#Charles Schwab Review

Text

#Charles Schwab#Charles Schwab Review#Charles Schwab Scam#Charles Schwab Reviews 2024#Charles Schwab Forex broker

0 notes

Text

BY PARK MACDOUGALD

The “movement,” in turn, while it recruits from among students and other self-motivated radicals willing to put their bodies on the line, relies heavily on the funding of progressive donors and nonprofits connected to the upper reaches of the Democratic Party. Take the epicenter of the nationwide protest movement, Columbia University. According to reporting in the New York Post, the Columbia encampment was principally organized by three groups: Students for Justice in Palestine (SJP), Jewish Voice for Peace (JVP), and Within Our Lifetime (WOL). Let’s take each in turn.

JVP is, in essence, the “Jewish”-branch of the Boycott, Divestment and Sanctions movement, backed by the usual big-money progressive donors—including some, like the Rockefeller Brothers Fund, that were instrumental in selling Obama’s Iran Deal to the public. JVP and its affiliated political action arm, JVP Action, have received at least $650,000 from various branches of George Soros’ philanthropic empire since 2017, $441,510 from the Kaphan Foundation (founded by early Amazon employee Sheldon Kaphan), $340,000 from the Rockefeller Brothers Fund, and smaller amounts from progressive donors such as the Quitiplas Foundation, according to reporting from the New York Post and NGO Monitor, a pro-Israel research institute. JVP has also received nearly $1.5 million from various donor-advised funds—which allow wealthy clients to give anonymously through their financial institutions—run through the charitable giving arms of Fidelity Investments, Charles Schwab, Morgan Stanley, Vanguard, and TIAA, according to NGO Monitor’s review of those institutions’ tax documents.

SJP, by contrast, is an outgrowth of the Islamist networks dissolved during the U.S. government’s prosecution of the Holy Land Foundation (HLF) and related charities for fundraising for Hamas. SJP is a subsidiary of an organization called American Muslims for Palestine (AMP); SJP in fact has no “formal corporate structure of its own but operates as AMP’s campus brand,” according to a lawsuit filed last week against AJP Educational Fund, the parent nonprofit of AMP. Both AMP and SJP were founded by the same man, Hatem Bazian, a Palestinian academic who formerly fundraised for KindHearts, an Islamic charity dissolved in 2012 pursuant to a settlement with the U.S. Treasury, which froze the group’s assets for fundraising for Hamas (KindHearts did not admit wrongdoing in the settlement). And several of AMP’s senior leaders are former fundraisers for HLF and related charities, according to November congressional testimony from former U.S. Treasury official Jonathan Schanzer. An ongoing federal lawsuit by the family of David Boim, an American teenager killed in a Hamas terrorist attack in 1996, goes so far as to allege that AMP is a “disguised continuance” and “legal alter-ego” of the Islamic Association for Palestine, was founded with startup money from current Hamas official Musa Abu Marzook and dissolved alongside HLF. AMP has denied it is a continuation of IAP.

Today, however, National SJP is legally a “fiscal sponsorship” of another nonprofit: a White Plains, New York, 501(c)(3) called the WESPAC Foundation. A fiscal sponsorship is a legal arrangement in which a larger nonprofit “sponsors” a smaller group, essentially lending it the sponsor’s tax-exempt status and providing back-office support in exchange for fees and influence over the sponsorship’s operations. For legal and tax purposes, the sponsor and the sponsorship are the same entity, meaning that the sponsorship is relieved of the requirement to independently disclose its donors or file a Form 990 with the IRS. This makes fiscal sponsorships a “convenient way to mask links between donors and controversial causes,” according to the Capital Research Center. Donors, in other words, can effectively use nonprofits such as WESPAC to obscure their direct connections to controversial causes.

Something of the sort appears to be happening with WESPAC. Run by the market researcher Howard Horowitz, WESPAC reveals very little about its donors, although scattered reporting and public disclosures suggest that the group is used as a pass-through between larger institutions and pro-Palestinian radicals. Since 2006, for instance, WESPAC has received more than half a million in donations from the Elias Foundation, a family foundation run by the private equity investor James Mann and his wife. WESPAC has also received smaller amounts from Grassroots International (an “environmental” group heavily funded by Thousand Currents), the Sparkplug Foundation (a far-left group funded by the Wall Street fortune of Felice and Yoram Gelman), and the Bafrayung Fund, run by Rachel Gelman, an heir to the Levi Strauss fortune and the sister of Democratic Rep. Dan Goldman. (A self-described “abolitionist,” Gelman was featured in a 2020 New York Times feature on “The Rich Kids Who Want to Tear Down Capitalism.”) In 2022, WESPAC also received $97,000 from the Tides Foundation, the grant-making arm of the Tides Nexus.

WESPAC, however, is not merely the fiscal sponsor of the Hamas-linked SJP but also the fiscal sponsor of the third group involved in organizing the Columbia protests, Within Our Lifetime (WOL), formerly known as New York City SJP. Founded by the Palestinian American lawyer Nerdeen Kiswani, a former activist with the Hunter College and CUNY chapters of SJP, WOL has emerged over the past seven months as perhaps the most notorious antisemitic group in the country, and has been banned from Facebook and Instagram for glorifying Hamas. A full list of the group’s provocations would take thousands of words, but it has been the central organizing force in the series of “Flood”-themed protests in New York City since Oct. 7, including multiple bridge and highway blockades, a November riot at Grand Central Station, the vandalism of the New York Public Library, and protests at the Rockefeller Center Christmas-tree lighting. In addition to their confrontational tactics, WOL-led protests tend to have a few other hallmarks. These include eliminationist rhetoric directed at the Jewish state—such as Arabic chants of “strike, strike, Tel Aviv”; the prominent display of Hezbollah flags and other insignia of explicitly Islamist resistance; the presence of masked Arab street muscle; and the antisemitic intimidation of counterprotesters by said masked Arab street muscle.

