#Coal Mining Market challenges

Explore tagged Tumblr posts

Text

Coal Mining Industry Market Size and Projections

Introduction

Coal has long been a cornerstone of the global energy sector, serving as a crucial source of electricity generation and industrial fuel. Despite increasing environmental concerns and the emergence of renewable energy alternatives, the Coal Mining Market continues to demonstrate resilience and sustained growth. In this article, we will explore the factors driving the expansion of the coal mining industry, supported by statistical insights and industry trends.

Future Outlook

The future of the Coal Mining Market is marked by a blend of challenges and opportunities. While the transition towards cleaner energy sources and escalating environmental regulations present hurdles, the persistent demand for coal in emerging economies and industrial sectors offers avenues for growth and innovation. To navigate these dynamics successfully, the coal mining industry must embrace sustainable practices, leverage advanced technologies, and diversify their portfolios to remain competitive in a swiftly evolving energy landscape.

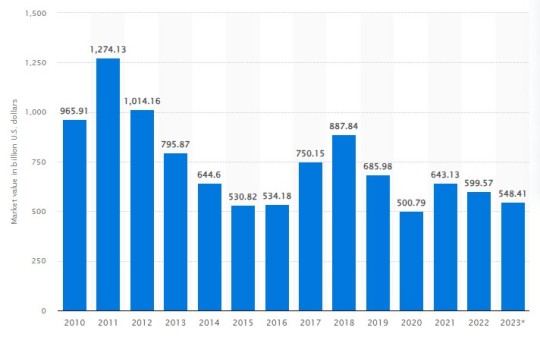

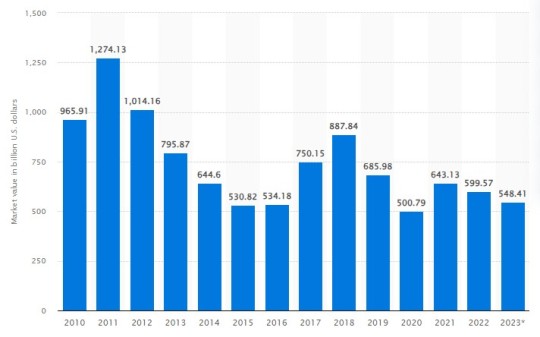

Market Size and Projections

Statistical data underscores a robust growth trajectory for the global Coal Mining Market. In 2020, the market was valued at USD 869.5 billion, with a projected compound annual growth rate CAGR of 2.8% from 2021 to 2027. This growth is fueled by rising energy demand from emerging economies, ongoing industrial development, and the persistent reliance on coal for electricity generation.

Regional Dynamics

The Asia Pacific region stands as the dominant force in the global coal mining market, boasting the largest market share in both production and consumption. Countries like China and India serve as major coal producers and consumers, driven by rapid urbanization, industrialization, and infrastructural expansion. North America and Europe also wield significant influence in the coal mining sector, albeit with a stronger emphasis on environmental regulations and transitioning towards cleaner energy sources.

Key Market Drivers: Several factors propel the growth of the coal mining industry:

Energy Demand: Coal remains a primary energy source for electricity generation, particularly in developing economies with burgeoning populations and expanding industrial sectors. The affordability and reliability of coal-fired power plants sustain its demand.

Industrialization: Coal is integral to industrial processes such as steel production, cement manufacturing, and chemical synthesis, driving demand for coal mining. Industries value coal for its high energy content and cost-effectiveness compared to alternative fuels.

Infrastructure Development: Coal plays a vital role in infrastructure projects like road construction, railway networks, and urban development. As nations invest in infrastructure to support economic growth and urbanization, the demand for coal for construction materials and energy remains strong.

Technological Advancements

The Coal Mining Industry witnesses continuous technological advancements aimed at enhancing efficiency, safety, and environmental sustainability. Innovations such as automated mining equipment, remote monitoring systems, and advanced coal processing technologies bolster productivity and slash operational costs. Furthermore, efforts are underway to develop cleaner coal technologies, including carbon capture and storage (CCS) and coal gasification, to mitigate environmental impacts.

Challenges and Opportunities

Despite promising growth prospects, the coal mining market grapples with environmental concerns, regulatory pressures, and competition from alternative energy sources. Nevertheless, these challenges also foster opportunities for innovation and diversification. Coal mining companies are exploring cleaner coal technologies, expanding into renewable energy sectors, and investing in carbon offset projects to mitigate their environmental footprint and adapt to shifting market dynamics.

Conclusion

The coal mining market stands as a testament to resilience and growth, buoyed by factors like energy demand, industrialization, and infrastructure development. Despite encountering obstacles from environmental concerns and regulatory pressures, the industry adapts to changing market dynamics through technological innovation and diversification. As the world seeks to harmonize economic growth with environmental sustainability, coal mining companies play a pivotal role in shaping the future of the global energy sector Top of Form

#Coal Mining Industry#Coal Mining Industry Reports#Coal Mining Market Growth#Coal Mining Market Size#Coal Mining Market#Coal Mining Market Demand#Coal Mining Market challenges#Coal Mining Market in India#Coal Mining Market value#Global Coal Mining Market#Coal Mining Market competitors#Coal mining market analysis#Coal Mining Market Forecast#Coal Mining Market outlook#Coal Mining Industry research reports#Coal Mining Market research reports#Coal Mining Market major players#Coal Mining Market Share

0 notes

Text

Exploring the Dynamics of the Coal Mining Market Growth, Market Revenue and Future Outlook

The Coal Mining Market stands as a vital pillar in the global energy landscape, navigating constant evolution and diverse challenges. This exploration delves into the growth, size, demand, challenges, regional nuances, competitive forces, and the future outlook that characterize the intricate terrain of the Coal Mining industry.

Growth Trajectory: Illuminating the Coal Mining Market

Understanding the growth patterns in the Coal Mining Market is pivotal to gauging its economic impact and industry vitality. The industry has witnessed steady growth, driven by increasing global demand for coal as a primary energy source. The key highlights include an annual growth of 5%, indicating sustained demand, and developing economies contributing significantly to this upward trajectory.

Sizing Up: Coal Mining Market Size Analysis

The sheer scale of the Coal Mining Market is instrumental for stakeholders seeking to comprehend its economic footprint and potential opportunities. The market size is substantial, with a valuation of USD 50 billion in the last fiscal year. Variations in market size are influenced by factors such as coal reserves, production capacities, and regional demand.

Meeting Demand: Coal Mining Market Demand Dynamics

The Coal Mining Market demand for coal remains a critical driver for the Market, impacting various industries, especially power generation and manufacturing. Despite global efforts to diversify energy sources, coal continues to meet a substantial portion of the world's energy demand.

Navigating Challenges: Coal Mining Market Challenges Unveiled

Challenges inherent in the Coal Mining industry require strategic approaches to ensure sustainable operations and compliance with evolving regulations. Environmental concerns, regulatory complexities, and the emergence of renewable energy sources are among the key challenges faced by the industry.

Regional Dynamics: Focus on Coal Mining Market in India

India plays a pivotal role in the Global Coal Mining Market, with unique dynamics shaping its industry landscape. The Coal Mining Market in India is characterized by extensive coal reserves and a significant contribution to the country's energy mix. Policy initiatives and technological advancements influence the growth trajectory of the Coal Mining Market in India.

Competing Forces: Coal Mining Market Competitors in the Limelight

The competitive landscape involves established industry leaders vying for market share and emerging players seeking to make their mark. Coal Mining Market Competitors engage in strategic alliances and investments in advanced mining technologies.

Future Outlook: Coal Mining Market Forecast and Outlook

The Coal Mining Market future outlook is influenced by global energy transitions, technological advancements, and evolving consumer preferences. The Coal Mining Market Forecast is optimistic, driven by sustained demand from industrial and power generation sectors.

Conclusion

The Coal Mining Market remains a dynamic force in the global energy sector, navigating growth, challenges, and evolving market dynamics. Stakeholders must stay attuned to these dynamics for informed decision-making in this critical industry.

