#CA office management software in India

Explore tagged Tumblr posts

Text

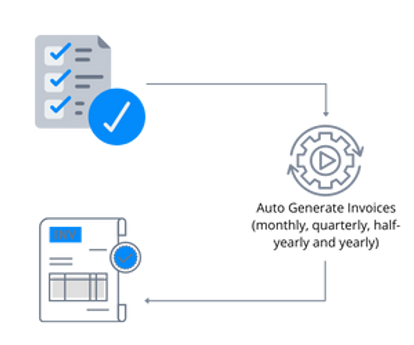

Searching for automated invoice generator software in 2023, in relaiable cost ? Then you are in right place. You can easily generate track invoices and payment through eProcessifyto know more click here

0 notes

Text

Tally products and their specializations in India

Tally is one of the best business software providers with global references. Tally spearheaded the "codeless" account which has since revolutionized the accounting sector. Intending to offer an affordable, effective, and simple-to-use solution, Tally developed robust and customizable TallyPrime software then Download Tally Software.

Tally products have diversified features that help you to carry out many activities like managing Inventory, Sales, Point of Sales, Purchase, Manufacturing, Costing, Payroll, Branch Management, Accounting, and Finance in addition to functionalities such as excise, statutory processes, and many more.

Tally products offer exceptional security features useful for securing all your data and files. You have access to smooth connection with all your staff, at various branch locations, CA's, and at any time without leaving your position. All these make Tally products revered and the most preferred TallyPrime software.

One of the most important software from Tally is TallyPrime. This software is used by many businesses and since its release more than 2 decades; the software solution has been growing in leaps and bounds. Now, it has come to a stage where they have great performance software that meets the demands of all businesses whether small or big. The Tally product comes with different features, adds-on, tally modules, and personalized solutions for specific industries.

With such diversified functionalities, cost-effectiveness, and efficient customer support to answer all your queries and issues, TallyPrime comes with the following line of products for your use.

TallyPrime software:

This software solution is ideal for Small and Medium Scale Enterprises that deal with trading, distribution, manufacturing, and service providers. This business software features key modules covering financial accounting and management, banking, inventory management, payroll, and statutory.

TallyPrime Server

This Tally product is designed to meet the needs of medium and large organizations in search of new ways to work efficiently. TallyPrime Server comes with an amazing design that makes your data protected and secured and at the same time, provides easy access from a single platform.

TallyPrime Auditor Edition

This is an auditing software solution solely designed to meet the needs of Chartered Accountants. With this software, you can easily deliver tax compliance and Audit services without leaving your office. This software will assist you to enhance your services and make you enjoy ease while achieving the optimum.

Tally.NET Subscription

This service comes with TallyPrime offering products update, data synchronization from many locations, remote access, and a variety of additional features that give a boost to your business performance.

Why Tally?

Tally believes in using the power of technology to help business owners work efficiently, and become better-off, so they can concentrate more on the important things in their business.

Tally delivers amazing flexibility in their product making it adaptable to different businesses and the way they work.

Tally rewards Certified Partners for their expertise with Tally products and their capacity to deliver outstanding customer service. Tally Certified Partners are completely prepared and ready to analyze your company needs, propose the best product, implement it, provide service and support, and even supply add-ons or solutions to tailor your user experience. In terms of automating your working practices, they function as your business consultants.

HBS Solutions is one of the best Tally partners that can help with Tally customization and handling. Every business has different needs and since the Tally products come with basic functionalities, there is a need to customize to suit your business needs. That is where you need the help of an expert.

HBS Solutions collaborates with their clients, to know how their business works, gain insight into their business operations, particular priorities, and procedures, and work on them. The team then determines the amount of demand that can be achieved by utilizing Tally's software basic functionality. If a gap exists, it is found and addressed for Tally Customization. In a nutshell, we ensure that the consumer benefits the most from Tally's features.

HBS Solutions have extensive expertise in implementing Enterprise business solutions available in the Tally enterprise framework. HBS Solutions provides comprehensive Tally solutions, including consulting, planning, development, execution, and training. We significantly increase our customers' performance by adopting an outstanding knowledge of business practices and executing them.

At HBS Solutions, we employ a precise technique that helps clients utilize Tally's features to the utmost and without draining their budget. Our service is cheap and yet effective. Our excellent performance at HBS Solutions is due to our ability to remain resilient, prompt customer support, a customer-focused approach, encouragement, and rewards for its staff, as well as its happy business partners.

At HBS Solutions, we employ a clear technique that enables clients to utilize Tally's advantages to the utmost extent and most economically. We are competent in all stages of Tally customization for any type of organization, Tally on Cloud solutions, Tally Training, and Tally Services.

HBS Solutions is dedicated to making things simpler, faster, and more accurate for you, regardless of whether you want TallyPrime setup or desire bespoke Tally integration. You may quickly do e-way billing with this TallyPrime software and obtain specialized Tally add-ons.

We are familiar with Tally and want to make sure that our clients are getting the best out of it too. The satisfaction of our customers is our priority and this is what is motivating us at HBS Solutions. Our team of experts is knowledgeable about the Tally world and has received training in how to treat clients politely. We can provide our customers with all the assistance they require to get the most out of their Tally installation because of our dedication and commitment to providing tailored and customized service.

Do you want to know more about how we can help you make the most of your Tally products, contact us today! As a certified Tally partner, we can assist you and respond to your questions via Remote Access.

Read more : Price Of Tally Software

2 notes

·

View notes

Text

Certified Accountant Course – Enroll & Upgrade Your Skills

Best Accountant Course for Job | बेस्ट अकाउंटेंट कोर्स फॉर जॉब

1. Introduction | परिचय

अकाउंटिंग (Accounting) आज के समय में सबसे ज्यादा डिमांड वाले करियर ऑप्शन में से एक है। हर छोटे और बड़े बिज़नेस को अकाउंटेंट की जरूरत होती है। अगर आप बेस्ट अकाउंटेंट कोर्स करके अच्छी जॉब पाना चाहते हैं, तो यह गाइड आपके लिए है।

2. Why Choose an Accounting Career? | अकाउंटिंग करियर क्यों चुनें?

Advantages of Becoming an Accountant | अकाउंटेंट बनने के फायदे

· High Demand | अधिक मांग – हर सेक्टर में अकाउंटेंट की जरूरत होती है।

· Good Salary | अच्छी सैलरी – अनुभव बढ़ने के साथ सैलरी भी बढ़ती है।

· Job Security | जॉब सिक्योरिटी – यह एक स्थिर करियर विकल्प है।

· Freelancing Opportunities | फ्रीलांसिंग के अवसर – आप खुद का अकाउंटिंग बिजनेस भी शुरू कर सकते हैं।

3. Key Skills Required for an Accountant | अकाउंटेंट के लिए आवश्यक कौशल

Important Skills | महत्वपूर्ण कौशल

· Mathematical Skills | गणितीय कौशल

· Analytical Thinking | विश्लेषणात्मक सोच

· Attention to Detail | बारीकियों पर ध्यान

· Knowledge of Accounting Software | अकाउंटिंग सॉफ्टवेयर की जानकारी

· Communication Skills | संचार कौशल

4. Types of Accountant Courses | अकाउंटेंट कोर्स के प्रकार

Basic Accounting Courses | बेसिक अकाउंटिंग कोर्स

· Tally ERP 9

· QuickBooks

· MS Excel for Accounting

Advanced Accounting Courses | एडवांस अकाउंटिंग कोर्स

· Cost Accounting

· Financial Accounting & Auditing

· Taxation (GST & Income Tax)

