make the same profit again.

Eventually, the annual average return records a loss, becomes addicted to stocks, can't forget the hit-and-run mindset, and typically ends up in debt.

Of course, at our Mr.10% K, we also recommend stocks whose profits exceed 100%, but that is occasional luck and fortune. You cannot succeed in investment by aligning your goals with hit-and-run or chance.

If I take Korea for an example, 92% of individual investors ultimately lose money without making even 1% profit annually.

Our service aims to prevent investors from losing their hard-earned money by being swept up in theme stocks or short-term surging stocks.

Being swept away here is the key point. Stocks are like drugs; if there's an opportunity to make big money, basic rationality gets paralyzed, leading to risky adventures.

And I also know that it's quite ordinary for people to see their stock profits drop to -80%.

Mr.10% is an algorithm that calculates the probability of earning a safe, over 10% return on [savings-like stocks] without any emotional influence. And some stocks with over an 80% probability later become theme or surging stocks.

Of course, Mr.10% does not guarantee a 10% return with 100% probability.

Wouldn't you like to walk the path of safe and meaningful investment with us at Mr.10% K?

► Download Mr.10% K app now

#stock market#stock#investing#money#korea#cash#advance#earnin#investment#crypto#kospi#kosdaq#market#finance#analysis#fund#manager#startup

0 notes

Text

What kind of bubble is AI?

My latest column for Locus Magazine is "What Kind of Bubble is AI?" All economic bubbles are hugely destructive, but some of them leave behind wreckage that can be salvaged for useful purposes, while others leave nothing behind but ashes:

https://locusmag.com/2023/12/commentary-cory-doctorow-what-kind-of-bubble-is-ai/

Think about some 21st century bubbles. The dotcom bubble was a terrible tragedy, one that drained the coffers of pension funds and other institutional investors and wiped out retail investors who were gulled by Superbowl Ads. But there was a lot left behind after the dotcoms were wiped out: cheap servers, office furniture and space, but far more importantly, a generation of young people who'd been trained as web makers, leaving nontechnical degree programs to learn HTML, perl and python. This created a whole cohort of technologists from non-technical backgrounds, a first in technological history. Many of these people became the vanguard of a more inclusive and humane tech development movement, and they were able to make interesting and useful services and products in an environment where raw materials – compute, bandwidth, space and talent – were available at firesale prices.

Contrast this with the crypto bubble. It, too, destroyed the fortunes of institutional and individual investors through fraud and Superbowl Ads. It, too, lured in nontechnical people to learn esoteric disciplines at investor expense. But apart from a smattering of Rust programmers, the main residue of crypto is bad digital art and worse Austrian economics.

Or think of Worldcom vs Enron. Both bubbles were built on pure fraud, but Enron's fraud left nothing behind but a string of suspicious deaths. By contrast, Worldcom's fraud was a Big Store con that required laying a ton of fiber that is still in the ground to this day, and is being bought and used at pennies on the dollar.

AI is definitely a bubble. As I write in the column, if you fly into SFO and rent a car and drive north to San Francisco or south to Silicon Valley, every single billboard is advertising an "AI" startup, many of which are not even using anything that can be remotely characterized as AI. That's amazing, considering what a meaningless buzzword AI already is.

So which kind of bubble is AI? When it pops, will something useful be left behind, or will it go away altogether? To be sure, there's a legion of technologists who are learning Tensorflow and Pytorch. These nominally open source tools are bound, respectively, to Google and Facebook's AI environments:

https://pluralistic.net/2023/08/18/openwashing/#you-keep-using-that-word-i-do-not-think-it-means-what-you-think-it-means

But if those environments go away, those programming skills become a lot less useful. Live, large-scale Big Tech AI projects are shockingly expensive to run. Some of their costs are fixed – collecting, labeling and processing training data – but the running costs for each query are prodigious. There's a massive primary energy bill for the servers, a nearly as large energy bill for the chillers, and a titanic wage bill for the specialized technical staff involved.

Once investor subsidies dry up, will the real-world, non-hyperbolic applications for AI be enough to cover these running costs? AI applications can be plotted on a 2X2 grid whose axes are "value" (how much customers will pay for them) and "risk tolerance" (how perfect the product needs to be).

Charging teenaged D&D players $10 month for an image generator that creates epic illustrations of their characters fighting monsters is low value and very risk tolerant (teenagers aren't overly worried about six-fingered swordspeople with three pupils in each eye). Charging scammy spamfarms $500/month for a text generator that spits out dull, search-algorithm-pleasing narratives to appear over recipes is likewise low-value and highly risk tolerant (your customer doesn't care if the text is nonsense). Charging visually impaired people $100 month for an app that plays a text-to-speech description of anything they point their cameras at is low-value and moderately risk tolerant ("that's your blue shirt" when it's green is not a big deal, while "the street is safe to cross" when it's not is a much bigger one).

Morganstanley doesn't talk about the trillions the AI industry will be worth some day because of these applications. These are just spinoffs from the main event, a collection of extremely high-value applications. Think of self-driving cars or radiology bots that analyze chest x-rays and characterize masses as cancerous or noncancerous.

These are high value – but only if they are also risk-tolerant. The pitch for self-driving cars is "fire most drivers and replace them with 'humans in the loop' who intervene at critical junctures." That's the risk-tolerant version of self-driving cars, and it's a failure. More than $100b has been incinerated chasing self-driving cars, and cars are nowhere near driving themselves:

https://pluralistic.net/2022/10/09/herbies-revenge/#100-billion-here-100-billion-there-pretty-soon-youre-talking-real-money

Quite the reverse, in fact. Cruise was just forced to quit the field after one of their cars maimed a woman – a pedestrian who had not opted into being part of a high-risk AI experiment – and dragged her body 20 feet through the streets of San Francisco. Afterwards, it emerged that Cruise had replaced the single low-waged driver who would normally be paid to operate a taxi with 1.5 high-waged skilled technicians who remotely oversaw each of its vehicles:

https://www.nytimes.com/2023/11/03/technology/cruise-general-motors-self-driving-cars.html

The self-driving pitch isn't that your car will correct your own human errors (like an alarm that sounds when you activate your turn signal while someone is in your blind-spot). Self-driving isn't about using automation to augment human skill – it's about replacing humans. There's no business case for spending hundreds of billions on better safety systems for cars (there's a human case for it, though!). The only way the price-tag justifies itself is if paid drivers can be fired and replaced with software that costs less than their wages.

What about radiologists? Radiologists certainly make mistakes from time to time, and if there's a computer vision system that makes different mistakes than the sort that humans make, they could be a cheap way of generating second opinions that trigger re-examination by a human radiologist. But no AI investor thinks their return will come from selling hospitals that reduce the number of X-rays each radiologist processes every day, as a second-opinion-generating system would. Rather, the value of AI radiologists comes from firing most of your human radiologists and replacing them with software whose judgments are cursorily double-checked by a human whose "automation blindness" will turn them into an OK-button-mashing automaton:

https://pluralistic.net/2023/08/23/automation-blindness/#humans-in-the-loop

The profit-generating pitch for high-value AI applications lies in creating "reverse centaurs": humans who serve as appendages for automation that operates at a speed and scale that is unrelated to the capacity or needs of the worker:

https://pluralistic.net/2022/04/17/revenge-of-the-chickenized-reverse-centaurs/

But unless these high-value applications are intrinsically risk-tolerant, they are poor candidates for automation. Cruise was able to nonconsensually enlist the population of San Francisco in an experimental murderbot development program thanks to the vast sums of money sloshing around the industry. Some of this money funds the inevitabilist narrative that self-driving cars are coming, it's only a matter of when, not if, and so SF had better get in the autonomous vehicle or get run over by the forces of history.

