#Cloud Access Security Brokers Market

Text

https://www.htfmarketintelligence.com/report/global-cloud-access-security-brokers-market

0 notes

Text

https://www.htfmarketintelligence.com/report/global-cloud-access-security-brokers-market

0 notes

Link

Stay up-to-date with Cloud Access Security Brokers Market research offered by AMA. Check how key trends and emerging drivers are shaping this industry growth.

#Cloud Access Security Brokers Market#Cloud Access Security Brokers Market Demand#Cloud Access Security Brokers Market Size#Cloud Access Security Brokers Market Status

0 notes

Text

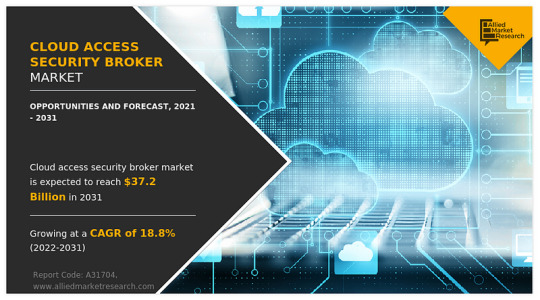

Cloud Access Security Broker Market Size to Reach USD 37.2 billion by 2031

According to a new report published by Allied Market Research, titled, “Cloud Access Security Broker Market,” The Cloud Access Security Broker Market Size was at $6.8 billion in 2021, and is estimated to reach $37.2 billion by 2031, growing at a CAGR of 18.8% from 2022 to 2031.

A cloud access security broker is a security policy enforcement point positioned between enterprise users and cloud service providers. CASBs provide flexible enterprise solutions that help ensure cloud app security across authorized & unauthorized applications and managed (and unmanaged devices). These flexible enterprise solutions can combine multiple different security policies, from authentication and credential mapping to encryption, malware detection, and others. Furthermore, key factors that drive the growth of the cloud access security broker market include growing demand for work-from-home and remote working policies during the period of the COVID-19 pandemic aided in propelling the demand for cloud and security solutions, hence empowering the growth of the cloud access security broker industry. However, higher installation costs and maintenance challenges of cloud access security broker platforms can hamper the cloud access security broker market forecast. On the contrary, the integration of advanced technologies such as machine learning and data analytics with cloud access security broker solutions suites is expected to offer remunerative opportunities for the expansion of the cloud access security broker industry during the forecast period.

On the basis of enterprise size, the large enterprise segment dominated the overall cloud access security broker market in 2021 and is expected to continue this trend during the forecast period. This is attributed to the complex security requirements of various large corporations needing custom management solutions. However, the SMEs segment is expected to witness the highest growth owing to their growing technological investments and growing innovation, which is expected to further fuel the growth of the global CASB market.

With effective risk and compliance solutions, business enterprises and organizations can ensure that their cloud applications are following industry and regulatory guidelines in various regions, without having to actively dedicate their time to researching the local policies of every region and cloud platform they are operating from. Moreover, cloud risk and compliance management solutions are further divided into policy management, compliance management, audit management, incident management, risk management, and other solutions.

Depending on the industry vertical, the IT and telecom segment dominated the cloud access security broker market share in 2021, and is expected to continue this trend during the forecast period owing to the growing cloud participation of IT and telecom sector companies, incentivizing major businesses of the sector to invest in effective cloud access security broker solutions for their organization. However, the healthcare segment is expected to witness the highest growth in the upcoming years, owing to the rising security standards and government regulatory policies being implemented in the sector.

Region wise, the cloud access security broker market was dominated by North America in 2021, and is expected to retain its position during the forecast period, owing to its highly advanced technology sector which is expected to drive the market for cloud access security broker within the region during the forecast period. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to its growing digital capabilities and a highly competitive market space, which is anticipated to fuel the cloud access security broker market growth in the region in the coming few years.

Inquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/32154

The alarming increase in COVID-19 cases has compelled many businesses and their employees to adjust to remote working and work-from-home standards, which in turn fueled the adoption of cloud access security broker solutions during the period. Moreover, with the outbreak of COVID-19, businesses had to secure their IT and network assets from cyber threats and data breaches. Moreover, the growing demand for cloud and security during the period drove the demand for the CASB market.

KEY FINDINGS OF THE STUDY

By enterprise size, the large enterprise segment accounted for the largest cloud access security broker market share in 2021.

By region, North America generated the highest revenue in 2021.

By application area, the data security segment generated the highest revenue in 2021.

The key players profiled in the cloud access security broker market analysis are Broadcom Inc., Cisco Systems, Inc., iboss Cybersecurity, Lookout, Microsoft Corporation, Netskope, Palo Alto Networks Inc, Proofpoint Inc, Skyhigh Networks, and Zscaler, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry and CASB Market Share.

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Contact Us:

David Correa

1209 Orange Street

Corporation Trust Center

Wilmington

New Castle

Delaware 19801

USA Int’l: +1–503–894–6022

Toll Free: +1–800–792–5285

Fax: +1–800–792–5285

#Cloud Access Security Broker Market#Cloud Access Security Broker Industry#Cloud Access Security Broker#Governance#Risk#and Compliance#Data Security#Application Security

0 notes

Text

Why ITSIPL is Best Forcepoint reseller

Helping business discover & buy the best Software to grow their business.

Established in 1996, I.T. Solutions India Pvt. Ltd. (ITSIPL) is one of the trusted & pioneers in providing I.T infrastructure and solutions on various platforms.

ITSIPL Technologies is a Delhi based System Integrator and a one-stop destination for all your business needs right from a desktop to software to marketing. Our main focus is to fulfill software, hardware & marketing needs of clients. ITSIPL works closely with their clients to ensure that they are getting maximum from their investments.

ITSIPL works on a client’s requirements & our portfolio consist of everything your business requires to grow. ITSIPL offers a technology vision as well as segment-specific architectures for building a network infrastructure that will meet your needs today and tomorrow. ITSIPL provides architecture road maps to help you build a more resilient, adaptive and intelligent network infrastructure.

➛ What is Forcepoint Services

Forcepoint is the leading user and data security cyber security company, entrusted to safeguard organizations while driving digital transformation and growth. Our solutions adapt in real-time to how people interact with data, providing secure access while enabling employees to create value.

➛ WHAT TYPE OF SOFTWARE IS FORCEPOINT

Computer security software

Forcepoint, an American multinational corporation software company headquartered in Austin, Texas, that develops computer security software and data protection, cloud access security broker, firewall and cross-domain solutions.

➛ WHAT IS FORCEPOINT IN NETWORK

Forcepoint combines true enterprise-class SD-WAN, advanced intrusion prevention, and seamless integration with cloud-based SASE security to keep your people and data safe—all at global scale. Detect and discover advanced threats.

➟ Deliver Forcepoint Services

It’s our goal for every customer to be delighted with the solutions they have chosen to protect their business and for the value of these solutions to be fully realized within their operational environment. For this reason, our sales coverage and expansion strategy is founded on the value of the consultative role of partners who integrate services, knowledge and experiences into customers’ projects. Forcepoint invites partners who sell our products and have a strong services capability to participate in our services ecosystem and help drive our customers’ success as accredited services

➢ WHY TO CHOOSE US

Browse options below. Based on reviewer data We are Best Forcepoint Reseller, you can see how Forcepoint Secure Web Gateway stacks up to the competition, check reviews from current & previous users in industries like Media Production, Banking, and Information Technology and Services, and find the best product for your business.

We follow a friendly & professional approach and a passion for delivering the best possible value for money for each customer and we really do go that extra mile whenever it is required.

2 notes

·

View notes

Text

The Future of Forex CRM: What Brokers Need to Know

Things go forward in Forex trading; hence, brokerage houses should be thinking of some innovation even in CRM process development. A very artfully designed Forex CRM will help to change how the brokers communicate with their clients, will assist them in managing sales, and will manage compliance issues.