Diploma & Certification Courses | डिप्लोमा और सर्टिफिकेट कोर्स

· Diploma in Financial Accounting

· Chartered Accountancy (CA)

· Certified Management Accountant (CMA)

5. Best Online Accountant Courses | बेस्ट ऑनलाइन अकाउंटेंट कोर्स

Top Online Platforms | टॉप ऑनलाइन प्लेटफार्म

· Coursera – Financial Accounting Fundamentals

· Udemy – Accounting & Bookkeeping Masterclass

· ICAI e-Learning Portal – CA Foundation Course

· LinkedIn Learning – Accounting Essentials

6. Best Offline Accountant Courses | बेस्ट ऑफलाइन अकाउंटेंट कोर्स

· ICAI (Institute of Chartered Accountants of India) – CA Course

· ICWA (Institute of Cost and Works Accountants) – CMA Course

· IGNOU (Indira Gandhi National Open University) – Diploma in Financial Accounting

7. Eligibility Criteria for Accountant Courses | अकाउंटिंग कोर्स के लिए पात्रता

· Basic Courses – 10+2 या ग्रेजुएशन

· Advanced Courses – ग्रेजुएशन के बाद

· Certification Courses – किसी मान्यता प्राप्त संस्थान से कोर्स करना अनिवार्य है।

8. Course Duration & Fees | कोर्स की अवधि और फीस

Course Name

Duration

Fees (INR)

Tally ERP 9

3-6 Months

₹5,000 - ₹15,000

Diploma in Accounting

6-12 Months

₹20,000 - ₹50,000

CA (Chartered Accountant)

3-5 Years

₹1,50,000+

CMA (Certified Management Accountant)

2-3 Years

₹1,00,000+

9. Job Opportunities After Completing Accountant Course | जॉब के अवसर

Best Job Roles for Accountants | अकाउंटेंट के लिए बेस्ट जॉब रोल्स

· Junior Accountant

· Financial Analyst

· Tax Consultant

· Auditor

· Cost Accountant

· Chartered Accountant (CA)

· Chief Financial Officer (CFO)

Top Companies Hiring Accountants | अकाउंटेंट्स को हायर करने वाली टॉप कंपनियां

· Deloitte

· KPMG

· EY (Ernst & Young)

· PwC (PricewaterhouseCoopers)

· Infosys

· TCS

10. Top Accounting Certifications | टॉप अकाउंटिंग सर्टिफिकेशन

· CA (Chartered Accountant) – Best for high-paying jobs.

· CMA (Certified Management Accountant) – Global recognition.

· CPA (Certified Public Accountant) – International career scope.

· ACCA (Association of Chartered Certified Accountants) – UK-based certification.

· CFA (Chartered Financial Analyst) – Ideal for investment banking & finance roles.

11. Conclusion | निष्कर्ष

अगर आप बेस्ट अकाउंटेंट कोर्स की तलाश में हैं, तो अपने करियर लक्ष्य को ध्यान में रखते हुए कोर्स चुनें। ऑनलाइन और ऑफलाइन दोनों ऑप्शंस मौजूद हैं, बस आपको सही कोर्स से शुरुआत करनी है। अकाउंटिंग में करियर न केवल स्टेबल है बल्कि इसमें शानदार ग्रोथ और कमाई की संभावनाएं भी हैं।

FAQs | अक्सर पूछे जाने वाले सवाल

1. कौन सा अकाउंटेंट कोर्स सबसे अच्छा है? अगर आप फुल-टाइम करियर चाहते हैं तो CA और CMA बेस्ट ऑप्शन हैं।

2. क्या बिना डिग्री के अकाउंटेंट बना जा सकता है? हाँ, कई डिप्लोमा और सर्टिफिकेट कोर्स बिना डिग्री के भी कर सकते हैं।

3. अकाउंटिंग में जॉब पाने के लिए कौन सा सर्टिफिकेट जरूरी है? Tally, CA, CMA, CPA, ACCA जैसी सर्टिफिकेशन से अच्छी जॉब मिल सकती है।

अब देर मत कीजिए! सही अकाउंटिंग कोर्स चुनें और अपने करियर को नई ऊँचाइयों तक ले जाएं। 🚀

Accounting interview Question Answers

How to become an accountant

How to become Tax consultant

How to become an income tax officer

How to become GST Practitioner

Learn Tally free online

Free Accounting Courses with Certificate

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs

ICWA Course

Tally Short Cut keys

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

#Diploma in Computer Application#Business Accounting and Taxation (BAT) Course#Basic Computer Course#GST Course#SAP FICO Course#Payroll Management Course#Diploma in Financial Accounting#Diploma In Taxation#Tally Course

0 notes

Text

Certified Accountant Course – Enroll & Upgrade Your Skills

Best Accountant Course for Job | बेस्ट अकाउंटेंट कोर्स फॉर जॉब

1. Introduction | परिचय

अकाउंटिंग (Accounting) आज के समय में सबसे ज्यादा डिमांड वाले करियर ऑप्शन में से एक है। हर छोटे और बड़े बिज़नेस को अकाउंटेंट की जरूरत होती है। अगर आप बेस्ट अकाउंटेंट कोर्स करके अच्छी जॉब पाना चाहते हैं, तो यह गाइड आपके लिए है।

2. Why Choose an Accounting Career? | अकाउंटिंग करियर क्यों चुनें?

Advantages of Becoming an Accountant | अकाउंटेंट बनने के फायदे

· High Demand | अधिक मांग – हर सेक्टर में अकाउंटेंट की जरूरत होती है।

· Good Salary | अच्छी सैलरी – अनुभव बढ़ने के साथ सैलरी भी बढ़ती है।

· Job Security | जॉब सिक्योरिटी – यह एक स्थिर करियर विकल्प है।

· Freelancing Opportunities | फ्रीलांसिंग के अवसर – आप खुद का अकाउंटिंग बिजनेस भी शुरू कर सकते हैं।

3. Key Skills Required for an Accountant | अकाउंटेंट के लिए आवश्यक कौशल

Important Skills | महत्वपूर्ण कौशल

· Mathematical Skills | गणितीय कौशल

· Analytical Thinking | विश्लेषणात्मक सोच

· Attention to Detail | बारीकियों पर ध्यान

· Knowledge of Accounting Software | अकाउंटिंग सॉफ्टवेयर की जानकारी

· Communication Skills | संचार कौशल

4. Types of Accountant Courses | अकाउंटेंट कोर्स के प्रकार

Basic Accounting Courses | बेसिक अकाउंटिंग कोर्स

· Tally ERP 9

· QuickBooks

· MS Excel for Accounting

Advanced Accounting Courses | एडवांस अकाउंटिंग कोर्स

· Cost Accounting

· Financial Accounting & Auditing

· Taxation (GST & Income Tax)

Diploma & Certification Courses | डिप्लोमा और सर्टिफिकेट कोर्स

· Diploma in Financial Accounting

· Chartered Accountancy (CA)

· Certified Management Accountant (CMA)

