#CBD Nutraceuticals Market Trend

Explore tagged Tumblr posts

Text

#CBD Nutraceuticals Market#CBD Nutraceuticals Market Trends#CBD Nutraceuticals Market Growth#CBD Nutraceuticals Market Industry#CBD Nutraceuticals Market Research#CBD Nutraceuticals Market Report

0 notes

Text

0 notes

Text

CBD Consumer Health Market Size To Reach $61.17Bn By 2030

CBD Consumer Health Market Growth & Trends

The global CBD consumer health market size is anticipated to reach USD 61.17 billion by 2030, according to a new report by Grand View Research, Inc. The market is projected to grow at a CAGR of 18.1% from 2023 to 2030. The growing adoption of cannabidiol (CBD) as a consumer health product due to increasing awareness about the health benefits of CBD and rise in the number of countries legalizing these products are the key factors driving the growth. Furthermore, the changing buyer perception and attitude toward cannabidiol products is an important factor bolstering the revenue growth.

Based on product type, nutraceuticals dominated the market with a revenue share of 62.4% in 2019. Rising awareness regarding cannabidiol, changing user preferences from chemical-based ingredients to organic ingredients in dietary supplements, and favorable government initiatives for hemp-derived cannabidiol are the key factors driving the growth. The segment is anticipated to witness the fastest CAGR during the forecast period, owing to an increase in the consumption of CBD-based nutraceutical products in health and wellness, sports nutrition, weight management, and other fields.

Based on distribution channels, retail pharmacies dominated the market for cannabidiol consumer health in 2019. An increase in the number of companies selling their products via retail pharmacies is fueling the growth of the segment. However, the online stores segment is anticipated to witness fastest growth over the forecast period. This can be attributed to the increase in penetration of e-commerce, rising demand for CBD-infused products, preference of consumers for buying CBD online, and easy availability of these products in emerging markets.

North America dominated the market in 2019, with a revenue share of 59.8%. The growing awareness about the medical benefits of CBD among consumers has resulted in greater sales of online and retail sales in the region. On the other hand, Europe is expected to be the fastest-growing region, owing to an increase in consumption, rising awareness, positive attitudes regarding CBD products, and strategic investments by major companies in the region.

Request a free sample copy: https://www.grandviewresearch.com/industry-analysis/cannabidiol-consumer-health-market

CBD Consumer Health Market Report Highlights

Nutraceuticals dominated the market in 2022 with a revenue share of 60%, owing to the changing consumer preferences from chemical-based ingredients to organic and herbal ingredients in dietary supplements

Online stores is anticipated to be the fastest-growing distribution channel segment over the forecast period, owing to the increase in penetration of e-commerce and the rising number of players offering their products online

North America dominated the CBD consumer health market for cannabidiol consumer health products, with a revenue share of around 70% in 2022.

CBD Consumer Health Market Segmentation

Grand View Research has segmented the global CBD consumer health market based on product type, distribution channel, and region:

CBD Consumer Health Product Type Outlook (Revenue, USD Million, 2018 - 2030)

Medical OTC Products

CBD Analgesic Products

CBD Dermatology Products

CBD Mental Health Products

CBD Sleeping Aids Products

Other OTC Products

Nutraceuticals

CBD Vitamins and Dietary Supplements (VDS)

CBD Sports Nutrition

CBD Weight Management and Wellbeing

CBD Consumer Health Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

Online Stores

Retail Stores

Retail Pharmacies

CBD Consumer Health Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Sweden

Norway

Denmark

Asia Pacific

China

Australia

Thailand

Japan

India

South Korea

Latin America

Brazil

Argentina

Mexico

Middle East & Africa (MEA)

Saudi Arabia

South Africa

UAE

Kuwait

List of Key Players in the Cannabidiol (CBD) Consumer Health Market

Elixinol Global Limited

ENDOCA

NuLeaf Naturals LLC

Kazmira

Charlotte's Web

Joy Organics

Lord Jones

Medical Marijuana Inc.

CV Sciences Inc.

Isodiol International Inc.

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/cannabidiol-consumer-health-market

#CBD Consumer Health Market#CBD Consumer Health Market Size#CBD Consumer Health Market Share#CBD Consumer Health Market Trends#CBD Consumer Health Market Sales#CBD Consumer Health Market Growth

0 notes

Text

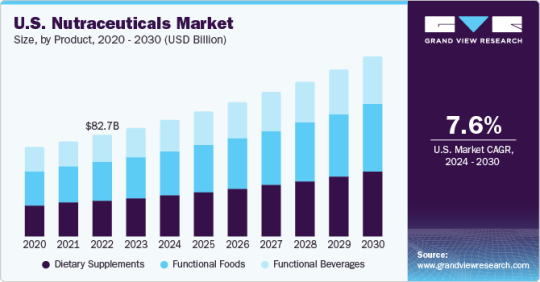

Nutraceuticals Market Is Expected To Grow Swiftly By 2030

The global nutraceuticals market size is projected to reach USD 599.71 billion by 2030, according to a new report by Grand View Research, Inc. The market is anticipated to grow at a CAGR of 9.6% from 2024 to 2030. Rising awareness regarding calorie reduction and weight loss in the major markets including the U.S., China, and India is expected to promote the application of the health and wellness segment and thus, in turn, will have a substantial impact on the industry.