#Coal Mining Industry#Coal Mining Industry Reports#Coal Mining Market Growth#Coal Mining Market Size#Coal Mining Market#Coal Mining Market Demand#Coal Mining Market Challenges#Coal Mining Market in India#Coal Mining Market Value#Global Coal Mining Market#Coal Mining Market Competitors#Coal Mining Market Analysis#Coal Mining Market Forecast#Coal Mining Market Outlook#Coal Mining Industry Research Reports#Coal Mining Market Research Reports#Coal Mining Market Major Players#Coal Mining Market Share

0 notes

Text

ROBERT REICH

FEB 7

Friends,

I wanted to make sure you saw this piece by Lina Khan, who until a few days ago was chair of the Federal Trade Commission. IMHO — as someone who was once an official of the FTC — Khan was one of the wisest and most courageous of its leaders. She wrote the following in the February 4 edition of The New York Times.

Stop Worshiping the American Tech Giants

By Lina M. Khan

When Chinese artificial intelligence firm DeepSeek shocked Silicon Valley and Wall Street with its powerful new A.I. model, Marc Andreessen, the Silicon Valley investor, went so far as to describe it as “A.I.’s Sputnik moment.” Presumably, Mr. Andreessen wasn’t calling on the federal government to start a massive new program like NASA, which was our response to the Soviet Union’s Sputnik satellite launch; he wants the U.S. government to flood private industry with capital, to ensure that America remains technologically and economically dominant.

As an antitrust enforcer, I see a different metaphor. DeepSeek is the canary in the coal mine. It’s warning us that when there isn’t enough competition, our tech industry grows vulnerable to its Chinese rivals, threatening U.S. geopolitical power in the 21st century.

Although it’s unclear precisely how much more efficient DeepSeek’s models are than, say, ChatGPT, its innovations are real and undermine a core argument that America’s dominant technology firms have been pushing — namely, that they are developing the best artificial intelligence technology the world has to offer, and that technological advances can be achieved only with enormous investment — in computing power, energy generation and cutting-edge chips. For years now, these companies have been arguing that the government must protect them from competition to ensure that America stays ahead.

But let’s not forget that America’s tech giants are awash in cash, computing power and data capacity. They are headquartered in the world’s strongest economy and enjoy the advantages conferred by the rule of law and a free enterprise system. And yet, despite all those advantages — as well as a U.S. government ban on the sales of cutting-edge chips and chip-making equipment to Chinese firms — America’s tech giants have seemingly been challenged on the cheap.

It should be no surprise that our big tech firms are at risk of being surpassed in A.I. innovation by foreign competitors. After companies like Google, Apple and Amazon helped transform the American economy in the 2000s, they maintained their dominance primarily through buying out rivals and building anticompetitive moats around their businesses.

Over the last decade, big tech chief executives have seemed more adept at reinventing themselves to suit the politics of the moment — resistance sympathizers, social justice warriors, MAGA enthusiasts — than on pioneering new pathbreaking innovations and breakthrough technologies.

There have been times when Washington has embraced the argument that certain businesses deserve to be treated as national champions and, as such, to become monopolies with the expectation that they will represent America’s national interests. Those times serve as a cautionary tale.

Boeing was one such star — the aircraft manufacturer’s reputation was so sterling that a former White House adviser during the Clinton administration referred to it as a “de facto national champion,” so important that “you can be an out-and-out advocate for it” in government. This superstar status was such that it likely helped Boeing gain the regulatory green light to absorb its remaining U.S. rival McDonnell Douglas. That 1997 merger played a significant role in damaging Boeing’s culture, leaving it plagued with a host of problems, including safety concerns.

On the other hand, the government’s decision to enforce antitrust laws against what is now AT&T Inc., IBM and Microsoft in the 1970s through the 1990s helped create the market conditions that gave rise to Silicon Valley’s dynamism and America’s subsequent technological lead. America’s bipartisan commitment to maintaining open and competitive markets from the 1930s to the 1980s — a commitment that many European countries and Japan did not share — was critical for generating the broad-based economic growth and technological edge that catapulted the United States to the top of the world order.

While monopolies may offer periodic advances, breakthrough innovations have historically come from disruptive outsiders, in part because huge behemoths rarely want to advance technologies that could displace or cannibalize their own businesses. Mired in red tape and bureaucratic inertia, those companies usually aren’t set up to deliver the seismic efficiencies that hungry start-ups can generate.

The recent history of artificial intelligence demonstrates this pattern. Google developed the groundbreaking Transformer architecture that underlies today’s A.I. revolution in 2017, but the technology was largely underutilized until researchers left to join or to found new companies. It took these independent firms, not the tech giant, to realize the technology’s transformative potential.

At the Federal Trade Commission, I argued that in the arena of artificial intelligence, developers should release enough information about their models to allow smaller players and upstarts to bring their ideas to market without being beholden to dominant firms’ pricing or access restrictions. Competition and openness, not centralization, drive innovation.

In the coming weeks and months, U.S. tech giants may renew their calls for the government to grant them special protections that close off markets and lock in their dominance. Indeed, top executives from these firms appear eager to curry favor and cut deals, which could include asking the federal government to pare back sensible efforts to require adequate testing of models before they are released to the public, or to look the other way when a dominant firm seeks to acquire an upstart competitor.

Enforcers and policymakers should be wary. During the first Trump and then the Biden administrations, antitrust enforcers brought major monopolization lawsuits against those same companies — making the case that by unlawfully buying up or excluding their rivals, these companies had undermined innovation and deprived America of the benefits that free and fair competition delivers. Reversing course would be a mistake. The best way for the United States to stay ahead globally is by promoting competition at home.

55 notes

·

View notes

Text

Growing trade friction over environmental issues at the WTO

Brazil emerges as second leading nation raising concerns over other countries’ or blocs’ practices

Trade frictions centered around environmental and national security issues are on the rise at the World Trade Organization (WTO), highlighting Brazil’s increasing challenges in the global trade arena. A WTO study reveals that Brazil ranked second in raising trade concerns in the environmental sector, challenging measures from other countries that could potentially obstruct Brazilian imports.

According to the report, 630 concerns were raised from 2016 to 2023, including 171 related to these specific topics.

The article “Canary in a Coal Mine: How Trade Concerns at the Goods Council Reflect the Changing Landscape of Trade Frictions at the WTO,” authored by Roy Santana and Adeed Dobhal from the WTO’s Market Access Division, indicates that the total interventions by member countries on these issues discussed at the Council for Trade in Goods (CTG) surged, peaking at 235 during the November 2023 meeting—the last month analyzed.

During that meeting, the number of interventions reached 83, accounting for 35% of the total 235. Combined, concerns involving environmental and national security issues were responsible for 56% of the interventions made by members at the gathering.

Continue reading.

#brazil#politics#environmentalism#economy#international politics#brazilian politics#world trade organization#image description in alt#mod nise da silveira

4 notes

·

View notes

Text

Excerpt from this story from Anthropocene Magazine:

I write about the climate and energy for a living and even I can’t quite wrap my head around how cheap low-carbon power technologies have gotten. The cost of onshore wind energy has dropped by 70% over just the last decade, and that of batteries and solar photovoltaic by a staggering 90%. Our World in Data points out that within a generation, solar power has gone from being one of the most expensive electricity sources to the cheapest in many countries—and it’s showing little signs of slowing down.

So where does this all end?

Back in the 1960s, the nuclear industry promised a future in which electricity was too cheap to meter. Decades later, the same vision seems to be on the horizon again, this time from solar. It seems, well, fantastic. Perhaps (almost) free renewable power leads to climate utopia. Then again, should we be careful what we wish for?

The Road To Decarbonization Is Paved With Cheap Green Power

1. More renewables = less carbon. The math isn’t complicated. The faster we transition to clean energy, the less carbon dioxide we’re adding to the atmosphere and the fewer effects of global warming we will suffer.While humanity is still emitting more greenhouse gases than ever, the carbon intensity of electricity production has been dropping for well over a decade.

