#Business valuations

Explore tagged Tumblr posts

Text

It's Tax Time SCV-SFV | CPA Howard Dagley

We’re In The New Year, It’s Almost Tax Season SCV & SFV! Don’t hold off on taxes until the last minute. Eliminate your risks for an IRS audit and maximize your refund in 2025! If you live in the Santa Clarita Valley or the San Fernando Valley, CPA Howard Dagley is here to help you this tax season. Howard Dagley is a certified tax accountant serving tax payers in the SCV, SFV & LA areas. Give…

#Accountant Santa Clarita#best cpa in Santa Clarita#book keeping#business valuations#CPA San Fernando Valley#CPA SCV#CPA SFV#Howard Dagley CPA SCV#It&039;s Almost Tax Season SCV & SFV#tax advisor#tax season scv sfv#tax services Santa Clarita

0 notes

Text

Business Valuations in Divorce Settlements

Divorce can be a complex and emotionally charged process, particularly when it involves determining the equitable distribution of assets. Among the most challenging assets to appraise are businesses owned by one or both spouses. Read more: https://sunbusinessvaluations.com/business-valuations-in-divorce-settlements/

0 notes

Text

Accurate business valuations are essential for informed decision-making, whether you’re planning to sell, merge, or grow your business. A professional valuation provides a clear picture of your company’s worth, considering factors like assets, revenue, market position, and growth potential. Understanding your business’s value can guide negotiations, attract investors, and help with strategic planning.

0 notes

Text

Strategic Partnerships Made Simple with M&A Business Advisors

With the help of Jackim Woods & Co., your M&A Business Advisors, you can quickly establish strategic partnerships. To discover new growth potential for your company, get in touch with us right now.

#M&A advisor#finance#investing#business growth#mergers and acquisitions#business valuations#sell-side advisory

1 note

·

View note

Text

0 notes

Text

Intangible Definition – Intangible Assets & Business Valuation

As businesses grow and expand, the value of their assets grows along with them. While physical assets such as equipment and property are easy to identify and value, it’s important not to overlook the value of intangible assets as well. In this blog post, we’ll discuss the intangible definition, the importance of valuing intangible assets, and the challenges associated with valuing them.

0 notes

Text

Business valuations should be part of your overall business strategy

Visit: https://www.rdcappraisals.com/business-valuations-should-be-part-of-your-overall-business-strategy/

0 notes

Text

Behind F1's Velvet Curtain

This article by Kate Wagner on her INEOS sponsored trip to the Austin GP at COTA last year was commissioned by Road and Track magazine and then taken down. Presumably because Kate has was pretty staunch in her opinions about what was essentially a paid trip.

It is exactly the kind of thing I have wanted to read about the felt experience of the money business of F1. It doesn't get into technicalities and does not produce any spreadsheets for reference. It's just, her experience of the presence of wealth in the sport.

She starts off by talking about how she has been covering cycling and NASCAR for a while now and both of those, in comparison, are scrappier sports with smaller sponsors and cheaper tickets.

What I also especially loved was how fascinated she was with the cars themselves, and how they seem like a true marvel of human engineering. She almost described the cars like these alien beasts that came into this dimension out of nowhere and were being constantly monitored and dueled with to furnish wins and glory (and shareholder value for sponsors).

I think I always had an understanding of the weird myth making surrounding F1 and the kind of media attention it attracts, but someone like Kate (who I have loved reading for a while now) putting it into perspective really made it click for me. This sport thrives off of the kind of cocoon it has built around it and understands exactly the certain exclusiveness it needs to maintain to keep the story alive.

Anyway, give it a read, especially because Road and Track is trying to bury it to not piss off sponsors.