WOL’s role appears to be that of shock troops, akin to the role played by black block militants on the anarchist side of the ledger. WOL is, however, connected to more seemingly “mainstream” elements of the anti-Israel movement. Abdullah Akl, a prominent WOL leader—indeed, the man leading the “strike Tel Aviv” chants in the video linked above—is also listed as a “field organizer” on the website of MPower Change, the “advocacy project” led by Linda Sarsour. MPower Change, in turn, is a fiscal sponsorship of NEO Philanthropy, another large progressive clearinghouse. NEO Philanthropy and its 501(c)(4) “sister,” NEO Philanthropy Action Fund, have received more than $37 million from Soros’ Open Society Foundations since 2021 alone, as well as substantial funding from the Rockefeller Brothers Fund, the Ford Foundation, and the Tides Foundation.

#tides foundation#national lawyers guild#within our lifetime#jewish voice for peace#students for justice in palestine#dark money#rockefeller brothers fund#funding for terrorism#lisa fithian#occupy

23 notes

·

View notes

Text

2023 Book Review

Photo Credit (original): Ed Robertson

I read 95 books this year. Here's some of what I enjoyed and what I didn't, in genre or arbitrary categories:

Fave SFF books

Jonathan Strange & Mr Norrell (Susanna Clarke)

Spinning Silver (Naomi Novik)

All Systems Red (Martha Wells)

The Library at Mount Char (Scott Hawkins)

Mammoths at the gates (Nghi Vo)

Gideon the Ninth (Tamsyn Muir)

Amberlough (Lara Elena Donnelly)

Fab m/m romances

Seven Summer Nights (Harper Fox)

The Lodestar of Ys (Amy Rae Durreson)

The Scottish Boy (Alex de Campi)

Magician (KL Noone)

Heated Rivalry (Rachel Reid)

Also Role Model and The Long Game (Rachel Reid)

The Secret Lives of Country Gentlemen (KJ Charles)

The older ones

(recently published books can feel very samey after a while. The irony of these being old books but feeling like a breath of fresh air)

Tam Lin (Pamela Dean) (1991)

Swordspoint (Ellen Kushner) (1987)

Wise Children (Angela Carter) (1991)

Chronicle of a Death Foretold (Gabriel Garcia Marquez) (1981)

(more books under the cut)

Best atmosphere

The Likeness (Tana French)

The fun rereads

Scum Villain's Self-Saving System (MXTX_

Grandmaster of Demonic Cultivation (MXTX)

The King of Attolia (Megan Whalen Turner)

Empress of Salt and Fortune (Nghi Vo)

The Ruin of a Rake (Cat Sebastian)

The unexpected delight

(it's a biography, and I never anticipated feeling so engrossed in one of them)

The invention of Angela Carter (Edmund Gordon)

The one that hurts so good

Checkmate (Dorothy Dunnett)

Didn't quite love the books but adored the characters

The Dreamer Trilogy by Maggie Stiefvater (my typical experience of her stories)

The meh

Bardugo's Nikolai duology

Schwab's Darker Shades of Magic

The dreadful and my only DNF

A Taste of Gold and Iron (Alexandra Rowland)

Most bitterly disappointing

The third installment of Hall's billionaire series How to Belong with a Billionaire.

Biggest book hangover

Seven Summer Nights and Heated Rivalry

Best book boyfriend

ILYA ROZANOV

Most bonkers book

The Library at Mount Char (Scott Hawkins)

The "not sure I liked it but it'll definitely stay with me"

Some Desperate Glory (Emily Tesh)

The writing craft book that actually offered a new insight

The Heroine's Journey (Gail Carriger)

Overall, a decent year. My goal of completing series I'd started in the past and hadn't finished meant I subjected myself to some less enjoyable books, but I also read some excellent romances and fantasy novels, and I really enjoyed reading some older books, a practice I plan to continue.

past years

2015 2016 2019 first half of 2020 top 5 books of 2020 2021 2022

#books#2023 books#year in review#2023 in review#posted early bc I'm ill and I doubt I'll finish another book before Sunday#i'm prob going to read fic or binge netflix#booklr#reading

21 notes

·

View notes

Note

Hiya! I’m trying to choose a bank, and was thinking that Charles Schwab seemed like a good idea. It’s good for travel-which I want to do in the future especially since I was to move abroad. Nerd Wallet ranks it well and there’s no bad reviews for it on Reddit as far as I checked (there are downsides listed but no one said Don’t use it). There seems to be no minimum deposit and no interest.

I was also looking at PNC bank, but the reviews are 50/50….

Hey cutie! You're doing everything right to evaluate the banks. So I don't know if this will tip the scales, but... this Bitch right here uses Charles Schwab. I have my 401(k) parked there currently and have no complaints. Bitch tested, Bitch approved.

But keep doing your homework! Make sure the bank you choose fulfills your personal needs. And remember--you can have more than one bank! Here's more advice:

How the Hell Does One Open a Bank Account? Asking for a Friend.

Cheat on Your Bank—It's Not Your Girlfriend

Did we just help you out? Tip us!

15 notes

·

View notes

Text

July - September 2023 | Reading Wrap Up

[Jan-March] [April-June]

Autumn is here, and with it, my summery wrap up! And speaking of summer... Here is my recap of Forgotten YA Gems' V Summer Bingo Reading Challenge, complete with fancy card. As usual, I loved it. I love a good literary bingo ;)

Note: Our beloved Forgotten YA Gems group, after several years of joyful activity, has closed its door on the Goodreads group, but is still active in Discord, for those of you who might be interested!

And now, onto the wrap up!

Code: books read in English are in black, books read in Spanish are in red and the book I read in French is in blue.

JULY (8)

Los hombres no son islas. Los clásicos nos ayudan a vivir - Nuccio Ordine, translation into Spanish by Jordi Bayod

A Lady by Midnight (Spindle Cove #3) - Tessa Dare -> 3/5

Pride and Prejudice - Jane Austen -> 5/5

Historias d’antis más de Biscarrues - Ed. Sandra Araguás [Only available in Spanish] -> 3/5

The Magpie Lord (A Charm of Magpies #1) - KJ Charles -> 3.5/5

Whose Body? (Lord Peter Wimsey #1) - Dorothy L. Sayers -> 3/5

A Witch's Guide to Fake Dating a Demon - Sarah Hawley -> 3/5

Tintin in America (Tintin #3) - Hergé, translation into English by Leslie Lonsdale-Cooper & Michael Turner -> 2.5/5

July was fun. Nuccio Ordine's philosophical analysis of the importance of classical books for the humanisation of our society was perhaps not fun, but it was surprisingly less dry than I expected it to be. Some good romances came along afterwards, as well as a collection of local myths and stories from Spain, a murder mystery, and my first Tintin! I'd had it aroung for years, it was part of a present from many years ago when my English wasn't yet good enough to read it and then I just never got around to it until this summer...

