#Cheese Powder Industry

Explore tagged Tumblr posts

Text

Future of the Cheese Powder Market: Trends and Innovations

The global cheese powder market was estimated at USD 4.86 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.6% from 2025 to 2030. A significant driver of this demand is the increasing popularity of convenience foods. As lifestyles become increasingly fast-paced, consumers are on the lookout for quick and easy meal solutions that do not sacrifice taste. Cheese powder serves as a versatile ingredient that can be effortlessly integrated into a variety of products, including snacks, sauces, and ready-to-eat meals. Furthermore, the growing snacking culture—especially among younger consumers—has boosted the demand for cheese-flavored snacks, presenting substantial opportunities for manufacturers of cheese powder.

Additionally, the rise of plant-based diets is reshaping the market dynamics, as a growing number of consumers seek alternatives that align with their dietary preferences. Cheese powders derived from traditional dairy sources are facing competition from plant-based options that utilize ingredients like nutritional yeast, cashews, and coconut to replicate classic cheese flavors. This transition reflects a broader trend towards plant-based eating, as consumers increasingly prioritize sustainable and environmentally friendly food choices. By incorporating plant-based cheese powder, manufacturers can engage with the expanding vegan and vegetarian markets, thereby driving innovation and broadening their product offerings within the cheese powder segment.

Gather more insights about the market drivers, restrains and growth of the Cheese Powder Market

Application Insights

In 2024, the snacks segment represented a substantial revenue share of 25.93% in the cheese powder market. The diversification of snack options, which includes gourmet popcorn and specialty chips, has significantly driven the demand for cheese powder in innovative and exciting ways. As brands strive to distinguish themselves in a competitive marketplace, they are increasingly experimenting with a variety of cheese powder formulations. This includes options like aged cheddar, blue cheese, and various spicy flavors designed to appeal to adventurous consumers who seek new taste experiences.

Furthermore, the rising consumer preference for convenient snacking solutions has contributed to the popularity of dehydrated cheese as a key ingredient in an array of snack foods. Items such as popcorn, chips, and seasoning blends are now incorporating cheese powder, which enhances flavor and texture. The ongoing trend toward on-the-go snacks that require minimal preparation has further fueled the appeal of cheese powder. This enables manufacturers to develop products that provide a rich cheese flavor while also ensuring a longer shelf life, making them more attractive to busy consumers.

The flavors segment of the cheese powder market is projected to grow at a compound annual growth rate (CAGR) of 7.6% from 2025 to 2030. A significant trend shaping this segment is the increasing demand for gourmet and artisanal flavors. As consumers explore more adventurous culinary experiences, there is a heightened interest in unique and diverse cheese powder options that can elevate dishes beyond standard cheese flavors. Specific flavors, including aged cheddar, truffle-infused varieties, and spicy pepper jack, are gaining popularity. These options cater to both home cooks and professional chefs who are looking to enhance the flavor profiles of their culinary creations.

This growing interest in gourmet flavors aligns well with the broader trend towards specialty foods and the rising demand for gourmet ingredients. Consequently, flavored cheese powders have become a highly sought-after addition across various applications, ranging from snack foods to gourmet sauces. The expansion of flavor profiles not only enriches culinary experiences but also opens new avenues for product innovation within the cheese powder market.

Order a free sample PDF of the Cheese Powder Market Intelligence Study, published by Grand View Research.

#Cheese Powder Market#Cheese Powder Market Analysis#Cheese Powder Market Report#Cheese Powder Industry

0 notes

Text

The cheese powder market is highly impacted by the increasing size of the convenience and fast-food industries and innovative offerings by cheese powder manufacturers. The growth rate of the fast-food industry is significant owing to the changing lifestyles of people around the globe.

#Cheese Powder Market#Cheese Powder#Cheese Powder Market Size#Cheese Powder Market Share#Cheese Powder Market Growth#Cheese Powder Market Trends#Cheese Powder Market Forecast#Cheese Powder Market Analysis#Cheese Powder Market Report#Cheese Powder Market Scope#Cheese Powder Market Overview#Cheese Powder Market Outlook#Cheese Powder Market Drivers#Cheese Powder Industry#Cheese Powder Companies

0 notes

Text

The cheese powder market is estimated at USD 630 million in 2023 and is projected to reach USD 895 million by 2028, at a CAGR of 7.3% from 2023 to 2028.

#Cheese Powder Market#Cheese Powder#Cheese Powder Market Size#Cheese Powder Market Share#Cheese Powder Market Growth#Cheese Powder Market Trends#Cheese Powder Market Forecast#Cheese Powder Market Analysis#Cheese Powder Market Report#Cheese Powder Market Scope#Cheese Powder Market Overview#Cheese Powder Market Outlook#Cheese Powder Market Drivers#Cheese Powder Industry#Cheese Powder Companies

0 notes

Text

Milton Orr looked across the rolling hills in northeast Tennessee. “I remember when we had over 1,000 dairy farms in this county. Now we have less than 40,” Orr, an agriculture adviser for Greene County, Tennessee, told me with a tinge of sadness.

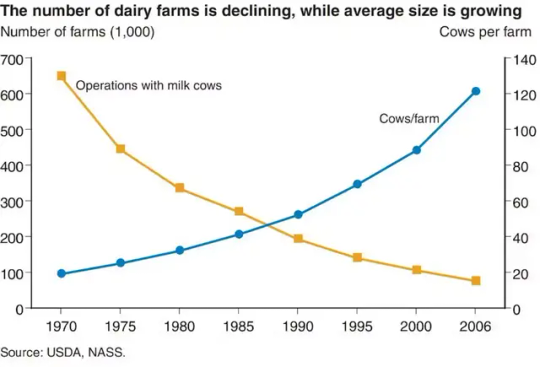

That was six years ago. Today, only 14 dairy farms remain in Greene County, and there are only 125 dairy farms in all of Tennessee. Across the country, the dairy industry is seeing the same trend: In 1970, more than 648,000 US dairy farms milked cattle. By 2022, only 24,470 dairy farms were in operation.

While the number of dairy farms has fallen, the average herd size—the number of cows per farm—has been rising. Today, more than 60 percent of all milk production occurs on farms with more than 2,500 cows.

This massive consolidation in dairy farming has an impact on rural communities. It also makes it more difficult for consumers to know where their food comes from and how it’s produced.

As a dairy specialist at the University of Tennessee, I’m constantly asked: Why are dairies going out of business? Well, like our friends’ Facebook relationship status, it’s complicated.

The Problem with Pricing

The biggest complication is how dairy farmers are paid for the products they produce.

In 1937, the Federal Milk Marketing Orders, or FMMO, were established under the Agricultural Marketing Agreement Act. The purpose of these orders was to set a monthly, uniform minimum price for milk based on its end use and to ensure that farmers were paid accurately and in a timely manner.