5. Best Online Accountant Courses | बेस्ट ऑनलाइन अकाउंटेंट कोर्स

Top Online Platforms | टॉप ऑनलाइन प्लेटफार्म

· Coursera – Financial Accounting Fundamentals

· Udemy – Accounting & Bookkeeping Masterclass

· ICAI e-Learning Portal – CA Foundation Course

· LinkedIn Learning – Accounting Essentials

6. Best Offline Accountant Courses | बेस्ट ऑफलाइन अकाउंटेंट कोर्स

· ICAI (Institute of Chartered Accountants of India) – CA Course

· ICWA (Institute of Cost and Works Accountants) – CMA Course

· IGNOU (Indira Gandhi National Open University) – Diploma in Financial Accounting

7. Eligibility Criteria for Accountant Courses | अकाउंटिंग कोर्स के लिए पात्रता

· Basic Courses – 10+2 या ग्रेजुएशन

· Advanced Courses – ग्रेजुएशन के बाद

· Certification Courses – किसी मान्यता प्राप्त संस्थान से कोर्स करना अनिवार्य है।

8. Course Duration & Fees | कोर्स की अवधि और फीस

Course Name

Duration

Fees (INR)

Tally ERP 9

3-6 Months

₹5,000 - ₹15,000

Diploma in Accounting

6-12 Months

₹20,000 - ₹50,000

CA (Chartered Accountant)

3-5 Years

₹1,50,000+

CMA (Certified Management Accountant)

2-3 Years

₹1,00,000+

9. Job Opportunities After Completing Accountant Course | जॉब के अवसर

Best Job Roles for Accountants | अकाउंटेंट के लिए बेस्ट जॉब रोल्स

· Junior Accountant

· Financial Analyst

· Tax Consultant

· Auditor

· Cost Accountant

· Chartered Accountant (CA)

· Chief Financial Officer (CFO)

Top Companies Hiring Accountants | अकाउंटेंट्स को हायर करने वाली टॉप कंपनियां

· Deloitte

· KPMG

· EY (Ernst & Young)

· PwC (PricewaterhouseCoopers)

· Infosys

· TCS

10. Top Accounting Certifications | टॉप अकाउंटिंग सर्टिफिकेशन

· CA (Chartered Accountant) – Best for high-paying jobs.

· CMA (Certified Management Accountant) – Global recognition.

· CPA (Certified Public Accountant) – International career scope.

· ACCA (Association of Chartered Certified Accountants) – UK-based certification.

· CFA (Chartered Financial Analyst) – Ideal for investment banking & finance roles.

11. Conclusion | निष्कर्ष

अगर आप बेस्ट अकाउंटेंट कोर्स की तलाश में हैं, तो अपने करियर लक्ष्य को ध्यान में रखते हुए कोर्स चुनें। ऑनलाइन और ऑफलाइन दोनों ऑप्शंस मौजूद हैं, बस आपको सही कोर्स से शुरुआत करनी है। अकाउंटिंग में करियर न केवल स्टेबल है बल्कि इसमें शानदार ग्रोथ और कमाई की संभावनाएं भी हैं।

FAQs | अक्सर पूछे जाने वाले सवाल

1. कौन सा अकाउंटेंट कोर्स सबसे अच्छा है? अगर आप फुल-टाइम करियर चाहते हैं तो CA और CMA बेस्ट ऑप्शन हैं।

2. क्या बिना डिग्री के अकाउंटेंट बना जा सकता है? हाँ, कई डिप्लोमा और सर्टिफिकेट कोर्स बिना डिग्री के भी कर सकते हैं।

3. अकाउंटिंग में जॉब पाने के लिए कौन सा सर्टिफिकेट जरूरी है? Tally, CA, CMA, CPA, ACCA जैसी सर्टिफिकेशन से अच्छी जॉब मिल सकती है।

अब देर मत कीजिए! सही अकाउंटिंग कोर्स चुनें और अपने करियर को नई ऊँचाइयों तक ले जाएं। 🚀

IPA OFFERS:-

Accounting Course after 12th ,

Diploma in Taxation law,

Best courses after 12th Commerce ,

What after b com ,

Diploma in accounting finance ,

SAP fico Course fee ,

BAT Course ,

GST certification Course ,

Computer Course in delhi ,

Payroll Course in Delhi,

Online Tally course ,

One year course diploma after b com ,

Advanced Excel classes in Delhi ,

Diploma in computer application course

Data Entry Operator Course,

diploma in banking finance ,

stock market trading Course ,

six months course

Income Tax

Accounting

Tally

Career

0 notes

Text

High Paying Jobs in Mumbai – Top Career Opportunities for Professionals

High Paying Jobs in Mumbai – Top Career Opportunities for Professionals

Mumbai, the financial capital of India, is home to some of the world’s largest companies, thriving industries, and a bustling job market. As the city of dreams, Mumbai attracts professionals from various fields, offering lucrative career opportunities across sectors. From finance and technology to entertainment and healthcare, the high-paying job market in Mumbai is vast and diverse.

If you're looking to advance your career and secure a high-paying job, Mumbai is the place to be. In this article, we'll explore the top career opportunities for professional jobs in Mumbai and how you can position yourself for success in this competitive landscape.

Why Mumbai is the Hub for High Paying Jobs

Before we dive into the top career opportunities, let’s take a moment to understand why Mumbai offers such high-paying roles.

Financial Capital of India Mumbai is home to India’s major financial institutions, including the Bombay Stock Exchange (BSE) and the Reserve Bank of India (RBI). The city hosts a significant number of multinational corporations (MNCs) and top Indian companies, making it a hotspot for finance professionals and business experts.

Growing Tech Industry With the rapid growth of the tech industry, Mumbai has become a central hub for IT and software development companies. Many top global tech firms, including Google, Amazon, and Microsoft, have established offices here, offering excellent salaries to skilled professionals.

Entertainment and Media Capital Mumbai is also the epicenter of India’s entertainment industry. Known as "Bollywood," the city offers career opportunities for those in the media, advertising, and entertainment fields, with many lucrative roles for content creators, producers, directors, and actors.

Diverse Job Market Mumbai offers job opportunities across a wide range of sectors including healthcare, law, real estate, consulting, and marketing. The diversity of industries makes it an attractive location for professionals from various backgrounds.

Top High Paying Jobs in Mumbai

Now that we’ve established why Mumbai is an ideal place for high-paying jobs, let’s look at some of the top career opportunities for professionals in the city.

1. Investment Banker

Investment banking is one of the most lucrative fields in Mumbai. Investment bankers help companies raise capital, manage mergers and acquisitions, and provide financial advisory services. With Mumbai being the hub for India’s financial institutions, investment bankers in the city are well-compensated for their expertise.

Skills Required:

Strong knowledge of financial markets and analysis

Excellent quantitative and analytical skills

MBA or finance-related qualifications

Communication and negotiation skills

Salary Range: ₹10,00,000 to ₹50,00,000 per annum (based on experience and seniority)

2. Software Engineer/Developer

Mumbai’s growing tech industry offers high-paying roles for software engineers and developers. With companies like TCS, Infosys, Cognizant, and international firms like Google and Microsoft, there is no shortage of opportunities for professionals with expertise in software development, cloud computing, artificial intelligence (AI), machine learning (ML), and data science.