Overall, nothing exceedingly remarkable (except for my dearly beloved P&P), but good vibes in the melting heat.

AUGUST (7)

Flight 714 to Sydney (Tintin #22) - Hergé, translation into English by Leslie Lonsdale-Cooper & Michael Turner -> 2/5

Cigars of the Pharaoh (Tintin #4) - Hergé, translation into English by Leslie Lonsdale-Cooper & Michael Turner -> 3/5

Cultish: The Language of Fanaticism - Amanda Montell -> 4.5/5

The Blue Lotus (Tintin #5) - Hergé, translation into English by Leslie Lonsdale-Cooper & Michael Turner -> 3/5

Broderies - Marjane Satrapi -> 3/5

The Near Witch - Victoria Schwab -> 3.5/5

Murder in the Orient Express (Hercule Poirot #9) - Agatha Christie -> 4.5/5

August was good! More Tintin (I have now finished all of the comics I had lying around in my parents' house), an amazing non-fiction book on linguistics by Amanda Montell (she also wrote Wordslut, which I loved, so clearly her writing is quite up my alley and I can't wait for her to publish her third book), a very good spooky story by Victoria Schwab, another autobiographical graphic novel by Marjane Satrapi that I hadn't read yet, and my first time reading Murder in the Orient Express in English (although the book itself I've read like six times). Can't complain.

SEPTEMBER (3)

The Secret Service of Tea and Treason (Dangerous Damsels #3) - India Holton -> 4/5

Prosa completa - Alejandra Pizarnik -> 1/5

Mythos: The Greek Myths Retold (Stephen Fry’s Great Mythology #1) - Stephen Fry -> 4/5

Welllllll apparently what I need to sit down and read is horrifying heatwaves because my September reading went down a notch. Alejandra Pizarnik's complete prose was absolute horrific, derailed my entire month, and I'll never get close to her writings ever again, but the other two were very good at least! And I was definitely entertained.

And thus another three months have gone by... I am not particularly close to reaching all of my reading goals, but I am also doing better than I was this time last year so I shall count it as a win. We'll see what the last quarter of the year holds!

A couple of last-minute links:

The Lesbrary is looking for reviewers!

I am asking for Portuguese-written book recs!

How was your summer reading?

5 notes

·

View notes

Note

im cheating and sending u the same numbers that you sent me because theyre like, the best questions okay 1, 2, 15, 19 KISSES

hiiiiii bestie my answers aren't nearly as interesting as yours sadly, i could NEVER be as well read as you. this got long so the tldr is don't listen to me for book recs just go to jess :)

1. book you’ve reread the most times?

technically it’s probably twilight but let’s say it’s not, and in that case let’s say it’s the raven boys by maggie stiefvater. it’s definitely my most heavily annotated book and i tend to date my annotations and well there’s just a lot of them

2. top 5 books of all time?

i’m gonna do a fiction list and a nonfiction list and again be nice bc i’m not super well read 😭😭 also in no particular order

fiction:

catching fire by suzanne collins sorry i’m a slut for the second book in a series

a gathering of shadows by v.e. schwab see above

the dream thieves by maggie stiefvater sigh. see above

six of crows by leigh bardugo

the secret history by donna tartt sorry women

nonfiction:

