#Companies Merger

Explore tagged Tumblr posts

Text

Mergers and Acquisitions (M&A) and cross-border restructurings are gaining tremendous significance for businesses seeking inorganic growth, recovery, and efficiency. Given the dynamic and complex nature of the statutory framework governing the Mergers and Acquisitions Transactions, it is imperative that these transactions should be structured appropriately in a tax and regulatory-compliant manner.

At R.K Associates, we provide our mergers and acquisitions services and transaction tax advisory services in which our experts understand your business, anticipate your needs and come up with robust tax solutions that help you achieve business objectives ensuring compliance and efficiency.

#mergers and acquisitions#M&A Advisors#Mergers and acquisitions conultants#Mergers#Ventures#Companies Merger

1 note

·

View note

Text

cute thing I have learned during this conference: a couple different players are working in the quantum computing space, and specifically working on encryption protection algorithms to defend against attacks---these algorithms are called "kyber" and "dilithium" respectively.

nerds.

#this is like a previous conference I attended where they discussed different merger&acquisition concepts#in terms of different courses of food. so there was the amuse-bouche the main course etc.#I remember that so well! a triumph of messaging really#.....also I know a lot more about technology than I thought I did. kind of impressed by myself#that I can at least keep up with discussions of encryption standards and interoperability/data cleansing etc.#no wonder the company has to secretly manipulate you

58 notes

·

View notes

Text

Kuda-gitsune of Limited Liability

磁癪折目 Jishaku Orime

Species: Kuda-gitsune (tube fox) Ability: Capable of making any deal sound beneficial

A youkai fox from the outside world. During the Meiji period, while other youkai saw the end of their way of life, Orime saw opportunity, and when whispers of the Great Hakurei Barrier's creation began to spread, she took off to the Outside World to live among humans. As Japan modernized, she took advantage of the rapid growth of business, and made a tidy enough living off of her business partners' ill fortune that she managed to remain a youkai for three-quarters of a century. However, after events in the 20th century, Japan's economy was decimated, and Orime looked for opportunity elsewhere... and where better than the much bigger, much more successful country that had just won the war? Orime bounced between industries, leaving questionable decisions in her wake everywhere she went, but eventually found the right mix of credulity and venture capital in the science and technology sector. However, following a certain incident involving the demise of a very old and very storied company in the early-mid 2010s, she found herself pursued by a terrifying creature called the Securities and Exchange Commission, and fled back to Japan, where her lack of industry connections nearly led to her being forgotten entirely. After practically begging an old mathematician friend of hers for entry, she wormed her way into Gensokyo, and has been causing economic chaos and stalled scientific development (the latter of which youkai find very helpful) since.

#touhou#orime jishaku#幻#my ocs#i suppose#the dots on her dress are meant to be reminiscent of the Agilent Technologies logo#as the company she caused the demise of was Varian (through merger and mismanagement)#thus why she has the NMR tube#happy foxgirl friday also

165 notes

·

View notes

Text

also I was reading bl and ok. to speak frankly, I enjoy bl with smut infinitely more when the writer adds any degree of personality and weirdness to it because then it gets funny and interesting. the main character was talking about his experience afterwards and the love interest was like. you sound like you’re reviewing a restaurant. are you kidding me that’s hysterical

#orlbs#misclb#it was a weird one but not like in the unhinged way#no point of ritual death which meant the romance felt like it had equal billing with the corporate developments#of a merger for rival pharmaceutical companies

12 notes

·

View notes

Text

new revival wishlist item is, if we get more mom backstory, i wanna see her as a child. i want her to be old money, like “her parents own a space emerald mine” money, still totally unsympathetic from birth, acting like veruca salt except with twenty times as much swearing. maybe she inherited the “mom” label or maybe, somehow, she was called “mom” as a child. maybe they called her “daughter.” she lashes out at her parents like she lashes out at her sons now. i want her to reprogram all the robot merch to backfire horribly cuz she’s mad she didn’t get a candy bar. that sort of shit.

#futurama#mom#mom futurama#hulurama predictions#carol miller#also xmas story confirms the friendly robot company was not called moms in 2801#(i presume she wasnt born yet even if she is balls old now)#so im curious what happened that led to a merger

20 notes

·

View notes

Text

realizing a lot of guns are in the 100-2k usd range is crazy. Like that’s an amount of money but not that expensive, especially on the lower end that’s scary man.