Skills Required:

Proficiency in programming languages like Java, Python, C++, and JavaScript

Strong problem-solving abilities

Experience with software development and databases

Knowledge of cloud computing and AI

Salary Range: ₹8,00,000 to ₹25,00,000 per annum

3. Chartered Accountant (CA)

Mumbai is a major hub for financial services and offers top-paying positions for Chartered Accountants (CAs). CAs are in high demand across various sectors, including banking, consulting, taxation, and corporate finance. The city’s top accounting firms, such as Deloitte, PwC, and EY, offer attractive packages to experienced professionals in this field.

Skills Required:

Chartered Accountant qualification

In-depth knowledge of accounting, auditing, and taxation

Analytical thinking and attention to detail

Good communication and interpersonal skills

Salary Range: ₹12,00,000 to ₹30,00,000 per annum

4. Marketing Director/Manager

The marketing industry in Mumbai is vibrant and offers excellent opportunities for professionals with leadership skills. Marketing directors and managers are responsible for planning and executing marketing strategies to build brand awareness and drive sales. Companies in Mumbai, especially those in the consumer goods, retail, and e-commerce industries, offer competitive salaries to top marketing professionals.

Skills Required:

Expertise in digital marketing, SEO, SEM, and content marketing

Strong leadership and project management skills

Ability to analyze market trends and customer data

Excellent communication and presentation skills

Salary Range: ₹12,00,000 to ₹35,00,000 per annum

5. Lawyers/Corporate Lawyers

Mumbai, as the financial capital, also hosts India’s top law firms and corporate houses. Corporate lawyers specializing in mergers and acquisitions, intellectual property (IP) law, and commercial law are highly sought after. High-end legal professionals working for MNCs and law firms in Mumbai enjoy lucrative compensation packages, along with perks and bonuses.

Skills Required:

Law degree (LLB or LLM)

Strong understanding of corporate law, litigation, and contracts

Exceptional negotiation and communication skills

Analytical and problem-solving skills

Salary Range: ₹10,00,000 to ₹40,00,000 per annum

6. Product Manager

In the fast-paced tech and e-commerce industry, product managers are crucial to the success of new products and services. They are responsible for overseeing product development, strategy, and implementation. With major tech firms and startups in Mumbai, product managers enjoy high-paying opportunities that often include performance-based bonuses and stock options.

Skills Required:

Experience in product lifecycle management

Strong analytical and strategic thinking skills

Understanding of market research and customer behavior

Leadership and team management skills

Salary Range: ₹12,00,000 to ₹35,00,000 per annum

7. Consultant (Management, Strategy, or IT)

Consultants, particularly in the fields of management, strategy, and IT, are highly paid professionals in Mumbai. Consulting firms like McKinsey & Company, Boston Consulting Group (BCG), and Accenture offer significant salaries and attractive benefits to professionals who provide advisory services to companies looking to optimize operations, improve business strategies, and implement technology solutions.

Skills Required:

Strong analytical and problem-solving abilities

Leadership and communication skills

MBA or equivalent qualifications

Industry-specific knowledge and expertise

Salary Range: ₹12,00,000 to ₹45,00,000 per annum

8. Data Scientist/Analyst

With the rise of big data, data scientists and analysts are in high demand in Mumbai’s tech and finance sectors. These professionals are responsible for analyzing complex data sets, identifying trends, and providing insights that help businesses make data-driven decisions. Companies in sectors like finance, healthcare, and e-commerce are offering high-paying opportunities for skilled data scientists.

Skills Required:

Proficiency in data analysis tools like Python, R, SQL, and Hadoop

Strong knowledge of machine learning and AI

Excellent problem-solving skills

Ability to communicate complex data insights to non-technical stakeholders

Salary Range: ₹10,00,000 to ₹30,00,000 per annum

How to Secure a High Paying Job in Mumbai

Network and Build Connections Networking plays a key role in landing high-paying jobs. Attend industry events, seminars, and connect with professionals on platforms like LinkedIn to increase your visibility and opportunities.

Upgrade Your Skills High-paying jobs require advanced skills and qualifications. Continuously upgrade your skills through online courses, certifications, and professional development programs to stay ahead of the competition.

Tailor Your Resume Ensure that your resume is customized to highlight the skills and experiences relevant to the job you're applying for. A well-crafted resume increases your chances of getting noticed by recruiters.

Prepare for Interviews Be prepared for tough interview rounds. Research the company thoroughly, understand its culture, and be ready to showcase how your skills align with the job requirements.

Conclusion

Mumbai is undoubtedly one of the best places to pursue high-paying jobs in India. With its diverse industries, multinational presence, and thriving job market, the city offers abundant opportunities for skilled professionals to grow and succeed. Whether you’re an investment banker, software engineer, marketing professional, or data scientist, Mumbai has something for everyone.

By upgrading your skills, networking effectively, and staying focused on your career goals, you can land one of the top high-paying jobs in Mumbai and take your career to new heights.

0 notes

Text

Which job has the highest salary in India?

India is home to a wide range of industries offering competitive salaries, but certain roles stand out in terms of income potential. Whether you're planning your career or considering a job switch, it’s important to know which professions pay the most. Let’s take a look at the top-paying jobs in India and understand what it takes to land one of these lucrative positions.

1. Management Professionals (CEO, CFO, COO)

Top executives, such as Chief Executive Officers (CEOs), Chief Financial Officers (CFOs), and Chief Operating Officers (COOs), are among the highest-paid professionals in India. Their compensation includes a combination of high base salaries, bonuses, and stock options.

Average Salary: ₹1,00,00,000 - ₹10,00,00,000 per annum (depending on the company and industry)

These roles require extensive experience, leadership skills, and the ability to drive business success at a strategic level.

2. Data Scientists

With the rise of big data, data scientists are in high demand. They analyze complex data to provide actionable insights that help businesses make data-driven decisions. Companies in industries like IT, e-commerce, and finance offer high salaries to skilled data scientists.

Average Salary: ₹7,00,000 - ₹30,00,000 per annum

A strong background in mathematics, statistics, and programming, along with proficiency in tools like Python, R, and SQL, can make you a top candidate.

3. Medical Professionals (Doctors, Surgeons)

Doctors, especially those in specialized fields like neurosurgery, orthopedics, and cardiology, are among the highest earners in India. The high cost of healthcare and the need for specialized expertise drive these salaries.

Average Salary: ₹10,00,000 - ₹50,00,000 per annum (or more for top surgeons in private practice)

Becoming a highly paid medical professional requires years of education, specialized training, and clinical experience.

4. IT Professionals (Software Engineers, Architects, and IT Managers)

The IT sector continues to dominate in terms of salary offerings. High-level IT professionals such as software engineers, IT architects, and IT managers working with cutting-edge technologies like artificial intelligence (AI), blockchain, and cloud computing enjoy lucrative compensation packages.

Average Salary: ₹6,00,000 - ₹20,00,000 per annum (with potential for higher earnings in multinational firms)

A strong technical background, along with expertise in emerging technologies, can significantly boost earning potential in the IT field.

5. Digital Marketing Managers

With businesses increasingly shifting online, digital marketing has become a crucial aspect of their growth. Digital marketing managers who can create effective strategies to drive online sales, lead generation, and brand awareness are in high demand. This profession has seen significant salary growth in recent years.