Farmers were paid based on how the milk they harvested was used, and that’s still how it works today.

Does it become bottled milk? That’s Class 1 price. Yogurt? Class 2 price. Cheddar cheese? Class 3 price. Butter or powdered dry milk? Class 4. Traditionally, Class 1 receives the highest price.

There are 11 FMMOs that divide up the country. The Florida, Southeast, and Appalachian FMMOs focus heavily on Class 1, or bottled, milk. The other FMMOs, such as Upper Midwest and Pacific Northwest, have more manufactured products such as cheese and butter.

For the past several decades, farmers have generally received the minimum price. Improvements in milk quality, milk production, transportation, refrigeration, and processing all led to greater quantities of milk, greater shelf life, and greater access to products across the US. Growing supply reduced competition among processing plants and reduced overall prices.

Along with these improvements in production came increased costs of production, such as cattle feed, farm labor, veterinary care, fuel, and equipment costs.

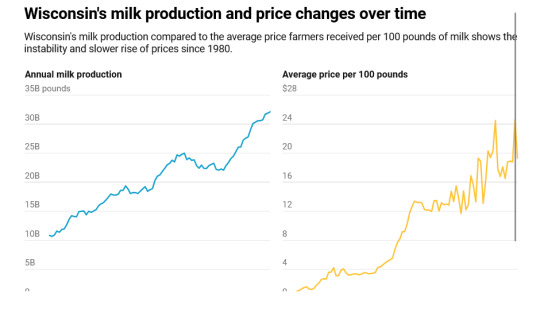

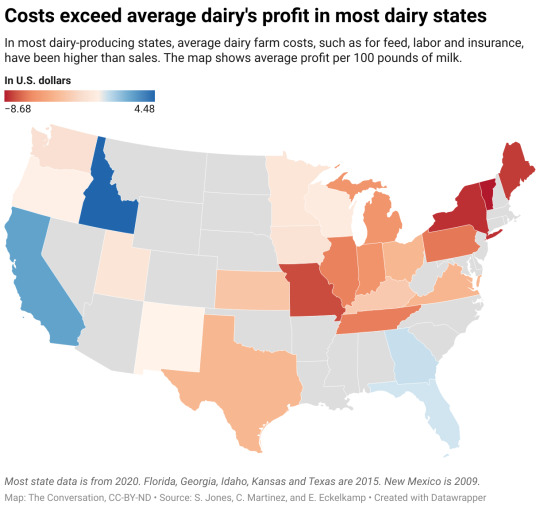

Researchers at the University of Tennessee in 2022 compared the price received for milk across regions against the primary costs of production: feed and labor. The results show why farms are struggling.

From 2005 to 2020, milk sales income per 100 pounds of milk produced ranged from $11.54 to $29.80, with an average price of $18.57. For that same period, the total costs to produce 100 pounds of milk ranged from $11.27 to $43.88, with an average cost of $25.80.

On average, that meant a single cow that produced 24,000 pounds of milk brought in about $4,457. Yet, it cost $6,192 to produce that milk, meaning a loss for the dairy farmer.

More efficient farms are able to reduce their costs of production by improving cow health, reproductive performance, and feed-to-milk conversion ratios. Larger farms or groups of farmers—cooperatives such as Dairy Farmers of America—may also be able to take advantage of forward contracting on grain and future milk prices. Investments in precision technologies such as robotic milking systems, rotary parlors, and wearable health and reproductive technologies can help reduce labor costs across farms.

Regardless of size, surviving in the dairy industry takes passion, dedication, and careful business management.

Some regions have had greater losses than others, which largely ties back to how farmers are paid, meaning the classes of milk, and the rising costs of production in their area. There are some insurance and hedging programs that can help farmers offset high costs of production or unexpected drops in price. If farmers take advantage of them, data shows they can functions as a safety net, but they don’t fix the underlying problem of costs exceeding income.

Passing the Torch to Future Farmers

Why do some dairy farmers still persist, despite low milk prices and high costs of production?

For many farmers, the answer is because it is a family business and a part of their heritage. Ninety-seven percent of US dairy farms are family owned and operated.

Some have grown large to survive. For many others, transitioning to the next generation is a major hurdle.

The average age of all farmers in the 2022 Census of Agriculture was 58.1. Only 9 percent were considered “young farmers,” age 34 or younger. These trends are also reflected in the dairy world. Yet, only 53 percent of all producers said they were actively engaged in estate or succession planning, meaning they had at least identified a successor.

How to Help Family Dairy Farms Thrive

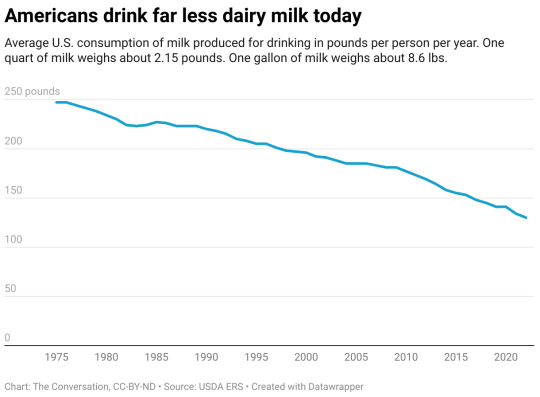

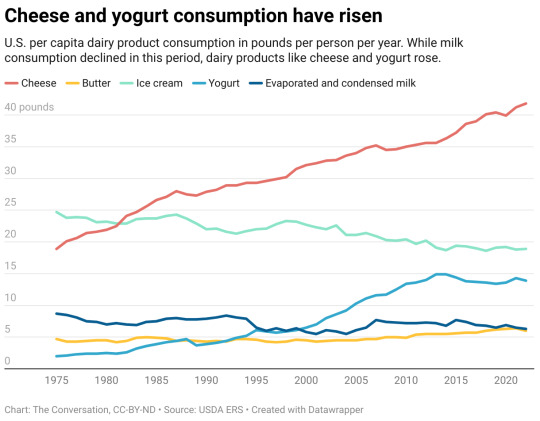

In theory, buying more dairy would drive up the market value of those products and influence the price producers receive for their milk. Society has actually done that. Dairy consumption has never been higher. But the way people consume dairy has changed.

Americans eat a lot, and I mean a lot, of cheese. We also consume a good amount of ice cream, yogurt, and butter, but not as much milk as we used to.

Does this mean the US should change the way milk is priced? Maybe.

The FMMO is currently undergoing reform, which may help stem the tide of dairy farmers exiting. The reform focuses on being more reflective of modern cows’ ability to produce greater fat and protein amounts; updating the cost support processors receive for cheese, butter, nonfat dry milk, and dried whey; and updating the way Class 1 is valued, among other changes. In theory, these changes would put milk pricing in line with the cost of production across the country.

