#Consumeraffairs

Explore tagged Tumblr posts

Text

Customizing a car that stands out from the crowd and delivers top-notch performance is a dream for many automotive enthusiasts. However, while focusing on enhancing aesthetics and power, it's essential not to overlook safety. Verified Market Reports states that the automobile modification market is expected to reach a valuation of $149.5 billion by 2030. This sector focuses on customizing vehicles to meet individual preferences, whether through performance upgrades, aesthetic changes, or technical enhancements. With a broad range of services, experts in this market help drivers transform their vehicles while ensuring safety, compliance, and high-quality results. A truly exceptional car balances unique design and high performance with the necessary safety measures to protect the driver and passengers. In this article, we'll look at the best ways to customize your car while considering safety. We will go over everything from picking the correct modifications to planning for unexpected dangers on the road. Choose the Right Modifications for Performance and Safety When customizing a vehicle, the modifications you choose play a significant role in both performance and safety. Engine upgrades, suspension modifications, and braking system enhancements are common choices for boosting performance, but each must be carefully selected and installed. Opt for high-quality components that are specifically designed for your vehicle model and have been tested for safety. For example, a lowered suspension can enhance handling, but only if paired with appropriate safety checks to avoid compromising ride quality and road clearance. Similarly, upgrading to a performance exhaust system can improve horsepower but should not compromise emission standards. In March 2024, the EPA announced stricter standards to cut harmful emissions from light- and medium-duty vehicles starting with the 2027 models. Building on earlier greenhouse gas standards set in 2021, these new rules aim to reduce air pollution, protect public health, and tackle climate change. Phasing in through 2032, these standards will also help drivers save on fuel and maintenance costs. When the Unexpected Hits the Road: Risks and Accidents Even with the best modifications, the road is full of unexpected risks. Accidents, adverse weather conditions, and road hazards can turn a pleasant drive into a dangerous situation. To deal with these risks, prioritize safety features alongside your custom upgrades. Consider investing in advanced driver assistance systems (ADAS), such as collision warning systems and lane departure alerts. These technologies can help you react more quickly to unexpected dangers. Additionally, ensure your vehicle is equipped with high-quality tires that offer excellent traction in various weather conditions. The Threats Posed by Commercial Vehicles One particular risk to be aware of is truck accidents. Areas that are commercial hubs, such as major cities and industrial zones, tend to have a higher concentration of large trucks on the roads. This raises the risk of accidents involving these huge transport vehicles. Truck accidents can prove to be particularly severe owing to the vehicles' size and weight. Adding to the challenge are the reckless or inattentive drivers commonly found in busy cities. These aggressive drivers can make the roads even more dangerous, particularly in areas with heavy traffic and high truck volumes. St. Louis, for example, is known for its unpredictable drivers and the city’s high rate of accidents. In a report by ConsumerAffairs, St. Louis ranked among the top five cities with the worst drivers in the United States. A concerning 32.39% of fatal crashes in the city involve drivers with a positive blood alcohol content. This statistic highlights the serious risks on the road in St. Louis. In January 2024, KSDK reported a tragic crash in south St. Louis involving a semi-truck and a speeding Pontiac G6. The accident occurred near South 2nd and Sidney streets, where the Pontiac failed to stop at a sign and collided with a 2019 Freightliner. Sadly, the 35-year-old Pontiac driver, Brant Renfro, was pronounced dead, while the 62-year-old semi-truck driver was hospitalized. According to TorHoerman Law, such cases usually end up in lawsuits. In these cases, the truck driver, the trucking company, and even the manufacturer of the truck can be held liable. If you or someone you know has been involved in a truck accident, it’s essential to consult with a truck accident lawyer. In the case mentioned above, a St. Louis truck accident lawyer would play a crucial role. They would evaluate the accident's details, identify liable parties, and ensure that victims receive the support and compensation they deserve. Whether through settlement negotiations or court proceedings, legal representation can be vital in securing a fair outcome in the aftermath of a truck accident. At this point, you must realize that the right safety features in your car could make a difference. Defensive driving is another key aspect of staying safe on the road. Balancing Aesthetics and Safety in Custom Designs Customizing your car’s appearance is a great way to express your personality, but it's crucial to balance aesthetics with safety. When selecting exterior modifications, such as custom paint jobs, body kits, or window tints, make sure they comply with local regulations. They also must not impede visibility or aerodynamics. For example, excessively dark window tints can limit your view, particularly at night. On the other hand, overly aggressive body kits can affect the car's stability at high speeds. Inside the car, choose custom seats and harnesses for both style and safety, ensuring they effectively protect occupants during a collision. FAQs How to stay safe when driving a modified car? Make sure any changes are professionally done and fulfill safety regulations if you want to drive a modified car safely. Check your car often, paying special attention to important parts like the suspension, tires, and brakes. Finally, always drive cautiously, as high-performance modifications may alter your car's handling in unexpected situations. When do I need a truck accident lawyer? If you were hurt in a truck crash, you should see a lawyer, especially if there were large losses or complicated responsibility concerns. A lawyer can guide you through insurance claims, assist in settlement negotiations, and guarantee just recompense. Consulting one early can protect your rights and strengthen your case. Is it alright if I install a body kit on my car? Adding a body kit to your car can enhance its appearance and aerodynamics, but it's important to consider the quality and fit. Choose a reputable kit that complements your vehicle's design without compromising safety. If in doubt, get expert advice for installation and to make sure it complies with regulations. It's fun to customize your car to be functional and distinctive, but safety should always come first. As you choose modifications, make sure they not only enhance performance but also keep you protected on the road. Investing in advanced safety features like collision warning systems and upgrading your tires can go a long way in minimizing risks. And don’t forget, driving defensively is key. The road can be unpredictable, so being prepared for unexpected challenges is essential. By prioritizing safety in your customizations, you can enjoy your upgraded ride with confidence and peace of mind. Read the full article

0 notes

Text

Pet Insurance Ohio- A Comprehensive Guide

Claiming a pet in Ohio gives pleasure and friendship, yet it likewise accompanies the obligation of guaranteeing their well-being and prosperity. One method for shielding your shaggy companions is through Pet Insurance Ohio. This article investigates all that you want to be aware of pet insurance in Ohio, including its advantages, inclusion choices, and ways to pick the right contract.