Average Salary: ₹8,00,000 - ₹25,00,000 per annum

Skills in SEO, SEM, content marketing, social media marketing, and analytics can help you secure a high-paying role in the field of digital marketing.

6. Lawyers (Corporate and Criminal Lawyers)

Lawyers specializing in corporate law or high-profile criminal cases earn some of the highest salaries in India. Their role in advising businesses on legal matters and representing clients in court is critical, and their fees can be substantial.

Average Salary: ₹8,00,000 - ₹50,00,000 per annum (or more, depending on experience and client base)

A degree in law, coupled with years of experience and specialization in lucrative sectors, is essential to securing these high-paying roles.

7. Chartered Accountants (CAs)

Chartered accountants are essential in managing finances for businesses and individuals. They are responsible for auditing, taxation, and financial planning, making them highly valuable in India’s finance-driven economy.

Average Salary: ₹6,00,000 - ₹15,00,000 per annum

CAs who work with large corporations or run their own successful firms often earn significantly more.

Is Digital Marketing a High-Paying Job?

While digital marketing may not be at the top of the salary list, it is a rapidly growing field with plenty of potential. As businesses shift their focus to online platforms, digital marketing experts are in demand. Roles such as digital marketing managers, SEO specialists, and social media strategists can earn substantial salaries with experience.

Elevate Your Career in Digital Marketing

If you're looking for a career with excellent growth prospects and high earning potential, consider digital marketing. Partner with a top digital marketing agency in Tamil Nadu to sharpen your skills and tap into the vast opportunities in this high-demand field.

Contact us today to start your journey toward a rewarding career in digital marketing!

0 notes

Text

Solar Energy Corporation of India Limited (SECI) Recruitment 2024: Apply for Young Professionals

Solar Energy Corporation of India Limited (SECI), a prestigious Government of India enterprise, has released Notification No: 02/2024, inviting applications for the position of Young Professionals in various fields. SECI is looking for innovative and dynamic candidates with proven academic credentials and professional achievements. Below are the key details of the recruitment:

Young Professional (Finance) - 03 Positions

Qualification: CA/CMA/MBA (Finance) with a minimum of 60% marks or equivalent CGPA.

Experience: At least 3 years of post-qualification experience in executive positions in a reputed organization.

Age Limit: Maximum 30 years.

Young Professional (Information Technology) - 02 Positions

Qualification: B.Tech/B.E. in Computer Science/IT or MCA with a minimum of 60% marks or equivalent CGPA.

Experience: Minimum 3 years of experience in IT hardware/software/cloud infrastructure management, network administration, and related areas.

Age Limit: Maximum 30 years.

Young Professional (Office of CMD) - 01 Position

Qualification: Bachelor's degree in Engineering/B.Tech or Master's degree in Science/Technology/Commerce/Statistics/Economics or related fields.

Experience: 3 years of experience in executive positions, with strong analytical skills and expertise in preparing presentations and Management Information Systems (MIS).

Age Limit: Maximum 30 years.

Young Professional (Human Resource) - 01 Position

Qualification: A degree in any discipline along with an MBA in HRM with at least 60% marks or equivalent CGPA.

Experience: 3 years of experience in HR functions, such as recruitment, manpower planning, and general administration.

Age Limit: Maximum 30 years.

Young Professional (Corporate Planning) - 01 Position

Qualification: B.Tech in any discipline and MBA/PGDM in Finance/Power Management or related fields with a minimum of 60% marks.

Experience: 3 years of experience in data analytics, market research for renewable energy projects, and financial modeling for project feasibility.

Age Limit: Maximum 30 years.

Important Dates

Online Registration Opens: 03.10.2024 (11:00 AM)

Online Registration Closes: 02.11.2024 (5:00 PM)

Application Process

Candidates interested in these positions must apply online through SECI's official website: www.seci.co.in. Only Indian Nationals are eligible to apply for these positions. A valid email ID is mandatory for correspondence, as all updates will be communicated through it.

How to Apply for SECI Young Professional Posts

Visit SECI's official website: Go to www.seci.co.in and find the recruitment section.

Register online: Create an account and provide all necessary details.

Upload documents: Ensure you have the required educational and experience certificates, photograph, and signature ready for uploading.

Submit the application: Double-check all details before submitting your application.

Take a printout: Keep a printed copy of your application for future reference.

Why Choose a Career at SECI?

The Solar Energy Corporation of India plays a vital role in the growth of renewable energy in India, and this opportunity provides young professionals with a platform to contribute to the nation’s clean energy future. Working at SECI allows individuals to be at the forefront of green energy projects, develop innovative solutions, and make a meaningful impact on India’s energy sector.

Eligibility Criteria for SECI Young Professional Recruitment

Nationality: Only Indian nationals can apply.

Educational Qualifications: Ensure that your degree aligns with the qualifications mentioned for each post, and that you meet the minimum mark requirement (60% or equivalent CGPA).

Experience: Applicants must have at least 3 years of experience in relevant fields.

SECI Recruitment Selection Process

Initial Screening: Based on the online applications, eligible candidates will be shortlisted.

Interview: Shortlisted candidates may be called for an interview or another assessment round.

Final Selection: The final selection will be based on qualifications, experience, and performance in the interview.

Key Benefits of Working at SECI

Opportunity to work in a pioneering government organization driving India’s solar energy revolution.

Competitive salary and benefits packages.

Dynamic work environment fostering professional growth and innovation.

Exposure to large-scale renewable energy projects.

SECI Young Professionals Recruitment FAQs

1. Can I apply for more than one post? Yes, candidates can apply for multiple positions, provided they meet the eligibility criteria for each position.

2. What documents are required during the online application? You will need to upload educational certificates, proof of work experience, a recent photograph, and a signature.

3. Is there an application fee? Check the official notification on the SECI website for details regarding any application fee.

4. Can I apply offline? No, the application process is entirely online. Offline applications will not be accepted.

5. What is the work location for these positions? The positions will be based in the SECI office or project sites as determined by the company.

0 notes

Text

Finding the Best CA Audit Firms in Hyderabad: A Comprehensive Guide

When it comes to managing your business’s finances, selecting the right Chartered Accountant (CA) audit firm is crucial. For businesses in Hyderabad, particularly in Madhapur, finding a reliable CA audit firm can make a significant difference in ensuring compliance, accuracy, and strategic financial planning. This guide will help you navigate the process of choosing the best CA audit firms in Hyderabad, with a special focus on why SBC stands out.

Understanding the Role of CA Audit Firms

CA audit firms play a critical role in the financial health of a business. They are responsible for conducting audits, ensuring compliance with financial regulations, and providing strategic advice to improve financial performance. A proficient CA audit firm will help in identifying financial risks, improving internal controls, and ensuring accurate financial reporting.

Why Location Matters: Focus on Madhapur

Madhapur, a bustling commercial hub in Hyderabad, is home to many businesses and, consequently, a plethora of CA audit firms. Choosing a firm located in or near Madhapur can offer several advantages. Proximity allows for more personalized service, easier communication, and a better understanding of the local business environment.

Key Criteria for Selecting CA Audit Firms in Hyderabad

Reputation and Experience

Look for firms with a strong reputation and extensive experience. Established CA audit firms in Hyderabad will have a track record of reliability and competence. Check reviews, ask for client testimonials, and assess their portfolio of services.