Once the bubble pops (all bubbles pop), AI applications will have to rise or fall on their actual merits, not their promise. The odds are stacked against the long-term survival of high-value, risk-intolerant AI applications.

The problem for AI is that while there are a lot of risk-tolerant applications, they're almost all low-value; while nearly all the high-value applications are risk-intolerant. Once AI has to be profitable – once investors withdraw their subsidies from money-losing ventures – the risk-tolerant applications need to be sufficient to run those tremendously expensive servers in those brutally expensive data-centers tended by exceptionally expensive technical workers.

If they aren't, then the business case for running those servers goes away, and so do the servers – and so do all those risk-tolerant, low-value applications. It doesn't matter if helping blind people make sense of their surroundings is socially beneficial. It doesn't matter if teenaged gamers love their epic character art. It doesn't even matter how horny scammers are for generating AI nonsense SEO websites:

https://twitter.com/jakezward/status/1728032634037567509

These applications are all riding on the coattails of the big AI models that are being built and operated at a loss in order to be profitable. If they remain unprofitable long enough, the private sector will no longer pay to operate them.

Now, there are smaller models, models that stand alone and run on commodity hardware. These would persist even after the AI bubble bursts, because most of their costs are setup costs that have already been borne by the well-funded companies who created them. These models are limited, of course, though the communities that have formed around them have pushed those limits in surprising ways, far beyond their original manufacturers' beliefs about their capacity. These communities will continue to push those limits for as long as they find the models useful.

These standalone, "toy" models are derived from the big models, though. When the AI bubble bursts and the private sector no longer subsidizes mass-scale model creation, it will cease to spin out more sophisticated models that run on commodity hardware (it's possible that Federated learning and other techniques for spreading out the work of making large-scale models will fill the gap).

So what kind of bubble is the AI bubble? What will we salvage from its wreckage? Perhaps the communities who've invested in becoming experts in Pytorch and Tensorflow will wrestle them away from their corporate masters and make them generally useful. Certainly, a lot of people will have gained skills in applying statistical techniques.

But there will also be a lot of unsalvageable wreckage. As big AI models get integrated into the processes of the productive economy, AI becomes a source of systemic risk. The only thing worse than having an automated process that is rendered dangerous or erratic based on AI integration is to have that process fail entirely because the AI suddenly disappeared, a collapse that is too precipitous for former AI customers to engineer a soft landing for their systems.

This is a blind spot in our policymakers debates about AI. The smart policymakers are asking questions about fairness, algorithmic bias, and fraud. The foolish policymakers are ensnared in fantasies about "AI safety," AKA "Will the chatbot become a superintelligence that turns the whole human race into paperclips?"

https://pluralistic.net/2023/11/27/10-types-of-people/#taking-up-a-lot-of-space

But no one is asking, "What will we do if" – when – "the AI bubble pops and most of this stuff disappears overnight?"

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/12/19/bubblenomics/#pop

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

--

tom_bullock (modified) https://www.flickr.com/photos/tombullock/25173469495/

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

4K notes

·

View notes

Text

Blockchain Investment And Web3 Crypto Projects Get A Boost With Venom Foundation's $1B Fund

The global blockchain market is predicted to witness unprecedented growth in the coming years, with estimates suggesting it will reach $94.0 billion by 2027. In light of this, the Abu Dhabi-based Venom Foundation has launched a $1 billion venture capital fund poised to boost blockchain investment and accelerate the growth of web3 crypto projects. The Fund will provide crucial startup funding to…

View On WordPress

#Blockchain#blockchain investment#blockchain technology#Latest blockchain news#Middle East#startup funding#venture capital fund#web3 and blockchain#web3 crypto projects

0 notes

Note

Forgive me if I'm mistaking you for another person, but I remember you speaking at multiple points on the unsustainability of free social media services (I think especially in response to the cohost collapse?), and I'm curious on what your thoughts on bluesky are so far. I'm not an expert on the subject, but from what I've read previously it seemed like they were on track to be financially sustainable, but I don't know if the recent floods of users has thrown those projections off. Sorry if I'm mixing you up with someone else on my timeline, in that case just ignore me.

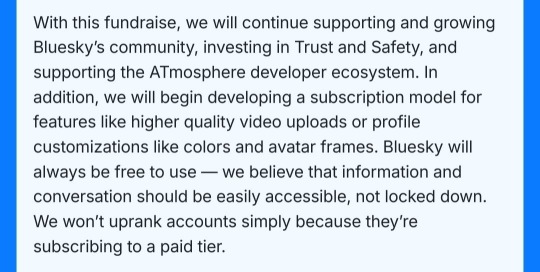

bluesky will almost certainly follow the same trajectory of monetisation => bloat => enshittification => decline as every other major platform built on venture capital and user hoarding. it's a terrible model that only works in the short term as a mirage for attracting funding and making founders look good for a year or two before they sell.

you can see the same effect in the decline of all the subscription box services that came into vogue just before covid: they feel great to use for as long as the initial injection of venture funding lasts, because the purpose of that funding at that stage is to attract users and impress the next round of funders with how pleasant/intuitive/efficient/ethical/good value the service is. that's the stage where they're handing out freebies and bowling over influencers, and every ingredient in the box is fresh and high quality and locally sourced. wow what a good deal, what a great system!!! why hasn't anyone done this before? the answer is because it's unsustainable by design. they rack up good reviews, sign on a billion new users, attract new funding from a bunch of much more credulous investors, and then gut all of the expensive parts. portions get smaller, ingredients get worse, packaging gets flimsier, prices go up, freebies turn into "5% off your first 9 boxes when you invite 3 friends", and customer service vanishes.

with social media (and platforms like discord) the logic is the same, it's just a little less glaringly obvious to the end user because they're not coming home to leaking packages of rancid chicken on the doorstep. bluesky has an advantage over tiny operations like cohost because it was founded by a billionaire making a point for the sake of his own image. it got a really significant chunk of startup funding, and the owner had existing connections and rep in the space to attract more. That's why it has survived the goldrush period, why it still feels good to use, and why users who have been burned so many times before are finally accepting it as a stable, reliable option. It's still in its venture capital honeymoon phase where the only thing worth spending money on is making the service attractive to users.

What I expect we will see next, with another mass influx of users from twitter and new funding from a rogue's gallery of tech venture sickos led by Blockchain Capital is a strong ramp up into monetising that userbase. They've already been pretty forthright about how they plan to do this, and I think it's a solid roadmap of how Bluesky will bloat and decay over the next few years:

this is a huge lol. don't worry, we're not going to hyperfinancialize the social experience through NFTs. the thing even crypto freaks started feigning amnesia about a year ago. real "our health conscious sodas are 100% arsenic free" messaging here. They know perfectly well that rubes users are suspicious of their typical 5 dimensional tech finance chess games and are patting our hands about last week's bogeymen so nobody worries too hard about whatever 'decentralised developer ecosystem' just happens to be helmed by a bunch of crypto guys. this definitely means something good and based and not a google-like single sign on user data harvesting operation.