2. Cheap, clean power also unlocks humanitarian goals. Modern civilization rests on a foundation of electricity. Beyond its obvious uses in heating, cooling, cooking, lighting and data, electricity can decarbonize transportation, construction, services, water purification, and food production. Increasing the supply and reducing the cost of green electricity doesn’t just help the climate, it improves equity and quality of life for the world’s poorest.

3. Scrubbing the skies will take a lot of juice. Once we get emissions under control, it’s time to tackle the mess we’ve made of the atmosphere. Today’s direct air capture (DAC) systems use about two megawatt hours of electricity for every ton of CO2 plucked from fresh air. Scale that up to the 7 to 9 million tons we need to be removing annually in the US by 2030, according to the World Resources Institute, and you’re looking at about 0.5% of the country’s current energy generation. Scale it again to the nearly 1,000 billion tons the IPCC wants to sequester during the 21st century, and we’ll need every kilowatt of solar power available—the cheaper the better.

Cheap Power Has Hidden Costs

1. Cheap technology doesn’t always mean cheap power. If solar cells are so damn cheap, why do electricity bills keep rising? One problem is that renewables are still just a fraction of the energy mix in most places, about 20% in the US and 30% globally. This recent report from think-tank Energy Innovation identifies volatility in natural gas costs and investments in uneconomic coal plants as big drivers for prices at the meter. Renewables will have to dominate the energy mix before retail prices can fall.

2. The cheaper the power, the more we’ll waste. Two cases in point: cryptocurrency mining and AI chat bots. Unless we make tough social and political decisions to fairly price carbon and promote climate action, the market will find its own uses for all the cheap green power we can generate. And they may not advance our climate goals one inch.

3. Centuries of petro-history to overcome. Cheap power alone can only get us so far. Even with EVs challenging gas cars, and heat pumps now outselling gas furnaces in the US, there is a monumental legacy of fossil fuel systems to dismantle. Getting 1.5 billion gas cars off the world’s roads will take generations, and such changes can have enormous social costs. To help smooth the transition, the Center for American Progress suggests replacing annual revenue-sharing payments from coal, oil, and natural gas production with stable, permanent distributions for mining and oil communities, funded by federal oil and gas revenue payments.

5 notes

·

View notes

Note

got any s27 plot ideas that focus on catg?

a-plot: tolkien clyde and jimmy create their own form of cryptocurrency because they want to get a head start on participating in the free market. it becomes an overnight hit and they find themselves in hot water when elon musk—jealous of their success—challenges them to a battle of wits and a battle of fists. midway through the episode there’s a rocky style montage of them training for the fight. the fight ends with tolkien getting one hit in and elon collapsing to the ground and sobbing violently about how mean everyone is to him for no reason and his fans who came to watch all crowd around him and reassure him that he’s a genius and very very impressive and super up-to-date with memes and youth trends.

b-plot: wendy tries to raise awareness of the dangers of crypto and data mining to the environment in the rise in popularity of crypto in the town because of tolkien jimmy and clyde’s success. this ends up confusing the other kids, who think data mining is actual physical mining like in the coal mines, which leads to a there will be blood esque parody with cartman trying to “mine” for data in the desert and kyle trying to stop him. for anyone who has seen the movie and cares, cartman is daniel day lewis and kyle is paul dano.

18 notes

·

View notes

Text

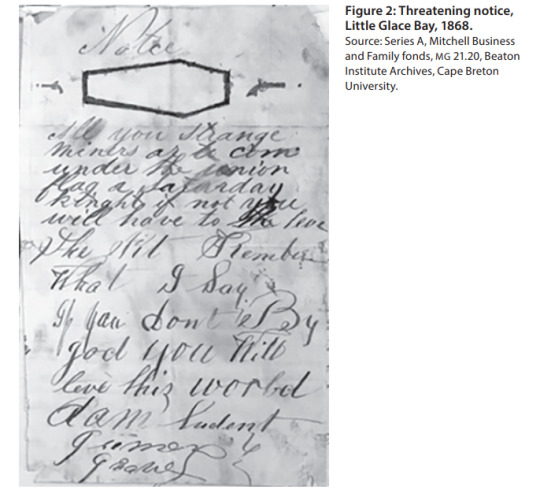

"In early 1868, the social order at Little Glace Bay was challenged by a miners’ strike. Though the strike was apparently broken by the spring, conflict persisted into the summer. In May, the miners sent to James R. Lithgow of the Glace Bay Mining Company a list of grievances that had “led to a total Stoppage of All work in the mine.” Henry Mitchell, the mine manager, was the focus. In January, the miners claimed, Mitchell had promised to pay four dollars per running yard, but at the end of the month he paid the miners by the tub so as to deprive them of one-third of their wages. Later he sent them to work in “narrow places three in each place at a [still] more reduced price”; the colliers asserted, “we could not earn enough to support ourselves or our families.” After stopping work at the end of February, Mitchell resumed production on 18 March at reduced wages, promising a return to regular levels of pay at the beginning of the shipping season, which he also failed to do. Finally, in the winter and spring, Mitchell had promised the miners at Little Glace Bay that he would not employ new hands. Despite this promise, “he took on about thirty pairs of coal cutters.”

In May, Mitchell discharged all the new miners. The miners’ petition to Lithgow explains,

we occasionally met among ourselves to pass the time to talk about our circumstances and other social talk, and it seems that all other oppression on us by Mitchell was not sufficient to satisfy him or enough to make us Slaves altogether for on the seventh of May he discharged all the new hands, as we think to punish them and us for meeting and talking together at all. When we asked for the reason why he discharged the Men whom he was taking on a few days, and also had some men employed for work in a few days afterwards[,] he ordered us to bring up our picks, and stopped the work.

Mitchell viewed the mingling of the new hands with the Little Glace Bay colliers as a threat to his authority and sought to stave off any further meetings between the two. The colliers appealed to E. P. Archbold, general manager of the Glace Bay Mining Company:

We have a Union raised amongst us, which the Bos[s] has much Statements against, but we can assure you that it is for no bad design, but help another where sickness might occur or injured at his labour, and it is our intention to raise funds to aid one another. We lay our suffrages before you hoping that you will consider our present position that we now stand in. We solicit you as a gentlemen the rights of our labour.

These petitions would have little impact. The recent end of the Reciprocity Treaty had greatly reduced access to important American coal markets. With the end of boom times, the miners’ bargaining position was significantly diminished. Indeed, it was Archbold who had thus advised Mitchell: “Coals are getting duller and cheaper in the U States. If they strike all we will have to do is to stop work." The deferential language of petition was a ritualized 19th-century form common in North American political culture. But the miners also spoke a far less deferential language. Anonymous notices threatening violence were posted in Little Glace Bay at the time of the strike. A number of these have been preserved in Henry Mitchell’s papers and reveal seething underground opposition. One notice, featuring a drawing of a coffin framed by two pistols at the top, declares:

“All you Strange Miners ar to com under the union flag a Saturday kinght [night] if not you will have to le[a]ve the Pit[.] Remember What I Say[.] if you don’t By god you Will le[a]ve this world” (Figure 2)

Another notice was addressed to someone named Morton, with a similar drawing of a coffin and pistol:

“be wear your time is com[.] a fue Days to chang your ways is given.”

Mitchell also received a threatening letter. Much of its contents have been cut out, but one can deduce its essence from the surviving bottom portion of the document:

i will blow heart out of you like a Squirel and Mitchel you Son of a Bitch I have got your Days nombered in my Brest and that is very few and i think it no more Sin to Sute [shoot] the like of you than a i would a dog for you are a son of hells fire and that will be your Distination [destination].