Expertise in Relevant Industries

Ensure the firm has experience in your specific industry. Different sectors have unique regulatory requirements and financial challenges, so a firm well-versed in your industry can offer more tailored advice and services.

Range of Services

A comprehensive CA audit firm should offer a range of services beyond just auditing, such as tax consulting, financial planning, and risk management. This breadth of services can be beneficial for holistic financial management.

Professional Credentials

Verify that the firm’s auditors are certified and in good standing with professional bodies. This includes checking their membership with the Institute of Chartered Accountants of India (ICAI) and other relevant bodies.

Technology and Innovation

In today’s digital age, the use of advanced technology can enhance the efficiency and accuracy of audits. A firm that leverages the latest tools and software can provide more insightful analysis and streamlined processes.

Why SBC Stands Out

Among the CA audit firms in Hyderabad, SBC (SBC Chartered Accountants) is a prominent choice for businesses in Madhapur. With a reputation for excellence and a client-centric approach, SBC offers a comprehensive range of audit and advisory services tailored to meet diverse business needs.

Key Features of SBC:

Experienced Professionals: SBC boasts a team of highly qualified and experienced professionals who are adept at handling complex audit requirements.

Industry-Specific Expertise: Their expertise spans various industries, ensuring that you receive relevant and practical advice.

Comprehensive Services: SBC provides a full suite of services, including auditing, tax planning, compliance, and risk management, ensuring all your financial needs are met.

Technology-Driven: Utilizing the latest in audit technology, SBC enhances the accuracy and efficiency of their services, providing clients with actionable insights and streamlined processes.

Contact SBC

For businesses in Madhapur and the broader Hyderabad area, SBC is a top choice for CA audit services. Their commitment to quality and client satisfaction makes them a reliable partner for your financial management needs. To learn more about how SBC can assist you, call them at 040-48555182 or visit their office in Madhapur.

Choosing the right CA audit firm is pivotal to your business’s financial health and compliance. By considering factors such as experience, expertise, and service range, you can make an informed decision. SBC stands out as a leading choice among CA audit firms in Hyderabad, offering the expertise and dedication needed to support your business’s success.

#big ca firms in hyderabad#big ca firms in madhapur#ca audit firms in hitech city#ca audit firms in hyderabad#ca audit firms in madhapur

0 notes

Text

Unity Small Finance Bank doubles SCF book with revamped volume strategy, delivered on UnciaChain

Unity Small Finance Bank is promoted by Centrum Financial Services, part of the diversified Centrum Group. Resilient Innovations Pvt. Ltd (BharatPe) is an investor in the Bank. The Supply Chain Finance (SCF) business was started before the formation of Unity Bank by Centrum Financial Services in 2017. They were among the pioneers entering India’s SCF sector. When they launched their SCF business, they strategically targeted large corporations to expand their operations.

In line with their strategy, they acquired the entire L&T Finance’s SCF portfolio, which majorly involved L&T as an anchor and all their suppliers/vendors as counterparties. However, India’s Supply Chain Finance (SCF) market became intensely competitive due to small profit margins and bank’s high cost of funds. Consequently, there came a point when they began reducing their portfolio.

Amidst these changes, Centrum Financial Services along with BharatPe formed Unity Bank. They rethought their strategy, focusing on mid mid-market anchors while expanding into both the Vendor and Dealer Finance segments. This shift required Unity Bank to onboard a larger number of anchors as compared to targeting large corporations.

To implement this new approach, Unity needed an efficient digital SCF back-office system combined with robust Loan Origination System (LOS). They aimed for a complete digital transformation, creating an end-to-end digital ecosystem for SCF. This transformation would enable them automated onboarding and underwriting of anchors and counterparties along with digital servicing during discounting process, providing a competitive edge in the market.

After an extensive evaluation of products available in the market, Unity chose UnciaChain as their platform of choice. Uncia’s in-depth understanding of Unity Bank’s business needs reflected in the bank specific solution walkthrough, backed by strong references from exiting UnciaChain users tilted the scale in Uncia’s favor.

UnciaChain designed as a cloud native, multi-tenanted SaaS-based solution, is built on cutting-edge microservices architecture. Functioning as a tri-party system, it enables Financial Institutes (FIs) to digitally onboard their anchors and counterparties, granting them platform access via portals for seamless digital transactions. The platform is API-driven and boasts high automation levels, effectively eliminating the need for manual intervention through Straight Through Processing (STP).

With comprehensive functional coverage, the platform comes pre-mapped with fifty-one predefined SCF product variations covering practically every SCF nuance within the Indian market, catering to both the Dealer and Vendor sides. It features a standalone limit management system, a Business Rule Engine, and UnciaStudio. UnciaStudio empowers users to reduce dependency on external support by enabling them to launch new products, configure rates and charges, manage user access restrictions, and more, independently. Designed for a seamless user experience, the platform automates the entire SCF business ecosystem, offering efficiency and ease of operation. Designed for a 30-day Go-Live, out of the box, the UnciaChain design dramatically reduces both the need to write custom code to meet a nuance, as well as the lead time for custom development, where it is unavoidable.

Uncia proposed the implementation in two phases. The first phase involved implementing the entire back office, allowing Unity Bank to transition into the new business ecosystem swiftly and immediately reap its benefits. In the second phase, Uncia worked closely with Unity, to build a bank specific Loan Origination Software (LOS) to cater specifically to their requirements, providing them with a substantial competitive edge.

As part of the project, Uncia facilitated integrations with Karza, Perfios, CIBIL, AML, and Posidex, enhancing Unity’s operational capabilities and competitiveness. These integrations collectively empower Unity with a holistic view of their customers, streamlined operations, improved risk assessment capabilities, and enhanced data accuracy. This suite of integrations ensures that Unity Bank can make informed decisions swiftly, maintain regulatory compliance, and deliver an elevated level of service to its clients.

The implementation of the supply chain finance platform was accomplished within 3 calendar months, while the LOS was completed within 6 calendar months. Parallelly, a complete data migration of 20,000 loan accounts was achieved within the same timeframe.

Unity Bank gained a significant competitive advantage through the implementation of the customized Lending Origination System (LOS). This system empowered them to digitally onboard and underwrite their anchors, and bring their complete ecosystem along with the counterparties in a complete digital mode to the platform. A comprehensive rollout of the integrated platform was executed across all branches and with partner institutions.

Before the platform implementation, Unity Bank operated with a book size of INR 400 Crores. Since the implementation, the bank has scaled its operations significantly to a book size of more than INR 1000 Crores within 6 months. This impressive business growth can be attributed to the establishment of a comprehensive digital ecosystem, reduced manual dependencies, and the implementation of robust compliance reporting mechanisms. By leveraging cutting-edge technology and strategic partnerships, Unity Bank is well-positioned to continue its trajectory of success in the dynamic landscape of the financial industry.

#supply chain finance platform#supply chain finance solutions#loan origination software#loan origination system

1 note

·

View note

Text

Transform Your Workflow with CA Practice Management Software

In the realm of accounting, efficiency is paramount. Chartered Accountants (CAs) navigate a complex landscape of financial tasks, from business accounting to income tax calculations, on a daily basis. To streamline operations and elevate productivity, accounting firms are increasingly turning to CA Practice Management Software solutions like webledger.