#‘’fishy why the fuck are you looking at guns’’ well u see I wanted to draw some Danny phantom fanart. and it turns out there’s a gun#company called ‘’grey ghost precision’’#they have a swag section in addition to the pistol and rifle sections#it is 2 pullover hoodies a single zip up hoodie and a sold out ineligible-for-backorder hat#so u know. very corporate swag. yearly bonus from a company u hope is killed by its 6flags merger type beat#anyways yeah not a gun guy. trying to draw ghost fighting based guns when idgaf is a challenge

5 notes

·

View notes

Text

That feeling when all your least favorite coworkers are the ones hit by layoffs.

#company did a merger acquisition thing awhile back and they're just getting around to eliminating duplicate roles#i dislike these people because they're annoying. i don't know if they're competent#worker solidarity and all but also#don't let the door hit you where the good lord split you#see you never

13 notes

·

View notes

Text

god i fucking hate capitalism i hate the united states government why is lobbying allowed like why is there Government Endorsed Bribery. fucking hell

#im serious this country is fucked we need to have another fucking revolution#if any Legal People see this: i am joking i love america and capitalism and i think revolution is bad#GOD#i hope all boeing CEOs post McDonnel-Douglas merger explode and get hit by a million hammers#yes this mini anticapitalist rant was inspired by airplanes#im serious boeing needs to go through a complete revamp or just be shut down altogether at this point#its profit over people which is. Not Good when the company in question makes machines for mass transport#boeing used to be an engineering driven company and then the mcdonnel douglas merger happened#anyways stupid rant over#janet rambles

1 note

·

View note

Text

A huge piece of this problem on the animation side of things is because the streaming bubble is bursting and companies are losing billions of dollars for it. Execs are outright saying they don't want to gamble on what they call "original IPs" anymore, they know reboots and remakes of existing IP will sell so that's all they want. Even if you have an idea and you think you can pitch it to a big studio: They don't want it. It's a new idea, new characters, new worlds, that's not a gamble they want to take, they don't know if there's an audience for it or how big it may be. They're desperately trying to make up all the money they're losing on streaming, and they only want to spend money on the most profitable projects possible.

If you have an original idea, indie is currently your only option. Nobody can tell your stories but you. Please don't wait for an opportunity and make it yourself if you have the means to!!!

I am being so serious when I say: if you have the financial and time privilege to get a group of friends together and make an indie project, PLEASE do. Indie games, indie animations, indie comics etc etc

the art industries are kind of in the shitter. It’s not so much because of AI (though that doesn’t help) but because studios just aren’t hiring people and funding projects anymore. People who’ve been in the industry for decades are finding themselves struggling, and once you have a mortgage or kids it’s harder to do something as risky as making something on your own.

completing projects is hard. it takes a lot of time and effort, and most people can’t afford it. so if you CAN afford to make art, even at the risk of no financial gain, I strongly encourage you to be as resilient as you can. We’re at a point where these industries are not going to turn around by themselves, and waiting for jobs to open up again in order to get experience and portfolio work might not be realistic.

people have been making art and telling stories longgggg before we were getting paid for it, and people aren’t going to stop just because no one has hired them to do so.

for everyone else: support indie artists when you can!!!! That person who made that cool indie game or youtube animation or webcomic might be doing this full time! your support might be the only reason they’re able to keep doing it.

and if you have already started an indie project: you’re so brave and I’m very proud of you!!! in fact, drop a link to it in the reblogs if you want! 👇

#frankly the game and comic industries aren't looking much better#the gaming industry seems to be suffering a lot of mergers and consolidating as well though i'm not sure of the cause#and when you merge identical companies there's a lot of suddenly redundant departments and a lot of layoffs#capitalism kills art etc etc

24K notes

·

View notes

Text

#Corporate Lawyers in Delhi#Corporate Litigation Lawyers in Delhi#Insolvency Bankruptcy Lawyers in Delhi#Arbitration Lawyers in Delhi#Private Equity Mergers & Acquisitions Investment Lawyers in Delhi#Technology Data Protection Fintech Lawyers in Delhi#Company Commercial Litigation Lawyers in Delhi#Investment Fraud Lawyers in Delhi#Investor Shareholder Litigation Lawyers in Delhi#Bail Criminal Defense Lawyers in Delhi#White Collar Crime Lawyers in Delhi#Startup Investor Lawyers in Delhi#Banking Finance Lawyers in Delhi

0 notes

Text

サブウェイがワタミ傘下に

私も好きで時々食べに行くアメリカ発のサブマリンサンドイッチのチェーン店、サブウェイですが、飲食店大手のワタミが日本での事業を展開すると発表しました。 サブウェイが日本に進出したのは1991年で、サントリーホールディングスが子会社を設立してマスターフランチャイズ契約を締結して事業を開始していました。この契約が2016年に終了してからはオランダに本社を置くSubway International…

0 notes

Text

Find the Right Business Investor for Exit/Fundraising Needs

Are you a business owner looking to connect with serious investors?