The US Department of Agriculture is also providing support for four Dairy Business Innovation Initiatives to help dairy farmers find ways to keep their operations going for future generations through grants, research support, and technical assistance.

Another way to boost local dairies is to buy directly from a farmer. Value-added or farmstead dairy operations that make and sell milk and products such as cheese straight to customers have been growing. These operations come with financial risks for the farmer, however. Being responsible for milking, processing, and marketing your milk takes the already big job of milk production and adds two more jobs on top of it. And customers have to be financially able to pay a higher price for the product and be willing to travel to get it.

33 notes

·

View notes

Text

Seek Shelter

SPN Fanfic

Characters - Briana x Jensen

Summary - Briana gets caught in a sudden downpour and seeks shelter under a bus stop awning and gets some unexpected company

Word Count - 1,556

A/N - This was written for the @spnfanficpond’s Valentine’s Day Writing Challenge. I chose the “caught in the rain” prompt. Beta’d by @candygramme

Warning - Mutual pining, almost PDA. *They are both married to their spouses in this, but they’re in open relationships and both partners are aware of their relationship.*

Read it on Ao3

Briana had woken early and decided to take a run to ready herself for a busy day. She had a day full of recording for her new show and then doing a photo shoot with Matt as promo for their new movie. She liked keeping busy, but she had to be in the right mindset to get through the busier days. Some good cardio would help with that.

It was pleasant and wasn’t raining when she set out, so she decided to forgo the gym in favor of fresh air and a new route. After about thirty minutes, she was quite a few miles away from her place, and the sky had darkened ominously. She was in an industrial part of town, no shops or people were around. she’d thought it quaint until the sun disappeared.

As the first, fat droplets hit her forehead, she began looking for shelter. At the end of the block stood a bus stop canopy. Before she could get there, a thunderclap sounded closely overhead, and then a fuck-ton of water started to fall all at once. By the time she got to the small awning, she was soaked through.

Checking her pulse, she marched in place to cool down instead of just stopping after her strenuous run. From the looks of it, she would be hunkered down for a while.

“Shit!” someone shouted as they ran under the shelter, bringing some of the rain in with them. “Oh, sorry.”

“Jensen?” Briana asked, shocked.

“Hey, you.” He smiled a crooked smile at her, then went in for a soggy hug.

She responded, not caring that she was getting even wetter. The feel of his arms around her was more comforting than the water was displeasing. “What are you doing here?”

“Just working on a few things, you know how it is,” he responded cryptically.

“Uh huh… but what are you doing here?” She gestured to the practically abandoned part of Vancouver they were currently seeking refuge in.

“Oh, well, I was checking out a new breakfast spot around the corner and decided to walk a new route to get to set. Then the bottom fell out and I saw this bus stop and ran like hell.”

She pursed her lips and nodded. “Well, fancy meeting you here!”

They both laughed. Jensen sat and pulled a partially dry bag out from under his jacket. He withdrew a bagel with cream cheese and held out half for Briana to take. Taking a look out at the darkened sky still sluicing rain, she nodded, sat beside him, and accepted the bagel. The cream cheese was thick and creamy and tasted of fruit, and the bagel was still warm from being toasted. It was refreshing and perfectly cozy given their circumstances.

“So, what have you been up to?” Jensen asked around a bite of bagel.

“Recording, shooting a little project with Matt,” she said with a shrug.

“I heard about that, that’s awesome!” His responding smile was warm and genuine.

“It was a ton of fun, it was great getting to work with him on something like that.”

“I bet, I’m glad it worked out for y’all.” He paused as he took another bite of his bagel. After a moment, he asked in a low voice, “How’s José?”

Briana bit back a smile. “Good. How’s Danneel?” Her voice was light, in contrast to the feeling in her gut.

“Good, and the kids are great,” he added.

“Valentina is as well,” Briana confirmed.

Bringing up their families was always how things started. Like they needed reminding that they were involved with other people, had families that they worked hard to provide for. That never seemed to deter them from doing what they were drawn to. They’d had a connection from the first time Jensen shoved that damn powdered donut in his mouth; meeting Briana’s slapstick beat for beat. He was genuine and thoughtful, not to mention too handsome to look at for very long. She’d been smitten from the start, and when they started spending more and more time together, things naturally escalated.

They were both swingers, José and Danneel were both very understanding people and had their own exploits when the opportunities arose. There was a mutually beneficial agreement. But just because everything checked off on paper, didn’t mean that feelings didn’t get hurt.

“I didn’t get to see much of you in Jacksonville,” he said, almost too quiet to be heard over the downpouring rain.

“I was busy,” she said, not unkindly, then reached out to grab his hand to further the point.

He froze for a moment, eyes flicking around to the torrential downpour around them as if a pap was waiting across the street for them to do something stupid. Of course, there was no one around. And even if there was someone out there, the rain was coming down in sheets and was nearly impossible to see through. The entire time they’d been sitting there, not one car had driven by. They were alone. They were also soaked and cold.

Ever so slowly, his eyes drifted down to where she held his hand, then raised his eyes to meet hers. “I’ve missed you.”

She smiled again. “It’s been a while since we could catch up properly.”

“Why don’t we go for dinner while I’m in town?” His emerald eyes shone with possibility and promise.

“You know I’m a sucker for a good dinner.”

“Name the time and place.”

“I’ll text you,” she promised.

“Alright,” he smiled. “It feels good to be back in Vancouver.”

Just after he finished speaking he shivered. Briana laughed.

“Poor choice of words, my friend.”

“Well, it did feel good, until I got caught out in the rain,” he said with a good-natured chuckle.

She loved that he didn’t put on his faux-grumpy façade with her. They were past that. She’d seen it for what it was from the start, he could never fool her into thinking he meant half of what he complained about. She’d called him on his bullshit and he’d dropped the act. There were a few people that he didn’t put on his go-to act for, and she considered it an honor that she was one of them.

Unable to control herself, Briana reached over to wipe a strand of waterlogged hair from his forehead. His eyes bored into hers, and she felt her stomach tighten at the look. She let her fingers trail down his face and trace over his strong jaw. Even dripping wet, he was stunning.

The sound of the rain pelting their awning thundered around them, almost blocking out the rush of blood in Briana’s ears. It was thrilling, being with him in public like this. Although they weren’t doing anything scandalous, it was an intimate moment. Were it to be caught on camera, they’d both have to deal with their PR people to get it toned down or swept under a rug. Regardless, Briana felt herself pulled toward him.

His eyes flicked down to her mouth, and his leaning toward her was all the permission she needed to close the distance between them. She slammed their lips together with needy urgency. He hummed into the kiss and met her push for pull. It had been months since they’d been able to slake such urges.