#I think matt oxley was talking about how motogp has been struggling with money and hence dorna is trying to woo the American market#and the american tech sponsors#but bikes don't require as much data driven performance engineering as f1 cars do#Ducati is probably leading the operation in this regard because they have audi behind them#anyway I knew motogp does not produce the same level of wealth but I still decided to check numbers#Marc's net worth is $25Mn and he is arguably the best driver of his generation with enough sponsors behind him#Max's net worth in comparison is $165Mn easily over 6 times that of Marc#Vale's net worth is $200Mn but he is still somewhat of an outlier because his popularity far outweighs that of motogp itself#Lewis is still around $300Mn and he hasn't even retired yet#Schumacher was around $800Mn#I know net worth is a very stupid number to consider but driver net worth is an easy way to translate impact ig#the current Max to Mercedes rumours caused Merc valuation to rise by $11Bn#Billion! 11 of them!#honestly I frequently get desensitized to money just purely as a number because I am exposed to businesses with large valuations but#I still wanted a moment to reconsider how much money rides on this sport#and how that ties to how rich people function#just made me remember that Ocon is the last driver from a working class background#Fernando and Lewis are the only other with working class beginnings and both of them are over 35 and ridiculously talented#its not a sport for regular people to break into#Vale also started with karts and had to shift to bikes#anyway I love Kate Wagner please read this#and talk to me about money and F1#Kate wagner#f1#formula 1#road and track magazine#lewis hamiton#mercedes amg petronas f1 team#Mercedes#INEOS

7 notes

·

View notes

Text

zefyron

Investor and Startup Database Made Easy with Global databse tool

Browse through the best database for startups and Investors available on this platform. Get access to the in-depth information with precise results and advanced filters

Global Startup Database

#enterpreneur#investors#startup#stock market#venture capitalist#startup funding#startup success#startup business#startup valuation#startup company#entrepreneur

2 notes

·

View notes

Text

The Valuation Slide That Wins Investors

The Valuation Slide That Wins Investors

In the glitzy world of startups, where innovation meets ambition, there’s one slide in a pitch deck that can command the attention of everyone in the room – the valuation slide. Whether you’re an early-stage startup or merely gauging the potential of a business idea, presenting the perfect valuation can set the stage for a successful fundraising effort. But how do you nail this slide, especially if you have no revenue yet? Let’s delve deeper.

Why Valuation Matters

The valuation of a startup isn’t just about numbers or potential revenue. It’s a narrative of the company’s potential, vision, and the value it aims to deliver to stakeholders. For investors, valuation serves as a compass – it guides them to ascertain the risk associated with your startup and the potential return on their investment. While revenue is a straightforward measure for established companies, startups often operate in the realm of vision, potential, and innovation. This makes the valuation slide not only about the worth but also about the story behind that worth.

Crafting the Perfect Valuation Slide

1. Simplicity is Key: Don’t overwhelm your audience with complex calculations or jargon. Present a clear, concise valuation figure and back it up with 3-4 key metrics or reasons that support it.

2. Storytelling: Numbers, on their own, can be lifeless. Weave a compelling story around your valuation. How did you arrive at this figure? What milestones or potential growth does this number represent?

3. Visual Appeal: A picture is worth a thousand words. Use charts, graphs, or infographics to represent data. It aids in comprehension and retention.

4. Be Prepared for Questions: The valuation slide will undoubtedly raise eyebrows and questions. Be ready to defend your valuation with data, research, and comparables from the industry.

The Role of Valuation Tools

Not everyone is a financial wizard, and that’s okay. In today’s tech-driven age, tools like ValuationGenius can give you an edge. These platforms provide an approximate valuation based on a range of factors, eliminating the need for deep financial know-how. While this shouldn’t be the sole basis of your valuation, it can serve as a starting point or a validation tool. When combined with market research and industry benchmarks, tools like these can make your valuation slide more credible and robust.

Case Study: Litemeup and the Power of AI in Valuation

Meet Litemeup, a fledgling startup on the brink of transforming the packaging industry with AI-driven design. While they had a groundbreaking concept, they faced a common challenge many early-stage startups grapple with: how to place a valuation on an idea when there’s no product or revenue in play?

Enter ValuationGenius

Without a product, without revenue, and seemingly without the necessary data points that typically inform valuation, Litemeup turned to our tool. ValuationGenius didn’t just spit out a random number. Instead, it provided a range of estimates based on different valuation methods. But what truly stood out was the grounding of these estimates. Each was justified not just by data, but by the wisdom of business development and an inherent understanding of the startup landscape.