This type of evidence presents to the historian “a sense of double vision”: deference and consensus on the surface, violent abuse and threats delivered in anonymity. As E. P. Thompson wrote of such apparent contradictions of expression, “both could flow from the same mind, as circumstance and calculation of advantage allowed.” The threatening letter was a “characteristic form of social protest” in a society “in which forms of collective organized defence are weak” and in which defiant individuals are vulnerable to “immediate victimization.” The anonymity of the threats directed at Mitchell and others was evidence of the vulnerability of the miners to the retribution of the coal operators and their allies. These allies included religious authorities at Little Glace Bay. In early June, local Catholic priest John Shaw and Presbyterian minister Alexander Farquharson Jr. prepared pledges for miners who promised never to attend union meetings again. Mitchell collected these, and they remain glued inside a tattered notebook – nine from Shaw and five from Farquharson. These clergymen had arrived in Little Glace Bay with the broader migration of Highland Scots from the Cape Breton countryside and were deeply embedded figures of religious authority in the community. The pledges they collected sought to absolve individual miners from prior associations with the union. An example of one, Farquharson wrote to Mitchell:

“The bearer hereof Angus McPherson has I understand been a member of those Union Meetings but declares that hereafter he shall take no part whatever in them. I know Angus well and I feel that I can rely upon what he says.”

Mitchell had apparently been sending miners to Farquharson and Shaw to make these pledges, but those sent likely complied only grudgingly. In one instance, Shaw complained to Mitchell, “send me none except those who are sincere and had made up their minds already.” “I care little for the stubborn Catholics who will never yield but because they cannot better themselves,” Shaw rumbled. Religious authority, in highly personal and direct forms, was drawn upon to reconcile the community to the prevailing social order at the mines.

In September, a local man wrote to Mitchell from Sherbrooke, Nova Scotia, where apparently some of the miners had removed themselves. “I have Sean [seen] some of you[r] old hands hear[.] the[y] Spok very hard againce [against] you.” The miners were defeated, and some were evidently banished from Little Glace Bay. Nonetheless, the stubbornness Shaw encountered as well as the “reveries” of the anonymous threats, in which Mitchell was “a son of hells fire,” indicate that the restoration of consensus and deference were not inwardly accepted." - Don Nerbas, “‘Lawless Coal Miners’ and the Lingan Strike of 1882–1883: Remaking Political Order on Cape Breton’s Sydney Coalfield,” Labour/Le Travail 92 (Fall 2023), p. 89-93.

#cape breton#glace bay nova scotia#strike#miners' strike#coal mining#coal miners#mining company#resource extraction#resource capitalism#nineteenth century canada#working class struggle#union organizing#threatening letters#social history#canadian history#working class history#academic quote#reading 2024#scottish immigration to canada

3 notes

·

View notes

Text

Activated Carbon Market Growth Driven by Increasing Water Purification and Air Filtration Demand Globally

The Dynamics of the Activated Carbon Market: Trends, Drivers, and Challenges

Activated carbon, also known as activated charcoal, is a versatile material with a broad range of applications, from purifying air and water to its role in medical treatments and industrial processes. As industries increasingly prioritize sustainability, environmental protection, and safety, the demand for activated carbon has been growing. The activated carbon market is evolving rapidly due to a variety of factors, including technological advancements, regulatory pressures, and the expanding scope of its applications. In this post, we will explore the key dynamics shaping the activated carbon market, including the driving forces, market trends, challenges, and future prospects.

What is Activated Carbon?

Activated carbon is a highly porous material created by heating carbon-rich materials like coal, wood, or coconut shells in the presence of a gas, activating the carbon and making it highly effective at trapping impurities. Due to its ability to adsorb contaminants, activated carbon is widely used in water purification, air filtration, gold extraction, and even in the pharmaceutical industry to treat poisonings.

Market Drivers

Several key factors are contributing to the growth and evolution of the activated carbon market:

Environmental Concerns and Regulations As environmental regulations become stricter globally, industries are required to adopt cleaner technologies. The demand for activated carbon in applications such as water treatment and air purification is increasing, driven by the need to meet these regulations. In particular, the industrial sector is focusing on reducing its carbon footprint and improving air quality, especially in emerging markets where pollution levels are high.

Water Purification Demand Clean water remains a critical issue worldwide, especially in developing regions. Activated carbon is one of the most efficient and cost-effective methods of purifying drinking water by removing contaminants such as chlorine, volatile organic compounds (VOCs), and heavy metals. The increasing demand for clean water, coupled with the rising awareness of waterborne diseases, is significantly boosting the use of activated carbon in water treatment systems.

Air Pollution and Filtration As urbanization and industrialization continue to rise, air pollution is becoming a pressing issue globally. Activated carbon is commonly used in air filters to remove harmful gases, volatile organic compounds (VOCs), and particulate matter. The growing emphasis on indoor air quality, particularly due to concerns over health issues like respiratory diseases, has driven demand for activated carbon in the air filtration market.

Health and Medical Applications Activated carbon’s role in the medical field, particularly in the treatment of poisoning and overdose, is well established. Its ability to absorb toxins and chemicals has led to increased use in emergency medical situations. In addition, there is growing interest in using activated carbon in skincare and personal care products, which further drives market growth.

Industrial Uses and Mining Activated carbon is a crucial element in the extraction of gold and other precious metals through the cyanide leaching process. This application continues to grow, particularly in developing countries where mining activities are expanding. Additionally, industries such as chemicals, food processing, and pharmaceuticals use activated carbon for refining and purification processes.

Market Trends

Shift Toward Sustainable Sourcing With increasing concerns over environmental sustainability, there is a shift in the sourcing of activated carbon. Coconut shells, considered a more sustainable raw material due to their rapid renewability compared to coal, are gaining popularity. This trend aligns with the broader push for sustainable practices in various industries, encouraging manufacturers to explore eco-friendly alternatives.

Advancements in Production Technologies Innovations in manufacturing technologies are driving the development of more efficient and higher-performance activated carbon. New activation processes are being introduced that improve the material’s adsorption capacity and durability, resulting in better performance in filtration systems. Additionally, advancements in reactivation technologies allow activated carbon to be reused, thereby reducing waste and increasing cost-efficiency.

Emerging Applications Beyond the traditional uses of activated carbon, emerging applications are beginning to gain traction. For example, activated carbon is being explored in hydrogen storage, and its use in the energy sector is expanding. Researchers are also looking into its potential role in capturing carbon dioxide, thus contributing to efforts aimed at mitigating climate change.

Market Challenges

High Production Costs Despite the broad range of applications for activated carbon, its production remains costly. The high price of raw materials, energy-intensive manufacturing processes, and the need for specialized equipment contribute to the overall cost. This price volatility, coupled with supply chain disruptions, can make it difficult for businesses to maintain stable production costs.

Supply Chain Instability The supply of raw materials, such as coconut shells and coal, can be affected by global economic conditions, weather disruptions, and geopolitical tensions. For instance, fluctuations in coconut production due to adverse weather events or restrictions on coal mining can have significant impacts on the supply of activated carbon.

Competition from Alternative Materials Although activated carbon remains a leading material for filtration and purification, it faces competition from alternative materials, such as biochar, silica gels, and other synthetic adsorbents. These alternatives are often perceived as more affordable and can offer comparable performance in certain applications. The emergence of these materials presents a challenge to the activated carbon market, particularly in price-sensitive industries.

Future Outlook

Looking ahead, the activated carbon market is poised for continued growth. The demand for clean air, water, and sustainable practices will drive the adoption of activated carbon across various sectors. Innovations in production technologies, along with the exploration of new applications, will further enhance the market’s potential. However, manufacturers will need to address challenges related to cost, supply chain stability, and competition from alternative materials to maintain growth.

In conclusion, the activated carbon market is evolving in response to a growing demand for environmental protection, public health safety, and industrial efficiency. As regulations tighten and new technologies emerge, activated carbon’s role in key industries will continue to expand, solidifying its importance in tackling some of the world’s most pressing challenges.

0 notes

Text

Underground Mining Equipment Market set to hit $101.5 billion by 2035

Industry revenue for Underground Mining Equipment is estimated to rise to $101.5 billion by 2035 from $40.1 billion of 2024. The revenue growth of market players is expected to average at 8.8% annually for the period 2024 to 2035.