WHAT IS PET INSURANCE OHIO?

Pet protection is a sort of health care coverage intended to cover veterinary costs for pets. Very much like human health care coverage, pet protection can assist with lessening the monetary weight of startling clinical expenses. It ordinarily covers a scope of administrations, including standard check-ups, crisis care, medical procedures, and meds.

WHY THINK OF PET PROTECTION OHIO

Rising Veterinary Expenses: The expense of veterinary consideration has been consistently expanding. As per the American Veterinary Clinical Affiliation (AVMA), pet people can hope to pay hundreds to thousands of dollars for medicines, particularly in crises.

The inward feeling of harmony: Pet protection permits you to pursue medical care choices for your pet without the mind-boggling worry about costs. You can zero in on getting your pet the consideration they need without monetary pressure.

Complete Consideration: With pet protection, you can furnish your pet with a more extensive scope of medicines. Approaches frequently cover mishaps and sicknesses as well as preventive consideration, for example, inoculations and yearly check-ups.

Figuring out Pet Protection in Ohio

Kinds of Inclusion

In Ohio, pet insurance contracts ordinarily fall into three fundamental classifications:

Mishap Just Plans: These arrangements cover wounds coming about because of mishaps, like broken bones or nibbles. They don’t cover diseases or preventive consideration.

Ailment Plans: This inclusion centers around treating sicknesses, like diseases, constant circumstances, and inherited issues. Nonetheless, they generally avoid mishaps.

Exhaustive Plans: Complete plans join both mishap and disease inclusion. They frequently incorporate preventive consideration, offering a balanced answer for pet medical care.

Normal Rejections

While pet protection can be important, it’s fundamental to know about normal prohibitions. Numerous approaches don’t cover:

Previous circumstances

Routine health visits

Restorative systems

Breed-explicit circumstances

Holding up Periods

Most pet insurance contracts have holding up periods before inclusion starts. This truly means that assuming your pet is harmed or becomes sick during this time, you may not get repayment for those costs. Commonplace holding up periods range from a couple of days to half a month, contingent upon the safety net provider and kind of inclusion.

Picking the Right Pet Protection in Ohio

Choosing the best pet protection for your requirements can overpower you. Here are a few vital variables to consider:

Evaluate Your Pet’s Necessities

Think about your pet’s variety, age, and wellbeing history. A few varieties are inclined toward specific medical problems, which might influence your decision of protection. More established pets frequently require more clinical consideration, so a thorough arrangement might be more reasonable.

Think about Plans and Suppliers

Research different pet protection suppliers in Ohio. Search for organizations that offer a scope of plans, adaptable deductibles, and adjustable inclusion choices. Some well-known pet insurance agencies in Ohio include

Peruse Client Audits

Client criticism can give significant experiences into a back up plan’s cases interaction, client assistance, and generally speaking fulfillment. Sites like ConsumerAffairs and Trustpilot can assist you with measuring an organization’s standing.

Check for Limits

Many pet insurance agencies offer limits for different pets, military staff, or yearly installments. Make a point to ask about any suitable limits to help bring down your expenses.

Grasp the Fine Print

Painstakingly read the strategy subtleties, including as far as possible, deductibles, and repayment rates. Guarantee you comprehend the terms to keep away from any shocks while recording a case.

Expenses of Pet Protection in Ohio

The expense of pet protection in Ohio differs generally based on a few elements, including:

Kind of Inclusion: Mishap just plans are for the most part more affordable than extensive plans.

Pet’s Age: More established pets ordinarily have higher charges because of their expanded gamble of medical problems.

Breed: Certain varieties might draw in higher expenses in light of their inclination to explicit circumstances.

Area: Veterinary expenses can differ by locale, affecting protection rates.

All things considered, pet protection in Ohio can go from $20 to $100 each month. It’s essential to offset the premium with the degree of inclusion you want.

Documenting a Case

At the point when your pet requires clinical consideration, the cases cycle is urgent. Here is a bit by bit manual for recording a case:

Visit the Veterinarian: After your pet’s treatment, get a nitty gritty receipt that frames the administration given.

Complete the Case Structure: Most insurance agencies give an on the web or downloadable case structure. Finish it up totally.

Present Your Case: Send your finished case structure alongside the receipt to your protection supplier. Many organizations offer internet-based accommodation for quicker handling.

Anticipate Repayment: Cases handling times can fluctuate. Most safety net providers will tell you of their choice within half a month. Whenever endorsed, you’ll get repayment given your strategy’s terms.

FAQs About Pet Protection in Ohio

Is Pet Protection Worth The effort?

Many pet people discover a sense of harmony of psyche and monetary security presented by pet protection offset the expenses. It permits you to settle on medical care choices without agonizing over costs.

Could I at any point Get Pet Protection for a More established Pet?

Indeed, numerous guarantors offer inclusion for more established pets, however expenses might be higher. A few organizations have age limits for enlistment, so it’s crucial for research choices early.

What Occurs on the off chance that I Don’t Utilize My Pet Protection?

In the event that you document no cases, you will not get any cash back from your charges. Notwithstanding, you will in any case take care of the security of knowing that you’re in the event of a crisis.

Are There Any Variety Explicit Arrangements?

Some insurance agency offer variety explicit arrangements that record for genetic circumstances normal in specific varieties. It merits getting some information about these choices.

How Would I Drop My Pet Insurance Contract?

On the off chance that you choose to drop your pet protection, contact your supplier and follow their wiping-out methods. Guarantee you do as such before your next installment to keep away from pointless charges.

CONCLUSION

Pet protection in Ohio is a fundamental apparatus for capable pet proprietorship. By putting resources into a reasonable strategy, you can guarantee your fuzzy mates get the most ideal consideration without the monetary pressure that frequently goes with veterinary bills. Get some margin to explore your choices, look at suppliers, and pick an arrangement that addresses both your issues and those of your pet. With the right protection, you can zero in on the main thing: partaking in the bond you share with your darling pet.