Nutraceuticals are products that provide health advantages and additional nutrition to the human body. It comprises fortified nutrients, such as taurine, CoQ10, omega-3, calcium, zinc, and antioxidants, that develop the complete health of consumers. These nutrients further benefit in averting medical conditions such as hypertension, diabetes, heart diseases, and allergies. As nutraceuticals develop the digestive and immune systems and enhance the cognitive behavior of consumers, their demand is witnessing a surge at the global level.

The increasing trend among consumers to alter dietary habits is likely to boost the demand for nutraceuticals. The consumer belief that improper diet results in an increase in the costs of pharmaceuticals is anticipated to boost the demand for nutraceuticals. This would also help the government as it would result in lesser expenditure on healthcare and low social security costs.

A rise in disposable income, increasing consumer awareness concerning health issues, and rapid urbanization are likely to boost the market growth over the forecast years. A positive outlook towards medical nutrition owing to the high prevalence of weight management programs, along with cardiovascular diseases, is anticipated to propel the product demand.

The rise and evolution of wellness-focused diets such as keto and paleo are driving food producers to cater their products in this direction. Functional food products such as probiotics and omega-3 are highly used in yogurt and fish oils to reduce the risk of cardiovascular diseases and develop the quality of intestinal microflora, which is further projected to fuel the growth of the functional food segment over the coming years.

Request a free sample copy or view report summary: Nutraceuticals Market Report

Nutraceuticals Market Report Highlights

Based on ingredient, in 2023, probiotics held a dominant position in the market; with a share of 27.7% owing to the majority of food manufacturing companies using probiotics as a primary ingredient to provide better nourishment and reduce health problems caused by harmful bacteria

The vitamins segment captured a significant market share in 2023. The segment is expected to witness significant growth in the coming years

In terms of product, the functional foods segment dominated the market with a revenue share of 37.65% in 2023. Rising healthcare costs, coupled with the increasing geriatric population across the world, are anticipated to assist the segment growth over the forecast period

North America held the largest revenue share of over 34.90% in 2023. The growing health concerns amongst consumers and increasing awareness regarding nutraceuticals are likely to be the major drivers of the North America market.

The market represents a highly competitive landscape. Key market players dominate the market space and have been focusing on various strategic initiatives including mergers & acquisitions, product innovation, and portfolio expansion

Nutraceuticals Market Segmentation

Grand View Research has segmented the global nutraceuticals market based on ingredient, product, application, and region:

Nutraceuticals Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

Aloe vera

Amino acids

Botanical Ingredients

Ashwagandha

Curcumin

Ginseng

Hemp

Others

Cannabidiol (CBD)

Carbohydrates

Carnitine

Food Color

Carotenoids

Astaxanthin

Lutein

Lycopene

Other carotenoids (Zeaxanthin, Betacarotene)

Spirulina

Collagen

Colostrum

Cultures and fermentation starters

Dairy ingredients

Emulsifiers

Enzymes

Essential oils

Fat replacers

Fats and oils

Fibers

Flavors

Fruit and vegetable products

Glucosamine / Chondroitin

Isoflavones

Juices and concentrates

Krill

Lipids / Fatty Acids

Marine ingredients

Minerals

Calcium

Iron

Magnesium

Selenium

Others

Omega-3s

Marine Derived

Plant-derived

Prebiotics

Probiotics

Proteins

Sweeteners

Stevia

Monkfruit

Others (Honey, sucrose, fructose, etc.)

Vitamins

Vitamin A

Vitamin B

Vitamin C

Vitamin D

Vitamin E

Vitamin K

Whey proteins

Other

Nutraceuticals Product Outlook (Revenue, USD Million, 2018 - 2030)

Dietary supplements

Functional foods

Functional beverages

Nutraceuticals Application Outlook (Revenue, USD Million, 2018 - 2030)

Allergy & intolerance

Animal nutrition

Healthy ageing

Bone & joint health

Cancer prevention

Children's health

Cognitive health

Diabetes

Digestive / Gut health

Energy & endurance

Eye health

Heart health

Immune system

Infant health

Inflammation

Maternal health

Men's health

Nutricosmetics

Oral care

Personalized nutrition

Post Pregnancy and reproductive health

Sexual health

Skin health

Sports nutrition

Weight management & satiety

Women's health

Other

Nutraceuticals Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

France

Italy

UK

Spain

The Netherlands

Asia Pacific

China

Japan

India

Australia & New Zealand

South Korea

Central & South America

Brazil

Argentina

Middle East & Africa

UAE

South Africa

List of Key Players in the Nutraceuticals Market

DSM

Amway

Pfizer Inc.