His hand wrapped around the side of her head, holding her in place as they tasted the sweetness of fruity cream cheese from each other’s mouths. His tongue flicked over hers and reminded her of just how talented he was with that particular muscle. She pressed her thighs together to relieve some of the pressure that built at the memory of his tongue flicking something a little more sensitive.

A horn honking made them jolt away from each other with surprised gasps.

“Fuck me,” Jensen said, laughing and running his hand over his face.

Briana busied herself making sure her top was on straight. “Damn,” she said on a shaky exhale.

“Yeah, we don’t look like two guilty people, at all!”

They both laughed again. Just then, Briana realized the rain had let up considerably. The sky had lightened and it was sprinkling gently. A bus pulled up to their shelter and stopped, opening the doors. The driver looked down expectantly at them.

“No, thank you,” Jensen said, waving them on.

Briana smiled at the driver, and they smiled back at her, closed the doors, and then drove off.

“Well, I guess I’d better get to set,” Jensen said after a moment.

“Yeah,” Briana agreed, checking her phone for the time. “I have to be at the studio in about an hour.”

Jensen stood and shook out his jacket, Briana did the same.

“Text me about dinner,” he said looking her over.

“Will do,” she said with a smile.

Jensen put a hand on her shoulder, then leaned in and placed a kiss at the corner of her mouth. Briana leaned into the touch and pressed her lips to his cheek in return. They maintained eye contact for a moment before Jensen cleared his throat. Putting her music back on, she took off at a jog, back to her place to get ready for the day. She didn’t see Jensen watching after her until she rounded the corner, a smile plastered to his face.

#Briana x Jensen#Jensen x Briana#mutual pining#cleighwrites#spn fanfic pond#valentine's day challenge

8 notes

·

View notes

Text

Nothing appears remarkable about a dish of fresh ravioli made with solein. It looks and tastes the same as normal pasta.

But the origins of the proteins which give it its full-bodied flavour are extraordinary: they come from Europe’s first factory dedicated to making human food from electricity and air.

The factory’s owner, Solar Foods, has started production at a site in Vantaa, near the Finnish capital of Helsinki, that will be able to produce 160 tonnes of food a year. It follows several years of experimenting at lab scale.

Solar Foods has already gained novel food approval for solein in Singapore, and is seeking to introduce its products in the US this autumn, followed by the EU by the end of 2025 – and the UK too, if the regulator can get through the deluge of cannabis-related products.

The factory’s output may be small in terms of the global food industry, but Pasi Vainikka, the Solar Foods co-founder and chief executive, hopes that proving its technology works will be a crucial step in revolutionising what humans eat.

Food and agriculture is responsible for about a quarter of all planet-heating carbon emissions. Its share of pollution is likely to grow as other industries shift to using green electricity, and ever-expanding middle-classes demand more meat for their tables. Up to now the focus for some climate campaigners has been to try to persuade people to eat less meat and more plants. Non-farmed proteins such as solein might make that approach more appealing.

Solein comes in the form of a yellowish powder made up of single-cell organisms, similar to yeast used in baking or beer-making. The company is hoping for those proteins to be used in meat alternatives, cheese and milkshakes, and as an egg replacement ingredient in noodles, pasta and mayonnaise.

The ravioli it served up this week was made with solein replacing egg, with a solein version of cream cheese. The Finnish confectioner Fazer has already sold chocolate bars in Singapore with added solein (which is also a handy source of iron for vegans). A Singaporean restaurant last year created a solein chocolate gelato, replacing dairy milk.

Vainikka was researching renewable energy systems at a Finnish research institute in 2014 when he met his co-founder, Juha-Pekka Pitkänen, a bioprocesses scientist. Pitkänen told him of soil-dwelling microbes that release the energy they need to live from oxidising hydrogen (rather than the glucose used by humans, for instance).

Together they built a 200-litre fermenter in a garage near Helsinki, to prove the technology could be used for food, but then went into the wild “finding new potatoes to grow”. All Vainikka will say on solein’s origins is that they found it somewhere “close to shore” in the Baltic Sea.

Almost all food consumed by humans at the moment ultimately comes from plants, which use energy from the sun for photosynthesis. That process converts carbon dioxide and water into the molecules they need to grow. Solar Foods instead uses the same renewable electricity from the sun to split water apart. It then feeds the hydrogen and oxygen to the microbes in a brewing vessel, plus carbon dioxide captured from the air from the company’s office ventilation system.

The claim that the proteins are made out of thin air is “never more than 95% true”, says Vainnika: 5% of the mixture in the brewing vessel is a solution containing other minerals needed by cells, such as iron, magnesium, calcium and phosphorus. The microbes are then pasteurised (killing them), then dried in a centrifuge and with hot air. That leaves a powder that can be used in food.

The process could also use CO2 from, for instance, burning fuels – although the molecule would end up back in the atmosphere once humans eat the solein and breathe out the carbon again. The real climate benefits from solein come from cutting the vast tracts of land used – and abused through deforestation on an epic scale – for animal feed and pasture. Instead, renewed forests could trap carbon.

Efficient US farmers get 3.3 tonnes of soya beans from each harvest of a hectare, according to the UN’s Food and Agriculture Organization. By contrast, Solar Foods’ pilot factory takes up a fifth of a hectare to produce 160 tonnes a year.

“As we can relieve pressures on agricultural land, they can rewild and return to being climate sinks,” Vainikka says.

Other companies are pursuing the same dream. Dozens are using microbes to create animal feed, although they often require sugars or fossil fuel feedstocks. One US rival, Air Protein, has opened a factory in California using similar “hydrogenotrophs” – hydrogen eaters. It has the backing of the food multinational Archer-Daniels-Midland, the British bank Barclays and GV (formerly Google Ventures).

The Dutch company Deep Branch, which is making fish food, claims its Proton protein will be 60% less carbon-intensive than conventional proteins. Deep Branch is looking at taking the CO2 produced by the UK biomass power generator Drax.

The companies have produced their test products. Now they face the challenge of proving their technology works at scale.

Vainikka says that is the key problem for cultured meat, or lab-grown meat. The market value of newly listed companies such as Beyond Meat soared during the coronavirus pandemic bubble, only to come crashing down as sales slumped. The opening of Solar Foods’ first factory will be crucial in persuading investors that the company will not suffer the same fate.

With meat protein, which is much more expensive than plants or cellular agriculture, there is simply no competition on price for each kilo. But Solar Foods and rivals could face other problems. Conservative politicians particularly in the US and Italy have identified lab-grown food as a threat to their ranching and farming cultures.