Introduction to CA Practice Management Software

CA Practice Management Software serves as a pivotal tool for modern accounting firms, providing a comprehensive suite of features tailored to meet the unique demands of CAs. From ledger accounting software to cloud-based solutions and all-in-one accounting software packages, these solutions have evolved significantly to address the evolving needs of the industry.

Key Features of CA Practice Management Software

The hallmark of CA Practice Management Software like webledger is its robust feature set designed to optimize workflow efficiency. Central to these features is the cloud-based architecture, enabling seamless access to data from any location at any time. Moreover, these solutions offer seamless integration with other systems, including income tax software and best accounting software in India, facilitating smooth data exchange and collaboration.

Automation is another cornerstone of CA Practice Management Software, streamlining repetitive tasks such as data entry and report generation to save time and minimize errors. Furthermore, advanced security measures ensure the safeguarding of sensitive financial information, instilling confidence in both firms and clients.

Benefits of CA Practice Management Software

The adoption of CA Practice Management Software yields a myriad of benefits for accounting firms. Primarily, it results in a significant enhancement of productivity by streamlining workflows and eliminating manual processes. This allows accountants to dedicate their time and efforts to strategic tasks, leading to expedited turnaround times and elevated client service levels.

Collaboration is also greatly facilitated through CA Practice Management Software, enabling team members to seamlessly share data and communicate in real-time. This fosters a cohesive working environment and ensures alignment across the board. Additionally, these solutions play a pivotal role in ensuring compliance with regulatory requirements, thanks to built-in compliance features and audit trails.

Choosing the Right CA Practice Management Software

Selecting the right CA Practice Management Software is paramount for the success of any accounting firm. Firms should meticulously evaluate factors such as functionality, ease of use, cost, and scalability when assessing different options. It's imperative to choose a solution that aligns with the firm's specific needs and objectives, be it ledger accounting software or office management software for CAs.

With a plethora of options available in the market, ranging from all-in-one accounting software to specialized CA office management software, thorough research and due diligence are essential. Seeking recommendations from industry peers and exploring case studies of firms that have successfully implemented similar solutions can provide invaluable insights.

Implementation Process

The implementation of CA Practice Management Software requires meticulous planning and execution. It typically involves several steps, including data migration, customization, and training. Firms should allocate ample time and resources to ensure a seamless transition to the new system.

Comprehensive training and support are pivotal aspects of the implementation process. Providing thorough training to staff members and offering ongoing support can help maximize the benefits of the software and minimize disruptions to workflow. Additionally, establishing clear communication channels with the software provider is crucial for addressing any issues or concerns that may arise during the implementation phase.

Case Studies

Numerous accounting firms have witnessed substantial improvements in productivity and efficiency following the implementation of CA Practice Management Software like webledger. For instance, XYZ Accounting Services reported a 50% increase in productivity and a 25% reduction in errors after adopting webledger's cloud-based solution.

Similarly, ABC Consultants experienced a 40% reduction in turnaround time for client deliverables and a 30% increase in client satisfaction scores post-implementation. These case studies underscore the transformative impact of CA Practice Management Software on accounting firms of all sizes.

Future Trends in CA Practice Management Software

Looking ahead, the future of CA Practice Management Software is promising. Advancements in technology, such as artificial intelligence and machine learning, are expected to further enhance the capabilities of these platforms. Additionally, there is a growing demand for mobile-friendly solutions that enable accountants to work on the go.

As such, we can anticipate continued innovation and development in this space, with a focus on user experience and accessibility. Moreover, regulatory changes and evolving client expectations will drive further refinements in CA Practice Management Software, ensuring that accounting firms remain competitive in the digital age.

Challenges and Solutions

While CA Practice Management Software offers numerous benefits, it also presents challenges such as data security concerns and integration issues. However, these challenges can be overcome with careful planning and implementation strategies.

For instance, firms can mitigate security risks by implementing multi-factor authentication and encryption protocols. Similarly, integration challenges can be addressed through thorough testing and collaboration with software vendors. By proactively tackling these challenges, accounting firms can fully leverage the potential of CA Practice Management Software and stay ahead of the curve.

Security Measures

Data security is a top priority for accounting firms, given the sensitive nature of financial information. CA Practice Management Software solutions like webledger employ various security measures, including encryption, firewalls, and regular security audits, to protect data from unauthorized access.

Furthermore, many software providers offer compliance features to help firms adhere to industry regulations such as GDPR and HIPAA. By implementing robust security measures, accounting firms can safeguard their clients' information and foster trust in their services.

Cost Considerations

Cost is another critical factor to consider when evaluating CA Practice Management Software solutions. While some solutions offer a subscription-based pricing model, others may require a one-time upfront payment. Firms should assess the total cost of ownership, including implementation, training, and ongoing support, to make an informed decision.

It's also essential to evaluate the return on investment (ROI) when investing in CA Practice Management Software. While the initial cost may seem significant, the long-term benefits in terms of time savings, efficiency gains, and client satisfaction can far outweigh the expense.

Integration with Other Systems

Many accounting firms utilize a variety of software systems to manage their operations, from business accounting software to income tax software. Integration with these systems is crucial for maximizing the value of CA Practice Management Software.

Fortunately, most modern solutions offer robust integration capabilities, allowing for seamless data exchange between different systems. Whether it's integrating with bookkeeping software for financial reporting or linking with online accounts software for billing and invoicing, CA Practice Management Software can help streamline operations and enhance overall efficiency.

In conclusion, CA Practice Management Software like webledger offers accounting firms a transformative tool to optimize workflows and enhance productivity. By leveraging cloud-based technology, automation, and integration capabilities, these solutions enable firms to foster collaboration, ensure compliance, and thrive in the digital age.

0 notes

Text

#CA office automation software#CA office management software#Accounting firm management software#Email and task management software India

0 notes

Text

electrocom.in I Income tax software, best income tax software, income tax return filing software free download, income tax software free download

Income tax software,income tax computation software

.

EasyTAX

Income Tax Return Filing Software

File your Income-Tax Returns Quickly with Ease & Accuracy

It offers a range of features to help Tax Professionals to streamline tax preparation process and ensure accurate computation of income and taxes. Completely automate the process of return preparation and computation of tax.

.

best income tax software,income tax software price

Auto Selection of applicable ITR as per Income, generates ITR forms 1, 2, 3, 4, 5, 6, 7 and ITR U (updated Return) in both paper and electronic format, making filing of e-returns easier. The JSON / XML Import facility helps to import master and return data easily.

.

income tax return filing software free download,income tax software for a.y. 2024-25

Other key features include Computation of business income for multiple businesses, Presumptive income under sections 44AD, 44ADA, and 44AE, Calculation of allowable remuneration and interest to partners in a firm, Auto set off and carry forward of losses, Interest Calculation under sections 234A, 234B, 234C, 234F, Comparative income tax summary for multiple assessment years, Computation for both the old & new Tax regime under section 115BAC with a comparative income statement, Generate various Analysis reports such as Pending returns, Filed returns with dates, Refund status, Tax Register etc. EasyOffice Software demo can be downloaded free of cost.

.

EasyOFFICE’s Income Tax Module EasyTAX is the Best Income Tax Software for Tax Professionals. The software simplifies the tax preparation process, reduces errors, and provides a more efficient way to file taxes.