Nestle

The Kraft Heinz Company

The Hain Celestial Group, Inc.

Nature's Bounty

General Mills Inc.

Danone

Tyson Foods

0 notes

Text

Global Nutraceutical Ingredients Market Size, Share, Trends - 2027

The nutraceutical ingredients market is a dynamic and growing sector. Nutraceuticals refer to food or food products that provide health benefits beyond basic nutrition. The market for nutraceutical ingredients includes a wide range of products, such as vitamins, minerals, amino acids, antioxidants, probiotics, prebiotics, herbal extracts, and other bioactive compounds.

The global nutraceutical ingredients market size is estimated to grow from USD 185.2 billion in 2022 to USD 261.7 billion by 2027. The compound annual growth rate is 7.2%. The increasing awareness of health & wellness among the consumers and tailored products according to the needs of the targeted audience are driving factors for the growth of the nutraceutical ingredients market. The rising cost of pharmaceutical and hospital expenses are considered as luxury among majority of the population, increase the demand for nutraceutical products as they can prevent health problems.

Nutraceutical ingredients market trends:

Plant-Based and Natural Ingredients: Consumers were increasingly inclined towards plant-based and natural ingredients. Nutraceutical products derived from plants, herbs, and botanicals were gaining popularity due to their perceived health benefits and alignment with clean-label preferences.

Personalized Nutrition: The trend of personalized nutrition was gaining momentum. Companies were exploring ways to offer customized nutraceutical solutions based on individual health needs, genetic factors, and lifestyle choices.

Gut Health Focus: There was a growing emphasis on gut health, leading to increased demand for probiotics and prebiotics. Products promoting digestive health and supporting a healthy microbiome were gaining traction.

Functional Beverages: The incorporation of nutraceutical ingredients into functional beverages was on the rise. Consumers were looking for beverages that not only quench their thirst but also provide functional benefits, such as energy enhancement, immunity support, or relaxation.

CBD and Hemp-Derived Ingredients: The interest in cannabidiol (CBD) and hemp-derived ingredients was increasing. CBD was being explored for its potential therapeutic benefits, leading to the development of nutraceutical products containing these compounds.

Immune System Support: The COVID-19 pandemic heightened awareness about the importance of immune health. Nutraceuticals offering immune system support, including vitamins, minerals, and antioxidants, saw increased demand.

The Food segments by application is projected to have the highest nutraceutical ingredient market share.

Research & development on nutraceutical product have been improving innovative products and developing customized products according to the consumer requirements. Products with customized requirement and trending food products would attract more customers. Various companies have understated their customers’ needs and have developed nutraceutical products like gummies, lozenges, hard candies, malt powders, nutrient bars, and more. These products are customized according to the health benefit, according to their diet, and more. Hence, their market is estimated to gain more market share in the nutraceutical ingredient market.

The dry ingredient, by form is projected to attain the fastest market growth in the global nutraceutical ingredients market throughout the forecasted period.

New emerging technologies like encapsulation methods, have helped various companies in making a liquid format ingredient to dry format. These encapsulated ingredients can preserve its liquid ingredient without degrading with other compounds in the product formulation and can also release the compound in desired rate to the product. such technology improvements have helped various formulator, as liquid form of ingredients is mostly unstable and can degrade.

The key players in this market include such Associated British Foods Plc (UK), Arla Foods Ingredients Group P/S (Denmark), DSM (Netherland), Ingredion (US), Tate & Lyle (UK), Ajinomoto Co., Inc. (Japan), CHR Hansen Holdings A/S. (Denmark), Kyowa Hakko Bio Co., Ltd. (Japan), Glanbia Plc (Ireland), Fonterra Co. Operative Group Limited (New Zealand), Cargill Incorporated (US), ADM (US), International Flavors & Fragrances, Inc. (US), BASF SE (Germany) and Kerry Groups (Ireland). Strategic partnerships were the dominant strategy adopted by the key players, followed by expansions and new product launches. These strategies have helped them to increase their presence in different regions and industrial segments.

0 notes

Text

Selling Print on Demand Hemp Oil: Smart Business Opportunity

Cannabidiol (CBD) sales have exploded in popularity over the last half-decade, making it one of the fastest-growing industries in the United States. The total number of U.S. CBD product sales increased from $108 million in 2014 to $1.6 billion in 2021, which is expected to reach nearly $2 billion by the end of 2022. Following a similar trajectory, legal cannabis sales in the United States are expected to reach $23 billion by 2025. With the coronavirus pandemic affecting industries across the country, it is no surprise that the majority of this growth has been driven by online sales, which will account for the vast majority of print on demand CBD product sales in the United States in 2020.