This is the same shit that's currently rotting the floorboards of discord. Bluntly, there is no way to run a platform on this scale without gating functionality behind paid services. Discord has been squeezing free-tier file uploads and call quality etc. down steadily and cranking up subscription costs over the last year or two, throwing in chaff like animated avatar frames to try and justify the user cost. They're also doing the same misdirection thing again here, pointing to Thing We All Hate to deflect from thing we might not like very much when they do it. Booo elon booo we all hate elon!!! wait how do we feel about subscription models again,

watch out for this to kill porn on bsky like it has killed porn on every other social platform 👍 boooo we hate elon boooo stupid idiot and his 'everything app' booooo wait why do you need my tax information, what's that about mastercard,

Look, we are all aware social media is a money pit. Let's not forget dorsey was looking to sell twitter in the first place, long before elon's very public plunge into total online derangement. Subscription services are not going to plug the hole, so we are gradually going to see more and more spaghetti thrown at the wall while early funders shuffle cards and do their pyramid scheme bit bringing in stupider and stupider investments. this is the window in which bluesky will be temporarily worth using for us, for the idiot public, the poorly rendered crowd jpegs in the background of their venture capital MOBA. it's in their interests to slow and pad the decline as much as possible, because that is how they get maximally paid.

Given the scale of the money involved, and dorsey's weird ego investment, I think bluesky will probably manage a controlled drift for a good few years before it gets really bloated and painful. and by then we will all be so used to the *checks notes* decentralised developer ecosystem that we'll just be posting through it, watching another generation of columnists call another collapsing platform 'their beloved hellsite' and passing around that meme about not getting out of our chairs no sir until idk we all get on a fediverse neurolink alternative to stick it to the elongated muskrat and our brains pop peacefully in our sleep. which I guess is the closest thing to viability any social media platform can achieve.

anyway diogenes the cynic is also on bluesky

483 notes

·

View notes

Video

youtube

Should Billionaires Exist?

Do billionaires have a right to exist?

America has driven more than 650 species to extinction. And it should do the same to billionaires.

Why? Because there are only five ways to become one, and they’re all bad for free-market capitalism:

1. Exploit a Monopoly.

Jamie Dimon is worth $2 billion today… but not because he succeeded in the “free market.” In 2008, the government bailed out his bank JPMorgan and other giant Wall Street banks, keeping them off the endangered species list.

This government “insurance policy” scored these struggling Mom-and-Pop megabanks an estimated $34 billion a year.

But doesn’t entrepreneur Jeff Bezos deserve his billions for building Amazon?

No, because he also built a monopoly that’s been charged by the federal government and 17 states for inflating prices, overcharging sellers, and stifling competition like a predator in the wild.

With better anti-monopoly enforcement, Bezos would be worth closer to his fair-market value.

2. Exploit Inside Information

Steven A. Cohen, worth roughly $20 billion headed a hedge fund charged by the Justice Department with insider trading “on a scale without known precedent.” Another innovator!

Taming insider trading would level the investing field between the C Suite and Main Street.

3. Buy Off Politicians

That’s a great way to become a billionaire! The Koch family and Koch Industries saved roughly $1 billion a year from the Trump tax cut they and allies spent $20 million lobbying for. What a return on investment!

If we had tougher lobbying laws, political corruption would go extinct.

4. Defraud Investors

Adam Neumann conned investors out of hundreds of millions for WeWork, an office-sharing startup. WeWork didn’t make a nickel of profit, but Neumann still funded his extravagant lifestyle, including a $60 million private jet. Not exactly “sharing.”

Elizabeth Holmes was convicted of fraud for her blood-testing company, Theranos. So was Sam Bankman-Fried of crypto-exchange FTX. Remember a supposed billionaire named Donald Trump? He was also found to have committed fraud.

Presumably, if we had tougher anti-fraud laws, more would be caught and there’d be fewer billionaires to preserve.

5. Get Money From Rich Relatives

About 60 percent of all wealth in America today is inherited.

That’s because loopholes in U.S. tax law —lobbied for by the wealthy — allow rich families to avoid taxes on assets they inherit. And the estate tax has been so defanged that fewer than 0.2 percent of estates have paid it in recent years.

Tax reform would disrupt the circle of life for the rich, stopping them from automatically becoming billionaires at their birth, or someone else’s death.

Now, don’t get me wrong. I’m not arguing against big rewards for entrepreneurs and inventors. But do today’s entrepreneurs really need billions of dollars? Couldn’t they survive on a measly hundred million?

Because they’re now using those billions to erode American institutions. They spent fortunes bringing Supreme Court justices with them into the wild.They treated news organizations and social media platforms like prey, and they turned their relationships with politicians into patronage troughs.

This has created an America where fewer than ever can become millionaires (or even thousandaires) through hard work and actual innovation.

If capitalism were working properly, billionaires would have gone the way of the dodo.

427 notes

·

View notes

Note

I’m in undergrad but I keep hearing and seeing people talking about using chatgpt for their schoolwork and it makes me want to rip my hair out lol. Like even the “radical” anti-chatgpt ones are like “Oh yea it’s only good for outlines I’d never use it for my actual essay.” You’re using it for OUTLINES????? That’s the easy part!! I can’t wait to get to grad school and hopefully be surrounded by people who actually want to be there 😭😭😭

Not to sound COMPLETELY like a grumpy old codger (although lbr, I am), but I think this whole AI craze is the obvious result of an education system that prizes "teaching for the test" as the most important thing, wherein there are Obvious Correct Answers that if you select them, pass the standardized test and etc etc mean you are now Educated. So if there's a machine that can theoretically pick the correct answers for you by recombining existing data without the hard part of going through and individually assessing and compiling it yourself, Win!

... but of course, that's not the way it works at all, because AI is shown to create misleading, nonsensical, or flat-out dangerously incorrect information in every field it's applied to, and the errors are spotted as soon as an actual human subject expert takes the time to read it closely. Not to go completely KIDS THESE DAYS ARE JUST LAZY AND DONT WANT TO WORK, since finding a clever way to cheat on your schoolwork is one of those human instincts likewise old as time and has evolved according to tools, technology, and educational philosophy just like everything else, but I think there's an especial fear of Being Wrong that drives the recourse to AI (and this is likewise a result of an educational system that only prioritizes passing standardized tests as the sole measure of competence). It's hard to sort through competing sources and form a judgment and write it up in a comprehensive way, and if you do it wrong, you might get a Bad Grade! (The irony being, of course, that AI will *not* get you a good grade and will be marked even lower if your teachers catch it, which they will, whether by recognizing that it's nonsense or running it through a software platform like Turnitin, which is adding AI detection tools to its usual plagiarism checkers.)

We obviously see this mindset on social media, where Being Wrong can get you dogpiled and/or excluded from your peer groups, so it's even more important in the minds of anxious undergrads that they aren't Wrong. But yeah, AI produces nonsense, it is an open waste of your tuition dollars that are supposed to help you develop these independent college-level analytical and critical thinking skills that are very different from just checking exam boxes, and relying on it is not going to help anyone build those skills in the long term (and is frankly a big reason that we're in this mess with an entire generation being raised with zero critical thinking skills at the exact moment it's more crucial than ever that they have them). I am mildly hopeful that the AI craze will go bust just like crypto as soon as the main platforms either run out of startup funding or get sued into oblivion for plagiarism, but frankly, not soon enough, there will be some replacement for it, and that doesn't mean we will stop having to deal with fake news and fake information generated by a machine and/or people who can't be arsed to actually learn the skills and abilities they are paying good money to acquire. Which doesn't make sense to me, but hey.

So: Yes. This. I feel you and you have my deepest sympathies. Now if you'll excuse me, I have to sit on the porch in my quilt-draped rocking chair and shout at kids to get off my lawn.