#Pet Insurance Ohio#Pet Insurance Ohio Review#Pet Insurance Ohio Latest Update#Pet Insurance Ohio Best Offers

0 notes

Text

0 notes

Text

Cyberattacks Soar: 2024 data breaches may break records again - NewsCenter1

ConsumerAffairs analyzed the Identity Theft Resource Center's database from 2018 through the first quarter of 2024 to uncover data breaches and ... http://dlvr.it/T8Qfm2

0 notes

Text

How to Choose a Financial Advisor in 2024 - ConsumerAffairs || #FindAFinancialAdvisor News Link Courtesy of FREE Financial and Financial Risk Consultation with Akamai Wealth Management for all Hawaii Residents Whether You're Retiring or Searching for More Income Text or Call 808.464.5292

ICYMI: http://dlvr.it/T7dw9W

0 notes

Text

The Downfall of USAA under Wayne Peacock's Leadership

In recent years, USAA, once revered for its unwavering commitment to serving military members and their families, has faced a profound shift in reputation under the leadership of Wayne Peacock. This blog delves into the critical analysis of USAA's challenges, dissatisfactions among its members, and the repercussions of decisions made during Peacock's tenure.

youtube

The exploration begins with an overview of USAA's historical standing, rooted in trust, reliability, and a commitment to exceptional service. Founded in 1922, the institution initially provided auto insurance, expanding its offerings to encompass a comprehensive range of financial products tailored to the unique needs of military personnel and their families.

Wayne Peacock's ascension to the CEO position in 2020 was anticipated to sustain USAA's legacy of excellence. However, the realities under his leadership revealed deviations from the institution's cherished values. The blog scrutinizes Peacock's leadership style and decision-making, highlighting a shift in priorities toward cost-cutting measures and operational changes that seemed to compromise service quality.

Under Peacock's guidance, USAA faced a multitude of challenges, encapsulated in four primary areas:

Customer Service Failures: Members reported a decline in responsiveness and empathy from USAA's customer support, leaving many feeling neglected and unheard.

Decline in Financial Services: Increased fees and reduced benefits stemming from policy changes disillusioned members, challenging the institution's commitment to its customers' financial well-being.

Technological Lags and Security Concerns: Outdated technology and security vulnerabilities heightened frustrations, impacting user experience and raising concerns about data safety.

Impact on Individuals and Families: Testimonials underscored the emotional and financial toll these shortcomings took on members, once reliant on USAA's unwavering support.

The blog corroborates these observations with credible sources, including Forbes, Consumer Reports, The Wall Street Journal, and J.D. Power & Associates, validating the outlined issues and dissatisfactions experienced by USAA members.

Further analysis incorporates links to testimonials and reviews from members sourced from platforms like Reddit, Trustpilot, and ConsumerAffairs. These real-life accounts vividly illustrate the frustrations and disappointments faced by individuals and families relying on USAA for their financial needs, corroborating the outlined challenges.

The assessment extends to public perception and reactions, examining online reviews, feedback, and social media sentiment. It becomes evident that the sentiment on these platforms echoes the dissatisfaction expressed by members, signaling a significant departure from the institution's once-revered service standards.

In the concluding section, the blog emphasizes the imperative need for USAA to address these challenges. It offers recommendations, advocating for enhanced customer service, policy reassessments, technological advancements, and a renewed focus on member-centricity. It emphasizes the pivotal role of leadership in restoring trust, underlining the importance of aligning decisions with members' best interests.

The blog envisions a path forward for USAA, urging a collective effort involving leadership commitment, member engagement, and a renewed dedication to the institution's founding principles. It asserts that by embracing transparency, accountability, and a renewed focus on members, USAA can navigate these challenges and regain its standing as a trusted financial institution serving the military community.

In essence, this comprehensive analysis provides a critical examination of USAA's challenges under Wayne Peacock's leadership, supported by credible sources and member testimonials. It illuminates the path for USAA's future revival, emphasizing the crucial role of leadership in restoring the institution's trust and commitment to its members' well-being.

#usaa#usaa wayne peacock#wayne peacock#usaa review#usaa reviews#usaa reviewed#united services automobile association#usaa insurance#usaa banking#usaa bank#usaa credit#usaa rates#usaa casualty insurance#usaa car insurance#usaa auto insurance#Youtube

1 note

·

View note

Text

Laith Alsarraf

Laith Alsarraf, an Iraqi-born entrepreneur, founded Birch Gold Group, a company well-known in the United States for its precious metals trading services. Laith has evolved Birch Gold Group into a recognised organisation in the business by empowering consumers through wise investment choices and in-depth expertise.

This article delves into Laith Alsarraf's background, Birch Gold Group's journey, its operational model, customer perception, product offerings, and more. It aims to provide a comprehensive overview to help potential clients make an informed decision about engaging with Birch Gold Group for their investment needs. For detailed information, check out: Birch Gold Group Reviews

Laith Alsarraf: The Founder of Birch Gold Group

Laith Alsarraf, the founder of Birch Gold Group, was born in Ontario, Canada, in 1969. Both his parents were doctors, and he initially embarked on a pre-med degree at UCLA, following family tradition. However, life had different plans for Laith. While at UCLA, he worked as a contract programmer and website designer. Recognizing the potential of his work in the burgeoning digital world, he put his formal education on hold to establish several corporations. One of them was Cybernet Ventures, Inc., which operated Adult Check—an online age verification service. Designed to limit underage access to adult content websites, Adult Check provided adults access to these sites through a secure personal identification number (PIN). Over 200,000 websites reportedly used this service, demonstrating the significant influence of Cybernet Ventures in the digital space. In 2003, Laith Alsarraf founded Birch Gold Group, marking his entry into the precious metals industry. The company, based in Burbank, California, is composed of financial advisors, former wealth managers, commodity brokers, and experienced experts. Their primary objective is to assist clients in asset diversification and retirement preparation through investments in precious metals such as gold, silver, platinum, and palladium. Despite his impressive achievements, Laith prefers to maintain a low online presence, shying away from media exposure. Therefore, the finer details about his transition from managing Cybernet to establishing Birch Gold Group remain unclear.