Vainikka argues that these fears are misplaced. He wants “coexistence of new and old”, with artisanal, high-quality farms remaining alongside cell farming that can deliver cheap, bulk foods. He argues it is “the opportunity of the century for the meat industry” to focus on quality rather than churning out as much cheap (and heavily subsidised) meat as possible. And plant agriculture will also remain, he argues.

“The future is not powder: the main body of food will still come through plants,” he says. The occasional “salami with the cultural heritage, that can remain. The meat in your lasagne during lunch will be done by cellular agriculture.”

3 notes

·

View notes

Text

Tips from a grocery worker/foodsafe certified waiter!

The temperature 'danger zone' for food and drink is 40-140F, with 2 hours being the limit without refrigeration/cooking.

Open container, Public Intoxication, and Driving Under Influence are all separate broken laws. Establishments that serve alcohol in the US are required to cut you off the moment you are visibly drunk. 'Open container' can also be a misnomer and vary by state- bottles and cans in anything less than a glued blox may need to be in a bag.

Raw flour has E. Coli bacteria, factory farmed eggs will have salmonella due to poor hygiene (sitting in their own shit).

Speaking of eggs, grocery eggs are 2 weeks old due to needing to properly settle to a baking standard. Eggs from a local farmer may be safer, but will also be somewhat different and not have enough air for baking until they are also that age.

Steak is safe to eat rare due to its thickness and proximity away to any nasties in the body waste; hamburger is not. Burger is ground up with various cuts and intestines so needs to be cooked properly well done. Chickens are too small to have this effect, so salmonella is a risk no matter what. Pork is somewhat in between, as there is a risk for trichinosis, but the larvae are much easier to spot, making this start to go extinct in domestic pigs.

Dogs and Cats in general cannot have spices or seasonings, grapes, chocolate, or milk.

Most creatures are lactose intolerant due to the fact that they will not grow up into 1000 lb animals. Goats however, are closer to human size so their milk and cheese is more digestible. Smaller animals will need dilluted goat's milk, into a custom formula. (your grocery store may have this in a can, powdered.)

Pasta noodles mainly exist to hold sauce flavor in proportion; thicker noodles like rotini are usually recommended for thicker sauces such as tomato/marinara.

It is safer for pizza chefs to not wear gloves, actually! Gloves cannot be washed, only changed, and they are trained anyways to not touch someone's food once cooked. Cooking trays/pans, industrial sized knives, spatulas, and boxes all make this possible.

Humans are very dense and weighty creatures proportionally, that they can essentially tank a lot of poison damage that other animals cannot. This is one of many reasons we are not picky eaters as a whole!

Kids instinctively dislike bitter foods due to not having grown up into this said tankiness; vegetables and things that may be good for them can taste like poison, and they cannot tell the difference yet.

Electric Kettles are more efficient at boiling water than stovetops. I'll let the video guy speak for himself, but they boil water directly rather then heating a pot/pan which then heats the water. This is great for things such as small meals, partially unclogging drains, or heating bathwater.

Keurig or similar machines do not boil the water for your coffee! They heat to 100 degrees, so if your town has a boil order up, do not pour unboiled water into their tanks!

Large packs of water and soda often have bar codes on the top- you may not have to lift them if a laser-gun can get involved!

chicken nuggets from the golden arches are beer battered, the way fish are. They're fish-fried chicken.

Grocery Register Belts can have some really dumb design- with the computer /register itself taking up half the width of the goddamn belt. Keep your food safer by loading the belt heavy to light if you can- or light to heavy. Also, putting your food in a straight line towards the checker. You cannot trust the infared camera to stop the belt unless your items are opaque- your beer will crush your bananas in front of them unless they can slide over the scanner zone. You will prefer a fixable scan error until we can perform alchemy.

Fruits and Vegetables have 4 digit international trade codes! unless you know what breed your apple is or are bad with numbers, these are probably easier to input if you happen to be ringing these up yourself. It is perfectly possible for a self-check system to sell you the wrong kind. Same thing with the numbers on a bar code- they also work, if your code is faded or corrupted. (or, for whatever fucking reason a brand decides, light colors like silver, or cute shapes. those suck. looking at you, bud fucking weiser with your fucking ribbon.) The laser guns are a bit more accurate than the belt as a second resort.

4 notes

·

View notes

Text

Are Canada's food labeling laws really lax? @thetabirb 's mom brought us a variety of these "hot chocolates"

[Image Description: a torn and empty packet of drink mix. The packet is green, with a cartoony dancing green T-Rex. The torn top is branded "Gourmet Village", and the packet is labeled "Green Color Changing White Hot Chocolate Mix", with it repeated on the bottom in French ("Mélange Pour Chocolat Chaud Blanc Qui Devient Vert"). In the bottom corners it says in tiny letters "Artificial flavor/Aromes Artefciels". End I.D]

from the northern border but the interesting thing is, uh

[Image Description: the white back of the packet, showing the ingredients (and two seals, one declaring it gluten free and the other declaring it vegetarian). The ingredients are: sugars (sugar, corn syrup solids), modified milk ingredients (whey protein concentrate, dairy product solids), coconut oil, salt, dipotassium phosphate, mono- and diglycerides, cellulose gum, guar gum, artificial flavours, silicon dioxide, turmeric, annatto, tartrazine, Sunset Yellow FCF, Brilliant Blue FCF. Contains: Milk". Beneath that the ingredients are repeated in French. End I.D]

There's no actual chocolate in it. And not even in a white chocolate way, where there's cocoa butter but no cocoa powder and cocoa solids. There's no cocoa anything, meaning it's not chocolate. Which works for me because cocoa powder and solids give me vomiting migraines (the cocoa butter in white chocolate is fine), and it bypasses the ethics of supporting the consumption of slave-made chocolate, but. I'm baffled

In the U.S this would have to be called something like "chok'lit drink" or something. It's why we have "cheez" or "kreme", because they can't legally be called cheese or cream given their ingredients and/or formulation, or vegan foods are called "chik'n" and the like. There's even a push by the dairy industry to ban the marketing and calling of calling plant-based milk, "milk". And I know the E.U is even more anal about food designations. Theta and I were in disbelief that it didn't have any cocoa anything in it last night. Out of six different packets, only one of them had actual cocoa product in it.

(Also I drank my "hot chocolate" already, but one thing it was honest about was that it actually did turn my milk green.)

5 notes

·

View notes

Text

The Role of Oxygen Scavengers in the Oil and Gas Industry: Applications and Benefits

The oil and gas industry is a vital sector of the global economy. It provides the energy required to power our homes, businesses, and industries. However, the products and processes used in this industry are often subject to oxidation, which can lead to corrosion, spoilage, and other detrimental effects. Oxygen scavengers are a class of chemical compounds that can help prevent these problems. In this article, we'll explore the role of oxygen scavengers in the oil and gas industry, as well as their applications and benefits. Additionally, we'll touch on the use of oxygen scavenging films in food packaging and oxygen scavenger pharmaceutical packaging.