The increased popularity of CBD in general, combined with the growth of online sales, presents an exciting opportunity for CBD online businesses, particularly those looking to expand into the world of ecommerce. Indeed, the transition to CBD ecommerce has already begun. Cannabidiol (CBD) sales in the ecommerce channel in the United States alone are expected to reach more than $6 billion by 2026.

What is Hemp Oil?

Hemp oil, also known as hemp seed oil, is derived from hemp, a cannabis plant similar to marijuana but contains little to no tetrahydrocannabinol (THC), the chemical that causes people to become "high." Instead of THC, hemp contains cannabidiol (CBD), a chemical used to treat conditions ranging from epilepsy to anxiety.

Hemp is becoming increasingly popular as a treatment for various ailments, including skin problems and stress. It may have properties that help reduce the risk of Alzheimer's and cardiovascular disease, but more research is needed. Hemp oil has the potential to reduce inflammation in the body. In addition to CBD, hemp oil contains high levels of omega-6 and omega-3 fats, which are good fats, and all nine essential amino acids, which your body uses to make protein.

Why Sell Print on Demand Hemp Oil?

CBD business is profitable because the US CBD market is expected to reach $20 billion by 2024. As a result, it's the best option if you're looking for a job in a growing industry. However, there are some critical factors to consider if you want to succeed. There are numerous ways to profit in the CBD industry. You could start your own CBD business by investing in hemp oils, tinctures, and topicals. Another possibility is to become a distributor for well-known brands and sell their print on demand products on your website or in local stores.

Whatever approach you take, there are several key areas that you must concentrate on to be successful. These include effectively marketing your company, building a strong brand with excellent customer service, and selecting high-quality products that appeal to your target market. Furthermore, staying current with industry trends and regulations is critical for remaining competitive and avoiding legal trouble.

The Hemp Oil Market

The hemp oil market was worth S 82.45 million in 2021 and is expected to be worth S 1,253.51 million by 2026, growing at a CAGR of 38.2% from 2021 to 2027. The rising demand for hemp oil due to its increasing use in personal care products and the food and beverage industries worldwide is a key driver of the global hemp oil market's expansion. Furthermore, increased awareness of the various health benefits of this oil, such as relief from anxiety, sleep disorders, chronic pain, and others, is leading to increased demand for hemp oil in the global market.

The increasing use of hemp oil in many nutraceutical and pharmaceutical applications, as well as increased awareness of hemp seed oil's ability to prevent diseases such as diabetes, inflammation, cancer, and others, are expected to drive growth in the global market. Furthermore, the rising e-commerce penetration of hemp oil and the rising adoption of hemp oil in the production of fuel, lubricants, paints, and other industrial uses are other factors that will likely drive the target market's expansion during the forecast period.

Hemp oil, among other things, relieves chronic pain, sleep disturbances, anxiety, and nerve pain. In recent years, the demand for hemp oil has increased due to the health benefits of hemp. Furthermore, the expansion of the online distribution channel is an important factor that hastened the growth of the global hemp oil market. The high cost of hemp oil is a significant factor that is expected to limit the target market's future growth.

Legal Obligations of Selling CBD Products

The fact that the 2018 Farm Bill federally legalized industrial hemp and, by extension, hemp extracts such as CBD oils does not mean that there aren't significant regulatory concerns surrounding the industrial hemp industry. The 2018 Farm Bill effectively removed CBD from the federal Controlled Substances Act and the Drug Enforcement Agency's oversight. Instead, it delegated control of the hemp industry and CBD oil to the FDA.

The FDA is still developing regulations, leaving the CBD industry in flux. So far, the FDA has indicated that marketing CBD as having health benefits will be prohibited. In some cases, it has also launched a crackdown on CBD-infused foods and beverages. Understanding your legal obligations and playing it safe is critical in a highly scrutinized industry. While CBD businesses worldwide await clearer regulatory guidance, it is critical to base your marketing strategy on something other than the purported benefits of CBD. It's also critical to stay current on new developments as the FDA drafts new regulations.

How To Gain A Competitive Advantage

The key to gaining a competitive advantage with staying power in the CBD industry is to create a high-quality print on demand product that can withstand the scrutiny of both regulators and educated consumers in the coming months. If you want to stand out from the crowd, you must provide third-party lab testing results to validate the quality of your product. Furthermore, pursuing certifications such as USDA organic, Good Manufacturing Practices, and FDA facility registrations are important steps in instilling consumer confidence in the quality of the product they are purchasing. Even if the process is complicated, the formula for success is simple.