Inside Birch Gold Group: Management and Employee Perception

Despite the company's diverse operational history, Birch Gold Group is viewed favourably by most of its employees and founder Laith Alsarraf. Former employees highlight the company's commitment to training programs and fostering a competitive environment. Online employee review platforms such as Glassdoor and Indeed echo these sentiments, with most reviewers recommending the company to a friend. While some employees have voiced dissatisfaction with their experience at Birch Gold Group, the overall consensus leans towards a positive work environment. This internal harmony is reflected in the quality of service the company provides to its clients.

Laith Alsarraf: Public Perception of Birch Gold Group

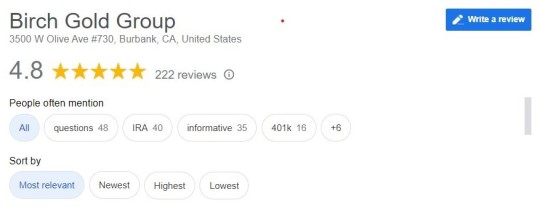

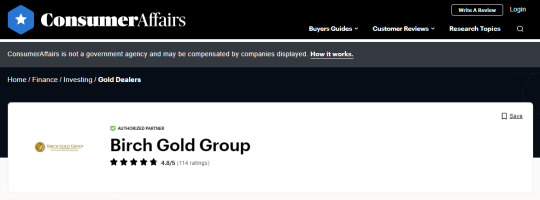

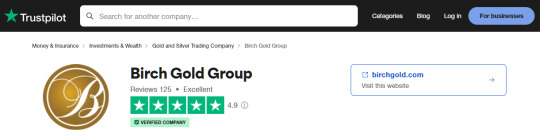

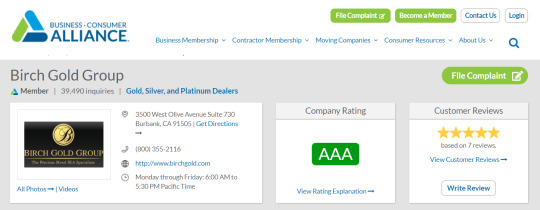

Customer satisfaction is a cornerstone of Birch Gold Group's business model. The company prides itself on providing top-tier services and products to its clients. The high regard customers hold for Birch Gold is evident in the positive reviews they leave on various online platforms. Here are some examples: Google reviews

ConsumerAffairs

Trustpilot

TrustLink

Business Consumer Alliance

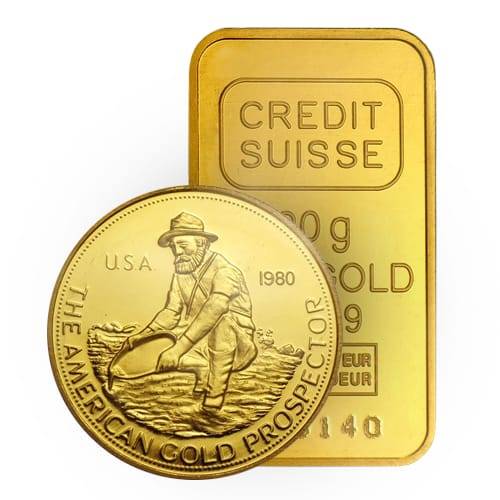

Birch Gold Group's Precious Metal Offerings

Birch Gold Group's product portfolio is diverse, offering a comprehensive range of precious metal products. Whether customers are interested in physical possession or precious metals IRA storage, Birch Gold has them covered. Here's a glimpse of the precious metals they offer: Gold American Gold Eagle (bullion)

American Buffalo

Canadian Gold Maple Leaf

Gold Gyrfalcon

Gold Bars and Rounds

Silver American Silver Eagle (bullion)

American Silver Eagle (proof)

America the Beautiful Silver Series

Canadian Silver Maple Leaf

Silver Gyrfalcon

Silver Twin Maples

St. Helena 1.25 oz. Silver Standing Lion Guinea

Silver Bars and Rounds

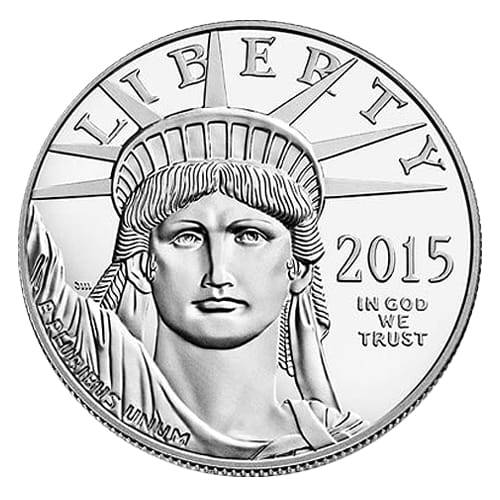

Platinum American Platinum Eagle

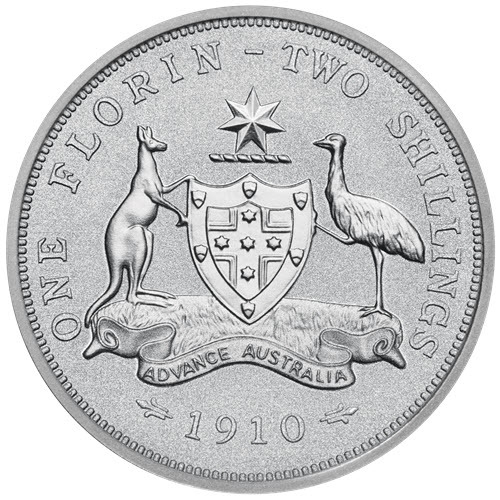

Australian 1/4 oz. Platinum Florin

Platinum Bars and Rounds

Palladium Canadian Palladium Maple Leaf

Palladium Bars and Rounds

The market value of these coins closely follows market spot prices. As such, Birch gold prices fluctuate over time, necessitating consultation with a specialist for accurate pricing information.