IndiaBizForSale has a network of 40,000+ business investors actively seeking investment or acquisition opportunities across 205+ industries and 1300+ locations.

Whether you're planning for an exit or need funding to scale, we can help you find the right investor.

Don't miss the opportunity to match with investors aligned with your business goals.

Join IndiaBizForSale today and take the next step towards your business success: https://www.indiabizforsale.com/business/investment-in-india

0 notes

Text

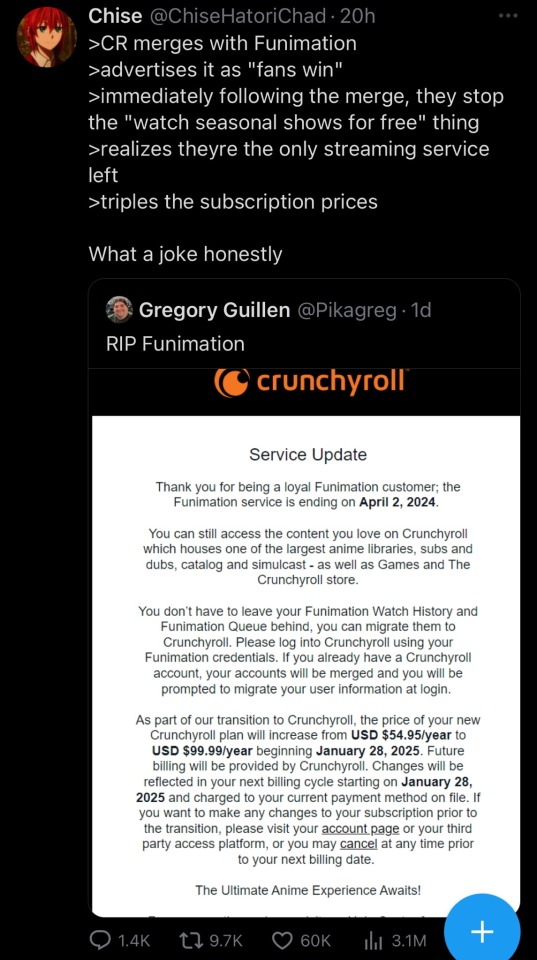

Reblogging again because, uh, yeah.

The tidbit about Funimation digital purchase-to-own options going away reminds me of what happened with Jmanga back in the day.

The site was launched in 2011 as a manga-exclusive streaming service. Like, a way to get interesting manga titles to western audiences. It had a very janky payment model (you had a subscription that gave you points, which you then used to buy books), but it was sponsored by a number of major Japanese publishers and had some titles nerds such as myself might like. As a young fan with a little disposable income, I bought into that hype and paid for more than one title on it. (Poyo Poyo was one of them, Hoshi no Samidare was another.) Sure, the purchases were going into your jmanga library and you couldn't download a pdf, but what's the difference? It wasn't like the site was going away, right?

…You know how this story ends. Site didn't even last 3 years, shuttered in March 2013, and all those digital books you digitally owned? Suddenly you didn't own 'em so much. Not the only time the internet taught me that media only owned via streaming or DRM aren't really owned at all.

I still have a few DVDs and a few books of manga on my shelf that I bought years before Jmanga then, but I got no copies of those books digital or otherwise. I miss 'em, too.

Oh…. Well, it’s over for Crunchyroll I guess

#crunchyroll#The enshittification of streaming continues#Reading this as I watch the super bowl “live” stream on my paramount plus account#That is like a full minute behind the FM radio broadcast#Obviously this sucks for fans#but the general merger also stank for the companies actually trying to produce the anime#Fewer licensors means fewer bidders on popular titles#means less money going to the production teams that can be used to hire animators#and so on#anyways

87K notes

·

View notes

Text

Cross Border Merger and Acquisition – An Accelerative Approach

Ministry of Corporate Affairs (MCA) has recently vide notification dated 13th April, 2017 has notified Section 234 of the Companies Act, 2013 (‘Act’) which deals with Merger or amalgamation of company with foreign company now allowing the merger or amalgamation of Company with foreign company. The corresponding rules have also been notified in consultation with Reserve Bank of India (RBI) for implementation of the said section. MCA has issued the Companies (Compromise, Arrangements and Amalgamation) Amendment Rules, 2017 inserting Rule 25A and Annexure B in prescribing rules in the Companies (Compromise, Arrangements and Amalgamation) Rules, 2016 in relation to operation of section 234.