Furthermore, you'll need a system for warehousing and managing inventory for your print on demand hemp oil products. When you first start, this could be done at home. After your business has grown, consider becoming an eCommerce fulfillment center by signing a warehouse lease or outsourcing print on demand fulfillment services. Ensure that your fulfillment technology integrates well with your eCommerce platform, payment processor, and other software.

Finally, double- and triple-check everything. Understand that there will be changes. Research as much as possible and recognize future opportunities by thinking outside the box.

Print on Demand Hemp Oil Is A Huge Business Opportunity

If approached correctly, selling print on demand hemp oil is a huge business opportunity. The CBD industry offers unrivaled growth potential. The cannabis industry is one of the fastest-growing in the country, and CBD is one of its fastest-growing sectors. Hemp CBD products are increasing at an alarming rate, particularly since the passage of the 2018 Farm Bill. You are not alone if you want to start a CBD business. For the past century, this industry has been mostly illegal. There is a lot of momentum right now. Many people are attempting to break in, so avoid following the crowd. You aspire to be a leader.

Due diligence combined with creativity will position your company for success in the CBD industry. Now is the time to get in on the ground floor and build a company that will last but stand out from the crowd with a high-quality product. And you can easily do this with the help of the top eCommerce fulfillment company - Fulfillplex. With the right support and systems in place, fulfilling your orders can be very simple, especially as demand increases. When you can no longer do it alone, Fulfillplex will ensure that the products your consumer order are delivered on time. Get in touch with us now!

#print on demand supplements#print on demand#print on demand fulfillment#print on demand company#eCommerce fulfillment#print on demand fulfillment provider#print on demand service provider#top eCommerce fulfillment company#eCommerce fulfillment company

1 note

·

View note

Text

0 notes

Text

0 notes

Text

CBD Nutraceuticals Market is Going to Boom |Gaia Botanicals, LLC, CV Sciences, Inc., Elixinol LLC, ENDOCA, Garden of Life, Green Roads

CBD Nutraceuticals Market is Going to Boom |Gaia Botanicals, LLC, CV Sciences, Inc., Elixinol LLC, ENDOCA, Garden of Life, Green Roads

CBD Nutraceuticals Market Size Analysis and Insights 2022: CBD NutraceuticalsMarket Report 2022, the business scene is covered from driving variables to upstream business sectors and the general condition of the market. An inside and out examination of the general development possibilities for the worldwide and regional market was given which depended on a top to bottom investigation of key…

View On WordPress

#CBD Nutraceuticals#CBD Nutraceuticals forecast#CBD Nutraceuticals Industry#CBD Nutraceuticals Market#CBD Nutraceuticals price#CBD Nutraceuticals report#CBD Nutraceuticals research#CBD Nutraceuticals share#CBD Nutraceuticals trends#Covid-19 Impact Analysis

0 notes

Text

Plant-based Cannabidiol (CBD) Nutraceuticals Market Research Analysis, Characterization And Quantification and top vendors like Medical Marijuana, Inc, CV Sciences, Inc., Charlotte's Web, etc

Plant-based Cannabidiol (CBD) Nutraceuticals Market Report Coverage: Key Growth Factors & Challenges, Segmentation & Regional Outlook, Top Industry Trends & Opportunities, Competition Analysis, COVID-19 Impact Analysis & Projected Recovery, and Market Sizing & Forecast.

Latest launched research on Global Plant-based Cannabidiol (CBD) Nutraceuticals Market, it provides detailed analysis with presentable graphs, charts and tables. This report covers an in depth study of the Plant-based Cannabidiol (CBD) Nutraceuticals Market size, growth, and share, trends, consumption, segments, application and Forecast 2028. With qualitative and quantitative analysis, we help you with thorough and comprehensive research on the global Plant-based Cannabidiol (CBD) Nutraceuticals Market. This report has been prepared by experienced and knowledgeable market analysts and researchers. Each section of the research study is specially prepared to explore key aspects of the global Plant-based Cannabidiol (CBD) Nutraceuticals Market. Buyers of the report will have access to accurate PESTLE, SWOT and other types of analysis on the global Plant-based Cannabidiol (CBD) Nutraceuticals market. Moreover, it offers highly accurate estimations on the CAGR, market share, and market size of key regions and countries.

Major Key players profiled in the report include: Medical Marijuana, Inc, CV Sciences, Inc., Charlotte's Web, Elixinol, Irwin Naturals, Diamond CBD, Green Roads, Isodiol, Garden of Life, Foria Wellness and More...

Download Free Sample PDF including COVID19 Impact Analysis, full TOC, Tables and Figures@ https://www.marketinforeports.com/Market-Reports/Request-Sample/483500

Don’t miss the trading opportunities on Plant-based Cannabidiol (CBD) Nutraceuticals Market. Talk to our analyst and gain key industry insights that will help your business grow as you create PDF sample reports.