The Role of Gold IRA Custodians in Birch Gold Group

To open a gold or silver IRA, one must choose an IRS-approved custodian—an institution qualified to manage your account, ensure tax compliance, and execute account transactions. For precious metals IRAs, a custodian specializing in this field is essential. Birch Gold Group partners with two such custodians—Equity Trust Company and STRATA Trust Company. Both are IRS-approved entities compliant with all IRS requirements for handling IRAs. They carry A+ ratings on BBB and have demonstrated exceptional service and reliability in the industry. With Birch Gold, customers are briefed about these partner custodians, ensuring they make an informed decision.

Precious Metal Depositories and Birch Gold Group

In addition to being a reputable custodian, a reliable storage facility for your precious metal assets is crucial. When partnering with Birch Gold Group, customers are given the choice of partnering with leading industry depositories. Birch Gold Group recommends two storage options: The Delaware Depository

The Delaware Depository, an approved facility, offers world-class physical precious metal storage services to individuals and financial institutions. They comply with IRS requirements, and Birch Gold Group customers can fully utilize their storage services. Additionally, the Delaware Depository provides an insurance package that includes $1 billion 'all-risk' coverage from Lloyd's of London and $100,000 per package of transportation coverage. Customers can choose between two of their secure facilities located in Wilmington, Delaware, or Boulder City, Nevada.

Visiting Your Precious Metals

Customers storing their Birch gold coins, bars, and other precious metals in one of Birch Gold's recommended depositories have the privilege of visiting their assets. Here is what you can expect during a visit: - Contact your custodian and request an in-person depository visitation. - Your custodian will contact your chosen depository regarding your request. - A depository staff member will contact you to set up the visitation schedule. You should prepare your identification credentials for identity verification before and after your visit. - A depository staff member will greet you upon arrival at the facility and lead you to an empty conference room. - Another staff member will retrieve your assets, which are usually stored in a metal container for security and convenience. - You can perform your audits and take pictures upon receiving your precious metals. - After you're satisfied with your stay and asset inspection, your depository assistant will assist you courteously to the exit. Another employee will take your precious metals back to the vault. Please note that not all depositories allow visitation. Some depositories will take pictures of your precious metals for you due to security reasons.

Why Are Investors Diversifying Their Portfolio?

Experts agree that the financial market is now even more fragile than pre-2008. Will your retirement portfolio weather the imminent financial crisis? Threats are many. Pick your poison..

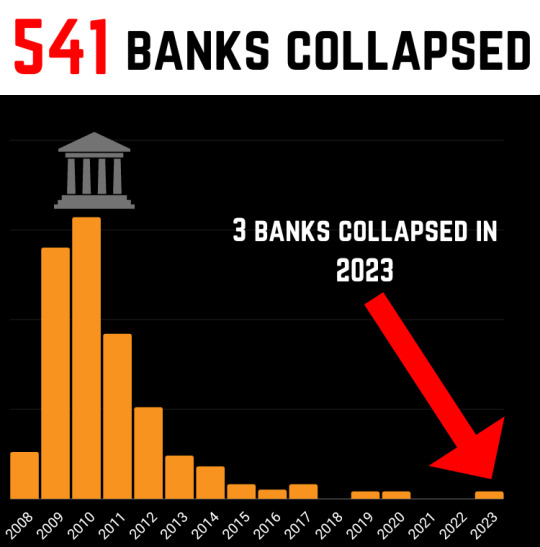

The financial system would be in great peril if one or more big banks fail. "When we get to a downturn, banks won't have the cushion to absorb the losses. Without a cushion, we will have 2008 and 2009 again."

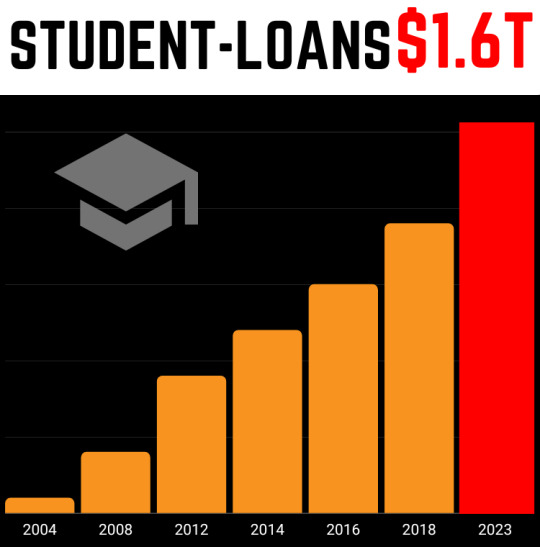

Student debt, which has been on a steep rise for years, could figure greatly in the next credit downturn. "There are parallels to 2008: There are massive amounts of unaffordable loans being made to people who can't pay them"

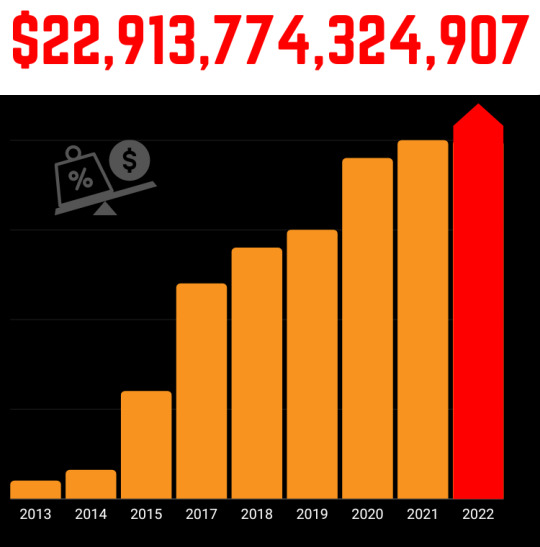

The US national debt has spiked $1 trillion in less than 6 months! "If we keep throwing gas on flames with deficit spending, I worry about how severe the next downturn is going to be--and whether we have enough bullets left ,"