What are Oxygen Scavengers?

Oxygen scavengers are chemical compounds that react with and remove oxygen from their surroundings. They are commonly used in a variety of applications where oxygen can cause damage or spoilage. Oxygen scavengers can take the form of powders, pellets, or films, and they are often added to products or packaging to protect them from the harmful effects of oxygen.

Applications of Oxygen Scavengers in the Oil and Gas Industry

In the oil and gas industry, oxygen scavengers are used to prevent corrosion, a process that occurs when oxygen reacts with metal surfaces. Corrosion can cause leaks, equipment failures, and other safety hazards. Oxygen scavengers work by removing oxygen from the environment, thus preventing it from reacting with metal surfaces. This helps to extend the life of equipment and prevent safety hazards.

Another application of oxygen scavengers in the oil and gas industry is in the preservation of oil and gas products. When oil or gas is exposed to oxygen, it can undergo oxidation, which can cause it to spoil or degrade. Oxygen scavengers can be used to remove oxygen from storage tanks, pipelines, and other equipment, thus helping to preserve the quality of these products.

Benefits of Oxygen Scavengers in the Oil and Gas Industry

The use of oxygen scavengers in the oil and gas industry offers several benefits, including:

Corrosion Prevention: By removing oxygen from the environment, oxygen scavengers can help prevent corrosion, which can extend the life of equipment and prevent safety hazards.

Improved Product Quality: Oxygen scavengers can help preserve the quality of oil and gas products by preventing oxidation and spoilage.

Cost Savings: By preventing corrosion and improving product quality, oxygen scavengers can help reduce maintenance costs and prevent the need for costly repairs.

Oxygen Scavenging Films in Food Packaging and Pharmaceutical Packaging

Oxygen scavenging films are also used in food packaging and pharmaceutical packaging. In these applications, oxygen scavengers help to preserve the freshness and quality of the products by removing oxygen from the packaging. This helps to extend the shelf life of the products and prevent spoilage.

In food packaging, oxygen scavenging films are commonly used for products such as meat, cheese, and baked goods. These products are particularly susceptible to spoilage caused by oxygen exposure. Oxygen scavenging films can help to prevent this by removing oxygen from the packaging.

In pharmaceutical packaging, oxygen scavenging films are used to preserve the quality and efficacy of drugs. Oxygen exposure can cause degradation of certain drugs, which can reduce their effectiveness. Oxygen scavenging films can help to prevent this by removing oxygen from the packaging.

Conclusion

Oxygen scavengers play a vital role in the oil and gas industry, as well as in food packaging and pharmaceutical packaging. They offer several benefits, including corrosion prevention, improved product quality, and cost savings. By removing oxygen from the environment, oxygen scavengers can help to extend the life of equipment and products, prevent spoilage, and preserve the effectiveness of drugs. As such, they are an important tool in maintaining the safety, quality, and efficiency of various products and processes.

#Oxygen scavenger pharmaceutical packaging#Oxygen scavenging films in food packaging#corrosion blocker#rust inhibitor for water#Oilfield chemicals manufacturer in India#Oilfield chemicals exporter in India#petrochemical companies#petrochemical industries#petrochemical solutions#oil and gas industry#oil and gas companies

6 notes

·

View notes

Text

The Role of Phosphoric Acid in the Food Industry

Phosphoric acid is a colorless, odorless, and tasteless inorganic acid that has been widely used in the food industry for many years. It is a key ingredient in many popular food and beverage products, such as soft drinks, jams, jellies, and processed cheeses. In this blog, we will discuss the role of phosphoric acid in the food industry and highlight some of the top phosphoric acid suppliers, exporters, and distributors in Saudi Arabia.

Firstly, let's look at the role of phosphoric acid in the food industry. Phosphoric acid is primarily used as a food additive to provide tartness or acidity to processed foods and beverages. It is also used as a preservative to prevent spoilage and extend the shelf life of food products. In addition, phosphoric acid is used in the production of phosphate salts, which are used in a wide range of food products, such as baking powder, cheese, and meats.

Another important use of phosphoric acid in the food industry is in the production of soft drinks. It is a key ingredient in many popular carbonated beverages, providing the distinctive tart flavor and acidity that consumers love. Phosphoric acid is also used as a chelating agent, which helps to remove metals from the water used in soft drink production, preventing the formation of unwanted flavors and odors.

Now, let's look at some of the top phosphoric acid suppliers, exporters, and distributors in Saudi Arabia. These companies offer high-quality phosphoric acid products that meet the strictest food safety and quality standards.

SABIC: SABIC is one of the largest chemical producers in the world, and a leading supplier of phosphoric acid in Saudi Arabia. The company's phosphoric acid products are widely used in the food, pharmaceutical, and agriculture industries.

Maaden: Maaden is a mining and minerals company that produces high-quality phosphoric acid products for the food industry. The company's products are exported to customers around the world, including major food and beverage manufacturers.

Arabian Chemical Company: Arabian Chemical Company is a leading distributor of phosphoric acid products in Saudi Arabia. The company offers a wide range of high-quality phosphoric acid products, including food-grade and technical-grade varieties.

In conclusion, phosphoric acid plays a critical role in the food industry, providing tartness, acidity, and preservative properties to a wide range of processed foods and beverages. If you are in need of phosphoric acid products for your food manufacturing operations, be sure to consider the top phosphoric acid suppliers, exporters, and distributors in Saudi Arabia, including SABIC, Maaden, and Arabian Chemical Company.

#Phosphoric acid suppliers in Saudi Arabia#Phosphoric acid exporters in Saudi Arabia#Phosphoric acid distributors in Saudi Arabia#palvifze

3 notes

·

View notes

Text

@tubbosbeess *cracks knuckles* history lesson time!!!!

so in the late 70s in the US, there was a huge dairy shortage. the government of the time decided it would be a good idea to step in and help the industry. so basically dairy farmers were like "let me make as much milk as humanly possible" because any overstock that wasn't bought by consumers would be bought by the government. they started turning the milk into cheese so it would last longer.

in the middle of all this a new president was elected, so it became his problem instead. they had Too Much Cheese. they started giving it away as gifts to people. it was going moldy. there was an entire slang term for subpar quality coined. "government cheese" was real.

this is where the caves come in. Springfield, Missouri is home to some deep limestone mines, and also climate controlled because, well, they're caves. 60 degrees is perfect for cheese. so. there's just. a vault of cheese. in the mines under Springfield.