dark waters: flood and redemption in the city of masterpieces by robert clark

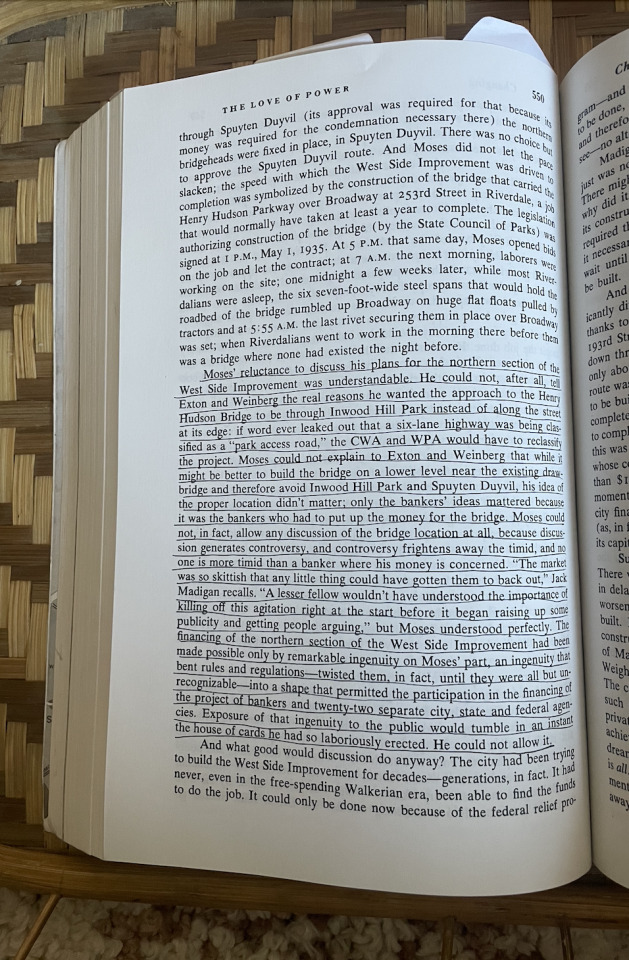

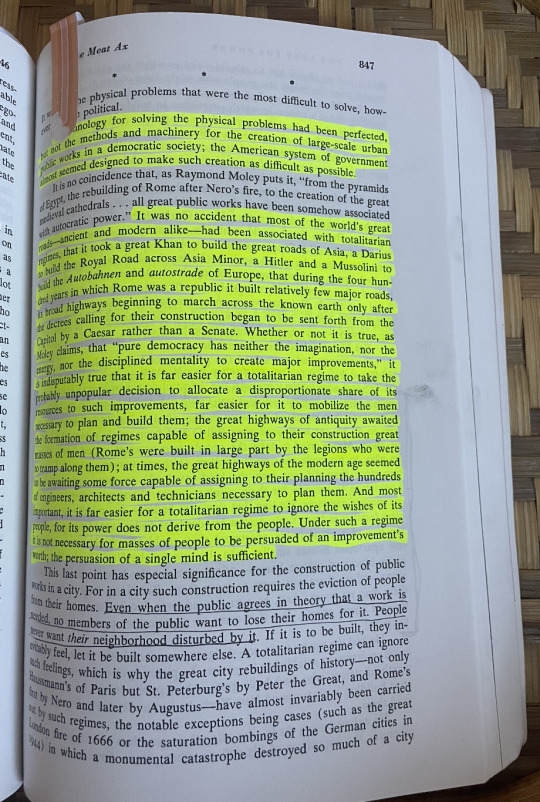

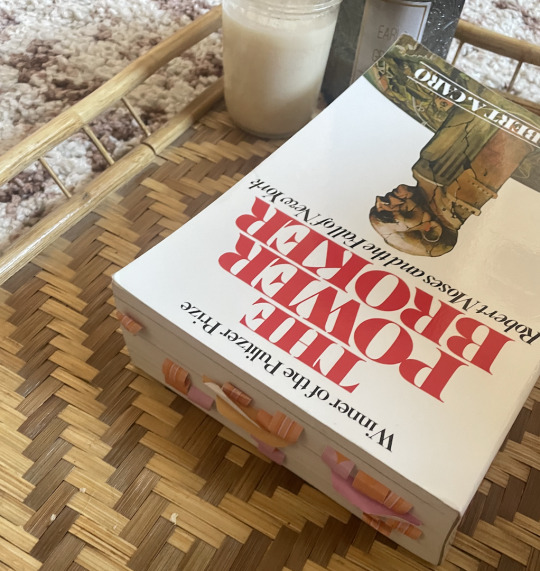

the power broker: robert moses and the fall of new york by robert caro

the line becomes a river: dispatches from the border by francisco cantù

dopesick: dealers, doctors, and the drug company that addicted america by beth macy

unsettling truths: the ongoing, dehumanizing legacy of the doctrine of discovery by mark charles and soong-chan rah sorry for listing a book on religion. also if these guys names mean anything to you pls do NOT look at me

15. recommend and review a book

ok ok gonna do my fave nonfiction i've read recently and some of you have been unlucky enough to hear me talk about it but it's the power broker by robert caro, it's a 1,200+ page brick of a nonfiction book published in the 1970's as a biography of robert moses and just new york city infrastructure in general. i read a lot of nonfiction and honestly a lot of the writing is just bad even if the content is interesting but this was seriously one of the most well-written pieces of work i've ever read and it completely changed the way i think about local government. some fun excerpts and all my notes:

granted, part of the fun was i read it with my dad and we had a lot of fun bonding over it, but still! it's been such a cool foundation for other works on urban studies, too - i recently finished davarian l baldwin's in the shadow of the ivory tower: how universities are plundering our cities and there was a whole chapter on new york that i felt really well-equipped to engage with

19. most disliked popular books?

ok not to be one of those ppl that are like teehee i hated it before it was problematic but genuinely i never got the hype about harry potter. i think the problem is i read them out obscenely out of order and probably just a little too young (i started with the order of the phoenix when i was 10) but nevertheless i've just never cared. more recently i read the midnight library and i was so unimpressed i was this could've just been a supernatural episode we didn't have to do all this

book asks <3

#so seriously. if you know of a series with a compelling second installment send it my way bc i’m bound to make it my whole personality#SORRY THIS WAS LONG WINDED#in short: don't come to me for book recs. go to jess!!#i know i got more of these asks but i am going to answer them later as i need to go get a slushie before my laundry finishes

10 notes

·

View notes

Text

5 Trade Ideas for Monday: DexCom, eBay, Hormel, Schwab and Walmart

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

DexCom, Ticker: $DXCM

DexCom, $DXCM, comes into the week approaching resistance. It has RSI in the bullish zone with the MACD positive and climbing. Look for a push over resistance to participate…..

eBay, Ticker: $EBAY

eBay, $EBAY, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

Hormel Foods, Ticker: $HRL

Hormel Foods, $HRL, comes into the week approaching resistance. It has a RSI in the bullish zone with the MACD positive. Look for a move over resistance to participate…..

Charles Schwab, Ticker: $SCHW

Charles Schwab, $SCHW, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive. Look for a move over resistance to participate…..

Walmart, Ticker: $WMT

Walmart, $WMT, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive and climbing. Look for a push over resistance to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the June Options Expiration and the FOMC meeting, noted equity market strength as a change of leadership with rotation into the Large Caps and Small Caps at the expense of Tech names, but not sinking Tech stocks.

Elsewhere look for the supporting cast to remain in consolidation. Gold looks to continue its consolidation in a pullback while Crude Oil consolidates in a broad range. The US Dollar Index looks to pullback in consolidation while US Treasuries churn sideways. The Shanghai Composite looks to continue in a short term consolidation while Emerging Markets consolidate in a tight range.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. Their charts look strong, especially on the longer timeframe. The SPY joined the QQQ with a move over the August 2022 high, both at the highest level in over a year, and the IWM rising out of consolidation. On the shorter timeframe the QQQ has moved to consolidation in the uptrend while the SPY and IWM continue higher. Use this information as you prepare for the coming week and trad’em well.

2 notes

·

View notes

Text

Top Forex Brokers of 2024: Comprehensive Reviews and Ratings

Top Forex Brokers of 2024: Comprehensive Reviews and Ratings

The forex market, known for its vast liquidity and 24-hour trading cycle, continues to attract traders worldwide. As we step into 2024, the landscape of forex trading has evolved, influenced by technological advancements, regulatory changes, and the global economic climate. Selecting the right forex broker is crucial for success in this dynamic market. Here, we present a comprehensive review and rating of the top forex brokers of 2024.To get more news about forex broker, you can visit our official website.

IG: Best Overall Broker, Most Trusted

IG stands out as the best overall broker for 2024. With over 100 available currency pairs and the ability to trade CFDs and forex options, IG offers a comprehensive trading package. The broker is regulated in multiple jurisdictions, including Switzerland and the U.S., ensuring a high level of trust and security for traders. IG’s platform features excellent trading and research tools, industry-leading education, and competitive pricing.