Underground Mining Equipment is critical across several key applications including mineral extraction, tunneling, coal mining and exploration & geological surveys. The report unwinds growth & revenue expansion opportunities at Underground Mining Equipment’s Type, Application, Power Source and Capacity including industry revenue forecast.

Industry Leadership and Competitive Landscape

The Underground Mining Equipment market is characterized by intense competition, with a number of leading players such as Komatsu Ltd, Caterpillar Inc, Sandvik AB, Epiroc AB, Atlas Copco, J.H. Fletcher & Co, Doosan Infracore Co. Ltd, Hitachi Construction Machinery Co. Ltd, Northern Heavy Industries Group Co. Ltd, Boart Longyear Ltd, Sany Heavy Equipment International Holdings Co. Ltd and China Coal Technology & Engineering Group Corp.

The Underground Mining Equipment market is projected to expand substantially, driven by increased demand for metals and minerals and technological advancements in equipment. This growth is expected to be further supported by Industry trends like Stringent Safety Regulations and Policies.

Detailed Analysis - https://datastringconsulting.com/industry-analysis/underground-mining-equipment-market-research-report

Moreover, the key opportunities, such as adoption of automated equipment, focus on environmentally friendly solutions and expansion in emerging markets, are anticipated to create revenue pockets in major demand hubs including China, U.S., Australia, India and Russia.

Regional Shifts and Evolving Supply Chains

North America and Europe are the two most active and leading regions in the market. With challenges like escalating costs of underground mining equipment and stringent regulations and compliance norms, Underground Mining Equipment market’s supply chain from raw material procurement / equipment manufacturing / distribution & supply to mine operators is expected to evolve & expand further; and industry players will make strategic advancement in emerging markets including Indonesia, Peru and Chile for revenue diversification and TAM expansion.

About DataString Consulting

DataString Consulting offers a complete range of market research and business intelligence solutions for both B2C and B2B markets all under one roof. We offer bespoke market research projects designed to meet the specific strategic objectives of the business. DataString’s leadership team has more than 30 years of combined experience in Market & business research and strategy advisory across the world. DataString Consulting’s data aggregators and Industry experts monitor high growth segments within more than 15 industries on an ongoing basis.

DataString Consulting is a professional market research company which aims at providing all the market & business research solutions under one roof. Get the right insights for your goals with our unique approach to market research and precisely tailored solutions. We offer services in strategy consulting, comprehensive opportunity assessment across various sectors, and solution-oriented approaches to solve business problems.

0 notes

Text

Exploring the Growth Trajectory of the Coal Mining Industry by 2027

Coal has long stood as a cornerstone of the global energy sector, serving as a primary source for electricity generation and industrial fuel. Despite mounting concerns about environmental impacts and the emergence of renewable energy alternatives, the coal mining market continues to demonstrate resilience and steady growth. In this blog, we will delve into the factors propelling the growth of the coal mining market, supported by statistical insights and industry trends.

Market Size and Projections:

Statistical data unveils a robust growth trajectory for the global Coal Mining Market. In 2020, the market size was estimated at USD 869.5 billion, with a projected compound annual growth rate (CAGR) of 2.8% from 2021 to 2027. This growth is underpinned by increasing energy demand from emerging economies, industrial expansion, and the persistent reliance on coal for electricity generation.

Regional Dynamics:

The Asia Pacific region dominates the global coal mining market, boasting the largest market share in both production and consumption. Nations like China and India emerge as major coal producers and consumers, fueled by rapid urbanization, industrial growth, and infrastructure development. North America and Europe also wield significant influence in the coal mining market, albeit with a stronger emphasis on environmental regulations and transitioning to cleaner energy sources.

Key Market Drivers:

Several factors are steering the growth of the coal mining market:

Energy Demand: Coal remains a primary energy source for electricity generation, particularly in developing economies with burgeoning populations and expanding industrial sectors. The affordability and reliability of coal-fired power plants sustain its demand.

Industrialization: Coal finds extensive use in industrial processes such as steel production, cement manufacturing, and chemical synthesis, driving demand for coal mining. Industries leverage coal for its high energy content and cost-effectiveness compared to alternative fuels.

Infrastructure Development: Coal plays an indispensable role in infrastructure endeavors, including road construction, railway networks, and urban expansion. As countries invest in infrastructure to bolster economic growth and urbanization, the demand for coal for construction materials and energy remains robust.

Technological Advancements:

The coal mining industry is witnessing technological innovations aimed at enhancing efficiency, safety, and environmental sustainability. Innovations such as automated mining equipment, remote monitoring systems, and advanced coal processing technologies bolster productivity and curtail operational costs. Moreover, endeavors are underway to develop cleaner coal technologies like carbon capture and storage (CCS) and coal gasification to mitigate environmental impacts.

Challenges and Opportunities:

Despite its growth potential, the coal mining market grapples with challenges such as environmental concerns, regulatory pressures, and competition from alternative energy sources. Nevertheless, these challenges also present avenues for innovation and diversification. Coal mining entities are exploring cleaner coal technologies, diversifying into renewable energy sectors, and investing in carbon offset initiatives to mitigate their environmental footprint and adapt to evolving market dynamics.

Future Outlook:

The future of the Coal Mining Market is characterized by a blend of challenges and opportunities. While the transition towards cleaner energy sources and escalating environmental regulations pose hurdles, the sustained demand for coal in emerging economies and industrial domains offers avenues for expansion and innovation. The coal mining industry must navigate these dynamics by embracing sustainable practices, adopting advanced technologies, and diversifying portfolios to maintain competitiveness in a swiftly evolving energy landscape.

Conclusion:

The coal mining market continues to showcase resilience and growth, propelled by factors like energy demand, industrialization, and infrastructure development. Despite confronting challenges from environmental and regulatory fronts, the industry is adapting to shifting market dynamics through technological innovation and diversification. As the world endeavors to strike a balance between economic prosperity and environmental sustainability, coal mining entities play a pivotal role in shaping the trajectory of the global energy sector.

#Coal Mining Industry#Coal Mining Industry Reports#Coal Mining Market Growth#Coal Mining Market Size#Coal Mining Market#Coal Mining Market Demand#Coal Mining Market challenges#Coal Mining Market in India#Coal Mining Market value#Global Coal Mining Market#Coal Mining Market competitors#Coal mining market analysis#Coal Mining Market Forecast#Coal Mining Market outlook#Coal Mining Industry research reports#Coal Mining Market research reports#Coal Mining Market major players#Coal Mining Market Share

0 notes

Text

Exploring the Coal Mining Market Growth, Share, and Major Players

The Coal Mining Market stands as a fundamental pillar, providing the essential fuel for global energy production. This comprehensive exploration delves into the nuanced intricacies of the market, shedding light on its growth trajectories, size, demand dynamics, challenges, global presence, competitive landscape, forecasts, research reports, and the major players shaping the industry's trajectory.

Fueling Progress: The Growth Trajectory of Coal Mining Market

The market serves as an indispensable contributor to the world's energy demands. In understanding the growth trajectory, it's essential to dissect the factors propelling its expansion. The Global Coal Mining Market has experienced commendable growth, boasting a compound annual growth rate (CAGR) of 3% over the last five years. This sustained growth is attributable to the unwavering reliance on coal for electricity generation, particularly in emerging economies.

Regional Dynamics:

Regional disparities in growth patterns exist, with Asia-Pacific dominating the coal mining landscape. China, India, and Australia emerge as pivotal contributors, fueled by their burgeoning economies and significant coal reserves.

Sizing Up the Industry: Coal Mining Market Size and Demand

Understanding the market's size and the dynamics driving coal demand is imperative for stakeholders seeking holistic insights into the industry. The current valuation of the Global Coal Mining Market exceeds USD 695 billion, indicative of its substantial influence. The demand for coal surpasses 8 billion metric tons annually, driven primarily by the insatiable energy needs of industries and the power sector.

Click here – To Know more about this industry

Meeting Energy Needs: Exploring Coal Mining Market Demand

The demand for coal intricately aligns with global energy requirements, making it imperative to dissect the factors shaping demand and its pivotal role in meeting diverse energy needs.