As we take a look at Forex CRM future, several trends and technologies and market needs shape the way brokers will be working and maintaining their advantage in the future. Here, in this article, we are going to discuss all the main elements for Forex CRM systems, emerging trends, and how to position the firm between efficiency maximization and more alive relationships with clients.

1. Understanding Forex CRM: The Basics

Briefly before going into the future of Forex CRM, it is very essential first to understand what Forex CRM is and why it is crucial to the success of a broker.

Forex CRM is an extremely niche product client relation management tool designed for exclusive Forex broker use. It is intended to manage lead flow, monitor activity pertaining to a client, automate processes, and heed regulatory compliance to guarantee the broker gets all the necessary information on regulatory requirements and best practices. In contrast to generic CRMs, Forex systems are specifically designed to handle the subtleties of the trading platform, the regulatory framework, and volatility pertaining to the Forex marketplace. Functions of a Forex CRM

The following are some of the most important functions a Forex CRM should have:

Lead management: the tracking and nurturing of potential clients through automated workflows

Sales automation: Chasing onboarding processes and managing the sales pipelines.

Regulatory compliance management: All client information and trading activities should be compliant with any applicable regulatory requirements

Customer support: Providing effective as well as efficient client assistance is often integrated with trading platforms and tools.

2. The Rise of AI and Automation in Forex CRM

AI has dominated the realm of disruptive trends in different industries today, and Forex has been no exception. Going forward, almost every feature of Forex CRM will essentially be AI-enabled to bring more efficiency to the workflow of the broker and ensure better levels of customer service.

The impact of AI will include:

Predictive Analytics: Broker will be able to predict the client requirement ahead of time based on the algorithm of machine learning on market trends and client behavior.

Lead Scoring: Automatic scoring system based on historical data and behavioral pattern suggests conversion of leads into sales, thus optimizing the sales process by using a system that automatically scores the same on the basis of specified criteria.

Personalized Client Interaction: Based on AI-powered CRM, recommendations, trading tips, and risk assessment are able to be made, and consequently presented to clients, therefore resulting in higher rates of client satisfaction and retention.

Further, automation will also bring innovation to Forex CRM by eliminating all the mundane tasks such as onboarding, checks on compliance, and lead nurturing. This will give brokers more free time for high-value activities.

3. Cloud-Based Solutions and Data Security

Cloud-based technology is already a highly visible trend in Forex CRM, and its applications will become increasingly significant for brokers in the coming years.

The following are some of the most important advantages that cloud-based CRM systems offer:

Scalability: Brokers can grow along with their CRM system without needing large infrastructural investments.

Real-Time Access: With cloud CRMs, brokers are at a flexibility advantage and access to all customer information, reports, and trading data both inside and outside the office area.

Lower IT costs: There are no expensive servers and software updates and security patches for brokers.

On the other hand, with growing dependence on cloud-based CRM systems, emphasis is required on data security. Client information, potentially sensitive, should be safeguarded by Forex brokers. Therefore, the coming years will bring full-fledged encryption, multiple authentications, and compliance with varying regulations introduced into Forex CRMs in order to reduce security risks.

4. Compliance and Regulatory Adaptability

The Forex market is characterized by a rather complicated legal environment and massive jurisdiction variability. When the changes in regulations themselves become a living reality, the tools used by brokers in their dealings with compliance must develop as well.

Forex CRM systems in the near future will be far more sensitive to various regulatory frameworks, making it easier for brokers to adapt quickly to new rules and remain compliant in various regions-through such features as:

Automated Reporting: Automatically generating and submitting the reports to the regulatory bodies in order to avoid errors from human mistakes.

Real-Time Monitoring: Transaction monitoring is included in its provision with regard to notification when such activity or violation of the regulatory policy takes place.

Integration of KYC and AML: The automation of the processes in the different processes of KYC and AML within the CRM to avoid physical compliance gestures.