Interactive Brokers: Great Overall, Best for Professionals

Interactive Brokers is renowned for its professional-grade trading platform and extensive range of tradable instruments. It offers competitive pricing and advanced trading tools, making it an excellent choice for professional traders. The broker’s robust regulatory framework and high trust score further enhance its appeal.

Saxo: Best Web-Based Trading Platform

Saxo Bank is recognized for its superior web-based trading platform. The platform provides advanced charting tools, a wide range of tradable instruments, and a user-friendly interface. Saxo’s commitment to providing a seamless trading experience makes it a top choice for traders seeking a reliable web-based platform.

CMC Markets: Excellent Overall, Best Platform Technology

CMC Markets excels in platform technology, offering a feature-rich trading platform with advanced charting tools and a wide range of tradable instruments. The broker’s competitive pricing and strong regulatory framework make it a reliable choice for traders of all levels.

FOREX.com: Excellent All-Round Offering

FOREX.com offers a well-rounded trading experience with a wide range of tradable instruments, competitive pricing, and robust regulatory oversight. The broker’s platform is user-friendly and provides access to advanced trading tools and educational resources, making it suitable for both novice and experienced traders.

Charles Schwab: Award-Winning Thinkorswim Platform

Charles Schwab’s Thinkorswim platform is highly regarded for its advanced trading tools and comprehensive market analysis features. The platform’s user-friendly interface and extensive educational resources make it an excellent choice for traders looking to enhance their trading skills.

City Index: Excellent All-Round Offering

City Index offers a comprehensive trading package with competitive pricing, a wide range of tradable instruments, and a robust regulatory framework. The broker’s platform is user-friendly and provides access to advanced trading tools and educational resources.

XTB: Great Research and Education

XTB is known for its exceptional research and educational resources. The broker offers a wide range of tradable instruments and competitive pricing, making it a top choice for traders seeking to enhance their trading knowledge and skills.

eToro: Best for Copy and Crypto Trading

eToro stands out for its innovative copy trading feature and extensive range of cryptocurrency trading options. The platform is user-friendly and provides access to a wide range of tradable instruments, making it an excellent choice for traders looking to diversify their trading strategies.

In conclusion, the top forex brokers of 2024 offer a diverse range of trading platforms, tools, and resources to cater to the needs of traders at all levels. Whether you are a novice trader seeking educational resources or a professional trader looking for advanced trading tools, these brokers provide the necessary support to help you succeed in the dynamic forex market.

0 notes

Text

How to transfer money and stocks from Robinhood to a bank account or another brokerage?

Here’s a guide on how to transfer money and stocks from Robinhood to a bank account or another brokerage like Fidelity or Charles Schwab:

Transferring Money from Robinhood to a Bank Account

Steps:

Open the Robinhood App: Log in to your account.

Go to the Account Menu: Tap the account icon in the bottom right corner.

Select ‘Transfers’: Choose the ‘Transfer to Your Bank’ option.

Enter the Amount: Specify the amount you want to transfer.

Choose the Bank Account: If you have multiple linked accounts, select the one you want to transfer to.

Confirm the Transfer: Review the details and confirm the transfer.

Note: It may take 3-5 business days for the funds to appear in your bank account.

Understanding Robinhood Withdrawable Cash

Withdrawable cash is the amount of money you can transfer to your bank account. This includes settled funds from stock sales or dividends but does not include funds from recent deposits or unsettled transactions.

Transferring Stocks from Robinhood to Fidelity

Steps:

Open a Fidelity Account: Ensure you have a Fidelity account ready.

Request a Transfer: Go to the Fidelity website or app and initiate a transfer request.

Select Full or Partial Transfer: Decide whether you want to transfer all your assets or just specific stocks.

Provide Robinhood Account Details: Enter your Robinhood account number and details.

Submit the Request: Fidelity will contact Robinhood to complete the transfer. This process may take 5-7 business days.

Transferring Stocks from Robinhood to Charles Schwab

Steps:

Open a Charles Schwab Account: Ensure you have an account at Schwab.

Initiate the Transfer: Start the transfer process from Schwab’s platform.

Choose Between Full or Partial Transfer: Select what you want to transfer.

Enter Robinhood Information: Provide your Robinhood account details.

Confirm and Submit: The process will be similar to the Fidelity transfer, taking about a week to complete.

Robinhood Wire Transfer

Robinhood does not support direct wire transfers for sending money out of the platform. All transfers must be done via the ACH (Automated Clearing House) network, which usually takes a few business days.

Conclusion

Transferring stocks from Robinhood to fidelity to a bank account or another brokerage like Fidelity or Charles Schwab involves a few steps, but is a straightforward process. Make sure to initiate the transfer from the receiving brokerage and have all your account details handy.

For more detailed guides or specific questions, it might be helpful to check Robinhood’s support resources or contact customer service.

0 notes

Text

How to Transfer Stocks from Robinhood to Fidelity and Schwab

In the rapidly evolving world of investing, many individuals find themselves seeking more flexibility and control over their portfolios. As a result, transferring stocks from one brokerage account to another has become a common practice. For those using Robinhood, moving their investments to established firms like Fidelity and Charles Schwab can offer a broader range of services, research tools, and customer support. In this comprehensive guide, we will walk you through how to transfer stocks from Robinhood to Fidelity and Schwab, ensuring a seamless transition of your assets.

Why Transfer Stocks from Robinhood to Fidelity or Schwab?

Before diving into the specifics of the transfer process, it's essential to understand why investors might consider moving their assets from Robinhood to brokers like Fidelity or Schwab. Both Fidelity and Schwab offer a more extensive range of financial products and services, including retirement accounts, mutual funds, and in-depth research tools. Additionally, they provide access to financial advisors and robust customer support, making them appealing to investors looking to manage larger or more complex portfolios.

Robinhood, while known for its user-friendly interface and commission-free trading, may not offer the depth of services that more experienced investors require. This leads many to seek out the additional resources and stability provided by larger, more traditional brokers.

How to Transfer Stocks from Robinhood to Fidelity?

Step 1: Open a Fidelity Account

If you haven't already, the first step in transferring your stocks from Robinhood to Fidelity is to open a Fidelity brokerage account. This process is straightforward and can be done online within minutes. Ensure that the account type at Fidelity matches your Robinhood account (e.g., individual brokerage account, IRA, etc.).