Energy Generation Backbone:

Coal's significance in electricity generation remains pronounced, contributing to over 40% of the world's electricity. The reliable and consistent energy output from coal-fired power plants positions it as a critical contributor to the global energy mix.

Overcoming Hurdles: Coal Mining Market Challenges

Despite its integral role, the coal mining industry faces a myriad of challenges, ranging from environmental concerns to the shifting dynamics of the global market.

Environmental Concerns and Market Dynamics:

Stringent environmental regulations pose a substantial challenge, prompting the industry to pivot towards cleaner technologies and sustainable mining practices. The perpetual challenge lies in finding the delicate balance between meeting energy needs and environmental stewardship. The evolving landscape of the global energy market, with a growing emphasis on renewable sources, presents a challenge for the coal mining industry. Adapting to these market dynamics requires strategic foresight and innovative approaches.

Global Reach of the Global Coal Mining Market

The coal mining industry's influence extends far beyond national borders, necessitating an examination of the global landscape and the role of key players in shaping its dynamics.

Major Players and Market Competitors:

Leading companies, including Coal India Limited, China Shenhua Energy, and BHP Billiton, command the industry. Their strategic investments, technological advancements, and sustainable practices contribute significantly to their competitive positions on the global stage. The competition within the coal mining sector is fierce, with major players engaging in strategic maneuvers to secure resources and market dominance. Collaboration, innovation, and sustainability initiatives define their competitive strategies.

Forecasting the Future: Coal Mining Market Forecast

Anticipating future trends and trajectories is integral for strategic planning within the coal mining industry. Despite challenges and the growing emphasis on renewable energy, the coal mining market is forecasted to maintain a stable trajectory with a modest annual growth rate of 2%. The continued demand for coal in steel production and power generation contributes to this resilience.

Insights from the Earth: Coal Mining Market Research Reports

Informed decision-making within the industry relies on robust research, emphasizing the significance of Coal Mining Market Research Reports in providing actionable insights for stakeholders. An annual influx of 25 comprehensive research reports enriches the industry's knowledge base. These reports cover diverse aspects, including market dynamics, technological advancements, and regulatory changes, offering valuable guidance for strategic planning.

Pillars of the Industry

Certain players lead the way, steering the industry towards innovation and sustainability. Coal Mining Market Major players, such as Peabody Energy and Glencore, are pioneers in clean coal technologies and sustainability practices. Their efforts align with the industry's evolution towards more environmentally responsible mining, ensuring a balance between energy needs and environmental stewardship.

Conclusion

The Coal Mining Market remains a linchpin in global energy production, overcoming challenges and evolving to meet changing demands. As the industry navigates environmental concerns, explores cleaner technologies, and adapts to market dynamics, its steadfast role in powering economies underscores its enduring significance.

#Coal Mining Industry#Coal Mining Industry Reports#Coal Mining Market Growth#Coal Mining Market Size#Coal Mining Market#Coal Mining Market Demand#Coal Mining Market challenges#Coal Mining Market in India#Coal Mining Market value#Global Coal Mining Market#Coal Mining Market competitors#Coal mining market analysis#Coal Mining Market Forecast#Coal Mining Market outlook#Coal Mining Industry research reports#Coal Mining Market research reports#Coal Mining Market major players#Coal Mining Market Share

0 notes

Text

Best shaft Mounted Gearbox manufacturer in India- Nisuka Industries

Introduction

When it comes to reliable industrial machinery, gearboxes play a crucial role in ensuring smooth and efficient operations. One of the most widely used types in the industry is the Shaft Mounted Speed Reducer (SMSR) gearbox, known for its durability, easy installation, and power efficiency. In India, where heavy-duty industries continue to grow rapidly, the demand for high-quality shaft mounted gearboxes is ever-increasing.

If you're looking for the best shaft mounted gearbox manufacturer in India, Nisuka Industries is the name that consistently stands out. With decades of expertise, modern manufacturing facilities, and a reputation for quality, Nisuka is a trusted brand serving diverse sectors across India and abroad.

About Nisuka Industries

Established in 1994, Nisuka Industries Private Limited was founded with a clear mission—to deliver precision-engineered products that meet the demanding needs of conveyor-driven industrial applications. Located in Ahmedabad, Gujarat, Nisuka operates from a 7,600 sq. ft. facility equipped with cutting-edge machinery and skilled manpower.

Over the years, Nisuka has grown to become a recognized leader in the field of shaft mounted gearboxes, offering a wide range of high-performance mechanical power transmission products.

Our Specialization – Shaft Mounted Gearboxes

At Nisuka Industries, we specialize in SMSR gearboxes in India that are designed for maximum strength and minimal maintenance. These gearboxes are ideal for belt conveyors and various material handling equipment across industries like:

Stone crushing and quarry operations

Cement and asphalt plants

Mining and coal handling units

Fertilizer and chemical processing

Sand and aggregate plants

Construction and recycling sites

Our shaft mounted gearboxes are:

Easy to install directly on the drive shaft

Compact and space-saving

Durable in challenging environments

Available in multiple gear ratios and sizes

Efficient in reducing motor speed and increasing torque

Why Choose Nisuka Industries?

1. Trusted Quality

We use high-grade raw materials and follow stringent quality control at every stage of production. Each gearbox undergoes rigorous testing to ensure it meets performance expectations and durability standards.

2. Expertise and Innovation

With over 30 years of experience, our team of engineers and technicians understands the real-world challenges industries face. We innovate constantly to improve gearbox efficiency, reduce energy consumption, and extend product life.

3. Complete Conveyor Solutions

Nisuka is more than just a gearbox manufacturer. We provide a comprehensive range of products used in conveyor systems, including:

Conveyor Gearboxes

Plummer Blocks

V-Belt Pulleys

Taper Lock Pulleys

Tension Units

Gear Oil Pumps

Suspension Magnets

Magnetic Drum Pulleys

Metal Detectors

This wide product line makes us a reliable one-stop solution for conveyor-based operations.

4. Customization Options

We understand that every plant has unique needs. That’s why we offer custom-designed gearboxes to match specific technical requirements. Whether you need a custom shaft diameter, mounting position, or torque range—we’ve got you covered.

5. Pan-India and Global Reach

As a leading shaft mounted gearbox supplier in India, we proudly serve clients all over the country. Our products are also exported to global markets, earning trust through consistency, quality, and service.

6. After-Sales Support

Our support doesn’t stop after the sale. We offer:

Installation guidance

Maintenance support

Prompt replacement services

Technical assistance whenever required

We believe in long-term relationships and strive to keep our clients satisfied beyond the first order.

Industries We Serve

Nisuka gearboxes and accessories are used across several core industries:

Mining & Quarrying

Cement & Construction

Fertilizers & Chemicals

Recycling Plants

Steel & Metal Processing

Aggregate & Sand Plants

Power Plants

Bulk Material Handling

Our experience across these sectors helps us design robust gearboxes that perform consistently even under extreme workloads.

Commitment to Quality & Growth

We continuously invest in:

Modern manufacturing technologies

Skilled workforce training

Product development and R&D

Efficient supply chain and logistics

Our goal is to deliver not just products, but also performance, reliability, and peace of mind.

Conclusion

In today’s competitive industrial landscape, choosing the right components can make all the difference. A reliable shaft mounted gearbox ensures your conveyor system operates smoothly, safely, and efficiently. When you choose Nisuka Industries, you are investing in a product built with experience, engineered for strength, and backed by a team that truly cares.

With a proven track record, a wide range of supporting products, and an unwavering commitment to quality, Nisuka Industries proudly stands as the best shaft mounted gearbox exporter in India.

#shaft Mounted Gearbox manufacturer in India#shaft Mounted Gearbox supplier in India#shaft Mounted Gearbox exporter in India

0 notes

Text

India’s $600M Lithium Investment in Australia: A Game-Changer for EV Expansion

India is making a significant move to strengthen its electric vehicle (EV) industry by pursuing a 20% stake in two major Australian lithium projects. The $600 million deal, involving Indian state-owned enterprises such as Khanij Bidesh India Ltd (KABIL), Coal India, Oil India, and ONGC Videsh, targets lithium assets owned by Chilean mining giant SQM. These include the Mount Holland and Andover lithium projects in Western Australia.