Greater scrutiny by regulators will position those Forex brokers that continue to utilize advanced Forex CRM systems in a better place to ride out the tides and the risks that lie within.

5. Mobile-First Forex CRM

As more and more traders are adapting to the mobile lifestyle, Forex CRM systems will have to catch up with that trend. More and more clients are now trading on the go, requiring brokers to be able to manage client relationships from the mobile.

Mobile Apps: Full-function mobile applications which brokers can use to track, monitor performance, and stay in touch with clients.

Push Notifications: To send real-time notifications of changing markets, important trades, or compliance updates right to their broker's and clients' phones.

Responsive Design: Ensuring that CRM interfaces are designed with mobile-first approach capabilities to provide seamless user experience cross-platform.

A mobile-first approach will help brokers be more agile, to provide timely support and personalized experiences, thus being the critical component of how their customers are retained.

6. Integrating Forex CRM with Trading Platforms

Probably one of the most exciting future developments concerning Forex CRM involves deeper integration between the platform and trading systems. Modern brokers need seamless connection between their CRM systems and the trading platforms on which their clients will operate.

Such integration brings the following:

Real-time Trading Data: The brokers will have a view of real-time trading information from the CRM, hence remaining crystal clear on the activities of their clients and the nature of their trades.

Automated Alerts: The CRM will alert brokers about all of the most critical actions a client has taken, for example, margin calls, very high levels of activity, or inactivity, and allow them to engage with them proactively.

One-click actions: Brokerage can execute trades, offer advisory and account management directly from the CRM, ensuring very seamless interactions with the clients.

Through integration with a variety of trading platforms, Forex CRM will thus work to enhance the efficiency of a broker's operations while providing more wholesome experience to their end-users.

7. Client-Centric CRM and the Future of Personalization

With rising competition in the Forex market, personalization is going to be the prerequisite for brokers to provide a customized experience to clients. The future of CRM in Forex will largely rely on its capacity to create tailored experiences according to the needs and preferences of every client.

Client-centric CRM will focus on:

Behavioral Insights: Data accumulation from trading activity, social media as well as interactions to give depth in the client profile.

Tailored Recommendations: Armed with this knowledge, brokers will be able to provide customized trading recommendations, market updates, and educational material for the client.

Client Segmentation: The clients will automatically be segmented or categorized on the grounds of trading volume, risk tolerance, or any other criteria with little effort. This allows the broker to come up with specially tailored engagement strategy.

In this crowded Forex space, tailored recommendations enable a broker to give his client a much more personal experience hence better retention and higher lifetime value.

Conclusion: The Future of Forex CRM

Therefore, the future of Forex CRM offers unfulfilled promises for such brokers who are open to change and embracing new technologies and shifting clients' expectations. AI, automation, cloud-based solutions, and deep integration with trading platforms make up the next gen Forex CRMs. These changes will help those brokers that take investment in improving their management and compliance -- thus being best placed to handle a changing market.

The future for Forex brokers who want to make optimal use of their CRM depends on flexibility, data security, and the personalization of their client experience. In embracing Forex CRM in the future, brokers will not only achieve greater operational efficiency but will also strengthen their relation with their clients.

#proptech#fxproptech#best prop firms#prop trading firms#my funded fx#best trading platform#funded trading accounts#prop firms#forex#forexcrm#forex prop firms funded account#funded

0 notes

Text

0 notes

Text

Get Free Sample Report + All Related Graphs & Charts 👉 https://www.htfmarketintelligence.com/sample-report/global-cloud-access-security-brokers-market

0 notes

Text

AMD Infinity Guard, BeeKeeperAI Collaborate Secret Computing

AMD Infinity Guard

The prevalence of ransomware attacks and data breaches in recent years has made it difficult for important business sectors to collaborate. Reports state that organizations are unable to work with suppliers who are attempting to develop potentially ground-breaking apps or discoveries due to the risk posed by threat actors. To keep up the strict restrictions necessary for specific data sets, some businesses don’t even share data within. Researchers’ failure to obtain vital data impedes their capacity to conduct significant study in a number of fields, including government, banking, and healthcare.