Step 2: Gather Necessary Information

To initiate the transfer, you'll need specific details about your Robinhood account, including your account number. This information can be found in the Robinhood app under the "Account" tab. Make sure you have this information readily available, as it will be required during the transfer process.

Step 3: Initiate the Transfer with Fidelity

Once your Fidelity account is set up and you have your Robinhood account details, log in to your Fidelity account. Navigate to the "Transfer" section and select "Transfer Assets" or "Transfer from Another Broker." Here, you will be prompted to enter your Robinhood account details and specify which assets you want to transfer.

Fidelity uses the Automated Customer Account Transfer Service (ACATS) to facilitate the transfer. This system allows for the seamless transfer of stocks, bonds, mutual funds, and other assets between brokerage accounts. Be sure to review the list of assets to confirm that everything you want to transfer is eligible.

Step 4: Monitor the Transfer

After initiating the transfer, it typically takes 5-7 business days for the assets to move from Robinhood to Fidelity. During this period, it's crucial to monitor the progress. You can check the status of your transfer in your Fidelity account under the "Transfer" section. Fidelity will notify you via email once the transfer is complete.

Step 5: Confirm the Transfer Completion

Once the transfer is complete, log in to your Fidelity account to confirm that all your assets have been successfully moved. Review your portfolio to ensure that everything is in order and matches your previous holdings on Robinhood. If you notice any discrepancies, contact Fidelity's customer support immediately.

How to Transfer Stocks from Robinhood to Schwab

Step 1: Open a Schwab Account

If you're looking to transfer Robinhood to schwab, the first step is to open a Schwab brokerage account. Like Fidelity, Schwab offers a wide range of account types, so ensure that you choose the one that corresponds to your Robinhood account.

Step 2: Collect Account Information

Gather the necessary information from your Robinhood account, including your account number and any other relevant details. This information will be required when initiating the transfer with Schwab.

Step 3: Initiate the Transfer with Schwab

Log in to your Schwab account and navigate to the "Accounts" tab, then select "Transfer Account." You'll be prompted to enter your Robinhood account information and specify the assets you wish to transfer. Schwab also utilizes the ACATS system, allowing a smooth transfer process.

Step 4: Monitor the Transfer Process

As with Fidelity, the transfer process to Schwab usually takes 5-7 business days. It's important to keep an eye on the status of your transfer by logging in to your Schwab account regularly. Schwab will send you notifications once the transfer is underway and when it is complete.

Step 5: Verify Transfer Completion

Once the transfer is complete, log in to your Schwab account and verify that all your assets have been transferred correctly. Cross-check your portfolio to ensure accuracy, and if any issues arise, contact Schwab's customer service for assistance.

Common Questions About Transferring Stocks from Robinhood to Fidelity or Schwab

Can I transfer all types of Stock from Robinhood to Fidelity or Schwab?

Yes, most stocks and ETFs held in a Robinhood account can be transferred to Fidelity or Schwab using the ACATS system. However, it's important to note that certain assets, such as fractional shares and cryptocurrencies, cannot be transferred through ACATS. These assets will need to be liquidated before initiating the transfer.

Are There Fees Associated with Transferring Stocks from Robinhood?

Robinhood charges a $75 fee for outgoing transfers. This fee will be deducted from your Robinhood account balance when you initiate the transfer. Neither Fidelity nor Schwab typically charges any fees to receive incoming transfers, but it's always a good idea to confirm this with your new brokerage.

How Long Does the Transfer Process Take?

The transfer process typically takes 5-7 business days. However, this timeline can vary depending on the transferred assets and the brokerages involved. It's recommended to initiate the transfer well in advance if you need to access your assets by a specific date.

What Happens to My Dividends During the Transfer?

Dividends paid during the transfer process may be held by Robinhood and then sent to your new brokerage once the transfer is complete. Depending on the timing, you may receive a separate dividend payment after your assets have been transferred.

Can I Transfer a Partial Account from Robinhood to Fidelity or Schwab?

Yes, both Fidelity and Schwab allow for partial account transfers. This means you can choose to transfer only certain assets from your Robinhood account, leaving the rest behind. This is particularly useful if you want to maintain some investments in Robinhood while diversifying your holdings in another brokerage.

Conclusion

Transferring stocks from Robinhood to established brokerages like Fidelity and Schwab is a strategic move for investors seeking more robust services and tools. By following the detailed steps outlined in this guide, you can ensure a smooth transition of your assets, allowing you to take full advantage of the benefits offered by these leading financial institutions.

0 notes

Text

https://medium.com/@profxlearn/charles-schwab-review-forex-broker-trading-markets-legit-or-a-scam-82e77678bef7

#Charles Schwab#Charles Schwab Review#Charles Schwab Scam#Charles Schwab Reviews 2024#Charles Schwab Forex broker

0 notes

Text

Navigating Financial Services in the USA: Insights from a Financial Services Consultant

Welcome to my microblog on financial services in the USA! As a seasoned financial services consultant, I aim to provide you with valuable insights, tips, and guidance to help you make informed financial decisions. Whether you're looking to invest, save, or plan for the future, this microblog is your go-to resource.

Understanding Financial Services

Financial services encompass a wide range of offerings, including banking, investments, insurance, and wealth management. Navigating these can be overwhelming, but with the right information, you can make choices that align with your financial goals.

Key Areas of Focus

1. Wealth Management

Wealth management involves creating a strategy to grow and protect your wealth. It includes investment management, financial planning, and tax services. Platforms like Vanguard, Charles Schwab, and Fidelity offer robust tools and services to help you manage your wealth effectively.

2. Investment Strategies

Investing is a crucial component of financial growth. Understanding different investment options, such as stocks, bonds, mutual funds, and ETFs, is essential. Diversification and risk management are key principles to keep in mind.

3. Retirement Planning

Planning for retirement is vital for financial security. Consider options like 401(k) plans, IRAs, and Roth IRAs. It's important to start early and regularly review your retirement plan to ensure it meets your long-term goals.

4. Insurance

Insurance provides financial protection against unforeseen events. Life, health, auto, and home insurance are common types. Evaluating your needs and choosing the right policies can safeguard your assets and provide peace of mind.