This strategic investment aligns with India’s goal of securing a stable supply of lithium, a critical mineral for battery production. With EV adoption rising rapidly, India seeks to reduce its dependence on lithium imports from China. In 2024, EV sales comprised just 2.5% of total car sales in India, but with an annual growth rate of 20%, demand is projected to surge. Securing a consistent lithium source is crucial to supporting this growth.

The Indian government has been actively diversifying its mineral supply chain. In 2023, a 5.9-million-tonne lithium reserve was discovered in Jammu and Kashmir, but political instability, challenging extraction conditions, and investor hesitancy have hindered progress. Consequently, India has shifted focus to international partnerships. In addition to the Australian deal, KABIL recently secured exploration rights for 15,700 hectares of lithium-rich land in Argentina.

By investing in Australian lithium, India aims to establish a resilient and independent supply chain for its EV and clean energy industries. SQM, the world’s second-largest lithium producer, is a key player in this effort. The Indian consortium is reportedly in discussions with mergers and acquisitions advisers to advance the transaction, with due diligence already underway.

Industry experts suggest that competition for lithium will intensify as global demand for EVs and renewable energy storage increases. India’s engagement with SQM underscores its commitment to securing long-term lithium resources and reducing reliance on unpredictable foreign suppliers.

If successful, the $600 million investment will strengthen India’s position in the global EV market, support its energy transition goals, and provide a much-needed boost to domestic battery production. The deal also marks India’s most ambitious overseas acquisition in the critical minerals sector, setting the stage for further international collaborations.

As the world moves toward sustainable energy solutions, India’s proactive approach to securing lithium supplies will play a crucial role in shaping the country’s EV future and reinforcing its energy security.

0 notes

Text

Acid Proof Lining Market Growth Trends and Key Innovations Shaping Industrial Corrosion Resistance Solutions Globally

The acid proof lining market has seen a significant upsurge in recent years, driven by growing industrialization, increasing infrastructure development, and a rising emphasis on longevity and safety in corrosive environments. With industries like chemicals, pharmaceuticals, metallurgy, power generation, and water treatment expanding rapidly, the demand for reliable corrosion resistance solutions is more critical than ever. Acid proof linings play a pivotal role in preserving equipment, structures, and pipelines exposed to harsh acidic substances, thereby minimizing downtime, reducing maintenance costs, and ensuring operational safety.

Growth Drivers of the Acid Proof Lining Market

One of the primary factors fueling the growth of the acid proof lining market is the increasing regulatory focus on environmental safety and worker protection. Governments and international agencies have implemented stringent norms that compel industries to adopt corrosion-resistant solutions to prevent chemical leaks and accidents. This has led to a surge in the use of acid-resistant linings in both new constructions and retrofitting projects.

Another key driver is the globalization of industrial production. As manufacturing facilities shift to developing regions, where environmental conditions and operational standards vary widely, the need for customized and robust acid proof solutions becomes crucial. Markets in Asia-Pacific, particularly China and India, are witnessing an accelerated demand for acid-resistant linings due to their booming industrial base and infrastructure development.

Emerging Trends in Material Technology

Technological innovations are reshaping the landscape of the acid proof lining market. Traditional linings made of ceramic bricks and carbon bricks are gradually being supplemented, and in some cases replaced, by advanced polymer and resin-based systems. These modern materials offer superior chemical resistance, ease of application, and lighter weight, making them suitable for a wide range of applications.

Thermosetting resins like epoxy, vinyl ester, and furan are increasingly used due to their excellent performance in extremely acidic environments. Additionally, rubber lining systems are gaining popularity in industries dealing with both mechanical wear and chemical exposure. The development of hybrid linings—combining the best properties of multiple materials—is another innovation gaining traction in the market.

Industry-Specific Applications

The acid proof lining market is witnessing segmented growth across various industries, each with its unique set of challenges. In the chemical processing industry, where highly corrosive substances are a constant, acid proof linings are indispensable. Similarly, in wastewater treatment plants, these linings prevent degradation of tanks and pipelines caused by acidic and biological contaminants.

In the power generation sector, especially coal-based thermal power plants, acid proof linings are used extensively in flue gas desulfurization units and chimneys to handle sulfuric acid vapors. The mining and metallurgy industries also require heavy-duty linings for ore processing tanks, acid leaching units, and pickling lines.

Global Market Outlook

Regionally, North America and Europe have been traditional strongholds due to their mature industrial infrastructure and regulatory compliance. However, the Asia-Pacific region is emerging as the fastest-growing market, with Latin America and the Middle East also showing promising potential. Urbanization, industrial expansion, and government-backed infrastructure projects are boosting the demand for corrosion protection solutions in these regions.

In terms of competition, the acid proof lining market is characterized by a mix of global players and regional specialists. Companies are focusing on product innovation, strategic partnerships, and expansion into untapped markets to gain a competitive edge. Sustainability is also becoming a key differentiator, with manufacturers developing environmentally friendly linings that comply with global green standards.

Conclusion

As industries continue to operate in increasingly aggressive chemical environments, the importance of robust, cost-effective, and sustainable corrosion resistance solutions cannot be overstated. The acid proof lining market is poised for steady growth, driven by technological advancements, regulatory pressures, and rising awareness about infrastructure longevity. With innovation at its core, the market is set to redefine standards in industrial protection and safety worldwide.

0 notes

Text

Mining Chemicals Market Analysis by Product Type, Global Size, Segmentation, Regional Trends, Key Players, Company Share, and Forecast from 2025 to 2035

Industry Outlook

The mining chemicals market was valued at USD 12.36 billion in 2024 and is projected to reach USD 24.71 billion by 2035, growing at a compound annual growth rate of approximately 6.5% from 2025 to 2035. Professionals in the industry provide specialized chemicals that enhance efficiency and productivity across mineral extraction, processing, and waste management stages.

Mining chemicals play a crucial role in improving mineral recovery rates and operational performance. These chemicals, including grinding aids, flotation reagents, extractants, and flocculants, are essential for processing base metals, precious metals, rare earth elements, coal, and non-metallic minerals. The market is expanding due to increasing mining activities, rising metal purity requirements, and advancements in chemical formulations. However, environmental regulations and health concerns pose challenges. The industry's shift toward sustainable, eco-friendly mining chemicals presents new opportunities for innovation and growth, particularly in emerging economies.

Get free sample Research Report - https://www.metatechinsights.com/request-sample/2154

Market Dynamics

Rising Demand for High-Purity Metals and Minerals

The global demand for pure metals and minerals is increasing due to their essential role in industries such as electronics, automotive, aerospace, and renewable energy. The growing adoption of electric vehicles and clean energy solutions has amplified the need for lithium, cobalt, and rare earth elements. Advanced mining chemicals, such as flotation reagents and grinding aids, optimize metal extraction by reducing material losses and enhancing recovery rates.

The construction and manufacturing sectors also contribute to the rising demand for metals, fueled by rapid urbanization and infrastructure development. Government initiatives aimed at domestic mineral sourcing and refining are further shaping industry growth. As sustainability concerns grow, the market is witnessing an increasing shift toward environmentally friendly mining solutions.

Innovations in Mining Chemicals Enhancing Efficiency

Ongoing research in mining chemicals has led to the development of advanced formulations that improve mineral recovery and operational efficiency while reducing costs. Modern flotation reagents, collectors, and flocculants enable precise mineral sorting, leading to higher yields with minimal waste. These innovative chemical solutions are particularly valuable for processing low-grade ores.

Advanced extractants and leaching agents facilitate efficient metal extraction while minimizing environmental impact. Additionally, automated chemical dosing systems optimize usage, enhancing efficiency and reducing operational costs. The industry is investing in sustainable chemical solutions to address the growing need for rare earth elements and specialty metals.