181 notes

·

View notes

Text

US senators Elizabeth Warren and Bill Cassidy have called for the Department of Justice and Department of Homeland Security to redouble efforts to stop the use of cryptocurrency to pay for child sexual abuse material (CSAM) online, a problem they claim has worsened.

In a letter sent on Thursday, addressed to Attorney General Merrick Garland and Secretary of Homeland Security Alejandro Mayorkas, the senators claim that the “pseudonymity” afforded by crypto transactions is helping those that trade in CSAM to evade detection by law enforcement.

Citing data from the US Treasury’s Financial Crime Enforcement Network as well as research from Chainalysis, a company that specializes in tracing crypto transactions, and the Internet Watch Foundation, a CSAM-focused charity, the letter asserts that the “use of cryptocurrency in the illicit trade of CSAM appears to be increasing.”

Between 2020 and 2022, financial institutions identified 1,800 bitcoin wallets suspected of engaging in transactions linked to child sexual exploitation or human trafficking, the letter states. Although the scale of the crypto-based market for CSAM decreased in 2023, Chainalysis found, an increase in sophistication among sellers allowed them to evade detection for far longer than in previous years.

The people participating in the trade of CSAM online use a variety of methods to conceal their activity, the senators claim, including using crypto mixing services and ATMs to conceal the origin of funds used in CSAM transactions and to launder the proceeds.

“These are deeply troubling findings revealing the extent to which cryptocurrency is the payment of choice for perpetrators of child sexual abuse and exploitation,” wrote the senators.

To jump-start a response, Warren and Cassidy have asked the DOJ and DHS to publish details of their own research into the scope of crypto’s role in the CSAM problem, as well as information about the challenges specific to prosecuting this category of crime. The senators have given the agencies until May 10 to respond to their questions.

For her frequent and voluble criticism of cryptocurrency and its role in illicit activity, Warren has become something of a villain in crypto circles. Lately, the senator has come under criticism for a piece of anti-money-laundering legislation she proposed in July 2023, which the Chamber of Digital Commerce, a crypto advocacy group, has claimed will “erase hundreds of billions of dollars in value for US startups and decimate the savings of countless Americans invested in this asset class legally.”

Warren has reiterated her stance that the crypto industry must follow the same stringent rules as other financial organizations in the US in order to prevent misuse by criminal actors, including vendors of CSAM.

9 notes

·

View notes

Text

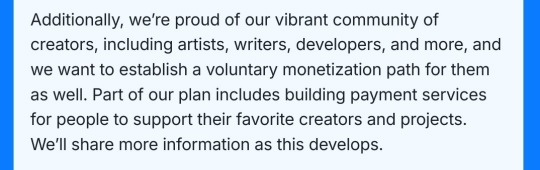

Start earning passive income now: BEMining Cloud Mining Guide

As the cryptocurrency market expands, the idea of making extra profit becomes more and more enticing. Some of the older methods, like trading or staking, require some technical knowledge and a certain level of commitment. But there is a simpler, more accessible option: cloud mining.

BEMining is the leading platform in the cloud mining industry, which allows you to easily earn Bitcoin and other cryptocurrencies with minimal effort. Whether you are new to cryptocurrency or an experienced investor, this guide will show you how BEMining can unlock passive income opportunities for you.

Cloud mining is a method of mining cryptocurrencies such as Bitcoin without owning or managing any physical mining hardware. Instead, clients rent computing power from other centralized data servers to mine cryptocurrencies.

This eliminates the need to:

Buy expensive mining equipment

How to deal with electricity bills

Oversee the maintenance and proper use of equipment

This is an ideal solution for those who want to try cryptocurrency mining but don’t want to go through the technical hassles.

Please visit BEMining.com to learn more about cloud mining and how it works with BEMining.

Why BEMining?

As the demand for cloud mining continues to grow, so does the number of platforms offering these services. Here are the reasons why BEMining stands out:

State-of-the-art technology

BEMining uses cutting-edge mining hardware hosted in optimized data centers. This ensures efficient and reliable mining operations.

User-friendly platform

The platform is friendly to everyone, whether the person is just starting their career or not – signing up, managing contracts, and withdrawing earned amounts don’t cause any difficulties either.

Flexible plans

BEMining offers a range of mining contracts for different budgets and investment goals.

Transparent Operations No hidden fees or surprises. What you see is what you get.

Secure Payments Secure payment methods make it easy to deposit and withdraw funds.

Learn more about our products and start mining now: Start mining with BEMining.

How to start mining Bitcoin with BEMining

Earning passive income with IONMining is quick and easy. Here is a step-by-step guide to get started:

1 Create your account Register with BEMining in just a few clicks and get $15 instantly upon registration

2 Choose a mining plan Choose from a variety of cloud mining contracts that fit your investment goals.

Whether you make a small or large commitment, we have a package that fits your needs.

3Deposit Funds Safely add funds to your account to activate your mining contract.

4Start Mining Sit back and let BEMining's advanced system mine Bitcoin and other cryptocurrencies for you.

5Withdraw Your Earnings You can check your balance and withdraw cash at any time.

Why Cloud Mining is the Future of Passive Income

The cryptocurrency market is booming, and cloud mining is expected to play a key role in its growth. Unlike active trading, mining offers a more stable and predictable source of income. With a trusted partner like IONMining, you can focus on making money and leave the heavy lifting to the experts.

Benefits of Cloud Mining with BEMining:

. Low startup costs . No technical background required . Develop a qualitative and flexible investment plan . Get professional-grade mining technology

Maximize your earnings with BEMining

Here are some tips to help you get the most out of your investment:

1 Reinvest your profits Use your earnings to buy additional contracts and increase your mining power.

2 Diversify In addition to Bitcoin, consider mining altcoins to diversify your portfolio.

3 Stay informed Crypto: Try tracking the movements of the virtual currency market to determine the right direction to invest.

Become a passive income earner today!

Whether you are seeking financial freedom or looking to diversify your portfolio, cloud mining with BEMining is a smart choice. With its user-friendly platform, transparent operations, and advanced technology, BEMining makes cryptocurrency mining accessible to everyone.

Don’t delay — start generating passive income now. Visit BEMining.com to explore your options and start mining Bitcoin today.

Cloud mining is a revolutionary new trend in the cryptocurrency investment space. Companies like BEMining are providing more opportunities to mine Bitcoin while making passive income easily.

That’s why when you choose BEMining, you’re not only buying mining power, you’re also entering into a partnership with a platform that cares about your further success. Join BEMining now and get everything moving in the right direction!

Company Name: BE Mining Investment Group

Company Email: [email protected]

For more information, visit their official website: https://bemining.com/

2 notes

·

View notes

Text

Discover Blum Memepad: Your Gateway to Launching and Supporting New Crypto Tokens

If you’ve been in the crypto space for a while, you know how challenging it can be to discover promising new tokens. The crypto world is huge, and with so many new tokens launching every day, how do you figure out which ones are worth your time and investment?

That's where Blum Memepad steps in. It’s like a launchpad that simplifies the process of discovering and supporting new rtokens—especially meme coins, the quirky tokens that often rely on community hype to grow. In this article, I’ll explain how Blum Memepad works and why it’s becoming a game-changer for anyone interested in the future of crypto.