So, when Litemeup pitched to investors, they had more than just a vision. They presented a detailed valuation slide that wasn’t built on optimistic projections or vague assumptions but on a solid foundation provided by ValuationGenius. The result? They secured the trust and, subsequently, the investment from stakeholders, proving that even in a world where numbers often dominate, there’s always room for common sense and astute business acumen.

Conclusion

While a startup’s journey is riddled with challenges, presenting the right valuation shouldn’t be one of them. Remember, your valuation is more than just a number. It’s a representation of your startup’s vision, potential, and promise. Craft it with care, back it up with data, and present it with confidence. Value startup with no revenue

#startup valuation#startup#business valuation#online startup valuation calculator#startup valuation calculator#startup valuation tool#valuation calculator startup#online valuation platform

2 notes

·

View notes

Text

Get Prepared For The New year - Howard Dagley SCV - SFV - LA

Get Prepared For The New year With SoCal’s best CPA, Howard Dagley! Tax filing season is just around the corner. Don’t be one of the millions of filers who delay filing their taxes until the last minute. File your taxes with ease in 2025! Howard Dagley, CPA is a certified tax accountant serving tax payers in the SCV, SFV & LA areas. To get started today, call Howard Dagley today at…

#Accountant Santa Clarita#best cpa in Santa Clarita#book keeping#business valuations#CPA San Fernando Valley#CPA Santa Clarita#CPA SCV#CPA SFV#Howard Dagley CPA SCV#new years eve taxes#Prepared For The New year SCV#tax advisor#Tax Preparation#Tax Returns#tax services Santa Clarita

1 note

·

View note

Text

The Importance of Business Valuations for Gifting and Estate Planning

Planning for the future involves making crucial decisions about the distribution of your assets. Whether you’re looking to transfer ownership of your business as a gift or manage your estate effectively, accurate business valuations are essential. At Sun Business Valuations, we specialize in providing detailed and reliable valuations for gift and estate planning. Read More: https://sunbusinessvaluations.com/the-importance-of-business-valuations-for-gifting-and-estate-planning/

0 notes

Text

In Melbourne, doctors not only diagnose and treat patients but also manage thriving medical practices. Understanding the value of your practice through independent business valuation, choosing the right business structure for doctors, and enlisting the support of a medical accountant are essential steps in achieving financial health.

2 notes

·

View notes

Text

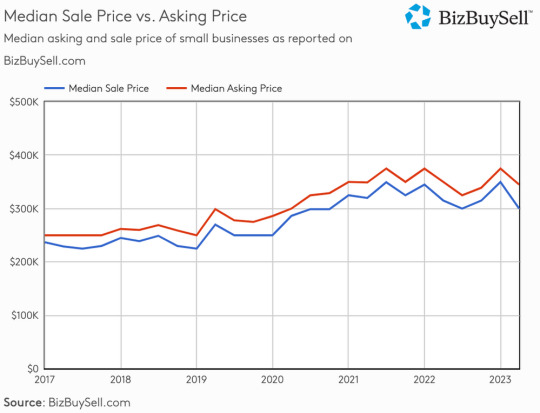

Q2 BizBuySell Report Shows Continued Increase in Small Business Acquisitions

The second quarter of 2023 was interesting. Typically, the summer months, especially July, are slow. However, this year, our firm saw an increase in business owners reaching out to learn about selling their business.

While interest rates continue to climb and put pressure on the selling prices, the number of businesses listed for sale continues to grow.

Q2 BizBuySell Report Shows Continued Increase in Small Business Acquisitions

BizBuySell has recently released their insight report for the second quarter of 2023. These reports are helpful to business owners and potential buyers as they project market trends and explain what was on the rise and what declined over the past three months. To see the full report, you can visit BizBuySell’s website. Here is an overview of what was presented and where market trends are leading as we progress through 2023.

Full report: https://www.bizbuysell.com/insight-report/

Overview

The most important statistic from the last three months is that business acquisitions increased by 8% versus just 4.8% in the first quarter of the year. This continues the positive trend that buyers and sellers are adjusting to an environment with higher interest rates.

However, it’s important to note that while acquisitions are trending upward, sale prices have continued to trend downward. In the second quarter, the median business sale price dropped 14% to $300,000 largely due to higher interest rates.