Regulatory Compliances

Section 234 of the Act provides for amalgamation of a foreign company incorporated in notified jurisdiction with a company incorporated under the provisions of the Act or under the provisions of the earlier Companies Act, 1956 and vice versa. It also provides that both inbound merger and outbound merger should be subject to prior approval of RBI and application of the other provisions of Chapter XV of the Act. Section 394 of the Companies Act, 1956 allowed inbound mergers only, there was no provision for outbound merger under the Companies Act, 1956.

Further, section 234 provides that a Scheme prepared for inbound merger/outbound merger may inter alia provide for payment of cash or issue of depository receipts or both as consideration to the shareholders of the merging company. For the purpose of Section 234, ‘Foreign Company’ means any company or body corporate incorporated outside India whether having a place of business in India or not.

Rule 25A prescribes as follows:

A foreign company, incorporated in any jurisdiction outside India, may merge with a company incorporated in India (“inbound merger”).

A company incorporated in India may merge with a foreign company incorporated in jurisdictions specified in Annexure “B” (“outbound merger”).

Both inbound merger and outbound merger require prior approval of RBI.

Both inbound merger and outbound merger should comply with the provisions of section 230 to 232 of the Act.

Concerned companies should file application with National Company Law Tribunal (NCLT) under provisions of section 230–232 of the Act and Rule 25A for obtaining approval of the NCLT.

In relation to outbound merger, the transferee company should ensure that the valuation conducted by valuers (being members of a recognized professional body in the jurisdiction of the transferee company) is in accordance with internationally acceptable principles of accounting and valuations and a declaration to that effect is filed with the RBI.

Annexure “B” specifies following jurisdictions in relation to outbound merger:

i. A jurisdiction whose securities market regulator is a signatory to the International Organisation of Securities Commission’s Multilateral Memorandum of Understanding (Appendix A) or a signatory to a bilateral MoU with Securities and Exchange Board of India; (or)

ii. A jurisdiction whose Central Bank is a member of the Bank of International Settlements (BIS) And

iii. A jurisdiction, not identified in the public statement of the Financial Action Task Force (FATF) as:

a) A jurisdiction having a strategic anti-money laundering or combating the financing of terrorism deficiencies to which counter measures apply; or

b) A jurisdiction that has not made sufficient progress in addressing the deficiencies or has not committed to an action plan developed with the FATF to address the deficiencies.

List of jurisdictions covered under Annexure “B” indicate that outbound mergers seem to be possible with foreign companies incorporated in jurisdictions such as Mauritius, Netherlands, Singapore, Cayman Islands, Abu Dhabi, DIFC (Dubai), UAE, United Kingdom, United States etc.

Rolling out draft Regulations for Cross Border Mergers by RBI

RBI has proposed fresh Regulations under Foreign Exchange Management Act, 1999 for Cross Border Mergers on April 26, 2017 and has Invited comments from stakeholders. The draft guidelines proposed to be issued on cross border merger transactions pursuant to the Rules notified by Ministry of Corporate Affairs through Companies (Compromises, Arrangements and Amalgamation) Amendment Rules, 2017 on April 13, 2017. The Reserve Bank of India has proposed these Regulations under the Foreign Exchange Management Act, 1999 (FEMA) in order…

Read More: https://www.acquisory.com/ArticleDetails/47/Cross-Border-Merger-and-Acquisition-%E2%80%93-An-Accelerative-Approach

0 notes

Text

Tata Steel Workers Secure 'Good Bonus' Despite Profit Decline

Union president hails ‘handsome’ agreement amid challenging market conditions Key Points: • Tata Workers Union negotiates favorable bonus for 2023-24 despite profit drop • 27,454 employees to benefit from ₹303.13 crore bonus agreement • Bonus formula set for revision next year based on company profits JAMSHEDPUR – Tata Steel workers secure a ₹303.13 crore bonus for 2023-24, despite a 55% drop in…

#बिजनेस#bonus agreement#business#company merger#employee benefits#Jamshedpur#profit-sharing#Sanjeev Choudhary#Steel Industry#Tata Steel#Tata Workers&039; Union

0 notes

Text

HELLO???

#context:#suit guy visited his old job at the board game store#and played a game with the girls about stock trading and mergers#which is his current job#he started venting about how he made a fucky wucky and lost the company 3 million dollars and got fired#the girls are all like. 15#and now he has to work at his parents' soba shop#after school dice club

0 notes