Healthcare AI acceleration via a safe platform for algorithm creators and data custodians to collaborate

Data is Never Exchanged or Viewed

The data steward’s safe, HIPAA-compliant environment is where the data is never removed.

Processing Real-World and Protected Data

Employs primary data, which comes directly from the source, as opposed to artificial or de-identified data. Every time, the data is encrypted.

Never Is Intellectual Property Seen or Shared

The algorithm is always encrypted, both when it is uploaded to EscrowAI and when it is moving through the container to the data steward and inside the protected environment of the data steward.

Technology with Secure Enclaves

EscrowAI uses secure enclave technology to reduce the possibility of algorithm IP questioning and data exfiltration during computing.

Matchmaker and intermediary

BeeKeeperAI reduces the time, effort, and expenses of data projects by more than 50% by serving as a matchmaker and broker between data stewards and algorithm developers.

Alan Czeszynski, an expert in the security industry and the marketing and product development leader at BeeKeeperAI, was gracious enough to join me on the AMD EPYC TechTalk podcast series following the Confidential Computing Summit industry gathering in San Francisco. They talked about the state of security and how there has never been a greater need for better hardware and software safeguards.

BeeKeeperAI

EscrowAI, a technology that combines private and confidential computing technology to allow software developers, data scientists, and data owners to collaborate in trusted execution environments (TEE), is utilized by San Francisco-based BeeKeeperAI.

The technology of BeeKeeperAI ensures that an owner always has control over their data. In addition to offering end-to-end encryption and algorithmic and model encryption to safeguard intellectual property, BeeKeeper also applies the algorithm to the data. The business establishes a TEE in a cloud data storage environment after an algorithm is prepared to run against data. Consequently, the data is cut off from all stakeholders, including BeeKeeperAI, the cloud service provider, the data owner, and the owner of the algorithm.

Nobody can see what goes on within the TEE; everyone can only access the output to which they are legally permitted.

“Bring these parties together to enable development and testing of artificial intelligence and machine learning models,” according to Alan, is made possible by BeeKeeper’s secure environment.

Big large language models (LLMs) and generative AI have gained popularity, and as a result, businesses are now more conscious of the need to secure AI, according to Alan. Protecting every stage of the AI and machine learning lifecycle has received a lot of attention lately. According to Alan, this is one of the reasons private computing is starting to get a lot of traction.

Alan warns that legacy security solutions might not provide enough protection in the AI era. The problem with LLMs is that they essentially turn into enormous repositories of all your secrets if you wish to locally train them on your own data,” he continued.

While CISOs and IT administrators prioritize data protection, business managers and data scientists frequently place greater importance on obtaining the data required to develop models that improve the company. Alan claimed that it is far too common for the procedure of obtaining private, protected data to be difficult, costly, and time-consuming. He described a few of the intricate details.

It is usually necessary for parties to have detailed, extremely formal data-use agreements in place. There are often several restrictions on how the data can be interacted with. Audits have to be done, and they always have to. BeeKeeperAI eliminates the effort by offering a technical answer to many of these security challenges.

“Their goal is to eliminate that from the end user and basically take it upon selves,” Alan stated. “The platform then allows the true value, which is basically secure collaboration, getting access to the data, developing your models, being able to execute your AI, ML lifecycle in a secure environment.”

Alan acknowledged that the security features incorporated by AMD EPYC CPUs had strengthened BeeKeeperAI’s offerings. AMD Infinity Guard includes these technologies, such as Secure Encrypted Virtualization and Secure Nested Paging, or SEV-SNP. They prevent the contents of a virtual machine’s memory from being accessed by other VMs operating on the same system or the server they are operating on.