Segmental Analysis: The report has classified the global Plant-based Cannabidiol (CBD) Nutraceuticals market into segments including product type and application. Every segment is evaluated based on share and growth rate. Besides, the analysts have studied the potential regions that may prove rewarding for the Plant-based Cannabidiol (CBD) Nutraceuticals manufcaturers in the coming years. The regional analysis includes reliable predictions on value and volume, there by helping market players to gain deep insights into the overall Plant-based Cannabidiol (CBD) Nutraceuticals industry.

Market split by Type, can be divided into: CBD Tinctures Capsules & Softgels CBD Gummies

Market split by Application, can be divided into: Pharmacies Retail Stores Online Sales

Share your budget and Get Exclusive Discount @ https://www.marketinforeports.com/Market-Reports/Request_discount/483500

The authors of the report have analyzed both developing and developed regions considered for the research and analysis of the global Plant-based Cannabidiol (CBD) Nutraceuticals market. The regional analysis section of the report provides an extensive research study on different regional and country-wise Plant-based Cannabidiol (CBD) Nutraceuticals industry to help players plan effective expansion strategies.

Regions Covered in the Global Plant-based Cannabidiol (CBD) Nutraceuticals Market: • The Middle East and Africa (GCC Countries and Egypt) • North America (the United States, Mexico, and Canada) • South America (Brazil etc.) • Europe (Turkey, Germany, Russia UK, Italy, France, etc.) • Asia-Pacific (Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia)

Years Considered to Estimate the Market Size: History Year: 2015-2019 Base Year: 2019 Estimated Year: 2022 Forecast Year: 2022-2028

Detailed TOC of Plant-based Cannabidiol (CBD) Nutraceuticals Market Report 2022-2028: Chapter 1: Plant-based Cannabidiol (CBD) Nutraceuticals Market Overview Chapter 2: Economic Impact on Industry Chapter 3: Market Competition by Manufacturers Chapter 4: Production, Revenue (Value) by Region Chapter 5: Supply (Production), Consumption, Export, Import by Regions Chapter 6: Production, Revenue (Value), Price Trend by Type Chapter 7: Market Analysis by Application Chapter 8: Manufacturing Cost Analysis Chapter 9: Industrial Chain, Sourcing Strategy and Downstream Buyers Chapter 10: Marketing Strategy Analysis, Distributors/Traders Chapter 11: Market Effect Factors Analysis Chapter 12: Plant-based Cannabidiol (CBD) Nutraceuticals Market Forecast Continued……

To learn more about the report, visit @ https://www.marketinforeports.com/Market-Reports/483500/plant-based-cannabidiol-(cbd)-nutraceuticals-market

What market dynamics does this report cover? The report shares key insights on:

Current market size

Market forecast

Market opportunities

Key drivers and restraints

Regulatory scenario

Industry trend

New product approvals/launch

Promotion and marketing initiatives

Pricing analysis

Competitive landscape

It helps companies make strategic decisions.

Does this report provide customization? Customization helps organizations gain insight into specific market segments and areas of interest. Therefore, Market Info Reports provides customized report information according to business needs for strategic calls.

Get Customization of the Report@: https://www.marketinforeports.com/Market-Reports/Request-Customization/483500/plant-based-cannabidiol-(cbd)-nutraceuticals-market

Why Choose Market Info Reports?: Market Info Reports Research delivers strategic market research reports, industry analysis, statistical surveys and forecast data on products and services, markets and companies. Our clientele ranges mix of global business leaders, government organizations, SME’s, individuals and Start-ups, top management consulting firms, universities, etc. Our library of 600,000 + reports targets high growth emerging markets in the USA, Europe Middle East, Africa, Asia Pacific covering industries like IT, Telecom, Chemical, Semiconductor, Healthcare, Pharmaceutical, Energy and Power, Manufacturing, Automotive and Transportation, Food and Beverages, etc. This large collection of insightful reports assists clients to stay ahead of time and competition. We help in business decision-making on aspects such as market entry strategies, market sizing, market share analysis, sales and revenue, technology trends, competitive analysis, product portfolio, and application analysis, etc.

Contact Us: Market Info Reports 17224 S. Figueroa Street, Gardena, California (CA) 90248, United States Call: +1 915 229 3004 (U.S) +44 7452 242832 (U.K) Website: www.marketinforeports.com

0 notes

Link

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-cbd-oil-market

0 notes

Link

1 note

·

View note

Photo

Matcha Tea Market Share, Size, Trends, Growth Opportunities, Segmentation, Competitive Landscape and Forecast

Market Synopsis:

As per Market Research Future (MRFR)’s assessment, the global matcha tea market share is expected to reach USD 5.62 Bn market towards the end of 2023. It is also estimated to thrive at a CAGR of 9.69% during the forecast period 2017 to 2023. Matcha tea is effective and efficient in treating largely prevalent health disorders such as cardiovascular diseases, obesity, high blood sugar levels, etc. The awareness about its benefits has attracted a larger customer base. The matcha tea market is far from maturity and is poised to expand at a healthy pace over the next couple of years.