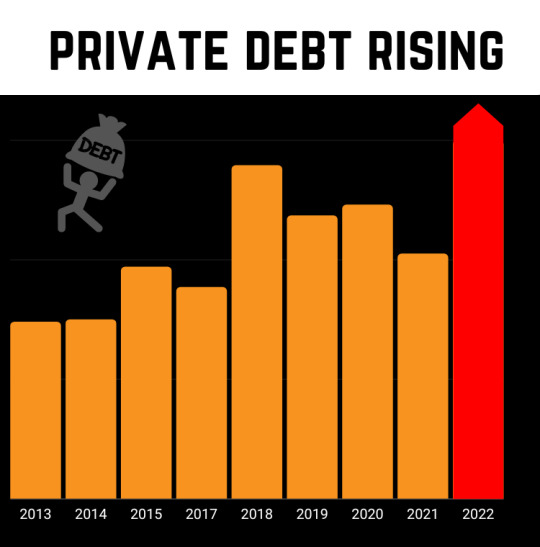

Total household debt rose to an all-time high of $13.67 trillion at year-end 2019. "Any type of secured lending backed by an asset that is overvalued should be a concern… that is what happened with housing." Get in touch with an expert using the button down below:

Birch Gold Group's Minimum Investment for Precious Metals IRA

To open a precious metals IRA with Birch Gold Group, a minimum investment of $10,000 is required. Compared to its competitor Augusta Precious Metals, which requires a minimum of $50,000, Birch Gold's initial investment is more affordable. The rollover process can be initiated if you have an existing account such as a Traditional IRA, Roth IRA, SEP IRA, Simple IRA, or eligible 401(k), without incurring tax penalties. With Birch Gold, an assigned precious metal specialist will guide and help you through the entire process.

Customer Complaints and Pending Lawsuits

As of this writing, there are no pending lawsuits against Birch Gold Group. However, like any gold IRA company, they have received several customer complaints on different online review sites. In each case, Birch Gold Group has been quick to investigate and devise a resolution to the satisfaction of all parties involved.

Birch Gold Group vs. Competitors

Birch Gold Group faces stiff competition from other players in the precious metals industry, such as Patriot Gold Group and Augusta Precious Metals. Here's a comparison of these three companies: Gold IRA CompanyAnnual FeeMinimum DepositAccommodates Precious Metals IRABuyback ProgramGoogle Reviews RatingBirch Gold Group$200$10,000YesYes4.8/5 stars (222 reviews)Patriot Gold Group$200$25,000YesYes4.8/5 stars (71 reviews)Augusta Precious Metals$200 after first year$50,000YesYes4.9/5 stars (296 reviews)

Conclusion: Is Birch Gold Group Legit?

In conclusion, Birch Gold Group is a legitimate and respected player in the precious metals industry. Founded by Laith Alsarraf in 2003, the company has empowered thousands of customers through proper education, quality customer service, and goal-oriented investment planning. With its trusted reputation and commitment to customer satisfaction, Birch Gold Group offers a reliable choice for those looking to invest in precious metals. Before you make any final decision, I recommend checking out our top gold IRA providers. There, you will find out what the industry's best has to offer. Also, it will ensure you make an informed decision. Or, you can check out the best gold dealer in your state below: Each state has its regulations and rules, so we've sorted and found the best Gold IRA company for each state. Find the best Gold IRA company in your state Read the full article

0 notes

Text

How to Choose a Financial Advisor in 2024 - ConsumerAffairs || #FindAFinancialAdvisor News Link Courtesy of FREE Financial and Financial Risk Consultation with Akamai Wealth Management for all Hawaii Residents Whether You're Retiring or Searching for More Income Text or Call 808.464.5292

http://dlvr.it/T7bLqk

0 notes

Text

11 Types of Hearing Tests | ConsumerAffairs

0 notes

Text

ConsumerAffairs Review Service | Buy ConsumerAffairs.com Verified Reviews

Welcome to our ConsumerAffairs Review Service. We are here to help you grow your business and increase your online reputation with verified reviews. ConsumerAffairs is a leading independent review platform providing trusted and unbiased insights from real customers to help consumers make informed decisions. Having verified reviews from ConsumerAffairs on your website is a powerful way to build…

View On WordPress

0 notes

Text

eharmony: Relationship & Actual Love On The App Store

eharmony: Relationship & Actual Love On The App Store

It is very important to do your personal evaluation earlier than making any investment based mostly on your own private circumstances and consult with your individual investment, financial, tax and legal advisers. Harvard Business School graduate, Mark Brooks, has been an expert within the Internet dating business since 1998. He is presently the CEO of Courtland Brooks, a consultancy company for the Internet dating trade, and runs OnlinePersonalsWatch.com.

To be a part of, customers should fill out a comprehensive questionnaire. EHarmony conducts all searches for its members – users do not have the choice of searching or searching profiles themselves. EHarmony generates matches based on a compatibility take a look at and profile standards that members fill out. The site sends e mail alerts when new matches are found. When it started, eHarmony did not offer same-sex matches; however from 2009 through 2019 the company supplied service by way of a separate platform, Compatible Partners.

Rankings And Reviews

four,183,308 critiques on ConsumerAffairs are verified. In 2014, eHarmony was criticized by the National Advertising Division of the Better Business Bureau over claims the company had made about their charges of success. This occurred after Match.com challenged claims made by eHarmony about the two corporations' relative success.

Give us a attempt when you’re ready for something real. What occurs when you apply scientific research to courting behavior? That’s why every 14 minutes, someone finds love on eharmony. Both eHarmony and Match supply their own statistics. EHarmony promotes that its site is responsible for 5 p.c of all U.S. marriages. Of couples who met on a relationship site then married, 25 % met on eHarmony.

Matchcom Vs Eharmony

I am sixty seven years old and it was late at evening, so I thought, that sounds good so I put in my bank card and paid the $69.ninety on 9 Jan 2023. I receive my credit card affirmation by way of e-mail shortly after I permitted the cost, and it showed the value of $395.forty all in the identical font. I instantly wrote back to eHarmony saying that I felt their advertising was deceptive and asked that they cancel my service and refund the money. Match promotes that one date in 1,369 leads to marriage. Of couples who met on a relationship web site, 30 p.c met on Match. 42% of the matches lead to dates, and 35% of the matches end in relationships of three or more months.