BUT THAT'S NOT ALL!!! they stored it under Kansas City, too, because they had too much cheese for one mine system to be able to hold. there are 161 million pounds of cheese under Kansas City.

the cheese caves had grown to hold over 1.2 billion (BILLION WITH A B) POUNDS OF CHEESE by 1984. the government was still buying unsold milk from farmers, because not supporting farmers would be a huge misstep in the public eye. this kind of where the got milk? ad campaign comes from, because the government wanted to stop buying milk and make the general public aware that they, too, can buy milk.

the part of the cheese caves that's owned by the department of agriculture is used to make school lunches and military foods. Kraft and other companies own other parts of the caves. the estimate now is that they contain 1.4 billion pounds of cheese and powdered milk. you can visit them. they'll probably give you some cheese.

46K notes

·

View notes

Text

The cheese powder market is estimated at USD 630 million in 2023 and is projected to reach USD 895 million by 2028, at a CAGR of 7.3% from 2023 to 2028.

#Cheese Powder Market#Cheese Powder Market Size#Cheese Powder Market Share#Cheese Powder Market Growth#Cheese Powder Market Trends#Cheese Powder Market Forecast#Cheese Powder Market Analysis#Cheese Powder Industry#Cheese Powder Industry Size#Cheese Powder Industry Share#Cheese Powder Industry Growth#Cheese Powder Industry Trends#Cheese Powder Industry Forecast#Cheese Powder Industry Analysis#Cheese Powder Industry Overview

0 notes

Text

Cheese Powder Market Projected to Garner Significant Revenues by 2028

According to MarketsandMarkets, the cheese powder market size is projected to reach USD 895 million by 2028 from USD 630 million by 2023, at a CAGR of 7.3% during the forecast period in terms of value. The demand for cheese powder is expected to grow owing to the growth of the fast-food industry, globally. The changing dietary preferences of people have led to a significant rise in the consumption of convenience and fast food worldwide, which in turn is expected to increase the demand for cheese powder.

The modern food landscape has witnessed a significant shift in consumer preferences, with snack foods emerging as a dominant and evolving segment. This transformation can be attributed to changing lifestyles, urbanization, busier routines, and a growing penchant for convenience. Among the plethora of snack options available, there has been a notable surge in the consumption of flavoured popcorn, chips, and other Savory snacks, which have become staple indulgences for people of all ages. The versatility of cheese powder has enabled manufacturers to explore a wide array of creative combinations and fusion Flavors. This flexibility allows snack producers to continually innovate and introduce new taste sensations to captivate ever-evolving consumer palates. As a result, the rising demand for snack foods has been intrinsically linked to the imaginative use of cheese powder, showcasing its capacity to be both a foundational element and a catalyst for culinary ingenuity.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=103908380

Thus, the demand for cheese powder is increasing to fulfill the growing demand for cheese flavorants by giant fast-food chains such as Domino's Pizza, Inc. (US), Pizza Hut of Yum! Brands (US), and Papa John's International, Inc. (US). Changing lifestyles such as increasing dependence on ready-made or ready-to-eat meals due to busier schedules, and increased demand for packaged foods, globally, have increased the demand for fast food products and ultimately fueled the demand for cheese powder products. Furthermore, above-the-line sales promotion activities such as advertisements through television, print media, and the Internet have also increased awareness regarding cheese-based fast-food products among people.

The cheese powder market is highly impacted with the increasing size of the convenience & fast-food industry and innovative offerings by cheese powder manufacturers. The growth rate of the fast-food industry is significant owing to the changing lifestyles of people around the globe. The U.S. is the dominant market in the fast-food industry and this trend is expected to continue. The emerging economies of the Asia-Pacific region are the major markets for cheese powders and are increasingly contributing to their demand, owing to the rising disposable income, rapidly increasing population, and an increase in the demand for processed foods in these countries.

The widespread impact of Western cuisines on developing regions such as Asia-Pacific and Latin America has led to a tremendous increase in demand for cheese-based fast-food products. Moreover, constant innovations offer investment opportunities to cheese powder manufacturers. On the other hand, rising awareness about the ill-health effects of cheese such as obesity, high cholesterol levels, and heart problems, and stringent government regulations for labeling cheese-based products act as challenges to the cheese powder market.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=103908380

The Asia Pacific region is projected to be the fastest growing in the global cheese powder market. Presently, most developing nations such as China, India, Indonesia, and Malaysia are dependent on exports from North America and Europe for cheese powder. Countries such as Australia and New Zealand produce cheese powder on a large scale.

India and Australia are the largest producers of milk in the region, wherein the socio-economic conditions of these countries offer growth opportunities to cheese powder manufacturers. Key players in the market are focusing on establishing their position in developing nations and are strengthening their distribution networks through mergers & acquisitions, partnerships, joint ventures, and collaborations.

The demand for cheese powder in the Asia Pacific region is driven by changing food preferences, increasing demand for convenient and processed foods, and the popularity of Western-style cuisines.

Request for Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=103908380

Land O'Lakes, Inc. (US), Kerry Group Plc (Ireland), Fonterra Co-operative Group Limited (New Zealand), Archer Daniels Midland (US), and Lactosan A/S (Denmark) are among the key players in the global cheese powder market. These players in this market are focusing on increasing their presence through partnership and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe.

#Cheese Powder Market#Cheese Powder#Cheese Powder Market Size#Cheese Powder Market Share#Cheese Powder Market Growth#Cheese Powder Market Trends#Cheese Powder Market Forecast#Cheese Powder Market Analysis#Cheese Powder Market Report#Cheese Powder Market Scope#Cheese Powder Market Overview#Cheese Powder Market Outlook#Cheese Powder Market Drivers#Cheese Powder Industry#Cheese Powder Companies

0 notes

Text

My understanding from memory is that during World War II they kept our economy going by bolstering every single thing we could domestically produce, one of the largest already being dairy, which was also tasked with making a cheap kind of cheese the government would amass in an enormous vault as an emergency public food ration because cheese keeps basically forever.

So dairy as an industry grew by several magnitudes in just a few short years and was seen as one of the forces helping America survive the war. It was either during or after this that the most powerful figures running that industry formed a lobby, which in a sense is kind of like a union, but instead of employees banding together to demand certain standards from their employer a lobby is rich people joining forces to donate so much money to our government that they can make demands, like "help keep us rich or we're cutting you off."

After the war we were stuck with this big milk empire producing way more milk than the population actually needed so they used that lobbying power to make various deals with other industries, coming up with more products that would use milk in them even if it wasn't really necessary, sonetimes even tje durextions on something like cake mix telling you to use milk even if there's already enough milk in the powder mix or milk would actually make the cake a little worse.

The biggest scheme was a decades long campaign to push dairy as a "basic fundamental food group" and a source of nutrition that we all need "to grow healthy bones and muscles," including paid "studies" that looked like real science but conflicted with any actual nutritional science.