The tea has its origin in the Asia countries, but its adoption by the western countries is projected to lead the expansion of the matcha tea market across the review period. Key players are focusing on the production of innovative products for intensifying their brand visibility. In addition, the fusion of matcha tea and other products such as beverages, desserts, etc. is another factor responsible for generating matcha tea demand. However, the production process of matcha tea remains labor-intensive for retaining its premium quality which requires massive capital investment. This, in turn, is likely to increase the cost of the end products, thus, restricting market growth.

Competitive Dashboard:

Some of the key players profiled in the report are Tata Global Beverages Ltd (India), Nestlé SA (Switzerland), The Unilever Group (U.K.), Aiya Co. Ltd. (Japan), AOI Tea Company (U.S.), ITO EN, LTD. (Japan), and Marukyu Koyamaen Co. Ltd. (Japan).

Market Segmentation:

By application, the global matcha tea market has been segmented into beverages, nutraceuticals and others. Among these, the beverages segment is likely to dominate the matcha tea market in the forthcoming years. Meanwhile, the nutraceutical segment is poised to expand at a relatively higher CAGR over the assessment period.

By formulation, the matcha tea market has been segmented into plain and flavored. The flavored segment currently has a larger consumer base and is prognosticated to retain its dominance in the upcoming years.

By distribution channel, the global matcha tea market has been segmented into store based and non-store based. The store based segment is prognosticated to penetrate a larger share of the market in the foreseeable future.

To get more info: https://www.marketresearchfuture.com/press-release/matcha-tea-industry

Regional Analysis:

By region, the global matcha tea market has been segmented into North America, Europe, Asia Pacific, and Rest of the World. Asia Pacific houses the origin of matcha tea and is likely to retain its prominence by holding major share of the global market. Japan is expected to ace the growth of the regional matcha tea market.

Europeans have been witnessed to have a higher preference for healthy diet and drinks. Matcha tea market participants have capitalized on the thriving health-conscious population in the region to accelerate revenue creation. The regional market is anticipated to secure the pole position in the global matcha tea market through the projection period.

Industry News:

In January 2019, Tempo Tea, a functional beverage company, has launched a trio of sparkling teas which include sparkling matcha with raspberry and lime, sparkling rooibos tea with hibiscus and strawberry, and, sparkling black tea with blood orange and ginseng.

In November 2018, Kickback Cold Brew, an innovator in the CBD-beverage industry, has announced the launch of its new line of CBD-infused loose-leaf teas. The lineup includes Matcha’cha and Peachy Dreams.

In July 2018, MatchaBar, which is on a mission to bring matcha to people, has closed a funding of USD 8 Mn.

In April 2018, Pinkberry®, a franchise of frozen dessert restaurants, has launched ‘A Perfect Matcha’ that features the new Green Tea Lemonade frozen yogurt topped with mango, pineapple, and sprinkled with matcha powder.

#Matcha Tea market#Matcha Tea market Size#Matcha Tea market share#Matcha Tea market research#Matcha Tea market research reports#Matcha Tea market trend#Matcha Tea market key players

0 notes

Text

Nanoemulsion Market Trends, Outlook, and Opportunity Analysis, 2018-2026

Nanoemulsion is the process of suspension of minimicrons of globules of one liquid to other liquids that are immiscible to each other. Nanoemulsions are oil-in-water emulsions with mean size ranging from 50 to 1000 nm. Average size of a droplet is between 100 and 500 nm. Nanoemulsions are made from surfactants approved for human consumption and food substances that are recognized as safe by the U.S. FDA. Nanoemulsion can be prepared using several techniques such as micro fluidization, high pressure homogenization and sonication. Nanoemulsion is also called miniemulsion, ultrafine emulsion, and submicron emulsion. Nanoemulsions can dissolve large quantities of hydrophobics, this along with its high compatibility and ability to protect drugs from hydrolysis and enzymatic degradation make them ideal vehicles for transport. There are several advantages of nanoemulsion over conventional emulsion. One such advantage is the extreme micro-droplet size of nanoemulsion with high surface area, which makes them highly effective as a transportation system. Nanoparticles do not cause any problem such as coalescence, flocculation or inherent creaming, which are generally faced by microemulsions. This makes it suitable for any form such as creams, sprays, and foams. These factors are collectively leading to its wide adoption across the pharmaceutical industry.