What is Blum Memepad

Blum Memepad is a platform designed to help new tokens launch and gain traction. It’s not just for any token; it focuses primarily on meme coins—tokens that rely heavily on community support. These tokens can sometimes be seen as fun or speculative, but they often turn out to be big surprises, just like those early-stage companies you hear about that take off unexpectedly.

But here’s the cool part: Blum Memepad isn’t about some big company or investor deciding whether your token deserves attention. It’s all about community involvement. If a token gains enough backing—specifically, 1,500 TON tokens—it automatically gets listed on STON.fi, a decentralized exchange (DEX) where users can trade and provide liquidity.

So, it’s really simple. If a token has enough community support, it gets the chance to be traded. Think of it like crowdfunding: if enough people believe in an idea, it gets funded. In this case, the idea is a new token, and the “funding” is in the form of community-backed TON tokens.

How Does Blum Memepad Work

The process of supporting a token through Blum Memepad is straightforward:

1. A token is launched: A developer or team creates a new token, often a meme coin, and presents it on Blum Memepad.

2. Community support: The crypto community comes together to support the token. To get listed on STON.fi, the token needs to gather at least 1,500 TON tokens.

3. Trading begins: Once the token hits the 1,500 TON target, it’s listed on STON.fi, where anyone can trade it. Liquidity providers can also contribute to the token’s success by offering their assets for trade.

That’s it! The beauty of Blum Memepad is its simplicity. It doesn’t require millions of dollars in funding or a complex approval process. If the community believes in a token, it gets a chance to succeed.

Why Meme Coins

You might be wondering why Blum Memepad is focusing specifically on meme coins. These tokens might seem like just a joke, but in reality, they hold a lot of potential. Meme coins often gain value through community excitement and strong online communities—think of them as the “underdog” tokens that come from nowhere and end up being massive hits.

Here’s an analogy: Imagine a small startup business with just a handful of employees. If that startup gets a loyal following from customers who believe in its mission, it can grow and succeed. Meme coins work the same way. It’s not about the technology or product behind the coin; it’s about the community of people who support it. And Blum Memepad allows these kinds of tokens to thrive, even if they start small.

What Makes Blum Memepad Different

Blum Memepad stands out for several reasons:

Community-Driven: This platform is all about the people. It’s not some corporate giant deciding which projects get listed. The community makes the decisions.

Simple Process: If you’re looking to support a token or get your token listed, Blum Memepad offers an easy-to-follow process without all the red tape you might find on other platforms.

Integrated with STON.fi: Once a token gains support on Blum Memepad, it automatically gets listed on STON.fi, a decentralized exchange that provides more visibility and liquidity.

Blum Memepad isn’t just another token launch platform. It’s a hub for community-backed projects, giving anyone a chance to launch and support tokens in a simple, straightforward way.

The Real Impact of Blum Memepad

In the past month, Blum Memepad has seen impressive activity. Over 34 million users have participated, completing tasks and accumulating Blum Points, which will play a significant role in the near future. This tells you just how much momentum the platform is gaining.

Real-world impact is important here. Blum Memepad isn’t just a theoretical idea—it’s already working, with active involvement from users and token developers alike. This platform is showing us that the power of crypto lies in its community—and Blum Memepad is a tool to channel that power into real success stories.

For Developers: An Easy Way to Launch Your Token

If you’re a developer with a new token idea, Blum Memepad makes launching your project incredibly accessible. In the past, getting a token listed on a major exchange required large amounts of capital or significant backing. Now, thanks to Blum Memepad, developers can leverage the power of community support to launch their tokens on STON.fi.

Think about it like starting a small business. In the traditional world, you’d need a huge investment to get off the ground. But in the crypto space, thanks to platforms like Blum Memepad, you can launch with just community support. If people believe in your token, they’ll back it—and you’ll have a chance to succeed.

For Investors: A Chance to Get In Early

For investors, Blum Memepad offers a chance to be part of the next big thing—before it takes off. It’s like discovering a startup that’s still in its infancy, but with a community-driven approach. By supporting a token early, you might just be getting in on the ground floor of a future success story.

Moreover, investing in tokens on Blum Memepad gives you the opportunity to get involved in TON blockchain, which is growing rapidly. It’s like being part of the early days of the internet—getting in now could lead to big rewards down the line.

Building the TON Ecosystem

Blum Memepad is more than just a platform for launching tokens—it’s a vital piece of the TON ecosystem. Every new token added to the network strengthens the ecosystem, creating a more vibrant and diverse community. The more tokens and projects that launch, the more users will get involved, helping the entire system grow.

You can think of it like building a city: the more buildings (tokens) that are constructed, the more people (users) move in. Over time, the city becomes stronger, more resilient, and more successful. That’s the goal for the TON ecosystem—and Blum Memepad is playing a key role in making it happen.

Explore Blum now

Conclusion

Blum Memepad is revolutionizing the way we launch, support, and trade new crypto tokens. Whether you’re a developer looking to launch your token or an investor looking for new opportunities, Blum Memepad offers an easy and community-driven way to get involved.

By focusing on meme coins and community-driven projects, Blum Memepad taps into the power of decentralization, where you—the people—have the power to decide which tokens succeed. So whether you're launching a token or just looking to explore new opportunities, Blum Memepad is the place to be. The crypto world is full of possibilities, and Blum Memepad is making it easier than ever to be a part of it.

3 notes

·

View notes

Text

Blum Memepad: The Simple Way to Discover and Launch New Crypto Tokens

If you’ve been part of the crypto world for any amount of time, you’ll know that finding promising new tokens can be a challenge. It’s like fishing in a vast ocean—there are tons of fish, but how do you find the ones worth your time? This is where Blum Memepad comes in. Think of it as your fishing guide to the world of new tokens—helping you discover, support, and even launch them with ease.

Let me break it down for you and show you how Blum Memepad is making the process of launching and supporting tokens simple, transparent, and accessible for everyone.

What Is Blum Memepad

Blum Memepad is a platform that helps new tokens get off the ground. It’s like a startup incubator for crypto, but with a focus on meme coins and community-driven projects. If a token can gather support from enough people in the form of TON tokens, it will be listed on STON.fi, a decentralized exchange where anyone can trade it.

It’s really simple. Just like how people band together to help fund a local small business, crypto enthusiasts come together to help fund and support new tokens. If the community backs it, the project gets a chance to grow and thrive.

How Does It Work

At the core of Blum Memepad is community involvement. Here’s how it goes:

1. A developer presents their token: This could be a new meme coin or any token idea.

2. Community decides: If the token gets 1,500 TON tokens (which is the currency used), it gets listed on STON.fi.

3. Tokens go live: Once it’s on STON.fi, people can start trading and providing liquidity for the new token.

It’s as straightforward as that. No complicated hoops to jump through, no need for big financial backing—just genuine support from the community.

Why Focus on Meme Coins

You may wonder why Blum Memepad is focused on meme coins. These are the fun, often quirky tokens that rely on community enthusiasm to grow. Think about it like collecting baseball cards or limited-edition sneakers—the value is often tied to the hype and excitement surrounding them.

While meme coins can seem like just fun or funny, they actually teach us a lot about the power of community. If a large group of people believe in something, it can take off—even if it’s a bit unconventional. And Blum Memepad gives meme coin projects a chance to prove their value.

What Makes Blum Memepad Stand Out

Blum Memepad has a few key features that make it stand out in the crowded world of crypto launchpads:

Community-driven: This platform is all about the people. If the community supports a token, it gets a chance to grow.

Straightforward process: No hidden fees, no complicated steps—just a simple process for launching and supporting tokens.