Alan also mentioned adaptability, which is another significant advantage of AMD EPYC. AMD have to provide [clients] a variety of possible platforms, and EPYC is a fantastic one,” said Alan. “In those situations, the safe paging feature of encrypted virtualization and secret containers or virtual machines based on the EPYC CPU is quite advantageous. One of the main advantages of utilizing EPYC processors is that algorithm developers no longer have to adhere to any certain OS type thanks to this lift-and-shift technique.”

Read more on govindhtech.com

#AMDInfinityGuard#BeeKeeperAI#Healthcare#AIacceleration#EscrowAI#AI#AMDEPYC#largelanguagemodels#generativeAI#machinelearning#news#Technews#technology#technlogynews#technologytrends#govindhtech

0 notes

Text

0 notes

Text

0 notes

Text

Common Misconceptions About Mortgage Brokers in Sydney

When it comes to securing a home loan, many people in Sydney consider turning to a mortgage broker for assistance. However, there are numerous myths related to mortgage brokers in Sydney that often cloud judgment and prevent potential borrowers from making informed decisions. In this article, we’ll address some of these misconceptions and highlight the true value that the best mortgage brokers in Sydney can offer.

Myth 1: Mortgage Brokers Are Expensive

One of the most common myths related to mortgage brokers in Sydney is that their services are costly. Many believe that working with a broker will add unnecessary fees to their home loan process. The truth, however, is that mortgage brokers in Sydney typically do not charge upfront fees for their services. Instead, they earn a commission from the lender once the loan is secured. This means that their primary focus is on finding the best possible loan for their clients, rather than padding their pockets with additional fees.

Myth 2: Brokers Only Offer Limited Loan Options

Another misconception is that mortgage brokers in Sydney have access to a limited number of loan products. Some borrowers believe that they would have better chances of finding the best home loan if they approached multiple banks directly. In reality, mortgage brokers in Sydney work with a wide range of lenders, including major banks, credit unions, and non-bank lenders. This allows them to compare numerous loan options and find the one that best suits your needs. The best mortgage brokers in Sydney are well-versed in the local market and can leverage their relationships with various lenders to secure favorable terms for their clients.

Myth 3: It’s Better to Go Directly to a Bank

Many borrowers think that going directly to a bank will result in a quicker or simpler process. However, this is another one of the myths related to mortgage brokers Sydney residents often encounter. Banks are typically limited to offering their own products, which may not be the best fit for every borrower. On the other hand, mortgage brokers in Sydney have the advantage of comparing loans from multiple lenders, giving borrowers a broader perspective on what’s available in the market. By working with a broker, you can save time and effort, as they do the legwork to find the most competitive home loan rates Sydney has to offer.

Myth 4: Mortgage Brokers Don’t Work in the Borrower’s Best Interest

A significant concern for some borrowers is that mortgage brokers are only interested in earning commissions and not in helping their clients find the best home loans Sydney has available. However, professional mortgage brokers in Sydney are legally required to act in the best interest of their clients. This means that they are obligated to provide recommendations based on what is most suitable for your financial situation and long-term goals. The best mortgage brokers in Sydney build their reputation on trust, transparency, and successful client outcomes.

Myth 5: Mortgage Brokers Only Help with Home Loans

While home loans are a significant part of what mortgage brokers in Sydney handle, their expertise extends beyond this. Many brokers also assist with refinancing, investment property loans, and even commercial loans. Whether you're a first-time homebuyer or an experienced property investor, the best mortgage brokers in Sydney can offer tailored advice and solutions to meet your specific needs.

The Value of Working with Efficient Capital

In summary, it's essential to look beyond the myths related to mortgage brokers in Sydney and understand the value they bring to the table. The best mortgage brokers in Sydney are skilled professionals who provide a broad range of loan options, act in your best interest, and can save you time and money throughout the home loan process. If you're looking for reliable guidance in securing the best home loan rates Sydney offers, consider reaching out to Efficient Capital. As one of the top financial providers in Sydney, Efficient Capital has the expertise to help you navigate the complex mortgage landscape with confidence.

https://www.efficientcapital.com.au/

0 notes