5. Tax Planning

Effective tax planning can help you minimize tax liabilities and maximize savings. Understanding tax-advantaged accounts, deductions, and credits is crucial. Working with a tax professional can provide tailored advice based on your financial situation.

Tips from a Consultant

Stay Informed: Financial markets and regulations are constantly evolving. Stay updated with the latest trends and news to make informed decisions.

Set Clear Goals: Define your financial objectives, whether it's buying a home, funding education, or retiring comfortably. Clear goals guide your financial strategy.

Seek Professional Advice: Working with a financial advisor or consultant can provide personalized guidance and help you navigate complex financial landscapes.

Regularly Review Your Plan: Financial plans should be dynamic. Regularly review and adjust your plan to ensure it aligns with your changing goals and circumstances.

Educate Yourself: Take advantage of educational resources, webinars, and workshops to enhance your financial literacy. Knowledge is power when it comes to managing your finances.

Conclusion

Navigating financial services in the USA can be complex, but with the right knowledge and strategies, you can achieve your financial goals. Stay informed, seek professional advice, and regularly review your plan to stay on track. Remember, your financial journey is unique, and a tailored approach is key to success.

Stay tuned for more insights and tips on financial services! Feel free to reach out with any questions or topics you'd like me to cover.

0 notes

Text

Navigating Financial Services in the USA: Insights from a Financial Services Consultant

Welcome to my microblog on financial services in the USA! As a seasoned financial services consultant, I aim to provide you with valuable insights, tips, and guidance to help you make informed financial decisions. Whether you're looking to invest, save, or plan for the future, this microblog is your go-to resource.

Understanding Financial Services

Financial services encompass a wide range of offerings, including banking, investments, insurance, and wealth management. Navigating these can be overwhelming, but with the right information, you can make choices that align with your financial goals.

Key Areas of Focus

1. Wealth Management

Wealth management involves creating a strategy to grow and protect your wealth. It includes investment management, financial planning, and tax services. Platforms like Vanguard, Charles Schwab, and Fidelity offer robust tools and services to help you manage your wealth effectively.

2. Investment Strategies

Investing is a crucial component of financial growth. Understanding different investment options, such as stocks, bonds, mutual funds, and ETFs, is essential. Diversification and risk management are key principles to keep in mind.

3. Retirement Planning

Planning for retirement is vital for financial security. Consider options like 401(k) plans, IRAs, and Roth IRAs. It's important to start early and regularly review your retirement plan to ensure it meets your long-term goals.

4. Insurance

Insurance provides financial protection against unforeseen events. Life, health, auto, and home insurance are common types. Evaluating your needs and choosing the right policies can safeguard your assets and provide peace of mind.

5. Tax Planning

Effective tax planning can help you minimize tax liabilities and maximize savings. Understanding tax-advantaged accounts, deductions, and credits is crucial. Working with a tax professional can provide tailored advice based on your financial situation.

Tips from a Consultant

Stay Informed: Financial markets and regulations are constantly evolving. Stay updated with the latest trends and news to make informed decisions.

Set Clear Goals: Define your financial objectives, whether it's buying a home, funding education, or retiring comfortably. Clear goals guide your financial strategy.

Seek Professional Advice: Working with a financial advisor or consultant can provide personalized guidance and help you navigate complex financial landscapes.

Regularly Review Your Plan: Financial plans should be dynamic. Regularly review and adjust your plan to ensure it aligns with your changing goals and circumstances.

Educate Yourself: Take advantage of educational resources, webinars, and workshops to enhance your financial literacy. Knowledge is power when it comes to managing your finances.

Conclusion

Navigating financial services in the USA can be complex, but with the right knowledge and strategies, you can achieve your financial goals. Stay informed, seek professional advice, and regularly review your plan to stay on track. Remember, your financial journey is unique, and a tailored approach is key to success.

Stay tuned for more insights and tips on financial services! Feel free to reach out with any questions or topics you'd like me to cover.

0 notes

Text

Top Forex Broker Reviews of 2024: Navigating the Best in the Market

Top Forex Broker Reviews of 2024: Navigating the Best in the Market

The forex market, known for its vast liquidity and 24-hour trading opportunities, continues to attract traders worldwide. As we step into 2024, the landscape of forex brokers has evolved, offering a plethora of options tailored to diverse trading needs. This article delves into the top forex brokers of 2024, highlighting their unique features and what sets them apart.To get more news about forex broker, you can visit our official website.

1. IG - Best Overall Broker, Most Trusted

IG stands out as the most trusted and comprehensive broker in 2024. With a trust score of 99, IG offers an extensive range of tradeable instruments, competitive pricing, and outstanding platforms and tools1. Their industry-leading education and research tools make them a top choice for both novice and experienced traders.

2. Interactive Brokers - Great Overall, Best for Professionals

Interactive Brokers is renowned for its professional-grade trading tools and platforms. Catering to seasoned traders, it offers a wide array of investment options and competitive fees1. Their robust infrastructure ensures fast execution speeds and reliability.

3. Saxo - Best Web-Based Trading Platform

Saxo Bank excels with its web-based trading platform, providing a seamless and intuitive trading experience. Known for its excellent platform technology, Saxo offers a broad spectrum of financial instruments and top-notch research tools.

4. CMC Markets - Excellent Overall, Best Platform Technology

CMC Markets is celebrated for its platform technology, offering a user-friendly interface and advanced trading tools. Their comprehensive offering includes competitive spreads, a wide range of instruments, and excellent customer support.

5. FOREX - Excellent All-Round Offering

FOREX provides an all-round excellent trading experience with a focus on education and research. Their platform is designed to cater to traders of all levels, offering competitive pricing and a variety of trading tools.

6. Charles Schwab - Award-Winning Thinkorswim Platform

Charles Schwab’s Thinkorswim platform is a favorite among traders for its advanced features and user-friendly interface. It offers a wide range of tradeable instruments and comprehensive research tools, making it a top choice for serious traders.

7. Exness - Best Overall for International Traders

Exness is a standout broker for international traders, offering multiple account types and competitive trading fees. Their platforms, including MT4 and MT5, are equipped with extensive research tools and educational resources.

8. FXTM - Best for Professional Traders

FXTM caters to professional traders with its ECN trading accounts and advanced trading platforms. Their copy trading feature, FXTM Invest, allows traders to follow and replicate the strategies of successful traders2.