Integration with STON.fi: Once a token is supported, it goes live on STON.fi for trading. This gives projects real exposure in the market.

Blum Memepad makes launching a token as easy as turning on a light switch. If people like what they see, they back it—and the token gets its shot.

Real-World Impact: What’s Been Happening on Blum Memepad

Let’s talk numbers for a second. Over the past month, more than 34 million users have gotten involved with Blum Memepad, completing tasks and earning Blum Points. These points will play a bigger role soon, showing just how much activity is happening on the platform.

This isn’t just a theory—Blum Memepad is proving that community-driven token launches work. It’s showing us that when people come together, real change happens in the crypto world.

For Developers: A Golden Opportunity

If you’re a developer with a cool new token idea, Blum Memepad could be your golden ticket. It’s not easy to get your token listed on major exchanges. In the past, you’d need a hefty marketing budget, big connections, or investors who believe in you. But with Blum Memepad, your community can help you out.

Imagine it like launching a new business. You don’t have to worry about investors not believing in your idea—your customers (the crypto community) help back you from the start. If you get enough people supporting your project, it gets listed, and you’ve got a thriving community around your token.

For Investors: A Chance to Get In Early

For investors, Blum Memepad gives you a chance to be part of something new. It’s like being an early supporter of a startup—you can get in on the ground floor and see the potential before it’s mainstream.

What makes this platform even more exciting is that it’s built on the TON blockchain, which is growing fast. It’s like being part of the early days of the internet—getting involved now could mean big things down the line.

Building the TON Ecosystem

Blum Memepad isn’t just about launching tokens—it’s about growing the TON ecosystem as a whole. Each new token adds to the vibrant community, attracting more users and developers, which makes the entire ecosystem stronger.

Think of it like planting seeds in a garden. Each new token is a seed, and as more seeds are planted, the garden grows. Over time, the ecosystem becomes more diverse and robust, offering new opportunities for everyone involved.

Wrapping Up

Blum Memepad is making it easier for everyone to launch, support, and discover new tokens. Whether you’re a developer with a great idea or an investor looking for early opportunities, this platform offers something for everyone.

The best part is that it’s all driven by the community. It’s a reminder that in the world of crypto, the people—us—hold the real power. Together, we can decide what tokens have value and which ideas deserve to succeed.

So, if you’re curious, jump in and explore Blum Memepad. Whether you’re launching or supporting, you’re helping build something that could be big in the crypto world. And who knows? The next token you support might just be the next big thing.

4 notes

·

View notes

Text

Blum Memepad: Revolutionizing Token Launches and Community-Driven Growth

If you’ve spent any time in the crypto or DeFi space, you’ll know how transformative blockchain technology has been. It’s like going from horse-drawn carriages to electric cars—an entirely new way of operating that’s faster, more efficient, and packed with potential. Yet, even in this advanced ecosystem, one challenge remains: how do we give new tokens and projects the attention and resources they need to thrive?

This question has been central to the growth of decentralized finance. Enter Blum Memepad, a platform that simplifies token launches and empowers communities to back the projects they believe in. Today, I want to share why Blum Memepad is a game-changer—not in abstract terms, but in a way that resonates with you as someone interested in the evolution of finance and crypto.

The Problem Blum Memepad Solves

Let’s start with a familiar analogy: launching a token in the crypto world is a lot like starting a small business in a bustling city. You might have an incredible product, but without visibility, support, and resources, you’ll struggle to make an impact. Traditionally, new tokens have faced the same hurdles. Developers needed significant funding, partnerships, or sheer luck to get noticed.

Blum Memepad flips the script. It acts like a decentralized “Shark Tank” where the community, rather than a few gatekeepers, decides which tokens deserve to succeed. This isn’t just empowering for developers; it’s transformative for investors, who now have a say in shaping the crypto landscape.

How Blum Memepad Works

Imagine you’re a developer with a groundbreaking idea for a token. On Blum Memepad, you can present your project directly to the community. Here’s how it works:

1. Developers create and launch their tokens on the platform.

2. The community evaluates the project and decides whether to back it by contributing TON tokens (the native currency of the TON blockchain).

3. If the project secures 1,500 TON, it automatically gets listed on STON.fi, a leading decentralized exchange (DEX).

It’s that simple. No need for endless meetings with potential investors or navigating complicated listing processes. With Blum Memepad, your token’s success depends on the merit of your idea and the trust of the community.

For traders and investors, this system is equally rewarding. It’s like being an early investor in a startup—you get in on the ground floor, where the potential for growth is highest. But, as with all investments, it’s crucial to do your due diligence and diversify your portfolio to manage risks.

Why Meme Coins

Now, let’s address a common question: why focus on meme coins? After all, aren’t they just jokes that trend for a while before disappearing?

Not quite. Meme coins are a fascinating case study in community power. Unlike traditional assets, whose value often hinges on complex fundamentals, meme coins derive their worth from the people who rally behind them. It’s not so different from art—sometimes, the value of a painting lies not in its materials but in the emotions it evokes and the community it inspires.

Blum Memepad recognizes this potential. By providing a structured launchpad for meme coins, it gives these tokens the visibility and legitimacy they need to succeed while ensuring that the process is transparent and community-driven.

Blum Memepad and the TON Ecosystem

One of the most exciting aspects of Blum Memepad is its integration with the TON blockchain, an ecosystem designed for speed, scalability, and security. Every token launched on Blum Memepad contributes to the growth and vibrancy of TON, creating a cycle of innovation and opportunity.

Think of TON as a thriving marketplace where Blum Memepad acts as a dynamic new stall. Each token launched not only adds to the variety of offerings but also attracts more traders, developers, and investors, making the entire ecosystem more robust.

Why This Matters to You

If you’re a developer, Blum Memepad offers an unprecedented opportunity to launch your token without the traditional barriers of cost, connections, or gatekeeping. It’s like being given a stage at the world’s largest expo, where all you need is a compelling idea and the courage to present it.

For traders and investors, Blum Memepad is a treasure chest of opportunities. By participating in token launches, you’re not just buying assets—you’re investing in ideas, supporting innovation, and helping shape the future of decentralized finance.

Blum Memepad in Action

Over the past month, Blum Memepad has already attracted more than 34 million users, with participants completing tasks and accumulating Blum Points. These points will soon play a significant role in the platform, adding another layer of engagement and reward.

This success isn’t just numbers—it’s proof of concept. It shows that the crypto community is ready for a platform that prioritizes transparency, accessibility, and community-driven growth.

The Bigger Picture

Blum Memepad is more than just a launchpad; it’s a symbol of what decentralized finance can achieve when innovation meets community trust. It embodies the principles that have made blockchain technology so revolutionary: transparency, inclusivity, and the power of the collective.

As someone passionate about the crypto space, I see Blum Memepad as a beacon for what’s possible. It simplifies the complex, democratizes the exclusive, and makes the future of finance accessible to everyone. Whether you’re a developer with a vision or an investor with a keen eye for potential, Blum Memepad offers a platform where your efforts can truly make a difference.

Final Thoughts

The world of crypto and blockchain is evolving rapidly, and staying ahead means embracing platforms like Blum Memepad that challenge the status quo. It’s not just about launching tokens; it’s about building an ecosystem where ideas can thrive, communities can grow, and innovation can flourish.

If you’re ready to be part of this revolution, now is the time to explore Blum Memepad. Not just as a platform, but as a movement toward a more decentralized and community-driven financial future.