Of marriages that began on a dating web site, 3.86 percent of eHarmony's lead to divorce, the bottom proportion of all sites. My frustrating with eHarmony was with their computerized renewal course of and the inability to cancel it. Once I was able to get someone from their customer eharmony worth it service area to respond it was too late to cancel. They renewed at a lot larger quantity than I had originally paid and were not willing to negotiate a shorter time frame nor regulate the amount. It is estimated that about 20% of eHarmony applicants are rejected.

Eharmony

He prides himself on being a New Media Futurist and could be reached at LinkedIn. Our moderators read all reviews to confirm high quality and helpfulness. Your relationship journey on our relationship app begins with the Compatibility Quiz. Because we get to know you better so we will match you better.

Affected members had been despatched e-mails by the corporate requesting them to change their password instantly. Please expand this text with properly sourced content material to fulfill Wikipedia's quality standards, occasion notability guideline, or encyclopedic content policy. For extra data, see the developer’s privacy policy. This replace contains bug fixes and quality improvements.

Feedback: Matchcom Vs Eharmony

The FTC and FBI wants to investigate these idiots. They are crooks and liars and stealing folks's cash. It’s a catch 22 and the collection agency is ready within the sidelines to Badger you for money.

Match profiles embrace basics, corresponding to age, top, hair color, eye colour, physique sort and ethnicity. Profiles also embody sexual orientation, relationship standing, whether or not the member has youngsters, whether they smoke or drink, and their location. Members write an open-ended essay about themselves and their match. Profiles might embrace interests, train habits, hobbies, political opinions, education, religion, background values, and whether or not the member has and even likes pets. Users could add as a lot as 26 pictures and even import photos from Facebook.

0 notes

Text

FIDELITY 401K GOLD IRA

Best Gold Ira Companies Of 2022 - Consumeraffairs

There is no doubt that Augusta can assist any American investor, who wants to secure his future life of retirement, comprehend today state of the economy, and likewise why and how to diversify with physical silver and gold. It is among the most crucial factors, in addition to unbelievable track record and attractive prices, to select Augusta over others. You can't lose with Augusta if you are believing of opening a Gold IRA for your retirement portfolio. Gold IRA: This is a retirement investment option with tax benefits enabled by the internal revenue service. In essence, it is a "self-directed" investment, allowing you to manage your own properties and make the most of the numerous benefits that silver and gold financial investments use. It has to be administered by a custodian and its storage needs to be in a safe and secure facility. Augusta offers its customer with the physical silver and gold for this sort of IRA. It likewise offers the services that assist you to not just discover and open your account, however likewise assist you on how to deal with the custodian along with storage facility.

Non-IRA Silver And Gold Cash Accounts: This allows financiers to buy gold and silver coins and keep them at any location of their choice. Over time, these coins value in worth, improving the wealth status of the financiers. Although the business offers silver and gold coins, they work hand in hand with storage centers that provide you with safe storage for these coins too.

Best Gold Ira Companies Of 2022 - Consumeraffairs

A silver or gold IRA has the requirement that your account be administered by a custodian. Augusta has tie-ups with a variety of custodians - which offers you self-confidence in the business's way of operating. Augusta in fact helps you, on completion, with 95% of the documents. Moreover, in contrast to some other gold IRA service providers, it continues dealing with you so that you can interact much better with your custodian subsequent to your purchase of silver and gold.

The Top 7 Best Gold IRA Companies of 2022 Reviewed Vashon-Maury Island Beachcomber

The business likewise offers, approximately a limit of 10 years, fee-free custodial services along with storage. Thus, it can be stated that Augusta's fee structure is very competitive. Further, the business's compliance department makes sure that you are informed on exactly what items you are paying for and just how much. * We might receive a referral fee from a few of the business featured in this article. This is not a monetary suggestions article. Refer to an expert for investment suggestions. (Ad) Buying gold is among the very best ways to secure your cost savings and diversify your retirement portfolio. Gold has stable development and little volatility compared to the stock exchange, making it the ideal hedge against inflation. The buyback program lets you offer your gold bullion back to American Hartford Gold (or another business) and save money on liquidation charges. American Hartford Gold has no charge for establishing a gold IRA nor charges for shipping your gold to the depository. It covers insurance coverage and tracking, however you'll likely require to pay yearly maintenance charges and storage charges if your investment is in a depository.

Best Gold Ira Companies Of 2022 - Consumeraffairs

The Top 7 Best Gold IRA Companies of 2022 Reviewed Vashon-Maury Island Beachcomber

The Top 7 Best Gold IRA Companies of 2022 Reviewed Vashon-Maury Island Beachcomber

youtube

American Hartford Gold is a good choice for financiers who want to diversify their wealth portfolio with gold financial investments. # 4. Oxford Gold Group: Best Customer Care California-based Oxford Gold Group has been running since 2018, and the business's creators have more than twenty years of experience in the valuable metals market. https://fidelity401kgoldira.blogspot.com/2022/12/fidelity-401k-gold-ira.html noble gold ira rollover wells fargo gold ira Best Gold IRA Companies 2022 https://themouldremoversteam383.blogspot.com/ https://themouldremoversteam383.blogspot.com/2022/12/the-mould-removers-team.html https://buildersbusinesscoach282.blogspot.com/ https://buildersbusinesscoach282.blogspot.com/2022/12/builders-business-coach.html https://persianrugrepairmissionviejo602.blogspot.com/

0 notes

Text

AI will act as a catalyst in India's development journey: Piyush Goyal

Union Minister for Commerce and Industry, Consumer Affairs, Food, and Public Distribution and Textiles, Piyush Goyal on Friday said if India truly aspires to be a developed nation by 2047, as articulated by Prime Minister Shri Narendra Modi in his Independence Day speech on 15 August 2022, Artificial Intelligence will help the country reach that destination and bring prosperity to every citizen of this country.

He was addressing the 3rd edition of the Global Artificial Intelligence Summit and Awards.