Pushing for milk to be declared a state drink in every state they could is just one of the many other examples both large and small.

The big twist of course is that dairy is only one of the industries with a lobby like this. Fossil fuels are one everybody knows. Corn, beef and eggs are some of the other food examples. All variations on the same story I just told, though I might have got some beats out of order.

37K notes

·

View notes

Text

How Heavy Metals in Whey Protein Could Be Harming Your Health!

As fitness enthusiasts, we are constantly looking for ways to enhance our workout results, boost muscle growth, and recover faster. Whey protein supplements have become a go-to solution for anyone looking to meet their daily protein requirements. Among the various options, Isolate Whey Protein has gained significant popularity due to its high protein content and low fat and carbohydrate content. However, recent studies have raised concerns about the presence of hidden heavy metals in many protein powders, potentially putting your health at risk. Are you unknowingly consuming dangerous toxins with every scoop of protein? Let's dive deeper into this issue and uncover the hidden heavy metal threat in protein supplements.

What Are Heavy Metals and Why Are They Dangerous?

Heavy metals are a group of elements that can be toxic even in small quantities. Some of the most common heavy metals found in protein supplements include:

Lead

Arsenic

Cadmium

Mercury

These metals are naturally occurring in the environment, but industrial pollution, soil contamination, and poor manufacturing practices can introduce them into food products, including protein powders.

Exposure to heavy metals can have serious health consequences. Long-term exposure, even at low levels, can lead to a variety of health issues, including:

Kidney damage

Neurological problems

Hormone disruption

An increased risk of cancer

For individuals who consume protein supplements regularly, the risk of accumulating these toxic metals over time becomes a serious concern.

How Do Heavy Metals End Up in Protein Supplements?

The presence of heavy metals in protein supplements is often the result of contaminated raw materials. Whey protein is derived from milk during the cheese-making process, and if the cows are exposed to contaminated feed, water, or soil, the heavy metals can end up in the whey protein. Similarly, plant-based proteins can also be contaminated if the plants absorb toxins from the soil.

Manufacturers sometimes neglect proper testing for heavy metals or fail to follow rigorous safety protocols during production, leading to products with higher-than-acceptable levels of toxic substances. Some companies may also use cheaper, lower-quality sources for their protein, which could be more likely to contain heavy metal contaminants.

The Hidden Threat in Popular Whey Protein Supplements

While not all Whey Protein Supplement are contaminated, numerous studies have found that many of the most popular brands contain concerning levels of heavy metals. A study by the Clean Label Project, which analyzed over 130 protein powders, found that:

74% of the products tested contained detectable levels of lead, arsenic, cadmium, or mercury.

Some of these products even contained levels of heavy metals that exceeded the safety limits set by the FDA.

Even protein powders labelled as “Isolate Whey Protein,” often marketed as the highest-quality protein with minimal impurities, are not immune to heavy metal contamination. Since Isolate Whey Protein undergoes additional processing to remove fats and carbohydrates, it should theoretically have fewer toxins. However, the raw whey used in the production still has the potential to contain heavy metals, especially if sourced from regions with poor agricultural practices or inadequate quality control.

How to Choose the Best Whey Protein Supplement?

As a fitness enthusiast, it's essential to choose a high-quality whey protein supplement that not only supports your fitness goals but also ensures your health is not compromised. When shopping for the Best Whey Protein Supplement, consider the following tips:

Check for Third-Party Testing

Look for products that have undergone third-party testing for heavy metals.

Reputable manufacturers often provide lab reports or certifications that indicate the product is free of dangerous toxins.

Choose a Trusted Brand

Stick to well-known brands that have a track record of quality and safety.

While lesser-known brands may be cheaper, they may also skimp on quality control, putting your health at risk.

Look for Isolate Whey Protein

If you’re looking for a purer, higher-quality form of protein, Isolate Whey Protein is typically the best choice.

This version undergoes more filtering, removing excess fat and carbs, and providing you with a protein source that is as clean as possible.

However, always verify that the brand follows stringent safety protocols during production.

Read Product Labels Carefully

Always check the product label for information about its sourcing and testing practices.

Avoid products that don’t provide transparent details on their ingredients, sourcing, and safety measures.

Consider Organic Options

Organic whey protein supplements are often a safer bet, as organic farms are subject to stricter regulations that limit the use of pesticides, herbicides, and fertilizers, which can introduce heavy metals into the food chain.

Fitspire Protein Supplements: A Safer Option

If you’re concerned about the quality and safety of your protein supplements, Fitspire is a brand that stands out as a reliable and trustworthy choice. Fitspire’s protein products, including their Whey Protein Isolate, are formulated to provide you with high-quality protein without the risk of harmful contaminants.

Fitspire takes a proactive approach to ensure the safety of their products. Their Whey Protein Isolate is made with premium ingredients that undergo rigorous testing for heavy metals and other impurities. The company works with certified manufacturers who adhere to strict quality control standards to provide consumers with a product that meets high safety and performance expectations.

Fitspire's commitment to quality goes beyond just the absence of toxins. Their whey protein is also packed with essential amino acids that support muscle recovery and growth, making it a great option for fitness enthusiasts. The product contains minimal fat and carbohydrates, making it suitable for those looking to maintain lean muscle mass while avoiding unnecessary calories.

Fitspire also offers transparency in its product labelling and testing, which is a crucial factor in ensuring consumer safety. By choosing Fitspire, you can rest assured that you’re getting the Best Protein Powder without the worry of hidden contaminants.

What Can You Do to Minimize Your Risk?

While the presence of heavy metals in protein supplements is concerning, there are steps you can take to minimize your risk:

Diversify Your Protein Sources

Don’t rely solely on protein powders for your protein intake.

Incorporate natural sources of protein, such as lean meats, fish, eggs, and legumes, into your diet to reduce your reliance on supplements.

Use Protein in Moderation

While protein supplements are convenient, they should not replace whole foods entirely.

Consume protein supplements in moderation, as part of a balanced diet, and avoid overconsumption, which could lead to an accumulation of heavy metals.

Educate Yourself

Stay informed about the potential risks of Protein Supplements.

Keep an eye on independent lab reports, reviews, and studies to ensure that you’re choosing the safest products available.

Conclusion

While Best Whey Protein Supplement, especially Isolate Whey Protein, can be a valuable tool for fitness enthusiasts looking to boost muscle growth and recovery, it's crucial to be aware of the hidden heavy metal threat in many protein powders. By choosing the Best Protein Powder with careful attention to quality control, third-party testing, and reputable brands, you can protect your health while reaching your fitness goals. Fitspire offers a safe, high-quality option that ensures you’re getting the protein you need without the hidden risks. Make informed choices and prioritize your health to ensure that your fitness journey is as safe as it is effective.

0 notes

Link

0 notes