6 notes

·

View notes

Text

Vance and the future of the anti-democracy movement

Vance has been anointed its future leader

ROBERT REICH

OCT 3

Trump, Vance, Thiel

Friends,

JD Vance, the Republican candidate for vice president, will almost certainly be the Republican presidential candidate in 2028, regardless of whether Trump wins in November.

But who is JD Vance, really? An opportunist chameleon who once viewed Donald Trump as “Hitler” and is now his pit bull?

Or does Vance have an agenda over and above mere political ambition?

In one of the most important exchanges of Tuesday’s vice presidential debate, Vance refused to say that Trump lost the 2020 election, and he downplayed the violent events of January 6, 2021. Vance also declined to rule out challenging the outcome of the upcoming election even if votes were certified by every state leader as legitimate.

Trump picked Vance for his vice president because Vance publicly stated he’d do what Mike Pence refused to do: overturn democracy and place America under MAGA control.

In response to a question ABC’s George Stephanopoulos put to Vance last February — “Had you been vice president on January 6th, would you have certified the election results?” — Vance said:

“If I had been vice president, I would have told the states, like Pennsylvania, Georgia, and so many others that we needed to have multiple slates of electors, and I think the U.S. Congress should have fought over it from there.”

In 2020, Vance alleged that the 2020 election was stolen and that Biden’s immigration policy meant “more Democrat voters pouring into this country.” In 2022, he suggested that Democrats were attempting to “transform the electorate” amid an immigrant “invasion.”

Echoing the so-called “great replacement theory,” Vance told voters, “You’re talking about a shift in the democratic makeup of this country that would mean we never win, meaning Republicans would never win a national election in this country ever again.”

In contrast to Trump, who has no ideology except accumulating power and wealth for himself and taking revenge on those who would deny them to him, Vance does have an ideology. He’s the emerging leader of the anti-democracy movement in America.

Vance would never have become a senator from Ohio in 2022 were it not for billionaire tech financier Peter Thiel, who staked $15 million on Vance’s election — a major portion of all the funds that went into Vance’s race.

Thiel knew what he was buying. Vance had worked for Thiel’s California venture capital firm before running for the Senate and was part of Thiel’s libertarian community of rich crypto bros, tech executives, back-to-the-landers, and disaffected far-right intellectuals.

Because Thiel had been a major funder of Trump’s 2016 presidential run, he had significant influence with the former president when urging Trump to pick Vance for his vice president.

Why has Thiel been such a strong sponsor of Vance? Because Thiel sees in his protege a future leader of a political movement to turn America away from democracy. “For Peter,” said one of the people familiar with his thinking, “Vance is a generational bet.”

Thiel is a self-styled libertarian who once wrote: “I no longer believe that freedom and democracy are compatible.”

Hello? Freedom is incompatible with democracy only if you view democracy as a potential constraint on your wealth and power.

That’s the point. Thiel and Vance — along with Elon Musk, Steve Bannon, Blake Masters, tech entrepreneur David Sacks, Palantir co-founder Joe Lonsdale, Palantir adviser Jacob Helberg, Sequoia Capital’s Doug Leone, blogger Curtis Yarvin, and others in the anti-democracy movement — believe that the only way true libertarians can win in America is for a Caesar-like figure to wrest power from the American establishment and install a monarchical regime, run like a startup.

Yarvin comes as close as anyone to being the intellectual godfather of the anti-democracy movement. He has written that real political power in the United States is held by a liberal amalgam of universities and the mainstream press, whose commitment to equality and justice is eroding social order.

In Yarvin’s view, democratic governments are inefficient and wasteful; they should be replaced with sovereign joint-stock corporations whose major “shareholders” select an executive with total power, who serves at their pleasure. Yarvin refers to the city-state of Singapore as an example of a successful authoritarian regime.

How to achieve Yarvin’s vision? The first step, as Vance offered in a 2021 podcast, is to replace “every single midlevel bureaucrat, every civil servant in the administrative state … with our people. And when the courts stop you, stand before the country, and say—” as did Andrew Jackson — that “the chief justice has made his ruling. Now let him enforce it.”

Vance has been anointed by Thiel and the rest of the anti-democracy movement as the post-Trump president, tasked with replacing the American establishment with an authoritarian regime.

Make no mistake: The foundation for America’s first true anti-democracy president is being laid right now.

3 notes

·

View notes

Text

@youzicha

#trying to understand wtf is happening to svb because uh. i want my salary

The business model of banks

The way banks work is that they take in deposits and make loans.

So I put money in a bank, but ALSO I took money out of a bank to get a car loan which let me buy the car that I used to commute to work to pay off the car loan. And also drive to Death Valley. GOOD little car. Could go from Vegas to SF on a tank of gas.

What this means from a bank's perspective is that your bank balance is a problem and the loans they make are assets. Because you took in $20K of deposits and then gave me an $18K car loan that I paid back at $400/month for 5 years. And at the end of 5 years, you will have taken $18000 and turned it into $24000.

And if one person asks for $2K back, you have $2K. And if someone(s) a year from now asks for $10K back, you have:

$2K in cash

But also the $4800 in cash I paid you last year. Minus the amount of money you spent last year running the actual bank.

The money used to found the bank (The Equity)

The ability to shop around and say "Poi is going to pay us $400/month every month for the next 4 years and if he stops doing that, you get a gently used Chrysler 200 to sell. How much are you willing to give us for that cashflow?" <- THIS IS THE PROBLEM

So as long as you are:

Liquid, meaning that you can give people their money back when they ask for it

Solvent, meaning that if EVERYONE asked for their money back, you'd sell off all the loans you'd made, give them their money back, and also have a >$0 pile of cash to go Scrooge McDuck in after you shut down the bank.

you get to keep existing.

If you're liquid, but non-solvent and somehow manage to hide it, this is called Bernie Madoff. But also "The Bank of Japan in 2023".

If you're solvent, but non-liquid, someone rolls up and buys your assets for "The value of your liabilities and also this Snickers Bar" and that's a pretty standard action.

And if you're non-liquid and insolvent, uh look crypto is weird but go look at FTX. There's a list of creditors and several months or even years from now, you'll get a fraction of your deposits back based on the recovery value of the underlying assets.

What specifically happened to SVIB

So you are a bank in 2019. And specifically, you are the Bank of Startups. And startups are very bad loan risks and also have giant piles of VC checks so they don't actually need loans.

$200 Billion of VC checks in fact. Which they gave to you. And because you're a good bank, you put $20 Billion in the cushion fund and now you have to figure out how to use $180 Billion to generate enough money to keep running the bank.

Unfortunately, it's 2019 and all the liquid risk-free assets pay 0.08% and that's not enough money to pay your bank tellers. So you make a (in retrospect dumb, in practice I'm not sure it's dumb enough I scream just at SVIB) decision to put it into:

A bunch of Treasuries that pay 1.5% or so

A bunch of mortgage-backed securities which are default risk-free b/c of post-2008 reforms. If someone forecloses, the government pays you back at par.

Corporate bonds which are risky but hey that's why you charged 5% right?

So these are illiquid, but they're not like... that illiquid and if interest rates ticked up a percentage point, a 5-year bond with 3 years to go is still like 98% of face value, it's totally fine.

And now you have $4-6 Billion/year to pay your bank tellers with and also improve that cushion.

And if you don't do these things, Silicon Valley Investment Bank does not exist. CHASE BANK does not exist. This was a prerequisite to having banking services in this country post-2008 in literally 0 interest rate environments.