Prevalent Scenarios in Nanoemulsion Market

Small size and high advantages of nanoemulsion allow for multiple applications in pharmaceuticals, creating significant growth opportunity for pharma companies. Nanoemulsions allow for small and slow administration of oral drugs and assure the complete absorption of drugs and reduce dose related toxicity. Various studies have been carried out to explore other avenues of drug delivery using nanoemulsion. In 2009, a study conducted in National Research Center, Dokki, Cairo, Egypt concluded potent use of nanoemulsion as potential ophthalmic drug delivery system for Dorzolamide Hydrochloride. Increasing awareness is creating opportunity for use of nanoemulsion in translational research for targeted cancer therapy. The increase in the potential of nanoemulsion and its various application in the pharmaceutical industry is the primary reason for the growing demand of nanoemulsion.

* The sample copy includes: Report Summary, Table of Contents, Segmentation, Competitive Landscape, Report Structure, Methodology.

Request a sample copy of this report: https://www.coherentmarketinsights.com/insight/request-sample/208

FDA considers nanoemulsion products under its regulation for nanomaterial products. Apart from drug delivery nanoemulsion are also used in cosmetics and are used in baby care wipes and makeup removal products. As they are highly non-toxic and non-irritant, nanoemulsions are widely used in cosmetic products creating opportunity for many cosmetic companies. The high cost associated with the preparation of nanoemulsion can act as the restrain to the global nanoemulsion market. Market players are focusing on integrating advanced technologies for production of nanoemulsion, with is further expected to act as a value-driver for the global market.

Developed countries account for the major share of the global nanoemulsion industry due to the availability of advanced technology and high disposable income. North America and Europe are the major consumers of nanoemulsion. Due to increasing advancements and high growth in pharmaceutical sector in emerging economies such as India and China, Asia Pacific is expected to emerge as a major nanoemulsion market in the near future.

Fragmented Market

The global nanoemulsion market is highly fragmented owing to the participation of many players into the research and development of nanoemulsion products. Major players involved in the nanoemulsion market are Covaris, Inc, LATITUDE Pharmaceuticals Inc., Taiwan Liposome Company (TLC), Allergan, and Abbott.

Browse Research Report: https://www.coherentmarketinsights.com/ongoing-insight/nanoemulsion-market-208

Key Developments

Product developments and launches by companies operating in the market are expected to drive demand for nanoemulsion in the near future. In August 2019, Pressure BioSciences, Inc. announced that they had received two purchase orders for the company’s BaroShear K45 Processing System, a nanoemulsification system for CBD related issues, which is to be commercially launch on 30th September 2019.

Continuous research and development activities are expected to generate demand for nanoemulsions in the pharmaceutical industry. In June 2019, a team of engineers from the MIT announced that they are developing a method of converting liquid nanoemulsions into solid gels.

Moreover, strategic collaborations and partnerships between market players are also expected to create high growth opportunities in the market. For instance, in January 2019, NutraFuels, Inc. and Pressure BioSciences, Inc. announced a collaboration on the development of water-soluble, nanoemulsion-based nutraceuticals, and other emulsion-based products, such as cosmetics.

Buy-Now this research report: https://www.coherentmarketinsights.com/insight/buy-now/208

About Coherent Market Insights:

Coherent Market Insights is a prominent market research and consulting firm offering action-ready syndicated research reports, custom market analysis, consulting services, and competitive analysis through various recommendations related to emerging market trends, technologies, and potential absolute dollar opportunity.

Contact Us:

mailto:[email protected]

U.S. Office:

Name: Mr. Shah

Coherent Market Insights 1001 4th Ave,

# 3200 Seattle, WA 98154, U.S.

US : +1-206-701-6702

UK : +44-020-8133-4027

JAPAN : +050-5539-1737

0 notes

Text

Top Nutraceutical Trends in2021 - Cannabis Is In

Cannabis has made a comeback. It's attained a level of popularity that few, if any, ingredients have ever attained. While the legalities of cannabis use are beyond the scope of this blog and are likely to change by the time it is published, nutraceutical companies are undoubtedly pushing the envelope when it comes to these products. This means large revenues for these businesses, but it also means a slew of legal repercussions that differ greatly depending on the legal jurisdiction. Because it may comprise marijuana, hemp, and/or cannabidiol (CBD), which can be produced from any of the former, navigating the cannabis sector can be a little tricky. By 2022, sales of CBD products in the United States are estimated to reach $646 million, with the natural product and specialty market channel accounting for $184.3 million of that. 1 Hemp is a similarly popular component, however its application and laws differ. Cannabis Hemp Cannabis, both hemp and marijuana, was categorized as a Schedule I federally restricted narcotic in 1970, and could not be farmed lawfully in the United States as a result. The Hemp Farming Act of 2018 changed all of that. Hemp cultivation is now legal, paving the way for its use in a wider range of products, including nutraceuticals. The act's supporters claim that it will boost the economy, create jobs, and revitalize farming towns. Indeed, according to one estimate, the hemp business will be worth $1.9 billion by 2022, up from $820 million in 2017. cannabis

0 notes