9. Eightcap - Best for Cryptocurrency Trading

Eightcap is the go-to broker for cryptocurrency enthusiasts, offering over 100 cryptocurrencies with low spreads and zero commissions. Their Crypto Crusher dashboard provides traders with valuable insights and trading signals.

10. IC Markets - Best Low Spreads

IC Markets is known for its low spreads and low commissions, making it an attractive option for cost-conscious traders. Their platforms, including MT4, MT5, and cTrader, offer advanced trading tools and fast execution speeds.

Conclusion

Choosing the right forex broker is crucial for success in the forex market. The brokers listed above have been meticulously evaluated based on their features, fees, and overall performance. Whether you are a beginner or a seasoned trader, these brokers offer a range of options to suit your trading needs in 2024.

0 notes

Text

A Review of Robinhood's 3 Percent Cash-Back Card - The New York Times

Robinhood's Credit Card Offers 3% Cash Back. Can It Last? Charles Schwab stopped offering a 2 percent card years ago, and most banks don't hand over ... https://www.google.com/url?rct=j&sa=t&url=https://www.nytimes.com/2024/03/28/your-money/robinhood-rewards-credit-card.html&ct=ga&cd=CAIyGjhlZmRiMTE5YjgyN2M3YTM6Y29tOmVuOlVT&usg=AOvVaw1QEOmjU2A2377I1h7fH8ra

0 notes

Text

Which broker is the best for option trading?

Determining the "best" broker for option trading depends on various factors, including your trading style, level of experience, specific needs, and preferences. However, there are several key features and considerations to evaluate when choosing a broker for option trading:

Commission and Fees: Look for brokers with competitive commission rates and fees, especially for options trading. Some brokers may offer discounted rates for active traders or volume discounts.

Options Trading Platform: A user-friendly and intuitive trading platform is essential for executing options trades efficiently. Look for platforms that offer advanced charting tools, options chains, customizable layouts, and real-time data.

Research and Analysis Tools: Comprehensive research and analysis tools can help you make informed trading decisions. Look for brokers that provide access to options scanners, volatility analysis, probability calculators, and options strategy builders.

Educational Resources: Especially if you're new to options trading, educational resources can be invaluable. Look for brokers that offer educational materials such as articles, tutorials, webinars, and demo accounts to help you learn about options trading strategies and risk management.

Options Contract Selection: Ensure that the broker offers a wide range of options contracts on various underlying assets, including stocks, ETFs, indices, and futures. This diversity allows you to implement different trading strategies and access different markets.

Customer Support: Responsive and knowledgeable customer support is crucial, especially when dealing with complex financial instruments like options. Look for brokers that offer multiple channels of support, including phone, email, and live chat, with prompt responses to inquiries.

Regulatory Compliance and Security: Verify that the broker is regulated by reputable financial authorities and adheres to strict security measures to protect your funds and personal information. Regulatory compliance provides an added layer of protection for traders.

Margin Requirements and Account Minimums: Understand the broker's margin requirements and account minimums for options trading. Some brokers may have higher margin requirements for complex options strategies or certain underlying assets.

Mobile Trading: If you prefer to trade on the go, consider brokers that offer robust mobile trading apps with features optimized for options trading. Mobile apps should provide access to options chains, order entry, portfolio management, and real-time market data.

Broker Reputation and Reviews: Research the broker's reputation and read reviews from other traders to gauge customer satisfaction, reliability, and overall user experience. Look for any complaints or negative feedback regarding order execution, platform stability, or customer service.

Some popular brokers known for their options trading capabilities include thinkorswim by TD Ameritrade, tastyworks, E*TRADE, Interactive Brokers, and Charles Schwab. However, the best broker for you ultimately depends on your individual trading needs and preferences, so consider evaluating multiple options before making a decision. Additionally, it's a good idea to test out a broker's platform and services using a demo account or small trades before committing a significant amount of capital.

LTP Calculator Overview:

LTP Calculator is a comprehensive stock market trading tool that focuses on providing real-time data, particularly the last traded price of various stocks. Its functionality extends beyond a conventional calculator, offering insights and analytics crucial for traders navigating the complexities of the stock market.

Also Available on Play store - Get the App

Key Features:

Real-time Last Traded Price:

The core feature of LTP Calculator is its ability to provide users with the latest information on stock prices. This real-time data empowers traders to make timely decisions based on the most recent market movements.

User-Friendly Interface:

Designed with traders in mind, LTP Calculator boasts a user-friendly interface that simplifies complex market data. This accessibility ensures that both novice and experienced traders can leverage the tool effectively.

Analytical Tools:

Beyond basic price information, LTP Calculator incorporates analytical tools that help users assess market trends, volatility, and potential risks. This multifaceted approach enables traders to develop a comprehensive understanding of the stocks they are dealing with.

Customizable Alerts:

Recognizing the importance of staying informed, LTP Calculator allows users to set customizable alerts for specific stocks. This feature ensures that traders receive timely notifications about significant market movements affecting their portfolio.

Vinay Prakash Tiwari - The Visionary Founder:

At the helm of LTP Calculator is Vinay Prakash Tiwari, a renowned figure in the stock market training arena. With a moniker like "Investment Daddy," Tiwari has earned respect for his expertise and commitment to empowering individuals in the financial domain.

Professional Background:

Vinay Prakash Tiwari brings a wealth of experience to the table, having traversed the intricacies of the stock market for several decades. His journey as a stock market trainer has equipped him with insights into the challenges faced by traders, inspiring him to develop tools like LTP Calculator.

Philosophy and Approach:

Tiwari's approach to stock market training revolves around education, empowerment, and simplifying complexities. LTP Calculator reflects this philosophy, offering a tool that aligns with his vision of making stock market information accessible and understandable for all.

Educational Initiatives:

Apart from his contributions as a tool developer, Vinay Prakash Tiwari has actively engaged in educational initiatives. Through online courses, webinars, and seminars, he has shared his knowledge with aspiring traders, reinforcing his commitment to fostering financial literacy.

In conclusion, LTP Calculator stands as a testament to Vinay Prakash Tiwari's dedication to enhancing the trading experience. As the financial landscape continues to evolve, tools like LTP Calculator and visionaries like Tiwari sir play a pivotal role in shaping a more informed and empowered community of traders.

0 notes