And then the Fed goes on a historically unprecedented interest increase. So your 1.x% bonds are now competing in the market with 5% bonds and your 2.6% mortgages are competing with 7% mortgages and hoooo boy.

A 2.6% $400K mortgage pays you $20K/year and is currently worth $260K at 7%. $180 Billion of assets marked down to ???? Billion. 7 years to break-even and your bank tellers need to get paid.

Now for most banks, this isn't a problem. They're an actually profitable Bernie Madoff by design as a feature. They can't give everyone their money back, but they don't have to. And the bonds are paying up and the mortgages are paying up and 5% nominal GDP growth isn't a lot, but it's something and of course, you're making NEW loans at 7% so if you can just keep paying 0% interest on bank deposits and keep pulling in 7% interest loans, you'll make it out of the next few years, and you're suddenly solvent again.

Except for you.

Because you are the Bank of Startups.

And when interest rates went up, VC funding went down. So you have these perfectly good businesses (for now at least) that are constantly and continuously drawing down on their bank accounts.

And remember, this isn't 1982. You're only making 2%. Your cap ratio is 5%. All those mortgages paying in 5% of book value every year and if you get out over your skis, you cease to exist. You're going to hear the words "Duration Risk" a lot and this is that.

So you try to do an equity raise. You'll sell the rights to some of that 5% cashflow (and remember, it's increasingly 7% interest/10% cap which is slightly more exciting) in exchange for the money you need NOW TODAY to pay out your withdrawals.

At which point Andreesen goes "Uh what my friends?", tells all of his buddies to pull their cash, and $42 Billion gets withdrawn in less than 24 hours. Leaving $160 Billion behind.

And now we remember that bank accounts over $250,000 (IE: One paycheck at a $6.5 Million payroll company) aren't technically FDIC insured.

Lessons Learned

And the thing is that I really can't just blame SVIB here. They got stuck in a pretty terrible trap caused by the US Government. And the US Government likes it when you buy Treasuries and likes it when you buy and SVIB was, more or less, doing the things you as a society wanted them to do.

And the Federal Reserve explicitly destroyed them for it.

Don't get me wrong, they were weird. But I'm not sure they were weird enough especially given the constraints of 2019-2021 that I can just go "Eh, screw them". Spread that blame AROUND.

And any bank that can survive a FORTY PERCENT drawdown in the value of the underlying assets.... isn't a bank. At least not as we mean it here in 2023. The Fed's stress tests involve a 'severely adverse scenario' where 10-year US Treasury yields are at 0.7% (and only get to 1.5%). They're currently at 3.6%.

The second set of lessons that we learned today goes like this:

There are lots and lots and LOTS of reasons that small or medium businesses might temporarily or permanently want more than $250K in raw USD cash in a bank account at some point. This is now a banking risk. (There's some tricks you can play if you're really large, but those also have limits)

However, if you bank at Chase Bank (or any other bank on the too-big-to-fail list), you are infinitely insured. Because CHASE BANK is backed by the entire combined firepower of the US Government and banking sectors. If Chase Bank stops existing, the nukes have fallen.

So why would I ever use a local bank for anything at all ever again? At which point you now get another round of contagion in the system where everyone gets out of these regional banks. Because remember, EVERY BANK IN THE WORLD INCLUDING THE BANK OF JAPAN is now insolvent.

Because they were destroyed for the crime of "Doing exactly we wanted them to do". Oh sure, in a risky sort of way, but see that note above about the Fed Stress tests.

Where "What we wanted them to do" involved buying government debts

Are you uh... 100% absolutely certain you want to be teaching those lessons? That if you buy US Treasuries, you will be destroyed for your crimes? That if you use a regional bank and they are destroyed for their crimes of making loans to the Feds, your business dies with it?

24 notes

·

View notes

Text

Crypto collapse: SEC takes on Terraform and Coinbase, ETF fallout continues, Tether is for crime

by Amy Castor and David Gerard

* SEC wins a lot of their claims against Terraform * Coinbase motion to dismiss hearing, with yet more Beanie Babies. (“funding my new startup by selling Stock Babies which are an asset just like a parcel of land, the value of which may reasonably fluctuate.” — Andrew Molitor) * ETF nonsense: Collateralized Rugpull Obligations * Tether is for crime

3 notes

·

View notes

Text

Celsius Web Services: The Billion-Dollar Plan That Could Have Saved The Network From Bankruptcy

Celsius Web Services: The Billion-Dollar Plan That Could Have Saved The Network From Bankruptcy https://bitcoinist.com/celsius-the-billion-dollar-saved-network-bankruptcy/ According to a report from The Block, Celsius Network, a cryptocurrency lending company that filed for Chapter 11 bankruptcy last year, had attempted to raise $1 billion for a project called Celsius Web Services (CWS). CWS aimed to offer generic versions of Celsius’s yield and custody-focused products and was described as a “web3 toolbox for a New World” in pitch decks presented to Goldman Sachs and Abu Dhabi-backed fund ADQ May and June 2021, respectively. Former Celsius CEO’s Plan Celsius’s former CEO, Alex Mashinsky, spearheaded the CWS plan, but the project failed to get off the ground as investors, including Celsius’s board, chose not to participate. Mashinsky had hoped to pivot Celsius away from its core crypto lending business and create the “Amazon Web Services of crypto” with CWS. The CWS plan was seen as a last-ditch effort by Mashinsky to save the company, as employees openly expressed concerns about Celsius’s financial health in May 2021. However, according to The Block, Mashinsky continued to assure customers that all was well. Mashinsky was later hit with a civil lawsuit by New York attorney general Letitia James, who accused him of misleading investors about the health of Celsius. Mashinsky dismissed the fraud claims as “baseless.” Celsius’s lending business ultimately led to its downfall as the company froze withdrawals on June 12, 2021, and filed for bankruptcy a month later. Over 100,000 users were owed over $4.7 billion. Despite Mashinsky’s efforts to launch new products and pivot the company, CWS couldn’t save Celsius from bankruptcy. The CWS plan was also likened to Plaid, a fintech startup that helps customers connect their financial data to new apps and services, by a second source close to Celsius. While the CWS plan did not come to fruition, it offers insight into how Mashinsky hoped to save the company. The plan involved white-labeling Celsius’s products and offering services for business transformation and growth. The types of services in the pitch deck included yield, custody, on-ramp services, and a tool for bridging centralized and decentralized ecosystems. The CWS project had the board’s and external investors’ full backing, but ultimately, Celsius’s existing investors chose not to participate. The Network’s Custody Settlement Withdrawals For Eligible Users On May 9th, Celsius Network announced that withdrawals have begun for eligible Custody account users who have opted into the Custody Settlement. The settlement was authorized by the Court last month and allowed users to receive a distribution of their assets in exchange for electing not to pursue any Custody-related claims or causes of action against Celsius and for voting their Custody claims in favor of the Plan. Last month, the Court authorized our settlement with the UCC and Custody Ad Hoc Group. Today, withdrawals begin for those who have opted in to the Settlement. — Celsius (@CelsiusNetwork) May 9, 2023 Furthermore, according to the announcement, the distribution of eligible assets will be carried out in two stages. The first distribution consists of 36.25% of each settling Custody account holder’s Custody account balance. Users can withdraw their assets once all account information is updated and verified. Moreover, the Network has provided a Custody Account Withdrawal FAQ for users seeking more information. Featured image from iStock, chart from TradingView.com via Bitcoinist.com https://bitcoinist.com May 13, 2023 at 02:00AM

8 notes

·

View notes