.

income tax software free download,it return software

Accurately Compute Income & Tax, Self-Assessment Tax, Advance Tax, Provision for set-off losses, clubbing of incomes, chapter VIA deductions, rebates, arrears, Interest Calculation, etc.

.

EasyOFFICE is a very popular software among Chartered Accountants and Tax professionals. Experience the ease of Tax Preparation with EasyTAX - The most effective & user-friendly Income Tax Software.

.

tax filing software , best income tax software in india

India’s Best Income Tax, TDS, GST Software

Electrocom’sEasyOffice and EasyGST Taxation software is specifically designed & developed to revolutionize the complete Taxation management of CA & Tax Professionals. Our Software has created a reputation in the PAN India market for user-friendly operations, Accuracy, Taxation process automation & excellent after-sales support.

best income tax software for chartered accountants,income tax software for ca

Show More

Simplifying Tax and Account Compliance

Easy, Effective & Efficient Software

Competitive Price

Fully Menu-Driven Solution for all Assessee status to prepare and file their income tax e-returns.

.

income tax software free for chartered accountants,Top 10 Income tax software in India free

Contact Us :

505, Sukhsagar Complex, Nr. Hotel Fortune Landmark, Usmanpura Cross Road, Ashram Road, Ahmedabad - 380013, Gujarat (INDIA),

Call us :079-27562400, 079-35014600

Website: https://easyofficesoftware.com/

Email us : [email protected]

Office Time : 10:15AM - 7PM (Mon-Fri), 10:30AM - 5PM (Sat)

0 notes

Text

Choosing the Right Office Management Software for CA Firms

Unlock seamless workflow and enhanced productivity for your CA firm! Dive into our guide on selecting the perfect office management software tailored to the unique needs of Chartered Accountants. Streamline tasks, manage data, and elevate your practice.

0 notes

Text

Building Energy Management Systems Market Is Likely to Experience a Tremendous Growth in Near Future

Advance Market Analytics released a new market study on Global Building Energy Management Systems Market Research report which presents a complete assessment of the Market and contains a future trend, current growth factors, attentive opinions, facts, and industry validated market data. The research study provides estimates for Global Building Energy Management Systems Forecast till 2027*.

Building Energy Management System (BEMS) is a system to manage, monitor and control technical services used in buildings. This system is equipped with various sensors, controller and actuators to control and improve buildings' energy performance. BEMS comprises of various components such as Building Energy Management Systems Service (BEMS) services, Building Energy Management Systems (BEMS) hardware and Building Energy Management Systems Software (BEMS) software. Growing smart city projects and government expenditures are expected to further fuel the very market growth.

Key Players included in the Research Coverage of Building Energy Management Systems Market are

Schneider Electric ( France)

Siemens (Germany)

Honeywell (United States)

Johnson Controls (United States)

GridPoint (United States)

C3 Energy (United United)

General Electric (United States)

CA Technologies (United States) What's Trending in Market: Growing Automation Technologies

Challenges: Reducing Operating Cost of the System

Issue Associated with

Opportunities: Favorable Government Initiatives Towards Energy Efficient

Growing Smart City

Market Growth Drivers: Reduces Carbon Footprint and Provide Sustainable Solution

Lowers Utility Bills and Building Ownership Expenses

The Global Building Energy Management Systems Market segments and Market Data Break Down by Type (Software, Hardware), Application (Commercial, Government (Defense & Government Utility Buildings), Residential), Services (Consulting & Training, Support & Maintenance Services), End Users (Manufacturing, Telecom and IT, Office and Commercial Buildings, Municipal, University, School and Hospital (MUSH) systems, Government), Software (Data Management, Asset Performance Optimization, Application Platform, HVAC System, Lightning system, Others), Communication Technology (Wired, Wireless) To comprehend Global Building Energy Management Systems market dynamics in the world mainly, the worldwide Building Energy Management Systems market is analyzed across major global regions. AMA also provides customized specific regional and country-level reports for the following areas. • North America: United States, Canada, and Mexico. • South & Central America: Argentina, Chile, Colombia and Brazil. • Middle East & Africa: Saudi Arabia, United Arab Emirates, Israel, Turkey, Egypt and South Africa. • Europe: United Kingdom, France, Italy, Germany, Spain, Belgium, Netherlands and Russia. • Asia-Pacific: India, China, Japan, South Korea, Indonesia, Malaysia, Singapore, and Australia. Presented By

AMA Research & Media LLP

0 notes

Text

Mobile Learning - The Best Online Courses In India

Online learning, specifically mobile learning has become a popular choice of late. The best online learning platforms such as M Learning make sure to keep a wide spectrum of courses available for students preparing for different examinations. No Matter if you wish to learn French online or understand the basics of engineering math, M Learning has you covered. Here are a few such courses that make you more exam-ready.

IIT JEE & NEET

Due to the huge number of students appearing for these tests and the limited seats available for the courses, securing a high position remains necessary to join the best engineering or medical institutions. M Learning offers online courses encompassing Physics, Chemistry, mathematics, and Biology to get ready for these national-level entrance examinations.

CA CPT & CLAT

M Learning offers comprehensive courses including classes for economics, accountancy, mercantile law, and quantitative aptitude for the aspirants to sharpen their competitive edges. Go through the course details to learn more about how these online courses augmented with video lecture sessions can help you be exam ready.

English & Foreign Language

If you have ambitions to study abroad, learn English online by availing of M Learning’s English language course. The length of the curriculum comprises vocabulary augmentation, grammar knowledge, comprehension skills, public speaking and more.

These courses will help students get ready for all sorts of competitive examinations in and outside of India. The foreign language courses offered by M Learning are perfect to learn German online. Students and professionals, willing to settle abroad, can also pick the courses for Spanish and French languages.

Generals Studies and Aptitude

M Learning offers comprehensive courses to learn Spanish online along with many more useful courses. The online courses in general aptitude and general studies are such programs.

Many students aspiring to crack the UPSC examinations or the national-level recruitment examinations find these two sections quite tricky.

The detailed course materials along with the engaging classes conducted by experienced teachers of M Learning make sure that every student becomes more efficient, accurate, fast, and confident.

Engineering Maths & Drawing

Students pursuing an engineering degree can also join M Learning’s engineering maths and drawing classes. Initially, to many students, these two papers become a source of challenge. With M learning’s individual doubt-clearing classes and expert mentors, scoring high from the first semester of your engineering course will be easier.

Computer Application & Digital Marketing

No Matter if you wish to learn French online or sophisticated software management skills, M Learning offers multiple courses matching the varied requirements of students.

The computer application course list includes highly demanded skills like Data Mining, Web Designing, Python Coding, MS Office, Java, and more. M Learning’s online courses also include digital marketing courses that will help you secure a job with fair pay without much hassle.

Class 8 to 12

Besides offering specialized courses, M Learning also offers school-level preparation courses for students from classes 8 to 12. Regular tests, one-to-one doubt-clearing classes, recorded classes for future reference, and in-depth explanations make these courses ideal for all students. M Learning offers the best courses for students willing to learn English online. Check the courses available to pick the best one for you. Rest assured that you or your child gets to integrate with the best subject experts for best results.

#mobile learning apps#mobile learning#online learning#online classes#learn English online#learn French online#learn Spanish online

0 notes