For more details: https://yourstory.com/2022/10/piyush-goyal-artificial-intelligence-catalyst-india-development/amp

0 notes

Text

American Hartford Gold Complaints

What is American Hartford Gold?

American Hartford Gold is a precious metals dealer in Los Angeles, California. Their address is 11900 W Olympic Blvd # 750, Los Angeles, CA 90064. Additionally, they can be reached at +1 866-379-0076. Since entering the market in 2015, AHG has experienced rapid growth. On several review websites, the company has received a 5/5 rating from more than 500 clients. The extensive range of IRA-approved products that AHG offers has something to offer for everyone.

The company also provides door-to-door delivery of its bullion products. The three-step enrolling method offered by the organization is uncomplicated and quick. AHG has also received support from a number of well-known figures, including Megyn Kelly, the Hodge Twins, Rob Carson, Rick Harrison (of the Pawn Stars), and Liz Wheeler. This precious metals dealer focuses on providing customers with custom solutions. On their website, they also provide a variety of resources for novice investors to learn more about investments in precious metals. For instance, you may watch the prices of gold and silver using one of their several charts.

Reviews of American Hartford Gold frequently praise the organization's emphasis on client education and openness. You can learn more about this business by reading the American Hartford Gold Reviews.

American Hartford Gold Reviews & Complaints

Hundreds of reviews of American Hartford Gold can be found online. I enjoyed that the bulk of them were positive about the company, which has achieved five-star ratings on all review sites. American Hartford has received a few complaints on (BBB and Trustpilot) American Hartford has received several unresolved complaints from customers. There are also several unresolved negative reviews on different platforms. Our #1 rated gold IRA company has ZERO unanswered complaints on BBB. American Hartford has established a strong brand for a corporation that has only been operating for around 6-7 years. Here is a more thorough summary of the reviews I located for American Hartford Gold on several websites: American Hartford Gold BBB: Based on more than 300 reviews, the American Hartford Gold BBB page has an A+ rating and a 4.95 out of 5-star average. Their excellent BBB rating demonstrates the company's moral character and dedication to prioritizing the needs of its customers.

Additionally, the business strongly advises customers to express their complaints with customer assistance via the page. So, if you run into any issues, you can get in touch with them right away and have them fixed. American Hartford Gold ConsumerAffairs: There are more than 90 reviews of American Hartford Gold on ConsumerAffairs. The company has a 4.9 out of 5-star rating based on these reviews.

The politeness and professionalism of AHG representatives are mentioned by reviews most frequently. The business is also quite active on the platform.

All reviews are addressed, which is a wonderful feature. The business's customer service is undoubtedly responsive and active. American Hartford Gold Trustpilot: On Trustpilot, the IRA company has over 1,000 reviews and a stellar 5 out of 5-star rating. This is a huge achievement for any bullion dealer let alone a relatively new firm.

More than 90% of the 1000+ reviews give it 5 stars, while only 8% give it 4 stars out of 5. Reviews of American Hartford Gold on this page mentioned how their agents are very accommodating and willing to go above and above to assist customers.

Linda, for instance, praises the firm's excellent service and expertise. She also says that the business has excellent customer service and that she would suggest it to anyone. American Hartford Gold Complaints: The business has had a lot of good customer feedback, but it has also had its fair share of complaints. There are many complaints against American Hartford Gold, as I discovered when searching for them. On their BBB profile, it is noted that they have only resolved 11 of the 22 complaints they have received.

The majority of complaints are about delivery problems. For instance, one customer conducted an IRA rollover and adhered to all of their instructions. The anticipated bonuses, though, never materialized.

Some concerns about American Hartford Gold centre on the significant premium they demand its precious metals. However, AHG's customer service team is quite proactive. They reply to these issues right away and have been able to successfully resolve the majority of them.

Conclusion

To find a detailed analysis of the company, I suggest checking out American Hartford Gold Reviews. Opening a precious metals IRA is a major decision. That's why I suggest checking out our top gold IRA providers list. There, you can find the best precious metals dealer in your state and choose accordingly. Also, the list will help you understand what the industry's best has to offer. Also, it helps with what you might miss out on. If you're unfamiliar with gold IRAs, check out this free guide: Find the best Gold IRA company in your state Read the full article

0 notes

Text

How to get your own book published: a step by step guide

http://dlvr.it/SWJLrg

0 notes

Text

How to prepare your finances for another recession: 'We think a hard landing will ultimately be unavoidable' Two years after the quick, sharp pandemi... Read the rest on our site with the url below https://worldwidetweets.com/how-to-prepare-your-finances-for-another-recession-we-think-a-hard-landing-will-ultimately-be-unavoidable/?feed_id=158874&_unique_id=6262be04a1391 #article_normal #banking #BankingCredit #business #BusinessConsumerServices #CampEIndustryNewsFilter #community #ConsumerAffairs #ConsumerProducts #consumerservices #ContentTypes #corporate #CorporateIndustrialNews #credit #dealing #EconomicNews #epidemics #FactivaFilters #FinancialInvestmentServices #FinancialServices #generalnews #governmentpolicy #Health #industrialnews #InfectiousDiseases #investing #InvestingSecurities #labor #LaborPersonnelIssues #LandTransport #Lifestyle #living #LivingLifestyle #logistics #MedicalConditions #NovelCoronaviruses #outbreaks #OutbreaksEpidemics #PersonalFinance #personnelissues #political #PoliticalGeneralNews #railtransport #regulation #RegulationGovernmentPolicy #RespiratoryTractDiseases #securities #securitybrokering #SecurityBrokeringDealing #society #SocietyCommunity #Transportation #TransportationLogistics

#Business#article_normal#banking#BankingCredit#business#BusinessConsumerServices#CampEIndustryNewsFilter#community#ConsumerAffairs#ConsumerProducts#consumerservices#ContentTypes#corporate#CorporateIndustrialNews#credit#dealing#EconomicNews#epidemics#FactivaFilters#FinancialInvestmentServices#FinancialServices#generalnews#governmentpolicy#Health#industrialnews#InfectiousDiseases#investing#InvestingSecurities#labor#LaborPersonnelIssues

0 notes