Environmental Regulations and Sustainability Challenges

Stringent environmental regulations pose significant challenges for the mining chemicals industry. Many countries have implemented strict policies to control the use of hazardous chemicals to protect water quality and ecosystems. Regulatory restrictions on cyanide and heavy-metal-based reagents have led mining companies to adopt sustainable alternatives or invest in advanced wastewater treatment systems.

Compliance with environmental policies requires substantial financial investment in sustainable waste management and pollution control solutions. Local communities and environmental organizations are increasingly scrutinizing mining operations, influencing regulatory decisions. Companies are focusing on developing non-toxic, biodegradable products to meet sustainability standards while maintaining market competitiveness.

Growing Preference for Eco-Friendly and Biodegradable Chemicals

The mining chemicals industry is experiencing a strong shift toward eco-friendly and biodegradable solutions due to regulatory pressure and sustainability concerns. Governments worldwide are enforcing stricter guidelines to limit the environmental impact of mining chemicals. This has led to increased adoption of green alternatives to harmful reagents such as cyanide and heavy metals.

Businesses are investing in sustainable chemical solutions that reduce environmental risks while enhancing operational efficiency. The demand for non-toxic, biodegradable reagents is expected to grow as companies prioritize regulatory compliance and environmental responsibility.

Expansion of Mining Activities in Emerging Regions

Mining companies are expanding operations into untapped regions, including Africa, South America, and parts of Asia, to access new mineral reserves. The depletion of resources in established mining areas has driven the search for alternative locations rich in valuable minerals.

These new mining sites require specialized chemicals to improve ore extraction efficiency and minimize processing costs. Operating in remote areas presents challenges such as limited water availability and complex regulatory frameworks, increasing the demand for innovative chemical formulations. Investment in mining infrastructure and technology in developing economies is further boosting market growth.

Industry Expert Insights

Mark Douglas, CEO of FMC Corporation, states, "The mining chemicals industry is undergoing a transformative shift driven by sustainability, efficiency, and technological advancements. As global demand for high-purity metals rises, innovative chemical solutions will play a crucial role in optimizing mineral recovery and reducing environmental impact. Companies that invest in eco-friendly and high-performance chemicals will shape the future of responsible mining."

Jean-François Claver, President of Solvay Special Chem, adds, "With the expansion of mining activities into emerging markets, the need for advanced and cost-effective chemical solutions has never been greater. The industry must focus on developing biodegradable and sustainable reagents to meet regulatory demands while improving efficiency. The future of mining chemicals lies in balancing operational effectiveness with environmental responsibility."

Segment Analysis

Product Types in the Mining Chemicals Market

The mining chemicals market is categorized into grinding aids, flotation chemicals, extractants, flocculants, collectors, and other specialized chemicals. Flotation chemicals are crucial for mineral processing as they enhance the extraction of valuable minerals from ores. Advancements in flotation reagents are gaining traction, particularly as demand for base and precious metals continues to grow.

Environmental regulations are driving a shift toward biodegradable and eco-friendly frothers and collectors. Selective flotation technologies are being developed to improve recovery rates while reducing operational costs. As mining activities expand worldwide, the demand for specialized chemicals continues to rise.

Applications of Mining Chemicals

The market is segmented into mineral processing, explosives and drilling, water treatment, waste management, and other applications. Water treatment chemicals play a critical role in managing wastewater, reducing pollution, and ensuring regulatory compliance. The need for efficient water recycling solutions is driving the adoption of flocculants, coagulants, and bioremediation technologies.

Strict environmental regulations and declining water supplies are compelling mining companies to adopt advanced water treatment methods. Sustainable water management is becoming essential, further increasing the demand for innovative chemical solutions, especially in regions facing water scarcity.

Read Full Research Report https://www.metatechinsights.com/industry-insights/mining-chemicals-market-2154

Regional Market Trends

North America

North America remains a dominant player in the mining chemicals market due to its well-established mining industry in the United States and Canada. The region's strong focus on sustainable mineral processing, compliance with stringent environmental regulations, and investments in eco-friendly mining solutions contribute to market growth.

The rising demand for rare earth metals, driven by clean energy technologies and electronics manufacturing, is propelling the need for advanced chemical solutions. Government initiatives supporting domestic mineral production further strengthen the market.

Asia-Pacific

The Asia-Pacific region is experiencing rapid growth in the mining chemicals market, with key contributions from China, Australia, and India. The demand for base metals, coal, and rare earth elements is rising, driven by industrial expansion and technological advancements.

The region is witnessing increased mineral processing activities and greater adoption of cost-effective performance chemicals. Sustainable mining practices are encouraging the use of biodegradable reagents and non-toxic alternatives. Government initiatives promoting domestic mining and infrastructure development are accelerating market expansion.

Competitive Landscape

The mining chemicals industry is dominated by leading companies, including BASF SE, Solvay S.A., Clariant AG, Kemira Oyj, Huntsman Corporation, and The Dow Chemical Company. These companies are strengthening their market position through strategic partnerships, acquisitions, and research-driven product development.

The industry is shifting toward sustainable chemical solutions to meet regulatory requirements and environmental concerns. Investments in digital automation technologies are enhancing the efficiency of chemical applications in mineral processing. Expansion into emerging mining regions and the development of specialized reagents are key growth strategies for maintaining market leadership.

Buy Now https://www.metatechinsights.com/checkout/2154

Recent Developments

In January 2024, Solvay S.A. launched a new range of sustainable flotation reagents for mineral processing.

In November 2023, BASF SE expanded its North American mining chemicals production facilities in response to increasing demand for specialized reagents.

0 notes

Text

Exploring Profitability in the Rare Earth Mineral Mining Industry

Mining is really a critical market that plays an essential position in giving organic components for sets from engineering to infrastructure. Yet, like any industry, mining profitability may vary based on numerous factors. These include source accessibility, environmental rules, market demand, and technological advancements.

Knowledge the variables that effect miners' profitability is essential for equally investors and operators seeking to increase returns. This information will discover the key aspects that affect mining profitability and suggest techniques to stay ahead in a aggressive and ever-changing market.

Mining is, by its nature, a capital-intensive company that needs substantial expense upfront. The profitability of mining operations is usually decided by the delicate stability of revenue from offering nutrients and the expenses involved with removal, job, energy, and equipment. Some of the crucial facets influencing mining profitability contain:

Possibly the most critical component influencing miners' profitability is the buying price of the commodity being mined. Whether it's silver, copper, coal, or lithium, the value of those natural components varies predicated on market conditions, geopolitical factors,

and supply-demand imbalances. Miners frequently experience the challenge of navigating these value fluctuations to keep up profitability. An immediate drop in commodity rates can considerably reduce prices, especially for smaller miners with less working flexibility.

Energy is one of many greatest operational prices for a lot of mining companies. The removal process, whether it's drilling, carrying, or refining, eats huge amounts of electricity or fuel. With power prices on the rise globally, particularly in fossil fuel-dependent markets, maintaining profitability becomes more difficult. Miners should innovate by adopting green energy sources, increasing energy efficiency, and exploring new methods to cut back their carbon footprint.

Technology plays an essential position in improving mining profitability. The advent of automation, synthetic intelligence, and knowledge analytics has considerably increased operational efficiency, paid down labor expenses, and improved security in mines.

Automation assists lower downtime, while predictive analytics can foresee gear problems before they occur, resulting in cost savings. Investing in the most recent mining systems can provide a competitive side and boost long-term profitability.

The mining business is extremely governed, with stringent environmental and protection requirements that vary across regions. Conformity with your regulations frequently involves costly investments in gear, remediation efforts, and legitimate fees.

More over, environmental regulations are getting significantly strict, particularly as the entire world techniques toward more sustainable practices. Miners should element in these costs for their profitability models. Failure to comply may result in fines or the suspension of operations.

Labor costs are still another important factor impacting mining profitability. Competent job is frequently necessary for top quality removal functions, which can include substantial price to the operation.