While the decline in the sales prices may seem like bad news to buyers, this decline proves that sellers need to get more creative with their offers. For instance, sellers may have to offer financing or increase the monthly rent on the buyer’s lease.

Overview of business sales and listing information for Sacramento, CA

In the Sacramento, Arden-Arcade, and Roseville, California areas, the median asking price continued to increase. The median asking price rose to $399,000, and listings increased from 253 to 264. Median revenue also increased significantly from $550,000 to $609,445.

Here are 3 Key Takeaways from BizBuySell’s report:

1. Seller financing continues to play an important role.

With higher interest rates, many buyers and lenders require some form of seller financing. This can seem challenging for sellers as only 22% plan to offer it, while 70% of potential buyers intend to ask sellers to finance at least part of the deal.

However, sellers need to stay flexible and consider adding financing to their deals. Leaving out this crucial component can reduce the amount of potential buyers and, in some cases, be a deal breaker for lenders, as many lenders are beginning to require at least a 10% note from sellers. This is especially important to buyer and seller timelines. As roughly 28% of business owners intend to sell by 2024, and buyers continue to increase their desire to purchase, seller financing continues to play an impactful role.

In good news for sellers, because interest rates are on the rise, so are the rates on seller financing, allowing sellers to enjoy tax benefits and meet buyer demands as well.

2. Restaurants show a steady comeback, while the retail sector shows a decline.

The restaurant sector has been making a slow but steady comeback post-pandemic. Restaurants saw a 10.3% increase in transitions from last year, and sale prices increased 15.9% from the previous quarter and 6.7% from the previous year. While these numbers are positive, the report indicates that many restaurants are still struggling, offering purchasing opportunities from competitors.

While restaurant numbers have increased, retail numbers are showing a decline. 2022 showed promising numbers post-pandemic, but with more consumers purchasing online and higher interest rates and inflation, these numbers have slowed in 2023. According to the report, retail transactions declined 12.3%, sale prices dropped 22%, revenue slipped 24%, and cash flow fell 9.4%.

3. Buyers continue to seek independence with entrepreneurship.

The number of interested buyers looking to leave their traditional jobs and embrace entrepreneurship continues to rise. The report indicates that 46% of surveyed buyers want to leave their current position to be more in control of their future. This is good news for the baby boomer generation looking to exit the market, even though some want to reinvest in other markets.

It’s also important to note that service businesses made up the largest number of companies for sale recently. Almost half of the sales recorded in the second quarter were service-based businesses, and 59% of surveyed buyers indicated they were interested in purchasing a service-based business.

Outlook for the remainder of 2023:

The BizBuySell report indicates that interest rates continue to be the most significant factor in the small business market. Some sectors are seeing a return to the workforce, while others are still experiencing stagnant or declining numbers. However, there are a few positive notes to consider:

The baby boomer generation continues to exit the market. According to the report, 47% of sellers surveyed marked retirement as their reason for exiting, while 34% indicated burnout. As this age group continues to leave the market, it creates new opportunities for those looking to enter.

As mentioned, seller financing should be considered. This can be a great selling point to buyers looking for interest rate relief and impact new requirements from lenders.

Next Steps

As market conditions continue to change and evolve, and as more buyers indicate their desire to purchase a business, it’s essential to fully understand the value of your company. Are you looking for a Sacramento business broker? Reach out today for a free consultation.

source https://www.sacramentobusinessbrokers.com/post/q2-bizbuysell-report-shows-continued-increase-in-small-business-acquisitions

2 notes

·

View notes

Text

A CTA business broker is a professional who specializes in facilitating the buying and selling of businesses within the commodity training advisor industry. CTA business broker acts as an intermediary between buyer and seller related to business. Visit now: https://www.ctadvise.com/about

#business brokerage#business broker seattle#best business brokers auburn wa#industrial design#aerospace business brokers#business valuations

0 notes

Video

tumblr

Valuation of goodwill can be a complex and important process for any business. At Sapient Services, we offer expert valuation services to help you accurately determine the worth of your company's goodwill. Contact Sapient Services today and get a clear understanding of your business's true value.

#Valuation of goodwill#motivation#business valuation#business services#valuation services#create backlinks#sapient services#business consultation

2 notes

·

View notes